GOING LIKE THE WIND

The virtuous circle of offshore wind benefits in Europe

“A

central element in accelerating decarbonisation will be unlocking the potential of clean energy through a collective EU focus on grids. Delivering a step change in grid deployment will require a new approach to planning at the EU and Member State levels, including the ability to effectively reach decisions and accelerate permitting, to mobilise adequate public and private financing and to innovate grid assets and processes. From a European perspective, rapidly increasing the installation of interconnectors should be the focus.”

The Draghi report, published on 9 September 2024, highlights the high cost of energy as a significant barrier to the competitiveness of European businesses. It identifies weaknesses in both gas and electricity markets that, if addressed, could help to reduce prices and their volatility. The report emphasises that accelerating the decarbonisation of the energy system in a technology-neutral and cost-effective manner is essential for sustainably lowering energy prices in the long term.

Extract from ‘The future of European competitiveness - A competitiveness strategy for Europe’ by Mario Draghi (2024)

WHAT IS A VIRTUOUS CIRCLE?

TABLE OF CONTENTS

A virtuous circle is a positive cycle of events, as part of which each event contributes to the success of the next. In the context of offshore wind benefits, the expression refers to a scenario in which addressing one challenge will make subsequent challenges easier to tackle. For example, by implementing riskreduction strategies that lower project financing costs, more private investors can be attracted to invest in the development of offshore wind energy, ultimately supporting Europe’s transition to a net-zero future.

CHAPTER 1, OFFSHORE WIND ENERGY AND CROSSBORDER CONNECTIONS ARE A WINNING COMBINATION

CHAPTER 2, STRATEGIC CROSS-BORDER PLANNING WILL MAXIMISE THE WIND POTENTIAL OF EUROPE’S SEAS WHILE ENHANCING

IT

FOREWORD

› Given that Europe’s offshore wind potential is not evenly spread out across different Member States, national solutions alone will not be enough to ensure the success of the energy transition.

› This vision paper provides a holistic view of the steps that need to be taken to reach Europe’s ambitious offshore wind targets and to bridge the gap between Europe’s current offshore wind capacity and its offshore capacity targets.

› By capitalising on the growth potential of offshore wind development, decarbonisation will become a significant source of economic growth. Moreover, Europe will be able to secure its energy future while boosting its economy and workforce.

RIPPLES OF POSITIVITY

EMPOWERING CLEAN COMPETITIVENESS IN EUROPE

Dear reader,

‘Ripples of positivity’ expresses the idea that positive actions can set off a chain reaction of beneficial outcomes, much like small waves spreading out across the surface of water. That is exactly what this vision paper is about.

‘Going Like the Wind’ explores the virtuous circle of offshore wind benefits in Europe. It demonstrates how international collaboration, strategic cross-border planning, investment security and the scaling up of supply chains in offshore wind development will each deliver benefits on their own and will also feed into each other’s success. The ripples of positivity initiated by these efforts have the potential to create a much larger wave of change. We are not alone in holding this view.

In April this year, Elia Group published Making Hybrids Happen with the Danish energy company Ørsted. In it, we proposed a novel approach to offshore development, including the adoption of a regional approach to the planning of offshore projects and the establishment of an Offshore Investment Bank to support the development of groups of projects located across the same sea basin areas together.

This vision paper goes one step further. It is not a blueprint for the future energy mix nor a grid development plan. Instead, it is one of the few papers that provides European actors with a more holistic view of the steps that need to be taken to bridge the gap between Europe’s current offshore wind capacity and its offshore capacity targets. These steps are essential, since, given that Europe’s offshore wind potential is not evenly spread out across different Member States, national solutions alone will not be enough to ensure the success of the energy transition.

Our aim for this viewpoint was to answer the following questions: what is the value of offshore wind for Europe today and what will it be in the future? How can offshore wind development be undertaken in the most efficient way possible whilst respecting wind resources and sustainability and economic feasibility considerations? How can planning, funding and risk allocation procedures be set up across sea basin areas and across borders?

Many stakeholders from the European energy sector, including other grid operators, various federations and academics, are grappling with the same questions and also endorse the urgent need for change. You’ll find their valuable contributions throughout the report. Moreover, the need for swift action is also gaining support from policymakers.

Mario Draghi’s most recent report, The Future of European Competitiveness’, has made clear what is currently at stake for Europe. It highlights the high cost of energy as being a significant barrier to the competitiveness of European businesses. The report emphasises that accelerating the decarbonisation of the energy system in a cost-effective manner is essential for sustainably lowering energy prices in the long term.

This message is undoubtedly resonating amongst European and national policymakers.

Shortly after her re-election as President of the European Commission in July, Ursula von der Leyen pointed out that the long-term goals of the Green Deal remain unchallenged. However, to maintain support for the energy transition, the Commission will place a greater importance on enhancing the competitiveness of our industries.

Although the next decade will be critical for empowering clean competitiveness in Europe, the Draghi report also carries a very hopeful message. Indeed, the EU is a global front-runner in clean technology, with one fifth of clean technologies worldwide being developed on the continent – and the global decarbonisation drive offers up an opportunity for EU industry to grow.

As demonstrated by our study, the ecosystem for offshore wind is well distributed across Europe, with several champions leading in the development of different elements of the value chain. By capitalising on the growth potential of offshore wind development, decarbonisation could become a significant source of economic growth. Europe could secure its energy future while boosting its economy and workforce.

However, to ensure that the benefits of offshore wind in Europe create a virtuous circle rather than a vicious one, many challenges need to be addressed. Unlocking the potential of clean energy at sea demands immediate political action regarding joint planning and funding and concrete laws for the manufacturing industry to scale up and deliver on Europe’s ambitions. These concrete actions all rely on the timely development of an integrated grid. As the Draghi report states: “From a European perspective, rapidly increasing the installation of interconnectors should be the priority”.

Maintaining the current status quo would not only put clean competitiveness at risk, it would also mean missing out on significant efficiency savings. The analysis for this study calculated the potential outcome of fully unlocking the benefits of international collaboration, the de-risking of investments, and an effective approach to offshore spatial planning. From 2030 to 2050, this could produce savings for the European energy system of more than €1000 billion.

Until now, the integrated European electricity market has primarily focused on imports and exports of electricity. We are slowly moving towards greater collaboration in the coordination and development of large-scale offshore wind projects. As a result, the energy futures of countries like Belgium and Germany will be increasingly intertwined with those of their European neighbours.

In any case, it is clear that good intentions in terms of cooperation and increased offshore wind targets alone are insufficient. After two successful North Sea summits in Esbjerg (May 2022) and Ostend (April 2023), the forthcoming summit in Hamburg in June 2025 will highlight what is truly at stake - and hopefully encourage actors to set the virtuous circle of benefits into motion.

This vison paper aims to offer up some key points for consideration during the upcoming discussions.

We hope you enjoy the read!

What does the figure above show?

The green bars represent the levels of offshore wind capacity that were installed across the EU, UK and Norway (in GW) in 2018 and 2023, alongside the total capacity that these three areas are likely to reach together by 2030 if the current installation pace is maintained.

The blue bars represent the offshore wind capacity targets that the EU, UK and Norway have collectively set themselves for 2030 and 2050: 166 GW and 496 respectively.

Frédéric Dunon CEO of Elia Transmission Belgium

Catherine Vandenborre Interim CEO

of Elia Group

Stefan Kapferer CEO of 50Hertz

It is clear that, if the current installation pace of 8 GW per year is maintained, only 90 GW of offshore wind capacity will be installed by 2030 – well below the 166 GW target. What does this tell us?

Whilst Europe and its neighbours recently managed to accelerate the pace at which they develop offshore wind assets, this pace will have to be sped up even further for offshore targets to be met. Given that offshore projects have long lead times (around 10 years), decisions about future projects must be taken now in order to ensure that the right amount of capacity can be developed in time.

At the invitation of Belgium, the second North Sea Summit took place in Ostend on 24 April 2023. By signing the Ostend Declaration, nine North Sea countries committed to developing the North Seas into the world’s largest green energy power plant.

“We will jointly develop the North Seas as a Green Power Plant of Europe, an offshore renewable energy system connecting our countries with a particular focus on joint hybrid/ multi-purpose and cross-border offshore projects and hubs, offshore wind and renewable hydrogen production at massive scale as well as electricity and hydrogen interconnectors and national projects, including the possibility for cofinancing by countries without direct access to the sea”.

Ostend Declaration, April 2023

THIS STUDY AIMS TO ADDRESS THE FOLLOWING KEY QUESTIONS:

1|

What essential steps are needed to bridge the gap between current offshore wind capacities in our seas and future offshore targets?

2| What is the value of offshore wind for Europe today, and what will it be in future?

3| How can offshore wind development be undertaken in the most efficient way possible whilst respecting wind resources and sustainability and economic feasibility considerations?

4| How can planning, funding and risk allocation procedures be set up to facilitate the development of sets of offshore wind projects across the same sea basin, and/or across borders?

OUR RESEARCH

In recent years, Elia Group has published several papers on offshore wind development and hybrid interconnectors in particular. We are convinced that this will help Europe to harness the full renewable potential of its seas while more effectively distributing the electricity produced among its Member States.

Elia Group publishes a white paper on the importance of hybrid interconnectors.

‘Harvesting Europe’s Full Offshore Potential’ proposes methods for incentivising countries with different amounts of RES potential to collaborate and de-risk the investments provided by wind generation and transmission developers.

Elia Transmission Belgium publishes its blueprint for the Belgian electricity system in the lead-up to 2050. The study concludes that without a long-term strategy and new policy measures in place for its future energy mix, Belgium will become increasingly reliant on imports. The study outlines several options for dealing with this change, each of which carries its own economic and technical impacts. One of the study’s insights is that, as an additional large-scale electricity source, non-domestic offshore wind seems to be a cost effective solution for Belgium.

April

Elia Group publishes its Roadmap to Net Zero study, which explores the building of a climate-neutral European energy system by 2050.

One of the study’s main conclusions is that Europe’s direct electricity demand can be met - but only if we accelerate RES expansion by a factor of three and build more interconnectors to balance out the uneven distribution of renewable energy sources (RES) across Europe.

Aside from their key role in enabling the exchange of RES between countries, interconnectors also level out (weekly) fluctuations in wind production. Therefore, they are also important for reducing the impact of local RES supply dips.

Elia Group and the Danish wind farm developer Ørsted launch a joint paper which proposes novel approaches to offshore development, including the adoption of a regional planning approach (across entire sea basins) to offshore development and mechanisms to give developers visibility on longterm commodity prices, thus strengthening their business case. The paper also proposes the concept of an Offshore Investment Bank for the first time.

HOW DID WE CONDUCT THIS STUDY?

The insights and recommendations included in this study are based on quantitative analyses of a range of scenarios as shown below. They included simulations with the Ten-Year Network Development Plan (TYNDP) 2024 scenarios by ENTSO-E and ETNSO-G, analyses of several decades of weather data, computations of supply chain demand as well as assessments of the latest maritime spatial plans. The scope of our analysis covered the whole of Europe, with a focus on the Baltic and North seas.

A framework of original analyses was set up for this study. Whilst the analyses were conducted independently, they were coupled with a selection of scenarios in order to investigate how much value collaboration holds. As a consequence, this study covers a range of aspects that should no longer be regarded as independent from each other; instead, they should be explored and viewed as forming part of one unified whole.

Over the past year, Elia Group has held discussions with over 50 companies, associations, universities and think thanks in order to outline the virtuous circle of offshore wind benefits in Europe. We would like to sincerely thank the stakeholders below for their valuable input and feedback.

CLARIFYING A FEW CONCEPTS COVERED IN THIS STUDY

RADIAL CONNECTIONS

A radial connection is a single-purpose solution. It directly links one or more domestic offshore wind farms to a designated point along one country’s main onshore electricity grid. To date, nearly all offshore wind capacity in Europe has been connected to the shore via radial connections, with the notable exception of the Krieger’s Flak - Combined Grid Solution (see point 3).

Looking ahead to 2030, offshore wind development in Europe will continue to rely on radial connections. However, several hybrid projects are already being planned and projects of this kind are expected to play an increasingly significant role in the future energy landscape.

Examples of radial connections:

▶ Elia’s Modular Offshore Grid (MOG) or plug-at-sea bundles the electricity generated by four wind farms together and then transmits it to Stevin, the high-voltage substation in Zeebrugge (Belgium). The MOG was commissioned in 2019.

▶ Ostwind 1 is 50Hertz’s first shared cabling project. It involved building three cables for two offshore wind farms (Wikinger and Arkona) in the German part of the Baltic Sea, with one of these three cables being a shared cable. The Ostwind 1 project was finished in 2019.

2| POINT-TO-POINT INTERCONNECTORS

Point-to-point interconnectors enable the direct transmission of electricity between two points. Typically, they run between two different regions, countries, or power systems. They play a crucial role in the integration of energy markets, allowing for a more efficient use of resources and helping to lower costs for consumers.

Examples of point-to-point interconnectors:

▶ Nemo Link Belgium’s first HVDC offshore interconnector, which links it to the UK; it has been operational since 2019.

▶ KONTEK the first HVDC interconnector to link Germany to Denmark; it stretches across the Baltic Sea and has been operational since 1995.

3| HYBRID INTERCONNECTORS

Hybrid interconnectors carry two functions: they link two countries together whilst also connecting these to one or several offshore wind farms.

Several projects of this kind are in different stages of planning and development across Europe, such as the Bornholm Energy Island (Denmark Germany), Nautilus (Belgium - United Kingdom) or Elwind (Estonia - Latvia).

Example of a hybrid interconnector:

To date, only one such project (the Kriegers Flak – Combined Grid Solution which connects Denmark to Germany) has been realised. This is primarily due to the regulatory framework in place, which has traditionally supported the development of either generation assets (wind farms) or transmission assets (interconnectors), rather than encouraging assets that include both – which hybrid projects do.

4| CROSS-BORDER RADIAL CONNECTIONS

Unlike domestic radial connections, cross-border radial connections directly link one or more offshore wind farms located in the exclusive economic zone of one country to the onshore electricity grid of another. Just like their domestic counterparts, these connections serve a single purpose: they do not link two separate energy systems together.

Although no cross-border radial connections currently exist, they could prove to be a valuable option for countries that are struggling to expand their domestic production of renewable energy. Crossborder radial connections could help to increase offshore wind capacity in Europe’s northern seas so that it grows beyond 400 GW, so promoting greater energy cooperation across borders.

THE VIRTUOUS CIRCLE OF OFFSHORE WIND BENEFITS IN EUROPE

2

ADOPTING A COORDINATED APPROACH TO SEA-BASIN-WIDE PLANNING IS REQUIRED FOR EUROPE TO TAP INTO THE MOST EFFICIENT OFFSHORE WIND LOCATIONS AND HARNESS ALMOST 500 GW OF OFFSHORE WIND ENERGY BY 2050.

1

3

FUNDING AND PLANNING GO HAND IN HAND. A JOINT FRAMEWORK TO FUND FUTURE OFFSHORE DEVELOPMENT WILL BE CRUCIAL FOR EFFECTIVELY STREAMLINING LIMITED FINANCIAL RESOURCES AND WILL BE A CRITICAL ENABLER FOR UNLOCKING THE BENEFITS OF SEA-BASIN-WIDE PLANNING.

4 FROM 2030 TO 2050, INTERNATIONAL COLLABORATION, THE DE-RISKING OF INVESTMENTS AND SPATIAL PLANNING IN OFFSHORE WIND DEVELOPMENT COULD LOWER SYSTEM COSTS BY MORE THAN € 1000 BN.

THE OFFSHORE WIND SECTOR IS SET TO GROW SIGNIFICANTLY, MEANING THE SUPPLY CHAIN NEEDS TO BE SCALED UP AND REQUIRING EUROPE TO SECURE ITS RAW MATERIAL IMPORTS. AT THE SAME TIME, THIS WILL OFFER UP SUBSTANTIAL GROWTH OPPORTUNITIES ALONG WITH THE CREATION OF 300,000 JOBS ACROSS EUROPE.

FROM 2030 TO 2050, INTERNATIONAL COLLABORATION,

DE-RISKING OF INVESTMENTS AND SPATIAL PLANNING IN OFFSHORE WIND DEVELOPMENT COULD LOWER THE COSTS OF THE ENERGY TRANSITION BY MORE THAN € 1000 BN.

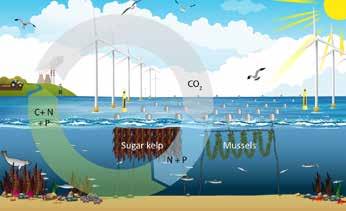

Offshore wind energy is set to become an essential component of Europe’s energy mix by 2050. As a costeffective solution for electrifying both industry and households, its full potential can only be realised via the establishment of an international collaboration framework. This could lower the overall system cost for Europe by more than €1000 billion between 2030 and 2050.

COLLABORATIVELY REALISING OFFSHORE WIND FARMS AND GRIDS UNLOCKS BENEFITS BEYOND MERE ENERGY SYSTEM COSTS

Offshore wind is a precious source of renewable energy. Whilst the investment costs for its development are higher than those associated with the development of onshore wind or solar power, it will contribute to keeping Europe’s energy transition affordable, as this study’s analyses reveal. Failing to develop offshore wind will be more expensive for Europe in the long run. The reason for this is linked to a range of benefits that a collaborative approach towards the development of offshore wind and grids can unlock as shown below.

What does the figure below show?

The figure below illustrates how multiple levers can act together to reduce the total cost of the future energy system for the period between 2030 and 2050. It sets out how an effective approach to offshore development will reduce the overall cost for the energy system.

Beginning on the left-hand side of the chart, the grey bar represents a scenario in which Europe fails to efficiently undertake offshore development.

The most impactful lever is the adoption of joint planning and funding (first step of the ladder), as this will allow Europe to increase its offshore capacity and will ensure that transmission capacity is constructed in an effective

manner across its sea basins. As a result of joint planning, wake losses will also be reduced (second step). Furthermore, efficiencies can be gained in the supply chain through bulk manufacturing and standardisation (third step). Note that these efficiencies will only be possible if shortages in manufacturing and imports are resolved. Enhanced financing that involves a strong de-risking of project portfolios will be another critical lever for cutting down on costs in the future (step four). Eventually, other indirect benefits will be unlocked such as the continent’s improved resilience against external shocks and a boost for local value creation.

What does this tell us?

The large-scale development of offshore wind in Europe is challenging. However, by adopting a forward-looking, holistic approach to the planning, financing and manufacturing of offshore wind assets, a range of benefits can be unlocked. Each of these benefits form a virtuous circle, reinforcing each other and contributing to indirect benefits such as Europe’s overall resilience to external shocks to its energy system. The bulk of investments and decisions still needs to be taken, which opens up a window of opportunity for optimally designing the governance structures that are needed to select the most impactful levers.

Countries are increasingly retreating into their own national shells, much like turtles. However, if we are aiming to achieve independence from fossil fuels and Russian gas, we must be prepared to rely more on like-minded countries. This necessitates greater collaboration at the European level. It is only through unity and cooperation that we can effectively transition to a more sustainable and affordable energy future.

Manon Van Beeck Chief Executive Officer, Tennet

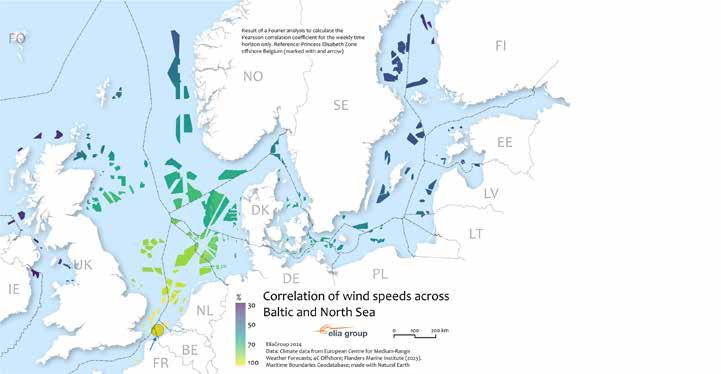

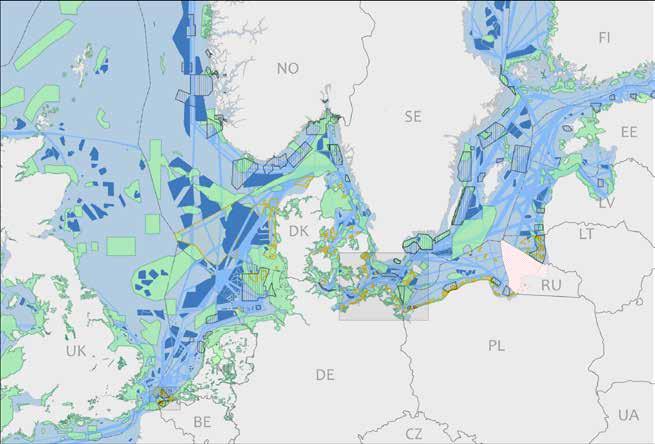

CORRELATION OF WIND SPEEDS ACROSS BALTIC AND NORTH SEAS USING THE BELGIAN PRINCESS ELISABETH ZONE (MARKED WITH A YELLOW CIRCLE) AS A REFERENCE POINT

THE LONG DISTANCE (INTER-) CONNECTION OF OFFSHORE WIND FARMS TO THE SHORE REDUCES VARIABILITY AND ELECTRICITY PRICES

Long-distance (hybrid) interconnectors level out local fluctuations in wind power generation. This reduces (but does not eliminate) the need for countries to invest in dispatchable capacity within their own borders, so reducing costs.

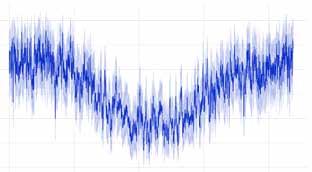

What does the figure on the left show?

The map shows how strongly the wind speeds in different regions of the Baltic Sea and the North Sea are correlated with each other – in other words, how often similar wind patterns occur across different regions. The map demonstrates that the further away two areas are from each other, the less likely they are to experience the same wind occurrences. By using the Belgian Princess Elisabeth Zone (PEZ) as an example, the further one moves away from it, so the amount of hours of simultaneous wind occurrences decreases (see darker colour shading). This pattern becomes particularly significant when two areas are located 500 kilometres or more from each other. Our analyses focus on assessing possible patterns across weekly time frames, since offshore wind is particularly variable and flexibility means are difficult to provide across such time frames.

This correlation effect can also be seen in the bar plot below. For the period 1979-2023, was shows the average number of days on which the offshore wind capacity is low in the German North Sea (70) and the German Baltic Sea (54), demonstrating that these two seas are windy for most of the year. Moreover, the plot shows that the average number of days on which the offshore wind capacity was low both in the German North Sea and the German Baltic Sea at the same time is even lower: 48.

What does this tell us?

Offshore wind infeed into the onshore grid from diverse and distant locations is more ‘valuable’ for the energy system. Both the variability of the resulting energy mix and flexibility needs are reduced. This makes the development of offshore wind across larger regions – and, indeed, across sea basins such as the Baltic and North seas or the Atlantic Ocean and Mediterranean Sea – so important for Europe’s power system.

HAD MULTIPLE HYBRID INTERCONNECTORS BEEN BUILT BY NOW, WE WOULD BE REAPING THEIR BENEFITS

Cross-border collaboration as part of the development of offshore wind is not solely a matter of planning for a distant future. In fact, such an approach is already making a huge difference in today’s system (as can be seen by the Kriegers Flak Combined Grid Solution, which was commissioned in 2020). The presence of additional longdistance interconnectors in today’s system could have generated further benefits, as illustrated by the example on the right.

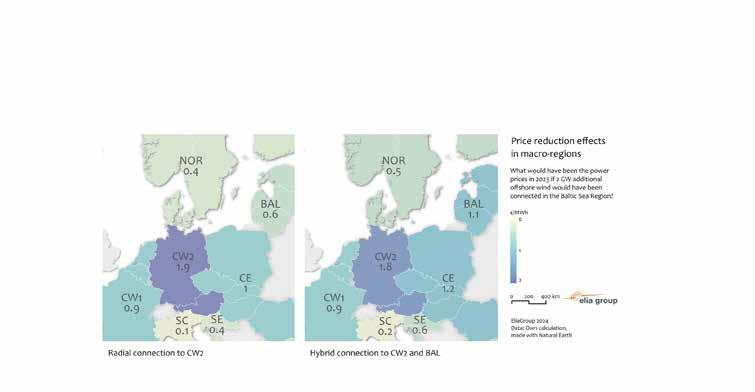

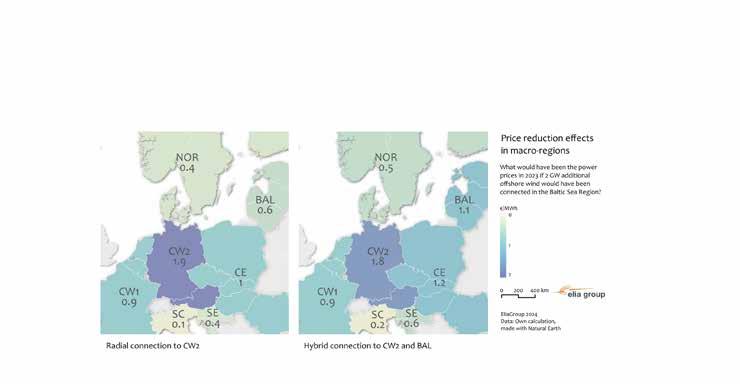

What does the figure on the right show?

The maps show what impact an additional offshore wind hub in the Baltic Sea would have had on today’s market. Historical day-ahead trades from 2023 were reproduced and our simulations checked how cross-border trades and power prices would have changed if a 2 GW offshore hub had existed in the system. Results were calculated for 2 set-ups: the first was radially connected to the central western area (CW2) which comprises Germany and Austria (see map on the left-hand side of the figure); the second was designed as a hybrid interconnector that linked the CW2 and Baltic areas together (the latter, BAL, comprises Estonia, Latvia and Lithuania; see map on the right-hand side of the figure). It is clear that just one additional single offshore (hybrid) interconnector would have had a noticeable impact on power prices in 2023.

What does this tell us?

An additional hybrid interconnector in 2023 would have made a huge difference on Europe’s energy system. This demonstrates how accelerating the development of offshore projects which carry the highest amount of European value should be prioritised. At the same time, the results highlight that distributional effects must not be overlooked, since price effects and power flows also impact market areas which are not directly linked to an offshore project – which underscores the need for cooperation to occur across whole sea basin areas at a time.

Thomas Egebo President and Chief Executive Officer, Energinet

If we do not find a way to share the benefits and costs between exporting and importing countries in a fair way, we will not be able to fully exploit the offshore potential in the North Sea and the Baltic Sea. It is not an easy task. TSOs cannot solve this alone. Member States must take their responsibility. But we as TSOs are eager to participate in developing and qualifying solutions.

ADOPTING A COORDINATED APPROACH TO SEA-BASIN-WIDE PLANNING IS REQUIRED FOR EUROPE TO TAP INTO THE MOST EFFICIENT OFFSHORE WIND LOCATIONS AND TO HARNESS ALMOST

500 GW OF OFFSHORE WIND ENERGY BY 2050.

By promoting a joint regional planning approach between countries with limited and abundant amounts of offshore wind potential and keen third countries, the most efficient projects that will benefit Europe as a whole will be unlocked. This approach will ensure that such projects are developed and that the full amount of offshore wind potential can be harnessed. Moreover, long-term planning across borders will help to mitigate wake losses and reduce the environmental impact of offshore projects on protected areas.

COORDINATED PLANNING SHAPES THE JOINT FUNDING OF

PROJECTS AND UNITES COUNTRIES AROUND A SEA BASIN THAT CARRY HIGH LEVELS OF OFFSHORE POTENTIAL WITH THOSE THAT LACK IT

Current planning methods remain overly state-based in their approach. They overlook the collective benefits of hybrid interconnectors and the crossborder radial connection of wind farms and the need for several parties to fund projects together. To meet Europe’s net-zero targets and optimise socioeconomic welfare, around 200 GW of offshore wind (or 40% of Europe’s total offshore wind capacity in 2050) need to be developed within ‘offshore energy exporting countries’ that have more offshore wind energy potential than they need to meet their domestic demand. A lack of collaboration may stall the realisation of offshore projects after 2030, due to a lack of appetite to support the costs of these projects in countries that have too much RES potential than they need.

What does the figure below show?

The bar plot below includes three different levels of offshore wind capacity that Europe could reach by 2050, depending on the level of collaboration between Countries. The figure shows the emergence of two main groups of countries: ‘offshore energy exporting countries’ and countries whose levels of domestic offshore energy generation fall short of meeting their needs

As can be seen from the bar plot, in a scenario in which a national approach to offshore wind development is adopted, 136 GW of Europe’s capacity is developed by exporting countries. The amount they develop then increases by 70 GW in a scenario in which collaboration involving hybrid interconnectors occurs.

ACROSS THE SCENARIOS FOR 2050

What does this tell us?

The infographics reveal a fundamental fact: how challenging – and beneficial – offshore wind development will be for the whole of Europe. It requires both types of countries to collaborate as part of the planning, development, financing and funding of different projects, and requires the costs and benefits of such projects to be shared in a fair manner to ensure that offshore wind is developed in the most efficient way possible. Encouraging countries to concentrate on only maximising their own domestic potential will not be sufficient.

SIMULATION RESULTS FOR OFFSHORE BUILDOUT IN EXPORTING AND IMPORTING COUNTRIES

CROSS-BORDER OFFSHORE DEVELOPMENT PROJECTS MUST BE CAREFULLY SPACED OUT TO MAINTAIN THE PRODUCTION EFFICIENCY OF WIND FARMS

The current planning approach is suitable for delivering the first 30+ GW of offshore wind today and another 100 GW across Europe by 2030. However, in the long run, the size and number of offshore wind farms are going to increase. This will require actors to pay closer attention to ensuring that the efficiency of wind farm production is maintained so that Europe’s expectations regarding its offshore wind capacity will indeed be met.

What does the figure below show?

Offshore wind plays an essential role for decarbonizing Europe´s electricity supply. With the current offshore wind planning in the North Sea, we are at risk to experience lower RES infeed compared to expectations today. A stronger cross border collaboration and focusing on cost-optimised electricity yield targets without reducing the ambitious expansion path will help to mitigate wake effects and unlock the capacities in the most efficient way.

Kerstin Andrae

Chairwoman of

the Executive Board, German Association of Energy and Water Industries, BDEW

Focusing on wind farms located in the EEZs of Denmark, Germany and the Netherlands, the maps depict three possible outcomes in terms of their production levels in 2050. The map on the left-hand side of the figure depicts the base case: a situation in which wind farm capacities for 2050 are assumed in line with the locations and densities that are included in current Member State spatial plans, and in which wake loss effects are high, triggering high reductions in the number of full-load hours (represented by the shades of dark purple). As one moves from the map on the left-hand side of the figure to the map on the right-hand side, the wind farms are gradually and more evenly spread out4 and the associated wake loss effects are reduced, so increasing the number of full-load hours (represented by the paler shades of purple). The map on the right depicts a situation in which

cross-border collaboration is used to position the wind farms in the North Sea: they are more spread out, with some wind farm locations being shifted across borders to mitigate wake losses.

What does this tell us?

Our analyses show that for the German Bay of the North Sea, adopting a cross-border approach to wake loss mitigation could lead to a significant decrease in wake losses (translating into about 8-9 GW of recovered capacity) compared with a business-as-usual approach. For comparison purposes, this is equal to the total amount of Belgium’s future domestic offshore generation and could amount to CAPEX savings of more than €20 billion.

MITIGATION OF FULL LOAD HOUR REDUCTIONS DUE TO WAKE EFFECTS IN THE GERMAN BAY OF THE NORTH SEA FOR THREE SIMULATED 2050 SCENARIOS

COORDINATED PLANNING FACILITATES THE EFFICIENT AND SUSTAINABLE POSITIONING OF OFFSHORE ASSETS

The bulk of wind farm development in Europe has yet to occur for it to reach its offshore targets. Transmission corridors and cross-border cables will need to be carefully located across Europe’s seas, and relevant actors will need to ensure they take into consideration other maritime activities, such as shipping, fishing, natural conservation, the extraction of raw materials and national defence.

What does the figure below show?

The figure compares two 2050 scenarios that were developed with a geographic information system (GIS). The map on the left-hand side of the figure depicts a scenario in which a business-as-usual approach was taken to the laying of transmission cables from offshore wind farms to the shore: here, the GIS was programmed to minimise the costs involved, favour the use of transmission corridors and avoid cables crossing through areas being used for other activities (with high penalty costs if crossings occurred). The map on the right-hand side of the figure depicts a scenario in which a nature-first approach was taken: here, the GIS was programmed to minimise the costs involved, favour the use of transmission corridors, and avoid nature conservation

areas (with penalty costs for this being twice as high as before). Under this scenario, the number of cables crossing nature conservation areas is significantly reduced. What does this tell us?

Our analysis reveals that taking sustainability targets into consideration early on in the planning process can minimise the number and length of cables that cross through protected areas. This can be achieved without significantly increasing the total number of needed assets (in our simulation only a 2% increase in total corridor length across entire sea basins); it just requires the adoption of a crossborder and collaborative spatial planning perspective.

MINIMISING THE SPATIAL FOOTPRINT OF CABLE CORRIDORS IN PROTECTED AREAS IS POSSIBLE THROUGH THE ADOPTION OF LONG-TERM AND CROSS-BORDER PLANNING APPROACHES

Nadine

Bethge Deputy Head of Energy & Climate, Deutsche Umwelthilfe

Wake effects are often mentioned as a coordination challenge for investors in offshore wind. This report nicely illustrates that they can also be a reason for governments to collaborate across borders.

Prof Leonardo Meeus

Director of the Florence School of Regulation at European University Institute

Allocating the ambitious goal of 70 GW in the German seas is challenging in two ways: more densely planned wind turbines lead to higher wake effects, making the areas unattractive for investors. At the same time, marine protection is impaired, as the German target is not achievable without encroaching on protected areas. Hence, both the allocation of wind farms and implementation of protected areas must be a matter of costal states’ coordination.

The North Sea stands as the most advanced offshore wind region globally. Achieving a meshed grid will require coordinated planning. Close collaboration amongst system operators across the North Sea will be essential for moving forward. Ben Wilson President, National Grid Ventures

FUNDING AND PLANNING GO HAND IN HAND. A

JOINT FRAMEWORK TO FUND FUTURE OFFSHORE

DEVELOPMENT WILL BE CRUCIAL FOR EFFECTIVELY

STREAMLINING LIMITED FINANCIAL RESOURCES AND WILL BE A CRITICAL ENABLER FOR UNLOCKING THE BENEFITS OF SEA-BASIN-WIDE PLANNING.

To ensure that the right amount of investment is secured for the construction of future offshore wind and transmission grid assets, the effective streamlining of financing sources is needed alongside the adoption of de-risking measures. The establishment of an organisation such as the Offshore Investment Bank (OIB) will play a vital role in ensuring the investment demand is met whilst also facilitating the effective sharing of costs and benefits across borders.

ADOPTING A SEA-BASIN-WIDE APPROACH TO OFFSHORE COOPERATION TO REACH AN OPTIMAL GRID BUILDOUT

Coordinated planning and funding the future offshore grid are mutually dependent. Establishing a joint framework to fund the development of the offshore grid will be crucial for effectively streamlining limited financial resources and facilitating the planning of the grid. The opposite is also true: without a joint funding framework, joint planning will not be possible. This joint planning will be key for sharing out the costs and benefits of different projects in a fair manner. The current cross-border cost allocation (CBCA) tool involves interconnector project costs being assessed on an individual, project-by-project basis - and only involves the 2 directly affected countries (ie. the 2 countries which host the interconnector). It therefore does not adopt a regional/sea basin scope for joint planning, project identification, or cost and benefit sharing, meaning it is unfit for the development of a hybrid meshed offshore grid. The cost and benefit allocation method therefore needs to be changed into a framework that involves multiple countries and projects across one sea basin at a time as well as a close link to the planning procedure. This proposed approach involves five key steps, as outlined in the figure below.

What does the figure on the right show?

The figure outlines the five steps that the proposed sea basin approach to offshore cooperation should involve: projects which are developed across the same sea basin should be identified, validated and approached together; TSOs should support the planning and governance of projects with their expertise; projects should be validated on a multi-country level; the approach should involve the establishment of an organisation such as the Offshore Investment Bank (OIB), which will aggregate different sources of project financing and ensure that project costs and benefits are distributed across different parties. This cooperation framework will be essential for ensuring that the full benefits of offshore wind power can be unlocked and financial risks associated with each project are reduced. Currently, too many projects are stalled amidst lengthy negotiations due to the current framework which is unfit for purpose.

To ensure that the right amount of investment is secured for the construction of future offshore wind and transmission grid assets, the effective streamlining of financing sources is needed alongside the adoption of de-risking measures. The establishment of an organisation such as the Offshore Investment Bank (OIB) will play a vital role in ensuring the investment demand is met whilst also facilitating the effective sharing of costs and benefits across borders.

This framework will allow parties with expertise (TSOs or merchant parties) to develop and realise projects, whilst taking into account regulatory regimes in different countries.

5.Project development 1. Sea basin scope

To ensure efficient and harmonious development across a sea basin, the involvement of all countries surrounding the sea basin should be considered (including non-EU countries such as the UK and Norway). Decisions should be agreed upon by all involved sea basin countries.

4. Offshore Investment Bank

The proposed Offshore Investment Bank will act as an intermediary which will manage funding from public entities, private investors, TSOs and wind developers across different sea basins. The OIB will also oversee the sharing out of project costs and benefits amongst all involved parties.

3. Political support from multiple countries for visibility and trust

Projects decided on during the joint planning process will enjoy public/political support from multiple countries and actors from across the EU. This will increase transparency and trust both within those countries which are involved and beyond. Such insights will also be vital for ensuring the early involvement of all impacted parties in the design, development and supply chain of offshore projects. Private partners should also be involved in the execution of projects which are jointly planned. Cooperation with these private entities would need to be organised through a non-discriminatory access approach for private competitors.

2. Joint coordinated planning supported by TSO expertise

As regulated entities, TSOs should take the lead in planning based on identified system needs (as identified in the ONDP or joint assessment studies). The outcome will be a collaborative approach to identifying concrete projects which carry benefits for the whole of Europe. This collaborative approach should involve three steps: (i) the optimal identification of system needs at an EU level; (ii) the optimal identification and scoping of concrete projects on a regional (sea-basin) level; (iii) joint decisionmaking at regional level.

ADDRESSING THE INTERDEPENDENCE OF PLANNING AND FUNDING: ALIGNING THE INTERESTS OF ALL INVOLVED PARTIES

Given that offshore wind development in Europe is still in its early stages, the total cost of investment in transmission infrastructure (at least 50,000 km of corridors) and offshore wind farms (up to 500 GW) is expected to reach around €1,700 billion by 2050. This study proposes a sea basin approach to the planning and funding of offshore projects in order to tackle this challenge. This will involve project benefits and costs being distributed in an effective manner amongst different parties and will reduce their associated risks.

The future financing and funding framework should be as simple as possible, highly replicable, and have a minimal impact on grid tariffs. It should ensure that projects are highly bankable and generate sufficient returns for investors. The framework should streamline the governance structure that covers the ownership and operational control of assets, and it should be compatible with different national TSO regulatory frameworks.

Felipe Montero Chief Executive Officer, Iberdrola Germany

The sharing of costs and benefits should be carried and felt by countries located beyond project hosting countries, such as across sea basins or coalitions of willing countries. If this is not the case, Europe will not be able to tap into the full potential of its seas (as key message 2 highlights). Moreover, the process should move from projects being assessed on an individual basis to projects being assessed on a collective basis.

Additionally, it should involve the allocation of a wide range of benefits to project stakeholders, moving beyond only assessing socioeconomic welfare to include the project integration of RES, contribution to adequacy, and positive effects on market liquidity. This process should be clear from the start, while still allowing for some flexibility as discussions and projects progress.

The adoption of a risk reduction strategy could reduce the financing costs of future offshore projects by €250 billion, with the OIB lying at the heart of unlocking these benefits.

A joint funding and and joint planning framework leads to increased trust by financial institutions, lower the cost of debt, which should lead to an additional reduction in cost of capital of around €35 billion. The OIB will act as a crucial entity that unites public and private funding to support renewable energy initiatives across different sea basins. It will provide private investors with the confidence that their funds will be directed towards government-backed projects within a stable regulatory framework. What does the figure below tell us?

We need funding from different sources to be aggregated. The Offshore Investment Bank is one proposal for how the pooling of these funds could be streamlined.

Offshore Wind development in Europe is at a turning point. While we have clear targets and high ambitions, for the objectives to be met, we need to ensure reliable business cases along the entire value chain, a stable regulatory environment and political commitment. At the same time, costs and benefits need to stay in balance. Offshore hybrids could play a very significant role in strengthening the industry and cooperation between European countries.

Dickson Chief Executive Officer, Wind Europe

Well done to Elia Group and Ørsted for proposing this Offshore Investment Bank. It’s a great way of reducing the financing costs of building out offshore wind and the grid connections to connect those offshore wind farms to the grid. Take a small amount of public investment, leverage large amounts of private investment, spread the risk, reduce the financing costs, make the buildout of offshore wind and grids even more affordable.

Dr Andreas Löschel Professor of Environmental/ Resource Economics and Sustainability at Ruhr-Universität Bochum

Transforming the energy system will require massive investments that can only be realised by stimulating private capital to invest in both generation and networks. It is therefore of paramount importance to provide a suitable regulatory framework.

Chief Executive Officer, RWE Offshore Wind GmbH

The system advantages of offshore hybrids are undisputed, but these projects will only go ahead if all states see a clear benefit and investors have a viable business case. The difficulties of ‘slicing up the cake’ should be solved via intensified cooperation. Offshore Investment Banks will establish a necessary joint approach for the sharing of costs and benefits and the collaborative funding and de-risking of investments, which could make it a key enabler for the long-term buildout of offshore wind.

De-risking projects is vital, as it makes them more affordable for everyone involved.

To facilitate this, we need clear boundary conditions and a defined timeline outlining what needs to be accomplished and by when. This clarity allows for project execution that can be consistently repeated, leading to the operational excellence required.

Ørsted

Unlocking hybrid projects offers a unique opportunity to give European industry rapid access to cheap renewable energy. To deliver this on a climate relevant timeline, we need to take the first step in implementing the necessary crossborder frameworks to deliver the necessary planning and financing – we believe that is establishing an offshore investment bank per seabasin.

Sven Utermöhlen

Giels

THE OFFSHORE WIND SECTOR IS SET TO GROW SIGNIFICANTLY, MEANING THE SUPPLY CHAIN NEEDS TO BE SCALED UP AND REQUIRING EUROPE TO SECURE ITS RAW MATERIAL IMPORTS. AT THE SAME TIME, THIS WILL OFFER UP SUBSTANTIAL GROWTH OPPORTUNITIES ALONG WITH THE CREATION OF 300,000 JOBS ACROSS EUROPE.

In addition to the direct benefits of offshore wind development outlined in this study, Europe will also be given to the opportunity to preserve a key industrial sector on its shores. By capitalising on the growth potential of offshore wind development, Europe can secure its energy future while boosting its economy and workforce, including in countries that are about to scale up their offshore activities.

GIVEN THAT OFFSHORE WIND SUPPLY CHAINS WILL CONTINUE TO BE INTERNATIONALLY AND GLOBALLY INTERLINKED, EUROPE WOULD BENEFIT FROM MAINTAINING ITS STATUS AS A STRONG SUPPLIER OF OFFSHORE WIND ASSETS

To date, almost no offshore wind farm has been developed, built, and operated by companies from one single country alone: until now, European and global players together have driven the development of offshore wind, and this is likely to continue in future. The European Commission’s Wind Power Package is already producing its first effects, with recent investment decisions being taken or announced across the continent.

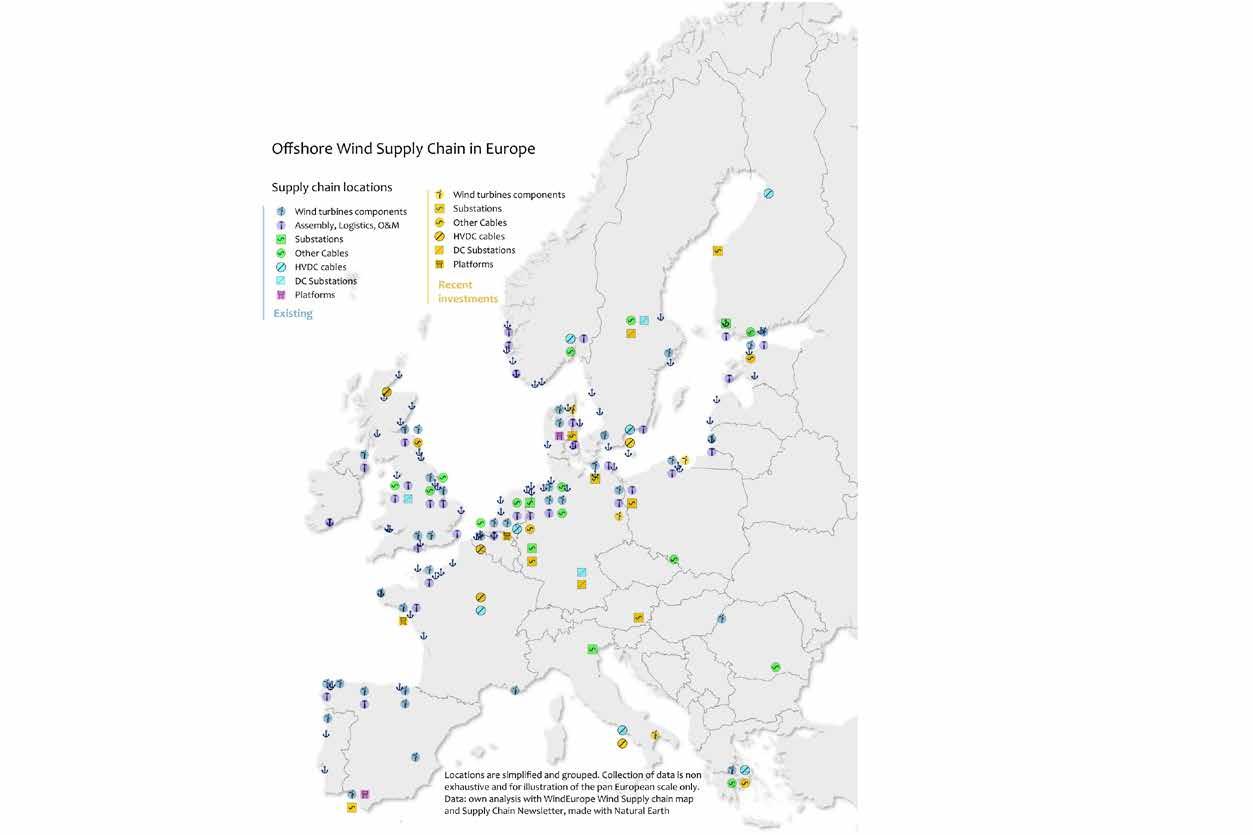

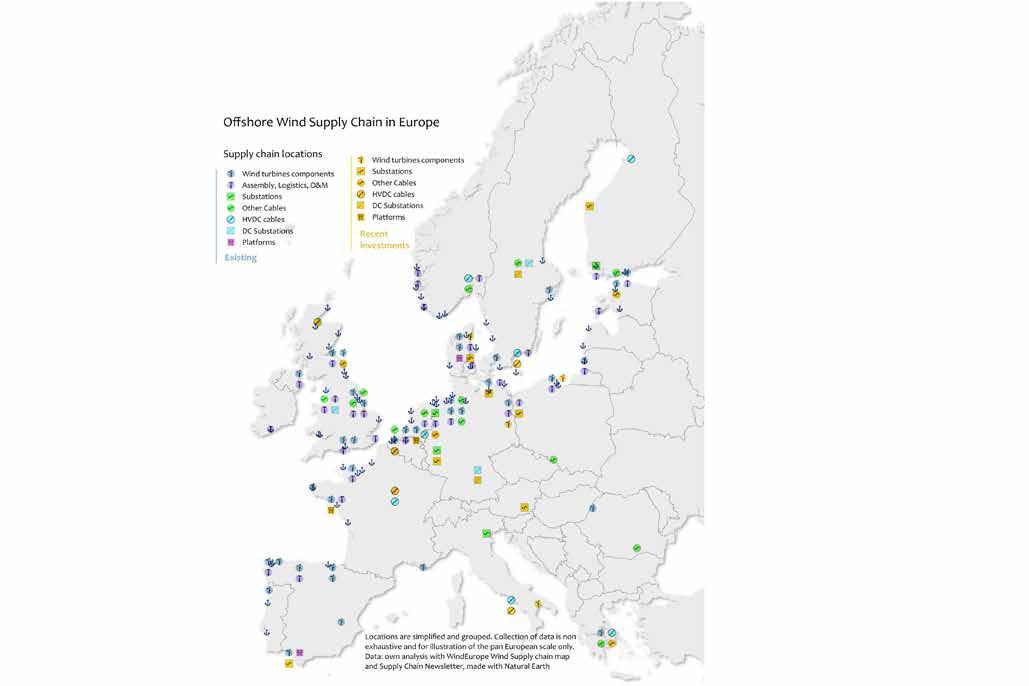

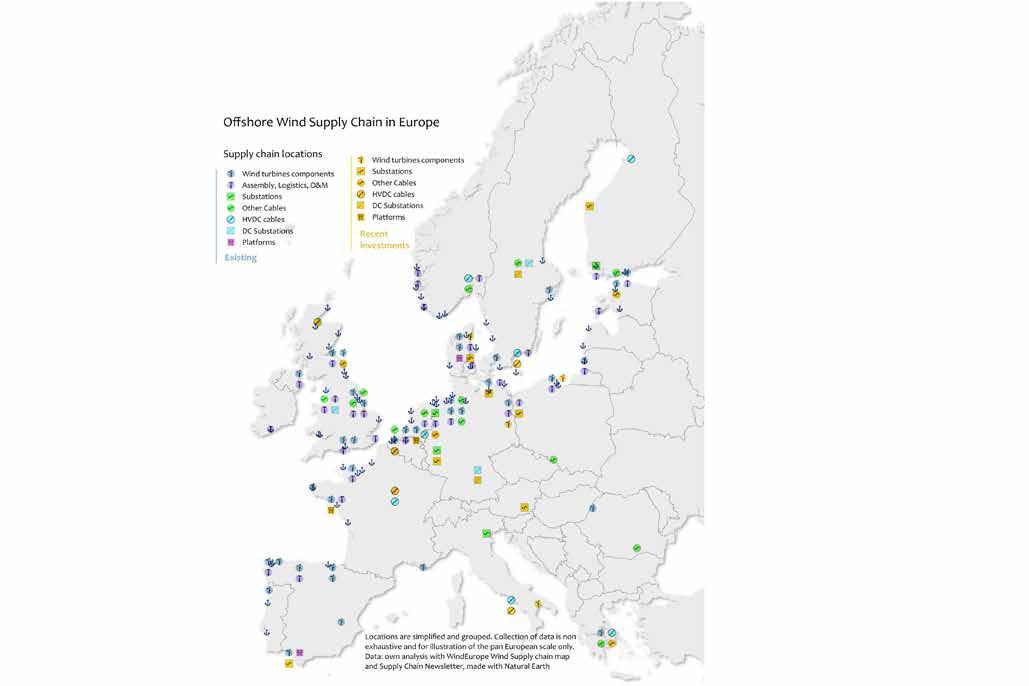

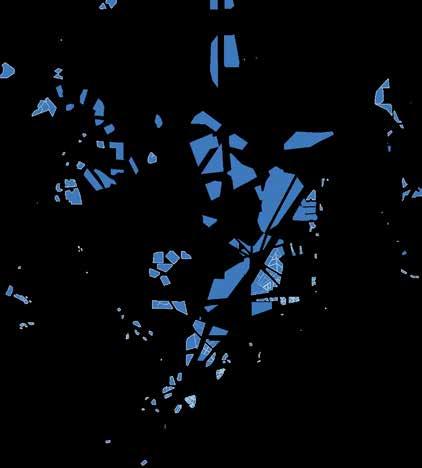

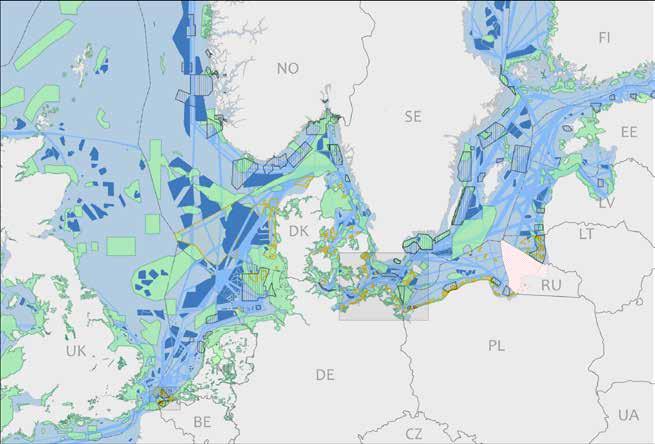

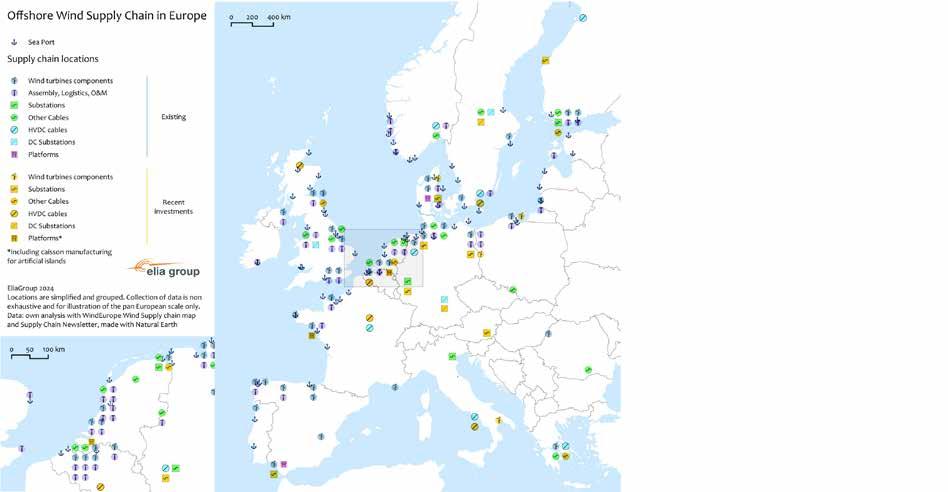

What does the figure on the right show?

The map depicts the sites belonging to different parts of Europe’s offshore wind development supply chains. In addition to manufacturing sites for wind turbine components (such as towers, blades and nacelles) and service hubs for the assembly of parts, logistics, and operation and maintenance activities, the map also includes information about (offshore) transmission grid asset manufacturers and shipyards where offshore platforms are constructed. Notice that there is no single European ‘champion’ of offshore wind development that produces everything; instead, many specialised and complementary hubs exist that develop different elements of the value chain. This pattern is being maintained, as evidenced by recent decisions that have been taken about investments in new facilities (including HVDC cables and converters), as represented by the yellow icons. What does this tell us?

The map demonstrates how the development of offshore wind is becoming an increasingly pan-European quest that involves activities that extend beyond the southern coasts of the Baltic Sea and North Sea (where the bulk of offshore development has occurred thus far). Both traditional leaders in offshore wind development (such as Belgium, Denmark, Germany, the Netherlands, and the UK) and an increasing amount of non-traditional players (such as countries located around the Baltic Sea region, Scotland and the Mediterranean Sea) are driving this.

TO

MEET EUROPE’S OFFSHORE TARGETS, MANUFACTURING CAPACITY

MUST BE SCALED UP; EUROPE’S LEADERS MUST THEREFORE ESTABLISH FRAMEWORKS THAT MAKE POLITICAL TARGETS RELIABLE VIA JOINT APPROACHES TO PLANNING AND FUNDING

Europe has been accelerating the pace at which it carries out offshore wind development in recent years, just as the demand for offshore wind installations has risen across the globe. Europe will need to increase its pace even further in order to meet its political pledges amidst a background of increasing competition and emerging offshore markets outside the Union.

What does the table below show?

The table compares current manufacturing capacities for three types of assets in Europe with the projected annual levels of demand between 2030 and 2050. The numbers show that the production capacities5 for all three asset types must be significantly increased to satisfy all of Europe’s needs via domestic suppliers only. While some of the demand may well be met by non-European suppliers, not all international manufacturers will be able to fulfil the technical and operational requirements that they need in order to qualify as suppliers in Europe. This means that European manufacturing capacities for central grid assets like converters and HVDC cables must therefore be scaled up. For this to occur, political declarations alone will not suffice; concrete enablers such as long-term planning and funding frameworks will be needed. This will establish the necessary trust for the supply chain to to scale up.

What does this tell us?

To date, the market for onshore and offshore wind energy development has largely been a European one Europe has demonstrated strong technological leadership through its manufacturing of assets and has played a leading role with regard to innovative ways of connecting countries and offshore wind farms together. Meeting the future demand for assets and services has the potential to generate the creation of 300,000 jobs across the value chain. Some of these jobs will be created in countries that are only just about to embark on their offshore development journeys.

Philippe Piron, Chief Executive Officer, GE Vernova Electrification Systems

The key question is not whether we are capable today, but rather whether we have the right visibility and commitment from our customers to justify our investments and determine the necessary dimensions for successful delivery. If we can achieve this visibility and commitment and prepare in advance, then yes, we are definitely capable!

Andreas Schierenbeck, Chief Executive Officer, Hitachi Energy

The need to integrate up to 500 GW of offshore wind in Europe by 2050 is driving a significant increase in demand for clean energy technologies. A businessas-usual approach will not be enough to deliver on our decarbonisation vision. Integrated planning, the deployment of technologies at speed and scale, innovative business models and collaboration are some of the essential enablers that can help us to accelerate the energy transition and achieve the ambitious targets we have set across the world.

THE DEMAND FOR RAW MATERIALS WILL BE HIGH, BUT NOT UNPRECEDENTED

The future demand for raw materials will be mainly driven by the rise in the development of offshore wind farms and associated grid infrastructure and factors which can only be roughly estimated today, such as future developments in the efficiency of materials; the operational lifetimes of the manufactured assets; and the circularity of materials (i.e. recycling quotas).

What do the figures below show?

The figure on the left-hand side summarises the total demand (in kilotonnes) for different (main) material types that will be needed for offshore wind development in 2050. The pie charts on the right-hand side of the figure illustrate that wind farms will be the main driver of the demand for materials (both in relative and absolute terms) in the future, especially in terms of steel, fibreglass, polymers and zinc.

The table on the right shows that the demand for certain materials will experience an eightfold increase, even with modest reductions in material intensity being assumed for the future. Note that the mere volume of future demand is not decisive on its own; indeed, the criticality of different materials (whether in terms of import dependencies, such as for rare earth metals or nickel), or in terms of competition for the use of the material (such as for copper or aluminium) is also important when considering the level of demand for different materials in future.

What does this tell us?

Accessing the right materials for the development of offshore wind will remain a key challenge that will need to be overcome. Our analysis also reveals a range of levers that can be used to reduce the size of the challenge ahead, including an increase in the material recycling rate, which would reduce the need for primary steel and copper, for instance. Furthermore, additional innovations in the substitution of materials will alleviate the demand for even the most critical materials such as rare earth metals. A comparison with historic demands for steel for gas and oil infrastructure in the Baltic Sea and the North Sea demonstrates that whilst the future demand for materials may seem enormous, such levels of demand are not unprecedented. For example, gas and oil infrastructure in the Baltic and North Sea are made out of about 60,000 kt and were built over a period of 30 years.

MATERIAL TONNAGE NEEDS AND MAIN ASSET TYPES THAT DRIVE IT

WE URGE THE EUROPEAN COMMISSION AND NATIONAL GOVERNMENTS TO…

continue to commit to the path set out in the European Green Deal by fostering European competitiveness, the decarbonisation of industry & end-use sectors and investing in clean energy infrastructure.

prioritise projects that carry the highest levels of European value by establishing a joint planning and a funding framework that aligns the interests of all involved parties. It is only this framework which will contribute to a more cost-efficient and affordable energy transition for consumers.

3

collaborate on spatial planning and the development of cross-border projects at regional level when planning the future offshore grid, and take into consideration spatial constraints and the efficiency of wind power production.

mobilise and streamline the necessary capital for wind farms, transmission systems and manufacturing capabilities by maximising public investment, leveraging and de-risking private capital, and implementing risk-absorbing measures to make it easier for commercial banks, investors, and venture capital firms to finance projects and companies. 5

capitalise on Europe’s technology leadership in the offshore wind sector and grid sector by stimulating a collective approach to industrial policy across Europe in order to step up critical manufacturing capabilities and secure the supply of raw materials. Research and innovation funding must be increased to improve efficiencies in the substitution of critical materials. Initiatives which ensure that Europe has a big enough workforce that has the right skills must be introduced.

“The rapid deployment of offshore wind projects and their grid connections, reinforcing electricity grids [...] connecting consumers and producers across Europe are probably the most important steps Europe has to take to succeed in its decarbonization path. They require a new alliance among the Member States involved in the projects and a strong EU-level support.”

The Letta report, published on 10 April 2024, highlights the importance of a single market in Europe and spells out proposals to transform the capital markets union into a savings and investments union. It urges Member States to facilitate this move as they are essential for financing the EU’s future needs associated with the green and digital transitions.

Extract from Much More than a Market’, Enrico Letta (2024)

OFFSHORE WIND IS A KEY INGREDIENT FOR EUROPE’S TRANSITION TO NET ZERO

Europe’s seas are set to become the green power plants of the future. The European Green Deal outlined the EU’s commitment to reaching climate neutrality by 2050. Following the signing of non-binding agreements at Marienborg in 2022 (relating to the Baltic Sea) and at the North Sea Summits in Esbjerg (2022) and Ostend (2023), offshore wind is set to make a significant contribution towards reaching this goal.

By combining the ambitions of the EU with those of Norway and the United Kingdom, almost 500 GW of offshore wind is due to be established across the European continent by 2050 Moreover, Elia Group’s 2021 study, ‘Roadmap to net zero’3 demonstrated that offshore wind will make a vital contribution to levelling out the intermittency of the onshore renewable components of the energy mix, such as wind and solar power. Both onshore and offshore wind turbines have a higher output in winter, whilst solar panels reach moments of peak generation in summer.

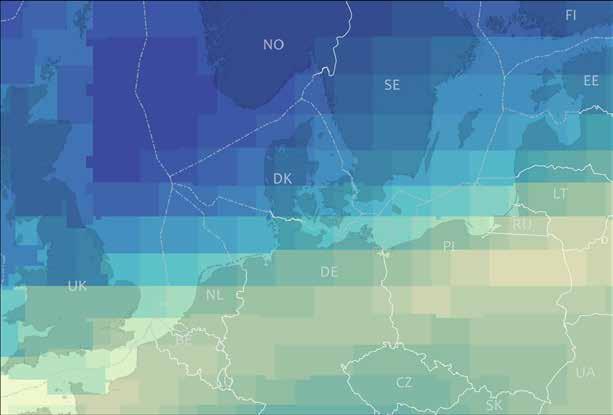

Furthermore, offshore wind farms typically have higher capacity factors due to more stable and stronger wind speeds out at sea compared with the wind speeds across land (please see the map on the next page).

The Baltic Sea and the North Sea are of particular relevance for Europe’s offshore ambitions. In addition to their overall wind potential (average wind speeds range from 9 to 14 metres per second at heights of 100 metres across these seas), their proximity to areas which carry the highest electricity demand in Europe (such as England, Belgium, the Netherlands and Germany) makes them crucial for the continent’s adoption of a more sustainable energy supply.

In fact, it is the complementarity of offshore wind sources in these two sea basins that make them a powerful combination, as demonstrated by this study’s results.

Moreover, both seas are characterised by extensive shallow waters, which lower the technical challenges and costs associated with the installation of wind turbines and other necessary infrastructure4 These favourable conditions offer up a significant opportunity for the large-scale production of offshore wind energy in the Baltic and North seas.

Dr Simon Schäfer-Stradowsky Executive Member of the Board of IKEM

Current crises have once again underscored the critical link between energy and security, particularly in the Baltic Sea region. Our research at IKEM demonstrates that addressing threats to energy supply will require a deeper commitment to transnational cooperation and significant investments in the necessary infrastructure. By advancing projects like cross-border links for offshore wind development, Elia Group is making a vital contribution to creating a unified energy region in and around the Baltic Sea

INTRODUCTION TO DEEP DIVE

1. Ursula von der Leyen renewed the Commission’s commitment to the Green Deal in ‘Political Guidelines for the next European Commission 2024-2029’: https://commission.europa.eu/document/e6cd4328-673c-4e7a-8683-f63ffb2cf648_en (last accessed on 18/09/24)

2. ENTSOE (2024). ‘Offshore Network Development Plan’, https://www.entsoe.eu/outlooks/offshore-hub/tyndp-ondp/ (last accessed on 02/09/24)

3. Eia Group (2021). ‘Roadmap to Net-Zero’, https://issuu.com/eliagroup/docs/20211203_roadmap-to-net-zero_en_1_?fr=sYzJlZTUyNzcyMTg (last accessed on 02/09/24)

4. The Baltic Sea and the North Sea comprise extensive areas with depths of less than 40 metres (please refer to a map in the annex for illustration). These depths are lower than those of other seas, such as the Mediterranean Sea (which has an average depth of 1,500 m). However, the seabed conditions in the North and Baltic seas can be challenging, since they often comprise mud, currents, and hard bottom complexes.

AVERAGE OFFSHORE WIND SPEEDS IN NORTHERN EUROPE OVER THE COURSE OF 40 HISTORICAL CLIMATE YEARS

TO OVERCOME THE CHALLENGES, WE MUST ACT NOW

Europe has always been a global leader in offshore wind. The first offshore wind farm was installed off the coast of Denmark in 1991, marking the beginning of decades of technology leadership and economic growth. To capitalise on Europe’s know-how and meet its ambitious targets, swift and decisive action needs to be taken. This is why Elia Group has chosen to publish this offshore viewpoint now. This study aims to contribute to discussions and decisions that are being taken about offshore wind development by providing policymakers with a thorough analysis of the main challenges ahead and demonstrating how they are interlinked. Notwithstanding the potential of offshore wind power and the historical success of Europe’s wind industry, Europe is facing a number of challenges. With lead times for new offshore wind farms and their corresponding grid connections of up to 10 years, these challenges will need to be addressed now to take effect in good time.

1 Firstly, Europe’s ambitious targets have to be turned into a Europe-wide plan, which in turn should be translated into real projects. This needs to happen at an accelerated pace, which will create an unprecedented need for financing and funding within a short time frame.

While designated and investigated areas for offshore development are suitable for the installation of the planned offshore capacities, the necessary growth in this area is not yet supported by the right financing and funding instruments. The challenge right now is to attract sufficient public and private capital and to direct it towards the projects that will deliver the highest value for Europe. This starts with deeper coordination between national and cross-border planning processes as both need to go hand in hand for the offshore grid of the future to be realised5

At the same time, reliable supply chains are necessary for realising these projects. These challenges have intensified in recent years due to high levels of inflation, geopolitical tensions, the advance of climate change, an insecure supply chain and constrained access to raw materials. To build a strong EU wind industry that can more than double its pace of wind energy deployment, we need a reliable and sustainable supply chain, a clear and secure pipeline of projects, access to funding, and fair global competition.

2 Secondly, offshore energy potential is not evenly distributed across the continent. Some countries have an offshore renewable energy potential that exceeds their domestic demand (e.g. the Nordic or the Baltic countries), while others do not have enough offshore renewable energy to meet their levels of demand (e.g. Belgium and Germany).

This means that the national expansion of RES alone will not be sufficient for meeting the EU’s direct electricity demand in 2050. To harness the full potential of offshore wind, collaboration between countries across whole sea basin areas must be enhanced. An increasing number of ambitious cross-border offshore projects have already been announced. Estonia and Latvia have set up a joint venture called ELWIND and Denmark has entered into political agreements to connect its planned energy islands to neighbouring countries in the North and Baltic Seas.

Moreover, Elia Group has been contributing to this trend: it commissioned the world’s first subsea hybrid interconnector (the Kriegers Flak - Combined Grid Solution), with its Danish counterpart in 2020, and is working on projects such as the Princess Elisabeth Island, Nautilus and Bornholm Energy Island

3

Thirdly, finding suitable locations for wind farms and establishing their connections to shore, whether through radial or hybrid transmission systems, is a complex process. Maximising the wind potential of Europe’s seas and leveraging the benefits of offshore wind will require Member States to work closely together when it comes to project development and maritime spatial planning.

This is particularly true in the case of strongly used sea basins such as the Baltic and North seas. Future infrastructure will need to co-exist with other activities hosted in these maritime spaces, such as conservation projects, shipping and defence.

Moreover, without a coordinated planning approach being adopted, Europe is at risk of having access to much lower levels of wind infeed than expected from its installed capacity. Wake losses, a phenomenon inherent to wind turbines, cause reduced wind speeds downstream of them. These reduced wind speeds lead to lower levels of energy production and trigger significant production losses in dense wind farm areas.

5. A sentiment that is also echoed by Mario Draghi (2024). ‘The future of European competitiveness’, https://commission.europa.eu/topics/strengthening-european-competitiveness/eu-competitiveness-looking-ahead_en (last accessed on 20/09/24)

6. ELWIND (https://elwindoffshore.eu/)

7. Elia Group (2023). ‘Transforming our seas into Europe’s sustainable economic engine’. https://issuu.com/eliagroup/docs/20220912_offshore-study?fr=sZThlMjY3OTU2NDE

INVESTIGATING THE VIRTUOUS CIRCLE OF BENEFITS

This study outlines how addressing one challenge can unlock effects that positively affect addressing another, meaning that positive actions in one area will reinforce each other. Moreover, this study takes a wider view of the benefits of offshore wind development by looking beyond system costs and socioeconomic welfare and outlining advantages that are important from a societal perspective. Adopting a coordinated planning approach for offshore wind projects, for instance, will facilitate decisions about how to finance and fund future offshore infrastructure and vice versa. As demonstrated throughout this study, this will also reduce the cost of financing offshore projects.

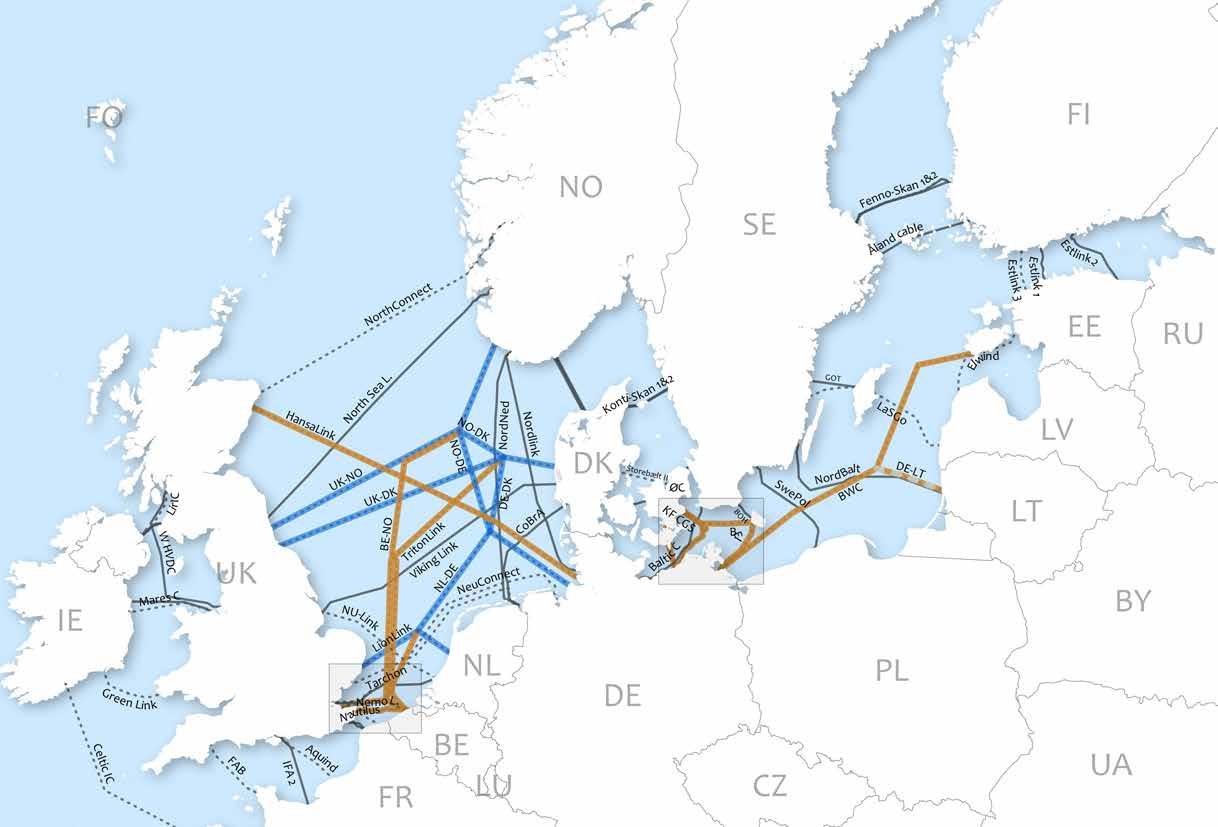

This study demonstrates how cross-border collaboration is essential for maximising Europe’s wind potential and enhancing overall efficiencies, which in turn will bring down total system costs for Europe and increase the efficiency of wind power generation. A clear pipeline of financed projects will incentivise manufacturers to follow and create robust and secure supply chains, which will contribute to increased levels of local value creation across the continent (please see for illustration the existing and future planned interconnectors in Europe in the map on the left side). Creating a prolific environment for offshore wind development is needed to strengthen this virtuous cycle of growth.

Chapter 1

This outlines the value of offshore wind development for Europe via a range of quantitative analyses. In particular, this chapter focuses on the role and benefits of (hybrid) interconnectors and cross-border projects, alongside Europe’s wind resource distribution.

Chapter 3

This addresses the challenge of the financing and funding of offshore infrastructure and emphasises the interdependency between this and coordinated planning. Additionally, the de-risking of financial investments and the distribution of costs and benefits across borders is addressed.

Chapter 2

This highlights the importance of coordinated planning, specifically in terms of the careful balancing of maritime interests and the efficient positioning of wind farms at sea. The chapter also outlines the impacts of long-term planning on supply chains.

OFFSHORE WIND ENERGY AND CROSSBORDER

The development of offshore wind is of key importance for the energy system of the future. Through the exploration of a variety of factors (e.g. system costs, trade volumes, wind variability), this chapter outlines the value that this energy source carries for society and why it is so important to collaborate across borders to leverage its benefits.

The first part of this chapter outlines how beneficial the development of offshore wind will be for Europe compared with an alternative pathway to net zero that involves the development of lower levels of offshore wind generation. The crucial ingredient of cross-border collaboration is explored in detail as this will ensure that the full benefits of offshore wind are reaped and ensure that decarbonisation targets are reached in a cost-optimal manner.

Furthermore, this chapter highlights how the benefits of offshore wind and HYBRID INTERCONNECTORS are not just part of a distant, climate-neutral future. Indeed, the simulations undertaken for this study demonstrate that visible price reduction effects could have been achieved had additional offshore wind generation capacities been present in today’s power system.

Finally, this chapter includes a deeper look at wind resources, emphasising that the integration of offshore wind farms which are located far away from the coastlines of countries that will use them will be particularly valuable for reducing the costs of Europe’s energy transition.

I. OFFSHORE WIND CAN REDUCE THE COSTS OF EUROPE’S ENERGY TRANSITION

DEVELOPING OFFSHORE WIND WILL BE CHEAPER FOR THE SYSTEM THAN NOT DEVELOPING IT

Wind and solar power will form an essential component of Europe’s future energy mix as it works towards net zero. Their combination makes them very valuable for ensuring a balanced energy mix, as was demonstrated in Elia Group’s 2021 viewpoint The analysis conducted as part of this study used this finding and expanded upon it (see section IV of this chapter). In fact, offshore wind is likely to make the energy transition cheaper for Europe. Limiting the development of offshore wind power will require Europe to rely on higher levels of electricity generated by thermal power plants and more energy imports. Whilst this will be feasible, the simulations outlined below demonstrate that this option will result in a more expensive future power system. Moreover, the increase in thermal generation in a scenario in which offshore wind development is restricted results in higher costs for the energy system. To some extend these are driven by higher CO emissions costs (denoted as the societal cost of carbon)2

Figure 1.1 summarises the main system cost findings across each of the scenarios that were assessed for this study (please see next page for a description of the modelling approach). It shows that, compared with a scenario in which offshore wind development is restricted after 2030, the development of offshore wind carries clear benefits in terms of costs for the European energy system (even when a national approach to offshore wind development is adopted.). The lower costs of the scenario with national focused offshore wind buildout (€460 billion over the period 2030-50) is due to savings in operational costs, such as those linked to: fuel for thermal power generation and the societal cost of carbon; hydrogen imports; and investments in thermal generation capacities. (please see information Box 1 for a description of considered energy system cost elements).

The high carbon costs are a result of the model emitting more CO overall in the restricted offshore scenario compared with the other scenarios. Moreover, a CO cap was only enforced for the target year 2050, but not the years before this.

Additional cost savings of €130 billion (i.e. €6.5 billion per year) were calculated as part of the simulations in a scenario where offshore wind development is carried out with European countries collaborating fully with each other and which includes innovative grid technologies that allow complex hybrid and meshed offshore connections to be built. These savings are mostly driven by the additional

deployment of offshore wind across attractive locations in northern Europe, allowing the green electricity generated to be efficiently exported across the rest of the continent. In other words, the savings are not solely driven by more offshore wind capacity (amounting to 50 GW) as such, but also by a different allocation of offshore capacity and improved crossborder exchanges that lead to a more efficient operation of the system. These effects will be further explored in the next sections, after a short introduction to the modelling approach adopted for this study.

SYSTEM COSTS

All modelled scenarios follow a path to achieve carbon neutrality by 2050. To reach this goal, the model could invest in renewable generation assets such as wind farms and solar power but also conventional generation capacities (gas- and hydrogen-fired power plants as well as nuclear power plants). In addition, gas pipelines and electricity transmission infrastructure could be built across different market areas to facilitate cross-border collaboration.

For the buildout of connections between offshore hubs, the commercial availability of DC breakers and multiterminal high-voltage converters was assumed. The respective costs were calculated in a post-processing step as an exact representation in a linear model would have been too complicated. Internal network enforcements were not modelled explicitly but their cost was partially included in the interconnector costs.

To fully capture the benefits of offshore wind integration, a dispatch of all generators, storage solutions and sectorcoupling components was calculated taking into account variable costs such as fuel costs, O&M costs and costs for hydrogen imports. Costs for congestion management inside market areas were not modelled. Altogether, the model aimed to minimise the system costs consisting of investment costs and operational costs for the full time horizon from 2030 to 2050.

(last

on 02/09/24) 2. ENTSO-E (2024). ‘4th ENTSO-E Guideline for cost-benefit

Collaborating closely with neighbouring European countries in planning infrastructure and areas for offshore wind energy projects is crucial to efficiently and sustainably maximising the potential of offshore wind resources.

MODELLING EUROPE’S FUTURE ENERGY SYSTEM

An analysis of European energy system changes in the lead-up to 2050 was carried out with the aim of better understanding the contribution of offshore wind to Europe’s goal of establishing a climate-neutral energy system. Four scenarios were defined (as shown in Information Box 2) in order to map out the benefits linked to the large-scale deployment of offshore wind and to assess the role played by cross-border collaboration. Each scenario was used to assess what the optimal decarbonisation pathway for Europe would be, given certain conditions, as follows.

1. No offshore buildout past 2030: no offshore wind farms are deployed beyond those which are associated with the realisation of current commitments outlined for 2030.

To harness the full benefits of the offshore wind potential, developments have to be approached holistically. All onshore grids around the sea basin require reinforcements. These have to be realised at the same pace as the development of the offshore grids. The lack of available onshore transmission capacity is a real risk from a wind developer’s perspective and can jeopardise the bankability of new offshore wind generation projects.

2. National approach to offshore buildout: the development of offshore wind is carried out in such a way that it satisfies the goals of each coastal country.

3. Collaboration with point-to-point connections: offshore wind is developed using (national and cross-border) radial connections and point-to-point interconnectors.

4. Collaboration with hybrid interconnectors and hubs: offshore wind is developed with a higher level of innovation involved (e.g. availability of DC circuit breakers) and the adoption of hybrid interconnectors.

By comparing these scenarios, a number of questions were explored relating to: