TO INSPIRE TO PROMOTE TO LEADSUPPORTING SOLICITORS IN SOLE PRACTICE

Top

Table

5th April 2025

IN THIS ISSUE:

To prenup or not to prenup - is that the question?

“Spotlight” on Robin Tilbrook

Top Table - Update

Top

5th April 2025

IN THIS ISSUE:

To prenup or not to prenup - is that the question?

“Spotlight” on Robin Tilbrook

Top Table - Update

Last year’s event was a resounding success, providing exceptional opportunity for engagement, networking, and professional development, bringing together a diverse group of professionals from across the legal industry. Attendees had the chance to:

• Engage with Regulators and Industry Leaders: The event featured insightful discussions and presentations from top regulatory and industry leaders, providing valuable perspectives on current trends and future developments.

• Network with Peers: The event facilitated meaningful connections among attendees, fostering a collaborative environment for sharing ideas and best practices.

• Enjoy a Luxurious Experience: Held at a prestigious venue, the event offered a perfect blend of professional enrichment and luxurious comfort.

For next year's event we are returning to the exquisite Hanbury Manor, a premier venue known for its elegance and sophistication. Nestled in the heart of the countryside, Hanbury Manor offers:

• Stunning Surroundings: The venue boasts beautiful gardens and scenic views, providing a serene backdrop for the event.

• Luxurious Amenities: Attendees can enjoy topnotch facilities, including fine dining, a worldclass spa, and comfortable accommodations.

• Historic Charm: With its rich history and classic architecture, Hanbury Manor offers a unique and memorable setting for our event.

The SPG Top Table event provides our members with an unparalleled opportunity to engage with key figures in the legal industry. Attendees will have the chance to:

• Engage in thought-provoking discussions and Q&A sessions with regulatory and industry leaders.

• Learn about the latest developments and trends in the legal field, and how they may impact your practice.

Due to feedback from our members and the substantial increase levied for the Compensation fund levy we have postponed the upcoming SPG Top Table event, set to take place in November 2024, to Saturday 5th April 2025 at the luxurious Hanbury Manor and tickets continue to be on sale.

• Connect with peers and leaders, fostering relationships that can benefit your professional growth.

We are pleased to offer inclusive ticket options for SPG members and their guests:

• Member Tickets: SPG members can purchase tickets at a special rate, ensuring that our valued members have the opportunity to attend this premier event.

• Guest Tickets: Members are encouraged to bring guests, who can also enjoy the event at a discounted rate. This is a great opportunity to introduce colleagues and friends to the benefits of SPG membership.

Don't miss out on this exceptional opportunity to engage with industry leaders, expand your network, and enjoy a luxurious experience at Hanbury Manor. Secure your tickets today and be part of an event that promises to be both professionally enriching and personally enjoyable. I and the Executive Committee look forward to welcoming you to the SPG Top Table event at Hanbury Manor!

Engagement with Regulators and the Profession I and the Executive Committee would like to congratulate Anna Bradley on the renewal of her term as Chair of the SRA.

We continue to engage with our Regulators on issues concerning our members. Our SPG Sub Committee, chaired by Chaman Balu meet and engage with the SRA, on a regular basis, the last meeting being in Birmingham on 4 September 2024. Issues discussed include the unregulated sector, the need to increase consumer protections, the changes to the Compensation Fund Levy.

I, along with our Vice Chair Rahil Chaudhari attended a lunch meeting in August with Liz Rosser, SRA Executive Director, Operations and

Resources at which members concerns were discussed.

I am met with both the Alan Kershaw Chair of the Legal Services Board, and Matthew Hill, the new Chief Executive of the Legal Services Board in September 2024 to discuss the unregulated sector, the unlimited fines issue and the increased Compensation fund levy.

Rahil Chaudhari is our Vice-Chair and the Regional Groups & Associations Officer. We want to ensure that our members' voices are heard, and their needs are addressed effectively. Rahil continues to implement changes to enhance member engagement and participation, including increasing our social media presence.

The SPG Executive Committee have started holding their Executive meetings in the different regions and will invite members to attend both the meeting and the dinner afterwards.

We continue to maintain contact with our members via Mail Chimp notifying you of seminars, consultations and other items that may be of interest you.

The SPG website’s members private interactive forum is live and can be accessed here spg.uk.com/forum. As it is a private member only forum, you will need to first register to access it. Members can engage with each other and access useful information in their areas of practice as well as other areas.

Joanna Connolly SPG Chair

Congratulations to Rahil Chaudhari, who is adding another string to his SPG Executive Committee bow, by taking on the role of Managing Editor of the SPG Solo magazine.

Rahil is already an active member of the SPG Executive Team, being Vice Chair, Regional Groups Co-ordinator, and Social Media & Communications Officer. Bringing experience and enthusiasm to this new position, we know he will excel in this new role, and he is looking forward to the challenges this will present.

“Rahil is very interested in hearing from all the members if there are any regular sections that

Following on to the SPG events questionnaire recently sent out, we wish to inform you that due to feedback from our members in response, the date of the next SPG Top Table event has been changed. Members requested a change of date because of the increase in Practising Certificate fees. The new date for

the Top Table is the 5th April 2025. The venue will remain unchanged, and still be held at Hanbury Manor Hotel in Ware, Hertfordshire.

Tickets are continuing to be sold on the Eventbrite website, and if you have already purchased a ticket, it will still be valid for the

Every SPG event is attended by some amazing people, whether they be speakers, members, or guests. This year’s annual conference was no different, but there was one woman who really made an impression on me, and I found her very inspirational.

The lovely woman I met was Nisha Balu, although Nisha was born with intellectual difficulties, this did not stop her from becoming an Olympic Gold Medal Champion in the Special Olympics!

they would like us to look at including, if so, send any suggestions you may have to sheila@spgevents.co.uk.”

SPG Executive Committee

2025 Top Table event. If for any reason you are unable to attend on the day of the new event date, a full refund will be issued upon request. To claim your refund, kindly get in touch with Sheila, by sending an email to sheila@spgevents.co.uk, who will ensure that your refund is issued.

SPG Events Team

Nisha now 40 has been in competitive sport since the age of 17 until she retired in 2009. Nisha’s first Special Olympic Games took place in Dublin in 2003 where she won Gold for Team GB in Basketball, in subsequent games Nisha won a Silver and Bronze medal. Although, now retired she continues to be an active athlete and plays Rugby at Worcester Warriors.

The first Special Olympic games was held in 1968 and was founded by Eunice Kennedy Shriver, sister of President John Kennedy. Why? - because Eunice believed in justice, and she could see how unjustly & unfairly people with intellectual disabilities were treated.

Sheila Mann Editorial Team

JOANNA CONNOLLY

Chair

Joanna is well known as an expert in the complex field of consumer credit law. She is a Solicitor Advocate and qualified to represent clients in the Higher Courts. Joanna’s experience and passion for helping people is reflected in her exceptionally high success rate. Joanna and her team run a thriving practice dealing with clients from all over the country. Hers is the ‘go-to’ consumer credit defence firm in the UK.

Tel: 0330 053 9340

Email: joanna@spg.uk.com

Joanna Connolly Solicitors

33 Cheadle Avenue • Liverpool • L13 3AE

RAHIL CHAUDHARI

Vice-Chair, Regional Groups & Associations Officer & Communications & Media Officer

Rahil Chaudhari is a Senior Solicitor at Arlingsworth Solicitors. Rahil secured an LLM at University College London and trained and worked at some of the most prestigious law firms in the City before joining Arlingsworth in 2005. Rahil is a highly experienced and versatile solicitor and specialises predominantly in immigration, human rights and company law. Rahil has become a leading authority in these areas, his client base spans a wide range of sectors from multinational companies to private individuals.

Tel: 01273 696 962

Email: rahil@spg.uk.com

Arlingsworth Solicitors Ltd

145 Islingword Road • Brighton East Sussex • BN2 9SH

TAHIRA SHAFFI

Honorary Secretary

Tahira has been qualified for 20 years and started as a sole practitioner in 2010 after being made redundant. Working on your own can be a lonely experience but she has found the SPG to be wonderful source of support and friendship. It is important for her that there is an independent body outside of the Law Society working hard to look after its members interests. Tahira is based in Bury, Greater Manchester where she lives with her family. She has many interests outside of the law. Tahira was previously an LEA school governor and has stood as a candidate in the local elections. She is passionate about civic duty and putting something back into the community.

Tel: 0161 222 6092

Email: tahira@spg.uk.com

Mikhael Law

197 Rochdale Road • Bury • Lancs • Bl9 7BB

PENNY RABY

Honorary Treasurer

Penny has been a SP specialising in family law for 20 years, working with her husband Mike a Forensic Accountant on divorce cases involving business and complex asset and income tracing and Inheritance Act disputes. She won Worcestershire Family Lawyer of the Year award in 2014 and was nominated for the National Family Law Magazine Family Law Firm of the Year for 2015. She has appeared on radio and television and has presented her networking pantomime ‘Snow White and the Seven Small Business People‘ here and abroad.

Tel: 01386 555 114

Email: penny@spg.uk.com

Penny Raby & Co

Harmony House • 7-9 Church Street

Pershore • Worcestershire • WR10 1DT

Executive Committee Member

Having qualified as a solicitor in India in 1983, after settling in England and running a grocery shop, I found myself wanting to go back to what I had studied so hard for at Punjab University Chandigarh. In 1993, I joined Staffordshire University Law School. In 1996 I completed my CPE, it took a further few years before I found a firm that would give me the opportunity to complete my articles and I qualified as a solicitor in 2004. I finally became self-employed in 2005, and since then, I have gone on to expand the firm, this has also enabled me to allow other solicitors to train with CLB Lawyers. Our main areas of work are Residential Conveyancing, Wills, Probate, Commercial Property leases, buying and selling Business, our work is all private client based.

Tel: 01384 451731

Email: chaman@spg.uk.com CLB Lawyers

208 Wolverhampton Street • Dudley • DY1 1ED

To prevent a claim arising in respect of the validity of a will, firms must exercise vigilance to ensure any drafted wills are witnessed in accordance with the relevant legislation.

Background – legislation on video witnessing Introduced in September 2020, the amendment to the Wills Act 1837 specified that where wills must be signed in the presence of at least two witnesses, their presence can be physical or virtual. It provided a temporary measure to accommodate social distancing and lockdown restrictions during the COVID-19 pandemic. The amendment was backdated to 01 January 2020 and applied for two years, before it was later extended until 31 January 2024.

For law firms, the adoption of video or remote witnessing had presented both opportunities and challenges. On one hand, it expanded their capacity to serve clients remotely, facilitating greater flexibility and accessibility. Law firms could reach clients who were unable or reluctant to visit offices in person, thus broadening their client base and enhancing overall service delivery and allowing the most vulnerable access to legal services.

Conversely, the reliance on video witnessing introduced complexities and risks. Ensuring compliance with evolving regulations and maintaining the integrity of the witnessing process posed inherent challenges and many practitioners raised concerns that videowitnessing allows for a higher risk of creating fraudulent or forged wills and an increase in undue influence being exerted. Law firms navigated technical issues, such as verifying

Following the end to the temporary legislation on video witnessing, wills witnessed after 31 January 2024 will no longer be valid if they are witnessed remotely. This transition carries profound implications for law firms and the broader legal sector, particularly concerning claims and notifications related to wills.

the identity of participants and preserving the evidentiary value of video recordings, to uphold the validity of wills executed remotely.

Implications of the transition

With the expiration of pandemic restrictions and emergency measures on 31 January 2024, the legal sector will revert to pre-pandemic requirements for will execution. This shift heralds the end of widespread video witnessing practices within the legal sector.

The return to conventional witnessing methods may streamline procedural formalities. However, it also raises concerns regarding access to legal services and the potential for increased legal disputes over matters including authenticity, undue influence, or testamentary capacity.

Clients may seek guidance on the implications of reverting to conventional witnessing practices, particularly regarding the validity of existing wills and the necessity for revisions.

For law firms, the end of video witnessing represents a crucial juncture to review and validate wills executed remotely during the pandemic. Moreover, firms must remain vigilant in addressing any discrepancies or challenges arising from wills previously executed via video conferencing. Particularly where the capacity of the testator is a concern, there is a risk of undue influence and the creation of fraudulent or forged wills.

To mitigate against potential claims and notifications associated with wills, thorough documentation and due diligence in will execution processes are essential.

Further reforms on making a will.

Despite the end to the temporary legislation, there may yet be a future for electronic wills. In late 2023, the Law Commission consulted on proposals to reform the law on making a will, to enable electronic wills.

The consultation covered questions on:

• Whether electronic wills could, or should, be able to comply with the formal requirements for a valid will.

• Whether, and how, it should be possible for wills to be executed or made using electronic means.

• Whether wills should be able to be stored and admitted to probate solely as electronic documents.

The Law Commission is expected to publish its final report and draft bill in early 2025.

Conclusion

With the era of COVID-induced video witnessing having drawn to a close, the legal sector faces a period of transition and adaptation. Law firms must recalibrate their practices to align with evolving regulatory frameworks and client expectations. While the end of video witnessing may restore procedural norms, it also underscores the enduring importance of legal expertise in safeguarding the interests of clients and upholding the integrity of testamentary instruments.

Danny Seaman Vice President - Lockton Solicitors

Lockton Solicitors spg@lockton.com

0330 123 3870

Dear Members,

I hope this message finds you well. As the Honorary Secretary of the Solicitors Sole Practitioners Group (SPG), I’m pleased to update you on some key developments and invite you to actively engage with our community.

Following the success of our annual conference in Istanbul this past June, we are already looking ahead to next year’s event. To ensure that the 2025 conference meets your expectations and needs, we have circulated a survey seeking your feedback on potential locations and other aspects of the event. Your input is invaluable in making the conference as relevant and engaging as possible, so please take a moment to share your thoughts. If you have ideas or suggestions, please reach out to our Conference Team, and email your ideas to sheila@spgevents.co.uk

We also have Top Table coming up in April 2025, if you have missed attending the Summer Conference, please attend our valuable Top Table Event, to be held at Hanbury Manor on 5th April 2025.

The SPG remains committed to advocating for the interests of sole practitioners across England and Wales. We are in ongoing discussions with the Solicitors Regulation Authority (SRA) regarding the recent increase in regulatory fees, as well as with other legal organisations, to address the broader impact on our members. Our Chair, Jo Connolly, is doing a stellar job representing our position as the voice of sole practitioners, and she will provide further updates soon.

Recent reports on legal trends have highlighted both opportunities and challenges for sole practitioners. Despite a general decline in billable hours, sole practitioners are actually billing and collecting more than ever before. However, despite this challenges such as realisation and collection rates remain a struggle for many practitioners. Realisation rates refer to the percentage of billable work that is actually invoiced, while collection rates refer to the percentage of invoiced work that gets paid. While there has been some improvement, many solo practitioners continue to struggle with ensuring that the work they do is billed and paid for in a timely manner.

Addressing these issues is essential for maintaining the financial health of our practices.

After Recognising the potential missed opportunity in connecting and relating to our members, The SPG are continuing to build their online presence and are very active across the social media platforms.

Our goal was to enhance visibility through platforms such as LinkedIn, Facebook, Instagram, and TikTok, in addition to our regular communication through Mailchimp. The SPG is active on the following accounts and if you wish to follow the SPG, we can be found on:

Facebook: www.facebook.com/profile. php?id=61565041620065

Instagram: www.instagram.com/spg. solepractitionersgroup/

TikTok: www.tiktok.com/@ solepractitionersgroup

LinkedIn: www.linkedin.com/company/thesolicitors-sole-practitioners-group/

Using online payment systems has been shown to significantly reduce the time it takes to collect payments, which could help practitioners increase their collection rates and overall financial stability.

It would be good to learn from members if this is something that affecting them and how they are overcoming these issues. Share your thoughts on our members forum: spg.uk.com/forum.

Strengthening Member Connections: Regional Groups

Our Regional Groups play a vital role in connecting members and facilitating communication within our community. These groups are an excellent platform for sharing experiences and raising issues that matter to you. If you would like to learn more about existing Regional Groups or are interested in establishing one in your area, please reach out to our Vice Chair and Head of Regions, Rahil Chaudhary.

We are eager to hear from you - whether it’s about next year’s conference, regional group activities, or any other concerns or ideas you may have. Let’s continue to work together to make the SPG a strong and supportive network for all sole practitioners.

Best regards,

Tahira Shaffi

Honorary Secretary,

Solicitors Sole Practitioners Group (SPG)

Your support in the upcoming year, will be most appreciated, by liking and sharing our posts and videos, so that we can effectively reach our members, increase SPG visibility and hopefully our membership.

In financial proceedings in divorce in England and Wales there is an absolute rule of comprehensive and ongoing disclosure of finances so that it is possible to negotiate a settlement or make an order after trial in the full knowledge of the financial circumstances of both parties.

Unfortunately, this rule is frequently breached, and in particular by sins of omission. Assets and investments are conveniently forgotten and omitted from the comprehensive disclosure required in Form E and filed at court and exchanged between husband and wife’s solicitors.

If one party has obtained evidence which proves this misleading disclosure, most clients expect that this would be a vital element to produce to the court to prove their case.

For many years there was a way to achieve this under the rules in the case of Hildebrand v Hilderbrand (1992) 1 FLR 244, where a husband who found and copied to the wife’s solicitors some of her private information he had uncovered which established that his wife was not telling the whole truth, was permitted to use it in his case before the court

However, in the case of Tchenguiz and ors v Imerman (2010) 2 FLR 814, the court took a different view.

Here, the wife’s brother worked in the same office as the husband and downloaded millions of pages from the husband’s private laptop.

After several hearings, the Court of Appeal ruled that she was not allowed to use the documents at trial and must return all to the husband’s solicitor as the husband was entitled to privacy as his human right even in divorce proceedings.

This was seen as a Cheat’s Charter - how else could the deceived party prove their case?

Fortunately, the more recent case of Arbili v Arbili (2016) FLR 413 heard in the Court of Appeal in 2015, has clarified and softened the Imerman ruling. THE CORRECT PROCEDURE NOW IS:1 THE IMERMAN DOCUMENTS MUST BE RETURNED TO THEIR OWNER.

2 THE OWNER’S DISCLOSURE OBLIGATION IS TRIGGERED BY THAT RETURN. 3 THE SPOUSE WHO WRONGLY OBTAINED THE DOCUMENT IS ENTITLED TO RELY ON THEIR RECOLLECTION OF THEIR CONTENTS.

This means that the owner should return to the finders any documents relevant to their disclosure of finances after the finder returns the documents to them. The question of whether this can be enforced by the finder remains open – watch this space for the result of my ongoing application!

If not successful, my client can still have the owner cross examined on the details she remembers from the documents found.

Not a complete win for the cheated spouse, but definitely a step forward from Imerman.

If your client feels their spouse is hiding assets – we have great experience in such cases, which are generally solved by scrupulous analysis of bank statements and business accounts records by our resident two accountants.

Happy to act as consultants or sub-contractors on cases.

Penny Raby & Co Specialists in complex divorce.

Business plan and budget 24/25 consultation

The SRA gave an update on their 2024-25 Business Plan and Budget. It will take them through the second year of their 2023-26 Corporate Strategy. It includes details of the SRA proportion of the practising certificate fee and sets out compensation fund contributions for 24/25.

They propose that the SRA proportion of the practising certificate fee is held at the same level as this year – £162 per person. They have set out that contributions to the SRA Compensation Fund from both firms and individuals will need to rise for the first time in five years:

• individual compensation fund contributions for next year will be £90 and £2,220 for firms.

This will allow fund reserves, significantly impacted by a substantial increase in the number of interventions and volume of claims over the past 18 months, to be rebuilt over the next two to three years.

It was explained that there has been a fall in the number of firms, so that has also not helped with compensation fund contributions.

A discussion was had around the split of the contributions between individuals and firms and about the impact on small firms of the increase. In terms of the 50/50 split between firms and individuals, they will continue with the current arrangements this year, but as part of the consumer protection review, they might be in a position to look at this and they are conscious of the impact that this increase might have on small firms.

The SRA have spoken with 150+ individuals through roundtables and discussions and that has included small firms and sole practitioners. They have heard that the majority support the principle of the fund: that the profession should pay collectively to ensure no consumer loses out due to dishonesty.

The SRA have also heard calls for better risk management. Consideration needs to be given to the practicalities of implementing policy

changes, including any impact on small firms. Feedback from SPG members has included that small firms are seen as riskier but sometimes unfairly so. The SRA have visited those firms that fell into ‘accumulator’ territory, and they had not found issues of specific concern at the firms visited so far.

Other suggestions have included that the SRA introduce restrictions on who can be a compliance officer, for example, or preventing the same person from being a compliance officer and a money laundering reporting officer (MLRO). They are conscious that some changes would be more challenging for smaller firms, and they will engage with the SPG throughout the process as the review develops. These are some of the many suggestions the SRA have heard from stakeholders. As yet nothing has been decided and they will be consulting formally in the autumn.

Warning notice: mass financial claims

The SRA updated that they had published a Warning Notice on 3 May to law firms working on financial compensation claims.

They are concerned about potential issues regarding firms getting proper instructions from clients/supervising staff in relation to financial services claims when part of high-volume/bulk claim processes involving multiple clients.

There is also concern that the sector may be facing a new surge in such complaints in light of reports of car finance being arranged at higher rates of interest than needed. Solicitors' obligations are very clear. They expect the profession to treat clients as individuals, not just a number within a group, and have issued various warning notices over the years – how mass claims are managed is a topic which regularly causes them, and other others such as the FCA concern.

• More information including guidance is available on the SRA website, and can be accessed on their website, using the following web address: www.sra.org.uk/solicitors/ guidance/claims-management-activity/

The SRA Chief Executive Paul Philip and Deputy Chief Executive Juliet Oliver gave evidence to the House of Lords Communications and Digital Committee on the issue of SLAPPs in May. They have also now made their first referrals to the Solicitors Disciplinary Tribunal (SDT) on SLAPPs cases.

The thematic review, published in April, looked at law firms understanding of best practice to avoid getting involved in SLAPP cases.

They found good overall awareness on the issues of SLAPPs amongst firms visited, and most firms were aware of the warning notice issued in 2022. The majority of firms visited were also found to be delivering a good standard of training on both SLAPPs and conduct in disputes to their fee earners.

Although they did identify some concerns around the lack of processes and controls regarding the use of third parties instructed by firms to work on their behalf. When instructing public relations companies or private investigators to work on a case, firms need to have checks and balances in place to make sure they are acting ethically and within the law.

In light of that, they have updated their warning notice (published 31 May). The updated notice:

• has further detail on the Government's definition of a SLAPP.

• builds on information gathered from their casework and thematic review.

• provides more detailed guidance and examples of circumstances in which they might take regulatory action, and also covers scenarios such as the contentious 'right to reply' process.

Over the summer the SRA would be consulting on their financial penalties’ framework. It will propose several changes. This will include updating guidance following the enactment of the Economic Crime and Corporate Transparency Act, and other amendments to reflect their experience of operating the current framework in practice since its implementation in May 2023.

The current framework has four fining bands (A-D), and they are proposing to add two new bands (E and F) for the most serious misconduct. They want to be clearer about when they would go above the current maximum of 5 per cent of income and use these additional bands.

The consultation will also consider if they should have minimum fines in place across all fining bands. The percentage-based system under the current framework means that some fines can be too low to act as a credible deterrent.

They are also seeking to change their approach to drink driving convictions and be very clear on how they approach these.

CH said a conversation with the SPG would be helpful ahead of the consultation launching.

Differing outcomes research

An update was given on the research commissioned through the University of Exeter to understand why minority ethnic students are more likely to have poorer outcomes than White candidates in legal professional assessments. The findings were published in June.

It was explained that this research was novel in investigating a broad range of factors, including how the workplace can affect education outcomes. Researchers also investigated how the different factors interact – for example, the overarching factors tend to be the resulting outcome of the other three set of factors; and these overarching factors are the key drivers of differential outcomes:

• pupils at independent schools generally have more exam preparation, and resources to develop skills that are valued in the profession, than state school pupils – which leads to greater confidence and self-efficacy in professional assessments.

• minority ethnic students tend to experience more discrimination and have more experiences of teachers having low expectations of them than white students have experienced – which creates a lower sense of belonging and creates additional challenges to maintaining the motivation and perseverance required to achieve high grades on professional assessments.

• minority ethnic LPC students were less likely than white students to have sponsorship for their studies from a law firm – which also

affected many of the overarching factors, for example by having less support from, and less interaction with, the profession.

The research is about recognising that there are several initiatives making a difference, and that it would be more effective to bring these together – the SRA are planning an event this autumn to unite stakeholders and will collaborate with stakeholders to create an action plan.

They also have an external reference group in place and will be meeting with them to get feedback and will meet law school heads (the Committee of Heads of University Law Schools, CHULS).

Wider conversation was had around the issues raised from the research, including around training opportunities and family support. The SPG suggested that we could provide an article in SOLO.

LegalEx 2024 is being held over 2 days at ExCeL London:

Wednesday 27th November 2024

09:30 - 17:00

Thursday 28th November 2024

09:30 - 16:30

There will be over 100 leading exhibitors, 30 plus expert speakers and 2000 plus visitors are expected, one of whom will be myself.

The Legal Industry as you well know, is wide-reaching and varied, and is constantly evolving. Not all legal firms and their staff will be at the same stage of adopting modern technologies and implementing new business protocols, and it's hard to keep up.

I find it invaluable attending, as I benefit from the expertise shared in the keynote sessions, connecting with other legal professionals through the unmatched networking opportunities, and discovering the latest cutting-edge technology suited for the modern hybrid-working environment.

LegalEx has something for everyone, and it is good for keeping you updated with the industry. I believe that LegalEx will help you run, grow and advance your legal practice by staying up to date with the ever-changing legal landscape. It will also give you the opportunity to network and share insights with peers to develop your knowledge and cultivate invaluable relationships.

Conference & Events

The County Court system in England has recently undergone significant changes aimed at improving the efficiency and effectiveness of mediation and case allocation. These changes are part of a broader effort to streamline court processes, reduce backlogs, and encourage alternative dispute resolution (ADR) methods. Below, we outline the key changes and their implications for litigants and legal practitioners.

One of the most notable changes is the increased emphasis on mediation as a preferred method of dispute resolution. The County Court now actively encourages parties to consider mediation at various stages of the litigation process. Key aspects of the new mediation procedures include:

• Mandatory Mediation Information Sessions: Parties are now required to attend mediation information sessions before proceeding to a full trial. These sessions aim to educate litigants about the benefits of mediation and how it can be a cost-effective and timely alternative to court proceedings.

• Court-Ordered Mediation: Judges have been given greater discretion to order mediation in appropriate cases. This means that even if one party is reluctant, the court can mandate mediation if it believes that it could lead to a resolution.

• Mediation Pilot Schemes: Several County Courts are participating in pilot schemes where mediation is integrated into the case management process. These pilots are designed to test the effectiveness of mandatory mediation and gather data on its impact on case outcomes and court resources.

The allocation of cases to different tracks (small claims, fast track, and multi-track) has also seen significant revisions. These changes aim to ensure that cases are handled by the most

appropriate track, thereby improving the efficiency of the court system. Key changes include:

• Revised Financial Thresholds:

The financial thresholds for each track have been adjusted to reflect current economic conditions. This ensures that more complex and higher-value cases are allocated to the appropriate track, where they can receive the necessary judicial attention.

• Streamlined Allocation Questionnaires: The allocation questionnaire process has been simplified to reduce administrative burdens on litigants and court staff. The new questionnaires are more user-friendly and designed to capture essential information more efficiently.

• Early Case Management Conferences:

For cases allocated to the fast track and multitrack, early case management conferences are now standard practice. These conferences allow judges to set clear timelines, identify key issues, and encourage ADR methods, including mediation, at an early stage.

The recent changes to mediation and case allocation procedures have several implications for those involved in County Court proceedings:

• Increased Use of ADR: Litigants should be prepared for a greater emphasis on mediation and other ADR methods. Engaging in mediation early can save time and costs associated with prolonged litigation.

• Preparation for Case Management: Legal practitioners need to be well-prepared

for early case management conferences. This includes having a clear understanding of the case issues, potential settlement options, and readiness to discuss ADR.

• Adapting to New Thresholds: Practitioners must be aware of the revised financial thresholds for case allocation to advise clients accurately on the likely track for their case and the associated procedural requirements.

The recent changes to the County Court's procedures in mediation and case allocation represent a significant shift towards more efficient and effective dispute resolution. By encouraging mediation and streamlining case allocation, the County Court aims to reduce backlogs, lower litigation costs, and provide quicker resolutions for litigants. Legal practitioners and litigants alike must adapt to these changes to navigate the new landscape of County Court proceedings successfully.

Joanna Connolly SPG Chair

Ever since the leading Supreme Court case of Radmacher v Granatino (2010) UKSC42, prenuptial arrangements have been given increasing weight in financial orders in divorce, in spite of the fact that they are not recognised by statute and the jurisdiction of the court cannot be excluded by any agreement.

This is not the same in most of Europe, where prenups have been binding for many years.

I recently had the opportunity to speak on a podcast for CostaWomen with a colleague Alex Radford, head of the Andalucian firm www.mylawyerinspain.com who was facing an interesting problem advising English clients wanting to buy a property in Spain and considering whether to register it in their adult children’s names.

They were concerned that this would give the children’s future spouses rights in the event of divorce, so Alex asked me to explain the position on prenuptial agreements in the law of England and Wales.

(Of course, post nuptial agreements are also possible, but far less likely as they would entail a spouse giving up rights they had already. And a difficult conversation if you wanted the marriage to continue!)

is that the question?

The Supreme Court in Radmacher supported the freedom of parties to determine their own division of assets, stating that nuptial agreements should be given ‘decisive weight’ unless the agreement itself is unfair – and it is the courts who determine what is considered ‘fair.’

So, the court has the last word - and this is even if the divorcing parties agree and file a draft order by consent. They will also have to file a D81 financial form, giving details of the parties’ finances as they will appear before and after any proposed settlement including earned, unearned income and pensions, the number of dependent children and with whom they will live, and any medical or other problems. The prenuptial agreement will also be included.

If the court decides the proposed agreement is unfair, they may ask for an explanation in writing, or a hearing before a judge.

So, it’s certainly not straightforward.

But even if the prenup is not accepted in full, it may well affect the final order because it must reflect the understanding and agreement of both spouses before they marry.

And if you don’t have one, it certainly won’t work!

So, what can you do to strengthen the agreement so that it has the best chance of holding in the event of divorce?

1. Financial disclosure

This does not have to be as comprehensive as in divorce but must give a realistic picture of each party’s wealth (or lack of it). So, for instance, omitting any mention of substantial business assets and investments would be prejudicial to enforcement.

2. Timing

Many cases of prenups being presented on the eve of a wedding have been thrown out. The negotiations should start at least 3 months before the wedding so that disclosure and advice on terms and drafting may be taken with a view to finalising the prenup at least one month before the ceremony.

3. Legal Advice

Both parties must have equal opportunity to take independent legal advice, which in practice frequently means that the more wealthy party has to pay for their poorer betrothed. This is well worth the expense as it can protect both in the event of a dispute.

4. Duress

Any suggestion of duress must be avoided - e.g. using only one solicitor paid by the wealthier party. Though it is not necessarily duress to simply say that there will be no marriage without a prenup.

5. Cover all bases

Try to cover predictable potential issues such as children, housing, illness, parental care duties, animals, inheritances and provide a date for a review if both parties agree. Circumstances change and what seems fair now can easily look unfair in 5 or 10 years.

6. Fairness

This is the overriding principle of our matrimonial law. If it doesn’t look fair, it won’t hold.

So, the bottom line is - Prenuptial Agreements are increasingly useful in deciding financial orders in divorce, if they are drafted correctly and observe the above advice.

The podcast referred to will also shortly appear on the SPG website

Memories of the fabulous SPG 2024 Conference held in Istanbul this year

The Solicitors Regulation Authority (SRA) has recently announced significant changes to the contributions required for the Compensation Fund. These changes include a substantial increase in the contributions from individual solicitors and law firms holding client accounts. Additionally, the Legal Services Board (LSB) has extended the approval period for these changes, which may have implications for the SRA, particularly during the practising certificate renewal period. This article will discuss these changes in detail and analyse their impact on different categories of law firms.

The SRA has increased the annual contributions to the Compensation Fund as follows:

• Individual Solicitors:

The contribution has increased from £30 to £90.

• Law Firms Holding Client Accounts:

The contribution has increased from £660 to £2,220.

These increases are aimed at ensuring the Compensation Fund remains adequately funded to protect clients who suffer financial loss due to a solicitor's dishonesty or failure to account for client money.

The Legal Services Board (LSB) has extended the approval period for changes to the Compensation Fund contributions from 28 days to 90 days. This extension allows for a more thorough review process but also introduces potential timing challenges, especially given the practising certificate renewal period from 1 to 31 October.

• Impact on the SRA:

The extended approval period means that the SRA must plan and submit proposed changes well in advance to ensure they are approved in time for the practising certificate renewal period. Any delays in approval could disrupt the renewal process and create uncertainty for solicitors and law firms.

The arbitrary increase in Compensation Fund contributions will have varying impacts on different categories of law firms, including magic circle firms, high street firms, and sole practitioners.

• Magic Circle Firms:

These large, prestigious firms typically have substantial financial resources and a high volume of client transactions. While the increased contributions represent a higher absolute cost for them due to the number of solicitors they employ whose licensing fees they pay, these firms are likely to absorb the increase without significant financial strain. However, they may pass on some of the costs to clients through higher fees.

• High Street Firms:

These firms, which often serve local communities and handle a mix of personal and small business legal matters, may find the increased contributions more challenging. The higher costs could impact their profitability, especially if they operate on thinner margins. High street firms may need to adjust their pricing strategies or find efficiencies to offset the increased contributions for each of the solicitors they employ where the pay the fees in addition to the increased contribution for holding a client account.

• Sole Practitioners: Sole practitioners, who operate independently, are likely to feel the impact of the increased contributions most acutely.

With limited resources and lower transaction volumes, the higher contributions could represent a significant financial burden. Sole practitioners may need to reconsider their business models, potentially increasing fees or reducing overheads to manage the additional costs.

The recent changes to the SRA Compensation Fund contributions represent a significant increase in costs for individual solicitors and law firms holding client accounts. While the Legal Services Board's extended approval period allows for a more thorough review, it also introduces potential timing challenges for the SRA, particularly during the practising certificate renewal period. The impact of these changes will vary across different categories of law firms, with sole practitioners likely to be the most affected. As the legal profession adapts to these changes, it will be important for firms to carefully manage their financial planning and client relationships to mitigate the impact of the increased contributions.

Joanna Connolly SPG Chair

An interesting article I came across the other day, written by Beth Cooper of Interlink Recruitment, it highlights a few simple ways we can all take the initiative in becoming more sustainable within the work environment.

Sustainable?

In the current climate, environmental sustainability is a pressing issue in our everyday life – and this must be reflected in the way the corporate world maps its carbon footprint.

Sustainability must be embedded within the heart of a law firm to ensure that it can maintain a low carbon business model to do its part in saving the planet (and money!). It also improves the firm's corporate image in the public eye because who wouldn’t want to work for a sustainable law firm?

There are many ways law firms can become more sustainable, as the world strives to reduce its carbon footprint. These include:

Law firms can reduce their carbon footprint by rethinking their modes of travel for employees. For instance, a business class flight from London to New York produces 2930kg of carbon dioxide emissions – and that’s just for a one-way ticket. This has the same carbon footprint as approximately 35,732 plastic water bottles. One up-side to the pandemic has been that businesses are now conducting meetings over video chat, as opposed to meeting in person, and studies have shown how this can help to reduce carbon emissions by 94%.

Law firms and corporate businesses in general should also be shifting their focus to their resource usage. The language understood best by business is money, and to conserve money and energy usage, companies should look to switch to a green energy provider. Doing so would provide an inexhaustible source of energy, and promote cleaner air, in a step towards netzero emissions (whilst also generating good PR for the business).

Another example of conserving energy in the office would include having motion sensored lights with LED bulbs, as this ensures that energy from the bulbs is only being used at necessary times within the day in specific areas of the office. Likewise, having a paperless office ensures that paper waste remains at a minimum. This is beneficial for corporate companies as everything can be stored on a hard drive to prevent important files from being lost and they can be accessed by everyone in the team.

Over 90 law firms in the UK have signed up to the LSA, to manage and measure their carbon emissions, committing to becoming net-zero. The LSA was founded in 2007 and is chaired by Caroline May (Norton Rose) and Matt Sparkes (Linklaters), who set out to encourage firms to hit a target of 100% renewable energy sources by 2025. They provide firms with a strategic, science-based intervention, working in partnership with Carbon Intelligence to aid in reducing their emissions.

As the corporate market continues to rapidly increase, it is important that companies in high growth areas with high volumes of employees contribute towards the global target of reducing carbon footprints to set examples to smaller companies and work together to save the planet.

Currently here at Interlink, we have made some small but significant steps to become more sustainable as a business. We have converted to a paperless system and installed energy saving lights to reduce wastage, in addition to recycling our old computer equipment to those in need of better resources. However, there is still more we all can do!

Beth Cooper Interlink Recruitment

£425,000

In February 2018 taxi driver Ashgar Bostan was jailed for 9 years at Sheffield Crown Court for raping “LIZ”*, a Rotherham girl who was 14 at the time. In a statement to the court, LIZ has said that her childhood and teenage years were “destroyed” by Bostan and that her dreams of a normal adult life were wrecked by the damage which he had done to her.

Mr Bostan’s criminality was not severely punished and served just half of his 9-year sentence, partly in the comfort of an open prison.

Now the High Court has given Judgment in tort of a massive £425, 924.09 in damages to “LIZ” after she took ground-breaking civil action against Bostan. It also made a pre-action Anonymity Order that she should be known as “LIZ” and a Freezing Order. She was represented by sole practitioner, Robin Tilbrook, of Tilbrook’s Solicitors.

LIZ said, “With the help of my friends at Hearts of Oak and other supporters like Jayne Senior,

and my solicitor Robin Tilbrook, I sued my rapist Bostan to at last get some real justice,” said LIZ. She also obtained a pre-action Freezing Order. “Lord Pearson and Lord Vinson raised the money for the case, and I can’t thank them and their friends enough.”

“But I also did it to show that, having been badly let down by South Yorkshire Police and by Rotherham Council, we survivors can take things into our own hands and fight back for real justice,” she said.

Baroness Cox, Secretary of the All-Party Parliamentary Group on Honour Based Abuse

said “I have met with many grooming gang survivors over the years, and I am delighted that LIZ has been awarded this financial justice. Her great legal victory should bring hope to many other survivors.”

Peter McIlvenna, director of the Free Speech Campaign Group ‘Hearts of Oak,’ said: “LIZ has been admirably courageous to see the legal process through to this victory.”

“Other grooming gang survivors should take heart from her success and contact us at Hearts of Oak,” said Peter. “We would like her ground-breaking civil action to be just the start of a wider campaign to

get compensation for more victims and to punish more grooming gang rapists where it hurts.”

LIZ has since also obtained a High Court Charging Order on her grooming gang rapist Asghar Bostan’s Rotherham home in preparation for the forced sale of the property.

“Bostan has failed to pay the damages, so we are doing what is necessary to seize his assets including his home in Rotherham,” said LIZ.

LIZ has been personally supported by campaigners Hearts of Oak, acted for, and advised on the court action by sole practitioner solicitor Robin Tilbrook of Tilbrook’s Solicitors and backed by a group of funders led by Lords Pearson of Rannoch and Vinson of Roddam Dene.

“It has been an honour to get to know LIZ throughout this process,” said Lord Pearson.

“She is an example to us all on how to seize victory from a harrowing situation. I’m delighted that we are now seeing the enforcement of the judge’s financial award which will provide some financial stability and security for LIZ.”

As a result of her successful court action, LIZ was invited to meet Prime Minister Rishi Sunak and former Home Secretary Suella Braverman in Manchester last year. They warmly congratulated her and listened to her experiences and her views on how to tackle the nationwide grooming gang scandal.

“I not only want to penalise Bostan big-time for wrecking my life when I was a vulnerable underage girl,” said LIZ, “but I also want to encourage and inspire other grooming gang survivors to take action against their rapists.

“After years of deliberate and disgusting neglect

by politically correct local authorities and police, survivors can now fight back for themselves,” continued LIZ. “If they want help to do so they should contact me via Hearts of Oak.”

Queries and Contact:

For queries and also for interviews with “LIZ”: call Peter McIlvenna of Hearts of Oak on 07467 739 013 or email media@heartsofoak.org

LIZ has written a book telling her story which is titled “Snatched: Trapped by a Woman to Be Sold to Men. My True Story.” Elizabeth Harper. 0008503214.

Robin Tilbrook Tilbrook’s Quires Green, Willingale, Ongar, Essex, CM5 0QP

Tel: 01277 896000

Email: robintilbrook@aol.com

The Executive Committee would like to say a huge THANK YOU to all the members that donated to the two charities that the SPG are supporting this year, by purchasing raffle tickets and bidding in the auction at our 2024 annual conference in Istanbul. A grand total of £1,493.68 was raised, thanks to your kindness and generosity.

The monies will be split between The Solicitors’ Charity and The Alzheimer's Society, each receiving the sum of £746.84.

The Solicitors’ Charity has been supporting solicitors at times of need or crisis since 1858.

An extract from their website:

“When times are hard, we provide financial, emotional, and practical support to help people get back on track. We aim to make a permanent and positive impact on the lives of the people that we help.”

Should you find yourself in need of their help or guidance their contact details are: Website: https://thesolicitorscharity.org/ Email: sec@thesolicitorscharity.org Tel: 020 8675 6440

The Alzheimer’s Society has been supporting people affected by dementia for 45 years.

An extract from their website:

“Dementia is the biggest health and social challenge of our time. There are currently estimated to be 900,000 people in the UK with dementia. Many are undiagnosed and facing the realities of their condition alone.

As a Society, and with the help of our supporters, we’re changing that.

With your help we can give vital support to those who need it most, hold decision-makers to account, and fund groundbreaking research to transform the future for everyone living with dementia.”

Should you find yourself in need of their help or guidance their contact details are: Website: www.alzheimers.org.uk/ Email: enquiries@alzheimers.org.uk

Tel: 0333 150 3456

Artificial Intelligence (AI) will be affecting the legal profession in many ways and so will the AI Regulation. Lawyers, clerks and legal advisors across the world are all exploring the implications of AI, join us to see how it will affect you in the future.

To comply with the Solicitor’s Regulation Authority (SRA) Code of Conduct for Solicitors, RELs and RFLs, all solicitors must maintain their competence to carry out their role. This means they must keep their professional knowledge and skills up to date.

As part of the annual practising certificate renewals, the SRA will ask if a solicitor has identified learning and development needs in the past year and addressed them.

This applies to all solicitors who have a practising certificate, whether they work in the UK or overseas.

Many legal professionals struggle to get the appropriate work-life balance, giving up their free time to attend seminars and events, working long hours, keeping up with legal updates and requirements.

The stress of not having enough hours in the day to achieve all that needs to be done, can cause your health and family life to suffer. To avoid this, we must achieve a work-life balance!

By attending the “one day” Top Table Event, you will be able to get the latest legal updates. “The

Burning Issues in the Profession” panel session will take place where the heads of our regulatory and representative bodies and key industry leaders will give you any pressing updates you need to be aware of and cover any presubmitted topics or questions.

Whilst attending the Top Table Event, you will have the opportunity to network with fellow Sole Practitioners and the heads of the legal regulatory bodies and key industry leaders, this can help you with personal and business growth, building relationships, and gaining a competitive edge in your profession.

Here are some of the key benefits of networking.

• Strengthen your business connections, networking is about sharing, not taking.

• Exchange fresh ideas on various topics relevant to your practice.

• Advance your career, branch out and add strings to your bow.

• Access new information that is important to your profession.

• Get career advice and support from those in the know.

• Build confidence in yourself and your abilities.

• Gain a different perspective on how you can achieve your goals.

• Develop long-lasting personal relationships.

It is a legitimate business expense, and therefore tax deductible, speak to your accountant.

Conference & Events Team

5th April 2025

HANBURY MANOR WARE, HERTFORDSHIRE

Our Top Table Event is purposely designed as a small and intimate conference to allow members to interact closely with the key industry leaders and heads of our regulatory and representative bodies.

Come and listen to our speakers share important updates that directly impact Sole Practitioners. The benefits of attending are many, and they include:

1 Full day conference, refreshments, gala dinner, AND an overnight stay

2 Cheap as chips! Early Bird ticket £310 (all inclusive) – full price £410

3 Sit face to face with the heads of our regulatory and representative bodies

4 Find out what is likely to impact the legal profession in the future

5 Get clarity on any burning issues you are facing in your practice

6 Fantastic networking opportunity

7 Tax deductible – speak to your accountant

8 Counts towards your ongoing professional learning

9 Beautiful 5* venue and use of facilities

10 Work on your business, rather than in your business for 1 full day

Early Bird ticket price of £310 (all inclusive). Full ticket price is £410 (all inclusive). Book using your PayPal account and you may have the option to spread the payments. This is a small intimate event and spaces are limited. Please visit our website spg.uk.com to book your tickets now.

This ticket includes: Entry to the conference, gala dinner, 1 night stay (double room for single occupancy), breakfast the next day and use of hotel facilities. early bird member all inclusive ticket: £310.00

This

This ticket includes: Entry to the conference, gala dinner. conference only ticket: £150.00

This ticket includes: Entry to the conference. dinner only ticket: £55.00

This ticket includes: Gala dinner. non-members ticket: £510.00

This

Over the last 12 months 3 new insurance markets are made available for the legal industries Professional Indemnity, all A rated.

The more insurers, the more competitive the market!

Some cyber insurers may have pulled out or added restrictions to your renewal. I work in partnership with key cyber insurers to provide proactive risk mitigation and policy reviews to ensure you have market leading cover that want to insure law firms.

With 20 years within the insurance industry, specialist insurance broker, Chris Cotterill provides Solicitors and Law Firms with top tips and advice on insurance and mitigating potential risks.

CHRIS COTTERILL

Client Director - 07788601 5007 Chris.Cotterill@konsileo.com

With 8 years industry experience within the legal sector and working closely with Sole Practitioners/1-3 Partner firms, I understand the frustrations in the build up to renewals. I can tailor an early approach to market and use my lasting relationships with underwriters to bolster final submissions.

GEORGE BROWN

Client Director - 07398861466 George.Brown@konsileo.com

Some of the more common claims for solicitors is ID fraud, to the point where the fraudster will meet you face to face with a fake passport. Some firms are also getting caught out in similar situations to the Dreamvar case in 2018. Even though you have known your clients for a number of years, solicitors further down the chain may not have the same strict ID checks that you have.

Some of the leading insurers have also noticed an increase in claims relating to Probate matters and may soon be overtaking conveyancing claims as one of the main risks to law firms. As well as training there are alternative insurance products for this type of work, which we can provide.

Contact us now to find out where we can help you.

We are already working on our next edition of the SPG Solo magazine, and we would like to get as many of our members involved as possible.

The topic of your article would be of your choice, it could be about:

l A change in the law that you have an opinion on.

l An interesting article you have read that you think may be of interest to our members.

l Something specific to the area of law you practice in.

l A book/course/seminar that may be of interest/benefit to our members.

l Your life in law.

l Anything law related that is amusing – that would be a bonus!

The article would ideally have a maximum of 750-word count, but that is not set in stone, if find yourself in full flow.

The deadline for you to submit an article is 3rd of November 2024!

You will appreciate that, depending on the number of articles we receive, we cannot guarantee that your article will be included in the next edition. But we will keep them on file, so that they may be used in later editions of Solo.

Please send your article for submission to info@spg.uk.com.

As a special thank you to the members of the SPG family who regularly attend the SPG events we have an added discount, as follows:

• SILVER - 10% discount for members who have attended an event in the last year.

• GOLD - 15% discount for members who have attended the last three consecutive events.

• PLATINUM - 20% discount for members who have attended the last five consecutive events.

When the SPG announce events, all members that have attended previous events, and are eligible for the additional discount, will receive their own personalised discount code, this is to be used when booking your tickets. The extra discount will be applied on top of any early bird discounts offered. This offer is only open to members booking for the full event ticket and cannot be used when booking guest tickets.

SPG Conference & Events Team

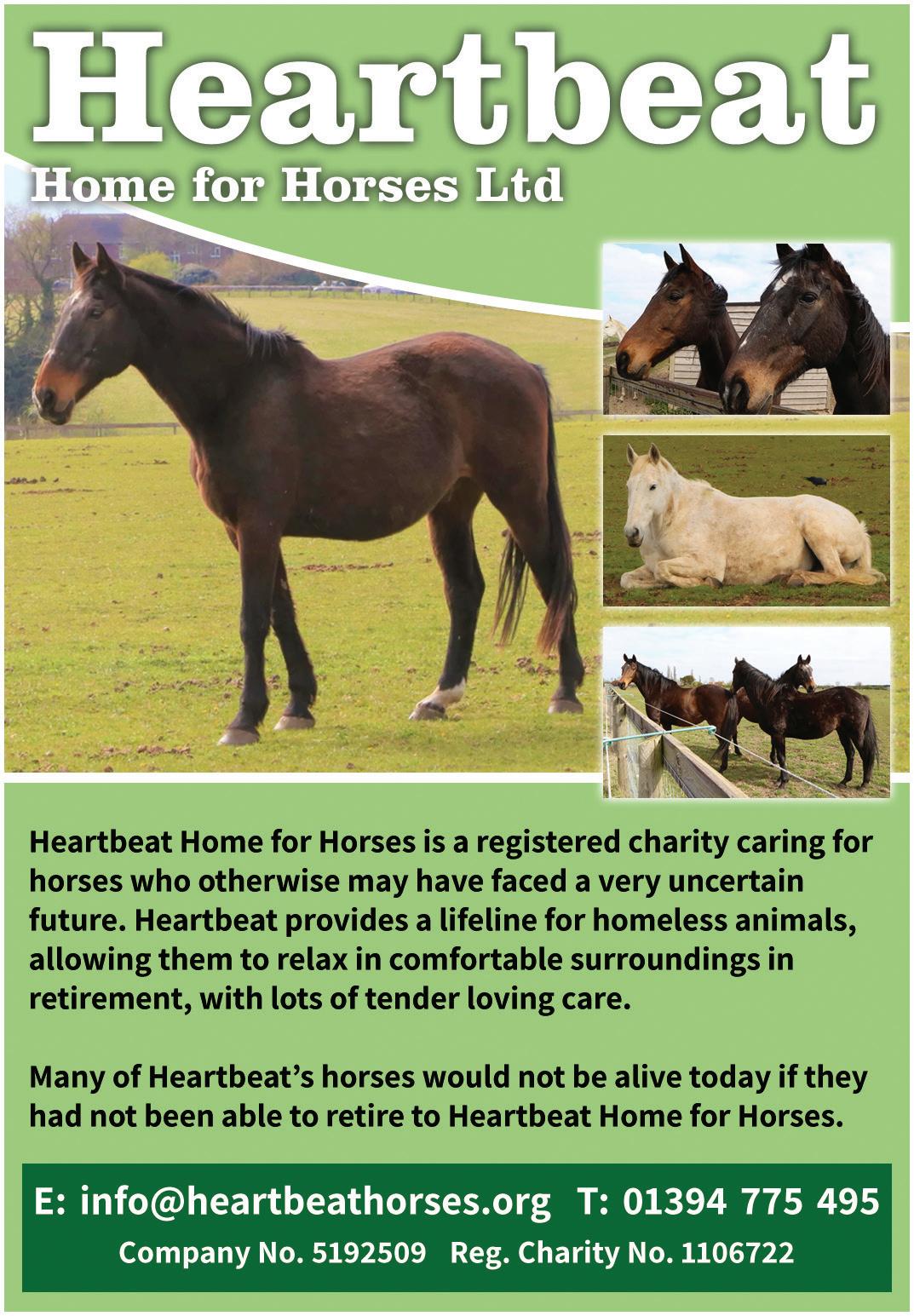

X-Press Legal Services, the largest independent provider of property searches and reports in England and Wales, is marking its milestone 25th anniversary by donating £25,000 to charitable causes.

Leveraging the firm’s network of 28 locally owned offices, X-Press initiated the fund to support charities and grassroots organisations throughout 2024. X-Press office owners have embraced the charitable opportunity, taking time to visit and better understand the organisations that have chosen to support. Donations so far include musical instruments for a primary school, sports kits for a youth football team, food for a pet sanctuary, and contributions to food banks.

“We are delighted to be celebrating 25 years of X-Press Legal Services and have enjoyed every minute of devising and delivering products to support hardworking conveyancers,” commented managing director, Lynne Lister.

“We have always championed charities, but this year, to celebrate our quarter-century and recognise the role that local communities have played in helping us grow, we have gone a step further. Our office owners have really got behind the campaign, engaging in extra fundraising activities and choosing projects where our donations can make real impact. It has been wonderful to see the results of our donations and we hope by the end of the year to have made a lasting impression on countless communities.”

The enduring success of the X-Press brand is a testament to the firm’s commitment to building long-standing relationships with clients. Its

independent local owners are dedicated to exceeding client expectations, becoming trusted and invaluable property partners, which sets them apart from other search companies.

X-Press provides a comprehensive service, including residential and commercial searches, pre- and post-completion services, cyber security, and compliance products.

To find out more about X-Press Legal Services, please visit https://xpresslegal.co.uk

A large proportion law firms were directly impacted by the Covid-19 pandemic, with many witnessing a reduction in profits, and some even facing the risk of insolvency. Fortunately, the Government put a number of measures in place to help all businesses stay afloat during this time of financial distress and uncertainty, including the Coronavirus Business Interruption Loan Scheme (CBILS).

Many law firms made use of the CBILS facility many of which featured, not only the effective lack of cost associated with interest for the first 12 months, but also capital repayment holiday periods.

Businesses, including those in the legal services industry, have now seen the holiday period on capital expire and interest requiring to be serviced. This, unsurprisingly, is creating cash flow pressures for many.

This, alongside a number of other financial pressures created by the current economic climate and the cost of living crisis may have

a lasting impact on many firms, and some solicitors may be beginning to consider their options for the future of their firms.

How can Recovery First Assist solicitors facing cashflow issues?

If you have taken out a CBILS loan and are now facing issues with cash flow, Recovery First can assist in a number of ways.

Perhaps you wish to exit a non-profitable market to focus on more lucrative areas of law? You may have considered selling your firm or closing the business completely. Another option may be to restructure or merge with another law firm.

Whichever route you decide to take for your firm, we can assist. Recovery First will ensure the most profitable outcome is achieved.

We offer a positive solution to any law firm by helping them exit any legal market whilst remaining solvent, maintaining cash flow, and ensuring they get the most out of their files.

As well as assisting firms who are going through restructuring, we also assist many firms who are going through the formal insolvency process. We work alongside the insolvency team to come up with the right plan tailored to meet the needs of each specific firm.

An additional benefit being that the firm’s clients not only get a seamless transfer, but they are also married up with a firm specialised in their particular needs.

The unique scheme offered by Recovery First is suitable for law firms and professional advisors, including restructuring and insolvency solicitors, insolvency practitioners and accountants. Our team manage the transfer of files from start to finish, placing case files with an approved law firm so as to protect the integrity of the client’s case.

We will provide you with all the advice and support you need, and we guarantee 100% confidentiality for all clients.

Working long hours, sitting in a chair, trying to meet deadlines and trying to achieve a work/ life balance, takes its toll on a person’s mind and body. But we can be proactive in reducing the effects of this, without feeling that we must do a tiring gym workout and need to use lots of fitness equipment. A gentle Yoga class achieves the same results, and all you need is a mat, and it can be done anywhere you have a space.

Yoga, meditation, and breathing exercises are wonderful ways to reduce stress, replenish your energy, and enhance your overall well-being. Dating back over 5,000 years, yoga is considered by many to be the oldest defined practice of selfdevelopment. The methods of classical yoga include ethical disciplines, physical postures, breathing control, and meditation. While it was first practiced in India, yoga has now become popular all over the world.

The practice of yoga involves stretching the body and forming different poses while keeping your breath slow and controlled. This helps the body become both relaxed and energized at the same time.

There are various styles of yoga, some moving through poses more quickly (almost like an aerobic workout) and others that focus on relaxing slowly and deeply into each pose. Some have a more spiritual angle while others are used purely as a form of exercise.

Yoga encourages mental and physical relaxation, which helps reduce stress and anxiety. The physical postures promote flexibility, relieve tension, and alleviate pain. Yoga poses may help you release physical blockages like muscle knots, helping release emotions and tension. In addition, there is a huge amount of research that has scientifically proven that yoga, even one class a week lowers the risk of heart disease, and certain cancers. Yoga will give you an improved mood, better sleep, and better thinking, it may also help with weight loss.

Almost anyone can do Yoga, and it can be modified for people of varying abilities.

Chair yoga is a gentle form of yoga that can be done sitting on a chair or standing on the ground while using the chair for support. Benefits of chair yoga include:

• improves flexibility

• improves concentration

• increased strength

• boost to your mood

• reduced stress and joint strain

• improves range of motion & mobility

• increases circulation

You don’t need any fancy clothes, just normal clothes for the Gym, shorts, track suit bottoms, leggings, and a T shirt/polo shirt. Ideally a base layer, then mid-layer, then an outer layer to put on during the last 5 minutes of the class during relaxation/meditation.

Bare foot is best, but if you want to wear socks, or trainers no problem. Yoga socks with very small rubber dimples for extra grip are fantastic.

Sheila Mann

INSPECTION CONDITION, NO RESPONSIBILITY, NO PROBLEM?

A few years ago, it was commonplace to have an inspection clause in every unoccupied property insurance policy requiring fortnightly or even weekly inspections of the property, inside and out.

Arranging weekly inspections was either expensive, engaging a local property agent or maintenance firm; or risky, cover relying on a family member arranging inspections and keeping records to evidence them.

More recently, a number of insurers have relaxed this requirement, much to the relief of the probate professional. Thirty day requirements are now commonplace. In fact, policies are also available with no formal inspection condition at all and seem to relieve the executor of any obligationbut to what extent is this really true?

CAN A PROBATE PROFESSIONAL ORGANISE UNOCCUPIED PROPERTY INSURANCE AND SIMPLY PASS THE RESPONSIBILITY TO THE INSURER FOR ANYTHING THAT GOES WRONG?

Unfortunately, it’s not that simple. Although the absence of a fortmal inspection warranty in a policy relieves the policyholder of a rigid ‘diary led’ inspection regime, there are other conditions which, if ignored can just as surely result in a claim being reduced or declined.

Just about every policy carries a written duty of care. Here you will find a written obligation to ‘take all reasonable care to protect the property from, or to limit loss or damage’

If a maintenance issue has been left unresolved for several months and this is found to have contributed to a loss, an insurer would be within their rights to cite the above duty whilst declining to pay for damage.

A typical unoccupied property insurance policy will exclude any loss or damage which pre-dates the policy being in force

If no initial inspection has been carried out, long-standing issues might go un-noticed

which may later lead to a severe loss. Your insurer will have little hesitation in evidencing the long-term nature of the cause.

Also, your policy will exclude any loss or damage which has occurred (even in part) through inadequate maintenance or wear and tear.

This is a particularly a wide-ranging statement (common to most policies), which can be used to decline or reduce payment in a great variety of situations, unless the insurer is provided with evidence that reasonable care has been taken to ensure the property is maintained in good condition.

Your client’s roof collapses or is torn off during bad weather. You register a claim, confident the insurer will pay for repairs.

No other building in the street was damaged. The loss adjuster investigates further. The garden is overgrown, the wall and some of the roof being covered by thick ivy which had dislodged and loosened gutters and slates, letting in moisture which has caused timbers to rot. The slates, their bond with the ivy stronger than that with the roof, have ended up in the garden. The long-term effects of dampness in the roof timbers is evident.

Many insurers have a written definition of what constitutes storm conditions. Remember, a well-maintained property should be able to withstand all but extreme weather.

In the above example, regular maintenance of the property and grounds may have provided a very different outcome. The claim may have been successful. The damage might never have occurred in the first place.

Even with no formal inspection condition, regular inspections will reduce the

likelihood of damage, as well as assist with evidence to support a valid claim.

At every inspection:

■ Maintenance of the garden should be viewed as an investment rather than a cost, protecting the property from damage from vegetation, reducing the risk of burglary, vandalism, damage by animals, and maintaining the property value.

■ Check roof for signs of damage, slipped tiles, excessive moss growth or weeds, cracked cement etc.

■ Check gutters, downpipes and drains are clear. Blockages or growth in gutters can cause damp and water ingress.

■ Blocked drains can cause flooding.

■ Check flat roof areas for signs of damage or weakness. A felt flat roof has a limited lifespan, anything more than 12 years old is likely to be severely weakened and in need of replacement.

■ Check windows, doors and frames for signs of rot or weathering.

■ Check that the stopcock is operating properly, check taps, pipes and radiators for signs of leaks or drips.

■ Check pipes in loft areas. If you have water pipes in the roof space, open the loft hatch by 12 inches to allow warm air to circulate in the loft.

COLIN BICKERS is a Director of Bickers Insurance Services, specialists in unoccupied property insurance for probate and householders in care. This general risk management advice should not be considered exhaustive, nor suitable for every property.

Bickers Insurance Services is a trading name of Bickers Insurance Services Limited. Authorised and regulated by the Financial Conduct Authority. Registered in England and Wales Reg No.08432640.

This year's Remember A Charity Week (9-15 September 2024) will see the launch of an interactive map of legacy giving, showcasing the impact of charitable gifts in Wills across the world. The Great Map of Willanthropy* will display a wide range of charitable services and places that have been funded or supported through gifts in Wills to UK charities, while also showing what future legacies could achieve.

Remember A Charity Week, now in its 15th year, brings together almost 200 member charities, 900 Campaign Supporters (solicitor firms and Will-writers), wealth advisers, and partners to encourage more people to consider leaving a gift to charity in their Will. While Remember A Charity runs consumer campaigns all year round, the week serves as a key moment to equip and activate all those in the consortium’s network to champion charitable legacies.

Alongside the digital map and a celebrity-backed national PR drive, Remember A Charity will launch the next phase of its Be Remembered consumer advertising campaign during Remember A Charity Week, encouraging the public to think about what they want to be remembered for. The consortium’s legal partners and Campaign Supporters will be provided with promotional assets to use on their digital channels to open up conversation about charitable Wills with clients and prospective clients.

Lucinda Frostick, Director of Remember A Charity, says:

“Remember A Charity Week is a wonderful opportunity for charities and the legal sector to collaborate to inspire people across the UK to not only write or update their Will but to leave a gift to their favourite charity. This year, we’ll be sharing a mix of warm, humorous and informative content throughout the week, aiming to win both hearts and minds, while encouraging people to take action.

“For professional advisers and Will-writing providers, it’s a great chance to promote the importance of having an up-to-date Will and deepen client relationships with values-led conversations about the good causes they care about.”

Solicitors, professional Will-writers and others who wish to participate in this year’s campaign and sign up as a Campaign Supporter, are encouraged to get in touch with Remember A Charity in the next few weeks.