Rogue® Smooth and Rogue® Bold. The two latest blends, now available from Rogue® Nicotine.

The drop your customers have been dreaming of.

COMING SOON

Two fresh takes on Rogue® Nicotine’s classic tobacco taste.

Add even more variety to your stock today with Rogue® Smooth and Rogue® Bold Nicotine Pouches.

UNDERAGE SALE PROHIBITED Rogue® Nicotine Products. Great taste. No compromises. For Trade Purposes Only.

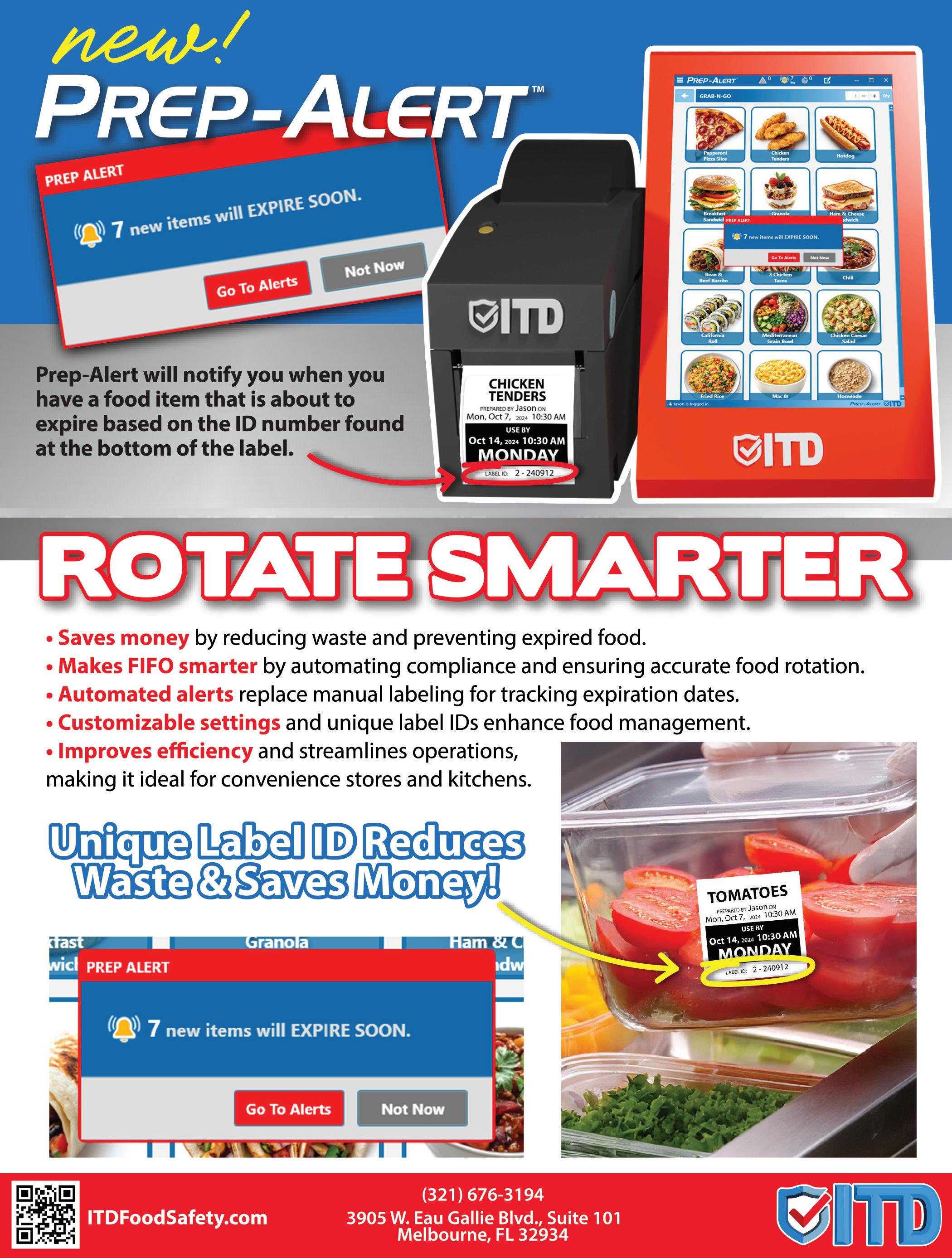

SMOKEFREE PRODUCTS ARE PICKING UP SPEED IN THE TOBACCO BUSINESS

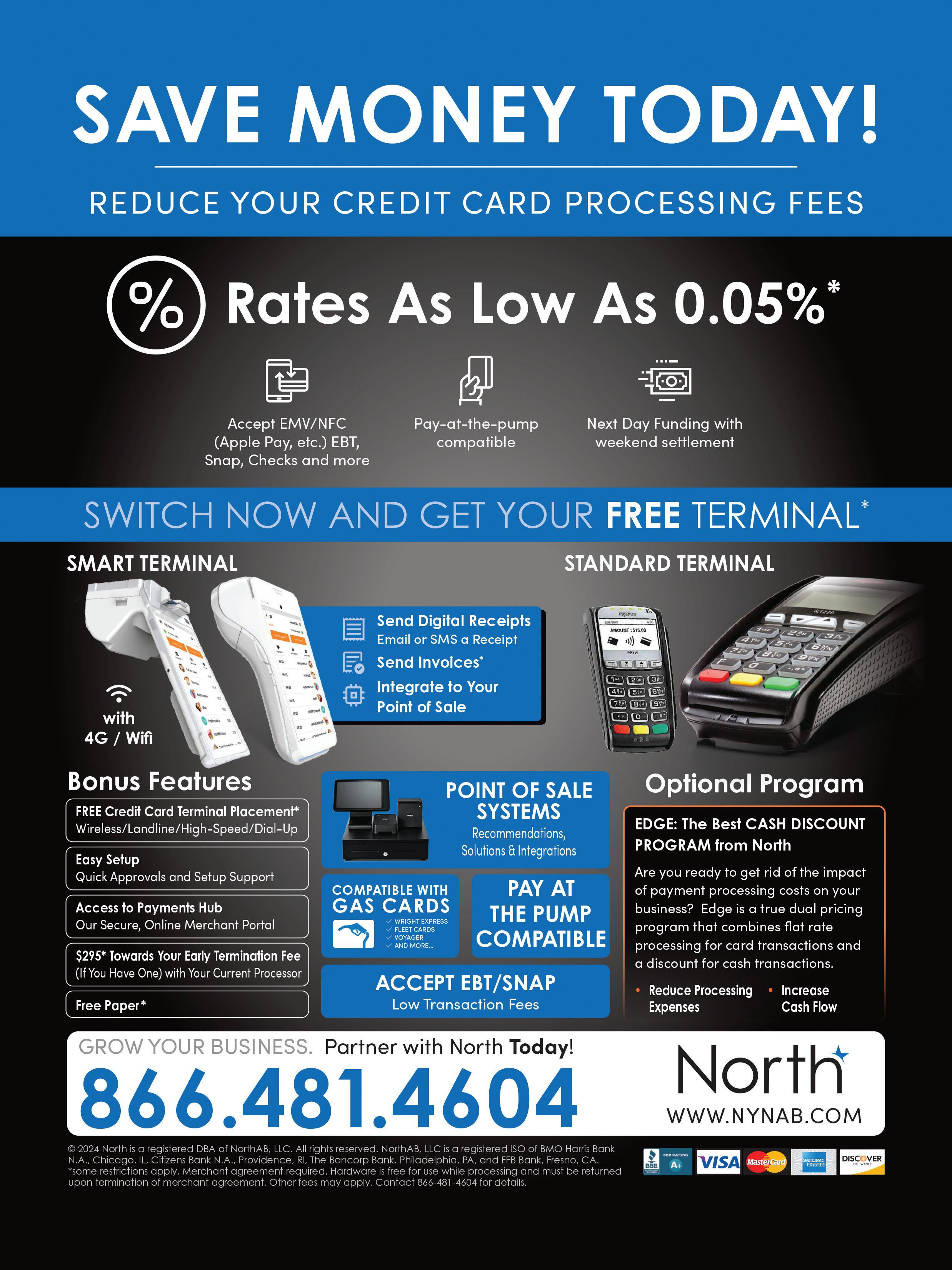

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

EASY TO EXECUTE

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

Tobacco Product Scanned Prompt to Scan for Age Validation Verify and Scan I.D. POS System Validates Transaction Continues

Is your backbar keeping up with the building momentum around harm reduction?

DESPITE THE INDUSTRY’S INCREASING FOCUS on providing high-quality prepared foods and innovative dispensed beverages, tobacco products are still a crucial part of the convenience store business, comprising roughly 30% of the industry’s annual in-store sales.

As I sit here pondering over the tobacco category, I can’t help but think of the saying, “Nothing worth having comes easy” — because selling tobacco products is anything but easy. It’s a challenging, always-changing business, especially when it comes to regulation.

Just in the first month of 2025, Convenience Store News reported that:

• The U.S. Food and Drug Administration (FDA) withdrew two proposed product standards: one to prohibit menthol as a characterizing flavor in cigarettes and the other to prohibit all characterizing flavors (other than tobacco) in cigars. Introduced in April 2022, these rules would have banned the sale of menthol cigarettes and flavored cigars in the country.

• The FDA formally issued a new proposed rule that would limit the amount of nicotine in cigarettes and certain other combusted tobacco products to “non- or minimally addictive levels.” If enacted, the rule would make the United States the first country to take such significant action to prevent and reduce smokingrelated disease and death.

• U.S. District Judge J. Campbell Barker in Tyler, Texas, postponed enactment of the FDA’s new graphic

EDITORIAL EXCELLENCE AWARDS (2016-2024)

2021 Jesse H. Neal National Business Journalism Award

Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award

Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

2024 Eddie Award, Folio: magazine

warnings on cigarettes, which were due to begin enforcement in December 2025. The judge ruled that the FDA went beyond its authority in requiring packaging and advertising to contain the 11 warnings. Further litigation is expected.

Another interesting development so far this year is that, for the first time ever, the FDA authorized the marketing and sale of a nicotine pouch product. A scientific review determined that the 20 approved ZYN products have the potential to provide a benefit to adults who smoke cigarettes and/or use other smokeless tobacco, outweighing the risks.

Like I said, always changing. And it’s pretty much guaranteed that more change is on the way because as our cover story this month explores (see page 28), reduced risk products are picking up speed as harm reduction — the strategy of offering better alternatives to adult smokers who would otherwise continue smoking cigarettes — is rapidly moving to the forefront.

Some c-store retailers are reacting accordingly. Half of those surveyed for the 2025 Convenience Store News Forecast Study said they plan to add more other tobacco product (OTP) SKUs this year and 47% plan to increase the square footage they devote to OTP.

If you haven’t already, it’s time to take a good, hard look at your backbar.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section, October 2024

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark Chris Hartman Rutter’s

More than just a buzzword, culture is the key to overcoming labor challenges

CONVENIENCE STORE RETAILERS have made remarkable strides in transforming their foodservice operations. Many are no longer just gas stations with a few snacks, but rather destinations for fresh, on-trend and elevated food offerings. However, as revealed in the most recent Convenience Store News Foodservice Study, 73% of retailers say difficulty hiring and retaining employees is their greatest obstacle to success in foodservice.

This alarming statistic underscores the critical need for convenience retailers to focus not only on their foodservice programs, but also on building a foodservice culture that resonates with their employees and customers alike.

Building a sustainable foodservice culture requires a strong brand identity, clear incentives, competitive pay structures, and a strategic vision that actively involves employees and customers.

Culture is more than just a buzzword. It’s a driving force that shapes every aspect of your business — from recruitment and training to product innovation and customer engagement.

We all like to talk about having a “great culture,” and some even claim to be “food-forward.” But let’s pause for a moment and ask: Who defines and drives that culture? Is it understood and embraced at the store level, where it matters most? Do employees feel invested in the mission, or is it merely a corporate ideal that doesn’t resonate on the front lines? More importantly, do customers — especially the younger generations — perceive it the way you intend?

Millennials, Gen Zers and the youngest generation, Alpha, now make up more than half of the population in the United States, according to the most recent U.S. Census. These young employees and customers have unique expectations for workplace culture and food innovation. Are your elevated food efforts aligned with their tastes for adventure, new flavors and authenticity? Or are they lost in translation, overshadowed by operational challenges and outdated approaches?

Building a sustainable foodservice culture requires a strong brand identity, clear incentives, competitive pay structures, and a strategic vision that actively involves employees and customers. It needs to move fast enough to cater to adventurous foodies, while keeping the base satisfied. It’s a delicate balancing act, but one that can lead to long-term success.

That’s why I strongly encourage all food-focused convenience store retailers to attend Convenience Store News’ 10th annual Convenience Foodservice Exchange event, taking place May 8-9 in Denver. This year’s theme, “Firing Up a Foodservice Culture,” will include educational sessions and speakers from some of the most successful retailers in the industry. Whether you already have a food-first identity or are building one, this event is designed to help you take your foodservice culture to the next level.

Now is the time to ask yourself: How does your culture impact the lives of your employees and customers, particularly when it comes to food? Let’s come together in Denver to find the answers — and shape the future of foodservice in convenience retail.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

For more information on the 2025 Convenience Foodservice Exchange event, go to: events.csnews.com/cfx2025

A1000 FLEX

off to go b com xp r nc t st ys.

s rch indic t s th t 75% of consum rs h ri d s lf-s r ic b r g s li off n int n to o s g in hil % b li h t con ni nc tor off tch s th u lity of c f off . P opl ly on con ni nc tor s for coff n sp ci lty rin s, m in r t s lf-s r ic off rogr m cruci s ch nn ls blu n consum rs xp ct high-qu lity coff h r r th y go. Do s your coff rogr t consum xp ct tions?

Th 1000 FLEX off rs th st of bot orl s, pro i ing tr ition lly br coff n spr sso b r g s, hot or ic ll in on chin . ith f tur s li ol - t r Byp ss for ic rin n t nt Br Unit sign for both coff n spr sso nsur s p rf ct b r g s ith customi tion, consist ncy n qu lity in s con s—m tin ll your consum rs’ n s!

Disco mor t

FEATURES

COVER STORY

28 The Harm Reduction Race

Smokefree products are picking up speed in the tobacco business.

FEATURE

42 The Talent Acquisition Toolkit

Companies need to break the cycle of “just-in-time” hiring practices and transition to a more holistic recruitment approach.

E DITOR’S NOTE

4 The Ever-Changing Category Is your backbar keeping up with the building momentum around harm reduction?

VIEWPOINT

6 Firing Up Your Foodservice Culture

More than just a buzzword, culture is the key to overcoming labor challenges.

12 CSNews Online

22 New Products

SMALL OPERATOR

24 Where Has Everyone Gone?

Whether President Trump’s deportation program is fully implemented or not, it is going to have a major impact on the convenience industry.

TWIC TALK

50 Bridging the Workforce Gap

Up to four different age brackets are collaborating in today’s workplaces.

INSIDE THE CONSUMER MIND

70 The Magnitude of Mobile

Younger c-store customers demand mobile ordering, mobile payment and mobile deals.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

SENIOR ACCOUNT EXECUTIVE Griffin Randall - (404) 702-6931 - grandall@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

MARKETING COORDINATOR Mateo Rosas mrosas@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

Jane Volland

multi-use Zip Track ® system handles different size and shape packages with ease.

ZIP Track® is a modern merchandising system that forwards and faces its product offerings at all times. Quickly add new facings with this cost-effective easy to install and adjust system.

Use actual product to set lane width. Slide product front-to-back to ‘ZIP’ tracks together in final position.

The company offered 40 cents off per gallon of fuel on Jan. 16, donating a portion of the proceeds from the three-hour event to Red Cross relief efforts. More than 240 Circle K locations across California, Oregon and Washington participated.

Sodexo plans to open nearly 100 Food Hive markets on college campuses across the country by 2026. The fast, cashless convenience experience focuses on supporting local partners and minority- and women-owned businesses by featuring their products.

The “America’s Best Customer Service” list for 2025 included Buc-ee’s, QuikTrip Corp., Valero, Wawa Inc., Sheetz Inc., Casey’s General Stores Inc. and Speedway in the c-store or gas station categories, respectively. The rankings were based on the results of an independent survey of more than 28,000 U.S. customers.

The 2025 “America’s Greatest Workplaces for Diversity” ranking recognizes companies that respect and value diversity, based on feedback from employees and rigorous research methodology. C-store retailers on this year’s list are Cumberland Farms, Kwik Trip Inc., Maverik — Adventure’s First Stop, Murphy USA Inc., Pilot Flying J, QuikTrip, RaceTrac Inc. and Wawa. 1 3 4 5 2

According to its annual “2024 Delivered Report,” made-to-order hot dogs, bananas and sodas topped the list of the most popular items ordered via Grubhub from convenience stores in 2024. Dr Pepper claimed the title as the most-ordered soda from c-stores.

While mergers and acquisitions hold significant growth potential, the work isn’t over after the ink dries, writes Cham Silvy, assistant vice president and strategic business unit head, retail markets, at Cognizant. For convenience stores acquiring smaller chains, success requires more than inheriting an established business. Successful strategies for seamless integration include prioritizing cultural integration; building an integration strategy aligned with business goals; and focusing on organizational change management and governance.

When considering how to draw in customers, most convenience store and travel center operators consider what benefits they can offer inside the building and on the forecourt. As inspiration for its current ad campaign, “See You Out Here,” Pilot looked far beyond those boundaries and invites consumers to explore their feelings for the open road. “It’s an inviting message that captures the essence of how we show up for drivers,” Adrienne Ingoldt, chief marketing officer at Pilot, told Convenience Store News. “Whether they’re heading out on cross-country long hauls or setting off on epic road trips, we’re there in those in-between moments, ready to fuel their journey.”

For more exclusive stories, visit the Special Features section of CSNews.com.

BIC EZ Reach Lighters is launching a new color series: Pastel. EZ Reach Pastel brings a fresh look to the brand’s classic design. According to the company, the new serene pastel hues evoke a sense of calm and serenity, making EZ Reach Pastel the perfect lighting accessory for candles and more. Each EZ Reach Lighter is 100% safety tested and features a 1.45-inch extended wand that helps keep fingers away from the flame.

BIC USA Shelton, Conn. us.bic.com

Its plan to split into two businesses is slated to be effective in late February 2025

By Angela Hanson

DESPITE AN ONGOING BATTLE for control of the company, Seven & i Holdings Co. Ltd. is looking to the future with growth top of mind.

During a January earnings call, the Tokyobased parent company of 7-Eleven Inc. said it expects a planned organizational restructuring to yield better results following the “turnaround year” of 2024. Seven & i announced in October that it would split into two businesses: one focused on 7-Eleven, other convenience stores and gas stations; and one consisting of a collection of 31 less profitable retail operations. The company also announced its intention to close 444 underperforming convenience stores in the United States, Canada and Mexico.

Seven & i plans to complete initiatives aimed at streamlining low-profit businesses and assets during its current fiscal year, setting it up for profit growth in 2025 and beyond, as well as expansion in the North American convenience channel, according to Chief Financial Officer and Managing Executive Officer Yoshimichi Maruyama.

In North America, Irving, Texas-based 7-Eleven saw third-quarter results fall below both previous-year benchmarks and expectations, which President Stan Reynolds attributed to factors such as the persisting inflation environment, consumers under economic pressure, and a major disruption to the point-ofsale systems at most Speedway stores due to the Crowdstrike outage that occurred this past July.

“However, we are now seeing directional improvement in sales and traffic,” Reynolds said.

He shared four key areas where 7-Eleven is concentrating its short- and intermediate-term tactics: driving value and traffic; growing proprietary products; continued progress of the 7NOW delivery program; and a “disciplined and rigorous” approach to removing costs from the business.

To achieve these goals and drive long-term value creation, 7-Eleven is launching a companywide program aimed at improving profitability that focuses on three primary areas: growth, margin and OSG&A. The program will be led by Reynolds and CEO Joe DePinto, with members of the company’s executive team leading each of the work streams.

For the first time, the agency gives market authorization to nicotine pouches

TOBACCO REGULATION at the federal level is showing no signs of slowing down in 2025.

On Jan. 16, the U.S. Food and Drug Administration (FDA) authorized the marketing of a nicotine pouch product for the first time. The agency announced the authorization of 20 ZYN products through its premarket tobacco product application (PMTA) pathway following a scientific review that determined these products have the potential to provide a benefit to adults who smoke cigarettes and/or use other smokeless tobacco, outweighing the risks.

ZYN is part of the Swedish Match portfolio, owned by Philip Morris International Inc. The FDA issued marketing granted orders for the following products, each with two nicotine strengths, 3 milligrams and 6 milligrams: ZYN Chill, ZYN Cinnamon, ZYN Citrus, ZYN Coffee, ZYN Cool Mint, ZYN Menthol, ZYN Peppermint, ZYN Smooth, ZYN Spearmint and ZYN Wintergreen.

The greenlighting of these products came just one day after the FDA formally issued a proposed rule that would limit the amount of nicotine in cigarettes and certain other combusted tobacco products to “non- or

minimally addictive levels.” A public comment period will run from Jan. 16 through Sept. 15. The FDA’s Tobacco Products Scientific Advisory Committee will provide input on the proposal as well.

If finalized, the rule would make the United States the first country to take such significant action to prevent and reduce smoking-related disease and death, according to the agency.

While the FDA is moving its agenda forward, one key initiative — to require graphic cigarette warnings — has been put on hold. In a Jan. 13 ruling, U.S. District Judge J. Campbell Barker in Tyler, Texas, found that the FDA went beyond its authority by requiring packaging and advertising to contain 11 specific warnings. His decision temporarily delays the effective date pending further litigation. The FDA had planned to begin enforcement in December 2025.

Due to the new presidential administration, the month of January also saw the agency withdraw two proposed rules that would have banned the sale of menthol cigarettes and flavored cigars. The FDA first introduced the two product standards — one to prohibit menthol as a characterizing flavor in cigarettes and the other to prohibit all characterizing flavors (other than tobacco) in cigars — in April 2022. The menthol rule was delayed indefinitely this past April.

Building on a sensational year, Krispy Krunchy is accelerating store and sales growth in convenience stores while introducing exciting new menu innovations.

Here, Matt Testa, Krispy Krunchy’s new COO, discusses the brand’s milestones over the past year and the blueprint for the future. With over 20 years of industry experience, Testa is well-equipped to drive the growth and expansion of the hot food concept within convenience stores.

It was a big year for Krispy Krunchy. Can you recap the highlights of 2024 and plans to keep the momentum going?

Matt Testa: With a new organizational structure in place and new product partners and platforms, Krispy Krunchy Chicken® is accelerating our national expansion. We opened 605 stores in 2024 and project we will exceed that total for new stores in 2025.

In 2024, Krispy Krunchy introduced successful menu innovations and LTOs, including our $4 Value Meal, created to address the growing demand for affordable, high-quality meal options following the rise of food costs and a push to onboard stores onto third-party delivery. We also (re)launched an all-new Cajun Chicken Sandwich in January of 2024, winning multiple awards and nearly doubling sales from the previous offering. This year, we expect the debut of our new Chicken Nuggets to be even more successful than the Cajun Chicken Sandwich.

In 2025, you will see more stores in more places and on more platforms, menus that work even harder and culinary innovation that increases our appeal and relevance across the system.

How are you helping c-stores capture more of the expanding third-party delivery business?

MT: We partner with OLO as our menu management solution and started rolling out that system in mid-2024, ending the year with nearly 500 stores on the platform. In this system, operators get orders from all their third-party delivery partners on one tablet, making it much easier for store teams to manage orders.

In addition to reducing complexity, negotiations with third-party partners have lowered commission fees for most operators, and initial sales have been strong, especially during days that are historically lower for other channels. Our sales volumes nearly doubled on Thanksgiving, with Christmas Day delivering sales at nearly four times our usual rate.

What are some of the efficiencies put in place that benefit operators?

MT: We understand operators’ pain points—a contracting labor pool, supply chain challenges, waste and more. To help, we narrowed our menu to the most efficient, best-selling items and streamlined logistics and supply chain processes.

Our menu simplification and optimization efforts delivered measurable benefits for our operators. We reduced the number of items on our menu while maintaining customer satisfaction and purchase frequency. A streamlined menu translates to greater efficiencies for operators—such as reduced labor and waste—while continuing to maximize customer reach and order frequency.

Efficient logistics are essential to reducing food waste, spoilage, and delivery times—critical factors given the supply chain disruptions affecting the c-store channel.

Krispy Krunchy transitioned from relying on 14 independent distributors to a centralized distribution model to address these challenges with Sysco. Sysco collaborates with 70 local suppliers, enabling us to deliver improved service and longer shelf life. By increasing the number of distribution points closer to the end consumer, we’ve enhanced efficiency and product freshness across the board.

What else do you want operators to know about Krispy Krunchy and what the brand delivers to the channel?

MT: Since joining in November, I’m impressed every day with the results c-stores can achieve by selling Krispy Krunchy.

The company was born and raised in c-stores and has become one of the fastest-growing hot food concepts in the industry. The store-in-store concept allows licensees to serve hand-breaded, mild Cajun-spiced fried chicken and all-white meat tenders to its guests to increase their in-store profitability and drive frequency. Our weekly chicken sales volume exceeds one million pounds.

And, it’s not just about selling chicken—the operator’s whole business thrives with a Krispy Krunchy program. After opening a Krispy Krunchy Chicken, average c-store foot traffic increases ~10-12% and average merchandise sales increase ~15-20%.

We continue to focus on operator profitability, third-party delivery, menu and pricing strategy, enterprise technology and serving ridiculously good fried chicken! For more information visit

Finally, we make it easy to get into the business with zero franchise and royalty fees, zero percent financing and comprehensive support. You truly can become everyone’s favorite restaurant without becoming a restaurant.

www.krispykrunchy.com/krispy-krunchy-program.

Casey’s General Stores Inc. acquired Wow! Foodmart LLC and its affiliated retail assets. The deal included a diverse portfolio of properties comprising one travel center, seven convenience stores and four liquor stores.

Reliance Fuel took control of The Store, operator of 20 c-stores. The Store locations will remain open and all employees will retain their positions.

Yatco Energy is opening its largest convenience store. The approximately 6,000-square-foot location in Worcester, Mass., will open in early 2025 and feature the Coffee Connections chain and a Slice pizza shop.

Stewart’s Shops closed on its acquisition of the assets of Jolley Associates LLC and S.B. Collins Inc. The transaction included 45 Jolley c-stores plus a wholesale dealer and the Clarence Brown heating oil business.

HRI Development opened the Lebec Travel Center. The California site features a flagship 7-Eleven store with an expanded food selection, 40 Supercharger stalls and a dedicated electric vehicle lounge.

Yesway wrapped up 2024 by making progress on its growth plans for the Allsup’s banner. The retailer cut the ribbon on five Allsup’s convenience stores in Texas and New Mexico during the final quarter of the year.

Applegreen plc will sell its gas station business in the United Kingdom to EG On the Move. Going forward, Applegreen intends to focus on larger sites that incorporate foodservice in the United States and the U.K.

TravelCenters of America (TA) will host Junction Briefings at select sites nationwide in collaboration with TAT, formerly Truckers Against Trafficking. The initiative is part of TA’s commitment to fighting human trafficking.

Casey’s General Stores Inc. launched a new coffee line, Darn Good Coffee. The offering consists of a variety of roasts and caffeine levels, which can be customized with complimentary creamers, sweeteners and condiments.

PepsiCo Inc. completed its $1.2 billion acquisition of Garza Food Ventures LLC dba Siete Foods. The transaction expands the food and beverage giant’s portfolio of products with the addition of nutritious, simple foods.

Utz Brands Inc. opened a 650,000-square-foot warehouse in Hanover, Pa. The logistics center will serve as the primary hub for inventory storage, consolidation and distribution for Utz facilities across the United States.

McLane Co. Inc. raised more than $1 million in 2024. The company’s teammates and partners supported a series of donation drives and charitable events that benefited nonprofit organizations nationwide.

Quality Oil is upgrading its loyalty program. The North Carolina-based chain of 138 stores will combine Paytronix’s loyalty and messaging with Rovertown’s mobile app platform to help it get closer to customers and drive engagement.

Alltown Fresh kicked off a two-month campaign to spotlight the fight against heart disease and champion the care of local children’s hospitals. A portion of every Breakfast Power Bowl sale will benefit a regional hospital in each state the chain operates.

RaceTrac Inc. partnered with AccuStore to streamline its store-level marketing plans. As part of the collaboration, the retailer deployed store profile-based marketing guides that leverage automation for accuracy and timeliness.

PDI Technologies acquired the Comdata Merchant Solutions business from Comdata’s parent company, Corpay Inc. This includes the point-of-sale hardware, software and systems that enable transactions at the site level for truck stops.

Hostess unveiled a new logo and packaging design as part of a brand refresh. The updated logo retains Hostess’ trademark heart while featuring a more playful font style and a brighter color palette.

New from f’real, Energy Freeze frozen, blended energy drinks offer a frosty twist on traditional grab-and-go energy beverages. The first caffeinated frozen blend made with coconut water, this product innovation marks the expansion of f’real’s offerings beyond shakes and smoothies into the energy beverage category. Each f’real Energy Freeze drink contains 100 milligrams of caffeine from green coffee extract. Currently available in Blue Raspberry and Strawberry Watermelon flavors, the beverages are being sold nationwide in a 12-ounce serving for $3.50.

RICH PRODUCTS CORP. • BUFFALO, N.Y. • FREAL.COM/FLAVORS/ENERGYFREEZES

European bakery company Vandemoortele presents a new Pistachio Filled Croissant under its Banquet d’Or brand. Made with the same authentic French recipe as the brand’s all butter croissants, this multilayered pastry surrounds a creamy, savory-sweet pistachio filling and is topped with crunchy seeds. Shipped frozen, the product is designed to be operator convenient, going from freezer to oven to ready to serve in just over 20 minutes. Pistachio will join Banquet d’Or’s full range of filled croissants offered in North America in the first quarter of 2025.

VANDEMOORTELE • NEW YORK • BANQUETDOR.COM

Toxic Waste Candy, a line of sour candies owned by Candy Dynamics Inc., debuts a pair of new products: Slime Licker Double Play and Slime Licker Spray. The Double Play gives Slime Licker fans the chance to enjoy both flavors of sour ooze, Strawberry and Blue Razz, in one 1.4-ounce pouch. It has a suggested retail price of $2.49. The Slime Licker Spray offers the same flavors in liquid form. The 0.95-ounce spray package also has a recommended retail price of $2.49.

CANDY DYNAMICS INC. • INDIANAPOLIS • TOXICWASTECANDY.COM

Cantaloupe Inc. introduces a series of Smart Stores, kiosks that use smart technology, weighted shelves and cameras to provide 99.9% accuracy in sales and theft prevention. To use the self-service solution, the customer presents payment at the point-of-sale (POS) to unlock the unit; grabs their desired item(s), which are added to their cart; and then completes the purchase by pressing pay. The Smart Store Series offers touchscreens, audio help and visual cues to ensure an accessible and seamless shopping experience. Planograms and product restocking are easily updated through the POS or backend portal with minimal effort, the company notes. CANTALOUPE INC. • MALVERN, PA. • CANTALOUPE.COM

Paytronix is launching Additive Lead Times, a group of new capabilities to its order throttling for Paytronix Online Ordering that helps convenience stores manage the number of orders they receive and process during busy times. Brands can set parameters around order timing, limits and capacity and then define these parameters universally, regionally, by street or at a store-by-store level. With Additive Lead Times, Paytronix has made several enhancements, such as: timing (prep/lead time), limits (throttling), capacity management and first-party delivery time.

PAYTRONIX SYSTEMS INC. • NEWTON, MASS. • PAYTRONIX.COM

Whether President Trump’s deportation program is fully implemented or not, it is going to have a major impact on the convenience industry

By Roy Strasburger, CEO, StrasGlobal

IT IS GOING TO BE LIKE “THE SNAP.” In the movie, “Avengers: Infinity War,” the antagonist Thanos achieves the power to eliminate half of the human race with the snap of his fingers. When “the Snap” happens, we watch people turn to ash, leaving behind loved ones and friends. Where bodies had been, there are now empty spaces.

Under the new deportation plans proposed by the Trump Administration, something similar could happen — although it won’t lead to the disappearance of half the U.S. population.

President Donald Trump has said that a key objective of his presidency is to remove all illegal immigrants in the United States. Trump officials estimate there are at least 11 million undocumented people in the country — just over 3% of the population, or one out of every 30 people.

I’m not here to argue whether Trump’s plan is a good one or not. Illegal immigration was a major issue he campaigned on and, at the time of my writing this, he seems committed to putting his plan into action. What I will argue is that a deportation plan, as proposed by Trump and his supporters, will have unintended consequences and negative knock-on effects, especially for retailers.

Whether the deportation program is fully implemented or not, it is going to have a major impact on the convenience industry in two distinct ways, neither of which I’ve

heard talked about enough in the media: labor and sales.

Here is how I think it is going to play out: The labor issue is not the obvious one where thousands of c-store employees are arrested and sent out of the country. On the contrary, I believe the great majority of c-store employees are legally employed and that most c-store business owners follow the labor laws. The problem will result from the impact the deportation program will have on other industries.

The first round of any deportation program will focus on efficiency and low-hanging fruit, targeting places where there are many immigration violators in one place. The most obvious places to strike are farms, service-sector businesses and jails/prisons.

It is the farm and service-sector scenario that is going to cause the chain reaction affecting convenience stores. Let’s say, conservatively, that half of the illegal immigrants are employed in the farm and service sectors. If the plan is successful, that is almost 6 million people who will disappear from the workforce within a matter of months, according to Trump.

Under the plan, two things will happen: arrests will be made, removing employees from their jobs; and employees will stop showing up for work because of fear they will be arrested while they are on the job. Regardless of the causation, the shortage of labor will need to be filled by either legal workers or technology.

The majority of the affected jobs will not be

filled by technology, or the technology will be very expensive. Therefore, in order to attract legal workers, employers are going to have to offer higher wages and better benefits to job candidates than they have in the past. The competition for the low-skill workers usually employed by c-stores will become fierce. Employee costs will go up significantly, and there will be a repeat of the labor scarcity issue that was experienced immediately after the pandemic.

Retailers’ profit margins will be squeezed as labor expenses go up and the cost of goods rise due to inflation. Shifts at stores will be understaffed, resulting in overtime costs or reduced operating hours (with the accompanying reduced revenue opportunities). Product deliveries will be disrupted due to shortages of warehouse staff and truck drivers because they take better-paying jobs elsewhere.

Bottom line: Retailers need to be ready for a major shift in their business model and learn to do more with less.

My second concern will compound the economic impact of the labor situation: a decline in sales. C-store customers tend to come from the lower economic demographic groups.

They include low-skill day workers (think farm hands, landscapers and construction workers — three industries that will be impacted by deportation), and people who treat the local c-store as their grocery store due to lack of transportation or limited purchasing power (oftentimes, the families of low-skill day workers). These will be the groups most impacted by deportation.

It sounds like the perfect storm for retailers: fewer customers cause sales to fall, rising wages increase operating costs and higher product costs reduce margins. Not a pretty picture.

So, what to do? First, put programs into place to attract and, more importantly, retain your employees. Offering competitive wages and benefits is only the starting point. You must also provide comprehensive training and skill development programs, and create a sense of mission and community within your company so that employees don’t want to look elsewhere for a job. The focus must be on empowering your workforce and having the attitude that every person who works for you is the most important person in the company.

My suggestion is that you develop a plan to operate your store with 75% of your current employee base and at 150% of your current labor cost.

Second, make sure you have a diversified group of reliable suppliers that will look after you when disruptions start. What are the companies that are going to work with you on cost control and order fulfillment? If one of your suppliers can no longer provide you with the products you need, who is your alternative? You need to plan now and build alternative business relationships.

Third, upgrade your store offer with a focus on foodservice to become a destination for the broadest customer base possible. You need to fight for every customer. What can you sell to keep your regular patrons coming into your store and attract new ones? This could mean changing your core product offer and introducing new programs and services.

You may also want to think about participating in community outreach programs if the neighborhoods around your store are heavily impacted by the new deportation program. Regardless of your political views, there may be a way to help the people in your market area in such a way that it will promote your business.

And fourth, review every element of your operations to make sure it is as cost and labor efficient as possible. How can you do more with fewer people? Are there jobs that technology can do for you? Are there tasks that are no longer necessary and can be eliminated? My suggestion is that you develop a plan to operate your store with 75% of your current employee base and at 150% of your current labor cost.

Yes, I think it is going to get that bad, and you don’t have much time to put these plans into place as the deportation plan is supposed to start right after the inauguration. Even if it is not activated immediately, anticipation of the program will have the same effects as people will either lay low or start to self-deport to avoid the traumatic experience of being arrested.

Snap! It is very possible that in a few months, you may look up and wonder where everyone has gone. CSN

Roy Strasburger is CEO of StrasGlobal, a privately held retail consulting, operations and management provider serving the small-format retail industry nationwide. StrasGlobal operates retail locations for companies that don’t have the desire, expertise or infrastructure to operate them. Learn more at strasglobal.com. Strasburger is also cofounder of Vision Group Network, whose members discuss future trends, challenges and opportunities, and then share with all retailers and suppliers, regardless of the size of their business. Editor’s note: The opinions expressed in this article are the author’s and do not necessarily reflect the views of Convenience Store News.

1839® cigarettes are made with a high concentration of flue-cure tobacco in our blen , thus provi ing an exceptional aroma an flavor experience.

BY RENÉE M. COVINO

THE RACE IS ON FOR SUCCESS in harm reduction: encouraging smokers to switch completely to reduced risk alternatives. Evidence of this rapidly evolving trend can be seen from all lanes — consumers, manufacturers, retailers, the government and even public health.

Citing the “2024 Surgeon General’s Report,” Kellsi Booth, chief legal officer for Black Buffalo, the Chicago-based maker of tobacco alternative chew and pouches, said: “Adult smoking and youth tobacco use are at all-time lows, which is a major public health milestone. The growing body of science and evidence around novel nicotine products supports the important role these products can play as acceptable alternatives for adult smokers to reduce the harm associated with current tobacco use.”

According to Booth, the widespread and growing availability of these products at retail has led to not only adult consumer awareness, but also interest and acceptance, as demonstrated by the rapid growth of the e-cigarette and modern oral categories in the United

States. The modern oral (pouch) market has grown significantly over the past several years with some industry reports indicating a $1 billion increase in U.S. retail sales between 2022 and 2023.

Every major tobacco manufacturer — Altria Group Inc., Reynolds American Inc., ITG Brands LLC, Japan Tobacco International USA Inc. and Philip Morris International Inc. (PMI) — now has a reduced-risk tobacco/nicotine product strategy as a significant, if not primary, commitment that is immediately apparent upon a visit to their website home pages.

These reduced-risk strategies are playing out domestically through modern oral nicotine pouches and e-cigarettes (vapor). Globally, heat-not-burn devices are out in front in countries such as Japan, where smoking formerly dominated.

“Millions of adult smokers are seeking new options, including those that reduce risk, and their preferences

are evolving rapidly,” Davien Anderson, a spokesperson for Altria, told Convenience Store News. “We believe it is our responsibility to create the conditions for harm reduction to succeed — through education, awareness and advocacy — as we build a strong portfolio of smokefree products that satisfy adult smokers’ evolving interests and preferences. We know that millions of adult consumers 21-plus are interested in completely switching from cigarettes to a smokefree tobacco product.”

At Reynolds American, its vision of “Building a Smokeless World” means becoming a predominantly smokeless business with 50% of its revenue from noncombustible products by 2035. “We have already started our transformation journey and year by year, we will continue to actively encourage adult smokers who are uninterested in quitting tobacco products altogether to transition to smokeless alternatives,” a company spokesperson said.

The U.S. Food and Drug Administration (FDA) and other public health experts agree that there is a broad continuum of risk among tobacco products, with cigarettes at the highest end of the spectrum and complete cessation at the lowest end.

“While there may be differences in risk profiles between specific smokefree pro-ducts, it will take years of epidemiology to quantify those differences. The body of evidence does, however, indicate a profound risk differential between combustible and smokefree product categories,” Anderson stated.

The FDA authorizes reduced-risk alternatives via a limited number of premarket tobacco product application (PMTA) and modified risk tobacco product (MRTP) classifications.

On Jan. 16, for the first time ever, the FDA authorized the marketing of a nicotine pouch product. Following a scientific review, the agency approved 20 ZYN products through the PMTA pathway, giving the greenlight for them to be marketed in the U.S. ZYN is part of the Swedish Match portfolio, which is owned by PMI.

“We know that millions of adult consumers 21-plus are interested in completely switching from cigarettes to a smokefree tobacco product.”

— Davien Anderson, Altria Group Inc.

The FDA’s evaluation showed that, due to substantially lower amounts of harmful constituents than cigarettes and most smokeless tobacco products — such as moist snuff and snus — the authorized products pose lower risk of cancer and other serious health conditions. The agency also noted that the company provided evidence from a study showing that a substantial proportion of adults who use cigarette and/or smokeless tobacco products completely switched to the newly authorized nicotine pouch products.

“To receive marketing authorizations, the FDA must have sufficient evidence that the new products offer greater benefits to population health than risks,” said Matthew Farrelly, director of the Office of Science in the FDA’s Center for Tobacco Products. “In this case, the data show that these nicotine pouch products meet that bar by benefiting adults who use cigarettes and/or smokeless tobacco products and completely switch to these products.”

Many in the industry want the FDA to move faster and say it’s necessary for true progress.

“We are seeing increasing interest in and pressure from lawmakers to expedite reviews for the hundreds of thousands of product applications that remain in process, which is crucial to

get to a fully regulated and compliant diversified marketplace,” said Black Buffalo’s Booth.

Altria’s Anderson agrees. To make true harm reduction a reality, he believes there needs to be faster progress from the FDA in three key areas:

1. Authorizing smokefree products

2. Informing adult smokers about the benefits of switching to smokefree alternatives

3. Enforcing the law to eliminate illicit e-vapor products

“A strong course-correction is needed to protect the harm reduction opportunity for the 30 million adult smokers in the U.S.,” said Anderson, explaining that consumers are misinformed about the role of nicotine, for starters. “The FDA has authorized only a handful of smokefree products, woefully insufficient to meet the growing adult tobacco consumer demand. And the marketplace is being overrun by illicit disposable e-vapor products that are flouting FDA regulation and contributing to underage use.”

Some progress was made this past summer when the FDA, jointly with U.S. Customs and Border Protection, seized more than 50,000 unauthorized vapor products from China at the Chicago port of entry. In August 2024, the FDA issued a proposed rule requiring all imported vapor products to include a PMTA submission tracking number.

“Closing this loophole is something for which we have long advocated,” Anderson said, adding that Altria provided comments in support of the rule and encouraged additional action, such as extending the rule to cover nicotine pouch products.

Booth pointed out that the FDA has an excellent model in Sweden, which declared itself officially “smokefree” in November, with fewer than 5% of its adult population using combustible cigarettes. “This landmark is a direct result of the Swedish government [being] focused on harm reduction rather than prohibition, by employing adult-focused advertising that increases awareness and encourages uptake, as well as enacting a proportionally lower tax on risk-reduced products to drive adoption,” Booth said.

New Zealand and the United Kingdom also have seen significant declines in smoking rates thanks to successful harm reduction strategies, according to Chris Howard, executive vice president of external affairs and new product compliance for Swisher, which operates Swisher Sweets Cigar Co., Helme Tobacco Co., Hempire, Rogue Holdings and Drew Estate.

Howard told CSNews that research has solidified the role of lower-risk products such as e-cigarettes and heated tobacco devices in reducing smoking prevalence. “Public Health England and organizations such as the Society for Research on Nicotine and Tobacco have highlighted that these alternatives are significantly less harmful than smoking. For instance, vaping is estimated to be 95% less harmful than combustible tobacco,” he said.

Convenience store operators looking to stay ahead of the harm reduction trend should keep in mind that the term is evolving. “In sum, it now encapsulates not only the use of safer alternatives, but also the broader framework of innovation, public health policy and greater access to less harmful nicotine products,” Howard explained.

Most retailers are aiming to keep their current cigarette offer in terms of SKUs and space for display. Large operators are leaning more towards reduction when compared to small operators.

Tobacco sales are over $84B in Multi Outlet with Convenience Store While sales are declining, c-store outperforms other channels.

Despite the fact that U.S. markets are “still hampered by the FDA’s regulatory scheme and the long delays from submission of PMTAs to market order,” he maintains that the future of reduced harm products is encouraging. “Both domestically and internationally, the tobacco industry continues to make significant investments in reduced harm products,” he said.

The launch of heat-not-burn devices in the U.S. by PMI in October 2024, as well as the expanded consideration of other tobacco harm products internationally, will factor into the future success of harm reduction, Booth stated.

“These are important developments because every adult consumer has different needs and subjective preferences, and we must meet them where they are, both in their risk reduction journey and in the places and occasions that require this widened scope of products,” she said.

Within the next few years, Reynolds expects to see a correction of the public misperceptions around the health effects of nicotine and potentially reduced risk products.

“We know that sustained and lasting changes to adult consumer behavior requires access to evidence-based information concerning alternative products. Our focus will be to correct these misperceptions by educating and engaging key stakeholders on the benefits of potentially reduced products, which is supported by scientific evidence,” the company’s spokesperson said. CSN

“Retailers can expect to see continuous new market entrants, especially in modern oral. This will drive a need to balance innovation with consistency to support a positive consumer experience, minimize shelf disruptions and avoid oversaturation.”

— Greg Schmidt, Swisher

The backbar has become somewhat of a mirror to the harm reduction movement as the typical convenience store offering has evolved to include more space for noncombustible products. But how can tobacco category managers be more strategic and proactive in the harm reduction race? Are there specific steps they should they be taking now?

According to Greg Schmidt, vice president of business analytics for Swisher, increasing alternatives to combustible cigarettes and shifting consumer preferences to emerging segments may necessitate reevaluation of product assortment and pricing strategy.

“Retailers can expect to see continuous new market entrants, especially in modern oral. This will drive a need to balance innovation with consistency to support a positive consumer experience, minimize shelf disruptions and avoid oversaturation,” he advised, noting that Swisher recommends retailers consider item productivity and exclusivity in awarding shelf space from combustible cigarettes to other tobacco products (OTP) to achieve the broadest consumer appeal.

“Delighting consumers in OTP with a variety of products can capture incremental margin opportunities with rotating seasonal or limited-time products from trusted manufacturers,” said Schmidt. Additionally, he challenges retailers to consider partnerships with manufacturers that are investing incrementally in innovation and product roadmaps, along with trialdriving initiatives aimed at accelerating transitions to noncombustible alternatives.

Forward-thinking convenience retailers in the harm reduction race also must anticipate portfolio shifts that align with regulatory changes. “Be prepared for item swaps, new item intros and item runouts to be more prevalent in the future,” Schmidt added.

Vetting for compliant products and manufacturers is another must, according to Kellsi Booth, chief legal officer for Black Buffalo. “The illicit market continues to thrive, including illegal importation of unauthorized e-cigarettes and nicotine pouches, as well as black market sales of banned products. Retailers can and should check that they are working with manufacturers of compliant products with demonstrated commitment to responsible marketing practices,” she stated, noting that the U.S. Food and Drug Administration’s Center for Tobacco Products has issued guidance and education materials to assist retailers.

Booth also emphasized that retailers play a critical role in preventing youth access and appeal, which she asserts will be of paramount importance to the success of emerging novel nicotine products. At a minimum, c-store retailers should ensure they are following the FDA’s recently released final rule increasing the minimum age for certain restrictions on tobacco sales, she said. Additionally, retailers may want to implement mandatory ID checking and/or scanning for all transactions to eliminate any guesswork from the equation.

Maintaining the physical space surrounding dispensed beverages is essential.

Maximize foodservice category returns by prioritizing your dispensed beverage offering

By Angela Hanson

CONVERSATION ABOUT THE FUTURE of convenience store foodservice often revolves around prepared food, but retailers must factor dispensed beverages into their strategy if they want to maximize returns in the category. Along with the potential for high sales volume and good profit margins, this segment gives operators the opportunity to be part of consumers’ daily routines.

According to the 2025 Convenience Store News Forecast Study, around 90% of c-store operators predict that their sales of hot, cold and frozen dispensed beverages will increase or hold steady in both dollars and units this year. Retailers can improve their odds by leaning into current dispensed beverage trends, which include flavor variety and customization options.

“Customers increasingly want to personalize their drink choices, whether it’s adjusting sweetness levels, adding flavor infusions or choosing between dairy and plant-based milk options,” said Shauna Seidenberg, category manager for dispensed beverages at Westborough, Mass.-based EG America, whose convenience store banners include Cumberland Farms, Certified Oil and Turkey Hill.

Customization will be “a key driver” across all beverage segments in 2025, Seidenberg said. “This trend will also be further fueled by the desire for sustainability, as many consumers are also seeking more ecofriendly and health-conscious beverage options,” she added.

In addition to offering more options, c-store retailers should “lean into the speciality,” advised Tim Powell, a principal at research and consulting firm Foodservice IP, headquartered in Chicago. He recommends retailers take a cue from quick-service operations such as Taco Bell’s beverage-forward Live Más Café.

“Operators are trying to find ways to reduce prices while they’re still very high on the supply side of things. For any of these categories, creative naming and marketing such as ‘handcrafted’ or ‘elixirs’ tend to resonate highly with Gen Z, and the labor and costs are nominal compared to food,” he said.

While carbonated soft drinks may be the king of the fountain, success in c-store dispensed beverages this year is likely to be driven by several other beverage types.

“Cold beverages will continue to see increased demand as consumers seek options that offer high levels of refreshment, fun and functional benefits like energy. As the demand for convenience

and personalization rises, we foresee a greater emphasis on offering customizable cold beverages,” Seidenberg explained.

Dispensed beverages with added vitamins and energy additives also will continue to resonate with consumers in search of both a caffeine boost and enhanced performance benefits, she said. And big-name national energy brands aren’t the only ones to catch consumers’ attention — EG America has found that “customers love” its proprietary energy beverage, NRG Kick.

When it comes to dispensed tea, however, opinions are mixed. Within the convenience channel at large, “tea has been seemingly on the cusp of growth for 20 years, but can’t quite get there,” Powell noted. Yet, certain retailers such as Curby’s Express Market in Lubbock, Texas, are very bullish on tea. Geography seems to be the differentiating factor.

“Tea is important to our customers, especially in the South region,” Seidelberg said.

In hot beverages, retailers are encouraged to offer seasonal coffee varieties while in frozen beverages, the recommendation is to market them as functional treats.

“Frozen coffee beverages will continue to be a major trend, especially with the rise of indulgence-driven consumers looking for high-quality coffee drinks that double as both a treat and a pick-me-up,” Seidelberg observed.

Along with offering on-trend options, retailers must put effort into maintaining this section of the store to max-

imize its effect. While the dispensed beverage segment is often viewed as a complement to the main draw of prepared food, it’s important for retailers to recognize the impact that the physical space has on customers, and do what they can to allocate labor to maintain it.

“In our research, we see that only about a quarter to a third of stores have dedicated foodservice staff. In an ideal world, where turnover was not an issue (it is) and labor costs weren’t so high, a staff member would be assigned to not just the condiment areas, but the foodservice grab-and-go spaces too,” Powell said. “If there is visible spillage, straw paper and lids scattered about, it’s not going to make it attractive for the consumer who stops in for say, the restroom, and on impulse buys a dispensed beverage.”

Without dedicated labor, the best substitute is self-serve units such as f’real milkshake machines and Coca-Cola Freestyle units, he added, but even this type of equipment requires maintenance and cleaning. “Unfortunately, there is no substitute for personnel,” Powell said.

Dispensed beverages should be a priority in marketing and promotions, particularly if a strong digital loyalty program is in place. Seidenberg noted that EG America’s SmartRewards loyalty app features deals and specials throughout the year to connect with customers looking for innovative, in-demand products at the best value.

In recent years, beverage subscription programs have generated some buzz as a vehicle to deliver value and increase visits. However, some retailers found these

“Customers increasingly want to personalize their drink choices, whether it’s adjusting sweetness levels, adding flavor infusions or choosing between dairy and plant-based milk options.”

— Shauna Seidenberg, EG America

“If there is visible spillage, straw paper and lids scattered about, it’s not going to make it attractive for the consumer who stops in for say, the restroom, and on impulse buys a dispensed beverage.”

— Tim Powell, Foodservice IP

programs depressed sales while not meaningfully driving traffic, as with Circle K’s Sip & Save program that ended in spring 2024.

Powell pointed out that while beverage subscriptions may be a good idea in general, the return on investment varies from retailer to retailer and is dependent on several factors.

“The cost on a hot dispensed coffee is about 5%, so even if one pays $10 a month … it increases the chances they will come in and purchase another item, increasing the check. I think the bigger question is how valuable it is to the consumer,” he said. “If it’s a loyal customer, they will likely be there every day anyway but for the moderate user, the verdict is out if they feel it is worth the money.”

CSN

EnsembleIQ is the premier resource of actionable insights and connections powering business growth throughout the path to purchase. We help retail, technology, consumer goods, healthcare and hospitality professionals make informed decisions and gain a competitive advantage.

EnsembleIQ delivers the most trusted business intelligence from leading industry experts, creative marketing solutions and impactful event experiences that connect best-in-class suppliers and service providers with our vibrant business-building communities.

Both negative and positive factors are at play in the packaged beverages category

A Convenience Store News Staff Report

PACKAGED BEVERAGES are a convenience store staple. However, expectations for the category this year are mixed and largely dependent on how many stores a retailer operates.

According to the findings of the 2025 Convenience Store News Forecast Study, small operators (1-20 stores) expect a stable performance this year, while large operators anticipate growth in both dollars and units. More specifically, 59% of large operators vs. 37% of small operators expect increased dollar sales for packaged beverages this year, while 53% of large operators vs. 30% of small operators expect increased unit volume.

As with many c-store product categories, the cold vault has been impacted by inflation causing downward pressure on consumer spending, leading to a pullback in discretionary spend, as well as declining trips to convenience stores. Inflation also has contributed to rising product costs for suppliers, passed along to retailers, and ultimately resulting in price increases for consumers.

Some good news is that c-store retailers predict a return to positive traffic growth in 2025. Some not-so-good news is that many retailers still expect additional price increases this year. One retailer participant in the Forecast Study said, “It will all be about how much we have to pay for the product before we can offer a lower price to our customers.” Another

echoed, “Packaged beverage sales will be a reflection of each vendor and what deals they’re willing to offer.”

Along with strong promotional activity, convenience retailers are hoping product innovation and new flavor offerings will help boost their packaged beverage business this year. “Introduction of clean energy beverages and better-foryou beverages will drive this,” said one operator.

By the same token, a common refrain among beverage suppliers on the expo floor at the 2024 NACS Show, held in October, was “better for you.” C-store customers are increasingly looking for healthier alternatives in their grab-and-go drinks, several suppliers told CSNews

“Celsius was launched back in 2004 and born into a very different space. The growth of our brand was ahead of its time, where it was positioned as better for you in a kind of a fitness-credible space. Then as we’ve transitioned, I think the timing has been amazing because you've seen both the category and consumer behavior shift to looking for those better-for-you options, while the traditional

More than one-third of large operators in the convenience channel expect to increase the square footage they dedicate to packaged beverages in 2025.

energy consumer has grown up a little bit and wants something that fits more in their lifestyle,” said Kyle Watson, chief marketing officer for Celsius Holdings Inc., the maker of premium energy drinks formulated to “power active lifestyles.”

Beverage development company Flavorman’s annual "Beverage Trends" report for 2025 also asserted that consumers are becoming more aware and concerned about what exactly they’re drinking after some functional beverage brands made headlines for inaccurate label claims.

“The term ‘false advertising’ can send shockwaves through consumer confidence and cause them to look closer at what’s in their cups. Gone are the days when a catchy claim alone could carry a product. Consumers are becoming more ingredient-savvy, scrutinizing formulations themselves,” Flavorman said. “Brands will respond by incorporating beneficial ingredients without loudly broadcasting the benefits, trusting consumers to connect the dots.”

To make way for new products, more than one-third of large operators in the convenience channel (and 17% of small operators) expect to increase the square footage they dedicate to packaged beverages in 2025. Half of large operators (and 13% of small operators) also expect to increase their packaged beverage SKU count, according to the Forecast Study. CSN

Companies need to break the cycle of “just-in-time” hiring practices and transition to a more holistic recruitment approach

By Danielle Romano

THE JOURNEY OF MODERN talent acquisition has ebbed and flowed, especially in recent years.

Over the last half-decade, talent acquisition has faced unprecedented market swings, going from spiking layoffs to rapid hiring mandates, to today where a slowing market is forcing a recalibration of talent acquisition priorities toward finding and keeping the right talent for the future.

According to Rachel Allen, senior director of talent acquisition at Irving, Texas-based 7-Eleven Inc., there are three waves of talent acquisition that hourly retail employers and employees have faced:

1. Disruption: The COVID-19 meltdown occurred from early 2020 to early 2021 and saw massive layoffs.

2. Recovery: The candidate market shifted from early 2021 to early 2022 when consumer

spending rebounded and hiring demand was high. This was also the height of the Great Resignation.

3. Protracted Regression: Taming inflation has impacted hiring from early 2022 through now, with the lowest hiring rates in three years, the highest rate of layoffs in three years and the cost of inflation driving up the cost of living.

“These three distinct eras have created a whiplash of ways that we’ve had to go after talent, and where we are right now is focusing on the right talent that's actually going to stay in place,” Allen explained during an education session at the recent 2024 NACS Show.

"There's still ongoing shortages in labor. There's still wage pressures. There's supply chain disruptions that we're still feeling. And all of this has impacted our industry, which really hasn't fully been able to stabilize since pre-pandemic," she continued. "While there are a sufficient number of people that we could fill these positions, it's about finding the right

candidates, and we have significant hurdles that we have to overcome in order to get people to join us and then to stay with us."

To contend with the current talent acquisition challenges, Allen presented three recruiting strategies for high-volume retail hiring:

1. Strategic Talent Sourcing

In the retail hourly workforce world, it is hard for employers to break the cycle of "just-intime" hiring practices — hiring whomever to fill immediate needs. Instead, she recommends a more holistic, three-pronged approach to attract diverse talent.

The first step is utilizing digital recruiting platforms and tailoring searches to find talent where they are. Nearly seven out of 10 hourly employees find information on companies the most on Indeed, Allen pointed out.

The second step is partnering with local organizations to build a pipeline. For example, 7-Eleven is a member of the JPMorgan Chase Veteran Jobs Mission, which helps active duty, reservist and other veterans transition from military to civilian life. Since the company's pledge to the organization in 2011, 7-Eleven has hired thousands of veterans in full- and part-time roles.

The third step is hosting and attending events to reach hourly talent. Allen cited

“Where we are right now is focusing on the right talent that's actually going to stay in place.”

— Rachel Allen, 7-Eleven Inc.

that approximately 45% of retail workers attended an employee-related event in the past five years, according to Veris Insights’ “2024 Hourly Talent Survey.”

"In-person candidates can get the information that's important to them to make the decisions they want to make. In addition to that, there's the human touch element that's harder to find in some of the processes that we have," she said. "When you are a part of these regional events, it gives you a stronger presence in your communities; that's where talent within hourly retail is."

2. A Compelling Employee Value Proposition

An employee value proposition is the promise that employers make to employees, and it's what differentiates organizations from their competitors. It is what convenience retailers will want to lean on in order to attract the right talent for their companies.

The first piece is knowing what attributes job seekers find important to them. Nearly seven out of 10 (67%)

say it's hourly wage, followed by work location (40%), job stability (38%), employer benefits (34%) and worklife balance (25%).

Two key benefits that drive retail talent to accept an offer from a company but are often overlooked are paid time off (PTO) and type of work schedule. According to Allen, two ways to convey work-life balance is providing predictable or flexible schedules, and offering a competitive PTO package that's anywhere from 40 to 80 hours.

"What's interesting is how important schedules are and it's often overlooked and not highly advertised, and that's part of the problem. It's obviously something that is very important to our candidates. As much as it is a very powerful benefit and reason why people will come us, it's also just as powerful of a driver as to why they decline us," she expressed.

Recruiting hourly talent often involves a tradeoff between speed and quality, and it's difficult to find the marriage of both these prospects. Sixty-eight percent of companies reported in the Veris Insights survey that hourly service roles were at least somewhat difficult to fill in 2024, and 46% of companies require one to four weeks more to fill open roles than before.

When it comes to why a retail candidate drops out of the process, 37% say it's because it took too long to hear back from the company, and 21% say the hiring process took too long.

So, how can retail companies find the most human touchpoints in the hiring process that are appealing to candidates, make for a great candidate experience and allow the organization to vet candidates accurately and quickly at scale? This is where artificial intelligence (AI) comes into play.

7-Eleven has automated 95% of the frontend of its recruitment process using RITA (Recruiting Individuals

Through Automation), which handles the process with candidates right up until they show up in-store for their interview. By utilizing RITA, 7-Eleven went from a 10-day hiring process to less than three days and saved store leaders more than 40,000 hours a week.

That being said, Allen acknowledges that it does take a sizable investment to make this kind of transformation. So, she also offered these no- to low-investment solutions:

• Job ads that detail pay, location and role details are the most likely to attract retail talent.

• Pre-hire assessments can tame high application volume and screen talent at scale.

• Streamlining interview processes can reduce attrition.

Once a candidate is hired, Allen advocates for having a high-tech, high-touch onboarding experience that automates logistics and builds belonging with coworkers. Another essential component for retention, she said, is describing pathways for long-term growth by outlining internal and external upskilling opportunities for employees. CSN

The 5

Most Important Pieces of Information to Provide at Hiring Events

1. Hourly wage ranges

2. Benefits offered

3. Work location

4. Skill requirements

5. Work-life balance policies

Source: "2024 Hourly Talent Survey," Veris Insights

C-store retailers tap IoT, AI and other technologies to increase efficiency and their bottom line

By Tammy Mastroberte

WHETHER A SINGLE STORE or a large chain, operating expenses are something every convenience store retailer must deal with. Finding ways to streamline operations and increase efficiency can have a huge impact on an operator’s bottom line and so, many c-store retailers are turning to technology to accomplish this goal.

“Operating expenses are expensive and one of the biggest is labor, which has become much more expensive since the pandemic,” said Kay Segal, founding partner at Business Accelerator Team, a convenience retailing consultancy based in Phoenix. “We need to rethink processes and use technology that can take repetitive actions away, and enhance the guest interaction.”

Technology, both in-store and at the headquarters level, is helping convenience retailers save on labor, monitor equipment, speed up training and onboarding of new employees, and improve customer satisfaction. In many cases, a company’s operations and technology departments are coming together to execute plans.

“More and more, I’m hearing about solutions that provide retailers with the ability to take a proactive approach to their operations,” said Ed Collupy, owner of Collupy System Solutions LLC, which offers consulting

services to the industry. “IoT [Internet of Things] and remote management systems where devices are monitored, such as temperatures and equipment status, or accessed from headquarters, allow retailers to take corrective action sooner rather than later.”

Adding new technology also can remove tasks from staff that are better handled with data, giving store employees and managers more time to interact with customers onsite, according to Ed Burcher, a partner at Business Accelerator Team. One example is automated ordering and replenishment, which he said is more accurate with real-time inventory and sales data.

“This applies to all product lines, including foodservice and ingredients,” Burcher said. “IoT, and now AI [artificial intelligence], may seem like overused terms, but they are areas where convenience stores can apply technology, connectivity and data to improve their operations.”

WARNING: Cigar smoking can cause lung cancer and heart disease.

Atlantis Management Group, which has 300 stores, 100 of which are company owned, is focused on giving its store managers more time to interact with shoppers.

“We are looking to get the manager out of the back office and more in the front of the store and forecourt,” said Rick Rigby, chief technology officer for the Mount Vernon, N.Y.-based company. “We are using tablets and mobile tools to free them up.”

Customer interaction and satisfaction can be improved by increasing transaction speed as well, using mobile apps for ordering and payment, and self-checkout, according to Burcher.

Additionally, he pointed out that using data “to gain more insight into shopping behaviors to improve the store and digital experience for the guest” can improve operations in real-time and provide ongoing feedback to the operator that can be acted upon at the store level.

“Whether you call it improved data analytics or AI, technology can be applied at many touch points for the guest and staff to improve the experience,” Burcher said.

Atlantis Management uses InStore.ai’s artificial intelligence audio tool to gather information from customers shopping in its stores and provide feedback to its operations team for areas of improvement, according to Rigby.

“We are looking to get the manager out of the back office and more in the front of the store and forecourt. We are using tablets and mobile tools to free them up.”

— Rick Rigby, Atlantis Management Group

“Technology can help with customer service by tracking guest interactions and reviewing transactions for opportunities,” Burcher noted. “This involves reviewing actual transactions and providing feedback and dashboards to the staff and store. These reviews can be used not only in a call center environment, but also at the point of purchase in-store.”

With foodservice becoming such an integral part of many convenience store’s offering, finding ways to streamline and improve operations in this high-margin category is crucial. C-store retailers still struggle to compete with the integrated technology available to quick-service restaurants that links customer ordering, food preparation, supply chain and more.

“Some retailers are investing in developing their own solutions or starting up integration projects that will unite kitchen management systems with back-office and POS [point-of-sale] systems,” Collupy explained. “There is still a lot of work to be done.”