WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

STUDY 2025

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

STUDY 2025

ECONOMIC OPTIMISM HAS THE CONVENIENCE STORE INDUSTRY

HOPEFUL ABOUT 2025 BUSINESS PROSPECTS

Ensure that retail remains the most trusted place to responsibly sell tobacco products.

Did you know the average number of FDA compliance checks per month are approaching pre-COVID-19 levels?

In 2023, as of 9/30/23, the FDA conducted 9,381 compliance checks per month, which was an uptick from previous years.*

*Source: FDA CTP Violation Rate analysis was completed using publicly available raw data posted online at fda.gov. Calculations of Total Compliance Checks and Violation Rates were computed by AGDC based on Decision Data published. Inspections data FFY 2019 - 2023 FDA COMPLIANCE CHECKS Per Month (Avg.)

Age Validation Technology (AVT)

Modernize and simplify the ID check process with AVT, helping to reduce the likelihood of selling tobacco products to underage individuals

Improve ID check rates at a store and individual employee level, with We Card™ Training, available for Free via AGDC

State and Federal Law

Summaries and additional resources via the We Card™ resource center

Reinforce your sales associates’ understanding of ID check requirements and policies with Mystery Shop incentives

Allow me to suggest a few New Year’s resolutions for convenience store operators

I CONSIDER MYSELF a largely optimistic person. I see the glass half full rather than half empty. A partly cloudy day can also easily be considered partly sunny. When beginning new endeavors, I tend to expect the best rather than prepare for the worst.

Over the past few years, optimism unfortunately has been scarcer in the U.S. convenience store industry on account of issues such as inflation, lower foot traffic, staffing challenges, increasing operational costs and heightened cross-channel competition.

The optimist in me is pleased to report, however, that the industry’s mood heading in 2025 is more upbeat. There’s hope that improved economic conditions will lower inflation and its impact, boosting disposable income among consumers, which will in turn increase foot traffic.

On a scale of one to five — where 1 represents “Terrible, wake me when it’s over” and 5 represents “It’s going to be our best year ever!” — nearly half of c-store retailers (49%) rate their expectations for 2025 at a 4 or 5. Only 7% give the new year a rating of 1 or 2, down 11 points from a year ago, according to the findings of the 2025 Convenience Store News Forecast Study (see page 20). The industry’s distributors and suppliers are even more optimistic, with 52% rating their expectations at a 4 or 5 — and not even one choosing the lowest rating.

EDITORIAL EXCELLENCE AWARDS (2016-2024)

2021 Jesse H. Neal National Business Journalism Award

Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications Intl. Tabbie Awards

Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

The start of a new year is, of course, a popular time for reflecting on the outgoing year and setting resolutions for the incoming year. If you haven’t already compiled your list of New Year’s resolutions for 2025, here are a few items I think should definitely be on it:

• Expand and diversify your prepared food options because this category has the highest anticipated sales growth according to c-store retailers’ predictions.

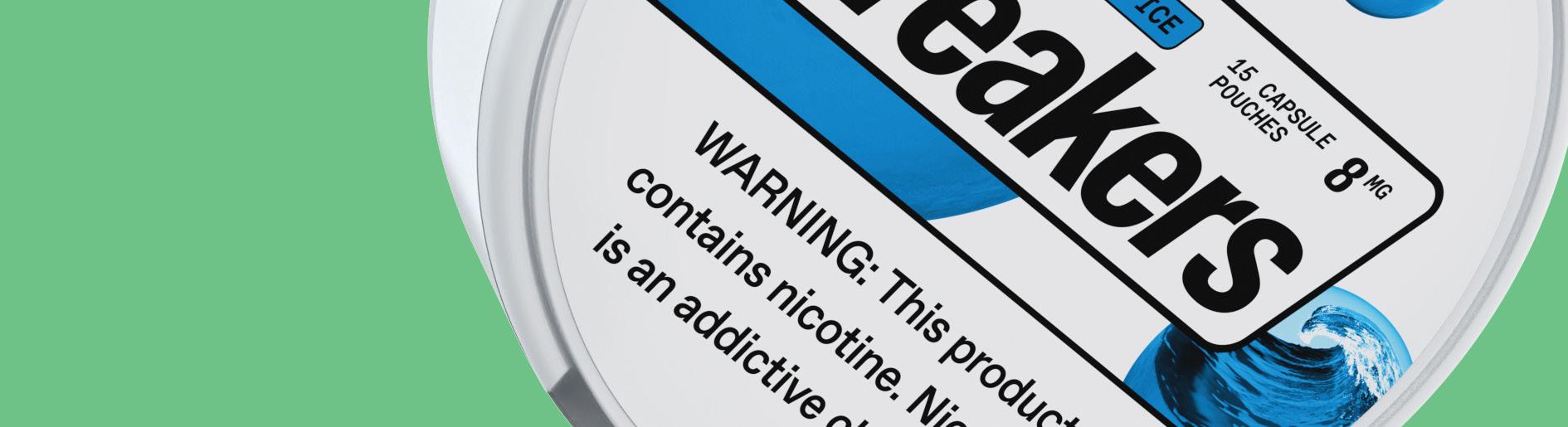

• Capitalize on the growing demand for other tobacco products, the category with the second-highest anticipated sales growth, by increasing product variety and display area.

• Explore the potential of alternative snacks and other health-conscious food and beverage options to meet the increasing consumer demand for healthier choices.

• Respond to evolving consumer preferences by investing in delivery. Today’s younger generations especially are willing to pay a premium for convenience.

• Leverage technology and automation tools to improve operational efficiency and employee experience, which will translate into better retention rates and happier workers.

I wish all our readers a happy and profitable new year!

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

EDITORIAL

Laura Aufleger OnCue Express

2024 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section, October 2024

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

Richard Cashion Curby’s Express Market

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Many of last year’s forecasts proved accurate, though not without some unexpected nuances.

AS WE START 2025, I thought I’d reflect on the predictions I made here a year ago and look ahead to trends shaping the convenience store industry. While 2024 certainly brought surprises, many of last year’s forecasts proved accurate, though not without some unexpected nuances:

• First, my prediction regarding the rise of electric vehicle (EV) infrastructure in c-stores was spot-on as EV charging stations have indeed expanded in the industry. In 2025, with a new administration that’s adverse to subsidizing sales of electric vehicles, c-stores might have to rethink their investment in EV chargers, at least in the short term. Nevertheless, for EV charging to work profitably for c-stores, retailers will need to create a destination experience for EV drivers, including enhanced seating areas, robust food and beverage offerings, and digital convenience options.

• As predicted, artificial intelligence (AI) had a profound impact in 2024, particularly in inventory management and food prep automation. For 2025, I believe the major tech focus of retailers will be cybersecurity. C-store operators must double down on robust security protocols to protect customer data, while continuing to adopt AI solutions to streamline operations. Expect further integration of AI-driven loyalty programs and tailored promotions this year.

• The big no-brainer was predicting the continued growth of foodservice sales in the channel. Best-in-class foodservice operators, such as those honored in Convenience Store News’ annual Foodservice Innovators Awards program, are redefining what convenience store dining can be. This year, we’re likely to see even more premium, healthy and culturally diverse menu items. As consumers grow savvier about their health choices, offering globally inspired fare and functional beverages will help differentiate c-stores from competitors.

• My concerns about menthol and flavored tobacco bans played out largely as expected. While the federal delay softened the initial blow, several states acted independently. In 2025, expect more localized restrictions and a continued push by c-stores to diversify their nicotine offerings with noncombustible products.

• Unfortunately, my concerns over retail theft not only materialized, but also intensified. Inventory shrink has increased four- or five-fold over the past few years. In certain areas, stores are being closed because of it. If the trend persists, 2025 could be the year that we see a major industrywide focus on enhanced security technology — from more cameras to AI-driven theft detection — to safeguard profitability.

• A pleasant surprise: retail media networks (RMNs). While I predicted their rise, the rapid adoption exceeded even my expectations. As RMNs grow into a robust revenue stream for convenience retailers, 2025 will see even more operators capitalize on this, turning their stores into data-driven advertising hubs.

• Finally, M&A activity did accelerate as I predicted, with several midsized chains merging or being acquired. This trend will likely continue this year, especially as smaller operators struggle with rising costs and compliance burdens.

As we head into 2025, we hope every year that legislators will rein in soaring credit card transaction fees, but those fees continue to skyrocket and cut into retailers’ bottom lines. I wish I could say I think retailers will get some relief in 2025. But, alas, I doubt it.

This year, the name of the game remains innovation, value and resilience. The convenience store industry has proven its adaptability time and time again, and I foresee another year of transformation and growth.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

FORECAST STUDY

20 A Move in the Right Direction

Economic optimism has the convenience store industry hopeful about 2025 business prospects.

22 Seeing the Light C-store retailers are heading into 2025 with more confidence than they had a year ago.

26 An Improved Outlook

The industry’s small operators are a bit more optimistic this year, but not as much as large operators.

30 Maintaining a Steady Course

Retailers expect more of the same in many product categories, but certain outliers spark optimism.

46 Things Are Looking Up

C-store suppliers and distributors expect better business conditions in 2025.

E DITOR’S NOTE

4 Heading Into 2025 With Optimism

Allow me to suggest a few New Year’s resolutions for convenience store operators.

VIEWPOINT

6 Reflecting on 2024 Predictions & What’s Next for 2025

The c-store industry faces another eventful year.

New Products

THE BUSINESS CASE FOR D&I

52 Addressing the Needs of Women Professional Drivers TravelCenters of America is working to improve the experience for this growing group. DEPARTMENTS

INSIDE THE CONSUMER MIND

70 Room for Improvement

As you set your 2025 strategy, consider these c-store shopper insights.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

SENIOR ACCOUNT EXECUTIVE Griffin Randall - (404) 702-6931 - grandall@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

MARKETING COORDINATOR Mateo Rosas mrosas@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

Supporters of diversity, equity and inclusion (DEI) programs in the convenience store industry say misconceptions are rampant and standing in the way of companies and individuals reaping the benefits of more diverse, equitable and inclusive workplaces. In this video, Convenience Store News tackles the biggest fallacies and misunderstandings around DEI.

For more exclusive content, visit the Special Features section of csnews.com.

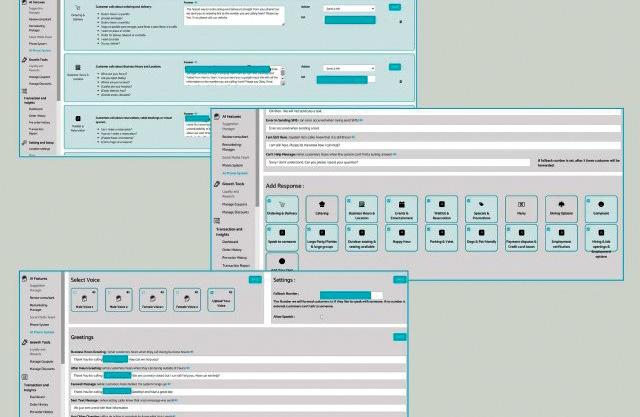

Swipeby launches an improved version of its Voice AI Phone System, designed specifically for small to medium-sized businesses. Powered by artificial intelligence, the new solution provides a more human-like experience for customers and enables staff to focus on their jobs instead of having to stop to answer the phone. The system can use the voice of the owner or an AI voice to interact with customers and allows the caller to request to speak in Spanish. While intended for single-unit businesses, multiunit operators also can utilize the Voice AI Phone System.

Swipeby Winston-Salem, N.C. swipe.by

The retailer alleges that 2 Wiseman Enterprises dba Duckees Drive Thru and its cartoon duck logo infringe on Buc-ee’s trademarks. The lawsuit seeks an injunction to halt Duckees from using its current logo.

PepsiCo Inc. agreed to acquire the remaining 50% interest in Sabra Dipping Co. LLC and PepsiCo-Strauss Fresh Dips & Spreads International GmbH. According to the company, the deal will enable it to continue transforming its portfolio and driving accelerated innovation.

Located in Otsego, Minn., Lockbourne, Ohio, and Hazelwood, Mo., the distribution centers average approximately 266,000 square feet. The retailer plans to contract out all warehouse and distribution operations at these sites to third-party logistics providers.

3 4

Love’s Travel Stops & Country Stores ranked No. 11 on the 2024 Forbes list with $24 billion in revenue and 40,000 employees. QuikTrip Corp. was the second-highest ranked company from the c-store industry at No. 20 with $19.6 billion in revenue and 33,027 employees.

The high court let stand a U.S. Food and Drug Administration rule that requires certain warnings to appear on the top 50% of the front and back of cigarette packages and at least 20% of the top of ads. The rule was issued in March 2020, with implementation pushed back several times.

Unlock the Power of Mentorship

Mentorship can build connections throughout every level of an organization, helping to attract and retain talent, keep team members engaged, and enable new employees to hit the ground running. Mentorship also brings together people from different racial and cultural backgrounds, belief systems, orientations, age groups and more. In a 30-minute webinar, now available for on-demand viewing at CSNews.com, Bob Carnicom, chief financial officer for Freemont, Ohio-based Beck Suppliers Inc./FriendShip Food Stores, and Carly LaBeau, retail accounting administrator for the company, discussed how their mentor/mentee relationship has benefited both of their careers.

Pending acquisition activity will add roughly 300 stores to its network over the next few months

By Melissa Kress

IT DOESN’T SEEM like Alimentation CoucheTard Inc. will satisfy its appetite for growth any time soon. Case in point: The Laval, Quebec-based company is preparing to wrap up acquisition deals with two regional convenience store chains, setting itself up to expand its network in 2025.

In August, the parent company of Circle K inked an agreement to acquire GetGo Café+Markets from Pittsburgh-based Giant Eagle Inc. for approximately $1.6 billion. GetGo, the c-store arm of the supermarket retailer, employs roughly 3,500 employees and operates approximately 270 stores across Pennsylvania, Ohio, West Virginia, Maryland and Indiana.

The transaction, according to Couche-Tard CEO Alex Miller, is expected to close in calendar year 2025. “I and members of the executive team spent a very productive few days with the GetGo management and employees in September, visiting stores and facilities,” he shared during the company’s second-quarter 2025 earnings call on Nov. 25. “We are excited about our early

learnings about GetGo’s extremely popular food and loyalty programs and dedicated team members.”

In addition to growing through the GetGo transaction, CoucheTard reached “a small tuck-in purchase agreement” with Elk City, Okla.-based Hutchinson Oil Co. LLC. The agreement will add 20 convenience stores in Oklahoma and Kansas, currently branded Huck’s, to Couche-Tard’s network and bring the Circle K banner back to those two states, Miller said. The transaction is expected to wrap up in the first quarter of calendar year 2025.

Couche-Tard has been busy overseas as well. “We are pleased with the ongoing work with our four new business units as they successfully transition out of a complex carve-out with TotalEnergies. The teams are highly energized and engaged, and are making good progress with store rebranding and integration plans,” Miller stated during the earnings call.

On the organic growth front, Couche-Tard is also making progress on its goal to build 500 new stores. The retailer opened 14 stores in the second quarter of its 2025 fiscal year and is on track to open more than 100 stores in North America this fiscal year.

Currently, Couche-Tard operates in 31 countries and territories, with more than 16,800 stores, of which approximately 13,000 offer road transportation fuel.

Parkland Corp. plans to add more than 100 new-to-industry convenience stores, raze-and-rebuilds or tuck-ins over the next three years. The company will support organic growth by allocating $1.3 billion of growth capital expenditures from 2025 to 2028.

RaceTrac Inc. cut the ribbon on its first store in Ohio. Located in the I-75 and CR 99 corridor in Findlay, the 8,100-square-foot travel center features a 16-pump forecourt, tractor trailer parking, and on-the-go food and beverage options.

Jacksons Food Stores acquired the assets of Hi-Noon Petroleum Inc. in Montana. The deal included three c-stores, 46 dealer accounts and Hi-Noon’s entire transportation fleet.

7-Eleven Inc. is opening five new stores in Arizona, marking its first new store openings in the state in 25 years. Three locations were added to the convenience retailer’s network in 2024, with the other two store openings slated for 2025.

OnCue welcomed customers to its largest travel center to date. Located in Oklahoma City, the site features a larger and more spacious layout. The lot can service up to 24 vehicles in the front and seven in the back.

Foxtrot Café & Market is making its return to Dallas this month. The upscale convenience retailer is reopening locations at 3130 Knox St. and 6565 Hillcrest Ave. in University Park to kick off the new year.

Love’s Travel Stops opened three new Speedco facilities and rebuilt an older Love’s Truck Care shop into a full-service Speedco. Speedco and Love’s Truck Care now comprise an over-the-road truck maintenance network with more than 430 locations and 1,100 roadside service trucks.

Sheetz Inc. and IONNA teamed up to open three electric vehicle “Rechargeries” at Sheetz convenience stores in late December. The companies are committed to opening 50 Sheetz/IONNA Rechargeries by the end of 2026.

The Kent Cos. has begun rebranding Jack’s Convenience Stores under the Kent Kwik banner. New signage is being installed at several of the eight Jack’s locations, which were acquired in May.

Gulf Oil’s latest national brand campaign, “Don’t Think About It,” hit the airwaves in late 2024. The campaign features a variety of 15-second and 30-second commercial spots airing on several connected TV offerings.

The Hershey Co.’s main controlling owner, Hershey Trust Co., rejected Mondelēz International Inc.’s preliminary takeover offer. A tie-up between the companies would create a food giant with combined sales of almost $50 billion.

The J.M. Smucker Co. closed on its $305 million transaction to divest the Voortman business to Second Nature Brands. The sale included all Voortman trademarks and a leased manufacturing facility in Burlington, Ontario in Canada.

Noble Roman’s Inc. opened approximately 19 new franchise locations during the fourth quarter of 2024, including three new units for Majors Management LLC. The pizza brand expected to reach 70 new nontraditional franchise unit openings by the end of the year.

Parker’s Kitchen expanded its partnership with Titan Cloud. The strategic move will help it accelerate plans for growth and operational improvements in the fuel retail sector.

7-Eleven Inc. tapped Jackpot.com to serve as the chain’s official lottery courier service. The program launched in 600-plus 7-Eleven and Speedway stores in Ohio and Massachusetts.

Legacy Markets LLC is investing in fuel technology following its acquisition of the 10-store Triangle Stop convenience retail chain. The company selected PriceAdvantage as its new fuel pricing software platform.

Ferrero North America opened a 169,000square-foot Kinder Bueno production facility in Bloomington, Ill. The $214 million investment created roughly 200 new jobs.

American Car Wash Supply transferred to new ownership, with John Olert assuming the role of CEO. The company plans to enhance its focus on providing equipment solutions coupled with responsive service and installation support.

Klimon entered the convenience channel through a distribution deal with 7-Eleven Inc. The company’s pints and ice cream novelties will initially be available at nearly 400 7-Eleven stores in southern California.

Morinaga America Inc., maker of Hi-Chew candy, held a groundbreaking ceremony for its second manufacturing facility. Located in Mebane, N.C., the facility is scheduled to open in January 2027.

Snacks remain one of the top traffic drivers for convenience stores, and pladis Global is dedicated to helping the channel expand category sales. “Convenience remains a key focus for pladis, and we’re committed to delivering more joy to our customers and consumers through this channel,” Bryan Baker, director for Convenience at pladis Global told Convenience Store News.

How are you supporting your brands to drive sales for the coming year?

Flipz chocolate-covered pretzels strike the perfect balance of sweet and salty, making them an irresistible addition to any Game Day spread.

ready and in stock.

Do delivery services have even greater potential for c-stores?

What is in store to keep sales thriving in 2025?

For more information, contact your broker and/or

Smithfield Select Bacon

Smithfield Culinary presents Smithfield Select Bacon, a fully cooked, ready-toeat option designed to be a time-saver for foodservice operators. The thick-cut bacon can be heated in the microwave or on a flat top, ensuring quick and easy preparation as well as easy clean-up, cutting down on back-of-house labor, according to the company. Available in both 14/18 Style and 18/22 Style, the bacon can be used in a wide range of menu applications, from classic breakfast platters to lunchtime sandwiches. Smithfield Select Bacon has a 360-day shelf life.

SMITHFIELD CULINARY • SMITHFIELD, VA. • SMITHFIELDCULINARY.COM

Celsius is adding two new flavors to its Celsius Essentials line. With the addition of Watermelon Ice and Grape Slush, the performance energy drink offering will grow to eight varieties. Celsius Essentials beverages, which debuted last year, are aimed at helping support physical and cognitive performance. According to the company, Grape Slush features sweet and tart notes to create an invigorating flavor experience, while Watermelon Ice delivers a mouthwatering taste experience that is refreshing and enticing. Available in 16-ounce cans, the new flavors will arrive in stores in early 2025.

CELSIUS HOLDINGS INC. • BOCA RATON, FLA. • CELSIUSHOLDINGSINC.COM

Smokehouse Rollers are the result of a collaboration between two family-owned companies: Stutzman Brothers Meats and F. McConnell and Sons, a distributor. Intended for the convenience channel, each roller is crafted from a special blend of tender trim and mild, savory seasonings. Smokehouse Rollers are cost-effective, require minimal labor and can move directly from the freezer to the grill, according to the companies. Currently, the rollers come in four varieties — Original Steak, Original Pork, Pork Jalapeño ‘n Cheese, and Steak ‘n Cheese — with each option being around 200 calories and having 15 to 17 grams of protein per serving.

F. MCCONNELL AND SONS • NEW HAVEN, IND. • SMOKEHOUSEROLLERS.COM

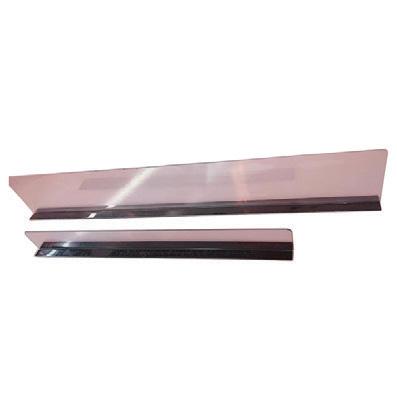

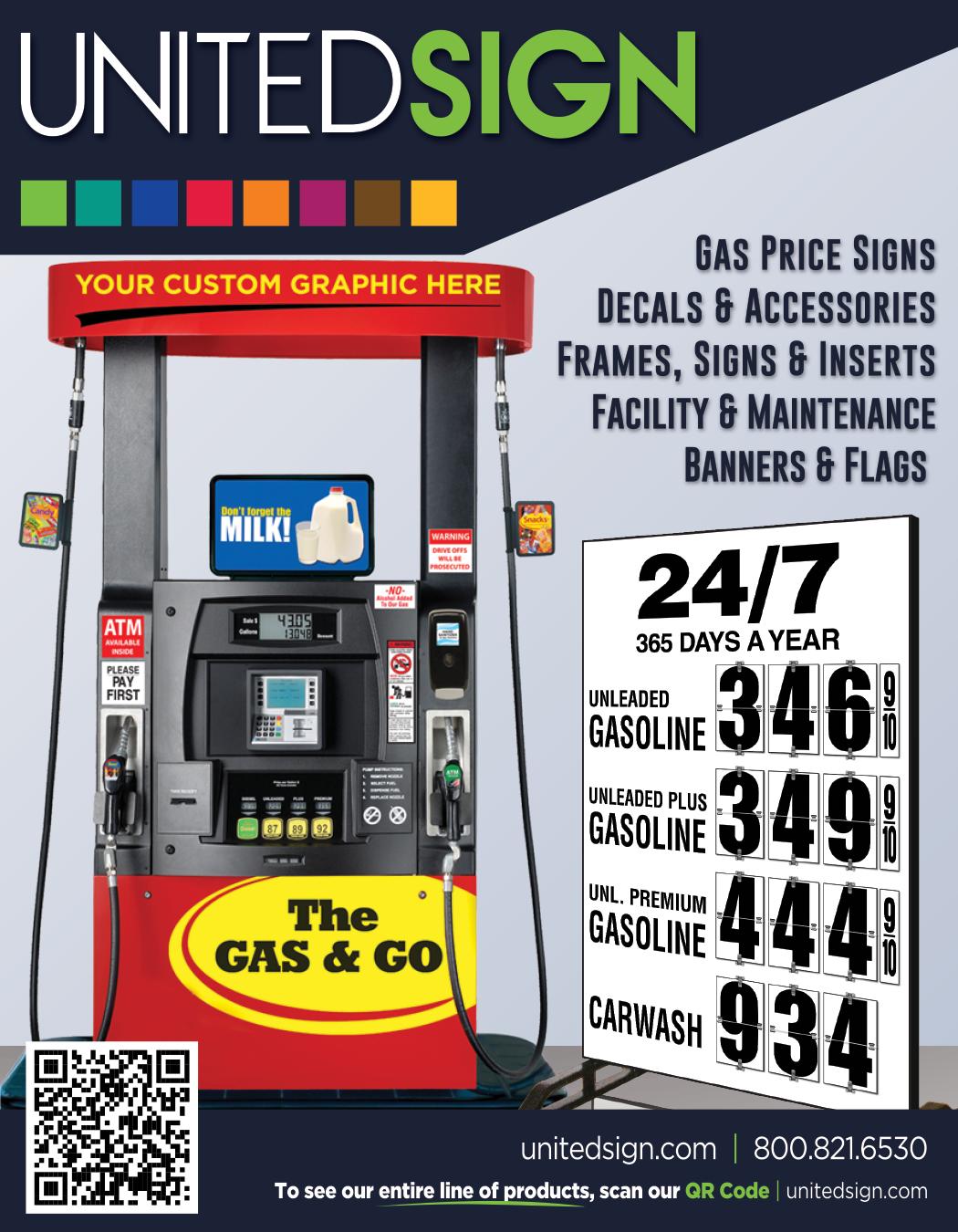

Alpina Gas Pump Frames

Hilco Sweets 5.5-Ounce Peg Bags

Hilco Sweets is once again partnering with Impact Confections and Kraft Heinz to introduce Warheads Mega Sour Booms and Kool-Aid Fruity Chews in larger-sized 5.5-ounce peg bags. Both were previously available in 2.5-ounce bags. Warheads Mega Sour Booms are sour dusted panned candy chews that come in four flavors: Cherry, Blue Raspberry, Green Apple and Orange. Kool-Aid Fruity Chews feature fruity panned candy chews inspired by the drink’s three most popular flavors: Tropical Punch, Cherry and Grape. Both products come with a suggested retail price of $2.99 to $3.99 and ship in four eight-count displays per case.

HILCO SWEETS • LOUISVILLE, KY. • HILCOUSA.COM

Alpina Manufacturing introduces Gas Pump Frames. Designed for eye-level placement at the pump as drivers fill up, the standard frames are black and designed for 5x7-inch or 8.5x11-inch graphics, but can be custom molded to an operator’s preferred size or color with a silkscreened logo on one or both sides. Made from ABS UV protected plastic, the frames can be mounted on the pump hose, on the top or side of the pump, or underneath the hood. The Gas Pump Frames can handle bending, winds, impacts, and both hot and cold weather, the company noted.

ALPINA MANUFACTURING • CHICAGO • GASPUMPFRAMES.COM

FOR THE PAST TWO YEARS, the state of the U.S. economy has not been instilling a great deal of confidence in the convenience store industry’s retailers, distributors and suppliers. And so, the industry’s key players headed into 2023 and 2024 with a largely neutral outlook on their business prospects.

This year, however, their outlook on both the U.S. economy and their own business prospects are more positive. The hope is that better economic conditions will lower inflation and its impact, boosting consumers’ disposable income, which will increase c-store foot traffic.

Verbatim comments from convenience channel retailers, distributors and suppliers who participated in the 2025 Convenience Store News Forecast Study include:

• “Inflation is abating."

• “The economy is getting better and prices are coming down.”

• “The Fed will start decreasing interest rates, which means people will feel less burden with debt.”

• “The economy will be vibrant.”

On a scale of one to five — where 1 represents “Terrible, wake me when it’s over” and 5 represents “It’s going to be our best year ever!” — nearly half of c-store retailers (49%) rate their expectations for 2025 at a 4 or 5. The industry’s distributors and suppliers are even more optimistic, with 52% rating their expectations at a 4 or 5.

Read on to learn more about what the industry’s key players predict for 2025.

C-store retailers are heading into 2025 with more confidence than they had a year ago

By Danielle Romano

AT THIS TIME LAST YEAR, most U.S. convenience store retailers were on the fence regarding their business outlook for 2024 and considerably less optimistic than they were the year prior.

This year, things appear to be a little brighter. Just under half of the c-store retailers surveyed by CSNews feel positive about their overall business outlook for 2025. On a scale of one to five — where 1 represents “Terrible, wake me up when it’s over” and 5 represents “It’s going to be our best year ever!” — 49% of retailers rate their expectations for the year ahead at a 4 or 5. Most of the remaining half give the new year a noncommittal rating of 3 (45%).

One retailer noted that lower interest rates set by the Federal Reserve, an uptick in consumer optimism and a less turbulent political climate are reasons for positivity.

Even with a better outlook for their business prospects in 2025, more c-store retailers are planning to stay the course when it comes to their store networks this year: 43% expect their store count to stay the same, up 4 points over last year’s study. Meanwhile, 52% intend to increase their count, a decline of 3 points compared to 2024. The industry’s large operators are more likely to be gearing up for expansion than small operators (one to 20 locations).

Interestingly, when asked how they will grow their networks, more retailers this year indicate they will grow organically (35%) vs. via acquisition (9%). The largest percentage, though, will utilize a combined approach of acquisitions and organic growth.

As one retailer remarked, “We have a solid growth plan.”

As in past years, the Forecast Study asked retailers to weigh in on the factors that will have the biggest impact on their sales and profitability in the year ahead. Even more so than last year when it was the third-ranked issue of importance, inflation and economic issues are top of mind with

Inflation and national economic issues

Increasing operational costs

Labor turnover and hiring

Changes in foot traffic patterns

Increasing regulation (excluding tobacco regulations)

Brick-and-mortar competition

Supply chain issues

Motor fuel prices

Tobacco and e-cigarette regulations

Changing consumer expectations of "convenience"

c-store retailers overall as they head into 2025 — 20% cite this as their top concern, while 49% put it in their top three.

Retailer comments on inflation and the economy include:

• “If inflation is not lowered, a lot of people will stop shopping at our stores because we have to raise prices.”

• “National economic conditions are VERY unstable and everyone is feeling the constant change in it.”

• “With inflation and rising prices, people won't have money to spend.”

Also dominating convenience retailers’ concerns are two interrelated issues: operational challenges and the labor market. For the second consecutive year, increasing operational costs comes in at No. 2 on the list of operator worries, followed by labor turnover and hiring, which fell to the No. 3 spot in this year’s study after ranking No. 1 last year.

One operator lamented that “shrinking margins” and “high wages for new hires” are problematic.

Retailers are still very much concerned about cross-channel competition as well. More than six in 10 operators expect cross-channel competition against the convenience store industry to increase in 2025. Likely due to inflation and the effect of rising prices on consumers, c-store retailers perceive dollar stores as their biggest competitive threat this year. The grocery channel and quick-service restaurants are on their radar, too.

Despite the obstacles, more than six in 10 c-store retailers (66%) forecast that their total sales per store will grow in 2025. Only 3% are bracing for a decline, while the remaining 31% project that their sales will stay the same year over year.

The top five categories where retailers are expecting sales increases are:

1. Prepared food (73% predict an increase)

2. Other tobacco products (63%)

3. Motor fuels (54%)

4. Packaged beverages (48%)

5. Dispensed beverages (44%)

Optimism for profit growth is pretty strong as well, with nearly half of retailers (49%) forecasting that their total profits

Expectations for In-Store Foot Traffic

per store will increase in 2025 — a jump of 15 points year over year. Just 12% are prepping for a decrease, while the remaining 39% anticipate no change.

Perhaps operators’ sunnier dispositions about sales and profits are driven by their expectations that in-store foot traffic will increase in 2025. More retailers in this year’s study (52%) predict their foot traffic will see an upturn, a rise of 20 points from last year’s study.

According to the retailers surveyed, the main trends that will impact their store performance relate to product offers and services. C-store operators are eying various initiatives to boost their sales and profitability in 2025, including foodservice expansion, third-party delivery, mobile app ordering, curbside pickup, contactless shopping via kiosk and contactless shopping via app.

Enhanced marketing efforts supported by promotions are also on many operators’ to-do lists.

"I think that we will try lowering prices across all departments, and [do] promotions with certain products every month,” one retailer shared. CSN

The industry’s small operators are a bit more optimistic this year, but not as much as large operators

By Linda Lisanti

INCREASING OPERATIONAL COSTS and uncertainty over the future state of the U.S. economy are keeping the convenience store industry’s small operators (those operating 20 stores or less) up at night as they head into 2025.

On a scale of one to five — where 1 represents “Terrible, wake me up when it’s over” and 5 represents “It’s going to be our best year ever!” — the largest percentage of small operators (48%) rate their expectations for this year at a 3. While the foremost rating last year was also a 3, the number of small operators choosing this option rose 5 points year over year.

In the good news column, fewer small operators opted for a negative rating this year. The percentage selecting a rating of 1 or 2 went from 19% last year to 10% this year. Similarly, the percentage who think 2025 is going to be their best year ever rose 6 points to 19%.

Interestingly, this figure is higher than among the industry’s large operators, only 6% of whom think 2025 is going to be their best year ever. Large operators in general, though, are more optimistic; the largest percentage rate their expectations for the year at a 4 out of 5.

While still concerned about inflation and national economic issues, the industry’s small operators have a better outlook on the U.S. economy than they did last year. Those who say they have a very/slightly negative outlook dropped 12 points year over year, though the total still stands at 42%. Those with a very/slightly positive outlook increased by 7 points to 29%.

“The economy is getting better and prices are coming down,” one small operator remarked.

Despite this improvement, large operators are more bullish on the economy than small operators as 44% say they have a very/slightly positive outlook, up 21 points from a year ago. Those with a very/slightly negative outlook, meanwhile, dropped 24 points year over year.

"The economy is getting better and prices are coming down."

— Small operator participant

Each year, the Forecast Study asks c-store retailers to identify the issues that will have the biggest impact on their sales and profitability in the year ahead. Along with concerns about rising operational costs (ranked No. 1 this year) and some hesitation around the economy (No. 2), labor issues such as hiring and retention continue to challenge small operators. A positive change, however, is that this issue fell from No. 1 last year to No. 3 this year among this group.

In spite of the challenges, both small and large operators anticipate growth in sales per store in 2025 — 65% of small operators and 68% of large operators expect an increase. Only 3% of each group foresees a decrease in sales, while the remainder expect the status quo.

On the contrary, a notable divergence emerges in profit expectations where small operators display less confidence than large operators: 56% of large operators expect to see their average profits per store rise in 2025, compared to 42% of small operators. A larger percentage of small operators (45%) expect their profits to stay the same, vs. 32% of large operators.

It’s a similar story when it comes to in-store foot traffic expectations where more large operators expect to see a change for the better: 59% of large operators anticipate stronger foot traffic this year (up a whopping 26 points year over year), vs. 45% of small operators (up 13 points).

“Big name c-stores are moving in," one small operator noted as a reason for pessimism.

Without the deep pockets of the industry’s largest chains, small operators are taking a measured approach to new investments in 2025. Technology appears to be an area of priority — likely in response to the various customer-driven advancements rolled out by competitors over the last few years. Tech also can help small operators improve operational efficiency.

Increasing operational costs

Inflation and national economic issues

Labor turnover and hiring

Changes in foot traffic patterns

Brick-and-mortar competition

Supply chain issues

Changing consumer expectations of "convenience"

Tobacco and e-cigarette regulations

Industry consolidation

Motor fuel prices

Emerging technologies

Rise in e-commerce

Demographic changes

Investments in foodservice

Increasing regulation (excluding tobacco regulations)

While the majority of small operators surveyed indicated that they already offer mobile pay both in-store and at the pump, ordering via mobile app and curbside pickup are the leading enhanced convenience services that small operators plan to add in the year ahead. Large operators, on the other hand, plan to focus on contactless shopping options and third-party delivery.

The industry’s small operators are taking a measured approach to expansion in 2025 as well. Only 36% expect to increase their store count this year, down 5 points from a year ago. That compares to 68% of large operators who plan to expand.

The majority of small operators (58%) intend to stay at the same store count. However, 6% say they will either decrease their store count or exit the industry in 2025. CSN

Retailers expect more of the same in many product categories, but certain outliers spark optimism

By Angela Hanson

IS NO NEWS GOOD NEWS? For the convenience store industry, that remains to be seen. For the most part, retailers do not predict that total store sales will decline in either dollars or units in 2025. However, in many key product categories, they also don’t expect to see sales increase, potentially resulting in a repeat of the last 12 months.

Despite the lower inflation rates seen at the end of 2024, operators still have concerns about rising costs and their negative effect on nearly every category. In spite of this, the 2025 Forecast Study also shows positive signs for the future, with predictions for other tobacco products (OTP) and prepared food standing out as reasons to be optimistic.

Here are the individual category forecasts for 2025:

Retailers continue to express mixed sentiments regarding the future of motor fuels. More than half of this year’s study participants (54%) expect their average fuel dollars per store to increase in 2025, up 11 points from a year ago, while just 13% expect sales to decrease.

Expectations for gallons sold are not as rosy, however, as just 32% of retailers believe their average gallons per store will increase in 2025 and 30% expect their gallons to decrease.

Small operators (one to 20 stores) demonstrate more confidence in motor fuels’ performance, while large operators are more cautious, particularly regarding dollar sales in the category. More than two-thirds of small operators expect their average fuel dollars per store to increase, compared to 42% of large operators. Along the same lines, 40% of small operators expect their average gallons per store to increase vs. 26% of large operators.

Retailers point to economic conditions and fuel prices as the main trends affecting the motor fuels category. “Hopefully, the cost will stay down. That will have the biggest impact on the motor [fuels] category,” one retailer remarked.

Category Forecast: Motor Fuels

Category Forecast: Cigarettes

Retailers continue to express mixed sentiments regarding the future of motor fuels.

Also expected to be an important factor is technology advancements that lead to less fuel demand, such as adoption of electric vehicles and increased fuel efficiency in standard vehicles. Convenience store operators are keeping a close eye on the regulatory environment, market dynamics and consumer behavior as well.

Expectations for cigarettes have tempered compared to one year ago, when sales projections took a sharp downward turn. Although nearly a third of retailers (32%) expect their average cigarette dollar sales per store to decline in 2025, this is a 14-point improvement from last year. Additionally, the percentage who believe their dollar sales will increase jumped 20 points to 37%.

Expectations for cigarette unit volume are seeing similar changes, with 44% of retailers projecting their average unit volume per store will decrease, down from 62% a year ago, and 26% reporting they expect unit volume to increase, up from 10% last year.

These positive shifts come in the face of price hikes and increased regulation for cigarettes, indicating that retailers believe consumers will maintain their purchases regardless of rising costs. “The prices keep going up and people keep paying them,” one retailer noted.

Small operators are more likely than large operators to expect an increase in dollar sales (47% vs. 28%, respectively), primarily due to price increases in the category. However, 37% of small operators also expect unit volume to increase, compared to 16% of large operators.

Along with price increases, retailers point to shifting consumer preferences and product diversification as other top category trends. “People are starting to move away from cigarettes to vapes or chew or [nicotine] pouches,” one retailer observed.

Still, the majority of retailers plan to maintain their current number of cigarette SKUs (53%) and square footage dedicated to the category (69%). Large operators are somewhat more likely than small operators to be considering reductions in SKUs and square footage.

The OTP category continues its multiyear streak of significantly more positive expectations. Sixty-three percent of retailers predict their average OTP dollar sales per store will increase this year, up 7 points from last year, while a quarter of respondents predict no change.

The forecast for OTP units is nearly identical, with 62% of retailers predicting an increase in their average unit volume per store and 27% predicting no change. A 9-point increase in the percentage of retailers predicting unit growth further signals optimism for this category.

In contrast with cigarettes, retailers’ outlook for OTP is encouraging regardless of store count. The majority of both large and small operators expect 2025 to bring positive results for both OTP dollar sales and unit volume. Accordingly, half of retailers plan to add SKUs and just under half plan to increase the square footage they devote to OTP.

Many retailers attribute their optimism to the increased variety in OTP options, including oral nicotine items, vaping products and more. However, the popularity of certain items such as vapes could lead to price increases in the future, some predict.

While the OTP category is expected to benefit from changing consumer behavior, it is not immune from the negative effects of the regulatory environment. Retailers report challenges from regulations targeting e-cigarettes, even as higher cigarette taxes lead to increased OTP sales.

2025 is very likely to be another year during which the foodservice category proves itself vital to success in the convenience channel.

Nearly three-quarters of retailers (73%) expect their average prepared food dollar sales per store to increase this year, while the remaining 27% predict no change. No retailers anticipate a decline. The unit forecast for prepared food is nearly as sunny, with 66% of retailers anticipating their average unit volume per store will increase, 29% predicting no change and just 5% bracing for a decline.

Large operators demonstrate more confidence in the category, as more than eight in 10 expect both dollar sales and unit volume increases. Meanwhile, 60% of small operators say their dollar sales will increase, but only 48% say their unit volume will increase.

Consequently, many large operators are making plans to add prepared food SKUs (77%) and expand their square footage for prepared food (58%) in 2025, while small operators are more likely to say they will maintain their current offerings (56% for both).

Investment in new prepared-food product offerings is likely to be the biggest category trend this year, with retailers making plans to expand their menus and enhance quality,

Category Forecast: Dispensed Beverages

Category Forecast: Packaged Beverages

"Convenience is the new consumers' fast food for price and speed of service."

—

Retailer participant

taste and innovation. Companies also are considering their operational strategies and marketing.

Rising costs could push prepared food prices up this year, making it challenging to stay competitive as consumers demand quality and a good value. Those who can hit both marks while navigating increased costs, though, stand to benefit greatly.

Category Forecast: Beer/Malt Beverages

“Fast food is restaurant prices, so convenience is the new consumers’ fast food for price and speed of service,” one retailer remarked.

Expectations for dispensed beverages, which include hot, cold and frozen drinks, have slipped compared to a year ago, but retailers predict the category will at least hold steady in 2025.

Convenience store operators are split on whether their average dollar sales per store of dispensed beverages will stay the same (47%, up 9 points year over year) or increase (44%, down 8 points). Projections for average unit volume per store are also split, with 49% saying they expect their dispensed beverage volume to stay the same and 40% predicting an increase.

There is little difference in how the industry’s small operators and large operators foresee dollar sales in the category, but company size does seem to make a difference in whether they anticipate growth in unit sales or stability. Only a third of small operators expect their dispensed beverage units to increase, compared to 45% of large operators.

Unsurprisingly, most retailers don’t plan to make significant changes to their dispensed beverage strategy in 2025. Around two-thirds anticipate keeping their SKUs and category square footage the same. Even so, retailers are looking for product innovation, such as new flavors and customization options, to shake up their offering this year.

Some point out that packaged beverages are cannibalizing fountain sales. “Customers are choosing away from fountain soda products as there are many choices in the cold vaults,” one c-store operator explained.

Retailers do believe that dispensed beverages present an opportunity to gain a competitive advantage through pricing strategies. “I will fight to keep retail prices low and undercut the coffee brand names,” one retailer vowed.

C-store operators are split on what to expect from packaged beverages in 2025. An equal percentage (48%) expect their average dollar sales per store to stay the same or increase, while just 3% predict dollar sales will fall. Retailers are likewise split on whether their unit volume per store will stay the same (48%) or increase (42%). One in 10 expect units to decline.

From the freezer - To The Fryer - To The Customer Hold time of up to 4 hours under heat lamps FLAVORS:

- Bacon Cheddar & Chive - Cheese Bomb - Bacon Jalapeno - The Reuben - Breakfast Skillet - Buffalo Chicken

Request Samples Today!

Small operators are more likely to forecast stability, while large operators are more likely to forecast growth in both dollars and units: 37% of small operators vs. 59% of large operators anticipate increased dollar sales for packaged beverages this year, while 30% of small operators vs. 53% of large operators anticipate increased unit volume.

This difference in optimism is driving half of large operators to add packaged beverage SKUs, compared to just 13% of small operators. Large operators also are more likely to say they will add square footage to the category, albeit two-thirds report no planned change.

As with dispensed beverages, variety is forecasted to be a notable packaged beverage trend in 2025, along with energy drinks. “Introduction of clean energy beverages and better-for-you beverages will drive this,” said one operator.

Pricing may be a concern, with some retailers noting that the category’s performance will hinge on their own costs. “It will all be about how much we have to pay for the product before we can offer a lower price to our customers,” another retailer noted.

The beer and malt beverage section of the cold vault is expected to repeat its 2024 performance, with a greater percentage of retailers predicting similar results this year.

More than half (54%) forecast their average dollar sales per store will stay the same, up 11 points year over year, while 40% expect their dollar sales will increase, down 11 points from a year ago. Retailers are even more likely to expect static performance in unit volume, as 60% predict their average units per store will stay the same — up 11 points from last year and nearly double the percentage who expect their unit volume to increase.

The industry’s large operators are slightly more likely than small operators to predict no change in 2025 unit volume for beer and malt beverages. Regarding dollar sales, roughly six in 10 large operators and half of small operators expect status quo.

Most c-store operators plan to keep their SKU count and square footage for beer and malt beverages the same. Just 8% plan to decrease SKUs, but this is a notable jump from last year when no retailers reported plans to do so. It may be a signal of early caution.

Retailers say product trends such as readyto-drink (RTD) cocktails, local brews and new offerings will have significant category impact during the year to come. Some observe that

Retailers predict RTD cocktails and local brews will have an impact on the beer and malt beverages category.

more consumers are reducing their alcohol consumption or turning to nonalcoholic options. Among those who do drink, rising interest in RTDs reflects a generational shift in consumer preferences.

“Life and weather make people drink. [The] newer generation picks things up like BeatBox or BuzzBallz or Twisted Teas or White Claws; lots of single units,” one retailer shared. “It’s not just your typical dad drinking beer after work anymore.”

Just over half of retailers expect the candy category to hold steady this year, although there is a sizable minority who anticipate category growth.

Expectations for average dollar sales per store are a virtual repeat of last year’s study, with 52% of retailers predicting no change, 40% expecting their sales to grow and 8% foreseeing a decrease. There is less optimism regarding unit volume. Nearly the same percentage of retailers (53%) expect their average units per store to stay the same, but 18% expect a decrease and just 29% foresee an increase. This indicates growth will mainly be driven by price increases.

Small operators express more optimism than large operators for candy sales this year: 52% say their dollar sales will increase vs. 30% of large operators, and 38% say their unit volume will increase vs. 21% of large operators. Likewise, more small operators report plans to expand candy SKUs (38%) and square footage (35%) compared to large operators (18% for both).

Retailers overwhelmingly cite price increases as the factor most likely to negatively impact candy sales in 2025. “Candy is following suit with tobacco and everything else. The price is becoming out of control,” one retailer stated. Another noted that “my candy customers skew young and I anticipate that they won’t have the money to grow my category.”

C-store operators also make note of the growing demand for healthier options, which they say may push them to invest more in better-for-you and natural products in this category.

As with the candy category, retailers expect little change in salty snack performance in 2025.

Optimism is down slightly from last year’s study. More than half of retailers (56%) expect no change in their average dollar sales per store, up 7 points from a year ago, while 38% expect their sales to increase, down 12 points. In regard to unit volume, more than six in 10 retailers predict their current situation will stay the same, while 31% expect growth.

Both large and small operators mainly expect dollar sales and unit volume to hold steady. Overall, compared to a year ago, retailers are displaying more caution regarding the outlook for salty snacks. As a result, a significant majority have no plans to change SKU count (71%) or the square footage they devote to the category (77%).

Retailers anticipate that economic challenges will continue to be a problem for salty snacks, with one predicting “shrinkflation will continue.” At the same time, some believe that opportunity can be found in new flavor combos and healthier items.

WARNING: Cigar smoking can cause lung cancer and heart disease.

“Innovative flavors and better-for-you brands will impress customers,” one retailer said. Another mentioned that products combining salty and sweet flavors will be “a great hit.”

Expectations for alternative snacks have moderated notably compared to last year’s study.

Although retailers have a generally positive view, with more than nine in 10 forecasting the category to hold steady or grow, the percentage who expect their average dollar sales per store of alternative snacks to increase saw a steep drop, falling 18 points to 31%, while 62% expect their dollar sales to stay the same, up 15 points from a year ago.

Around two-thirds of retailers predict their average unit volume per store will stay the same, up 10 points from last year, while just over a quarter predict increased volume, down 13 points.

Although a majority of operators predict no change in alternative snacks’ performance, large operators are more optimistic: 37% expect their average dollar sales to rise and 30% expect units to grow, compared to 25% and 21% of small operators, respectively. Most retailers plan to keep their alternative snack SKUs and square footage the same, although large operators indicate more openness to category expansion.

Retailers expect rising prices to affect alternative snacks, same as several other categories. “Increasing costs will probably result in reduced sales,” one retailer stated.

The category may benefit from increased consumer demand for healthier options and new products. One operator noted that “people love trying new, better foods” while another advocated for taking a balanced approach, “stick[ing] to the old snacks while introducing the new to see if it works.”

Retailers expect to see steady sales in the edible grocery category in 2025. Six in 10 c-store operators predict their average edible grocery dollar sales per store will stay the same in the coming year, up 8 points compared to last year’s study, and 64% expect no change in their average unit volume per store, up 10 points from a year ago.

C-store operators expect steady sales in the edible and nonedible grocery categories in 2025.

While 2025 projections are fairly uniform among retailers, large operators are less certain about unit volume: 21% predict a decrease vs. 11% of small operators. Large operators are also less likely to think their volume will stay the same: 57% vs. 70% of small operators.

This sentiment carries over to plans for edible grocery SKUs and category square footage, as nearly a third of large operators plan to reduce both, compared to 15% of small operators.

Some retailers say rising prices are pushing them to deprioritize the category. One study participant noted that it is “too expensive to even have a lot of shelf space.”

Following in edible grocery’s footsteps, retailers believe nonedible grocery is unlikely to see much positive or negative change this year. Seventy percent expect both their average dollar sales per store and average unit volume per store to stay the same in 2025.

Small operators are more likely than large operators to predict improved dollars and units. Just over six in 10 retailers plan to maintain

their current nonedible grocery SKUs and square footage, with little difference based on store count.

The future could become rockier for nonedible grocery if rising costs reduce purchases and trigger an overall category decline, some retailers speculate. “Increasing costs will probably drive consumers toward focusing on edible grocery more than nonedible, but they will more than likely focus on the cheaper options resulting in similar tonnage,” one retailer said.

The forecast for general merchandise is similar to the past two years, with roughly half of retailers expecting a neutral performance from the category in both dollars and units.

Just under half of retailers (48%) predict their average dollar sales per store from general merchandise will stay the same, while the remainder are split on whether they expect dollars to increase (34%) or decrease (19%). Operators are similarly split on unit volume, with a slight majority (54%) predicting no change in their average volume per store.

Small operators are more likely than to large operators to anticipate increases in both metrics. Nevertheless, around six in 10 retailers overall plan to keep the same general merchandise SKUs and square footage in 2025.

Retailers point to cell phone accessories, seasonal items and novelties as potential opportunities, although they acknowledge that general merchandise faces notable competition from cross-channel competitors such as dollar stores and drugstores.

As with other categories, rising prices are expected to continue having an impact on general merchandise sales. “General merch is following everything else,” commented one retailer. “Too much of a jump in price.”

Roughly half of the retailers surveyed expect the performance of health and beauty care (HBC) to stay the same in 2025. However, this category stands out as one for which c-store operators are more willing to predict declines.

Fifty-one percent of retailers expect their average dollar sales of HBC to hold steady, while the percentage predicting a decrease jumped 8 points to 27%. Along the same

lines, 57% of retailers anticipate no change in their average HBC unit volume per store, while 29% predict a decrease.

Small and large operators indicate similar levels of skepticism, with around three in 10 predicting decreases in both dollars and units, and about half predicting no change to either. Most retailers do not plan to change their HBC SKUs or square footage, but 28% of small operators plan to decrease SKUs and 24% will cut back square footage.

Competition from channels that can offer lower prices and a wider variety of HBC items is one of the category’s top challenges. As one retailer pointed out, “Increasing costs will drive consumers toward cheaper options.” CSN

suppliers and distributors expect better business conditions in 2025

By Melissa Kress

WILL THE U.S. ECONOMY turn a corner in 2025? Quite possibly, according to the convenience channel suppliers and distributors who participated in this year’s Forecast Study.

More than half (52%) say they have a very/ slightly positive outlook on the nation’s economy heading into the new year — an increase of 10 points from last year’s forecast. Those holding a neutral view also rose 10 points to 27%, while those with a negative outlook dropped 20 points to 21%.

The supplier/distributor community’s feelings about their company’s business prospects for the coming 12 months paint a similar picture. A combined 52% land on the positive side of the spectrum, compared to only 5% who fall on the opposite end. The remaining 43% report neutral feelings.

When it comes to their specific product category, seven out of 10 suppliers/ distributors anticipate improvement in the coming year — that is a 16-point increase from the 2024 forecast. Respondents with a neutral view (9%) and those with a very/ slightly negative view (21%) dropped 10 points and 6 points, respectively, year over year.

While more c-store industry suppliers and distributors are feeling better about the economy and their business prospects for 2025, their view of the convenience channel vs. competitors is down slightly compared to a year ago. Nearly two-thirds (65%) say they have a very/slightly positive view of the channel’s competitive position, a 5 point decrease year over year.

Closing the competitive gap are grocery stores, as 60% of suppliers and distributors view business conditions in the grocery channel as very/slightly positive — a 7 point improvement over last year. Conversely, the percentage of suppliers and distributors with a positive view on dollar stores and mass merchants fell 11 points and 12 points, respectively.

The supplier/distributor community expects cross-channel competition to intensify in 2025, with more than six in 10 (64%) making that prediction — up 18 points from

C-store industry

and distributors continue to see inflation as their primary challenge.

a year ago. Only 7% expect cross-channel competition to decrease, down 5 points from last year.

When asked about the biggest cross-channel threats, respondents pointed to quick-service restaurants (43%), food delivery sites/apps (38%), dollar stores (34%), grocery delivery sites/apps (34%), Amazon/ Amazon Fresh (32%) and grocery retailer sites/apps (32%).

Along with cross-channel competition, c-store industry suppliers and distributors continue to see inflation as their primary challenge; rising prices impact consumer spending. Specifically, 20% of respondents say inflation and national economic issues will have the biggest impact

GREAT FLAVORS -MINT, WINTERGREEN, ORANGE, CINNAMON, BERRY AND FLAVOR FREE

AVAILABLE IN 3MG, 6MG, AND 9MG STRENGTHS

NIC-S® is a premium, tobacco-free, nicotine brand backed by extensive scientific research, made with pharmaceutical-grade nicotine, and setting a higher standard in this OTP category.

EXTENDED NICOTINE RELEASE

LONG LASTING FLAVOR

PREMIUM SOFT POUCHES

on their sales and profitability in 2025 and 46% put it in their top three. Along the same lines, 13% cite consumer spending decline as their biggest challenge and 43% place it in their top three.

Other top challenges are labor turnover and hiring, and increasing operational costs.

“Innovation will increase as economic conditions improve.”

—Supplier/distributor participant

Despite concerns, convenience channel suppliers and distributors have a lot to say about their reasons for optimism heading into 2025. Comments include:

• Economy: “We anticipate fuel prices to continue to remain steady and even decline, which would spur more driving and trips to convenience stores.”

• Business Growth & Expansion:

“We are a growth company with a tremendous upside and have just started larger business rollouts.”

• Innovation & Technology:

“Innovation has slowed through the inflationary period and I believe it will increase as economic conditions improve.”

Other leading reasons for optimism are operational improvements, and changing political and regulatory factors following the November 2024 presidential election. C-store industry suppliers and distributors are also bullish on new product development and

unit expansion.

By Tammy Mastroberte

MANY OF THE TECHNOLOGIES that have been top of mind for convenience store retailers over the past couple of years will remain that way as the industry moves into 2025.

Whether it’s bringing new people into the store, getting more visits from existing customers, building loyalty or understanding behavior to drive sales, retailers plan to continue utilizing digital and mobile technologies, capturing and dissecting data to help them make better decisions, and harnessing artificial intelligence (AI) in new ways to meet their goals.

“I recently participated in developing and the presentation of the Conexxus 2025 Roadmap that highlighted three technology areas [where] retailers have been talking about taking steps to implement additional solutions: digital media, mobility commerce and identity,” noted Ed Collupy, owner of Collupy System Solutions LLC, which offers consulting services to the industry. “The consumer journey and experience have been on retailers’ own roadmaps for years, but evolving consumer expectations, advancements and opportunities are leading retailers to consider what’s next.”

Of course, the ultimate goal is to get consumers into the store and then have them

come back often. Technologies can assist with this, such as analyzing and understanding shopping data, according to Kay Segal, founding partner of Business Accelerator Team, a convenience retailing consultancy based in Phoenix.

“Many retailers are focused on loyalty technology or technologies that may enhance their current app to make the loyalty technology more sophisticated,” she said. “However, most consumers are not part of a retailer’s loyalty program, so acquisition tactics need to be a focus for retailers.”

“The consumer journey and experience have been on retailers’ own roadmaps for years, but evolving consumer expectations, advancements and opportunities are leading retailers to consider what’s next.”

— Ed Collupy, Collupy System Solutions

Four technologies that convenience retailers are prioritizing for 2025 are:

C-store retailers are testing and discovering new ways to use AI, from helping with store operations to better understanding customer behavior in the store, and more.

“I hear and see retailers trying to determine how artificial intelligence will impact and become a real benefit for their business,” said Collupy. “They are using and getting payback from solutions using voice analytics, computer vision and publicly available tools. I’m finding that trying things out using AI is creating other use cases as knowledge.”

At Fav Trip, the operator of five convenience stores in Missouri, the retailer is working with InStore.ai and using cameras to get heat maps of its customer flow, as well as capture customer impressions as they come into the store and leave. Fav Trip’s policy is “Come Happy, Leave Happy.”

“We are monitoring if they are coming in angry, but leaving happy, for example,” President and CEO Babir Sultan explained, adding that the retailer has a great online following, so AI is playing into its social media content and decision-making as well.

Another retailer using AI to understand customer behavior — and keep them coming back — is Mount Vernon, N.Y.-based Atlantis Management Group (AMG), the operator of 300 locations, 100 of which are company owned. AMG is partnering with AI companies such as InStore. ai and Insider for audio insights into customer and employee interactions and to monitor loyalty promotions, out-of-stocks and other issues in its stores.

“We analyze the audio in the stores using a large language model for insights, and we are expanding the rollout of that in 2025,” reported Rick Rigby, chief technology officer. “We are gaining insights by searching the audio in-store and learning a lot to make things better for customers.”

For example, if a fuel pump goes down and someone doesn’t report it right away but the audio picks up

people complaining about it, AMG can look at automating this process to create a ticket and free up employees from having to create one, Rigby explained.

“Also, if we have a new loyalty promotion, we can monitor if cashiers are pushing the program, which ones are doing it well, and what resonates with the customer and what doesn’t,” he said.

“We are gaining insights by searching the audio in-store and learning a lot to make things better for customers.”

— Rick Rigby, Atlantis Management Group

Gaining customer loyalty is key to repeat visits and increased purchases for convenience store retailers, which is why so many are focusing on loyalty programs and digital apps.

“Once a consumer opts into the app, they need to be incentivized to stay actively engaged,” said Segal.

In 2025, retailers will continue their efforts to find technologies and systems that “reduce the gap between POS [point-of-sale] and loyalty data,” so they can better understand the actions of consumers and target their marketing and merchandising investments, Collupy noted. “This will be needed to get ahead of the efforts to get to personalization [in marketing],” he added.

Fav Trip has an app that offers 24-hour delivery service, as well as a text club with more than 17,000 people opted in. While individuals may change email addresses, they rarely change their phone numbers, Sultan said as to why the company chose a text format.

To drive more signups, Fav Trip is using the InStore.ai audio feature to finetune its pitch to customers and determine what’s working well to get them into the program. For example, store personnel started asking customers if they were part of the text club and then changed to asking them if they would like a discount on gas.

“We continue to learn and take action accordingly, so we are paying attention to how we are pitching, looking at what people are saying, and at what our staff is saying before a customer signs up for the program. Also, what are they saying if they don’t want to sign up,” Sultan said.

Likewise, Atlantis Management is planning “a big push” on loyalty in 2025 and expanding what the company is doing around rewards and delivery, Rigby shared. AMG has partnered with PDI/Excentus and used its internal development team to create a mobile app.

“We are in the crawl, walk, run phase. So first, it’s to get the data we are gathering into Snowflake, the data

warehouse, and then start analyzing and leveraging the data for better insight, marketing and automation,” Rigby detailed.

With all the data being gathered in c-stores today— from POS and loyalty programs to apps and AI — convenience retailers are constantly finding new ways, and new technologies, to help them analyze the data and use it to influence customer behavior, driving store visits and sales.

“My belief, given the momentum in new technologies and competitive threats to ‘convenience,’ is that more companies need to and will be undertaking projects to build out a comprehensive system and data strategy around business objectives,” Collupy predicted.

Fav Trip is turning to data more and more, utilizing InStore.ai and the data that is being collected around customer expectations. “We’ve been sitting on a lot of data and are finding ways to monetize it,” Sultan pointed out.

Atlantis Management’s Rigby said his main mantra right now on the technology side is “get good data in the hands of smart people, so they can do smart things with it.”

The retailer is leveraging companies such as Snowflake Inc. and Power BI on the reporting side to bring insights to the headquarters level, as well as to store managers. Additionally, AMG is focused on automating reports that people were doing manually in the past.

The chain’s goal is to get to a personalized level when marketing to customers by using data from its self-checkout and mobile app. Working with a third party to segment its customer base, the data can show

“We’ve been sitting on a lot of data and are finding ways to monetize it.”

— Babir Sultan, Fav Trip

what they like to purchase and therefore, what can be promoted to them, according to Rigby.

“What we hope is to get to know the customer more when they are at the point of purchase, and know what products they like, so we can give them offers for it or for what we think they might like,” he explained.

From theft detection, to combining AI with digital cameras to gain insights, to triggering notices for items out of stock, c-store retailers are finding more ways to use digital cameras both inside and outside the store.

At Fav Trip stores, there is live monitoring for shoplifting detection and the company is moving to a system where it will have its own 24/7 live monitoring rather than working with outside companies, according to Sultan. Aside from shoplifting, its cameras will detect when a shelf is missing a 12-pack of beer for example and alert the staff to restock.

“We are trying to remove human errors,” he said. “We are combining IT with marketing and video to solve our problems when it comes to streamlining operations.”

Security is also top of mind at Atlantis Management, where the company is looking to use AI and cameras to improve security and safety, specifically partnering with camera companies to try to identify behaviors on the forecourt or in the store.

“We want to learn where shoppers are congregating, but also if we do have a crime or theft, we want to use the cameras more effectively moving forward,” said Rigby.

Cameras have become much more useful than simply for theft detection, Collupy echoed.

“I’ve been amazed at how involved IT teams are with digital camera system technologies. These systems now sit on company networks, providing visibility and accessibility to management and law enforcement in real time or historically,” he said. “Extending their use to people counting, heat mapping the customer’s journey and license plate recognition are the next steps being taken across the industry." CSN

TravelCenters of America is working to improve the experience for this growing group

By Danielle Romano

By Danielle Romano

TRAVELCENTERS OF AMERICA (TA), part of the bp portfolio, is on a mission to return every traveler to the road better than they were. The Westlake, Ohio-based company’s 19,000 team members serve guests in more than 300 locations in 44 states.

LOVE’S TRAVEL STOPS is committed to having a world-class culture. This is evident by the company’s No. 1 ranking in Indeed’s 2023 Better Work Awards, which recognize organizations that are prioritizing work wellbeing and building toward a future of better work. With this distinction, Love’s beat out major retailers such as Nike, Microsoft and Apple.

CEO Debi Boffa recently spoke with Convenience Store News about how a firsthand experience provided insights into the unique challenges women professional drivers face, prompting TA to focus on improving safety and the overall customer experience for this group.

CSN: Debbie Shelton, a vice president with TA, spent a few days on the road with a professional woman truck driver. What were some of the observations she made during her journey?

BOFFA: Debbie was lucky enough to be able to go out with Violet Helferich. [She] works for ACE Doran Hauling & Rigging Co., a division of the Bennett Family of Cos., and drives a heavy haul 18-wheeler. Debbie had an amazing time, and she came back full of ideas and insights of what she learned and what she experienced on that weeklong trip.

Commitment to inclusion and diversity (I&D) is a key component of Love’s culture and has been a core tenant of the family-owned and -operated business since its founding in 1964. From employee resource groups (ERGs) to culture tours to community giving, Love’s I&D efforts impact nearly 40,000 team members in North America and Europe across 642 locations in 42 states.

The biggest reflection I take from getting the debrief from Debbie was how, as a professional driver, so many things are outside of your control — whether it’s the weather, or you’re waiting on someone to load your truck or unload your truck, or there’s road delays, or you’ve arrived at a travel center and everyone else is at the travel center filling up with diesel. So much is out of your control. So, what can we do? How do we make it easier by recognizing the value of time and of Violet’s time during those periods?

Jenny Love Meyer, executive vice president and chief culture officer of Oklahoma City-based Love’s Travel Stops, recently spoke with Convenience Store News about the retailer’s award-winning culture and how its I&D initiatives factor in.

Part of doing the road trip was that earlier this year, we stood up an advisory panel which has about a dozen professional drivers as part of it … and what we wanted to do was get feedback from them. But then, this real-life experience that Debbie had really helped cement some of our programs that we’re now implementing at our locations, and there’s kind of three big things that we’re focusing on and they came through in Debbie’s visits.

CSN: What makes Love’s company culture award-winning and why is having a strong company culture so important?