5 minute read

Keep Your Eyes On This

Matt Dalgleish, Thomas Elder Markets.

A short summary of key factors to keep an eye on in red meat markets during the 2021 season.

Advertisement

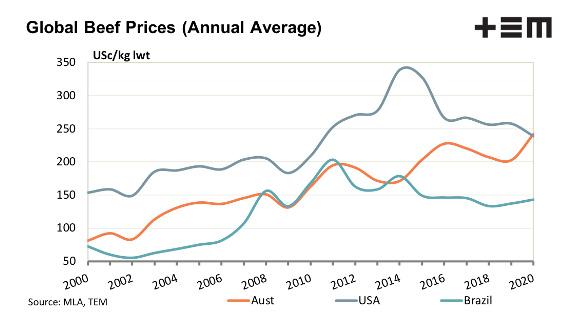

CATTLE MARKET GLOBAL CATTLE VS DOMESTIC CATTLE PRICES

Tight supply and more favourable seasonal conditions have seen Australian cattle prices reach for the stars during 2020, eliminating the normal premium spread held by US cattle. Further to the strong domestic cattle prices, the Australian dollar has appreciated significantly, eroding our international competitiveness in global beef markets.

The prospect of an Australian dollar into the high 70US cent region, or even above 80US cents into 2021 will act as an additional headwind on cattle prices. Furthermore, Australian beef processors have been battling with negative profit margins for much of the 2020 season. This tough trading environment for beef processors is not expected to ease into 2021, given the forecast for the lowest beef herd in nearly thirty years.

Therefore, there will be limited opportunity for Aussie finished cattle prices to continue to climb higher into 2021. Despite the strong desire to restock, young cattle prices will also be limited as to how far they can extend higher too, without finished cattle prices moving higher.

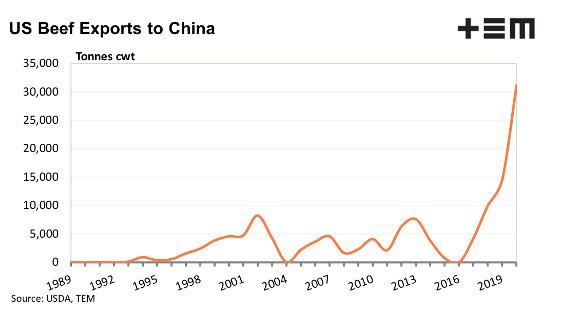

ONGOING TRADE TENSIONS AND THE GROWTH OF US BEEF EXPORTS TO CHINA

Don’t expect the Chinese Australian trade tensions to fade into 2021. The Biden administration in the USA are committed to keeping the Trump Phase One trade deal with China, which has already seen a significant increase in US beef flows to China during the 2020 season at the expense of Australian beef exporters.

Australia’s frosty relations with China appear unlikely to thaw out anytime soon. In 2010 China put Norway in the trade “sin bin”, cutting off their salmon exports and the trade spat between them lasted for about six years. Expect China to continue to make an example of Australia in 2021 with beef exports remaining in Chinese sights as one of several trade targets to punish us.

SLOW HERD REBUILD AND THE RETURN OF DROUGHT

The female slaughter ratio has been slow to return to levels consistent with a herd rebuild, despite some obvious restocker activity in southern regions. A prolonged herd rebuild is a concern given the potential for the Australian climate to switch back into drought mode.

Analysis of the last century of rainfall indicates that much wetter than normal seasons (like what is being experienced currently) don’t last very long, often switching back to drought conditions within a two-to-four-year period. Missing the current opportunity to rebuild the herd (off of nearly thirty-year lows) poses the risk that a return of drought by, or before, 2025.

This could see the herd sink to even lower historic levels should the current rebuild phase stall. While the low supply will be good for prices, it won’t be great for maintaining our export market share in key destinations and risks the long-term viability of the industry.

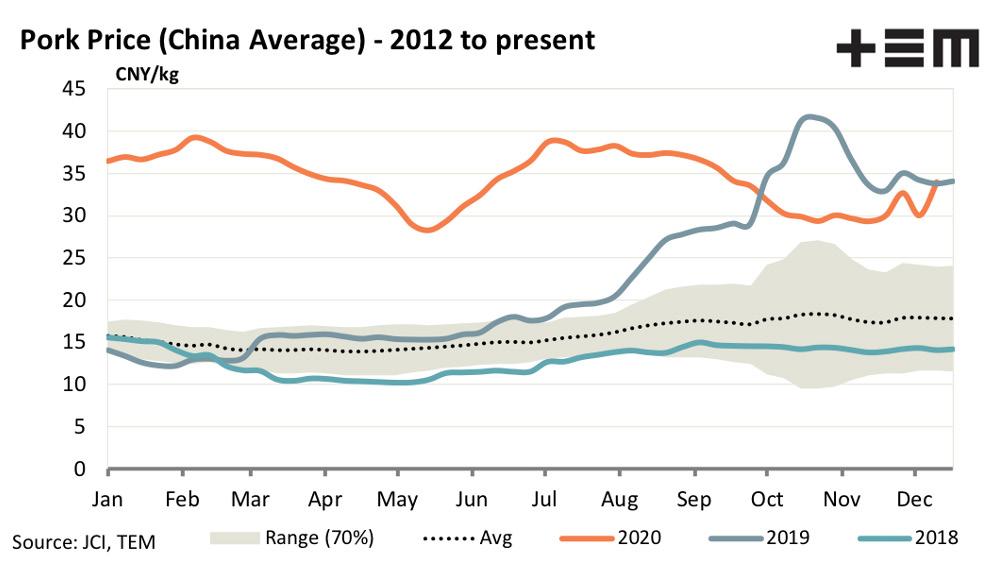

SHEEP MARKET CHINA PIG PRICES AND MEAT IMPORT VOLUMES

Speculation that the Chinese pig herd and pork production is back near pre- African Swine Fever levels is questionable. Rather than relying on the official word from the Chinese authorities keep a close watch on the pork price in China and the level of Chinese meat import flows. While prices remain elevated and meat imports (of all types and from various source countries) remains high this suggests that the pork production deficit in China remains.

During 2020 Chinese demand for Australian sheep meat remained strong. Despite some recent suggestions that China may be targeting Aussie sheep meat in an escalation of trade tensions there has been little evidence of this occurring. Given the reliance the global sheep meat export sector has on Australian sheep meat (circa 40% of global sheep meat demand is satisfied by Australia) there is limited scope for China to shun the Aussie supply, particularly while their pork meat production gap remains.

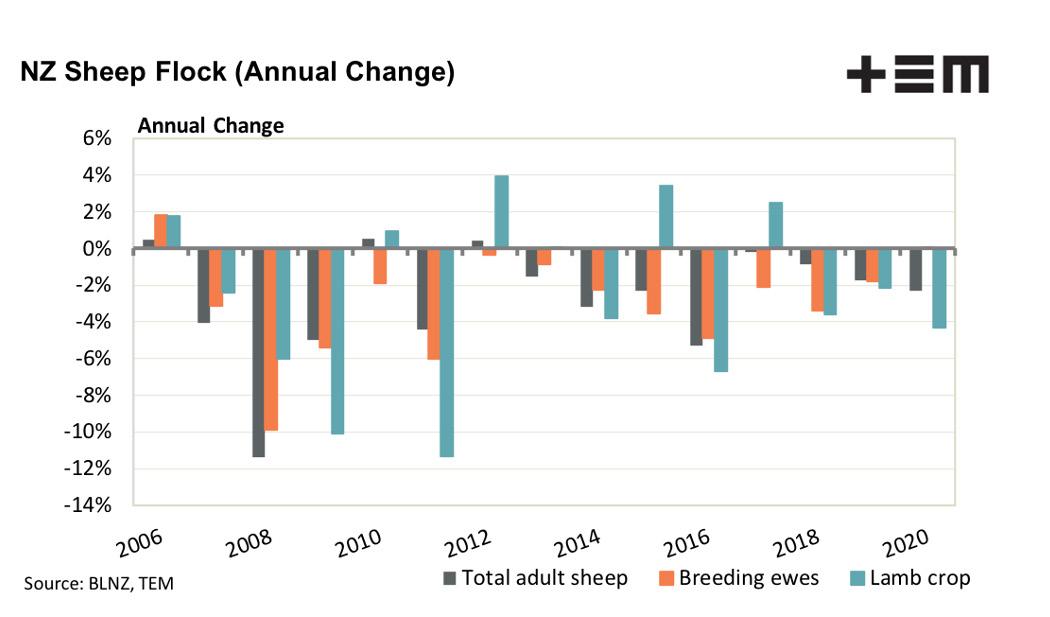

NZ SHEEP FLOCK

The sheep flock in NZ has been in steady decline for more than three decades with sixteen of the last eighteen seasons posting an annual decline in the number of breeding ewes. The forecast from Beef & Lamb New Zealand for the 2020/21 season shows the first increase in breeding ewe numbers since 2006. The NZ breeding ewe flock is anticipated to grow 0.1% from 16.85 million head to 16.86 million head. Despite the increase to breeding ewe numbers the NZ lamb crop is expected to reduce by 4.3% from 22.3 million head in 2020 to 22.3 million head in 2021.

New Zealand is Australia’s only real export competitor in the sheep meat export space and while they continue to see a decline in sheep numbers, lamb crop, sheep meat production and export volumes they provide an opportunity for Australian producers and Aussie sheep meat exports to increase market share.

ONGOING COVID-19 COMPLICATIONS

Sheep meat export demand is susceptible to decreased economic growth levels, so the pace of the global recovery is key to supporting lamb/sheep prices into 2021.

The outbreak of a more contagious variant COVID-19 in the UK has forced parts of the country back into a strict lockdown, despite the rolling out of a vaccination program. While the UK aren’t a huge proportion of Australia’s sheep meat export program the prospect of a new variant wave of Covid-19 spreading around the globe in 2021 could delay the economic recovery in many regions that are key sheep meat trade partners. Already the more contagious UK variant of COVID-19 has been discovered in the USA and there is a South African strain also beginning to spread into Europe and Asia that is equally highly contagious.

Additionally, there is a risk of a US lockdown phase early in the new year after the Biden administration takes over. During the first US lockdown phase in 2019 Australian sheep meat export volumes suffered a few months of reduced flows, particularly impacting domestic prices paid for heavy lambs.

Remember around 60% of Australian sheep meat exports to the USA go to the food service sector and 60% of these flows end up in the fine-dining restaurants (which will likely be the first food sector participants to be locked down and last to re-open).