3 minute read

Pod 3: The race for green milestones

In the third content pod, speakers dived deeper into the different wording and standards used to set mining’s climate targets. Heidi Grantner, General Manager at Synergy Enterprises, noted the differences between net-zero, which tends to be focused on removing as much carbon as the company produces in scope 1 and 2 emissions, and carbon neutrality, which tends to also include scope 3. “The reason the net-zero by 2050 target is so popular is that it’s a science-based target aligned with the Paris Agreement. To get to 2050, there will be a lot of variation in interim targets, which will really depend on site analysis,” she said. One of the aspects miners should pay attention to, is whether their targets are based on carbon intensity or on absolute emissions. “Miners face headwinds such as deepening, increasing ore hardness, increasing strip ratios and falling grades. The tendency is to say: ‘I can see efficiency gains here and lower intensity’, but there’s not going to be any escaping the absolute reduction requirements, and observers are becoming much more attuned to that,” warned Mark Fellows, Co-Founder and CEO of Skarn Associates.

Tracking progress will require setting baselines and communicating results, and there is currently a multitude of different frameworks and standards a mine could choose to abide to, which makes reporting challenging. According to Grantner, the most relevant recent development in the standards space is the formation of the International Sustainability Standards Board (ISSB), a consolidation of the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (VFR). The ISSB plans to have a unified standard in place around climate disclosure requirements by June 2022, which should help to compare progress between different companies. As miners begin to hit their scope 1 and 2 targets and shift their focus on their scope 3 emissions, experts believe the whole industry will be redefined. “Some of the most aggressive measures are on the scope 3 side, where miners are deciding to

Advertisement

get out of business areas entirely, getting rid of their coal assets for example,” said Michael Widmer, Head of Metals Research at Bank of America Merrill Lynch. Going even further, climate targets could soon determine whether or not investors pursue new projects, particularly in remote areas where zero-carbon power may be challenging. “There’s a general assumption that if you’re planning to produce a commodity, you will always find a market. But not every commodity warrants development of a mine: one could argue diamonds are not essential to civilization, for instance. If a mine is going to be developed off the grid in a remote environment, it will need to produce a commodity the world really needs,” said Patrick Evans, CEO of Mayfair Gold, which is currently developing Canada’s first net-zero gold project.

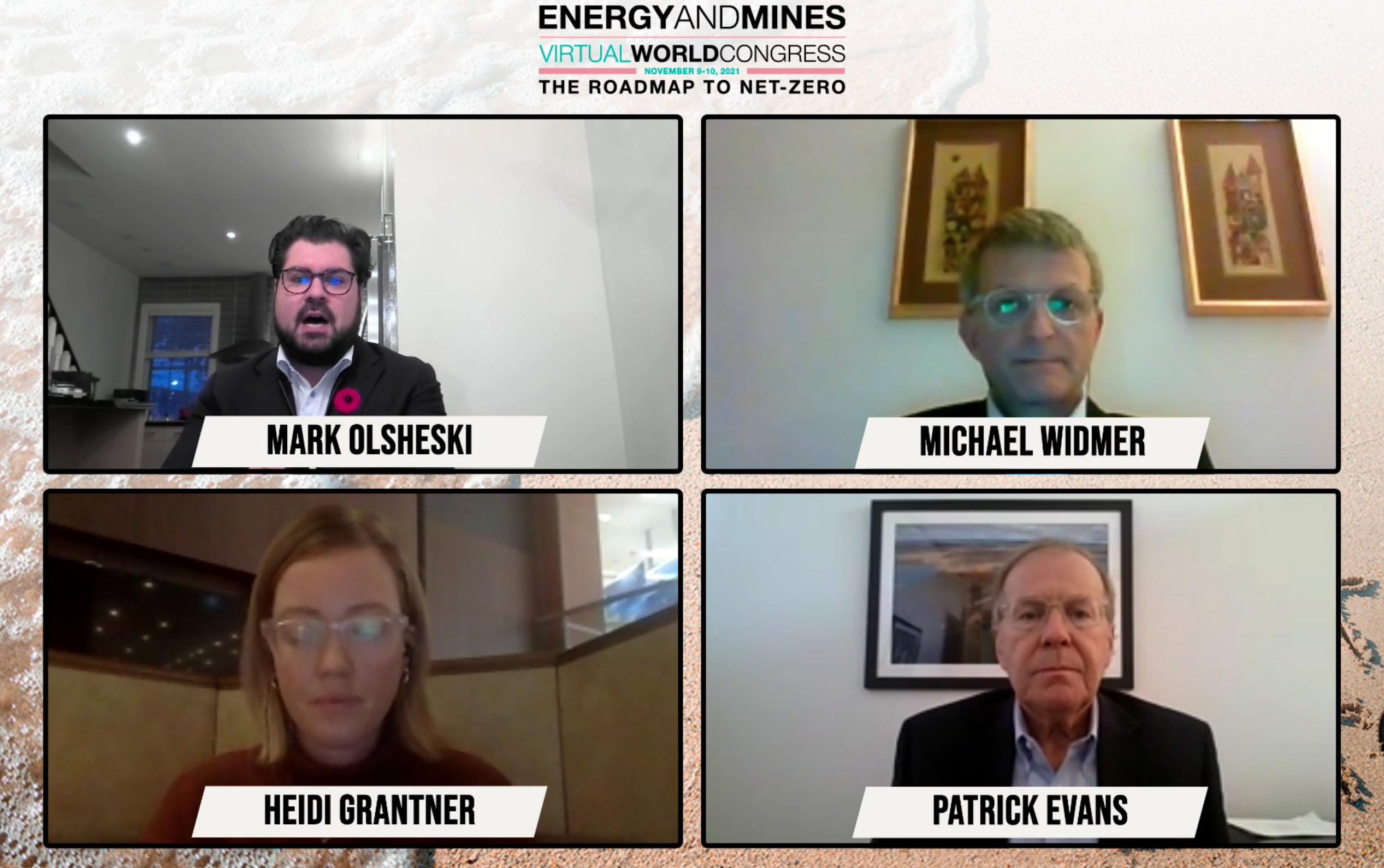

Mark Olsheski, Vice President, Energy and Environment, Sussex Strategy Group chairs a panel on Green Milestones with Michael Widmer, Head of Metals Research, Bank of America Merrill Lynch ; Heidi Grantner, General Manager, Synergy Enterprises; and Patrick Evans, CEO, Mayfair Gold

Mark Olsheski, Vice President, Energy and Environment, Sussex Strategy Group chairs a panel on Green Milestones with Michael Widmer, Head of Metals Research, Bank of America Merrill Lynch ; Heidi Grantner, General Manager, Synergy Enterprises; and Patrick Evans, CEO, Mayfair Gold