EXEMPLARY AT ESG

Read

PG reveals this year’s Category Captains

PRIME TIME FOR PROTEIN Shortcuts, value and variety maintain consumer interest

RETAILER OF THE YEAR

EXEMPLARY AT ESG

Read

PG reveals this year’s Category Captains

PRIME TIME FOR PROTEIN Shortcuts, value and variety maintain consumer interest

RETAILER OF THE YEAR

This year’s Impact Awards shine the spotlight on a range of grocery industry retailers, suppliers and solution providers that are doing good in various ways.

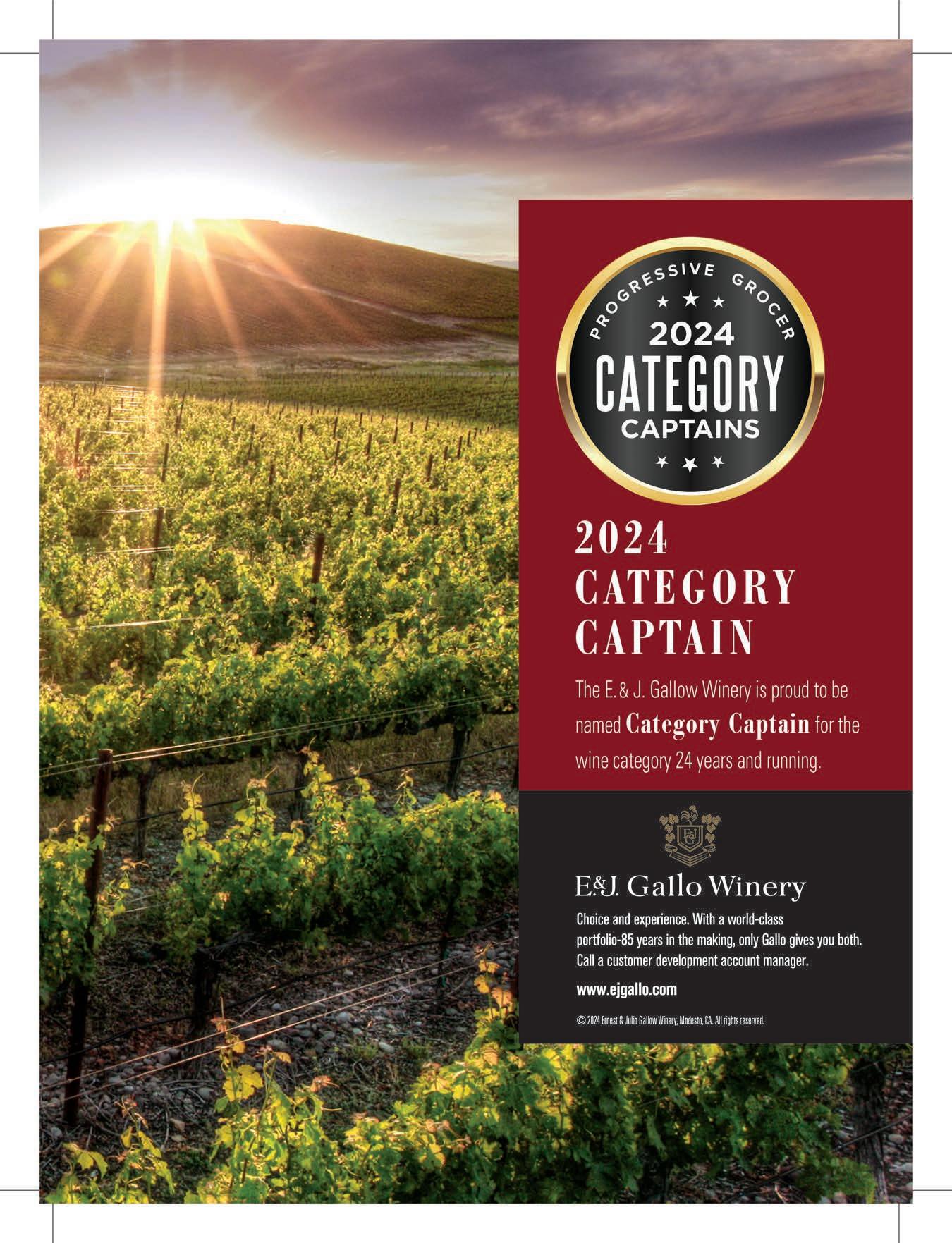

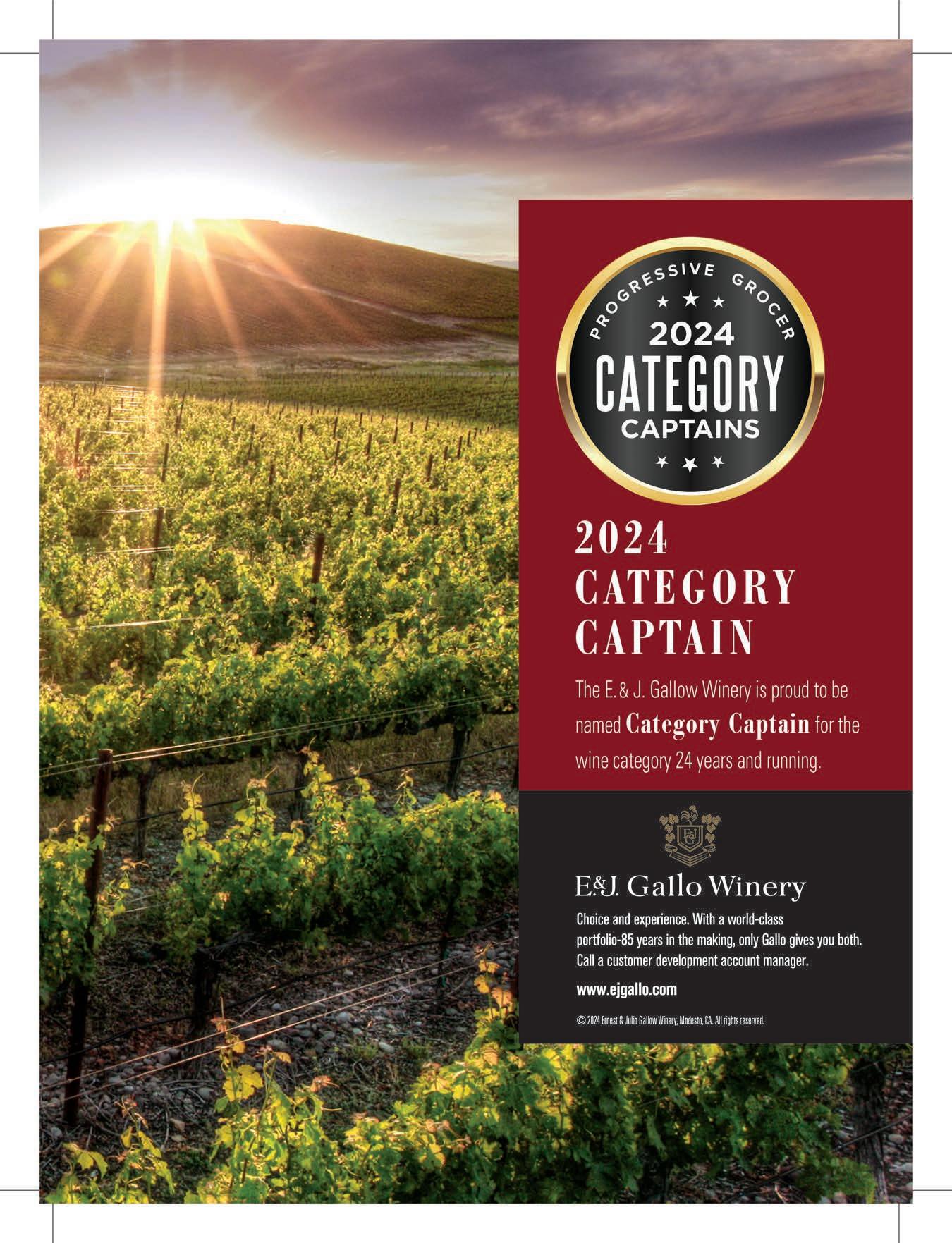

PG’s current Category Captains show themselves to be masters of sales growth across the store. 53 PHOTO ALBUM Grocery Impact and Top Women in Grocery

Discover or relive memorable moments from PG’s fl agship event and its culminating awards gala.

Shortcuts, value and variety remain expected ways to drive protein shopper behaviors into a new year.

Retailers can catch their share of protein sales by providing cook-at-home consumers with more options, ideas and information. 64

The 2024 Top Women In Store Brands honorees each offer unique skill sets that are helping drive business.

76 SPECIAL REPORT: PG’S RETAIL INNOVATION OUTLOOK Technology Takes the Lead

Grocers and solution providers put the focus on customer experience, associate success, and more.

82 EQUIPMENT & DESIGN The Future of Fixtures

Key company executives and board members discuss the company’s current impact on the grocery business, as well as growth opportunities in the years ahead.

Flexibility is the name of the game for retailers keen to address shifting consumer preferences, seasonal trends and inventory changes.

By Gina Acosta

THE HOLIDAYS ARE A GOOD TIME TO SHOW GRATITUDE.

Gina Acosta Editorial Director & Associate Publisher gacosta@ensembleiq.com

ere at Progressive Grocer, we have a lot to be thankful for in 2024.

Our annual GroceryTech and Grocery Impact events were big successes, attracting record numbers of attendees, from retailers large and small to so many new and returning sponsors — whom we thank for their support.

Our 24/7/365 original reporting continues to resonate with so many of the wonderful people in the grocery industry and beyond.

But sometimes we forget to show gratitude for one another, and this year I want to extend some special thanks to all of the people who work so hard to drive excellence at PG every day:

Managing Editor Bridget Goldschmidt is the queen of PG, and we could not thrive without her.

Senior Editor Lynn Petrak is our roving reporter driving thousands of miles across the country just to cover a store opening or product innovation at a trade show.

Digital Editor Marian Zboraj is marking milestone after milestone on social media and our website, elevating our presence every day across the world.

Multimedia Editor Emily Crowe is creating exclusive and engaging content that leads in the B2B media space.

Art Director Bill Antkowiak is a true artiste — a master of design — and we couldn’t get anything done without him.

Senior Sales Managers Tammy Rokowski and Theresa Kossack bring brilliant and inspiring ideas to the organization every day.

Our production, marketing, events and digital operations experts Jackie Batson, Teresa Dombach, Alexandra Voulu, Nicola Tidbury, Marci Saling, Emily Dubovec and Valetta Dsouza (and many others) help bring our content to beautiful life digitally and in person.

Group Brand Director Eric Savitch is our fearless leader as we go into another year of exploring new opportunities.

EnsembleIQ CEO Jennifer Litterick serves as a role model for me and so many of us at this company, with her passion for the industry and dedication to innovation.

And last, but certainly not least, there is you, our faithful audience. Turning to us when you have other choices. Reading our breaking-news texts or listening to our podcasts or attending our events across the country. We are so thankful for you. And we cannot wait to create more content and special events for you in the new year.

See you in 2025!

8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631

Phone: 773-992-4450 Fax: 773-992-4455

www.ensembleiq.com

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR Eric Savitch esavitch@ensembleiq.com

EDITORIAL

EDITORIAL DIRECTOR & ASSOCIATE PUBLISHER Gina Acosta gacosta@ensembleiq.com

MANAGING EDITOR Bridget Goldschmidt bgoldschmidt@ensembleiq.com

SENIOR DIGITAL & TECHNOLOGY EDITOR Marian Zboraj mzboraj@ensembleiq.com

SENIOR EDITOR Lynn Petrak lpetrak@ensembleiq.com

MULTIMEDIA EDITOR Emily Crowe ecrowe@ensembleiq.com

CONTRIBUTING EDITORS Mike Duff and Debby Garbato

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER, REGIONAL SALES MANAGER Tammy Rokowski (INTERNATIONAL, SOUTHWEST, MI) 248-514-9500 trokowski@ensembleiq.com

REGIONAL SALES MANGER Theresa Kossack (MIDWEST, GA, FL) 214-226-6468 tkossack@ensembleiq.com

REGIONAL SALES MANGER Natalie Filtser (CT, DE, MA, ME, RI, SC, TN, NH, VT, MD, VA, KY) 917-690-3245 nfi ltser@ensembleiq.com

PROJECT MANAGEMENT/PRODUCTION/ART

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

ADVERTISING/PRODUCTION MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

SENIOR DIRECTOR OF MARKETING Nicola Tidbury ntidbury@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com SUBSCRIPTION QUESTIONS contact@progressivegrocer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

PROGRESSIVE GROCER (ISSN 0033-0787, USPS 920-600) is published monthly, except for July/August and November/December, which are double issues, by EnsembleIQ, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Single copy price $17, except selected special issues. Foreign single copy price $20.40, except selected special issues. Subscription: $150 a year; $276 for a two year supscription; Canada/Mexico $204 for a one year supscription; $390 for a two year supscription (Canada Post Publications Mail Agreement No. 40031729. Foreign $204 a one year supscrption; $390 for a two year supscription (call for air mail rates). Digital Subscription: $87 one year supscription; $161 two year supscription. Periodicals postage paid at Chicago, IL 60631 and additional mailing offices. Printed in USA. POSTMASTER: Send all address changes to brand, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. Copyright ©2024 EnsembleIQ All rights reserved, including the rights to reproduce in whole or in part. All letters to the editors of this magazine will be treated as having been submitted for publication. The magazine reserves the right to edit and abridge them. The publication is available in microform from University Microfilms International, 300 North Zeeb Road, Ann Arbor, MI 48106. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations.

Our Jasmine Rice is 100% Thai Hom Mali rice imported directly from Thailand to guarantee the best quality and flavor possible. Stock your shelves with GOYA® Jasmine Rice, a top-selling brand in the U.S.,* and offer your shoppers the perfect ingredient to elevate their recipes.

5

National Keto Day. Spotlight products suitable for people following this popular eating regimen.

12

National Pharmacist Day. Suggest that shoppers visit the store pharmacy to say hello to the friendly staffers who work there, and to get any questions answered.

19 Tin Can Day. Make shoppers aware that canned foods can be part of a healthy –and tasty – diet.

26

On Australia Day, let’s pay tribute to our friends down under with some of their favorite things to eat, like Vegemite on toast or a pavlova for dessert.

6

National Take Down the Christmas Tree Day

Three Kings Day

7

Dry January

National CBD Month

National Sunday Supper Month

National Staying Healthy Month

1

New Year’s Day is also Apple Gifting Day, sopolish up that McIntosh to present to a loved one.

8

2

Swiss Cheese Day. Encourage customers to share a “hole” lot of recipes using this favorite variety.

9

3

National Wheat Bread Month

Prune Breakfast Month

Veganuary

In honor of musician Kenny Loggins’ birthday, crank up your yacht rock playlist to serenade customers as they shop.

13

National GlutenFree Day. Make sure that your shelf tags throughout the store call out all products with this particular attribute.

20

Martin Luther King Jr. Day

14 Poetry at Work Day. Perhaps there’s a budding bard among your associates? Hold a fun supermarketthemed poetry contest to find out.

21

National Grandma Day. You know what Nana would like to do? Go shopping at her preferred grocery store.

National JoyGerm Day. Use this occasion to spread happiness among your associates and shoppers.

15

National Pothole Day. Keep your parking lot(s) free of these driving and pedestrian hazards.

Healthy Weight, Healthy Look Day. Have your retail dietitian share tips with customers to help them shed pounds.

16

22

National Grandpa Day. Gramps isn’t much for shopping, but he’d appreciate a case of his favorite beer from the market.

National Boston Day. Celebrate the many culinary delights that come from the city, including the baked legumes that gave it the nickname Beantown.

23

National Rhubarb Pie Day. Here’s that opportunity to promote greater consumption of this vegetable that’s used like a fruit.

28

Data Privacy Day. Employ the most advanced solutions to ensure that your customers’ sensitive info isn’t leaked.

Tubers and Dried Fruit Month

International Mind-Body Wellness Day. Direct shoppers to treatments featuring ingredients found within your aisles.

10

National Bittersweet Chocolate Day. This baking essential adds deliciousness to a wide range of treats.

4

National Spaghetti Day. From Lady and the Tramp on down, everybody loves this pasta.

11

National Arkansas Day. Champion those unique foods and beverages hailing from the Natural State.

17 On Popeye Day, remind health-minded shoppers that they’ll be strong to the “finich” if they eat their spinach.

18

24

International Day of Education.

National Preschool Health and Fitness Day. Have your healthy-living team recommend nutritious snacks and invigorating activities to keep tots in peak condition. IN-STORE

Enable your associates to learn more so they can further their careers at your company.

National Gourmet Coffee Day. Highlight the premium brands in this segment, as well as café-quality beverages that customers can prepare at home.

25

National Fish Taco Day. Offer yummy alternatives to beef and chicken for family Mexican meal nights that don’t have to be on Tuesdays.

27 For Better Business Communication Day, commit to working harder at making yourself better understood when interacting with colleagues.

29

Chinese New Year. Happy Year of the Snake!

30

National Draw a Dinosaur Day. See what your younger shoppers can come up when asked to imagine these giants in the store – a T. rex trying (and failing) to steer a shopping cart?

31

Berry Fresh Month

Exotic Vegetables and Star Fruit Month

National Avocado and Banana Month

National Bake for Family Fun Month

National Fondue Month

National Grapefruit Month

National Macadamia Nut Month

National Snack Food Month

2

Groundhog Day. It’s also Hedgehog Day and Marmot Day, but Punxsutawney Phil and his shadow get all of the attention.

3 For Doggy Date Night, suggest that pet parents stock up on treats and toys to pamper their preferred pooches.

9

With the Big Game taking place today, promote National Homegating Day.

4

National Stuffed Mushroom Day. There are myriad recipes for this tasty appetizer that you can share with your shoppers.

5

On Disaster Day, make sure that your plans in case of a catastrophe are up to date.

6

National Valentine Shopping Reminder Day. Come on, there’s just over a week left to buy something special for your significant other!

7

National Send a Card to a Friend Say. Your greeting card selection can provide many creative choices.

1

Decorating With Candy Day. Offer consumers some fun edible projects for the whole family.

16

For Innovation Day, ask associates what they would do to make business better, and then act on the best suggestions.

10 Sick of Food Waste Day. As well as publicizing your own efforts to manage this concerning issue, provide tips enabling shoppers to do their bit.

11

For Get Out Your Guitar Day, request that a musically talented associate serenade customers in the aisles.

17

Presidents Day. Time for some starspangled savings to celebrate our 47 commanders-in-chief (so far).

18

12

National Lost Penny Day. You know what they say: It’s good luck if you pick one up.

19

13

National Tortellini Day. However it’s prepared, this succulent stuffed pasta slaps.

20

14

Valentine’s Day need not only be about romantic couples, but also the many types of love between people.

8

National Iowa Day. Shine the spotlight on the distinctive foods and beverages of the Hawkeye State.

15

National I Want Butterscotch Day. Then you shall have it – look no further than the candy aisle.

21

22

National CrabStuffed Flounder Day. Direct shoppers to the seafood section to get the main ingredients for this elegant but easyto-make dish.

National Vet Girls ROCK Day. Pay tribute to all of your female staffers who served in the armed forces.

National Leadership Day. Identify those among your associates with the potential to advance, and arrange mentorships to help them move up.

National Caregivers Day. Make sure people fulfilling this important duty have all that they need when they visit your store(s).

It’s Open That Bottle Night, so have a fine selection of wines and spirits available (laws permitting), along with helpful pairing recommendations.

23

Curling Is Cool Day. Let’s keep raising this winter sport’s profile in the United States through themed promotions with local clubs.

24 On World Bartender Day, hold a video demonstration showing shoppers how to be their own mixologists.

25

Let’s All Eat Right Day. Your retail dietitian can help customers remake their diets.

26

Letter to an Elder Day. This is a good opportunity for young shoppers and teenage associates to write notes of appreciation for seniors in the local community, with screenshots posted online.

27

National Protein Day. Animal or plantbased – it’s time to highlight the benefits of this essential nutrient.

28

National Vegan Lipstick Day. If you carry it in your cosmetics section, let your cruelty-free customers know.

The Inspired Home Show ® is the industry epicenter for everything new and next in home + housewares, bringing both enduring and emerging trends to the table. Since 1939, the Show has been a reliable conduit for innovation and incubator for brands to introduce the next must-have products your customers are looking for.

Don’t miss this milestone event where the industry connects around innovation, insight and inspiration.

$3.73 for all condiments, up 1.1% compared with a year ago

$5.27 for mayonnaise, up 2.7% compared with a year ago

$3.54 for ketchup, up 0.6% compared with a year ago

$3.22 for hot sauce/chili, down 0.5% compared with a year ago

What is the value per occasion for condiments versus the year-ago period? $4.98

$5.78 for

Source: NIQ, Total U.S. (all outlets combined) during the 52 weeks ending Sept. 28, 2024

$2.37

$2.24 for mustard, down 0.8% compared with a year ago

$5.30 for sandwich dressing, up 0.2% compared with a year ago

Source: NIQ, Total U.S. (all outlets combined) during the 52 weeks ending Oct. 5, 2024

Yogurt has maintained its place in consumer households and its perceived health benefi ts, affordability and familiarity. This has positioned it positively during a time when people are watching their grocery spending. Increased snacking frequency and growing consumer interest in health have primed yogurt for future success.

Fun, innovative flavors and improved product attributes aren’t enough to increase usage for most. Opportunity lies in revolving innovation around what consumers most expect to receive when purchasing this category. Ensuring that innovation truly meets the needs of consumers is a must.

Changing lifestyles and eating behaviors won’t push consumers out of the category; rather, they will open doors for new opportunities to expand usage. Yogurt drinks, tubes and pouches are prime for takeoff, as they give consumers all of the desired health benefits, with greater convenience.

The basics continue to reign in yogurt, especially when grocery budgets are tight. Fruit-forward, spoonable styles are maintaining their position as top players, and consumers are happy with current offerings. People largely turn to yogurt as a simple protein booster and gut supporter; thus, health benefi ts and convenience are expected.

Younger generations are changing their eating behaviors and swapping meals for snacks to fuel their day. With naturally high protein and easy consumption, yogurt is prime for on-the-go occasions. Emphasizing nutrition benefits and portability has the potential to ensure that yogurt and yogurt drinks have a place in changing diets and lifestyles.

Yogurt is a staple; health, convenience and value form the trifecta of purchase drivers. Even with rising costs, yogurt’s trusted health image and familiarity keep consumers coming back to the category. Emphasizing clear benefi ts in regard to these purchase drivers ensure that consumers’ expectations are met in this category.

Innovation plays a role in maintaining consumer engage–ment, yet too many new products cause decision fatigue and brand cannibalization. Revolving innovation around yogurt’s key purchase drivers — health and convenience — can ensure that new product launches are truly relevant on the shelf and provide value to consumers.

With snacking poised to replace traditional mealtimes, brands have a chance to become necessities in snack repertoires. Emphasizing ease and portability of yogurt drinks, along with highlighting the value of tubes and pouches to adolescents and adults as well as children, can position yogurt as a valuable product for on-the-go sustenance.

Brands can lean into yogurt’s perceived nutrition, affordability and convenience to show value during inflationary times. Highlighting yogurt-forward recipes for both sweet and savory dishes and beyond to such applications as beauty — e.g., homemade face masks — can inspire yogurt usage in new occasions and simultaneously alleviate concerns over food waste.

By Molly Hembree, MS, RD, LD

ealthy eating habits established early in life are a strong predictor of long-term food choices made into adulthood. Eating styles and patterns followed at a young age set the foundation for a life’s worth of food consumption. It’s important to create a fun, safe and encouraging environment around food for kids, as this can lead to improved health outcomes and a positive relationship with food. The grocery store is where it all starts, where choices are made at the shelf edge, and these foods are provided to children whose growth and development rely on sound nutrition.

Toddlers and school-age children are sorting through many new thoughts and feelings, some of which include how and what to eat. Younger children are often curious and inquisitive about tastes, textures and smells associated with food, while older eaters may be finding their favorite flavors and go-to meals and snacks. Now is the time to regularly introduce a variety of foods to help expand children’s acceptance and enjoyment of different products. Some parents craft weekly grocery lists alongside their children so little ones can have a greater influence on what foods are available in the home.

Encourage shoppers to make mealtime more of an adventure for their families with recipe cards in the physical or digital aisle, a greater number of coupons dedicated to kid-friendly fare, and expanded options in your kitchen equipment department, such as kid-sized aprons or small silicone spatulas for holiday baking.

There’s a sense of pride when we contribute to the success of something, even a tasty family breakfast on Sunday morning. The creativity involved in putting together food is a spectacle for kids and heightens their appreciation of nutrition. Any effort to get kids in the kitchen to construct their own meal, snack or beverage, puts them in charge of what they eat or drink and helps build important life skills in meal preparation.

Your retailer can support these interests by offering dietitian-led personal shopping tours with kids and their parents or chef cook-alongs for children, or by setting up tables with kid-friendly activities such as fruit and vegetable scavenger hunts and stickers.

Perspective is everything. When it comes to children in particular, the attitude conveyed toward certain foods will be noticed. Avoid assigning a “good” or “bad” distinction to foods. This can make children think that they should fall

Eating styles and patterns followed at a young age set the foundation for a life’s worth of food consumption.

in love with a certain food if it’s considered “good” or turn up their nose when presented with a “bad” food. Show kids just as much enthusiasm for a fresh, juicy pear as a gummy bear, or for a crisp whole grain cracker as a gingerbread cookie, and you may persuade youngsters to give equal attention and attempts to either food.

Work with your category strategists, packaging specialists or private label managers to fi nd better ways to position healthy packaged foods toward children. This may also be a good time to expand your in-store sampling program to include exotic fruits or a better-for-you station with kid-centric foods.

The first years of a child’s life can determine years of habits, including eating habits. Your retailer can be a champion for good food that nourishes people at a pivotal time in their early lives.

Molly Hembree, MS, RD, LD, is a registered dietitian for Kroger Health.

By Gina Acosta

Last year, Sprouts Farmers Market CEO Jack Sinclair walked onto a stage at the National Retail Federation’s Big Show in New York City and gave everyone in the audience the recipe for the retailer’s secret sauce:

“It’s very important for us to have the curation and differentiation that allows us to have that appeal to a customer that you can’t buy elsewhere. A lot of the investment from the digital world that’s moving into the physical world is based on having an assortment that everyone can access. Our aspiration is to be a great, curated organization so that people can only get what they want at Sprouts.”

That recipe for success has proved to be a big hit with shoppers.

Fast-forward to 2024, and Sprouts Farmers Market can’t seem to open stores fast enough as the retailer attracts scores of young families and consumers hungry for a simplified yet curated shopping experience that offers the right products at the right

“Sprouts Farmers Market is honored to receive Progres sive Grocer’s Retailer of the Year award, a reflection of the dedicated people, culture and values that define our organization,” says Sinclair. “This achievement would not be possible without the commitment of our more than 33,000 team members across the country, who work tirelessly to care for our customers and deliver an exceptional shopping experience every day. As we expand to new markets across the country, we will stay true to our roots of fresh produce and healthier products that inspire our customers to live and eat better and enrich the communities we serve.”

Borrowing from its farmstand heritage, Sprouts aims to offer a unique grocery experience featuring an open layout with fresh produce at the heart of the store. Sprouts wants to attract the wellness shopper with a carefully curated assortment of betterfor-you products. The healthy grocer is focused on sourcing the latest in wholesome, innovative products made with lifestyle-friendly ingredients offering such attributes as organic, plant-based and gluten-free. However, Sprouts is managing to attract not just the health-minded shopper, but also the traditional grocery customer.

Based in Phoenix, Sprouts today is one of the largest and fastest-growing retailers of food in the

Sprouts CEO Jack Sinclair says that the retailer has taken advantage of the consumer’s pivot back toward food at home by increasing meal solutions across the fresh and frozen departments.

United States, with annual sales of $6.8 billion in 2023. It employs approximately 33,000 team members and operates more than 430 stores in 24 states nationwide, with a long runway of growth ahead.

In 2023, Sprouts, which previously had been operating formats spanning around 30,000 square feet, opened 30 stores debuting a new smaller format of around 23,000 square feet, featuring innovation tables, self-checkouts, and reimagined deli, frozen and meat departments. These features are designed to make it easier for customers to find new and unique products, according to the company. So far in 2024, Sprouts has opened 35 stores as it continues to expand into new and existing markets, from California to Florida and the Mid-Atlantic. Since the pandemic began in 2020, the company has opened more than 106 new stores.

In its latest earnings report, published in late September, the retailer surpassed expectations. Sales at Sprouts during its third quarter increased by 14% compared with the third quarter of 2023, including an 8.4% increase in same-store sales, while diluted earnings per share grew by 40% from last year.

Today’s consumers are looking for high-quality, unique items to add to their shopping carts — and products from Ireland are one option grocery retailers can turn to deliver what those consumers seek.

What is it about Irish food and drink items that is so appealing to shoppers? And why should grocers make sure those products are in their inventory? Mossie Power, Vice President of Grocery for Bord Bia North America, the organization that connects U.S. buyers and distributors with Irish food and drink brands, answers those questions and more for Progressive Grocer readers.

Progressive Grocer: Grocers might not think of Irish products right away when they’re considering new items to bring in-store. Why should they be on the list of items to introduce?

Mossie Power: Exports of Irish food and drink to the U.S. have increased by 25% over the past 5 years, a strong performance by any measure. In a crowded, competitive landscape, Irish products increasingly stand out. Branded offerings in key categories have drawn consumer attention to our industry’s core strengths: food and drink sustainably produced by farmers and manufacturers who care for the quality and authenticity of their products. It is an opportunity that extends across the retail sector and speaks to increasing consumer demand for premium and distinctive brands.

There is a growing demand for quality products amongst consumers who are ever more informed on the origin of their food and drink. Consumers are prioritizing taste, along with health, and now are increasingly aware of the sustainability credentials of the products they choose. Ireland’s pioneering and unique sustainability program for its food and drink industry, Origin Green, covers over 90% of food and drink exports. This means when sourcing from Ireland, retailers can be confident they are choosing products that meet clear and independently audited sustainability and environmental criteria.

PG: Bord Bia has launched a U.S.-focused Supplier Development Program. What would you like grocers to know about that program?

MP: Through our U.S.-focused Supplier Development Program, we ensure Irish food and drink companies ambitious to succeed in the U.S. are primed with the insights and expertise needed to hit the ground running. Working with leading industry experts and market mentors, companies participating in our program have their positioning, marketing and supply strategies thoroughly interrogated and tested to ensure their market readiness and route to market strategy is fully developed.

Ireland’s food and drink industry is globally focused exporting 90% of what we produce, meaning a secure source of supply for retailers. The objective of the program is to bring a cohort of high potential and innovative Irish food suppliers through a rigorous capability framework leading to a successful launch with their retail partner. Essentially this eliminates as much of the risk in launching a new Irish brand while also ensuring any committed supply relationship is developed beyond the initial trial stage on shelf. This program is tailored to meet the specific needs of each retailer we collaborate with, ensuring that buyers can confidently engage with new Irish brands poised for suc-

cess. The support these brands receive from Bord Bia complements the efforts of their broker and distributor partners, as well as the retailers themselves.

PG: What are some of the food and beverage categories that are especially popular with U.S. consumers?

MP: Today, the U.S. is one of Ireland’s largest food export markets. It’s a success story built on long-standing fundamentals — from grass-based farming systems to stringent food safety standards and to our commitments to producing to the highest international quality criteria. Ireland is best known for its quality dairy products though this extends across the store to Irish beef, as well products such as potato chips to nutritional bars to mention only a few.

To learn more about how Bord Bia can help your store meet the growing opportunity for Irish food and drink in the U.S., please contact Mossie Power Maurice.power@bordbia.ie.

“We are driving robust traffic growth and continue to execute at a very high level,” Sinclair said when the report came out. “We remain confident in our long-term growth potential.”

Also in the third quarter, total sales were $1.9 billion, up $232 million from the same period last year.

“Our comp was split fairly evenly between traffic and basket, and we saw a strong traffic comp both in store and online,” said CFO Curtis Valentine during the company’s earning call. Sprouts began offering grocery e-commerce services in 2015 and now provides delivery and pickup at all locations through its website, powered by Instacart, Uber Eats and DoorDash. Sprouts’ e-commerce sales have grown 36%, representing 14.5% of total sales. The retailer’s online assortment serves as an extension of its in-store offerings, providing customers convenient access to a variety of healthy choices, whether fresh or dry grocery.

“The consumer’s pivot toward food at home and a growing focus on healthy living are bringing additional customers to Sprouts,” Valentine added during the earnings call.

According to a recent report from Santa Cruz, Calif.-based research firm Placer.ai, Sprouts’ foot traffic during its third quarter increased by 8.1% year over year, and the average number of visits to each location was up 2.6%. Additionally, during September, visits were up 8.1% year over year, and they were also up 8.5% in August and 7.9% in July.

Sprouts opened nine new stores during Q3. The company has nearly 110 approved new stores and more than 70 executed leases in the pipeline for the years ahead.

“We are more committed than ever to making healthier options available to our customers in as many communities as possible,” Sinclair said this past September.

The retailer expects total sales growth to be approximately 12% for the full year and comp sales to be approximately 7% in fiscal 2024. For the full year, Sprouts anticipates capital expenditures to be between $205 million and $215 million. The

Sprouts is always looking to expand its range of organic produce, which is experiencing faster growth than conventional produce. Organic produce now comprises more than 46% of total produce sales at Sprouts.

company plans to open 33 new stores instead of the previous guidance of 35, after deciding to delay two store openings in Florida, due to the impact of Hurricane Milton, until the first quarter of 2025.

“We acknowledge that we have some macro tailwinds at our back, but we are putting in the effort to establish a strong foundation that will enable the business to thrive in every environment,” explained Sinclair. “Our third-quarter results and overall momentum continue to confirm our belief in our target customer-focused strategy. … Our results enable us to keep investing in our growth. We’re enthusiastic about the opportunities ahead, and our teams are rising to the challenge.”

Sprouts’ robust financial performance in 2024 — with strength in same-store sales, traffic, e-commerce and merchandising innovation — showcases its momentum and potential in the grocery sector in the years ahead.

According to Sprouts, it works to make sure that the shopping experience remains elevated in a world of new operational challenges by focus-

“As we expand to new markets across the country, we will stay true to our roots of fresh produce and healthier products that inspire our customers to live and eat better and enrich the communities we serve.”

—Jack Sinclair, Sprouts Farmers Market CEO

ing on the needs of its core customer: Sprouts shoppers are really into their food. In fact, the Sprouts website urges them: “Find your healthy.”

Sprouts’ core customer is looking to make healthy choices (for example, produce represents 20% of sales at the company) and experience new things that align with their unique diets (more than 70% of Sprouts products are attribute-driven). They’re also highly engaged and connected to their food and how they shop for it.

The company remains committed to a smaller format built to provide shoppers with a simple, intuitive store that delivers a true treasure-hunt shopping experience, full of fresh, unique and local products.

In-store, Sprouts offers a bright and airy farmers market experience with an open layout, community feel, personal connections, treasure-hunt shopping, and produce always at the

heart of the market. Signage next to local and unique products promotes value through storytelling.

As an example of its better-for-you focus, the company has refined its plant-powered proteins offering as a destination, and a “New For You” innovation center showcases the latest products exclusive to Sprouts. In fact, the retailer puts niche brands first and has grown many mom-and-pop companies into national brands. The innovation center is updated frequently to deliver the newest and most original products to surprise and delight shoppers.

“Our ongoing innovation efforts continue to be a differentiator for us,” asserts Sinclair. “This year, over 170 new items have transitioned from our innovation center to our inline shelves. As Sprouts is becoming a vendor of choice for new trend-forward brands, our foraging team also continues to explore new tastes and trends from across the globe, [going] from trade shows to restaurants for inspiration.”

This innovation extends to the frozen department, where Sprouts has added more than 115 new items that are leaders in natural and organic innovation. The retailer has also vastly expanded its grab-and-go options and prepared foods such as fresh-baked bread, meal-prep items, soups, salads, sandwiches and other fresh products.

“We’ve taken advantage of the consumer’s pivot back towards food at home by increasing our meal solutions across our fresh and frozen departments, with items like our grass-fed beef, stuffed peppers, black garlic marinated NAE [no antibiotics ever] chicken skewers and our organic grass-fed meatballs,” says Sinclair. “These unique natural products you can only find at Sprouts, and they lead our category growth.”

Sprouts offers approximately 200 SKUs of nuts, seeds, candies and grains, which are resonating well with shoppers who care about value and reduced packaging.

The retailer is currently testing a loyalty program in two markets, with plans to extend to more markets in early 2025.

“Our new loyalty program will be our data acquisition engine

?

We pride ourselves on creating irresistible products that consumers love. As a family-owned company, we’re focused on launching products we know will delight our consumers, even if those products take years to perfect. Pretzel Bites have been years in the making; we’ve tweaked the recipe over and over to get it just right. Before launching nationally, we ensured that approximately 90% of consumers agreed the product tastes ‘GREAT.’ The innovation journey allowed us to make sure we delivered an irresistible product we could be proud to sell to our retailers and their shoppers.

Because Pretzel Bites pair so well with items like cheese dips and condiments, we’ve noticed bigger basket sizes on average for those buying Bites with about a 16% increase in spend per trip. Our initial data also shows that nearly 50% of Pretzel Bites buyers are new to our brand, and many are even new to the category. While it’s still early, we know from extensive internal testing that the product has a high repeat purchase rate, which gives us confidence to invest in trial-driving activities to grow awareness, especially leading up to the Big Game. We’ve also seen initial velocities average two to three times those of our closest competitor in the soft pretzel snacking category.

King’s Hawaiian is a well-known powerhouse brand loved by consumers. Our net promoter score as a brand is incredibly high, meaning consumers love our brand and trust us to deliver a positive experience. Introducing Pretzel Bites into the growing snack category will only help drive incremental sales within the bakery/ deli department — our typical home location. Because soft Pretzel Bites pair perfectly with cheese dips, mustard, chocolate, and many other condiments, we’ve seen early results showing this product drives higher basket rings for our retailers. We’ve also noticed grocers proactively putting Bites in secondary placements such as in the beer and wine aisle, and incorporating Bites into perimeter displays with dips, soft drinks, and other complementary items.

In addition to a robust national sampling tour, we also have significant omnichannel and in-store retail support planned. We plan to kick off during fall football and the holidays and to go big with media support in the weeks leading up to the Big Game. Our TV commercials featuring Peyton and Eli Manning will also continue airing, letting consumers know about Pretzel Bites and encouraging them to stock up for their game-watch parties. We also have exciting partnerships with other popular national brands planned to provide shoppers with easy and delicious snacking solutions.

For more information, please reach out to your Irresistible Foods Group representative.

for personalization efforts,” says Sinclair. “While still early, we’re pleased with the progress we’re making and the learnings we’re gathering from our loyalty test. Signups and scans are meeting and even slightly exceeding our early goals. We plan to extend this test to a couple more markets in early 2025 to accelerate our learnings that will inform our rollout later in 2025.”

Right now, through the Sprouts app, shoppers can get exclusive offers, clip digital coupons, view the weekly ad, and order groceries for pickup or delivery. App users are also the first to hear about exclusive offers and get the weekly ad early on Tuesdays.

Another area that plays a key role in the Sprouts customer engagement strategy is social media. As a result of new

social marketing efforts, the retailer is seeing more new customers, improved customer retention and increased shopping frequency, leading to strong comp traffic momentum.

“Our team has brought our unique assortment and experience to life and has found willing partners with many influencers and celebrities, whose products and purposes align with ours,” observes Sinclair. “What is even more encouraging is seeing authentic posts from our customers, sharing their experiences in-store and with our products.” According to Sinclair, the retailer is also seeing younger customers in its stores.

“That 18-to-34 cohort is one of the ones where we’ve seen the strongest growth,” he affirms, “and I think that’s a credit to our marketing team and the work they’re doing in social media and bringing in those younger customers. We’re pleased with where we’re headed there. To further support our long-term customer engagement, we’re investing in technology to build a customer data foundation to tailor and personalize our customer communications.”

To meet the needs of its health-conscious customers, Sprouts is always growing its assortment of differentiated products. The assortment at Sprouts is curated to cater to the company’s “health enthusiast customers.” To highlight a few examples, the retailer is always looking to expand its range of organic produce, which is experiencing faster growth than conventional produce. Organic produce now comprises more than 46% of total produce sales at Sprouts.

Another focus is store brands, which contributed 23% to total sales for the latest quarter. Sprouts offers thousands of items from its private label Sprouts Brand, more than half of which are non-GMO or organic. From everyday staples to innovative specialty items, Sprouts Brand products meet strict quality standards while delivering value, novel flavor profiles and quality. The company often customizes flavor profiles and refines ingredients to suit Sprouts’ standards for quality, taste and value.

“Our Sprouts brand continues to grow and gain affinity with unique items and attributes that our customers desire,” notes Sinclair. “We have released more than 300 new Sprouts brand items this year, such as Italian-made stock gnocchi, frozen risottos sourced from Italy, and our latest Moroccan and al pastor-flavored chickpeas.” Most recently, it launched a line of more than 130 premium body care and home fragrance items under the Real Root by Sprouts brand.

“We’re very excited about the launch of Real Root by Sprouts,” says Sinclair. “They’re free from many things, including parabens, phthalates, [and] artificial fragrances and colors. These products help customers live healthier, nurturing inner and outer well-being.”

To showcase its differentiated products, Sprouts held several in-store experiences throughout the third quarter. In July, it debuted the first Sprouts Brand Discovery Days, during which customers explored the latest trends and new better-for-you products. Additionally, the retailer’s back-to-school event focused on healthy school snacks and lunch offerings.

Sinclair says that keeping customers happy starts with keeping employees happy, and the company is working hard to do just that.

“We’ve worked hard to create a culture that attracts, develops and retains top talent, building ‘Sprouties’ for the long term,” notes Sinclair. “We recently held our annual SproutsCon conference, which brought together all our store managers and various department managers, with over 1,600 team members in attendance. During the event, the operations team learned about our business initiatives, received leadership development training, and were introduced to new products in our innovation pipeline, some through live vendor pitch slams.”

More than 1,500 vendors attended the private show to discuss their products, allowing each team member to bring back their knowledge to the stores and share it with their customers and fellow team members.

“Our HR teams are focused on coaching and leadership training this year to build new leaders and our talent engines to support our growth objectives,” says Sinclair. “They’re doing a great job.”

In 2023, Sprouts created 3,000 new jobs, promoted more than 20% of its team members and filled 64% of store manager positions with internal candidates. It also provided 800,000-plus training hours across the business.

The retailer will continue to prioritize workforce diversity — 54% of 2022 promotions were female and 48% ethnically diverse, and VP-plus roles are 21% female and 16% ethnically diverse — building careers by providing devel-

opment opportunities via investment in training and internal and external leadership education programs, and offering competitive entry wages, robust benefits and mental health support.

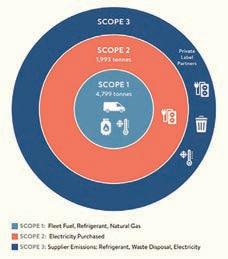

On the ESG front, the retailer is working with a top consultant on developing carbon reduction targets; focusing on selling products with lower carbon impact (i.e., plant-based and organic), building smaller stores and placing them closer to distribution centers (88% are within 250 miles); employing energy management options (LED lighting, CO2 and lower-GWP refrigerants); and exploring renewable-energy programs (on-site solar and off-site renewable projects).

“Our operations team is laser-focused on delivering exceptional customer service and an in-store experience that fosters long-term loyalty,” says Sinclair. “This commitment to bringing our unique products to life through exemplary service, engaging sampling and in-store execution continues to set us apart and win customers.”

This year’s Impact Awards shine the spotlight on a range of grocery industry retailers, suppliers and solution providers that are doing good in various ways. By PG Staff

ne of the most important roles that grocery industry companies undertake is that of being good stewards in the area of environmental, social and governance (ESG) investments. As shown by Progressive Grocer’s 2024 Impact Awards, which this year boasts an impressive 75 honorees, chosen from close to 200 nominees across retailers, CPG companies and solution providers, this impetus to make the world a better place is stronger than ever. PG recognized companies’ outstanding achievements in the following categories: Community Service/Local Impact; Diversity Equity, Inclusion and Belonging; Educational Support/Learning Advancement;

COMMUNITY SERVICE/LOCAL IMPACT

Associated Wholesale Grocers Inc.

Each year, AWG Cares, the employee charitable foundation for Associated Wholesale Grocers, sponsors an Annual Day of Service dedicated to providing voluntary service in each of its communities. Volunteers from each location in AWG’s footprint participate in various local community service projects, including community beautification, packing boxes for local food banks or shelters, and volunteering at local charity events. Throughout the year, AWG employees at all divisions also regularly participate in various clothing and/or canned food drives.

COMMUNITY SERVICE/LOCAL IMPACT

Brattleboro Food Co-op

A 2023 bylaw change meant that shareholders of this Vermont food cooperative could now receive a “working shareholder” discount by engaging with one of its Commitment to Community (C2C) partners. Shareholders volunteering at least two hours per month with a C2C nonprofit earn a 5% discount. Additionally, shareholders can donate their hours to those unable to volunteer, thus further expanding access to the co-op. Last year, participants in the co-op’s Food for All program who also volunteered with a C2C partner earned a 15% discount. The result? A 55% increase in the number of hours that shareholders volunteered.

Ethical Sourcing/Supply Chain Transparency; Food Security/Nutritional Leadership; Philanthropic Innovation/ Corporate Giving; Sustainability/Resource Conservation; and Workforce Development/Employee Support. Whether doing good works at home or abroad, with the aim of benefiting local communities or potentially millions around the globe, all of the Impact Award recipients stepped up to the plate to improve the status quo and assure consumers that they’re walking the talk when it comes to ESG measures.

Read on to find out more about — and be inspired by — the 2024 Impact Award honorees’ actions in this space.

COMMUNITY SERVICE/LOCAL IMPACT

Giant Food

The Giant Gives Grant allows the Ahold Delhaize USA brand’s associates to make a meaningful difference by donating $300 for an individual volunteer grant or $500 for a group volunteer grant in their name(s) to a nonprofit with which they have volunteered 10 hours individually or 20 hours as a group. By facilitating these grants, the chain not only encourages associates to volunteer, but also gives them the means to support the causes they care about. In 2023 alone, its associates collectively dedicated 1,800-plus community service hours.

COMMUNITY SERVICE/LOCAL IMPACT

Heritage Grocers Group LLC

Heritage Grocers Group’s commitment to community service and corporate giving is shown by the philanthropic efforts of the Cardenas Markets Foundation, Tony’s Charitable Foundation, and Manos y Corazones Unidos, the recently established philanthropic arm of El Rancho Supermercado. Each strives to help those in the wide-ranging and diverse areas in which Heritage operates. They are deeply rooted in their local communities and are always searching for opportunities to give back to organizations committed to disaster relief efforts, advancing health and well-being initiatives, children’s well-being, hunger relief, and education.

COMMUNITY SERVICE/LOCAL IMPACT

This year, J&C developed a new partnership with Caring for Miami, which gets basic critical resources to underserved families. J&C provided a monetary donation, along with employee volunteers who packed 500 bags as weekend meals for children on meal plans at school. In addition to partnerships focusing on food security and nutrition, the company partners with Operation Christmas Child during the holiday season. As J&C grows nationally, it will continue to expand its relationships with South Florida-based organizations.

COMMUNITY SERVICE/LOCAL IMPACT

Luker’s Chocolate Dream program aims to address challenges faced by cocoa-producing regions in Colombia, including the high rate of migration of youth to urban areas due to violence and economic issues, and the deterioration of ecosystems. The company collaborates with diverse stakeholders to establish long-term relationships centered on chocolate, crafting brighter futures tailored to each region’s needs. Luker also works closely with the farmers and local community, as well as offering its clients, which include chocolate brands and food companies worldwide, the opportunity to invest directly in these initiatives.

COMMUNITY SERVICE/LOCAL IMPACT

In 2023, Village Super Markets, which operates ShopRite, Fairway and Gourmet Garage stores, launched its first annual Pennies for Produce campaign with America’s Grow-a-Row, a nonprofit that supplies the retailer’s trade areas with produce. Not only was this a front of store campaign, but Village also did volunteer farm days with its associates, planting and helping harvest the produce to be sent to its store’s communities. With shoppers invited to join as well, the effort raised more than $67,000 in its first year, equating to about 335,000 servings of produce.

Circana established the volunteer, employee-led Diversity Advantage Program (DAP) in 2021 to help level the playing field for minority- and women-owned small CPG businesses to grow. DAP provides valuable consumer data, coaching and consultancy services, guiding participants toward business growth and success. Now in its third year, DAP has grown to 58 participants and gained the support of 250-plus U.S. and U.K. Circana employees, who contribute more than 15,000 volunteer hours annually in support. The program is strengthened by collaboration with such retailer partners as Amazon, Kroger, Target and Walmart.

COMMUNITY SERVICE/LOCAL IMPACT

Stop & Shop

Stop & Shop launched the Turkey Express program to tackle the issue of food insecurity during the holidays. By distributing Thanksgiving turkeys to hunger relief organizations across the Ahold Delhaize USA brand’s market area, the initiative aimed to help needy families. Stop & Shop actively engaged both associates and shoppers in the program: Associates participated in the planning and execution phases, while shoppers could contribute through in-store promotions and awareness campaigns. The retailer aims to integrate more community events to further raise awareness and foster a culture of collective action against food insecurity.

Diversity, equity, inclusion and belonging is woven into the fabric of Dollar General’s (DG) 20,000-plus stores, 32 distribution centers, fleet teams and corporate office, as well as the communities it serves, through such initiatives as My Difference Makes a Difference, which enables employees to share their stories of uniqueness and diversity, and how showing up as their authentic selves has helped unlock their potential at work. Further, in the past two years, DG has seen a 250% increase in employees joining employee resource groups organized around chosen commonalities.

Understanding that schools are integral parts of communities, Tops Markets encourages shoppers to participate in its Tops in Education program by selecting their K-12 school of choice and purchasing Tops branded products. The company then contributes 5% of those sales to the designated school. To date, Tops has donated more than $1.7 million through the program. The grocer also supports education by providing scholarship opportunities to its associates and their dependents. So far, Tops has awarded 26,700-plus scholarships totaling more than $25,000,000.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

BriarPatch Food Co-op

Under the Apples for Gardens program, BriarPatch Food Co-op each month donates 10 cents per pound of apples sold to a selected school or nonprofit-run community garden. The money raised goes directly toward garden educators, plants or infrastructure. As extracurricular educational opportunities like school gardens are frequently the first to face budget cuts, BriarPatch’s program helps ensure continued support for these valuable learning tools. Donations to gardens have totaled more than $50,000 since the program’s inception and continue to edge upward as community awareness spreads.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

Lunds & Byerlys

As traditional meat-cutting trade programs became obsolete and many grocers shifted to pre-packaged meat, the necessary industry skills evolved. In response, Lunds & Byerlys developed a seven-month training program encompassing classroom learning, hands-on experiences and eld visits. So far, the program has sponsored 16 culinary professionals, achieved 95% retention of trainees and facilitated expected career advancements. Customer satisfaction and demo sales in the meat and seafood department have risen as well. Following the program’s success, the retailer has launched a deli and foodservice culinary professional program, with more such programs in the works.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

The Raley’s Companies

First created in 2016, Raley’s Store Team Leader Tracker (STL) Program helps individuals who want to move up to the position of store manager. The program is intended to further develop leadership traits, management fundamentals and business acumen. In 2023, the program launched at Raley’s banner Bashas’, and the results were compelling: 14 of the 22 STL Leadership Track participants were promoted. Across the enterprise, there have been 167 total graduates, over eight different programs/years, with an 84% retention rate since the program’s inception.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

In April 2024, The Milk Processor Education Program (MilkPEP) launched “Dairy Diaries,” a sh-outof-water journey into the world of dairy farming, which premiered on streaming service Roku. In the humorous ve-part series, sketch comedian and actress Vanessa Bayer took viewers behind the scenes at Beck Farms, a fourth-generation dairy farm in upstate New York. Halfway through its third week on Roku, “Dairy Diaries” had already reached 86% of its target impressions. The campaign received more than 124,000 digital impressions, 224 million-plus earned-media impressions, 509 earned-media placements and 96.6% positive sentiment.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

NielsenIQ

In response to the efforts of brands and retailers to make the business case for sustainability, NielsenIQ (NIQ) partnered with McKinsey & Co. to do a deep analysis of ve years of data across the entire store of sustainable brands. Through the research, they were able to identify the business case and key insights to help guide the entire industry. A subsequent white paper has been viewed more than 25,000 times and downloaded 3,000 times from the NIQ website. Additionally, webinars and industry presentations have reached 5,000plus industry leaders across more than 20 industry events.

Western Michigan University

With a 100% job placement rate and multiple alumni in senior leadership roles throughout the industry, the Western Michigan University (WMU) Food Marketing program focuses on teaching the fundamentals in category management, professional selling, supply chain management and retail merchandising, while heavily applying these concepts through industry-leading engagement with top retailers, CPGs and agencies. WMU offers the only university-based certi cation for category management in the country. What’s more, the program’s participants are 70% female, which is contributing to increased diversity in leadership roles in the food industry.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

The Giant Co.

In celebration of its partnerships with local agricultural producers, on National Farmer’s Day (Oct. 12) in 2023, The Giant Co. revealed a $20,000 donation to support education programs for future food and agriculture leaders. In partnership with Future Farmers of America (FFA), the grocer is supporting more than 5,000 high school students through leadership conferences and programming. FFA is a youth organization that prepares members for premier leadership, personal growth and career success through schoolbased agricultural education. More than 500 FFA chapters comprising 36,000 students span The Giant Co.’s four-state footprint.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

Albertsons Cos.

Through Albertsons Cos.’ Responsible Seafood Program, the retailer is working to improve transparency within the seafood supply chain. This not only helps Albertsons’ customers feel condent in the source of its products, but also supports the protection of ocean resources and the fair treatment of those working in the shing industry. Additionally, all seafood products sold under the grocer’s Waterfront Bistro and Open Nature brands display the Responsible Choice logo, indicating which products meet Albertsons’ Responsible Seafood Policy and Commitment and making it easier for shoppers to identify such products.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

Big Tree Farms

Ethical sourcing is at the core of Big Tree Farms, a producer of coconut sugar and coconut aminos. The company’s vertically integrated supply chain is both Fair for Life and USDA Organic certi ed, ensuring that it meets rigorous social, environmental, and economic standards. This ethical foundation supports farmers and fosters long-term, positive impacts on their communities. Further, transparency is a cornerstone of Big Tree Farms’ supply chain: It uses Koltiva software to maintain real-time communication with farmer partners and ensure visibility in quality, pricing and sustainability.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

Equifruit

Long-term contracts and Fairtrade International audits ensure that Equifruit pays its grower partners a non-negotiable minimum price reflecting sustainable production costs. The company’s 100% Fairtrade certification provides transparency, showing the origins of its bananas, the farmers who picked them and when. Additionally, Fairtrade certification requires farms to meet such rigorous standards as safe working conditions, no forced child labor, decent wages and promoting gender equity. Equifruit also pays a Fairtrade social premium of $1 per 40-pound case, used for projects chosen by farmers and workers to benefit their communities.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

Fairtrade America

Fairtrade’s West Africa Cocoa Program (WACP) is an example of the impact of reinvesting in farming communities. WACP aims to build the professionalism of Fairtrade certified smallholder cocoa-farming cooperatives in Ghana and Côte d’Ivoire, the origin countries for 60% of the world’s cocoa. Since 2016, it has focused on strengthening Fairtrade-certified farming organizations in delivering quality service to their members and becoming proactive business entities to their commercial partners. In that time, there has been significant growth in training across both countries as well as Sierra Leone, a promising new player in the world’s cocoa production.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

Hannaford Supermarkets

In 2023, Ahold Delhaize USA brand Hannaford Supermarkets continued the implementation of the Farmers Assuring Responsible Management (FARM) assessment tool across its dairy supply chain in collaboration with its private label milk supplier. The FARM assessment tool, which supports farmers in building excellent and safe work environments, is currently being used by more than 3,000 farms across the country. So far, Hannaford’s private label milk suppliers have completed FARM Workforce Development assessments on more than 220 farms across Hannaford’s entire geography, up from 70 by the end of 2022.

EDUCATIONAL SUPPORT/LEARNING ADVANCEMENT

Sarilla

Sparkling beverage brand Sarilla exclusively uses organic and fairtrade tea leaves and botanicals, ensuring sustainable sourcing and fair compensation for farmers. Its partnerships with Rwandan farmers have resulted in significant economic benefits: By providing fair wages and investing in local infrastructure, Sarilla has improved living standards and created a sustainable economic model. The company also supports genocide survivors in Rwanda through an annual crop-to-cup trip, which offers guests the opportunity to witness its impact firsthand. This initiative empowers these communities, providing sustainable livelihoods and honoring their resilience.

Stemilt first partnered with CIERTO, an organization with a mission of actively developing and sustaining a professional agricultural workforce that’s committed to returning to farms year after year, in 2018 to support 300 of its farmworkers. CIERTO streamlines the complex H2A visa recruiting and petition process so that growers can focus on running their farms profitably and efficiently, and workers can focus on their jobs, feeling comfortable and prepared. Today, 100% of Stemilt’s 1,616 H2A farmworkers come through the CIERTO program, and the company has a 95% return rate.

Earlier this year, Wiliot introduced its new Ambient Food Safety initiative designed to create completely transparent and traceable food supply chains – soon to be required for FSMA 204 compliance – through the adoption of battery-free, wireless ambient IoT technology. The initiative unites technology companies, standards organizations and food brands through the shared vision that ambient IoT is the most effective, scalable and low-labor approach to achieving safer, more sustainable and completely transparent food supply chains. Ambient IoT allows food products to be connected to the internet and AI at a fraction of the cost of legacy technologies.

The majority of food sold on Flashfood, a marketplace that reduces retail food waste by connecting consumers with deep discounts on products nearing their best-by dates, is fresh – 70% – meaning that it helps people save money on nutritious food. Flashfood has also expanded the availability of SNAP EBT as a payment method, enabling shoppers to stretch their dollars further. In April 2024, the company reached the milestone of 100 million pounds of food waste diverted from landfills, equal to 83 million meals and more than $250 million dollars saved.

The Giant Eagle Mobile Market was developed and brought to life as a response to food access challenges in the grocer’s communities. Operating in Pittsburgh-area food deserts, the “grocery store on wheels” brings fresh, nutritious food to residents of 10 neighborhoods, visiting each stop once a week to ensure consistent access to products. The Mobile Market offers items across categories, including produce, dairy and meat, along with infant formula and senior nutritional supplements. It accepts SNAP and was the first market of its kind in Pennsylvania to accept WIC.

FOOD SECURITY/NUTRITIONAL

As inflation increased and federal SNAP benefits came to an end in 2023, food banks across the nation saw increased demand. Observing this need within its own communities, Hy-Vee decided to provide 100 million meals for people in need. To maximize the dollars generated, the grocer developed a partnership with Feeding America. Every $1 donated helps to secure and distribute at least 10 meals through Feeding America’s network of partner food banks. Fighting hunger has been a focus for Hy-Vee since it was founded more than 90 years ago.

FOOD SECURITY/NUTRITIONAL LEADERSHIP

Sifter’s platform is used by many businesses and organizations to build Food as Medicine solutions. Retailers turn to Sifter to personalize e-commerce and loyalty applications by matching grocery promotions and products to a customer’s specific health needs. Integration of Sifter’s barcode-scanning technology allows in-store shoppers to scan store products for a custom diet fit and health incentives. Meanwhile, dietitians can use the technology to create food scripts and medically tailored grocery lists, and Sifter also fuels produce prescription programs, supplemental food benefit cards and digital health apps.

The Kroger Co.

Kroger Health uses its Food as Medicine Initiative – a dedicated, educated and personalized ap proach to eating and enjoying fresh food – to prevent illness before it be gins. With this strategy, the grocer collaborates with industry experts to address how they all can make impactful changes in communities. Building on the momentum of the White House’s Conference on Hun ger, Nutrition and Health in 2022, Kroger hosted its first-ever Nour ishing Change Summit in 2023 and expanded the conference this year to solve the nation’s largest health needs and create viable solutions to fuel thriving communities.

Superior Foods International

Superior’s volunteers deliver weekly groceries to families with children battling cancer, ensuring that vulnerable community mem bers receive consistent access to nutritious food, and the company partners with a local organization to sponsor events and regularly help serve hot food at a daily free lunch program, among other food security endeavors. Additionally, Superior supports nutrition education through a culinary garden and teaching kitchen project at an elementary school and sponsors a cooking class for teens and a community garden enabling low-income residents to grow their own food.

ny’s commitment to donate 1% of proceeds from the sale of Acme brand cold-smoked salmon retail products to fund the Seafood Industry Climate Awards (SICA), a program run by the Acme Smoked Fish Foundation, the philanthropic arm of the corporation. The signature awards program just celebrated its second year.

rates of food insecurity. During July, the private label brand donated one meal for every O Organics product purchased, resulting in the donation of $7 million, the equivalent of enabling 28 million meals. Donations were made to Nourishing Neighbors, the signature cause platform of Albertsons Cos. Foundation, to fund grants dedicated to providing healthy meals for at-risk youth throughout the summer.

In retail, every sale counts, and every sale starts at the shelf. Brain Corp empowers retailers to track and manage inventory with precision, ensuring the right products are on the right shelves, at the right prices. With our solutions, you’ll boost accuracy, enhance efficiency, and drive accountability throughout your store.

WANT TO LEARN MORE?

22M+

PHILANTHROPIC INNOVATION/ CORPORATE GIVING

Brookshire Grocery Co.

Examples of Brookshire Grocery Co.’s (BGC) many philanthropic efforts include the 34th annual BGC Charity Golf Tournament, which raised nearly $1 million dollars for charities, bringing the total funds raised more than $9.5 million since the tournament’s inception in 1988; the FRESH 15 race, which raised $180,500 this year for nonprofits in east Texas; and the Giving Back program, which has donated more than $785,000 to nonprofits that support education, hunger relief, military, first responders, health and wellness, and child and family well-being.

PHILANTHROPIC INNOVATION/ CORPORATE GIVING

Tipsy Spritzers

Tipsy Spritzers believes in leveraging its success to make a meaningful impact in the world, which is why the beverage company has committed to donating 1% of its profits to support organizations fighting human trafficking. This decision wasn’t just about giving back – it was a strategic initiative born from Tipsy Spritzers founder Katie Shields’ core values and a desire to create positive change in the communities it serves. Human trafficking is a pervasive and devastating crime that affects millions of people worldwide.

PHILANTHROPIC INNOVATION/ CORPORATE GIVING

CLEAN Cause Inc. is a mission-first venture in which 50% net profits –or 5% net revenues, whichever is greater – go to support individuals pursuing recovery from alcohol and other drug addictions. It does that by offering a better-for-you ready-to-drink yerba mate tea and through a giveback program that to date has donated $3.1 million-plus to the CLEAN Cause Foundation to grant recovery housing scholarships to more than 5,000 individuals. The company is also proud to hire a large number of individuals in recovery for its team.

PHILANTHROPIC INNOVATION/ CORPORATE GIVING

By funding water projects, fresh fruit and vegetable grower, shipper and importer Continental Fresh is helping to break the cycle of poverty and illness, fostering empowerment and opportunity in underserved Latin American communities. Its Water For All branded produce program donates a percentage of proceeds to BLUE Missions, facilitating the funding of clean water and sanitation projects that have provided access to clean water for more than 33,000 individuals so far. Through marketing initiatives and collaboration with supply chain partners, the program has garnered $150,000plus in three years.

PHILANTHROPIC INNOVATION/ CORPORATE GIVING

Each year, Traditional Medicinals prioritizes investment in source communities, partnering with farmers, wild collectors and local organizations. Just a few of its projects this year ensured that 4,000 people in Zimbabwe gained access to safe drinking water, 510 farmers in Madagascar were trained in good agricultural practices, and 2,300 women in Egypt enrolled in maternal and child health education and economic empowerment sessions. The company also explored the feasibility of bringing mobile health care to remote sourcing communities, including a remote island in the Philippines.

PHILANTHROPIC INNOVATION/ CORPORATE GIVING UNFI

Through the UNFI Foundation and a new corporate giving strategy, the distributor has undertaken initiatives that address the food system’s most pressing social and environmental challenges. For example, by both accelerating and specifically directing the foundation’s impact investment portfolio into the regenerative-agriculture sector, UNFI is helping make capital more affordable for farmers producing food in this way. In 2023, the UNFI Foundation made its first impact investment of $100,000 into MadCapital’s regenerative-agriculture fund, which seeks to transition 25,000plus acres of farmland to regenerative or organic practice.

PHILANTHROPIC INNOVATION/ CORPORATE

Food solutions company SpartanNash dedicated its annual Helping Hands Day volunteer event in June 2024 to providing disaster-stricken families with meals and personal hygiene products. The company rented out DeVos Place, in Grand Rapids, Mich., for the event, during which SpartanNash associates, supplier partners and volunteers of nonprofit partner Convoy of Hope packed nearly 15,000 meal boxes and 5,000 toiletry kits to help address immediate needs following disasters. Product donations exceeded $1 million, and SpartanNash also presented Convoy of Hope with a $100,000 check.

Afresh Technologies

Afresh helps grocers reach their environmental, social and governance (ESG) goals by reducing shrink. Its store ordering and inventory management solution creates intelligent inventory estimations based on such fresh-specific factors as perishability that power truck-to- shelf orders. By helping grocers run leaner backrooms, Afresh also helps boost sales, as food can more easily reach its highest and best use instead of ending up in a landfill or being used for compost. Afresh’s mission is to eliminate food waste and make fresh food accessible to all.

SUSTAINABILITY/RESOURCE CONSERVATION

In January 2024, ALDI revealed that it had met its goal to remove plastic shopping bags by the end of 2023, becoming the rst major U.S. retailer to do so. This decision has led to the prevention of nearly 4,400 tons, or nearly 9 million pounds, of plastic from going into circulation each year. Before eliminating plastic shopping bags from its stores, ALDI charged for plastic bags at checkout, a move that had already saved an estimated 15 billion bags from land lls and oceans.

SUSTAINABILITY/RESOURCE CONSERVATION

In early 2023, Cabot transitioned its retail cultured packaging – yogurt, cottage, sour cream and dips – to thermoformed containers made by Polytainers. This transition reduced the plastic resin in cultured packaging by 19%. By streamlining the containers and allowing more to t in a case, Cabot saw a reduction in corrugated cases of 17%. and inbound pallet usage of 18%. These reductions resulted in seven fewer trucks needing to be shipped to the co-op’s Montpelier, Vt., distribution center, which equated to a 16% reduction in emissions.

Among its various sustainability initiatives, AWG in 2023 diverted 32,430,794 pounds of food from land lls into such environmentally friendly options as recycling, reuse, energy, composting and land application. From January 2020 to December 2023, the company had diverted more than 122,316,012 pounds from land lls. Also during 2023, AWG recycled 2,309,000-plus pounds of polyethylene plastic lm through Trex, the world’s largest manufacturer of high-performance wood-alternative decking and railing. Since that program began in 2009, AWG has recycled more than 28,880,000 pounds of polyethylene plastic lm through Trex.

SUSTAINABILITY/RESOURCE

Cascades embarked on developing ber-based packaging to meet the urgent need for sustainable alternatives to plastic in food packaging, aiming to reduce the environmental impact by using recycled bers and promoting circular design principles. Another signi cant initiative is ensuring that its cardboard food trays are composed of 100% recycled bers from post- consumer recycled content, aligning with the company’s commitment to sustainability and addressing the demand for environmentally responsible packaging options. These efforts reinforce Cascades’ position as a leader in sustainable packaging solutions.

SUSTAINABILITY/RESOURCE CONSERVATION

Bay Cities

Bay Cities, a designer and manufacturer of packaging and displays, has implemented two major sustainability initiatives: a collaboration between New Indy and Encorr, and the Bay Cities Green Program. New Indy generates steam that powers Bay Cities’ 100% ef cient, zero-waste corrugator, Encorr. These facilities eliminate transportation costs through a bridge that directly delivers sheet rolls from New Indy to Encorr, reducing carbon emissions. The other program targets savings in energy, chemicals, fuel, and materials using at least 60% recycled content to lower operating costs and foster employee eco-consciousness.

SUSTAINABILITY/RESOURCE CONSERVATION

Dairy cooperative CDPI integrates sustainability into many facets of its operations. Project Sunshine is the co-op’s ongoing commitment to maintaining excellence and making progress in four critical categories: animal welfare, greenhouse-gas emission reduction, water conservation and renewable energy. CDPI member-owner farms have embraced climate-friendly practices and technologies to reduce their environmental footprint and promote long-term ecological health. An unwavering commitment to sustainability, animal welfare and environmental stewardship has positioned CDPI as a leader in the dairy industry, continuously striving to improve and innovate for a better tomorrow.

SUSTAINABILITY/RESOURCE CONSERVATION

Blackhawk Network (BHN)

In September 2023, BHN became the rst in its industry to transition its network-branded prepaid products distributed by third-party retail networks from plastic to paper-based materials, in partnership with Visa. The initiative rolled out in the United States, Canada and Australia. Converting to sustainable materials has the potential to affect more than 350 million open-loop and multi-branded products produced by BHN, and up to another 700 million third-party cards just in BHN’s network, with the the industry-level impact of this effort reaching far beyond that number.

SUSTAINABILITY/RESOURCE CONSERVATION

Denali