9 minute read

Index

adjusted coefficient of determination, 401 advertising: informative, 24, 175, 233; negative, 176; persuasive, 24, 175, 233; positive, 176 adverse selection, 131, 330, 344–345 Akerlof, George A., 344 allocating function of prices, 49–50 antitrust legislation: Cellar-Kefauver

Act, 180, 212–213; Clayton Act, 14, 180, 210–211, 389; Federal Trade

Advertisement

Commission Act, 14, 211; Hart-

Scott-Rodino Act, 213; Robinson-

Patman Act, 211–212; Sherman Act, 14, 209–210; Telecommunications

Act, 389; Wheeler-Lea Act, 212;

Willis-Graham Act, 211 Arrow, Kenneth J., 353n1 asymmetric impatience, 309–311, 310 asymmetric information, 131–133, 146, 189, 330, 344–350, 370 auctioneer, 369 auction environment, 368 auction rules, 368 auction: closed-bid, 368–369; common-value, 375–376; completeinformation, 370; Dutch, 369,

373–374; English, 369, 372–373; incomplete-information, 370–377; multiple-item Dutch, 369–370, 373, 374; open-ascending-bid, see English auction; open-bid, 368; open-descending-bid, see Dutch auction; oral, 369; procurement, 368; reverse, see procurement auction; sealed-bid, 369; sealed-bid, first-price, 369–372; sealed-bid, second-price, 369, 372; standard, 368; Vickery, see sealed-bid, second-price auction auctions, 367–370 average product, 82 Axelrod, Robert, 252–253

backward induction, 257–258, 297, 307, 338 Bain, Joe S., 220 bargaining, 303–313 bargaining: Nash, 304–305; Rubinstein, 306–311 bargaining surplus, 304 barriers to entry, 172, 203, 206–207, 219 Baumol, William J., 213

428 Index

Bayesian updating, 341–344 Bayes’ theorem, 353n3 Bazerman, Max H., 376 belief profile, 343 Bernoulli, Daniel, 321 Bertrand, Joseph L. F., 223 Bertrand model, 223–226 Bertrand paradox, 225–227 best-response function, 222, 239 Bettis, Richard A., 145 Binmore, Kenneth G., 313n2 Black, Fischer, 336 Black–Scholes–Merton model, 335–336 bond, 12 bottleneck, 388–390 bottleneck: one-sided, 388, 388–389; two-sided, 389, 389 branch, 256 Brandenburger, Adam M., 98 breach of contract, 362 breach remedy, 362–364 Brush, Thomas H., 145 buyer’s reservation price, 269, 306, 337

capital intensive, 188 Cassano, James, 145 ceteris paribus, 21, 71 chain of command, 150 Chamberlin, Edward H., 227, 229, 231 chance node, 319 Chandler, Alfred D., 154, 162 coefficient of determination, 399–401 collusion, 220, 227–228, 248 common stock, 12 complements in consumption, 25 complements in production, 34 concentration ratio, 177–178 confidence interval, 397–398 conglomerate, 145, 190 conglomerate merger, 106, 145, 180, 190, 212 consumer surplus, 29–31, 31, 37–38, 205, 268–281 contestable market, 213–215, 233 contestable monopoly, 213 contract, 120–123, 141, 244, 304, 355–366 contract: exclusive, 211; futures, 120; incentive, 131–132; options, 332–336; tying, 211 contracting environment, 356 contracting phase, 356–357 contractual relationship, 356 contribution margin per unit, 288 Cooper, Russell, 265n2 coordination and control, 148, 151, 154, 158 corporate culture, 125, 163–165 correlated value estimates, 370, 375–377 cost: accounting, see explicit cost; agency, 130; average fixed, 89–90; average total, 89; average variable, 90; bargaining, 125; explicit, 8; implicit, 8, 288; incremental, 90–92; marginal, 90; opportunity, 2–3, 22, 119, 277, 308, 359; quasi-fixed, 88; search, 336–338; short-run total, 87; sunk, 88, 123, 172, 214; total economic, 8, 87; total fixed, 87–88; total operating, 10; total variable, 10, 15, 88; transaction, 103, 119, 140–141, 190, 280, 367, 390; cost complementarities, 106–107, 204, 283 Cournot, Antoine Augustin, 220 Cournot model, 220–222 cross-section data, 400 cross subsidization, 146, 190–191, 287 Cullen, Patrick G., 1

damages, 363 damages: expectation, 363; punitive, 244; reliance, 363; restitution, 244, 364 Darwin, Charles, 381 Datar, Srikant M., 1 deadweight loss, 45, 47, 208

Index 429

decision node, 256, 319 decision node: basic, 257; complex, 257; trivial, 257 DeJong, Douglas V., 265n2 demand determinants, 23–27, 27 departmentalization, 150–151 discount rate, 6, 228, 308 diseconomies of scale, 98–101, 103–105, 150, 383 diversification, 144–147, 190–191, 330–332 Dixit, Avinash K. 265n1 double marginalization, 129, 292 dropout price, 373 duopoly, 220 dynamic game, 241, 255–260, 338–344

econometrics, 394 economic efficiency, 13–14, 209 Economides, Nicholas, 387 economics, 2–3 economics of information, 315–350 economies of scale, 98–103, 143–145, 172, 204, 387 economies of scope, 105–106, 144–145, 204 elasticities: advertising elasticity of demand, 71, 233; arc price elasticity of demand, 59; cross-price elasticity of demand, 70, 143, 178, 283; income elasticity of demand, 69–70; point price elasticity of demand, 59–60; price elasticity of demand, 55–57, 184, 233, 268, 288 elasticity, 55 end-of-game problem, 249–251 equilibrium: Bayesian Nash, 319;

Bertrand-Nash, 225; Cournot-Nash, 222; evolutionary, 382; market, 36–37; Nash, 243–244, 305, 319, 371, 386; perfect Bayesian, 343; pooling, 348; separating, 348; subgame, 257; subgame-perfect, 256–257, 297, 307, 338, 357–358 evolutionary game theory, 381–382 expected value, 316, 376 external incentives, 131 externalities, 13

fair gamble, 321 fair insurance, 328 financial derivative, 132–133, 332 financial instrument, 12, 147, 332 finitely-repeated static game, 248–251 firm architecture, 148–150 first-mover advantage, 223, 258–260, 297, 305, 387 five forces, 171–173, 172 fold-back method. See backward induction Forsythe, Robert, 265n2 Frederickson, James W., 162 Friedman, Milton, 194 F-statistic, 401

Galbraith, John Kenneth, 191 game theory, 3, 239–241, 303, 356, 381–382 game tree, 255, 338 Garvin, David A., 1 Golder, Peter N., 260 Goldwin, Samuel, 366n1 government franchise, 187, 203, 383

Harsanyi, John C., 243 Herfindahl-Hirschman Index, 180–182 Hofbauer, Josef, 382 hold-up problem. See opportunism horizontal alliance, 147 horizontal differentiation, 234 horizontal integration, 143–144, 180, 190 hostile takeover, 131

imperfect competition, 174 implementation phase, 357–362 income effect, 22, 69 incomplete information, 319, 362 independent investments, 326 independent private values, 370–374

430 Index

industrial concentration, 177–182, 179, 388 industrial integration, 189–191 inferior good, 23, 69 infinitely-repeated static game, 253–255 information partition, 342 information set, 341 information structure, 370–377 insurance, 328–330 intercorporate stockholding, 211 interest rate, 6 interlocking directorate, 211 internal incentives, 130 isocost line, 94–96 isoquant, 84–86, 113 isoquant map, 85, 85, 113 investor indifference curve, 325–326

job security, 131 joint venture, 96, 147

Knight, Frank H., 315

labor intensive, 188 last-mover advantage, 308 law of demand, 21–22, 61, 387 law of diminishing returns, 5, 83–84 law of supply, 31–32 Lerner index, 182–183, 268 learning curve effect, 97–98 liability, 363 Liebowitz, Stan, 387 long-run average total cost curve, 99 luxury good, 69

macroeconomic policy, 12 managerial economics, 3 manager-worker principal-agent problem, 133–134, 247 marginal product, 82 marginal rate of technical substitution, 84 marginal resource cost of labor, 116 marginal resource cost of capital, 116 marginal revenue, 15, 66 market, 21 market demand curve, 21 market power, 11, 143, 169, 182–184, 193, 219, 248, 267, 388 market structure, 38, 169–171, 174, 193–194, 267, 219, 387 McAfee, R. Preston, 371 McMillan, John, 371, 378n1 mean. See expected value Merton, Robert C., 336 microeconomic policy, 12–13 midpoint formula, 58–59 minimum efficient scale of production, 101, 199 monopolistic competition, 174, 174–175, 229–234 monopoly, 174, 177, 201–209, 219, 268, 386 monopsony, 170 moral hazard, 131, 330, 345–346, 357 multiproduct cost function, 105–107 mutually exclusive investments, 326

Nalebuff, Barry J., 265n1 Nash, John Forbes, Jr., 243 Nathanson, Daniel, 145 natural monopoly, 204 necessity, 69 net present value, 6–7 net social welfare, 37–39, 46, 203 network, 144, 206, 381–392 network types: one-way, see unidirectional network; reciprocal, 383, 383, 385–386; two-way, see reciprocal network; unidirectional, 383; virtual, 383 normal good, 23, 69 normal rate of return. See normal profit North, Douglass C., 119

OECD, 191 oligopoly, 174, 175–176, 219–229 oligopsony, 170 one-time game, 241

Index 431

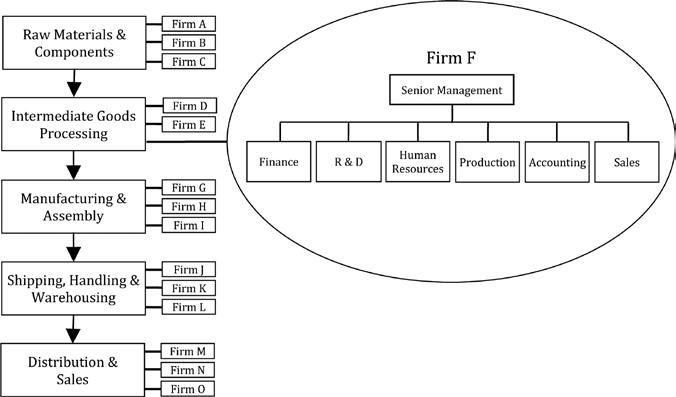

OPEC, 45, 186, 289 opportunism, 126–127, 141, 190 ordinary least-squares regression analysis, 20n1, 53n2, 109n1, 393 organizational structure, 55, 129, 150–163 organizational structure types: contractual network, 160–162, 161; functional form, see unitary from; matrix structure, 158–160, 159;

M-form, see multidivisional form; multidivisional form, 154–156, 155;

U-form, see unitary form; U-form/

M-form hybrid, 157, 157–158; unitary form, 152–154, 153 Osborne, Martin J., 313n2 Oster, Clinton V., 298 out-of-pocket expenses. See explicit cost owner-manager principal-agent problem, 130–133

Panzar, John C., 213 patent, 204–205 payoff, 240 Penrose, Edith T., 145 perfect competition, 173–174, 174, 193–200, 268 perfect recall. See total recall performance bond, 127, 369 performance bonus, 104, 130 piece work, 134 player, 240 Porter, Michael E., 171 positive feedback effects. See positive network externalities positive network externalities, 205–206, 384–385 Prahalad, C. K., 145 Pratt, John W., 353n1 present value, 6, 112, 228, 253, 297, 308, 325 price: ceiling, 44, 46, 44–45; floor, 47, 47–48; maker, 174, 177, 182, 201, 219; taker, 21, 174, 182, 193, 267 price elastic, 61 price inelastic, 61–62 pricing strategies: barometric price leadership, 290; block pricing, 273–274; capacity peak-load pricing, 281–283; commodity bundling, 277–278; cost-plus pricing, 287–288; discrimination, 210, 389; dominant price leadership, 291; entry deterrence, 296–299; first-degree price discrimination, 269–273; full-cost pricing, see costplus pricing; imperfect first-degree price discrimination, 270–271; indirect price discrimination, 280; limit pricing, 298–299; mark-up pricing, see cost-plus pricing; mostfavored customer, 290; multiproduct pricing, 283–287; penetration pricing, 291–292; perfect firstdegree price discrimination, 269–270; predatory pricing, 98, 297; price discrimination, 210, 269–281, 389; price fixing, 228, 248, 288–289; price leadership, 290–291; price matching, 289–290; price skimming, 272; seconddegree price discrimination, 273–278; third-degree price discrimination, 278–281; transfer pricing, 129, 292–296; twopart pricing, 274–277; volume discounting, see second-degree price discrimination; principal-agent problem, 104, 129–134, 151 prisoner’s dilemma, 242, 289, 342 producer surplus. See operating profit product differentiation, 170–171, 174, 227, 232–236 production function, 5, 77–81, 111 production function: Cobb-Douglas, 80–81; Leontief, 79; linear, 78–79; long-run, 81; short-run, 81 profit: accounting, 8; economic, 8, 112, 169, 194, 219, 267, 388;

432 Index

normal, 9–10; operating, 10, 35, 36, 196–197, 208, 270; profit center, 105, 113, 151, 292; profit sharing, 104, 130 Pruett-Jones, Melinda, 382 Pruett-Jones, Stephen, 382 p-value, 399

queuing, 45

rational behavior, 241, 381 rationing function of prices, 11, 43–49 reaction function. See best-response function relationship-specific exchange, 123–124 repeated game, 241 reproductive success, 381–382 reputation, 131 research and development, 191 returns to scale, 5, 98–99, 99 returns to scale: constant, 98; decreasing, 99; increasing, 99 risk, 9, 12, 315–317, 320–323, 324–336 risk averse, 321–328, 377 risk loving, 324 risk neutral, 322 risk premium, 12, 322–323 Robinson, Joan, 229, 231 root of a game tree, 256 Ross, Thomas W., 265n2 Rothschild index, 183–184 Rubinstein, Ariel, 310, 313n2

salvage value, 88 Samuelson, William F., 376 scarcity, 2 Schelling, Thomas C., 241 Scholes, Myron, 336 Schumpeter, Joseph, 191 screening, 349–350 self-selection, 280, 349 seller’s reservation price, 306, 369 Selten, Reinhard, 243 sequential-move game. See dynamic game Shavell, Steven, 366n3 shareholder revolt, 131 Sigmund, Karl, 382 signaling, 346–348 Simon, Herbert A., 241, 287 simultaneous-move game. See static game Smith, Adam, 13 Smith, John Maynard, 381 specialized investment, 123–127, 141, 173 specialized investments types: dedicated asset, 124–125; physical-asset-specific specialized investment, 124; site-specific specialized investment, 124 spot checks, 134, 247 spot exchange, 120, 141 Stackelberg model, 222–223 standard deviation, 317, 397 standard error, 397–398 Standard Industrial Classification (SIC), 178, 190n1 static Bayesian game, 319 static game, 240, 242–246, 304, 318–320 Stein, Jeremy C., 146 Stigler, George J., 220 stock options, 104, 130, 153 strategic alliance, 147–148, 244 strategic behavior, 3, 175, 219, 239 strategy, 240 strategy: dominant, 242; mixed, 240, 246–248; pooling, 248–249; pure, 240, 320; secure, 244–246; separating, 348–349 strategy profile, 240 Strong, John S., 298 subgame, 257 subgame perfection. See subgameperfect equilibrium subroot, 257

substitutes in consumption, 24 substitutes in production, 34 substitution effect, 22 supply chain, 139–141, 140, 180 supply determinants, 32–34, 35 symmetric impatience, 308–309, 309 synergy, 145

tapered integration, 142–143 tax: ad valorem, 26; per-unit, 25 Tellis, Gerard J., 260 terminal node, 256, 338 time clock, 134 time-series data, 400 tit-for-tat, 251–253 too-big-to-fail, 132, 137n2 total product of labor, 81 total product of capital, 81 total recall, 342 total revenue, 6, 25 t-statistic, 398–399 uncertainty, 315–316, 336–344 underinvestment, 125–126 unit elastic, 63

valid information set, 342 value marginal product of labor, 116 value marginal product of capital, 116 variance, 316–317 vertical alliance, 147 vertical differentiation, 234 vertical integration, 123, 141–143, 180, 190, 212 Vickrey, William, 369 von Stackelberg, Heinrich F., 222

Williamson, Oliver E., 162 Willig, Robert D., 213 winner’s curse, 375–376 winner-take-all, 387

yield to maturity, 12

Index 433