P2PI.com SEPT/OCT 2022 THIS GROWING CPG SECTOR IS POISED TO BECOME A MULTI-CATEGORY MARKET DISRUPTOR P2PI LIVE Your guide to the show SPECIAL REPORT Shopper Engagement with Retail Media (in collaboration with Vibenomics) P-O-P SHOWCASE A roundup of effective in-store activations CANNABIS

HOW TO WIN AT RETAIL

With in-house expertise in design and manufacturing, we bring your vision to life and transform an average shopping day into a memorable experience. Our innovative approach adapts to changing markets and shoppers’ needs with transformational displays from temporary to permanent.

Get started today 855.909.2053 or greatnortherninstore.com FROM CONCEPT TO REALITY

RESPONSIVE CONSULTATIVE CREATIVE HIGH QUALITY COST EFFECTIVE RELIABLE

Contents

Cannabis: Ready to Ignite CPG

This growing CPG category is poised to become a significant multi-category influencer and market disruptor.

FEATURES

18

P2PI LIVE & Expo Sneak Peek

Want to know what to expect at our flagship show in October? Here’s the inside scoop on the must-attend special events and conference lineup.

Special Report: Shopper Engagement with Retail Media

Exclusive research examines what consumers think about retail media, and how they are interacting with it across platforms. (In collaboration with Vibenomics.)

30 44

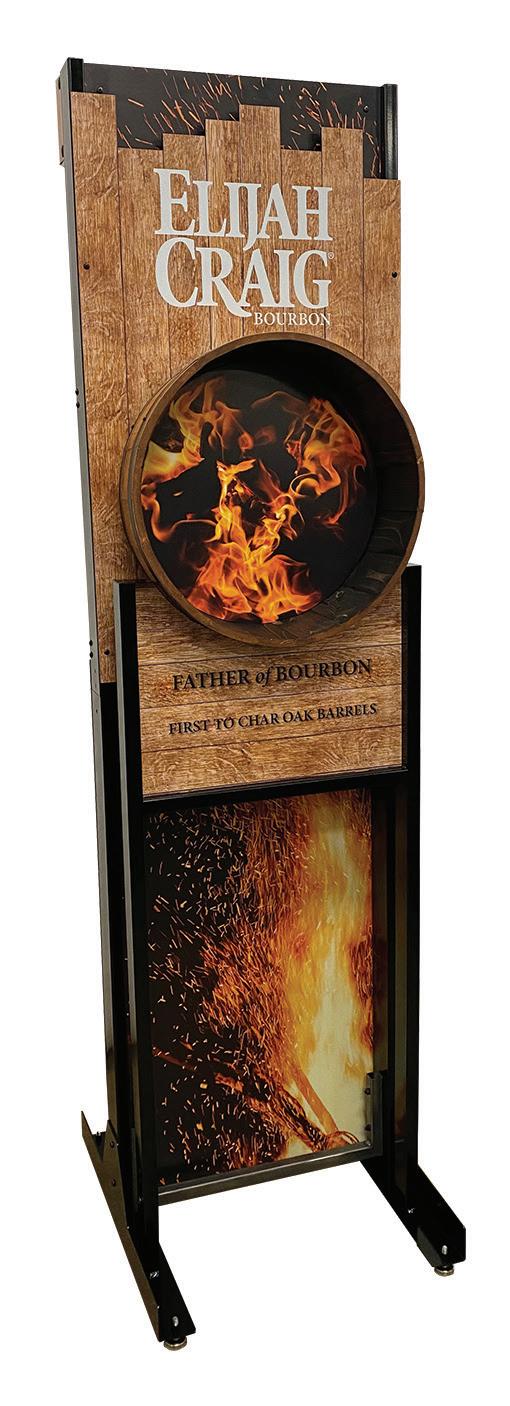

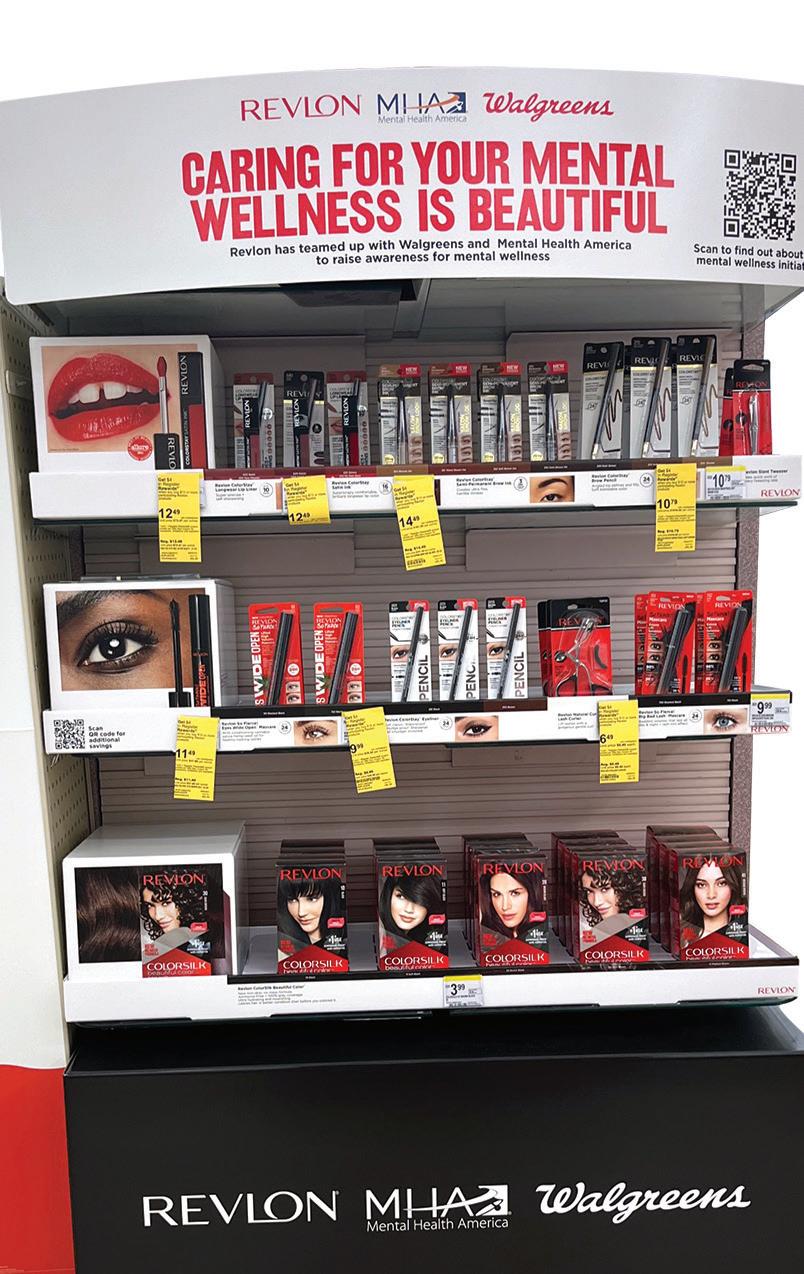

P-O-P Showcase

Our gallery presents a sampling of eyecatching and effective in-store activations.

Path to Purchase Institute magazine (USPS 4568, ISSN 2688-4984) is published bi-monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rate for the U.S.: $80 one year; $155 two year; $14 single issue copy (pre-paid only); Canada and Mexico: $105 one year; $185 two year; $16 single issue copy (pre-paid only); Foreign: $115 one year; $215 two year; $16 single issue copy (pre-paid only); $56. Periodical postage paid at Chicago, IL 60631 Copyright 2022 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Path to Purchase Institute magazine, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631.

STORY

Path to Purchase Institute magazine (USPS 4568, ISSN 2688-4984) is published bi-monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rate for the U.S.: $80 one year; $155 two year; $14 single issue copy (pre-paid only); Canada and Mexico: $105 one year; $185 two year; $16 single issue copy (pre-paid only); Foreign: $115 one year; $215 two year; $16 single issue copy (pre-paid only); $56. Periodical postage paid at Chicago, IL 60631 Copyright 2022 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Path to Purchase Institute magazine, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631.

STORY

Sept/Oct 2022 VOLUME 35 | ISSUE 5

P2PI.com

24

COVER

Editorial Advisory Board

Keith Albright

Post Consumer Brands

Dana Barba

Coca-Cola North America

Stephen Bettencourt

Peapod Digital Labs

Lianna Cabrera

L’Oreal Paris Cosmetics

Mia Croft Native

Christiana DiMattesa

Under Armour

Gregg Dorazio

Giant Food (Ahold Delhaize)

Paige Dunn

FIJI Water, JUSTIN Vineyards & Winery, Landmark Vineyards & JNSQ Wines

DEPARTMENTS

5

6

8

Editor’s Note

Cannabis: A CPG Story

P2PI Member Spotlight

The New Consumer

How inflation is impacting grocery purchasing behaviors.

10 Brand Watch: Mielle Organics

The beauty brand rolls out an exclusive line at Ulta.

12

In-Store Experience

Best Buy’s new format serves as an immersive experience hub.

15 On Trend

A Q&A on social shopping; Jose Cuervo in the metaverse.

Activation Gallery

Back to School

58

Insider Intel

Clorox leverages AR at Walmart for spring cleaning.

Follow the Path to Purchase Institute here:

Jessica Fair

The J.M. Smucker Company

Tony Fung

Bob Evans Farms

Patrick Hallberg Apple

Travis Harry Home Depot

Brendon Lynch

Jushi Holdings

José Raul Padron

The Hershey Experience

Rodney Waights Beiersdorf

Contents 4 l Sept/Oct 2022 55 52

52

55 Solutions & Innovations

10 12 16

Editor’s Note

Cannabis: A CPG Story

Recently, I was chatting with someone who described cannabis — and its potential market positioning — as “a zerocalorie White Claw.” It’s an analogy that has stuck with me as we dove into this issue of P2PI Magazine and began working on the cover story, which explores how cannabis is poised to become a significant multi-category influencer and market disruptor with global sales forecasted to reach $55 billion by 2026.

Whether you agree with the White Claw metaphor or not, the premise is no less tantalizing and provocative. Could cannabis be the disruptor that will turn the BevAlc, Big Pharma and wellness industries on their heads? What will the landscape look like when cannabis use is further normalized? And what does this all mean for commerce marketers as cannabis infi ltrates across categories with its own host of big brands and labels?

We sought out to answer these questions in our cover story, delving into branding, marketing, customer strategy, e-commerce, loyalty, packaging and physical retail — all as they relate to the burgeoning market.

Vice President, Brand Director Eric Savitch, esavitch@ensembleiq.com

Editorial Director Jessie Dowd, jdowd@ensembleiq.com

Executive Editor Tim Binder, tbinder@ensembleiq.com

Managing Editor Charlie Menchaca, cmenchaca@ensembleiq.com

Digital Editor Jacqueline Barba, jbarba@ensembleiq.com

Director/Member Content Patrycja Malinowska, pmalinowska@ensembleiq.com

Managing Editor/Member Content Cyndi Loza, cloza@ensembleiq.com

Editor/Member Content Heidi Bitsoli, hbitsoli@ensembleiq.com

Events Content Director Lori Pugh Marcum, lpughmarcum@ensembleiq.com

Director – Production Ed Ward, eward@ensembleiq.com

Creative Director Colette Magliaro, cmagliaro@ensembleiq.com

Art Director Michael Escobedo, mescobedo@ensembleiq.com

CONTRIBUTING WRITERS

Michael Applebaum, Ed Finkel, Erika Flynn, Chris Gelbach, Jenny Rebholz, Bill Schober

SALES & P2PI MEMBER DEVELOPMENT

Associate Director, Brand Partnerships Arlene Schusteff, 773.992.4414, aschusteff@ensembleiq.com

Regional Sales Manager Orlando Llerandi, 678.591.8284, ollerandi@ensembleiq.com

Central to all of this, marketers working in this emerging sector are tasked with educating consumers on how to integrate beneficial products into their daily lives and giving cannabis a sense of normalcy. And part of shedding its legacy stigma and rebranding cannabis for normalcy lies in reimagining the shopping experience from its medical and underground roots.

The dispensary experience has already come quite a long way in just a few short years, evolving from the seedy (pun intended … is it really a cannabis story without some sort of stoner dad joke thrown in for good measure?) first days of shady-looking dispensaries located under a bridge in a run-down part of town, to the elevated concierge experiences and uber-efficient pickup spots nestled in between trendy boutiques and restaurants we see across more and more cities today.

On page 28 of our cover story, we dive into the plethora of exciting new dispensary concepts, featuring a handful of unique locations, pop-ups and other formats from various cannabis retailers. This roundup includes Wyllow (pictured on the cover), an other-worldly 500-square-foot Los Angeles dispensary reminiscent of a jewel box, which captivates customers’ senses while a dedicated Atelier guides their shopping journey.

In addition to the spread of dispensaries, there are also now cannabis kiosks, consumption lounges and delivery options popping up across the U.S. and Canada. Perhaps buying it with your weekly groceries may not be as far off as we think. Just imagine all of the cross-promotional merchandising that would be possible … BOGO on Nestle Toll House chocolate chip cookies with your vape cartridge refi ll? Don’t mind if I do!

Director, Membership Development Nicole Mitchell, 203.434.5733, nmitchell@ensembleiq.com

Director, Membership Development Christopher Barry, cbarry@ensembleiq.com

Membership Experience Manager Ann Estey, aestey@ensembleiq.com

Manager, Membership Development Brady O’Brien, bobrien@ensembleiq.com

Membership Experience Manager Heather Kurtik, 724.553.0093, hkurtik@ensembleiq.com

AUDIENCE

List Rental MeritDirect Marie Briganti, 914.309.3378

SUBSCRIBER SERVICES/CUSTOMER CARE

TOLL-FREE: 1.877.687.7321

FAX: 1.888.520.3608

Between 9 a.m. to 5 p.m. EST weekdays contact@pathtopurchaseiq.com

ENSEMBLEIQ LEADERSHIP TEAM

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Executive Vice President, Operations Derek Estey

Executive Vice President, Content & Communications Joe Territo

EDITORIAL AND EXECUTIVE OFFICES 8550 W. Bryn Mawr Ave., Suite 200 Chicago, IL 60631

JESSIE DOWD, Editorial Director

Phone: 773.992.4450 | Fax: 773.992.4455

Shedding its legacy stigma and rebranding cannabis for normalcy lies in reimagining the shopping experience.

P2PI.com

Member Spotlight Meet the Marketers

HERE’S A SNAPSHOT OF INDUSTRY LEADERS FROM THE P2PI MEMBER COMMUNITY.

large store, convenience and value channels.

DANA BARBA Senior Vice President, Marketing, North America Operating Unit The Coca-Cola Co.

Main job responsibilities: I lead the frontline marketing team, which amplifies brand and shopper strategies with our bottling system, integrates shopper marketing with our top retail customers, and leads the marketing of our Freestyle beverage experience for North America. Collectively, the team serves as the face of our brands to the customers, asset partners and bottling system. My team focuses on the last mile to the consumer.

As part of our evolution in 2021, we launched a new high-touch, brand edge field marketing capability. It combines strategic consumer recruitment and partnership marketing with retail engagement. Unique and authentic sampling experiences are amplified by local influencer, social media and partnership drops, and then leveraged for new business and sales.

How you win with shoppers during uncertain economic times: We are focused on building end-to-end experiences tailored to our customers, which has helped us react quickly and adapt to challenges as they arise. We used agile design principles to introduce (in just six weeks) “The Coca-Cola Value Collection,” which features new and existing package assortments of our popular sparkling beverages across various price points, sizes and flavors. The value packs will be featured in

New marketing tactic in your toolbox: We’re very excited about the way we have approached our Coca-Cola Creations innovation platform. Coca-Cola Starlight harnessed Gen Z influencer culture with a digital experience that articulated the full magic of the Starlight experience, including bespoke influencer “unboxing” of product and an AR music performance unlocked by the label. Next, inspired by Gen Z’s connection to drop and gaming culture, Coca-Cola Byte became the fi rst Coca-Cola product to launch in the metaverse and debut on the livestreaming platform Twitch. We continued to build on this successful platform with our most recent launch of Coca-Cola Dreamworld in August.

Memorable aha moment in your career: Learning about and applying insights from our new consumer segmentation model. It’s defi ned by higher order needs and motivations versus simple demographics. It can be applied to customer planning and shopper marketing. The aha came when in diving into the work, they described a consumer based just on demographics. We look at six additional layers of influences and differentiators beyond demographics to really understand who the consumer is, what is important to them and how to connect with them.

AMBER HUBBS GOLEGOS Shopper Marketing Manager Merrick Pet Care, Nestle Purina

How you win with shoppers during uncertain economic times: Our messaging has a humanized approach to develop a connection with our pet parents. Similar to how they shop for their children, pet parents are not willing to sacrifice quality for a lower cost.

New marketing tactic in your toolbox: Not a tactic, but a new approach. All of our programs are built from an omnichannel lens. We try to think about the pet parents’ shopping behaviors as a cohesive experience between online and instore. Personalization has been a big unlock for us also. We bring this to life via digital media and CRM activations.

Best career advice you’ve received: Start with the end in mind. When you understand what success looks like, you are able to create more effective marketing plans that measure against your KPIs. And as a mom with two boys under 2, the advice was, “It takes courage to be a working mom. You need the courage to leave your kids with someone other than you. You need courage to prove your value in the workplace. And you need courage to focus on what’s right for your family. As a working mom, you are stronger than you think.”

Memorable aha moment in your career: During a summer internship, I gathered more information and found that a role in sales would be extremely beneficial in making me a well-rounded candidate for future marketing roles. From that invaluable experience, I realized that not all paths are linear. There are infinite ways you can get to an end goal, you just have to be open to alternate routes to get there.

6 l Sept/Oct 2022

Perfect

to

Learning Labs & Virtual Forums included in corporate and universal memberships

Plan

CORPORATE

The ONLY community that connects THOUSANDS of MEDIA, SHOPPER, OMNICHANNEL and COMMERCE MARKETING professionals essential for solving today’s business problems and driving growth.

300+ COMPANIES representing over 18,000 industry executives and thought leaders. The most comprehensive collection of commerce insights and perspectives in North America.

Sharing the TOOLS, KNOWLEDGE & EXPERTISE necessary to activate and execute against today’s shopper marketing demands.

CONTACT: Nicole Mitchell nmitchell@ensembleiq.com

Community

&

Tools & Training

Research & Thought Leadership

Recognition

Insights

Perspectives

••••••• ••••••• ••••••• 2022 MEMBERSHIP BENEFITS JOIN! is the

Time

NOW

UNIVERSAL A Membership

for EVERY size company: NEW IN 2022 All

2022 EVENT SCHEDULE (may be subject to change) LIVE EVENTS VIRTUAL EVENT

The

Inflation and Shopping

A LOOK AT HOW AD SPEND IS INCREASING AND HOW INFLATION IS TURNING RETAIL ON ITS HEAD, IMPACTING GROCERY PURCHASING BEHAVIORS.

BY JACQUELINE BARBA

Findings from a recent report on inflation commissioned by Nielsen and Catalina’s joint venture NCSolutions (NCS), a purchase-based ad targeting and measurement firm serving the CPG industry, found that nearly half of U.S. consumers (45%) feel like they can’t afford their previous lifestyle and 76% said their family has changed how they buy food with prices on the rise. The report includes findings from a June consumer sentiment survey as well as proprietary NCS purchase data, which reflects the buying trends of consumers for CPG products.

Takeaways from the NCS report include:

• Six in 10 Americans believe CPG product packaging has gotten smaller but costs the same, compared to one year ago. Consumers still feel the strain of supply chain issues, as 69% said there are fewer items of the same product on the shelves.

• Fifty-three percent said they find basic food staples more expensive, and 40% believe a recession will occur in 2023. Seventy-one percent said the increased price of groceries is straining their savings. And 45% said increased prices in the grocery aisles mean seeking out less expensive brands.

• Other ways consumers are coping with the increased price of groceries are loading up the pantry (27%) or freezer (26%), or shopping closer to home (24%).

• When it comes to consumers’ preferred brands, 60% are seeking less expensive alternatives when their favorite brands reach a price beyond their budget. Forty-six percent plan to go without their favorite brands, and 43% look for sales to offset the cost.

• There was an almost 13% price increase on average over six years.

“For the second time in a little over two years, consumers are pivoting to new purchasing behaviors at the grocery store,” said Alan Miles, CEO, NCSolutions, in a news release about the survey results. “Since the start of the pandemic,

Year-over-Year (YoY) Spending Growth

they’ve been swapping their favorite brands for what’s available. Today, though, value is the centerpiece more often than availability, (and) consumers are selecting brands and products to stretch their budgets as far as possible. CPG brands that meet customers where they are both in this inflationary moment and as prices ease have the best shot at keeping them for the long term.”

Adjusting for Inflation

Quantum Metrics’ latest retail benchmarks report, “Adjusting for Inflation,” analyzed data from the software company’s clients as well as survey responses from 3,400 consumers in the U.S. and U.K. to identify how rising prices caused by inflation and concerns about a recession are causing consumers to rethink their shopping habits.

A key takeaway from the research indicates the shift from “spontaneous shopping culture,” driven by big-box stores and Amazon, to more planned purchases of multiple items in one checkout. Consumers are also putting more of an emphasis on value as money constraints remain top of mind. Other trends highlighted in the report include:

• Generic store brands are the new go-to. As costs climb, consumers are increasingly considering replacing name brands with generic items, particularly in the U.K., where two in three Brits will opt for generic or store-brand health and wellness items (69%) to cut costs. More than half in the U.S. and U.K. (55%) would even go generic for home goods such as furniture, sheets or appliances.

• Consumer technology purchases are taking a backseat . Unlike during the height of the COVID-19 pandemic when many consumers were upgrading their tech to work and study remotely, new and backto-school tech (such as laptops or tablets) will make up less than 10% of consumer school supply budgets, while warranties, parts replacements and other accessory upgrades will likely see a boost.

Retail Media Paid Search Paid Social

New Consumer 8 l Sept/Oct 2022

+45% +40% +35% +30% +25% +20% +15% +10% +5% +0% Q2 2022 Q1 2022 (from previous QTR) +42% +38% +11% +10% +15% +15%

• Checkout is evolving. Most consumers across the U.S. and U.K. are leaning into interest-free, buy-now-pay-later (BNPL) programs like Klarna to manage costs. There are already concerns that BNPL usage over the summer could have lasting effects on fall and holiday spending. Americans are looking to credit cards, as 39% plan to apply for new credit cards ahead of the holidays and more than half will reserve their credit card points or rewards to redeem for holiday gifts.

• Black Friday and Cyber Monday will be busy. Due to rising costs, four in five consumers (80%) already plan to shop Black Friday this year, and 57% of those who will shop the sales have either never done so before or have just a few times in the past. Despite storefronts being fully open, most sales traffic will still happen online, with 75% of consumers planning to do most of their shopping digitally.

Ad Spending Increases Across Channels

Recent research from Skai’s “Q2 2022 Digital Marketing Quarterly Trends” infographic, an in-depth analysis of the digital marketing trends that defi ned the second quarter, revealed that advertising spending increased across channels overall in the quarter, compared to previous quarter and 2021.

It also indicated that commerce ads across retail media and social channels showed robust growth, while paid search spending focused more on services than goods. Some other key takeaways from the Q2 research included:

1. Overall spending growth continues: Retail media growth accelerated 42% year-over-year (YOY) in Q2 as advertisers continued to increase spending both on Amazon and the growing number of other retail media networks. Paid social media spending growth grew 15%, as 2022 has proved a more stable spending environment than the same period in 2021. Paid search spending increased 11% YOY.

2. Shopping a big factor across channels: Retail media growth was driven by more

brands trying to reach a larger group of shoppers while they are in-market. Paid social spending growth in the quarter also benefited from investment on commercefocused ad types and advertisers. Only in paid search did investment follow the trend away from goods and toward services.

3. Social advertisers are adjusting to IDFA (Identifier for Advertisers — the random device identifier assigned by Apple to a user’s device): 2021 saw “sequential spending declines” from April to May to June as the release of iOS 14.5 introduced changes to privacy controls and availability of data for both targeting and measurement.

There are already concerns that BNPL usage over the summer could have lasting effects on fall and holiday spending.

4. Responsive search ads dominate search spend: The migration of paid search from the expanded text ad (ETA) format to the responsive search ad (RSA) format has put RSA in the dominant position, comprising 38% of total Q2 spend compared to 23% in Q2 of 2021. ETA spend has dropped from 40% to 27% of spend over that same period, with shopping ads making up most of the balance.

Other key fi ndings include:

• Commerce spending in social media was a major driver of overall investment, whether based on accounts or ad types, even outgrowing retail media both quarter-on-quarter and YOY.

• Ads for CPG products are proliferating on newer retailer media networks, including Instacart’s and Kroger’s.

• More sophisticated ad formats and bidding strategies continue to drive growth as they replace legacy options.

Prices Rise & Consumers Shift Choices

Increased Prices

Change the way they buy groceries

Feel a strain on their savings

Drive Americans to: 76% 71% 60%

Buy less expensive alternatives when they can’t afford their favorite brand

Seek out sales and promotions to afford their favorite brands

Source:

P2PI.com

NCS Consumer Sentiment Survey, June 2022

43%

Mielle Organics Shines at Ulta

THE FEMALE- AND BLACK-OWNED BRAND ROLLS OUT A NEW LINE EXCLUSIVELY AT THE SPECIALTY RETAILER.

BY CHARLIE MENCHACA

Mielle Organics made a splash this summer with the launch of a six-piece collection exclusively at Ulta Beauty.

The Mango and Tulsi botanical blend collection is positioned as the fi rst textured haircare collection to feature tulsi, which is known for its nourishing leaves and richness in vitamin C and zinc to maintain scalp moisture.

“It is one of my greatest passions to fi nd new ingredients

and develop problem-solving products,” Monique Rodriguez, founder and CEO of the Black-owned beauty brand, said in a media release for the product launch.

The vegan and cruelty-free product line consists of a serum, shampoo, conditioner, leave-in conditioner, whipping creme and styling gel.

To support the launch, the Mango and Tulsi collection had

Brand Watch 10 l Sept/Oct 2022

— Monique Rodriguez , Mielle Organics

a dedicated endcap in Ulta stores in August, says Nicole Ray Robinson, senior brand director at Mielle Organics. The collection was also featured on two themed etageres at Ulta — “Black Brilliance Off-Shelf” and “Curl Cocktailing.”

To highlight the collection’s exclusivity, “only here” messaging appeared on product display pages, the Mielle landing page on Ulta.com and a circular feature within Ulta’s Aug. 28-Sept. 17 store ad. Emails, text messages and social media posts touted the launch, Robinson says. The social media activity included a static post and video content from Rodriguez, and several Mielle Mavens, or influencers and members of the brand’s loyalty program.

Various posts on Mielle’s social media accounts in June and July plugged a “Mielle x Ulta Mango & Tulsi” giveaway. For a chance to win an Ulta store gift card and Ulta Salon hair service, participants were asked to tag three friends and follow Mielle and Ulta Beauty on social media. The entrants then had to comment using a specific phrase and an #MiUltaMTMadness hashtag, which refers to the retailer and the new product line. The entry process concluded when participants shared their posts in a story while tagging Ulta, Mielle and an account related to Rodriguez, the brand’s founder.

Ulta began to carry Mielle’s other products in stores and online in April. A photo and bio of Rodriguez was added to a dedicated web page within Ulta.com celebrating Black-owned and founded brands.

“The brand has established a loyal fan base over the years and we’re excited to offer yet another touchpoint for beauty enthusiasts to discover their beloved products,” said Jessica Phillips, VP of merchandising at Ulta Beauty, in a media release.

It is one of my greatest passions to find new ingredients and develop problemsolving products.

P2PI.com

In-Store Experience

Best Buy’s Experiential Format

NEW STORE IN CHARLOTTE SERVES AS AN IMMERSIVE EXPERIENCE HUB FOR AUDIO, HOME THEATER, APPLIANCES AND OTHER CONSUMER ELECTRONICS.

BY JACQUELINE BARBA

Best Buy has been testing new store formats in the Charlotte, North Carolina, area over the past two years, including an experiential format, a smaller digital-fi rst store concept and an outlet store.

After seeing success with the pilots, the electronics retailer will expand the number of experiential stores by remodeling about 50 locations in the next year and transforming approximately 300 locations by 2025. The retailer also plans to increase the number of outlet centers to 30 by the end of 2023, while expanding beyond major appliances and televisions to also include computers, gaming consoles and mobile phones in those locations.

The Path to Purchase Institute recently visited Best Buy’s 35,000-square-foot Charlotte-North Lake experiential store. The location, which was renovated in 2021, serves as a hub of immersive experiences for audio, home theater, appliances and other consumer electronics. In addition to the noticeably absent carpet covering much of the store, here’s what else stood out:

Located at 10221 Perimeter Pkwy., the remodeled Charlotte store includes expanded in-store experiences from brands such as Samsung, Meta’s Oculus, Amazon and Lego, in addition to larger Apple and Microsoft shops.

Best Buy will expand the number of experiential stores by remodeling about 50 locations in the next year and transforming about 300 locations by 2025.

12 l Sept/Oct 2022

The Oculus brand store-within-a-store has grown from an interactive endcap display found in Best Buy’s standard stores to a larger handson experience for shoppers to try out the tech with plenty of space. At the time of our visit, the Oculus space was demoing Beat Saber, a VR rhythm game, on a large screen.

Premium experiences for audio, home theater and luxury appliances are also part of the offering, as well as an in-store selection of fitness equipment, still a relatively new and growing category for Best Buy. This store offers dedicated spaces for shoppers to view, touch and try out unboxed large exercise equipment, including a treadmill and cycling machine from NordicTrack, as well as a smart mirror from Tempo complete with a floor cling and informational signage to provide an immersive product testing experience.

Like most Best Buy stores, the experiential format also offers a curated selection of popular products and categories, including home theater and audio, computing, headphones, wearables, cell phones, cameras, smart home and small appliances. Each product category is elevated in the store with unboxed product showcased on a display and/or inside a clear case for viewing. Digital price labels are also used throughout the store, something Best Buy has expanded in recent years.

The camera selection in particular is wide ranging and merchandises individual cameras

P2PI.com

In-Store Experience

on extended endcaps in front of screens displaying product information, store promotions and other assistance.

The smart home assortment also received a facelift at this store, offering a more immersive experience for shoppers of the category via wall displays, including touchscreens.

More digital and interactive endcaps also are part of the enhanced in-store experience. Most endcaps in the experiential store include large TV screens playing promotional, educational or other information from Best Buy or a brand. Unique endcaps that particularly stood out include a double-sided display from Hyperice, merchandising

Normatec compression boots and muscle massagers, as well as an illuminated product showcase endcap for the new PlayStation Plus.

The experiential store also offers a larger Geek Squad experience, a range of fulfillment options such as lockers and curbside pickup, and other engaging experiences and in-store expertise from Best Buy’s Blue Shirt associates.

With a focus on store remodels, Best Buy currently expects to close 20-30 stores annually through 2025, consistent with prior-year trends. Best Buy currently operates 1,144 stores in the U.S. and abroad.

14 l Sept/Oct 2022

On Trend

Social Shopping

WE TALK TO HAMUTAL (TULA) SCHIEBER ABOUT WHAT’S WORKING AND WHAT CHALLENGES REMAIN IN THE DIGITAL COMMERCE SPACE.

BY CHARLIE MENCHACA

BY CHARLIE MENCHACA

Every day it appears another company is fi nding a way for consumers to “add to cart” faster and complete transactions in one click (or swipe). Such is the current state of commerce that now exists in nearly any place at any time.

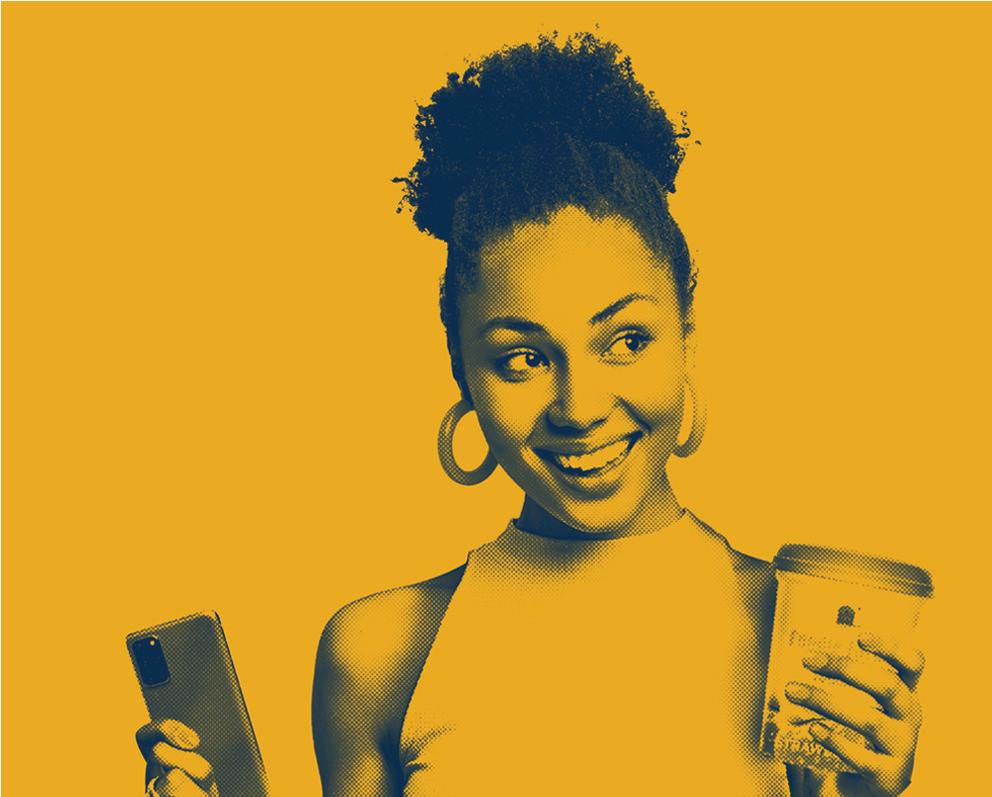

The “everything commerce” revolution is concentrated on social shopping — the notion of making social content shoppable, and making shoppable content social, says Hamutal (Tula) Schieber, CEO and founder of Schieber Research. She answered a few questions about platforms, purchase drivers and the anticipated rise of consumer-to-consumer commerce.

P2PI: How do you classify the various social shopping platforms?

Schieber: Generally, we can divide them into three groups. First, there are currently thriving social commerce platforms such as YouTube, TikTok, Instagram and Snapchat. Those platforms enable tools like live shopping, direct-to-purchase video ads and catalog listing ads. Consumers expect — and want — to discover brands and shop through those platforms. The challenge is to break through the noise with engaging, relevant content, and to drive awareness and influence through creators.

Second, there are walled gardens, or places where people influence each other, talk, and recommend products and services. Brands and retailers are not openly welcome here. In some of these consumer-to-consumer platforms, commerce also is taking place. Those include Discord, Reddit, and the many long-tail, peer-to-peer reselling, creator and upcycling platforms. To benefit from these platforms, the best move for a brand will be to humbly participate in the conversation, ethically, as an equal.

Finally, there are platforms where brands and retailers are invited, and consumers are active, but are not currently thriving as social shopping platforms. These are mainly gaming platforms and content streaming.

P2PI: You’ve indicated that stress is a main driver of social shopping. Why is that?

Schieber: While digital shopping is by itself a less stressful way to shop (less time-consuming, convenient, enables price and product comparisons), it is actually proven to be physically

stress inducing. Social shopping enables a more personalized discovery process. It allows for easier decision-making based on people we trust, like friends, family and creators. This type of shopping can even avoid stress-inducing errors, such as wrong size or color, since one may consult the seller or other members of the community. TikTok, for instance, combats decision fatigue by explaining that the personalization on the “for you” discovery page allows you to see more relevant choices (i.e., minimizing the number of decisions).

The above is not limited to digital shopping. The best shopper marketers already know how important it is to maintain the sense of curation and personalization in physical stores, as well as corresponding with the overall omnichannel strategy. Today it means connecting social media trends to the store by helping customers easily fi nd the products they discovered online or helping them make decisions based on creators they know and trust. A famous example is Barnes & Noble’s in-store connection to the “TikTok made me read it” trend, featuring books that are trending on “booktok.” Various brands also are launching limited-edition products to correspond to social media trends.

P2PI: What are some of the remaining challenges or friction points as it relates to social commerce?

Schieber: One of the biggest future challenges for brands and retailers will be their participation in consumer-to-consumer (C2C) commerce. Brands and retailers gradually lose control of the conversation with consumers. In the past, we saw a brand or retailer selling on social media and including a user-generatedcontent element (reviews, recommendations, etc.) to support decisions. Today, the conversation is seldomly led by brands, and consumers discover new products based on what their favorite content creators and their friends recommend. The sale also is increasingly led by creators, who sell directly to fans without the need to enable a brand or a retailer to partake in the process.

The real challenge is the C2C platforms — such as resell, fan art and upcycling — which could leave brands and retailers out of the conversation entirely. In my opinion, to play in the field, you must adopt a platform mindset to enable transactions and empower consumers. The bottom line is that brands must come to shoppers where they are spending their time and offer a personal and seamless experience, and relevant content — no matter the technology.

P2PI.com

On Trend

Inside a Metaverse Distillery

LANDER OTEGUI, MARKETING SVP AT PROXIMO SPIRITS, EXPLAINS THE PROCESS OF GOING VIRTUAL FOR JOSE CUERVO AND HOW IT CAN TRANSLATE TO REAL-LIFE PURCHASES.

BY CHARLIE MENCHACA

Proximo Spirits fully embraced the metaverse this summer by opening a virtual reality distillery for its Jose Cuervo tequila brand.

The “metadistillery” launched July 24 on the Decentraland digital platform to coincide with National Tequila Day. As metaverse avatars, users completed a gamified version of the tequila-making process and concluded their adventure with a virtual cocktail while mingling with other avatars. Those who completed the experience during the opening received digital wearables for their avatar.

To fully explore what this digital space can offer, we spoke with Lander Otegui, senior vice president of marketing at Proximo Spirits, importer and distributor of Jose Cuervo.

P2PI: Why did Jose Cuervo decide to enter the metaverse? Otegui: We are always looking for new ways to meet our consumers where they are, and we know that Millennials and Gen Z have a genuine interest and curiosity in the metaverse. We also see great value in bringing tequila to this emerging tech frontier.

Jose Cuervo was the fi rst tequila brand to be granted a license to distill more than 260 years ago. We’ve been pioneering within the industry ever since. … It’s only natural for us to be the fi rst tequila brand to open a

16 l Sept/Oct 2022

distillery in the metaverse and set a precedent for how this experience can come to life for others in the category.

Cuervo aims to help our fans create genuine connections. We recognized how Decentraland offers its visitors many ways to connect that they don’t often do in real life. That’s why we created the metadistillery — to bring strangers together. From the distillery space itself to shared activities and experiences, followed by prizes and tokens that reward people for making friends, we see this as a chance to show the world that Cuervo can fast-forward friendship both online and off.

P2PI: What are the objectives of this multistep virtual experience?

Otegui: Our primary objective is to demonstrate to visitors how tequila can be emulated in a virtual environment. Cuervo has been a brand unafraid to venture into new territories when it comes to innovating the liquid, so it’s only natural for us to explore how we can bring tequila to life in this new frontier. We want to show tequila lovers that there are numerous ways they can learn about and interact with the spirit, and the Cuervo metadistillery helps translate that experience into a platform with endless opportunities.

We also know that at large, Cuervo fans and tequila lovers are energized by enriching experiences that allow them to meet new friends and build lasting memories with existing connections. That’s why we’re encouraging strangers to form new bonds, whether it’s by experiencing many of the touchpoints within the virtual experience or just enjoying some quality time at the Familia Bar. Cuervo has always been a brand with a strong focus on fostering connections, and the metadistillery is another avenue to explore that passion point.

P2PI: How did you decide on the sequence and visual representation of each step?

Otegui: As we started conceptualizing the Cuervo metadistillery, it was important that we translate the distillery experience one would have at La Rojena — the oldest operating distillery in Latin America where Cuervo is produced — and elevate it with the boundless limitations that only the metaverse can provide.

That ethos is felt throughout the entire experience and is meant to mirror the distillation process from start to fi nish. From the beginning touchpoint, where visitors can harvest their very

That’s why we created the metadistillery — to bring strangers together. … We see this as a chance to show the world that Cuervo can fast-forward friendship both online and off.

— Lander Otegui, Proximo Spirits

own agave pinas for distilling, to the barrel maze that evokes the aging process via American white oak barrels, visitors will fi nd that each interactive moment evokes the tequila distillation process. We’ll continue to explore new ways to recreate the steps throughout the metadistillery and are excited to receive user feedback to make the entire experience true to Cuervo’s heritage and tequila-making process.

P2PI: How does the metadistillery lead age21-and-over shoppers to purchase Jose Cuervo products in the real world?

Otegui: At this stage, we’re offering a $5 discount code for new Drizly users following the completion of the metadistillery experience that visitors can use to purchase Cuervo expressions in real life. We’re exploring new ways to connect the metadistillery to physical Cuervo offerings and are excited at the possibilities — with more to come in the future.

P2PI: Whom did you collaborate with for this project?

Otegui: It started with the Jose Cuervo brand team, along with Mekanism, our creative agency of record. Consulting agency Ache served as creative co-lead, while Tangible headed up the metaverse experience.

Bompas & Parr, food and beverage experience designers, were responsible for the aesthetic and consumer experience in the distillery. Innovation firm Rojkind Arquitectos handled the architectural design while M2 Studio covered architecture optimization for the metaverse environment. Finally, Vegas City was responsible for programming.

Decentraland offers its visitors many ways to connect that they don’t often do in real life.

P2PI.com

Want to know what to expect at P2PI LIVE?

the inside scoop …

Inspiring Keynotes

Be ready at 8 a.m. as the P2PI LIVE conference agenda kicks off with impactful keynote presentations each morning.

Tuesday, Oct. 18:

• “The Zero-Compromise Customer Experience,” Bill Bennett, VP of eCommerce, The Kroger Co.

• “The Evolving (and Fast-Moving) CPG Path To Purchase,” Justin Honaman, Head, Worldwide Business Development, Consumer Products - Food & Beverage, Amazon Web Services, Amazon

• “Confluencer Commerce: Navigating the Integration of Commerce, Media and Content,” Bryan Gildenberg, SVP, Commerce, Omnicom Commerce Group

Wednesday, Oct. 19:

• “Reimagining Brick-and-Mortar Retail,” Carla Dunham, Chief Marketing Officer, Foxtrot

“The Frictionless Future of BevAlc E-Commerce,” Derek Correia, President, ReserveBar

Thursday, Oct. 20:

• “The Sunny Future of Cannabis,” Cory Rothschild, National Retail President, Cresco Labs

• “Tomorrow’s Shopping Era: From Community Commerce to Commerceverse,” Amy Lanzi, Chief Operating Officer, Publicis Groupe, and Roberto Cymrot, Director, Cross-Category Market Insights, Samsung Electronics America

• “Reconnecting with Rite Aid,” Andre Persaud, Executive Vice President & Chief Retail Officer, Rite Aid

Carla

Bill

Andre

Carla

Bill

Andre

Here’s

•

18 l Sept/Oct 2022 Sneak Peek

Dunham

Bennett

Persaud

Sponsored by 84.51LUNCHEON

The Path to Purchase Institute’s second-annual OmniShopper Awards will celebrate innovative commerce marketing activations from brands, retailers, marketing agencies and consumer-facing solution providers driving engagement across the entire path to purchase. Find out who will be recognized for their excellence in shopper engagement during an awards luncheon at 12:15 p.m. CDT on Thursday, Oct. 20, when we’ll announce the winners live and share what made them rise to the top.

Women of Excellence Awards Ceremony & Cocktail Reception

Sponsored

The Path to Purchase Institute’s seventhannual Women of Excellence Awards program recognizes female brand marketers, retailers, agency executives and solution providers for their achievements in influencing shoppers along the path to purchase. The categories include Technology Award, Innovator Award, Mentorship Award, Industry Impact Award, Business Excellence Award and Executive of the Year Award. Come celebrate the winners at 5 p.m. CDT on Tuesday, Oct. 18, at the awards ceremony and cocktail reception.

Visit the Exhibit Floor

Visit the expo floor anytime during show hours and peruse the various booths to meet the players and learn more about the exciting innovations and solutions offered from more than 25 exhibitors.

by AdAdapted

P2PI.com

You’re invited to the PAVE Bash @ P2PI LIVE, which takes place at 8 p.m. on Wednesday, Oct. 19, at Untitled Supper Club. We’re celebrating 30 years of PAVE as well as the Path to Purchase Institute’s 20-year anniversary. Purchase a special discounted ticket to the Bash for $50 during registration and help support the future of in-store experience. The party will combine music, food, cocktails and entertainment for a fun evening of networking — all for a great cause. Ticket proceeds benefit PAVE’s educational and student aid programs.

PAVE X Frito-Lay Student DESIGN CHALLENGE

The PAVE X Frito-Lay Student Design Challenge is a project that brings together some of the best student design talent to showcase P-O-P display creativity. Frito-Lay presented a real-life design problem to the students, who in turn had to address these challenges to offer a creative display solution. The best designs have been chosen and the sponsoring manufacturers — Menasha and Bish Creative — have worked directly with the students in a mentoring role to translate their intentions into prototypes. These prototypes will be proudly displayed in the PAVE booth on the expo floor.

Networking Opportunities

Connect with industry friends and meet new faces during various networking breaks, lunches and awards ceremonies throughout the show. Be sure not to miss the cocktail reception (sponsored by Product of the Year) on Wednesday, Oct. 19, from 4:45 p.m. to 5:45 p.m., for an extra opportunity to mingle with fellow attendees.

20 l Sept/Oct 2022

BevAlc Track

P2PI LIVE ’s curated conference sessions have focused topic areas, including a track dedicated to the BevAlc category on Wednesday, Oct. 19. Among the scheduled speakers in that track are:

• Tammy Ackerman, VP Retail eCommerce, Treasury Wine Estates

• Matt Hodge, Vice President, B2C eCommerce, RNDC

• Jason Oziel, Manager, eCommerce Sales Strategy, Boston Beer Company

• Sara Goucher, North American eCommerce Director, Molson Coors

• Brandy Rand, Chief Strategy Officer, IWSR Drinks Market Analysis

• Risa Crandall, SVP, CPG Strategy + Sales, Aki Technologies, an Inmar Intelligence Company

Campfi res/Ask the Experts

Following the keynote sessions on Oct. 18 and 19, attendees have their choice of attending any of the various breakout sessions on the agenda or joining in on an informal peer-to-peer discussion in the Hilton’s Buckingham Room. Come eager to share. Among the experts conversing will be Anne Louise Marquis (pictured) of Campari America.

Special Session: SM2 COMMISSION

In a breakout session on Thursday, Oct. 20, hear updates from the SM2 Commission. Responding to the lack of common understanding of how to measure the impact of shopper marketing in the industry, the SM2 Commission convened in 2020 to identify a common approach that would standardize shopper marketing measurement. The effort included preliminary studies, the development of a world-class Playbook and ultimately — despite the challenging executional environment brought on by the COVID-19 pandemic — measurement modeling executed across three real-life pilot programs. This panel discussion with commission participants will reveal the current shopper marketing measurement landscape, the results of the modeling pilots, and a path forward.

Tammy Ackerman Matt Hodge

Tammy Ackerman Matt Hodge

P2PI.com

Visit the Product of the Year Booth

Stop by the Product of the Year (POY) booth on the expo show floor to learn about entering the 2023 Product of the Year Awards — the largest consumer-voted award for product innovation, where winners are chosen by the votes of 40,000 American shoppers. Chat with the POY team, enter to win daily giveaways, and enjoy goodies and surprise activations throughout the conference.

Product of the Year Awards

Product of the Year is the largest consumer-voted award for product innovation. Each year, winners are determined using a nationally representative study — conducted by consumer research fi rm Kantar — with the votes of 40,000 real shoppers.

The Product of the Year Award positions winners as the people’s choice for the best and most innovative product in their categories. Honorees often fi nd success using the win as a powerful merchandising strategy, giving their new products an edge over the competition.

Below, four brands share their experiences as former winners:

Drinks Are on POY

After a full day at P2PI LIVE on Wednesday, Oct. 19, come to the Continental Ballroom at the Chicago Hilton at 4:45 p.m. to unwind and network with fellow attendees at the Product of the Year-sponsored cocktail reception.

Nexcare Duo Bandages: “Winning this award has helped raise brand awareness, incentivize trial and expand household penetration for this exciting new product launch,” says Peter Berens, Nexcare Global Portfolio Leader, 3M.

Purex Crystals: “The 40,000 people is the thing that stands out the most for us; while I’d love to get the seal of approval from a bunch of scientists that my product works — I know it works, and it’s great to have consumers tell me that it’s something they really love,” says Devin Angle, Brand Manager, Henkel.

Pro Plan LiveClear: “We are currently using the POY emblem on our website to highlight our product innovation and boost credibility in the marketplace. Winning this award has also helped drive awareness to new customers in the time since the original product launch,” says Vanessa Hopkins, Pro Plan Brand Manager, Nestle Purina.

Veggieful Pocket Pies: “The award provides us a reassurance that we are indeed offering a product that is beloved by consumers, so we use the award when talking about our product directly with consumers on social media,” says Liam Farrell, VP of Brand Marketing, Del Monte.

22 l Sept/Oct 2022

CHICAGO

CHICAGO

OCTOBER 18-20

OCTOBER 18-20

THE PREMIERE INDUSTRY EVENT FOR COMMERCE MARKETERS

THE PREMIERE INDUSTRY EVENT FOR COMMERCE MARKETERS

Come experience and unmatched lineup of conference sessions and exciting networking opportunities crafted to inspire, educate and cultivate new connections with the top experts and industry trailblazers in commerce marketing.

Come experience and unmatched lineup of conference sessions and exciting networking opportunities crafted to inspire, educate and cultivate new connections with the top experts and industry trailblazers in commerce marketing.

WE CAN’T WAIT TO SEE YOU OCTOBER 18-20

WE CAN’T WAIT TO SEE YOU OCTOBER 18-20

SPONSORSHIPS & EXHIBIT

THE P2PI LIVE EXPERIENCE

THE P2PI LIVE EXPERIENCE

CURATED SESSIONS

CURATED SESSIONS

FOCUSED TOPICS

FOCUSED TOPICS

BEVALC SESSIONS

BEVALC SESSIONS

OMNISHOPPER AWARDS

OMNISHOPPER AWARDS

WOMEN OF EXCELLENCE AWARDS

WOMEN OF EXCELLENCE AWARDS

EXPO SHOWCASE

EXPO SHOWCASE

RECONNECT WITH COLLEAGUES

SPONSORSHIPS & EXHIBIT

BOOTHS AVAILABLE, CONTACT:

RECONNECT WITH COLLEAGUES

BOOTHS AVAILABLE, CONTACT:

Arlene Schusteff 847•533•2697

LATEST IN P-O-P AND IN-STORE

Orlando Llerandi 678•591•8284

Arlene Schusteff 847•533•2697

Orlando Llerandi 678•591•8284

LATEST IN P-O-P AND IN-STORE

NETWORKING HAPPY HOURS

NETWORKING HAPPY HOURS

INNOVATIVE SOLUTIONS

INNOVATIVE SOLUTIONS

•

•

24 l Sept/Oct 2022 CANNABIS: READY TO IGNITE

BY JENNY REBHOLZ

Itis no secret that the cannabis industry is ripe with opportunity. However, discussions often position this growth in future terms. Well, that future is now.

The cannabis industry has seen meteoric growth in recent years, spurred by the legalization of recreational use across the U.S. Combined medical and recreational cannabis sales could reach $33 billion in the U.S. by the end of 2022 — and global sales are projected to reach $55 billion by 2026.

With legal cannabis products poised to become the largest-growing new CPG segment in the U.S., companies are seizing this opportunity with the launch of exciting new brands and retail concepts. And cannabis has the opportunity to grab market share in multiple expansive CPG categories, including alcohol, medicine and wellness.

“When you think about existing consumer product categories and you think about the potential of what cannabis is going to be, it is incredibly significant,” says marketing veteran Cory Rothschild, now national retail president of cannabis and medical marijuana company Cresco Labs, which operates its own retail banner, Sunnyside. “And those use occasions are not just in a narrow percentage of adults’ lives. You are talking about 21- to 81-year-olds who have very different needs — a huge percentage of the U.S. adult population with parts of their lives that cannabis can make better.”

IGNITE CPG

With global sales forecasted to reach $55 billion by 2026, this growing CPG category is poised to become a significant multi-category influencer and market disruptor.

P2PI.com

The strategy for bringing this coveted CPG category to market may not be as different as you think. Branding, marketing and customer strategy, e-commerce, brick-and-mortar retail and the overall customer experience can leverage lessons learned in traditional categories. However, legacy stigma and complex regulations that vary from state to state and across international lines make this exciting category also a very tricky one.

Branded for Normalcy

Due to the reach of cannabis across categories and the number of people it can impact, the drug is on the path to normalcy. “Something used by that many people will be, by defi nition, normal,” says Rothschild. “It literally has to be normal because so many people will be using it in so many different parts of their lives.”

This sets the stage for powerful branding opportunities. “It means that the brands that exist in these categories will be some of the largest brands in the world,” says Rothschild. “Because it is in an industry that needs education, because it is so new and growing up so fast, and because there is legacy stigma based on the way it has been regulated in the past, brands are very important to help people understand the category, trust the category, set expectations and deliver on them.”

Jason Vegotsky, CEO of Petalfast, a fi rst-of-its-kind, route-through-market platform for the cannabis industry, believes heightened competition in cannabis markets across the U.S. is forcing companies to implement new branding strategies. “It’s a new era in the industry where brands need to race to the bottom on price or back up more high-priced products with quality,” he says. “In this competitive landscape, brands must fi gure out how to connect on a deeper level with the consumer, which is why more companies are opting to invest strategically in brand building.”

The 2021 BDSA and IRI industry report “What’s Next for Cannabis as a Consumer Packaged Good?” found that: “Brand alone doesn’t seem to matter at the surface, but a good experience, trusted recommendations and brand familiarity does.”

Rothschild believes the industry will see the emergence of big brands. “Not unlike other categories, there will be scaled brands and retailers that drive a consistent experience that you know and can expect. Those will have the lion’s share of the category,” he says.

Vegotsky predicts that the brands that can successfully scale through multi-state expansion will be in the best position for long-term growth, especially brands that have broken through in the competitive California market and expanded east. Vegotsky highlights Wyld, Stiiizy, Wonderbrett, Lowell, Cann and Kiva as cannabis brands to watch.

Through education and raising awareness, brands will introduce consumers to cannabis products that can help with health concerns and

support social aspects of their daily lives. From options to address issues such as insomnia, muscle soreness or anxiety to beverages that can be offered at a backyard BBQ, this is the path to normalcy.

In fact, the cannabis beverage category has been gaining a good deal of market traction. Beverage brands are highlighting the benefits of this alternative and speaking directly to consumer hot buttons — plant-based, low- or no-calorie, same session quality and less likely to induce a hangover.

“If the basic deliverable of alcohol can be done with cannabis, you are starting to think about a structurally better value proposition than one of the largest categories in the U.S.,” says Rothschild.

Marketing & Customer Strategy

When building brands and customer bases from scratch, there are endless opportunities for innovation. While cannabis regulations can pose numerous challenges, these restrictions raise the bar for innovation and push teams to create breakthrough ads, inventive packaging and clever social posts. Education across marketing channels plays a key role in customer strategy and efforts to achieve normalcy.

Rachel Soulsby, senior director of marketing at Agrify, a provider of advanced cultivation and extraction solutions for the cannabis industry, believes that as the sector matures through the end of the year and into 2023, marketing tactics will mature alongside the space. She emphasizes the importance of providing free education and doubling down on consumer base values, from a heightened focus on video assets and staying in tune with changing social media algorithms to live and virtual events.

Soulsby also recommends leveraging wellness propositions. “The wellness sector is booming, just like cannabis is,” she says. “Find alignment with brands and influencers in the wellness space that want to link arms.”

The wellness sector is booming, just like cannabis is. Find alignment with brands and influencers in the wellness space that want to link arms.

— Rachel Soulsby, Agrify

26 l Sept/Oct 2022

Connecting with Products

The pandemic helped the industry stretch boundaries in many ways, especially advancing technologically via robust e-commerce and POS systems. This means cannabis brands are now gathering consumer data like other categories and leveraging that information to better connect with their customers through target marketing.

Similar to traditional CPG, one of the fi rst places a consumer interacts with a product is on the shelf, so product packaging plays a significant role in brand recognition.

Cannabis consumers also are much more likely to shop by ingredient, in terms of strains, terpenes or percentage of THC, Rothschild notes. But he hopes branding efforts can help change that. “Most people don’t walk down the chip aisle and shop ingredients; they are picking favorite brands and flavors and the quality for the type of event,” he says. “That’s what brands do for us in all parts of our life. That’s what we need in cannabis, and packaging plays a significant role.”

Rothschild also emphasizes the need to fi nd more sustainable packaging options. “It is required by law to have all the layers of packaging, so it is on us to fi nd ways to make sustainable solutions, so cannabis doesn’t become one of the most polluting industries,” he says.

Unlike other CPG categories, a major cannabis retail challenge is that most consumers can’t see the product until after purchasing it. This is another area where Rothschild hopes to see a change in the future. “These regulations for control and safety are understandable when you are starting a new industry,” he says. “So, how can we do that responsibly? I think a lot about that because it would change the experience for millions of people who come through our doors and help them find a product that is a better fit for them.”

Depending on local regulations, retailers are exploring options such as products under lockable enclosed glass or employee-driven interactions.

Retailers are also leveraging digital platforms and incorporating sounds and scents in the retail environment to give customers the best sensory experience currently possible.

The Evolving Dispensary Experience

Brands continue to raise the bar on the dispensary experience, exploring multisensory strategies, nostalgic references, unique collaborations, community connections and event planning that positions them at the heart of culture. The in-store experience plays an important role in transforming consumer perceptions of cannabis. This is a way to normalize cannabis shopping, reinforce brand relationships with savvy customers, and connect with and educate new or potential customers.

As competition increases and product offerings become similar over time, the dispensary experience will become a true differentiator.

The COVID-19 pandemic forced dispensary owners to fine-tune design and systems, and to leverage technology for maximum shopping efficiency. With more efficiencies in place, retailers are using the technology to constantly analyze the dispensary experience to

make sure they are elevating the customer journey for different types of shoppers as well as different customer journeys.

Just like Sephora, Total Wine or the local hardware store, dispensaries need to support the in-and-out, express trip, the browsing experience to gain familiarity or a longer, consultative purchasing process. “We have to fi nd a way to address the different customer needs if we are going to be a scalable retailer that everyone knows about,” says Rothschild. “We have to win on the experience we deliver.”

Brands and retailers are advocating and pushing boundaries to continue to enhance the customer journey and be at the center of culture.

With products in hand, customers are limited to certain places for consumption. This is what’s next in the cannabis customer journey. Industry innovators are exploring this opportunity in states and locations where they can. This includes the emergence of cannabis lounges, the integration of visible grow facilities within dispensaries, concert experiences and the evolving topic of canna-tourism.

If there are brewery and winery tours and wine country destinations, why not the same for cannabis?

P2PI.com

CANNABIS RETAIL SPOTLIGHT

Here are a few examples of brands bringing unique designs, features and events to round out the customer experiences in the markets they serve:

The Artist Tree evolved its brand with the community aspect front and center. Each store (currently six locations) is also an art gallery that showcases revolving exhibits from local artists. Aside from hosting art shows, contributions are made to arts organizations and art supplies are gathered for donations. There are in-store presentations by artists and participation in arts-related events. The Artist Tree in West Hollywood, California, features a cannabis lounge adjacent to its retail location.

Thrive, the largest independent cannabis retailer in Nevada, currently has eight locations across the state. Each store prioritizes efficiency and security within a sleek minimalist design, and a few unique features depending on the location. The Southern Highlands location highlights an innovative, automated conveyor belt that delivers orders to customers, while the North Vegas location offers a drive-thru. The recently opened flagship off the Vegas Strip will also open a consumption lounge in the near future.

When it comes to immersive shopping experiences Jushi Holdings Inc. , a vertically integrated, multistate cannabis operator, is committed to raising retail expectations. Their reinvented motto “Beyond Hello” is focused on retail experiences that engage all the senses and establish a place at the heart of culture. These sensory experiences are aimed to create a “retail scene” that mixes art, performance and curated, designed products. The company is engaging consumers with a variety of experiences. Tasteology/Astrology comprises pop-up events for the Tasteology brand — real fruit, cannabis-infused gummies and chewable tablets. To play on the tarot-card theme of the brand, Jushi offered tarot card readings in its Massachusetts dispensaries.

Photo credit – Thrive

Photo credit – Martin Depict

Photo credit – Jushi

Photo credit – Thrive

Photo credit – Martin Depict

Photo credit – Jushi

28 l Sept/Oct 2022

Superette (French for mini supermarket) launched in 2019 and has received multiple awards for its brand identity and store design. The brand banks on the familiar and making a relevant connection to normal daily life experiences. The nostalgic shop designs recreate memorable diner, deli, bodega, flower shop, candy store and subway newsstand experiences. They are hyperlocal-focused with each new immersive shop experience adapted to its surrounding neighborhood. The most recent, The Annex, is a 500-square-foot, Italian-deli-inspired store immersed in a student-centric neighborhood in Toronto. In 2021, Superette opened Sip ‘N’ Smoke (pictured), a first-of-itskind “express” cannabis retail concept located in Toronto’s Trinity-Bellwoods Park. The 690-square-foot kiosk serves only pre-rolls and infused beverages that are meant to be enjoyed at the park. The walk-up location and cafeteria-style shopping experience push the retail boundaries.

Sunnyside is the first national retail brand of multi-state operator Cresco Labs. There are currently 53 Sunnyside dispensary locations with plans to expand to 150 locations by the end of 2023. This expansion will bring their retail experience to 17 states and make it the most expansive cannabis retail footprint. Focused on building an optimal and efficient experience in the midst of the pandemic, the company is now leveraging the bright, welcoming atmosphere and passionate staff to enhance interactions and education. The clean, fresh design is increasingly enhanced with digital screens and projections, QR code educational touchpoints, and music to create a full-sensory experience and inviting culture for staff and customers.

Wyllow ’s 500-square-foot Los Angeles dispensary captivates customers’ senses while a dedicated Atelier guides their shopping journey — a truly immersive cannabis experience designed by Space Objekt. The storefront is clad with cone-shaped mirrors and provides a perfect selfie moment. The design takes inspiration from Wyllow product packaging, incorporates sustainable materials derived from hemp and makes architectural nods to the neoclassical era. Multicolored lights, backlit product displays and four appointed guest seats create a lush, jewelbox setting. Customers are further delighted with an interactive terpenebased scent installation as well as curated soundscapes (by sound artist Intriguant) that layer sounds of nature with spoken word and details such as the rolling of paper.

Photo credit – Sunnyside

Photo credit – Alex Lysakowski

Photo credit – Chris Greenwell

Photo credit – Sunnyside

Photo credit – Alex Lysakowski

Photo credit – Chris Greenwell

P2PI.com

Shopper Engagement Retail Media

Retail media might just be the hottest topic in the world of commerce

marketing — and it’s showing no signs of slowing down. But what do consumers think about retail media, and how are they actually interacting with it across platforms? On the following pages, we invite you to dig into retail media from the shopper’s viewpoint. (Hint: promotion/sale messaging still reigns supreme!)

BY TIM BINDER

BY TIM BINDER

Research from the Path to Purchase Institute earlier this year focused on the state of retail media from the industry’s perspective — that of CPG and durable goods professionals. But what about retail media insights from the consumers, or shoppers?

While average consumers likely have little or no knowledge about the term “retail media,” they are exposed to it often. And their opinions on their exposure to retail media’s tactics could be a gold mine for those same industry professionals we heard from in our May survey (reported in our July/August issue).

Before we fielded our survey of consumers in July, we had to fi rst identify retail media’s primary touchpoints. To get there, we looked at the published/known tactics of established retailer media networks (including Walmart Connect,

General Attitude about Advertising Inside of Stores

I enjoy seeing or hearing about the products available at the retailer and am open to considering purchasing them during my shopping trip.

I enjoy seeing or hearing about the products available at the retailer and may consider purchasing them during future trips.

I don’t usually pay much attention or notice the advertising when shopping in-store.

I find in-store advertising intrusive, and it takes away from my shopping experience.

Q. When thinking generally about the advertising retailers use inside of their stores, which of the following best describes you? [Not asked among online-only shoppers]

Source: Path

30 l Sept/Oct 2022

SPECIAL REPORT

to Purchase Institute Shopper Engagement with Retail Media Study, July 2022

59% 14% 25% 2% Frequency of Noticing Advertising In-Store Source: Path to Purchase Institute Shopper Engagement with Retail Media Study, July 2022 Brand displays on shelves Video ads on TV screens Video screens at gas pumps Digital screens or displays at checkout In-store audio Digital displays at EV charging stations Q. When you shop in physical stores, how often would you say you notice specific brands’ advertising in each of the following ways? 41% 40% 37% 40% 40% 17% 11% 15% 8% 17% 13% 18% 10% 19% 11% 29% 43% 5% 37% 33% 32% 30% 24% 30% Frequently Sometimes Rarely Never

Engagement with

Advertising Encouraging Action

Target’s Roundel and Kroger Precision Marketing) and devised general questions about retailers’ instore, online, email and social media engagement with consumers, as well as the relevant activity that occurs on third-party media sellers’ websites.

We surveyed 1,000 self-identified shoppers who shop in-store and/or online at least once per month at one of the 25-plus retailers we named who operate their own media networks. Respondents’ shopping activity broke down like this:

• 74% shop both in-store and online.

• 22% shop in-store only.

• 3% shop online only.

We asked them to identify which retailers they shopped, with Amazon (76%), Walmart (72%), Dollar General (60%), Target (51%), CVS (48%), Walgreens (47%), Kroger (42%) and Family Dollar (41%) being cited most often.

In-Store Advertising – Grabbing Their Attention

Tells me about a promotion or sale

Advertisement is unique or eye-catching

Introduces me to a new or unique product

Reminds me about a product I needed to buy

Advertises for a brand I know and trust Happens to be related to my reason for that shopping trip

Is exactly what I want or need on that trip

Advertises a new brand I haven’t heard of before Directs me to a location within the store to find a particular item

None, I don’t pay attention to in-store ads

Q. What is it about brands’ advertising inside retail stores that most catches your attention or makes you want to learn more about the product being advertised? (Select up to two)

Source:

P2PI.com

In collaboration with Source: Path to Purchase Institute Shopper Engagement with Retail Media Study, July 2022 Q. You said you notice [INSERT CHANNEL] when shopping in-store. How often would you say seeing or hearing those advertisements encourages you to do any of the following? 1. Locate product in-store and consider purchasing 2. Find product online and consider purchasing 3. Briefly consider but take no further action Frequently Frequently FrequentlySometimes Sometimes Sometimes

In-store audio Brand displays on shelves Video ads on TV screens Digital displays at EV charging stations Digital screens or displays at checkout Video screens at gas pumps 48% 54% 48% 39% 48% 44% 27% 27% 27% 38% 30% 24% 47% 48% 48% 43% 49% 41% 26% 21% 27% 33% 27% 22% 46% 50% 45% 42% 48% 44% 29% 26% 27% 33% 27% 27%

Path to Purchase Institute Shopper Engagement with Retail Media Study, July 2022 32% 22% 21% 19% 18% 17% 15% 14% 11% 8%

Special Report

Noticing Advertising In-Store (after Online Exposure)

Frequency of noticing brand advertising in-store after seeing/hearing ad online:

What captures attention for a second time, in-store:

Tells me about a promotion or sale for that item

Advertisement is unique or eye-catching

Reminds me about the product Is a brand I know and trust

I am already planning to purchase the item Happens to be related to my main reason for that shopping trip

Directs me to a location within the store to find the item

Frequently Sometimes Rarely Never

Q. Do you ever notice brands’ advertising while shopping in physical stores after previously seeing or hearing an ad for that brand online?

Q. What is it about that brand’s ad that catches your attention for a second time, this time in-store?

Source: Path to Purchase Institute Shopper Engagement with Retail Media Study, July 2022

In-Store Retail Media

To start, we investigated the advertising that retailers use inside of their stores. Eighty-four percent of respondents said they enjoy seeing or hearing about available products while shopping in-store — and 59% not only said they enjoy it, but that they are also open to purchasing the items advertised. Meanwhile, 14% said they don’t pay attention to that advertising, and just 2% said they fi nd in-store advertising intrusive.

We next asked how often they notice specific types of brand advertising in stores: 84% of respondents said they frequently or sometimes notice brand displays on shelves. Furthermore, at least 70% of respondents said they frequently or sometimes notice video ads on TV screens, video screens at gas pumps, digital screens or displays at checkout, and in-store audio. Among our choices, only digital displays at electric vehicle charging stations came in below 60% (likely impacted by the lack of these types of locations to begin with).

Breaking things down further, for those who indicated they enjoy seeing or hearing advertising in-store, 47% said they “frequently notice” brand displays on shelves — significantly higher than for those who said they don’t pay attention or fi nd ads intrusive, which came in at 21% for noticing brand

Seeking Out Brands In-Store (after Online Exposure)

Men

of the time Most of the time Some of the time

Source: Path to Purchase Institute Shopper Engagement with Retail Media Study,

Rarely Never

2022

displays on shelves. Those two groups also noticed in-store audio at much different rates: 34% for ad lovers compared to 13% for the ad-adverse/aloof.

Next, we zeroed in on those who said they notice a particular tactic in stores, asking them if they believe seeing or hearing those advertisements encourages them to locate a product in the store, to fi nd the product online and consider purchasing, or to briefly consider but take no further action.

There were similar results across the board:

• 68% (video screens at gas pumps) to 81% (brand displays on shelves) said they frequently or sometimes locate the product in-store and consider purchasing.

Q. How often do you seek out brands in-store after seeing their ads online?

32 l Sept/Oct 2022

All

July

21% 34% 29% 12% 4%

and Millennials more often say they often seek out brands in-store after seeing their ads online (‘All of the time’ or ‘Most of the time’): 73% of men vs. 38% of women 59% of Millennials vs. 39% of Gen Z & 45% of Gen X

31% 28% 25% 24% 23% 21% 18%

28% 16% 50% 6%

Special Report

Reasons for Visiting Retailer Websites/Apps

• 63% (video screens at gas pumps) to 76% (digital screens at checkout, and digital displays at EV charging stations) said they frequently or sometimes fi nd the product online and consider purchasing.

• 72% (video ads on TV screens) to 76% (brand displays on shelves) said they frequently or sometimes briefly consider but take no further action.

Shopping Behavior on Retailer Websites/Apps

We then asked what aspect of brands’ in-store advertising most catches their attention or makes them want to learn more about the product. “Tells me about a promotion or sale” topped the list at 32%, followed by “Advertisement is unique or eye-catching” (22%), “Introduces me to a new or unique product” (21%) and “Reminds me about a product I needed to buy” (19%). Other responses fi nished close behind. (See chart, page 31.)

FAST FACT:

To understand how online exposure to ads affects their in-store shopping, we asked if they ever notice a brand’s advertising in-store after previously encountering an ad for that brand online. The “frequently” (28%) and “sometimes” (50%) answers outpaced “rarely” (16%) and “never” (6%).

Furthermore, we asked what about that ad catches their attention for a second time. The top responses were: “Tells me about a promotion or sale for that item” (31%) and “Advertisement is unique or eye-catching” (28%).

Looking at things differently, we asked how often they seek out brands in-store after seeing

that when

they

know exactly what they are

34 l Sept/Oct 2022

Source: Path to Purchase Institute Shopper Engagement with Retail Media Study, July 2022 48% 45% 42% 39% 37% 34% 32% 28% Look for promotions, deals or coupons Compare prices with other retailers Browse their products or find inspiration Re-purchase items I buy regularly Purchase new items or items I do not buy regularly To build a shopping list To find a location near me Share product ideas with family or friends Q. Why do you typically visit retailers’ websites or mobile apps? Source: Path to Purchase Institute Shopper Engagement with Retail Media Study, July 2022

I usually know exactly what I’m looking for and navigate there right away. Sometimes I know exactly what I’m looking for, but other times I am just there to browse. I am often just browsing to see if I might come across anything interesting. Q. Which of the following statements best describes you when thinking about how you shop on these retailers’ websites or mobile apps? 48% 44% 8% Noticing Brand Advertising on Retailer Websites/Apps Frequently RarelySometimes Never Source: Path to Purchase Institute Shopper Engagement with Retail Media Study, July 2022 Q. How often would you say you notice brands advertising on retailers’ websites or mobiles apps? 39% 9% 49% 2%

48% say

shopping on retailers’ websites,

usually

looking for.

INSIDE THE DATA

Research shows why in-store audio marketing generates results

BY PAUL BRENNER