12 minute read

Cover Story Private Labels taking up the sustainability challenge

Private Labels

taking up the Sustainability Challenge

Private label lines have led the charge in terms of dynamics on this issue in recent years. The sector’s 2019 turnover figures in Italy topped €10.8 billion, driving 80% of the food industry’s growth in the last 16 years.

Consumption figures were hard hit in 2020. The COVID altar swept away $12.5 trillion of global GDP in just one year. The most recent forecasts for Italy stand at -10%, and our country will only return to pre-COVID levels in 2023 (or 2025 for the most pessimistic cases). However, the concern Italians have for sustainability remains one of the constants the pandemic has failed to banish. While 35% of the managers interviewed in the survey "Italia 2021, il Next Normal degli italiani" (Italy 2021, the Next Normal for Italians) believe that developing the green economy is one of the trends that will positively characterise the post-COVID era, this sort of national green awareness is nevertheless reflected in related purchases: 27% of the inhabitants of the “Bel Paese” buy more sustainable and eco-friendly products than before COVID (trailed by the French and Spanish at 18%) and 20% buy more from worker-friendly companies. The 2020 Coop Report found that over half of all consumers intend to buy mainly Made in Italy products, preferably sustainable ones, aspects considered important by 53% and 48% of the respondents respectively. The very concept of a sustainable product is now becoming more nuanced, with the concept of local production or production linked to the local area (among other things, 50% combine this with sustainability) and a controlled supply chain (49%) being added to the generic concept of being environmentally friendly. The principle of fair remuneration for the various actors in the chain also appears (47% of the sample mentioned it in connection with sustainability). The crisis (and a revival of plastic packaging) notwithstanding, the Italian shopping cart remains quite green, bucking the trend in many other

European countries and the United States. More than one in four consumers (27%) increased their purchase of ecofriendly products and one in five bought them from outlets that promote sustainable consumption (21%). Italians are intent on sticking to this habit in 2021, as 36% of respondents plan to buy even more sustainable food this year and only 6% plan to buy less. Interestingly, over two thirds of those surveyed would gladly change their supermarket of choice to one that is more committed to this issue, offering more sustainable packaging and environmental initiatives.

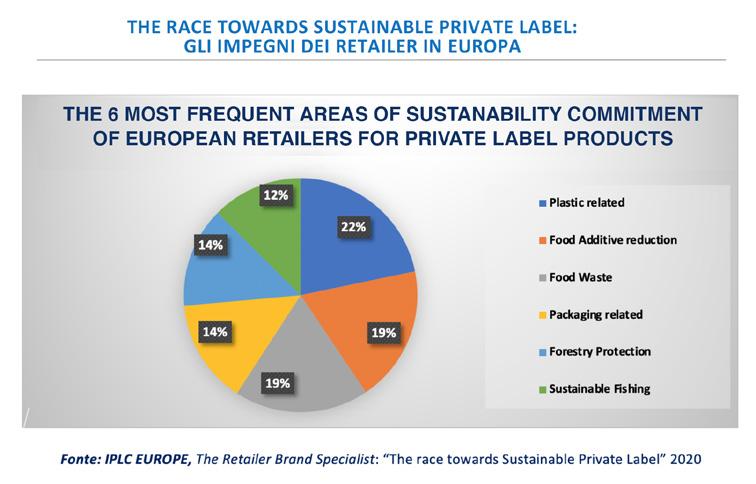

INCREASING RETAILER ENGAGEMENT It should therefore come to no surprise that retailers, particularly food retailers, explicitly involved in the issue of sustainability with visible and measurable actions: as providers of everyday needs, they see initiatives in this area as an opportunity to gain visibility and distinguish themselves. Within the retailer's house brand (private label) strategy, sustainability in all its forms offers them a unique opportunity to respond to the consumer's quest for 'conscious living'. This was illustrated in "The Race Towards Sustainable Private Label. Carrot, stick or collaboration? How retailers in Europe address sustainability with private label" a research report published last year by IPLC Europe. "The role of private label has changed since the 1980s, when it developed its own momentum. At the beginning, it was all about margin improvement and changing the leadership within the supply chain (retailer in the lead as opposed to brand manufacturers), subsequently switching to differentiation and category management. Nowadays, private label strategies aim for supporting the retailer store image and sustainability objectives offer a unique opportunity to do so. Topics such as the carbon footprint, packaging and waste reduction, responsible fishing, animal welfare, social responsibility and biodiversity can all be directly or indirectly addressed with private label."

PL DRIVING SUSTAINABILITY... It is no coincidence that private label lines had the greatest dynamism in terms of sustainability. The sector’s 2019 turnover figures in Italy topped €10.8 billion, driving 80% of the food industry’s growth in the last 16 years (domestic segment and internal market). Last year, the European House - Ambrosetti and Associazione Distribuzione Moderna (ADM) presented "The Contribution of Private Labels to the Challenge for Sustainable Development and Italian Growth", research proving that sustainability is expressed not only in products that are increasingly in line with new consumer needs but above all in the supply chain: an analysis of suppliers' balance sheets over the last six years shows that companies have better economic, employment and income performance

Daunting challenges for suppliers

Working jointly with industrial partners in this context proves to be essential to share development projects and thus render an accessible and economically sustainable final product. Producers constantly fret over the conflict between distributors’ demand for lower prices and the need to innovate with new packaging solutions, ingredients, traceability etc. This is by no means a new problem, since it has always been difficult to share the costs of innovation in the supply chain whenever it is deemed that shared choices do not generate new value. It is therefore crucial that the path to sustainability is pursued with a common entrepreneurial vision among private label manufacturers and retailers. “We are working with our supplier partners," explains Pietro Poltronieri, Crai's PL manager, "to take concrete action directly in the choice of materials. For example, we have worked on recycled plastics in categories such as water, liquid detergents and commodities, and in 2021 we have a number of other categories that we will work on, including sliced meats, stuffed pasta and eggs. Another issue to which we are committed is to make our seafood offer more and more connected to the theme of sustainable fishing and protection of the seas." than other food companies, a dynamism that increases as the share of turnover generated by PL increases. "Virtually 50% of the organic product offer in Italy is made by retailers and private labels who are assuming a leadership role on sustainability: by coordinating and helping supply chain actors towards sustainable practices and products, they enable shoppers and consumers to find a wider sustainable offer on the shelves." This is how Paolo Palomba, managing partner at Expertise on Field-IPLC Italy, put it.

...BUT THERE IS STILL A LONG WAY TO GO In recent years, retailers have also been encouraged in their efforts by the Italian Alliance for Sustainable Development (ASVIS, founded in 2016), which promotes the adoption of practices aimed at achieving the 17 Sustainable Development Goals of the United Nations. Retailer commitments and product offerings, however, still fall short of the mark when measured against the scale and urgency of the climate crisis and sustainability agenda. Nielsen noted that 74% of consumers believe that companies are committed to the environment, yet only 16.4% of them offer "green" products, even though over 70% of Italian consumers are willing to pay more for them (Nielsen Sustainable Shopper Report, 2019).

Coop Italia stands among Italy’s most active chains on this front, in terms of projects and communications alike. In this regard, the chain launched the campaign “Con buone scelte di acquisto puoi cambiare il mondo” (With the right shopping decisions, you can change the world) in late 2019. The cooperative is also actively engaged in reducing the use of pesticides, particularly glyphosate in farming, which has led to the largest range of organic products available in Italy under a single brand name: Vivi Verde Coop. "Italy's first organic brand sold in the mass consumer sector tallied a total revenue of over €150 million in 2019 and has not stopped growing during and after the lockdown, with a value trend of +9%," affirmed Maura Latini, managing director of Coop Italia during the presentation of the annual Report. The chain, together with Carrefour, leads the effort in Italy on traceability and transparency for the egg, chicken and citrus fruit supply chains. And finally, Coop also launched the Buoni e Giusti (Good and Fair) campaign, which focuses on buying and selling fruit and vegetables produced without exploiting workers. Another major player, Conad, has pledged to eliminate plastic by 2021 from many branded packages and track plastic and CO2 reductions. For Esselunga, offering sustainable products means measuring and assessing their impacts throughout their life cycle, and secondly, developing sales lines with minimal environmental impact. With this in mind, the company has quantified the environmental impact of all phases of the life cycle of some of its branded products by adopting the Life Cycle Assessment (LCA) methodology. It also started a trial of collecting plastic bottles in its shops.

PRIMARY TARGET: PACKAGING IPLC data show that packaging is among the main targets of European retailers (14%). In response to how much the issue has become relevant and heartfelt, Bennet presented its first sustainability report for 2019 in 2020. The commitment to safeguarding the future has led to significant results in terms of reducing packaging materials (-43.9% in plastics in 2019 vs 2018). The commitment to safeguarding the future has led to significant results in terms of reducing the packaging materials used (-43.9% in the use of plastic in 2019 vs 2018). Where reduction is more difficult today, for technological and food safety reasons, the company has oriented its choice towards 'more sustainable' mono-material packaging, which is easier to dispose of and recycle, towards materials and products obtained from the recycling of plastic waste with the Plastica Seconda Vita (Second Life Plastic) environmental certification marking, towards the use of bioplastics, obtained from material of vegetable origin, which can be disposed of in the organic fraction, towards the use of paper packaging certified with chain of custody (FSC, PEFC, ATICELCA). Despar follows two central tenets when developing new products: health and well-being on hand, and the environment on the other. "For some years now," says Michela Cocchi, Brand Manager Despar Italy, "we have been putting icons on our products that simply explain the materials used in the packaging and how to dispose of packaging waste”. Selex (Selex, Vale, Il Gigante) is also focused on packaging, as Luca Vaccaro, PL director, points out: "We are working on reducing packaging, the use of mono-materials, with a preference for recyclable and recycled materials, to reduce overpack with the aim of putting less on the market, simplifying disposal and eliminating the most polluting materials. This is a major project covering all our products, over 5,000 references, and already in the first months of this year we are making changes to many of our packages: ranging from water bottles, which will now be made partly from recycled plastic, to reducing the thickness of bags of fresh-cut salad, and changing the packaging material of biscuits to make it totally disposable in paper."

DISCOUNTERS NOT LAGGING BEHIND... The growth of sustainability awareness in discounters is also significant and goes hand in hand with the growth of the channel. “One of the biggest challenges we face," says Alessia Bonifazi, Communications & CSR Manager at Lidl Italy, "is to reduce the use of plastic throughout the supply chain. One of the most prominent of our many initiatives over the years is REset Plastic, the Schwarz Group's international plastics strategy, which Lidl Italy has joined. We are aiming to for a 20% reduction in plastic in own-brand product packaging by 2025 and also make 100% of our own-brand product packaging recyclable by that date. Achieving these goals requires a new holistic approach, from eliminating plastics wherever possible, to designing new, more recyclable packaging, to innovation and public awareness." PL's 'green' vocation is encapsulated in the project “La Buona Spesa non solo a parole” (Good Shopping, not just words). The environmental commitment also extends to the packaging of branded products through precise instructions on proper disposal and implementation of the use of compostable materials. Currently this covers about 80% of products, while 40% of coffee capsules are already compostable. Even the world of frozen food is enticed: in the coming months, vegetable wrappers will be compostable and disposable in the organic sector. The 'flou green' disposable cutlery line is fully compostable, while the Dat5 detergent line uses recycled plastic in its bottles, and even FSC-certified paper.

Partnership against waste

◆ Helping retailers with sustainability practices has come from organisations such as Last Minute Market or the local Caritas organisation, which work with retailers to collect surplus food that is about to expire and make it available to people living in poverty. Apps such as Too Good to Go also offer very cheap products close to their expiry date to consumers who come to the shop to collect them. To help manufacturers and retail companies, the Observatory on Innovative and Sustainable Packaging, founded in 2019 by the Business School of the University of Bologna, helps measure the CO2eq impact of supermarkets' selected ranges, starting with the Life Cycle Assessment of ingredients and packaging.

...WITH PURPOSEFUL INITIATIVES In 2018, just a few months after the first openings in Italy, Aldi launched "Io riciclo!" (I recycle!), a customer awareness initiative for environmental protection. Thanks to clear and visible icons on the packaging of private label products, consumers receive information on the type of material used in the packaging, simplifying the correct disposal of waste in the municipal collection system. All sales outlets also offer space for disposing unwanted packaging and used batteries. Aldi has also worked to make milk bottles of the 'Bonlà' and 'Enjoy Free' brands more sustainable. The new bottles are made from 50% recycled PET (rPET) and are also 100% recyclable. "This will reduce the introduction of new plastic into the environment, saving more than 40 tonnes per year. In addition, all fresh egg references on the shelf are now packaged in a 100% pulp pack and are made of at least 70% recycled material." Within primary packaging, polystyrene (styrofoam) trays have already been phased out and the percentage of rPET and PET packaging as an alternative to other plastics has increased. Aldi is also the first retailer in Italy to support Plastic Bank, a social enterprise committed to collecting and recycling environmentally dispersed plastics that pollute the oceans. In November 2020, it launched the first fruit and vegetable products with food packaging made of 100% Social Plastic in partnership with Carton Pack and Plastic Bank. Penny Market is also increasingly focusing on its commitment to a sustainable future. A concrete example is the inclusion on the packaging of some branded product lines of information on proper waste disposal. "The 'MY Bio bellezze Naturali' line of fruit and vegetables, which ambitiously seeks to tackle the fight against food waste by offering products that are 'Special on the outside but perfect on the inside'," adds Paola Monica Dimaggio, private label manager & sustainability coordinator of Penny Market Italia, "uses only biodegradable and compostable film and netting and 100% recyclable trays."

Maria Teresa Manuelli