WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

2023

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

2023

CONVENIENCE STORES SEE RECORD SALES AS LIFE RETURNS TO NORMAL POST-PANDEMIC.

CONVENIENCE STORE retailers are investing heavily in enhancing their in-store offers, from expanding their fresh food options, to introducing new customizable beverages, to developing exclusive private-label products that can’t be found anywhere else.

Still, however, 56 percent of the convenience store shoppers surveyed for the 2023 Convenience Store News Realities of the Aisle Study — which polled 1,500 consumers who shop a c-store at least once a month — said they visit a convenience store weekly for fuel only.

And despite retailers’ ongoing efforts to boost their in-store offerings, the sales mix of the industry continues to skew more toward fuel. According to the 2023 CSNews Industry Report, the longest-running annual analysis of U.S. c-store industry performance (see page 24), fuel comprised 66.2 percent of total sales in 2022 while in-store comprised 33.8 percent.

During the height of the COVID-19 pandemic in 2020, when Americans were driving less, staying home more and looking to consolidate trips, the c-store industry’s sales mix shifted to just 54.4 percent fuel and 45.6 percent in-store. But that swing proved short-lived.

It is apparent that more must be done to increase the pump-to-store customer conversion rate, especially because in terms of profitability, in-store most often provides the best margins for operators. Last year’s convenience channel gross profit dollar mix was

59.2 percent in-store vs. 40.8 percent fuel, according to our Industry Report

So, how can c-store operators get more customers from the pumps into the store?

It starts with making customers filling up their gas tanks aware of what products and services they can find inside the building. Advertising through audio and video messaging at the pump on a screen or within the retailer’s mobile app can accomplish this.

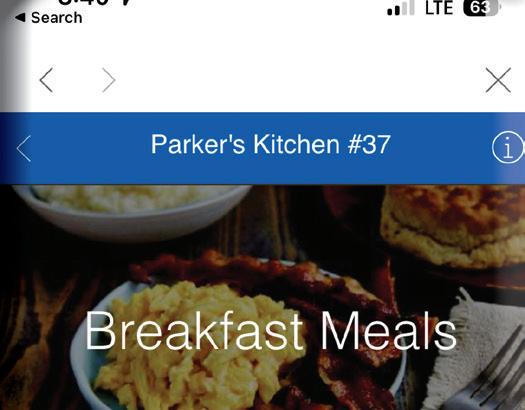

To take it to the next level, operators can enable in-store items to be purchased by the customer while at the pump. Again, this can be done through the fuel pump itself or via the retailer’s mobile app. At Parker’s, the Savannah, Ga.based operator of convenience stores in coastal Georgia and South Carolina, customers can use the retailer’s app to activate the fuel pump, pay for fuel, and order and pay for food for in-store pickup, bypassing any lines inside.

The final step in the pump-to-store equation is personalizing promotions. Whether advertised through screens on the pump or a mobile app, the more personalized the offers, the better. Loyalty programs can be integrated into the fuel dispensers to personalize offers based on a customer’s spending history and even greet the customer by name.

Check out our “Enhancing the Forecourt Experience” story on page 70 for more ideas.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards

Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

Laura Aufleger OnCue Express

Chad Beck Core-Mark

Edward Davidson

Ed Davidson & Associates (7-Eleven Inc., retired)

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Eby-Brown Co.

Chris Hartman Rutter’s

Ray Johnson Speedee Mart

Ruth Ann Lilly GPM Investments LLC

Vito Maurici McLane Co. Inc.

Jonathan Polansky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Roy Strasburger StrasGlobal

More must be done to increase the pump-to-store customer

LAST FALL, in our annual Top 100 report, Convenience Store News noted that rapid merger-and-acquisition (M&A) activity in the convenience store industry was slowing down compared to previous years. The year prior was marked by 7-Eleven’s bold acquisition of Speedway. 2020 saw Murphy USA buy Mid-Atlantic regional chain QuickChek and the year before that, U.K.-based EG Group made its presence felt with the acquisition of Kroger’s convenience store portfolio, before adding to its store count with the purchase of East Coast powerhouse Cumberland Farms.

The relative lack of blockbuster M&A deals last year led some to think the larger “consolidators” in the channel were taking a breather. Commenting on the state of M&A last fall, Terry Monroe of American Business Brokers & Advisors said: “There is not much to buy; that’s why you’re not seeing much announced. There is more money chasing fewer deals. It still comes down to supply and demand. There is a huge demand from investors and other operators to purchase, but very little supply.”

Globally, M&A activity shrank to its lowest level in more than a decade in the first quarter of 2023. Analysts blamed rising interest rates, high inflation and fears of a recession for souring the appetite of companies looking to make major purchases.

However, the old retail maxim of “grow or die” remains true. In retailing, if you’re not growing, you’re dying. Just in the last two months, we’ve seen three major deals announced through which nearly 1,000 stores will change hands. These deals were supplemented by another four modest acquisitions that included more than 100 stores.

In the month of April alone, we reported:

• Tri Star Energy, parent company of Twice Daily, acquired 54 stores from Cox Oil.

• Love’s bought 22 c-stores and travel centers from EZ GO Convenience Stores.

• Petroleum Marketing Group purchased 43 Short Stop stores.

• BP finalized a deal to acquire 281 travel centers from TravelCenters of America.

• Maverik is swallowing up a company its own size by buying 400-plus-unit Kum & Go.

• Circle K and Majors Management are splitting up the 300-plus-store MAPCO chain. For dessert, Circle K gobbled up 10 Dion’s Quik Marts from Uphoff Ventures as well.

I expect M&A activity to continue this year as companies adapt to the tougher economic climate. In addition, I think the supply of companies interested in being acquired will increase as operators face the hard truths about the investments needed for long-term success in the convenience store industry — technology, labor, electric vehicle chargers, etc.

The relative lack of major deals last year resulted in little change among the topranked retailers on this year’s Top 100 list (see page 50). If the more heated M&A activity of the past few months continues, it’ll be very interesting to see what changes are wrought among the biggest convenience channel players.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

I expect M&A activity to continue this year as companies adapt to the tougher economic climate.

FEATURES

COVER STORY

24 Reaching New Highs

Convenience stores see record sales as life returns to normal post-pandemic.

TOP 100

50 The Calm Before the Storm

The 2023 Convenience Store News Top 100 looks largely like a carbon copy of last year, but recent M&A activity will shake things up in the next 12 months.

DEPARTMENTS

E DITOR’S NOTE

3 Leaving Money in the Parking Lot More must be done to increase the pump-to-store customer conversion rate.

VIEWPOINT

4 Grow or Die Still a Retail Mantra Merger-and-acquisition activity is on the upswing in the c-store industry.

10 CSNews Online

18 New Products

SMALL OPERATOR

20 The Customers You Don’t Want Don’t be left with an empty bird feeder because of interlopers.

TWIC TALK

76 An Important Message for All Women

“We are our own best resource in closing the equity gap,” entrepreneur Deb Boelkes says.

INSIDE THE CONSUMER MIND

98 The Loyalty Picture

Active participation in c-store loyalty programs has increased, but not across all generations.

Many

8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT & GROUP BRAND DIRECTOR Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS

Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST

SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ASSOCIATE PUBLISHER & MIDWEST SALES MANAGER Kelly Fischer - (773) 992-4464 - kfischer@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (201) 855-7615 - tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley (856) 809-0050 - marybeth@marybethmedley.com

DESIGN/PRODUCTION/MARKETING

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Ed Ward edward@ensembleiq.com

MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

CHIEF OPERATING OFFICER Derek Estey

QuikTrip Corp. opened its 1,000th location in Converse, Texas, after 65 years in business, while Wawa Inc. opened its 1,000th store in Oaklyn, N.J., soon after its 59th anniversary.

In a letter to shareholders, Seven & i Holdings Inc. outlined its food-focused strategy and investments, citing its food expertise and fresh food offerings as drivers of global growth.

The convenience store operator shared plans for its first store in the state, which will be located in Kill Devil Hills. The store will be built west of U.S. 158, the main artery through the beach towns of Kill Devil Hills, Nags Head and Kitty Hawk.

Adi Dhandhania will be responsible for the day-to-day leadership of the company, its growth strategy and the continued evolution of the brand. He will also join the board of directors.

The lawsuit is in response to the issuance of several Notices of Determination that allege certain Camel and Newport cigarette styles are “presumptively” flavored based on their promotional materials. Filed in California state court, the suit seeks declaratory and injunctive relief, including that the notices be rescinded.

During the third-annual in-person meeting of the Convenience Foodservice Alliance, c-store foodservice professionals talked about challenges, shared solutions and connected with peers. Roundtable discussion topics included labor and turnover, menu innovation, automation solutions and more. Additionally, foodservice consultant Jessica Williams, founder and CEO of Food Forward Thinking, shared a presentation focused on “Telling & Selling Your Foodservice Story.” According to Williams, three things retailers must keep in mind are: success never happens by accident; curiosity improves design; and photographs impact sales.

For more exclusive stories, visit the Special Features section of csnews.com.

During its first set of Core-Mark Expo events since becoming a fully integrated company with Eby-Brown Co. under parent Performance Food Group, Core-Mark highlighted offerings such as its Tru-Q Barbecue program, which has genuine, fully cooked, slow smoked barbecue with an authentic taste, and its renamed Fresh Take line of grab-and-go items, which includes fresh and healthy sandwiches, salads and snacks. Core-Mark also continues to feature its Top Off Rewards loyalty program that assists independent operators with less than 20 locations by tying specific rewards to specific locations rather than treat all stores interchangeably.

Talking Rain Beverage Co. unveiled a new program, I.C.E. Labs. Short for “Innovate, Create and Enjoy,” I.C.E. Labs refrigerators will maximize Talking Rain’s ability to test products more efficiently on a smaller scale, generating consumer response over a six- to nine-month basis, according to the company. This approach will utilize a variety of store types and locations to cater to different demographics and markets, ranging from convenience stores to specialty grocers. Products that are successfully tested will be moved to larger test markets, eventually expanding on a national scale.

that are successfully tested will be moved to larger test markets,

separate transactions divide more than

MAPCO EXPRESS INC. is the latest convenience store retailer to find itself on the selling end of a notable merger-and-acquisition play.

Alimentation Couche-Tard Inc. and Majors Management LLC are acquiring MAPCO’s portfolio in two separate transactions. The Franklin, Tenn.-based retailer operates more than 300 convenience stores across Tennessee, Alabama, Georgia, Arkansas, Kentucky and Mississippi. It is a subsidiary of COPEC, a leading South America-based retail company.

Laval, Quebec-based Couche-Tard, parent company of the global Circle K brand, inked an agreement to acquire 112 MAPCO convenience and fuel sites in Tennessee, Alabama, Kentucky and Georgia. All the sites are company-operated, and most of the real estate is owned. The transaction also includes surplus property and a logistics fleet.

“We are delighted to add MAPCO’s high-quality sites to our footprint in the Southeastern U.S.,” said Alex Miller, Couche-Tard’s chief operating officer. “As we continue to grow our presence in the region, we look forward to bringing the Circle K experience to new customers and making their lives a little easier every day.”

Couche-Tard is a global leader in convenience and fuel retailing, operating in 24 countries and territories, with more than 14,300 stores.

The Majors Management transaction includes the MAPCO My Rewards loyalty program, the MAPCO brand and the remaining c-store and fuel locations across the Southeastern United States in attractive and desirable markets predominantly in Tennessee, Alabama and Georgia.

“We are thrilled to bring the MAPCO and Majors’ teams together,” said Ben Smith, president of Lawrenceville, Ga.-based Majors Management. “We are honored to maintain and grow the MAPCO brand, and we are excited to serve MAPCO’s customers and uphold and build upon the culture of operational excellence at MAPCO.”

Majors is an owner, developer and operator of convenience stores and a distributor of branded motor fuels. Majors and its affiliates supply fuel to more than 1,400 c-stores. In the last three years, Majors has completed 18 acquisitions across 14 states.

Both deals, which are contingent on the other transaction closing, are expected to be completed in the second half of 2023, subject to standard regulatory approvals and closing conditions.

The $1.3 billion transaction will boost BP’s convenience and mobility business

HOUSTON-BASED BP’s $1.3 billion acquisition of TravelCenters of America Inc. (TA) closed on May 15, adding 280-plus locations to BP’s network that complement its off-highway convenience and mobility business.

TA stockholders approved the transaction with more than 72 percent of the shares outstanding and 93 percent of the total shares voting in favor of the merger at a special meeting on May 10. The tally paved the way for the deal to close three months after its announcement, which occurred Feb. 16.

“We are thrilled to welcome the TravelCenters of America team to BP and give a turbo-boost to our convenience and mobility business in the U.S. Combining TA’s sites on U.S. highways with our brilliant retail network off the highway immediately expands our offer and doubles our global convenience gross margin,” said Emma Delaney, executive vice president of

customers and products at BP. “By integrating BP pulse, along with biofuels and renewable natural gas businesses — and in time, hydrogen — we can help America’s vital fleets and logistics companies decarbonize.”

Convenience is one of five strategic transition growth engines that BP intends to grow rapidly through the decade, with roughly half of its anticipated $55 billion to $65 billion cumulative investments going into convenience, bioenergy and electric vehicle charging by 2030.

business consisting of approximately 200 fuel supply accounts.

Alimentation Couche-Tard Inc. bought Dion’s Quik Marts from Uphoff Ventures, which had been operating the chain since 2016. The locations will now carry the Circle K banner.

Apro LLC dba United Pacific acquired Boyett Petroleum’s 10 company-owned convenience stores. In a separate transaction, Boyett acquired United Pacific’s wholesale fuel distribution

Yesway and TMS recently reached a multiyear agreement naming Allsup’s the Official Convenience Store of Texas Motor Speedway.

Yesway opened its newest Allsup’s store at Texas Motor Speedway (TMS) in Fort Worth on April 1. This store is a first-of-its-kind Allsup’s Express Grab & Go concept.

QuikTrip Corp. opened its 1,000th convenience store in Converse, Texas. The retailer released a series of 1,000 digital collectibles to commemorate the milestone.

Tri Star Energy LLC picked up 54 convenience stores from Cox Oil Co. Inc., marking the latter’s exit from the industry. The stores operated under the Little General Convenience Stores and Maverick Quick Shop brands.

Sheetz Inc. surpassed a major milestone of more than 2 million electric vehicle (EV) charging sessions. An early adopter of public EV charging stations, Sheetz installed its first EV charger in 2012 in Pennsylvania.

Twice Daily unveiled a refreshed loyalty app that allows members to use a rewards catalog to track and manage their rewards progress. The new app can be used across its convenience stores and its White Bison Coffee sites.

Altria Group Inc. reached an agreement on terms to resolve at least 6,000 JUULrelated state and federal cases for $235 million. The cases include roughly 50 economic class actions, 4,500 personal injury actions and 1,500 government entity actions.

DiversityInc ranked The Hershey Co. No. 3 on its annual Top 50 Companies for Diversity list. Hershey’s efforts are guided by The Pathways Project, a fiveyear plan to make the company more diverse and inclusive.

Pilot Co. kicked off an initiative to hire more than 10,000 new team members across its family of travel center brands. A large number of the openings are in key summer travel states, including Arizona, California, Florida, Georgia, Illinois, Kentucky, Missouri, Ohio, Texas and Virginia.

Sunshine Gasoline Distributors Inc. is partnering with REGO Restaurant Group to open at least 13 combined, dual-branded Quiznos and Taco Del Mar restaurants in central and south Florida. The first opening is slated for February 2024.

Wawa Inc. teamed up with ezCater to expand its corporate catering operations. The Wawa Catering menu includes a variety of breakfast, coffee and lunch items, which come individually packaged or in trays.

Stinker Stores introduced a customer feedback pilot program at four locations. In partnership with FeedbackNow by Forrester, the program includes a combination of FeedbackNow’s Smiley Box devices, multiple-choice buttons and QR codes in strategic locations throughout the stores.

Imperial Trading Co. LLC completed the acquisition of certain assets of City Wholesale on April 14. The purchase is expected to add $150 million to Imperial Trading’s previous $3 billion in annual revenues.

Reynolds American Inc. subsidiary R.J. Reynolds Tobacco Co. filed a lawsuit against California state officials, including Attorney General Robert Bonta, whose office alleges new Camel and Newport styles violate the state’s flavor ban.

Mondelez International Inc.’s SnackFutures hub selected nine startups to participate in the third cohort of CoLab. Participants receive a 12-week curriculum of virtual and hands-on sessions, networking opportunities and a $20,000 grant.

PepsiCo Inc. unveiled a new logo and visual identity for its titular brand. The new look will roll out in North America in time for the brand’s 125th anniversary this fall, to be later followed by a global introduction in 2024.

IT’S NOW ILLEGAL IN CALIFORNIA TO SELL MOST FLAVORED TOBACCO PRODUCTS, INCLUDING VAPES AND MENTHOL CIGARETTES. FOLLOW THE LAW TO PROTECT KIDS FROM A LIFETIME OF DEADLY ADDICTION.

MAKE SURE YOU’RE FOLLOWING THE LAW AT NOFLAVORS.ORG

Wild Brands introduces STEP Cigarettes, nontobacco cigarettes that incorporate a layered tobacco-style flavor system. STEP Cigarettes (short for Satisfaction, Taste, Experience and Price) are not subject to flavor bans, excise taxes or MSA payments, according to the company. Offering retailers an option to replace traditional cigarettes in the U.S. market, STEP Cigarettes are currently available in two variants: full flavor and green menthol.

GLOBAL TOBACCO LLC • DALLAS • MWALTERS@GLOBALTOBACCOLLC.COM • GLOBALTOBACCOLLC.COM

Molson Coors, in partnership with The Coca-Cola Co., will launch Peace Hard Tea in September 2023. Capitalizing on the hard tea trend, the company said the new brand will build on Peace Tea’s existing fanbase while bringing in additional legal drinking-age consumers. The Peace Hard Tea line will debut with three flavors — Freedom of Peach, Really Really Razzy and More Peace More Lemon — each clocking in at 5 percent ABV. At launch, the drinks will be available in 24-ounce single cans in select U.S. regions.

MOLSON COORS BEVERAGE CO. • CHICAGO • MOLSONCOORS.COM

Prairie City Bakery is offering a new bulk Sweet Cinnamon Roll, a sweet treat layered with cinnamon and a generous dollop of cream cheese icing on top. The cinnamon rolls are flash-frozen for maximum freshness and convenience, and come packed in a four-count tray, with 10 trays to a case. Prairie City also introduces a new product line, Coffee House Muffins, which are available in two classic flavors: Blueberry and Banana Nut. The muffins are made using real fruit and come individually wrapped with a 45-day shelf life from thaw.

PRAIRIE CITY BAKERY • VERNON HILLS, ILL. • CUSTOMERSERVICE@PCBAKERY.COM • PCBAKERY.COM

Dave’s Killer Bread enters the snacks category with its latest offering: Organic Snack Bars. In line with the company’s bread products, the bars are certified USDA organic, Non-GMO Project verified and contain no artificial ingredients, preservatives, colors or flavors. Dave’s Killer Bread Organic Snack Bars are available in three varieties: Cocoa Brownie Blitz, which is packed with organic chocolate chunks; Trail Mix Crumble, which delivers a mix of chocolate, fruits and seeds; and Oat-rageous Honey Almond, which includes organic rolled oats, honey and dry roasted almonds. Individual bars retail for $1.99.

DAVE’S KILLER BREAD • MILWAUKIE, ORE. • DAVESKILLERBREAD.COM/ SNACK-BARS

SWIPEBY Snapshot is a new tool that enables food retailers to generate realistic images based on menu item descriptions and headlines. Incorporating Open AI and Stability AI text-to-photo models, SWIPEBY Snapshot helps make online menus more user-friendly and can potentially increase ordering rates by up to 35 percent, according to the company. Each image is unique, realistic and allows customers to easily visualize what they’re ordering. The images can be downloaded for use on websites, direct mail, social media, printed menus and other marketing materials.

SWIPEBY • WINSTON-SALEM, N.C. • RANDY@SWIPE.BY • SWIPE.BY

High Noon expands its offering with the introduction of High Noon Tequila Seltzer, a malt-based, tequila-flavored hard seltzer. The adult beverage is available in four flavors, all made with real fruit juice and layered with blanco tequila. The flavors are Strawberry, Lime, Grapefruit and Passionfruit. High Noon Tequila Seltzer is health conscious, with only 100 calories per serving and no added sugar or gluten, according to the maker. The variety eight-pack of 355-millimeter cans retails for $21.99. The product started rolling out in March, with national availability beginning in May.

HIGH NOON SPIRITS CO. • MODESTO, CALIF. • HIGHNOONSPIRITS.COM

Good2grow enters the food product category with the launch of a better-for-you kids product, Snackers. Like Good2grow’s beverage portfolio, Snackers combine fun and nutrition with collectible, licensed character tops on reusable cups and wholesome ingredients, according to the company. Snackers are sold in 2-ounce, single-serve packages and feature baked oat and wheat crackers in two flavors: cinnamon and chocolate. Character tops include kid-favorites from Disney, Nickelodeon, Hasbro, Comcast Universal and more.

GOOD2GROW • ATLANTA • GOOD2GROW.COM

Hi-Chew reimagines its chewlets with Hi-Chew Bites, a new product that features unwrapped chewlets in three flavors: mango, green apple and strawberry. Until now, the core lineup of Hi-Chew offerings has mainly consisted of individually wrapped chewlets. The gluten-free Hi-Chew Bites are coated in a plant-derived powder that helps prevent the candy from sticking together, without compromising the chewy texture. Hi-Chew Bites are offered in a 2.12-ounce bag for a suggested retail price of $1.99 (varies per market). They’re currently available at participating 7-Eleven and Speedway stores nationwide, with wider distribution planned for later this year.

MORINAGA AMERICA INC. • IRVINE, CALIF. • HI-CHEW.COM

Island Brands USA is ramping up its Crush flavored malt beverage line with new eye-catching label art and a new flavor option: Crush Strawberry Lemonade. The changes come as the company brings distribution of the beverage line to Florida, Georgia, South Carolina, North Carolina and Tennessee. Crush Strawberry Lemonade joins Crush Tropical Punch and Crush Lime Margarita, all of which clock in at 10 percent ABV and are available in 16-ounce or 19.2-ounce cans in either singles, four-packs or 24-can cases.

ISLAND BRANDS USA • CHARLESTON, S.C. • ISLANDBRANDSUSA.COM

A first-of-its-kind power distribution unit designed for managed services, Active Power Edge from Hughes Network Systems can be deployed across a Hughes software-defined wide area network or managed broadband deployment. The new smart plug monitors power and connection status at each endpoint, and leverages artificial intelligence to reset outlets and power cycle connected devices as needed. Scalable from a few receptacles to thousands, Active Power Edge delivers insights to the HughesON Portal, the company’s single pane-of-glass management viewport for Hughes enterprise customers.

HUGHES NETWORK SYSTEMS LLC • GERMANTOWN, MD. • HUGHES.COM

AS SPRING TURNS into summer, we’ve started to have more visitors to our house. They always show up this time of year. You know how it goes, they just happen to be in the neighborhood and drop by. They are expected, but you don’t know the timing.

We are always delighted to see them, of course. Our guests brighten up our day, are usually entertaining and often create moments of inspiration (you are now experiencing the results). We welcome them and look forward to their arrival.

But having visitors can have a downside. In our case, they are always eating, are noisy (especially if we are trying to sleep), come and go as they please, and make a huge mess. They are also very fickle — if you don’t give them what they want, they will take off without warning.

Overall, we’ve really enjoyed our bird feeder. It has been a great addition to our backyard and provides us with the opportunity to watch blue jays, cardinals, sparrows and grackles (if you live in central Texas, you know what I am talking about), to name a few of the species we see.

If you put up a bird feeder, it makes sense that you will attract birds since that is what it is designed to do. It is sort of like in the movie “Field of Dreams;” an

“if you build it, they will come” type of thing. And, despite all the pros and cons mentioned above, the birds are lovely to have around. They provide a real return on the effort you put into it through their beauty, activity and song they provide. A “social ROI,” if you will.

And then you have the interlopers, the squirrels. The attraction of the bird seed is just too much for them to resist. Unfortunately, they are not content to just clean up the food that has fallen on the ground — they want to go to the source, the bird feeder itself. When that happens, the squirrels start scaring off the birds, causing them to relocate to a less threatening and intimidating feeder.

The net result is fewer birds and less entertainment. If you want the birds to come back, you have to get rid of the squirrels.

I see the bird feeder as being analogous to a convenience store. You find a good place to locate it so that you can be seen by as many people as possible. Then, you work really hard to bring customers in: you stock the shelves, clean the floors, train your staff and offer promotions. You do everything you can to be welcoming and inviting.

But you can also start getting people you

don’t want at the store, the ones hanging around in the parking lot or behind the store who use your location as a gathering place. Admittedly, a convenience store offers a lot of advantages if someone is looking for a place to hang out: there is usually a lot of space in the parking lot where they can gather, the openness of the parking lot provides excellent visibility to be able to spot threats from far away and … there’s snacks!

As you have probably experienced yourself, having people just milling about in the parking lot of a store can be a frightening experience. It makes you think twice about whether you want to walk from your car to the front door of the store. This is especially true for any person who feels vulnerable or is worried about their personal safety.

If your customers don’t feel safe when they visit your store, they’ll stop coming, your business will suffer and you’ll be left with an empty bird feeder. The situation starts becoming one negative spiral and the problem begins feeding on itself — fewer customers mean less foot traffic and cars on the parking lot, which amplifies the space and visibility conditions mentioned above.

I’m working on a situation like this at the moment. There is a store in an urban location that should be a really good, high-traffic store. It’s on a busy street corner; it’s a large lot with a gasoline offer; there is a high-density middle-income neighborhood surrounding it; there is a school located across the street; it has good access from both roads; and there’s no significant competition.

However, there’s been an ongoing problem with people loitering in the parking lot. Several open-air drug deals have been reported, and there’s been shootings in the parking lot on a couple of occasions. Ironically, there has not been a high incidence of robbery or theft at the store itself, even though you might think there was a history

of it with all the bulletproof glass and bars on the windows. My understanding is that shrink is a problem, though.

The local police department has made dozens of visits to the site and, frankly, the police are tired of having to deal with the frequent complaints. The situation in the parking lot is also hurting the store’s sales as the loiterers intimidate people from coming into the store. There has been a sales decline over the last 18 months and transaction numbers are down. The bulk of store sales are made up of low-margin items, mainly cigarettes.

So, what to do? I’m working with the business owner and his landlord to put in place a program to enhance the outside and inside of the store. In my next column, I am going to present the specific strategies we are using and, I hope, the initial results from the program. My goal is to provide insight on how we addressed a specific problem, in case you are experiencing similar issues.

Generally speaking, the strategy is that by firstly making the location a less inviting area for people to loiter and secondly increasing the legitimate customer traffic, a busier store will help drive out the problematic people. With more customers and activity, the parking lot will be less attractive for people to hang around.

We are going to implement both passive and proactive programs to discourage the crowd (this site has had a security guard on the premises, but it has not been a deterrent). I’m also excited about implementing some artificial intelligence tools related to store security that were discussed in the latest Convenience Leaders Vision Group report that was released in May of this year.

I recognize that there are several caveats to our program. First, we know that we are not going to “solve” the loitering problem; we are just going to be able to move it somewhere else. Second, the current loiterers are customers of the store, so moving them on could negatively affect sales, but we are planning on new customer sales replacing and exceeding those lost sales. And third, putting the program into place will cost money to implement.

Our goal is to show that there is a financial ROI through increased sales and reduced shrink and a social ROI by reducing police visits and increasing the goodwill of the neighborhood.

Check back in a couple of months when my next column comes out. I’ll let you know the results — good and bad — and whether the birds have come back. CSN

Roy Strasburger is CEO of StrasGlobal, a privately held retail consulting, operations and management provider serving the small-format retail industry nationwide. StrasGlobal operates retail locations for companies that don’t have the desire, expertise or infrastructure to operate them. Learn more at strasglobal.com. Strasburger is also co-founder of Vision Group Network, whose members discuss future trends, challenges and opportunities, and then share with all retailers and suppliers, regardless of the size of their business Editor’s note: The opinions expressed in this article are the author’s and do not necessarily reflect the views of Convenience Store News.

With demand for moist smokeless tobacco (MST) and white nicotine pouches (also known as modern oral nicotine, or MON) driving so many shoppers in-store, c-store retailers are hungry for ways to become a destination for adult consumers of these products. Convenience Store News reached out to Matthew Hanson, Chief Growth Officer of Black Buffalo Inc., to discuss this rapidly evolving category.

Convenience Store News: Let’s talk about the state of the oral tobacco/nicotine marketplace. What are consumers looking for?

Matthew Hanson: There’s been a shockingly fast evolution in adult consumer preferences over the past few years. MON has taken over large sections of the backbar space only a few years from its market introduction. MON products are drawing interest from both combustible consumers as well as MST users, who are seeking alternatives to traditional tobacco products for myriad reasons, including poly usage (using combustibles and oral nicotine products in different settings), persistent price inflation of tobacco products, and seeking to move away from traditional products and toward innovative attributes found in new products. Retailers should always challenge themselves to find innovative products that meet the constantly changing needs and preferences of their adult consumers.

CSN: What makes Black Buffalo unique?

MH: Black Buffalo’s products live in the space between and overlapping both MON and MST. We have taken the experience of MST and successfully married that with the innovation of MON, at the heart of which lies nicotine delivery without actual tobacco, as well as wide-ranging flavor alternatives. This is why we see ~60% of Black Buffalo consumers with a history of purchasing MST and ~40% who have previously purchased MON and other non-MST nicotine products. MON had been the obvious alternative for adult consumers migrating from traditional MST, but when they’ve tried MON, they missed the heart and soul of the dipping ritual. We believe we have carved out a new alternative to the alternative, and our sales volume and growth certainly make that case.

CSN: What are some challenges that c-stores face in selecting inventory for their backbars?

MH: Some of the biggest tobacco manufacturers continue to use contracts and/or are leveraging multiple categories

to secure merchandising space, which may limit retailers’ ability to bring in innovative new products.

Then there’s the added complexity created by today’s regulatory environment, which is a bewildering matrix of issues. There is also the potential reputational and/ or economic risk of bringing in products that are worthy of consideration but are not from major manufacturers. Thankfully there is an ever-increasing number of forward-thinking retailers who know that being early with emerging trends like energy drinks, functional beverages, hard seltzers, curated food service offerings, and novel oral nicotine products is essential for them to win new and retain existing adult consumers in their highly competitive markets.

We’re finding ways to meet and exceed adult consumers’ expectations and preferences — all within the realm of regulatory compliance and responsible marketing. We timely filed PMTAs for our products by the FDA’s September 9, 2020 deadline, and our products were commercially available for sale in the U.S. before August 8, 2016 (the “Deeming Rule” deadline). Retailers can carry Black Buffalo’s products with confidence because we’re a well-established manufacturer who has invested millions of dollars in regulatory compliance. We stand very proudly on our regulatory history.

CSN: What products can retailers choose from?

MH: Black Buffalo offers a full line of pouches and long cut products, in both nicotine and nicotine-free versions. Our pouches products contain approximately 11.25 milligrams of nicotine per pouch and come in Wintergreen, Mint, and Straight flavors. Our long cut products contain approximately 7.5 mg of nicotine per gram and come in Wintergreen, Mint, Straight, Peach, and Blood Orange flavors. For adults who want an oral alternative product but don’t want nicotine, we offer Black Buffalo ZERO — a nicotine-free, tobacco-leaf-free alternative that dips like the real thing.

And retailers can always send our products back for any reason — we stand behind our products with a full guarantee. We want our retailers and their adult consumers to fully enjoy Black Buffalo.

To learn how Black Buffalo can make your store a destination for adult consumers of both MST and MON, visit wholesale@blackbuffalo.com .

“Charging Ahead…. Is BLACK BUFFALO the next brand for your stores?”

Convenience stores see record sales as life returns to normal post-pandemic

2023ON MAY 11 OF THIS YEAR, U.S. President Joe Biden formally declared the national state of emergency for the COVID-19 pandemic over but, for much of the last year, Americans already have been returning to normal living and the nation’s convenience stores have been benefitting as traditional commuting routines and shopping behaviors bounce back.

Total U.S. convenience store sales reached a record high of $814 billion last year, an increase of nearly 23 percent year over year, according to the 2023 Convenience Store News Industry Report, the longest-running annual analysis of U.S. c-store industry performance.

For the second year in a row, motor fuel sales posted an annual increase upwards of 30 percent. Largely driven by higher gas prices, the industry’s 2022 fuel revenue rose by 32.9 percent to reach $538.7 billion. Fuel volume grew slightly, with gallons up 1.6 percent for the year.

Taking the higher prices out of the mix, the industry’s motor fuel business appears to be leveling off compared to 2021 when gallons were up nearly 8 percent after dropping almost 20 percent the previous year as consumers stayed home during the worst of the pandemic.

Also for the second consecutive year, in-store sales at U.S. convenience stores hit a new high of $275.3 billion last year, up 6.6 percent over the prior year. While inflation pushed product prices higher throughout 2022, a 1.5 percent increase in the industry’s store count — led by single-

store operators — contributed as well to last year’s strong in-store sales growth.

After four years of decline, the number of industry locations operated by singlestore operators rose by 1.2 percent last year as this sector added 1,087 stores. Single stores account for more than 60 percent of the industry. The number of

THE WOOD TIP CATEGORY DRIVES +24.1% INCREMENTALITY TO PLASTIC TIP*

THE BLK BRAND GREW +32.7%

AVAILABLE IN 5PK AND IMPULSE BOX.

IN

stores operated by chains also ticked up last year by 1,061 locations, increasing 1.8 percent. The industry ended the year with a total store count of 150,174 vs. 148,026 in 2021.

Despite the record in-store performance, the convenience store industry’s sales mix for 2022 still skewed more toward motor fuels, with fuel comprising 66.2 percent of total sales and in-store comprising 33.8 percent. In 2021, the ratio was 62.1 percent fuel and 38.9 percent in-store.

In terms of profitability, however, last year’s gross profit dollar mix tilted more toward in-store. The 2022 ratio was 59.2 percent in-store and 40.8 percent fuel. The prior year, the split was 58.6 percent in-store and 41.4 percent fuel.

Industry gross profits overall jumped 3.3 percent last year, down slightly from the nearly 5 percent increase of 2021. While both in-store and motor fuel gross profits climbed last year, in-store saw a stronger increase, propelled by the power of the foodservice category. In-store gross profits totaled $73.35 billion for the year, while fuel profits totaled $50.61 billion.

Coming off a 12.3 percent jump in 2021, direct store operating expenses continued to increase at a faster pace last year, putting pressure on c-store retailers already dealing with inflationary pressures. Rising 14.5 percent, 2022 operating expenses per store totaled $978,797.

Labor, including wages, payroll taxes, workers’ compensation, health insurance and other benefits, accounted for the largest share of operating expenses at $571,973 per store, up 11.2 percent vs. the prior year when the industry saw a 10 percent increase in labor costs.

The ongoing labor shortage has c-store retailers raising their starting wages and offering retention bonuses to try to attract and keep store-level employees. Wages alone increased 11.8 percent per store last year. This line item is now nearing the $500,000 mark.

Despite retailers’ efforts, though, turnover keeps rising. The 2022 turnover rate for store associates was 163 percent, up from 160 percent in 2021. Meanwhile, last year’s turnover rate for store managers climbed to 94 percent, compared to 86 percent in 2021. Over the last four years, the store manager turnover rate has nearly tripled; it was 35 percent in 2019.

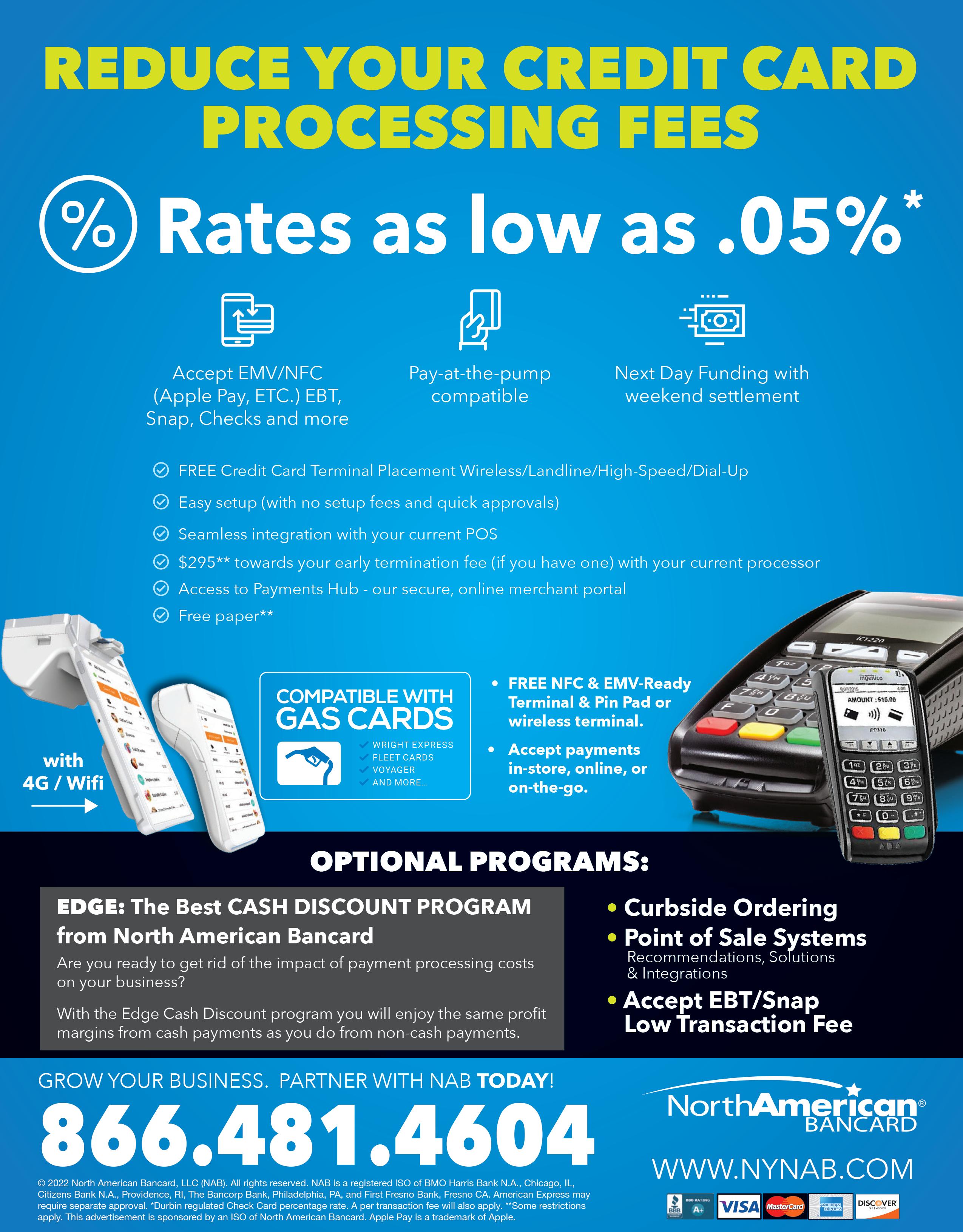

Still, the biggest percentage increase in direct store operating expenses last year came from rising credit card fees. In 2021, these fees on card transactions ballooned by 23 percent. Last year, they rose another 32.4 percent, going from $112,749 per store to $149,280.

In another sign of life returning to normal post-pandemic, in-store transactions per week at U.S. convenience stores increased 7.2 percent last year, while motor fuel transactions per week increased only 3.6 percent. More and more c-store retailers are enhancing their in-store offers to entice customers to visit the store even when they don’t need to fill up their gas tank.

Foodservice is an integral part of this effort and customers appear to be taking to it well. While the industry’s in-store merchandise sales were up 4 percent last year, foodservice sales industrywide were up a whopping 19.5 percent. 2022 marked the second consecutive year of stellar convenience foodservice sales as 2021 brought a 20.5 percent increase.

Other product categories turning in strong performances last year were salty snacks, packaged sweet snacks, candy and edible grocery. Each of these categories posted a doubledigit percentage increase in sales per store year over year.

Retail gasoline prices rose again in 2022 as the market felt the effects of Russia’s invasion of Ukraine. The weighted average for all grades of gasoline and diesel fuel was $3.99 per gallon, an increase of 29.8 percent from 2021, which also saw a major increase from the prior year.

This contributed to a 32.9 percent increase in dollar sales, but the number of gallons sold also increased 1.6 percent as consumers returned to in-office or hybrid work schedules. The average gross margin per gallon was up 4.6 percent to 29.9 cents per gallon.

The percentage of U.S. convenience stores selling motor fuels rose less than 1 point to 79 percent. More than 118,000 c-stores sold fuel last year, up from roughly 116,000 in 2021.

After dropping significantly to $289.8 billion in 2020, industrywide dollar sales of motor fuels have more than bounced back, reaching $538.7 billion last year. The number of gallons sold

Continued on page 36

has risen at a slower rate to 135 billion gallons last year, down from a five-year high of 154.1 billion gallons in 2018.

Following two years of growth, cigarette sales returned to a pre-pandemic trajectory in 2022, declining 3.9 percent to $434,876 in average sales per store — an unsurprising result considering the significant slowdown to 0.3 percent growth in 2021. Total industry sales also declined, falling 3.3 percent last year.

Note: 2021 results restated to reflect revised category definitions.

The performance of individual segments reflected a certain amount of belt-tightening among consumers, as per-store sales of economy/value cigarettes grew 1.5 percent at the same time that sales of premium/super-premium decreased 4.5 percent and mid-level cigarette sales decreased 2.1 percent. Premium/super-premium remains the top cigarette segment in dollars.

Total cigarette unit volume decreased for another year, falling 7.6 percent — the largest drop in five years, and lower than the previous five-year low of -6.0 percent in 2021.

In terms of share of in-store sales, the cigarettes category last year continued its years-long decline, hitting 23.49 percent share, down from 25.9 percent the previous year.

Other tobacco products (OTP) had a more successful year in 2022 than traditional cigarettes, despite an ongoing slowdown in growth. Average OTP sales per store increased 4 percent to $147,727, down from 8.1 percent growth the previous year.

Smokeless tobacco alternatives experienced the greatest segment growth, with average sales per store increasing 46.2 percent, while smokeless decreased 0.6 percent in average sales per store but remains the top-selling OTP segment. Vaping products are No. 2 in both average dollar sales per store and segment growth (up 5.9 percent).

Note: 2021 results restated to reflect revised category definitions.

Total industry sales of OTP were up 4.6 percent last year, although 2022 marked a notable drop from 8.1 percent growth in 2021 and 8.3 percent growth in 2020. Total unit volume also fell 0.5 percent, a slight improvement from the 1.4 percent drop of the previous year.

The category’s share of in-store sales remained fairly static at 7.98 percent.

Foodservice growth slowed in 2022, but this almost certainly reflects a return to normal operations after the major post-pandemic rebound that occurred in 2021. Average foodservice sales per store still rose

Responsible retailers are seen as solution providers, offer your adult customers VLN® today.

Of adult smokers consistently show interest in using VLN®

Indicate they would use VLN® along with their usual brand

Of VLN® users would migrate to other higher margin in-store products

an impressive 18.8 percent last year to $347,432, clearly demonstrating the category’s continued importance to the convenience channel.

Prepared food led the way in both per-store sales growth (20.9 percent) and actual dollars, while hot and frozen dispensed beverages both saw double-digit per-store sales growth of 14.8 percent and 13.5 percent, respectively. Growth of cold dispensed beverages lagged behind, but still rose 9.1 percent in average sales per store for the year.

Total industry foodservice sales increased 19.5 percent — just one point less than in 2021 and the second-highest growth to occur in the last five years. The category’s share of in-store sales jumped about 2 points to 18.77 percent, a five-year high.

Cold vault sales continued to see solid, albeit slowed, growth in 2022. Packaged beverage sales per store increased 7.1 percent to $253,986, down from 12.7 growth the previous year.

2022 marked the second straight year of sales growth across all segments within the category. Consumers continue to value beverages with functional benefits, as the segments that experienced the most growth in average sales per store year over year were enhanced water (up 11.2 percent) and sports drinks (up 10 percent). Energy/alternative drinks remain the top seller within the category and grew 6.9 percent in average sales per store.

Carbonated soft drinks maintain the No. 2 position in the category and saw average sales per store increase 7.9 percent in 2022, up from 6.2 percent growth in 2021. This strengthens the argument that many consumers grew used to buying from the cold vault during the pandemic and do not intend to return to the fountain.

Total industry sales of packaged beverages increased 7.8 percent in 2022, slowing from 10.9 percent growth the prior year. Total unit volume fell 1.1 percent, returning to a years-long pattern of flat to declining volume after seeing a 5.2 percent jump in 2021.

The category’s share of in-store sales increased less than a point to 13.72 percent.

As a category, beer and malt beverages experienced modest growth in 2022. However, the performance of individual segments ranged from falling sales to doubledigit growth.

Average sales per store of beer and malt beverages increased 3.5 percent to $167,828, marking a turnaround from 2021 when per-store sales fell 1.3 percent following a boom year during the height of the pandemic. Some of the biggest jumps last year occurred in flavored malt beverages (up 15.9 percent in per-store sales), premium plus/super premium beer (up 10.2 percent) and imported beer (up 10.1 percent). The newly measured cheladas segment grew 22 percent in average sales per store, but was fairly low in actual dollars.

Premium beer remains the top-selling segment overall despite per-store sales declining 2.5 percent year over year. Other segments posting a drop in average sales per store last year were alcoholic seltzer, microbrews/ craft beer and budget/value beer.

Total industry sales of beer and malt beverages rose 4.1 percent in 2022, up from a 2.8 percent decrease the previous year. However, this is likely the result of inflation-driven price increases as total unit volume was flat at 0.1 percent growth following a 5 percent decline in 2021.

The category’s share of in-store sales saw a slight drop to 9.07 percent. Just over 80 percent of all convenience stores in the United States sold beer and malt beverages in 2022.

The candy category experienced another year of double-digit growth in 2022, with nearly all segments seeing a boost. Average sales per store increased 12 percent to $64,391, down slightly from 13.7 percent growth in 2021.

Note: 2021 results restated to reflect revised category definitions.

The top-selling segment of chocolate bars/packs saw average sales per store increase 9.9 percent. Meanwhile, double-digit growth came from bagged/repackaged peg candy (up 14.7 percent), nonchocolate bars/packs (up 11.2 percent) and gum (up 17.8 percent). Per-store sales of novelties increased 83.3 percent, a year-over-year figure skewed by the segment’s low actual dollars. Seasonal candy was the only segment to see per-store sales decline.

Total industry sales of candy grew 12.7 percent last year, outpacing the previous five-year high of 11.9 percent growth in 2021. However, as with beer and malt beverages, this is likely an effect of rising prices as unit volume decreased 1 percent, down from a 5.5 percent increase in 2021.

Candy’s share of in-store sales increased by less than one point to 3.48 percent.

Buoyed by consumers’ love of snacking, the salty snacks category improved on its impressive 2021 growth with average sales per store in 2022 increasing 15 percent to $55,541.

Note: 2021 results restated to reflect revised category definitions.

Tortilla/corn chips saw per-store sales jump by 20.9 percent, but remained the No. 2 segment overall. Potato chips, the top seller, saw average sales per store increase 14.8 percent. A majority of the category’s segments posted double-digit growth, including popcorn (up 21.3 percent in per-store sales) and puffed cheese (up 20.6 percent). The only segments to see single-digit sales growth were nut/seeds (up 3.6 percent) and mixed salty snacks (up 6.4 percent).

Total industry sales of salty snacks rose 15.7 percent, up from 10.2 percent growth the previous year. This increase was the largest to occur in the last five years. Total unit volume for the category rose 2.8 percent in 2022, slowing from the prior year but still marking the second consecutive year of volume growth after three years of declines.

Salty snacks’ share of in-store sales rose slightly to 3 percent last year.

Alternative snacks, on the other hand, saw more modest growth last year, with average sales per store rising 3.4 percent to $22,101, down from 20.6 percent growth in 2021.

While per-store sales of meat snacks were flat, the segment significantly outpaces all other alternative

snack types in dollars. Health/energy bars (up 12.2 percent last year) and granola/yogurt bars (up 10 percent) posted the biggest growth in average sales per store within the category, but they remain lower sellers in terms of actual dollars.

Total industry sales of alternative snacks rose 4 percent in 2022, down from 18.7 percent growth the previous year. However, this was the second-largest increase in the last five years. Total unit volume, though, fell 3.7 percent, down from 8.7 percent growth in 2021.

Alternative snacks’ share of in-store sales stayed flat at 1.19 percent.

Sales of edible grocery jumped in 2022 after slowing down in 2021 following the category’s pandemicdriven boost. Average sales per store of edible grocery increased 14.8 percent to $100,585, up from 5.3 percent growth in 2021.

Other dairy/deli products saw per-store sales rise 13.1 percent and generated the most dollars, followed by the segments of other edible grocery (up 22 percent) and frozen foods (up 18.4 percent). The only segments to post less than double-digit growth were packaged

coffee/tea (up 5.2 percent in average sales per store) and packaged bread (up 7 percent).

Total industry sales of edible grocery increased 15.5 percent, up from 3.6 percent growth in 2021, extending its streak of steady growth to four years. Total unit volume increased 8.2 percent, up from 1.1 percent growth the previous year and marking a five-year high.

The category’s share of in-store sales saw a slight uptick to 5.43 percent.

The performance of nonedible grocery improved in 2022 after an early pandemic-driven sales spike subsided during 2021. Average sales per store of nonedible grocery increased 8.2 percent to $30,473, up from 2.6 percent growth in 2021.

Most segments within the category saw sales rise last year. Laundry care experienced the most growth for the second year in a row, rising 21.9 percent in average sales per store. Top segments paper/plastic/foil

products and household care also saw per-store sales rise 6.3 percent and 7.8 percent, respectively. Only the other nonedible grocery segment declined.

Total industry sales of nonedible grocery increased 8.9 percent in 2022, up from -4.1 percent in 2021. Total unit volume rose 3.6 percent, shifting course from the prior year’s 6.6 percent decline.

Nonedible grocery’s share of in-store sales held steady at 1.65 percent.

GENERAL MERCHANDISE

Sales of general merchandise cooled in 2022, with average sales per store increasing just 1.6 percent to $61,035, down from 5.3 percent growth the previous year.

The hardware, tools, housewares segment saw the most growth, with per-store sales rising 15.8 percent. The newly measured automotive products segment posted the second-largest increase at 10.5 percent. This top-selling segment, at $26,996 in average sales per store, brings in about double the dollars of smoking accessories, which ranks in second place.

Serving Ancient Grains has never been so convenient. Furmano’s Ancient Grain products are available in a variety of packaging and serving options that meet your specific needs. Whether your customers want prepared dishes or grab-and-go convenience, Furmano’s has an easy and delicious way t er simple, nutrient-rich foods they want.

Available In #10 Equivalent Pouches, 24 oz. Pouches and Individually Portioned Cups

School and office supplies and seasonal products also posted modest growth last year (up 7.2 percent and 4.8 percent, respectively). A big drop in sales of personal protective equipment contributed to a 55.6 percent decline in the all other general merchandise segment.

Total industry sales of general merchandise rose 2.2 percent, a slowdown from the prior two years. Total unit volume decreased 3.1 percent, continuing a streak of declining volume.

The category’s share of in-store sales fell less than one point to 3.3 percent.

The health & beauty care (HBC) category in 2022 saw significant growth in some segments while others showed more modest improvement. Average sales per store of HBC increased 6 percent to $12,122, up slightly from 5.7 percent growth the prior year.

Liquid vitamins/supplements/energy saw average sales per store drop 4.2 percent following an impressive jump of 25.2 percent in 2021, causing it to fall to the No. 2 segment in the category. Family planning was the only other segment to experience a sales decrease.

HEALTH & BEAUTY CARE

Vitamins/supplements, the new No. 1 segment in the category, spiked 21.5 percent in per-store sales, and cold/ cough remedies also grew an impressive 14.3 percent in average sales per store.

Total industry sales of HBC increased 6.6 percent, the largest growth of the last five years. However, total unit volume fell 0.5 percent, returning to a streak of declines apart from 2021.

The category’s share of in-store sales stayed virtually the same at 0.65 percent. CSN

The 48th annual Convenience Store News Industry Report features data from a variety of sources in order to provide a complete picture of the financial health of the convenience store industry. Store census data was provided by TDLinx, which maintains a national count of c-store locations based on NACS’ definition of a convenience store. Sales data for most categories was provided by NIQ from its Convenience Track retail measurement service, which is based on UPC sales and other methods that are counted through the use of point-of-sale scan data, as well as from data captured via electronic invoice and sales audits. Additionally, non-UPC coded merchandise, including prepared food and hot, cold and frozen dispensed beverages, was provided by a retailer survey conducted by Convenience Store News. Government sources include the Census Bureau of Labor Statistics, Department of Energy, and Federal Tax Administration.

Note: In 2022, NIQ changed definitions within several categories and restated previous results to reflect these revisions. These categories are indicated within this report.

THE CONVENIENCE STORE industry is coming off a relatively quiet year in terms of mergers and acquisitions (M&A). Yes, deals still got done, but when it comes to the 2023 Convenience Store News Top 100 ranking, the moves resulted in very little change.

After crunching the numbers, this year’s Top 100 report reveals that just six convenience channel retailers made notable jumps up the ranks, led by Houston-based Break Time Corner Market LLC, which rose from No. 67 in 2022 to the midway mark of No. 50 in 2023.

Six companies also cracked into this year’s Top 100, led by Shell Retail and Convenience Operations LLC, a wholly owned subsidiary of Shell Oil Products US, following its acquisition of the Timewise brand from Houston-based Landmark Industries.

That being said, the top five chains remain intact. Taking the No. 1 spot for another year is 7-Eleven Inc. The Irving, Texas-based retailer has a total U.S. store count of 12,763 locations, according to TDLinx, which partners with CSNews for this annual report.

7-Eleven is again followed by Laval, Quebec-based Alimentation Couche-Tard Inc. (5,716 c-stores), Ankeny, Iowa-based Casey’s General Stores Inc. (2,489), Westborough, Mass.-based EG America (1,681) and Richmond, Va.-based GPM Investments LLC (1,491).

Rounding out the top 10 are El Dorado, Ark.-based Murphy USA Inc. (1,105 stores), Media, Pa.-based Wawa Inc. (998), Tulsa, Okla.-based QuikTrip Corp. (992), La Crosse, Wis.-based Kwik Trip Inc. (829) and Altoona, Pa.-based Sheetz Inc. (679).

The 2023 Convenience Store News Top 100 looks largely like a carbon copy of last year, but recent M&A activity will shake things up in the next 12 months

In all, the top 10 chains account for a combined 28,064 stores of the industry’s overall 150,445 locations, or 18.65 percent. Broken down even further, the top three chains account for a combined 20,968 stores, or roughly 14 percent of the industry.

As evidenced by the slight movements up and down the Top 100, deals on a smaller scale did get done last year, but blockbuster transactions were nil.

The same cannot be said for 2023 so far. Only halfway through the year and the industry is already abuzz with the news that BP finalized a $1.3 billion agreement to acquire TravelCenters of America Inc. (TA). The addition of Westlake, Ohio-based TA’s 280-plus locations in 44 states will help solidify Houston-based BP’s presence in the convenience retail space. The transaction, which closed on May 15, comes as BP prepares to mark the two-year anniversary of becoming sole owner of Louisville, Ky.based Thorntons.

ARKO Corp., parent company of GPM Investments, tried to get in on the deal. The retailer made an unsolicited bid of $92 per share for TA, higher than the BP offer, which the travel center operator’s board of directors repeatedly rejected. The bidding war played out over several weeks this spring, culminating in a May 10 special meeting during which the overwhelming majority of TA stockholders voted in favor of the BP tie-up, clearing the way for the deal to close.

While dueling offers for TA was not surprising, Petroleum Equity Group CEO and Managing Director Ken Shriber was surprised TA was for sale in the first place.

“It’s a good portfolio, so I’m not surprised there’s additional interest,” he said.

The TA network comes with the benefit of existing locations, noted Terry Monroe, founder and president of American Business Brokers & Advisors. He pointed out that ARKO knows buying existing convenience stores is cheaper than building new stores — plus, the availability of a chain the size of TA is becoming less and less.

“If you look at the top 250 convenience store chains in the U.S., you will notice there are the really large chains like 7-Eleven and Circle K. Then, the number drops into the 2,000s and then, there are a few in 500-plus. And then, it really drops to 120 and less, and a lot of 25- to 75-store chains,” Monroe explained. “If you already have 2,000-plus stores and you can buy a 250-store chain and apply your buying power to the 250-store chain, there are considerable synergies that will come about.

“It is almost always more profitable to buy an existing business that has cashflow and apply your best practices and vendor relationships to the new business and generate more profit than the previous business owner,” he continued.

The bidding war for TA highlights growing interest in the travel center space. Earlier this year, Berkshire Hathaway upped its stake in Knoxville, Tenn.-based Pilot Co. to become majority shareholder, and traditional convenience store players such as QuikTrip and Atlanta-based RaceTrac Inc. have been building their own new-to-industry travel centers.

“Travel centers are [situated] on highways and have very high customer counts and volumes, and there’s additional business centers, too, that go along with it. Look at Pilot; it has foodservice, showers, trucker services and offers other kinds of fuels.

They are also [located] on big parcels of land,” Shriber said.

The increasing interest in the travel center and truck stop space speaks as well to infrastructure across the U.S. and road

transportation, he said, adding that “it’s a good business.” Travel centers may be considered almost recession-proof because there’s always going to be supplies being moved across the country.

The way Monroe sees it, those branching out into the travel center space are using “visionary thinking.”

“Most of us are guilty of linear thinking; we see the world as it is today and, in our mind, we believe going forward, the world will be the same just being extended,” he said. “However, with a lot of talk about electric cars and every year the reduction in the sale of fossil fuels at all locations across the U.S., the concept of the convenience store will change.”

Create a sales stampede with the new limited edition blend from last year’s fastest-growing moist snuff brand.

2X rewards points on every can. Online rewards points promotion drives even more sales.

Contact your sales rep today!

Only Available June 5th - August 28th

It is not hard to envision what the marketplace will look like in five or even seven years, but a visionary must look out 20 to 40 years, according to Monroe, and try to determine who their customer will be and if their business model of today will service those customers of the future.

“The successful retailers like RaceTrac, QuikTrip, Buc-ee’s, Wawa and Sheetz are building their stores with this vision in mind,” he said.

History can attest to the continuing evolution of the c-store industry, Monroe added, explaining that fuel retailing started with small buildings offering minimal

services. In time, the mechanic’s bay area transformed into a retail space selling candy bars and beverages.

“What we are seeing is a natural evolution

of what we know as the convenience store. Going forward, chances are they may not be called convenience stores or travel centers; they may be called something different,” he said. “I always think of the five-and-dime stores.

They became big-box stores, which became Walmart [and] then Walmart Supercenters.”

While M&A has been slower than in past years, convenience store retailers are not staying put — literally. Several Top 100 chains have revealed plans over the past 12 months to expand outside of what’s considered their traditional markets.

Among the top expansion moves, Sheetz named Detroit the next market on its radar, with its first Michigan store slated to open in 2025. The retailer currently operates c-stores in Pennsylvania, West Virginia, Virginia, Maryland, Ohio and North Carolina. Its move into Michigan will mark the first time Sheetz has expanded into a new state in nearly two decades, when it opened its first convenience store in North Carolina in 2004.

Additionally, Wawa closed out 2022 with news of the company’s plans to set up shop in three more states in the near future: Ohio, Indiana and Kentucky. This followed previous announcements of its intentions to enter southern and coastal Georgia, the Florida Panhandle region and the adjacent region in Alabama, Tennessee and North Carolina. Wawa expanded into Florida in 2012, followed by Washington, D.C., in 2017. Today, the Mid-Atlantic-based retailer also operates in the states of Pennsylvania, New Jersey, Delaware, Maryland and Virginia.

Lake Jackson, Texas-based Buc-ee’s is another notable retailer expanding its reach. What was once an exclusively Texas brand, Buc-ee’s can now be found in several regions across the United States. Since beginning a multistate expansion in 2019, Buc-ee’s has opened travel centers in Alabama, Florida, Georgia, Kentucky, South Carolina and Tennessee. Its current agenda calls for new sites in Colorado, Missouri, Virginia and Wisconsin.

According to Shriber, these operators all have great business models and a winning formula wherever they go. For instance, looking at Buc-ee’s, he calls out its proprietary food offerings and the retailer’s focus on employee training, pay and benefits. “It’s a destination. Wherever they go, the customers follow,” he said.

Monroe agrees. “The retailers you mention are very successful presently and know in detail the demographics of who their customers are and are able to use this data to overlay it into areas where there is a void

in the marketplace and their business model will service the customers in that area,” he said.

Referring to Walmart’s expansion strategy 60 years ago, Monroe pointed out that the big-box retailer’s business model was to service the marketplace with a large selection of products at a low price in areas that did not have anyone servicing them.

“Isn’t this what Buc-ee’s, Wawa and Sheetz are doing? Offering more foodservice and a wide selection of products in areas where such an array of products and services are not being offered?” he posed. “Remember, there are over 150,000 convenience stores in the United States, but how many of those are kiosks or small stores? Some areas of the United States may have 20 of these kind of convenience stores servicing a certain area where a Buc-ee’s or Wawa or Sheetz comes in and offers a multitude of services under one roof. More convenience and more products in one stop for the customer, it is a natural evolution.”

As mentioned earlier, 2023 is shaping up to be busier than 2022 in terms of M&A activity and this goes beyond just the blockbuster BP and TravelCenters of America tie-up.

In mid-April, news broke that Salt Lake Citybased Maverik — Adventure’s First Stop is acquiring Kum & Go LC, a chain of more than 400 c-stores across 13 states, from the Krause Group. As part of the deal for the Des Moines, Iowa-based retailer, Maverik will also acquire Solar Transport, a tank truck carrier and logistics provider owned by the Krause Group.

“What we are seeing is a natural evolution of what we know as the convenience store.

Going forward, chances are they may not be called convenience stores or travel centers; they may be called something di erent.”

— Terry Monroe, American Business Brokers & Advisors

A week after the Kum & Go news, Franklin, Tenn.-based MAPCO Express Inc., a subsidiary of COPEC, a leading South America-based retail company, revealed that it is selling its business to two separate buyers: CoucheTard and Lawrenceville, Ga.-based Majors Management Inc.

Couche-Tard inked an agreement to acquire 112 MAPCO convenience store and fuel sites in Tennessee, Alabama, Kentucky and Georgia. Majors Management is purchasing the remaining locations, the MAPCO My Rewards loyalty program and the MAPCO brand.

“The demand for businesses with good cashflow and good assets is still in demand and will continue to grow,” Monroe said.

“There are many smaller and midsized convenience store chains in the United States that are owned by baby boomers who are at retirement age. Consolidation of the convenience

store industry is not slowing down anytime soon.”

He also shared that his company, American Business Brokers & Advisors, gets no less than two inquiries a week from qualified financial buyers outside of the industry wanting to purchase convenience stores because of the consistent cashflow the channel has generated over the years.

“The last four years, we have seen more acquisitions in the convenience store space be more aggressive than the first 20 years, and we anticipate the pace for acquisitions to increase due to the fact there are a lot of small chains that are thinking about exiting the business and most of the ‘A’ sites in the towns across the country are already taken," Monroe added.

Shriber agrees that M&A activity in the industry will continue at least over the next 12 to 24 months, but with higher interest rates and lower multiples. “It will be a continuation of those smaller deals, with some surprises,” he said, pointing to the BP and TA transaction. CSN

SHELL STRENGTHENS ITS U.S. MARKET PRESENCE WITH THE ACQUISITION OF TIMEWISE STORES

Shell is a well-known and well-established brand in the U.S. convenience and fuel retailing industry but, this year, Shell Retail and Convenience Operations LLC makes its debut on the Convenience Store News Top 100 thanks to a move into the company-owned column.

Driven by its recent acquisition of company-owned fuel and convenience sites from Houston-based Landmark Industries, Shell Retail and Convenience Operations, a wholly owned subsidiary of Shell Oil Products US, claims the No. 40 spot in this year’s ranking.

The two companies inked the deal in the fall of 2021 and closed the transaction in June 2022. When first announced, the purchase included 248 company-owned convenience stores and gas stations. However, the two sides amended the pact to remove company-owned Landmark sites that currently sell Exxon Mobil-branded fuels.

The convenience stores acquired by Shell operate in Texas under the Timewise banner. The chain began operations in 1982 with one store in Hempstead, Texas. Over the past 40-plus years, Timewise has grown in and around the Houston, San Antonio, Austin and Laredo markets.

According to Shell, this acquisition brings the company closer to its customers and enhances its market presence by growing its mobility footprint in a key region of the United States.

The transaction also included Shell purchasing the remaining 50-percent share in Texas Petroleum Group LLC (TPG), previously a 50/50 joint venture between Equilon Enterprises LLC dba Shell Oil Products US and Landmark Industries Holdings Ltd. TPG will now be a wholly owned subsidiary of Shell Retail and Convenience Operations.

WHEN JIMMY BIR SINGH was looking to add a foodservice component to his new 11,000-square-foot travel plaza with a convenience store currently under construction in Dandridge, Tenn., there were two key things to consider: He needed a concept that would allow him to offer prepared food items from early morning through evening’s end, and one that would be competitive while differentiating his store from the branded restaurants already in his market.

Singh ultimately settled on Jack in the Box, a San Diego-based quick-service restaurant (QSR) chain that has 83 units at c-stores nationwide, with additional signed deals in the pipeline.

“I chose Jack in the Box because they checked all of the boxes. It is an iconic brand that offers a great menu for all dayparts, including breakfast, lunch, dinner, snack occasions and late night,”

said Singh, who believes truckers and motorists will enjoy the variety he’s able to offer. “I considered opening my own concept, but I am located next to Interstate 40 and I believe Jack in the Box will bring in more people."

Singh is just one of the myriad convenience store operators navigating the world of foodservice today — a world that all c-store retailers must explore to remain competitive in today’s highly competitive, continuously evolving marketplace.

Foodservice, of course, is nothing new to the convenience channel. Van Ingram, vice president of franchise development for Jack in the Box, said he’s seen the category trending since the 1990s when he worked on the wholesale petroleum side of the industry.