Less Complexity. More Time. Transform pharmacy by automating virtually every aspect of prescription filling and pickup.

18 GUEST COLUMN by True Rx Health Strategists’ Eric Barker

20 GUEST COLUMN by Appriss Retail’s Kathleen Garner

22 GUEST COLUMN by UltiMed’s Sarah Hanssen

36 ONE-ON-ONE with IPC Digital’s Ashton Maaraba

34 ONE-ON-ONE with Relaxium’s Timea Ciliberti

86 LAST WORD by consultant David Orgel

Facebook.com/DrugStoreNews linkedin.com/company/drug-store-news/ instagram.com/dsn_media

30 INSIDE BEAUTY | THE DELICATE BALANCE OF OLD AND NEW Legacy brands are resetting to keep up with new beauty contenders

46 RETAIL DESIGN

How the design and layout of a drugstore lure shoppers and grow purchasesc

52 INSIDE BEAUTY

Skin, bath and cosmetics brands are ready to meet emerging trends

60 INSIDE BEAUTY

Follett strives to meet Gen Z needs

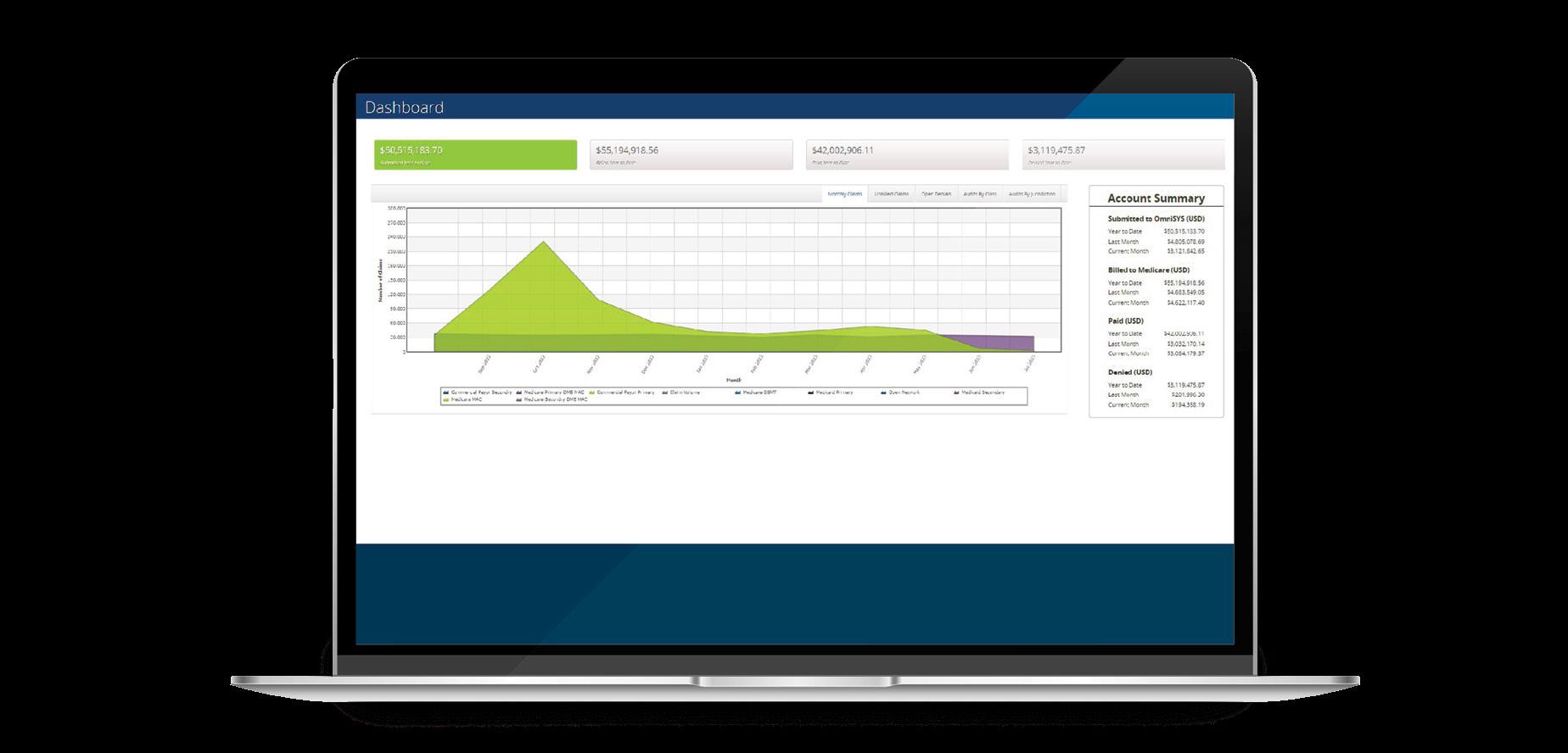

68 PHARMACY: TECHNOLOGY & AUTOMATION

A growing roster of technologies are freeing pharmacists from manual tasks, allowing them to perform higher-profit clinical services

74 HEALTH: OTC COUGH, COLD & ALLERGY

With the future of phenylephrine up in the air, the cough/cold/ allergy segment is ripe for innovation

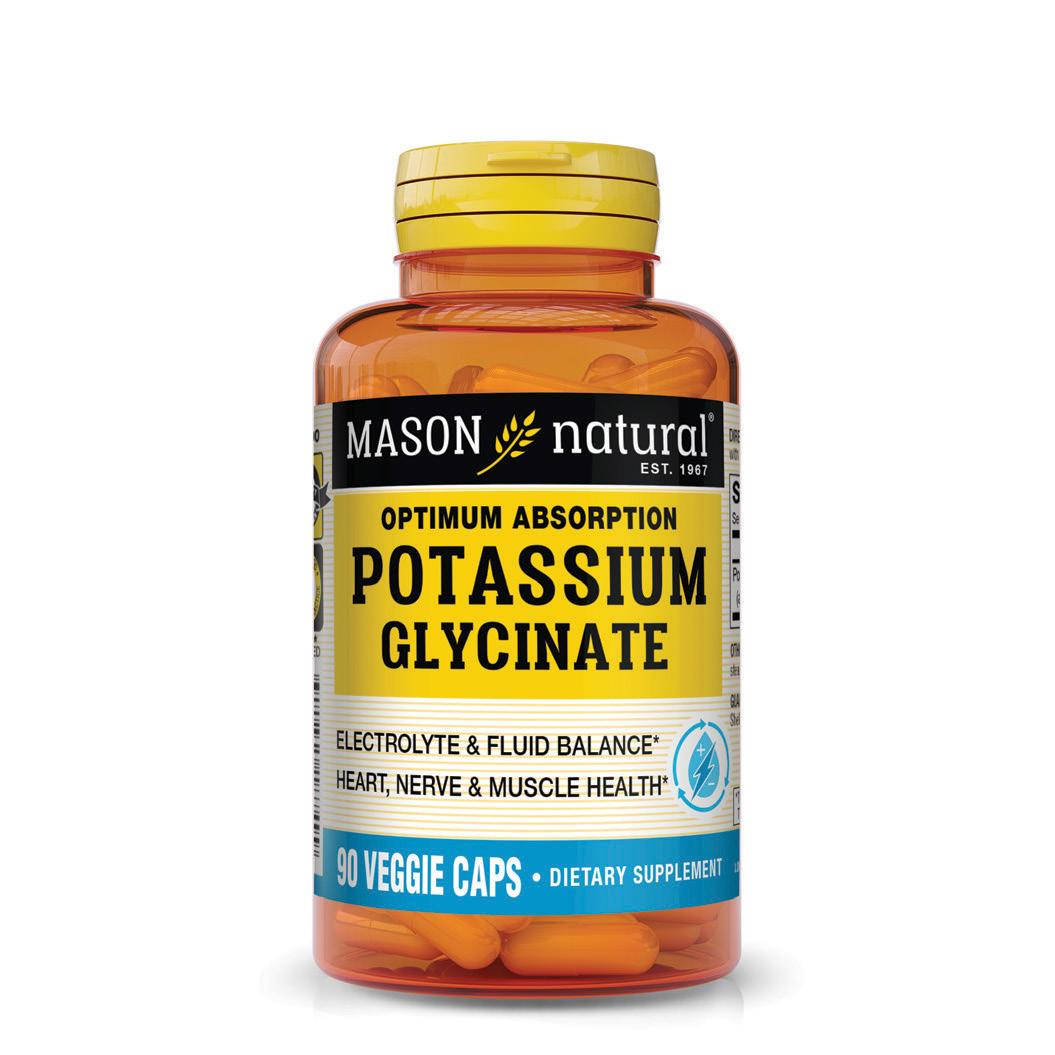

79 REX AWARDS: NATURAL PRODUCTS

Drug Store News’ Retail Excellence Awards recognize manufacturers for innovation in natural products

• Made from 3,200 mg of elderberries per serving

• Elderberry extract with naturally occurring anthocyanins, an antioxidant

• Adults and children ages 4+, chew 2 gummies daily

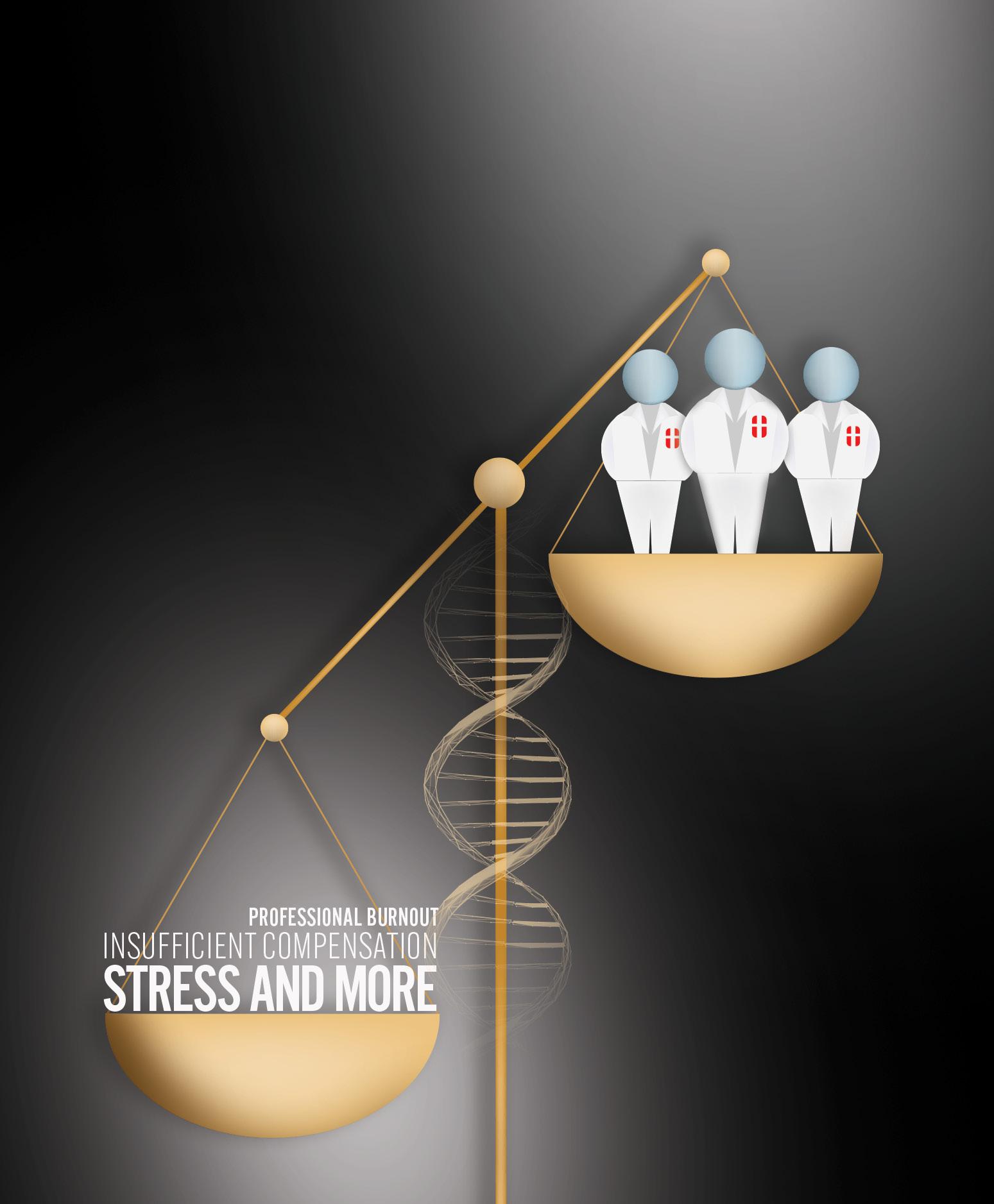

If current staffing and pharmacy school trends continue, retail pharmacy will have a monumental problem

“I WAKE UP EVERY MORNING AND GO TO BED EVERY NIGHT THINKING ABOUT ENROLLMENT IN OUR COLLEGES OF PHARMACY.”

-LEE VERMEULEN,

EXECUTIVE

VICE PRESIDENT AND CEO, AMERICAN ASSOCIATION OF COLLEGES OF PHARMACY

At NACDS Annual last year, retailers had many burning issues on their minds—PBM reform, competition from online retailers, rising drug prices. The list goes on. But one retail executive we spoke to said the one thing that keeps him up at night is the shortage of students entering pharmacy schools. It’s the ticking time bomb that should be taken more seriously, he said.

The numbers support his concerns. In 2022, the healthcare industry saw the graduation of 13,323 new pharmacists from 136 pharmacy schools reporting to the American Association of Colleges of Pharmacy, Philadelphia College of Osteopathic Medicine said. This number was down from 14,223 the previous year, marking the largest drop since 1983.

“But what’s particularly alarming is that only 9,743 students were accepted through the Pharmacy College Application Service by the application deadline of June 2023,” the school wrote last year. “This unsettling statistic indicates a sharp decrease in new entrants to the job market within the next four years.”

“The pharmacist shortage isn’t just a numbers game; it’s become a tipping point for healthcare access,” the report said. “The shortage is magnified in underserved areas, creating what’s known as ‘pharmacy deserts,’ where patients have limited or no access to essential medications and health advice.”

When you combine the decline in pharmacy school enrollment with the fact that there are an estimated 10,000 pharmacist jobs unfilled (estimates vary), the outlook for the industry does not look good.

This month’s cover story (page 36) explores the issues surrounding the pharmacist shortage and what retailers are doing about it. It also looks at what the declining rate of pharmacy school enrollment means for the long-term health of retail pharmacy.

“I wake up every morning and go to bed every night thinking about enrollment in our colleges of pharmacy,” said Lee Vermeulen, executive vice president and CEO, American Association of Colleges of Pharmacy. “It is a huge challenge, and I think it’s going to lead to a public health crisis.”

EDITORIAL

Managing

Senior

DESIGN/PRODUCTION/MARKETING

Art

Production

“We know our customers are busier than ever, and this expansion gives us a unique opportunity to make their lives easier.”

- Emily Henao, VP of digital experience, Meijer

Meijer has expanded its home delivery service area from a 20-minute radius from its stores to 60 minutes. This extended delivery zone makes the popular service available to nearly four million additional households in rural and urban areas across the Midwest.

“We heard from many customers that were interested in using home delivery to make their grocery shopping more convenient but couldn’t because they were outside of the delivery range,” said Emily Henao, vice president of digital experience at Meijer.

“We know our customers are busier than ever, and this expansion gives us a unique opportunity to make their lives easier.”

Customers can verify whether they are in a delivery area through the Meijer app or through the retailer’s website by navigating to “Delivery” and then adding their address.

To encourage customers to try the service, Meijer is offering free home delivery in the extended zone to those who purchase at least $35 in pet or beauty products, or $50 in general merchandise, through Feb. 1. After the promotion expires, customers in the extended home delivery zone will see an extended range delivery fee. Customers using SNAP benefits can continue to receive free home delivery in the extended zone after the promotion ends.

Meijer first launched home delivery in the Detroit market in 2016 and gradually broadened the service’s availability across its Midwest footprint over the next few years. When the pandemic increased demand for grocery delivery, the retailer

expanded its hours to allow more customers to take advantage of the service.

All Meijer Grocery stores and supercenters offer home delivery. The retailer also offers pickup and Shop & Scan, to provide more options for customers to shop in ways that best fits their needs.

Mike Creedon, interim CEO of Dollar Tree, has announced that Jeff Davis, chief financial officer, will step down.

The company has launched an external search and to ensure a smooth transition, Davis has agreed to remain with the company through the filing of its fiscal 2024 Form 10-K.

“We thank Jeff for his service and appreciate the contributions he made to the business during his time with Dollar Tree and Family Dollar,” Creedon added. “We remain committed to our business strategy and are focused on driving lasting value for our customers and shareholders.”

Creedon said that Dollar Tree’s third quarter sales came in at the high-end of its expected range. “As an organization, our top priorities remain accelerating the growth of the Dollar Tree segment, completing the Family Dollar strategic review process, and unlocking value for Dollar Tree shareholders,” Creedon said.

Walmart announced the pilot of a free resource for blind and low-vision customers. The company said this resource is one of the most requested accessibility initiatives.

Through the Aira app, customers can be connected to a trained visual interpreter and navigate all Walmart stores or Walmart.com independently and confidently.

Using remote access to a phone camera or piece of wearable tech, Aira interpreters act as eyes inside the store, the companies said.

“I think the thing they’re going to gain the most from our partnership is this demonstration to the world that Walmart and Aira really do think about the customers they serve,” said Everette Bacon, the chief of blindness initiatives at Aira, who is blind himself. “That’s a testament to the kind of service Walmart has provided for years and wants to continue to lead on.”

“Not having to depend on someone, and take them away from their job duties, or ask a friend or family member, just to do this on my own time and on my own terms—it’s very freeing,” Everette explained.

“The reality is, we have tons of shoppers with disabilities who we want to make sure are having as good, if not better, of a

shopping experience with us as someone who doesn’t have a disability,” said Gayatri Agnew, head of Walmart’s Accessibility Center of Excellence.

Aira is free to use in all Walmart U.S. stores and is available 24 hours a day, seven days a week on Walmart.com.

Tim Barry, CEO and co-founder of VillageMD, has stepped down. Jim Murray, VillageMD’s chief operations officer, is replacing Barry on an interim basis.

“Tim Barry has stepped down as CEO and Board Chair,” Molly Lynch, a VillageMD spokesperson, said in a statement. “The Board has appointed VillageMD Chief Operations Officer Jim Murray to serve as Interim CEO.

Effective immediately, Murray assumes day-to-day leadership responsibilities to ensure a smooth transition and continuity of care. VillageMD reaffirms its commitment to providing high-quality, accessible health care services for individuals and communities across the United States.”

Barry founded VillageMD in 2013.

CVS Health announced that Len Shankman will be president, pharmacy and consumer wellness, reporting to group president Prem Shah.

In addition, the company announced the appointment of Lucille Accetta, RPh, MPH, MBA, as chief pharmacy officer, also reporting to Shah. Both appointments are effective immediately.

Shankman will oversee the front store and retail pharmacy businesses across the company’s more than 9,000 pharmacy locations. In his new role, Shankman will lead the team in continuing to deliver integrated digitally-led experiences that address consumer’s health and wellness needs, the company said.

Shankman joined CVS Health in 2002 and has held positions of increasing responsibility, most recently serving as senior vice president and chief financial officer, pharmacy and consumer wellness. Shankman has also held leadership positions in the company’s Specialty Pharmacy business and as general manager for Coram, the CVS Specialty infusion business. Before joining CVS Health, Shankman served in the United States Navy.

“Len has a deep knowledge of our Pharmacy and Consumer Wellness business and our company, and his focus on strategy execution, operational strength, and financial performance will help us continue to lead in the market,” said CVS Health president and CEO David Joyner. “His disciplined, strategic guidance will further position CVS Pharmacy as a trusted resource for the communities we serve.”

As chief pharmacy officer, Accetta will advocate for the role of the pharmacist in health care and will be responsible for creating and implementing strategic opportunities to connect pharmacy assets across the CVS Health enterprise. She also will continue to oversee the Specialty Pharmacy, Coram and Omnicare businesses in her role as senior vice president, specialty pharmacy operations.

Since joining CVS Health in 2017, Accetta has held multiple roles. Prior to joining the company, she held leadership roles at Teva Pharmaceuticals, Rx Ally, Express Scripts and Medco, building her skills in patient services management, pharmacy product development and clinical operations, the company said.

“Our specialty pharmacy is entrusted with the care of people who are facing challenging and complex diagnoses, and Lucille leads with heart, driving the operational excellence our patients deserve along with instilling in our team an unwavering focus on caring for patients,” said Joyner. “Her passion and commitment to the practice of pharmacy make her an excellent advocate for the profession.”

Dollar Tree and Family Dollar are partnering with No Kid Hungry, a national campaign led by Share Our Strength, which is committed to ending childhood hunger and poverty.

With a shared mission of ensuring equitable access to food and essential resources, the partnership aims to impact the country by helping schools and communities feed millions of children daily.

“We are privileged to work with Share our Strength and the No Kid Hungry campaign in their critical work to solve childhood hunger and poverty in the United States,” said Jennifer Silberman, chief sustainability and impact officer at Dollar Tree.”

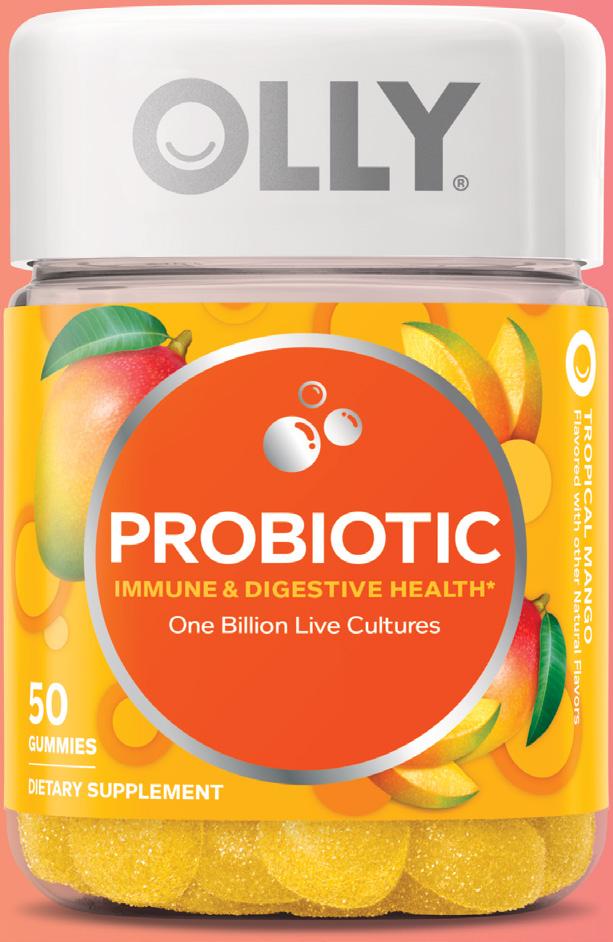

Dollar Tree and Family Dollar also are supporting the Mayors Alliance to End Childhood Hunger. This nonpartisan coalition of mayors is working alongside No Kid Hungry to end childhood hunger and address food insecurity in cities across the nation. dsn

HBased on a survey of pharmacists who recommend branded vitamins and supplements.

HRG’s five notable products from December

2 4 1 3 5

Product introductions almost doubled in December, seeing their second straight month of increases and ending a volatile year for new product launches.

In December, suppliers introduced 140 new products—66 more products than the 74 products they released in November. Waukesha, Wis.-based HRG reviewed 24 products in the health category, 80 items in the wellness sector and 36 products in the beauty aisle to see which ones stood out as Products to Watch.

Here are the top five:

Prestige Consumer Healthcare Inc. said that it developed Debrox Kids Ear Discomfort Relief Drops to help alleviate pain for waterclogged ears. The 95% isopropyl alcohol formula was developed to be kid-friendly and to rapidly dry trapped water in ears, efficiently and safely, the company said. It comes in a 1-oz. bottle.

Head & Shoulders Bare Pure Clean 2in1 Shampoo & Conditioner by Procter & Gamble was developed to provide the same antidandruff effectiveness as the traditional formulation, the brand said. It uses nine ingredients and no sulfates, silicones or dyes. The company claims the holistic solution leaves the scalp and hair clean and comes in an eco bottle made with 45% less plastic, which can be rolled and flattened to use the last drop. It comes in a 13.5-oz. bottle.

2San LLC said its SpeedySwab Rapid COVID-19 + Flu A&B Antigen Self-Test provides three test results in 15 minutes with one convenient cassette. Able to be completed in four steps at home, the tests have a shelf life of 18 months and the results are reliable when the test is taken within the first five days of symptom onset, the company said. A pack contains two tests.

Fleet Stimulant Laxative tablets from Prestige Consumer Healthcare Inc. contain bisacodyl 5mg. The company claims the coated tablets provide gentle, overnight relief, and the bisacodyl works within 6-12 hours to help pass stool from the system. One pack contains 25 tablets.

L’Oreal’s CeraVe Intensive Moisturizing Lotion is designed to provide deep hydration for extra-dry skin to help restore and strengthen the skin barrier without greasy residue for up to 72 hours. The lotion is formulated with three essential ceramides, hyaluronic acid, MVE Delivery Technology and Hydro-Urea Technology. The prouduct is meant to defend against dryness, itching, tightness, roughness, scaling/flaking and discoloration. It comes in a 12-oz. bottle. dsn

SCAN HERE TO LEARN MORE ABOUT UNIFINE PEN NEEDLES!

From conventional pen needles to unique technologies, Unifine makes taking care of your patients easier with products that are available in a broad range of sizes and covered across almost every commercial plan. As one of the most trusted pen needle brands in the U.S., we put the patient first with innovative features that help enhance quality of life and drive adherence. We make patient access a priority by investing in programs that improve accessibility and affordability for all commercially covered patients. Doing the right thing for your patients shouldn’t be difficult. Unifine® makes it simple.

By Sarah Hanssen

Sarah Hanssen is vice president of sales and marketing at UltiMed, a manufacturer and distributor of injection devices for consumer diabetes, animal health and medical surgical markets

When they have healthcare needs, a majority of Americans (58%) first seek care and counsel at their local pharmacy. As the reliance on pharmacies as healthcare hubs increases, so does the stress on pharmacists and pharmacy technicians.

In addition to their duties, pharmacies are pivotal in fostering sustainable communities by integrating environmentally responsible practices into their operations. This proactive approach helps create a more sustainable future by reducing pollution, conserving resources and encouraging environmental stewardship.

Fortunately, there are easy ways pharmacy teams can safeguard patients and the environment without adding to their workload. Pharmacists and pharmacy staff can promote the use of eco-friendly packaging. They can implement proper disposal practices for unused or expired medications and minimize paper usage to promote environmental sustainability.

More sustainable packaging options are a simple swap that benefits the environment. Pharmacists and pharmacy buyers should look for products that utilize compostable or biodegradable materials in place of plastics-based packaging.

Additionally, packaging that does double duty—such as bundling pen needles with a sharps container—makes it easy for pharmacists and their patients to choose a more environmentally responsible option. Multi-purpose medical packaging reduces the need for multiple single-use packages, thereby cutting down on waste and resource consumption.

Patients often consider convenience and medication availability when they analyze pharmacies. However, pharmacy teams don’t just provide medications, they are often tasked with advising on the safety of medical items as well.

Take, for example, pen needles. Many medical conditions, such as diabetes, require the use of pen needles, which are of-

ten prescribed in boxes of 100. Without a focus on the full life cycle of these products, however, the used needles often end up being flushed down the toilet, stored in the back of a closet or even returned to pharmacies in unsafe containers like plastic bags.

Pharmacists can instead choose to fill a patient’s prescription with a brand of pen needles that is packaged with an FDAcleared sharps container. Patients are also receiving a convenient way to safeguard their families and keep medical waste out of the environment.

The proper storage and disposal of medications and medical items is a critical piece of health and safety for patients and for communities. When your pharmacy offers a secure medication disposal box in a pharmacy location, it not only helps protect patients and the environment, but it prevents patients attempting to return medications to the pharmacy.

Cutting down on paper medication education materials is another way to help the environment. It saves staff time, but it can also save considerable costs as well. Patients can choose from a variety of options to receive their medication education documents, including email, text, online patient portal, and pharmacy teams no longer need to spend time printing those items.

Going paperless helps reduce deforestation and keeps unwanted paper out of landfills. Additionally, patients have unlimited access to their digital files any time they need to refer to medication instructions or have a question.

It’s time we recognize the important role pharmacies play in our communities. By integrating these practices into their daily routines, pharmacists support both individual health outcomes and broader environmental conservation efforts. dsn

Quest Produc t s creates healthcare solutions for the way people live now: healing pain, providing relief and putting the power of self-care in their hands. We use the most for ward-thinking technolog y and ingredient s to transform how people approach their healthcare challenges.

Are you ready to prepare employers for expanded GLP-1 costs and coverage?

By Eric Barker

Health care spending is estimated to increase by 8% in 2025, the highest growth level in 13 years. One of the key inflators is the higher expected utilization of glucagon-like peptide, also known as GLP-1 drugs.

The first GLP-1 was approved by the Food and Drug Administration to treat diabetes in 2005. However, researchers are finding other indications for GLP-1s, which will make it harder to contain overall spending on these drugs. There are several steps brokers can take to help employers prepare for these trends.

Last year, the FDA approved a new indication for Wegovy (semaglutide) injection to reduce the risk of cardiovascular death, heart attack and stroke. Researchers are also looking at how GLP-1 drugs can treat other ailments, such as sleep apnea, pre-diabetes, fatty liver disease and more. Once these become FDA-approved indications, we will see significantly increased utilization of these medications.

The best-known use of semaglutide and high-dose liraglutide is for obesity. It has become a cause célèbre — literally. Celebrities have spoken out about using the drugs and several have formally endorsed the products. But GLP-1 use for weight loss continues to be a top focus due to the cost implications and prevalence of obesity in the United States.

More than one in five adults presented with obesity in 2022, according to the CDC. As obesity rises, more plan members are at risk of developing conditions that require ongoing treatment.

In 2021, people with large employer private insurance coverage who had an obesity or overweight diagnosis generated an average of $12,588 in total annual health costs, which is more than double the $4,699 in health spending for those with no obesity or overweight diagnosis, according to the PetersonKFF Health System Tracker.

While many health insurance plans do not currently cover GLP-1s for weight loss, that could change if federal legislation passes. In late June, the House Ways and Means Committee passed a bill that would support Medicare coverage for GLP1s prescribed for patients diagnosed with obesity. If this legislation passes in the House and Senate, it will open the door to commercial insurance companies also covering GLP-1s for weight loss.

In a measure of increasing GLP-1 costs, total gross Medicare spending on the three GLP-1s skyrocketed from $57 million in 2018 to $5.7 billion in 2022. These costs are taking employers by surprise.

There are several important ways brokers or pharmacy plan consultants can help clients prepare for increasing GLP-1 costs and coverage:

1. Estimate the Cost Impact Now

Employers can expect the percentage of spending on GLP-1 drugs to more than double in the next year or two.

2. Implement Lifestyle Programs

Weight loss programs are one employee resource that can be used in conjunction with medical treatment.

3. Prior Authorization Criteria

Prior authorization protocols for GLP-1s for weight loss can help contain spending.

Many employers use the FDA guidelines for GLP-1s for obesity as part of their Prior Authorization criteria. Discussing cost impacts, lifestyle programs and prior authorization criteria with potential PBMs can help your clients successfully contain GLP-1 costs and improve health outcomes for members with obesity. dsn

For almost a century, Boiron has provided families with the purest medicines made from the earth’s best resources. From our renowned Arnicare® line, to trusted Oscillococcinum® and Camilia® brands, our expanding range meets the diverse needs of your customers.

*CLAIMS BASED ON TRADITIONAL HOMEOPATHIC PRACTICE, NOT ACCEPTED MEDICAL EVIDENCE. NOT FDA EVALUATED.

By Kathleen Garner

Kathleen Garner, a strategic customer success manager at Appriss Retail, spent more than 13 years in Loss Prevention leadership at Kmart and Sears.

Picture a store associate stocking shelves down a narrow aisle. Nearby, they spot a shoplifter concealing a few cans of baby formula and sprint toward the exit. What’s their next move? Run after the thief in a crowded store or stand down?

Decades ago, store managers expected staff and security to chase after shoplifters, but that sentiment has changed. For the safety of employees, running after a shoplifter isn’t worth the risk.

According to the National Retail Security Survey from the National Retail Federation and Loss Prevention Research Council, more than two-thirds of respondents said they experienced a spike in violence and aggression from bad actors in stores. So, what’s a retailer to do? A strong alternative to pursuing shoplifters on foot is to enable AI-powered technology to do the chasing.

Some of the most shoplifted items sit on shelves in drugstores. The NRF security survey listed diapers, formula, alcohol, candy, energy drinks, cosmetics, pain medicines, vitamins and personal care products as frequently targeted items. Plus, pharmacies tend to have small footprints, enticing a quicker in-and-out.

The NRF and LPRC security survey also reported that:

• 70% of retailer executives surveyed are seeing an increase in repeat offenders.

• Shoplifting incidents often involve around three people working together.

• Smash-and-grab shoplifting attempts can be the most violent.

To limit theft, many stores resort to locking up items behind plastic cases. They’ll also tie up detergent bottles and other

products with locked cords. It’s not a great look on-shelf, and the practice could deter consumers. Keeping associates safe is a priority for retailers, so to combat retail theft, they need to lean more into technology to stop shoplifters.

For a long time, security cameras have been used to record shoplifters. But with technological advancement, they can now leverage computer vision capabilities to do a lot more.

They can identify and notify staff of any suspicious activity occurring in real time along an aisle and use facial recognition to identify a known shoplifter or computer vision to analyze a license plate on a car that a shoplifter used to flee a store.

Cameras keep watch and can follow bad actors beyond the store to help law enforcement. Additionally, AI-powered technology can monitor transactions for unusual behavior, particularly identifying a shoplifter who looks to return stolen items at another store.

AI-powered models can also read through an abundance of store data, such as receipts, returns and inventory to quickly identify suspicious activity and alert investigators of the cases that are most likely to be resolved.

Theft inside volatile retail channels can account for nearly 70% of a retailer’s shrink, according to the NRF and LPRC security survey. The report said in 2022, shrink equaled $112.1 billion in losses, up from nearly $94 billion the year before.

AI detects theft cases that were missed in a store and can discourage associates and security from pursuing shoplifters they spot. Enable technology to do the chasing for loss prevention teams and help reduce the dramatic financial impacts that theft can cause on a retailer’s bottom line. dsn

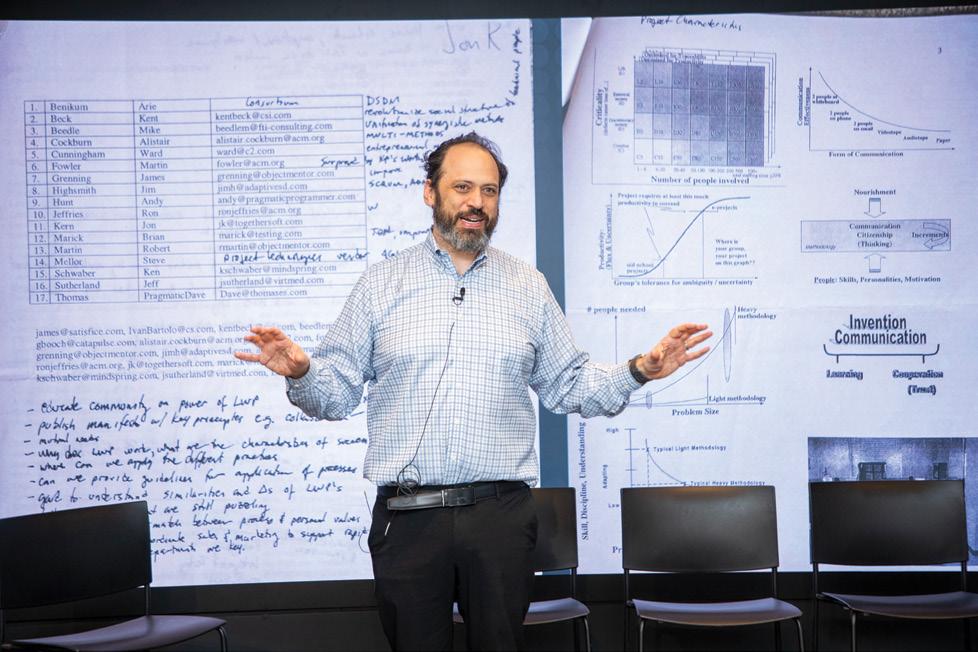

At the 26th annual event in New York City, leaders put a heavy emphasis on meeting patients’ and consumers’ needs

By Sandra Levy

Drug Store News’ 26th annual Industry Issues Summit, co-hosted with The CPG Guys, explored a myriad of issues and trends in the health, wellness and beauty space, with speakers putting a heavy emphasis on meeting patients’ and consumers’ needs.

A prime example was the panel titled “How Pharmacy’s Footprint Plays an Increasingly Important Role Providing Access to Healthcare.” Moderated by Scott Miller, president of strategic, community and specialized pharmacy at McKesson, the panel included Stacy Burch, vice president of North America marketing at Embecta; Davey Lavergne, VP, health and wellness business unit operations at Walmart and Rina Shah, senior vice president, pharmacy growth at Walgreens.

Lavergne shared how Walmart is aligning its offerings to meet healthcare trends and patients’ needs.

“The trends we see and believe are most relevant are convenience and exceeding customer and patient expectations,” Lavergne said. He advised that one of most important things teams and companies can do is to listen to customers and patients.

To that end, Walmart recently launched pharmacy delivery, which includes prescriptions, groceries and general merchandise

as part of the order. “This truly enables a mixed product experience that’s convenient and accessible,” Lavergne said. Pharmacy delivery, which is currently available in six states, will be available in 49 states by the end of January.

Next, Shah addressed the importance of Walgreens’ physical store footprint and how being present in communities plays a role in Walgreens’ long-term strategy in delivering health care.

“What is the value of a human-to-human connection?” Shah asked, noting that the value of a pharmacist or pharmacy team is where Walgreens can engage with patients and understand what is going on in their lives.

“Being able to connect with patients to help them navigate through the various aspects of the journey and leveraging technology and solutions like delivery, which is very customer centric, is going to be critical, but the physical aspect of it is also a key component to ensure that you are heading on the right track,” Shah said.

Lastly, Burch emphasized that diabetes prevalence continues to grow. “We know that you need to get ahead of it and our best way to do that is through education and partnerships with retailers and suppliers,” she said.

This year Embecta launched a campaign that focuses on ensuring diabetes patients are receiving the care they need, including ensuring proper injection technique and adequate supplies. The omnichannel education campaign includes videos, online tools and education materials at local pharmacies.

Another panel, “Dermatology and Retail Alliance,” showcased how collaboration across sectors strengthens access to skin health and advances the path toward accessible health care for all. Panelists included Carolina Howski, senior director, DMM at Walgreens; Gina Daley, assistant VP, integrated health at L’Oréal and Dr. Heather Woolery-Lloyd, dermatologist and founder of DermFriends.

Daley noted that the inspiration for the creation of The Dermatology and Retail Alliance is the fact that the number of certified dermatologists in the United States is not keeping up with the demand from patients who are seeking skin health solutions. “One in four Americans is impacted by skin conditions and yet in 2022 only 10% of Americans saw a dermatologist, and the wait times are pretty long,” she said.

Pointing out that consumers are turning to unreliable sources such as social media for solutions, Daley said, “We know that retail can play a role in demystifying skin care for the consumer, but in order to effectively do that they need to understand dermatological

EnsembleIQ is the premier resource of actionable insights and connections powering business growth throughout the path to purchase. We help retail, technology, consumer goods, healthcare and hospitality professionals make informed decisions and gain a competitive advantage.

EnsembleIQ delivers the most trusted business intelligence from leading industry experts, creative marketing solutions and impactful event experiences that connect best-in-class suppliers and service providers with our vibrant business-building communities.

approaches and how the board certified dermatologist thinks about OTC solutions and skin care.”

Daley went on to say that the DRA has grown from 2021, when its first event featured four dermatologists and executives from three retailers. The recent event in October 2024 included 14 board certified dermatologists and executives from 12 retailers, including Kroger, Meijer, Walmart and Amazon.

Noting that pharmacy makes more than 310 million skin care recommendations per year, Daley said, “I’m proud L’Oréal has fueled this initiative because it creates access to dermatologic care and expertise, which is much needed in this country.”

Howski added, “When we think about the importance of skin health and how much Walgreens prioritizes not only skin health, but sun care and scalp health, and how we’re bringing that education to life to our customers through in store graphics and displays as well as through our beauty events is where we leverage what we’ve learned at DRA.” Lastly, Woolery-Lloyd pointed out that in addition to prescribing medications, dermatologists often recommend OTC skin care products. “One of the huge benefits of the DRA is that it helps dermatologists learn what happens when patients go to retailers,” she said. “A lot of dermatologists didn’t know about the beauty and wellness coordinators that many retailers have that help guide patients to make their purchase.” dsn

Attendees mingled, learned and networked during DSN’s 26th annual event in New York City

PioneerRx equips your pharmacy with the tools you need to thrive:

Improve patient care with custom care goals and automated interventions.

Optimize staff efficiency with powerful features and tailored workflows.

Drive informed decisions with comprehensive, customizable reports.

Drug Store News caught up with Timea Ciliberti, executive chairwoman of Relaxium, to learn more about the nutraceutical product

Drug Store News: What are the driving forces behind Relaxium?

Timea Ciliberti: Timea Ciliberti, executive chairwoman of Relaxium, is the driving force behind this innovative nutraceutical wellness company. By focusing on solving consumers’ problems with cleaner products, Relaxium has gained millions of loyal customers and topped numerous categories. Timea’s diverse experience and unique perspective have been pivotal in this success, challenging corporate norms and assumptions.

DSN: How is Relaxium driving consumers to retail doors in 2024?

TC: We strategically use nationally targeted digital and TV advertising campaigns to promote Relaxium, making it the top brand at GNC and other retailers. Our $205 million investment in 2024 is expected to reach 58% of ad viewers likely to shop in stores, driving over 102 million people into retail locations. Relaxium is committed to creating impactful solutions that improve the well-being of millions.

DSN: How is Relaxium positioned in the market?

TC: Relaxium is America’s #1 Trusted Brand! Positioned as the leading brand in the Sleep & Mood categories across Direct to Consumer, Amazon and select retail channels, it has achieved unprecedented customer loyalty on Amazon, outperforming industry averages by 3X for all supplements in AOV, LTV and Avg orders, according to Metrilo

DSN: What differentiates Relaxium from other brands?

TC: Relaxium products are studied, tested and formulated by renowned clinical neurologist Dr. Eric Ciliberti. Supported by extensive research and studies we’ve created a brand that consistently delivers outstanding results, while prioritizing the health and well-being of consumers by addressing every top concern: sleep, mood, pain, joint, memory and brain health and soon launching our new line of women’s wellness products in 2024.

DSN: What’s next for Relaxium?

TC: Relaxium is set to change even more lives with our launch of Flexium Fast Acting Joint Support and our Flexium Full Body Pain Relief Spray. The brand’s effective formulas have positively impacted consumers, including well-known figures like Dan Marino. Furthermore, Relaxium is set to enter the

women’s wellness space later this year with highly effective ingredients supported by robust clinical research.

DSN: What inspires you personally?

TC: My advocacy surpasses the boardroom. I find inspiration in championing important causes such as environmental sustainability and the empowerment of women’s entrepreneurship. I’m committed to shaping a more equitable and sustainable world through initiatives like the Relaxium Dreamers Contest. I believe it’s important for influential individuals to use their platforms to advocate for positive change in the world. dsn

SOLVES TOP CONSUMER PROBLEMS DRIVES CATEGORY GROWTH CONSUMER RETENTION & LOYALTY VS LEADING BRAND 3X

AMERICA’S #1 TRUSTED BRAND SPEND ON DIGITAL Retail Stores!

DR

TV Media in 2024! $205M Consumers to DRIVES102M

NEUROLOGIST DEVELOPED BRAIN & MOOD SUPPORT THAT WORK! Dan Marino’s

# 1 TRUSTED BRAND TM

DRIVES MILLIONS OF SHOPPERS TO BUY EFFICACIOUS SOLUTIONS CONSUMERS WANT

Drug Store News: What is iCare+, and how does it empower independent pharmacies to offer telehealth services?

Ashton Maaraba, president of IPC Digital Health, LLC.: iCare+ is a comprehensive Virtual Healthcare Program that is designed to offer independent pharmacists a modern-day, future-ready healthcare clinic, and mobile treatment option for patients. This includes Telemedicine, Tele-pharmacy Lite, Cash Savings Card (iCare+ ScriptPass) Remote Patient Monitoring solutions, both medication delivery and people transport options for medically necessary travel. The platform is designed to empower independent pharmacies by enabling them to provide telehealth services, including virtual consultations, medication therapy management and prescription services. Independent pharmacies can leverage telemedicine and remote patient monitoring to expand their services beyond traditional dispensing. By adopting telehealth tools like iCare+, pharmacies can offer virtual consultations, medication therapy management, and follow-up care, improving patient engagement and outcomes.

DSN: What are the key advantages for independent pharmacies that implement telepharmacy Lite through iCare+?

AM: Implementing telepharmacy- Lite through iCare+ provides several key advantages for independent pharmacies, including:

Increased patient reach: Pharmacies can serve patients remotely, increasing access to care, particularly in underserved or rural areas.

Improved patient engagement: Virtual consultations and medication management tools foster stronger relationships with patients, improving medication adherence and health outcomes.

Revenue growth: By diversifying services, such as telehealth consultations and remote monitoring, pharmacies can generate additional revenue streams.

Operational efficiency: The platform streamlines processes, reducing the time spent on administrative tasks and allowing staff to focus on patient care.

DSN: How can digital health platforms such as iCare+ help uninsured and underinsured patients access affordable care and prescription savings?

AM: Digital health platforms like iCare+ offer significant benefits to uninsured and underinsured patients by providing affordable virtual consultations and reducing the need for in-person visits. This can lower transportation and clinic costs. Additionally, iCare+ connects patients with discount programs through our unique iCare+ ScriptPass cash savings program and helps them find the most cost-effective medications, making prescriptions more affordable. By facilitating access to lower-cost telehealth options and offering remote consultations, iCare+ ensures that more patients can receive necessary care without financial strain.

DSN: How does iCare+ position independent pharmacies to lead in the future of virtual healthcare and telepharmacy-Lite?

AM: iCare+ positions independent pharmacies at the forefront of the future of healthcare by enabling them to offer virtual care services that meet growing patient demand for convenience and accessibility. As the healthcare landscape continues to shift toward digital solutions, iCare+ equips pharmacies with the tools to provide telepharmacy-Lite services, remote monitoring and telemedicine. This not only helps independent pharmacies stay competitive but also ensures that they play an integral role in delivering quality care in a virtual healthcare environment. By adopting iCare+, pharmacies can lead the way in integrating technology into everyday care, offering an innovative solution for both patients and providers in a rapidly changing healthcare system. dsn

By offering iCare+, you’re not only growing your business, you’re also providing care to the part of your community that needs it most. The + means more.

• Telehealth

• Telemedicine

• Remote Patient Monitoring

• Diagnostic Testing

• Uber Patient Transport

• ScriptPass® Contact us today to see what iCare+ can do for you and your patients.

As staffing challenges persist and pharmacy school enrollment declines, retailers explore various strategies

By Mark Hamstra

The COVID pandemic propelled retail pharmacists into the national spotlight as essential front-line workers, but their service has come at a cost.

Reports of overwhelming workloads and job dissatisfaction have reverberated throughout the industry, making it harder for many retailers to find and retain pharmacists and pharmacy technicians. In addition, fewer students are choosing pharmacy careers, leading to a projected shortfall in the pipeline of new pharmacists to replace those who are retiring or changing careers.

It is a huge challenge, and I think it’s going to lead to a public health crisis. We’re just not graduating enough new pharmacists.”

– Lee Vermeulen, executive vice president and CEO, AACP

The industry has an opportunity to enhance the appeal pharmacy as a career by focusing on the important role that pharmacists played during the pandemic, Vermeulen said. The AACP has been working on that issue with its member schools and with retailers directly, he said, seeking to highlight the positive role that pharmacists played during the pandemic.

“We got our country out of the pandemic because we took over vaccination,” said Vermeulen. “While that put a lot of pressure on our pharmacists, we’re looking back at this saying we ought to be proud of what we accomplished.”

Both retailers and pharmacy schools could benefit from positioning a pharmacy career as a challenging but highly rewarding career, he said.

“We’re working to make sure that the rewarding parts of this job are what drive the narrative and not the problems,” said Vermeulen. “Every profession has problems.”

This effort is reflected in the Pharmacy is Right for Me educational campaign, a collaborative initiative among the AACP, the American Pharmacists Association and other national pharmacy associations.

“Our enrollment has been declining for a decade,” said Lee Vermeulen, executive vice president and CEO, American Association of Colleges of Pharmacy.

Pharmacy schools are in a position to graduate between 3,000 and 4,000 too few pharmacists during the next five to six years, he said. Although retailers have continued to close hundreds of locations, releasing some pharmacists into the workforce, thousands of jobs are expected to remain unfilled.

Job growth for pharmacists is expected to be about 5% per year from 2023 to 2033, according to the Occupational Outlook Handbook from the Bureau of Labor Statistics. About 14,200 openings for pharmacists are expected each year, on average, during that time, the BLS projected.

Pharmacy schools, meanwhile, are expected to graduate only 8,000 Doctor of Pharmacy students in 2026, or about 60% of the number needed, according to research from the University of Missouri-Kansas City and the University of Health Sciences and Pharmacy in St. Louis.

“I wake up every morning and go to bed every night thinking about enrollment in our colleges of pharmacy,” said Vermeulen. “It is a huge challenge, and I think it’s going to lead to a public health crisis. We’re just not graduating enough new pharmacists.”

The pharmacist shortage that has followed the pandemic has become a complicated, multifaceted challenge for both pharmacy retailers and pharmacy schools, he said.

In addition to the negative buzz around pharmacy employment, the hiring environment for pharmacists is also impacted by the challenging economic environment for retail pharmacies, where pharmacy benefit management companies often squeeze the profitability out of each prescription dispensed.

“I honestly think the biggest phenomenon right now is this idea of transitioning from a practice model that is focused on product to one that is based on care,” said Vermeulen. “Pharmacists will always be the stewards of the medication use process. We’ve got to transition our model to be billing for delivering care.”

Pharmacists’ role in educating patients is critical, and compensating pharmacists for providing that and other care related to their medications could help elevate the profession and make it more attractive to potential pharmacists.

“There isn’t another place in the U.S. healthcare system where any other profession cares for patients and doesn’t get paid for it,” said Vermeulen. “Dentists get paid, doctors get paid, hospitals, nurses and physical therapists—everybody else gets paid. Pharmacists deliver all that care for nothing, and that’s got to stop.”

While some states have made progress in allowing pharmacies to bill for the services they provide, more work needs to be done to help ensure that pharmacies, and pharmacists, are rewarded fairly for the services they provide, he said.

Retailers have taken significant steps to improve the working conditions in their pharmacies, including increasing compensation and investing in technologies and systems that seek to free up pharmacists to spend more time providing direct care for patients.

“Supporting the day-to-day work and careers of pharmacists and technicians are vital to attracting and retaining talent,” said Amy Thibault, a spokesperson for CVS Health, adding that the retailer continually seeks to refine and enhance its recruitment practices and strengthen pharmacy technician training, which many see as a key opportunity to improve pharmacy working conditions (see sidebar).

The retailer also seeks to leverage innovative tools and technologies to support the pharmacy workload and streamline the workflow, which are enabling pharmacy teams to focus on patient care and clinical interactions with their patients, she said.

In addition, CVS has invested about $1 billion in wage increases and other investments in its pharmacy teams during the past four years and this year awarded another $70 million to recognize pharmacists, pharmacy technicians and other frontline workers, Thibault said.

The company also offers tuition reimbursement and scholarship programs to encourage career development. In 2024, CVS also launched a new, postgraduate year-one pharmacy residency

The challenges that pharmacists face in their work environment and the difficulties retailers have in finding and retaining pharmacy technicians are actually closely intertwined, said Lee Vermeulen, executive vice president and CEO, American Association of Colleges of Pharmacy.

High turnover among technicians can contribute to an unstable environment in the pharmacy, which in turn puts even more pressure on pharmacists, he said.

The AACP and its member colleges have been looking at potential solutions, including encouraging technicians to explore opportunities to become pharmacists. However, Vermeulen cautioned that many longtime pharmacy technicians enjoy their chosen professions and are not interested in “moving up” to become pharmacists.

“When you talk to a lot of career technicians, what you hear from them is, ‘Look, I’m a technician because I want to be a technician, and if I wanted to be a pharmacist, I would have gone to pharmacy school.’

“You have to respect their profession, and their profession is being a pharmacy technician,” he said.

The solution, Vermeulen said, may lie in elevating the pharmacy technician’s role to make the job more rewarding for those individuals, in order to improve retention and make the job more appealing.

Among the opportunities could be offering bachelor’s degree programs specifically designed for pharmacy technicians, which could not only help boost their salaries, but would also recognize the increasingly important role they play in providing services to patients.

“One of the biggest challenges we have with technicians is that we don’t pay them a living wage,” said Vermeulen. “We’re competing for technicians with McDonald’s and with other retailers.”

Paying higher salaries to technicians could require retailers to rethink their pharmacy labor budgets, but the concept may be worth consideration, Vermeulen said.

Research from the AACP’s Pharmacy Workforce Center found that one the biggest drivers of frustration for pharmacists is the high rate of turnover among technicians, he said. Pharmacists who work with a stable team of technicians tend to be happier and more satisfied with their jobs, Vermeulen said.

I think independents definitely benefit from having a better work environment overall.”

– Kurt Proctor, senior vice president, strategic initiatives, NCPA

program to help prepare the next generation of pharmacists with expanded clinical and leadership skills, enabling them to support expanded pharmacy services in a community-based setting, Thibault said.

CVS also awards up to $20,000 per year to all eligible CVS Pharmacy interns in their last two years of pharmacy school. In partnership with the AACP, the company also launched a new Community Pharmacy Health Equity Award that will grant $20,000 to 21 student pharmacists who face financial barriers in their pursuit of education.

Walgreens has been engaged in developing the pharmacy career pipeline by working with schools, and in early 2024 established the Deans Advisory Council to expand those relationships.

The Council, which has relationships with all 140 schools of pharmacy, gives Walgreens the opportunity to build awareness of pharmacy careers among high school and early college students, a Walgreens spokesperson said.

“We are working with academia to increase the talent pipeline into pharmacy schools, as well as taking steps to make community pharmacy the practice setting of choice for pharmacists,” the spokesperson said.

Walgreens also seeks to support the development of the pharmacy career pipeline with tools such as its Student Loan 401(k) Match Program. This new benefit, available beginning in January 2025, treats enrolled employee student loan payments like contributions to the Walgreens Retirement Savings Plan. Walgreens will match eligible student loan payments up to 4% of eligible pay.

Additionally, the retailer recently enhanced its Walgreens Pharmacy Educational Assistance Program, which provides

The pharmacist shortage is exacerbating the need for technologies that enhance work efficiencies and streamline operations for pharmacists and technicians.

Walgreens, for example, has invested in more centralized services to streamline pharmacy operations and free up pharmacists’ time to focus on patients. In fiscal 2024, Walgreens’ centralized services processed more than one million prescription work items, answered more than 100,000 pharmacy phone calls and provided immunization scheduling support of 4,500 calls each day.

This equates to more than 400 million tasks removed from Walgreens’ retail pharmacy locations in the last fiscal year, which included:

* Performing 330 million data entry/data reviews;

* Handling more than 30 million pharmacy phone calls;

* Executing 18 million medication therapy management and adherence interventions;

* Delivering 16 million third party resolutions;

* Answering 3 million pharmacy chats, and

* Scheduling more than 2 million immunizations.

* In addition, Walgreens’ 11 micro-fulfillment centers (MFCs) filled 142 million prescriptions during fiscal 2024. MFC-supported stores are driving higher patient satisfaction scores, along with key pharmacy metrics, the retailer said

In addition, MFC-supported stores:

* Administered 46% more immunizations;

* Drove 150% increase in medication therapy management (MTM), and

* Completed 2.5 times more clinical intervention calls and converted at a higher rate.

tuition assistance each year for eligible employees who are enrolled in a professional pharmacy program while working for Walgreens as a pharmacy intern. For all years combined, the awards can be as much as $40,000 in total.

In fiscal year 2023, 806 Walgreens team members received funding from the company’s Pharmacy Educational Assistance Program, which provides awards to pharmacy students during each year enrolled in a professional pharmacy program while working for Walgreens as a pharmacy intern, up to $40,000 total. In fiscal 2024, the number of employees who used this program increased to 1,026.

Independent drugstore retailers have tended to face fewer challenges finding and retaining pharmacists, said Kurt Proctor, senior vice president, strategic initiatives, at the National Community Pharmacists Association.

“I think independents definitely benefit from having a better work environment overall,” he said.

Still, staffing remains a challenge for many pharmacies, as 70% of independent pharmacy managers reported difficulty filling open staff positions in NCPA’s fall survey.

“In general, we hear more about the difficulty finding technicians and other help in the store than we do about the difficulty finding pharmacists,” Proctor said. “But it’s definitely a tight market.”

Many NCPA retailers are closely involved with their local pharmacy schools, and the NCPA itself has student chapters at colleges around the country to help develop the pharmacist pipeline and promote community pharmacy.

The NCPA Foundation’s Good Neighbor Pharmacy NCPA Pruitt-Schutte Student Business Plan Competition is one of the association’s flagship programs promoting independent pharmacy among students. The goal of the competition is to motivate student pharmacists to create a business model for buying an existing independent community pharmacy or developing a new one. The competition is supported by Good Neighbor Pharmacy, Pharmacists Mutual Insurance Company, and the NCPA Foundation.

Meanwhile, Jeff Harrell, who was recently installed as the 2024-2025 NCPA president, is planning to spend some of his term traveling to colleges of pharmacy across the country to tout independent pharmacy as a good career choice.

“The pharmacy schools need to emphasize the positive nature of community pharmacy practice because that’s where a lot of the graduates are going to practice,” said Proctor. dsn

Breathe Right®

Drug-free nasal congestion relief and clearing you can feel right away with our nasal strips and sparkling saline nasal rinse spray.

Children’s Dimetapp®

Parents’ stress-free sick day solution for children’s cough, cold, and allergy symptoms.

NEW fast-dissolving, 24-hour relief of classic indoor and outdoor allergy symptoms.

Campho Phenique®

A powerful cold sore formula that relieves pain and itch, dries the cold sore and moisturizes.

A powerful decongestant nasal spray that quickly relieves sinus and nasal congestion for up to 12 hours. Dristan®

By Amanda Baltazar

Hundreds of drugstores have closed in recent years as consumers have taken their prescription business online and convenience stores, big box retailers and grocery stores have become more attractive for quick shopping stops.

But drugstores can become more appealing to today’s shopper through interior design that performs many functions, including a great experience.

“Drugstores want loyal customers, and want to create lots of opportunities for people to visit the store, so you have to think about the fundamentals,” said Stephen Jay, head of design solutions, Americas, JLL, a real estate investment management firm in Chicago.

The goal is to keep the shopper in the store, says Vince Guzzi, managing partner, Watt International, a retail design and strategy consultancy in Toronto. Because drugstores have been evolving to a hybrid of drug, corner, convenience and even grocery stores, “they’re playing a different role as a community hub,” he said. “You want the shopper to see you’re a viable outlet in her ecosystem.”

How can drugstores become more appealing places, inviting customers not only to come in, but to stay a while?

As customers enter a drugstore, they should immediately see some simple, welcoming messaging, highlighting specials and new products, without it being overwhelming, said Kimberly Aune, senior vice president and principal, Shea, Inc., Minneapolis, Minn. A mixture of horizontal and vertical disrupters are a great idea, she explained, to capture the eye and showcase specialty products.

And they should provide a break in the appearance of long aisles, without blocking access to products, she suggested. This can include unique shelf talkers that not only communicate price but connect and establish a helpful (yet short) dialogue with customers. “Providing a form of blade signage is also a strong solution to directing attention down the long aisles,” she added.

The Inspired Home Show ® is the industry epicenter for everything new and next in home + housewares, bringing both enduring and emerging trends to the table. Since 1939, the Show has been a reliable conduit for innovation and incubator for brands to introduce the next must-have products your customers are looking for.

Don’t miss this milestone event where the industry connects around innovation, insight and inspiration.

The key to all approaches, Aune added, is to grab attention within the customer’s cone of vision. “Floor graphics can help wayfinding in bigger, open areas when customers are looking down, but once in the product areas, concentrating on natural sightlines is key,” she pointed out.

Many times, wayfinding is hung too high or low and the design blends in, making it difficult to achieve its purpose, points out Aune.

To bring efficiency to the store, use clear signage, but don’t go overboard on it, explains Joseph Bona, president of Bona Design Lab in New York City, and point out categories rather than products because “consumers are pretty savvy.”

Signage doesn’t always need to be written, said Jay, but color can indicate certain categories of the store, such as ‘cough and cold’ or ‘baby,’ and can help define those distinctive spaces. These can become a store-within-a-store and there can be three to five of them within a drugstore, he said.

Categories can be called out in other ways, too, he explained, such as materiality, particularly the type of flooring or the colors used in the flooring, or in lighting, which tends to be brighter in an area like cosmetics. “Drugstores can create focal spots,” he said.

When Lyn Falk worked on Pharmasave in Vancouver, B.C., she created six different departments—including health and wellness; school supply; children and baby; and seasonal gifts.

“People want to get engaged with something,” says the president and CEO, Retailworks, Milwaukee, Wisc., Differentiated flooring, signage and lighting “starts training customers in what to look for,” she said. And all signs should align—aisle signs, promotional signs, informational signs.

Overall, said Jay, drugstores should make customers feel comfortable and confident in their ability to shop, via their interior design. This can be accomplished, he said, by dropping

shelf heights and adding softer, curved signage. “Dropping shelf heights lessens anxiety so you can see across the store and it helps you find your way, which provides a sense of comfort.”

Another benefit to dropping shelf heights is staff can see across the store at all times, helping with loss prevention.

Lower shelf heights means less merchandise space, but retailers can raise the height of perimeter shelves. This allows them to carry the lowest amount of inventory while preventing out-of-stocks.

“ Pharmacies need to be uplifting, inspirational, and that change in mindset needs to be addressed in the design, communications and color palates and not so much clinical.”

– Vince Guzzi, managing partner, Watt International

Categories that can particularly connect with shoppers like “baby” and “health and beauty,” can go a long way to forming a connection with shoppers, he points out. These sections are trip drivers but also “very emotional categories,” that portray a feel of wellness and self-care.

But the design of a store can’t all be touchy-feely, Jay said, the business has to turn a profit. Most of this comes from the pharmacy, which is traditionally tucked away at the back. And

“ I think you’d have a hard time identifying a Walgreens from a Rite Aid. You need to break the mold a bit to change people’s perceptions.”

– Joseph Bona, president of Bona Design Lab

a lot of high profit margin items are merchandised at the front end, where they also create the first and last impressions.

A good drugstore will guide consumers through specialty product areas to the pharmacy or convenience sections so they see a mix of products they’re (hopefully) compelled to buy, Aune said. “Angling aisles and providing visual disruptors can help provide a less direct path to the main purpose of their visit. It’s a tricky balance between great wayfinding, but less than direct paths to get from point A to B.”

It’s a balance between effectively guiding consumers to the reason they are there, while presenting them with additional products and options, Aune said. “If they came for paper towels and lotion, use focused design to introduce beauty care or cosmetics as well.”

In general, Jay pointed out, consumers’ trips to drug stores are often driven by picking up a prescription, so mostly people want to get in and get out.

A drugstore’s job, he said, is to help a shopper find the three or four items on her shopping list as efficiently as possible, then expose her to those things she’s not there for “and make an incremental purchase.”

End caps can also draw attention, especially to specialty products or high volume categories. “End caps are often used as gateways to an aisle,” said Guzzi. “They can drive sales and basket-building opportunities but also proposition certain things. Retailers can even dress them up with added pieces and even make them bigger to create special moments.”

Traffic flow and simplicity need to be maintained in a drugstore, said Guzzi. So while a store might be known for its selection of baby products but has a limited footprint, it can vary fixtures and do something unique at the shelf level, bumping out certain aspects or using shippers.

Pharmacies are becoming more comfortable spaces, designed to bring customers in with questions for the pharmacist, or simply to pick up prescriptions. Counter heights have dropped so customers are eye-to-eye-with technicians and have ready access to the pharmacists who are visible—either for reassurance or a quick question—or often, with their own window to answer any longer—or more personal—questions.

Pharmacies are becoming wellness centers, Jay said, and have been for many years, with the addition of specialty services. They should have upholstered seating with calming colors, and often a private room for immunizations or private chats.

“You need to set a tone that creates an ambiance so people feel ‘this is a space for people like me,’” said Jay.

Drugstore pharmacies should be bright and well-lit “so you feel confident in the pharmacist,” said Bona. And having the pharmacist visible goes a long way to creating connections with the customer

Every drugstore needs to feel that it is a shopper’s own drug store and stores should connect with customers.

That can be done through highlighting a local landmark or the building the store is in, or décor like a local map, with signage saying “Your neighborhood drugstore,” or something similar, says Vincent Guzzi, managing partner, Watt International, a retail design and strategy consultancy in Toronto.

Kimberly Aune, senior vice president and principal, Shea, Inc., Minneapolis, Minn., has integrated community into drugstore design by naming aisles after local streets, creating custom wallcoverings with historic photos, and giving local ties to store-within-a-store concept names and signage. “The approaches need to be strategic within the small footprints of drugstores to not take away from product focus,” she explained.

“People need to feel safe and secure because maybe they’re not feeling good. Having places that are more optimistic and cheerful goes a long way.”

Falk expects to see more changes to pharmacies in the coming years, with them becoming more comfortable and offering services like swabs and blood draws, saving patients a visit to the doctor. As pharmacies grow these services they need to allow for a bigger footprint—both for private rooms and a waiting area.

And really think about that waiting area, Falk said. Customers using it might have difficulty walking or be overweight. So make sure you have extra wide chairs and chairs with arms to make it easy for them to get up and sit down.

Another thing that can make these areas more pleasant—and give the perception that the wait is shorter—is including screens for patients to watch, Falk added. These could show informative videos—such as about diabetes—interspersed with fun facts or timely news information.

“Pharmacies need to be uplifting, inspirational, and that change in mindset needs to be addressed in the design, communications and color palates and not so much clinical,” said Guzzi.

And don’t forget to include clear signage in your pharmacy. Show customers where to drop off prescriptions, where to pick them up, and where they can chat to the pharmacist, which will help with customer flow.

At the end of the day, Bona said, most drugstores look very similar. “I think you’d have a hard time identifying a Walgreens from a Rite Aid.”

Chains looking to stand out could put the pharmacy up front or highlight the health and wellness of the business, he suggested. “You need to break the mold a bit to change people’s perceptions.” dsn

Spate’s crystal ball reveals opportunities for mass beauty

Spate’s 2025 Beauty Trends Report indicates that there is a growing importance placed on body care, multibenefit solutions and products that deliver sensorial experiences. With indicators that consumers are hunting for beauty bargains, mass merchants are beefing up selections, looking for on-trend merchandise and elevating the shopping experience to nab more category sales.

For the past four years, prestige growth has eclipsed mass. U.S. prestige beauty sales grew by 8% to $15.3 billion in the first half of 2024—with mass sales remaining flat. Could this be the year the mass market roars back?

Retailers are implementing tactics to improve the shopping experience—both in stores and online. CVS is spotlighting new brands on special displays in its stores. Walmart launched an online premium marketplace in August with brands like ColorWow, CosRX and Paul Mitchell. Target is playing up its exclusives like Blake Brown, founded by Blake Lively, and L’Oréal’s Colorsonic. And Walgreens has a new line of private-label beauty items inspired by high-end brands at a fraction of the price.

There are signs that mass merchants could be chipping away at specialty market dominance, especially with Gen Z customers. Target gained four points in the Piper Sandler semiannual Taking Stock With Teens Survey, grabbing a 37% share of the “retailer of choice” pie. Walmart expanded from a 5% to 7% share.

Here are some new items that help mass retailers match their assortments to Spate’s top skin, bath and makeup searches:

Clean girl, ‘no makeup’ makeup still growing in searches: Spate finds that clean girl makeup registered a 25% gain in searches.

“Consumers are increasingly interested in solutions that enhance a natural look while streamlining beauty routines, aligning with the ‘effortless but elevated’ aesthetic,” Spate reported.

Milani is on target with its new Conceal + Perfect Blur Out Skin Tint Stick. It is an ultra-lightweight, silky formula offering buildable semi-sheer to medium coverage, delivering a soft blur, satin finish that keeps skin hydrated. According to Milani’s chief marketing officer, Jeremy Lowenstein, it is perfect for achieving a no makeup, makeup look.

Brow business: Searches for brow stains and brow mascara are up 44.8% and 36.3%, respectively, according to Spate. Milani’s new Stay Put Tinted Brow Mousse meets demand. The ultra-nourishing, high-pigment tint is infused with shea butter, jojoba seed oil and hair-nourishing panthenol vitamin B5 to condition brows while taming and boosting them to their lushest, fullest arch, per the brand.

Safe and healthy driving in skin care sales: Spate reports that skin care searches center on the desire for skin health and product safety.

“In recent years, the beauty and skin care industry has undergone a significant transformation, shifting its focus toward natural and sustainable products that resonate with consumers’ growing environmental consciousness. This movement reflects a broader acknowledgment of the importance of using ingredients that are not only effective but also derived from nature and produced responsibly,” said Chithra Kanna, founder and CEO of Skin Centrick. Kanna’s brand brings products that harness the power of plant-based serums infused with stem cells. “Skin Centrick’s commitment to science-backed formulations showcases how effective skin care can be achieved without compromising sustainability.”

Consumers eyeing ingredient stories: Turmeric is making noise in skin and hair. “It’s in face masks, creams, and serums because it can help with redness, pimples and make your skin look bright. Lots of people love it. It’s super popular because it’s a natural way to help your skin,” said Juan Morillo, social media manager for Okay Pure Naturals.

Okay formulates with turmeric in products encompassing body wash, hand and body lotions, facial cleansers and soap.

People are searching for more gentle forms of retinol. “Skin care is evolving toward natural, scientifically advanced alternatives to traditional ingredients like retinol,” said Sean Finney, founder of Tano Skincare. His brand harnesses the power of balbisiana banana sap to offer a retinal alternative that boosts collagen production and improves skin elasticity, hydration and overall resilience without the irritation some people experience from retinoids.

Mature skin products gain traction: Spate identifies products for mature skin as an untapped market. For the past few years, brands have been laser-focused on younger shoppers. With 76 million baby boomers in the United States , the cohort is hard to ignore.

“Brands should tap into this growing trend and offer products adapted to more mature skins, with an emphasis on how

PRECIOUS MINERALZ Restorative Hand & Body Cream

important textures, formulas and application techniques are,” the Spate report suggested.

OKAY PURE NATURALS

Skin Brightening

Turmeric Hand & Body Lotion

Pure Mineralz is in sync with the opportunity, and sees growth in the men’s sector. “We continue to see opportunities in men’s grooming. We are developing a men’s line for introduction at the end of the first quarter of 2025,” said Deborah Dixon, the creator of Pure Mineralz. “It will be a limited line of products that make skin care grooming easy for men, especially mature men.”

Dixon is also bringing travel-size options for the brand’s Renewing Face Cream, Restorative Hand and Body Cream, Eyelash Booster and Eye Brow Booster. “The travel size products were developed as a direct result of customer feedback,” she said.

Searches spiking for bath and body products: Bodycare and bath products are having a moment—and mass merchants are saving space for it, literally. After registering gains in facial skin care, retailers are stocking up on products for below the neck.

“We see an increasing crossover between body care and skin care, with products such as glycolic body lotion, vitamin C lotion and turmeric soap,” the Spate report says “This blending of categories not only expands the body care market but also offers brands an opportunity to innovate with multi-benefit products that address comprehensive skincare goals from head to toe.”

Skin care is evolving toward natural, scientifically advanced alternatives to traditional ingredients like retinol.”

– Sean Finney, founder, Tano Skincare

Circana data supports the swelling demand for body and bath, calling the category the fastest growing in 2024, with sales up 7% over 2023.

Tree Hut has emerged as a brand attracting young consumers who like to collect different scents. Target set up an endcap devoted to Tree Hut gel wash and sugar scrubs during the holiday season.

CVS devotes an entire gondola to Hand in Hand, a collection of bath and body items. The CVS Beauty Spotlight displays also present bath and body items from Raw Sugar and Bubble.

So what’s next? Spate’s search data pulls back the curtain on future opportunities for mass brands.

Skin care: There is still room left in the K-beauty skin care category, particularly in sunscreens. Search volume is high with low competition.

Top searched concerns, such as oily skin, acne-prone [skin] and sensitive skin, reveal consumers are looking for products that will work with their skin type.

Trending searches in overall skin care include fragrancefree, skin barrier repair, acne safe and hypoallergenic.

Body care: If searches are on target, African net sponges are about to be on fire. The sponges are predicted to register a 126% increase in searches for 2025. Many inquiries center on the difference between the African net sponges and loofahs. (An African net sponge is a flexible, stretchy mesh bathing tool made from nylon fibers that effectively exfoliates the skin, while a loofah is a natural sponge derived from a dried gourd.)

Rising search volumes for perioral dermatitis, sweat bumps and heat rash highlight the growing intersection between wellness and beauty care. dsn

The college bookstore has evolved to a vibrant destination for, of all things, beauty products

By Megan Moyer

What was once a destination for textbooks and school supplies, the college bookstore has evolved to a vibrant destination for students, faculty and fans; and Follett Higher Education is meeting shopper needs with a new addition—beauty products.

Adding a cosmetics section to their stores has been under consideration for some time. “We have been exploring the beauty category in response to feedback from our students, who expressed that it was a gap in our assortment offerings,” said Angela Moses, vice president for hardlines and partnerships for Follett.

PITCH YOUR PRODUCTS IN ONE-ON-ONE MEETINGS WITH BUYERS ACROSS ALL RETAIL CHANNELS

30 YEARS OF EXCELLENCE: MAKING CONNECTIONS THAT MATTER

VITAMIN, WEIGHT MANAGEMENT & SPORTS NUTRITION SESSION September 8 - 11, 2024

PGA National Resort & Spa

Palm Beach Gardens, Florida

As more and more course materials move to digital formats and into programs that offer students day-one access to materials as part of tuition, campus stores now find themselves with additional retail space that can be used to offer in-demand products. “With new space available that was previously dedicated to textbooks, we capitalized on the opportunity to reimagine and transform it with requested product offerings,” Moses said.

Moses said their partners L&R Distributors and PM Plastics were integral in bringing the vision to life. “We relied on both partners as experts in their fields to bring this full circle.” The installation of the new beauty initiative was targeted to 30 of Follett’s stores across the country and included two- and four-year schools. Depending on the store size, the displays were either 12, 18 or 30 feet.

L&R, in partnership with the Follett team, was responsible for determining which brands to include in the assortments.

Cassy Kehoe, vice president of category development at L&R, said, “We analyzed trend information for the demographic and the marketplace; we also researched brands that are currently trending. We focused on the Gen Z customer and what is important for them as they shop the category. We then used market performance data by brand to identify strong performers, and based our footage recommendation on that. Cultural demographics for each school location were also applied to be sure we had the right assortments. We have great partnerships with these trusted companies and cosmetics brands, and they have been partnering in the strategy along the way.”

PM Plastics’ Universal Merchandising System is the fixture system used for the store displays. Larry Alper, senior vice president of business development for PM Plastics said, “The system is very flexible for custom fixture installations. It looks high-end but doesn’t come with the cost of customized systems. They are fully lit, so it’s like a beacon in the stores.”

PM Plastics utilized HRG’s category analyst experts to build the planograms and provide tools for use in-store to make installation go smoothly. Following space planning processes, the HRG team converted PSA files to ensure all products chosen would fit in the fixtures as planned. Planogram packets helped installers efficiently build and stock the displays.

Moses believes adding the beauty sections helps make the bookstores “exciting and purposeful” so students will want to visit. “I believe students will find the convenience and cost savings appealing, particularly since they can bypass shipping an online order in exchange for free pick up in-store,“ said

FOR HAIR AND FOR YOUR CHAIN'S BUSINESS.

Omega-rich hydration.

Antioxidant protection.

Rejuvenating care.

FROM THE VERY FIRST USE.

To transform your bottom line, Obliphica Professional offers generous sampling, beautiful displays and comprehensive consumer media support. Obliphica.com 855-330-5530

Moses. “College students are social savvy, budget savvy and they do their research.”

“Brands are eager to connect with college-age consumers. This is an opportunity for them to establish a physical presence to reach and engage untapped markets.” Moses says they are also working on putting together a think tank, getting the brands, L&R, and students together to share feedback and ideas.