INFLATION, HIGHER OPERATING COSTS AND LOWER FUEL PRICES TOOK THEIR TOLL IN 2023

• Establishes a digital foundation to optimize the ATC 21+ journey

• Enables an integrated marketing approach focused on the ATC 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Help responsibly connect and engage with your ATC 21+ in the digital environment

Invest in digital infrastructure that responsibly optimizes and enables new channels for ATC 21+ experiences

Meet the evolving ATCs 21+ expectations to improve consumer experiences by enhancing retail digital capabilities and building a foundation of responsibility

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

EXECUTE

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

It would be wise to focus on value this year as inflation is sticking around

THE SUMMER SEASON is upon us, and there’s some good news for the convenience store industry: easing gas prices are expected to prompt more drivers to hit the road this summer.

According to GasBuddy’s “2024 Summer Travel Survey,” more than three-quarters of Americans (76%) plan to take a road trip between Memorial Day and Labor Day — a significant increase from 18% last year. The average traveler actually has two road trips planned, with nearly half (49%) expecting to drive five or more hours to reach their destination.

More road trips mean more stops at c-stores and travel centers across the country.

Leading up to Memorial Day 2024, announcements started pouring in from retailers unveiling new products, promotions and sweepstakes for the summer season:

• Casey’s General Stores Inc. kicked off the season with the introduction of a BBQ Pulled Pork Pizza and a King’s Hawaiian Pulled Pork Slider. Over the next few months, Casey’s will offer deals such as a large specialty pizza for just $14 on Mondays, Tuesdays and Wednesdays through June 25; buy one, get one 50% off any large single-topping pizza through June 25; buy any large pizza, get a large single-topping pizza 50% off from June 26 through Sept. 3; and $3 cheesy breadsticks with any large pizza through Sept. 3.

• 7-Eleven Inc. ushered in summer with the introduction of new sweet and spicy items: the Mangonada Donut with Tajin seasoning and the limited-edition Peach Candy Lemonade Slurpee. 7Rewards and Speedy Rewards members can get discounts on summertime favorites, including any-size Slurpee drink and bagged

EDITORIAL EXCELLENCE AWARDS (2016-2024)

2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022 Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015 Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

candy for $2 through Aug. 27, and a small Slurpee drink for just $1 through Jan. 7, 2025.

• For the first time since coming together as one entity in 2023, Maverik — Adventure’s First Stop and Kum & Go are offering consistent summer savings on fresh food, sweet treats and beverages across their combined 20-state footprint. Among the highlights, Maverik and Kum & Go rewards members can take part in the 89-cent Fountain Frenzy through Oct. 1, available for up to a large-size fountain drink.

• GPM Investments LLC, a wholly owned subsidiary of ARKO Corp., is holding a “100 Days of Summer” promo through Sept. 3. Available across ARKO’s network of brands, the company’s partnership with various suppliers will enable customers to save on numerous products, including beverages, food and candy. Extra discounts will be available to fas REWARDS members.

• TravelCenters of America (TA), part of the bp portfolio, is hosting “Summermania” from May 24 through Sept. 2. Customers have the chance to win more than $100,000 in prizes, including candy for a year, a free meal every week at Country Pride or Iron Skillet, and free gas for a year via a bp gift card. Everyday giveaways will include a free fountain drink or coffee, a free meal at one of TA’s quick-service restaurants and a free meal at one of TA’s full-service restaurants.

These retailers are wise to focus on deals this year as inflation persists and expenses are a major factor shaping summer travel. Roughly 63% of the respondents to the GasBuddy survey cited cost as their top consideration when planning trips. Maximize the 2024 summer season by letting travelers — and locals alike — know how you provide value.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017 Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

Caffeine from black and green tea.

All convenience retailers should review their hiring practices

I’M SURPRISED there hasn’t been more uproar from the convenience store industry about the U.S. Equal Employment Opportunity Commission’s (EEOC) lawsuit accusing Sheetz Inc. of racially discriminatory hiring practices for running background checks for criminal convictions on all job applicants and then allegedly denying them employment based on those records.

As reported in April on CSNews.com, the federal agency claims that the convenience store operator has maintained a longstanding practice of screening all job applicants for records of criminal conviction and then denying them employment based on those records. This disproportionately screened out Black, Native American/Alaska Native and multiracial applicants, which violated provisions of Title VII of the Civil Rights Act that prohibit disparate impact discrimination, the lawsuit states.

At a time when finding reliable workers is a major problem for c-store retailers, actions like this from the federal government only make the problem worse.

I’m not a lawyer, and I don’t know the specific details of the EEOC’s suit, but it seems to me that there are so many things questionable about this action.

Sheetz has been one of the more progressive companies in the c-store industry when it comes to diversity and inclusion. An integral part of the company’s corporate strategy is its IDEA (Inclusion, Diversity, Equity and Accessibility) Initiative.

The EEOC lawsuit doesn’t allege that Sheetz was motivated by race when making hiring decisions. Yet, the federal agency claims that doing criminal background checks discriminates against minorities because Black men’s imprisonment rate is nearly seven times higher than White men and almost three times higher than Hispanic men. The EEOC calls this “disparate impact” and uses this statistical disparity to justify designating criminal offenders as a “protected class” under federal civil rights law.

Sheetz, like many other forward-thinking companies, has Employee Resource Groups (ERGs) to support Black, female, LGBTQIA+ and Latinx employees. If the EEOC has its way, the company will have to start an ERG for ex-cons.

I joke about the ERG, but it’s no joke if this EEOC lawsuit is successful, or if the federal agency starts going after other retailers that perform criminal background checks on prospective employees. At a time when finding reliable workers is a major problem for c-store retailers, actions like this from the federal government only make the problem worse.

Sheetz, in a statement, said that it has attempted to work with the EEOC for nearly eight years to find common ground and resolve this dispute. “We will address the claims in court when the time comes,” the company told Convenience Store News

I don’t think employers should automatically disqualify any job candidate with a criminal history. However, the employer should be able to consider how appropriate that person’s record may be for the specific responsibilities of the job being filled. Hiring decisions should always be on a case-by-case basis. It’s probably a good time for other companies in the industry to review their own hiring practices to ensure they meet EEOC guidelines.

In 2019, a federal appeals court sided with the state of Texas when it challenged EEOC guidance against using criminal background checks in hiring decisions. Hopefully, the Sheetz case will have a similar outcome.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

Limited-Edition Longhorn Americana gives your customers the satisfaction they want at a price that drives your sales.

Summer Release: June 3rd (first ship) — August 3rd. Contact your sales rep today!

FEATURES

COVER STORY

30 A Trying Year

Inflation, higher operating costs and lower fuel prices took their toll in 2023.

TOP 100

52 Slow Motion

Settling from the impact of three big deals in 2023, questions surrounding the imminency of c-store industry M&A for the remainder of 2024 swirl.

E DITOR’S NOTE

4 Maximize the Summer Season

It would be wise to focus on value this year as inflation is sticking around

VIEWPOINT

6 EEOC Suit Impacts

More Than Just Sheetz

All convenience retailers should review their hiring practices.

SMALL OPERATOR

24 Trust & Transparency

Strong partnerships with distributors and suppliers help small operators stay competitive.

TWIC TALK

78 Addressing Ageism

Nearly eight in 10 women have experienced age-related discrimination in the workplace.

INSIDE THE CONSUMER MIND

98 Earning Loyalty

Satisfaction with c-store loyalty programs is declining among active members.

67 Taking the Branded Route C-store operators can realize multiple benefits from partnering with a recognizable

74 Transformation Through Technology Convenience store retailers discussed their journeys at the 2024 Conexxus Annual Conference.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT-GROUP PUBLISHERUS GROCERY & CONVENIENCE GROUP Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

SENIOR MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER

CHIEF OPERATING OFFICER

Entitled “It’s Not Crazy, It’s Casey’s,” the campaign highlights how the brand stands out in the increasingly personalized, guest-centric and digital-forward convenience store channel. Casey’s points to its high-quality food offerings, unique limited-time menu options and value-driven products.

The pilot site, which opened eight years ago at the intersection of Peachtree and 6th streets in Atlanta, will be used as a “learning experience” to help the brand as it expands. The company is in the process of identifying a new Atlanta location for a full-service store.

Effective July 1, the salary threshold for overtime protection will increase to the equivalent of an annual salary of $43,888 before increasing to $58,656 on Jan. 1, 2025. The rule, according to NACS, will reduce employees’ flexibility and its costs will fuel inflation.

On April 26, the retailer officially opened in Fairhope, Ala., the first of three sites slated to open in the South Alabama market before the end of summer. Overall, Wawa plans to open seven to 10 stores in the Baldwin County and Mobile markets over the next three to four years.

1 3 4 5 2

The retailer is focusing on adding new and remodeled convenience stores as a key strategic move, with 30 to 35 new stores projected to open this year. Currently, 22 raze-and-rebuilds are underway along with nine new-to-industry stores, including new QuickChek branded stores.

A big hurdle for many convenience store retailers is spotting the sneaky “margin creep” and “revenue creep” that come from ineffective promotions, writes Patrick O’Mara, a solution principal for RELEX Solutions, a supply chain management software provider. Without a clear method to analyze these promotions, stores could be unknowingly hurting their profits. For instance, a promotion intended to boost sales might instead cannibalize sales of other products or shift demand without genuinely increasing revenue. Adopting advanced artificial intelligence and machine learning-driven analytical tools can provide c-stores with the insights needed to make informed decisions.

In an era of substantial consolidation, Hot Spot — the convenience store banner of R.L. Jordan Oil Co. of North Carolina — has worked to maintain its ever-growing family roots. Celebrating its 75th anniversary this year, the company now employs three generations of Jordans, with the children of founder Robert L. Jordan all co-owning the business.

Employee retention and relationships have played a big part in allowing R.L. Jordan Oil to maintain its independence for so long. Current CEO Wilton L. Jordan talked with Convenience Store News about the family’s history and the way it’s intertwined with the company itself.

For more exclusive stories, visit the Special Features section of csnews.com.

Häagen-Dazs unveils two new options in its ice cream bar line, Dulce de Leche and Chocolate Cookie Crumble. The Dulce de Leche bars feature ice cream mixed with swirls of dulce de leche sauce coated in milk chocolate, while the Chocolate Cookie Crumble bars include sweet cream ice cream with a touch of Madagascar vanilla and fudge swirls, dipped in milk chocolate and covered with chocolate cookie pieces. Both offerings are now available at select locations in six-count minis for $6.99 and three-count full-sized for $5.99.

The sale of tobacco products including e-cigs is prohibited to persons under 21.

Don’t get fined. Scan to learn more.

The Biden Administration hits the pause button due to “an immense amount of feedback”

A FEDERAL BAN on menthol cigarettes has been delayed again and this time, the Biden Administration is pointing the finger at the amount of feedback received on the proposal.

The proposed ban was first delayed in December 2023, with plans to finalize pushed back. In a statement issued on April 26, U.S. Health and Human Services Secretary Xavier Becerra said the proposed ban “will take significantly more time.”

“This rule has garnered historic attention, and the public comment period has yielded an immense amount of feedback, including from various elements of the civil rights and criminal justice movement,” Becerra explained. “It’s clear that there are still more conversations to have, and that will take significantly more time.”

In published remarks, administration officials stated that they are still committed to implementing a ban. Menthol cigarettes account for approximately 34% of cigarette sales, according to NACS.

In early May, the African American

Tobacco Control Leadership Council, Action on Smoking and Health and the National Medical Association filed a lawsuit against the U.S. Food and Drug Administration (FDA) in response to its inaction on the proposed ban. This is the second suit the groups have brought against the administration, after an initial filing in June 2020 that specifically sought to compel the FDA’s determination on whether to add menthol to the list of prohibited characterizing flavors.

The pending menthol ban has received opposition from other groups, including NACS. The association argues that prohibition does not rid these products from society, but instead pushes current users to the illicit market, creating an issue for society as a whole and undermining the compliance efforts and investments made by responsible tobacco retailers. In addition, prohibition leads to an influx of these products on the illicit market and illicit sellers do not comply with laws limiting sales to minors, NACS noted.

“We appreciate the willingness of the Department of Health and Human Services to give more consideration to its policies relating to menthol cigarettes,” said Doug Kantor, general counsel at NACS. “Real-world data and results have shown that prohibition of menthol cigarettes does not reduce smoking or advance public health. Instead, like the experience with prohibition of other entrenched products, it simply leads to more illicit sales. We hope the weight of evidence showing the ineffectiveness of what was originally proposed leads the department to change course entirely.”

“T v or us and w ”

Gregory, Exec. Director, Newnan, GA

“T v incr I ”

Tony, Owner Operator Willoughby, OH o hav his.

and much mor ganiz ”

Rutter’s broke ground on a 13,500-squarefoot prototype store, due to open later this year in central Pennsylvania. Located near Milton in Northumberland County, the design features an entirely new look that the company said has “game-changing features.”

Wawa Inc. cut the ribbon on its first North Carolina store in Kill Devil Hills. The retailer plans to open 90 stores throughout the state in the coming years, with locations planned for the Wilmington, Jacksonville and Fayetteville areas.

The first new Enmarket store of 2024 opened its doors in Savannah, Ga., bringing the chain’s network to 131 locations. The 6,098-square-foot store features

an Enmarket Eatery and a Marketwash car wash situated at the east end of the property.

ARKO Corp. subsidiary GPM Investments LLC broke ground on its 65th Fast Market convenience store. The 5,600-square-foot location is slated to open later this year in Gilbert, Ariz., and will offer many new foodservice menu items.

Love’s Travel Stops reported that it opened a new location in St. Augustine, Fla.; rebuilt an existing location in Troutdale, Ore.; and cut the ribbon on five new Speedco locations. Love’s also completed upgrades to two existing maintenance shops.

bp is looking to expand its U.S. electric vehicle (EV) charging unit following news that Tesla abruptly disbanded its EV charging team. The energy company will prioritize the Northeast, West Coast, Sun Belt and Great Lakes regions.

24_003915_Conv_Store_News_JUN Mod: May 16, 2024 1:54 PM Print: 05/17/24 page 1 v2.5

Foxtrot and Dom’s Kitchen & Market shuttered their combined 30-plus locations on April 23. The decision came less than six months after the two retailers joined forces under a new entity, Outfox Hospitality.

TravelCenters of America (TA) partnered with The NATSO Foundation to equip all TA Truck Service Emergency Roadside Assistance vehicles with the HAAS Alert Safety Cloud digital alerting platform. The software sends “slow down” and “move over” alerts to oncoming drivers.

Kwik Trip Inc.’s newest innovation combines the snackability of two customer favorites: doughnuts and chips. Blueberry Dunker flavored URGE potato chips are a

LSI Industries Inc. is acquiring EMI Industries for an all-cash purchase price of $50 million. The lighting and display solutions company will retain EMI Industries’ leadership team and its five production facilities.

Certain subsidiaries of Utz Brands Inc. entered into a definitive agreement for the sale of certain assets to Our Home, an independent better-for-you platform. Included in the deal are Utz’s Berlin, Pa., and Fitchburg, Mass., manufacturing facilities.

McLane Co. Inc. cut the ribbon on an Innovation Kitchen at the company’s headquarters in Temple, Texas. Featuring a full-scale replica of the complete c-store experience, it showcases how innovative

nod to the chain’s popular Blueberry Dunker doughnuts, which debuted in 2013.

Gas N Wash, in partnership with Rovertown, unveiled an enhanced mobile app and rewards program following a successful soft launch in 2023. The app allows users to save at the pump, collect cash back on in-store purchases and earn complimentary car washes.

H&S Energy Products LLC is teaming up with Liquid Barcodes Inc. for a new car wash subscription program. The offering will roll out to the retailer’s 170-plus ExtraMile and Power Market convenience stores.

Wesco Inc. reported that it surpassed $3 million in annual sales last year. The western Michigan-based chain achieved 43% growth in delivery service operations in 2023. Delivery is offered at approximately 33 stores.

retail foodservice equipment and products from the distributor can fit into various footprints and counter spaces.

The Coca-Cola Co. is launching CocaCola Lens, an insights platform designed to empower operators in the foodservice and retail industries to make data-driven decisions. To kick off the platform, there are 16 stories covering topics as broad as macroeconomic trends and as tailored as premium water trends.

Mars Inc. will invest $47 million over three years to reduce the carbon footprint of its dairy sourcing. This initiative is in line with the company’s 2030 ambition to slash emissions by 50%.

49%

of 8- to 18-year-olds report that they like to post about their restaurant experiences on social media.

— Y-Pulse

The U.S. gift card market is forecasted to reach a value of more than $247 billion by 2027.

— Blackhawk Network & NAPCO Research

30%

The average number of unique drivers using workplace charging ports throughout the last year jumped 30%.

— ChargePoint & CBRE Group Inc.

The Coca-Cola Co. introduces a new offering to the ready-to-drink coffee market. Made with real cane sugar, dairy milk and approximately 85 milligrams of caffeine, Costa Iced Coffee Lattes are available in three flavors: Mocha, a fusion of coffee with a hint of chocolate; Caramel, which contains 40% less sugar than other brands; and Signature Blend, a traditional coffee blend with just a hint of sweetness. The line underwent a successful pilot this past fall and is now expanding its footprint across U.S. markets, including at select 7-Eleven and QuikTrip stores. Costa Iced Coffee Lattes come in 11-ounce cans with a suggested retail price of $3.49. THE COCA-COLA CO. • ATLANTA • US.COSTACOFFEE.COM

Hubba Bubba Skittles Mini Gum

Mars Inc.’s Hubba Bubba gum brand unveils a new format: mini gum. The first product in the line is Hubba Bubba Skittles Mini Gum, which features a mix of fan-favorite Skittles original flavors, including lemon, strawberry, grape, orange and lime. The first new gum format from the brand since 1988, Hubba Bubba Skittles Mini Gum’s poppable pieces are now available at select retailers in 40-count bottles and 120-count stand-up pouches. Mars plans to continue rolling out the product nationally throughout the year. MARS INC. • NEWARK, N.J. • HUBBABUBBA.COM

Aspire Drinks introduces a new look for its Healthy Energy Drinks line, a refresh that will be supported by an integrated marketing campaign featuring a national influencer program, updated social media, sampling events and public relations. The beverages have no sugar but contain 80 milligrams of caffeine; B and C vitamins that are intended to enhance clarity and focus; biotin that, according to the company, can support healthy skin and nails; ginger root for circulation; and L-carnitine for a more effective metabolism. The line is keto friendly, vegan, gluten free, soy free, kosher and suitable for people with diabetes. Available nationwide, Aspire Healthy Energy Drinks are sold as individual cans, four-packs, 12-packs, 15-packs, 18-packs and 24-packs.

ASPIRE DRINKS • CHICAGO • ASPIREDRINKS.COM

Rich’s Turtle Cheesecake Mousse Parfait Rich Products Corp. presents Our Specialty Treat Shop Turtle Cheesecake Mousse Parfait, a layered dessert featuring a cheesecake mousse on a bed of chocolate crumbs, topped with caramel, chocolate chips and pecans. This indulgent treat arrives frozen, fully finished and retail ready in a convenient 5.75ounce cup. The refrigerated shelf life is eight days while the frozen shelf life is 365 days. The product comes eight per case, with a suggested retail price range of $3.49 to $3.99 per serving.

RICH PRODUCTS CORP. • BUFFALO, N.Y. • RICHSCONVENIENCE.COM

CIMA Cash Handling America Inc. releases the CasHere 9000, a compact, high-capacity cash recycler for back-office retail cash management. The CasHere 9000 is an all-in-one cassette-based, cash-in, cash-out cash recycler that offers increased capacity and up to 20 possible configurations. The recycler accepts, authenticates, stores and dispenses banknotes through a high-capacity input/output/reject slot, with banknote detection handled by a validator that can either perform authenticity detection only or incorporate banknote fitness sorting. Recycling and storage are carried out via five scalable cash boxes/cassettes with a range of features. The CasHere 9000 can also be paired with a coin recycler. CIMA CASH HANDLING AMERICA INC. • HOUSTON • CIMA-AMERICA.COM

BIC relaunches its Maxi Pocket Lighters in the new Special Edition Vacation Series. Featuring designs of sunny beaches, relaxing hammocks at sunset and surfers ready to hit the waves, this series may have a spring launch, but it is ready for summer, according to the company. Like all BIC Maxi Lighters, the Pocket Lighters are long-lasting, reliable and 100% quality inspected. The Special Edition Vacation Series comes with a suggested retail price of $2.39 per lighter.

BIC USA INC. • SHELTON, CONN. • US.BIC.COM/EN_US

Haribo brings a new entry to its line of shaped gummi candies. Unicorn-i-licious combines the brand’s signature chew with whimsical unicorn shapes. Featuring a rainbow array of unicorns in six flavors — apple, blue raspberry, berry punch, banana, cotton candy and tangerine — the offering marks the company’s first gummi to feature unicorns and is exclusive to the U.S. market. In addition to the new shape, Unicorn-i-licious introduces the Cotton Candy flavor to U.S. Haribo products. The item is now available nationwide.

HARIBO • ROSEMONT, ILL. • HARIBO.COM

Prairie Farms Mocha & Caramel Iced Coffee

Prairie Farms Dairy Inc. expands its presence in the bottled drink category with two new single-serve options for the brand’s Barista Style Iced Coffee: Mocha and Caramel. With the company’s iced coffee options previously available only in half-gallon cartons, on-the-go customers can now find the product in more convenient 14-ounce bottles. Prairie Farms Barista Style Iced Coffee is available at convenience stores, as well as grocery and mass merchandiser outlets, throughout the United States.

PRAIRIE FARMS DAIRY INC. • EDWARDSVILLE, ILL. • PRAIRIEFARMS.COM

Gerrit J. Verburg Co. Classic Gum Brands

Gerrit J. Verburg Co. is bringing back to market four different classic gum brands in bitesize, sugarless form and covered in a hard shell coating. Beemans, Black Jack, Clove and Gerrit’s Teaberry chewing gums now come in recloseable tubes to maintain freshness, and are gluten free and GMO free. Beemans, Black Jack and Clove are long-established brands with histories stretching back to the late 19th and early 20th centuries.

GERRIT J. VERBURG CO. • FENTON, MICH. • VINTAGEGUMS.COM

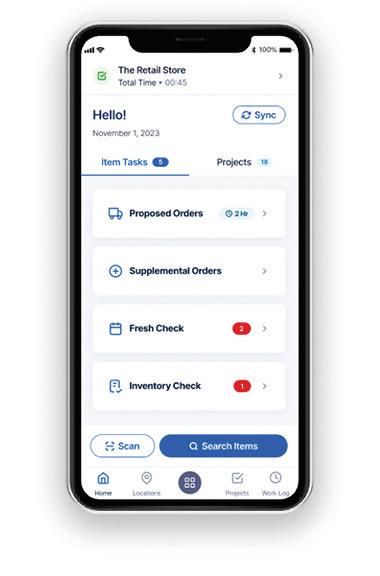

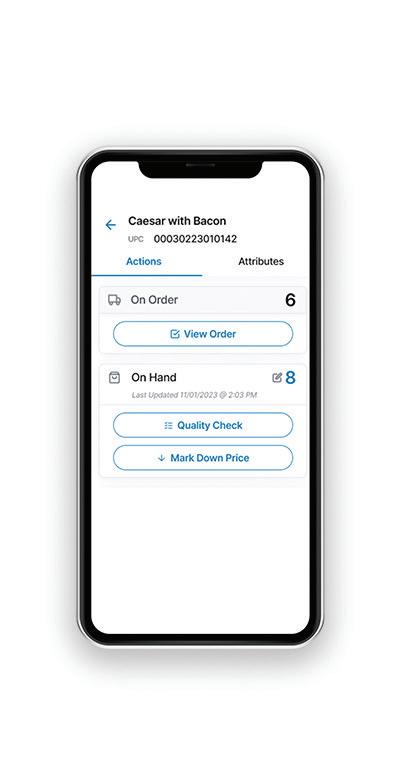

RELEX Mobile Pro

RELEX Solutions introduces RELEX Mobile Pro, an AI-driven, in-store execution application for retailers, suppliers, wholesalers and manufacturers. As a platform to help retailers consolidate their in-store tools and processes, Mobile Pro offers a range of capabilities to streamline inventory management and ensure fresh departments are up-to-date. Users can review and amend orders based on suggested replenishment amounts and make modifications based on stock counting updates. The solution also allows for ad-hoc order creation to address unexpected needs, while scanning and search functionalities enable users to instantly access product-specific data while in-store.

RELEX SOLUTIONS • ATLANTA • RELEXSOLUTIONS.COM

Strong partnerships with distributors and suppliers help small operators stay competitive

By Renée M. CovinoHISTORICALLY, the practice of convenience store retailers aligning with suppliers and distributors to fulfill the quick needs of their customers has given the advantage to larger chains and their bigger buying power.

However, the COVID-19 pandemic produced something of a supply-chain silver lining across the channel. Large retailers, small retailers, suppliers and distributors were all in the same overturned boat. Trust and transparency were heightened like never before in order to produce solutions to get everyone back on track. The result: updated best practices in collaboration that recognize forward-thinking small operators in a bigger way.

The pandemic accelerated the need for greater access to real-time data to inform decision-making amid supply chain disruptions, labor shortages and decreases in consumer spending, noted Blake Weber, retail technology project manager at Clarkston Consulting, based in Atlanta. “While these challenges may have added tensions to some existing retailer/supplier relationships, overall we are seeing that they have actually driven collaboration and

trust in the partnerships, large and small, as both sides have worked together to navigate these issues,” he told Convenience Store News.

For example, Weber cited that exchanging inventory and forecast data is now providing advanced visibility to avoid retail stock-outs; outsourcing inventory management to suppliers and distributors is removing friction in the retail ordering process and ensuring shelves are quickly replenished; and collaborating on managing promotions and leveraging historical sales data is driving promotion efficiency and execution.

“As smaller c-store operators adjusted to industrywide changes, they have been exploring ways to lean into the supplier and distributor partnerships to achieve efficiencies in resourcing and costs,” he added. “Rather than selecting suppliers based on costs and margins, c-store operators are evaluating relationships more holistically through the lens of creating long-term, mutually beneficial — and profitable — partnerships that will ultimately provide the best experiences for their customers.”

The pandemic inspired positive changes in how Lacey, Wash.-based Harbor Wholesale, the largest independent distributor in the West, serves small operators. The fourth-generation, family-owned company serves more than 6,000 convenience stores, independent grocers and

quick-service restaurants with a selection of local and national products, business solutions and its proprietary Real Fresh Brands items.

“We started doing more with social media and e-newsletters to ensure that all the information was getting to our retailers,” said Harbor Wholesale President Rick Jensen. “Our product mix also shifted; we added more traditional grocery items to support the local communities our retailers serve. Lastly, we became more flexible in order to manage through supplychain challenges and changes in product availability.”

Because Harbor Wholesale is a familyowned company that’s “entrepreneurial at heart, we understand the unique challenges the independent business owner faces,” Jensen explained, noting that the distributor is currently working with its c-store partners on high-quality foodservice programs, promotional activity and store-level rebates through its Harbor Rewards program, and a new seasonal candy program to get more consumers inside the stores and drive incremental sales.

“We have grown with our independent c-store customers,” Jensen said. “As their needs change and grow, we continue to learn and add new solutions to our business. Our mission is dedicated to supporting the local entrepreneurs that provide jobs in their communities, bring convenience to busy lives, and invite us all to experience life around the table every day.”

The pandemic has had a lasting impact on

“Rather than selecting suppliers based on costs and margins, c-store operators are evaluating relationships more holistically through the lens of creating long-term, mutually beneficial — and profitable — partnerships that will ultimately provide the best experiences for their customers.”

— Blake Weber, Clarkston Consulting

Temple, Texas-based McLane Co. Inc., one of the largest distributors in America, as well, according to Jeff Opp, who serves as sales director for independent business. Since then, McLane has reimagined and launched a new pizza program, beverage program, fresh program and more with an emphasis on innovation, on-trend items and being a strategic growth partner, as well as a one-stop-shop for the convenience store industry’s smaller players.

“We want to equip the smaller c-store to succeed to the highest quality with turnkey programs,” Opp stated. “We have trucks making deliveries in every zip code in the country, essentially. We know we can reach them, and we think we have the assortment and tools to help them grow.”

• Maintain transparent and frequent communication. Establish how that will take place at the onset of the relationship.

• Share the “why” behind changes, good or bad, within the business. Often, this is all it takes for patience and understanding on both sides.

• Have conversations about your short- and long-term growth strategies. Try to avoid surprises.

• Decide if the distributor/supplier will act as category manager. Regardless, take the time to listen and learn when a supplier/distributor shares knowledge.

• Challenge your partners to provide category and trend information you don’t know.

• Be open to new ideas and methods to generate additional revenue.

• Work with your reps to ensure you understand all the products, discounts, rebates, programs and elements of support being offered.

• Secure access to supplier/distributor data so that you can make more datadriven decisions on future procurement and merchandising activities.

• Embrace resiliency and adaptability to better meet the needs of consumers.

While the consensus is that the pandemic accelerated a better world of partnerships for small operators, the question now is: What will make them even better?

Recognizing that small operators don’t often have the staff to study and analyze their businesses, Bill Nolan, a partner with Business Accelerator Team, a group of c-store industry consultants based in Phoenix, hopes they can let go more and rely on suppliers and distributors to provide trends in the marketplace, new item and promotional insights/opportunities, and assistance with planograms and seasonal resets.

“The partnerships that improve the most will be those that stay in touch, respond quickly to calls and follow up on problems or issues,” he said. “Staying connected beyond just the next delivery means the small operator should inquire about special programs, promotions and marketing opportunities. It means distributors/suppliers should share how they are working to be more efficient and helping to drive costs out of their business that can be passed along to the small operator.”

From a foodservice perspective, Tim Powell, managing principal of Foodservice IP, a research-based management consulting firm headquartered in Chicago, agrees that for small operators to have healthy collaborations into the future, it will depend on the retailer’s ability to make sure their partners understand their unique operating pressures, business structure, concept, requirements and potential, and to build a consultative relationship with them.

“In the future, I expect to see more external intelligence. Distributors and suppliers will help smaller operators understand commodity information, marketplace information, demographics, menu ideas and competitive intelligence,” he said.

The way Clarkston Consulting’s Weber sees it, the c-store industry is shifting away from being fuel-focused to being a destination for customers to buy fresh food and beverages, household items and quick-service meals. “Retailers and suppliers can strengthen their relationships by embracing this change. Leveraging each of their data, they can collaborate on tailoring the assortment to bring new and innovative products to their local customer base and look for opportunities to innovate together across categories,” he advised.

Relationships between retailers of all sizes and their suppliers can also benefit from the adoption of new technologies that help drive operational efficiencies. Ultimately, Weber believes technology can simplify and/ or automate many of the back-and-forth exchanges in the future, driving down costs and improving profitability for both parties.

“Whether it’s integrating existing systems, leveraging cost-effective SaaS solutions or interacting directly with suppliers’ and distributors’ digital platforms, c-store operators can streamline their inventory management, ordering and replenishment, AR/AP processes and even exception processes to handle credits for mispicks or damaged goods,” he explained.

Opp envisions small and independent c-store retailers also leveraging more private-label products in the future, which he said are especially attractive among millennials these days. He noted that McLane’s CVP (Consumer Value Products) line of more than 240 private-label products is continually being tweaked and expanded.

“It’s a lower-cash outlay for consumers, higher profits for retailers and contributes to a more loyal customer base overall,” Opp said. “It addresses some of the challenges of our independent operators, and we will continue to extend it in popular categories.” CSN

INFLATION, HIGHER OPERATING COSTS AND LOWER FUEL PRICES TOOK THEIR TOLL IN 2023

BY ANGELA HANSON & LINDA LISANTIHEADING INTO 2023, inflation, the ongoing labor shortage and motor fuel prices had convenience store retailers worried about their business prospects for the year ahead. It turns out they had cause for concern.

After hitting record-high sales in 2022, total U.S. convenience store sales declined 4.7% in 2023, going from $814 billion to $775.5 billion, according to the 2024 Convenience Store News Industry Report, the longest-running annual analysis of U.S. c-store industry performance.

For the third consecutive year, in-store sales at U.S. convenience stores hit a new high of $287.7 billion last year, up 4.5% over the prior year. Much of that increase, however, was due to inflation pushing product prices higher throughout 2023. The consumer price index, which measures price changes over time, was 5.7% for the year, down slightly from 6.5% in 2022.

In-store sales growth also came from a 1.5% increase in the industry’s

store count, which now stands at 152,396 locations. Chains account for 39.8%, while single stores comprise 60.2%. The number of industry locations operated by chains rose 1.4% year over year, while the number of stores operated by single-store operators ticked up by 1.5%.

The chief contributor to the overall sales decline was motor fuels. Fuel volume grew slightly, with gallons up 1.4% for the year. But lower gas prices drove the industry’s 2023 fuel revenue to decrease by 9.4%, going from $538.7 billion to $487.8 billion.

As a result, the convenience store industry’s sales mix for 2023 still skewed more toward motor fuels, but in-store sales captured a larger slice of the pie than a year ago. In-store comprised 37.1%, up from 33.8% in 2022. Fuel comprised 62.9%, down from 66.2%.

The in-store business also made gains in profitability last year. Looking at the industry’s gross profit dollar mix, in-store accounted for 60.3%, up from 59.2% a year ago — its highest percentage in the last five years. Fuel accounted for 39.7%, down from 40.8%. Overall, industry gross profits rose a meager 2.3% last year to $126.83 billion.

Both in-store and fuel transactions per week at U.S. convenience stores dropped in 2023 vs. 2022, likely due to customers feeling the pinch of inflation. Less disposable income translated into fewer visits to the channel. In-store transactions per week dropped 3% and motor fuel transactions per week dropped 3.7%. This was a

significant reversal from the prior year when in-store transactions increased 7.2% and motor fuel transactions increased 3.6%.

Adding to the challenging environment, direct store operating expenses continued to increase at a double-digit pace last year. Rising 11.3%, 2023 operating expenses per store topped the $1 million mark. Credit card fees saw the steepest increase, jumping 26.6% year over year.

Labor, including wages, payroll taxes, workers compensation, health insurance and other benefits, accounted for the largest share of operating expenses at $609,705 per store, up 6.6% vs. the prior year when the industry saw an 11.2% increase in labor costs.

The ongoing labor shortage, which dates back to the COVID-19 pandemic, has prompted c-store retailers to raise their starting wages and offer retention bonuses to try to attract and keep storelevel employees. Pre-pandemic, 2019 wages per store totaled $354,271. In 2023, this line item crossed the $500,000 threshold, totaling $518,297 per store.

Despite retailers’ efforts, turnover remains high. Last year, though, did bring some improvement. The 2023 turnover rate for store associates was 158%, down from 163% in 2022. The turnover rate for store managers was 90%, down from 94%.

The percentage of convenience stores selling gasoline held steady last year, dropping less than a percentage point to 78.8%. Approximately 120,061 U.S. c-stores in total offer motor fuels.

Premier Manufacturing is excited to introduce NIC-S®. Premium tobacco-free nicotine pouches backed by extensive scientific research, made with pharmaceutical grade nicotine, and is setting a higher standard for nicotine pouches.

PHARMACEUTICAL GRADE NICOTINE

LONG

6 FLAVOR PROFILES WITH 3 STRENGTHS (3MG, 6MG, AND 9MG)

PREMIUM SOFT POUCHES

Retail gasoline prices eased in 2023 compared to the previous year, when the market most acutely felt the effects of Russia’s invasion of Ukraine. The weighted average price of all grades of gasoline and diesel declined 10.8% to $3.56 per gallon, down from $3.99 in 2022.

Accordingly, total motor fuel dollar sales across the industry fell to $487.8 billion. Despite the drop from $538.7 billion the previous year, this still marked the secondhighest amount for fuel dollar sales in the past five years. Total gallons sold (136.9 billion) also reached their second-highest level in that timeframe, trailing 153.7 billion gallons in 2019.

Average motor fuel gross margin in 2023 slipped 4% to 28.7 cents per gallon.

For the second year in a row, cigarette sales shrank in the

convenience channel in 2023, declining 5.7% to $409,985 in average sales per store.

Economy/value cigarettes were the bright spot in terms of growth. The segment increased 19.7% to $27,209 in average sales per store, indicating that smokers are looking to save money on their cigarette purchases. This segment, however, was also the smallest in terms of actual dollar sales.

Premium/super premium cigarettes at $327,279 in average sales per store and midlevel cigarettes at $55,497 in average sales per store led the category in dollar sales, yet both segments saw per-store sales decline by more than 7% each.

Total industry dollar sales of cigarettes fell 4.3% in 2023, while total unit volume decreased 7.4%, the secondlargest drop in the last five years. Cigarettes’ share of in-store sales fell to a new five-year low of 21.51%, down from 23.49% the previous year.

Other tobacco products (OTP) saw better results than cigarettes in 2023, although the category still experienced a slowdown. Average dollar sales per store increased just 2.4% to $151,205, down from 4% growth the prior year.

The top three segments in the category — smokeless, vaping products and cigars — all saw average dollar sales drop. The smokeless tobacco alternatives segment saw the most growth with a 61.1% increase in sales per

store, up from the already impressive 46.2% growth the segment posted in 2022. Papers, pipe/cigarette tobacco and other tobacco nicotine products also grew, but remain low in actual dollar sales.

Total industry sales of OTP were up 3.9% last year, dipping slightly from 4.6% growth in 2022. Total unit volume saw a 3.3% drop, down from a 0.5% drop the previous year. OTP’s share of in-store sales held steady at 7.93%.

Foodservice was the standout in 2023. The category posted double-digit sales growth, albeit the rate of growth slowed from the previous year. Average foodservice sales per store increased 11.9% to $388,607, down from 18.8% growth in 2022.

All foodservice segments experienced an increase in dollar sales, reinforcing the category’s importance to the channel. Prepared food, though, led the way as both the top-selling segment and the biggest grower, with average dollar sales per store increasing 12.9%.

Cold dispensed beverages and frozen dispensed beverages both saw average dollar sales growth of at least 10%. Hot dispensed beverages posted the lowest sales growth at 7.8%, but the segment generated the second-most dollar sales by a comfortable margin.

Total industry sales of foodservice jumped 13.5%. This was a slowdown from the previous two years, which hovered around 20% growth as the industry recovered from the COVID-19 pandemic, but above the 5.2% industry sales increase seen in 2019. Foodservice’s share of in-store sales set a new high-water mark of 20.4%, up from 18.77% the previous year.

The cold vault had another solid year with nearly all segments experiencing growth. Average sales per store of packaged beverages increased 6.3% to $269,973, down less than a percentage point from the previous year’s growth.

The energy/alternative drinks segment solidified its position as the top seller and was the only segment to see double-digit growth, with per-store dollar sales rising 10.8%. Other segments where dollar sales increased 5% or more included No. 2 carbonated soft drinks (up 5.1%), sports drinks (up 6.2%) and enhanced water (up 7.3%), demonstrating continued consumer interest in functional beverages. Ready-to-drink coffee was the only segment to see a decline.

Total industry sales of packaged beverages increased 7.9% in 2023, virtually matching the previous year’s growth rate. Total unit volume saw no change year over year. The category’s share of in-store sales grew less than a point to 14.17%, a five-year high point.

Beer and malt beverage sales slowed in 2023 due to mixed results among the various segments. Average sales per store rose 1.6% to $170,456, down from 3.5% growth in 2022.

Flavored malt beverages and cheladas saw some of the most significant growth last year, with per-store sales increasing 19.3% and 18.4%, respectively. Imported beer (up 6.9%), microbrews/craft (up 6%) and alcoholic cider (up 9.6%) also experienced healthy sales growth.

Conversely, multiple other segments saw sales decline. Although premium beer remains the top seller in actual dollars, the segment’s average sales per store fell 6.1%. Additionally, the boom days of alcoholic seltzer appear to be over as the segment’s sales dropped 10.8%.

Total industry sales of beer and malt beverages increased 3.1%, but total unit volume remained flat at 0.6% growth, indicating that inflation was the likely driver of dollar growth. The category’s share of in-store sales fell less than a percentage point to 8.94%. Just over 80% of U.S. c-stores sold beer and malt beverages in 2023, marking no change from 2022.

2023 was a fairly sweet year for the candy category with all segments seeing growth. Average sales per store increased 8% to $69,523, slowing from 12% growth in 2022.

For the second year in a row, gum posted the largest percentage increase at 16.8%, with the exception of novelty candy, a relatively small segment. Meanwhile, the top-selling segment of chocolate bars/packs saw 3.9% growth in per-store sales, down from 9.9% growth the previous year. Bagged/repackaged peg candy, the runner-up in terms of actual dollar sales, saw less of a year-over-year slip with a 12.3% increase, down from 14.7% growth in 2022.

The candy category appears to be particularly buoyed by inflation as 2023’s healthy 9.6% growth in total industry sales masked a 4.4% decline in total unit volume. The category’s share of in-store sales increased by less than a percentage point to 3.65%.

Similar to the candy category, salty snack sales growth slowed but stayed positive across all segments last year. Average sales per store of salty snacks overall increased 8.6% to $60,294 in 2023, down from 15% growth the previous year.

While the puffed cheese segment posted the highest growth rate of 13%, potato chips and tortilla/corn chips remained the category’s top sellers and saw average dollar sales per store rise 8.3% and 9.6% for the year, respectively.

Total industry sales of salty snacks increased 10.2%, while total unit volume decreased 1.2% following two prior years of volume growth. The decrease in unit volume, combined with dollar sales growth that was solid but down substantially from the previous year, indicates that inflation drove salty snack revenue in 2023 but not as significantly as the previous year. Salty snacks’ share of in-store sales saw little change and stands at 3.16%.

The alternative snacks category experienced a flatter year than salty snacks with average sales per store increasing just 0.9% to $22,295, down from 3.4% growth in 2022.

Bars had the most success within the category as health/energy bars grew 11.5% in per-store sales and

granola/yogurt bars were up 11%. Conversely, meat snacks — the largest alternative snack segment by far — saw per-store sales decline 4%.

Total industry sales of alternative snacks rose 2.4% in 2023, down from 4% growth the previous year, while total unit volume dropped 5.2%, marking a second consecutive year of declines. Alternative snacks’ share of in-store sales held steady at 1.17%.

Sales of edible grocery slowed but stayed in the green in 2023, with average sales per store increasing 4.1% to $104,737, down from 14.8% growth the previous year.

Other dairy/deli products saw the most growth in dollar sales, increasing 7.7%, while remaining the top-selling segment in the category by a significant margin. Frozen foods, condiments, packaged bread and other edible grocery all posted modest growth, while breakfast cereal (down 2% in sales per store) and packaged coffee/tea (down 4.7%) were in the red.

Total industry sales of edible grocery rose 5.7% last year, a drop of nearly 10 points from 2022. Edible grocery’s total unit volume declined for the first time in the last five years, falling 1.4%. The category’s share of in-store sales saw little change at 5.5%.

The nonedible grocery category saw mostly positive results in 2023, with average sales per store increasing 2.4% to $31,191. This was down from 8.2% growth the previous year.

Paper/plastic/foil products

continued to hold the top spot within the category with 4.6% growth in dollar sales. Laundry care, though, posted the biggest increase for the third year in a row with a 6.3% rise in per-store sales last year.

Total industry sales of nonedible grocery rose 3.9%, marking the second consecutive year of growth, but total unit volume decreased 2.8%, down from 3.6% growth in 2022. The category’s share of in-store sales stayed nearly the same at 1.64%.

Mixed results across the various segments of general merchandise led to an overall sales decline for the category in 2023. Average sales per store fell 2.5% to

$59,531, down from 1.6% growth the prior year.

Hardware/tools/housewares, seasonal, and school and office supplies were the only segments to see per-store sales increase last year, with hardware/tools/ housewares also posting the most growth at 13.6%. All other segments experienced sales declines, with telecommunications hardware seeing the biggest drop of 9.8%.

Total industry sales of general merchandise decreased 1%, marking the first decline after three years of growth. Total unit volume fell 5%, following a 3.3% drop in 2022. General merchandise’s share of in-store sales decreased by less than one point to 3.12%.

Sales declined across many segments of health and beauty care (HBC) last year, but the category overall still saw growth driven by the vitamins and supplements segment. Average sales per store of HBC increased 3.5% to $12,541, down from 5.7% growth the previous year.

Per-store sales of vitamins and supplements jumped 23.4%, a slight decrease from 2022 when sales increased by more than 25%, pushing it into the No. 1 spot. Grooming aids and stomach remedies were the only other HBC segments to see growth last year.

Total industry sales of HBC rose 5%, slipping from 6.6% growth the previous year. Total unit volume declined 0.7%. The category’s share of in-store sales held steady at 0.66%. CSN

The 49th annual Convenience Store News Industry Report features data from a variety of sources in order to provide a complete picture of the financial health of the convenience store industry. Store census data was provided by TDLinx, which maintains a national count of c-store locations based on NACS’ definition of a convenience store. Sales data for most categories was provided by NIQ from its Convenience Track retail measurement service, which is based on UPC sales and other methods that are counted through the use of point-of-sale scan data, as well as from data captured via electronic invoice and sales audits. Additionally, non-UPC coded merchandise, including prepared food and hot, cold and frozen dispensed beverages, was provided by a retailer survey conducted by Convenience Store News. Government sources include the Census Bureau of Labor Statistics, Department of Energy and Federal Tax Administration.

Settling from the impact of three big deals in 2023, questions surrounding the imminency of c-store industry M&A for the remainder of 2024 swirl

By Melissa Kress & Danielle Romano2023 SAW THREE MERGER-AND-ACQUISITION (M&A) deals that had notable impacts on the U.S. convenience store industry in terms of size and scope of individual companies.

The first was Houston-based bp’s pickup of Westlake, Ohio-based TravelCenters of America Inc. (TA) for $1.3 billion. The deal added 280-plus locations to bp’s network, complementing its existing off-highway convenience and mobility business.

The second was Lawrenceville, Ga.-based Majors Management Inc.’s purchase of roughly 200 MAPCO Express sites from a subsidiary of COPEC, a South America-based retail company. The two-part sale of MAPCO saw Laval, Quebec-based Alimentation Couche-Tard Inc. take 112 of the convenience and fuel sites, with the remaining locations from MAPCO’s 300-plus-store network going to Majors Management.

The third was Salt Lake City-based Maverik — Adventure's First Stop’s acquisition of Des Moines, Iowa-based Kum & Go LC. The purchase added 400-plus convenience stores to Maverik’s network, more than doubling the retailer’s store count.

Because of these three deals, the 2024 Convenience Store News

Top 100 ranking looks a little different compared to last year, as bp moved up the ranks to No. 5 (from No. 31 in 2023), Maverik jumped to No. 11 (from No. 16 last year), and Majors Management climbed to No. 19 (from No. 46 in 2023).

Still, with the exception of bp cracking into the top five, the companies atop this year’s list are a carbon copy of last year. Capturing the top five spots on the 2024 Top 100 are Irving, Texas-based 7-Eleven Inc. with 12,577 stores; Couche-Tard with 5,851 stores; Ankeny, Iowa-based Casey’s General Stores Inc. with 2,663 stores; Westborough, Mass.based EG America with 1,568 stores; and bp with 1,540 stores, according to TDLinx, which partners with CSNews for this annual report.

Rounding out the top 10 are Richmond, Va.-based GPM Investments LLC (1,515 stores); El Dorado, Ark.-based Murphy USA Inc. (1,133 stores); Tulsa, Okla.-based QuikTrip Corp. (1,060 stores); Media,

Pa.-based Wawa Inc. (1,050 stores); and La Crosse,

Kwik Trip Inc. (858 stores).

As a whole, the top 10 account for a combined

INTRODUCING The LINDOR 3-pack: Discover A New Way To Indulge

locations, or 19.56% (up from 18.65% a year ago). The top three chains account for a combined 21,091 stores, or 13.83% of the industry total (down slightly

TA are not totally out of the question, this year's acquisitions are most likely to come from smaller brands getting out of the business, particularly familyoperated companies that lack succession plans, according to Dennis Ruben, executive managing director of NRC Realty & Capital Advisors LLC.

"What we're seeing now is the small to midsize guys that are realizing they can't compete with the big guys," he said. "There's a smaller universe of operators now, and there's just been a ton of consolidation. I think it'll continue, but I think it's going to be more like the 10- to 50-store guys."

The sale of smaller operators is an attractive

1

2

3

offer to larger chains. Typically, when purchasing chains of approximately 15 or more locations, there will be smaller-footprint stores involved, especially in urban locations. Although these smaller-footprint locations are

not the preference for larger chains in

explained John C. Flippen Jr., managing

“The purchase of smaller chains by much larger operators allows for better pricing of both in-store items and fuel at the wholesale level, along with the spreading out of corporate expenses to a larger number of units,” Flippen pointed out.

The way American Business Brokers & Advisors President Terry Monroe sees it, retailers’ desire for speed and simplicity means more acquisitions are likely on the horizon.

"Organic growth takes more time and involves more risk than buying an existing business with a proven cashflow," Monroe told CSNews, adding that organic growth is also less popular because most of the A-rated locations are already taken.

"The numbers for return on investment are always stronger for acquisitions after you factor in the time it takes to find the right location, get the needed approvals to build, site work, design, then actually build the store and the time it takes for the new build to become cashflow positive," he said.

The Attraction of Organic Growth

On the other hand, with rising interest rates and political uncertainty this election year, acquisition activities should moderate for the rest of 2024, predicts Mark Radosevich, president of PetroActive Real Estate Services LLC.

“Midsized chain availability has diminished, leaving primarily larger acquisition targets. Oil companies seem the best candidates for these larger deals given their need to maintain brand relevance against the big unbranded store operators,” he said.

Taking into account the limitations on expansion due to funding costs, return-oninvestment hurdles and the restrictive position of the current administration, Radosevich noted that organic growth can be beneficial for operators wanting to make their stores more attractive to customers.

“[With organic growth,] sites can be designed to meet modern standards, to better ensure long-term competitiveness in the event of market intrusion by sophisticated chain operators,” he noted.

Earlier this year, ARKO Corp. — which has closed on 26 acquisitions over the last decade — announced that as the company moves through 2024, its focus will be to further push, refine and improve performance across its existing network.

The Richmond, Va.-based parent company of Top 100 climber GPM Investments plans to harness the potential of additional land

opportunities that were included in previous acquisitions. This will include new-to-industry locations and new formats.

Similarly, CrossAmerica Partners LP, which sits at No. 25 on this year’s Top 100, is staying focused on optimizing its portfolio to create long-term value for its unitholders, according to President and CEO Charles Nifong. The partnership’s approach is to convert certain controlled sites from existing classes of trade to companyoperated retail or commission sites.

“The purchase of smaller chains by much larger operators allows for better pricing of both in-store items and fuel at the wholesale level, along with the spreading out of corporate expenses to a larger number of units.”

—

John C. Flippen Jr., Petroleum Capital & Real Estate LLC

Whether their plans are to grow organically or via acquisition, industry experts point to Casey’s and Majors Management as the convenience store chains to watch going forward.

Casey’s continues to expand its store count with complementary geographic growth. Recent acquisitions strengthened the company’s eastern footprint in Kentucky and Tennessee, while the chain has also ventured into Texas, harnessing its footprint in the Southwest.

"Under the management of CEO Darren Rebelez, [Casey’s] reinvented itself to be good at expanding its store count by becoming more aggressive at acquisitions and combined it with the company’s ability to have organic growth, too, which allows them to pick specific locations to build and specific markets to enter with acquisitions and then remodel the stores they acquired to the Casey's model," Monroe explained.

Meanwhile, in its transaction for MAPCO Express, Majors Management picked up roughly 200 c-stores in attractive and desirable markets predominantly in Tennessee, Alabama and Georgia, as well as the MAPCO My Rewards loyalty program and the MAPCO brand. All these elements combined make MAPCO an attractive brand well positioned for growth, Radosevich said.

“Majors is transitioning from a dealer-supply operational model to a store-operational model because of the MAPCO deal and the established operational capabilities they acquired,” he said. “Given their recognized appetite for growth through acquisition, they seem to be best suited to expand the MAPCO brand once they fully digest what they bought and get their strategic-growth ducks in a row.”

CSN

“Midsized chain availability has diminished, leaving primarily larger acquisition targets. Oil companies seem the best candidates for these larger deals given their need to maintain brand relevance against the big unbranded store operators.”— Mark Radosevich, PetroActive Real Estate Services LLC

THIS YEAR’S TOP 100 WELCOMES SOME NEW NAMES WHILE SAYING GOODBYE TO OTHERS

Three convenience store companies arrived on this year's Top 100 list — S&S Petroleum Inc. (at No. 79t), Byrne Dairy Inc. (No. 91t) and J&H Oil Inc. (No. 94) — just as three others departed following notable merger-and-acquisition activity in 2023.

In what was arguably one of the most-talked about deals of the year, Salt Lake City-based Maverik —Adventure's First Stop acquired Kum & Go LC in August. The addition of more than 400 convenience stores boosted Maverik up the ranks. However, the transaction marked Des Moines, Iowa-based Kum & Go's exit from the convenience channel. Kum & Go ranked No. 17 on the 2023 Top 100.

COPEC Inc., the former parent company of MAPCO Express and a leading South Americabased retail company, also took the exit this year after holding the No. 21 spot last year. In November, a subsidiary of COPEC sold the 300-plusstore MAPCO portfolio to two buyers, Laval, Quebec-based Alimentation Couche-Tard Inc. and Lawrenceville, Ga.-based Majors Management Inc.

One other name missing from this year’s Top 100 is TravelCenters of America Inc. (TA), which sat at No. 27 on the 2023 ranking. As a result of bp's $1.3 billion acquisition of the chain in spring 2023, TA dropped from the list as a standalone company.

Looking ahead, at least two companies may be making their last appearances on the Top 100.

Cal's Convenience Inc., based in Frisco, Texas, captured the No. 33 spot this year. However, shortly after the rankings were compiled in March 2024, the company's Stripes convenience stores were acquired by Irving, Texas-based 7-Eleven Inc. The $950 million transaction closed in April.

While Cal's disappearance from the Top 100 is all but guaranteed, the future of No. 70 SQRL remains up in the air. After experiencing a quick growth spurt in late 2023, reports have surfaced that the Little Rock, Ark.-based company is selling o assets in the face of a financial crunch.

WARNING: Cigar smoking can cause cancers of the mouth and throat, even if you do not inhale.

152,396 45,979 30.17%

Total Number of Stores in the Convenience Store Industry

29,815 13.83%

Number of Stores Operated by the Top 10 Chains

Number of Stores Operated by the Top 100 Chains

Percentage of Stores Operated by the Top 100 Chains

19.56% 21,091

Percentage

Stores

Number of Stores Operated by the Top 3 Chains

Differentiation is a key driver as retailers in the segment develop new products to boost own brand assortments.

INSIDE

FROZEN FOOD

P. SB10

SUSTAINABILITY

P. SB14

DIFFERENTIATION IS A KEY DRIVER AS RETAILERS IN THE SEGMENT DEVELOP NEW PRODUCTS TO BOOST THEIR OWN-BRAND ASSORTMENTS.

By Greg SleterAt a time when American consumers are looking to save money when they shop, the store closures affecting Family Dollar and 99 Cents Only came as a surprise to some.

Despite this news, the retail industry as a whole remains bullish on the channel. Playing an ever-growing role within the aisles of dollar stores are private label products. Leading retailers in the channel have grown their respective assortments in recent years by developing items that are something other than name-brand equivalents. This

Dollar

• Leading discount retailers have grown their respective own-brand assortments in recent years by developing items that are something other than namebrand equivalents.

• Challenges facing discounters include keeping store shelves stocked with items priced at or near $1, and competition from the likes of Walmart and ALDI.

• Grocery is a potential growth area for private label assortments at discount stores.

continued effort is not only providing highvalue items to consumers, but also offering points of differentiation for each retailer.

For example, when Dollar General launched its proprietary Clover Valley line nearly 30 years ago, it did so intending to carry products that would be equivalent to name-brand items currently available. But as has been seen with many retailers in recent years, the mindset of the dollar store’s merchandise team evolved.

U.S. Alliance Paper, one of the largest private label manufacturers of household paper, offers a high-margin store brand solution to retailers who want to offer their shoppers an eco-friendly choice. Created especially for retailers who don’t have the volume for a private label program, Earth One products are made from 100% recycled paper - gentle on our planet because it’s the only one we have.

• Paper towels, napkins, and bath tissue

• Bold packaging, strong shelf presence

• Made from 100% recycled paper with 80% post-consumer content, no chlorine bleach.

“Our customers started telling us they wanted variety and innovation, not only me-too products,” says Jackie Li, SVP of private brands and global sourcing at Goodlettsville, Tenn.-based Dollar General. “We then started developing products that were equal to or better than the national brands.”

New product development has also been key to private label growth at Dollar Tree-owned Family Dollar. At the end of 2023, Rick Dreiling, chairman and CEO of Chesapeake, Va.-based Dollar Tree, reported that private label penetration rates at Family Dollar had reached 14%, and that the retailer was on target to hit its penetration rate goal of 20% by 2026. This was despite the fact that Family Dollar was in the midst of shrinking its store count by 600 by the midway point of 2024.

“We believe that as the customer is looking for greater value, they have more options within our private brands,” said Dollar Tree CFO Jeff Davis during the company’s fourth-quarter conference call. “It’s an opportunity for us to improve our margins. And, to the extent that there is sort of price deflation, there’s an opportunity to provide even more value as we think about how we sort that particular product line.”

The shedding of stores by Family Dollar, along with the closure of 99 Cents Only, which in April revealed that it was going out of business and closing its 371 stores across four states, has done little to temper the overall positive outlook that retail analysts have regarding the distribution channel.

“We do not view the planned closure of 99 Cents Only and a tranche of stores by Family Dollar as reflective of the overall state of the dollar and discount store sector,” notes Sujeet Naik, an analyst with New York-based Coresight Research. “We remain bullish on

the market-share prospects for high-quality and/or well-positioned discount formats over the longer term.”

He observes that the start of the 2020s was characterized by high inflation and macroeconomic uncertainty, which prompted a shift in consumer shopping habits and made consumers more valueoriented. As a result, Naik expects the movement toward greater frugality to be a structural trend that will outlast short-term economic disruptions and boost discount sales through the rest of this decade.

While an economy that has a larger number of price-sensitive consumers would seem to favor dollar stores and the value proposition they offer, there are challenges facing these retailers. One such challenge is keeping store shelves stocked with items that are priced at or near the magic $1 threshold. Not meeting or coming close to this key price point could make these retailers less attractive to shoppers looking for products at this price level.

Competition from the likes of Walmart and ALDI is another hurdle facing dollar store retailers. Bentonville, Ark.-based Walmart’s private label assortment is growing with the launch of its bettergoods assortment, which offers 300 items across a host of categories, with most priced at less than $5. ALDI will also be a bigger presence going forward as the Batavia, Ill.-based discount grocer moves forward with plans to open 800 stores in the United States by 2028.

“Walmart and ALDI have gotten much better at offering lower prices on a variety of goods,” says Naik. “This makes dollar stores have to work harder to stand out.”

Dollar General’s Li notes that ever-changing economic conditions

One of the many ways Dollar General differentiates itself is our focus on value. We want to make our customers happy by meeting and exceeding expectations. We made significant enhancements to our private brands in 2023, and we know how important these value offerings are for our customers.

—Jackie Li, Dollar General

We believe every project we work on is a way to create a dynamic customer experience. That’s why we design customized packaging solutions to fit exactly what your customer needs.

To find out how we can help, visit us at mrpsolutions.com

We believe that as the customer is looking for greater value, they have more options within our private brands. And, to the extent that there is sort of price deflation, there’s an opportunity to provide even more value as we think about how we sort that particular product line.

—Je Davis, Dollar Tree

have created growth opportunities for the value retailer and store brands overall. As a result, the continued development of private label assortments could be the key to dollar stores’ efforts to separate themselves from other retailers while also offering shoppers highvalue products.

“One of the many ways Dollar General differentiates itself is our focus on value,” he asserts. “We want to make our customers happy by meeting and exceeding expectations. We made significant enhancements to our private brands in 2023, and we know how important these value offerings are for our customers. We believe these products will further differentiate Dollar General in the marketplace as we look to provide quality products that are customer-centric, on-trend, national-brand or better, and stretch our shoppers’ dollars even further.”

The ongoing effort to expand its private label assortment in recent years is highlighted by the launch of the reformulated and rebranded Nature’s Menu assortment of dog and cat food in 2022.

Responding to consumers seeking affordable, high-quality pet food, the line was revamped to include dry-food options made with natural ingredients such as real beef, lamb and cage-free chicken. The wet-food assortment was updated with added vitamins and minerals, and made with real meat, poultry or fish.

Also in 2022, the retailer debuted its OhGood! private label nutritional supplement line. The assortment of gummy vitamins is non-GMO and gluten-free, with select vegetarian or vegan options. Items in the line have retail prices between $5 and $7.

A year later, Dollar General launched the aforementioned Clover Valley private label assortment of more than 100 new items, including sauces, condiments, entrées, sides and snacks.

With continued expansion of private label assortments a focus for dollar stores, industry experts contend that there’s more these retailers can do to expand their respective customer bases. Grocery is one area of potential growth.

“Food and grocery essentials generally carry lower margins but are fast-moving goods and have higher sales densities than general merchandise products,” says Coresight’s Naik. “The increase in shopping frequency will provide the opportunity to drive incremental sales across all categories, including higher-margin discretionary products.”

ity in Every Drop

Your one-stop shop for own brand oils

•National brand equivalent extra virgin olive oil

•Specialty oils, & oil blends

•Innovative packaging solutions

•Certified Non-GMO, USDA Organic, Kosher & Halal options to give your customer confidence in your products

•Olive oil experts since 1900 Visit us

By Greg Sleter

By Greg Sleter

One in five consumers who purchase frozen food items usually buy a store-brand product, and that figure is growing, according to “The Power of Frozen 2023” report from the American Frozen Food Institute (AFFI) and FMI – The Food Industry Association.

The big factor turning the eyes of consumers toward private label products, unsurprisingly, is price. While private label and nationalbrand frozen products each saw unit share erosion in 2023 — down 3% for private label and down 5.4% for national brands — both segments saw dollar sales grow 7.7% during the prior year.

Also notable is the rather weak brand loyalty that consumers have within frozen food despite the category’s having some long-standing national brands. The AFFI report found that 20% of consumers usually purchase private label frozen food products, while 16% said that they prefer national brands. Nearly four in 10 said that brand preference varies by item, and 26% had no brand preference.