Time to move beyond the burger and branch out. Plant-based retail sales reached a whopping $8.1 billion US dollars in 2023. Is your store maximizing the opportunity?

Shoppers seeking plant-based products spend more than other shoppers, and there are more of them than ever before. That’s why it’s vital that you capture and maintain their business.

Join the the global plant-based gathering for retail & foodservice professionals, coming to New York City this fall.

Discover proven and future best-selling products, taste the latest innovations from this exciting market, learn from expert-led sessions included in your pass and network with peers in the food and beverage industry. All under one roof for two days only.

Qualified buyers register free! Or use the code GROCER20 to get 20% off any paid pass: Visit: www.plantbasedworldexpo.com/register

Kroger and Albertsons navigate merger uncertainty by staying focused on value creation models.

Energy Surge

Spurred by greater product variety, cleaner ingredients and broader appeal, the energy drink category gets set to soar.

Poultry’s Big Moment

Brands and retailers deliver on demands for affordability, variety and convenience.

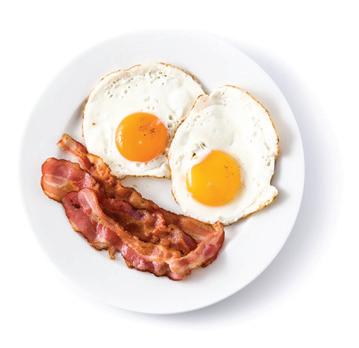

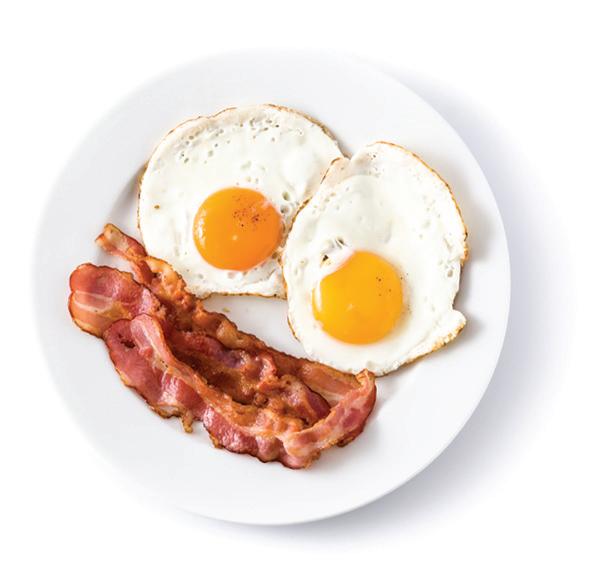

Let’s Meat at Breakfast Convenience, novel flavors, cleaner ingredients and heritage breeds are among the trends enlivening this venerable segment.

Today’s beverage alcohol category offers novel flavors in refreshing formats.

48 FRESH FOOD

Whither Deli?

Grab-and-go items and prepared food come on strong as labor issues affect the service counter.

51 EQUIPMENT & DESIGN

Inside the Renovation of Bozeman Community Food Co-op

The Montana facility is now twice its original size.

Beloved Kraft Heinz brand Oscar Mayer has rolled out its Stuffed Dogs line to grocery retailers nationwide. Capitalizing on rising consumer demand for bold and unique fl avors, as well as indulgence, Oscar Mayer has reimagined its iconic wieners in three restaurant-inspired fl avors — craveable Cheese, hot Jalapeño Cheddar and spicy Chili Cheese — made from real ingredients and able to be enjoyed in buns or on their own. The launch comes at a time when the cheese dog category is outpacing the hot dog category in dollar growth. An 8-pack of Oscar Mayer Stuffed Dogs retails for a suggested $4.99. https://www.oscarmayer.com/

French-inspired baked goods brand bakerly is expanding its line of signature crêpes and convenient snacks with Peanut Butter and Grape Filled Crêpes To-Go. Melding two cultures, the crêpes are made from real, simple ingredients, with no artificial colors or high-fructose corn syrup, using original French recipes and filled with the favorite American combination of creamy peanut butter and sweet grape filling. Each crêpe also comes individually wrapped and requires no prep time, making the item ideal for busy schedules and on-the-go snacking. A 6-count package of 1.13-ounce crêpes retails for a suggested $3.98. The Crêpes To-Go line also includes chocolate hazelnut- and strawberry-filled options. https://bakerly.com/

Long famous for its sweet bread products, King’s Hawaiian has now entered the snacking category with the rollout of Original Hawaiian Sweet Soft Pretzel Bites, set to hit retailers’ shelves nationwide this summer. Combining sweet and salty, the convenient pre-salted pretzel bites can be eaten right out of the container or dipped in a favorite sauce. Marketing support for the product began in early summer with a 360 campaign to drive awareness and trial, including paid media, sampling activations, PR and foodservice partners. Further, King’s Hawaiian tapped into one of the biggest snacking occasions around through a partnership with “Despicable Me 4” and as part of a Mega Mayhem Combo at AMC Theatres across the country, The combo also included two drinks, popcorn and candy. A 10.2-ounce container of Original Hawaiian Sweet Soft Pretzel Bites retails for a suggested $8.99. https://kingshawaiian.com/

8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631

Phone: 773-992-4450 Fax: 773-992-4455

www.ensembleiq.com

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR Paula Lashinsky 917-446-4117 plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj mzboraj@ensembleiq.com

SENIOR EDITOR Lynn Petrak lpetrak@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS

Mike Duff, Laura Landon, Ben Lloyd and Barbara Sax

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER Tammy Rokowski (INTERNATIONAL, SOUTHWEST, MI) 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALES MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

REGIONAL SALES MANGER Natalie Filtser (CT, DE, MA, ME, RI, SC, TN, NH, VT, MD, VA, KY) 917-690-3245 nfiltser@ensembleiq.com

PROJECT MANAGEMENT/PRODUCTION/ART

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly, except for July/August and November/December, which are double issues, by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Single copy price $17, except selected special issues. Foreign single copy price $20.40, except selected special issues. Subscription: $150 a year; $276 for a two year supscription; Canada/Mexico $204 for a one year supscription; $390 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $204 a one year supscrption; $390 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA. POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Copyright ©2024 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

By Gina Acosta

INVESTMENTS IN WORKFORCE, SUPPLY CHAIN AND SHOPPER ENGAGEMENT WILL PAY OFF LATER.

s grocery retailers prepare to head into the all-important holiday season, the industry faces some worrisome headwinds.

Headlines (and podcasts and TikToks and …) about grocery price inflation and product recalls are incessant. At Progressive Grocer’s GroceryTech event in June, retailers spoke of challenges with expense control, shopper promotions and a “theft crisis.” Meanwhile, the Kroger-Albertsons merger still hangs in the balance. And profit margins across the food retail landscape continue to be under tremendous pressure. But there is much to celebrate and to do.

According to the Food Industry Association’s (FMI) 75th annual research report, “The Food Retailing Industry Speaks,” impressive operational improvements are happening across the board in the grocery channel. Both retailers and suppliers reported significant declines in the negative impacts of supply chain and transportation capacity issues that have plagued the industry over the past few years. According to FMI’s survey, the percentage of retailers emphasizing negative impacts from trucking/ transportation challenges declined from 79% to 35%, while suppliers noted a decline from 72% to 58%. Retailers are also reporting a dramatic drop in out-of-stock rates, which fell from 10.7% in 2022 to 6.5% in 2023 — even lower than the typical historic rate of 8%.

PG reports that companies such as Walmart are investing in supply chain modernization this year, with the retailer set to open its second automated perishable distribution center, in Lancaster, Texas, followed by sites in Wellford, S.C.; Belvidere, Ill.; and Pilesgrove, N.J.

The FMI research also showed that retailers and suppliers are shoring up employee retention, another persistent hot-button issue for the industry. Food retailers and suppliers offered more positive feedback about their ability to recruit and retain quality talent, with average turnover rates for food retail employees falling slightly from a historic high of 65% in 2022 to 58% last year.

Companies such as SpartanNash are making great strides when it comes to creating workforce cultures that bring out the best in each and every employee, as Nicole Zube, EVP and chief human resources officer at the company, detailed in PG’s latest TWIG Podcast.

And yes, retailers are still investing — specifically in innovative strategies to improve customer experience and increase growth, according to the FMI survey. Top initiatives include experimenting with in-store technolo-

gies to enhance the shopping experience (81%). Retailers are also responding to changing consumer habits by increasing in-store space for freshly prepared graband-go items (79%) and carrying more private-brand items (67%) and locally sourced foods (57%).

In recent visits to stores operated by Kroger, Fresh Thyme Farmers Market, ALDI, Price Chopper/Market 32, Tops Markets LLC, Albertsons, Wegmans Food Markets, Publix Supermarkets and H-E-B, a renewed focus on grab-and-go, private brands and local is gloriously obvious.

Technology is also playing a bigger role in the grocery shopping experience, with 41% of food retailers and 69% of food suppliers reporting the use of artificial intelligence (AI) for parts of their businesses — the retailer usage percentage nearly doubling year over year. Some of the tech priorities for retailers attending GroceryTech included launching or expanding electronic shelf labels, deploying replenishment-friendly robots, and adopting retail media.

“The food industry continues to demonstrate its collective resilience and adaptability in solving persistent transportation and employee turnover issues so it can focus on operational efficiencies,” said FMI President and CEO Leslie G. Sarasin. “Inflationary pressures and other challenges continue to squeeze profit margins, but even these obstacles do not stop the industry from its investment commitments to sustainability, emerging technologies, and marketing and modernization strategies that improve the in-store shopping experience.”

I can’t wait to see what else 2024 brings.

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

Consumers expect online product purchases to arrive in pristine condition. Retailers and E-tailers need to minimize costly returns. Shipping in corrugated boxes makes everyone happy. Corrugated packaging combines structural rigidity with wavy flutes to cushion and protect contents from damage. Perfect for stacking, cubing, and meeting the needs of omni-channel distribution to delight consumers with joyful unboxing experiences.

When it comes to protecting goods, corrugated delivers. LEARN MORE

1

National Tofu Day. Share a collection of recipes illustrating how consumers can best use this popular bean curd offering.

2

Labor Day. Bid farewell to summer with deals on seasonal staples.

3

U.S. Bowling League Day. Pay homage to this allAmerican pastime with a guide to portable pre- and post-game snacks.

8 International Literacy Day. Highlight your corporate responsibility activities in this crucial educational area.

9 International Box Wine Day. Who says oenophilia has to focus only on the bottled stuff?

Better Breakfast Month

Hispanic Heritage Month (Sept. 15-Oct. 15)

National Italian Cheese Month

4

Eat an Extra Dessert Day

We’re all for second helpings, but try steering hungry shoppers to betterfor-you options.

10

11

5

World Samosa Day. Make sure this tasty South Asian pastry with a savory filling is on shoppers’ food radar.

6

National Mushroom Month

National Potato Month

Self-Care Awareness Month

Sourdough September

National Food Bank Day. Use this time to make generous donations to your preferred hunger relief partners.

12

7

National Tailgating Day

14

World Suicide Prevention Day. Give your associates the resources to get help for themselves and their loved ones.

15

National Double Cheeseburger Day. Whether created at home or enjoyed at a favorite eatery, this fast-food specialty never goes out of style.

22

16 Working Parents Day. Offer in your monthly magazine quick and easy meals that moms and dads with limited time can whip up in a flash.

Autumnal Equinox. Have a great fall!

29

VFW Day. Show your appreciation for the veterans of foreign wars still among us with a discount and a special in-store lunch.

23 Go With Your Gut Day. Have your retail dietitian create a list of foods that people with stomach issues can partake of without discomfort.

30 International Podcast Day. This could be the occasion on which you launch yours.

17 International Country Music Day. Now is the time to showcase the breadth and depth of this uniquely American art form — from the Carter Family to Beyoncé (a.k.a. Cowboy Carter).

24

National Voter Registration Day. Encourage your associates who aren’t registered to vote to take some time today to sign up and be counted.

Patriot Day. Take a moment to remember those who perished on Sept. 11, 2001.

18

Locate an Old Friend Day. And when you do, meet for coffee and shopping at the nearest supermarket.

25 National Foodservice Workers Day. Salute the employees who prepare the culinary delights in your on-site or central kitchens — they help your brand stand out.

National Day of Encouragement. Provide some positive reinforcement to let your hardworking staffers know that they’re on the right track.

13 European Heritage Days. Ask shoppers to post on social media some of their favorite recipes for dishes from this continent.

19

In honor of Cass Elliot, who was born on this date in 1941 and died in 1974, play some of her best-loved hits with the Mamas and the Papas, as well as her solo work.

26

National Dumpling Day. Nearly every culture offers some variation on these yummy stuffed dough pockets, so take your pick of products to include in your next e-newsletter.

20

National Punch Day. Remember to offer nonalcoholic versions of this party perennial, for those who don’t drink.

National Virginia Day. Shine the spotlight on foods and beverages from the Old Dominion.

21

National Chai Day. This sweet, spicy, milky tea beverage from India can be consumed either hot or cold.

27

Ancestor Appreciation Day. On this occasion, families can recognize their origins with recipes handed down through the generations.

28

National Good Neighbor Day. Customers can demonstrate how good they are by driving the elderly lady next door to the grocery store or even going shopping for her.

American Pharmacists Month

Eat Better, Eat Together Month

Emotional Wellness Month

Halloween Safety Month

6

National Coaches Day. Remind shoppers to celebrate the teachers, trainers and guides in their lives with a special treat or card.

13 International Day for Disaster Risk Reduction. Review your procedures for dealing with any catastrophic event.

7 National Frappe Day. With the proper ingredients — and a blender — this delicious beverage is easy to whip up at home.

14 Indigenous Peoples’ Day. Pay homage to America’s first inhabitants and their varied cultures with a range of artwork.

20

National Chicken and Waffles Day. Speaking of regional fare, this famous combo is now ubiquitous nationwide.

21

National Pumpkin Cheesecake Day. For Spooky Season, offer this scarily scrumptious dessert.

27

National Motherin-Law Day. Suggest to customers that their spouse’s mom deserves a bouquet from the floral department.

Italian-American Heritage Month

National Apple Month

National Non-GMO Month

National Pasta Month

1

National Fruit at Work Day. Have plenty of grab-andgo options on hand in your produce department.

8

National Face Your Fears Day. In supermarket terms, this means urging customers to try a food they’ve usually avoided.

2

National Coffee With a Cop Day. Invite a local police officer over for some java — the doughnut is optional — and a gift card for off-duty shopping at the store.

3

National Boyfriend Day. Invite those with beaux to take them food shopping.

4

National Golf Lovers Day. Create some appropriate snacks for those fond of watching the Scottish sport, or to enjoy between rounds.

5

15 Pharmacy Technician Day. Salute these indispensable associates who help keep your shoppers healthy.

22

28 National First Responders Day. Police, firefighters and EMTs should all get a special discount today.

9

National Moldy Cheese Day. OK, the name isn’t great, but blue cheese is a favorite for many.

10

Inclusion Day. Make your employees from all walks of life feel welcome and appreciated.

16

Frugal Fun Day. Devise diverting activities for families, including how they can make their own inexpensive meals and snacks.

11

National Coming Out Day. Recognize the bravery of your openly LGBTQ+ associates who do their jobs as their authentic selves.

Sukkot. This Jewish harvest festival runs through sundown on Oct. 23.

National Nut Day. For snacking or recipes, this food item can’t be bettered.

29

National Prescription Drug Take Back Day. Publicize this event to let shoppers know that they have a place to bring their unwanted meds.

23

Swallows Depart From San Juan Capistrano Day. Don’t worry — they’ll come back around March 19.

17

Child Poverty Day. Draw attention to this issue by setting up checkout donations to aid organizations that keep kids fed and clothed.

18

National Mashed Potato Day. Some like fries best, but not us, and they’re even creamier when you add a dairy product.

30

National Checklist Day. Go over your action plans and gain satisfaction from ticking off completed items.

24

World Tripe Day. Provide various ways for customers to prepare this underused animal protein.

31

Halloween. Boo! Offer a little fearsome fun with an afternoon costume parade for local little ones.

25 Frankenstein Friday. Sponsor a contest to determine who among your associates and customers best embodies Mary Shelley’s monster — or his bride.

12

National Pulled Pork Day. Direct customers to your prepared food department to purchase this beloved barbecue dish.

19

National Kentucky Day. The Bluegrass State isn’t only famous for mint juleps and fried chicken — tell your shoppers what else Kentucky offers in the way of food and drink.

26 Make a Difference Day. Encourage employees and shoppers alike to volunteer their time and talents to help others.

Following its spin-off last October, WK Kellogg Co has been charting a more focused – but no less innovative – course, blending its rich heritage and a renewed concentration on cereal with the agility of a start-up. By embracing innovation and consumer insights, the company is shaping the future of the category while positively impacting people and the planet. ProgressiveGrocer caught up with the consumer goods giant to see how these plans are shaking out so far.

PG: Can you discuss WK Kellogg Co’s new business strategy and how you bring the spirit of a startup to a foundational, iconic brand?

We’re entering a new chapter as a “118-year-old start-up.” This phrase captures our history, solid foundation and iconic brands. But it also highlights our future — driven by passion, commitment and a start-up mindset. Focusing on cereal allows us to sharpen our priorities, boost agility and operational flexibility, enhance profitability and build a unique corporate culture. Our foundation is solid and our vision is clear: it’s about serving cereal with passion and precision.

PG: What’s happening in the cereal category and how are you attracting new consumers as well as re-engaging with those who grew up with cereal as their go-to breakfast?

In terms of at home breakfast, cereal is still the number one choice. At retail, it’s the number three center store category.

Consumers are looking for variety and excitement in cereal and we have a proven record of successful innovation. According to NIQ data, 67 percent of consumers are trying to consume more protein and plant-based options continue to be an area of growth. We recently introduced Eat Your Mouth Off, a plant-based, high-protein, zero grams added sugar1 cereal that’s all about taste.

Cereal isn’t just for breakfast anymore. Our single-serve Jumbo Snax line is ideal for snacking occasions and we see this segment growing significantly. We’re also turning up the fun with partnerships and limitedtime offers like Squishmallow, Minecraft, Crocs and Wednesday (The Addams Family) cereals.

WK Kellogg Co has a strong portfolio of brands that have broad appeal across cohorts. We’re activating a new marketing model that aims to connect with our consumers in a culture-first way, through data-enabled consumer plans.

PG: What sales benefits does cereal deliver to grocers, such as larger baskets?

Research tells us that baskets are roughly 1.5x bigger when cereal is purchased. Cereal is also a staple in many households, meaning more frequent purchases, driving consistent foot traffic to stores.

While the category is always evolving, consumers have grown up with our brands — across the US and Canada, 9 of the category’s top 20 brands are WK Kellogg Co brands — and are loyal to specific cereals, which can lead to repeat business and higher customer retention rates.

Cross-merchandising cereal with staples like fruit and milk will not only increase basket size, but also help shoppers build meals that meet their needs, all for under a dollar per serving.2

Feeding Happiness is part of everything we do, whether that’s making nutritious foods, minimizing our environmental impact, or partnering with local communities and retailers to do good where we live and work.

PG: Can you provide an update on the Feeding Happiness framework announced earlier this year?

In February, we announced Feeding HappinessTM ,our company’s sustainable business strategy, which we are bringing to life by unlocking the power of our foods to create joy and connection to inspire gr-r-reat days. Our three-pronged approach focuses on “Make Eating Well Easy,” “Help Kids Be Their Best,” and “Better Our Communities.”

Feeding Happiness is part of everything we do, whether that’s making nutritious foods, examining our environmental impact, or partnering with local communities and retailers to do good where we live and work.

We’ve already been successful with such programs as Mission Tiger, an initiative that brings sports to middle schools across the country. We’ve provided over 1 million sports experiences since 2019, with a goal to provide 2.5 million by 2025. We look forward to reporting our Feeding Happiness progress in 2025 in our inaugural Corporate Responsibility Report.

1. Not a low-calorie food. See nutritional facts for sugar & calorie info.

2. Based on the average cost of a serving of Kellogg’s cereal products with more than 4 servings per container, ¾ cup milk, and 2oz of bananas, apples or strawberries (Nielsen: 52 WE, March 25, 2024).

$9.08 for lunchmeat, up 1.1% compared with a year ago

Source: NIQ, Total U.S. (all outlets combined) during the 52 weeks ending June 8, 2024

Index by Number of Persons in Household

$6.80 for fully cooked meat, up 1.6% compared with a year ago

$6.46 for cheese, up 0.4% compared with a year ago

What is the value per occasion for deli items versus the year-ago period?

$8.09 for all

up 0.2% compared with a year ago

$6.23 for deli cheese, up 1.9% compared with a year ago

$5.21 for

$6.16 for prepared foods, up 1.4% compared with a year ago

$4.60 for dips/spreads, up 1.9% compared with a year ago

Source: NIQ, Total U.S. (all outlets combined) during the 52 weeks ending June 8, 2024

While rice/grain remains one of the few food categories to still enjoy robust sales growth not influenced entirely by inflation, things may be about to change. Brands can strike while pantries are full and savings are still top of mind.

Flavor is the leading factor that determines product rice/grain choice, and while consumers tend to flock to the blank canvas that basic options provide, interest in global culinary expansion suggests that diverse palates want more ways to explore and customize.

It’s time for both brands and consumers to shake up old habits. Not only do a salient group of consumers stick with the same brands, prep methods and recipes, but brands also tend to focus on the same groups and occasions, so change is required from both groups.

Even subtle shifts that nudge consumers beyond traditional dayparts and meal types associated with grains and rice can go a long way toward maintaining the momentum found in 2020 and again in 2022-23.

While health stands out as an attribute for about four in 10 consumers, there’s still room for improvement. Yet brands may be best served by raising the bar on tepid excitement, taste and indulgence scores to reinvigorate consumers’ notions of rice and grains.

While routines often benefit brands, they can hinder consumer creativity and narrow views on potential. Four in 10 category users stick with the same types, preparations, uses and brands. Diversifying occasions, flavors and innovation is essential to transform rice and grains from an afterthought to something to look forward to.

Culinary-inspired kits and prepared options can create excitement in an otherwise lackluster category to reach a contemporary audience. Younger palates seek elevated experiences with diverse flavors and cuisines, yet they still want simplicity. Rice and grains’ role in global cuisines makes this a no-brainer.

Marketing focuses on families and parents for grains, acknowledging their importance, but targeting occasions with low effort and smaller portions could enhance overall consumer frequency. Innovation isn’t crucial; meal-planning tips aid busy nutritious lifestyles for all, young or old.

Sluggish 202223 rice mix performance signals the need for segment revival. Convenience, affordability and flavor drive choice across the segment, yet dry mixes lag in “flavored” perceptions, suggesting an identity crisis. To cater to modern flavor-forward interest, brands can focus on livening up their portfolios.

By Molly Hembree, MS, RD, LD

OFFERING NUTRITIOUS FOOD OPTIONS IN VARIOUS WAYS FOR BUSY CONSUMERS MAKES DOLLARS AND SENSE.

onvenience reigns as king when it comes to how America eats. Shortcuts are invited, and life often calls for less time in the kitchen, while maintaining our health and eating tasty food remain priorities. In fact, according to FMI – The Food Industry Association’s “U.S. Grocery Shopper Trends Finding Value Report 2024,” 32% of us spend less than 30 minutes on dinner prep during the workweek, while nutrition objectives for shoppers have generally remained consistent. Thankfully, the grocery store abounds with healthy foods that cater to a wide range of busy lifestyles and needs. In today’s market, “on the go” doesn’t mean food has to sacrifice nutrition, flavor or appeal. With some intentional planning, strategic grocery shopping and realistic goal setting, your customers can build bigger baskets with your retailer’s on-the-go foods while experiencing fewer trips to the drive-thru.

With some intentional planning, strategic grocery shopping and realistic goal setting, your customers can build bigger baskets with your retailer’s onthe-go foods while experiencing fewer trips to the drive-thru.

Whether your destination is to a rural Midwestern homestead or the shores of the Caribbean, having reliable healthy products in tow between locations is important. Particularly if travels include a road trip, coolers can be kept inside vehicles to keep good food fresh and ready for easy snacking. Shoppers can think ahead by stocking up on BOGO cereals, crackers, trail mixes, freshly cut fruit and bottled water for the long haul. Stock your store’s shelves with themed food containers for beach vacationers, or perfectly packaged snacks for the campground.

Moms, dads and other caregivers usually have a lot to juggle and what often feels like fewer hours in the day to do it in. Canned, frozen and other shelf-stable goods may be a great fit for this demographic of shoppers. Parents themselves can rely on products like reduced-sodium soups, carrot and hummus packs, or well-balanced frozen meals, while kids can turn to no-sugar-added pineapple cups, yogurt or veggie-blend pouches, freeze-dried fruit, and oatmeal bars to keep them happily distracted during car rides or at home. Dedicate a part of your circular to catering to this group of folks to make meal and snack times fun and simple.

Lunch may not be granted the title of “most important meal of that day,” but it comes close. Nourishment at or around the halfway point of the day is imperative to keep energy afloat, especially to avoid the notorious afternoon slump. Customers know that having a strong midday meal is going to predict the latter half of the day’s focus and momentum, especially for working adults. Find ways to cross-merchandise colorful lunchboxes, handy silver-

ware, freeze packs and collapsible bento boxes next to single-serve healthy favorites. Set up an area with these items next to yogurt, string cheese and cottage cheese cups in the dairy case, or near aisles with animal- or plant-based tuna pouches, beef jerky, and canned chicken.

Although gym bags might not be the cleanest environment for stowing healthy to-go foods, they’re likely the first places that customers will think to throw some portable snacks to enjoy before, during or after a workout. Make healthy eating for everyday athletes a no-brainer by dedicating a section of your retailer website to a list or carousel of on-trend products, alongside an expert nutrition article about eating and hydrating for effective workouts. Key products that make an impact include performance bars, electrolyte drinks, water enhancer mixes, granola, raisins or peanut butter packs. Targeted efforts to reach convenience shoppers with on-the-go healthy foods can be a win-win for your retailer.

Molly Hembree, MS, RD, LD, is a registered dietitian for Kroger Health.

The retail grocery store landscape is evolving to become more experiential and community oriented. As consumers have come to expect a seamless shopping experience fueled by interactive technology, grocers are blurring the lines between digital and physical store experiences to create seamless shopping journeys for consumers. But what role is technology playing in this shift?

Grocers are implementing data-driven loyalty programs, next-generation technology tools and robust omnichannel strategies to drive operational efficiencies and power scalable growth.

Cognizant is leading the charge and helping craft compelling, interactive shopping experiences backed by technological foresight and rich industry expertise. With solutions that span the entire retail value chain, we prepare clients with future-proof strategies to thrive in the next grocery retail era.

Get the latest from Cognizant

With over 25 years of experience, Abhijit (Abhi) Vaidya is an associate VP and strategic business unit head for Grocery Retail at Cognizant, an IT and consulting firm helping companies modernize technology, reimagine processes and transform experiences.

Progressive Grocer recently talked with Abhi to dive deeper into tackling grocery-specific challenges, the role of generative artificial intelligence (AI), how to build on omnichannel momentum, and more.

PG: What are some current challenges in the grocery industry, and how can grocers effectively meet shoppers’ needs to maintain their loyalty?

Abhi: First, consumer expectations are shifting. Traditionally, grocery stores were transactional, but today that is shifting to become more experience oriented.

Next, leveraging generative AI to analyze consumer data and recommend products, recipes and meal plans aligned to consumers’ health and wellness goals builds loyalty by providing educational resources and datadriven recommendations.

That said, grocers are interested in optimizing hyperpersonalization efforts and improving the customer experience across in-store and digital formats.

PG: What role will generative AI play within grocery?

Abhi: Industry experts estimate generative AI to deliver more than $1 trillion in annual growth by 2032. Here are three ways grocers are using generative AI to drive innovation:

Product search and discovery. Grocers can recommend healthier options, such as gluten-free products, to diabetic shoppers searching for bread on a mobile app. These recommendations are tailored to consumers’ unique dietary preferences and past purchases to create a health and nutrition profile that grocers can use to suggest products.

Labor and demand management. Grocers can leverage insights to analyze historical sales data to predict demand for specific products and optimize inventory levels, reducing stockouts, minimizing waste, and optimizing the supply chain.

Shopping smarter. Grocers can use generative AI to personalize options for customers such as recipes and meal plans, as well as delivery options. For example, grocers can give customers the option to pick up a product from a nearby retail store or offer to deliver an item via third-party delivery services when an item is out of stock or unavailable online.

PG: CEO Vivek Sankaran reinforced in Albertsons’ latest financial report that “there is reason for optimism in the omnichannel.” Why is there excitement around omnichannel, and what can grocers do to build on this momentum?

Abhi: We have seen grocers like Kroger and Albertsons increase delivery sales over the last year, and Walmart’s digital sales have surged 21% in Q1 from in-store-fulfilled pickup and delivery, and marketplace segments.

Thus, grocers are focused on unifying the digital and physical store experience to remove friction and allow consumers to shop more fluidly. A robust omnichannel strategy should:

• Be convenient: Empower customers to choose how they want to shop with flexible shopping options.

• Improve inventory: Optimize visibility into inventory to reduce food waste, and improve operational efficiencies.

• Include personalization: Make informed decisions to optimize marketing, assortment, pricing and promotions.

• Increase revenue and loyalty: Create multi-channel touchpoints to encourage shoppers to spend more money, more frequently, and across different channels.

PG: What will grocery stores look like in the future? How can grocers set themselves up today to better prepare for it?

Abhi: Grocery stores will be more experiential and community oriented. They will infuse themselves with other entertainment channels to make their shopping experience more memorable and engaging.

To prepare for this shift, grocers should consider partnering with other entertainment vendors to create a ‘one-stop-shop’ for consumers. Whether it’s bringing customers together for community events, such as sporting, live music, or wine tastings, grocery stores should continue to find ways to put the community at the center of their customer experiences.

By Gina Acosta

he latest twist in the Kroger-Albertsons merger saga is fueling more uncertainty about whether this deal will ever get done.

On July 25, the retailers and the state of Colorado all agreed to an order to again delay the proposed $24.6 billion merger between The Kroger Co. and Albertsons Cos. The order grants a temporary injunction, and Kroger and Albertsons now must wait until a September trial to see whether they can move forward with their plans to merge.

But CEO Rodney McMullen says that no matter what happens with the merger — or the economy or the consumer, for that matter — Kroger’s strategy remains the same: solving problems for customers.

“When we work to solve “what’s for dinner?” for our customers, we don’t think about “the grocery industry” … we think about how to make

meals easier, fresher and more affordable,” McMullen said. “When meals are a problem to solve, families come to Kroger for the answer. When people think food, we want them to think Kroger.”

Since Cincinnati-based Kroger, which has annual revenue of $150 billion and more than 414,000 associates, revealed plans to merge with Boise, Idaho-based Albertsons in October 2022, federal and state lawsuits have piled up, on top of attacks from unions, the media and anyone who loves to shop at grocery stores. The lawsuits are in various stages of litigation, and the bad press for Kroger has been relentless. It’s a bad time to be a couple of unionized supermarket chains trying to merge so as to compete with non-union grocery giants such as Walmart and Costco. Meanwhile, consumers are feeling squeezed by inflationary grocery prices and the Federal Trade Commission (FTC) is eager to fight any move by retailers that might be seen as anti-competitive.

“While we firmly believe Kroger offers the best products at the best prices, we acknowledge both Walmart and Amazon have clear advantages,” McMullen told the U.S. Senate when he appeared before the Subcommittee on Competition Policy, Antitrust and Consumer Rights on Nov. 29, 2022, to testify about the merger. “Our combination with Albertsons will allow us to more effectively compete

against non-union retailers, from Amazon and Walmart to Costco and Aldi. The customer reach, as well as digital and technology capabilities, we expect to gain through this merger will enable us to provide an enhanced seamless shopping experience, both in store and online. We will have an expanded network of stores and distribution centers, and a broader supplier base allowing us to deliver fresher food faster to more customers. Albertsons’ portfolio will expand our core supermarket, fuel and pharmacy businesses, bolstering our ability to drive additional traffic into stores and digital channels, which in turn provides even more value to our customers.”

Kroger, which operates around 2,750 stores, has been doing everything that it can to assuage fears of the public and the FTC that a combined company with Albertsons, which operates around 2,300 stores, might turn into a monopoly.

On July 9, Kroger released a list of the stores, distribution centers and plant locations that it plans to divest to Keene, N.H.-based C&S Wholesale Grocers should the merger be completed. Some 579 Kroger and Albertsons stores, as well as other assets, will be divested as part of the plan, and Kroger has begun the process of informing associates at those locations of the move. It’s unclear whether additional divestitures will be required to get the deal done. There’s a more important narrative underpinning this story, however, and that’s whether traditional

grocery retailers will be allowed to compete fairly against an increasingly fragmented grocery channel dominated by non-union players.

For now, McMullen says that his company is focused on what it does best: maximizing value for a strained U.S. shopper.

“Kroger is in the meal solution business, and we know many families feel overwhelmed and are looking for help,” he notes. “Their budgets are stretched, and the activities of daily life create full and complicated schedules. Often deciding ‘what’s for dinner tonight’ just feels like one more problem to solve. And families have endless ways to solve this problem — from restaurant takeout to meal delivery to buying ingredients and cooking together.”

To that end, the retailer unveiled an amended divestiture plan in April detailing how its merger with Albertsons will result in lower prices. The company committed to investing $500 million to begin lowering prices on day one post-close. This commitment builds on Kroger’s track record of reducing prices every year, with $5 billion invested to lower prices since 2003.

“Our strategy is centered around providing solutions for our customers, no matter the economic environment,” McMullen says. “To minimize the impacts of ongoing economic uncertainty, we are keeping our prices low — this is the foundation of our strategy. Plainly and simply, lower prices attract more loyal customers who help us grow our business. This allows us to reinvest in even lower prices, an ever-improving

“The customer reach, as well as digital and technology capabilities, we expect to gain through this merger will enable us to provide an enhanced seamless shopping experience, both in store and online. We will have an expanded network of stores and distribution centers, and a broader supplier base allowing us to deliver fresher food faster to more customers.”

— Rodney McMullen, The Kroger Co. CEO

shopping experience and higher wages [Kroger’s average hourly rate is nearly $19, or nearly $25 with comprehensive benefits. This represents a 33% increase in rate in the past five years.]. We know this model works, because we have been using it successfully for many years.”

According to the retailer, customers will also have access to more favorite items from their own communities, as Kroger has committed to increasing the number of local products in its

stores by 10% post-close. The company is additionally committed to expanding its already top-selling array of 12,600 private-brand products generating around $31 billion in revenue annually.

“The Our Brands team is taking a fresh approach to their work,” McMullen explains.

“With 800 new products coming to our shelves this year alone, even picky eaters can find a new item they will love. From our organic Simple Truth options and indulgent Private Selection products to the ever-popular Kroger brand choices and budget-conscious Smart Way line, we offer inflation-resistant items that continue to earn their place on our customers’ dinner tables.”

Last year, Kroger launched Kroger Mercado, a Hispanic-inspired brand offering more than 50 products, including such items as fresh meat, beverages, snacks, sides and desserts.

“We are seeing customers who are more interested in exploring new flavors than ever before, which makes the Our Brands work so exciting,” McMullen observes. “This renewed interest in international flavors prompted us to launch our new Hispanic-inspired Mercado brand. It features authentic

products that fit into any budget. This is just one example of the innovation that makes Our Brands products so special.”

Kroger is in year seven of its “Restock Kroger” transformation initiative, which it says has improved processes, created new revenue streams, and freed resources to invest in associates, technology and lower prices. The initiative has also removed $3 billion in costs from the business.

So where does Restock Kroger stand now?

“As part of our capital investment plans for 2024, we announced that we are building more new stores in a meaningful way that will support our long-term growth model,” McMullen says. “When we launched Restock Kroger, we knew that a strong omnichannel experience was a key to serving our customers in the future. We are pleased with the progress we’ve made there and will continue to invest in digital, as it remains an important part of our growth model.”

In its earnings report for the first quarter ended in June, Kroger logged growth in digital sales, increased total household penetration and touted its better-than-expected performance. However, its net income dipped for the first time in 12 months. The retailer said when it released the report that same-store sales were flat and that earnings had dropped 1.6% to $947 million, compared with the prior year.

According to Kroger, the decreases were attributable to increased price investments and lower pharmacy margins, but McMullen stresses that the company continues to be bullish on its health- and-wellness business.

“Our Kroger Health business continues to grow and support families who want to live healthier lives,” he asserts. “Our pharmacists, techs, dietitians and nurse practitioners are available to patients every day to address big and small health needs. From dietary counseling to questions about medications, patients can find expert, convenient care right in their neighborhood store. We are optimistic about the potential of this area of our business. Our [prescription] adherence initiatives are on track, and our teams are providing excellent care, which helps patients live healthier lives. Additionally, our marketing plans and in-store activations designed to raise awareness and attract new patients are launching now to help drive growth in the back half of the year.”

Digital sales overall grew more than 8% during the quarter, and Kroger’s delivery and pickup business combined for double-digit growth. During Q1, Kroger increased delivery sales by 17% over last year, and also grew digitally engaged households by 9%. Additionally, the grocer achieved a new record for quarterly pickup fill rate.

Kroger CEO Rodney McMullen says the company's health business “continues to grow and support families who want to live healthier lives. ... Our pharmacists, techs, dietitians and nurse practitioners are available to patients every day to address their needs."

The growth in digital came at a time when Kroger had paused some of its digital delivery plans, specifically with its partner Ocado. In 2018, Kroger revealed a partnership with the U.K.-based grocery tech business to launch more than 20 customer fulfillment centers (CFCs) across the United States, but then put a hold on some of those openings. Now the retailer, which has opened only eight CFCs so far, seems to be fine-tuning its delivery strategy with new offerings from Ocado.

In late July, Ocado said that Kroger had placed an order for new automated technologies to roll out in CFCs across its network. The technologies include proprietary Ocado innovations such as On-Grid Robotic Pick (OGRP) and Automated Frameload (AFL), both of which aim to bring new levels of efficiency and labor productivity to the Kroger Delivery network. These innovations will enable Kroger to further drive down its costs to fulfill orders from CFCs.

As for brick and mortar, McMullen says that expanding the store network is important to increasing overall omni sales.

“We believe a strong and growing store network is important,” he notes. “Many of the ways we go to market in digital still come through the store channel. We know that our most profitable customers shop both in-store and online, so it’s important to be there for our customers in the way they choose to shop with us. As a result, we expect new stores to be an important part of sales growth in our [total shareholder return] model going forward.”

Meanwhile, Albertsons is moving along on its own transformation path, which it calls Customers for Life. Launched in 2022, the five-pronged strategy is designed to place the customer at the center of everything that Albertsons does, with the ultimate goal of supporting customers every day, every week and for a lifetime.

At the Western Association of Food Chains convention in Denver this past May, Gineal Davidson, SVP of national merchandising at Albertsons, summed the strategy up this way: “Our purpose remains simple: bringing people together around the joys of food and inspiring well-being through food that supports traditions through innovative and fresh food, through flavors and functional products that we collectively bring to market to build up our families and communities.”

Davidson and a slew of other Albertsons senior leaders detailed at the show how the company is driving its “ambition of creating customers for life by connecting with and supporting customers in all stages of their life.”

When Albertsons debuted the strategy, the retailer defined it as digitally connecting and engaging customers; differentiating the store experience; elevating the retailer’s distinctiveness in fresh by expanding private-brand products and services, as well as by enhancing product offerings in center store; modernizing capabilities through an improved supply chain, enhanced data and data analytics, and ongoing productivity; and further embedding environmental, social and governance (ESG) initiatives throughout its operations.

Davidson went further, though, by explaining how the company is working to create distinction in the minds of customers by making their lives easier through convenience, quality, health, value and personalization.

“We’re creating compelling reasons for customers to interact with us daily, not only to shop, but to engage with us,” Davidson observed. “We want to help them plan their meals, find new recipes, support their routines in a very easy way and find information that inspires them.”

Davidson explained that the keys to success for Albertsons this year include thinking more deeply about the insights and information that the retailer has about customers, “and about the customers that we don’t get and about tomorrow’s customers, so that we can drive more trips and traffic, sign up new members, retain our current members, increase the breadth and depth of our categories, and continue to grow our share of wallet in the market. … We want to build emotional connections, personalized and relevant communications, delightful and rewarding experiences, meaningful brand connections.”

When Albertsons, which has annual sales of around $80 billion and more than 285,000 associates, reported first-quarter earnings this past July, one metric in particular was a

At left, Albertsons SVP of National Merchandising Gineal Davidson says the retailer's purpose remains simple: bringing people together around the joys of food and inspiring well-being through food that builds up families and communities.

highlight: Loyalty members increased 15% to 41.4 million during the period.

CEO Vivek Sankaran credited the Customers for Life strategy with the increase. “In the first quarter of fiscal 2024, we continued to invest in our Customers for Life strategy and the digital and omnichannel capabilities necessary to support it,” Sankaran said. “Our Customers for Life strategy is placing the customer at the center of everything we do, and we continued to drive strong year-overyear growth in loyalty members as we launched our new simplified for U loyalty program.” Earlier this year, the retailer transitioned its loyalty program to a single points-based system and added a new automatic cash-off option for more convenient savings and other benefits.

Sankaran also pointed out that amid an evolving economic and industry backdrop in Q1, Albertsons continued to deliver outsized growth in its digital and pharmacy businesses.

The company reported that its Q1 net sales and other revenue came to $24.3 billion, compared with $24.1 billion during Q1 2023. The increase was driven by Albertsons’ 1.4% growth in same-store sales, along with strong growth in pharmacy sales.

Net income dropped to $240.7 million, or 41 cents per share, however. Last year’s net income was $417.2 million, or 72 cents per share, which included the $49.7 million, or 9-cent-per-share, benefit related to the reduction in the reserve for an uncertain tax position.

During Q1, the company completed 17 remodels, opened one new store, and invested in digital and technology platforms. Albertsons sees challenges ahead, though.

“As we look ahead to the balance of fiscal 2024, we expect to see headwinds related to investments in associate wages and benefits, an increasing mix of our pharmacy and digital businesses which carry lower margins, and the cycling of prior-year food inflation,” Sankaran said. “We expect these headwinds to be partially offset by ongoing productivity initiatives.”

In addition to those factors, uncertainties regarding macroeconomic conditions, employee morale, consumer behavior and, of course, the merger with Kroger are sure to pose extra difficulties.

By Emily Crowe

s grocers fight to capture market share in an increasingly competitive playing field, having powerful capabilities that can optimize key drivers of success will be crucial to prolonged, profitable growth. The future of the grocery store will be shaped by four disruptive imperatives — workforce, sustainability, customer experience and omnichannel — each of which should be carefully considered when making investment decisions and forward-looking plans.

While the role of front-line associates in food retail hasn’t fundamentally changed since the industry’s inception, the environment in which they function has been irrevocably altered over the past several years. From a pandemic to increased workplace violence and changing consumer attitudes, the grocery store as a workplace is evolving and will only continue to do so.

With associates perennially focused on getting their work done safely and efficiently while also providing an exceptional guest experience, certain considerations must be taken into account when hiring, training, reducing churn and keeping workers happy, both now and in the future.

“The important question I think we

There is a lot of talk about the Store of the Future. Electronic Shelf Labels are one tool grocery retailers can use to begin building their Store of the Future today. Progressive Grocer asked Mike Flynn, Vice President and General Manager of Aperion, to explain the benefits grocers can realize by implementing ESLs.

Progressive Grocer: What are the most important features and immediate benefits ESLs can deliver for grocery retailers?

Mike Flynn: How much time do you have? (laughs) The truth is that by simply executing pricing and promotion updates, ESLs deliver enhanced operational margin opportunities. But they can be so much more. We like to work with our retail customers on building crawl, walk, run models in how they roll out the more advanced features ESLs can open for them.

ESLs can drive greater engagement with your loyalty apps and promotional programs, compare and saves (to drive Own Brand sales) and share product information to offer details customers want at the shelf edge. Our open platform can integrate with other tools and solutions you are using which allows you to drive greater ROI across your stores.

PG: ESLs have operational savings built in, but their full potential lies in crafting a cohesive strategy to align with other systems and tech. How can stores craft that strategy?

MF: The answer isn’t the same for every retailer. Our first step with any potential customer is to understand their specific go-to-market strategy. We need to understand their goals and objectives to provide an effective prescription for how ESLs can tie into that.

I tell retailers all the time that they should start by thinking of how this replaces the inefficient (and sometimes inaccurate) issues with paper tags because that alone is reason enough to consider ESLs. But they can be a complete transformation of your shelf edge. Our customers utilize a variety of strategies like integrating with e-com providers for ‘Pick-to-light’ functionality, displaying supply chain information, and showing on-hand inventory and other stocking details right on the shelf edge.

Our customers often tell us these products have become the backbone of their digital efforts and have become a natural extension of their Retail Media Networks. Creating

and executing on these strategies is how retailers are able to drive ROI faster with ESL technology.

At the end of the day that is what Aperion does. Our service and ongoing support model are foundational to what we provide. We aren’t just going to take an order and ship hardware to your store. Our business is built on working hand-in-hand with retailers to maximize your return and speed to implement.

PG: What should operators look for and what questions should they ask when ready to invest in ESLs?

MF: The truth is ESL adoption has been exploding across many channels recently. This rapid conversion has led to retailers telling us that it’s becoming a requirement to stay competitive in the market. For retailers investigating ESL options, most of my advice would be around focusing on expertise and support. It might come down to asking yourself, ‘Does this provider understand the retail environment? And my individual goals? And does the provider offer ongoing support?’

Working with a vendor that understands how to drive ROI and implement effectively is critical. It’s something we are constantly focused on as a team at Aperion: What else can we provide to help increase the return on investment our customers are making with us? How can we continue to evolve and help meet their needs? We aren’t in the business of just shipping hardware to retailers and wishing them luck.

‘We work with our retail clients’ whether they are single mom-and-pop shops or large retailers with a national footprint. And what we’ve found is that no matter the size of the retailer, when it comes to getting the most out of this technology it is critical to work with a partner who understands how to use the technology to power your business forward.

need to ask ourselves is if we’ve been

momentum is only going to continue to

terms of food safety and recalls.”

—Karin Witton, Tosca

don’t invest in managers,” he says.

Sustainable business practices have become table stakes for grocers of all shapes and sizes in recent years, and that

avoiding costly, unwanted food waste that could otherwise end up in a landfill.

Tomatoes, for example, often go through up to 12 distinct touchpoints on their journey from field to store, increasing the possibility of damage or product

loss. Automation covering processes like washing, packing and labeling could aid in this journey, Witton believes.

One thing that’s guaranteed never to go out of style at food retail is striving to create an optimal customer experience. Shoppers now have, and will continue to have, more options than ever when it comes to choosing where to purchase their groceries, and making a positive impact both online and in brick-andmortar stores remains vital.

Bill Gray, president of Alpharetta, Ga.-based Givex Rewards, believes that the future of customer experience and engagement lies in the marriage of rewards and loyalty. “They’ve been around forever, and I think they’re going to continue to be around,” observes Gray. “But what’s changing now is getting rewards more personalized, and the retailer being more in touch with the shopper and

knowing what they want next.” Analytics, data mining, first-person data, third-person data and other forms of technology will all continue to be imperative when getting to know shoppers and giving them exactly what they want, when they want it. Loyalty programs can help drive this data and knowledge, while rewards add to the customer experience, as well as encouraging repeat visits.

Another avenue to consider when looking at the future of customer experience is subscription programs, such as Walmart+ or Kroger Boost, which can help food retailers of all sizes extend their physical aisles out into the internet and offer shoppers access to better deals and products. Grocers that adopt this strategy will have the ability to sell non-standard grocery products, ethnic items, and more, and also offer better deals on larger product sizes. Gray believes that the technology and supply chains of the future will help aid the

“The best investment any retailer can make in improving the front-line employee experience and boosting performance within stores and distribution centers is making sure that every associate has a capable, available manager.”

—JD Dillon, Axonify

“Can we create an omnichannel experience where a visit to the store actually allows me to increase my basket size once I get there? Can we think about creating triggers in the store experience that allow me

frictionless adoption of these programs. When it comes to driving a positive online customer experience, Gray stresses the need to reduce friction and make shopping a truly seamless journey. “It’s just making it easier and staying ahead of the competition,” he says.

“You’ve got to make it easier because the competitor down the street is going to be making it easier,” continues Gray. “They’re going to be putting relevant deals in front of the shoppers, and if you’re not doing it, you’re out of the game.”

Technology enhancements like smart carts, electronic shelf labels, and more can enhance the in-store shopping experience, but at the end of the day, customer experience could come down to very simple terms, such as grocers having the same products that their competitors have, as well

fication via mobile phone or email in two weeks when they’re likely ready to buy more, and then have those paper towels delivered directly to their home. “These are the things that we want to really focus on, making sure that the experiences that we’re willing to invest in work in the short term, but also in the long term,” he explains.

Another major consideration for successful omnichannel operations will be taking a hard look at what role digital and physical play in individual sectors of the grocery business. Canned and boxed goods are easily purchased online, for example, while many shoppers still prefer to purchase products like fruits and vegetables, meat, and fish instore. While doing so might seem like an easy lift, getting the mix right can be massively important.

“It doesn’t mean you don’t want

By Bridget Goldschmidt

t couldn’t be more easy: Hard beverages can mean big sales at grocery retail.

“At ALDI, we have seen tremendous growth with hard beverages, focusing on hard seltzers, lemonades, teas and ciders,” asserts Arlin Zajmi, director of national buying for adult beverages at the fast-growing Batavia, Ill.-based chain. “In fact, we offer Vista Bay Hard Seltzer in two everyday variety packs of classic flavors, plus a variety pack of lemonade at $12.99 nationwide — a sharp discount to national brands — and the beverage is growing double digits. We recently launched the new ALDI-exclusive brand, All Play Iced Tea, with a variety pack of delicious flavors. It is currently rolling out to ALDI stores nationwide that sell alcohol, due to the demand of flavored malt beverages in the marketplace. In the cider space, our Wicked Grove Cider has a cult following, and it’s now the No. 2 hard cider brand in the U.S. because we can deliver on the quality and taste of pricier national brands for less.”

According to Zajmi: “Hard beverages have become the ‘fourth category’ of adult beverages, outside of wine, beer and spirits, due to the popularity of the segment in the last five years or so. More consumers, specifically Millennials, are gravitating towards other alternative alcoholic beverages like flavored malt beverages

More consumers, specifically Millennials, are opting for such alcoholic beverages as flavored malt beverages with lemonades and teas, and ready-to-drink cocktails and ciders.

Innovative flavors from global and U.S. cultures will continue to influence the hard-beverage segment.

Making the segment easy to shop and telling the story behind brands are key ways to further pique consumer interest in hard beverages.

Mike's Hard Lemonade has debuted a Limonada Fresca line incorporating refreshing tropical flavors.

(FMBs) with lemonades and teas, and ready-to-drink (RTD) cocktails and ciders. These products offer a unique taste with more fl avor, variety and sweetness in comparison to hard seltzers. They are easy to understand and convenient to serve.”

Having seen products with a higher alcohol-by-volume (ABV) percentage perform well, ALDI recently launched a Dragonfruit Imperial Hard Seltzer, infused with dragonfruit, pineapple and soursop flavors and boasting a 9% ABV, for the summer season, aiming to meet consumer demand for stronger taste and bigger value. “It originally debuted as an ALDI Find in 2023 and flew off shelves, so we decided to bring it back this year as a seasonal product,” recounts Zajmi.

The retailer also offers cocktail options in unique flavors like Espresso Martini.

Speaking of out-of-the-box flavors, Mike’s Hard Lemonade has debuted a Limonada Fresca line, described by the Chicago-based Mark Anthony brand as “a blend of luscious citrus, lime and lemon flavors, with real fruit juice and agave nectar” and offering a distinctly tropical ambiance. Available in Watermelon Lime, Mangonada, Citrus Limonada and Pineapple Guava flavors, the 5% ABV beverages come in 12-packs of 12-ounce cans. Mike’s has also rolled out a line of 8% ABV Harder Mixed Drink single-serve cans in Piña Colada, Hurricane Punch and Screwdriver varieties.

For its part, Lake Forest, Calif.-based Spirited Brands Holdings Inc., a female-owned beverage innovation company, has introduced two all-natural canned cocktails with Mexican and Asian flavor profiles. The 5% ABV, 140-calorie-per-serving premium offerings are Sok , a unique blend of Junmai sake and soda, and Soula, a margarita-infused Mexican agave azul wine. Both are packaged in convenient 12-ounce cans.

“Our vision is to create exceptional, premium beverages and to offer an experience in every can,” said Melanie Nelson, president and co-founder of Spirited Brands, at the time of the products’ launch in January. “Through co-founder Anita Goodson, our creative force behind our cocktails … who passionately draws inspiration from her Mexican heritage, we aim to celebrate various cultures by infusing our creations with authentic and vibrant influences. Furthermore, through Sok and Soula, we aim to redefine the ready-to-drink cocktail market by providing consumers transparency of nutrition facts on each can and offering them low-alcohol and lower-calorie options without compromising on [their] full-bodied flavor.”

Sok comes in White Peach, Lychee, Cherry Blossom and Yuzu Ginger flavors, while Soula is available in Mango Citrus, Lime, Paloma and Pineapple Chili varieties. The vegan; handcrafted; clean-ingredient; and sulfate-, GMO- and gluten-free beverages are sold at retail in 8-count variety packs for $24.99 (Sok ) and $19.99 (Soula) and online in a 4-pack for $12.99 (both beverage lines).

Employing flavors closer to home — but not often seen in adult beverages — is Grown Folks, the first Black-, mom-and female-owned brand in the hard-seltzer segment, offering Peach Cobbler, Ambrosia and Key Lime options.

According to founder Danica Dias, a seasoned entrepreneur who drew on her Louisiana Creole roots to create the product line: “The hard-beverage scene is really evolving towards more sophisticated and complex flavor options. People want drinks with unique flavors made from quality ingredients. I believe this shift is driven by consumers who are more informed and want a better drinking experience that fits their lifestyle and values and is driven by taste.”

As for her product line in particular, Dias says: “The fl avors for Grown Folks are inspired by these soul food dishes and the fl avors I grew up loving. These fl avors are familiar and nostalgic, and I knew they would resonate with a broad consumer base. We wanted our fl avors to be sweet-focused and well balanced, using a neutral sugar brew base with no aftertaste, and the freshest ingredients possible, including real fruit juice.”

When it comes to merchandising hard beverages, simplicity is key.

“We know our customers are looking for the highest quality for the best price,” observes Zajmi. “We merchandise hard beverages together with our beer se lection to make it easy to shop. We stay on top of industry and customer trends and refresh our alcohol assortment on a seasonal basis.”

“Our branding and merchandising are designed to visually represent what we stand for as a brand,” explains Dias. “Our cans feature illustrations that convey Creole vibes through a beautiful, celebratory and inclusive scene. This includes diverse skin tones and body shapes enjoying life freely and vibrantly. We worked with a talented illustrator, Alexia Briana Taylor, to create our signature font and can illustrations. At grocery, our priority is storytelling — the more we can tell our origin story and get liquid to lips. We focus on hosting sampling events

have become the ‘fourth category’ of adult beverages, outside of wine, beer and spirits, due to the popularity of the segment in the last five years or so.”

— Arlin Zajmi, ALDI

and on-site activations to engage customers.”

Asked about the future of the hard-beverage segment, Dias believes that it’s “heading towards more innovation and diversification. As consumers continue to seek options that match their cultural backgrounds, we’ll see more beverages offering more unique flavors and marketing. Socially conscious products will also be a key focus, with more emphasis on what brands support and believe in.”

“The ‘fourth category’ is here to stay,” affirms Zajmi. “Innovation will continue in the hard-beverage space, as consumers love the unique flavors, taste profile and the convenience this category provides.”

Red Bull has enlisted college basketball star MiLaysia Fulwiley (above) to promote its latest sugar-free energy drinks, while C4 Energy has teamed with Creamsicle on a limited-time beverage evoking the taste of the frozen treat.

Product diversification has helped maintain consumer interest in energy drinks.

Manufacturers of these beverages are working to appeal more to women, as well as addressing consumers’ health and functionality concerns.

As energy drinks grow in sales and visibility, major sponsorship opportunities beckon.

5-Hour ENERGY's refreshed 16-ounce energy drink line provides the same level of energy as its shots, according to the brand.

By Bridget Goldschmidt

ust in time for summer, energy drink brand C4 Energy, a brand of Austin, Texas-based Nutrabolt, has teamed up with Creamsicle for a seasonal flavor available exclusively at 7-Eleven stores across the country. Powered by 200 milligrams of caffeine and CarnoSyn Beta-Alanine, C4 Energy x Creamsicle offers a sweet tangy orange taste with a frosty vanilla finish reminiscent of the famous frozen treat. Knowing that 70% of Creamsicle buyers are also energy drink consumers, C4 Energy inked an official license deal with Good Humor and Unilever to create the limited-time beverage.

To mark the collaboration launch with Creamsicle, C4 Energy is holding a summer-long program with rapper and actor Ludacris, evoking 7-Eleven’s car culture and getting the word out about this latest product offering.

As can be seen by the rollout of a fun new flavor at one of the biggest retailers in the nation — No. 24 on The PG 100 — the U.S. energy drink market is on the upswing. According to Dublin, Ireland-based Research and Markets, it’s expected to reach $36.71 billion by 2028, from $23.2 billion in 2022, increasing at a compound annual growth rate of 8.1%. This surge is driven by several factors, the market research firm notes, among them the introduction of a variety of options such as sugar-free, natural and organic, which has helped diversify product offerings and kept consumers interested in such beverages.

“The category has seen new entrants featuring perceived betterfor-you (healthier) options [and] cleaner ingredient decks, as well as additional sugar-free options,” agrees Jeff Sigouin, president and COO of Farmington Hills, Mich.-based Living Essentials, the maker of 5-hour ENERGY beverages. “Unlike many brands that have added new sugar-free options, all 5-hour ENERGY product variants have always been sugar-free.”

In March 2023, the trend of enhancing water with powdered and liquid drink mixes swept across TikTok, captivating millions. This phenomenon, known as #WaterTok, amassed over 1 billion views, transforming the way people think about hydration. Jel Sert, the company at the forefront of the powdered drink stick category, became a favorite among creators crafting innovative #WaterTok recipes. Progressive Grocer sat down with Jeff DeLaere, Vice President of Marketing and Digital Commerce, to discuss how the company adeptly leveraged this trend to introduce exciting new flavors and ignite a surge in sales.

Progressive Grocer: Were you taken by surprise at how fast #WaterTok took off and at the impact it had on your Singles to Go product line?

Jeff DeLaere: We were initially surprised by the sudden swell in sales and traffic to our products, but as we became more familiar with the #WaterTok trend, we saw how uniquely positioned Jel Sert was to capitalize on it and why creators flocked to our products vs. others. Influencers were combining and mixing Jel Sert Singles to Go stick packs to create fun flavored waters like “Cotton Candy,” “Peach Ring,” and “Unicorn Delight.” Seeing Singles to Go at the center of a massive social media trend like #WaterTok reinforced that our products and our flavors were hitting the mark, and it motivated us to do even more in this category.

PG: Once you realized Jel Sert Singles to Go flavors were taking TikTok by storm, how did you respond?

JD: With the #WaterTok trend, it was clear that we had stumbled upon a goldmine of consumer insights. The organic engagement and creativity of TikTok creators provided us with invaluable real-time market research. However, we knew that to capitalize on this momentum, we had to rethink how we approached flavor innovation.

We listened to the creative community and began developing flavors in what was almost a real-time response. We developed new flavors such as Peach Ring, Unicorn, and Mermaid under our Wyler’s Light brand. Each was carefully crafted to meet

the demands of the audience based on the recipes they were creating and to help extend the #WaterTok trend. We then paired the new flavors with more dynamic packaging that embodied the playful, energetic spirit of #WaterTok.

Launching these products exclusively through Dollar General and Amazon, we achieved sell-out success almost instantaneously without traditional advertising or public relations campaigns. This demonstrated the power of authentic consumer engagement and social media’s ability to drive product innovation and sales in unprecedented ways.

PG: Why is the #WaterTok story important for grocery retailers to consider as they try to decide which drink mixes to carry?

JD: As a family-owned company that handles all aspects of manufacturing and marketing — from product development to manufacturing, marketing, sales, and more — Jel Sert has the unique ability to respond to market trends swiftly and introduce new products with remarkable speed. This allows us to keep consumers engaged and excited while keeping supply flowing to online and brick-and-mortar retailers. That creates a significant competitive advantage for us and retailers who carry our products.

Our Singles to Go line accounts for one in four drink mix stick units sold nationally totaling 85 million units annually.* That is a testament to how deeply our products resonate with consumers.

At a time when grocery budgets are tight, the appeal of a product that is both simple and costeffective — requiring just water for preparation — can’t be overstated. Furthermore, our TikTok-inspired flavors are successfully engaging Gen Z, a crucial demographic that grocery retailers often find challenging to reach. The #WaterTok trend has generated younger shoppers’ interest in Wyler’s Light, which has been exciting.

Overall, our success lies in our ability to offer the right products with the right flavors at the right time. We are committed to sustaining this momentum, continually innovating, and introducing new flavors that allow retailers to capitalize on the enduring popularity of the #WaterTok trend.

*NielsenIQ data

The Sugar-Free Space

Speaking of which, 5-Hour ENERGY, the leader in the 2-ounce energy shot segment, has rolled out a refreshed lineup of its 16-ounce energy drinks that provides the same level of energy as the shots. “We made the designs on these cans bolder, enhanced our classic fan-favorite flavors and introduced two new flavors to the lineup,” Rainbow Sherbet, a combination of orange and lemon-lime flavors, and Raspberry Razz, says Sigouin of the refresh, which coincides with the brand’s 20th anniversary. “The 16-ounce beverages are sugar-free, [have] zero calories, and contain our proprietary blend of vitamins and taurine.”

Meanwhile, Santa Monica, Calif.-based Red Bull has expanded its zero-sugar portfolio with two additional flavors: Red Bull Red Edition Sugarfree, with the taste of watermelon, and Red Bull Amber Edition Sugarfree, with the taste of strawberry apricot, have joined original Red Bull Sugarfree and Red Bull Zero. Both new flavors come in 8.4-fluid-ounce and 12-fluid-ounce single-serve cans or in a 4-pack. The brand has enlisted college basketball star MiLaysia Fulwiley, guard for the South Carolina Gamecocks, to promote the additional beverages.