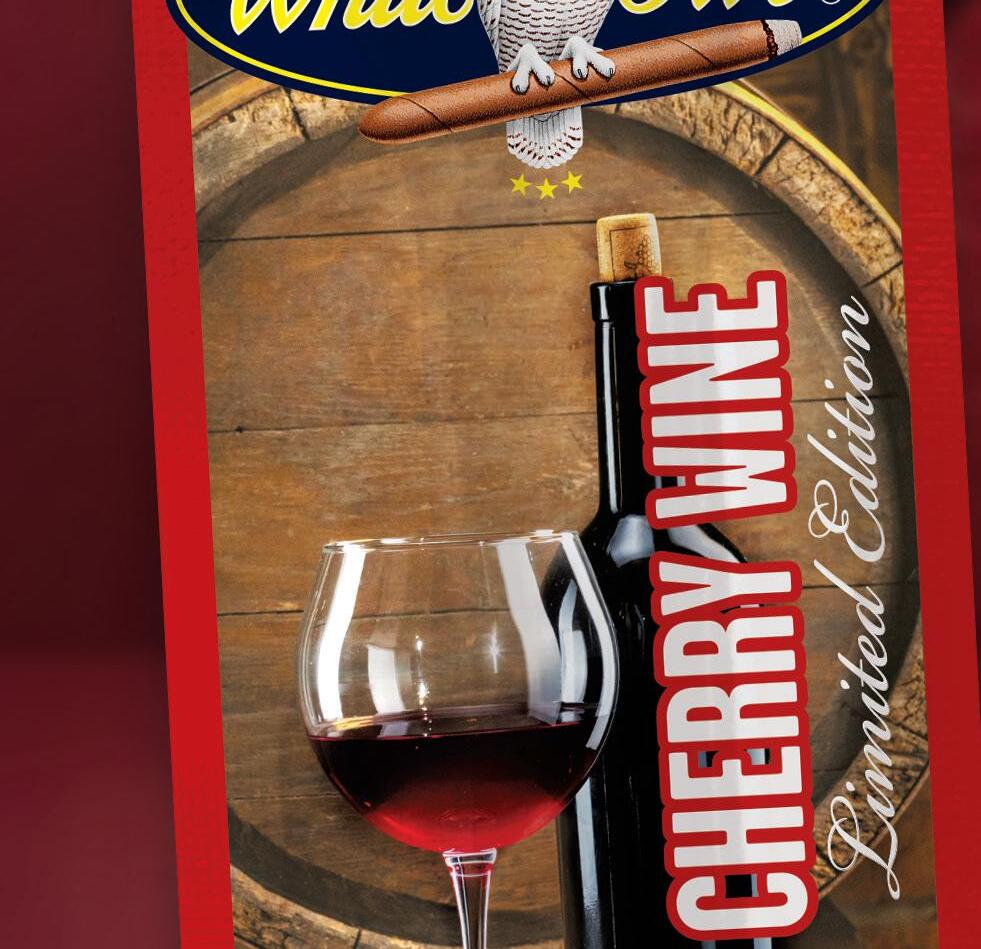

Swisher Sweets delivers a perfect smoke for any occasion. Don’t miss out—stock your shelves with these best-selling cigarillos today.

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

Swisher Sweets delivers a perfect smoke for any occasion. Don’t miss out—stock your shelves with these best-selling cigarillos today.

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

OUR INAUGURAL CATEGORY EXCELLENCE AWARDS RECOGNIZE OUTSTANDING INDUSTRY COLLABORATIONS

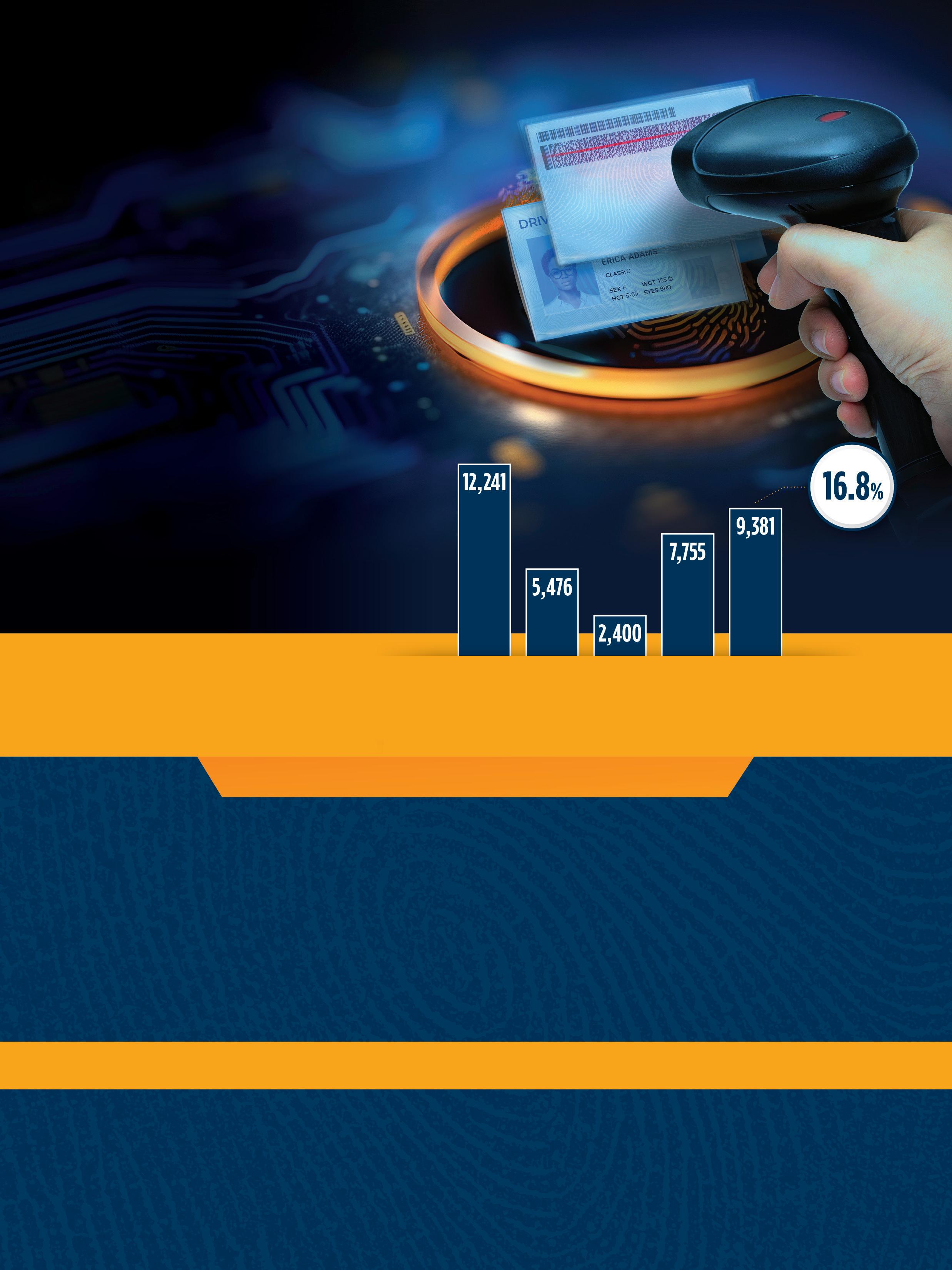

Ensure that retail remains the most trusted place to responsibly sell tobacco products.

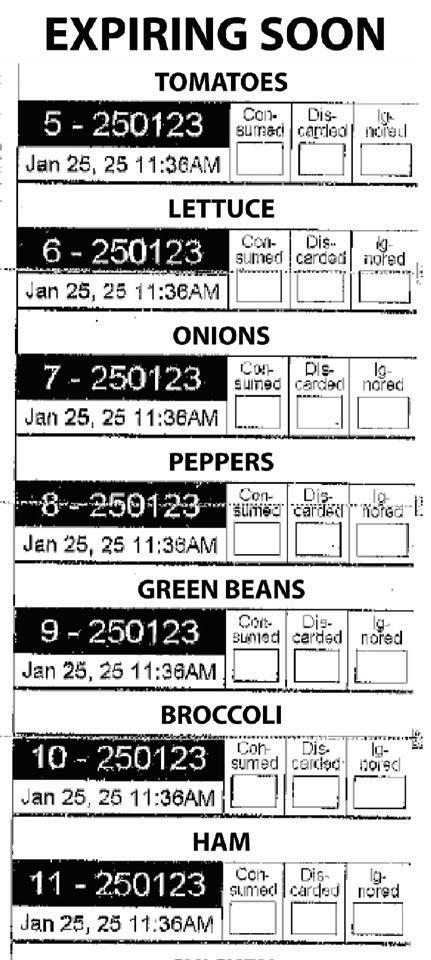

Did you know the average number of FDA compliance checks per month are approaching pre-COVID-19 levels?

In 2023, as of 9/30/23, the FDA conducted 9,381 compliance checks per month, which was an uptick from previous years.*

*Source: FDA CTP Violation Rate analysis was completed using publicly available raw data posted online at fda.gov. Calculations of Total Compliance Checks and Violation Rates were computed by AGDC based on Decision Data published. Inspections data FFY 2019 - 2023 FDA COMPLIANCE CHECKS Per Month (Avg.)

Age Validation Technology (AVT)

Modernize and simplify the ID check process with AVT, helping to reduce the likelihood of selling tobacco products to underage individuals

Improve ID check rates at a store and individual employee level, with We Card™ Training, available for Free via AGDC

State and Federal Law

Summaries and additional resources via the We Card™ resource center

Reinforce your sales associates’ understanding of ID check requirements and policies with Mystery Shop incentives

Convenience Store News is launching a new event dedicated to the industry’s smaller players

OF THE 152,255 CONVENIENCE STORES currently serving customers in the United States, 63% are owned by single-store owners or those with less than 10 stores in total. Despite their lead in store count, though, the industry’s smaller players are under increasing pressure.

That’s partially because the convenience channel’s largest players — those with more than 500 stores — keep expanding. Over the last three years, their ranks have steadily ticked up, going from 21.1% share in 2023 to 21.6% in 2024 to 22.4% this year. Meanwhile, the smaller players’ share has ticked down bit by bit, going from 63.2% to 63.1% to now 63%.

This trend is expected to continue as the industry’s consolidators, larger regional chains and private equity groups are shifting their focus to smaller, bolt-on acquisitions to expand their site counts and market share (see page 19). Larger c-store companies have pricing power and economies of scale that make it easier for them to weather turbulent times, as well as the capital to successfully execute a growth strategy.

In spite of their collective power, single-store owners and small chains must work harder than large operators to shield themselves from the impact of ballooning inflation and interest rates, increasing operational costs, and difficulties around labor hiring and retention.

To help the convenience channel’s small operators not only navigate these challenges, but also elevate their

EDITORIAL EXCELLENCE AWARDS (2016-2025)

2021 Jesse H. Neal National Business Journalism Award

Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award

Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

2024 Eddie Award, Folio: magazine

businesses to better compete against large operators, Convenience Store News is launching the Outstanding Independents Summit. All convenience store retailers operating one to 20 stores in the U.S. are eligible to attend this free virtual event on Friday, April 25.

The agenda will tackle today’s biggest pain points for small operators, and provide valuable insights, expert advice and actionable knowledge that attendees can immediately implement to upgrade their operations. The event will culminate in the presentation of the firstever Outstanding Independents Awards, created to recognize single-store owners and small operators that are standing out and serving their communities well.

Convenience Store News has long been doing its part to support the small operator community with our annual State of the Small Operator Study, Small Operator content in every issue of the magazine, an entire Small Operator section of our website and a weekly Small Operator newsletter delivered to inboxes every Monday. We’re thrilled to be taking our commitment to the next level with this new, exciting event!

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

For more information on the 2025 Outstanding Independents Summit, go to: https://events.csnews.com/outstandingindependentssummit

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section, October 2024

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

AS THE NEW TRUMP ADMINISTRATION BEGINS shaping its economic policies, convenience store retailers are watching closely. In an industry driven by fuel prices, consumer spending and employment trends, even small economic shifts can have a major impact on the bottom line.

One of the biggest areas of concern is inflation. With wage growth and tax cuts potentially spurring consumer demand, the cost of goods could rise. For retailers, this means higher wholesale prices on everything from packaged goods to foodservice ingredients. Keeping margins intact while maintaining competitive pricing will be a challenge.

In an industry driven by fuel prices, consumer spending and employment trends, even small economic shifts can have a major impact on the bottom line.

Fuel prices, always a critical factor for convenience stores, are another wild card. The Trump Administration has signaled support for increased domestic oil production and fewer regulatory constraints on drilling and pipeline construction. In theory, this could help stabilize crude oil prices and keep gasoline costs in check. However, geopolitical uncertainty and OPEC’s influence on supply could still drive volatility at the pump. Lower gas prices would be a boon for c-stores, encouraging more fuel sales, more driving and more in-store purchases. If prices spike, though, retailers should brace for reduced discretionary spending.

Unemployment and consumer spending also will be key indicators to watch. The administration’s focus on deregulation and tax relief for businesses could drive job growth, increasing disposable income. More employed consumers with extra money in their pockets typically translates to stronger in-store sales. But if inflation outpaces wage growth, the net effect could be negative, leaving customers with less purchasing power for discretionary items such as snacks, prepared foods and tobacco products.

Another area of concern is trade policy. The administration’s proposed tariffs on goods from Canada, Mexico and China have sent shockwaves through the business community. While these tariffs have been delayed, they signal a shift away from traditional free trade principles toward what the administration calls “fair trade.” For convenience retailers, this raises concerns about potential price hikes on imported goods, including key items like aluminum cans for beverages, food products, and even the electronics and technology they utilize. If enacted, these tariffs could drive up costs for retailers and consumers alike.

Looking ahead, convenience store retailers should focus on adaptability. Competitive fuel pricing, cost-control strategies and an emphasis on high-margin categories such as foodservice will be crucial to maintaining profitability. Additionally, keeping a close eye on evolving labor policies — such as potential changes to minimum wage laws and healthcare requirements — will be vital to managing operational costs.

For comments, please contact Don

Longo, Editorial Director Emeritus,

at dlongo@ensembleiq.com.

FEATURE

42 Is the Car Wash Business for You? From space to equipment to payment, convenience store operators have much to consider.

46 Breaking Tradition

Traditional smokeless tobacco is feeling the impact of modern oral’s growing popularity.

FOODSERVICE

50 Advancing Foodservice Through Technology & Automation

C-store operators turn to innovative equipment and solutions to improve their kitchen operations.

ALCOHOLIC BEVERAGES

54 Are You Ready for Gen Z?

This demographic group is already reshaping alcoholic beverage consumption.

From driving culture to fueling foodservice, convenience retailers

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

SENIOR ACCOUNT EXECUTIVE Griffin Randall - (404) 702-6931 - grandall@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

MARKETING COORDINATOR Mateo Rosas mrosas@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

Thirteen miles from the Oregon state border, the new Stinker Travel Center is a unique kind of “Welcome to Idaho” sign for professional drivers and traveling families. It is the largest store to date for Boise, Idaho-based Stinker Stores Inc. and boasts many unique features and services compared to one of the chain’s standard convenience stores. The site, located on Interstate 84 and Black Canyon Road in Caldwell, represents Stinker’s first scrape-and-rebuild for a truck stop/travel plaza. “We saw this as an excellent opportunity to design not only a store, but an entire property to serve as an oasis between Ontario, Ore., and Boise, Idaho,” Billy Colemire, vice president of marketing and brand, told Convenience Store News.

For more exclusive content, visit the Special Features section of csnews.com.

Slim Jim Bites

Slim Jim Bites are small in stature, but big on taste, according to maker Conagra Brands. Packaged in 3.75-ounce resealable bags, the bite-sized meat snacks are available in original and mild varieties, and have a suggested retail price of $6.49. The company noted that bite-sized meat snacks are up 19% over the past year and are the category’s fastest-growing segment with $234 million in annual sales.

Conagra Brands

Chicago conagrabrands.com

The brands were chosen from the first-ever Casey’s Innovation Summit, which focused on discovering innovative brands and their products for distribution across the retailer’s network. The new products will appear in Casey’s stores in the coming months.

The percentage of those planning to cut back on alcohol consumption has been trending consistently upward over the last three years, according to new findings from NCSolutions. Sales of nonalcoholic beer were up more than 20% from December 2023 to November 2024 in comparison to the prior year.

The retailer filed suit against Dallas-based Super Fuels, alleging infringement. Super Fuels’ logo features a dog mascot wearing a red cape, set against a blue circle backdrop, while Buc-ee’s logo features a beaver wearing a red hat, set against a yellow circle backdrop.

Michele Buck, chairman of the board of directors, president and CEO, will retire from the company effective June 30, 2026. A special committee will direct the search for her successor and consider both external and internal candidates.

The 37th annual “USA TODAY Ad Meter competition” gauged public sentiment and opinions regarding advertisements broadcast nationally during this year’s Super Bowl. The top ads featured brands such as Budweiser, Lay’s, Michelob Ultra and Stella Artois.

As technology executives have a greater voice in the retail conversation, it is increasingly important that leaders in the tech space work together with leaders in other areas of the operation. During a session at the 2025 Conexxus Annual Conference, NexChapter Founder and CEO Art Sebastian discussed how transformation will continue but change. “It’s not going to be about the loyalty program, and e-commerce and delivery,” he said. “No doubt, those are going to be top of mind, but we’re going to expand the discussion around technology to include these big words: automation, mobilefirst platforms and cybersecurity.”

The acquisition marked Hutchinson Oil’s exit from the convenience store industry

CIRCLE K STORES INC. wrapped up its acquisition of the convenience and retail gas assets of Hutchinson Oil Co. Inc. In all, the transaction added 20 Hutch’s c-stores and travel centers in western Oklahoma and southern Kansas to Circle K’s network.

Hutchinson Oil is a third-generation, family-owned and -operated business that was founded by Ross Hutchinson in 1969. His son, David Hutchinson, assumed the role of president in the 1990s and focused the company’s efforts on expanding the Hutch’s brand by building large c-stores and travel centers with amenities catering to both passenger vehicle and professional driver customers, according to Matrix Capital Markets Group Inc., which provided advisory services to the seller.

The stores feature the Hutch’s Deli proprietary food and beverage program with made-to-order foodservice, as well as a selection of traditional convenience merchandise.

This deal only included Hutchinson Oil’s petroleum marketing and convenience retail network. The Elk City, Okla.-based company

sold its delivered fuels business to Hampel Oil Distributors Inc. in the fourth quarter of 2024. That business sold commercial refined fuels products to a diverse commercial and industrial customer base throughout western Oklahoma.

With the closing of the convenience retail and travel centers transaction in January 2025, the Hutchinson family officially exited the industry.

Circle K is the global banner of Laval, Quebecbased Alimentation Couche-Tard Inc. In the company’s second-quarter fiscal year 2025 earnings call on Nov. 25, CEO Alex Miller noted that this tuck-in agreement brings the Circle K banner back to Oklahoma and Kansas.

The acquisition of Hutch’s c-store chain is just one piece of Couche-Tard’s recent growth. In the second half of calendar year 2024, the company inked an acquisition agreement for GetGo Café+Markets, the c-store arm of Pittsburgh-based Giant Eagle Inc., for approximately $1.6 billion. GetGo operates approximately 270 stores across Pennsylvania, Ohio, West Virginia, Maryland and Indiana.

NATSO applauds move to reevaluate the National Electric Vehicle Infrastructure program

The Trump Administration moved to halt the $5 billion National Electric Vehicle Infrastructure (NEVI) program, instructing states not to spend their previously allocated funding. This leaves the future of a federally funded EV charging network in question as of press time.

The Federal Highway Administration (FHWA) sent a letter on Feb. 6 to state transportation directors stating it was suspending approval of annual implementation plans that states previously submitted for fiscal years 2022-2025, according to reports. The letter noted that states will be able to receive reimbursement for existing obligations to design and build charging stations.

“Effective immediately, no new obligations may occur under the NEVI Formula Program until the updated final NEVI Formula Program Guidance is issued and new state plans are submitted and approved,” wrote Emily Biondi, FHWA’s associate administrator for planning, environment and realty.

FHWA said it plans to publish new draft guidance on the NEVI program this spring and will hold a comment period, after which it will issue new final guidance.

NATSO, an association that represents the nation’s truck stops, travel centers and off-highway fuel retailers, applauded the move.

“The NEVI program has, in many states, helped catalyze existing gas stations and truck stops to install fast, state-of-the-art EV charging stations. In other states, NEVI has been implemented poorly, with chargers either still not built or, if they are, they’re in places nobody wants to stop,” said David Fialkov, executive vice president of government affairs for NATSO and SIGMA.

“We are encouraged that the Trump Administration is reevaluating rather than abandoning the NEVI program and intend to work closely with the administration to share our experience and keep what’s been working, while reconsidering clearly unproductive approaches,” Fialkov added.

— NCR Voyix Corp. 36%

More than one-third of shoppers (36%) prefer self-checkout because it has shorter lines.

The U.S. c-store industry now comprises 152,255 stores — a year-over-year decrease of 141 stores.

— NACS/NIQ TDLinx Convenience Industry Store Count

of Americans say that an unclean or unpleasant restroom at a business has a negative impact on their overall impression of that business.

— Bradley Co. 84%

The company also plans to add approximately 1,000 new truck parking spaces to its network in 2025.

Love’s Travel Stops will start construction on 20 new stores and begin updating 50 existing locations this year under its Strategic Remodel Initiative.

Foxtrot Café & Market is back in business in Dallas. The upscale convenience retailer kicked off its return with the mid-January reopening of a store at 3130 Knox St., followed by the reopening of a store in University Park in early February.

Buc-ee’s first location in Wisconsin is slated to open in Oak Creek in early 2027. The 73,370-square-foot store will feature 120 gas pumps and electric vehicle charging.

Two convenience stores have joined QuickChek’s New Jersey portfolio. The Phillipsburg and Neptune locations boast indoor and outdoor seating, multiproduct fuel dispensers on the forecourt, and full-service deli and beverage counters.

Nittany MinitMart is now ringing up customers at a new convenience store in Dunnstown, Pa. Located across the street from its previous location, the redesigned store is more spacious with an improved layout and upgraded features and amenities.

Murphy USA Inc. completed 32 new-to-industry stores in 2024, meeting its goal of 30 to 35 new sites. Additionally, the company completed 47 raze-and-rebuild projects.

The change is a shift from its previous one-size-fits-all printing operation.

Stewart’s Shops is selling five convenience stores in New York and Vermont following its acquisition of the Jolley Stores chain in late 2024. The retailer is divesting the locations as part of an agreement with the Federal Trade Commission.

Parker’s Kitchen is rolling out NCR Voyix Corp.’s self-checkout technology across its store portfolio. To date, the option is available at 62 sites, enabling the retailer to optimize the guest shopping experience, especially during peak shopping times.

RaceTrac Inc. teamed up with ColorWorks to bring the retailer’s shelf tagging and product labeling operations in-house using on-demand color label printers. The shelf strips feature RaceTrac branding and detailed product information.

K&G Petroleum partnered with car wash technology provider DRB to launch a new mobile app for its Pure Auto Wash brand. The app can be used at the 33 car wash sites at K&G-owned convenience stores across Colorado and Nevada.

Sparky’s One Stop, the convenience store arm of Al’s Corner Oil Co., received the Secretary’s Ethanol Marketing Award in Iowa. The chain, which markets E15 and E85, was recognized for promoting biofuels in the state.

Sunoco and Flexcar partnered to launch the Flexcar Gas Saver program. The initiative offers Flexcar members in New England 30 cents off per gallon and 20 cents off in southern markets at participating Sunoco locations.

Krispy Krunchy Chicken closed out 2024 with a record-breaking 605 store openings. The company also rolled out third-party delivery last year with partners such as DoorDash, UberEats and Grubhub.

Cantaloupe Inc. was recognized as a “2024 Champion of Board Diversity” by The Forum of Executive Women, a greater Philadelphia women’s organization. This marks the fourth consecutive year that Cantaloupe received this honor for having a board with at least 30% women.

AB InBev extended its nearly 40-year partnership with FIFA to include the FIFA Club World Cup 2025. Budweiser and Michelob ULTRA will lead the partnership, complemented with local brands in select markets.

EnsembleIQ is the premier resource of actionable insights and connections powering business growth throughout the path to purchase. We help retail, technology, consumer goods, healthcare and hospitality professionals make informed decisions and gain a competitive advantage.

EnsembleIQ delivers the most trusted business intelligence from leading industry experts, creative marketing solutions and impactful event experiences that connect best-in-class suppliers and service providers with our vibrant business-building communities.

ENSEMBLEIQ.COM

GasBuddy launched a Pay with GasBuddy+ card, a fuel card that offers drivers discounts of up to 33 cents per gallon on fuel purchases. The card extends the reach of the Pay with GasBuddy program into the convenience store.

InStore.ai entered into a strategic partnership with the Loss Prevention Research Council. This collaboration aims to provide retailers with new tools and practices to reduce theft and enhance workplace safety.

National Retail Solutions launched “Marty’s Minutes, C-Store Basics 101,” an educational video series for c-store owners and managers. The videos feature industry veteran Marty Glick of National Convenience Distributors.

Pringles Mingles are a shareable, bowtie-shaped snack that offers a new way to enjoy Pringles. Crispy on the outside and light and airy on the inside, Pringles Mingles are the brand’s first-ever puffed offering and mark its foray into a bag for the first time in 15-plus years. The product is available nationwide in three flavor varieties: Cheddar & Sour Cream, Sharp White Cheddar & Ranch, and Dill Pickle & Ranch. Pringles Mingles are a permanent addition to the Pringles collection.

KELLANOVA • CHICAGO • KELLANOVA.COM

Daniel’s

Ferrara Candy Co.’s Trolli brand launches Trolli Sour Brite Squad Gummies. The pack includes three new crawler shapes that offer unique ridges to enhance the flavors of the Trolli Sour Brite Crawlers. The flavor combinations include Blackberry-Lime, Strawberry-Lemonade and Raspberry-Orange. The product is available in 4.24-ounce, 6.3-ounce and 12.3-ounce packages with prices ranging from $2.39 to $5.39.

FERRARA CANDY CO. • CHICAGO • TROLLI.COM

Jack Daniel’s Country Cocktails Bolder line delivers the same taste and refreshment consumers love with a bolder kick of 8% ABV in single-serve cans, according to the company. The higher ABV cocktails come in two fan-favorite flavors: Southern Peach, featuring a ripe peach nose and sweet peach flavor with a citrus twist; and Downhome Punch, a sweet, tangy blend of cherry, peach, melon and orange flavors. Both varieties are available nationwide in 23.5-ounce and 16-ounce cans.

JACK DANIEL BEVERAGE CO. • LOUISVILLE, KY. • JACKDANIELS.COM/EN-US/WHISKEY/ COUNTRY-COCKTAILS

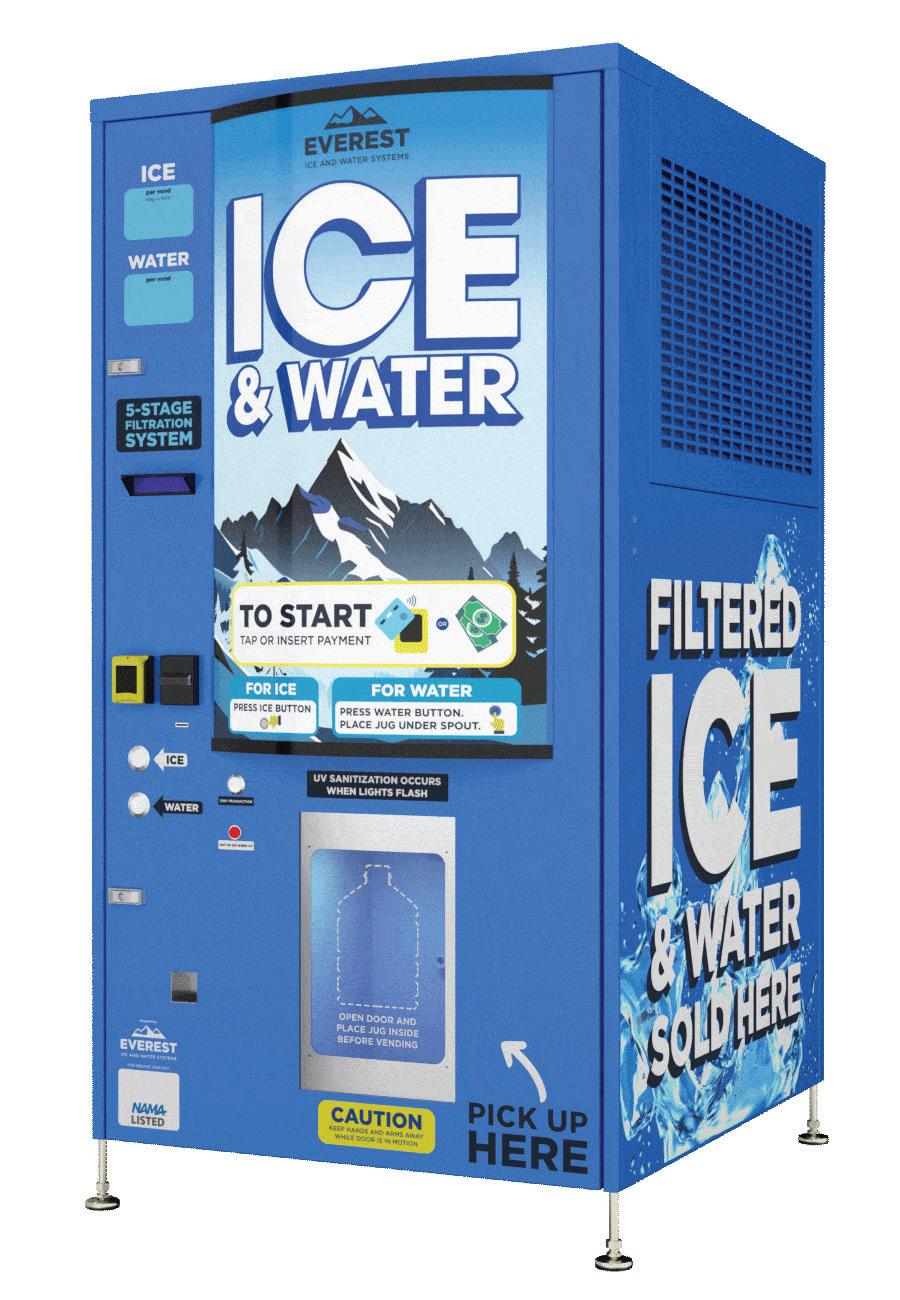

Everest Ice and Water Systems introduces two new products: the Everest Avalanche, a vending machine designed to redefine convenience, efficiency and hygiene for businesses; and the Everest Ascent, a through-wall model tailored for modern construction and year-round operation. The Avalanche introduces Everest’s auto-bagging system, a patented feature that utilizes a rotating barrel to deliver fresh, bagged ice without adding complex mechanical parts. The Ascent complements the Avalanche by offering a through-wall design, ideal for businesses integrating vending machines into their construction. Customers access the Ascent from the exterior, ensuring operation in any weather.

EVEREST ICE AND WATER SYSTEMS • ORLANDO, FLA. • EVERESTICEANDWATER.COM

Clear Demand, a provider of price and promotion optimization software for convenience stores, enhances its Tobacco Pricing Solution to support a broader assortment of products and drive additional profitability for retailers. By expanding the scope of its solution to include other tobacco products (OTP), retailers can now optimize pricing decisions across the entire category. The update allows retailers to finetune OTP prices based on local market conditions, customer behavior and retailers’ business rules, ensuring maximum competitiveness and margin protection while complying with government regulations.

CLEAR DEMAND • SCOTTSDALE, ARIZ. • CLEARDEMAND.COM/TOBACCO-PRICING

Despite their lead in store count, the convenience channel’s small operators are under pressure

By Danielle Romano

LOOKING BACK ON 2024, merger and acquisition (M&A) activity in the convenience channel didn’t drum up as much excitement as in previous years — think headlinegrabbing, blockbuster deals. Instead, the focus shifted to smaller, regional chains.

For example, The Kent Cos. closed out the year with a flurry of deals, including the acquisition of all eight Jack’s Convenience Stores in Texas, as well as the purchase of DC Oil Co.’s 13 Chevron Texaco-branded stores. Family-owned Mini Mart sold all its locations to Fischer’s Neighborhood Markets, just a year after the business celebrated its 50th anniversary.

Similarly, after nearly three decades in operation, Fast Track exited the convenience channel upon the sale of its petroleum marketing, convenience retail and quickservice restaurant businesses to Anabi Real Estate Development LLC.

Can we expect the trend toward selling to continue? Absolutely, industry M&A experts say.

“Industry consolidation will persist as consolidators, larger regional chains and private equity groups continue acquiring smaller portfolios to drive growth. With fewer large-scale deals involving chains of 100 or more locations, acquirers will remain active by shifting their focus to smaller, bolt-on acquisitions to expand market share and site counts,” Jeff Traub, partner at Jonesboro, Ark.-based advisory firm Downstream Energy Partners, told Convenience Store News.

The U.S. convenience industry store count now stands at 152,255 stores, with the majority (63%) falling in the “A-sized” operator category, defined as having one to 10 stores. By comparison, “E-sized” operators, with more than 500 stores, account for 22.4% of the total.

The consolidation happening across the industry is as strong as it is because of supply and demand, according to Terry Monroe, president of American Business Brokers & Advisors, headquartered in Fort Myers, Fla. While ballooning inflation and interest rates have created difficult economic conditions for smaller players, larger c-store companies have pricing power and economies of scale that make it easier to weather turbulent times — and they have the capital to execute a growth strategy.

“Larger operators want to expand their footprint and they know the best way to grow their business in numbers and return on their investment is through acquisitions,” he explained. “But there aren’t enough good stores for sale, which in turn has kept the value of stores in demand and at a premium price.”

As the Federal Reserve began rapidly raising interest rates, the cost of investing in growth became prohibitive for some operators. That picture is shifting — albeit gradually, Traub said. Borrowing costs peaked in 2023, with multiple rate cuts throughout 2024 offering some relief. In 2025, the Federal Reserve’s cautious stance has stabilized rates, signaling a departure from aggressive hikes.

“However, interest rates remain elevated compared to historical norms, posing ongoing challenges for operators seeking to finance growth through debt or sale-leasebacks, which are highly sensitive to interest rate fluctuations,” he said. “While conditions are improving, operators must continue to be strategic and selective in their investment decisions, as borrowing costs are still notably higher than in the past decade.”

Traub cautions that small operators should prioritize growing their portfolios until the right time for a strategic exit. “Maintaining the status quo without pursuing growth is rarely an effective strategy,” he advised.

How can small operators know when to go or grow?

In addition to industry consolidation, Monroe points to several other factors that may drive convenience’s smaller players to sell: retirement; there is no succession plan in place; owners don’t want to invest the time or money anymore; struggling with labor; or they simply cannot compete with new players entering their playing field.

“[Small operators should evaluate] and see what their situation is. Do they have a succession plan? If so, there is one solution. Did they not invest in their business during the time they owned the stores and is it going to cost too much to bring the stores up to speed? What is their market like?” Monroe posed. “In some states I work in, the competition has gotten so bad, there are new stores being built in the operators’ territory and they don’t have a choice whether to keep going or not because they have lost 40% to 50% of their business because of new competition and they are forced to sell.”

If a small operator plans to grow or enhance, Traub offers up three key considerations:

1. Strategic plan: Do I have a well-defined, actionable plan to grow the business through new-to-industry development or acquisitions?

2. Capital resources: Are adequate financial resources available, including both equity and debt, to execute my growth strategy effectively?

3. Infrastructure and technology: Is the necessary infrastructure in place — including talent, systems and operational procedures — to support sustainable growth?

Monroe pointed out that there are advantages to being a smaller operator in the convenience channel, so he urges these retailers to proceed with caution when considering growth.

“Being small and in control of your business will make you very successful. Bigger is not always better,” he said. “If an operator doesn’t have the right people, controls and offerings to their customers, adding more stores only makes the situation worse.”

Despite the challenges, the future for the convenience industry’s small operators is not all doom and gloom. The way Monroe sees it, “there is a long life left for small operators — but there’s

“Industry consolidation will persist as consolidators, larger regional chains and private equity groups continue acquiring smaller portfolios to drive growth.”

— Jeff Traub, Downstream Energy Partners

a breaking point,” whether that is five stores, seven stores or 10 stores.

Small operators can quickly adapt to market trends and customer preferences without the red tape that often slows down larger organizations. This allows them to implement changes, test new products or adopt innovative concepts more rapidly, Traub noted. With fewer layers of management, decision-making processes are streamlined, which helps optimize operations and reduce costs.

“Smaller operators often have closer relationships with their customer base, enabling them to tailor offerings and services to meet local preferences and build customer loyalty,” he added. “Being embedded in the local community often fosters goodwill, allowing small operators to build a loyal customer base through trust and authenticity.”

Just one example of a small operator tapping into its strengths is Kentucky-based Go Time. Owned and operated by retail and convenience industry veteran Kim King and her husband Scott, they currently have nine Go Time stores, with No. 10 slated to open in early spring.

At a glance, Go Time offers both proprietary and branded foodservice programs, sells private label products, has a loyalty program and mobile app, and relies heavily on technology to remain successful. The owners scan at least 98% of the chain’s products and use data to see top-selling products, plan items in the coolers, and more.

“If you don’t have some form of tech, you can’t operate and compete. I’m a small chain and right next door to our store in Corbin, Ky., we have a Pilot Travel Center and Love’s, so we have to stay advanced on our technology,” King recently told CSNews.

Although a couple of large companies have approached her and her husband with offers to buy the chain, King isn’t interested in that right now. Instead, she’s eager to continue expanding Go Time with more locations as opportunities present themselves.

“I’m not ready to sell and probably won’t be in my lifetime,” she said. “Someone may call me tomorrow with stores to sell and I may buy them. We are very hands-on business owners.” CSN

OUR INAUGURAL CATEGORY EXCELLENCE AWARDS RECOGNIZE OUTSTANDING INDUSTRY COLLABORATIONS

A CONVENIENCE STORE NEWS STAFF REPORT

AS CONVENIENCE RETAILING continues to get more complex and competitive, collaboration between the industry’s retailers, suppliers and distributors is of increasing importance. Teamwork is essential for winning executions and overall success.

To spotlight the power of partnership in the convenience store industry, Convenience Store News introduces the Category Excellence Awards, which recognize outstanding collaborations between a retailer category manager and their supplier or distributor partner.

Nominations were submitted to CSNews by c-store industry retailers, suppliers and distributors. Nominators were asked to describe the key contributions of the retailer category manager and the key contributions of the supplier/distributor partner, as well as provide specific metrics on how the partnership improved category sales and profits. Collaborations in all edible and nonedible product categories were eligible for entry, as well as fuels, loyalty, technology, lottery/gaming, ATM and car wash.

After much deliberation, judges selected 19 winners in six award categories:

• Digital & Loyalty Excellence

• Exclusive Product Collaboration Excellence

• New Product Launch Excellence

• Planogram Excellence

• Promotion Excellence

• Overall Partnership Excellence

Category Excellence Awards winners are: Digital & Loyalty Excellence

• Retailer Partner: Erica Miller, Marketing Specialist, Jiffy Trip

• Supplier Partner: Rovertown

A shared dedication to innovation, rapid execution and measurable success were cornerstones of the partnership between Jiffy Trip and Rovertown, which resulted in the development and launch of the Jiffy Trip Mobile App in just three months — a pace far exceeding industry norms.

The Rovertown team worked closely with Jiffy Trip’s marketing specialist, project manager and app steering committee to bring the app from concept to launch. Rovertown provided best practices for content, layout, design and functionality, and ensured the app met industry standards and consumer expectations while addressing Jiffy Trip’s unique goals. Plus, its ongoing support has been instrumental in optimizing the app’s performance.

Jiffy Trip’s Marketing Specialist Erica Miller played a pivotal role in the project, collaborating closely with Rovertown and leading the app steering committee. She

continues to oversee the app’s performance by working with the retailer’s merchandising and marketing teams to maintain its relevance and appeal. Her leadership has been crucial in developing app-exclusive monthly coupons — a hallmark feature that drives customer engagement and offers deep discounts on Jiffy Trip’s most popular food and beverage items.

Since its launch in late June, the Jiffy Trip Mobile App has seen growth every month. It has attracted more than 15,000 unique users across the retailer’s 30 locations in small and midsized towns and to date, 40,000-plus coupons have been redeemed.

• Retailer Partner: Jackson Tolk, Loyalty and Mobile App Manager, Tri-Star Energy

• Supplier Partner: Paytronix

Paytronix and Twice Daily, the convenience store brand owned by Tri-Star Energy, collaborated to add a custom mobile app and the Paytronix Order and Delivery platform to the retailer’s preexisting Paytronix-powered loyalty program.

As Twice Daily expanded its foodservice offerings, the chain needed a branded mobile app with online ordering to stay competitive with quick-service restaurant brands. Paytronix built a customized, branded mobile app for Twice Daily that makes its made-to-order items available for customers on the go. The retailer then integrated Paytronix Loyalty with Online Ordering to create a streamlined guest experience that makes it easier to receive special offers, track rewards, and order everything from coffee to baked goods to made-to-order sandwiches and burritos.

Tri-Star Energy’s Loyalty and Mobile App Manager Jackson Tolk oversaw the creation and deployment of the new order and delivery addition to Twice Daily’s app and loyalty program. He now handles ongoing management to get more from the platform for customer engagement.

The combination of loyalty and online ordering has increased both spend and frequency. Tri-Star Energy has achieved a 225% increase in sales dollars, a 55% monthly lift in orders, and a 95% increase in unique customers as the order-ahead feature is attracting new customers.

• Retailer Partner: Steve Rosati, Category Manager, Packaged Bakery, 7-Eleven Inc.

• Supplier Partner: The J.M. Smucker Co.

This collaboration combined two iconic brands: 7-Eleven’s Slurpee and Hostess’ Twinkie. Years in the making, the idea to create a special Twinkie flavor aligned with a Slurpee drink flavor came to fruition with the debut of the Cherry Twinkie inspired by the Cherry Slurpee drink.

Extensive research and tastings were done by the supplier to determine the top flavors to present to 7-Eleven for consideration. Once the cherry flavor was selected, J.M. Smucker worked with 7-Eleven’s Packaged Bakery Category Manager Steve Rosati to coordinate detailed communication, advertisements and promotional events to ensure the success of the campaign. Together, they focused on designing impactful displays and packaging while collaborating closely with key partners, ensuring seamless execution throughout the process.

Leveraging creativity and a can-do attitude, Rosati helped make this partnership a success by collaborating with 7-Eleven’s proprietary beverage category team, as well as the retailer’s internal marketing team to ensure a successful launch. He also successfully advocated for additional promotional signage to help drive customers to the product in-store.

Stores displayed the Cherry Twinkie near the Slurpee drink machine, as well as in other high-traffic areas around the store. There were various in-store, loyalty rewards and 7NOW Delivery promotions from June 26 through Aug. 28 that included the Cherry Twinkie, Original Twinkie and Chocolate Lovers Twinkie.

The collaboration drove sales and brought in new buyers. The Cherry Twinkie grew almost triple digits in dollars and units vs. both year-ago and the weeks prior to the promotion. Almost three-quarters of the buyers had not bought Hostess in the 13 weeks prior to the promotion and more than half had not bought the packaged bakery category over the same period.

• Retailer Partner: April Gelber, Category Manager, Center Store Grocery, Cubby’s

• Supplier Partner: Kellanova

Cubby’s and Kellanova came together to promote the new Harvest Blend and Scorchin’ Buffalo Pringles with a buy one, get one campaign. To bring awareness to the new snack offerings, Cubby’s promoted the entire Pringles line with spinner tree racks across the retailer’s 36-store network and a mobile app promotion, which also sought to increase the customer base for its Bear Bucks loyalty program.

Additionally, the collaboration ran a radio promotion in Omaha, Neb., and launched an in-store contest giving loyalty members the chance to win a year’s worth of Pringles — with a total of five winners. As an incentive for Cubby’s employees, the store that signed up the most new loyalty members received a gift card that would be split among the associates.

April Gelber, Cubby’s category manager for center store grocery, worked with each store manager to get them excited about the contest. She also oversaw the spinner rack setups in each Cubby’s location with promotional signage — working closely with Kellanova to ensure all needed materials were included — and worked to get the radio promo on the air.

As a result of the effort, Cubby’s salty snack category was up 150% for the first quarter of 2024. Specifically, Q1 salty snack sales were $31,095 vs. $12,754 in the same period of 2023.

• Retailer Partner: Kate Weisman, Category Manager, EG America

• Supplier Partner: Home Market Foods

Looking to fill a breakfast need, the partnership between EG America and Home Market Foods started with a simple question: “What if we created a chicken and waffle inspired sweet breakfast item?” From there, the companies worked through 10 iterations, carefully refining the concept with input from both teams, ultimately perfecting a unique and delicious offering that showcased the strength of their collaboration and shared commitment to excellence.

EG America Category Manager Kate Weisman worked directly with the Home Market Foods chef and brand manager, and held taste tests in EG America’s home office. Throughout the development process, Home Market Foods created numerous bench samples and visited the retailer’s office multiple times for thorough taste testing. The supplier worked tirelessly to achieve the ideal balance of sweetness and saltiness, finetuned the product’s color and perfected the mouthfeel to ensure an exceptional overall consumer experience.

EG America and Home Market Foods’ relentless pursuit of quality and attention to detail played a pivotal role in bringing the limited-time product, Chicken and Waffle RollerBites, to fruition. According to the retailer, the product generated excitement, led to an increase in sales and was the best limited-time offer to launch in its history with Home Market Foods.

2025 CATEGORY EXCELLENCE AWARD

WINNERS FOR PROMOTION EXCELLENCE

NICK TRIANTAFELLOU

DIRECTOR OF MARKETING & MERCHANDISING, WEIGEL’S

JESSICA STARNES

DIRECTOR OF LOYALTY, WEIGEL’S

COCA-COLA CONSOLIDATED

Congratulations on your remarkable accomplishments and collaborations that help shape the growth of the convenience retail industry. Your commitment to both the industry and community is inspiring, and we’re honored to partner with you.

• Retailer Partner: Thomas Hartman, Category Manager, CEFCO Stores

• Supplier Partner: Inter-Continental Cigar Corp.

Within just weeks of agreeing to bring Al Capone Wraps into its convenience stores outside of Texas, CEFCO completed a full fixture reset — ensuring the product was on shelves, prominently displayed and supported with prominent point-of-sale materials. These efforts helped fast-track adult consumer interest, and drove immediate engagement and sales.

Al Capone, the second-largest cigarillo manufacturer in the world, aims to serve as a dynamic and scalable partner in maximizing tobacco retail profitability. Al Capone wraps are the only double-bonded, self-sealing cellulose wraps on the market. According to the company, these easy-to-roll wraps secure high penny profits, turn in most cases seven times faster than the industry average, and have up to 80% customer retention.

The introduction of Al Capone Wraps at CEFCO stores not only led to larger basket sizes and increased overall promotional engagement among adult consumers, but

• Retailer Partner: Mike Keller & Gretchen Monroe, Senior Category Managers, Circle K

• Supplier Partner: Mars Wrigley

The launch of Snickers Pecan at Circle K showcased the power of strategic partnership in achieving exceptional results. Together, Circle K and the Snickers team worked seamlessly to ensure the chocolate bar innovation reached the retailer’s stores efficiently and effectively, meeting consumer demand and exceeding performance expectations.

Circle K Senior Category Managers Mike Keller and Gretchen Monroe ensured that Snickers Pecan was properly set up in the retailer’s systems and that distribution was expedited to stores, enabling a rapid rollout across locations. By leveraging insights from a key retailer report, they were able to identify gaps in distribution and took proactive steps to address these opportunities, ensuring the product reached stores promptly and maximizing sales potential.

also had a positive impact on cigarillo products already on the backbar. Distribution increased 13%, volume increased 64%, and the retailer saw a 15% increase in item assortment.

After several months on-shelf, distribution remained at 100% and volume rose four times over the course of the year from the initial launch. CEFCO’s partnership with Al Capone yielded noticeable results, and the Al Capone Wraps product quickly became one of the top-performing items in its category for the retailer.

For Mars Wrigley’s part, timely production and distribution of Snickers Pecan were critical to meet Circle K’s aggressive rollout schedule, achieving 80% ACV in just two weeks and 92% ACV to date. The supplier collaborated closely with Circle K to monitor sales performance, provide detailed analytics and adjust strategies to drive continued growth.

This launch has driven high incremental sales and contributed significantly to category growth. Circle K accounts for 10% of total U.S. convenience Snickers Pecan share size sales, and Snickers incremental candy sales increased by 32% with unit sales up 37% since the launch.

Showcase your pizzas like never before with NEXT PRO™ PizzaRack™

Gone are the days of burying your pizzas in flat, hard-to-see stacks. With NEXT PRO PizzaRack’s unique edge-display design, your pizzas are set to shine in shoppers’ sightlines, featuring every delicious topping and vibrant brand detail, transforming an ordinary shelf into a visual billboard.

NEXT PRO PizzaRack helps keep things streamlined and organized.

The rack’s locking, adjustable-width sidewalls ensure that every box stays in its place, keeping planograms perfect and shelves pristine. With its pusher paddle and anti-tip technology, every pizza package stays upright while maintaining product integrity.

Make your pizzas the star of your freezer and bring them into the spotlight with NEXT PRO PizzaRack!

• Retailer Partner: Brian Sullenger, Vice President of Center Store Merchandising, Sapp Bros.

• Supplier Partner: Old Trapper Smoked Products

2024 was a particularly hard year for the meat snacks category and it was imperative to address changing demands due to the economy and fluctuating market conditions. Old Trapper and Sapp Bros. collaborated to achieve best-in-class meat snack planograms, using an unbiased process.

Brian Sullenger set goals to increase basket sales, purchase frequency and meat snack category sales while enticing new guests to shop the category and the store overall. Tapping his analytical insights and rich understanding of Sapp Bros.’ guests, Sullenger and Old Trapper worked closely to create new fixturing that would allow guests to more easily shop the category.

Item placement within planograms is key as studies show the meat snack customer shops the category first based on form and then brand, size, protein source and, lastly, flavor. Consequently, Old Trapper utilized planogram heat mapping to place SKUs with the highest average weekly dollars per stores selling in order to achieve the highest returns and create a best-in-class assortment based on performance across all brands.

As a result, the meat snacks category at Sapp Bros. grew more than 14% in dollar sales while the market area was down 3.1%.

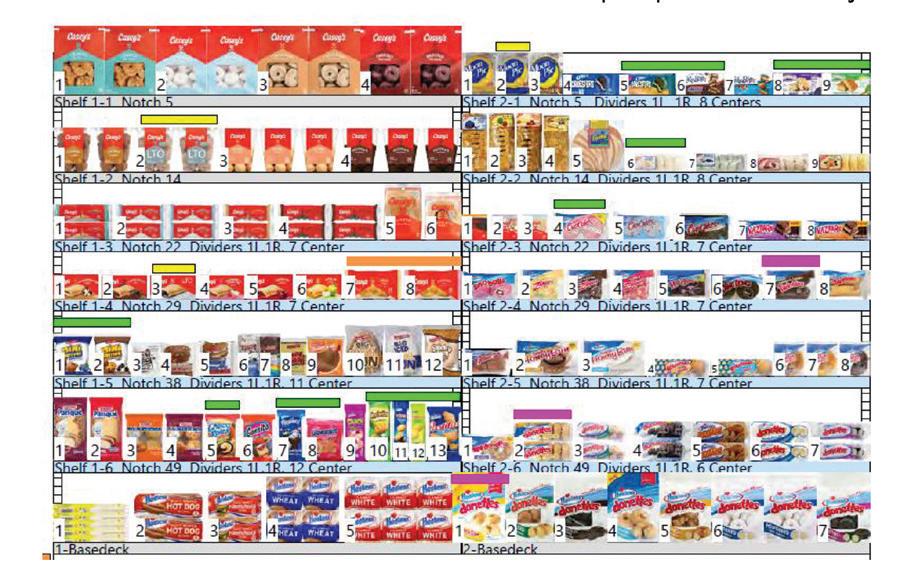

• Retailer Partner: Christine Schaaf, Category Manager, Casey’s General Stores Inc.

• Supplier Partner: The J.M. Smucker Co.

Heading into the fall of 2023, the packaged bakery category at Casey’s was growing in sales, but at a significantly slower rate than the competition. There was also opportunity to improve assortment to capture new and regular guests. Little Debbie was added as a new brand earlier in the year, but that new placement did not include a reflow of the planogram. Additionally, Krispy Kreme had just discontinued its entire product line in the middle of the year, so small changes were needed to fill that space.

To drive category and brand growth in 2024, Casey’s enlisted the help of J.M. Smucker to jointly rebuild the planogram. After multiple discussions and ideation sessions, the retailer and supplier decided there needed to be two main aspects for the planogram reflow:

1. Brand block: As opposed to segment block, the brand block continues to be the most impactful way to flow the packaged bakery category.

2. Price tiers: Brands that were similarly priced would be placed adjacent to each other, leading to less tradedown from the higher-priced brands to the value brands.

Although it was the lead vendor, J.M. Smucker and Casey’s worked collaboratively and diligently identifying the top items across all brands within packaged bakery that would perform best while also maximizing the space. This would ensure less shelves had multiple brands on them to prevent items from bleeding into the space of another brand, causing confusion for shoppers.

As a result, in the 26 weeks following the September 2023 planogram update, the packaged bakery category at Casey’s, including most major brands, grew in dollars per store per week, units per store per week, and trips. All major brands in the category had double-digit buyer growth, with some brands like Hostess seeing more than 30% buyer increases.

• Retailer Partner: EG America’s Category Management Team — Brian Ferguson, John Lutz, Kim Ross, Mark Kurland, Andrea Annicelli & Josh Perrin

• Supplier Partner: McLane Co. Inc.

Since 2017, McLane has provided distribution services to EG America, as well as extensive planogram support. In 2024, EG America and McLane came together for in-depth planogram development sessions, led by McLane’s Center for Category Innovation (CCI). During these meetings,

the companies created new planograms for EG America’s candy, nutrition, salty snacks, auto, grocery, cookie/cracker, better for you and general merchandise categories, which were subsequently implemented in the retailer’s 875-plus stores.

Because EG America wanted to quickly revamp the store layouts across its brands, the McLane CCI brought internal, vendor and broker teams together and worked through the planogram design in real time. The EG America and vendor teams each provided their volume, sales, movement and market share data for the specific categories. This allowed McLane to perform an in-depth analysis and comparison to evaluate productivity and inform upgrades to the space allocations, ensuring the planograms included high-velocity and innovative items in each set. During the development process, EG America and its vendor partners also were instrumental in highlighting opportunities and gaps in space, pack size and market share.

Over the course of two four-day in-depth sessions, McLane’s category development analysts worked alongside EG America’s category management team, vendors and brokers to develop multiple planograms that were rolled out to EG America’s brands nationwide. The McLane team provided valuable industry data, geographical data, technical expertise and space planning software to facilitate the development of the new planograms and assortments.

The collaboration between McLane and EG America proved to be successful following the implementation of the new planograms, as EG America experienced a 12% lift in the impacted categories over the previous year.

• Retailer Partner: Jackie Stalsberg, Category Manager, Kwik Trip Inc.

• Supplier Partner: Mars Wrigley

Creating an optimal shopping experience for the guest in a specific category relies on the fundamentals of how the shopper interacts with the shelf in-store where the decision is made. Kwik Trip, in collaboration with Mars Wrigley, leveraged insights and consumer decision tree work to remerchandise the confectionery aisle by brand and pack, improving the shopping experience and resulting in category growth and larger baskets.

Jackie Stalsberg identified a list of pilot stores to implement a new merchandising set, and served as the primary liaison with internal Kwik Trip teams to coordinate the in-store execution and supply data for monitoring the test. She presented findings that supported making the merchandising change, which involved gaining alignment from internal stakeholders who had long-held beliefs on the current merchandising flow. She also solicited direct feedback from store managers on how the change was impacting shoppers in their stores.

On its end, Mars Wrigley continually supplied Kwik Trip with new and updated confectionery consumer decision hierarchies and insights on convenience store shopping

trends. The company provided updated planograms with the proposed merchandising flow, which could be quickly input into the Kwik Trip system with little additional work needed.

The confectionery category at Kwik Trip saw 11% same-store growth the year the new planogram merchandising was implemented. Chocolate, the largest segment, grew 4.5% in comp-store dollar sales, while the fruity and gum/mints segments were up 22%.

• Retailer Partner: Kimberly Ross, Category Manager, Candy and Packaged Sweets, EG America

• Supplier Partner: The Hershey Co.

As inflation continues to be top of mind for shoppers, EG America has been at the forefront of delivering quick and affordable meal solutions for its guests, while partnering with key manufacturers and nationally recognized brands across multiple categories to drive consumer excitement and takeaway. A best-in-class example is EG’s $5 Meal Deal activation.

Kimberly Ross, EG’s category manager for candy and packaged sweets, worked cross-functionally with both internal and external partners to select key brands and products that would drive the highest shopper engagement for the meal deal bundles. She collaborated with The Hershey Co.; EG’s Packaged Beverages Category Manager Madison Everett and The Coca-Cola Co.; and EG’s foodservice category managers to select products and determine promotional pricing, signage and displays to support the program.

Hershey provided shopper insights focused on the bundle offerings that were most engaging to include food, beverage and candy for a set price. Hershey’s Customer Sales Executive Joe Lera also worked closely with the EG category managers to ensure that enough product would be available during the promotion, and leveraged Hershey’s retail field sales team to assist with execution needs before and during the promotional window.

This collaboration drove a 2x take rate on the meal deal bundle while growing total confection and packaged beverage category sales during the promotion.

• Retailer Partner: Jessica Starnes, Director of Loyalty & Nick Triantafellou, Director of Marketing and Merchandising, Weigel’s

• Supplier Partner: Coca-Cola Consolidated

Weigel’s and Coca-Cola Consolidated partnered to create a season-long strategy around NIL athletes Christian Moore (baseball) and Karlyn Pickens (softball) of The University of Tennessee, offering free 24-ounce Coca-Cola products for specific achievements such as Moore’s home runs and Pickens’ strikeouts. These promotions — communicated solely through Weigel’s social media accounts — seamlessly linked sports excitement and community connection with customer engagement.

When the baseball team won the national championship — a moment of immense pride for the community — Weigel’s Director of Marketing and Merchandising Nick Triantafellou and Director of Loyalty Jessica Starnes quickly pivoted and worked together to coordinate a one-day celebration that featured 10 free items for loyalty members from Coca-Cola and other vendor partners. This achieved a record-high daily penetration rate of 40.5%.

Coca-Cola Consolidated played a pivotal role in the success of the collaboration by providing exceptional support, flexibility and resources to execute both the season-long and post-championship promotions. The company successfully managed the distribution of 94,000 free Coca-Cola products across Weigel’s 83 stores without any disruptions in stock levels, and collaborated on promotional materials and messaging to highlight the NIL athletes and the giveaways, helping to create cohesive and engaging marketing that resonated with customers.

Through meticulous planning, seamless execution and a shared commitment to creating unforgettable moments, this partnership drove measurable results, increased brand visibility and strengthened community ties. Social media campaigns tied to the NIL promotions and national title celebration generated 6 million impressions in the week of the championship. Active loyalty users increased by 12%, showcasing the promotion’s ability to drive long-term engagement.

• Retailer Partner: Adam Long, Senior Category Manager, Rutter’s

• Supplier Partner: Black Buffalo

Rutter’s and Black Buffalo have built their partnership as one of mutual commitment to success, avoiding a common pitfall in which a supplier carries out much of the actual in-store execution. Together, the companies pursued a strategy of utilizing Black Buffalo’s innovative products to grow overall moist smokeless tobacco/modern oral nicotine category performance.

Starting in 2021, Rutter’s Senior Category Manager Adam Long focused on the need to capitalize on products and brands that are growing and the importance of building brand equity, while the Black Buffalo team leveraged the chain’s regional influence and category consistency. This collaboration led to a new product launch across all Rutter’s locations, and has continued to develop over the years as both companies explore new ways to grow the category and brand at Rutter’s.

Black Buffalo regularly develops custom marketing resources to participate in Rutter’s proprietary retail infrastructure. To facilitate this, Long and Raz Rahman, the supplier’s senior vice president of retail, meet monthly to review business performance and identify trends and opportunities that are unique to Rutter’s. The Black Buffalo marketing team then develops a plan to support the retailer in product assortment, point-of-sale (POS), promotion and digital market. Black Buffalo also participates in store sales contests to recognize the top-performing Rutter’s locations.

These efforts continue to yield positive results, helping Black Buffalo become a leading brand as Rutter’s continues to grow the moist smokeless tobacco/modern oral nicotine category. Rutter’s was honored as a Black Buffalo Herd Preferred Award winner for being a top seven chain in the country for Black Buffalo CPW performance.

• Retailer Partner: Chris Dillard, Tobacco Category Manager, The Spinx Co.

• Supplier Partner: Swisher

This winning collaboration between The Spinx Co. and Swisher was built on a combination of shared values and shared practical insights. Through a foundation of partnership, innovation and data-driven decisions, the two companies became one true team and achieved significant business results in the other tobacco products (OTP) category.

Their efforts were driven by three core strategies: a thorough reevaluation of the backbar to optimize product offerings; the deployment of innovative racking and point-of-sale to showcase leading brands and categories; and a digital loyalty initiative designed to enhance consumer engagement. After analyzing market trends and consumer preferences, the team refined product offerings to focus on highpotential and in-demand offerings. This resulted in double-digit growth of OTP dollar sales in 2024 for Spinx.

The Spinx Xtras loyalty program offers on Swisher brands proved to be a standout achievement. Through app push notifications, email communications and digital presence, the retailer effectively informed consumers about targeted offers available at its stores, leading to an open rate two to four times higher than the industry standard. The high engagement rate successfully translated into increased in-store traffic. Swisher’s Rogue products achieved a particularly impressive 60% loyalty penetration rate. This strong performance fueled consistent double-digit unit and dollar growth each month throughout 2024.

The companies also saw success from the development and implementation of innovative racking solutions and marketexclusive POS materials, such as the “Made in the Carolinas” display to highlight the Rogue brand being manufactured in the area. Custom-designed displays improved product visibility and accessibility, and created a more engaging and efficient experience. As a result, Rogue saw a 121% increase in dollar sales and an 85% increase in units sold last year at Spinx stores.

Overall Partnership Excellence

• Retailer Partner: Donnie Green, Senior Sales Manager, Fuel/Convenience, Albertsons Companies Inc.

• Supplier Partner: McLane Co. Inc.

In 2024, Albertsons and McLane enhanced an existing partnership to support Albertsons’ goal of making its convenience stores nationwide a one-stop shop while elevating fresh foodservice as a key part of its growth strategy. The Albertsons and McLane Fresh teams met weekly to discuss operations, logistics, results on current and upcoming programs, and product needs.

Rather than roll out one-size-fits-all offerings, the companies considered the limitations and real estate that matter most to c-stores and created programs that made the most sense for Albertsons’ operations. Special consideration was given to the varying needs of specific stores in different locations that might require different equipment programming.

Along with implementing McLane Fresh offerings such as Central Eats, Prendisimo, Better Case Bakery and CupZa!, McLane provided new and standardized planograms, marketing support, merchandising, competitively priced equipment bundles, expert guidance and food safety training.

Led by Donnie Green, Albertsons was instrumental in building the programs while offering a level of operational transparency that helped McLane identify ways its offerings could successfully support the retailer’s business goals. Albertsons’ strong embrace of McLane Fresh created a frictionless environment that allowed McLane to better market the new programs and train teams. The symbiotic relationship also enabled McLane to program equipment on Albertsons’ behalf and create new standard operating procedures to increase efficiency and consistency.

More than 40 Albertsons convenience stores implemented McLane Fresh during the second quarter of 2024, resulting in 38% year-over-year growth in the fresh food category.

Overall Partnership Excellence

• Retailer Partner: Chris Johnson, Senior Category Manager, 7-Eleven Inc.

• Supplier Partner: The Hershey Co.

7-Eleven and Hershey connected with a third iconic brand — Super Mario — as they sought a fun and exciting way to drive foot traffic and meaningfully connect with shoppers. Not only is the Nintendoowned brand the top-selling video game franchise of all time, but video gaming is a popular occasion for families and the Generation Z/millennial demographic with which 7-Eleven overindexes.

The 7-Eleven Confection Team led the internal efforts to bring a Super Mario Kit Kat Promotion to life, working with the marketing department to develop point-of-purchase (POP) and signage to display instore; the merchandising team to secure a secondary display location for the initiative’s custom merchandising unit; and the omni and digital team to create and execute banner ads on the 7NOW platform and social media. The confection team also worked closely with operations to inform and engage the 7-Eleven franchise network ahead of program implementation.

Meanwhile, Hershey collaborated with its supply chain partners, demand planning, merchandising and omnichannel marketing team to create a 360-marketing program that included a sweepstakes offering consumers more than $250,000 in prizes, digital media support, an in-store endcap with POP and header card, and a custom merchandising display to support the program at 7-Eleven.

The results proved to be as super as the program’s namesake character. Kit Kat king-size sales at 7-Eleven increased 22% throughout the promotion, and the initiative contributed to confection trips being up 3.8% during the program.

• Retailer Partner: Dave Weiss, Category Manager, Center Store, Chevron ExtraMile

• Supplier Partner: Mars Wrigley

The 2024 collaboration between Chevron ExtraMile and Mars Wrigley reversed course on a historically inconsistent partnership that previously resulted in missed opportunities. After two years of hard work, tough conversations and extreme persistence, the companies successfully changed course, resulting in ExtraMile’s category trends pacing more than three times better than the market last year. They focused on two key areas: executing new confectionery secondary display racks above ice cream bunkers, and planogram excellence via category captaincy.

Tight store layouts along the West Coast pushed Mars Wrigley to get creative in selling ideas for space creation and SKU growth. The company developed the ice cream bunker rack as a solution to expand future consumption candy space in small formats, and conducted a third-party retail audit — going into 930 of ExtraMile’s 1,000 stores — to compile and analyze the necessary data for planning.

On the ExtraMile side, Center Store Category Manager Dave Weiss worked diligently to secure internal approval for the ice cream bunker rack. His efforts included getting

• Retailer Partner: Mike Tosi, Category Manager, Wawa Inc.

• Supplier Partner: Mars Wrigley

No one likes to see prices go up, but when Wawa and Mars Wrigley faced price increases that challenged buyer trips and decreased unit sales, they used that as motivation to stir their creativity and use store space in innovative new ways.

Starting with peg risers, the companies added six inches of merchandisable space at eye level, or six additional peg items for every three feet of space. This bumped Wawa’s future consumption candy business up 5% last year, five times that of the convenience channel.

Mars Wrigley Senior Customer Manager Mike Sullivan proposed the idea of peg extenders and worked closely with Wawa Category Manager Mike Tosi and the operations team to develop the rack prototype. They also collaborated to optimize SKU mix and product placement. The project significantly expanded merchandisable space, allowing the retailer to enhance

approval to conduct the third-party survey, gaining franchise acceptance and approval, conducting a live demonstration, identifying a third party for shipping and installment, and more. Extra Mile executed 423 ice cream bunker racks across the chain, resulting in 12.3% fruity growth year to date vs. previous year.

In the area of planogram excellence, Mars Wrigley and ExtraMile collaborated to completely remerchandise all 150-plus planograms, along with optimizing assortment for all brands, pack types and subcategories. At the recommendation of Mars Wrigley, ExtraMile moved from its previous strike zone merchandising approach to shopper-based merchandising. The result was strong confectionery sales that outpaced the West Convenience Region.

the shopping experience for its customers through an expanded assortment and optimized merchandising.

In the latest 26 weeks, Wawa saw future consumption candy grow 9% and units grow 6%, compared to -0.3% and -4%, respectively, for total U.S. performance. CSN

From space to equipment to payment, convenience store operators have much to consider

By Tammy Mastroberte

CONVENIENCE STORE RETAILERS are always looking for ways to differentiate themselves from their competitors and offer new profit centers to add to their bottom line. Many who have the space available are turning to car washes. Not only can they bring in additional revenue, but they also drive traffic both to the pump and inside the store.

“One main benefit is increased overall revenue to a location, which is the main reason to add a wash, but it can drive other profit centers like gas and foodservice,” said Jim Koch, director of national accounts at Washworld Inc., a car wash equipment company based in De Pere, Wis. “A good car wash with a great customer experience will make it a destination spot.”

While a car wash does require maintenance and cleaning, it is “more or less labor-free revenue” as automation increases, and it can operate 24/7 even when a store isn’t open, noted Ken Underhill, director of marketing at D&S Car Wash Supply, based in High Ridge, Mo.

Still, just like the c-store and fuel pumps are treated as profit centers, c-store

operators must give the same attention to a car wash. Daily maintenance is important to keep it running and keep the experience high-quality, so customers will return again and again.

“Once a day in the morning, run a car through and watch to see what is working or not working, such as a blocked nozzle,” advised Martin Geller, owner of Superior Car Wash Systems, a division of Vehicle Wash Systems Inc., based in Weymouth, Mass.

When a retailer is considering entry into the car wash space, there are multiple facets to research, such as space, competition, traffic, equipment, subscriptions and more.

“When thinking about adding a car wash, make sure you have enough space for the type of equipment you want, like an in-bay automatic or a tunnel system,” said Kendra Pravlik, car wash district manager at Fremont, Ohio-based Beck Car Wash Systems. “The spot should be easy to get in and out of, and visible enough to draw in customers — and look at the initial costs of equipment, installation and any sitework changes that may be needed.”

Zoning issues are another consideration, such as being close to residential locations, which could cause problems with the noise that dryers make, according to Washworld’s Koch. Necessary modifications, such as making a building longer to keep the doors shut when

dryers are running, should be known early on, he cautioned.

Traffic volume at the location and competition in the area are other key things to explore when considering the addition of a car wash. Specifically, looking at what other car washes are in a one- to threemile radius, as well as their quality.

“Not only the locations, but the level of that competition should be examined. There could be four car washes but if they are all junk, then don’t count them,” Koch explained. “Don’t shy away from an investment if the competition is poor.”

Gas volume at a site can help predict the return on investment (ROI) of a location, coupled with the competition in the area. Having customers already onsite purchasing fuel or shopping the store makes it easier for a c-store compared to a standalone car wash.

“If I have 100,000 gallons per month ideally, if I’m looking to get an ROI, I should be successful. But I do have smaller operations with two pumps, and pumping 50,000 [gallons] in a month, they are

“A good car wash with a great customer experience will make it a destination spot.”

— Jim Koch, Washworld Inc.

killing it because there is no competition,” said Koch.

To support retailers in the decision-making process, there are AI-generated site selection tools that many car wash manufacturers have access to, which can assist with projections for a car wash, as well as the potential in-store sales increase with its addition, Underhill stated.

The majority of c-stores install in-bay automatic car washes vs. tunnel systems because they require less labor, and can be run with more ease and less maintenance. An in-bay automatic offers two options: touchfree with nozzles and sprays but no brushes; or one that uses brushes to do the washing, often referred to as soft touch.

“There are advantages to both, and the current sales distribution between the two is almost 50-50, but touchfree has been gaining a lot of traction,” Underhill reported. “Touchfree is more expensive to purchase and operate

because it requires more water and energy to get a car clean, but it’s customer-driven because many are wary of brushes on their cars, especially high-end.”

Many c-store operators also are choosing touchfree because it’s easier to manage in terms of maintenance and cleaning, according to Koch, emphasizing that when it comes to weighing their options, it is important for retailers to differentiate from their competition.

“If there are a lot of touchfree bays, then go with a friction wash because that could make you stand out,” he said. “If there are a lot of friction, then touchfree might be the way to go because there is a huge segment of the population that is afraid of friction.”

Koch also pointed out that there are combination machines that enable each customer to choose either touchfree or friction, which he said could provide a unique experience.

In addition to the equipment needed to wash the cars, retailers need to investigate payment equipment — whether selling washes at the pump, via a kiosk or via a mobile app.

“In a c-store environment, many washes are purchased at the pump and then activated at a paystation via a code or scanning a QR code,” said Kayla Knudsen, marketing coordinator at Hugo, Minn.based WashCard Systems Inc., which offers payment hardware and software. “With this method, you are missing an opportunity to get a customer inside your storefront.”

Using a mobile app, however, provides the opportunity to highlight in-store offers and even present specials or discounts to drive in-store traffic and capitalize on the car wash customer. C-stores with an app and loyalty program can roll the car wash into what already exists. WashCard offers the option to highlight in-store offers while customers are moving through the wash.

Another company, CarwashFX, offers options such as voice directions, music and sound effects, and pushing digital offers to a mobile device or via text message at the customer’s choice.

“C-stores can send a promotion or coupon in a vivid graphic, through voice

prompts or via text message or email,” explained Sherry Sheffield, senior vice president of sales and marketing for the Lawrenceville, Ga.-based company. “Customers are captive in a car wash, so you can transform their experience with … lights, sound, music and marketing, and make it entertaining.”

Along with offering single washes, subscription plans are becoming more popular.

“Subscriptions are great because they offer a steady revenue stream, helping stabilize cash flow,” said Pravlik of Beck Car Wash Systems. “They also encourage customer loyalty as members are more likely to return to use their membership. … Subscriptions can lead to more frequent visits, increasing the chances of additional purchases from the convenience store.”