TOP WOMEN IN HARDWARE & BUILDING SUPPLY

things running smoothly, but our operational model controls our expenses and we pass these savings along to our dealers.

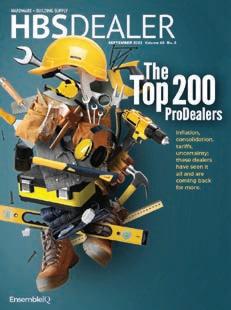

Hardware + Building Supply Dealer (ISSN 2376-5852) is published monthly, except for July/August and November/December, which are double issues, by EnsembleIQ, 8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631. Subscription rate in the United States: $110 one year; $200 two year; $14 single issue copy; Canada and Mexico: $130 one year; $235 two year; $16 single issue copy; Foreign: $150 one year; $285 two year; $16 single issue copy; in all other countries (air mail only). Digital Subscription: $75 one year; $140 two year. Periodical postage paid at Chicago, IL., and additional mailing offices. POSTMASTER: Please send address changes to HBSD, Circulation Fulfillment Director, 8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631. Copyright © 2022 by EnsembleIQ. All rights reserved.

What an honor it is to have 15 of our team members recognized as Top Women in Hardware & Building Supply. Each of these elite professionals have proven they have the skills, talent and perseverance needed to meet and exceed high expectations. Builders FirstSource celebrates their success and the road they’ve helped carve within our ever-changing industry.

Cheers to these ladies, all the other winners and to the future leaders they continue to inspire!

Amy Messersmith Chief People OfficerAmy Garner, Asst. General Manager - Anchorage, AK

• Carrie White, General Manager - Leesburg, VA •

Evelyn Lizarraga, Office Manager - Riverside, CA •

Giana Noonan, Sr. Director, Digital Mktg. & Demand Gen. - Raleigh, NC • Kim Holloway, Outside Sales Rep - Lake City, FL • Lea Allah, Sr. Director Human ResourcesRaleigh, NC • Nerida Jones, Inside Sales Rep - McCall, ID

• Olivia Layhue, Inventory Control Specialist - Villa Rica, GA • Tina Fox, Purchasing Manager - Coppell, TX • Traci Johnson, Asst. General Manager - Anchorage, AK

Emily Stiles, Inside Sales Rep - Oklahoma City, OK

• Gabriela Sanchez, Asst. Fleet Manager - Phoenix, AZ • Margo Mitchell, Field Service Rep - Auburn, WA • Miranda Copeland, Inside Sales Rep - Detroit Lakes, MN • Nikki Adams, Manager Installation - Vidalia, GA

What does a $300, lighted, $12-foot-high mummy-like Halloween decoration have to do with the U.S. economy?

If it flies off the shelves, as it did at Lowe’s this Halloween, it could mean a lot.

Lowe’s Executive Vice President of Mer chandising Bill Boltz told analysts during the company’s third quarter earnings call: “Some of you have asked if we’re seeing a shift away from discretionary purchases which is what we typically expect to see in a softer macro environment,” said Boltz. “And the straightforward answer is, no.”

on housing starts and home sales, and you might expect a weak quarter.

In the same earnings call, Lowe’s CEO Marvin Ellison clarified what he called “misperceptions” about demand drivers for home improvement, which “are distinctly different from those that drive home building,” Ellison said.

The CEO laid out the three highest correlating factors of home improve ment demand:

“Even if there is a broad-based decline in home prices, homeowners currently have a record amount of equity in their homes, nearly $330,000 on average, which remains supportive of home improvement investment,” he said. And even in those areas where home prices have declined after big run ups, the retailer isn’t seeing any impact on sales.

“Roughly 3 million more homes built during the housing boom in the mid two thousands will be entering prime remodel ing years by 2025, which is a key inflection point for big ticket repairs,” he said.

Disposable personal income.

550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 www.HBSDealer.com

SENIOR VICE PRESIDENT John Kenlon (516) 650-2064 jkenlon@ensembleiq.com

EDITORIAL EDITOR-IN-CHIEF Ken Clark kclark@ensembleiq.com

LBM EDITOR Andy Carlo acarlo@ensembleiq.com

Hardware Editor Tim Burke tburke@ensembleiq.com

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER Amy Platter Grant

MIDWEST & SOUTHERN STATES (773) 294-8598 agrant@ensembleiq.com

REGIONAL MANAGER Greg Cole

NORTHEAST & GREAT LAKES STATES (317) 775-2206 gcole@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

PRODUCTION MANAGER Patricia Wisser pwisser@ensembleiq.com

MARKETING MANAGER Kathryn Abrahamsen kabrahamsen@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

contact@HBSDealer.com

Enter the mummy.

Boltz explained that the retailer’s electric Halloween decoration com pletely sold out ahead of expectations. “One could argue that this is one of the most discretionary items we sell,” he said. “And with Halloween in total being a highly discretionary category, this continues to give us a positive indica tion of the strength of our consumer.”

Overall, DIY and pro demand were strong in the third quarter at both Lowe’s and Home Depot (see page 16). These results came despite wallet-tightening consumer-rattling inflation and rising interest rates. Throw in downward trends

“Consumer savings are near record highs, while disposable personal income remains strong,” Ellison said. “And more than 90% of homeowners either own their home or are locked into a low fixed mort gage, insulating them from rising rates.”

All of the above, plus the idea that 250,000 first time millennial home buyers are entering the market, gives Lowe’s confidence.

Do you agree with the Ellison’s big three drivers? Let us know at news@ hbsdealer.com. First reader to respond gets leftover Halloween candy.

LBM Advantage

Wendy Whiteash, EVP of culture, US LBM Holdings

Tom Cost, owner, Killingworth True Value

Brad McDaniel, owner, McDaniel’s Do it Center

Joe Kallen, CEO, Busy Beaver Building Centers

Permissions: No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. connect with us

Since the arrival of Marvin Ellison as president and CEO of Lowe’s in 2018, the home improvement retail giant has continued to sharpen its focus on its core, domestic retail strategy.

Shortly after Ellison was named as Lowe’s top executive, the company announced in November 2018 that it would shed its retail operations in Mexico. Lowe’s first entered in Mexico 2010 but closed all 13 of its stores by 2019.

Now the company is making a much more dramatic international exit with the sale of its Canadian division.

On Nov. 3, in a surprising announce ment, Lowe’s revealed that it was selling Lowe’s Canada to Sycamore Partners, a private equity firm specializing in retail, consumer and distribution-related invest ments, for $400 million in cash, and per formance-based deferred consideration.

The Boucherville, Quebec-based busi ness includes about 450 corporate and independent affiliate dealer stores in a number of complementary formats under different banners: RONA, Lowe’s Canada, Réno-Dépôt, and Dick’s Lumber.

In announcing the deal, Ellison — named chairman of Lowe’s in 2001 — said, “The sale of our Canadian retail business is an important step toward simplifying the Lowe’s business model.”

Although Lowe’s Canada accounts for 7% of the home im provement retailer’s full year 2022 sales out look, it also represents approximately 60 basis points of dilution on its full year 2022 operating margin outlook, Ellison noted.

Lowe’s is also paying a much higher ticket price to exit Canada than it did to make its major entry into the nation. And the entrance and departure of Lowe’s are both arguably the biggest

Canadian home improvement retail stories of the past decade.

The sale of Lowe’s Canada is expected to close in early 2023.

In 2016, Lowe’s paid $2.4 billion to complete its acquisition of RONA. At the time, RONA was a thriving, independent Canadian home improvement retailer that essentially set the stage for Lowe’s Canada’s business model. Prior, RONA had entertained thoughts of entering the

The purchase of RONA brought pro forma revenues of approximately 6 billion Canadian dollars (US$4.44 billion). Ad ditionally, the RONA acquisition brought Lowe’s a network of 496 corporate and dealer-owned stores in a number of complementary formats, as well as nine distribution centers.

But Lowe’s continues to sharpen its focus on U.S. sales and its core big box business.

“By executing this transaction, we will intensify our focus on enhancing our operating margin and ROIC, taking market share in the U.S. and creating greater shareholder

LOWE'SEXITS CANADA TO FOCUS ON THE CORE. By Andy Carlo

“The sale of our Canadian retail business is an important step toward simplifying the Lowe’s business model.”

—Marvin Ellison, president and CEO, Lowe’s

Chicago-based True Value Company has acquired the brand trademark rights from Agway Farm & Home Supply, a wholesale product distribution company serving a network of private dealers, primarily in the U.S. Northeast.

“Purchasing the Agway brand is an excellent fit for True Value as we contin ue to grow through strategic acquisi tions,” said Chris Kempa, CEO of True Value Company.

The Agway Trademark acquisition expands True Value’s capabilities in the fast-growing farm, ranch, auto and pet category, said the firm.

“Farm and ranch is an important cate gory for True Value and owning the Agway brand deepens our capacity to support our retailers in providing their customers with

from page 10

value,” Ellison said. “I want to thank our entire Canadian team for their hard work and dedication to our customers. We look forward to working with Sycamore Part ners in executing a seamless transition.”

The sale of Lowe’s Canada is ex pected to close in early 2023. Lowe’s also said it expects to record a pretax non-cash impairment charge of approximately $2.0 billion related to its Canadian retail business.

In August, Lowe’s reported sales for the second quarter were $27.5 billion compared to $27.6 billion in the second quarter of 2021 as comparable sales decreased 0.3%. The retailer expects full-year sales to range between $97 billion and $99 billion.

Another major move made under Ellison’s leadership was the August 2018 decision to close 99 Orchard Supply Hardware stores in California, Oregon, and Florida. Lowe’s had purchased Orchard Supply Hardware just five years earlier.

That decision was also aimed at placing a greater emphasis on Lowe’s traditional stores.

the products they need,” said Kempa.

As part of the purchase, True Value said it has also obtained the rights to select private-label products and equipment. Currently, close to 600 retail stores operate under the Agway name.

Current Agway stores interested in con tinuing to use the brand were advised to contact AgwayTrueValue.com.

The transaction represents True Value’s second completed acquisition in 2022. In March, True Value announced the purchase of Majic, The Yenkin-Ma jestic Paint Corporation’s consumer paint division.

Product: Siligun Compact 4” Caulk Gun

Manufacturer: Unique Solutions

Moving forward, Lowe’s Canada and the Rona banners will be po sitioned as a standalone company based in Boucherville, according to Stefan Kaluzny, managing director of Sycamore Partners.

“We look forward to working with the company’s management team to build on its 83-year history as a leading Canadian home improvement business serving families, builders, and contrac tors in their communities across the country,” Kaluzny said.

Tony Cioffi was appointed presi dent of Lowe’s Canada this past January and succeeded Tony Hurst who moved to U.S. oper ations after being named Lowe’s senior vice president of pro, services, and international.

We are excited to work with Syca more Partners on this next chapter of growth for our business.” Cioffi said. “Together, we will remain committed to supporting our associates, our Cana dian- and Quebec-based vendors and our dealer network.”

Based in Mooresville, N.C., Lowe’s operates early 2,200 U.S. home improve ment and hardware stores and employs over 300,000 associates.

Knowledge: The Siligun mea sures a mere 4 inches in length, allowing for caulking and sealing in tight spots around the house or job site. Described as the smallest and lightest, non-drip caulk gun on the market, the innovative gun delivers an efficient flow of caulk with a 12:1 thrust ratio.

MSRP: $29.95

Fun fact: The traditional caulk gun, according to Unique Solu tions, has maintained the same basic design for 127 years.

A l u f h 65 , k w h d f bu ld b f h w kd v b u full f lu fi ll d d k u u du v Y u l d k w b u u , f d h f , d qu l Bu w l u u b ll d l , l ff d v d bu ld f w dd , u l d w d d bu w k k k bu ld full k d u l u bu wh l u b h u u ’ u l u bu w h h lu bu ld d l , v u w b go.strongtie.com/buildersolutions ll (8 ) 999 5 99

The California-based treatment and research facility for cancer and other diseases has celebrated fundraising with some of the biggest names in the home improvement business. This year is no different as Lowe’s CEO Marvin Ellison will accept the Spirit of Life Award at a Las Vegas gala event slated for Jan. 30.

The chairman and CEO of Lowe’s Companies will accept the City of Hope Spirit of Life Award taking on the chief fundraising role for the National Hardware/Homebuilding industry. In

doing so, Ellison joins a long list of industry leaders in the post, including two who are on his executive team.

Lowe’s Executive VP of Merchandis ing Bill Boltz, accepted the award in 2021. And Joe McFarland, currently Lowe’s senior VP of stores, accepted the award in 2015, when he was with Lowe’s rival as president of Home Depot’s northern division.

But retail rivalries are pushed aside during City of Hope events. In a span of nearly four decades, the National Hardware/Homebuilding Industry group has raised more than $170 million for the research and treatment center.

More than a third (36 percent) of Americans say their garage is so clut tered, there’s no room to park the car.

That’s just the beginning of the findings from the Take Back Your Garage Survey, commissioned by Craftsman, the Towson, Md.-based tool and tool storage brand.

“There are over 82 million garages in the U.S., and according to the Craftsman survey, more than 60% of Americans with garages feel their garage is the untidiest area in their house,” said Tabata Gomez, chief marketing officer of tools and out door for Stanley Black & Decker.

Other major findings from the online

Home Depot and Lowe’s posted third quarter performances that beat Wall Street estimates. Other similarities from the two earnings reports delivered within 24 hours of each other included the idea that demand remains strong — for both the DIY and Pro customer — despite headwinds such as inflation, rising interest rates, and a housing downturn.

survey of more than 2,000 adult Americans Include:.

62 percent of U.S. adults say their garage is the most cluttered space in their home; 53 percent say they use their garage for at-home workshop DIY projects; and 52 percent of Americans with garages are unsatisfied with how their garage is organized.

The survey also tracked the outdoor equipment products most commonly stored in the American garage: leaf blowers (62 percent); String trimmers

Rivalry

Depot

Lowes Comp-store sales comparison for U.S. stores Source: Company reports

With a low barrier to entry, Feeney®’s Authorized Dealer Program makes it easy for you to access unparalleled marketing support, special pricing and lead referrals that will reinforce your margin growth. Become a dealer today and discover how easy it is to increase your revenue with the highest-quality products to surpass the highest expectations.

Become a Feeney Dealer at Feeneyinc.com/Become-a-Feeney-Dealer.

Feeney Makes It Easy TM

Illustration of retailers and dealers in various stages of coming and going. For more retail news, visit HBSDealer.com

OPENING CLOSING ACQUISITION

TAL Holdings agreed to acquire Miller’s Home Center with four locations in Baker City and La Grande, Oregon. Miller’s operates home centers, lumberyards, retail stores as well as a truss plant and cabinet manufacturing facility.

Grant Rosenberger, the owner of a State College, Pa., Ace Hardware store, opened a second location. “I heard that Lewistown had lost some of its hardware stores and that it was a great community,” Rosenberger told the Sentinel newspaper. “So far, it’s been true.”

Kodiak Building Partners acquired Goodrich Lumber. Founded in 1906, Goodrich operates a 45,000-squarefoot drive-through lumber yard, an 8,500-square-foot store and showroom, and a 1,700-square-foot millwork shop.

Mead Lumber Company, HBSDealer’s 2019 ProDealer of the Year, purchased four-unit Teague Lumber Company of the Kansas City metro area. With the purchase, Mead Lumber now has 53 locations in nine western states.

Huffstutlers Hardware is closing after 85 years in business. Jean Huffstutler, the daughter-in-law of founder Tom Huffstutler, Sr., told the Homewood Star newspaper: “It’s just time for me to retire.”

Wehrung’s Lumber and Home Center added a fifth store. Wehrung’s Macungie aims to be a “one stop shop,” for LBM and DIY customers said Brad Jacobs, vice president of purchasing at Wehrung’s family of businesses and general manager of Wehrung’s Macungie.

Do it Best is proud to recognize this year’s HBSDealer Top Women in Hardware & Building Supply honorees. These women are nominated by their peers and selected by a panel of judges for their powerful impact on our industry. Together, they are proving that hard work and the drive to fulfill a vision are a winning formula for success.

Jennifer Coleman Dunkirk Hardware and Home Center

Katie Crowther

Lilian Lumber Company, Lilian’s She Shed Sharona Eiserer Wood Shed Lumber & Hardware

Cherié Jacobs Do it Best

Alison Kelley Kelley Hardware Kassi Lamon Nations Best Holdings

Shannon Patterson Big R Fernley Michelle Stern Lampert Lumber

Rising Stars Award

Jennifer Coleman Dunkirk Hardware and Home Center

Katie Crowther

Lilian Lumber Company, Lilian’s She Shed Sharona Eiserer Wood Shed Lumber & Hardware

Cherié Jacobs Do it Best

Alison Kelley Kelley Hardware Kassi Lamon Nations Best Holdings

Shannon Patterson Big R Fernley Michelle Stern Lampert Lumber

Rising Stars Award

Tony Shepley has been honored by the Massachusetts Retail Lumber Dealers Association (MRLDA) with its Lifetime Achievement Award.

With no experience in the lumber and building materials indus try, a used lumber truck, $4,000, and an idea that there was a need for another lumberyard in Hyannis, Mass., Tony Shepley and a partner started Shepley Wood Products in 1978.

The MRLDA Lifetime Achievement Award honors an individual for their cumula tive contributions to the lumber industry. It is a special recognition to a person who has truly “made a difference” in the business and has made a significant and mea surable impact on the lumber industry and the communities in which they serve.

The award is not presented every year and is only given when a person is nominated and fits the special criteria.

When Shepley Wood Products was founded, the idea of an upstart lumber yard competing with the six established competitors in a 10-mile radius was a preposterous idea. And the competing yards didn’t take Shepley seriously.

Today, Shepley is the only lumberyard remaining in the Hyannis area with additional locations in Wellfleet and Nantucket. The company, a division of Kodiak Building Partners, has over 160 employees.

The MRLDA said Shepley has been a leader in both the industry and his community. He served on the MRLDA board of directors from 1992 to 2001, including one term as president, and on the Northeastern Retail Lumber Asso ciation board from 2007-2013, including one term as chairman.

Shepley has also served on the board for the Cape Cod Chamber of Commerce, Cape & Islands United Way, and the Rehabilitation Hospital of Cape Cod and Islands (now Spaulding Rehabilitation Hospital).

The lumber and building materials executive views his community efforts as “paying your civic rent.”

“I view ‘civic rent’ as a social obligation that we should pay back to our community both personally and professionally,” Shepley said. “The center

of every family is the home. Without safe, stable, and affordable housing, any family is at risk.”

In 1996, Shepley hosted its first charita ble golf tournament — The Shepley Wide Open. Now in its 26th year, the annual event has raised more than $1 million for organizations on the Cape and Islands.

In 2021, Kodiak Building Partners acquired Shepley Wood Products and Shepley transitioned into a new role as president of the company.

Shepley remains excited about lead ing the company he founded in its next stage of growth.

“We have always said that we were in the people business and yes, we sell lum ber and building materials,” Shepley says. “We are an industry of relationship sellers, where your word is still your bond.”

According to Shepley, the dealer has always focused on selling to building pro fessionals. This includes a third generation of the same customer in some cases.

“I have had the same job title for 45 years,” he says. “My goal is to coach and mentor and to carefully choose the times to get out of the way of others to let them grow and prosper.”

Shepley was also honored to share his special MRLDA evening of recognition with two other deserving individuals.

Garry Prevedini from US Lumber also received a Lifetime Achievement Award and Tom McManus from Cape Cod Lum ber Company, Inc. was honored as the MRLDA Lumberperson of the Year.

A Boston native, Shepley has lived in Hyannisport since 1971. He and his wife Lorraine also spend time in Bethel, Maine. They have two sons, Niles and Cole.

Niles works in operations for Shepley’s Nantucket branch and Cole is in his senior year of college, studying architecture.

Midterm elections are always a referendum on the occupant of the White House and the 2022 midterms were no exception. President Biden, armed with a slew of policy victories (e.g., the Bipartisan Infrastructure Law and the Inflation Reduction Act) and social touchpoints (e.g., the Supreme Court’s Dobbs decision to overturn the federal right to abortion and Biden’s executive order on stu dent loan debt forgiveness), campaigned for a continuation of Democratic control of Con gress. To the contrary, the GOP campaigned on the need for change in Washington, citing high crime rates, inflationary pressure driving up the cost of living and the specter of an economic recession.

With the parties well-funded by record-breaking campaign spend ing and both chambers of Congress closely divided, it did not take a “wave” election for either party to claim the majority; it was merely a question “by how many seats.” The high number of early voting bal lots and the counting rules in many states make “election night” more of an “election season.” Eight days after the midterm elections, we do not know the outcome of a handful of the House races and one Sen ate contest, but we do know that the anticipated GOP wave never materialized, and the electorate is split down the middle. Republicans have reclaimed a narrow majority in the House of Representatives. Democrats retained the Senate with a slim 50-49 margin, as Georgia is heading to its third runoff election in less than two years.

So, what does this all mean for home building and housing?

Regardless of the final House and Senate tallies, any legislation with a prayer of being signed into law by Biden must be bipartisan. While the next speaker of the House can likely wrangle the 218 votes needed to move legislation, Senate Majority Leader Chuck Schumer (D-N.Y.) does not have the 60 votes needed to overcome a filibuster. So the parties will need to negotiate and compro mise to move important legislation forward in the next Congress, including housing legislation.

Housing has always been a bipartisan issue. High home prices have pushed ownership out of reach for most Americans and sky-high rents are punishing renters. The housing affordability crisis in America has become a top-tier political issue. As the Federal Reserve continues to tighten monetary policy and the housing sector faces a recession, Congress and the administra tion must turn their focus to policy solutions that lower the cost of building and allow the nation’s home builders to expand housing production. NAHB is poised to work with the new Congress to propose bipartisan solutions to create more affordable and attainable housing.

This article originally appeared at NAHB.org.

Source: HBSDealer Poll Question, n=176

ight off the bat our phones were ringing off the hook.”

That’s Tim Owata describing becoming an Ace Handyman franchisee. Tim and his wife Elena own Coon Rapids Ace Hardware, located in a north ern suburb of Minneapolis, with a population of nearly 64,000.

The owner believed a big part of the handyman experience was the Ace brand recognition. They wanted their service to be an extension of their store — not just ‘the helpful place,’ but the ‘bring helpful to your home,’” as they called it.

Let’s dial back to how this all began.

The story starts with Handyman Matters, a business first founded in 1998 in Denver by Andy and Colette Bell. They grew it locally, expanded it to California, then franchised.

In 2019 Ace Hardware acquired Handyman Matters and in 2020 it was rebranded to “Ace Handyman Services.” At the time of acquisition, there were 64 franchisees with 119 territories. At the latest count, Ace Handyman Services has 191 franchise owners and 344 territories.

The business was created to improve on home improvement, by providing a professional option for homeowners.

The service people who work for the franchisee, have had background checks, carry insurance, and “don’t ask for a penny from the homeowner until the work is done and the quality

For more Ace news, including the co-op's record third quarter, visit HBSDealer.com.

is satisfactory. All work performed has a one-year warranty.”

The success of the program is rooted in the tremendous amount of trust homeowners have in the brand.

“This led more sophisticated franchise buyers to our essen tial business model, including Ace Hardware retailers them selves,” said the owner.

The recent pandemic only served to, “fuel the flames of growth with this essential business.”

With that much growth, there will always be challenges.

Ace Handyman Services has doubled their corporate support and marketing staff to en sure every franchise owner receives the correct support for their growth. “And of course, the labor shortage has had an impact,” said Bell.

Some fast numbers: Currently, of the 191 fran chise owners who own 344 territories, 27 are Ace Hardware store retailers who own 48 territories.

“We cover more than 700 Ace Hardware stores with all our territories, regardless of who owns the franchise.”

On average, one Ace Handyman Services territo ry comprises zip codes totaling 70,000 households and can encompass three to four store locations.

“There is so much more room to grow. This is likely to be a rocket ship, with trust of the Ace brand as a dependable supplier, and so many open territories available,” said Jeff Gooding, corporate VP marketing at Ace Hardware.

The owner provided tips for other owners thinking about launching a handyman program: “Use business systems, technology and software, process and procedures that cre ate a scalable business model.

“Keeping track of each handyman and handywoman, what they can do, each customer, what they want done and have had done in the past and making all that run smoothly and delighting customers every time is not an accident.

“It takes work, process, and more than 24 years of experience.”

The American consumer is transitioning from a Do-ItYourself mentality to a Do It For Me society that purchases more and more home services, he said, and the Millennial generation is the largest.

“They are buying the home, but not the ladder, lawn mower, drill or saw to do any of the home restoration projects they want accomplished.”

“Elena and I own a couple of Ace Hardware stores; and rarely a day would go by that a customer didn’t ask if we could have someone come over and work on their project,” said Tim Owata.

He reached out to Colette Bell to ask for more information about the program, and it didn’t take long to know that it was “a perfect fit,” he said, for their business model.

Owata said there is, “a wonderful support team to make sure things go as smooth as possible.”

The owner of Coon Rapids Ace Hardware said it took a couple months to really get a solid team put together, but once they had that, everything started moving along well.

There were some obstacles too.

“The challenge was not lack of work, rather the lack of qualified craftsmen,” said Owata. “The employee turnover rate is high in the carpentry and handyman trades; this was apparent immediately.”

But he saw the value the service added to his store.

“I know from my own experience before owning an Ace Handyman Service franchise, that there were some apprehensions referring our customers to any service out there without fully knowing the quality of work being done.”

Now he sees, “the high standards that Ace Handy man Services hold their franchises to and can with confidence vouch that this is a great partnership.”

The owner pointed out that handyman services help differentiate their hardware business.

“One of the biggest complaints our customers have had with other services is just getting someone to answer the phone or return a call. This is a huge issue,” said Owata.

“Our customers love that we set exact appoint ments, not just a time window; and our craftspeople are calling the night before to confirm the appoint ment and go over what needs to be done.”

He said the reviews speak for themselves, as thus far they are maintaining 5 out of 5 stars.

“We strive to be the premium service in the market and even just a few months into opening our fran chise, we have many repeat customers already.”

Want to launch a handyman program?

Owata said there’s more work out there than there are people to do it – but the market demands quality of service and communication.

“Set your standards high from the get-go and don’t waiver – be prepared to put in the work,” he said.

Then added: “Ace Handyman Services is a class act. You won’t find a better partner.”

FORGET THE HEADWINDS, THIS HARDWARE CHAIN IS GROWING.

By Ken ClarkDon’t let the headlines hyping inflation and reces sion get you down. The hardware business is on a win-streak, and there’s no need to break it.

That’s one of the messages emanating from Deer Park, N.Y., headquarters of the ambitious, family owned Costel lo’s Ace Hardware chain and its growing fleet of 46 stores.

“We’re going to lean into 2023, ignore the naysayers and invest in what’s working well for us,” said Ken Goodgame, senior vice presi dent of merchandising and marketing for Costello’s Ace Hardware.

Goodgame’s comments followed a busy period for the retailer. Costello’s recently hosted more than 40 of its largest vendors in Long Island for its annual Vendor Summit. Previously, the retailer closed a deal to acquire five new hardware stores from the Smith’s Ace chain in New Jersey and eastern Pennsylvania. (A sixth Smith’s Ace store was not part of the deal.)

And on top of everything else, a new-from-the-ground-up Costello’s Ace Hardware store opened in mid-October in Pur cellville, Va., about 40 minutes west of Washington, D.C.

The retailer’s growth was another point of emphasis during Costello’s second annual Vendor Summit.

“One of the major messages from the summit was to emphasize growth opportunities for our vendors when they support Costello’s,” said Joey Costello, director of marketing for the family-owned retailer. “’Lean into Costello’s’—that was the theme. And grow with us.”

The retailer has shown itself quite capable of expanding its

footprint in the densely populated New York metro area and New Jersey. And the company has a lofty goal of reaching 75 stores by 2025.

According to Goodgame, the five Smith’s Ace stores represent a perfect opportunity for Costel lo’s Ace to bring its “special sauce” of culture and operations to five high-income markets, including Princeton and Chatham in New Jersey, and New town, Pa. “We’ll do a little remodeling, get them in stock and make sure the grill departments are in line with what we are doing in other stores that have yielded great results for us,” he said.

The five Smith’s Ace stores will convert to the “Costello’s” banner eventually, probably in early 2023.

During its vendor summit, Costello’s recognized The Hillman Group as the company’s 2022 partner of the year. Costello’s also recognized two regional sales/ser vice representatives for their distinguished service: Dan Grantham of Creedan and Mike Castan of Arett Sales.

Costello’s Ace Hardware, with stores in New York, New Jersey, Pennsylvania, Maryland and Virginia, will celebrate its 50 th anniversary next year.

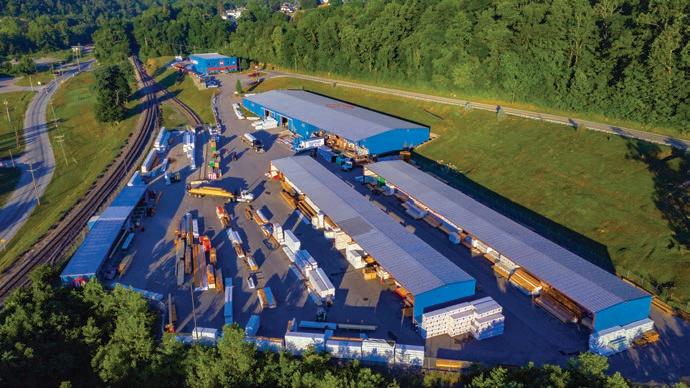

SCOTTSDALE, Ariz. — Record growth was on the agenda at Epicor’s Insights 2022 for Building Supply conference.

Held here at the Westin Kierland Resort and Spa, the software and technology solutions provider provided of how the compa ny has grown in recent years at its most-highly attended LBM conference to date.

In her opening, keynote address, Epicor President Lisa Pope noted that Epicor has broken the $1 billion in revenue mark and now has 21,000 customers globally. About 10,000 of those cus tomers are on the cloud with Epicor witnessing a 67% increase in year-over-year growth in regard to customer cloud migration.

“Our customers are choosing to stay with us,” Pope told an audience of dealers during her opening remarks.

In the past year, Epicor has also made five acquisitions while establishing 25 new channel partners.

This year’s LBM conference also followed the path to growth. About 800 attendees representing more than 600 company cus tomers were present. When the conference began 15 years ago, 59 customers attended. Just under 400 attended in 2017.

While the economy has been slow to add new jobs, with just 200,000 added this past month, Pope noted that the market is strug gling with finding highly skilled labor. But Pope said Epicor has been doing a thorough job in “investing in people,” and the recruitment, retention, and development of company associates is a top priority.

Epicor also presented awards to three customer companies and made contributions to their charities of choice.

The BisTrack Excellence Award was presented to Arnold Lumber Company, based in Rhode Island.

Arnold Lumber Company has been serving build ers, remodelers, homeowners, and the community since 1911. Overall, the partnership with Epicor and Arnold Lumber Company has allowed for process es to become more efficient, user friendly, and helped the dealer step into the future.

A $2,000 check was presented to a team at Arnold Lumber who chose the Rhode Island Food Bank as its charity.

The President’s Excellence Award was given to Spahn & Rose Lumber Co. with 28 locations across the Midwest. Spahn & Rose joined the BisTrack fami ly in Jan. 2019.

Over the years, Spahn & Rose has continually improved its operations, adopted technological inno vations and improved efficiency—all while maintaining its steadfast commitment to its customers.

According to Spahn & Rose, BisTrack has allowed the dealer “to centralize processes, to take mun dane tasks away from the yard, and let the yards be more customer-focused.”

The data that drives the company has also driven up profits in recent years. While Spahn & Rose nearly reaching the $200,000 million mark in sales.

The Iowa-based prodealer chose The Fountain of Youth as its charity.

The Epicor LumberTrack Excellence Award was presented to the Mendocino Family of Companies, which manufactures and distributes environmentally certified wood products to diverse markets throughout California and the Western United States. Mendocino owns over 228,000 acres of timberlands within California.

Mendocino joined the Epicor LumberTrack family in June of 2012 with tech implementation consisting of two major phases. The company’s All-Weath er Wood Preserving Company, headquartered in Washougal, Wash. went live in January 2013 followed by Mendocino Forest Products in Central California. With facilities across California, Oregon, Washington, Colorado, and Utah, Mendicino became one of our largest LumberTrack customers.

The integration of LumberTrack and the Unified Transportation System streamlined truck management and scheduling with Mendocino implementing an An droid-based picking app that improved operations.

The company chose The Community Foundation of Mendocino County as its charity.

Also during the conference, Epicor unveiled new offer ings and features for LBM customers. Highlights include improved security, scalability, performance, and data localization, as well as enhanced functionality for distributors.

The hardware and building supply dealers compete for share of wallet with retailers across sectors. That’s why HBSDealer features its Eye on Retail re ports each week, to keep tabs on ideas, trends and tactics that are impacting, or may eventually impact, our space.

Here’s some of the latest reports for this industry to keep an eye on.

Amazon reported that it will continue efforts to reduce its headcount.

The e-tail giant con firmed it will consoli date some positions in its devices and ser vices organization (responsible for product lines such as Amazon Echo and Kindle devices) and has also offered voluntary reductions for some employees in its people, experience, and technology (PXT) organization, will lay off more employees in early 2023.

In a corporate blog post, Andy Jassy, CEO of Amazon, said there will be more role reductions as its annual planning process continues into early 2023.

Jassy also said the company will notify affected employees and departments ahead of any public layoff announcements. Amazon will try to place laid-off workers in other roles within the company, and provide packages that include a separation payment, tran sitional health insurance benefits, and external job placement support for employees that cannot be internally placed.

Although Amazon has not made a final selection of the exact number of jobs it will eliminate, a reduction of 10,000 workers would represent the largest layoff in company history, totaling less than 1% of the e-tail giant’s total worldwide workforce and about 3% of its corporate staff.

In time for the holidays, Shipt is upgrading its experience both for customers placing and delivery personnel fulfilling online orders.

The same-day delivery and last-mile company, which was acquired by Target in 2017, is introducing several new tools for its shoppers (Shipt’s term for the contactors who pick and deliver items for customer orders), including:

Drop orders anytime: If a shopper has something come up before they start shipping an order, they no longer need to have a conversation with Shipt. With the click of a button, shoppers can

now drop most orders, and Shipt personnel will ensure orders are claimed by another available shopper.

Incorporating chat into apps: Conversations between shoppers and customers will now take place in the Shipt shopper app instead of via SMS text, creating a central hub that keeps order information in one place.

Automatic ratings forgiveness: Soon, Shipt will roll out a new feature that tracks customer rating patterns and helps evaluate when a customer’s poor rating of a shopper should be forgiven.

Shipt has also redesigned its customer experience: Universal search: A new browsing feature allows customers to first search for the product they’re looking for, and then serves up results across all the retailers that carry that product.

The nation’s largest sporting goods retailer is making a strategic investment into SidelineSwap, a platform for buying and selling new and used sporting goods. The unspecified investment builds upon a partnership the two companies initially launched in August 2022.

SidelineSwap offers the SidelineSwap Trade-in Platform, which includes pop-up events, in-store and online trade-in options, and a suite of tools for resellers to manage their own trade-in experiences. The Trade-in Platform runs on SidelineSwap’s propri etary marketplace technology and resale data.

The platform’s hybrid model, which includes peerto-peer and first party sales, gives sellers the option to choose direct resale or instant trade-in value. Customers can also find listings on some platform partners’ branded marketplaces.

As part of their previously existing partnership, Dick’s and SidelineSwap are offering a series of 50 new tradein events in seven states through the end of 2022. The companies have previously held 10 trade-in events at four Dick’s locations, with plans to expand their partner ship to additional markets in 2023.

Customers who attend trade-in events at Dick’s locations can bring their used gear and have it evaluated by SidelineSwap buying experts, using SidelineSwap’s proprietary trade-in software and value guide.

Veterans Day 2022 was marked by what seemed like a battalion of industry events that supported those who served in the military. What follows is just a sample of the kinds of generous support this industry commonly serves up for those who served.

Beacon, the roofing and building product distributor, has announced the winners of its annual Beacon of Hope con test. The program awards U.S. and Canadian veterans with new roofs. Together with local roofing companies, Beacon will deliver and facilitate roof replacements for 10 veteran contest winners at no cost to the award recipients.

“Veterans are important members of our employee team and local communities, so it is our honor to support them beyond their years of service,” said Jonathan Bennett, chief commercial officer at Beacon. “The Beacon of Hope contest ensures they have a safe home secured by a reliable roof. To extend the impact of this program in the Veteran community, we are also excited to be replacing the roof on an American Legion Post this year.”

In honor of Veterans Day, The Home Depot Foundation surprised 1,000 U.S. veterans across the country with rental and mortgage payment assistance for the month of December.

“This housing payment assistance is just one of the ways The Home Depot Foundation and the company are commit

A recent HBSDealer reader survey asked: How, if at all, does your company recruit military veterans?

The results:

A)

3% B)

C) Both A and B; 14%

D) Neither A nor B; 49%

ted to supporting and thanking those who served our nation,” said Ted Decker, chair, president and CEO of Home Depot.

Many of these veterans previously faced homelessness before securing permanent sup portive housing in facilities operated by long standing Foundation partners, said the retailer, including U.S. Vets, Volunteers of America and Quest Communities.

The US LBM Foundation recently donat ed $300,000 to the Gary Sinise Foundation to support the construction of a mortgage-free, spe cially adapted smart home for retired U.S. Army Captain Jason Church.

The US LBM Foundation presented the dona tion to Church and his wife Bella at the US LBM Foundation’s annual golf fundraiser in September. Captain Church had both of his legs severed below the knee in 2012 when an Improvised Ex plosive Device (IED) detonated while he was on a routine patrol in Afghanistan.

Supporting veterans is a year round practice. 84 Lumber held its seventh annual Operation Appreciation campaign during the month of May (Military Appreciation Month), doling out $10,000 each week to various military-related charities. More recently, 84 Lumber shared highlights of the career of John Vincent, who began with 84 Lumber as a management train ee, rose to store manager, and now serves as area manager for Tennessee and Alabama.

“Veterans understand camaraderie and seek it outside of the military service,” Vincent said.

“With the leadership training I received in the army, it was my goal to continue leading a team and to become a store manager. It was easy for me to relate working in a store to my military service. At the end of the day, both require a team of people working together to accomplish a goal. With hard work and dedication, 84 Lumber provides the op portunity for everyone to advance.”

We actively work with military job placement programs;

We actively seek out veterans in informal ways; 34%

The Top Women Awards Event was back in Chicago, and bigger than ever.

By HBSDealer StaffRising Stars and Business Excellence honorees generated applause and enthusiasm during opening night of the 2022 Top Women in Hardware and Building Supply event.

HBSDealer Associate Publisher Amy Grant helped kick off the gala by welcoming honorees and all attendees who “are here to help celebrate this industry and the amazing women that are a part of it.”

The two-day event was much more than a celebration. Detailed analysis was applied to issues that matter most to women in the work force: from advice on creating corporate allies to a deep dive into the Strengths, Weak nesses, Opportunities and Threats facing the role of women in a male-dominated industry.

Sarah Alter, founder of NextUp (formerly The Network of Executive Women) shared a presentation on the state of Diversity, Equity, Inclusion and — the most recent addition to the business-building concept of DEI — Belonging.

“Belonging is feeling a sense of connect edness and community,” Alter said.

There was a strong feeling of belonging during the awards ceremony that recog nized Rising Stars and Business Excel lence honorees.

“When you walk into an account, find value in every person in all levels of the organization,” said Diane Frazee, a Business Excellence honoree and national account man ager from National Gypsum. “From the forklift driver to the purchasing agent too the president. Connect with them. Recognize their contributions, and at the same time establish your own value. Know that your words and your actions matter.”

advice she received as an 18-year old from her grandmother: “If you’re going to be anyone in business,” Renaud related, “you have to learn to drink scotch.”

That unorthodox advice seems to have paid off for Renaud, who, like several other honorees, also shared appreciation for this industry.

“To have an opportunity to be in a role where I actually get to participate in creating beautiful homes, beautiful spaces, quiet spaces and safe spaces, is absolutely amazing,” she said.

More than 330 people attended the 2022 Top Women in Hardware & Building Supply event, a significant increase from the first live event held in 2021. Looking ahead: The 2023 event is slated for Nov. 14-15, back in downtown Chicago at the Sheraton Grand Chicago.

The two-day Chicago event brought more than 330 industry professionals together to network, share ideas and support the role of women in the industry.

The best years are still ahead for these Rising Stars.

By HBSDealer StaffDuring the course of the selection process for the 2022 class of Top Women in Hardware and Building Supply, the official nomina tion forms received by HBSDealer told the highly abbreviated stories and shared pertinent career highlights of well over a hundred talented professionals whose best years in the business remain in the future.

The pool of candidates for the honorary title of “Rising Star,” included account reps, sales trainees, marketers, merchants, managers and even presidents. But more important than their titles, these women were making a difference in the day-to-day operations of their compa nies, and making positive contributions to the industry.

The nomination forms included specific phrases such as:

“Always eager to help customers.”

“People like her will bring the building materials industry to the next level.”

“A champion of continuous improvement … she plays a significant role in driving a positive culture.”

“Excels at seeking out what more could be done — and how we could do it better.”

The Rising Star award recognizes a talent ed professional with the potential to make a significant positive difference within her company and within the industry for years to come. And in general, the sheer volume of submissions left no doubt that the talent in the industry is rising, along with the careers of these stars.

Here and on the following pages, we cel ebrate the accomplished Rising Stars of the 2022 class of Top Women in Hardware and Building Supply.

Materials matter when you’re installing floors. EXACOR™ MgO boards can help protect against fire and sound in multifamily structures,* and stay dimensionally stable during your build. EXACOR™ panels can also help projects stay on schedule by reducing the number of trades on site. So the question is, why would you ever build with gypsum underlayment again?

ake miracles happen.”

“Never quit on your goals.”

Those were the opening words from Fran Monk, VP of mar keting at LMC, moderating the SWOT panel at the Top Women in Hardware and Build ing Supply event hosted by HBSDealer.

During the discussion on strengths, weaknesses, opportu nities and threats, industry leaders shared their thoughts on advocating for yourself and other women.

It began with a song.

Stefanie Couch, director of sales for American Builders Supply, told the audience of some 300 women and men during introductions that she was a trained opera singer. At the crowd’s request, she sang a solo — to a standing ovation. illustrating one of the panel’s major themes: “Use your voice,“ she said. “Speak up about the things you need.”

The panel was one of several on day two of the event that touched on heavy topics for women in the industry.

“Business tends to be old school,” said Emily Morgan, CEO Ashby Lumber. “Companies in the industry need to have better benefits, so that way your organization lifts you up.”

Margi Vagell, SVP and general merchandising manager at Lowe’s, said women should be “advocates for the balances in life we need.”

Along those lines, moderator Monk posed to the pane the question: “How do women promote themselves?”

“Question things. Ask yourself, ‘can we do things better?’” said Couch, adding, “don’t be afraid to ask

for help and support.”

Speaking up for oneself is one side of the coin. Speaking up for colleagues is the other.

So much of your role is mentoring, said Vagell, looking out on the faces of the attendees. “Remem ber we’ve gotten so much help along the way,” she said. “We must pay it forward.”

The topic of Allies and Advancement was taken up full force by a suvse quent panel. Sunny Bowman, presi

POINTS MADE: Day two topics included a deep dive into “Alllies and Advancement” plus a SWOT analysis of the status of women in the industry. (Clockwise from top left) Sunny Bowman of Dakota County Lumber speaks as Home Hardware’s Carol Crystal looks on. Stefani Couch of American Builders Supply urged the audience to “use your voice.” Lowe’s Margi Vagell makes a point during the “SWOT Session.”

dent and owner of Dakota County Lumber, set the state with some stats. Figures from the Bureau of Labor Statistics and noted that wom en make up just 11% of the construction industry compared to 46% of the overall workforce.

“Obviously we have some catching up to do,” Bowman said.

Amy Bass Messersmith, chief people officer at Builders FirstSource, noted that women in the industry sometimes need to feel a sense of belonging and availability. “I need to look around and see other women that I can learn from and establish a sense of community,” she explained.

Builders FirstSource is currently piloting a program in the Northeast where women can get together for discussions about their career experiences. Messersmith said the group recently had an “impressive” in-person meeting and the pro gram is “well underway” for a national rollout.

Home Depot launched a similar program, Women in Pro, that allows that provides a space for discussions, guest speakers, team-building events, and opportunities to learn about one another’s hurdles.

“With Women in Pro, it gives us a chance to share our experiences,” said Kimberly DeJesso, regional pro sales director, The Home Depot.

DeJesso noted that while her career ascended at The Home Depot, it was not without challenges her male peers did not have to contend with. This included maintaining a house hold and parenting while working long hours.

Messersmith suggested a remedy and said that women can outsource some jobs at home such as grocery shopping. “Outsource what doesn’t bring you joy,” she said.

The Builders FirstSource executive also noted that she is a “people studier,” which has led her to success in finding mentors.

“I look at how they relate or demonstrate empathy or bring fine point to a discussion,” Messersmith explained. “Go to that person and ask to learn about the person’s process; those are mentors.”

“Sometimes we are overcomplicated,” she add ed. “There are people who have mentored me and they never knew it.”

This new line of attachments quickly converts select impact drivers into fast, powerful cutting tools.

“Instead of purchasing separate dedicated pipe cutting tools, Impact Connect attachments leverage the power of users’ current impact drivers to perform the job quickly with less cutting effort,” said Doug Redpath, president of hand tools, accessories and stor age at Stanley Black & Decker.

Designed to improve user productivity, the system is rolling out two new attachments: A copper pipe cutter attachment (DWACPRIR); and a PVC/PEX pipe cutter attachment (DWAPVCIR) Both shown here.

The copper pipe cutter can make four times faster cuts with up to oneinch maximum cut capacity, said the firm. The PVC/PEX pipe cutter can make six times faster cuts with up to two-inch cut capacity in schedule 80 PVC. Both have 360-degree rotation.

The newest cordless FrameFAST Structural Framing System by FastenMaster is de signed to drive jobsite productivity. The cordless FrameFAST Tool offers contractors and installers a tangle-free experience that increases safety on the job site while increasing speed and productivity. With the choice of a professional grade DeWalt or Milwau kee drill, the FrameFAST tool comes with a limited 3year warranty. Using the recom mended battery, users will be able to drive up to 200 fasteners on a single charge.

The system consists of both the structural wood screw and the FrameFAST tool. One tool, with three interchangeable heads, provides consistently accurate installa tion along with increased speed and safety and eliminates a variety of clips, straps and ties used to transfer forces from one faming member to the next.

Additionally, the system allows PROs to stand safely on the floor, eliminating the need for ladders, pneumatic nailers, and other safety hazards. Critical connections are made five times faster and provide greater uplift and lateral load capacity.

Manufactured to give the professional the best fitting screwdriver with max grip, this new screwdriver is custom machined to deliver a precise fit and reduce stripping during demanding fastening applications.

For added confidence, the tips are laser etched to increase the gripping surface. Manufactured with high-strength boron-in fused steel for in creased hardness, the product also provides increased versatility. Certain screwdrivers include a wrenchready bolster for added torque, and a knurled shank for precision control.

Quick identifica tion markings on the handle make it easy to identify screwdriver tip size, including Phillips, cabinet, ECX, slot ted, and square.

Made in the USA, and backed by a complete Lifetime Guarantee, the screw driver offering comes in shank sizes from 3-inch to 10-inch.

The Power Drive delivers a hand-held cordless threading solu tion. Designed for portability and ease of use on the jobsite.

Powered by Ridgid all-new FXP Technology Platform, the battery-powered tool features the same proven profes sional quality and durability, with intuitive smart technolo gy to improve the users’ threading experience.

The 760 FXP threads faster than any other cordless handheld threader on the market today when threading 1 ½-inch to 2-inch Schedule 40 pipe.

ToughBuilt pointed to stats show ing the global hand saws market is valued at more than $450 million and is forecasted to grow to $565.3 million by 2028 (a CAGR of 3.6%).

Into that market comes what Toughbuilt describes as the first ever safe-folding pull saw. It features a folding dual-edged ryoba-style pull saw. The integrated folding mechanism allows the blade to store inside the saw’s handle, providing the user with a full-length saw that can be safely stored or transported in a compact form.

RIDGID threader die heads of that type. It reaches 42 RPM in forward and reverse.

“At Ridgid we are continuously talking to trade professionals about what they need and want on the jobsite. Our team regularly hears requests for new tools that provide quality results, save them time and put less strain on their body,” said. Zach Mospens, product manager, Ridgid.

The760FXPPower Drive threads1/8-inch to 2-inch pipe and is ideal for multiple new construc tion and repair applications on mechanical, electri cal, plumbing, HVAC and oil/gas projects.

ToughBuilt Industries’ CEO, Michael Panosian, stated, “We expect that this line of high-quality, trade-specific saws will allow us to capture further market share in the hand tools segment.” Panosian continued, “At present, innovation is the key fac tor that helps recharge marketplace demand for new products. Launching the industry’s first safe-folding double-edge pull saw as we enter the hand saws market provides us with a unique opportunity to lead this category and expand our brand awareness.”

The product is part of a launch of 21 new SKUs into the global handsaws segment The new line will be available Q4 2022.

The equipment rental industry is expected to see single-digit increases over the next four years according to the latest American Rental Associa tion (ARA) forecast.

The forecast calls for equipment rental revenue — which in cludes the construction and industrial as well as the general tool segments — to increase by 3.4% in 2023 to nearly $57.7 billion after growth of 11% in 2022 to reach almost $55.8 billion.

In subsequent years, equipment rental revenue is expected to grow 2.9% in 2024, 3.3% in 2025, and another 3.4% in 2026 to reach nearly $63.4 billion.

“In the current forecast we see a definite softening in rental reve nue growth, but we do not see negative growth,” says John McClel land, ARA vice president for government affairs and chief economist.

The construction and industrial segment, according to S&P Global Market Intelligence, the forecasting firm that compiles data for the ARA forecast and the ARA Rentalytics subscription

service, showed double-digit revenue increases in 2021 and 2022 at 10.2% and 12.7% respectively.

The segment is forecast to show a 4%increase in 2023, 2% in 2024, and 3% in 2025 and 2026.

On the general tool side, revenue growth was a more moderate 4.5% in 2021 and 6.2% in 2022 and is forecast to be 1% in 2023 and then 5% in 2024 and 2025 and 4%in 2026.

“There is variability in the forecast, depending on the end markets rental companies serve. However, nonresidential construction spending will be strong, and money continues to be spent from government stimulus programs, which both are positives for the rental industry,” says Tom Doyle, ARA vice president, association program development.

“In addition, the supply chain is improving, which can help alleviate the backlog of equipment orders,

allowing equipment rental companies to expand inventory to meet demand, which adds to the positive outlook for the industry in 2023 and beyond,” Doyle added.

According to S&P Global Market Intelligence, investment in con struction and industrial equipment now is expected to decline slightly in 2023 after growth of 55.1% in 2021 and 40% in 2022. Investment

The American Rental Association anticipates an 11% increase in equipment rental revenue for 2022.

growth is forecast to be 4.8% in 2024 and 6.4% in 2025.

In Canada, equipment rental revenue also showed a post-pandemic boost of 15.8% and 11.1% in 2022 to reach $4.6 billion. The same as in the U.S., revenue growth is expected to settle into a single-digit pattern over the next four years.

The ARA forecast calls for equipment rental reve nue in Canada to increase by 1.6% percent in 2023, 4% in 2024, 5.3% in 2025 and 3.5% in 2026 to reach nearly $5.3 billion.

The American Rental Association, based in Moline, Ill., is an international trade association for owners of equipment and event rental businesses and the manufacturers and suppliers of construction/industrial, general tool and party/event rental equipment.

ARA members include more than 11,500 rental businesses and more than 1,000 manufacturers and suppliers in the United States and 44 countries worldwide.

Builders FirstSource surprisingly announced that President and CEO Dave Flitman has stepped down to accept another opportu nity outside of the industry.

Flitman was also a member of the company’s board of directors. At presstime, it’s not known where Flitman is headed.

In the meantime, the board has appointed Dave Rush, executive vice president, to serve as interim CEO until a permanent successor is named.

A special committee, led by Builders First Source Chairman Paul Levy, has also been formed to search for a new CEO.

Rush, 60, has spent 23 years with Builders FirstSource. In his current role as EVP, Strategic Management Office (SMO), Rush oversees the execution of enterprise-wide initiatives to advance the company’s long-term strategy and provide en hanced value to stakeholders, the company said.

Prior, Rush led the integration and synergy efforts for our acquisitions of BMC and ProBuild.

“With deep operational, financial and busi ness development capabilities, we are confident in Dave’s ability to lead Builders FirstSource as interim CEO,” Levy said. “Heading into the new year, we are well-positioned to continue to outperform the market, owing to a deep and experienced leadership team, fundamental strengths and advantages, a clear strategy and a strong balance sheet.”

Rush started his career at Builders FirstSource in 1999, serving in operational roles of increasing responsibility including as Chief Operating Officer of the compa ny’s eastern division and EVP, Integration Management Office, responsible for the integration of Builders FirstSource and BMC.

“I’m honored and excited to serve as interim CEO during such an important time for the company,” Rush said. “Despite a challenging macroeconomic environment, Builders First

Source has an advantaged geographic footprint, industry-leading market position, and a strong culture, which position us well for continued success.”

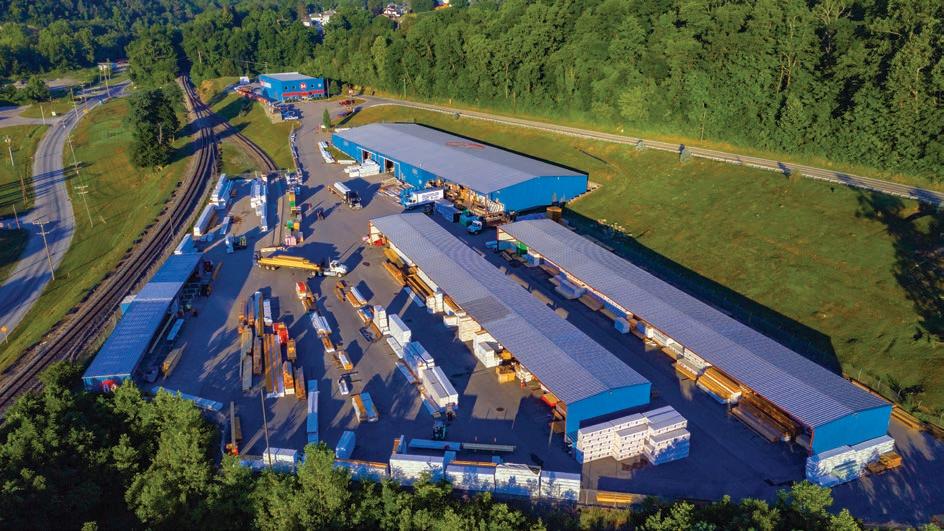

Based in Dallas, Texas, Builders FirstSource is the largest U.S. supplier of building products, prefabricated com ponents, and value-added services to the professional market segment for new residential construction and repair and remodeling. The company operates about 575 locations in 42 states.

Flitman took over as company the com pany’s top executive in April 2001 follow ing the retirement of CEO Chad Crow.

Prior, Flitman served as CEO of BMC Holdings before it merged with Builders FirstSource at the start of 2001.

“The board is grateful for Dave Flitman’s many contributions,” Levy said. “Under his leadership, the Company successfully merged with BMC, increased its share in value-added products, and accelerated its profitable growth strategy. On behalf of all Builders FirstSource team members, we wish him the best in his next role.”

The company has been in good hands under Flitman’s guidance as it ramped up a collection of acquisitions over the past two year and saw third quarter sales rise 4.5% to $5.8 billion. During the quarter, core organic sales increased by 6.9% and acquisitions contributed net sales growth of 5.2%.

“It has been an honor to work with our great team, stakeholders, and board of directors,” Flitman said in a statement issued by the company. “Builders First Source is stronger than ever and I am confident the company is poised to outperform the market over the next several years as it transforms the homebuilding industry. I am truly grateful to have had the opportu nity to lead this incredible company.”

Profits have also surged at the super dealer as it reported a third quarter net income of $738 million, growing more than 20% from a net income of $631.1 million for the same period a year ago.

Looking ahead, Builders FirstSource has not deviated from its forecast for the year and expects full-year sales to grow to a range of $22.5 billion to $23 billion, or approximately 13% to 16%, over 2021 sales of $19.9 billion.

“Heading into the new year, we are wellpositioned to continue to outperform the market.”

—Paul Levy, Chairman, Builders FirstSource

announced that Tim Knavish, chief operating officer, has been named presi dent and CEO, effec tive Jan. 1, 2023. He joined the company’s board of directors, effective October 20, 2022. Knavish has served as PPG’s chief operating officer since March and succeeds Chairman and CEO Michael McGarry in the role of CEO.

installation management for exterior building products, sales management, and personal in-home sales.

Kodiak Building Partners named Scott Morrison to the newly created role of vice president of continuous improvement. In this role,

A new Haslet, Texas branch of ABC Supply will be managed Anthony Favara, who joined ABC Sup ply’s Garland, Texas, location in 2018 as an outside sales represen tative. During his sales tenure, Favara built a loyal customer base and quickly became one of the top sales associates in his district.

BrassCraft

Avon Plastics announced the addition of Doug DeLuca as vice president of sales and marketing. DeLuca has over 30 years of home improvement ex pertise in varying functions, including national program management for both a big box re tailer and distributor, national training director responsibilities for home improvement manufacturers, regional

DeLuca

Morrison will help develop Kodiak’s nationwide initiatives for eliminating waste and streamlining operations processes. Morrison is known for his prior consulting business, Scott Morrison Consulting, where he has helped numerous building materials companies over the years. He has successfully completed projects in about 10 Kodiak companies over the past 18 months, giving him a unique understanding of how to support and interact with Kodiak’s leader ship team and thrive in a locally-led organization.

Company named Mike Roberts vice president of sales and marketing, taking over for the retiring George Werner, after 27 years of service. The company said Roberts will now lead a unified global sales, marketing, and product development team. As a 12-year Masco veteran, Roberts joined BrassCraft as VP of marketing and product development in 2018, previously having managed the fixtures business at Delta Faucet Company.

Clamps without compromise. A woman running a manufacturing company was unheard of in 1903. But that’s exactly what our founder, Adele Holman, did. She was a leader who never compromised. As a proud sponsor of HBSDealer’s Top Women in Hardware and Building Supply Awards, we continue to honor her legacy and celebrate the women who are blazing new trails in our industry. ponyjorgensen.com

When the pressure’s on, we don’t budge.Founder, Adele Holman