June 2023

IMF's perspective on oil, growth and challenges

Exclusive Interview with Jihad Azour, Director ME & CA, International Monetary Fund

BRICS

Challenging global financial order

ESG investing fuels demand for sustainable finance

2 conomy middle east june 2023

1 conomy middle eastJUNE 2023

IMF's perspective on

Banking & Finance Economy

Interview with H.E. Younis Haji Al Khoori, Undersecretary of the Ministry of Finance, UAE

By Ahmed Abdelaal, Group CEO, Mashreq

Interview with H.E. Younis Haji Al Khoori, Undersecretary of the Ministry of Finance, UAE

By Ahmed Abdelaal, Group CEO, Mashreq

global financial

Contents | June 2023

Interview with Damian Bunce, Chief Customer Officer, Exness Challenging

order

Positive growth outlook to sustain continued progress for UAE economy ESG investing fuels demand for sustainable finance

top market maker themes

Exness unveils

Cover story with Jihad Azour, Director of the Middle East and Central Asia Department, IMF

oil, growth

in

economic

22

and challenges

MENA's

landscape

Interview with Mohamed Abdalla Al Zaabi, Group CEO, Miral world-class immersive experiences

Miral: 32 26 28

Crafting 36 42

16

Maktoum bin Mohammed's inauguration of Dubai Centre for Family Businesses marks new era of support

BRICS

6 conomy middle east june 2023 Contents | June 2023 Media Technology & Innovation Real Estate Lifestyle Sustainability Meta implements initiatives to accelerate Middle East's growth potential 44 46 60 62 Interview with Fares Akkad, MEA Regional Director, Meta

Tech-driven learning: enhancing the educational experience

With Professor Paul Hopkinson, Dean of the College of Interdisciplinary Studies,

Zayed University

Balancing climate goals and regional expansion Investing in infrastructure for a greener

Driving Middle Eastern aviation towards net zero 50 52 A haven for the wealthy Redefines supercar performance with hybrid innovation Branded residences Ferrari 296 GTS

By Steven Rees, MENA Head of Investments, J.P. Morgan Private Bank

future

Publisher . JOSEPH CHIDIAC

EDITORIAL

Managing Editor . HADI KHATIB

Senior Editor . ANTHON GARCIA

Editor-at-large, Automotive & Lifestyle . ALP SARPER

Economy Contributor . HALA SAGHBINI

Energy Contributor . KATE DOURIAN

Digital Editor & Translator . ELIAS AL HELOU

CONTRIBUTORS

AHMED ABDELAAL, BASSEL BOUTROS, GREG HASTINGS, HUSAM ZAMMAR, STEVEN REES

PR & Content Strategy Director . CYNTIA BSOUSSI

Creative Director . RAYAN BARAKAT

For General Inquiries: info@jcmediagroup.com

For Editorial Inquiries: editorial@jcmediagroup.com

For Advertising Inquiries: commercial@jcmediagroup.com

Publishing House . JC MEDIA GROUP LLC

www.JCmediagroup.com

www.EconomyMiddleEast.com

@economymiddleeast

@economy_me

NOTICE

8 conomy middle east june 2023

Printed at Masar Printing

Publishing LLC

and

Opinions and views expressed in this publication are solely those of the contributors and not necessarily those of the publisher. No part of this publication may be reproduced or transmitted in any form or by any means

written permission of the publisher. When you have finished with this magazine, please recycle it. recycle

without

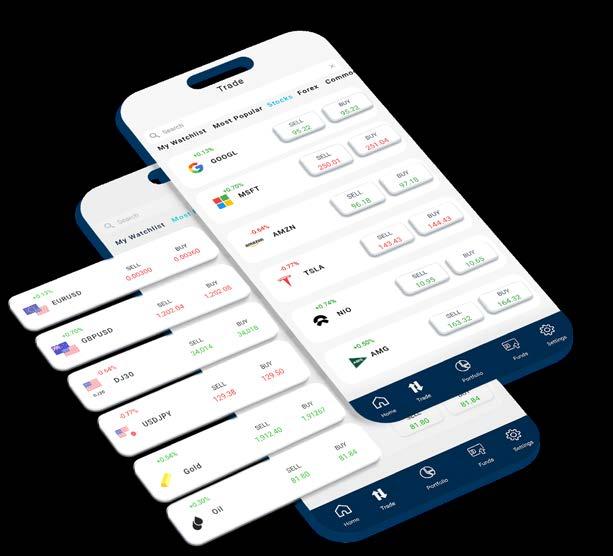

BE ONE STEP AHEAD With the CFI Trading App

15,000 + instruments

Trade on the go Explore

a user-friendly platform WWW.CFI.TRADE Regulated by the DFSA. Trading involves a high risk to the investor's capital. Understand all risks before investing.

Benefit from full risk management Enjoy

Building Resilience: Safeguarding Against a Repeat of the 2009 Debt

The alarming statistics recently released by the Institute of International Finance have captured my attention, shedding light on the alarming surge in global debt accumulation during the first quarter of this year. These figures not only serve as a warning of the imminent crisis but also add to the collection of crises that have severely disrupted our lives and economies.

According to the Institute’s data, global debt has skyrocketed by $45 trillion from pre-COVID-19 levels, reaching an unprecedented total of $305 trillion. Of this staggering amount, one-third has been allocated to emerging markets.

The underlying concern stems from the fact that heavily indebted nations, driven to borrow from financial markets due to their inability to service existing debts, may encounter significant challenges in breaking free from the vicious cycle of debt. Their relentless efforts to overcome this predicament may face obstacles, particularly in light of persistently high-interest rates that impede economic recovery. Consequently, the risk of default looms larger, posing a threat to economic stability and impeding progress toward achieving sustainable development goals.

In the private sector, the recent upheaval in the banking

industry has expedited the rise of problematic corporate debt. Stricter credit conditions imposed by banks have presented challenges for companies burdened with substantial debt and limited profitability. Consequently, these companies may struggle to secure debt refinancing, potentially leading them to resort to bankruptcy as a last resort.

Within the Arab region, it is evident that the situation varies across different countries. Oil-importing nations face mounting risks due to the expansion of their debt portfolios and the challenges of financing them at reasonable costs given the prevailing interest rates. On the other hand, oil-producing countries have taken a gradual approach to addressing this issue, prioritizing the diversification of their economies. This diversification effort has played a crucial role in bolstering nonoil revenues and improving their overall financial standing.

Recognizing the gravity of the debt issue, global financial institutions have elevated their concerns to a critical position on their policy agenda, convening extensive meetings to address the matter (which took center stage during the spring meetings). It is expected that the challenges confronting the global economy will require decisive measures from policymakers to assist countries in managing their debt burdens. It is crucial not to postpone addressing this problem to a stage where finding a solution becomes increasingly complex. We vividly recall the far-reaching repercussions of the prolonged European debt crisis that originated in 2009, causing fragmentation across numerous nations.

Chief Executive Officer – Publisher

Joe Chidiac

10 conomy middle east june 2023

EDITORIAL LETTER

NEOM secures $8.4B financing for green hydrogen plant

World’s largest carbon-free plant to produce green ammonia by 2026

NEOM Green Hydrogen Company (NGHC), a joint venture (JV) between ACWA Power, Air Products, and NEOM, has announced the successful completion of financing agreements for its state-of-the-art green hydrogen production facility. The plant, located in Oxagon within Saudi Arabia’s NEOM region, will represent a significant investment of $8.4 billion.

NGHC has secured financing from a consortium of 23 local, regional, and international banks and investment firms, demonstrating the strong support and confidence in the project.

By 2026, NGHC aims to establish the world’s largest carbonfree green hydrogen plant, capable of producing green

ammonia on a large scale. Air Products has been selected as the contractor and system integrator for the entire facility. Furthermore, NGHC has entered into an exclusive 30-year off-take agreement with Air Products for all the green ammonia generated at the plant.

The project is jointly owned by ACWA Power, Air Products, and NEOM, with each partner having an equal share. The NGHC mega-plant will integrate up to 4GW of solar and wind energy, enabling the production of approximately 600 tonnes per day of carbon-free hydrogen by the end of 2026. This production will primarily be in the form of green ammonia, providing a cost-effective solution for the global transportation and industrial sectors.

Egypt takes significant step toward promoting renewable energy

Egypt and Statkraft AS, a Norwegian company, have recently entered into a Memorandum of Understanding (MoU) to undertake studies on a groundbreaking renewable energy export project from Egypt to Europe via Italy. This collaboration represents a significant milestone in Egypt’s ongoing endeavors to promote renewable energy and establish itself as a prominent participant in the global energy market.

Mohamed Shaker, the Egyptian Minister of Electricity and Renewable Energy, highlighted that this MoU reflects the commitment to bolster and reinforce cooperation

frameworks between Egypt and the European Union. He further emphasized that this agreement marks a significant stride towards fostering collaboration and coordination between the two entities.

Sabah Mashaly, Chairman of the Board of the Egyptian Electricity Transmission Company, elaborated on the details of the memorandum, stating that it involves collaborative efforts to initiate preliminary studies as a precursor to the execution of a project intended to export renewable energy to Europe via Italy. The envisioned project will leverage a sea interconnection with a minimum capacity of 3 gigawatts.

In its pursuit to establish a pivotal role in the energy sector of the Middle East, Egypt has been actively engaging in electrical interconnection projects with its neighboring countries. Notably, Italy, Greece and Cyprus have recently expressed their interest in importing Egypt’s surplus electricity production, estimated to be around 25,000 megawatts. Official data suggests that Egypt’s daily electricity production currently stands at 58,000 megawatts, while its daily consumption is reported to be 33,000 megawatts, according to the Arab News Agency.

12 conomy middle east june 2023 short news

Country joins forces with Norwegian firm to export renewable energy to Europe

S&P expects Dubai's debt to fall amid strong economic growth

Government’s debt stock could fall faster

Standard & Poor’s predicts that Dubai’s government debt burden will decrease to approximately 51 percent of GDP in 2023, down from a peak of 78 percent in 2020.

According to a report by S&P, “The government’s debt stock could fall faster if the reduction in nominal debt, which occurred in 2021 and to a more significant extent in 2022, continues over the coming years.”

This year, Standard & Poor’s expects Dubai’s real GDP to grow by approximately 3 percent, while the UAE-wide structural and social reforms and programs are expected to support long-term growth. “We expect Dubai’s relatively diversified and service-oriented economy to expand by around 3 percent in 2023, slowing from 5 percent in 2022

and 6.2 percent in 2021. In our view, this year will be more reflective of the emirate’s steady economic activity than the years of post-pandemic recovery. We expect strong momentum in the hospitality, real estate, trade, and financial services sectors to continue to support growth,” the report said. Standard & Poor’s estimates Dubai’s GDP per capita to be $34,000 in 2023, which is lower than that of Abu Dhabi due to the latter’s significant wealth derived from the hydrocarbon sector. “We expect GDP growth rates to be largely similar in Dubai and small emirates in 2023, with Abu Dhabi’s growth weakened by the expected decline in hydrocarbon production due to OPEC+ production cuts. In terms of nominal GDP, we estimate that Dubai’s economy is about 3.3 times the size of Sharjah’s and 10.5 times the economy of Ras Al Khaimah.”

Change due to decline in public debt burden, ability to meet financial obligations

Moody’s has upgraded Oman’s credit rating from “Ba3” to “Ba2” and maintained a positive outlook. This upgrade is a result of the decline in public debt burdens and the improvement in the Sultanate’s ability to meet its financial obligations in 2022.

The agency attributed this improvement, along with the increase in public revenues, to “the tangible efforts made by the government in controlling financial conditions, and its decision to direct fiscal surpluses toward reducing public debt, noting the improvement in the effectiveness of fiscal policy and the efficiency of financial governance.”

The International Monetary Fund predicts that the Sultanate

of Oman will achieve the highest economic growth rate among Arab countries next year, projected at 5.2 percent. Furthermore, the World Bank forecasts that Oman will have the fastest-growing economy in the GCC in 2023, with a growth rate expected to reach 4.3 percent.

The World Bank highlights the government’s budget reform and debt reduction efforts, aiming to decrease total debt to 40 percent of GDP in 2022 from around 60 percent in 2021. These efforts have contributed to Oman’s positive outlook.

Data released in May revealed that Oman recorded a budget surplus of $1.2 billion in the first quarter. This surplus was driven by a 9 percent increase in net oil revenues, resulting from higher oil prices and production.

“Government efforts have had a tangible impact on maximizing fiscal surpluses, and more than 15 percent of total public debt declined during 2022, down from 68 percent in 2020 to 40 percent in 2022 as a percentage of GDP,” Moody’s said in its report.

13 conomy middle eastJUNE 2023

Moody's upgrades Oman to "Ba2" with positive outlook

First global payments platform Checkout.com granted CBUAE acquiring license

License unlocks provider’s full payments model for merchants in UAE

Renowned global payments service provider Checkout. com has achieved a significant milestone by obtaining a Retail Payment Services license from the Central Bank of the United Arab Emirates (CBUAE). This notable accomplishment solidifies Checkout.com as the first global payments provider to receive an acquiring license in the country, reinforcing its prominent position as a leader in the MENA region. Securing this acquiring license empowers Checkout.com to fully unleash its comprehensive offerings for merchants in the UAE. It encompasses a range of merchant-acquiring solutions, payment aggregation services, and efficient cross-

border fund transfers. By directly acquiring transactions, Checkout.com gains enhanced control over processing outcomes, enabling them to deliver exceptional payment acceptance performance, setting a benchmark for industry standards.

Guillaume Pousaz, the CEO and founder of Checkout.com, expressed his appreciation, saying: “The issuance of this license shows the level of trust, commitment, and strength of the relationship we continue to have in serving both domestic and international brands to expand in the UAE.”

The eCommerce sector in the UAE is projected to experience a Compound Annual Growth Rate (CAGR) of 11%, propelling the market size to a staggering $17 billion by 2025. This substantial growth is primarily driven by the shifting preferences of consumers, with 91% of individuals in the UAE now favoring online purchases. Checkout.com has already established partnerships with prominent local brands such as Shahid, Qlub, Carrefour, The Entertainer, Namshi, Mamo, MakeMyTrip, Cafu and Washmen, underscoring their commitment to supporting the country’s business landscape.

KSA launches first film investment fund worth $100M

Vision 2030 targets $24 billion film industry for Saudi economy

The Saudi Cultural Fund has recently signed a preliminary agreement with the Middle East Financial Investment Company (MEFIC) and Roaa Media Ventures to establish a groundbreaking investment fund in the film sector. The fund is valued at SAR 375 million (approximately $100 million). Under this agreement, the Cultural Fund plans to contribute 40 percent of the total amount through a SAR 300 million investment program, which was launched during the prestigious Cannes Festival. This initiative is part of the IGNITE government’s digital content program and aims to provide financial support to the film sector.

Saudi Arabia has ambitious goals for its film industry. By 2030, the country hopes to surpass annual box office revenues of $1 billion, increase local production to 70 films per year, and expand the number of cinemas to 350 with 2,500 screens. The film industry is projected to contribute around $24 billion to the economy and generate over 30,000 permanent jobs. The primary objective of the newly established fund is to invest in film sector companies and projects, as well as provide necessary financing. Additionally, the fund aims to develop a network of entrepreneurs and distribution experts to support these companies, while effectively managing investment portfolio risks in the sector. The statement also highlights the fund’s intention to collaborate with both local and international investors, attracting foreign expertise to transform Saudi Arabia into a prominent hub for film-making.

Notably, the Saudi film sector financing initiative boasts the highest budget allocation among all artistic and cultural initiatives in the Kingdom, amounting to SAR 879 million. Some 30 percent of this budget has been allocated to the establishment of companies and facilities that support the film sector, while the remaining 70 percent will be directed toward developing, producing, and distributing film content.

14 conomy middle east june 2023

short news

Egypt's grain silos receive $66M in EU, French funding

Storage capacity to increase by 420,000 tons

A delegation from the European Commission in Cairo has announced that the European Union and the French Development Agency (AFD) will provide Egypt with facilities valued at 60 million euros ($66 million) to enhance the storage capacity of grain silos. An official from the delegation conveyed through an email that the funding is intended to augment the storage capacity by a minimum of 420,000 tons, primarily allocated to wheat and potentially other grains. This allocation signifies a 12 percent increase in Egypt’s existing wheat storage capacity, which currently stands at around 3.5 million tons. The financial support forms part of a broader aid

package previously unveiled to bolster food security in the Middle East and North Africa region, which has been affected by the Russian invasion of Ukraine. The total value of the package is 225 million euros ($240.71 million), with Egypt slated to receive 100 million euros of the overall sum. In March, the Italian Agency for Development Cooperation (AICS) and the EU signed a 40 million euro agreement for funding projects related to grain and seed production, silo construction and wheat transportation management in Egypt.

Prior to the implementation of the national silos project, Egypt incurred annual losses of approximately 10 billion Egyptian pounds (equivalent to $640 million) due to significant wheat losses.

Founders hub, other Microsoft learning tools to be made accessible to Qatari entrepreneurs

Qatar Development Bank has formed a strategic alliance with Microsoft to empower entrepreneurs and innovators in Qatar with an extensive array of technologies and resources to enhance their success. The primary objective of this collaboration is to expedite the digital transformation of start-ups and small and medium enterprises, foster innovation, and solidify Qatar’s position as a prominent regional innovation and technology hub. As part of the partnership, SMEs will have the opportunity to leverage Microsoft Cloud, enabling them to enhance

performance, increase productivity, reduce costs, and cultivate ground-breaking solutions using cutting-edge technologies. Additionally, entrepreneurs and employees can acquire valuable digital skills through the Microsoft Learn platform, equipping them with the necessary expertise to accelerate digital transformation and achieve growth within a knowledgebased economy.

To further support QDB’s start-ups, Microsoft’s Founders Hub platform will be made accessible, serving as a comprehensive resource that amalgamates people, knowledge, and technology to assist founders in overcoming challenges at every stage of their entrepreneurial journey. By harnessing Microsoft’s learning tools, entrepreneurs and start-ups can effectively utilize cloud technology, including artificial intelligence, data analytics, and the Internet of Things, to launch and thrive in a successful business venture.

Mr. Abdulrahman Hesham Al Sowaidi, acting CEO of QDB, expressed his views on the partnership, emphasizing the provision of an advanced set of digital platforms and ensuring that innovators and startups are well-prepared to pursue their aspirations. For her part, Lana Khalaf, general manager of Microsoft Qatar, said, “Start-ups and SMEs play a pivotal role in accelerating Qatar’s digital economy and its position as an innovation hub for investment.”

15 conomy middle eastJUNE 2023

Qatar Development Bank, Microsoft join forces to support startups

IMF's perspective on oil, growth and challenges in MENA's economic landscape

Jihad Azour’s insights on economic reforms, inflation and climate change initiatives

16 conomy middle east june 2023 cover story

Jihad Azour, Director of the Middle East and Central Asia Department, International Monetary Fund

Jihad Azour, Director of the Middle East and Central Asia Department, International Monetary Fund

Despite a series of shocks, the economies of the Middle East and North Africa, including the GCC, proved resilient in 2022. However, this year and next, growth is expected to slow reflecting tight policies to restore macroeconomic stability, agreed OPEC+ oil production cuts, and the fallout from the recent deterioration in financial conditions. The outlook depends on external and global factors. Amid continued uncertainty, policy tradeoffs remain complex, and striking the right policy balance will be critical. Oil exporters should carefully manage oil revenues, avoid expanding current expenditures, improve budget transparency, and strengthen mediumterm fiscal frameworks.

“Given the importance of oil production to the economies of the Gulf Cooperation Council countries, the OPEC+ cuts will affect overall growth,” says Jihad Azour, Director of the Middle East and Central Asia Department at the International Monetary Fund, in an exclusive interview with “Economy Middle East.” Oil will remain the primary driver of economic activity for the GCC in 2023 and 2024, with an average annual growth rate of around 4.0 percent.

Azour emphasized that oil contributes to more than two-thirds of the total growth in the GCC countries.

The significance of oil production extends beyond the GCC countries, affecting the entire MENA region. As the IMF revises its economic prospects for MENA countries, it becomes crucial to understand the challenges and opportunities faced by these nations in light of the evolving global economic landscape.

In this article, we delve with Jihad Azour into issues that influence the outlook for MENA, including insights on the impact of oil production cuts, the key economic and financial challenges facing countries in the region, and policy recommendations that help address them. We will explore the importance of holding the largest economic gathering – the IMF and World Bank Annual meetings – in Morocco in October this year, as well as the IMF’s role in the upcoming COP28 conference. By understanding these factors, we can gain valuable insights into the path toward economic recovery and resilience for the MENA region.

18 conomy middle east june 2023

cover story

Regional Economic Outlook

The International Monetary Fund has recently revised its economic prospects for MENA countries, reflecting the impact of tightening policies and reduced oil production, among other issues. In its latest April report, the IMF lowered its forecast for economic growth in the region by 0.1 percent for 2023 and 2024 compared to its previous estimates in January. It now expects the growth rate to reach 3.1 percent and 3.4 percent, respectively, down from 5.3 percent in 2022.

“Our revisions reflect the impact of tighter monetary and fiscal policies. While these policies were critical in safeguarding macroeconomic stability, they are expected to dampen domestic demand in the region’s emerging market economies. At the same time, the growth slowdown in oil exporters reflects lower oil production in line with the October OPEC+ agreement,” Azour said.

Looking specifically at the Gulf Cooperation Council countries, the IMF forecasts a real annual GDP growth of 2.9 percent by 2023. “Given the importance of oil production for the GCC economies, OPEC+ cuts will weigh on overall growth. Going forward, however, we expect that non-oil growth will be the main driver of economic activity in 2023 and 2024 at about 4.0 percent annual growth on average, and contribute more than two-thirds of these countries’ total growth,” Azour added. This positive momentum is driven by retail and services sectors, as well as rapid private investment growth.

The impact of reduced oil production in the GCC countries extends beyond their borders, affecting the rest of the MENA region. According to Azour, lower growth in the GCC countries can lead to reduced trade and remittances, which could weigh on the economic growth of other countries in the region. On the flip side, lower oil prices resulting from the current futures curves may help alleviate energy costs for oil-importing countries in the MENA region.

Challenges and Policy Recommendations for the MENA Region

MENA countries face multiple challenges and risks in 2023/24, which require strategic measures to mitigate their impact. One of the primary challenges is addressing inflation. According to Azour, it is crucial for authorities, particularly in countries where inflation is high, to adopt a tight monetary approach to rein in inflation. “This will imply further tightening for countries where the current monetary stance is loose. For countries where headline inflation has peaked, and the monetary stance is tight, central banks should be cautious to avoid premature loosening until there are clear signs that core inflation is on a downward trajectory,” he said.

Another significant challenge is ensuring financial sustainability in a global environment of high-interest rates. MENA countries are encouraged to intensify their efforts to preserve fiscal sustainability. This requires implementing tight fiscal policies that support the fight against inflation and mitigate debt sustainability risks. Authorities should focus on prudent fiscal management, such as avoiding the expansion of current expenditures, improving budget transparency, and exploring mediumterm fiscal frameworks with risk management strategies,

19 conomy middle eastJUNE 2023

"MENA countries need to intensify their efforts to preserve fiscal sustainability."

including greater transparency and accountability. Accelerating reforms is essential to enhance growth potential and strengthen resilience against recurring shocks. Policymakers should prioritize implementing reforms at an accelerated pace, aiming to promote structural transformation, foster private sector development, and increase access to opportunities for the population. “In practical terms, the authorities should consider a wide range of reforms to promote the structural transformation of their economies. These reforms range from fostering private sector development including downsizing the state footprint in the economy as to attract investment, to medium term fiscal frameworks that adopt risk management strategies including greater transparency and accountability,” Azour said. Global financial conditions pose a potential risk to debt sustainability in the region. A further tightening of global financial conditions could prompt investors to reassess the sustainability of high debt levels in certain countries. This could lead to increased fiscal pressures and hinder private sector investment and growth. According to Azour, to mitigate this risk, MENA countries should focus on implementing consistent and sound macroeconomic policies that preserve fiscal sustainability and price stability. Additionally, structural reforms that accelerate the transformation and inclusion of their economies can help enhance resilience and mitigate the potential negative consequences of tightening global financial conditions.

Banking Sector Turmoil and its Implications

Saudi MCIT and Huawei sign ICT MOU

The banking sector turmoil has been a significant concern, and the IMF has assessed its implications for the MENA region. Despite the challenges posed by the COVID-19 pandemic, the banking sectors in the region have shown resilience, thanks to supportive measures and diligent supervision. However, it is crucial for authorities to maintain a high level of vigilance and closely monitor the situation. Vigilant supervision remains essential in the face of potential risks that could arise from the banking sector crisis. There is a need for supervisors to remain watchful, particularly considering the possibility of renewed global banking pressures that could affect the region. These pressures, if not properly managed, may undermine the ability of banks to provide sufficient credit to the economy, thus weakening growth prospects. The contraction of credit is a potential risk that needs to be carefully addressed. If banks face significant pressures that constrain their lending capacity, it can have adverse implications for economic activity and investment. Therefore, proactive measures by authorities are essential to ensure that the banking sector crisis does not lead to a credit contraction that hampers growth.

Authorities should consider implementing measures that provide support to banks, such as capital injections or liquidity support, if needed. This will help maintain the

stability of the financial system and ensure that banks can continue to play their crucial role in providing credit to the economy.

Moreover, proactive measures by authorities are required to address the challenges and vulnerabilities in the banking sector. This may involve implementing reforms to strengthen the resilience of banks, enhance risk management practices, and improve governance and transparency. It is important for policymakers to prioritize the stability and soundness of the banking sector to sustain economic growth and mitigate the potential adverse effects of the crisis.

The IMF’s Role in Addressing Economic Challenges

The Annual Meetings of the IMF and the World Bank in Marrakech in October this year present an opportune platform for global leaders and policymakers to come together and address the pressing economic challenges facing the MENA region and the world. These meetings serve as a crucial forum for discussions, knowledge sharing, and coordination of efforts to promote global economic stability and sustainable development. Global cooperation plays a pivotal role in addressing economic challenges effectively. The interconnectedness of economies means that no country or region can tackle these challenges in isolation. Cooperation among nations, international organizations, and financial institutions like the IMF is essential to pool resources, share expertise, and coordinate policy actions.

The proposed themes for the Annual Meetings emphasize the need to build resilience, promote structural transformation, and foster global cooperation, Azour said. These themes reflect the recognition that addressing economic challenges requires a multifaceted approach that combines short-term measures to tackle immediate crises with long-term strategies for sustainable growth.

Building resilience is crucial in the face of ongoing uncertainties and potential shocks. The IMF advocates for policies and measures that strengthen countries’ ability to withstand economic disruptions, including enhancing fiscal and monetary frameworks, improving financial

20 conomy middle east june 2023 cover story

"Vigilant supervision remains essential in the face of potential risks that could arise from the banking sector crisis."

sector resilience and implementing social safety nets. By building resilience, countries can better navigate economic challenges and minimize their adverse impact on growth and development.

Promoting structural transformation is another key aspect emphasized by the IMF. Structural reforms that enhance productivity, foster innovation, and diversify economies are vital for long-term sustainable growth. The IMF encourages countries in the MENA region to undertake reforms that improve the business environment, enhance labor market flexibility, and invest in education and skills development. These reforms can help unlock the region’s potential and create opportunities for inclusive and sustainable economic growth.

In terms of policy recommendations, the IMF encourages countries in the MENA region to prioritize structural reforms, invest in human capital, and enhance governance and transparency. These measures can promote economic diversification, attract investment, and create an enabling environment for private sector development. The IMF also emphasizes the importance of inclusive growth and social protection measures to ensure that the benefits of economic development are shared equitably.

“The IMF remains a steadfast partner of MENA countries through policy advice, financing, and capacity development. On policy advice, we are engaging very closely with country authorities in our role as trusted and confidential advisors, in line with our mandate to foster global macroeconomic and financial stability, through sound policymaking,” Azour said.

“We have also been very active in providing financial support. Since January 2020, the IMF has approved $25 billion of new financing for MENA countries, including recent programs for Egypt, Mauritania and Morocco. This is in addition to the 2021 SDR allocation which increased MENA’s reserves by over $42 billion,” he added.

“Lastly, to help countries face emerging challenges, our capacity development has been strengthened, with increased presence on the ground in Beirut, Kuwait City, and a new regional office in Riyadh that will be opened later this year.”

The IMF’s Contribution to COP28

The IMF has placed a significant emphasis on climaterelated issues and has forged a strategic partnership with the United Arab Emirates (UAE) in preparation for COP28, the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change (UNFCCC). This partnership highlights the IMF’s commitment to supporting global efforts in addressing climate change and its recognition of the UAE’s leadership in promoting sustainability. As part of its contribution to COP28, the IMF plays a crucial role in providing analytical support and evaluating progress in achieving climate goals. Its expertise in macroeconomic analysis and policy advice allows it to assess the economic implications of climate change and the transition to a low-carbon economy. Through its research and analysis, the IMF helps policymakers understand the potential risks and opportunities associated with climate change and develop strategies for a sustainable and resilient future. One of the key initiatives of the IMF in supporting countries’ efforts to address climate change is the establishment of the Resilience and Sustainability Facility. This facility aims to provide financial and technical assistance to member countries in implementing policy reforms and investments for climate change mitigation and adaptation. The facility supports countries in designing and implementing climate-related policies, such as carbon pricing mechanisms, renewable energy transition plans, and climate resilience strategies. According to Azour, the Resilience and Sustainability Facility also assists countries in mobilizing and leveraging additional sources of climate finance, including public and private sector funding. By helping countries access financial resources, the IMF contributes to the scaling up of climate investments, particularly in vulnerable and developing economies. The facility works in close collaboration with other international organizations, development banks, and stakeholders to ensure coordinated support and maximize the impact of climate-related initiatives. Through its strategic partnership with the UAE for COP28, the IMF aims to strengthen the global response to climate change by promoting dialogue, knowledge sharing, and capacity building. The partnership facilitates the exchange of best practices, lessons learned, and innovative approaches to climate action. By leveraging the UAE’s expertise and experience in sustainable development, the IMF can enhance its analytical work and policy advice in the context of climate change.

21 conomy middle eastJUNE 2023

"Global cooperation plays a pivotal role in addressing economic challenges effectively."

Positive growth outlook to sustain continued progress of the UAE economy

Measures to support future growth include new corporate taxation, innovation initiatives and massive support for SMEs

The UAE economy remains robust, surpassing expectations as the World Bank projects a remarkable growth rate of 4.1 percent this year, even amid challenging business conditions in key global markets. In this interview with His Excellency Younis Haji Al Khoori, Undersecretary of the Ministry of Finance, Economy Middle East looks at the Ministry’s latest initiatives aimed at maintaining the UAE’s competitive edge, sustaining its momentum toward sustainable growth, and actively contributing to the fulfilment of the nation’s development goals and aspirations.

banking & finance

The World Bank estimates a 4.1 percent growth for the UAE economy this year. Do you share a similar outlook, or do you think a better performance can be achieved?

The UAE enjoys a positive economic outlook, as evidenced by a strong and growing economy with low unemployment levels, increasing wages, and increasing business activity. Our economy reflected a strong performance in the oil and nonoil sectors in 2022, as it expanded by 7.6 percent.

For 2023, the Central Bank of the UAE projects a growth rate of 3.9 percent for the country’s economy. This includes an estimated growth of 4.2 percent in non-oil GDP and 3 percent in oil GDP, considering the anticipated decrease in oil production in line with the OPEC+ agreements. However, there is always uncertainty when it comes to economic projections, due to the complexity of the systems involved and the challenges in accurately predicting them. Various factors, such as international financial conditions

and the state of the global supply chain, can potentially impact these projections. UAE firms continue to show forward-looking expectations, as reflected by the increase of the Composite Business Confidence Index (BCI) (Northern Emirates) from 109.8 points in Q3 of 2022 to 119.4 points in Q4 of 2022.

Domestic consumption, one of the determinants of the growth and success of the economy, demonstrated remarkable performance in the fourth quarter of 2022. This impressive outcome was fueled by a substantial surge in employment rates, with the three-month moving average of individuals employed in the UAE and private sector wages experiencing a double-digit year-on-year increase, surpassing their pre-pandemic levels.

The UAE has always been a top destination for foreign direct investment and expatriate talent. Will the 9 percent corporate tax to be applied beginning June 2023 have an impact?

Given the UAE’s status as a prominent international business and financial hub, the implementation of a comprehensive corporate income tax system would enhance the ease of conducting international business for UAE companies.

By introducing a corporate tax regime in the UAE that adheres to the latest international tax practices, businesses would be safeguarded against punitive taxation in foreign countries

and ensure they receive relief from foreign taxation under double taxation agreements. This would contribute to attracting more businesses to the UAE, thanks to its secure and internationally compliant business environment. The UAE government is fully dedicated to establishing a tax regime that includes the introduction of a Corporate Tax system. This commitment reaffirms the UAE’s resolve to uphold international standards for tax transparency and prevent harmful tax practices.

What is the significance of Agreements on Mutual Promotion and Protection of Investments and Avoidance of Double Taxation Agreements?

Let’s begin by discussing the importance of Avoidance of Double Taxation Agreements. Some countries impose taxes of the same nature on the same individual and goods, resulting in double taxation. This practice has had detrimental effects on the exchange of goods, services, and international mutual investments. The UAE recognizes the importance of eliminating double taxation. Consequently, the Ministry of Finance has diligently followed international standards set forth by the G20 and the Organization for Economic Cooperation and Development. These standards address harmful practices, as well as the exchange of information and the misuse of agreements to gain advantages for third parties or to establish non-economic entities within the state.

In line with this commitment, Cabinet Resolution No. 3/196 of 1989 was enacted, empowering the Ministry of Finance to engage in negotiations and sign comprehensive bilateral agreements aimed at avoiding double taxation. As of now, the UAE has successfully concluded 142 such agreements.

Double taxation avoidance agreements serve multiple purposes in the UAE. They promote development goals, diversify national income sources, and eliminate instances of

23 conomy middle eastJUNE 2023

H.E. Younis Haji Al Khoori, Undersecretary of the Ministry of Finance, UAE

double taxation, including additional and indirect taxes, as well as fiscal evasion. These agreements address challenges related to cross-border trade and investment, offering comprehensive protection against direct and indirect forms of double taxation. Their objective is to facilitate free trade and investment flow, attract larger investments, and support development goals while considering evolving the global economy, financial sectors, and new financial instruments like transfer pricing mechanisms. Additionally, these agreements encourage the exchange of goods, services, and capital movements. Secondly, the Protection and Promotion of Investment Agreements are aligned with the UAE’s efforts to strengthen its global standing by showcasing the favorable investment environment available within the UAE at local, regional, and international levels. Consistent with our wise leadership’s vision to foster sustainable development and establish an investment ecosystem that appeals to both the public and private sectors, these agreements also seek to fortify relationships and cultivate strategic alliances with Arab and foreign nations.

The Cabinet Resolution No. 382/1 of 1989 was issued to authorize the Ministry of Finance to negotiate and sign bilateral agreements with Arab and foreign countries to safeguard and promote investments. To date, a total of 110 agreements have been reached, all aimed at shielding investments from non-commercial risks such as nationalization, expropriation, sequestration, and freezing. They facilitate the establishment and licensing of investments, guarantee the unrestricted transfer of profits and other returns in a freely convertible currency, ensure equal treatment as per the laws enforced in the host country, and extend the most favored national treatment concerning the management, maintenance, and expansion of investments.

The agreements ensure fair and prompt compensation to the investor in the event of expropriation of their investment for the public interest,

in accordance with the law and without any discrimination This compensation should correspond to the fair market value of the investment prior to the expropriation. Furthermore, these agreements establish the procedures for resolving disputes between the investor and the State, allowing for amicable solutions, recourse to local courts, or resorting to international arbitration.

What steps has the Ministry of Finance taken to secure green financing instruments and are there measures to motivate investors to adopt this type of financing?

The UAE was the first Gulf country to commit to net-zero emissions. In 2021, the UAE launched its Net Zero 2050 Strategic Initiative, which aims to promote investments in clean and renewable energy sources to achieve net-zero by 2050. Our commitment to net neutrality entails the provision of climate finance, building on an effective sustainable finance ecosystem in the UAE. On that note, the UAE has experienced remarkable growth in the issuance of green and sustainable finance in the past couple of years. The UAE’s ESG bonds market for green sukuk, bonds and loans is also thriving, with a valuation that nearly reached $17 billion in 2021.

The Ministry of Finance plays a central role in shaping the sustainable finance landscape in the UAE. Internationally, the ministry is leading the UAE’s contribution to global sustainable finance policy discussions through G20 and other global multilateral forums. On a local level, the ministry is participating in the UAE Sustainable Finance Working Group, which aims to develop the local sustainable finance ecosystem. The group is also developing a UAE Sustainable Finance governance model, as well as disclosure requirements and taxonomy. Additionally, we are working closely with the UAE COP28 Team to explore climate finance opportunities and challenges in order to inform them of local and international efforts and objectives in this regard.

Innovation is a valued practice in the UAE, and highly encouraged by its leaders. Can you share the latest innovation initiatives of the Ministry of Finance?

Innovation is deeply ingrained in the UAE’s DNA, and as the Ministry of Finance, we are committed to continuously fostering a culture of innovation within our organizational work environment. Over the past decades, our ministry has successfully embraced a fully digitalized approach to providing services, adhering to the highest international standards. This reaffirms our position as a global leader in government financial work and contributes to elevating the customer experience while driving economic development in the UAE.

24 conomy middle east june 2023

banking & finance

To further enhance accessibility to our services, we have introduced the Digital Service Guide – a user-friendly and interactive digital platform. Its purpose is to simplify the process of accessing information, submitting applications and obtaining services for individuals and businesses. Moreover, the Mohammed bin Rashid Innovation Fund is a groundbreaking initiative by the Ministry of Finance, launched under the patronage of His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai. MBRIF aims to empower the innovation ecosystem and support innovators in making a positive impact on the UAE’s transition to a knowledgebased economy. Through this initiative, we aspire to achieve prosperity and sustainability for our nation. MBRIF has meticulously developed two comprehensive programs tailored to meet the unique needs of every innovator, with the invaluable support of our like-minded network of partners.

What are the ministry’s plans to support entrepreneurs, as well as startups and small businesses?

Supporting the growth of SMEs is a priority for the Ministry of Finance. The thriving SME sector in the UAE plays a vital role in driving sustainable development, unlocking the economy’s potential, and fostering growth, diversity, flexibility and innovation.

In line with our mission to make the UAE a global business hub and a promising destination for SMEs, the Ministry of Finance introduced advanced digital solutions to create a business-friendly and encouraging environment for business owners and entrepreneurs. Furthermore, we offer various forms of sponsorship that cover all stages of establishing and developing thriving businesses and promising projects. The ministry extends support and sponsorship for innovative businesses and entrepreneurs, offering modern environment, transparent procedures, smart services, digital platforms, open data and futuristic models.

SME owners and entrepreneurs can also register their companies in the

Federal Supplier Register to apply for all government bids and tenders proposed by federal government entities. Moreover, in line with our mission to foster an innovationdriven environment and shape the future of the UAE economy, we facilitate affordable financing and streamlined loan processes through government-backed guarantees for unique and innovative ideas from companies and SMEs.

We also provide incentive packages for companies that include a 50 percent discount on first-time registration in the Federal Supplier Register, free registration renewals, exemption of SMEs from registration fees for the first two years from the establishment date, a 10 percent price preference to SMEs and a free tender booklet.

In addition to a 0 percent Corporate Tax rate for taxable income up to and including AED375,000, small businesses with revenue below a certain threshold can claim “small business relief,” allowing them to be treated as having no taxable income during the relevant

Tax Period. They may also be subject to simplified compliance obligations. To claim small business relief, a formal election must be made to the FTA.

Recently, the Ministry of Finance issued Ministerial Decision No. 73 of 2023 on “Small Business Relief,” aimed at supporting startups and other small or micro businesses by reducing their Corporate Tax burden and compliance costs. This decision specifies the revenue threshold and conditions for eligible taxable persons to elect for small business relief. It also provides clarity on the treatment of carriedforward Tax Losses and disallows Net Interest Expenditure under the “Small Business Relief’ scheme.

According to the Ministerial Decision on “Small Business Relief,” resident taxable persons can claim this relief if their revenue in the relevant tax period and previous tax periods is below AED3 million for each tax period. However, once a taxable person exceeds the AED3 million revenue threshold in any tax period, the “Small Business Relief” will no longer be available.

25 conomy middle eastJUNE 2023

ESG investing is accelerating the appetite for sustainable finance

By Ahmed Abdelaal

By Ahmed Abdelaal

The MENA region is particularly vulnerable to the adverse effects of climate change due to various geographical factors, making it one of the most severely affected regions. This reality has created a sense of urgency for economic change in most countries across the region, especially as GCC nations make substantial progress in building resilient and sustainable non-oil economies. In this changing paradigm, new opportunities are surfacing for investors and financial institutions across a diverse range of industries, including renewable energy, infrastructure development, digital technologies, e-commerce, and fintech. This may be a vast spectrum of sectors, but what they all have in common is the increasing influence of sustainable finance.

The concept of responsible business has rapidly gained recognition in the public consciousness as an essential corporate requirement. This is evident in the promising outlook for sustainable financing. Moreover, within the framework of addressing

climate change, sustainable financing has emerged as a crucial factor in meeting consumer preferences. Supported by regulatory initiatives, this has given rise to a new paradigm where the most viable investments are those aligned with environmental, social, and governance (ESG) principles. Consequently, consumers now possess the power to enact change through their choices. As a result, the emergence of ESG investing has rapidly changed how investors think and the associated choices they make. In particular, the ESG spotlight has led to an emphasis on the importance of investment decisions that mitigate exposure to climate risk, comply with current and future regulations and limit any potential reputational damage. This is why banks and investment firms are devising green and sustainable strategies, incorporating them into their business strategies, and aligning their funding mechanisms to their sustainable development commitments.

conomy middle east june 2023

banking & finance

Financing the region’s sustainability-focused long-term vision

We are witnessing the positive impact of these mechanisms as they drive successful outcomes, thanks in part to their inclusion of long-term agreements. Mashreq has played a pivotal role in expediting the uptake of sustainable financing opportunities, facilitating a total of $15.5 billion in investments in sustainable finance and adaptation across Egypt, India, Bahrain, Qatar and the UAE over the past two years. Several of these nations are furthering their commitment to sustainability by actively promoting the issuance of green bonds and Sukuk.

Egypt was the first country to issue a sovereign green bond in MENA in 2020, issuing $750 million worth of five-year bonds. The sovereign green bond was seven times oversubscribed, leading to a 50 percent upsizing of the transaction to its $750 million ultimate issuance level. The investor response presents a glimpse into the opportunity and appetite for green financing in the MENA region, as well as an insight into how seriously investors are focusing on the social and economic threats from climate change.

Additionally, and in a nod to the worsening issue of water security, Mashreq has also facilitated $1.3 billion in water-related projects across Egypt, India, Bahrain, Qatar and the UAE that will build resilience to scarcity and water-scarcity-related disasters. As part of these efforts, the bank has been heavily involved in financing solutions for projects like the Abu Rawash Wastewater Treatment Plant in Egypt, among many other water-related programs.

This investment is set to have a significant impact, benefiting over 8 million individuals, primarily in the Giza Governorate, the Eastern side of the Nile River and the CairoAlexandria Desert Road. Additionally, the project has successfully created 1,600 employment opportunities, with 20 percent allocated for women, contributing to a broader positive social effect. Mashreq has also played

a leading role in facilitating the Sustainability Linked Loan for Nogaholding in Bahrain, an impressive achievement considering its substantial value of $2.2 billion, making it the largest SLL in the region. Looking ahead, Mashreq’s vision is highly ambitious, aiming to achieve $30 billion in sustainable financing by 2030.

Collaboration among stakeholders to achieve common climate goals

However, such financing targets are only part of the picture. To further boost its impact, the banking sector must partner closely with its clients, advising them on transition strategies, managing risk and helping them access appropriate sustainable financing for their needs – across CAPEX, OPEX or even retraining their workforce and raising awareness among employees. Partnerships with policymakers have also become important, not only regionally but at a global level. This year’s COP28 in the UAE – following COP27 in Egypt in 2022 – will provide a new opportunity for governments as well as the public and private sectors to collaborate to streamline details on national and regional finance frameworks, and work together to accelerate adoption of sustainable finance. This will help boost clarity, which is integral to strengthening investors’ appetites and confidence. Looking ahead, all banks have a responsibility to build their sustainable financing solutions within the context of national, regional and international regulations, standards and policies. Across the MENA region, it is crucial for the banking sector to prioritize alignment with national and regional frameworks, including the UAE’s climate goals, along with global environmental initiatives. This imperative goes beyond financial considerations and extends to a moral and ethical responsibility.

April 2023 saw Mashreq join the World Green Building Council’s Advancing

Net Zero Readiness Framework as a Collaborator in the MENA region, following the bank’s decision to join the United Nations Global Compact initiative in August 2022. Through its involvement with both institutions, Mashreq looks to further incorporate the principles of social and environmental responsibility, integrity, transparency and robust social and governance practices across its operations and activities.

All corporations in the financial industry have a fundamental responsibility to act as corporate citizens and lead by example. With COP28 on the horizon, now more than ever – and particularly in the UAE – a firm commitment to ESG principles will provide leading banks with a competitive advantage and set them apart from their fellow industry players. This unique positioning becomes pivotal for the banking sector’s goal of fostering sustainable business practices and driving the adoption of sustainable financing. By doing so, these leading banks will be at the forefront, facilitating the rapid adoption of sustainable finance and paving the way for its accelerated growth.

27 conomy middle eastJUNE 2023

Ahmed Abdelaal, Group CEO Mashreq

Safeguarding clients with gap level protection, liquidation buffers

Multi-asset brokerage Exness reveals top market maker themes

Exness, a global brokerage firm, concluded 2022 impressively, recording a monthly trading volume of $2.5 trillion in December. The positive momentum continued into 2023, with company’s monthly trading volumes surpassing $2.8 trillion. Last March, trading volumes soared to an impressive $3.8 trillion. Additionally, Exness experienced a significant surge in active clients, reaching nearly 375,000, as indicated by their financial data.

Damian Bunce, the chief customer officer at Exness, told Economy Middle East that the exceptional performance can be attributed to a combination of factors. Bunce highlighted their effective distribution model, which enables them to enter new markets

strategically, identify suitable partners, and successfully promote their products and services. “We’re a company of 2,000 people and 800 of those are working in technology and data science, allowing us to avail very big volumes and build excellent products that are highly price competitive,” he said.

Bunce emphasized that once clients engage in trading with Exness products, the company ensures these traders have the assurance that in the event of any incidents or issues arising, these are promptly addressed and resolved. “So, when you combine distribution, product and service, you have a compelling proposition with Exness,” Bunce said.

conomy middle east june 2023

banking & finance

CFDs: Leveraging and risks

CFDs, also known as contracts for differences, are financial instruments that allow clients to adopt either a long or short position, i.e. profit from both upward and downward market movements. One of the key advantages of CFDs is that they provide traders with leverage, granting them the ability to borrow funds from brokers to engage in more substantial contracts, such as those involving gold and oil.

“CFDs have become popular because of the functionality they offer in a big industry that has roughly 1 trillion in traded volume per day for retail alone. But education around leverage is really crucial,” Bunce cautioned. Leverage does have the benefit of providing upside opportunity. “For less money, you can buy something pricier. But the downside of course is that you can lose your money quickly, including all your deposits. So, it’s important to be measured about not overleveraging.” Bunce

said

Exness products garnering mass appeal

Bunce elaborated on one of Exness’ popular products, which addresses a common industry paint point known as “Slippage.” This occurs when a client specifies a trade price that is ultimately not fulfilled due to market movements, also referred to as “gapping.” Bunce clarified that the responsibility for slippage lies not with the broker but rather with the market itself.

To alleviate this concern, Exness provides a feature called “gap level protection,” which has garnered significant appeal among customers, especially in volatile markets. In certain instances, brokers may choose to widen spreads, this is usually a risk management measure to protect the broker and historically it has the negative side effect of liquidating some clients’ leveraged positions.

“At Exness this can never happen. Clients’ positions are never liquidated as a result of spread widening - this was a very deliberate measure introduced as part of Exness’ unique advantages and is referred to as

volatility protection. With clients that trade with leverage, they can get upside and never lose more than their initial deposit and so, there’s never a situation where a trading customer of Exness could effectively “owe” Exness money as a consequence of us liquidating a leveraged position which would have made the client balances negative. That negative is always Exness liability.”

Exness plans for the region

Exness invests heavily in having a robust presence in many regional conferences. “We usually have the largest stand. We do that because people want to see their counterparts, and want to know we are real, big and well capitalized,” Bunce said. In terms of regulatory matters, Exness acquired a brokerage company in Jordan, obtaining its first license in the country. Recognizing the immense opportunities available in the area, Bunce emphasized that Exness is actively engaged in ongoing discussions with local regulators to determine the most suitable operational structure for the region.

Upcoming market themes

According to Bunce, today presents a remarkable opportunity for trading, with numerous possibilities available, although he cautioned that some opportunities come with inherent risks. One significant concern he highlighted is the unresolved issue of the debt ceiling within the US Congress. If this matter is not resolved in a timely manner, it could have catastrophic consequences for the market, particularly regarding defaults on US debt. Bunce added that any financial instrument linked to the dollar would likely be impacted if such a scenario were to unfold. He provided an example from the past 6 to 12 months involving the Japanese yen. As the U.S. Federal Reserve raised interest rates to combat inflation while the Bank of Japan maintained stability, the yen weakened against the dollar. This, in turn, created extensive trading opportunities.

Bunce explained that the narrative surrounding the strengthening of the dollar is expected to remain a significant

theme in the future. He also pointed to the issue of de-dollarization some countries are resorting to but said that this scenario playing out over the next 12 months was highly unlikely.

According to Bunce, the potential shift of Saudi Arabia considering accepting oil payments in yuan, in addition to or instead of the dollar, represents a significant market-making move.

“And then there are themes around cryptocurrencies. We’ve seen the Bitcoin Summer, and Winter, and now maybe we’re in Spring. Bitcoin provides many traders with relatively interesting alternatives to traditional assets. With daily trading at roughly $68 billion, Bitcoin is a pretty relevant asset today.”

Bunce also noted gold as being another market theme. “Exness is a very big gold trader. It’s an asset with a lot of intraday volatility and, in some ways, relates to all the major assets. So, when equities are booming, there’s an impact on gold and the same goes with inflation and interest rate moves,” he said.

Those interested in trading on Exness can visit the company’s official corporate website, Exness.com. Once there, clients can sign up, provide their credential, and proceed to download either Exness’ proprietary platform or third-party platforms to begin trading. “But we’re not yet operating in all jurisdictions of the world. We have some restrictions,” Bunce said.

29 conomy middle eastJUNE 2023

Damian Bunce, Chief Customer Officer, Exness

Basel III a crucial framework for preventing future banking crises

Lawmakers urged to fully implement regulations amid recent turmoil

In the aftermath of banking crises aftershocks, financial authorities have repeatedly assured depositors that the sector is healthy and solid. However, these assurances failed to prevent the domino effect that resulted in the collapse of several U.S. banks. In the wake of these collapses, including those of Silicon Valley, Signature, and First Republic, Federal Reserve officials, led by Chairman Jerome Powell, have emphasized the strength of the sector, and maintained that the incidents were isolated and not indicative of a contagion that would impact the entire financial sector.

During a period of a severe confidence crisis, Swiss bank “Credit Suisse” was acquired by its rival “UBS.” Swiss authorities intervened promptly to prevent the spread of fear and uncertainty to other banks in Switzerland and Europe. On multiple occasions, central banks and banking supervisors have conveyed the message that the recent incidents in the banking sector were not a repetition of the

2008 global financial crisis and should not be considered as equally dangerous. This may be true, as with the exception of Credit Suisse, European banks have weathered the turmoil. The issue appears to be limited to banks operating within the United States, as their situation was exacerbated by their exposure to the Federal Reserve’s hawkish policy of raising interest rates.

According to ECB President Christine Lagarde, the failure of U.S. banks can be attributed to the country’s incomplete implementation of the Basel III requirements. During the previous administration led by Donald Trump, regulatory obligations on liquidity reserves for small and mediumsized banks were lifted, preventing regulators from promptly accessing information on banks’ liquidity status to prevent their collapse. Lagarde pointed out that due to the incomplete implementation of the standards, “only 14 banks – yes, just

banking & finance

14 banks,” were subject to the full Basel III requirements. In contrast, the ECB’s own analysis revealed that the corresponding figure for the EU was 2,200 banks. There are over 4,000 banks in the United States, which averages to 80 banks per state across the 50 states. This number has decreased by more than two-thirds since the early 1980s when it reached a peak of over 14,000. In an interview, MEP Jonás Fernández, a member of the European Parliament’s Committee on Economic and Monetary Affairs, emphasized that the current crisis should “encourage lawmakers to review the way we all think about banking regulation” and fully implement Basel III as soon as possible.

In a November 2022 ECB blog, three high-level ECB officials warned that parliamentary negotiations on the banking package would “deviate from international standards.” Instead, the regulators called for the full implementation of Basel III, which comprises “carefully crafted rules to ensure a minimum worldwide safety net against a large number of risks that we have painfully suffered through in the midst of the global financial crisis.”

The “banking package” is a crucial component of the banking regulatory framework put forth by the EU in the past 10 years, encompassing reviews of capital requirement guidelines and regulations, including those established by the Basel III reforms.

The Basel III requirements

Basel III is a global regulatory framework that promotes bank capital adequacy, stress testing, and market liquidity risks. It was developed in response to the shortcomings in financial regulation revealed by the 2007-08 financial crisis.

The Basel III regulatory framework’s first pillar requires banks to meet minimum regulatory capital requirements. The Net Stable Funding Standard (NSFR) and Liquidity Coverage Standard (LCR) are among these requirements.

The Liquidity Coverage Standard mandates that banks maintain a minimum of 100 percent reserves to ensure they have enough high-quality liquid assets to cover net cash outflows for the next 30 days.

Overall, Basel III aims to enhance the minimum capital ratios for banks to deal with unexpected losses, establish requirements for high-quality liquid asset holdings and funding stability, and mitigate the risks of excessive account withdrawals that could undermine the banks’ abilities. Although designed as a deterrent mechanism against bank collapses, several U.S. banks were still struck by such events this year, with the possibility of re-enactments occurring in the near future.

Silicon Valley Bank was primarily geared toward providing financial services to high-risk startups. Despite being the 16th largest bank in the U.S., it was not regarded as a major player in the industry. This was largely due to its classification as a Tier IV bank, which meant that its assets were below $250 billion and it was not subject to the same level of regulation as larger financial institutions considered “too big to fail.” As a result, Silicon Valley Bank was exempt from complying with the Federal Reserve’s Net Stable Funding and Liquidity Coverage Criteria requirements.

Silicon Valley Bank’s focus on serving high-funding startups required it to maintain sufficient liquidity and comply with Basel rules on liquidity, ensuring that it had enough funds to weather economic downturns. However, during the crisis it faced, the bank was unable to cover a sudden rush of customer withdrawals, which eroded customer confidence and ultimately led to its collapse.

This was largely due to the bank’s investment of its deposits in long-term U.S. Treasuries, which declined in value as interest rates rose, causing the bank’s investment portfolio to suffer.

It is evident that compliance with the Basel III regulatory framework is crucial to ensure stability in the banking sector and prevent future crises from occurring in a domino-like fashion.

31 conomy middle eastJUNE 2023

Group CEO Mohamed Abdalla Al Zaabi reflects on Miral's success in crafting world-class immersive destinations and experiences

SeaWorld Abu Dhabi set to boost company’s position as region’s leading leisure, tourism and lifestyle entity

Driven by a commitment to customer satisfaction, progressiveness, and operational excellence, Miral has established a distinguished reputation for crafting immersive destinations and experiences that garner international acclaim and captivate visitors worldwide. With an impressive history of success, Miral has consistently delivered globally recognized attractions, solidifying its standing as a regional powerhouse in the industry and a trusted partner of Abu Dhabi in its endeavor to position the emirate as a prominent global tourism hub. Group CEO Mohamed Abdalla Al Zaabi shares Miral’s strategic initiatives that have propelled its remarkable achievements and fostered a mutually beneficial partnership with Abu Dhabi.

economy

SeaWorld Yas Island, Abu Dhabi - One Ocean

How does Miral collaborate with local authorities, businesses and community stakeholders to enhance the overall tourism and entertainment experience in Abu Dhabi?

As a leading creator of immersive destinations and experiences in Abu Dhabi, Miral has been driving the growth of the leisure and entertainment sector for the past 11 years. Through partnerships, design, creation, development, operation, and management, Miral has positioned Abu Dhabi as a top global tourism destination. We have successfully brought to life immersive destinations and experiences such as CLYMB Abu Dhabi, Qasr Al Watan, Yas Waterfront, Warner Bros. World Abu Dhabi, and the world’s first-ever Warner Bros. themed hotel. In 2022, Miral was appointed by the Department of Culture and Tourism - Abu Dhabi (DCT Abu Dhabi) to oversee the Destination Management Strategy of Saadiyat Island. This appointment aimed to strengthen Saadiyat Island’s position within the global culture, leisure, and business tourism ecosystem. Furthermore, Miral, in collaboration with DCT Abu Dhabi, has conceptualized and is developing two exciting upcoming additions to the Saadiyat Cultural District: the Natural History Museum Abu Dhabi and teamLab Phenomena Abu Dhabi. The Natural History Museum Abu Dhabi is expected to be the largest of its kind in the region, offering visitors a 14-billion-year journey through time and space, encompassing the earliest origins of our universe to a captivating perspective on Earth’s future. Miral’s vision for teamLab Phenomena Abu Dhabi is to create an immersive and inspiring space at the forefront of art and technology, igniting curiosity, imagination and creativity. We also work closely with DCT Abu Dhabi to enhance the city’s overall tourism and entertainment sector. By hosting high-profile events such as music festivals, concerts, and sports on Yas Island, Miral contributes to the vibrant cultural landscape of Abu Dhabi. Notable events include the NBA Abu

Dhabi Games 2022, the International Indian Film Academy Awards (IIFA), and ‘The Lion King’ musical, among others. Through a partnership with the Abu Dhabi Convention and Exhibition Bureau (ADCEB), Miral actively promotes the capital as a premier destination for meetings, conferences, and exhibitions (MICE), strategically targeting business events with over 500 attendees. We have maintained a strong partnership with the Abu Dhabi Sports Council for several years, collaborating on world-class sporting events. Yas

Island offers unparalleled entertainment experiences. Our collaboration with Warner Bros. Discovery resulted in the establishment of Warner Bros. World Abu Dhabi, the world’s largest indoor theme park, as well as the opening of The WB Abu Dhabi, the first Warner Bros.-branded hotel. Building upon our success, we have recently announced plans to introduce the region’s first Harry Potter-themed area, further expanding the park’s immersive zones.

Miral places a strong emphasis on innovation and recognizes the importance of digital transformation in delivering captivating and personalized visitor experiences. In line with this commitment, we have partnered with Microsoft to launch a generative AI service, enhancing our help and information offerings for guests at Yas Island’s theme parks and experiences.

Furthermore, our recent collaboration with SeaWorld® Parks & Entertainment to establish SeaWorld Yas Island, Abu Dhabi, marks a significant milestone in reinforcing the capital’s appeal as a prominent global tourism destination with a next-generation Marine Life Theme Park.

Overall, Miral’s partnerships have been pivotal in positioning Yas Island as a premier destination for entertainment and leisure. We are dedicated to working alongside partners who share our vision of creating immersive destinations and experiences that contribute to the growth of the leisure and entertainment industry while promoting Abu Dhabi’s economic diversification.

What economic benefits have been gained from Miral group’s destinations and how does the group contribute to the Abu Dhabi Vision 2030?

Island has successfully hosted prestigious international competitions including the Fina World Swimming Championships, Abu Dhabi HSBC Golf Championship, World Triathlon Championship Finals and FIBA 3X3.

Thanks to our enduring relationship with global intellectual property holders, Yas

Miral is driven by its ambition to be a customer-centric, progressive, and efficient organization. With a proven track record of excellence, we have successfully created globally renowned immersive destinations and experiences that attract visitors from around the world. As a trusted partner in the leisure and entertainment

33 conomy middle eastJUNE 2023

Mohamed Abdalla Al Zaabi, Group CEO, Miral

"Our endeavors have brought significant economic benefits to the region, boosting tourism revenue and creating numerous employment opportunities."

industry, we are aligned with Abu Dhabi’s vision and proudly contribute to the transformation of the sector in Abu Dhabi, as well as the economic diversification and growth of the Emirate. Our efforts position Abu Dhabi as a global tourism hub.

Over the past 11 years, Miral has been creating unique and unforgettable destinations and experiences which have helped establish Abu Dhabi as a top global hub for leisure, entertainment, and tourism. Our endeavors have brought significant economic benefits to the region, boosting tourism revenue and creating numerous employment opportunities.

At the core of Abu Dhabi’s Vision 2030 lies a commitment to innovation. In 2021, we launched the Noor Initiative, a decision analytics strategy that enhances our investment in predictive data analytics and integrates innovation throughout our operations. This initiative enables us to deliver personalized experiences for local and international visitors to Yas Island while solidifying Abu Dhabi’s position as a data-driven capital. We have introduced FacePass, a facial recognition technology, and partnered with Microsoft to launch a new customer-facing generative AI powered by ChatGPT, providing personalized guidance and information to visitors.

We have made significant progress in showcasing Abu Dhabi’s leadership in the virtual world through a groundbreaking partnership between DCT Abu Dhabi, Aldar, Miral, twofour54, Abu Dhabi

Motorsports Management, Flash Entertainment, and Yas Island. Together, we have recreated an entire physical destination across world-leading immersive platforms, a first for the UAE. This allows virtual visitors to access Yas Island and experience its wonders through the metaverse, regardless of their location.