Visit to download the full and correct content document: https://ebookmass.com/product/the-essentials-of-financial-modeling-in-excel-a-concis e-guide-to-concepts-and-methods-michael-rees/

More products digital (pdf, epub, mobi) instant download maybe you interests ...

eTextbook 978-1133366171 Financial Accounting: An Introduction to Concepts Methods and Uses 14th Edition

https://ebookmass.com/product/etextbook-978-1133366171-financialaccounting-an-introduction-to-concepts-methods-and-uses-14thedition/

Learn VBA Programming: For Finance & Accounting: A Concise Guide to Financial Programming with VBA Schwartz

https://ebookmass.com/product/learn-vba-programming-for-financeaccounting-a-concise-guide-to-financial-programming-with-vbaschwartz/

Excel 2022 3 Books In 1: A to Z Mastery Guide on Excel Basic Operations, Excel Formulas Joe Webinar

https://ebookmass.com/product/excel-2022-3-books-in-1-a-to-zmastery-guide-on-excel-basic-operations-excel-formulas-joewebinar/

Samurai: A Concise History Michael Wert

https://ebookmass.com/product/samurai-a-concise-history-michaelwert/

The History

of Emotions:

A Student Guide to Methods and Sources Katie Barclay [Barclay

https://ebookmass.com/product/the-history-of-emotions-a-studentguide-to-methods-and-sources-katie-barclay-barclay/

Elephants under human care : the behaviour, ecology, and welfare of elephants in captivity Paul A. Rees

https://ebookmass.com/product/elephants-under-human-care-thebehaviour-ecology-and-welfare-of-elephants-in-captivity-paul-arees/

Concise Guide to Paralegal Ethics (Aspen Paralegal)

https://ebookmass.com/product/concise-guide-to-paralegal-ethicsaspen-paralegal/

The Market Research Toolbox: A Concise Guide for Beginners

https://ebookmass.com/product/the-market-research-toolbox-aconcise-guide-for-beginners/

Personal Financial Planning for Executives and Entrepreneurs: The Path to Financial Peace of Mind 1st ed. Edition Michael J. Nathanson

https://ebookmass.com/product/personal-financial-planning-forexecutives-and-entrepreneurs-the-path-to-financial-peace-ofmind-1st-ed-edition-michael-j-nathanson/

Table of Contents

Cover

TitlePage

Copyright

Dedication

AboutThisBook

TheAuthor

PartOne:IntroductiontoModeling

1ModelingandItsUses

1.1WHATISAMODEL?

1.2WHATAREMODELSUSEDFOR?

2PrinciplesofModelDesign

2.1INTRODUCTION

2.2DECISIONIDENTIFICATION,FRAMING,ANDSTRUCTURE

2.3DECISIONCRITERIAANDINFORMATIONNEEDS

2.4SENSITIVITY‐BASEDDESIGN

2.5DATAANDDATASOURCES

2.6MODELMAPPINGANDAPPROXIMATIONS

2.7BUILDINGANDTESTING

2.8RESULTSPRESENTATION

2.9BIASES

PartTwo:EssentialsofExcel

3Menus,Operations,Functions,andFeatures

3.1INTRODUCTION

3.2STRUCTUREANDMENUS

3.3CALCULATIONSUSINGARITHMETIC

3.4FUNCTIONBASICS

3.5ACOREFUNCTIONSET

3.6FURTHERPROPERTIESANDUSESOFFUNCTIONS

3.7CALCULATIONSETTINGSANDOPTIONS

3.8KEYTIPSANDSHORTCUTS

3.9ABSOLUTEANDRELATIVEREFERENCING

3.10AUDITINGANDLOGICTRACING

3.11NAMEDRANGES

3.12BESTPRACTICES:OVERVIEW

3.13BESTPRACTICES:FLOW

3.14BESTPRACTICES:TIMEAXIS

3.15BESTPRACTICES:MULTIPLEWORKSHEETS

3.16BESTPRACTICES:FORMATTING

3.17MODELTESTING,CHECKING,ANDERRORMANAGEMENT

3.18GRAPHSANDCHARTS

4SensitivityandScenarioAnalysis

4.1INTRODUCTION

4.2BASICORMANUALSENSITIVITYANALYSIS

4.3AUTOMATINGSENSITIVITYANALYSIS:ANINTRODUCTION

4.4USINGDataTables

4.5CHECKINGTHERESULTS,LIMITATIONS,ANDTIPS

4.6CREATINGFLEXIBILITYINTHEOUTPUTSTHATAREANALYZED

4.7SCENARIOANALYSIS

4.8VARIATIONSANALYSIS

4.9USINGGoalSeek

4.10FURTHERTOPICS:OPTIMIZATION,RISK,UNCERTAINTY,ANDSIMULATION

PartThree:GeneralCalculationsandStructures

5GrowthCalculationsforForecasting

5.1INTRODUCTION

5.2GROWTHMEASUREMENTANDFORECASTING

5.3LOGICREVERSALS

5.4FORECASTINGSTRUCTURESINPRACTICE

5.5SIMPLIFYINGTHESENSITIVITYANALYSISANDREDUCINGTHENUMBEROF PARAMETERS

5.6DEALINGWITHINFLATION

5.7CONVERSIONSFORMODELPERIODS

5.8FURTHERTOPICS:LOGARITHMICANDEXPONENTIALGROWTH

6ModularStructuresandSummaryReports

6.1INTRODUCTION

6.2MOTIVATIONFORSUMMARYAREASANDTHEIRPLACEMENT

6.3EXAMPLEI:SUMMARIESANDCONDITIONALSUMMARIES

6.4EXAMPLEII:TARGETS,FLAGS,ANDMATCHING

6.5SENSITIVITYANALYSIS

6.6COMMENTSONFORMATTING

6.7INITIALIZATIONAREAS

7ScalingandRatio‐drivenForecasts

7.1INTRODUCTION

7.2BASICUSES

7.3LINKSTOLENGTHOFMODELPERIODS

7.4DAYS'EQUIVALENTAPPROACHES

7.5EXAMPLEI:FORECASTINGFROMREVENUESTOEBITDA

7.6USINGRATIO‐BASEDFORECASTINGEFFECTIVELY

7.7EXAMPLEII:RATIO‐BASEDFORECASTINGOFCAPITALITEMS

7.8FURTHERTOPICS:LINKSTOGENERALRATIOANALYSIS

8CorkscrewsandReverseCorkscrews

8.1INTRODUCTION

8.2CLASSICALCORKSCREWS

8.3BENEFITSANDFURTHERUSES

8.4REVERSECORKSCREWS

9WaterfallAllocations

9.1INTRODUCTION

9.2EXAMPLEI:COSTSHARING

9.3EXAMPLEII:TAXCALCULATIONS

9.4OPTIONSFORLAYOUTANDSTRUCTURE

9.5FURTHERTOPICS:WATERFALLSFORSHARINGCAPITALRETURNSORCARRIED INTEREST

10.1INTRODUCTION

10.2EXAMPLEI:LINEARSMOOTHING

10.3EXAMPLEII:PROPORTIONALSMOOTHING

10.4USESOFTAPERINGANDINTERPOLATION

10.5TRIANGLES

10.6FURTHERTOPICS:TRIANGLES

PartFour:EconomicFoundationsandEvaluation

11BreakevenandPaybackAnalysis

11.1INTRODUCTION

11.2SINGLE‐PERIODBREAKEVENANALYSIS:PRICESANDVOLUMES

11.3BREAKEVENTIMEANDPAYBACKPERIODS

12InterestRatesandCompounding

12.1INTRODUCTION

12.2STATEDRATESANDCALCULATIONSWITHOUTCOMPOUNDING

12.3COMPOUNDINGTYPESANDEFFECTIVERATES

12.4CONVERSIONOFEFFECTIVERATESFORPERIODSOFDIFFERENTLENGTHS

12.5AVERAGEEFFECTIVERATES

12.6IMPLIEDRATESANDBOOTSTRAPPING

13LoanRepaymentCalculations

13.1INTRODUCTION

13.2EFFECTIVERATESFORINTEREST‐ONLYREPAYMENTS

13.3ALIGNINGMODELPERIODSWITHINTERESTREPAYMENTS

13.4CONSTANTREPAYMENTLOANSUSINGTHEPMTFUNCTION

13.5CONSTANTREPAYMENTLOANS:OTHERFUNCTIONS

13.6PERIODSOFDIFFERENTLENGTHS

14Discounting,PresentValues,andAnnuities

14.1INTRODUCTION

14.2THETIMEVALUEOFMONEY

14.3CALCULATIONOPTIONSFORPRESENTVALUES

14.4ANNUITIESANDPERPETUITIES

14.5MULTI‐PERIODAPPROACHESANDTERMINALVALUES

14.6FURTHERTOPICSI:MATHEMATICSOFANNUITIES

14.7FURTHERTOPICSII:CASHFLOWTIMING

15ReturnsandInternalRateofReturn

15.1INTRODUCTION

15.2SINGLEINVESTMENTSANDPAYBACKS

15.3MULTIPLEPAYBACKS:AVERAGERETURNSANDTHEINTERNALRATEOF RETURN

15.4USINGECONOMICMETRICSTOGUIDEINVESTMENTDECISIONS

15.5PROPERTIESANDCOMPARISONOFNPVANDIRR

PartV:CorporateFinanceandValuation

16TheCostofCapital

16.1INTRODUCTION

16.2RETURNS,COSTS,ANDOPPORTUNITYCOSTSOFCAPITAL

16.3THEROLEOFRISKINDETERMININGTHECOSTOFCAPITAL

16.4THEPROPERTIESANDBENEFITSOFDEBT

16.5THEFINANCINGMIXANDTHEWEIGHTEDAVERAGECOSTOFCAPITAL

16.6MODIGLIANI‐MILLERANDLEVERAGEADJUSTMENTS

16.7THECAPITALASSETPRICINGMODEL

16.8FURTHERTOPICS:DERIVATIONOFLEVERAGINGANDDELEVERAGING FORMULAS

17FinancialStatementModeling

17.1INTRODUCTION

17.2FINANCIALSTATEMENTESSENTIALS

17.3KEYCHALLENGESINBUILDINGINTEGRATEDFINANCIALSTATEMENTMODELS

17.4FORECASTINGOFTHEINTEGRATEDSTATEMENTS:ASIMPLEEXAMPLE

17.5THEDYNAMICFINANCINGADJUSTMENTMECHANISM

17.6GENERALIZINGTHEMODELFEATURESANDCAPABILITIES

17.7STEPSANDPRINCIPLESINBUILDINGAFINANCIALSTATEMENTMODEL

17.8FURTHERTOPICS:AVOIDINGCIRCULARITIES

18CorporateValuationModeling

18.1INTRODUCTION

18.2OVERVIEWOFVALUATIONMETHODS

18.3PRINCIPLESOFCASHFLOWVALUATION

18.4FREECASHFLOWFORENTERPRISEVALUATION

18.5THEROLEOFTHEEXPLICITFORECAST

18.6EXAMPLE:EXPLICITFORECASTWITHTERMINALVALUECALCULATION

18.7FURTHERTOPICSI:ENTERPRISEVALUEBASEDONFREECASHFLOWAND EQUIVALENCES

18.8FURTHERTOPICSII:VALUE‐DRIVERFORMULAS

18.9FURTHERTOPICSIII:IMPLIEDCOSTOFEQUITY

19RatioAnalysis

19.1INTRODUCTION

19.2USEANDPRINCIPLES

19.3RATIOSFORPROFITABILITYANDVALUATION

19.4RATIOSRELATINGTOOPERATIONSANDEFFICIENCY

19.5RATIOSFORLIQUIDITYANDLEVERAGE

19.6DuPontANALYSIS

19.7VARIATIONSANALYSISWITHINTHEDuPontFRAMEWORK

19.8FURTHERTOPICS:PORTFOLIOSANDTHEPIOTROSKIF‐SCORE

PartSix:DataandStatisticalAnalysis

20StatisticalAnalysisandMeasures

20.1INTRODUCTION

20.2DATASTRUCTURESINEXCELANDTHEIMPACTONFUNCTIONALITY

20.3AVERAGESANDSPREAD

20.4THEAGGREGATEFUNCTION

20.5CONDITIONALAGGREGATIONS

20.6DATABASEFUNCTIONS

20.7CORRELATIONS,COVARIANCE,ANDREGRESSION

20.8EXCELTABLES

20.9PIVOTTABLES

20.10FURTHERTOPICS:MOREONAVERAGES,CORRELATIONS,ANDCONFIDENCE INTERVALS 21DataPreparation:Sourcing,Manipulation,andIntegration

Index

21.1INTRODUCTION

21.2MODELINGCONSIDERATIONS

21.3OVERVIEWOFDATAMANIPULATIONPROCESS

21.4CLEANINGEXCELDATASETS

21.5INTEGRATIONOFEXCELDATASETS

21.6FURTHERTOPICSI:INTRODUCTIONTOPowerQuery–APPENDINGTABLES

21.7FURTHERTOPICSII:INTRODUCTIONTOPowerQuery–DATAMANIPULATION

21.8FURTHERTOPICSIII:INTRODUCTIONTOPowerPivotANDTHEDATAMODEL

EndUserLicenseAgreement

List of Illustrations

Chapter1

Figure1.1InfluenceDiagramofaSimpleRevenueModel

Figure1.2ExcelModelThatContainsFormulasbutNoValues

Figure1.3ExcelModelwithInputCellsPopulatedwithValues

Figure1.4InputCellswithColor‐Coding

Figure1.5UsingaModeltoCompareSalesRevenuesforBusinessDesignOptio...

Chapter2

Figure2.1Basic“Go/NoGo”DecisionwithSub‐Options

Figure2.2UsingtheDecisiontoDesigntheModelThatSupportstheDecision

Figure2.3UsingaSensitivity‐BasedThoughtProcesstoDefineModelVariabl...

Chapter3

Figure3.1CoreMenuTabs

Figure3.2TheHomeTab(left‐hand‐sideonly)

Figure3.3TheFormulasTab(left‐hand‐sideonly)

Figure3.4ExampleoftheSUMFunction

Figure3.5TheInsertFunctionMenu

Figure3.6TheIFFunctionandItsArguments

Figure3.7EnteringtheUNIQUEFunctioninaSingleCell

Figure3.8TheDynamicOutputRangeoftheUNIQUEFunction

Figure3.9Using#ToRefertoaDynamicOutputRange

Figure3.10TheCalculationOptionsontheFormulasTab

Figure3.11EffectofChangestoInputValuesinManualSetting

Figure3.12AccessingtheMenuUsingKeyTips

Figure3.13SelectingaRangetobeCopied

Figure3.14ResultsAfterPasting

Figure3.15TheAdjustedandCompletedModel

Figure3.16ThePasteSpecialMenu

Figure3.17CentralCostsAllocatedAccordingtoTrips

Figure3.18FormulasUsedtoAllocateCentralCost

Figure3.19TheFormulas/FormulaAuditingMenu

Figure3.20TheFormulaView

Figure3.21UsingTraceDependentsandTracePrecedents

Figure3.22InspectingaFormulaUsingtheF2Key

Figure3.23TheWatchWindow

Figure3.24UsingtheNameManager

Figure3.25SimpleModelwithNamedInputs

Figure3.26TheNameBox

Figure3.27AccessingtheGoTo(F5)Functionality

Figure3.28DiagonalDependencyPaths

Figure3.29HorizontalandVerticalDependencyPaths

Chapter4

Figure4.1AccessingaDataTableUsingData/What‐IfAnalysis

Figure4.2RecapofCab(Taxi)BusinessProfitModel

Figure4.3ThreeRawDataTableStructures

Figure4.4CompletingaTwo‐WayDataTable

Figure4.5TheCompletedTwo‐WayDataTable

Figure4.6TheRawDataTableStructuresforDataTableswithMultipleOutputs

Figure4.7SummaryAreawithSelectionMenu

Figure4.8DataTablewithChoiceofOutputstoAnalyze

Figure4.9UsingDataValidationtoRestrictaUser'sChoicestoValidItems...

Figure4.10ModelInputsAreReplacedbyCellReferencestotheScenarioCho...

Figure4.11ImplementingtheScenarioResultsUsingaDataTable

Figure4.12SimpleExampleofVarianceAnalysis

Figure4.13ExampleofUsingGoalSeek

Chapter5

Figure5.1BasicGrowthForecast

Figure5.2HistoricalInformationandGrowthForecasting

Figure5.3CommonLayoutofGrowthForecasting

Figure5.4Multi‐periodForecastUsingtheCommonLayout

Figure5.5ReducingtheNumberofSeparateInputAssumptions

Figure5.6FullSeparationofInputsfromCalculations

Figure5.7DataTableofYear5RevenuestoTwoGrowthAssumptions

Figure5.8UsingInflationasaSeparateItem

Figure5.9ComparisonofMeasurementandForecastingResults

Figure5.10RawDataonGrowthRatesMeasuredbyEachMethod

Figure5.11CalculationofTotalandAverageGrowthUsingEachMethod

Chapter6

Figure6.1AnInitialFive‐YearModelwithQuarterlyPeriods

Figure6.2SummaryofFive‐YearandSpecifiedYear

Figure6.3UsingFlagFieldstoFindWhenaTargetisMet

Figure6.4UsingaDataTableforItemsintheSummaryReport

Figure6.5SettingaConditionalFormatRule

Figure6.6DependencieswithoutInitializationArea

Figure6.7UseofanInitializationAreatoBeAbletoHaveConsistentFormu...

Chapter7

Figure7.1HistoricalCalibrationandRatio‐BasedForecastforaFlowItem...

Figure7.2HistoricalCalibrationandRatio‐BasedForecastforaStockItem...

Figure7.3UsingtheDays,EquivalentMethod

Figure7.4PriceForecastfortheExampleModel

Figure7.5SalesRevenueCalculation

Figure7.6CalculationofFixedandVariableCosts

Figure7.7CalculationofEBITDAintheSimpleModel

Figure7.8CalculationofCapExUsingaVolume‐BasedRatioandInflation...

Chapter8

Figure8.1FrameworkforaCorkscrewStructure

Figure8.2LinkingofCapExintotheCorkscrewStructure

Figure8.3LinkingofCapExintotheCorkscrewStructure

Figure8.4CompletionofStructurefortheFirstPeriod

Figure8.5CompletedStructurewithDependencyPathsShown

Figure8.6BasicRatioAnalysisofAssetstoSales

Figure8.7CalculationofNetFlowItems

Figure8.8CoreStructureofaReverseCorkscrew

Figure8.9InclusionofOneFlowItem

Figure8.10CompletionofBothFlowItems

Chapter9

Figure9.1GeneralSplitUsingtheMINFunction

Figure9.2TwoCategoryWaterfallSplit–VerticalLayout

Figure9.3TwoCategoryWaterfallSplit–HorizontalLayout

Figure9.4CapacitiesoftheMultipleLayers

Figure9.5CompletedCalculationsofMultipleLayerExample

Figure9.6WaterfallStructureforTaxCalculation

Figure9.7VerticalWaterfallStructuredbyItem

Figure9.8TimeAxisonaVerticalWaterfallStructuredbyItem

Figure9.9VerticalWaterfallStructuredbyBand

Figure9.10CapitalReturnWaterfallwithSingleThreshold

Figure9.11CapitalReturnWaterfallwithAlternativeValue

Figure9.12CapitalReturnWaterfallwithAlternativeValue

Chapter10

Figure10.1OverviewofModelwithInterpolatedGrowthRates

Figure10.2TheFormulaUsedinCellH11

Figure10.3ProportionalSmoothingwithFlexiblePeriodStart

Figure10.4LogicFlowforEachForecastFormula

Figure10.5FormulaUsedinCellH8

Figure10.6ExampleoftheEffectofaCombinedSmoothing

Figure10.7TriangleInputs:Time‐SpecificPurchasesandGenericTimeAlloca...

Figure10.8Time‐SpecificAllocations(Step1)

Figure10.9Time‐SpecificAllocations(Step2)

Figure10.10TriangleOutputsFeedingaCorkscrew

Chapter11

Figure11.1ModelUsedforSingle‐PeriodAnalysis

Figure11.2CostStructureasVolumeisVaried

Figure11.3Revenue,Cost,andProfitasVolumeisVaried

Figure11.4ThresholdsandCombinationstoAchieveBreakeven

Figure11.5Time‐BasedForecastfromSalestoEBITDA

Figure11.6CompletedModelwithForecasttoCashFlows

Figure11.7CompletedSetofCalculations

Figure11.8TheFormulaViewoftheCompletedCalculations

Chapter12

Figure12.1ExampleofCompoundedInterestCalculations

Figure12.2ExampleoftheEFFECTFunction

Figure12.3EffectivePeriodicRatesforDifferentCompoundingFrequencies

Figure12.4UseofFVSCHEDULEFunction

Figure12.5YieldCurveBootstrappingAssumptionsandContext

Figure12.6YieldCurveBootstrappingResults

Chapter13

Figure13.1UseoftheDerivedFormulatoCalculateanEffectiveRateGiven...

Figure13.2ExplicitCalculationoftheEffectiveRateGivenRepayments

Figure13.3ExampleofthePMTFunction

Figure13.4FunctionArgumentsforthePMTFunction

Figure13.5ExplicitCalculationofLoanRepaymentUsingaCorkscrewStructu...

Figure13.6PaymentValuewithStart‐of‐PeriodPayments

Figure13.7ExplicitCalculationWhenPaymentIsattheStartofEachPeriod

Figure13.8ReversalofNaturalValueswhenUsingPMT

Figure13.9VerificationofCalculationsUsingSignReversal

Figure13.10ExamplesoftheRATE,NPER,FV,andPVFunctions

Figure13.11RatesWhentheLoanPeriodIsaMultipleoftheCompoundingPer Chapter14

Figure14.1TheAssumedCashFlowProfileforaDiscountingExample

Figure14.2TheAssumedOne‐YearDiscountRates

Figure14.3PossibilitiestoCalculatetheDiscountFactors

Figure14.4TheDiscountedCashFlowsandtheTotal

Figure14.5ConstantDiscountRatewithExplicitProfile

Figure14.6UseoftheNPVFunction

Figure14.7ValuinganAnnuitybyExplicitCalculationoftheCashFlows

Figure14.8ApplicationoftheAnnuityFormulas

Figure14.9InputAssumptionsforTwo‐StageTerminalValueCalculation

Figure14.10ImplementationofTwo‐StageTerminalValueCalculation

Chapter15

Figure15.1PercentageReturnsCalculatedExplicitlyinaSimpleCase

Figure15.2ReturnsExpressedonaPer‐PeriodBasis

Figure15.3ExamplewithPaybackOccurringinTwoPeriods

Figure15.4InflatingorDiscountingCashFlowstoAchieveaTotalValueof...

Figure15.5UsingtheIRRFunction

Figure15.6IRRwithSeveralPeriodsofInvestmentandPayback

Chapter16

Figure16.1ThresholdLevelforDebt‐EquitySubstitutionandwithoutTaxes...

Figure16.2ThresholdLevelforDebt‐EquitySubstitutionandwithoutTaxes...

Figure16.3TheLeverageEffectofDebtonReturnstoEquity(atBookValue)

Figure16.4EffectofDebtwithTaxes

Figure16.5EffectofDebtIfChargesWereNotOffsetAgainstTaxes

Figure16.6GenericEffectofLeverageonCostofCapital:Equity,Debt,and...

Figure16.7ASimpleExampleoftheCalculationoftheExpectedReturn

Chapter17

Figure17.1IncomeStatementforSimpleModel

Figure17.2CashandEquityCorkscrews

Figure17.3TheBalanceSheetfortheBaseCase

Figure17.4TheBalanceSheetwithaLowerInitialCapitalInjection

Figure17.5ImplementationoftheAdjustmentMechanism

Figure17.6CompletionofStatementstoReflecttheEquityInjection

Figure17.7ExampleofAddinganAccountsReceivableFunctionality

Chapter18

Figure18.1ForecasttotheNOPATline

Figure18.2CalculationoftheValueintheExplicitForecastPeriod

Figure18.3TerminalValueCalculation

Figure18.4TotalEnterpriseandEquityValue

Chapter19

Figure19.1GenericExampleofDuPontAnalysisUsingLinearScales

Figure19.2VariationsAnalysisUsingComponentParts

Chapter20

Figure20.1RawDataforInputtotheStatisticalFunctions

Figure20.2ExamplesoftheUseofAGGREGATE

Figure20.3UsingAGGREGATEwithitsFourthArgument

Figure20.4AugmentedDataSetwithMonthandYearInformation

Figure20.5UseoftheAVERAGEIFSFunction

Figure20.6DataSetwithFieldHeaders

Figure20.7ExampleofaCriteriaRangeforaDatabaseFunction

Figure20.8FunctionArgumentsfortheDatabaseFunctions

Figure20.9ResultsofApplyingtheDatabaseFunctions

Figure20.10DataSetforCorrelationandRegressionAnalysis

Figure20.11X‐YScatterPlotwithTrendlineDisplayed

Figure20.12CalculationofSlope,Correlations,andStandardDeviations

Figure20.13CreatingaTable

Figure20.14TheTableDesignTab

Figure20.15EnteringaFormulaThatWillRefertoaTable

Figure20.16CompletedPivotTablewithaRowStructure

Figure20.17FirstSteptoInsertaPivotTable

Figure20.18CompletionofStep‐by‐StepCreationofaPivotTable

Figure20.19PopulationofthePivotTableStructure

Figure20.20ResultsoftheLINESTFunction

Chapter21

Figure21.1RawDataandDesiredTransformation

Figure21.2CalculationStepsforOneItem,ShowninaColumn

Figure21.3RowFormoftheCalculationsandResults

Figure21.4DataIncludingTransactionValuesinLocalCurrency

Figure21.5TableswithAdditionalInformationThatNeedtoBeReferenced

Figure21.6AugmentedMainTableShowingCountryNames

Figure21.7MainTablewithFurtherAugmentation

Figure21.8TheCompletedFlatTable

Figure21.9ResultsofAppendingTwoTablestoCreateaThird

Figure21.10ThePowerQueryEditor

Figure21.11SelectingtoCreateaConnectionOnly

Figure21.12Queries&ConnectionsBeforeAppending

Figure21.13UsingtheTable.CombineOperation

Figure21.14UsingPowerQueryfortheFullProcess

Figure21.15TablesandTheirRelationshipswithintheDataModel

Figure21.16CreationofaMeasure

Figure21.17PivotTablethatDisplaystheValueofaPowerPivotMeasure

METHODS

MichaelRees

Thiseditionfirstpublished2023

©2023MichaelRees

Allrightsreserved.Nopartofthispublicationmaybereproduced,storedinaretrievalsystem,ortransmitted,in anyformorbyanymeans,electronic,mechanical,photocopying,recordingorotherwise,exceptaspermittedby law.Adviceonhowtoobtainpermissiontoreusematerialfromthistitleisavailableat http://www.wiley.com/go/permissions

TherightofMichaelReestobeidentifiedastheauthorofthisworkhasbeenassertedinaccordancewithlaw. Registered Offices

JohnWiley&Sons,Inc.,111RiverStreet,Hoboken,NJ07030,USA

JohnWiley&SonsLtd,TheAtrium,SouthernGate,Chichester,WestSussex,PO198SQ,UK

Editorial Office

TheAtrium,SouthernGate,Chichester,WestSussex,PO198SQ,UK

Fordetailsofourglobaleditorialoffices,customerservices,andmoreinformationaboutWileyproductsvisitusat www.wiley.com.

Wileyalsopublishesitsbooksinavarietyofelectronicformatsandbyprint‐on‐demand.Somecontentthat appearsinstandardprintversionsofthisbookmaynotbeavailableinotherformats.

Trademarks:WileyandtheWileylogoaretrademarksorregisteredtrademarksofJohnWiley&Sons,Inc.and/or itsaffiliatesintheUnitedStatesandothercountriesandmaynotbeusedwithoutwrittenpermission.Allother trademarksarethepropertyoftheirrespectiveowners.JohnWiley&Sons,Inc.isnotassociatedwithanyproduct orvendormentionedinthisbook.

Limit of Liability/Disclaimer of Warranty

Whilethepublisherandauthorshaveusedtheirbesteffortsinpreparingthiswork,theymakenorepresentations orwarrantieswithrespecttotheaccuracyorcompletenessofthecontentsofthisworkandspecificallydisclaimall warranties,includingwithoutlimitationanyimpliedwarrantiesofmerchantabilityorfitnessforaparticular purpose.Nowarrantymaybecreatedorextendedbysalesrepresentatives,writtensalesmaterialsorpromotional statementsforthiswork.Thefactthatanorganization,website,orproductisreferredtointhisworkasacitation and/orpotentialsourceoffurtherinformationdoesnotmeanthatthepublisherandauthorsendorsethe informationorservicestheorganization,website,orproductmayprovideorrecommendationsitmaymake.This workissoldwiththeunderstandingthatthepublisherisnotengagedinrenderingprofessionalservices.The adviceandstrategiescontainedhereinmaynotbesuitableforyoursituation.Youshouldconsultwithaspecialist whereappropriate.Further,readersshouldbeawarethatwebsiteslistedinthisworkmayhavechangedor disappearedbetweenwhenthisworkwaswrittenandwhenitisread.Neitherthepublishernorauthorsshallbe liableforanylossofprofitoranyothercommercialdamages,includingbutnotlimitedtospecial,incidental, consequential,orotherdamages.

Library of Congress Cataloging‐in‐Publication Data

Names:Rees,Michael,1964‐author

Title:TheessentialsoffinancialmodelinginExcel:aconciseguidetoconceptsandmethods/MichaelRees.

Description:Hoboken,NJ:JohnWiley&Sons,Inc.,2023.|Includesindex.

Identifiers:LCCN2022043302(print)|LCCN2022043303(ebook)|ISBN9781394157785(paperback)|ISBN 9781394157792(adobepdf)|ISBN9781394157808(epub)

Subjects:LCSH:Finance—Mathematicalmodels.|Corporations—Finance—Mathematicalmodels.|Microsoft Excel(Computerfile)

Classification:LCCHG106.R4392023(print)|LCCHG106(ebook)|DDC332.0285/554—dc23/eng/20220908

LCrecordavailableathttps://lccn.loc.gov/2022043302

LCebookrecordavailableathttps://lccn.loc.gov/2022043303

CoverDesign:Wiley

CoverImage:©Skylines/Shutterstock

This book is dedicated to Elsa and Raphael.

About This Book

ThisbookprovidesaconciseintroductiontofinancialmodelinginExcel.Itaimstoprovidereaderswithawell‐structuredandpracticaltoolkittolearnmodeling“fromthegroundup.”Itisuniqueinthatitfocusesonthe conceptsandstructuresthatarecommonlyrequiredwithinExcelmodels,ratherthanonExcelperse. Thebookisstructuredintosixparts(containingtwenty‐onechaptersintotal):

PartIintroducesfinancialmodelingandthegeneralfactorstoconsiderwhendesigning,building,andusing models.

PartIIdiscussesthecorefeaturesofExcelthatareneededtobuildandusemodels.Itcoversoperationsand functionality,calculationsandfunctions,andsensitivityandscenarioanalysis.

PartIIIcoversthefundamentalstructuresandcalculationsthatareveryfrequentlyusedinmodeling.This includesgrowth‐basedforecasting,ratio‐drivencalculations,corkscrewstructures,waterfalls,allocations, triangles,andvariationsofthese.

PartIVdiscusseseconomicmodeling,measurement,andevaluation.Itcoverstheanalysisofinvestments, interestcalculationsandcompounding,loancalculations,returnsanalysis,discounting,andpresentvalues.

PartVtreatsthecoreapplicationsofmodelingwithincorporatefinance.Itcoversthecostofcapital,the modelingoffinancialstatements,cashflowvaluation,andratioanalysis.

PartVIcoversstatisticalanalysis,aswellasdatapreparation,manipulation,andintegration.

Readerswillgenerallyobtainthemaximumbenefitbystudyingthetextfromthebeginningandworkingthrough itinorder.Itisintendedthatthereaderbuildsfromscratchthemodelsthatareshown,toreinforcethelearning experienceandtoenhancepracticalskills.Ofcourse,theremaybeareaswhicharealreadyfamiliartosome readers,andwhichcanbeskim‐read.Nevertheless,thetextisintendedtobeconciseandpractical,andtocontain informationthatispotentiallyusefuleventoreaderswhomayhavesomefamiliaritywiththesubject.

Althoughthetextisfocusedontheessentials,atvariousplacesitbrieflyhighlightssomeaspectsofmore advancedtopics.ThesearedescribedinFurtherTopicssections,whicharesituatedattheendofsomechapters. Thesesectionscanbeskippedatthereader'sdiscretionwithoutaffectingthecomprehensionofthesubsequent text.Notethatanotheroftheauthor'sworks(Principles of Financial Modelling: Model Design and Best Practices Using Excel and VBA,JohnWiley&Sons,2018)discussesindetailsometopicsthatareonlybriefly(ornot) coveredinthistext(notablyVBAmacros,optimization,circularities,namedranges,andothers).Forconvenience, inthecurrenttextthisothertextisoccasionallymentionedatspecificplaceswhereitcontainssignificant additionalmaterialsrelatedtothediscussion,andissubsequentlyreferredtoas PFM.

The Author

Dr.MichaelReesisaleadingexpertinquantitativemodelingandanalysisforapplicationsinbusinesseconomics, finance,valuation,andriskassessment.HeisProfessorofFinanceatAudenciaBusinessSchoolinNantes (France),whereheteachessubjectsrelatedtovaluation,financialengineering,optimization,riskassessment, modeling,andbusinessstrategy.HisearlieracademiccredentialsincludeaDoctorateinMathematicalModelling andNumericalAlgorithms,andaBAwithFirstClassHonoursinMathematics,bothfromOxfordUniversityin theUK.HehasanMBAwithDistinctionfromINSEADinFrance.HealsostudiedfortheCertificateof QuantitativeFinance,graduatingtopoftheclassforcoursework,andreceivingtheWilmottAwardforthehighest finalexammark.Priortohisacademiccareer,hegainedover30years'practicalexperience,includinginsenior rolesatleadingfirmsinfinanceandstrategyconsulting(JPMorgan,MercerManagementConsulting,andBraxton Associates),aswellasworkingasanindependentconsultantandtrainer.Hisclientsincludedcompaniesand entrepreneursinprivateequity;auditingandconsulting;finance;bankingandinsurance;pharmaceuticalsand biotechnology;oil,gas,andresources;construction;chemicals;engineering;telecommunications;transportation; thepublicsector;software;andtrainingproviders.Inadditiontothistext,heistheauthorof Principles of Financial Modelling: Model Design and Best Practices Using Excel and VBA (2018); Business Risk and Simulation Modelling in Practice: Using Excel, VBA and @RISK (2015);and Financial Modelling in Practice: A Concise Guide for Intermediate and Advanced Level (2008).

1.1 WHAT IS A MODEL?

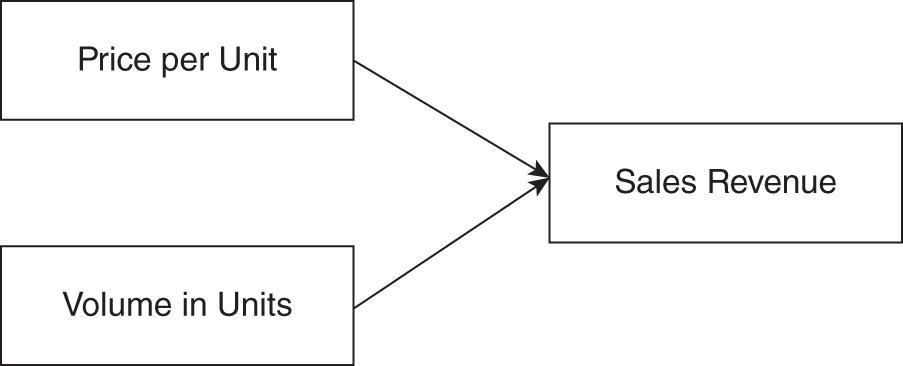

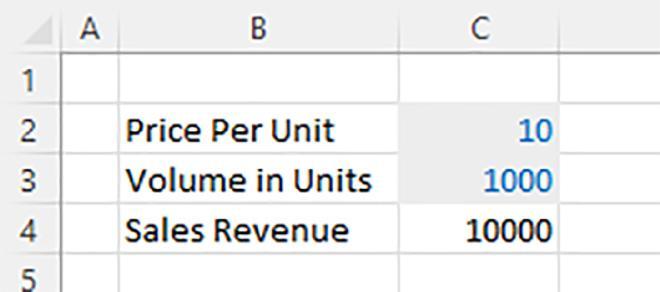

Afinancialmodelisarepresentationofareal‐lifesituationinbusiness,economics,orfinance.Thatis,itidentifies theitemsthatrepresentthecorepropertiesofthesituationandexpressestherelationshipsbetweenthese.For example,thereisarelationshipbetweenthepriceperunit,thevolumesold,andthesalesrevenueofabusiness. Thiscanbecapturedvisuallyinaninfluencediagram(Figure1.1).

Fromapuretheoreticalperspective,therelationshipcanbedefinedmorepreciselyusingaformula:

(Where V isthevolumesold, P istheaveragepriceachievedperunit,and S isthesalesrevenue.)

ItisworthnotingthatthearrowsinFigure1.1indicatethedirectionalityofthelogic.(Forconvenience,such diagramswouldusethe“natural”left‐to‐rightflowwhereverpossible.)Ontheotherhand,intheformula, thelogic is“right‐to‐left”:Inthecontextofnumericalcomputations(andmodeling),the=signisusedtomeanthattheitem ontheleft(calledtheoutput)iscalculatedfromthoseontheright(calledtheinputs).Inotherwords,although fromapurelymathematicalperspectivetheleft‐andright‐sidesoftheformulacouldbereversed,thiswouldnot bepossiblefromtheperspectiveofmodeling,whereformulasactnotonlyasastatementofmathematicalequality, butalsoofdirectionality.

Figure1.1InfluenceDiagramofaSimpleRevenueModel

AnExcelworksheetcanbeusedtorepresentthesituationinaverysimilarway(i.e.tocaptureonlythe relationships).Forexample,Figure1.2showstheformula(incellC4)thatcalculatesSalesRevenueby multiplyingthevalueofthePriceperUnit(cellC2)withthatoftheVolumeinUnits(cellC3),evenastheinput cells(i.e.C2andC3)arecurrentlyblank.

1.2ExcelModelThatContainsFormulasbutNoValues

InExcel,the*symbolisusedformultiplication,sothattheformulacanbethoughtofas:

ThepresentationofthevalueofcellC4reinforcesthatC2andC3aretheinputs(ontheright),withC4beingthe output(ontheleft).

Ofcourse,ifonewereinterestedinrepresentingtherelationshipsfromatheoreticalperspectiveonly,thenExcel wouldbearelativelyineffectivewaytodoso(i.e.onewouldbebetterusingmathematicalformulasdirectlyina textdocument).Inpracticalapplications,aworksheet(model)willbepopulatedwithactualinputvalues,which arerelevantforthespecificsituationunderconsideration.Forexample, Figure1.3showsthesamemodelbut wheretheinputcells(C2andC3)containspecificvalues,sothatcellC4calculatestheSalesRevenuethat correspondstothatsituation.

Theinputvaluescanbeenteredoralteredbythemodeler(orbyanotheruserofthemodel).Forthisreason,when workinginExcel,itisgoodpracticetomakeacleardistinctionbetweeninputsandcalculations(formulas),sothat auserknowswhichitemscanbechanged(andwhichshouldnotbe). Figure1.4showsanexampleofusingthe shadingofacelltomakesuchadistinction(whileperhapslessclearintheblackandwhiteimage,inadditionto thebackgroundshading,thefontofsuchacellcanbeadifferentcolortothatofthefontusedofacalculatedcell, inordertoincreasethedistinctionfurther).

Figure

Figure1.3ExcelModelwithInputCellsPopulatedwithValues

Figure1.4InputCellswithColor‐Coding

Notethatinmathematicalformulas,eachitem(suchas P, V,or S)representsboththenameandthevalueofthat variable.However,inExcel,bydefaultaformulais“stand‐alone,”andiscreateddirectlywithreferencetothe valuesoftheitems.Thatis,aformulaisgivenmeaning(orcontext)bythelabelsthatareusedinothercells.For example,inFigure1.4,cellC2containsavalue(10),butweknowthatthisrepresentsthepricebecauseofthe labelthatisenteredincellB2.Similarly,weknowthatthevalueinC3representsthevolumebyreferencetothe labelinB3.Similarly,thelabelinB4forthesalesrevenueisanappropriatelabelforthevalueinC4simply becausethevalueiscalculatedbymultiplyingpricewithvolume(ratherthan,say,addingthem).Infact,inExcel, itispossibletocombinetheseroles(i.e.ofthelabelandthevalue)bynamingthecells(suchasnamingcellC2 “Price,”cellC3“Volume”andC4“SalesRevenue”).Thisisdiscussedin Chapter3inmoredetail.

Ofcourse,theinputvaluesshouldbeappropriateforthesituationthatisbeingaddressed.Further–asanentry intoacellofExcel–eachinputvalueisasinglenumber(inprinciple).Theoutputisalsoasinglenumberthatis calculatedfromtheinputs.Theterms“basecase”or“centralcase”areoftenusedtorefertothissinglecore “reference”case,whichinprincipleshouldrepresentarealisticscenarioforthevaluesthatmayarise(other scenarioscanbedefinedandstoredinthemodel,suchasoptimisticorpessimisticcases;see Chapter4).

Infact,veryoften,thevalueusedforaninputissimplyabestestimateorajudgment,orafigurethatisderived fromacomparablesituation,orfromanalyzinghistoricaldata.Therefore,theremaybesomeuncertaintyastothe truevalue.Similarly,someinputsmayrepresentitemsoverwhichadecision‐makerhassomecontrolinreal‐life andthereforerelatetoadecisionorchoice(ratherthanbeinguncertain).Thesesituationscanbecapturedbyusing variousvaluesfortheinputassumptionstocreatescenarios,meaningalsothattherewillbearangeinvaluesfor theoutput.Infact,thecreationandanalysisofthepossiblerangeofoutcomesisanimportantpartofusing modelingindecisionsupport.Themethodstodosorangefromthesimplest(e.g.copyingthemodelseveraltimes, usingdifferentinputvaluesforeach),tospecificsensitivity‐analysisfunctionalitywithinExcel(coveredin Chapter4),aswellastomoreadvancedapproaches,includingriskanalysis,simulation,andoptimizationanalysis (whicharementionedintheFurtherTopicsSectionsinChapter4andChapter20).

1.2 WHAT ARE MODELS USED FOR?

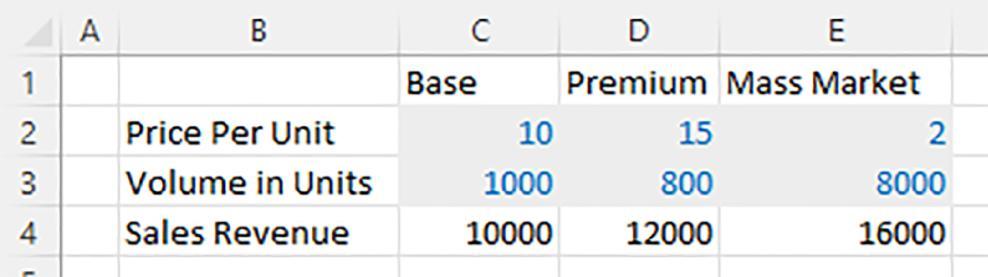

Modelscanbeusedtotrytogainabetterunderstandingof(orinsightabout)areal‐lifesituation,withtheaimof makingamoreinformeddecisioninrelationtoit.Forexample,onemaybedecidingwhethertolaunchabusiness ornot.Withintheoveralldecision,theremaybeseveralsub‐options:

Amid‐market“base”businessdesign(reasonablepricesandvolumes)

A“premium”focus(higherpricesbutachievinglowervolumes)

A“mass‐market”approach(lowerpricesandachievinghighervolumes)

Figure1.5UsingaModeltoCompareSalesRevenuesforBusinessDesignOptions

Assumingthatonecanestimatethevolumeofconsumers’purchasesthatarelikelyateachpricepoint(oruse marketresearchtodoso),themodelcouldbeusedtocapturetheeffect(onsalesrevenues)ofeachoption.Figure 1.5showsanexample.

(Notethatforsimplicityofpresentationatthisstage,themodelhasbeencreatedthreetimes,i.e.ineachcolumn C,D,andE,usingthecommonsetoflabelsincolumnB.However,inpracticethemodelwouldtypicallybe createdonlyonce,andasensitivityorscenarioanalysiswouldbeusedtoshowthedifferentcases.)

Also,ofcourse,inareal‐lifesituation,therewouldalmostcertainlybemorefactorstoconsider.Forexample,the decisiontolaunchthebusiness(andwithwhichdesign)wouldnodoubtalsoneedtoreflectthecostsandthe potentialtomakeaprofit(notjustthesalesrevenue).Modelsshouldthereforebedesignedsothattheyinclude andevaluatethekeydecisioncriteria(asdiscussedindepthin Chapter2).

Thesetofapplicationsofmodelingistoonumeroustolistfully,butincludesforecasting,businessplanning, investmentanalysis,valuation,targetsetting,creditassessment,portfolioselection,andoptimization,andrisk analysis.Withineachofthese,therearemanyvariations,sincemostbusinessesordecisioncontextshavespecific featuresthatneedtobecaptured.Nevertheless,therearenumerousconceptswhicharecommontomany situations,aswellascalculationsandtypesofstructuresthatarefrequentlyusedinExceltoimplementthese.The focusofthistextistotreattheseessentialsindetail.

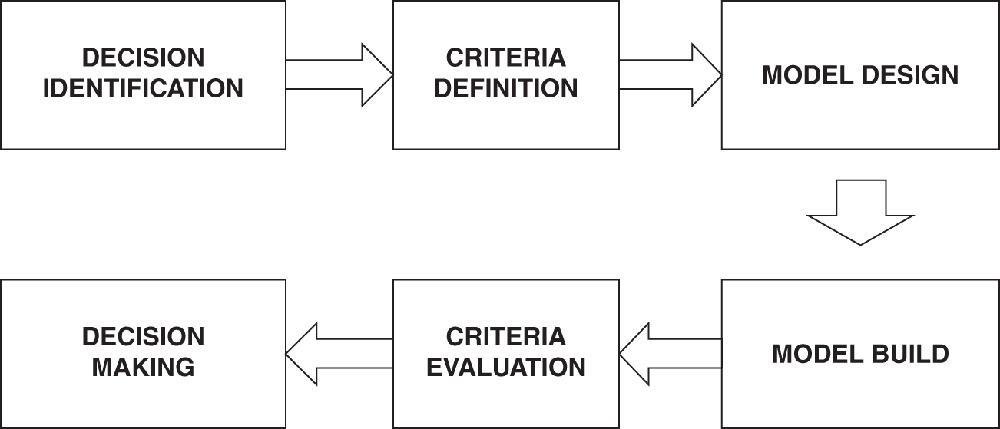

2.1 INTRODUCTION

Modelingactivitytakesplacewithinanoverallcontextandawidersetofbusinessprocesses.Atahighlevel,the mainstepstoconsiderwhenplanningandbuildingafinancialmodelfordecisionsupportare:

Identifyingthedecisionanditsstructure,options,andcriteria.

Mappingtheelementsofreal‐lifethatshouldbecaptured,includingthevariablesandlogicflow

Buildingandtestingthemodel.

Usingrelevantexternaldata.

Usingtheresults,includingpresentation,graphics,sensitivityanalysis,reports,anddocumentation. Thischapterexploresthesetopics,discussingthecoreprinciplesofeachpointandthemainpracticalissues.Note thatinthischapter,thediscussionisstillquitegeneric;infact,mostoftheprinciplesapplywhetheramodelisto bebuiltinExcelorinsomeotherplatform.However,therestofthebook(fromChapter3onwards)isdevotedto implementingthesewithintheExcelenvironment.

2.2 DECISION IDENTIFICATION, FRAMING, AND STRUCTURE

Amodelisgenerallyusedtosupportadecisionprocessinsomeway.Therefore,itisimportanttoestablishwhat decisionisbeingaddressed,whataretheobjectives,andwhataretheconstraintsorlimitationsthatmustbe respected.

Acommonfailingofdecisionprocessesisknownasthe“fallacyofchoice”:Thisiswherewhatwouldhavebeen thebestdecisionoptionisnotconsideredatall.Clearly,foramodeltobemostuseful,itmustalsoreflectthe relevantdecisionandthemostappropriateorbestoption(s).

Generically,onemaythinkofadecisionashavingabinarystructure(“goornogo?”).Mostcommonly,Excel modelsreflectthis:Themodelrepresentsthe“go”option,whereasthe“nogo”optionisnotmodeledexplicitly (i.e.itisimplicitlyconsideredasbeingneutralorevaluatingtozero).

Itisalsofrequentlythecasethat(withinthe“go”option)therearesetofsub‐optionswhicheachhavethesame structure.Thatis,thereisonlyonemodel,andthesub‐optionsarecapturedasscenarios(eachsimplyusing differentinputvalues).Ifthereweremajorstructuraldifferencesbetweenthesub‐optionsthenadifferentmodel wouldberequiredforeach(and,inthatcase,theyarestrictlyspeakingnotsub‐optionsatall). Figure2.1 illustratesthisforthesituationdiscussedin Chapter1(seeFigure1.5andtheassociateddiscussion).

Othertypesofdecisionstructuresincludeallocationsoroptimizations(e.g.howmuchcapitalshallweallocateto projectA,andhowmuchtoprojectB?),multiplestructurallydifferentoptions(suchaswhethertorenovateone's house,buyanewcar,orgoonvacation),anddecisionsequences(e.g.usingaphasedapproachratherthanmaking asingleup‐frontdecision).Thesemayrequiremoreadvancedmodelsandtoolstoproperlyaddressthem. However,thecorepointsarethattheappropriatedecisionneedstobeidentifiedandthatthemodelshouldreflect thestructureofthedecisionsituation.

2.4 SENSITIVITY‐BASED DESIGN

Sensitivityanalysisistheexplorationofthechangesthatoccurtothevalueofacalculateditemwhenoneormore oftheinputvalue(s)ischanged.Itisakeypartofdecisionsupport,asitcan:

Helptounderstandtheconditionsunderwhichadecisionmakessense(ornot).Forexample,whileabase casemayindicatethata“go”decisionispreferable(to“nogo”),asensitivityanalysiscouldidentifythatthis istrueonlyifcostsdonotrisebymorethan10%.

Establishtherangeoflikelyoutcomesandgenerallytoassessthepotentialupsidesanddownsides. Identifytherelativeimportanceofthekeyinputvariables,andhencetheeffectivenessofpotential managementactionsthatcouldbeusedtomaximize(oroptimize)theoverallresultwhilemitigatingor reducingrisk.

Aseeminglyobvious–butoftenoverlooked–pointisthatsensitivityanalysisshouldbeconsideredbeforethe modelisbuilt(i.e.asaplanninganddesigntool):Ifitisconsideredonlyafterwards,themodelmayhavebeen builtinawaywhichdoesnotallowthenecessarysensitivitiestoberun!Theapproachtoimplementingsensitivity techniquesvariesaccordingtothestagewithinthemodelingprocess:

Atthedesignandplanningstage,itrevolvesaroundidentifyingaspreciselyaspossiblethesensitivitiesthat willneedtoberunlater.Thiscanhelptodefinethevariablesthatshouldbeincludedinthemodel,theirroles asinputsoroutputs(i.e.thelogicflow),aswellasthelevelofdetailorgranularitythatisneeded.

Whenamodelisbeingbuilt,itcanbeusedtoverifyandtestitsgeneralbehavior,notablybycheckingthat therelationshipsthatarepresentinthereal‐lifesituationarereflectedproperly.Itcanalsobeusedtodevelop andcheckcomplexcalculations,bytestingtheirresultsatvariousvalues(ideallyacombinationofsimple values,extremevalues,andvalueswhicharecriticalinhowtheformulaswouldevaluate).

Figure2.3showsasimpleillustrationoftheuseofasensitivitythoughtprocessinmodeldesignandplanning. WhencreatingamodelforecastofSalesRevenue,therecouldbeseveralfundamentallydifferentapproachesto thechoiceofvariablesandthelogicused.Theseinclude:

VolumemultipliedbyPrice.

MarketSizemultipliedbyMarketShare.

SumoftheSalesRevenueperCustomer(orperproduct,geographicregion,etc.).

Byconsideringthenatureofthesensitivityanalysisthatwillbeneededwhenthemodeliscomplete,oneshouldbe abletoseewhichoftheseismostappropriateorwhatvariationsofoneofthemmayberequired.(Theprocess couldalsohighlightthatnoneoftheseoptionsaresuitableandthatothermodelingapproachesshouldbe considered.)

2.5 DATA AND DATA SOURCES

AsnotedinChapter1,modelsalmostalwaysnotonlycapturetherelationshipsbetweenitems,butalsohaveinput fieldsthatarepopulatedwithrelevantvaluesoractualdata.Insomecases,thevaluesusedfortheinputsmay simplybeabestestimateorajudgmentmadebyan expert(e.g.forabespokeorunusualprojectwherelittle historicalorcomparableinformationisavailable).Insuchacase,theprocessofdataintegrationmaybesosimple thatitmaybarelybethoughtofasonethatrequiresspecificconsiderationortechniques.Ontheotherhand,in veryadvancedapplications(suchasmachinelearning),onemayneedtoautomatethesourcing,manipulation, integration,andanalysisoflargedatasetsthatarestoredonexternalservers,andwhicharebeingfrequently updated.Therefore,whilesomedataanalysisisusuallyrequiredaspartoftheoverallmodelingactivity,itsnature couldrangefromsimpletocomplex,highlyadvancedanalytics.Ingeneral,oneiscommonlyfacedwitha situationthatisinbetweenthesetwoextremes:Frequently,somedataisavailableandneedstobeanalyzedor summarizedtoinformthevaluesusedforthemodelassumptions.Forexample,whenbuildingaforecastingmodel tovalueabusinessbasedonitsexpectedprofitabilityoverthenext5to10years,itmaybesufficienttoforecast theoperatingcostsatanaggregatelevelonly(e.g.thetotalcostbycategoryineachquarteroryear),evenasthe business'sITandaccountingsystemsmaybeabletoprovideamuchmoredetailedbreakdownofthehistorical costofeverylineitem.Similarly,regressionorcorrelationanalysismaybeneededtoexploreordetermine relationshipsbetweenvariablesthatmaybeneededwithinthemodel.

Fromthepointofviewofmodelplanninganddesign,whenfacedwithamodelingsituation,itisusefultoask questionssuchas:

Theoverallroleandimportanceofdatatothemodel.Howmuchdataisavailable,andfromwhattypesof sources?Whatwouldthedatabeusedfor?

Howisthedatastructured?Howmanydatasetsarethere?Wherearetheylocated?Howcantheybe accessed?Howlargearethey?

Isthedata“clean”andconsistent?Howaccurateisit?Coulditcontainerrors,orneedcorrection?Would someformofmanipulationorintegrationberequired?

Howoftenwillthedatabeupdated,andwillthemodelalsoneedtobeupdatedasoften?

Theanswerstothesequestionswillhelptoformaclearpictureofthedataandlogicalstructuresandofthe techniquesthatarerequiredtoimplementamodel.Thesearediscussedindetailin PartVI

2.6 MODEL MAPPING AND APPROXIMATIONS

Theterm“mapping”referstothetranslationofthecoreaspectsofthereal‐lifesituation(andtherelationships withinit)intothemodel.Thisrequiresonetodefine:

Thevariablestobeusedandtheirrole(inputs,calculations,outputs).

Theoveralllogicandflow.

Thelevelofdetail(granularity)ofthese,suchaswhethertherevenuesarebrokendownforeachindividual product,whetherthetimeaxisisannualormonthly,andsoon.

Fromapracticalpointofview,itisoftenbesttostartwithitemsthatrelatetooperationalandinvestmentissues (suchasprices,volume,revenues,operatingcosts,investmentneeds,andsoon)beforecapturingthefullimpactof theseoncashflowsandontheconsequencesforthefinancing.

Themappingprocessisnottobedoneinisolation:Itshouldconsidertheissuesmentionedearlier(notablythe decisionstructureandcriteria,theuseofsensitivityanalysisasathought‐process,andtheavailabilityanduseof

datasets).Theprocessalsorequiresthatthemodelerhasanadequateknowledgeoftheareaofapplication,in ordertounderstandthebehaviorandrelationshipswithinthereal‐lifesituation.Forthisreason,thistextaimsto providesomecoreelementsofthisforarangeofcommonapplicationareas.(However,inaspecificcasethatone isfacedwith,itmaybenecessarytodoextraresearchorstudyspecificconceptsineconomics,finance,or accountinginmoredepth.)

Amodelisusuallyanapproximationorasimplification:Therearetypicallyaspectsofasituationthatcannotbe capturedinfulldetailorrarescenariosthatmayoccurinreallifethatarenotreflectedinthemodel.Forexample, ifamodelusespriceandvolumeasitsunderlyinginputs(withrevenuescalculatedasanoutput),thenitprovides notracingback(explanationorcausality)ofthefundamentalfactorsthatthemselvesdeterminethepriceor volume.Forexample,inthecaseofahotelbusiness,anincreaseininterestratesmayreducebusinessactivityand hencereduceboththepriceandthevolumethatmaybeabletoachieve(aswellasincreasingitscostof borrowing).Byextendingthelogicofthemodelfurther“backwards”inthecausalitychain,onewouldcreatea larger,morecomplex,andmoredetailedmodel.However,theinputsforthenewmodelarestillonlypotential “startingpoints”forayetlargermodel,andsoon.Thus,eventhemostdetailedmodelisunlikelytoeverbeable tocapturethefullbehaviorofthereal‐lifesituationineverypossible situationthatcouldarise,whilethecreation ofsuchadetailedmodelmayinvolvesignificantwork,andnotnecessarilybemoreaccurate,norprovide additionalbenefitorinsight.Akeyskill(andobjective)istocapturethekeyelementsinawaythatissufficientto fulfilltheparticularpurposeathand,notablytosupporttheneedsofdecision‐makers.Thephrases“Everymodel shouldbeassimpleaspossible,butnosimpler”(adaptedfromaquotebyEinstein),and“Everymodeliswrong, someareuseful”shouldalsobekeptinmindaspotentiallyhelpfulguidelines.

2.7 BUILDING AND TESTING

Thereareseveralprinciplesinvolvedinbuildingmodelsinaccordancewith“bestpractices.”Theseincludeto:

Namethevariablesclearly

Separateinputsfromcalculations.

Createtransparencyandclearlogicalflows.

Breakcomplexcalculationsintocomponents.

Usemodularstructures(largelyself‐containedthatcontaincloselyrelateditems,andwhicharelinked togetherwitharelativelysmallsetoflinkstocreateawhole).

Testthemodelrobustlybeforeapplyingit.

Theimplementationoftheseprinciplesisoftenspecifictothemodelingplatformusedandarethereforediscussed indetailinthecontextofExcelinChapter3.

2.8 RESULTS PRESENTATION

Thecoreprinciplesofusingmodelresultsfordecisionsupportinclude:

Presentingthesituationandassumptionsclearly

Highlightingthekeyinformationneedsthatdecision‐makershave,notablytheevaluationofthedecision criteriaandrelatedreportingneeds.

Showingtherangeofpossibleoutcomes(e.g.throughsensitivity,scenario,orriskanalysis),andtheleversby whichtheoutcomecanbeinfluenced.

Usinggraphicaloutputasappropriate.Careshouldbetakentoensurethatthemostappropriatetypeofgraph ischosenandthatthemessagethatthechartisintendedtoconveyiseasytoseedirectlyonthechart.

Providingadequatedocumentation.Thisshouldnotethecontextinwhichthemodelisvalid,orwhether adaptationsarenecessaryasthedecisionsituationorcriteriachanges.

Tryingtominimizetheeffectofbiases.

(Onceagain,mostoftheseprinciplesarecoveredinmoredetailin Chapter3,toshowtheirimplementationinthe Excelenvironment.)

2.9 BIASES

Biasescanimpactdecisionidentificationandselectioneveniftherightinformationhasbeengiventodecision‐makersfromatechnicalorobjectiveperspective.Thetopicofbiasesislinkedtohumanpsychology(atthe individualandgrouplevel)andtoevolution.Whileitsscopeisverylarge,importantexamplesofbiasesinclude:

Thebiasof“framing.”Thismeansthat–forthesamesituation–onewouldmakeadifferentdecision dependingonhowtheinformationispresented.

Thebiasof“lossaversion.”Thismeansthatpeoplearetypicallyrisk‐seekingtoavoidlosses,butrisk‐averse inthefaceofgains.

Thesebiasescaninteractoroverlapintheireffects.Forexample,onemaybereluctanttosellaninvestment(such asastock)thathasdecreasedinvalue(i.e.toretaintheinvestmentratherthanrealizingitsvaluebyturningitinto cash).Atthesametime,ifaskedtoincreaseone'sholdingofthesameinvestment,onemayalsobereluctanttodo so.Thatis,onesimultaneouslyprefersholdingtheinvestmentratherthancashandholdingcashratherthanthe investment.Similarly,abusinessdecisionaboutwhethertocontinuetoinvestinapoorprojectcanbeaffectedby whetherthefocusisonloss‐avoidance(“Wehaveinvestedsomuchthatwecan'tstopnow.”)ratherthanpotential gains(“Let'sinvestinthefutureofthishighlyuncertainproject–afterall,itcouldturnoutwellintheend.”).An awarenessofpotentialbiasescanbeimportanttominimizingtheireffect.However,afulltreatmentofthisrich topic(andrelatedaspectssuchasbehavioralfinance)isbeyondthescopeofthistext.

3.1 INTRODUCTION

Excelisgenerallyanexcellentplatformformostcommonfinancialmodelingapplications.Itiseasytolearnata basiclevelandcanprovideatransparentandflexibleenvironment(ifusedwell).Ithasmanyfunctionsand features,andnewfunctionalityisaddedregularly.Incaseswhereonemayneedtoconductoperationsthatarenot presentinthedefaultversionsofExcel,thesecanoftenbefoundinthefreeshippedadd‐insorbyusingVBA macros.(However,mostoftheapplicationswherethesewouldbeneededarebeyondthescopeofthistext.) Finally,althoughthereareareasofapplicationwhereExcelmaynotbeapracticaltoolforthefinal implementationofasolution(suchasifveryhighcomputationalintensityisrequiredtomanipulatehugedatasets extremelyquickly),itcanoftenbeaconvenientplatformtocommunicateandtesttheconceptsortodevelop prototypesforthesesolutions.

ThischapteraimstohighlightthefeaturesofExcelthatareindispensabletoanymodelerworkingincommon areasofapplication.Itisintendedtobeastructuredsummary,notonlytoactasaguideforreaderswhoareless familiarwithExcel,butalsotoformachecklistofcorecompetencesforthosewhoalreadyhavesomeexperience. Thetopicscoveredrelateto:

Thestructureandmenus.

Thecreationofcalculations.

Themostimportantandfrequentlyusedfunctions(around100arehighlighted;thesearethefunctionsused laterinthetext).

Thecoreoperationsthatareneededtobuild,test,anduseamodel.

Calculationoptionsandsettings.

TheuseofshortcutsandKeyTips.

Bestpracticesandthecreationoftransparency.

Auditing,testing,andthetracingoflogic.

Usinggraphsandcharts.

3.2 STRUCTURE AND MENUS

SomeofthekeypointsaboutthestructureofExcelare:

AnExcelworkbookcontainsoneormoreworksheets.Eachworksheetismadeupofatabularsetofcells, whichareidentifiedbyacolumn‐rowreferenceaddress(suchasC5,toindicatethecellinthethirdcolumn andfifthrow).

Eachcellmaybeblankorhavecontententeredintoit,suchasanumberortext.Formulasorfunctionsmay insteadbeentered;theseconductcalculationsthatgenerallyreturnnumbers(butcanreturntext,logical items,orerrors).

Typically,tocreateacalculationinacell,theinputsarethevaluesthatarepresentinothercells.(Fixed numberscanbeembeddedwithinformulas,butitisingeneralnotgoodpracticetodoso.)

Asetofcellsthatformsarectangularstructure(orrange)canbereferredtobyusingthecelladdressofthe firstandlastcells.Forexample,C5:E9referstotherectangularrangewhichstartsatcellC5andendsatE9. Thisallowsformultiplecellstobereferredtosimultaneously.

Aswellasitsvalueorcontent,acellorrangehasotherproperties.Theseincludethesizeandcolorofthe font,thetypeofshading(ifany),andthetypeofborderplacedaroundit(ifany).

TheExceltoolbarcontainsseveraltabs,eachofwhichhasadescriptivetitlethatrelatestothetypesofmenu operationsthatareofferedbytheitemsonthetab.ThecoretabsarepresentbydefaultwhenExcelisfirstinstalled (seeFigure3.1).

Figure3.2showstheleft‐hand‐sideoftheHometab,whichcontainsmanyfrequentlyrequiredoperations.