Research reveals updated insights into shopping patterns and areas of opportunity (In collaboration with Great Northern Instore) P2PI.com MAY/JUNE 2024 P2PI. com MAY/JUNE 2024 SPECIAL REPORT The State of Content Management (In collaboration with Vizit) 40 UNDER 40 Profiling our Class of 2024

IN-STORE SHOPPING EXPERIENCE

Special Report: Evolution of the In-Store Shopping Experience

Our proprietary research examines the factors that impact shoppers’ satisfaction with the in-store experience, reinforcing areas of opportunity for brands and retailers. In collaboration with Great Northern Instore.

40 Under 40 Awards

We showcase the individuals on our third annual list of winners. Nominated by their peers and selected by our editors, these rising leaders are redefining the future of commerce marketing.

Special Report: The State of Content Management

This exclusive research examines how brand, retailer and agency professionals are leveraging AI, including their concerns about the technology and how they plan to continue to use it.

In collaboration with Vizit.

Path to Purchase Institute magazine (USPS 4568, ISSN 2835-0219) is published bi-monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631. Subscription rate for the U.S.: $96 one year; $186 two year; $17 single issue copy (pre-paid only); Canada and Mexico: $138 one year; $258 two year; $20.40 single issue copy (pre-paid only); Foreign: $138 one year; $258 two year; $20.40 single issue copy (pre-paid only). Periodical postage paid at Chicago, IL 60631 Copyright 2024 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Path to Purchase Institute magazine, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. Contents VOLUME 37 | ISSUE 3 May/June 2024 P2PI.com FEATURES 24 12 36

COVER STORY

Follow the Path to Purchase Institute here: Editorial Advisory Board Dana Barba The Lemon Perfect Co. Stephen Bettencourt CVS Health Lianna Cabrera L’Oreal Paris Cosmetics Contents Mia Croft Native Christiana DiMattesa Houser Under Armour Gregg Dorazio Giant Food (Ahold Delhaize) Paige Dunn FIJI Water, JUSTIN Vineyards & Winery, Landmark Vineyards & JNSQ Wines Tony Fung Bob Evans Farms Patrick Hallberg Apple Travis Harry Home Depot Carter Jensen General Mills Brendon Lynch Jushi Holdings José Raul Padron The Hershey Experience Kelly Sweeney The J.M. Smucker Company Joseph Vizcarra The Coca-Cola Company Rodney Waights Beiersdorf 4 l May/June 2024 46 10 8 44 DEPARTMENTS 5 Editor’s Note What’s in Store for In-Store? 6 P2PI Member Spotlight 7 P2PI Member Perspective 8 FOCUS: Retail Media Co-op’s Retail Media Journey 10 In-Store Experience The Largest Wawa 44 Activation Gallery Drugstore Beauty 46 Insider Intel BelVita Gamifies Shopping

Editor’s Note

What’s in Store for In-Store?

The buzzwords in commerce marketing are many as of late — cookie deprecation, AI, full-funnel, incrementality and, the latest (and perhaps most exciting, although it’s certainly not new), in-store. Specifically, I’m talking about in-store retail media.

As I write the Editor’s Note for this issue, we are in the midst of wrapping up a qualitative study on in-store retail media, conducted in collaboration with our friends at the IAB. The goal of this latest research is to understand how retailers and CPG brands are evaluating in-store retail media by gathering their thoughts and experiences on measurement, challenges and future innovations in the space. By interviewing industry leaders across the ecosystem and incorporating insights from the top retailer media networks (RMNs) and CPG brands, our aim is to illuminate the path forward with best practices on how to integrate and maximize the full potential of in-store retail media as a powerful advertising platform.

The results of this study will be unveiled in just a few weeks’ time, when the Path to Purchase Institute makes our inaugural splash at the Cannes Lions International Festival of Creativity this summer. In just a few weeks’ time, commerce marketers will be walking down La Croisette in their sunglasses and linen, working up a sweat bouncing from activation to activation, listening in on expert panel discussions and making connections at the 200 networking events they’ve aggressively RSVP’d to.

While Cannes certainly has a reputation for being an over-the-top experience — I mean, how many fancy yacht parties can one human being attend in four days? (The correct answer, in case you’re curious, is that the limit does not exist) — the festival is also known for being a hot bed of innovative ideas and THE place for changemakers to gather and explore the future of advertising.

So, it came as no surprise when we began to hear from our industry of commerce marketers that this was a place they wanted to gather — which is why P2PI will be there right alongside them this year, collaborating with our commerce friends to connect the community and share insights that will help further our industry and drive innovation. VIPs will get an exclusive fi rst look at the in-store retail media study results at a handful of exclusive events we’re partnering on, where you can expect thought-provoking discussions, plenty of networking, idea exchange and, of course, rosé. Following the study debut in Cannes, we’ll release the fi ndings to the greater industry at large — so be on the lookout!

If in-store insights is what you’re looking for, you don’t have to wait or travel to France. P2PI’s latest proprietary research, in collaboration with Great Northern Instore (page 24), examines the factors that impact shoppers’ satisfaction with the in-store experience, reinforcing areas of opportunity for brands and retailers. We also leveraged our trip to Philadelphia for Future Forward in May with a visit to the largest Wawa convenience store (page 10).

Beyond in-store, we’ll be unveiling the results of even more research when we stage the largest conference dedicated to retail media — Retail Media Summit in Chicago, June 25-27. This sell-out event will bring together the brightest minds in retail media for one-on-one meetings, education, inspiration and networking. We hope you’ll join us for RMS (we are the OG of retail media events, after all) as we explore powering commerce across the evolving landscape.

8550 W. Bryn Mawr Ave., Suite 225, Chicago, IL 60631 877.687.7321 www.p2pi.com

BRAND MANAGEMENT

Senior Vice President, Brand Director Eric Savitch esavitch@ensembleiq.com

EDITORIAL

Editorial Director Jessie Dowd jdowd@ensembleiq.com

Executive Editor Tim Binder tbinder@ensembleiq.com

Managing Editor Charlie Menchaca cmenchaca@ensembleiq.com

Digital Editor Jacqueline Barba jbarba@ensembleiq.com

Managing Editor, Member Content Cyndi Loza cloza@ensembleiq.com

Editor, Member Content Heidi Bitsoli hbitsoli@ensembleiq.com

Director, Events Content and Strategic Engagement Lori Pugh lpugh@ensembleiq.com

Contributing Writers Michael Applebaum, Erika Flynn, Jenny Rebholz, Bill Schober

ADVERTISING SALES & BUSINESS

Associate Director, Brand Partnerships Arlene Schusteff 847.533.2697, aschusteff@ensembleiq.com

Regional Sales Manager Orlando Llerandi 678.591.8284, ollerandi@ensembleiq.com

MEMBER DEVELOPMENT

Director of Retail Patrycja Malinowska pmalinowska@ensembleiq.com

Sr. Director, Membership Development Nicole Mitchell 203.434.5733, nmitchell@ensembleiq.com

Membership Experience Manager Ann Estey aestey@ensembleiq.com

Manager, Membership Development Brady O’Brien bobrien@ensembleiq.com

Membership Experience Manager Heather Kurtik 724.553.0093, hkurtik@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

Art Director Catalina Gonzalez Carrasco cgonzalezcarrasco@ensembleiq.com

Production Director Michael Kimpton mkimpton@ensembleiq.com

Marketing Manager Mackenzie Fennell mfennell@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@pathtopurchase.com

CORPORATE OFFICERS

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Chief Strategy Officer Joe Territo

Chief Operating Officer Derek Estey , Editorial Director

P2PI.com

Member Spotlight

Meet the Marketers

HERE’S A SNAPSHOT OF INDUSTRY LEADERS FROM THE P2PI MEMBER COMMUNITY.

NIA MACK RODNEY Senior Manager, Omnichannel Marketing Kind

NIA MACK RODNEY Senior Manager, Omnichannel Marketing Kind

Main job responsibilities: I spearhead the strategy and execution of Kind’s online and in-store marketing initiatives, strategically aligning them with prominent retailers in the mass, club and e-commerce distribution channels. With a focus on enhancing consumer engagement and driving sales, I orchestrate comprehensive digital and retail media strategies across major platforms such as Amazon, Walmart, Target, Costco, Sam’s Club and BJ’s Wholesale Club. My mission is to craft compelling and cohesive consumer experiences that not only bolster acquisition and retention efforts, but also maximize website traffic and revenue generation.

I also am at the forefront of cultivating diversity, equity and inclusion (DEI) within our organization, intertwining it seamlessly with our annual strategic plans. My role extends to igniting dialogues that push for heightened diversity within our marketing narratives and messaging, championing the inclusion and active involvement of varied communities. In fostering an environment that thrives on productivity and engagement, I’m dedicated to nurturing a workplace culture at Kind that celebrates diversity in all its forms.

How you win with shoppers during uncertain economic times: I keep a keen eye on the dynamics of consumer behavior. I remain attuned to their motivations and actions, meticulously tailoring retail marketing strategy with sales objectives to match tactics and content for the shopper’s ever-evolving preferences.

New marketing tactic that you use: The ongoing evolution of shoppable recipe media and personalized moments media remains a steadfast driver of robust consumer engagement, consistently delivering impressive performance metrics. It also goes without saying that the integration of generative AI represents a pivotal stride toward the future. AI is in our toolbox, but we are learning the proper ways to activate within retail media, ensuring alignment with legal parameters and upholding the highest standards of company ethics.

What you are reading or watching right now: As an active member of the company’s Women at Kind resource group, I’m participating in its second annual book club centered around “The Joy Luck Club.” I also am currently engrossed in “How to Raise an Adult.” Then I indulge in the TV series “Suits” whenever time permits.

Summer travel plans: We’re embarking on a road trip to Montreal, followed by our annual vacation to our beloved island paradise, Jamaica.

BRIAN KITTELSON CEO Public Label

BRIAN KITTELSON CEO Public Label

Main job responsibilities: I oversee all activities geared to unlock differential growth for our clients.

How you win with shoppers during uncertain economic times: There are four key areas we’re focused on to help clients navigate these times: Optimize budgets for effectiveness (high ROI channels/tactics), elevated insight mining, promoting value and deepening brand resonance.

New marketing tactic that you use: It’s not a single tactic but rather an approach to developing more effective shopper plans, by retailer. We call it the 5i shopper model (issue, information, insight, implication and implementation). The model helps brands create custom, insight-based and retailer-specific shopper plans that simply hit harder.

Memorable aha moment in your career: When I was a junior brand manager, a category buyer once told me that all brands are commodities to a retailer as they can be found in all channels and across most retailers. A brand stops being a commodity when it brings forward solutions that truly grow the category. This simple statement was an aha moment for me and changed my approach to how I develop brand plans.

6 l May/June 2024

Crafting an OTC Strategy

BRANDS CAN FOLLOW THREE ESSENTIAL STEPS TO HAVE AN ‘ALWAYS-ON’ APPROACH.

BY LINDSAY STEWART

As consumers desire convenience more than ever before, OTC brands have had a significant advantage, offering quick fi xes to colds, flus, allergies and building immunity.

The brands also meet consumers’ demand for personalized and proactive approaches to wellness that emerged as more Americans became increasingly health-conscious.

The OTC category is not without its challenges. We’re seeing increased competition amid a surge in supplement and vitamin brands. Then there’s an uncertain economic environment with record-high inflation impacting consumers’ purchase decisions.

Faced with both opportunities and challenges, it’s essential for OTC brands to maximize the moment. Brands must drive awareness with engaging, always-on campaigns so they’re not just top of mind during seasonal moments, but go-to consumer favorites throughout the year.

By uncovering your brand’s biggest moments, unlocking creativity and upleveling measurement, you’ll craft an always-on strategy that fuels enhanced engagement, sales and loyalty.

Here are three ways brands can optimize their strategies:

1.

Uncover your biggest brand moments. Start by looking at your insights. Focus on where you’re seeing spikes and dips in sales. While your allergy or vitamin offerings might remain consumer favorites, are sales soft due to consumers adjusting doses or trading down due to price? Look to see who is winning share — competitors or private-label brands. Looking at purchase insights and conducting a lapsed/lost/low usage analysis might be helpful in pinpointing trends, new challenges or opportunities. Combined, these insights will empower a better understanding of the health of both your overall business and individual product lines, which helps ensure you’re not missing out on pivotal opportunities for engagement.

2. Unlock creativity to drive engagement and conversion. Consider testing an immersive ad campaign. One example could be “choose your own adventure” experiences, which allow consumers to have active roles in their viewing experience. Take this strategy a step further by dynamically updating the creatives based on weather and regional insights into past purchase trends during cold and flu season to ensure you’re reaching that right customer with the right message.

Dynamic ad testing can also be helpful to fi ne-tune performance, be it the right offer or incorporating convenient services such as curbside pickup. These types of mobile ads have proven to generate click-through rates up to 8.72%, which is more than 14.4 times the industry benchmark for mobile advertising. These creative enhancements nod to the importance of personalization, which has become a key driver in consumers’ purchase decision-making.

3. Uplevel measurement to enhance results. Expand measurement beyond a traditional post-campaign analysis and consider adopting real-time in-fl ight optimization, which offers an opportunity to drive

By uncovering your brand’s biggest moments, unlocking creativity and upleveling measurement, you’ll craft an always- on strategy that fuels enhanced engagement, sales and loyalty.

increased performance during an active campaign. Making adjustments to creatives, offers or media buys is proven to eliminate media waste up to 94% and allows brands to further optimize more than 75% of media spend. Most important, enhanced measurement helps marketers close the loop across top- and bottom-of-the-funnel campaigns, which is critical for driving awareness, sales and customer loyalty.

It’s an exciting time in the OTC space. For marketers, it’s a time to meet the current challenges and look for opportunities by uncovering and testing new unique moments, unlocking creativity and upleveling measurement. Transform oneoff seasonal campaigns into an always-on strategy that drives next-level engagement and strengthens customer relationships throughout the year.

About the Author

Lindsay Stewart is the senior vice president of sales at InMarket, where she has helped hundreds of leading brands power and measure digital campaigns. An expert in digital marketing with more than 25 years of sales experience, Stewart has played a pivotal role in driving InMarket’s exponential growth.

P2PI.com Member Perspective

FOCUS: Retail Media

Co-op’s Retail Media Journey

DEAN

HARRIS, HEAD OF CO-OP MEDIA NETWORK, DISCUSSES

THE RETAILER’S

UNIQUE

MARKET POSITION IN THE U.K., PLANS FOR THE FUTURE AND MORE.

BY CYNDI LOZA

British retailer Co-op in January debuted Co-op Media Network, creating the first retailer media network in the convenience store sector in the U.K.

We caught up with Dean Harris, head of Co-op Media Network for Coop, to discuss the retailer’s journey up to this point, its unique position in the market and its focus for the future.

P2PI: Can you tell us a bit about Co-op and its typical shopper?

Harris: Co-op is a leader in the U.K. grocery convenience sector, with about 2,400 stores across the U.K., making it the most geographically widespread retailer with a store in every postal code area. A significant strength of Co-op is its proximity to customers, with 82% of the U.K. population living within two miles of a Co-op store.

The typical Co-op shopper demographic includes both older “empty nesters” and younger “pre-family” customers. Our shoppers prioritize ease and speed, with around 50% of shopping trips aimed at “topping up” essentials.

P2PI: How do people shop in the convenience channel in the U.K.?

Harris: U.K. convenience shopping is characterized by high trip frequency and a variety of shopping missions ranging from top-ups and distress purchases to “meals for tonight.” (Co-op is particularly strong in the “meals for tonight” category, being the No. 1 grocer in the U.K. for these missions).

Co-op stands out for its convenience, with most stores being visited for quick, impulsive decisions facilitated by their proximity to shoppers’ homes or workplaces. Quoting Andy Murray, shoppers have three budgets that must be catered for: money, time and frustration. In convenience, the demands on all these are exacerbated.

P2PI: You’ve been at Co-op for more than 10 years. What has Co-op’s retail media journey looked like?

Harris: Co-op’s retail media offer has evolved significantly.

In 2016, we had a limited in-store only toolkit. Back then, media investment was perceived as a cost of doing business with a retailer, as opposed to a channel advertisers could grow their brands through. And retailers didn’t invest in innovating their media products or operational excellence.

Appointing Threefold (part of the SMG agency network) that year sparked a revolution in our products and services from 2017 onward. We expanded our toolkit, improved compliance and enhanced service levels with brands. As a result, shopper execution was better, which drove higher sales uplifts, creating stronger ROIs for brands. This led to a 2.5 times increase in Co-op’s retail media revenue between 2017 and 2023.

The years 2016-2020 was “intervene & fi x,” 2020-2022 was “improve & innovate” and 2023 onward represents our “transform and revolutionize” into a retail media network with a strong brand, clear positioning and meaningful proposition. I’m in my ninth role at Co-op across 11 years, and I’ve never been so excited and grateful for the position I’m in now. We have a unique opportunity, an incredible network of partners, great brand clients and a fantastic team of 30 dedicated Co-op Media Network colleagues. The next few years is going to be an amazing adventure for us all. We’re enjoying every day of it.

P2PI: How long was Co-op Media Network in the works?

Can you explain the role of the retailer’s long-term agency partner Threefold in the launch? ?

Harris: Co-op Media Network is powered by Threefold, and having recently renewed that partnership until 2028, we have had one of the longest strategic collaborations in the industry — surpassing over a decade together.

The decision to evolve from a de-branded sales house model toward a Co-op branded retail media network began early last year. Kenyatte Nelson joined the business as chief marketing and customer officer (CMCO), and he endorsed the prioritization of retail media as an opportunity to capitalize on three existing strategies:

1. Growing our membership base

2. Fully focusing our grocery business to convenience

3. Extending Co-op’s income opportunities into new markets

This gave us license to review our strategy and look at our convenience grocery business through the lens of a media owner, as opposed to a grocery retailer. When we did that, we

8 l May/June 2024

started crafting a revised strategy around our role as a conveniencefocused retail media network. And executing plans to align our brand, marketing, operations, products, and people to that strategy — which is an ongoing, three-year roadmap.

P2PI: Did any shopper insights influence the network and its solutions?

Harris: The development of Co-op Media Network and our solutions has been significantly influenced by shopper insights, focusing on the value of convenience, and leveraging Co-op’s unique positioning in the market.

The strategy emphasizes tailoring advertising to meet the distinctive needs of the convenience shopper. Convenience store shopping is different than large grocery stores. Trips tend to be unplanned, spontaneous, impatient, quick, few items without a shopping list. Often the purchase is close to the consumption (buy now, use now/soon). Whereas larger grocery store trips are more planned, routine, longer, against a shopping list with many items (buy now, use later).

P2PI: What are some of Co-op Media Network’s solutions?

Harris: We provide various data and media solutions, including in-store advertising (print, radio and digital), onsite e-commerce advertising, offsite media using both third-party (e.g., geo-targeting) and fi rst-party data (shopper data), as well as tailored in-app activations for specific member cohorts. We also provide robust planning and measurement capabilities, utilizing both our PlanApps (via Threefold) and Circana partnerships.

These innovations are designed to leverage Co-op’s strengths in convenience and customer proximity, and we have an innovation roadmap to continue our ability to make purchasing decisions easier for the convenience shopper.

P2PI: So much has changed and continues to change when it comes to retail media in the commerce marketing world. What has that looked like for you and how do you see retail media evolving in the U.K.? How do you see it evolving globally?

Harris: Due to data privacy regulations and geographical size, the U.S. and U.K. are at opposite ends of the journey. In the U.S., fi rst-party data driven offsite media came after onsite e-commerce media, with in-store advertising to come next. In the U.K., we started with in-store advertising then onsite media became more of a focus with COVID, and only recently has the

market invested in data-media collaborations to combine fi rstparty data with offsite media.

Both markets are pursuing store digitization. And all digital media offerings (including the store) are moving away from tenancy and CPM models, toward programmatic buys, which allows more self-service and less managed service models. Once you get into automated buys in retail media, which rely on data to make decisions, you inevitably end up with AI opportunities to make those decisions as optimal as possible.

And of course, data-media collaborations will continue to be formed between agencies, publishers, retailers and the bigger brands — CTV being the recent focus. (I’m going to my fi rst CTV dedicated retail media conference this year.)

P2PI: You mentioned AI. What impact do you think AI will have in the retail media and the broader commerce marketing industry?

Harris: Data drives decisions in advertising. Currently humans are sat in the middle, using data to make those decisions. Eventually AI will be sat in the middle. Not in every situation, but in a lot of them. Especially as the market shifts to be more programmatic and self-serve.

But I’m fairly confident that relationships between people (brands and retailers) will remain significant and navigating this media fast-changing landscape will require a lot of input from talented marketers for many years to come.

So, I see AI as a catalyst, removing the pain from processes, planning and executing tactical activity, allowing us, humans, to focus on the value-adding evolution of the industry within all our respective organizations.

P2PI: What advice do you have for brand marketers who want to work with Co-op Media Network?

Harris: Before focusing on Co-op Media Network specifically, my fi rst piece of advice — especially for global brands, who have other convenience retail media networks to work with overseas — is to reset your assumptions about the value of convenience in retail media. Open your mind to the power of the channel, by evaluating convenience in terms of the media metrics that matter (reach, frequency, attention).

Advertising tends to put grocery into two buckets: online and offl ine. But it should be four, separating out convenience shopping (in-store baskets, and online mopeds). So, ask yourself, are you covering all four effectively and efficiently? Are you using each one in the same way or tailoring your approach to unlock the maximum benefit? The missions between these four boxes are very different, the experience is different, even the shoppers are different.

When that perception shifts (which we believe it will), things get exciting as it opens up discussions about different ways to collaborate, execute, and unlock those largely untapped, undervalued and underestimated media benefits.

P2PI.com

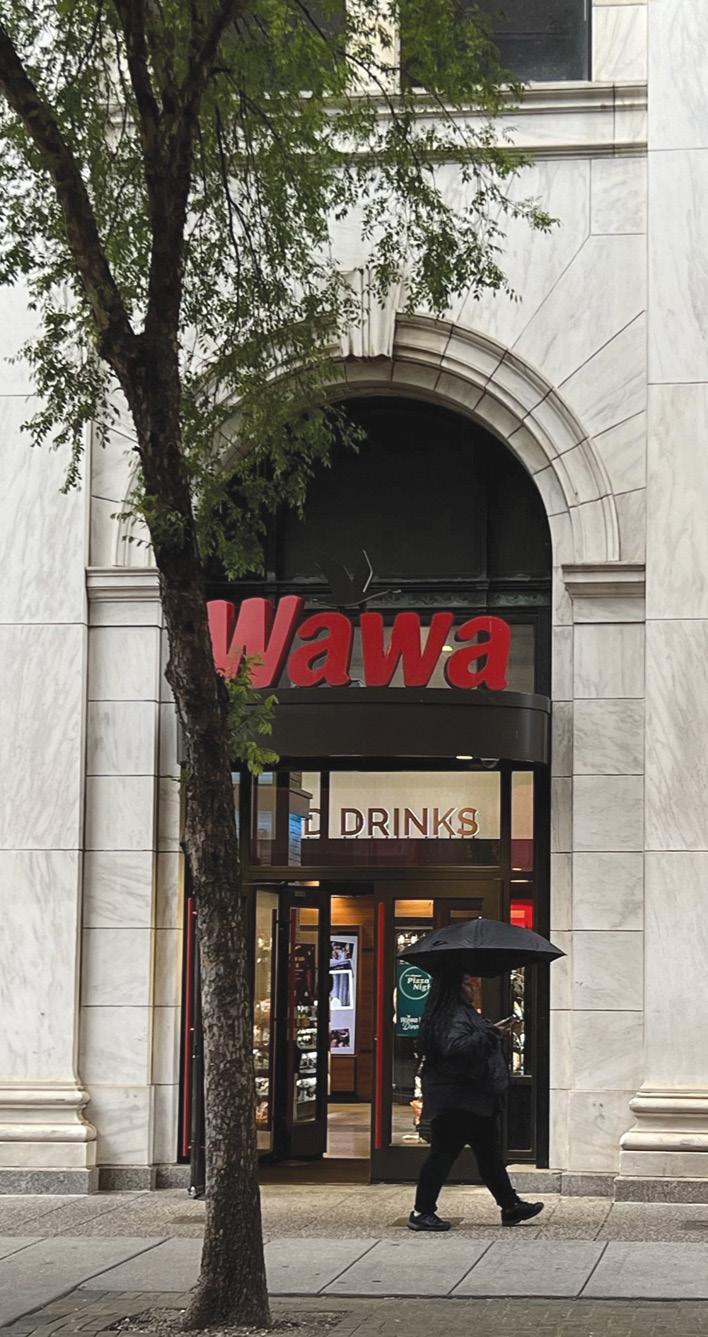

In-Store Experience

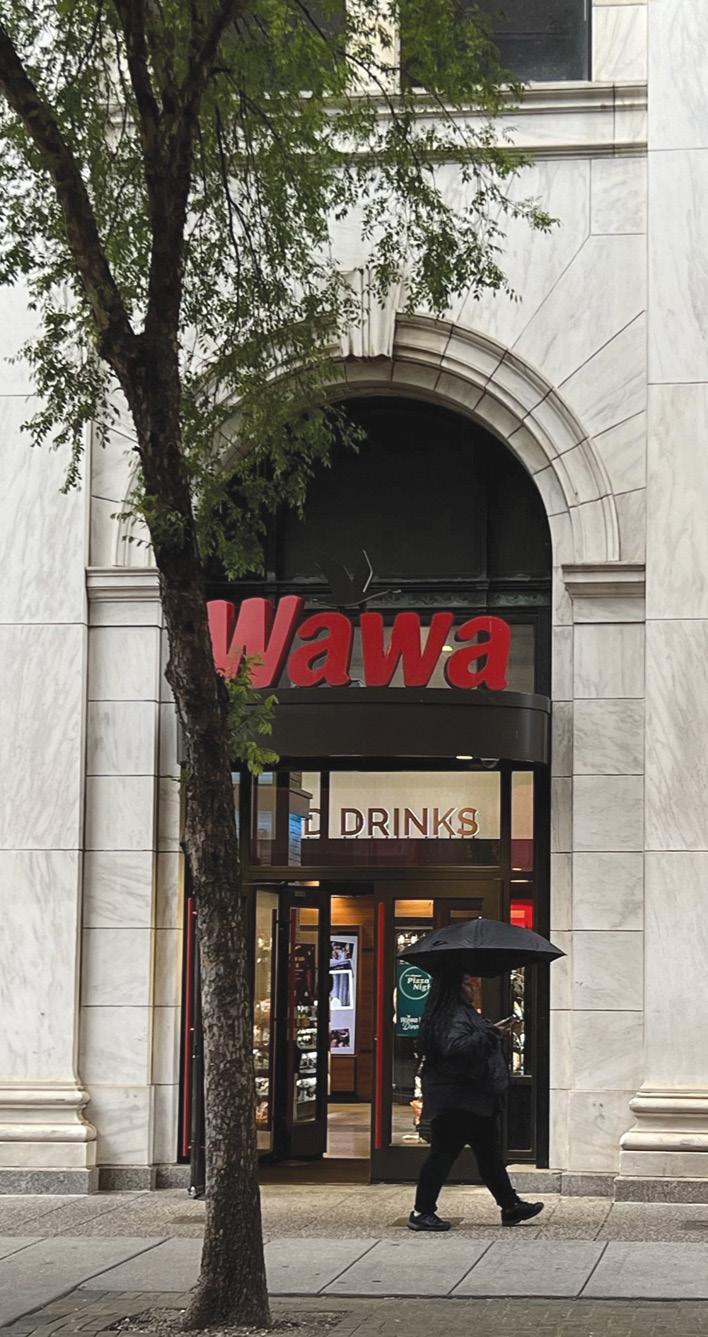

The Largest Wawa

THIS LOCATION IN PHILADELPHIA SHOWS OFF WHY ITS FANS/ CUSTOMERS LOVE THE EXPANDING CONVENIENCE CHAIN SO MUCH.

BY JACQUELINE BARBA

Wawa, a privately held and family-owned convenience store and gas station chain, has a rich history and origins in the Philadelphia metropolitan area.

The retailer has a cult-like following, similar to how Wisconsinites feel about convenience store chain Kwik Trip. The love Wawa’s loyal customers and fanbase have for the retailer, and particularly its popular prepared hoagies, even inspired a viral clip from a 2021 “Saturday Night Live” commercial advertisement parody of HBO limited series “Mare of Easttown.”

The fi rst Wawa Food Market opened in 1964 in Pennsylvania as an outlet for dairy products, but the name Wawa Inc. dates to 1803, when the company began as an iron foundry in New Jersey.

Today, the company has more than 1,000 U.S. locations (and New Jersey has the most). Its footprint is spread along the East Coast, but in 2024 Wawa is opening more than 70 stores, including its fi rst in Alabama, Georgia and North Carolina.

In May, while the Path to Purchase Institute was in Philadelphia for its Future Forward event, we paid a visit to not just Wawa, but the largest Wawa that exists. At approximately 11,500 square feet, the flagship store is located at 6th and Chestnut Street in the Center City neighborhood. It opened in late 2018 within a charming historical building.

The brightly lit interior features a combination of old Art Deco and warm, modern architectural design elements with high ceilings, tall windows and unique light installations. It’s spacious and by no means overcrowded or cluttered.

The space almost seems split in two halves. One side is dedicated to its convenience store offerings and features coolers and freezers, a large fresh food selection, a self-serve “ice cold drinks” section, registers and a few aisles clearly identifying snacks, candy, grocery items and more. Some in-aisle merchandising space appears illuminated, shining light onto products on shelves.

10 l May/June 2024

In this area, multiple digital screens looped a photo compilation of its customers derived from photos posted on social media using #Wawa. One slide invited shoppers to use the hashtag to be featured on the screens.

Wawa is growing its use of digital screens in stores (and at the pump at select gas stations) through its recently launched retailer media network Goose Media Network. While brand advertisements weren’t playing during our visit to this location, the retailer has said it is using screens to promote new products, promotions and the brand’s overall messaging at more locations.

The other half of the store is more like a cafe, restaurant and bakery combination, primarily dedicated to its freshly made offerings. This side includes seating areas, a food and beverage ordering counter for its iconic hoagies and other fresh offerings, a bakery counter, a “made-for-you food & beverage” kiosk with self-serve screens, small sporadic c-store racks for snacks, and another checkout counter with a couple of self-checkout spots.

Throughout the store, but primarily in the convenience side, brand activity includes account-specific cooler and freezer clings, floorstands, corrugated shelf bins, signage on racks and baskets, and other secondary merchandising space.

Another endearing element of the store is sporadic odes to Philadelphia and Wawa’s history, such as colorful murals as well as permanent signage on the walls like something you’d see at a museum. It pays specific homage to landmarks such as City Hall and the William Penn statue, and the Union Fire Company founded in 1736.

P2PI.com

INTRODUCING THE 2024 CLASS OF THE PATH TO PURCHASE INSTITUTE’S

BY ERIKA FLYNN

We are proud to showcase the third annual list of winners. This talented group of rising leaders, nominated by their peers and selected by our editors, is redefining the future of commerce marketing. Learn more about these impressive individuals on the following pages.

DAREN ALLI

DAREN ALLI

Financial Operations

CVS Media Exchange (CMX)

Age 33

Alli was a key contributor in housing and scaling the Lowe’s One Roof Media Network throughout 2023 before joining CVS Media Exchange this year. As head of business and financial operations at One Roof, he helped implement financial controls and rigors supporting annual and long-range planning, along with forecasting and month-end P&L management. Alli also negotiated and implemented contracts to elevate external partnerships, along with internal customer relationship management and order management systems in his most recent position. He is currently a member of the IAB (Interactive Advertising Bureau) CRO Council and learns from industry leaders across the digital media ecosystem. After beginning his career working at a Big 4 accounting firm and transitioning to the healthcare industry with a focus around business analytics and financial management, he ventured into the retail media space six years ago at Triad. He then moved to Walmart in financial reporting and sales reporting development, and later was the key financial contact for more than 10 retailers before moving to Sam’s Club through business acquisition. There, he set up financial processes and provided the financial modeling and cross-functional support for the launch of a Curbside Sampling program, allowing new item launches and brand recognition to be front and center in the hands of consumers through a new channel experience. He received two “Make A Difference” awards while at Walmart/Sam’s Club for his contributions.

Alli is an avid golfer who tries to enjoy the beautiful Florida sunshine and play once a weekend. He was able to shoot his first round under 80 and celebrated making a hole-in-one while playing with his father.

12 l May/June 2024

CASEY BLADES

Director of Shopper and Omni-Channel Marketing

CASEY BLADES

Director of Shopper and Omni-Channel Marketing

Sun Bum

Age 37

Blades was recently promoted to her current post, where she is leading the development of the shopper and omnichannel marketing department from scratch, crafting a KPIdriven playbook based on test-and-learn strategies, and planning for future expansion. Her responsibilities include spearheading the creation and execution of 360-degree brand campaigns, such as designing custom in-store displays, organizing sampling events and managing e-retail media. She is proud of her achievements in orchestrating the company’s first-ever college activations, where Sun Bum will host unique campus events and drive meaningful 1-on-1 moments and brand awareness with its key shoppers. Her work conceptualizing the KPI-driven shopper marketing playbook also helped her reach a significant milestone this year. The playbook led to the company’s highest-ever results in an e-retail campaign, with more than 14 million impressions, $1.3 million in incremental sales, and a final return on ad spend four times higher than any previous campaign. Before joining Sun Bum, Blades spent 12 years with The Hershey Co. During her tenure there, she spearheaded the first-ever microseasons shopper marketing campaign, achieving more than 10 million impressions and $1 million in additional sales. This campaign earned recognition through a Progressive Grocer Category Captainship award.

Blades loves working with animal rescues; she has two rescue dogs herself.

LAUREN BIONDI

LAUREN BIONDI

Manager, Social Media, Content Creation and Digital Advertising

Wakefern Food Corp.

Age 36

Biondi spearheads innovative strategies for ShopRite, The Fresh Grocer, Price Rite Marketplace and Fairway Markets, elevating their online presence and customer engagement. She has spent more than nine years at Wakefern, orchestrating multifaceted campaigns that encompass social media, influencer marketing and digital advertising initiatives. Biondi holds a bachelor’s degree in communications, a master’s in public and organizational relations, and an MBA in food marketing. Her team has been dedicated to growing the ShopRite YouTube presence and has forged mutually beneficial influencer partnerships with New Jersey-based celebrities, such as Mike Sorrentino of “The Jersey Shore” and Melissa Gorga of “The Real Housewives of New Jersey.” Videos featuring these “hometown heroes” earned significant engagement and follower growth for ShopRite accounts, along with some credit with Millennial and Gen Z shoppers. The team was also recently honored with two National Grocer Association Creative Choice Awards, including Outstanding Grand Opening or Remodel Campaign with its ShopRite of Huntington Station Grand Opening, and The Unilever People Positive Award for its ShopRite LPGA Classic: A Jersey Shore Tradition Campaign. She says her biggest accomplishment of the past year was returning to work after her maternity leave and successfully navigating her new role as a working mom.

Biondi is a yoga teacher. She teaches two hot vinyasa classes a week at a local studio, and says it is a great creative outlet and stress-reliever.

JEFFREY BUSTOS

JEFFREY BUSTOS

Vice President, Measurement

Addressability Data

IAB

Age 33

Bustos played a pivotal role in spearheading the development of the IAB/MRC Retail Media Measurement Guidelines. His leadership is central to setting new standards in retail media metrics, driving greater transparency and improving the accuracy of advertising measurements. His work has helped shape the current retail advertising landscape, fostering a more accountable and effective environment for media investments. Bustos coalesced retailers, brands, agencies and ad-tech companies to develop Retail Media Measurement Standards in the U.S. this past year, and he’s working in a global capacity across Europe and LATAM to bring standards to other regions. In his role at the Interactive Advertising Bureau, Bustos is instrumental in developing industry standards and guidelines for measurement and addressability solutions. His work primarily focuses on enhancing revenue growth, efficiency and scalability across various sectors such as retail media, data clean rooms, and privacy enhancing technologies. Previously, he worked at GroupM, where he led data and audience strategy for e-commerce clients, specializing in cookieless solutions, audience strategy and data taxonomy. His extensive background in programmatic and data-driven initiatives positions him on the leading edge of navigating the complex landscape of digital advertising, particularly in a time when privacy concerns and data transparency are paramount .

Bustos drinks hot chocolate every day. He may even add some

LILY CHOU Senior Manager, Digital Marketing

Fairlife

Age 34

Chou transitioned from a brand role to spearheading the company’s digital marketing efforts this past year. Key work has been with the company’s Amazon marketing strategies for which Chou crafted audience-led strategies and full-funnel activations, tailoring messages and tactics based on shopper behaviors. Her strategic approach drove record household penetration and subscription rates while achieving a notable 20% year-over-year improvement in marketing efficiency. Under her leadership and collaboration, Core Power became the leading brand within the Coca-Cola portfolio on Amazon, establishing a new benchmark for marketing activations and holistic measurements, and serving as a model for other Coca-Cola brands. She also spearheaded Fairlife’s first commerce marketing mix modeling, establishing benchmarks for retail media investments across more than 10 retailers. Collaborating cross-functionally, she derived robust insights from the MMM (marketing mix modeling) initiative, significantly contributing to the optimization and standardization of commerce marketing practices. Chou also pioneered an omnichannel audience framework for the Fairlife portfolio, elevating commerce marketing to an audience-centric approach. Enhancing engagement rigorously based on shopper behaviors, occasions and basket affinity aligned with brand strategy and insights. She optimized the consumer experience by tailoring creatives and tactics to the audience, inspiring other teams to refine their audience strategies and share insights.

Chou has a younger brother with whom she shares a striking resemblance despite a four-year age gap. Their mutual love for travel led them to create a YouTube channel to share their story, which has recently crossed the milestone of 10,000 subscribers.

P2PI.com

cheese to melt inside.

ALEX CRAWFORD

Senior Marketing Specialist

ALEX CRAWFORD

Senior Marketing Specialist

7-Eleven

Age 34

Crawford spearheaded 7-Eleven’s Ja’Marr Chase Always Open Collection this past football season after the Cincinnati Bengals wide receiver compared himself to the convenience store chain, saying that “he’s always open.” She collaborated with cross-functional partners to create a merchandise line in less than five days after his tweet went viral. Crawford’s work also includes The Convenience Tour Golf Collection, which she saw from concept and production to marketing and promotion. The collection gained viral traction and was covered by media outlets including Golf Digest, Complex, Hypebeast and others. She also took the reins of the 7Collection, captained the management of a new e-commerce venture in its inaugural year, and has played a pivotal part in expanding 7-Eleven’s cultural footprint by engaging with fresh fandoms, such as golf enthusiasts, supporters of Ja’Marr Chase, and Pac-Man fans. A standout moment was when Blink-182’s bassist, Mark Hoppus, organically wore one of the chain’s t-shirts during their reunion performance at Coachella. Crawford began her career with the Dallas Cowboys, then moved into shopper marketing on the agency side and worked on the 7-Eleven account before joining the company just over five years ago. She’s held various roles within the marketing department, spanning teams such as P-O-P, private brands, shopper, sports and, most recently, e-commerce.

One of Crawford’s tweets was read on “The Tonight Show with Jimmy Fallon,” during a segment called #weddingfails. It ended up going viral and was featured on news outlets like Buzzfeed, The Daily Mail and The Mirror

AARON DUNFORD

General Manager of Nordstrom Media

Nordstrom

Age 36

Dunford’s career at Nordstrom has spanned more than a decade. Early roles included spearheading the men’s customer marketing strategy, resulting in an increase in digital campaign performance by more than 50% year over year; marketing finance, where he supported the growth and management of the largest vendor-funded marketing program at the time, surpassing the planned target by 33%; and marketing analytics, during which time he built the Merchant & Vendor Insights team. Then, as director of marketing strategy, he developed and launched Nordstrom’s retail media practice, the Nordstrom Media Network. Dunford was promoted to senior director of Nordstrom e-commerce in 2021. In that role, he drove topline sales, restructured digital merchandising and divisional-focused marketing, and achieved a 25% increase in labor efficiency. After he assumed the role of general manager of Nordstrom Retail Media in mid-2023, he led all retail media strategy, development and execution, beating the 2023 plan by double digits. Named to his current post earlier this year, Dunford now oversees all media at Nordstrom, including both enterprise and retail media, and saw Nordstrom Media Network exceed growth plans for a fourth consecutive year.

Dunford is a motorcycle junkie; he has never ridden one he didn’t like.

COURTNEY CROSSLEY

Vice President, Commerce Media

The Mars Agency Age 31

Crossley’s work this past year included playing a key role in securing and onboarding six new clients while developing and implementing a new organizational structure for The Mars Agency’s rapidly growing commerce media team. Internally, she also led work to develop the agency’s retail-forward search strategy to continue to push the integration of commerce and media, and oversaw production of the quarterly Retail Media Report Card. She also consulted with retail media network partners to help them ideate and implement strategic best practices, helped develop the IAB’s recommendations for standardized measurement, and spoke frequently at industry events/podcasts. She is most proud of her work being able to maintain the agency’s high standards for client excellence as well as its entrepreneurial and collaborative culture as it more than doubled the size and scope of work of its commerce media team. Crossley started her career as a client relations associate at PepsiCo. She then learned the technical aspects of media as an account manager with Google, and she worked with large traditional brands on growing their digital presence. Her next stop was at Kroger’s 84.51 as an account executive. She joined The Mars Agency in 2022 as commerce media director for the Kroger practice and was promoted to a vice president role less than two years later. Crossley is an accomplished equestrian, competing in three-day eventing at the FEI (International Federation for Equestrian Sports) level. On most weekends, you can find her out at the barn or with horses competing along the East Coast.

SONJA EVANS

Vice President, Business Intelligence & Strategy

Blue Chip Age 39

Evans led the development of Blue Chip’s “The Future of Retail” trends presentation for multiple organizations, including E. & J. Gallo, Brown-Forman, White Castle and Bausch & Lomb. She was also a key contributor to the agency’s Commerce Center of Excellence and New Business teams. She is proud and honored to have been awarded the agency’s “Beautiful Mind” award at its annual meeting this past year. The award was named in memory of a former colleague and her personal mentor. Evans also acts as a mentor to the agency’s team of young talent and says it’s very rewarding to watch them grow into amazing strategic planners. Evans started her marketing career as a marketing associate with a Chicago-based restaurant group. The position was what she refers to as a “crash course” in all things marketing, from planning and buying the media, writing radio copy, designing print ads, PR and media relations, to planning and executing hundreds of events, website and email management. She then transitioned onto the agency side in account management/client leadership at Blue Chip. Throughout her time at the agency, she has worn many hats including account leadership, presentation design, business development, and marketing and strategic planning. She has worked across many CPG categories including alcoholic beverages, frozen, snacking, beauty, health and wellness and others.

Evans has been skydiving over Cape Cod and Martha’s Vineyard.

14 l May/June 2024

LACHLAN GOW President Qsic

LACHLAN GOW President Qsic

Age 37

Gow has extensive experience in technology, digital, media, advertising, operations, planning, risk management, contractual negotiations and executive-level client management. He oversees the Qsic team’s efforts, which led to notable business growth exceeding 90% in 2023. He says this growth has been driven by the successful execution of Qsic’s strategy, product evolution and feature adoption among its valued clients. This past year he worked closely across Qsic’s efforts in retail media, c-store, grocery and QSR. Qsic is a commercial music streaming platform, influencing more than 100 million shoppers at the point of purchase monthly. In addition to helping businesses establish and own their brand sound, the company also helps retailers to set up, run and commercialize their audio assets. This extends from music curation and collateral to ad sales and price evaluation. Qsic has invested heavily in developing a patented method of measuring the impact of audio advertising on real-world transactions. Qsic is now a leading provider of AI technology that strategically leverages the power of audio to deliver better customer and sales experiences. Recently, Gow partnered with the team at Gulp Media Networks to develop Gulp Radio. They ultimately gained approval in 2023 to build the world’s largest and most sophisticated commercial radio network, reaching more than 12 million customers daily. Gulp Radio is powered by Qsic’s innovative AI advertising platform and will soon be deployed into 7-Eleven, Speedway and Stripes locations.

Gow always wanted to win a 30-under-30 award.

KELVIN HILL

Associate Creative

KELVIN HILL

Associate Creative

Director/Copy Arc Worldwide Age 36

Hill has more than 13 years of advertising and digital marketing experience. He held copywriting positions at Leo Burnett, Trisect Agency and Geometry Global before joining Arc Worldwide in March 2021. He currently helps manage everything from projects to creative careers while also leading creative teams for client Unilever. In the past year, his work was awarded three Reggie and two Effie awards for campaigns done in collaboration with clients Walgreens, CVS and Unilever. Walgreens’ Untold Beauty was created to give minorities and women who have been historically underrepresented a platform to show the world what makes them beautiful. It challenges conventional beauty standards by featuring real people and representing authentic beauty. CVS’ Positively Real encourages CVS shoppers to show up as their most confident and authentic self both in-person and online. With Unilever brands, Hill says his team is making strides to accurately represent real people in this industry. This past year, he has also taught a class at Chicago State University that aims to build a pipeline into the advertising industry for minority students who have faced significant barriers. The class not only introduces the students to an industry they may have never considered, but it also gives them a foundation to get hired at an internship or junior position after college. Hill is a hang-glider pilot.

TARA HEKMAT

Client Director

Threefold

Age 31

Hekmat has experience working on both the brand and agency side, with the majority of her career spent at SMG, a network of retail media specialist agencies that includes Threefold, Capture and Plan-Apps. She has worked with major CPG brands to help plan, manage and measure their retail media campaigns across top grocery retailers amid the ever-changing demands of the retail and commerce marketing landscapes. In 2023, she joined Threefold’s North American team to support its expansion plans across the U.S. and Canada, working with retailers and CPGs to accelerate developments in the retail media space from Threefold’s New York headquarters. She says it was a big leap to put her life in London on hold to move to the U.S. and spearhead Threefold’s ambitious expansion. Notable work this past year includes partnering with a major U.S. retailer to help advance its retail media network offering. She was also involved in the refreshed brand platform of the U.K.’s favorite biscuit brand, relaunching it in the U.K. grocery space with successful results. She also led one of the company’s retail media delivery teams to execute best-in-class, multi-retailer campaigns, collaborating with key retailers and media partners.

Hekmat has three passports, studied four languages (but she can’t claim to speak them fluently) and has been lucky enough to travel to six out of the seven continents.

SHANTERIA JONES

Senior Manager, Omni Commerce/ Shopper Marketing Kellanova

Age 28

Under Jones’s leadership, Walmart e-commerce sales have seen a significant increase in revenue versus a year ago, including the categories salty up 35%, frozen up 39%, and portable wholesome snacks up 32%. Jones executed strategic initiatives and innovative marketing campaigns, including the company’s Cheez-It & PUBG: Battlegrounds marketing campaign. For the first time, the brand pivoted away from its iconic red to introduce disruptive packaging for consumers digitally and at retail. She developed a go-to-market omni-program to drive product awareness that included a “Gaming Forward” editorial in the Celebrate Arkansas magazine, a strategic influencer partnership, the ideation of the Cheez-It Battleground exhibit, and product reveal at a gaming-centric festival while leaning into paid search amplification through Walmart Connect. She also helped shape and bring to life a discussion panel that brought together retail, CPG partners and content creators to discuss omnichannel collaborations and the future of gaming. The activation increased new-to-category consumers by 26% in 30 days. She is most proud of being promoted to her current post last year, charged with managing digital and physical activations for iconic brands. The promotion expanded her experience and exposure into a new segment of the business, portable wholesome snacks. Jones started her career at Gulfstream Aerospace Corp. during high school and college, then landed at Walmart in real estate, integrating and accelerating the digital transformation at a small-format university campus store. Once in merchandising and eventually transitioning to Kellanova, she honed her knowledge and expertise in omni-commerce.

Recently, she renewed her vows in Thailand with her high school sweetheart, Troy.

P2PI.com

SHOBHA KANSAL

Director of Category Leadership

SHOBHA KANSAL

Director of Category Leadership

Kraft Heinz

Age 36

Kansal began her career as an intern at Procter & Gamble. After earning her master’s degree in sociology, she joined Kraft Heinz on its omni-commerce team, collaborating with various retailers and solution providers on driving digital commerce excellence. In her current role, she is responsible for leading and developing a team of 27 individuals, including both people leaders and individual contributors. Her focus is on enabling each team member to achieve their career aspirations while also implementing and activating path to purchase principles to enhance shopper loyalty for the company’s retail partners. Recently, she was involved in sponsoring an omnichannel category workstream initiative. The project was designed to enhance the fluency and democratization of information across the category and sales organizations. Kansal says she is extremely passionate about dismantling organizational barriers in order to improve efficiency and transparency. She also recently had the honor of participating in a panel discussion on motherhood for nonprofit organization, Beautifully EmpowHERed, whose mission is to offer mental health services, career counseling and inspirational events to empower women to be their true selves. Another accomplishment she is very proud of was being named the “Volunteer of the Year” at her children’s school.

Kansal is a certified yoga instructor.

ELINOR LEE

Director, E-Commerce Marketing

Paramount

Age 37

In 2023, Paramount launched two tentpole theatrical campaigns for its franchises, “Teenage Mutant Ninja Turtles (TMNT): Mutant Mayhem” and “PAW Patrol: The Mighty Movie.” Lee drove Amazon’s omnichannel strategy and prioritized on-site consumer engagement by bringing compelling content to the forefront. She is most proud of her work in helping bring together a theatrical retail campaign for the TMNT movie, including a first-of-its-kind Sewer Shop experience that was powered by Amazon, which unlocked incremental marketing across the ecosystem. The Sewer Shop was hosted at the TMNT: Mutant Mayhem Experience in New York and Los Angeles, which featured a cross-category assortment, reignited the fandom behind a beloved 40-year-old franchise, and captivated a new generation of fans. Lee oversees commerce marketing for Paramount’s Amazon business across a diverse portfolio of content, managing more than 12 brand stores and spearheading paid advertising strategy. She has been at the entertainment company for five years and has seen the intellectual property portfolio expand from Nickelodeon to adding MTV, Yellowstone, Paramount Pictures, Star Trek and more. Lee started her marketing career at Martha Stewart Living Omnimedia, managing marketing campaigns in support of Stewart’s Crafts, Pets, Office and Gardening lines, which she helped launch on Amazon.

Lee has visited 11 U.S. national parks already, with a goal to visit as many as possible in her lifetime.

SAMANTHA LANDRY Manager, Digital Shelf Bacardi USA

Age 34

Landry and her team work closely with both national account managers and shopper marketing to create omnichannel program sell-in focusing on its top Bacardi brands during key selling seasons. She is most proud of the fact that Bacardi USA is recognized by both retailers and BevAlc distributors as having the most optimized product content. All Bacardi brands not only have completely optimized image carousels, enhanced content and search-engine optimized copy, but they are continuously winning onsite placement at Walmart, Kroger, SPECS, ABC Liquors and others. The world of digital shelf is ever-changing for Landry and her team. Not only is it a daily workstream to create and present omnichannel programming throughout the year to key retailers, but meeting retailer product information requirements, maintenance of syndication providers, and producing product content requires on-going maintenance. Landry’s career started at Century 21 Real Estate working across digital marketing, events, communications and national advertising. Since then she has gained experience across different industries within various marketing functions until she found the niche of digital shelf just before the pandemic. Ever since, she has leveraged the science of digital shelf to optimize and grow the online footprint for prestige consumer healthcare brands and Bacardi brands.

Landry’s love of history has brought her to countless countries and many castle explorations.

JESSE LEIKIN

Co-Founder and Senior Vice President, Product and Technology Incremental Age 34

Leikin is proud of Incremental’s focus on empowering enterprising brands and agencies to consciously expand their advertising efforts and determine their optimal media mix. The company’s neutral media measurement enables clients to look beyond DTC safe havens and increase awareness within even more impactful channels across the advertising landscape. He is particularly proud of the engineering process that the Incremental team has developed. Rather than hyper-focusing on creating the elusive “perfect product” at the company’s launch, its ongoing goal is to refine its measurement iterations and innovate alongside its solution at a granularity and speed that accurately reflects that of the retail media landscape, as a whole. Leikin’s entrepreneurial career evolution began at age 12, offering technology support services. During his time at the University of Maryland, he founded several companies and finally entered the advertising field with Verizon Media (then known as Millennial Media), where he focused on developing innovative ad units for iOS and Android. In 2020, Leikin co-founded Incremental, a measurement and analytics provider using its innovative data platform to help brands and agencies obtain granular insights into their retail media investments.

Leikin is an avid trivia player and part of a four-time championship trivia team in the Baltimore area.

16 l May/June 2024

JACKIE LIU

Marketing Manager, Retail Marketing

JACKIE LIU

Marketing Manager, Retail Marketing

Mattel Inc.

Age 32

Liu led Mattel’s Barbie “Best Week Ever” Amazon program, a seven-day, backto-back retail execution showcasing unique themes from 2023’s hit Barbie movie. The campaign exceeded expectations, ultimately increasing ordered revenue by 81.5%. The program won the Online Media, Marketing and Advertising (OMMA) award for Advertising/Promotion Website or Microsite. A nearly four-year veteran in retail marketing at Mattel, Liu began her career in the PR industry at Ogilvy Public Relations in Taiwan before making a shift to the digital marketing field. However, she says it was in retail marketing where she found her true passion. Working closely with retailers, advertisers, and brand marketing teams, she focuses daily on driving conversion and boosting sales.

Liu enjoys traveling and immersing herself in different cultures. She had the opportunity to learn how to cook Tom Yum Soup in Bangkok, Thailand, explore tea culture in Kyoto, Japan, and join an aboriginal dance group in her home country of Taiwan.

MARIA McMANUS

Vice President of Marketing & Innovation

Deep Indian Kitchen

Age 39

McManus joined Deep Indian Kitchen in late 2022 to help lead the brand’s strategic, highgrowth initiative, and has since seen it grow by more than five times and expand to more than 20,000 doors. Her recent work has resulted in the company delivering 44% syndicated retail sales unit growth in 2023 versus the year prior, not including Costco or e-commerce. Deep Indian Kitchen has seen success as the leading frozen Indian food brand in America, in part by creating new frozen Indian food consumption, and with 72% of its growth incremental to the frozen entrees and appetizers category. McManus led the marketing team to deliver impactful, mid- and upper-funnel campaigns and tactical executions, resulting in e-commerce (online, pickup and delivery) performance that is two to three times the industry average. The company was selected as No. 16 on Instacart’s Fastest Growing Emerging Brands list for 2023, crediting the marketing team’s strong tactical execution on the platform that helped drive velocity and distribution growth. In celebration of Diwali 2023, McManus led the marketing efforts to create the company’s largest activation as a brand to date. The activation welcomed consumers nationwide to Deep Indian Kitchen’s holiday table and featured a 10,000-meal giveaway via Instacart. The press release, influencers and multi-pronged digital campaign were a significant success and a first for the brand, holiday and Instacart.

McManus is a former trick water skier, completed the NYC marathon, and loves to sail. Oil painting, drawing and spending time with her family are her favorite ways to unwind.

GEORGIA MARTIN

Partnership Director

Boots Media Group (Part of SMG)

Age 32

In leading the Boots Media Group team, Martin has doubled the size of the business in the past two years with a strong focus on innovation, team development and positive team culture. Martin’s recent work includes introducing new digital inventory both in-store and online, enhancing the company’s presence in the digital marketing space, and launching “Audience 360,” a ground-breaking tool allowing supplier brands to leverage Boots’ first-party data across various platforms including META, Google and The Trade Desk with comprehensive end-to-end measurement for offl ine and online sales. She has also driven innovation by securing major partnerships with media players such as ITV, offering new CTV opportunities to supplier brands. One of Martin’s passions is developing people; she has grown BMG from 10 members to more than 40 individuals who are all working toward a clear growth and innovation strategy. Martin spearheaded the transformation of the retail media organization into Boots Media Group, showcasing her strategic vision and adaptability to market trends. Martin has worked for SMG in retail media for the last nine years and has taken on multiple roles across leading U.K. retailers, including The Very Group, Coop and Boots.

Martin is an avid dog lover and is a proud mum to her dog Rick.

DANIELLE MATHEWS

Vice President, Commerce and Performance Media

Mosaic

Age 36

Throughout this year, Mathews’ role has been laser-focused on spearheading new business endeavors, culminating in the successful conversion of more than 15 new clients into media clients. A standout project for her involved a collaborative effort with a baby food brand, where she championed the infusion of fresh perspectives into the annual planning processes. Through strategic partnerships with innovative firms like Blis and Aki, the team breathed life into creative concepts in novel ways. The team’s approach ensured optimal funding allocation for search initiatives and the implementation of supplementary tactics during pivotal sales periods, in tandem with the retail media networks, resulting in substantial impact and success. Mathews also works closely with parent company Acosta alongside the digital commerce team to orchestrate end-to-end solutions for clients. She says the collaboration ensures the team’s ability to drive sales across various shopping channels, optimizing its approach from an e-commerce perspective. Additionally, spearheading the acquisition of a new brand as the Shopper Agency of Record has been a highlight in the past year, witnessing the tangible impact of its strategies reflected in significant sales growth at key retailers. In particular, seeing a major shift in online sales catapulting the client to a category leader status has been a standout achievement.

As much as she thoroughly enjoys her job, Mathews equally enjoys “Wheel of Fortune.” She has applied numerous times and actually got a casting call this year.

P2PI.com

KURTIS McMULLEN

Head of Non-Alcoholic Beverages

Labatt Brewing Co.

Age 32

McMullen has spent his 12-plus-year career at Labatt, holding eight different roles across the brewer’s commercial function. Most recently, he was the brand activation manager for Budweiser in Canada. Now leading the efforts for non-alcoholic beverages for three years, he acts as a cross-functional general manager. The company launched Corona Sunbrew, which is the first-of-its-kind to offer a source of Vitamin D. He and his team scaled the new product to the number one non-alcoholic brand in Canada over the last 18 months. It was the first-to-market globally, starting with sixpack bottles (which is iconic for Corona), then 12-pack cans (for summer) and 24-pack bottles (for Costco volume), becoming a global benchmark for success. He has also overseen non-alcoholic category expansion and leadership, including grocery and new channels. While non-alcoholic beer is historically sold in grocery, the company has been growing the category in liquor retailers, mass merchandise stores, on-premise/quick-service restaurants, convenience stores and Amazon, etc. These channels are driving strong awareness for the category and incremental sales, including the first “non-alcoholic beverages” category on Amazon and exclusive areas on-shelf in liquor channels versus being merchandised with their alcoholic mother brands and dispersed through the store. New grocery aisle signs and building retailer out-of-aisle programs to help shoppers find the company’s products has also been a focus for McMullen. He has led the transformation of the brewer’s non-alcoholic business through a new RTM partnership, developing emerging channels, integrated omnimarketing campaigns, and collaborative retailer activations. McMullen loves to travel and explore nature. In his free time, he can be found diving with sharks in Africa, hiking Machu Picchu, or searching for new beaches around the world. With one son and another on the way, he hopes they share his joy for adventures.

JORDAN MIKESKA

Director of Shopper Marketing

Nature Nate’s Honey Co.

Age 33

Mikeska manages all shopper marketing, e-commerce and retail media for Nate’s Honey, charged with introducing customers to the company’s honey products through in-store activations, digital retailer-specific marketing efforts and more. A member of the marketing leadership team, she supports other departments including innovation, commercialization, operations and sales. She also serves as a critical link between sales, operations and marketing. In 2023, she oversaw the execution of more than 200 shopper marketing programs in 25-plus retailers and helped secure record numbers for honey households. Mikeska is most proud of the multiple ways her programs work together to instill a level of trust with retailers and customers alike. She knows that each time a customer picks up the company’s iconic, orange-labeled honey bottle or sees an in-store advertisement or activation, it’s an opportunity to earn trust with the communities it serves. As the retail landscape continues to change, she is quick to pivot, utilizing trends and leveraging her deep relationships with retailers to keep Nate’s a brand leader in the honey category. Her background is rooted in driving brand success through innovative shopper marketing strategies, with experience starting on the agency side for companies like Keurig Dr. Pepper.

Mikeska was born over Texas soil in Tulsa, Oklahoma. Hook ‘em horns!

NIKKI NAGY

Team Lead, Trade & Shopper Marketing

Boston Beer Co.

Age 39

With more than a decade of experience in shopper insights, strategic media planning, and team leadership, Nagy is dedicated to driving brand growth and innovation. Over the past year, Boston Beer has been undergoing a transformation from conventional trade marketing to the dynamic realm of commercial marketing, a journey that Nagy says entails embracing an omnichannel strategy that is designed to break down silos with dedicated departments of shopper marketing, channel marketing, performance marketing and connected commerce to redefine industry standards. Throughout her career, she has successfully managed multiple projects from both the agency and client-side, with a focus on driving year-over-year return on ad spend improvements in the ever-changing retail media landscape. Nagy is committed to fostering collaboration and mentorship, driving teams toward achieving impactful outcomes in their go-to-market strategies. In addition to her professional accomplishments, Nagy is passionate about staying at the forefront of media innovations and contributing to industry thought leadership. This year she tried her hand at new product development in the outdoor furniture sector and was awarded her first patent based on the assembly mechanism. She now has prototypes and is hoping to launch this summer.

Nagy has a mild addiction to home improvement and renovation projects. She just took on her first beach house on stilts.

BRENDAN O’BRIEN

Commercial Strategy Director, Insights

84.51

Age 32

O’Brien leads commercial strategy for the innovation team within 84.51 Commercial Insights, which builds products and services for client data science and data engineering teams. Recent work includes launching the 84.51 Clean Room to enable privacy enhanced first-party data collaboration between Kroger and consumer product goods clients. By creating a shared understanding of mutual customers, he says it empowers both sides to create more thoughtful experiences in store, online and through Kroger Precision Marketing. He also oversaw the launch of 84.51 Data Direct to enable cloud-scalable data sharing architecture to CPGs, agencies, brokers and other clients, an evolution in merchandising data sharing that the company says will collectively save clients thousands of hours in regular reporting tasks. Data Direct helps CPGs access more granular Kroger data to create their own internal/external reporting and automate daily and weekly tasks. He is proud of his work with CPG company leaders in showcasing success stories of how they are driving business strategy and growth with the data, science and consulting from 84.51 insights in conferences throughout this past year. Prior to joining this team, he served as an insights account manager, and prior to joining 84.51 nearly seven years ago, he worked at the global brand consultancy, Landor.

O’Brien plays drums in a band that’s celebrating its 10 th anniversary as an outfit this year.

18 l May/June 2024

ANGELA PARGAS

ANGELA PARGAS

National Shopper Marketing Manager

Talking Rain Beverage Co.

Age 37

Pargas leads campaigns that not only drive revenue but also set new standards in the Away from Home landscape. She uses data-driven shopper insights to drive successful programs that include gamification, augmented reality experiences, location-based marketing, social commerce integration and sustainability programming. Pargas also inspires her team to push boundaries and embrace change, fostering a culture of continuous learning. She was recognized by Talking Rain’s leadership team as the first “Marketing Unicorn” award recipient, noting her contributions to business growth and commitment for going above and beyond. This past year, Pargas also led the successful product launch of the company’s new Sparkling Ice +Energy brand, emphasized growth channels such as c-stores and foodservice, and was awarded the company’s Flavorful Futures & Go Green Scholarships, which highlight sustainability and academic excellence, and contribute to community growth and development. She was a speaker at the Brand Innovators’ Future of CPG Roundtable, and executed a series called Blooming Mood Boosters for adults with developmental disabilities after winning the Talking Rain Passion Fund Grant. Outside of work, she was chosen as one of the top floral designers for the Fleurs de Villes ARTISTE 2024 National Floral Exhibition Series.

Pargas is the founder of Sol Bloom, a Chicago-based floral company from which every arrangement benefits a local charity. Her grandmother taught her floral design before she passed away during the pandemic, and now Pargas proudly shares the skill with her community.

JOEY PETRACCA

Co-Founder & COO

Chicory

Age 33

Petracca recently led the building and development of four new products that are now in beta testing, including Chicory Aisle, Chicory Portfolio, Chicory Reach and Chicory Print. All four leverage the company’s proprietary contextual recipe targeting and enable brands to reach active shoppers beyond the recipe card and across the broader recipe page, boosting incremental return on advertising spend for Chicory’s clients. He owns all of Chicory’s technical partnerships with retailers, retail media networks and publishers. He was also instrumental in securing a partnership with Giant Eagle’s retail media network, Leap Media Group this year, helping the teams align on a measurement strategy that serves all parties. Recent work also included the successful development of Chicory’s new internal campaign insights database, which it uses to provide additional value to CPG clients. He also led the development and launch of Chicory’s first self-service insights and reporting platform, Partner Portal. Publishers can now easily access performance data through this user-friendly platform, empowering them to analyze and optimize recipe card performance. Petracca was the key player in securing Chicory’s long-standing partnership with Kroger Precision Marketing/84.51. This partnership delivers additional insights and value to Chicory’s clients, improving customer retention and overall campaign performance. Petracca is a blackbelt in taekwondo.

CAITLIN PEARSON

Senior Director, Sales Aki Technologies, the Media Division of Inmar Intelligence Age 37

Pearson was one of the top revenue producers at Aki last year and was awarded a spot in the 2023 President’s Club. Her work included leading two award-winning campaigns, including Nature Valley, which won a Platinum Hermes Creative Award as Best Advertising Campaign because of its success in driving incremental sales across mobile and CTV using personalization at scale. The Primal Kitchen campaign won a Gold Hermes Creative Award for Best TV Ad Campaign for driving a sales lift using Aki’s CTV ONE that serves different versions of CTV ads as users stream their content, grabbing their attention and creating a larger conversation. Pearson’s career began in power tool sales, where she honed her customer service and sales skills. After earning an MBA at the University of Minnesota Carlson School of Business, she became a buyer on the merchandising team at Target and gained experience in product selection, marketing, understanding consumer behavior, and business through the eyes of a retailer. She says this blend of sales, business and marketing experience ultimately led her to a career in ad-tech. Pearson has been with Aki for more than five years and is fueled by the ever-growing and evolving market, and the company’s capabilities to problem-solve for clients.

One of Pearson’s goals in 2023 was to try a new pasta shape every month. Hot tip: Sfoglini’s Cascatelli is worth the hype.

CHRIS PLACENCIA

Client Success Senior Director Albertsons Media Collective

Age 39

As the partnership lead for Albertsons Media Collective, Placencia’s primary focus is on developing and implementing connected commerce programming to deliver exceptional experiences in support of Albertsons’ merchandising and brand priorities. He has been instrumental in overseeing some of its largest in-store and digital programs, including Super Bowl, Back-to-School and Holiday in collaboration with CPG partners. His work extended beyond media when he developed an internal guide outlining best practices for merchandising partnerships, bridging the gap between retail and media and transforming how The Collective collaborates with merchandising. In the past year, he also spearheaded the reimagination of the Albertsons Media Collective annual planning process. Collaborating with creative, data and analytics, audience and media ops counterparts, he rolled out the revamped process internally, aiming to expand and grow collaborative CPG partnerships. His efforts included search, display, social, in-store, division programming and sampling initiatives, all aligned with CPG and merchandising objectives and KPIs. Prior to joining Albertsons, Placencia held key positions at Procter & Gamble, managing the Walmart.com business, and at Coty/Wella, overseeing the Amazon business across a range of categories and achieving notable growth. Before that, his experience at Zulily involved onboarding both new and established QVC partners for successful limited-time events.

Placencia, a golfer, has made two hole-in-ones — both of which were blind shots. He didn’t get to see them go in, but instead was surprised each time to find his ball in the hole when he walked up to the green.

P2PI.com

HUNTER POOLE

Vice President, Brand Partnerships

Acorn Influence

Age 33

Poole was named to his current post in October 2023, charged with expanding Acorn Influence’s sellable solutions and team infrastructure by building a framework for its Sales Operations department. He also designed the framework for the company’s brand ambassador programs, including “Brand Immersion Days,” a model now used to lock in larger, long-term partnerships with major brands. Its goal is to take influencer programs from transactional, one-off activations to fully integrated strategies that act as the anchor of shopper marketing plans. He also led efforts into the experiential activation space through a successful Pet Brunch with an event that included 50 dogs – reverse engineering concepts designed to only live in the social/digital space and bringing them to life in the physical space. He is proud to have hosted and performed in Beyonce-inspired drag for more than 200 people across Acorn’s overall enterprise as part of its Diversity, Equity, Inclusion and Belonging Committee Happy Hour during the most recent all-company retreat in Mexico. Poole was an early stage employee at companies like Collective Bias and Chicory before joining Acorn Influence. He’s contributed to the introduction and evolution of influencer to the shopper marketing world, and has played pivotal roles in building businesses from the ground up in spaces that are now fundamental to the commerce marketing ecosystem, like creator content and shoppability.