How

P2PI.com JAN/FEB 2023

RETAIL MEDIA

look at the forces shaping the current and future landscape BATTLING INFLATION

FOCUS:

A

marketers are dealing with the impact of high prices at the shelf JAN/FEB 2023 P2PI. com TRENDS RETAIL MEDIA METAVERSE DIRECT-TO-CONSUMER PHYSICAL EXPERIENCES 2023 E-COMMERCE RETAINING TALENT DATA SHARING RETENTION & TURNOVER DATA TRANSPARENCY SUPPLY CHAIN IN-STORE TACTICS ROI BRAND MARKETING PERMANENT DISPLAY

COMMERCE SOCIAL MEDIA DATA SHARING SHOPPER MARKETING BUSINESS-RELATED CONCERNS BUDGETING SUPPLY CHAIN SHOPPER ENGAGEMENT ECONOMY & INFLATION TARGETING EFFECTIVENESS OMNICHANNEL MEASUREMENT TEMPORARY DISPLAYS DIGITAL MARKETING

SURVEY RESULTS REVEAL THE

CHALLENGES AND

SOCIAL

OUR

TOP

OPPORTUNITIES

HOW TO WIN AT RETAIL

Get started today 855.909.2053 or greatnortherninstore.com FROM CONCEPT TO REALITY

With in-house expertise in design and manufacturing, we bring your vision to life and transform an average shopping day into a memorable experience. Our innovative approach adapts to changing markets and shoppers’ needs with transformational displays from temporary to permanent RESPONSIVE CONSULTATIVE CREATIVE HIGH QUALITY COST EFFECTIVE RELIABLE

Path to Purchase Institute magazine (USPS 4568, ISSN 2835-0219) is published bi-monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rate for the U.S.: $80 one year; $155 two year; $14 single issue copy (pre-paid only); Canada and Mexico: $105 one year; $185 two year; $16 single issue copy (pre-paid only); Foreign: $115 one year; $215 two year; $16 single issue copy (pre-paid only); $56. Periodical postage paid at Chicago, IL 60631 Copyright 2023 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Path to Purchase Institute magazine, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. FEATURES Jan/Feb 2023 VOLUME 36 | ISSUE 1 Contents P2PI.com 22 34 Trends 2023 Our annual path to purchase survey examines the challenges and opportunities facing the commerce marketing industry as we enter a new year. Battling Inflation CPG brands continue to focus on product quality, creating value for consumers and strengthening retailer relationships. COVER STORY TRENDS RETAIL MEDIA METAVERSE DIRECT-TO-CONSUMER PHYSICAL EXPERIENCES 2023 E-COMMERCE RETAINING TALENT DATA SHARING RETENTION & TURNOVER DATA TRANSPARENCY SUPPLY CHAIN IN-STORE TACTICS ROI BRAND MARKETING PERMANENT DISPLAY SOCIAL COMMERCE SOCIAL MEDIA DATA SHARING SHOPPER MARKETING BUSINESS-RELATED CONCERNS BUDGETING SUPPLY CHAIN SHOPPER ENGAGEMENT ECONOMY & INFLATION TARGETING EFFECTIVENESS OMNICHANNEL MEASUREMENT TEMPORARY DISPLAYS DIGITAL MARKETING OUR SURVEY RESULTS REVEAL THE TOP CHALLENGES AND OPPORTUNITIES

Editorial Advisory Board

Keith Albright

Kimberly-Clark

Dana Barba

Coca-Cola North America

Stephen Bettencourt CVS Health

Lianna Cabrera

L’Oreal Paris Cosmetics

Mia Croft

Native Christiana DiMattesa Under Armour

Gregg Dorazio Giant Food (Ahold Delhaize)

Paige Dunn

Water, JUSTIN Vineyards & Winery, Landmark Vineyards & JNSQ Wines

Fung

FIJI

Lynch

Padron The Hershey Experience

Rigby Amazon Jeff Sciurba Dyson Americas Kelly Sweeney The J.M. Smucker Company Rodney Waights Beiersdorf Ethelbert Williams Johnson & Johnson Consumer Health

Tony

Bob Evans Farms Patrick Hallberg Apple Travis Harry Home Depot Brendon

Jushi Holdings José Raul

Jonny

Follow the Path to Purchase Institute here: Contents 4 l Jan/Feb 2023 DEPARTMENTS 6 Editor’s Note The Pulse of the Industry 8 P2PI Member Spotlight 10 Perspectives 12 Focus: Retail Media Q&A with Criteo 14 The New Consumer 16 Brand Watch Molson Coors and Drizly 18 In-Store Experience Ulta’s Merchandising Overhaul 20 On Trend E-Commerce Product Content 38 Activation Gallery Holiday 2022 42 Solutions & Innovations 46 Insider Intel Sour Patch Kids gives Circle K an exclusive flavor. 46 16 42 18

The Pulse of the Industry

As I write this month’s Editor’s Note, I am listening to an inane series of nursery rhymes blasting from a tablet at an absolutely outrageous, brain-rattling volume. “This is our class pet, her name is Jellybean. She has such tiny feet, she’s cuddly and sweet.” On repeat. (Bonus points if you know where that line comes from, and my condolences if you’ve been subjected to it as well.)

This is the world many of us work in now thanks to today’s remote and hybrid office models. Don’t get me wrong, I would not trade working remote for anything in the world — the flexibility to be home with a sick child (as outlined above) can certainly make the logistics of life easier — but it can be both a blessing and curse. The challenges of evolving workplace models are affecting all businesses in how they recruit and retain talent and operate — and the commerce marketing industry is no exception.

In the Path to Purchase Institute’s 27th annual Trends Survey (page 22), we take a deep dive into the challenges and opportunities that commerce marketers are facing in their roles. And this year, we specifically asked our readers and members what challenges, if any, their organizations are facing in regard to recruiting, training and/ or retaining talent. The responses followed similar themes:

Concern 1: Remote/hybrid workplace models or the lack thereof

• “Trying to get leadership onboard with remote work. Employees want to work from home, and we are not where we need to be with that. So, struggling to attract the right talent.”

• “Difficult to get anyone to move to our location and willing to have on-site requirements.”

Concern 2: A competitive marketplace with high turnover

• “Turnover is higher than ever. Keeping high-level employees engaged and fulfi lled requires evolution of previous strategies as well as intentional management. Remote work has opened opportunities for recruitment of high-caliber individuals from a broader geographic base.”

• “It’s a HOT labor market. My best people are being approached weekly, if not daily, with offers to jump ship in return for more money or some other condition that might appeal to them. So far, we’ve been able to do a good job of retaining our people, but the pressure is there.”

Concern 3: Expertise issues/knowledge gaps

• “Finding people with an understanding of the emerging omnichannel (e-commerce) space and what it takes to be competitive in that space, along with the right level of customer/shopper marketing experience.”

• “Not many people trained in the new digital capabilities. Digital companies stole them (Amazon, Netfl ix, Instacart).”

In our Trends Survey, we also polled our audience on a host of other topics to take the pulse of the industry — including asking them to evaluate and rate key retailer media network metrics (the retail media section starts on page 30).

8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631 773.992.4450 www.p2pi.com

BRAND MANAGEMENT

Vice President, Brand Director Eric Savitch esavitch@ensembleiq.com

EDITORIAL

Editorial Director Jessie Dowd jdowd@ensembleiq.com

Executive Editor Tim Binder tbinder@ensembleiq.com

Managing Editor Charlie Menchaca cmenchaca@ensembleiq.com

Digital Editor Jacqueline Barba jbarba@ensembleiq.com

Director, Member Content Patrycja Malinowska pmalinowska@ensembleiq.com

Managing Editor, Member Content Cyndi Loza cloza@ensembleiq.com

Editor, Member Content Heidi Bitsoli hbitsoli@ensembleiq.com

Events Content Director Lori Pugh Marcum lpughmarcum@ensembleiq.com

Contributing Writers Michael Applebaum, Ed Finkel, Erika Flynn, Chris Gelbach, Jenny Rebholz, Bill Schober

ADVERTISING SALES & BUSINESS

Associate Director, Brand Partnerships Arlene Schusteff 773.992.4414, aschusteff@ensembleiq.com

Regional Sales Manager Orlando Llerandi 678.591.8284, ollerandi@ensembleiq.com

MEMBER DEVELOPMENT

Director, Membership Development Nicole Mitchell 203.434.5733, nmitchell@ensembleiq.com

Director, Membership Development Christopher Barry cbarry@ensembleiq.com

Membership Experience Manager Ann Estey aestey@ensembleiq.com

Manager, Membership Development Brady O’Brien bobrien@ensembleiq.com

Membership Experience Manager Heather Kurtik 724.553.0093, hkurtik@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Senior Creative Director Colette Magliaro cmagliaro@ensembleiq.com

Art Director Michael Escobedo mescobedo@ensembleiq.com

Production Director Ed Ward eward@ensembleiq.com

Marketing Director Marlene Shaffer mshaffer@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@pathtopurchase.com

CORPORATE OFFICERS

fi our

We hope you fi nd the results of our survey insightful and helpful in navigating the year ahead!

JESSIE DOWD, Editorial Director

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Executive Vice President, Content & Communications Joe Territo

Executive Vice President, Operations Derek Estey

6 l Jan/Feb 2023

Editor’s Note

Membership has its Benefits JOIN! is the Perfect Time to NOW The only community that is committed to serving the needs of consumer brand marketers, retailers, agencies and solution providers in the quickly evolving realm of commerce marketing. Exclusive access to the most comprehensive collection of commerce marketing insights and intelligence in North America. World-class events that unite the community through networking, education and fresh perspectives. Are you ready to put the power of the P2PI community to work for you? Contact us at JoinNow@P2PI.com ••••••• ••••••• ••••••• ••••••• Solving Today’s Business Challenges and Driving Tomorrow’s Growth

Meet the Marketers

HERE’S A SNAPSHOT OF INDUSTRY LEADERS FROM THE P2PI MEMBER COMMUNITY.

is being adopted in areas that were not possible previously.

Main job responsibilities: I conduct strategy, planning and execution across our portfolio of brands, including Stonyfield Organic, Siggi’s and Brown Cow.

How you win with shoppers during uncertain economic times: We begin with consumer insights, focusing on shoppers and buying behaviors to personalize offers and meet their needs.

New marketing tactic that you use: We have seen success in working with vendors that are able to tap into firstparty data sources and using that to inform our targeting methodology and approach. Also in the toolbox are tactics that allow for shoppable integrations and personalization.

Best career advice you’ve received: Dare to be a leader. Leaders are people who hold themselves accountable for recognizing potential in people and ideas — then developing that potential. Stay curious and ask questions.

What you are watching right now: “City on a Hill” and eagerly awaiting the next season of “Succession.”

What you do when you’re not working: Spend time with my family and friends, and I added a few road trips on the East Coast to the mix.

Main job responsibilities: I lead the shopper marketing practice for Grey North America, as well as partnering with our global offices to deliver borderless shopper solutions. I’m responsible for strategy, capabilities, vendor evaluation and, in general, developing our shopper and commerce department.

How you win with shoppers during uncertain economic times: Uncertainty brings immense opportunity to shopper marketing/commerce, as we know shoppers are obsessed with finding a good value and brands are focused on delivering a strong ROI on their marketing spend. This brings together the perfect opportunity to find ways to add value for shoppers (not always a discount), as well as to deliver on ROI goals, due to shopper marketing/commerce sitting at the point of sales conversion.

New marketing tactic that you use: I’m finding success with anything that breaks through conventional behaviors to disrupt and reach the shopper in an unexpected way. Sometimes this means what’s old is new again. For example, out of home (OOH) is now becoming prevalent in many additional locations versus the past world of billboards. Measurement has come into the space, as well as digitalization and the ability to buy programmatically. As a result, the tactic is growing exponentially and

Another area that I’ve been pushing into is Web 3.0 and expanding our capabilities to deliver solutions for any brand within the space. One of the biggest mistakes I see brands make in this area is jumping in because everyone else is. Instead, we must focus on having a clear objective and desired outcomes. A full-on metaverse or NFT may not be the right experience for your brand at this point, but there are many ways into this world to begin testing and learning with low risk.

Best career advice you’ve received: Never lose your curiosity. There is always something new to learn. To be impactful in your position, you must be deeply curious about new technologies, platforms and innovative approaches others are taking. When I started my career, brands were beginning to form “digital marketing,” but in 2023 “digital marketing” is just marketing. If you don’t understand the importance of digital due to a loss of curiosity, you now find yourself behind. The next example of this I see in the making is Web 3.0. Many people don’t understand the space or think it will be decades before it gains mass adoption. But it’s coming and if you are not learning now you will be left behind by the industry.

Memorable aha moment in your career: As cliche as it may sound, there is no one-size-fits-all approach in marketing. I’ve worked in beauty and personal care for most of my career — both on the agency and client side. I can say with confidence that what works for one category, brand or retailer is unlikely to work universally across the board. As marketers, we must seek to gain as much data and implement

Member Spotlight 8 l Jan/Feb 2023

ALI DEMBISHACK Senior Manager, Omnichannel Marketing Lactalis US Yogurt

RICK SHUMAN Head of Shopper Marketing Grey

strategies to constantly be testing and learning in a small way before we scale into new tactics.

What you are watching or reading right now: I’m watching “Mad Men” for the third time. Now that I work in advertising again, I just can’t get enough. And I’m reading “Meditations” by Marcus Aurelius.

Recent travels: My wife and I have family all over the country, so during the fall we traveled to California and West Virginia to see much of them. In December, we headed to Spain, France and Italy for two weeks of relaxation.

Stand in the Spotlight

If you are a current member of the Path to Purchase Institute and would like to see your colleagues (or yourself) in a future spotlight, send their name and email address to cmenchaca@ensembleiq.com.

LISA TRAVIESO Senior Manager, Shopper Marketing Nestle Coffee Partners

Main job responsibilities: I am focused on developing strategy and communication frameworks for how we connect with our shopper in the future. I’m leading a shopper consumer journey that bridges our brand team campaigns with shopper-facing communication. I also oversee our annual planning process, shopper marketing toolkits for innovation launches at retail, and measuring our program success by leading our marketing mix.

How you win with shoppers during uncertain economic times: A coffee purchase is so personal to different shoppers. Some are only focused on price, and they have their preferred brands that work for them. Others are focused on taste and how they craft their cup. For these shoppers, we are balancing quality and experience, while being mindful that everyone is making tough choices when they shop. Therefore, we are laser-focused on what we say, how we say it and where our communication shows up, so that we drive behavior change and purchase.

New marketing tactic that you use: I’m in a measurement state of mind these days. Shopper marketing measurement is so complex, but we have to use the data we collect in a way that captures our impact to the business without oversimplifying and not focus on tactics that might erode brand equity.

Memorable aha moment in your career: When I led shopper marketing

for the dollar channel, I saw the magic of shopper marketing — how you can connect with the shopper, meet retailer objectives and deliver profitable growth for your company. It all started by sharing an insight with the buyer, collaborating with other CPG partners to develop a holistic shopper activation plan (before omni was a thing) and drive profitable results by selling in incremental merchandising. It is so satisfying to see hard work pay off and be a win for everyone.

What you are reading right now: I’m reading “The Midnight Library” by Matthew Haig. It’s a great story that takes the reader through the journey of a young woman who lives a dull and uninspiring life. Then, when she takes some action, she enters a magical library where she gets to try out different lives and see how different choices result in different outcomes. It’s been great to think about all the choices we make in life and how changes could make small or significant impacts in our lives.

Recent travels: We visited family in Texas over the holidays. Then I’m going to make a trip to Hawaii a reality this quarter. I’ve unsuccessfully planned a trip there four times, and this time, it’s going to happen!

P2PI.com

We are laser-focused on what we say, how we say it and where our communication shows up, so that we drive behavior change and purchase.

Never lose your curiosity. There is always something new to learn. To be impactful in your position, you must be deeply curious about new technologies, platforms and innovative approaches others are taking.

All About Shopper Measurement

HERE ARE THREE KEY PRINCIPLES TO CONSIDER FOR THE FUTURE OF THIS PRACTICE.

BY MATTHEW SHARP

After all these years, shopper marketers still have a unique and challenging job. With advances in technology and increased access to data, one would think the job would get easier, and the path to impact would be clearer. But with data coming from different directions — and at different levels of granularity — it’s hard to know what’s most useful and actionable. Some data is not easily accessible, which creates unfortunate gaps and blind spots.

For these reasons, the SM2 Commission was formed to standardize definitions and measurement approaches of shopper marketing for the industry. With the release of our updated “Industry Playbook” last fall, I believe we took a meaningful step forward.

Based on that effort and my previous work on the marketing science team at Meta, I’d like to offer a vision of the future of shopper marketing measurement that’s grounded in three key principles.

Increase the quality of data inputs.

“Garbage in, garbage out.” We’ve all heard and likely used this phrase to express the idea that poor quality inputs will always produce poor quality outputs. The future of measurement for shopper marketers — a future with higher-quality, actionable outputs — relies greatly on improving the quality of data we feed into our measurement systems, or inputs.

This starts with increasing secure access to data that enables meaningful analyses and measurement of business outcomes that truly matter. From there, granularity and consistency of those inputs is key if shopper marketers hope to conduct any cross-channel analyses. The SM2 Commission learned this in our modeling pilots, and Steve Tobias, an executive in the Media Center of Excellence practice at IRI, summarized it well. He said, “If we benchmark shopper marketing impact as an aggregate effect versus measured down at a more tactical level, the models with more disaggregate shopper marketing inputs actually produce a greater total contribution and ROI.”

Similar dynamics were seen at Meta. In a marketing mix modeling (MMM) meta-analysis completed with Accenture in 2022 (and involving 30-plus brands and five verticals in North America), Meta found that its ROI increased by 7.8% to 12.7% when using granular data inputs in MMMs. Whether measuring a key component of a CPG’s marketing mix like shopper marketing, or the impact of an individual channel like Meta, model outputs can vary significantly when more granular data is used.

Innovate new and better measurement solutions.

Working closely with trusted third-party solution providers will continue to be an important part of the measurement and analytics strategy for shopper marketers, given these third parties’ access to data and specialized skills.

Perspectives 10 l Jan/Feb 2023

Additionally, it is so important for shopper marketers to take note of and consider capitalizing on new technologies that can advance their own organizations’ capabilities. For example, Open Source Techniques (OSTs) aim to democratize access to advanced analytics tools leveraging publicly available, open-source code. These techniques represent opportunities for shopper marketers to move capabilities in-house and enable their teams to increase focus on business outcomes, adding rigor to existing measurement practices.

Improve marketing performance by prioritizing experimentation.

Experimentation is the primary means of helping all businesses grow by transforming marketing practices grounded in data and science.

One of the valuable outputs from the SM2 Commission’s modeling work is the set of fi ndings from the modeling phase that, while not conclusive and scalable on their own (we only modeled three brands), provides the industry a strong basis for further experimentation on three important variables:

• Core product messaging versus innovation messaging;

• Presence of an offer or incentive; and

• Channel-level performance (namely digital versus traditional shopper tactics).

To wrap up this piece, I want to give a few shoutouts. I want to recognize all of my fellow panelists from the P2PI LIVE event last fall. I’m

talking about Kelly Kachnowski, vice president, commercial development, Marilyn Platform at The Mars Agency; Cheryl Policastro, chief strategy officer at TPN; and Steve Tobias. Thank you for your thought leadership and for sharing your expertise with myself and the commission.

Thank you to Patrycja Malinowska, P2PI’s director of member content, for wrangling our points of view into a cohesive narrative and for hosting a successful panel discussion at P2PI LIVE.

Finally, I’m grateful to all my fellow commission members for your collaboration over the past twoand-a-half years. I’m proud of the work we’ve done together to move the industry forward.

About the Author

Matthew Sharp was most recently part of the marketing science team at Meta, where he partnered with some of the world’s largest CPGs to measure the impact of their marketing investments. Sharp is an expert in experimental design, as well as research and measurement methods. He advises marketers on how to leverage both to drive learning and ultimately make better marketing decisions. Sharp brings 15 years of experience across marketing analytics and primary research disciplines. He has a bachelor’s in psychology from Whitworth University in Spokane, Washington.

P2PI.com

From left: Kelly Kachnowski of The Mars Agency, Matthew Sharp, Cheryl Policastro of TPN, Steve Tobias of IRI and Patrycja Malinowska of P2PI participate in a panel discussion about shopper marketing measurement at P2PI LIVE in October.

The future of measurement for shopper marketers — a future with higher-quality, actionable outputs — relies greatly on improving the quality of data we feed into our measurement systems, or inputs.

‘Retail Media Unplugged’

CRITEO’S COURTNEY COCHRANE DISCUSSES THE PATH TO PURCHASE INSTITUTE’S NEW VIDEO SERIES AS WELL AS THE STATE OF RETAIL MEDIA.

BY CYNDI LOZA

BY CYNDI LOZA

The Path to Purchase Institute, in partnership with Criteo, is launching a new retail media video series to explore the latest trends, strategies and tactics for success. The six-episode “Retail Media Unplugged” series will take viewers behind the scenes with special guests to dig into their approach to navigating the constantly evolving realm of retail media. P2PI chatted with Courtney Cochrane, Criteo’s managing director, enterprise, Americas, to discuss the challenges and future of retailer media networks (RMNs) and what viewers can expect from the series.

P2PI: Can you tell us a bit about Criteo and how the company works with retailer media networks?

Cochrane: Criteo has been enabling retailers and marketplaces to scale monetization and media programs while serving brands and agencies for more than six years. Put simply, we’ve built a leading platform for retailers to manage their entire retail media business. We offer everything from on-site sponsored product and display advertising to off-site audience extension on the open internet. Criteo has one platform for all ad formats and demand sources, which reduces operational and tech management complexity and allows advertisers to easily optimize their campaigns.

We help retailers by providing the ability to acquire and retain targeted customers, but also scale their retail media businesses. Just as importantly, we have the experience and knowledge to work with retailers and RMNs across different types, sizes, categories and retail media experience levels. Clientcentricity, or putting the client at the center of our focus, is how we approach each and every relationship. While the front end looks seamless and intuitive, on the back end, there is no “one size fits all” and that’s our strength.

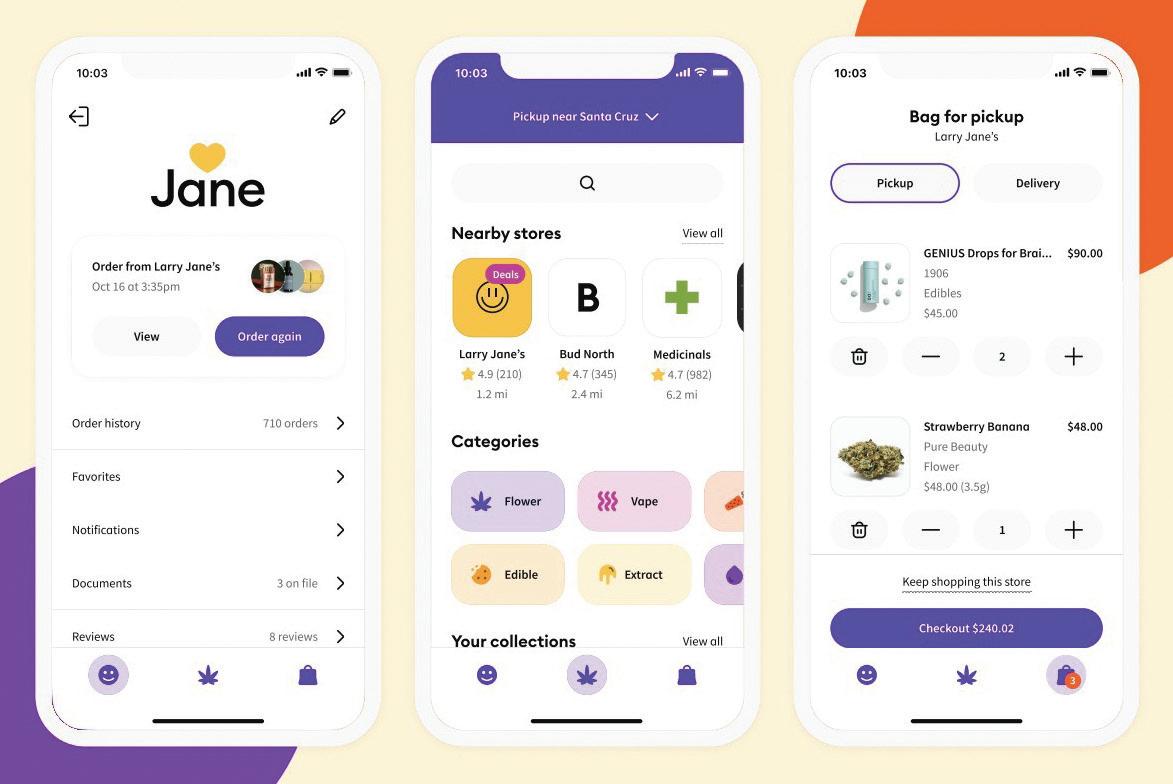

P2PI: There has been a proliferation of retailer media networks in the past five years. Can you share a bit about how your company has seen retail media evolve?

Cochrane: We could go deep here, but I’d say the biggest and most obvious change has been that retail media has gone from an opportunistic play to an integrated part of digital strategies for retailers, brands and agencies. Retailers have watched Amazon and Walmart create multibillion-dollar, high-margin businesses and are looking to capitalize on the same opportunity with their own unique audiences. Brands have seen the incrementality and performance of retail media and are restructuring their strategies and budgets to better take advantage of these opportunities. Agencies have formed or expanded to help guide clients to success.

P2PI: What is the biggest challenge in retail media?

Cochrane: If you asked 10 different people this question, you’d get 10 different answers, naturally. My perspective is that managing complexity is the biggest challenge we face. With the kind of growth this industry is facing, everyone is moving so quickly that things are getting very complex, very quickly. This pertains to how to structure your retail media program, how to offer and access ad inventory as broadly yet simply as possible, how to measure consistently and uniformly, and more. But all of these roll up to complexity challenges.

P2PI: How do you see retailer media networks evolving in the next few years?

Cochrane: There are a lot of possible answers to this question, but I’ll highlight two key trends. First, we see even more retailers and marketplaces willing to get into the retail media game, especially coming from more specialized categories. Michaels, the leading arts and crafts retailer in North America, launched with Criteo this year and is a great example. Nordstrom, operating in the luxury segment, is another. Some of these will want to operate as their own RMN, while others prefer not to run their own media business and will enlist partners like Criteo to

FOCUS: Retail Media 12 l Jan/Feb 2023

Managing complexity is the biggest challenge we face. With the kind of growth this industry is facing, everyone is moving so quickly that things are getting very complex, very quickly.

enable them to succeed. The reason [Boston Consulting Group] is forecasting the retail media industry to grow to $42 billion by 2025 is that it’s clearly successful!

Second, in order to capture the trade marketing budgets that are shifting online, networks will continue to expand their product offerings, both on-site and off-site. This will happen via expansion of existing solutions and a move to new, creative formats and targeting across the open internet. Reaching a shopper across their entire journey is more critical and more possible than ever before.

P2PI: What are you hoping listeners will gain from tuning into the “Retail Media Unplugged” video series?

Cochrane: We’re looking forward to sharing insights from industry players on the front lines of retail media evolution, partnered with the view Criteo has from operating with 160-plus retailers, 1,500-plus brand advertisers and 175-plus agency partners globally. A lot of the information out there about retail media is generalized, but with this series, you’ll be able to hear unique and specific perspectives. We’re very excited to be sponsoring this series to bring these perspectives to a broader audience.

The Path to Purchase Institute, in partnership with Criteo, presents a new six-episode video series:

Retail Media Unplugged

The first episode will drop in late January. Subsequent episodes will release in March, May, July, September and November.

The series will dive deep into retail media, exploring the latest trends, strategies and tactics for success. In each episode, we’ll go behind the scenes with special guests to reveal how they’re navigating the evolving realm of retail media. Visit

P2PI.com

P2PI.com/RetailMediaUnplugged

Digital Commerce Trends

SEPARATE RESEARCH FROM RAIN THE GROWTH AGENCY AND CHICORY EXAMINES HOW SHOPPERS, BRANDS AND RETAILERS ARE BEING IMPACTED.

BY JACQUELINE BARBA

The COVID-19 pandemic accelerated digital shopping behaviors across the board over the last few years and subsequently impacted how brands reach consumers. Recent research examining these trends and behaviors closely, particularly as they relate to the affluent Baby Boomer demographic, shows how things have quickly evolved.

Rain the Growth Agency, an independent DTC advertising agency, in December published a report titled “Boomers Digital Shopping Trends,” which looks at the social media platforms, apps and other digital tools that are impacting buying decisions.

The report identified three discrete segments within the Boomer population, which Rain the Growth says represents more than $2.6 trillion in buying power: “Nostalgic Conservatives,” “Seniors Living Simply” and “Progressive, Knowledgeable Nesters.”

Key findings from the report include:

• Boomers primarily use digital tools (e.g., Amazon, search, retailer and brand websites, product reviews, mobile apps) to make shopping easier (47%) and to save money (45%) and time (40%).

Importance of online shopping tools

Amazon (Amazon.com)

Search engine (e.g., Google, Firefox, etc.)

Retailer websites

Brand websites

Emails from retailers

Emails from brands

• With Boomer social media users, Meta’s Facebook and YouTube are the primary platforms (78% and 63% usage rates, respectively), followed by Etsy and Pinterest.

• Younger, tech-savvy Boomers (ages 55-64) are more open to advertising, are active on social media (typically using a smartphone), and don’t shy away from video streaming services (77%).

• Younger Boomers’ favored channels include TV (37%), direct mail (33%), print magazines (25%), billboards (25%), online (23%) and radio (22%).

• Search is the shopping gateway for seniors — reinforcing the importance of investments in paid search.

• 26% of seniors say that social media has inspired purchases from never-before considered brands and products.

The New Consumer 14 l Jan/Feb 2023

50% 64% 64% 55% 54% 71% 75% 69% 61% 53% 49% 68% 54% 50% 49% 58% 67% 68% 46% 44% 17% 36% 61% 35% 28% 24% 51% 59% 32% 36% 34% 65% 57% 47% 30%

Mobile apps

(among tool users) GenZ

Gen

Silent Generation High Importance (Top 2 Box)

Millennials

X Boomers

Source: Rain the Growth Agency’s “Boomers Digital Shopping Trends” report

Top Challenges with Retail Media Networks

Budget requirements

Internal bandwidth

Effectiveness — Return on ad spend [ROAS]

Effectiveness — Ability to reach new shoppers

Selecting the right RMN partner[s] out of the many different options

Effectiveness — Size of the audience reached

More walled gardens that limit data access

Building a supporting marketing tech stack for RMN strategy

Other

How CPGs, Grocers Are Responding

Brands and retailers are evolving how they target and connect with shoppers digitally as their behaviors change. Chicory released a report exploring how brands and grocery retailers are responding to key advertising trends, including the rise of retailer media networks (RMNs), the depreciation of third-party cookies and the emergence of new media tactics such as commerce media.

The “CPG and Grocery Digital Advertising Report” is based on survey results primarily from Chicory’s CPG clients, as well as a select number of grocery retailer partners.

Some key data points from the report include:

• Growing e-commerce sales, followed by the rise of RMNs, had the greatest impact on CPG advertising strategies over the past 12 months.

• The emergence of new media tactics is expected to have the greatest impact on CPG advertising strategies over the next 12 months.

• 84% of respondents said in-recipe commerce media (e.g., shoppable recipes) will be the most popular commerce media tactic in 2023, then retail media strategies, on-site and off-site.

• Amid inflation, add-to-cart value has increased 28% year-over-year while item count remains the same, per Chicory recipe network data.

In addition, most CPG marketers said they are “satisfied” or “somewhat satisfied” with their current RMN relationships and feel optimistic about digital advertising in 2023. Their main concerns include budget requirements, internal bandwidth and ROAS/effectiveness.

For retailers, the top challenges they faced in 2022 include:

• Managing different partners and technologies (due to the emergence of new media tactics).

• Alignment among internal teams that interact with the CPG community.

• Increased competition with other RMNs.

• Competing for media spend with digital-fi rst grocery delivery platforms.

• High advertising demand.

Other trends and predictions echoed by study respondents regarding the future of grocery advertising related to growth in the metaverse, connected TV, increased privacy as well as a shift to prioritize off-site media with the latest integrations with DSP providers.

P2PI.com

Growing e-commerce sales, followed by the rise of RMNs, had the greatest impact on CPG advertising strategies over the past 12 months.

68% 48% 48% 40% 40% 20% 20% 16% 16%

(The CPG respondents could select more than one answer)

Source: Chicory’s Top CPG Advertising Trends of the last 12 Months

Molson Coors Celebrates with Drizly

THE BEVALC COMPANY’S TOPO CHICO HARD SELTZER FINDS AN AUDIENCE ONLINE.

BY CHARLIE MENCHACA

The summer selling season was the perfect time for Molson Coors Beverage Co. to highlight one of its hard seltzer brands on the Drizly platform.

In August 2022, the manufacturer executed a delivery-forward brand activation to create awareness of Topo Chico hard seltzer on Drizly’s BevAlc e-commerce site. The program focused on hard seltzer versions of a raspado, or a Mexicanstyle shaved-ice drink, traditionally topped with fruit, flavoring, syrup and various condiments.

“Topo Chico hard seltzer has an authentic legacy and tie to the Latin community, so crafting a raspado with this brand was a meaningful extension,” says Stephanie Spesia, senior marketing manager, e-commerce, at Molson Coors. As part of an agreement with The CocaCola Co., Molson Coors produces, distributes and markets Topo Chico hard seltzer.

The idea promoted both Drizly and the hard seltzer, furthering the partnership with Drizly and delivering excitement for the consumers, Spesia says. The target audience was Gen Z and Millennial consumers ages 21 through 34. These consumers are likely already familiar with using delivery platforms as a way to explore and experience new brands, she says.

Four unique raspado recipes were developed with a mixologist to align to four flavors within the Topo Chico hard seltzer variety pack. “The

Brand Watch 16 l Jan/Feb 2023

Topo Chico hard seltzer has an authentic legacy and tie to the Latin community, so crafting a raspado with this brand was a meaningful extension.

Stephanie Spesia, Molson Coors Beverage Co.

promotional assets — from recipes to media to photography — were developed to deliver a one-of-a-kind experience for our Drizly shopper,” Spesia says.

Molson Coors’ influencer partners, including @nibblesnfeasts, @cocktailsbyc and @Bad_Birdy, posted their own video on Instagram demonstrating how to create one of the raspado drinks. The paid influencers, earned media and recipe-focused ads on Facebook drove drinkers to a Topo Chico hard seltzer brand page on Drizly. This is where Molson Coors staged a sweepstakes to drive awareness of the hard seltzer and its delivery availability via Drizly. For a chance to win a raspado party at home, participants were asked to text “Raspado” to a dedicated number or visit TCHSRaspado.com.

The program resulted in a 3.5% increase in dollar share of seltzer during the program timeframe and an increase of 2.5% dollar share of seltzer in the four weeks post-program, Spesia says. Paid media delivered 136 million impressions, which was three times the benchmark. There was also an 83% message penetration, which exceeded the benchmark by 13%.

Nicole Werner, customer marketing manager, e-commerce, and Bill Holland, associate marketing manager, e-commerce, partnered with Stephanie Donelson, associate marketing manager of the Topo Chico hard seltzer brand team, to ideate and execute the program.

Learn More

For details on BevAlc activations from Molson Coors and other brands, visit P2PI.com.

P2PI.com

Ulta’s Merchandising Overhaul

ULTA BEAUTY’S NEW LAYOUT SHOWCASES BRANDS AS WELL AS CATEGORIES, WHILE ALSO EMPHASIZING SERVICE OFFERINGS.

BY JACQUELINE BARBA

In 2022, Ulta Beauty began rolling out a new layout that better spotlights mass and prestige brands and emerging categories, while also emphasizing its service offerings, navigation and discovery at dozens of stores. Ulta has said that all new stores and remodeled stores will feature the new layout going forward.

In January, the Path to Purchase Institute visited one of Ulta’s recently remodeled stores in Skokie, Illinois, just outside of Chicago.

Upon entering, shoppers are surrounded by both conjoined and freestanding floorstands, merchandising tables and racks, some branded but most outfitted in retailer-led signage promoting current savings events and deals.

Ulta’s last substantial merchandising overhaul came in 2018. The latest redesign keeps some of the improvements introduced

then, while taking others to a new level.

While prestige and mass brands are still separated on opposite sides of the store, each section has undergone noticeable enhancements.

Expanded brow and makeup services, offered in collaboration with Benefit and MAC Cosmetics, respectively, feature beauty bars located near the center of the store.

On the prestige side of the store, MAC also secures an illuminated gondola to merchandise its extensive assortment of cosmetics next to a Chanel wall vignette.

Also in prestige, a Chanel-dedicated half-gondola showcases individual tester products from its N°1 De Chanel skincare collection with illuminated mirrors for try-on. Other brands spotlighted in the section include Hourglass, Stilla, Urban Decay and Two Faced.

In-Store Experience 18 l Jan/Feb 2023

Decked-out gondolas elevating upscale brands, such as Estee Lauder, Clinique and Lancome, are positioned near the middle of the store to transition shoppers to the mass-market brands on the other side. Kylie Jenner’s Kylie Cosmetics and Kylie Skin also fall near this section, sharing merchandising space with cult-classic skincare brand Drunk Elephant with colorful shelving units.

One brand that particularly stands out in the skincare section is Kiehl’s. Garnering substantial space at the back of the store, located between Ulta’s Skin Bar services section and its instore hair salon, the brand’s extensive product assortment is merchandised on a wall underneath an illuminated and permanent Kiehl’s sign.

Facing the wall is a unique display on one side of a gondola showcasing “Men’s Skincare and Grooming” and resembling a lab, complete with a desk, two lampshades and an enclosed glass case displaying “Mr. Bones,” a skeleton in a lab coat similar to the one Kiehl’s used in its New York apothecary to educate consumers about the brand’s remedies. A shelf on the desk spotlights individual tester products from Kiehl’s, inviting shoppers to “try our best sellers.”

Notable is that many brands and categories that enjoy prime merchandising space via a dedicated endcap display or freestanding table display located up and down the aisles are mostly new and/or exclusive to Ulta, celebrity-backed or have earned Ulta’s Conscious Beauty designation. The latter signifies brands that use clean ingredients, are cruelty-free and use sustainable packaging.

Also present in this store is The Wellness Shop, an initiative that was introduced in 2021 and has rolled out online but only in select stores. Less of a physical shop and more of a dedicated space for self-care items “for the mind, body and spirit,” The Wellness Shop spotlights products such as bath salts and relaxation products like gummies and even sexual wellness products, a category relatively new to the retailer.

With the new layout, mass and prestige skincare brands have been brought together — no longer separated like the cosmetic brands still are. The fragrance section has been moved nearer the middle/back of the store, leaving more space in the front of the store for dedicated brand and product launches across categories.

P2PI.com

Seeing Brands Clearly

COLGATE-PALMOLIVE AND 1WORLDSYNC SHARE BEST PRACTICES FOR PRODUCT CONTENT.

BY CHARLIE MENCHACA

With the seemingly endless number of SKUs that shoppers have to choose from, accurate information is a must at retail.

“Relevant, impactful product content is essential everywhere commerce happens,” says Steve Sivitter, CEO of 1WorldSync, an e-commerce product content platform. “While consumers might be tightening their wallets, they’re spending more time researching and reviewing product content.”

In this Q&A, Sivitter provides further insight on this topic with Todd Hassenfelt, e-commerce director, growth and planning, at Colgate-Palmolive.

P2PI: How has the role of product content evolved in today’s market?

Sivitter: A majority of online shoppers say poor content (or no content) often dissuades them from making a purchase. As ongoing economic uncertainty and inflation concerns continue, consumers have modified their shopping behavior, from streamlining their budgets to visiting multiple websites and product detail pages before making a purchase decision. When brands fail to deliver impactful product content across multiple channels, they risk failing to meet customer expectations and damaging their reputation.

P2PI: What about product content platforms? How do they help brands?

Hassenfelt: Consumers expect up-todate and expansive product details across different platforms, while retailers want more data in more formats and often require disparate information. Product content platforms help companies fi netune and safeguard the product information management process, providing the information consumers want and data retailers need. Robust content platforms empower brands to maintain a consistent image across all e-commerce, retail and distribution channels, automating the validation of product attributes to ensure accuracy. These platforms help create a single source of truth for all digital assets and help brands manage, upload and tailor their assets for various digital scenarios. This allows companies to sidestep manual processes, eliminating costly errors and saving their teams valuable time.

P2PI: What role does search data play in optimizing product content?

Hassenfelt: Search is a critical aspect of product content strategy. Most e-commerce shopping experiences begin with a simple query on a search engine or an e-commerce marketplace. To ensure maximum visibility, brands must

MOBILE RESEARCH

The percentage of shoppers who look for one or more of the following while on their phones in-store:

53% PRICE COMPARISONS

46% CUSTOMER REVIEWS

35% DETAILED PRODUCT DESCRIPTION

28% HEALTH NUTRITIONAL INFORMATION

26% INFORMATION ABOUT BRAND REPUTATION

Source: 1WorldSync 2022 Consumer Product Content Benchmark Report

On Trend 20 l Jan/Feb 2023

thoroughly understand keyword trends for their categories. They must adhere closely to each of their trading partners’ internal search engine optimization best practices and style guides.

Believe it or not, SEO also plays an important role for in-store shopping. According to a 2021 1WorldSync survey, 61% of shoppers use search engines to research products before they go to the store.

Companies must learn — and incorporate — all the ways customers talk about their products. For example, consumers are more likely to use nonbranded search terms like “whitening toothpaste” than search for a branded product like “Colgate Optic White Renewal toothpaste.” Prioritize writing engaging and authentic product descriptions to reach more customers.

P2PI: How can brands tell their story on a product detail page (PDP) while still adhering to their retailer partners’ requirements?

Sivitter: PDPs allow brands to tell their story in myriad ways and elevate above the competition. The most impactful PDPs include product imagery. High-quality product photos influence the purchasing decisions of more than half of shoppers. The most helpful imagery styles include 360-degree spin, action, customer and scale. But while images are critical, they tell only part of a product’s story. A PDP also needs creative, concise and conversion-driving copy to highlight unique specs

and features to generate sales. Customer reviews also build brand loyalty, especially when brands engage with customer feedback — both the good and the bad.

Brands can comply with retailer requirements by using a product content platform. For instance, Colgate leverages 1WorldSync to facilitate storytelling while applying content rules and vendor formatting to ensure brands distribute current, brand-verified product content.

P2PI: How can brands’ success in e-commerce inform strategies for the physical shelf?

Hassenfelt: A digital shelf strategy helps companies draw customers to their websites and leverage rich product data to engage and increase purchases. When successful, a digital shelf strategy significantly impacts physical store sales. By strengthening its online performance, a brand can directly impact a customer’s overall retail experience. For example, even when shopping in-store, 90% of shoppers use smartphones to look up product information like reviews, features and specs (according to 1WorldSync’s 2022 Product Consumer Benchmark Report). Bridging the gap between the physical and digital commerce worlds helps brands maintain momentum and retain sales growth.

P2PI: What challenges remain for CPGs as it relates to product content? What are some possible solutions?

Sivitter: Digital technologies are reshaping how people discover and shop for consumer packaged goods. Grocery shopping has also migrated online, and CPG marketers must adapt to meet new demands in the crowded e-commerce market. To achieve success in the CPG space, brands must display product information — including updated availability and price — that consumers can easily fi nd.

P2PI.com

7 of 10

Source: 1WorldSync 2022 Consumer Product Content Benchmark Report

The number of online shoppers who often decide not to buy a product due to poor quality product content, or lack of content.

Path to Purchase Trends

22 l Jan/Feb 2023 RETAIL MEDIA METAVERSE DIRECT-TO-CONSUMER

EXPERIENCES E-COMMERCE RETAINING TALENT RETENTION & TURNOVER IN-STORE TACTICS BRAND MARKETING

PHYSICAL

MEDIA

MARKETING BUDGETING

CHAIN

ENGAGEMENT

PERMANENT DISPLAY SOCIAL

DATA SHARING SHOPPER

SUPPLY

SHOPPER

ECONOMY & INFLATION TARGETING EFFECTIVENESS

DISPLAYS

MARKETING CHALLENGES OPPORTUNITIES

OMNICHANNEL MEASUREMENT TEMPORARY

DIGITAL

SUPPLY CHAIN ROI SOCIAL COMMERCE

BUSINESS-RELATED CONCERNS

METAVERSE DATA SHARING

Trends 2023

CHALLENGES AND OPPORTUNITIES

Our 27th annual survey finds commerce marketers concerned about navigating inflation and the economy, while also trying to figure out how to leverage the promise that retailer media networks bring.

BY TIM BINDER

RETAIL MEDIA TRENDS: Ratings of retailer networks, chain by chain — Page 30

P2PI.com

DATA TRANSPARENCY

Path to Purchase Trends 2023

Identifying commerce marketing trends and opportunities is our primary goal each year as we conduct the Path to Purchase Trends survey. This go-around, our 27th annual survey (which was fielded in November 2022) saw two areas of focus jump to the forefront: retail media and inflation.

Retail media and, specifically, retailer media networks aren’t new on our radar; they have been a major part of our trends report for the past three years. But retail media is continually growing, and increasing in importance, as this year’s survey results indicate — 58% of respondents said their organization’s investment in retailer media networks increased in 2022. And it will come as no surprise that inflation and the economy were hands down the most frequently mentioned businessrelated concerns for our respondents as they headed into 2023. With our survey, we were able to pick the brains of 166 marketing executives, who shared their opinions on various other important topics as well. Read on to dig into the results…

How investment (budgetary spend and/or attention) in the following areas changed in 2022 compared to 2021

24 l Jan/Feb 2023

Source: 2023 Path to Purchase Institute Trends Study, November 2022 Retailer media networks Shopper marketing Social media E-commerce content (PIM, DAM, delivery packaging, etc.) Other digital media beyond RMNs & social media (paid search, internet ads) Insights & analytics Consumer promotion Trade promotion Mobile (SMS, mobile app/website advertising) In-store marketing Traditional media (TV, print, etc.) 44% 42% 49% 50% 44% 40% 37% 36% 12% 37% 11% 40% 8% 45% 6% 8% 20% 14% 14% 22% 37% 58% 5% 52% 52% 52% 49% 48% 38% 37% 36% 34% 23% Increased Stayed the same Decreased 2022 INVESTMENT CHANGES

In-store display

Strategies/tactics most important in the past year

Strategies & Tactics

We asked what strategies or tactics have been most important to survey participants’ organizations over the last year, allowing them to choose up to three from our list of 13. Fifty percent selected retailer media networks — which was 18 points higher than the results from our fall of 2021 survey when we asked the same question.

E-commerce content finished second with 48%, followed by digital media (other than retailer networks and social media) at 34% and social media at 33%. In-store display activity for brand-driven programs was selected by 21% of respondents, and that percentage was 9 points higher than in last year’s survey.

With an open-ended question, we asked respondents to tell us more about the strategies and tactics they’ve used. Here’s a sampling of what they had to say:

• “We have relied more on retailer media networks as they have become more advanced and offered more tactics to invest in. We have also put more budget and analysis into paid search.”

• “Retail media networks have been the most important due to the spend we

had to invest per the retailer. We’re spending time to ensure it is working as hard as it could and evaluating it almost on a daily basis.”

• “We have almost doubled our in-store trade spending to increase velocities on our base items. From a marketing standpoint, we have moved away from base TV advertising and put more of the dollars into connected TV advertising options.”

• “We’ve increased social media based on the significant ROI derived from TikTok and continued to invest in consistent performers Instagram and Facebook, among others.”

• “We focused on e-commerce business opportunities and are building fewer, bigger, better programs.”

• “We relaunched our direct-to-consumer to drive more loyalty, so there has been a big focus there and driving DTC exclusives.”

• “We have increased more upper funnel tactics to drive category/brand engagement to drive traffic to top retailers during our key season to get shoppers to engage.”

P2PI.com

Source: 2023 Path to Purchase Institute Trends Study, November 2022 50% 48% 34% 33% 21% 18% 14% 12% 6% 9% 6% 5% 6% 8% Retailer media networks E-commerce content (i.e., product pages) Digital media (other than retailer networks and social media) Social media

activity

programs In-store media/signage In-store display activity for retailer-driven programs Direct-to-consumer sales Traditional media Mobile marketing In-store sampling/demos Alternate venue sampling/demos Online sampling/demos Something else Significant Change YoY (+ 18 pts) (+ 9 pts)

for brand-driven

Retail media networks have been the most important [strategy/tactic] due to the spend we had to invest per the retailer. We’re spending time to ensure it is working as hard as it could and evaluating it almost on a daily basis.

Concerns & Challenges

Without steering them in any direction, we asked respondents what their biggest businessrelated concern was heading into 2023. Sixty percent of them mentioned the economy, inflation or a possible recession in their answers. And more than a few resurfaced the topic of retailer media networks — mainly the required spend being a top challenge.

In their words, here are some concerns:

• “Navigating ever-changing economic conditions.”

• “Inflation and impact on consumer buying behavior.”

• “Inflation and recession. That coupled with retailers asking (or demanding) manufacturers/marketers invest in their media networks.”

• “The increasing demand from retailers on ‘forced’ spends on their platforms. We don’t have allocated budgets to meet their demands and it is causing friction on the relationships.” This “biggest concern” question also brought an ongoing challenge to the forefront — the workforce. “Labor,” said one respondent. “There’s no one to hire.”

In a separate part of the survey, we also asked respondents about the challenges their organizations are facing with regard to recruiting, training and/or retaining talent. Of the 10 possible responses we presented, “Desire for remote work” and “Difficult to recruit talent with appropriate experience” were the clear leaders, with one-fifth of survey takers naming each. Fourteen percent answered “retention/turnover,” while 19% said there were no challenges in this area. Respondents were asked to explain their answers, and here’s a sampling of the workforce challenges they’re facing:

Biggest business-related concern heading into 2023

What challenges are you facing with regard to recruiting, training, and/or retaining talent?

• “Turnover is higher than ever. However, remote work has opened opportunities for recruitment of high-caliber individuals from a broader geographic base.”

• “Not many are trained in the new digital capabilities. Digital companies (Amazon, Netflix, Instacart) stole them.”

• “Digital marketing and analytics positions are highly competitive and [employees are] hard to keep.”

We then asked respondents if the roles and responsibilities of brand and shopper marketing were converging at their organizations — and 56% said yes. “These used to be much more siloed,” explained one respondent. “As the state of the market is changing, so is the landscape of our internal teams and their responsibilities when it comes to omnichannel approach.”

Convergence of brand and shopper marketing roles/responsibilities?

26 l Jan/Feb 2023

Source: 2023 Path to Purchase Institute Trends Study, November 2022 60% 13% 8% 7% 6% 5% 4% 4% 4% 4% Economy/inflation/recession Demand management/supply chain management Controlling costs/prices Targeting/awareness/retention RMN costs/optimizing spend Optimizing marketing investments Budget Consumer sentiment/behavior General growth Category downturns/business volume down !

Source: 2023 Path to Purchase Institute Trends Study, November 2022 23% 22% 14% 9% 7% 4% 2% 1% 1% 19% Desire for remote work Difficult to recruit talent with appropriate experience Retention/turnover Competitive marketplace Budget limitations Layoffs/growing pains Difficult to recruit and retain young talent Finding talent in timely fashion Internal challenges No challenges !

Source: 2023 Path to Purchase Institute Trends Study, November 2022 Yes No 56% 44% Path to Purchase

2023

Trends

In Stores & Beyond

When choosing up to two answers from our list of seven options to most effectively drive shopper engagement inside the store, 50% of respondents said that a “true omnichannel approach” was the way to go. Forty-five percent chose the tried and true “pricing/promotion” path, while 30% said innovative merchandising was the key.

When asked if they leverage physical experiences outside the traditional retail environment, 45% said yes. As for which types of experiences: 73% named “Demos or experiential activations” and 65% said “hosting or being

What

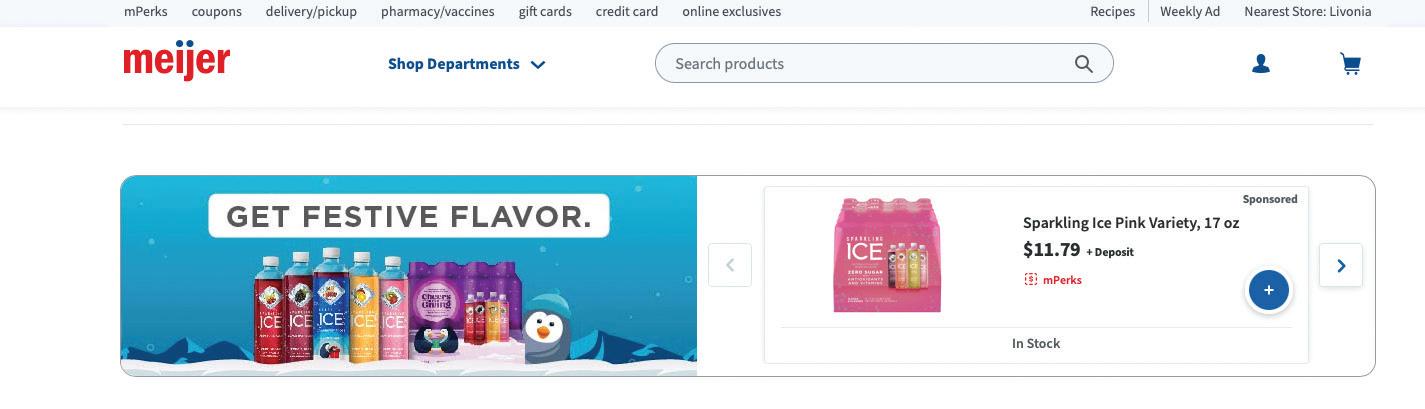

Retailers’ ability to share actionable shopper data to drive more effective marketing

7-Eleven (n = 27)

Ahold Delhaize (n = 53)

Albertsons (n = 60)

Aldi (n = 21)

Amazon (n = 74)

Best Buy (n = 10)*

Costco (n = 62)

CVS (n = 47)

Dollar General (n = 55)

Family Dollar (n = 39)

H-E-B (n = 56)

Home Depot (n = 27)

Hy-Vee (n = 46)

Instacart (n = 59)

Kroger (n = 72)

Loblaws (n = 17)*

Lowe’s (n = 30)

Meijer (n = 67)

Petco (n = 6)**

PetSmart (n = 6)**

Publix (n = 59)

Sam’s Club (n = 63)

ShopRite (n = 50)

Sobeys (n = 9)**

Southeastern Grocers (n = 45)

Target (n = 73)

Total Wine & More (n = 12)*

Ulta (n = 9)**

Walgreens (n = 50)

Walmart (n = 80)

Wegmans (n = 44)

Whole Foods Market (n = 33)

*Sample size is <20. Use caution when interpreting results.

**Sample size is <10. Use caution when interpreting results.

Source: 2023 Path to Purchase Institute Trends Study, November 2022

P2PI.com

50% 50% 40% 60% 33% 67% 50% 50% 47% 53% 63% 37% 39% 61% 37% 63% 35% 65% 50% 50% 34% 66% 48% 52% 59% 41% 45% 55% 42% 58% 42% 58% 48% 52% 58% 50% 55% 45% 45% 55% 39% 61% 0% 100% 44% 56% 46% 54% 56% 44% 83% 17% 49% 51% 37% 63% 47% 53% 36% 64% Excellent They don’t share any data Data sharing is collaborative Data sharing is a revenue source Good Poor 4% 4% 7% 48% 27% 40% 40% 20% 35% 15% 15% 43% 47% 7% 12% 17% 17% 2% 2% 39% 32% 27% 6% 6% 30% 43% 21% 42% 22% 36% 21% 58% 25% 17% 45% 4% 48% 24% 24% 22% 55% 14% 5% 22% 33% 56% 18% 5% 40% 24% 45% 33% 42% 16% 54% 29% 11% 37% 34% 27% 50% 50% 33% 33% 52% 24% 12% 33% 20% 40% 24% 29% 44% 6% 7% 44% 31% 10% 2% 2% 41% 31% 26% 3% 55% 30% 15% 1% 36% 36% 27% 44% 38% 15% 47% 33% 18% 17% 28% 40% 35% 30% 40% 16% 12% 19% 33% 45% 35% 13% 36% 39% 21% 33% 19% 44%

Source: 2023

Study, November 2022 50% 45% 30% 19% 13% 12% 8% True omnichannel approach Pricing/promotions Innovative merchandising Complimentary merchandising of products Experiential marketing Exclusive products On-shelf signage

will drive shopper engagement inside the store?

Path to Purchase Institute Trends

Path to Purchase Trends 2023

Do you leverage physical experiences outside the traditional retail environment?

Q. Does your brand leverage physical experiences outside the traditional retail environment?

Q. What types of physical experiences outside the traditional retail environment does your brand leverage?

present at local/community events.”

When asked if they incorporate social commerce into their omnichannel marketing budgets, 61% said yes. Facebook (55%) and Instagram (54%) were the platforms named most often.

Staying outside the physical environment, we asked if respondents’ organizations are activating in the metaverse. Eleven percent answered yes, and another 15% said they were planning to do so soon.

When asked for more details about this next era of commerce, respondents answered:

• “We’re mostly creating digital universes for people to explore and buy NFTs.”

• “Our brand teams launched NFTs and another had a small execution within the metaverse.”

• “All plans and strategies concerning the metaverse are being managed by our head office; at the moment, it is not a local focus.”

28 l Jan/Feb 2023 Yes, it’s been around for a while Yes, it’s newly launched No, but we’re thinking about/working on it No, we’re not going there 41% 22% 17% 20% Does your brand have a direct-to-consumer (DTC) capability? Source: 2023 Path to Purchase Institute Trends Study, November 2022

Source: 2023 Path to Purchase Institute Trends Study, November 2022 73% 65% 51% 32% 32% 8% Demos or experiential activations Hosting or being present at local/community events Large event sponsorships (e.g., concerts, races, festivals) Retailtainment Popups Something else

Yes No 45% 55% Are you incorporating social commerce into your omnichannel marketing budgets? If so, which platforms? Source: 2023 Path to Purchase Institute Trends Study, November 2022 Yes No 61% 39% 55% 54% 41% 37% 27%

All plans and strategies concerning the metaverse are being managed by our head office; at the moment, it is not a local focus.

Significant Change YoY (-17 pts)

Investment in permanent and/or temporary displays

Q. Does your organization invest in both permanent and temporary in-store displays?

Q. Does your organization invest more in permanent or temporary in-store displays?

Source: 2023 Path to Purchase Institute Trends Study, November 2022

Insight from a CEN member ...

WHICH EMERGING COMMERCE MARKETING TRENDS ARE YOU EXCITED ABOUT?

John Stanwood, Senior Marketing ManagerStrategic Channels, Sargento Foods, says …

The emergence of social commerce, where people are shopping in traditional social channels. Also, how has the emergence of video commerce impacted this? And why? With Gen Z’s and younger Millennials’ high rates of mobile usage, this trend will become more impactful as the Gen Z’s mature to heads of households.

The impact of retailer (food & mass) recipe hubs to the e-commerce shopping journey (food, Walmart, Target). Why? As food and mass retailers want to impact a bigger portion of the e-commerce shopping journey, it’s important to understand their recipe approach, how successful they are, and how CPGs should respond to this.

P2PI.com

Yes No 69% 31% More in permanent More in temporary Equal investments in both 17% 23% 60% Source:

Are you activating in the metaverse? Yes No, but we’re planning to soon No, and we have no plans 11% 15% 74%

2023 Path to Purchase Institute Trends Study, November 2022

Retailer Media Networks: RATINGS AND CHALLENGES

BY CYNDI LOZA

From Google’s third-party cookie deprecation plans to the rise of e-commerce grocery adoption, there are a variety of reasons retail media has become a hot topic in recent years. In spite of continued growth, however, challenges related to data sharing and transparency persist.

“Lack of attributable data — they are getting better, but it’s still essentially a black hole of information,” said one survey respondent when asked what has been most challenging in working with retailer media networks (RMNs). “You spend money with a lack of understanding on the return you are receiving for that investment.”

“Data sharing and transparency” was cited as

Do you work with retailer media networks?

What’s your assessment of retailer media networks?

From which budget is your retailer media network spend most often allocated?

30 l Jan/Feb 2023

Source: 2023 Path to Purchase Institute Trends Study, November 2022 13% 34% 32% 21% A simple money grab for the retailer More effective than other digital media Other Effective, but no more so than other digital media 2021 Results 33% 43% 15% 10%

Source: 2023 Path to Purchase Institute Trends Study, November 2022 Yes No Not sure 68% 21% 11% Shopper marketing National media It’s determined campaign by campaign Other 56% 13% 19% 12% How much of that spend

None 11-20% 1-10% 21-30% 31-40% 41-50% > 50% 44% 16% 16% 6% 6% 6% 6% Path to Purchase Trends 2023

is incremental to base budget(s)?

a challenge in working with RMNs by more than a quarter of respondents. Survey takers also shared issues with the investment level required and consistency in measurement across platforms.

“It’s expensive and we don’t have the budget to do all we would like,” noted a respondent. “Because it is fairly new for us, we are learning what is the most effective campaign as we go.” Another respondent agreed, sharing “investment levels are hard to meet given current budgets.”

The number of RMNs in the marketplace also makes it difficult for a company to manage, said one survey taker. “It is incredibly inefficient for our organization to manage these programs — especially when there are so many programs run across so many different retailers.”

Challenges in working with retailer media networks

Investment level required

Difficult to manage

Does not deliver on promised outcomes

No consistency in measurement across platforms

Lack of creative freedom

Lack of collaboration

Audit compliance

Evolving capabilities to address critical gaps

Alignment across teams

Aligning to the needs of our business

Contract cycle

Legalities due to alcohol beverage laws

DSP, 93% of survey takers gave the network at least a “good” rating for return on investment (ROI).

Among other results:

• 70% or more of respondents gave Walmart Connect at least a “good” score across all metrics.

• 80% of survey takers who worked with Instacart gave the platform at least a “good” score for sales growth.

When it came to rating specific RMNs, some stood out above others with regard to different performance metrics. We asked respondents to rate the retailer media networks with which they work based on their relative strengths in targeting effectiveness, measurement capabilities, ROI, data sharing, sales growth, creative freedom and traffic-driving capabilities.

Not surprisingly, Walmart Connect, Target’s Roundel, Kroger’s Kroger Precision Marketing (KPM) and Amazon DSP were the networks our brand respondents worked with the most followed by Albertsons Media Collective and Instacart.

Among these networks — and among most other networks included in the survey — KPM and Amazon led the way across metrics. At least half of respondents gave KPM an “excellent/very good” (EVG) score — the highest marks — for traffic-driving capabilities and measurement capabilities, and nearly 60% gave the network an EVG rating for targeting effectiveness and data sharing. For Amazon

• 70% of respondents gave Roundel at least a “good” score for measurement capabilities.

When asked from what budget their retailer media spend is most often allocated, 56% of respondents noted shopper marketing, up from 50% in last year’s Trend survey and the year prior. Despite their challenges, 34% of respondents also noted RMNs are more effective than other digital media, a huge jump from 15% who said so last year and 14% the year prior. Skeptics remain, however, with 21% noting RMNs are a simple money grab for the retailer and 32% citing they are effective, but no more so than other digital media.

“It is a money grab, but I believe in the promise,” said a survey respondent. “I am just waiting for it to be reality.”

SURVEY METHODOLOGY

In November 2022, marketing executives at consumer product manufacturers were emailed a questionnaire to be completed online. The names were drawn from P2PI Magazine subscribers, Path to Purchase Institute members and others in the EnsembleIQ database, with an emphasis on people with manager, director or senior executive titles. From those emails, 166 executives submitted surveys. Each respondent was entered into a drawing for one of four $100 Amazon gift cards.

P2PI.com

Source: 2023 Path to Purchase Institute Trends Study, November 2022 28% 21% 19% 13% 13% 9% 6% 4% 2% 2% 2% 2% 2% Data transparency/sharing

[RMNs are] expensive and we don’t have the budget to do all we would like.

Because it is fairly new for us, we are learning what is the most effective campaign as we go.

RATING RETAILER MEDIA NETWORKS

For any retailer media network you have worked with, please rate its performance in the following areas …

32 l Jan/Feb 2023 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Ahold Delhaize (AD Retail Media) 14% 21% 7% 7% 7% 7% 14% 57% 36% 36% 43% 36% 43% 43% 29% 43% 57% 50% 57% 43% 50% Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Albertsons (Albertsons Media Collective) 17% 12% 13% 17% 12% 29% 24% 29% 25% 29% 29% 25% 38% 21% 54% 63% 58% 54% 63% 38% 50% Respondents: 24 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Dollar General (DG Media Network) 20% 40% 7% 7% 7% 60% 13% 33% 33% 53% 33% 53% 67% 27% 27% 27% 53% 40% 20% 40% 40% Respondents: 15 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Amazon (Amazon DSP) 48% 49% 34% 31% 38% 41% 31% 48% 41% 59% 59% 48% 41% 45% 4% 10% 7% 10% 14% 28% 14% Respondents: 29 Respondents: 14 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Costco 14% 43% 14% 43% 71% 14% 14% 72% 57% 57% 57% 29% 43% 57% 14% 29% 43% 29% Interpret with caution: Results are directional only as base size is small. Respondents: 7 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities CVS (CVS Media Exchange) 24% 75% 50% 25% 12% 12% 12% 38% 50% 50% 50% 63% 50% 38% 25% 25% 38% 25% 38% Interpret with caution: Results are directional only as base size is small. Respondents: 8 Source: 2023 Path to Purchase Institute Trends Study, November 2022

Excellent/Very Good Good Fair/Poor

Path to Purchase Trends 2023

The Home Depot

Interpret with caution: Results are directional only as base size is small.

For additional findings from our annual survey, Path to Purchase Institute members can view the full Trends 2023 survey report at P2PI.com under the Research tab in the Members-Only Resources section of the navigation bar.

P2PI.com Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Walmart (Walmart Connect) 51% 41% 41% 35% 49% 32% 46% 32% 41% 41% 32% 36% 38% 38% 16% 18% 24% 27% 16% 30% 16% Respondents: 37 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Sam’s Club (Sam’s Club Member Access Platform) 14% 7% 14% 29% 21% 7% 7% 43% 57% 57% 36% 58% 36% 36% 43% 38% 14% 50% 21% 57% 57% Respondents: 14 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Target (Roundel) 30% 13% 24% 11% 22% 13% 24% 32% 57% 40% 38% 46% 41% 38% 38% 30% 49% 38% 32% 46% 38% Respondents: 37 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Kroger (Kroger Precision Marketing) 59% 56% 59% 38% 38% 50% 32% 32% 35% 41% 26% 47% 53% 38% 9% 9% 21% 15% 15% 15% 12% Respondents: 34 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Meijer 36% 14% 28% 7% 36% 21% 43% 36% 43% 43% 36% 28% 21% 36% 28% 43% 50% 36% 36% 36% 43% Respondents: 14 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities Instacart (Instacart Ads) 30% 30% 35% 40% 45% 40% 25% 45% 45% 35% 30% 35% 45% 35% 25% 25% 25% 35% 20% 30% 25% Respondents: 20 Targeting effectiveness Measurement capabilities ROI Data sharing Sales growth Creative freedom Traffic-driving capabilities

(Retail Media+) 22% 11% 11% 56% 45% 33% 22% 33% 33% 22% 45% 33% 11% 22% 45% 56% 22% 44% 22% 67% 45% Respondents: 9

How CPG Marketers are BATTLING INFLATION

To offset the impact of high prices at the shelf, CPG brands continue to focus on product quality, creating value for consumers and strengthening retailer relationships.

BY MICHAEL APPLEBAUM

A nyone under the age of 50 probably has little or no memory of the runaway inflation of the 1970s, which is the most recent historical comparison to today’s sky-high prices at the gas pump and grocery store. That includes many CPG marketers, who were forced to confront the spike in food and household goods inflation in 2022 on the heels of an unprecedented global pandemic that sent household budgets and shopping behaviors into a tailspin.

Once again, those marketers found themselves in uncharted territory and they had to make major adjustments — including price hikes at the shelf — to account for the sudden inflationary shocks and resulting changes in consumer behavior. Now, marketers must determine which strategies to keep in place, with inflation starting to cool but likely remaining elevated for much of this year. While the U.S. Department of Agriculture expects food inflation to be lower in 2023, it still forecasts price increases of 3.5% to 4.5% — well below the 10% average increases of 2022, but a far cry from the 2.4% national average of the last 20 years.

“Most CPGs didn’t have the muscle memory to be able to execute price increases effectively and were scared to death to do it, because there was a lot of pushback from the retailers,” says Ken Harris, a veteran CPG industry executive and managing partner at Cadent Consulting Group. “There were real input costs going up, and there were CPG organizations that were not equipped to pass along that pricing, because they didn’t know what the choreography was or what the language was that they had to use.”

But they soon learned. In food categories hit hardest by inflation — such as milk products, beverages, lunch meats, pet food and eggs — many national brands either raised prices or shrank package sizes without lowering prices (a controversial practice often referred to as shrinkflation) in order to offset lower margins. At the same time, marketers stepped up discounts and promotional offers while delivering messages of quality and value to dissuade consumers from trading down to lower-priced products.

“In many cases, consumers don’t want to trade down, but they

34 l Jan/Feb 2023

have to do what makes the most sense economically for themselves and their families,” says Alex Harrison, vice president of sales at Breaktime Media, whose clients include General Mills, Mondelez International, Nestle and Unilever. “When the perceived value of a product outweighs the cost, it becomes easier for the consumer to justify the purchase.”

Responding to Changing Shopping Patterns

U.S. consumers have adapted to inflation by altering many of their “normal” pre-pandemic shopping behaviors. For example, surveys conducted last spring revealed that shoppers were cutting their budgets and taking fewer trips with shorter lists at grocery stores, while increasing club channel

memberships and buying more items in bulk at discount stores.

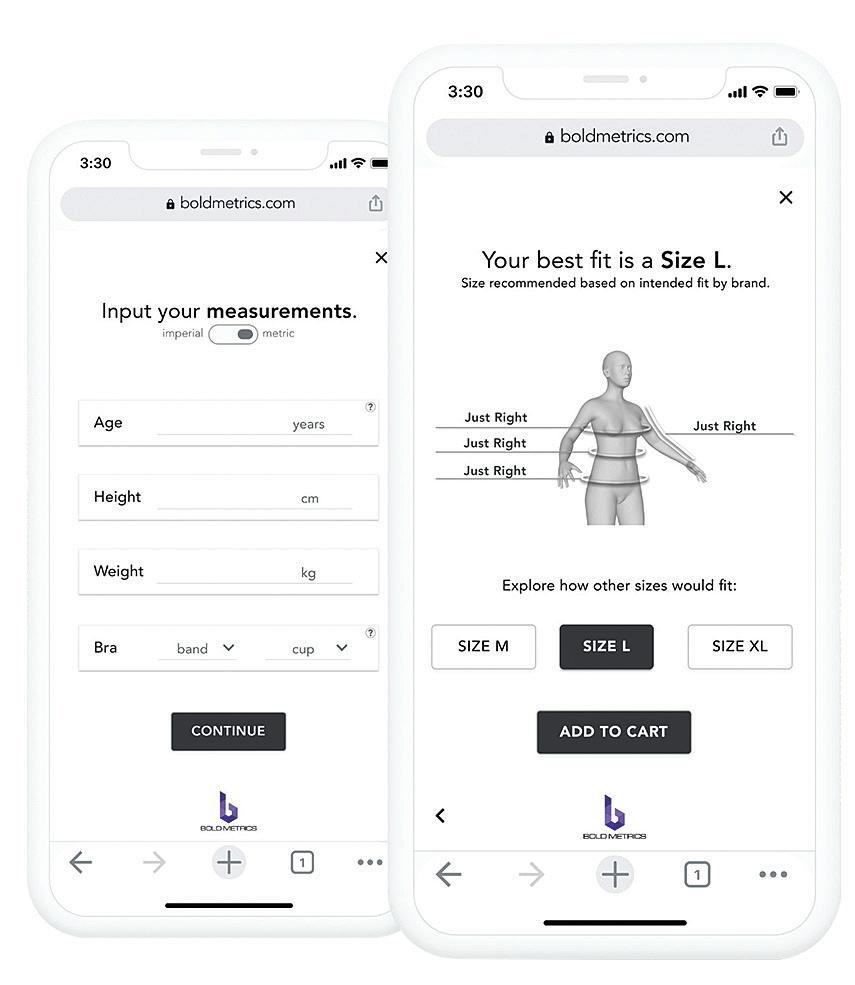

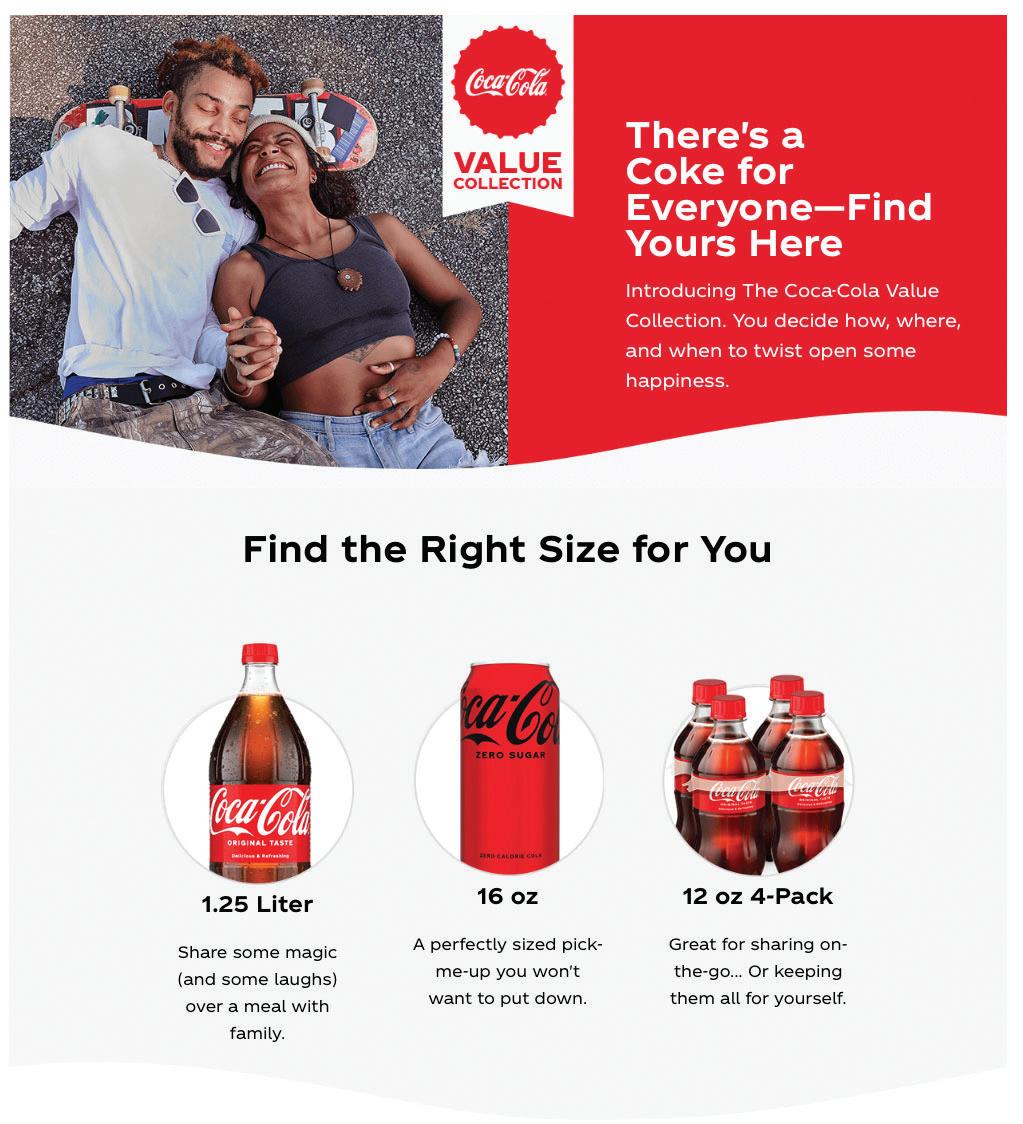

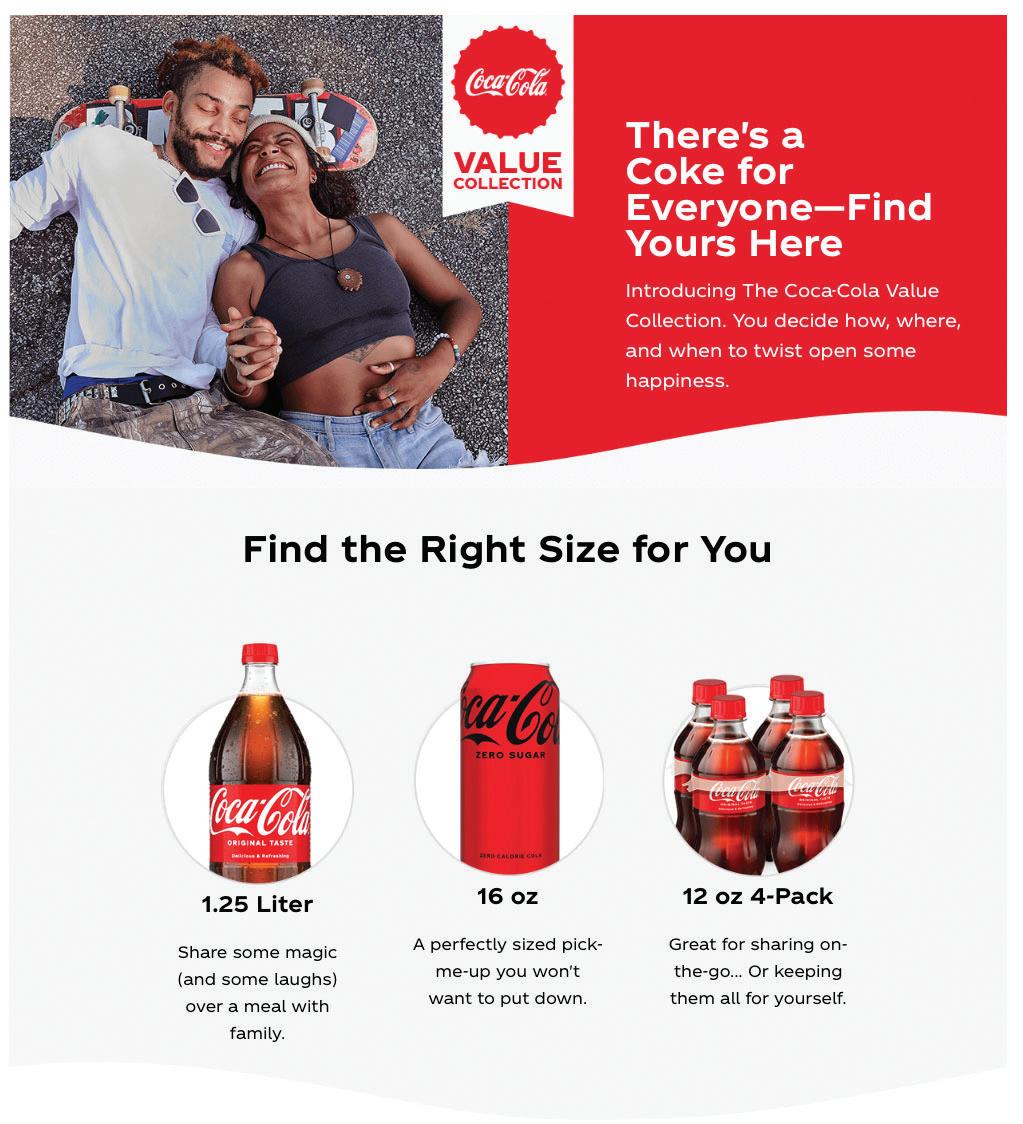

In response to these trends, major marketers, including Coca-Cola, adjusted assortments and pack sizes, a strategy presumably designed to help compensate for the fewer grocery trips.

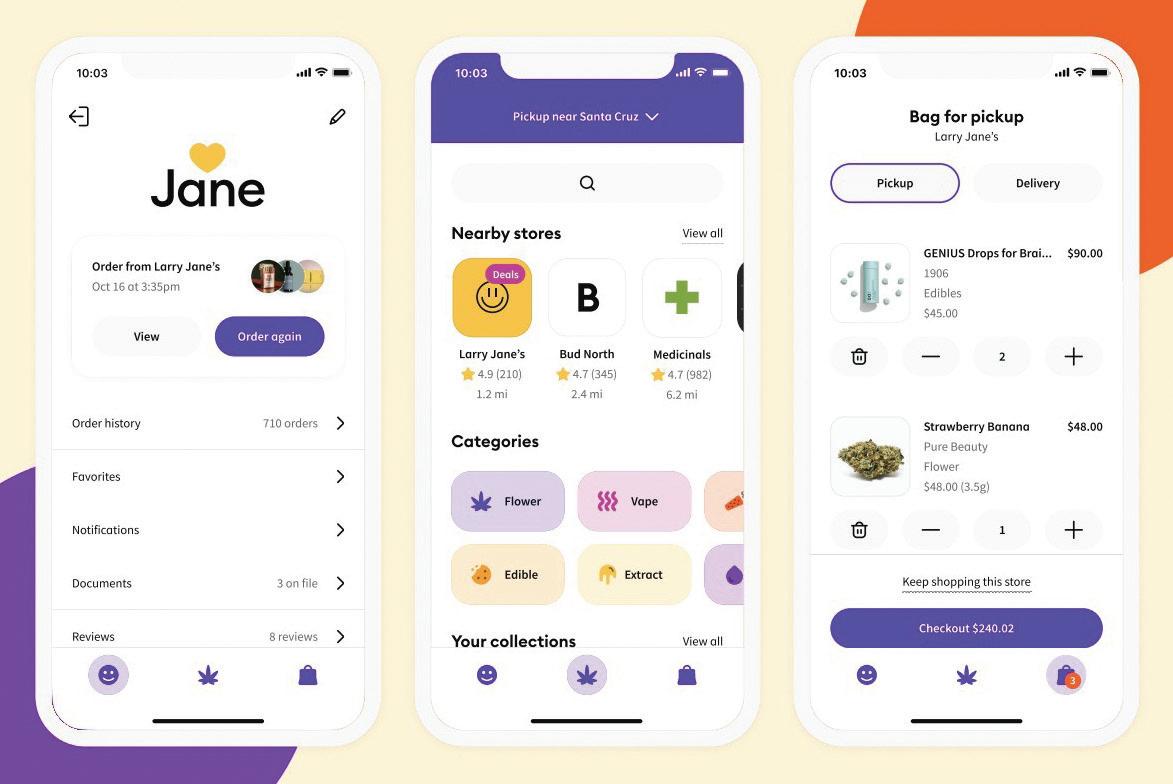

Joe Vizcarra, group vice president of customer marketing at Coca-Cola, told audiences during a Path to Purchase NOW webinar back in October that the company’s new Value Collection was the result of a six-week sprint in which agile principles were used to develop innovative ways to help shoppers stay within budgets while filling their baskets at the store.

“It is basically a different mix, item count and lower price point than what you would normally find, and in some of the sizes and flavors that people really wanted to purchase,” Vizcarra explained. “These value packs, if you will, started being featured in large stores, including Walmart, convenience and some value channels. They were extremely well-received. So now we’re taking a look at the next iteration of that strategy.”