Norfolk Law

Legal Walk Edition

A record number of lawyers walked to raise money for access to justice in May. Pictures inside of the walk and from Countdown.

A record number of lawyers walked to raise money for access to justice in May. Pictures inside of the walk and from Countdown.

Another busy few months have passed. In March we enjoyed Count down for lawyers thank you to all the teams who entered but in the end, Spire held the Teapot! Special thanks to Jessica Piper, Mark Fitch, for making the evening run so well. Thank you also to Jeremy Woodrow and our Smith & Pinching sponsors for the event. They have kindly offered to do the same for next year. Then legal walk on the 11 May was a great success with 200 walkers and quite a few 4 legged ones! Despite the ‘4 seasons in a day’ weather conditions we escaped the showers. In addition, £6500 was raised for our local community services NCLS and CAB. Thank you to Claire Clarke of Rampling Clarke for sponsoring and organising. Maddie Taylor from Birkett’s and Eleanor Chapman of Leathes Prior who go far and above to make

this event run smoothly and successfully. Looking ahead it’s still a busy year to come albeit time to enjoy the summer. The Annual dinner is booked for the 19 October at Carrow road, we plan to add a bit of surprise with this year thanks to help from the main sponsors Index. Please do diarise the date and watch the website. There will be just 4 awards this year with some changes to the categories. On 9 November we have the Rt Hon Lady Hale of Richmond attending to host our combined law lecture with the UEA law school and your attendance will we welcomed. Free ticket bookings shall be circulated soon. If your firm would be interested in sponsoring then please do drop me an email g.colman@valemuslaw.com

Ginny Colman President, Norfolk & Norwich Law Society 2023-24

Ginny Colman President, Norfolk & Norwich Law Society 2023-24

Poppy’s

When Poppy’s Dog Guardian conta

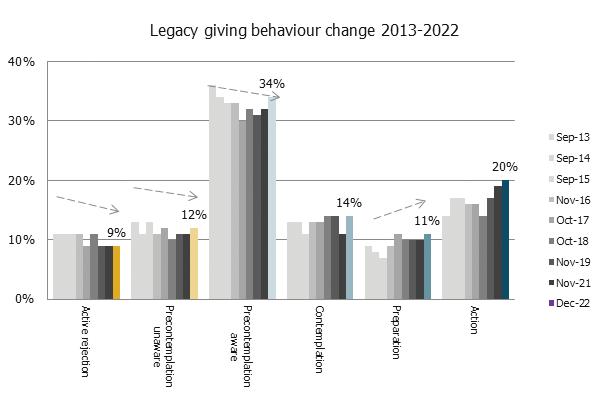

Monday 3 APRIL 2023: Legacy giving has risen by 43% over the past decade according to new research out today. 20% of UK charity supporters aged 40+ now say they have left a charitable gift in their Will compared with 14% in 2013. The research charts a steady rise in the proportion of people choosing to give from their Will over time.

Legal advisers play a critical role in making clients aware of the option of including a gift in their Will, with more than half of the giving public (54%) saying they have used or would use a solicitor or professional Will-writer to set out their final wishes.

The Remember A Charity consumer benchmarking research*, carried out by independent research firm OKO, surveys more than 2,000 charity donors aged 40+ to track legacy giving attitudes and behaviour year-on-year. The 2022 research released today found that:

• One in five supporters said they had included a charity in their Will (20%)

• Just over one in 10 said they are preparing to do so (11%)

• Fewer than one in 10 reject the concept altogether (9%).

• Shape

The tracking research, which follows Prochaska’s Stages of Change model, shows forward movement over the years from donors’ rejection and lack of awareness through to awareness, contemplation, preparation and action (leaving a gift).**

Lucinda Frostick , Director at Remember A Charity, the consortium of 200 UK charities working to promote charitable gifts in Wills, says: “This continued growth in appetite for legacy giving is hugely encouraging, reflecting greater understanding of the option to pass on gifts

to good causes alongside loved ones in a Will. It may take years – in some cases decades – for donations to filter through, but that income will be crucial in funding charitable services for generations to come.”

Just under two thirds of people surveyed (63%) had already written a Will, with three in 10 of those having included a charitable donation (29%). Despite the economic climate, the large majority of all respondents (80%) said they were just as likely to leave a charitable gift as 12 months earlier, with twice as many people (14%) saying they were more likely to give than those saying they were less likely (6%). More than four in ten people are aware of the inheritance tax advantages of leaving charitable gifts in Wills.

The age at which people first wrote a Will is unchanged; just over half write their first Will when under the age of 50, with the average age of first Will-writing being 50. Those more likely to have written a will are older and more financially affluent. Those with less assets, no children or grandchildren, or from ethnic minorities are less likely to have written a Will. The research reports that death of a loved one is a key trigger - particularly for those making their first Will when younger. Birth, marriage or house purchases are also strong triggers for younger Will-makers, while retirement is a major driver for older generations.

Remember A Charity runs a free Campaign Supporter scheme for solicitors and Will-writers, providing promotional resources and useful guidance for referencing legacy giving with clients. Find out more at www.rememberacharity.org. uk/about-us/for-solicitors-will-writers

Commissioned by Remember A Charity, the consumer benchmark research explores the public’s attitudes to legacy giving, with regular surveys carried out since 2009. The latest survey was carried out by OKO in December 2022; an online survey of 2,003 charity supporters across the UK, aged 40+. The research has been carried out by OKO since 2021, and nfpSynergy before that.

The Stages of Change model features six levels: rejection of leaving a gift in their Will; pre-contemplation unaware –those who have never thought about it and are not sure if they would consider it, pre-contemplation aware – those who have thought about it and given it low consideration; contemplation - those who know about it and would consider leaving a gift; preparation – those who intend to give; and action - those who have already left a gift in their Will.

Published on24 May 2023

Remember A Charity is giving member charities an easy way to create assets with their own messaging, imagery and branding.

Promotional assets are available for use all-year-round but can only be customised up until 14 July 2023.

While our consumer advertising and PR campaign to grow gifts in Wills runs throughout the year, activity peaks during Remember A Charity Week (11-17 September 2023) with promotion through the campaign’s partners, including

its network of over 800 solicitors and Will-writers.

Lucinda Frostick, director of Remember A Charity, says:

“The more charities that come together and use this opportunity to shine a light on the importance of legacies for good causes, the more noise we can make and the more we can get people thinking about leaving a gift in their Will.”

“Giving charities their own personalised assets means they can start their own legacy conversations with supporters throughout the year. This dialogue can be crucial, not only in building awareness around gifts in Wills, but in helping to break down some

of the myths around gift size and flexibility, and inspiring supporters to take action.”

Charities within the consortium are invited to use Remember A Charity’s digital platform to upload their own messaging, imagery, branding, QR code, web address and more. From there, they can order a suite of assets including website banners, social GIFs, bookmarks, posters, table standees and coat hanger cards.

“Legacies are a crucial source of income for the survival of The Elizabeth Foundation. A personalised campaign

brings to life the needs of our beneficiaries and the importance of the work of the charity.”

– Julie Hughes, Chief Executive at The Elizabeth Foundation

Promotional activity for legacy giving continues throughout the year, with Remember A Charity working to drive conversation and build understanding of the importance of legacy giving among the giving public, government, and professional advisers.

Find out more about joining the consortium and taking part in Remember A Charity Week here.

A key issue on this case was to assess the market value of the company at a point 10 years earlier and based on the information that would have been available at that time and so avoiding tainting my view with the benefit of hindsight.

The last few months have been particularly varied and interesting in terms of the matters on which I have been instructed as expert witness. I am fortunate to be assisted by an experienced team of forensic accountants which enables us to accept a number of instructions from large fraud investigations and professional negligence cases through to smaller matrimonial matters. Here are just a few of our recent cases highlighting what we found particularly interesting or challenging.

Instruction as party expert to assess a warranty claim and to determine the value of any loss arising

I was instructed as party expert by a transport technology company to review and give an opinion on a warranty claim arising in respect of buying a business in which the sale completed in 2021. I was instructed to review the completion accounts and to give a view on the warranty claim and the potential loss arising.

We reviewed the completion accounts and management accounting with particular reference to the recognition of income on the customer contracts. In our opinion the completion accounts materially overstated the income and there was a claim under the warranties.

Following the preparation and disclosure of our report and correspondence between the parties, the matter settled in favour of our client and therefore on this occasion avoided protracted and costly litigation.

A key challenge on this case was to determine an approach that enabled us to focus our review on the key contracts ensuring that our work was cost proportionate.

The client, a business providing services in the construction sector, was involved in a professional negligence claim against a firm of solicitors, arising from the advice given in relation to the corporate finance transaction regarding the disposal of the business. The company was claiming for a resulting loss, as the sale consideration was substantially less than was anticipated. I was engaged as party expert witness to give a valuation of the company at the time of the sale, which had taken place around 10 years earlier.

We prepared financial and market analysis looking at the information available at the time of the sale. My valuation considered the relevance of alternative methodologies and explored the value that an alternative purchaser might have placed on the company. Following the valuation, a joint report was prepared, combining our team’s findings with the findings from the other party’s expert who provided an alternative view.

The matter was settled just prior to the court hearing, in favour of our client. The lawyers said the work undertaken by us had placed the client in a good position to negotiate the deal achieved.

Following a report by a whistleblower, I was engaged to undertake a financial investigation into the financial reporting, corporate governance and internal controls of a fast growing entrepreneurial business in the technology sector. The engagement required a rapid deployment of our Forensic Services team to complete the investigation, as the matter had a potentially significant impact on business operations.

We were appointed as forensic accountants to undertake the in-depth investigation, including a review of financial records, interviews of company staff, and the investigation of electronic records. Our Forensic Services staff were deployed from our Cambridge, Norwich and Birmingham offices alongside our forensic technology team, and worked on the investigation with the instructed lawyers. Our review initially identified over 240,000 documents; the team was able to refine these to a subset of 15,000 potentially relevant items that were included in our investigation.

FRP’s engagement was concluded – and a full report including recommendations issued – within 10 weeks. The client and instructing lawyers were pleased with the efficiency and thoroughness of our team’s investigation. Following the issue of our report the investigation was concluded and the company was able to share the executive summary with relevant parties.

The key challenge in this case was to sift through 240,000 documents and using search methodology to reduce the documents to a manageable number that could be reviewed by the team.

• 25% in South East are worried they will fail to make mortgage repayments within the next year (30% nationally)

• More than a third (37%) expect it will take significantly longer to pay off their mortgage than originally anticipated

• 53% expect to have less money to put into savings, pensions or investments (compared with 46% nationally) if interest rates continue to rise

• To help manage monthly expenses, three in five (60%) homeowners have cut-back on takeaways or meals out – 65% in the South East.

Firms that take action now, while transaction volumes are lower, to examine their resources and adopt tools designed to digitise and modernise workflows — and increase productivity and profitability — will have a significant head start on their competitors once the market returns to normal.

In March, Dye & Durham commissioned an independent survey of 2,000 UK mortgage holders to understand the extent of the cost-of-living crisis and, specifically, how it is impacting shortterm spending, long-term financial planning and day-to-day budgeting.

The survey revealed a general feeling of unease and uncertainty. Nearly a third of respondents (30%) say they are worried they’ll fail to make mortgage payments within the next year.

With recession worries and rising interest rates weighing heavily on the nation’s mortgage holders, our research showed the impact not only on decisions about buying or selling homes but also on their financial wellbeing and mental health.

For conveyancing and property solicitors who rely on transaction volumes, it’s critical to identify ways to shield against volatile property market conditions and to help ease the overall anxieties of homeowners. We believe the answer may lie with digitisation and unlocking technology.

First, let’s take a closer look at what mortgage holders in the South East of England told us:

• Almost half of UK mortgage holders (47%) say the cost-of-living crisis is affecting their mental health (56% nationally)

• 68% are worried their offspring will be unable to get into the housing market

It’s clear that economic uncertainties, including the effects of high interest rates, energy bills and increased costs overall, is weighing on the minds of the nation’s property owners and the fallout cannot be underestimated.

Our survey data shows us that people across the UK are concerned about both their short- and long-term financial futures and, as such, have reduced spending, raided savings and are delaying major purchases.

What does this mean for the industry?

Many UK law firms continue to manage much of their operations via manual or resource-intensive processes, which lack the necessary ease of access, seamless case management abilities or increased security measures to be truly productive and profitable.

Strategic plans to digitise processes were put on hold by many firms amid the peak in property transactions following the COVID-19 pandemic as they concentrated on taking cases from the offer phase through to completion.

The survey findings point to the fact that the UK property market may face considerable challenges due to consumers’ reservations, but there are steps that can be taken now to help weather the storm.

By adopting digital practice management tools, legal professionals can spend more time on revenuedriving tasks and less on non-billable administration like case management, client intake and invoicing.

At the same time, increasing the security of your information, reducing overall risk and providing a more modernised customer experience for clients can only benefit all – both now and in the future, when the market bounces back to previous levels.

If you’re interested in finding out ways you can protect your bottom line against market volatility, contact the Dye & Durham team today: bit.ly/3FotstY

www.dyedurham.co.uk

About the survey: Using an online methodology, Danebury Research conducted a nationally representative survey of 2,000 UK based homeowners with a mortgage aged between 18 and 65.Fieldwork was conducted from 12th February to 16th February, 2023.

someone clicks on the advert to visit your website.

In addition to this, listing your business information on directory sites such as www.lawconnect.co.uk means that prospective clients looking for the right law firm for their needs can find you. By ensuring your details are featured and accurate, you can be considered for their business.

seamless and accessible as possible, you are working to keep your clients satisfied.

The past few years have provided extra challenges for businesses. Navigating Brexit, the COVID-19 pandemic and two general elections have created extra uncertainty for business leaders looking to expand and secure company longevity.

In the legal sector, a skills shortage has resulted in the addition of recruitment challenges to this list. Many law firms are reviewing their positioning, processes and culture to ensure that they are not only appealing to great talent for any vacancies, but also competing in their field and delivering the best service to their clients.

Prioritising activity that will build and sustain businesses for the long term is vital. Here are three pointers for legal business leaders to remember in order to grow their law firms to last.

1. Increase your law firm’s visibility

You might be the best law firm in your region, but unless prospective clients know about you, this is meaningless. Increasing your visibility will give you greater chances to secure new business.

Improved search engine optimisation (SEO) helps your site rank higher on the likes of Google and Bing, and comes as a result of changes to your website’s content, structure, keywords and phrases. Allocating a budget for pay per click (PPC) adverts on search engines such as Google Ads will position you in front of more prospective clients when

Raising your profile often has a snowball effect, so the more you do to increase visibility through listings and networking, the more clients you will attract, and the easier this becomes.

2. Optimise your time

The old adage “time is money” has never been truer than in the legal profession. When lawyers spend their days chasing up overdue invoices, tracking each billable unit and scheduling client meetings, their time is spent on administration rather than chargeable work. This is considerably less profitable and can demotivate valued and talented professionals.

Investing in good practice management software enables simpler tasks like this to be automated, freeing up the lawyers to practice. Automatic timers can track billable minutes, and software can instantly generate invoices. Good practice management software has the capability to manage your staff schedules too, so you can speed up planning by knowing your firm’s availability.

By optimising your time and introducing efficient working practices that can be passed on to new staff, you can become a more profitable firm and create a culture of working smarter.

Technology has revolutionised our private lives, which means prospective customers have a level of expectation from law firms when it comes to technology. By making processes and collaboration with your law firm as

The right technology available from leading practice management providers enables lawyers to securely collaborate with clients on matters from start to finish. This includes uploading, viewing, commenting on, and sharing large confidential items from any location, reliable version control with live updates, and the ability to sign time critical documents from any device.

By investing in secure collaboration tools, you’re providing clients with confidence and convenience, helping to ensure their overall experience with your law firm is positive. Through recommendations, good experiences like this become free marketing to help you grow your business, and when these are in the form of online reviews, these statements will speak for themselves for years to come.

To learn more about how the right tools can help you grow your law firm, please visit www.leap.co.uk

LEAP Legal Software has been helping law firms to become more efficient and profitable globally for more than 25 years. LEAP is committed to consistently providing world-class legal practice productivity solutions and has innovation at the heart of its research and development so that users continually have the best possible experience.

Occupying a unique position in the legal software market, LEAP includes legal case management, legal accounting, document assembly, document management and legal publishing assets in one solution. Its software is designed to streamline tasks such as matter management, time recording document management, email management, automated forms, client accounting, billing, reporting and remote working.

For more information, please visit www.leap.co.uk

mean that there’s set to be a dramatic reduction of premiums. For many firms, rising inflation has fuelled an increase in fee income, which will naturally have an impact on the premiums charged by insurers. It does mean, however, that for well-run and successful practices, the cost of PII premiums should not erode profit margins further, as it may well have done at recent renewal periods.

The vast majority of leading participating insurers have an appetite to actively grow their respective portfolios with the addition of new business. Furthermore, new capacity is set to enter the marketplace before October, meaning firms with a desirable profile are going to have even more insurer options available to them at this year’s renewal.

If we reflect briefly on what happened in the now well-populated recent spring renewal season, although a proportion of insurers did wish to increase rates – albeit more modestly than they have in recent seasons – the majority of insurers’ rates plateaued. This is a reflection of the positive dynamics within the PII marketplace, with more active competition for business. Extended policy periods also returned to availability, albeit in limited number. Nonetheless, this signals a sea change to recent years.

The one slight frustration of the spring renewal season was premium financing, with costs of borrowing increasing throughout the period, largely as a result of macroeconomic factors. Finance providers were also strengthening their due diligence processes, adversely impacting the speed of decision-making and processing of loans. We anticipate that the due diligence process will become even more stringent as we move into the October renewal.

With the likelihood of the emergence of new insurer capacity on the immediate horizon, coupled with an increased appetite among insurers already active in the market, wellrun practices can expect a softening in the rates charged come October. What is not yet known, is how diluted rates will become. We also expect extended policy periods to become more readily available, with insurers once again offering the choice of up to 18 months for a portion of their portfolios.

Without wishing to dampen the positive tone of this update, the one caveat to give is that the dilution of rates doesn’t necessarily

It will be of no surprise that the softening of rates may not positively impact the entire legal profession of England and Wales. This is particularly true of practices that have experienced an adverse claims position, and those that are heavily involved in perceived higherrisk practice areas. Practices should not be complacent, and cannot expect premiums to fall without any effort on their part. I cannot stress the importance in providing your chosen representative(s) with the appropriate evidence to share with the underwriters, in order to justify applying positive price corrections.

To capitalise on the improving insurance market conditions, our recommendation to you would be to commence the renewal process early. Most importantly, take the time to prepare a quality presentation that provides a positive reflection of your practice. As Lockton have advised countless times, this is your shop window for insurers, so use the opportunity wisely. It is prudent to remember that approximately two-thirds of the legal profession of England and Wales renew at the end of September, so you will be vying for the attention of the underwriting teams along with a substantial number of your peers.

Whilst insurers have an increased appetite for business, their underwriting teams will only have a finite amount of time to undertake their risk assessments. With that in mind, make sure your practice stands out from the crowd. Should you have experienced claims, provide a narrative of the situation, along with detail of what measures you have implemented to prevent their repeat. Simply stating that the fee earner responsible for the claims is no longer with your firm, is not necessarily what insurers are looking for.

I encourage you to use this opportunity to help your chosen representative(s) to educate insurers about your firm, what

you do, and how you do it. Consider the fact that specialist underwriters are not solicitors, and although they will understand risk and the ramifications of any mistakes, they may not understand the intricacies of your specialism entirely. At the same time, no two practices are identical, so articulate why you are better. As they say, perception is not always the reality – an underwriter could always form an opinion which is incorrect. And once opinions are formed, they are much harder to change.

In terms of timescales, we recommend providing the presentation at least six, but preferably eight weeks in advance of your renewal date. Begin exploring finance options much earlier in the process than you have done so previously, given that the process is longer, and you may need to shop around to get the most favourable terms.

Choose your representative(s) wisely, acknowledging the fact that it would not be advantageous to scatter your presentation across the marketplace, as this may dilute the work that you have done to present your practice in a positive light. There is a possibility that your representative may not be able to reach all of the active participating insurers directly, and this may well result in you not being able to achieve the optimum solution possible for your practice. Before selecting your representative(s), establish which insurers that they can approach directly on your behalf. You will not truly benefit from an improving PII landscape should you inadvertently exclude half of the active participating insurers.

We would welcome an opportunity to canvass the market for all members of Norfolk Law Society, or provide a second opinion. We have direct access to more active participating insurers than any of our peers, and will have insurer solutions that your current representatives cannot provide for you.

I do hope that you take up this offer, and wish you all the best.

Brian Boehmer Partner E: brian.boehmer@lockton.com W: www.locktonsolicitors.co.uk

As we rapidly approach the summer and the halfway point in the 2023 calendar year, I am pleased to advise that there is cause for optimism amongst well-run firms with regards to PII market conditions as we look ahead to the October renewal season.

Q1. What does Finders International do and what services does it offer?

At Finders International, we are a probate genealogy company that specialises in tracing heirs to estates, properties, and assets worldwide. We offer a range of global research and support services, including locating missing legatees and beneficiaries all over the world, obtaining family documents, carrying out overseas bankruptcy searches, missing will searches and handling the difficult aspects of overseas assets such as multi-jurisdictional share portfolios, as well as carrying out all important family tree verification work for Statutory Will Applications. Our clients include solicitors, estate administration professionals, and financial institutions in the private sector, as well as local authorities, coroners, and hospitals in the public sector.

Heir Hunters (IAPPR), an international organization representing elite firms across the world. Additionally, we have been honoured to be featured on BBC 1’s Heir Hunters for five series and over 70 cases, as well as winning multiple awards, including Best Probate Research Firm of the Year at the Probate Research Awards for the past four years.

Q3. How has Finders International’s appearance on BBC 1’s Heir Hunters impacted business, and have you seen an increase in inquiries?

Our appearance on BBC 1’s Heir Hunters has raised the profile of probate genealogy among the public and helped them understand a previously unknown niche area of work. We receive numerous inquiries from people interested in delving into their family history, and some of the stories they share are of real historical interest. Additionally, we have had stories relating to beneficiaries in the press, demonstrating the continued interest that the public has in their family history and how it ties into the world of probate genealogy.

Q4. What sets Finders International apart from other probate genealogy companies?

and Heir Hunters (IAPPR), we are dedicated to raising the standards of our industry and promoting best practices. Overall, our commitment to excellence, professionalism, and client satisfaction is what sets us apart from other probate genealogy companies.

Q5. What are your plans for the future of Finders International?

At Finders International, we are always looking for ways to improve our processes and better serve our clients and beneficiaries. Our plan for the future is to concentrate on improving our services by investing in new technologies and training for our staff.

Q2. What are the biggest highlights of Finders International’s 26 years of existence?

Finders International was founded in 1997 by our MD, Danny Curran, in a small office in Southwest London. Since then, we have experienced tremendous growth, expanding to over 150 personnel across four offices in North London, Yorkshire, Edinburgh, Dublin, and Sydney. As an unregulated industry, we have always focused on raising the standards of our industry and have looked to selfregulate as much as possible. We are proud to be a founding member of the International Association of Professional Probate Researchers, Genealogists and

At Finders International, we believe that our commitment to excellence and our dedication to our clients sets us apart from other probate genealogy companies. We understand that dealing with estate and asset matters can be a difficult and emotional process, which is why we approach every case with empathy, professionalism, and attention to detail. Our team of highly skilled researchers and support staff work tirelessly to locate missing beneficiaries, assets, and wills, ensuring that our clients receive the best possible service. We are also proud to offer a range of pro-bono services, helping people reunite with lost family members or reclaim family heirlooms. Additionally, as a founding member of the International Association of Professional Probate Researchers, Genealogists

We also recognise the vital role we play in helping legal professionals through the difficulties that can occur during the administration of an estate. We want to continue building strong relationships with our clients and help align the two industries of probate genealogy and legal practice by working together to promote best practices, ethical standards, and transparency.

Overall, we are committed to remaining at the forefront of the probate genealogy industry, providing exceptional service to our clients and helping families around the world discover their past and secure their future.

If you would like further information on Finders International and the services they provide, visit their website www.findersinternational.co.uk, call 0800 085 8796 or email quotes@ findersinternational.co.uk

Personal relationships are still the heartbeat of business success, despite the increasing use of technology. Personal relationships convey how we value one another. Personal relationships enable us to have empathy with one another’s situations.

In his seminal book, “How to win friends and influence people,” Dale Carnegie wrote

Don’t get me wrong, consolidation has brought with it huge advances in technology and customer experience. Gone are the days of endlessly calling suppliers to order reports, collating them manually, printing off reams of paper and hand delivering the search to the office…. and good riddance too! With the exception of local authority searches, most of the reports are now available same day, with many returned in minutes.

The delivery platforms are slicker, smarter, more intuitive and spot potential risks that might need to be accounted for, and errors in search requests. But some of this technological advancement has come at the expense of good, old-fashioned customer service. The personal touch.

supplier. When I asked what it was that brought them back to us they said that they felt as though they were a number, rather than a client. It was the personal touch that was missing from their communications; they didn’t feel as though they ever spoke to the same person twice. There wasn’t a familiar voice at the end of phone when things went wrong (as things inevitably do in conveyancing!).

Business relationships then are as much about understanding the challenges we all face in our daily encounters.

The search industry has seen significant changes in recent years. Massive consolidation has seen so many of the traditional search companies swallowed up into larger corporates. We have to find ways of differentiating our service offerings, building that trust in client relationships, and delivering services which conveyancers feel add value to their business.

Do we rely on technology too much? Are chat bots, apps and portals what our clients really want and need? What happens when things go wrong? People need reassurance, they need to be able to pick up the phone, or send an email, and feel as though somebody is taking a personal interest in resolving their issue rather than “chat” to a faceless bot or send messages via portals.

I recently won back a client from a rival

In our experience 90% of orders go through with little to no intervention required. But that 10% is where relationships are made and broken. This is where knowledge, experience, and expertise really make a difference. Recognising that the conveyancer is almost certainly under pressure, whether it be from the client, agent or the other side, and being able to take that weight off and deal with the issue through to completion is a critical part of the business relationship.

Whether it’s a query on a report back which requires clarification, or chasing up an expedited service. It’s about trusting that the job is going to get done right, first time.

Winning friends and influencing people is all about understanding their situation and being empathetic to their challenges while excelling at service delivery

“If there is any one secret of success, it lies in the ability to get the other person’s point of view and see things from that person’s angle as well as from your own.”

Poppy’s

When Poppy’s Dog Guardian conta

faced with an extraordinary extended network of half-siblings.

The donation of sperm or eggs is a very laudable social service and demand in the UK is increasing 1 , albeit, sperm is in short supply for artificial insemination (AI). The service can be carried out by one of the many reputable licenced clinics recommended by the HFEA which regulates their activities and gives a great deal of clarity about consent and responsibilities towards children created from the donor sperm. 2

There are, however, shocking and indeed harrowing stories about sperm donors who have fathered multiple children and we would like to explore some of the issues. The cause of disquiet is the very real possibility of inbreeding (a genetic abnormality arising from inadvertent half sibling reproduction as the result of a common father – the genetic term is consanguinity), incest and psychosocial/emotional issues in donor children. Consent, if it has been given, is often far from informed.

A recent case involves a musician in the Netherlands who has been accused of fathering more than 550 children from his “donations” which were offered via social media and to a significant number of clinics, of which 11 were in the Netherlands. The court in The Hague has recently found against him in a case brought by one of the mothers and the charity DonorKind.eu , on the basis that he lied to the clinic/mothers about his history and activities; had they known, they would not have chosen him as a donor. This judgement of preliminary relief will deter him from making further donations. 3 These mothers are now

There have been many other circumstances of sperm donors fathering multiple offspring, both consensual 4 and adversarial. 5 In the latter instance there have been multiple cases of doctor-donor conceived children in the US, with fertility fraud being documented on websites such as donordeceived.org and even Netflix 6

Many people feel it is important to know their origins, as it gives them both identity and helps them make sense of their being. The UK took a giant step in this direction on 1st April 2005 when individuals became able to identify their sperm donor, upon reaching the age of 18 (from this year, 2023). This was a result of studies which acknowledged the need for individuals to know the identity of their biological parents and which followed up the International Convention on the Rights of the Child, adopted by the UN General assembly in 1990. This shift from anonymous to open identity sperm donors has been replicated in other countries, nearly always with limits placed on the number of times a particular donor sperm can be used. In the UK, this is 10. In the Netherlands, this is 25. 7 For the genuine sperm donor and child relationship open identity is seen as a very positive circumstance. Donors are on a registry that can be accessed by the child via the HFEA, if wanted, and many people find surety in knowing their biological as well as their social father. More difficulty arises in cases of fertility fraud, where a quest to find the biological parent has often resulted in the discovery of many half siblings. The psychological and social effects on the individual are rarely taken into proper consideration and indeed, as these situations evolve, are probably not yet fully understood. There is in fact no evidence for the choice of this number relating to how many times a donor can be used and the number chosen by each country is arbitrary. 8

The primary concern seems to be the possibility of genetic disorder, which though significant is in fact less than that of a first cousin mating (taboo in many countries but not the UK or indeed to Charles Darwin himself) but in our view, more concerning is the psycho-social impact of such a large number of siblings on the individual, which after all, is unprecedented in any human society.

DNA testing technology using broad brush ancestry services (Direct to Consumer) has enabled half siblings to discover not only anonymous biological fathers, but possible other half-siblings – the use of a precision DNA test to determine the true family relationship (always recommended) enables this to be confirmed with a reliable statistical probability. 9 Data indicates that from use of these tests, the discovery of nonparent expected (NPE) events (that one or more parent is not biological) ranges from 4-12 %. Whilst there are of course other explanations, one of these is that social parents have not discussed with the child the circumstances of their conception. The evidence suggests 10 that donor conceived children often have difficulty (often seeking help) coming to terms with; a) the nature of their conception, b) the efforts to find a biological parent and c) their reaction upon hearing about it. This is particularly acute if they discover that the father has sired many children.

Regarding consent, then the DNA testing technology that is now available for tracing biological relatives was not available when many of the donor conceived children were actually conceived. As we know it now, informed consent would have been impossible at that time and many of the issues since raised are very new to science, society and law. Genetic technology is changing fast and information is coming to light so quickly, that it is impossible to give informed consent in the present (informed consent has only even been relevant in the precise time window it is given, and can only

be based on the state of knowledge at that precise time). By sequencing individual human genomes, we can reveal information relating to genetic disease that was unknown; sometimes these are late onset disorders and/or could not be known or predicted at the time of conception. Other times, we (or more specifically the direct to consumer client) will have the genetic information and either not know or be in a position to know how it relates to disease or the prediction of characteristics. The fact is of course, that we are all genetically pre-disposed to something, as much as we can be genetically protected from the very same things.

Donor conception is a delight to many – but the emergence of fertility fraud has raised several important questions, for which there are simply not enough informed counsellors. Maybe, given the vast data sources, artificial intelligence

(AI), has a role to play in AI after all.

About the author:

Dr Neil Sullivan , BSc, MBA (DIC), LLM, PhD is General Manager of Complement Genomics Ltd (trading as Dadcheck®gold).

Complement Genomics Ltd (trading as Dadcheck®) is accredited by the Ministry of Justice as a body that may carry out parentage tests directed by the civil courts in England and Wales under section 20 of the Family Law Reform Act 1969.

Please see: https://dadcheckgold.com

Tel: 0191 543 6334

e-mail: sales@dadcheckgold.com

Notes

1https://www.hfea.gov.uk/about-us/

publications/research-and-data/ trends-in-egg-sperm-and-embryodonation-2020/

2https://www.hfea.gov.uk/choosea-clinic/consent-to-treatment-andstorage/

3https://nltimes.nl/2023/04/28/courtorders-sperm-donor-550-kids-stop

4https://www.theguardian.com/ science/2018/nov/24/sperm-donorman-who-fathered-200-children

5https://www.nbcbayarea.com/ investigations/doctor-sperm-donorcases-fertility/3148093/

6https://www.netflix.com/gb/ title/81227735 ; https://donordeceived. org/

7https://doi.org/10.1016/j. fertnstert.2007.06.020

8doi:10.1093/humrep/deq038

9https://dadchecksilver.com/siblingtests/

10https://bioethics.hms.harvard.edu/ journal/donor-technology

The SRA has recently published new case studies to help law firms remain compliant with the SRA Accounts Rule 3.3. This rule states that solicitors cannot provide banking facilities to clients or third parties and that there must be proper connection between client funds held and the delivery of regulated services. This update reaffirms the SRA’s focus on this rule and how seriously they view the provision of banking facilities. We summarise each of the additional case studies and provide action points.

Where the conditions of a mortgage offer require other debts to be settled before the balance is released to the borrower, there would not be a breach of rule 3.3, provided the conditions are detailed specifically.

This example is where a firm is providing advice in relation to Stamp Duty Land Tax (SDLT) but did not act for the property purchase. The client wants to forward the tax payable to the firm for onward payment to HMRC on their behalf. The conclusion is that this is a breach of rule 3.3 as there is no obvious reason for the money to pass through the firm’s client account and it’s not directly related to the advice being provided.

on the parent’s matter to cover the firm’s fees on the child’s matter, there is no breach of rule 3.3, so long as there are no other red flags as outlined in the warning notice.

Where a retention is held as part of a conveyancing matter, there shouldn’t be a breach of rule 3.3. Ordinarily, the money for a retention would not be required to be held for long, although the SRA acknowledges there are instances where it will take longer. In those instances, firms are advised to review the need to hold the retention on a regular basis so that funds are not held for longer than necessary.

Action points:

• It’s important to remember that each matter should be reviewed on an individual basis and firms should consider the circumstances unique to that case in detail. Matters should not be “shoehorned” into one of the case study examples where the underlying facts are different.

• Make sure that you continually question why you’re being asked to receive or send funds and how this is related to the services provided.

• Ensure your teams are sufficiently trained on the requirements of the rules and know who to approach if they have a query in relation to compliance.

• Make sure sufficient notes are kept on file of any judgement reached.

If you have any queries in relation to the SRA Accounts Rules, please reach out to our Legal accounting team. We would be delighted to assist you. Call 0330 024 0888 or email enquiry@larking-gowen.co.uk

This case describes a situation where net sale proceeds have not been distributed as an agreement between the parties is yet to be reached. In the absence of a court order, the SRA don’t consider there to be a breach of rule 3.3 and the firm can retain the funds. Where a solicitor is asked to settle a debt to a third party from the net sale proceeds and there is no court order, again, the SRA would not consider a payment a breach of rule 3.3. However, they do expect firms to be mindful of their professional obligations and make sure that:

• The payment is in respect of an existing debt which would be taken into account in the resolution of the ancillary proceedings.

• The firm has the written consent of both of their respective solicitors.

• The firm is satisfied that this is not an insolvency situation risking the preferential treatment of one creditor over others.

This example is where a firm has acted on a matter for a parent, and their child has instructed another solicitor in the firm to act on an unassociated matter. If money is retained

Ellis Lake