NFB Financial Services | Standard Bank | OUTsurance | Vodacom

Backed up by almost 100 years of experience, with a track record that defined and shaped our pedigree on the South African retail property landscape, comes a fresh and innovative asset and property management company – Mowana Properties.

We are committed to serving our customers by providing innovative and pro-active property solutions. Contact us and find out how we can ensure the continued growth of your business.

mowanaproperties.co.za

+27 (0) 11 073 6800 | info@mowanaproperties.co.za

EDITOR Joe Forshaw joe@finance-focus.net

SENIOR PROJECT MANAGER Sam Hendricks sam@finance-focus.net

SENIOR PROJECT MANAGER James Davey jamesd@finance-focus.net

PROJECT MANAGER Ekwa Bikaka ekwa@finance-focus.net

PROJECT MANAGER Eleanor Sarbutt-King eleanor@finance-focus.net

PROJECT MANAGER Jamie Waters jamie@finance-focus.net

LEAD DESIGNER Aaron Protheroe aaron@finance-focus.net

FINANCE MANAGER Isabel Murphy isabel@finance-focus.net

CONTRIBUTOR Manelesi Dumasi

CONTRIBUTOR Timothy Reeder

CONTRIBUTOR Benjamin Southwold

CONTRIBUTOR William Denstone

Finance Focus is written and produced by a team of journalists with a collective experience of over 35 years in business to business journalism. Every month we bring stories, from across the industry, of companies striving to make a positive difference to the sectors they serve, be it through innovative cutting edge technology, entrepreneurial individuals influencing the industrial landscape, ground breaking projects and developments as well as many other inspirational pieces.

The media world is evolving rapidly, technology is helping to connect people and business in an instant. We embrace this and invest heavily in our distribution channels to ensure that the publication is easy to read through a digital circulation which is accessible at your desk or on your travels through smartphone and tablet compatibility. Whilst being at the forefront of the digital push, we also retain a superb quality print run to deliver a traditional hard copy magazine every month.

Our award winning editorial and design teams work tirelessly to produce the best content in the most well designed publication of its type, helping businesses of any size and stature to deliver news, and grow brands.

Our readership is made up of business professionals across every finance industry sector in Europe, the Middle East and Africa. Typically decision makers such as CEO’s, directors, and senior managers read the publication regularly and with a subscriber base of over 110,000 individuals the coverage that Finance Focus offers is perfect for any business with a story to tell or a product to promote.

Get in touch and tell us more about your company’s circular endeavours. We’re online at LinkedIn.

Published by

Chris Bolderstone – General Manager E. chris@cmb-multimedia.co.uk

Fuel Studios, Kiln House, Pottergate, Norwich NR2 1DX +44 (0) 1603 855 161 www.cmb-media.co.uk

CMB Media Group does not accept responsibility for omissions or errors. The points of view expressed in articles by attributing writers and/or in advertisements included in this magazine do not necessarily represent those of the publisher. Whilst every effort is made to ensure the accuracy of the information contained within this magazine, no legal responsibility will be accepted by the publishers for loss arising from use of information published. All rights reserved. No part of this publication may be reproduced or stored in a retrievable system or transmitted in any form or by any means without the prior written consent of the publisher.

© CMB Media Group Ltd 2022

Joe Forshaw EDITOR GET IN TOUCH +44 (0) 1603 855 161 joe@finance-focus.net www.finance-focus.net

EDITOR’S LETTER

www.f inance-focus.net | 3

MIANZO

Shot in the Arm for Black SMEs

NFB FINANCIAL SERVICES

Steadfast in Quest to Turn Knowledge Into Wealth

GAIA

Catalysing the African Infrastructure Investment Landscape

STANDARD BANK

The Best Bank in Africa, Officially

6 14 18 24 4 | www.f inance-focus.net

14

CONTENTS www.f inance-focus.net | 5 44 OUTSURANCE Out-of-this-World Service When You Need It Most AVBOB Incomparable Care and Compassion in Times of Covid and Beyond VODACOM Super App Set to Disrupt South African E-Commerce 30 38 44

CEO and Portfolio Manager, Luvo Tyandela.

CEO and Portfolio Manager, Luvo Tyandela.

SHOT IN THE ARM FOR BLACK SMES

For South Africa’s failure prone SMEs, access to finance is a major stumbling block. But the launch of a R100m SME fund enterprise by Black-owned Cape Town-based asset manager Mianzo, is geared to help emerging entrepreneurs gain access to growth capital.

MIANZO

PRODUCTION: Colin Chinery

www.enterprise-africa.net / 7

INDUSTRY FOCUS: ASSET MANAGEMENT

Wi th five out of seven failing within their first year, and 100% Blackowned businesses notable victims, South Africa has one of the world’s highest SME failure rates.

Th e consequences are stark. With their higher capacity to absorb labour, and a lower average capital cost per job created, SMEs are crucial job creators in a country with high unemployment. South Africa’s unemployment rate hit a historical new high of 34.9% in the third quarter of 2021, up from 34.4% in the second quarter. If the expanded definition of unemployment is used, which includes discouraged job seekers, unemployment rate is sitting at 46.6%.

BI G BUT TROUBLED

SM Es across South Africa represent more than 98% of businesses, employing between 50 and 60% of the country’s workforce across all sectors, and responsible for a quarter of job growth in the private sector.

Ye t access to finance is a major stumbling block, with only 6% of SMEs reporting they have received government support.

But in May, Mianzo, in partnership with SME incubator Black Umbrellas, launched a R100m SME fund enterprise to help emerging entrepreneurs gain access to growth capital.

Kn own as the Black Umbrellas Mianzo SME Debt Fund, it will provide loans to 51% Blackowned SMEs based in South Africa, addressing the low levels of entrepreneurship and high failure rate of emerging businesses in Africa.

BL ACK SME INCUBATOR

In itially spearheaded by Cape Town social entrepreneurs Mark Frankel and Charles Maisel to support SMEs, Black Umbrellas is a development incubation organisation with partners in the private sector,

Government, and civil society.

In 2009, the Cyril Ramaphosa Foundation, then the Shanduka Foundation, partnered with Black Umbrellas to position the project on a national level with a R5.2 million investment.

To day there are nine incubators countrywide, and Ramaphosa, Patron of Cyril Ramaphosa Foundation, is deeply committed to the vision of Black Umbrellas as a catalyst in the development of entrepreneurs, a sector he has identified as critical to the empowerment of historically marginalised South Africans.

NE W BEGINNINGS

Th e Black Umbrellas Mianzo SME Debt Fund is the latest initiative

8 | www.f inance-focus.net

“WE ARE DEFINITELY LOOKING AT EXPANDING OUR PRODUCT RANGE, AND ON THE EQUITY SIDE WE ARE CONTINUALLY ASSESSING VARIOUS OPTIONS IN TERMS OF WHAT WE CAN ADD TO OUR PORTFOLIO WITHOUT COMPROMISING OUR INVESTMENT PHILOSOPHY”

by Mianzo – ‘New Beginnings’ in Swahili – founded

in 2010 and one of only a handful of Black asset managers in Cape Town.

Wi th the objective of differentiating itself from the big corporates in terms of doing investments, and delivering “certainty in uncertain times,” boutique and bespoke Mianzo is founded on prudent principles, yet with a mindset challenging the status quo.

“We wanted it to be a derivatives investment boutique that provided downside protection to any asset class,” explains founding member, CEO and Portfolio Manager, Luvo Tyandela.

“O ur philosophy is ‘preserving capital, and then search for yield pick-up’. If the market goes down, our portfolios are more robust than others that are growth oriented.

We are more conservative than the big competitors. Our quality value, benchmark cognisant approach attests to this.”

TO P ASSET MANAGERS

Wi th offerings in institutional, global, annuity, and collective investment schemes (CIS) platforms, and currently managing assets just short of R12b, Mianzo is ranked as one of the top Black asset management companies in South Africa.

Ac cording to the 27four BEE. conomics 2021 annual survey, which provides risk and performance data on black asset managers, Mianzo ranks in the top 15 of black asset managers. The firm has been growing by 30% its AUM.

“B ased on the 27four BEE. economics survey, Mianzo is

ranked in the top 15 of black Asset Managers in South Africa,” says Operations Manager, Faldie Isaacs.

“Competition is tough, and it takes a lot of work to move from R1 billion to R5 billion and then on to R10 billion. Yet, based on monthly Alexander Forbes surveys, over the past 12 to 24 months our performance has been greater than most of our competitors, even among non-Black asset managers.”

FL AGSHIP LAUNCHES

It ’s a period that has seen flagship launches propelling Mianzo into the spotlight.

Mi anzo in partnership with 27four Investment Managers, launched two new retail unit trusts with fee structures that rival low-cost passive investment products, Mianzo Equity

Find out more

Through our collaborative approach and international perspective, our growing team of financial service experts provide forward-thinking solutions that helps businesses in the financial services sector comply with regulations, manage risks and transform their business.

MIANZO www.f inance-focus.net | 9

We deliver tailored services to asset management, banking, real estate and insurance clients.

INDUSTRY FOCUS: ASSET MANAGEMENT

27four and Mianzo CPI+3% 27Four.

Th e retail savings products aim to attract new inflows from historically ignored lower-income communities who can access the products for as little as R199 a month or via a R1,999 lump sum.

An d in another challenge to the asset management establishment, the products charge a management fee of just 0.55%, with no performance fees, a long cry from the total expense ratios of most

established players. Based on internal research conducted by Mianzo, the average management fee in the industry is around the 2% mark.

CO MPASS RESET

Wi th asset managers great and small suffering declines in institutional fund flows as the Covid-19 impact resulted in retrenched workers suspending monthly retirement fund contributions or accessing their funds to make ends meet, the industry has had to re-set its compass.

And with a long-term play focussed exclusively on the shrinking asset pool and increased competition within the institutional space, no longer sustainable, Mianzo has been looking to diversify its revenue streams.

Th is entails building a retail book, bringing in new investors in the lower LSM market, and ultimately playing in the discretionary savings space rather than being only exposed in the retirement space.

It would see Mianzo attracting money from savings pools that traditionally save in bank accounts rather than unit trusts, and would include public servants, women’s groups, and even street vendors.

On e of the key players here is Portfolio Manager Thembeka Sobekwa, holder of a BBus.Sci in Actuarial Science majoring in the field of Quantitative Finance, University of Cape Town.

“I n an industry dominated 99.9% by males, having Thembeka is marvellous for us internally, and we always like to celebrate these positive outcomes in terms of real-life stories,” says Isaacs.

Un surprisingly, this high launch activity has seen increased media exposure. But true to the conservative spirit of Mianzo, Isaacs takes a measured view. “We are seeing success, yet we remain humble, because what goes up can come down.

“COMPETITION IS TOUGH, AND IT TAKES A LOT OF WORK TO MOVE FROM ONE BILLION TO FIVE AND THEN ON TO 10 BILLION”

10 | www.f inance-focus.net

“We are definitely looking at expanding our product range, and on the equity side we are continually assessing various options in terms of what we can add to our portfolio without compromising our investment philosophy. That is very important.”

UP AND OUT FROM THE CAPE

As with every sector of the country’s investment business, Covid-19 and ensuing crash, hit Mianzo’s assets under management, but acumen, expertise, and resilience are deep within its DNA.

“T hrough the professionalism and dedication of the team, we regained investor confidence throughout those tough pandemic months, with existing clients topping up their investments, as well as onboarding new clients,” says Isaacs.

“O ur response also allowed us to invest in our people in the form of staff promotions, job creation in senior roles, and recruiting new staff.

“I t is not common for people to come into asset management of our size during a pandemic, because in these tough times people are inclined to play safe and stay where they are. But we have achieved this.”

According to Deputy Finance Minister David Masondo, privately held Black-owned asset managers oversee just 9% of SA’s total savings pool.

BL ACK TALENT PLATFORM

It is against this backdrop that a founding mission for Mianzo was the creation of a platform for

talented Black students to learn and receive mentoring and grow.

“S outh African universities are full of such talent. 90% of the people interviewed at Mianzo for an analyst position are Black students, and our criteria is that, on an equal skill set, we will prioritise the student that comes from a disadvantaged background.”

It is a recruitment and training programme that is driving increasing success.

“We have a unique set of investment professionals, a team that remains firm on the principles of our investment philosophy, advancing our continuing success, and with the passion, dedication and commitment to ensure that we operate in the best interest of our clients and our business, based on our pedigree, and the leadership that is steering the Mianzo ship,” Isaacs concludes.

WWW.MIANZO.CO.ZA

MIANZO www.f inance-focus.net | 11

“IN AN INDUSTRY DOMINATED 99.9% BY MALES, HAVING THEMBEKA IS MARVELLOUS FOR US INTERNALLY”

STEADFAST IN QUEST TO TURN KNOWLEDGE INTO WEALTH

“We are a leading South African financial services provider offering highly specialised, fiercely independent financial advice, products and services,” sets out NFB Financial Services. With in excess of R30 billion in assets under management and more than 35 years of experience NFB is there at every step to help clients achieve objectives, from growing and preserving wealth to maturing into the golden years of retirement.

NFB FINANCIAL SERVICES

PRODUCTION: William Denstone

www.f inance-focus.net | 13

INDUSTRY FOCUS: WEALTH MANAGEMENT

NFB’s financial advisors are, to a man and woman, industryleading experts placed to offer independent financial advice, products and services to high worth individuals, trusts, businesses, and institutions. “We have a history of bringing shared wealth opportunities to fruition,” it asserts, of its mission to help grow and nurture assets. “We use hard won experience along with new age due diligence to achieve exceptional results for our clients.

“We partner with you to achieve financial fulfilment, and have an instinct for growth.”

Since 1985 it has been using this combination of expertise and intuition to establish and affirm its position as one of the country’s leading broadspectrum financial services businesses, with its wisdom employed by all major registered South African, and a select number of preferred international, financial institutions in the banking,

insurance, listed equity, government and quasi-government sectors.

“Planning is the most important step in achieving,” NFB states, adding that such an ethos has arguably been more critical than ever before in its nearly four-decade lifetime. “When times are tough, a consistent, structured approach to financial management is necessary. Tough economic climates call for preparation and resilience to achieve results.”

UN WAVERING DEDICATION

Now with more than 130 employees nationwide, with some R30 billion of assets under management and boasting an incredible 98% client retention rate, NFB occupies a dominant position in SA private wealth management. Enterprise Africa asked NFB’s sole remaining founder and Chairman Mike Estment to talked us through the company’s astounding development under his leadership,

right from its establishment in offices in Port Elizabeth and Cape Town.

“There were five of us in the beginning,” he recounts. “The rationale behind the creation was to have something we owned as opposed to something we worked for. We were all into wealth management and we all came from banking backgrounds, so we wanted to establish something that had a long-term legacy and wealth creation opportunity both for ourselves and others, and it’s worked out rather well.

“I t certainly hasn’t happened without headwinds,” Estment

“TOUGH ECONOMIC CLIMATES CALL FOR PREPARATION AND RESILIENCE TO ACHIEVE RESULTS”

14 | www.f inance-focus.net

qualified. “I like to climb mountains and remember the party at the top rather than the very tough bit between base camp and the summit, but it has been challenging.”

The NFB approach is centred around an unwavering dedication to its craft. “Financial expertise starts with a relationship,” it outlines. “We take great care in understanding our clients, getting to know their story and their specific financial objectives; so that we can guide their journey with care and insight.” The truly tailored client experience is one of

the main reasons cited for such impressive customer loyalty over NFB’s long lifespan.

“Each financial journey is unique,” it acknowledges, “and requires a bespoke service offering aligned to the client’s distinctive lifestyle and future ambitions. We are also proudly independent which allows us to be unbiased in the crafting of a solution-based financial management strategy for clients, matching the top product offerings on the open market to their needs, without compromise or institutional lock-in.

“O ur highly-qualified specialists advise and arm clients with the knowledge and insight they need to make informed decisions.”

Th e devotion of its customers speaks loudly of the quality and expertise on offer at NFB, and while this is easily affirmation enough of the strength of its service it

has nonetheless been endorsed countless times over the years by the most prestigious awards in the industry. Taking home a trio of gongs at the 2019 Intellidex Top Private Banks & Wealth Managers Awards was matched by similar acclaim for NFB Asset Management, as it again outperformed its peers to win the Raging Bull Certificate for Top Performance for its Ci Stable Fund.

“These awards are testament to the uniquely personal relationships our advisors have with their clients,” Estment assessed. “We focus on simplifying the complexity of wealth and portfolio management for our clients while delivering exceptional value. This recognition and exceptional achievement would not be possible without the extraordinary team at NFB.

Visit www.glacierinsights.co.za for more information. RETIRE WITH CONFIDENCE Glacier by Sanlam. Leaders in retirement solutions. Glacier Financial Solutions (Pty) Ltd and Sanlam Life Insurance Ltd are licensed financial services providers. NFB FINANCIAL SERVICES www.f inance-focus.net | 15

“NFB IS USED AS BENCHMARK IN THE FINANCIAL MARKETS OF SOUTH AFRICA”

INDUSTRY FOCUS: WEALTH MANAGEMENT

“N FB has built an enviable reputation in the industry, one in which we and our customers take great pride in. Intellidex is an influential barometer of the wealth management market in South Africa. Being able to win three awards, including the main category award, illustrates our effectiveness and understanding of how best to provide holistic financial services.”

MAINTAINING FOCUS

NF B’s longevity, unbending commitment and obvious success has been driven by a fiercely entrepreneurial spirit, and one that never omits to acknowledge the value of teamwork. “We are exceptionally proud of our long-serving people who collaborate effectively across business skill sets, to ensure that every decision made for you is the best possible one,” enthused Estment.

“My experiences and personal beliefs have had me lead NFB in a certain direction, very ably and strongly supported by a crop of leadership that has been remarkable. This has left me with a deep belief in the value of teams,” he elaborates. “The kaleidoscope of people each with their skills and backgrounds, are enabled to have a voice and make a difference, this is a massive strength to NFB. Every NFB employee, from our directors to our drivers and ops teams, has combined to grow, make safe and maintain our various businesses.”

NFB will be able to draw on this wealth of knowledge and ingrained spirit of teamwork in leading the fightback in months to come. In trying times, a consistent, structured approach to financial

16 | www.f inance-focus.net

“OUR HIGHLY-QUALIFIED SPECIALISTS ADVISE AND ARM CLIENTS WITH THE KNOWLEDGE AND INSIGHT THEY NEED TO MAKE INFORMED DECISIONS”

management becomes crucial, and such circumstances are but further opportunity for NFB to prove its worth, drawing on every ounce of its history and know-how to help steer clients through this significant turbulence.

“Tough economic climates call for preparation and resilience to achieve results,” NFB elucidates. “When markets are volatile and confidence is low, searching for reassurance is human instinct. Your path to future

certainty lies in a financial plan crafted by a team of professional wealth managers and financial planners with the skills, knowledge and independence to empower you with the security you seek and the financial rewards you’ve earned.

“E verything we do is focused on making our clients happy and keeping them with us for the long term,” Estment wraps up. “The last nearly 40 years are peppered with

experiences and remarkable business and personal growth, and I stand proudly as chairman and active wealth managers as we now feel able to look forward to supporting our new leadership and all our customers.

“We are so lucky to have built a business capable of sustaining itself in the situation we find ourselves in at present. NFB is used as benchmark in the financial markets of South Africa, and we will move forward now by always going the extra yard to protect our clients and exceed our responsibilities through service, excellence and avoiding pitfalls.”

WWW.NFB.CO.ZA

NFB FINANCIAL SERVICES www.f inance-focus.net | 17

“WE FOCUS ON SIMPLIFYING THE COMPLEXITY OF WEALTH AND PORTFOLIO MANAGEMENT FOR OUR CLIENTS WHILE DELIVERING EXCEPTIONAL VALUE”

GAIA

CATALYSING THE AFRICAN INFRASTRUCTURE INVESTMENT LANDSCAPE

Attractive South African and sub-Saharan African opportunities, which deliver investors predictable, inflation linked and long-term cash yielding returns: this is the Gaia proposition. Providing access to both listed and unlisted investment vehicles, Gaia has pioneered infrastructure as a viable asset class and now looks to secure its position as its leader across sub-Saharan Africa, says CIO Hendrick Snyman.

PRODUCTION: William Denstone

18 | www.f inance-focus.net

Tsitsikamma Community Wind Farm © Stefanie de Beer – “Line of Sight”, 2015

Tsitsikamma Community Wind Farm © Stefanie de Beer – “Line of Sight”, 2015

INDUSTRY FOCUS: INVESTMENTS

record,” Snyman says of the small but perfectly formed team undertaking these lofty feats, before going on to detail Gaia’s formation and its genesis in recognising untapped potential.

AS SET CLASS PIONEERS

To understand Gaia, it is essential to know where we came from,” he begins. “Gaia was founded when South Africa initiated its renewable energy programme, and began developing greenfield wind farm projects.

“D uring the development of these sites, the financially skilled engineers who were overseeing the projects, all with backgrounds in the investment and corporate finance space, realised that the cashflows that emanate from infrastructure projects are very well-suited to pension funds and life products.

“From the original company that developed these wind farms Gaia was then founded, with the goal of mobilising institutional long-term capital into sustainable infrastructure projects. We exist to facilitate financial flows, in order to invest in infrastructure and, in so doing, open up reciprocal benefits: for investors, of course, but for the country, in terms of the National Development Plan and the intrinsic link between infrastructure and economic growth, and therefore poverty alleviation.

“We want to deploy long-term capital in infrastructure to match investors’ requirements with what infrastructure can deliver for them.”

Established in 2012 as a specialist asset manager, Gaia focuses exclusively on facilitating the investment of long-term investor capital in infrastructure and agriculture investments in Southern Africa.

“We pride ourselves on our unique engineering, project development and finance skills to execute upon the investment options throughout the project lifecycle,” introduces Hendrik Snyman, Chief Investment Officer.

To date, Gaia has deployed its

unique approach to invest nearly R4 billion through more than 20 transactions. These are in turn spread across nine utility-scale renewable energy projects, among them a toll-road, fibre optic network infrastructure and a litany of farming and agriprocessing initiatives.

“G aia comprises highly skilled actuarial, engineering, project development, and investment professionals with a demonstrated investment performance track

Ga ia has been an innovator in the specialist secondary infrastructure transaction space in South Africa, having concluded a number of firsts and record deals to date. “The renewable energy programme was probably the first opportunity that external investors had to gain access to this very new asset class,” Snyman explains, “and Gaia has been a pioneer in convincing South African institutional investors to support it.

“We did the first secondary, or brownfield, transaction within South

20 | www.f inance-focus.net

Tsitsikamma Community Wind Farm © Stefanie de Beer – “Line of Sight”, 2015

INVESTMENT SPACE”

Africa in 2015, and have gone on to complete a further 12 renewable energy secondary transactions in the country.”

Ma ny have attempted to follow in Gaia’s footsteps, but the company has a key differentiator over the competition, according to Snyman.

“We are the best team out there,” he recognises, “and unique in that we are exclusively engineers that have come from the development landscape and,

as a result, deeply understand it from the grassroots up.”

Wi th access to electricity in sub-Saharan Africa becoming ever-more critical in the fight to rise above poverty and nearly 600 million currently without, Gaia has been selected as one of five funds by the International Climate Finance Accelerator (ICFA) Luxembourg to replicate its success within the continent. Africa has been identified as a key tipping point in sustainability, being home to 17% of the world’s population and possessing seven of the top 20 fastest growing economies, as well as 17 of the top 20 fastest growing cities.

De spite the challenges it presents, it also has a young population and arguably the greatest renewable energy

potential in the world which, considering predictions that its energy consumption will quadruple over the next 20 years, makes it vital to energise in a cleaner, more sustainable manner. “Africa’s contribution to climate change has been the least but, as we chart our economic future, Africa must be central to the global climate solution,” warns the Intergovernmental Panel on Climate Chang (IPCC), as the Gaia Africa Climate Fund looks to catalyse an infrastructure development snowball and, in turn, develop a sustainable local industry.

SUSTAINABLE INVESTING

Ga ia’s strategic aim is to replicate what is has achieved to date throughout the remainder of sub-Saharan Africa,

GAIA

“WE WANT TO BE THE BE THE BRAND LEADER, FIRST MOVER AND INNOVATOR IN THE INFRASTRUCTURE

The Office group of companies offers a range of multifaceted administrative services for high-networth families, trusts, individuals & select businesses. Finally, a collective solution to meet all your administrative needs 021 8829872 Property management Social Responsibility & Philanthropy Trust Administration Accounting & Administrative Support Company Secretarial Corporate Governance Human Resources www.theoffices.co.za admin@theoffices.co.za www.f inance-focus.net | 21

INDUSTRY FOCUS: INVESTMENTS

Snyman elaborates. “Primarily, this will entail a continuation of our current investment themes, specifically targeting climate infrastructure such as solar and wind electricity generation and transmission, sewage and water reclamation. What will explicitly link all these projects is stable cash flows for Gaia’s investors, allowing project developers to recycle their capital and develop new projects to the benefit of the continent and its people.”

Th is is another factor emphasising Gaia’s long-term commitment to sustainable investing, in tandem with the 17 interlinked goals set in 2015 by the UN General Assembly, to achieve a better, more sustainable future for all. “The goals have a range of desired outcomes, including food and water security,

poverty reduction, healthy living and climate action,” Snyman details. “We desperately need to promote prosperity for all, and protect our planet. Gaia has taken hold of the flame, and our investment mission is aligned with the fundamental principles of sustainability.”

On e of Gaia’s most recent developments is the Fibonacci Fibre Fund, designed to offer investors attractive risk-adjusted returns, again based on stable cash flows and annual distribution growth in line with inflation. “We are investing in fibre networks which are de-risked to such a degree that it is an attractive proposition to investors seeking to minimise risks, and to harvest the cash flows from these assets,” Snyman says of this exclusively South African fund, in contrast to the sub-Saharan

scope of its infrastructure bedfellow.

“The fund will only acquire premium sites which have already achieved a minimum uptake of 25%, with the probability that at least 40% of potential clients will sign-on to the network. This investment process mitigates many of the construction risks,” he elaborates. “The fund’s resilient and stable cash flows provide

“GAIA HAS BEEN A PIONEER IN CONVINCING SOUTH AFRICAN INVESTORS TO SUPPORT INFRASTRUCTURE AS AN ASSET CLASS”

22 | www.f inance-focus.net

Tsitsikamma Community Wind Farm © Stefanie de Beer – “Line of Sight”, 2015

Linteg, Fibre is extremely proud to be associated with the GAIA Group, as they are pioneering fibre infrastructure as an asset group on the continent.

With our world class leading technology stacks, Linteg provides a full turnkey infrastructure management service like no other. As the fibre network operator we manage the entire customer and investor journey through transparency and awesome customer service to the end users. Established in 2011 with the initial focus on providing micro-trenching and network build services for all major mobile operators, we have leveraged our technical expertise and focus on innovation and superior customer service to grow our footprint throughout the country. Today we provide a wide range of services to an ever expanding roster of blue chip clients. At Linteg we believe in “Connecting homes and not just passing them”

Giles Marshman (CEO) of Linteg says: "Our goal is to provide our clients with a single electronic turnkey solution that brings multiple benefits. By thinking outside the box where fibre is concerned we’ve unlocked benefits far beyond mere data. This is how Linteg Fibre can today offer a far broader range of connectivity services to our clients."

excellent diversification benefits, while the exclusivity of the fibre networks allows the fund to act as toll operator for growing data consumption.”

SECURING A FOOTHOLD

Having pioneered the viability of an entire asset class and led the way in sustainable investing to promote a positive environmental, social and governance impact, Snyman tells us that Gaia will now cement its position as the example to follow in infrastructure investment.

“A s a company we want to

establish a foothold as the best independent secondary transaction investor in South Africa,” he outlines. “There are a number of companies that do what we do, but they are connected to the larger institutions and so although they are ‘independent’, their capital comes from their parent companies.

“We want to be the be the brand leader, first mover and innovator in the infrastructure investment space, truly independent of a large institution. In the greater sub-Saharan region, we would like to catalyse the

infrastructure investment landscape. “We are committed to proposing a solution that encompasses a positive environmental, social and governance impact,” Snyman reasserts. “Our aim is to prove the case of Africa as an infrastructure investment destination, and to show that it is not as risky as it might be perceived in order to crowd in investors in the development cycle. In this way, we will be integral to enabling Africa to develop to its full potential.”

l 010 592 1857

www.lintegfibre.com

WWW.GAIA.GROUP

www.f inance-focus.net | 23 GAIA

“WE DEPLOY LONG-TERM CAPITAL IN INFRASTRUCTURE TO MATCH INVESTORS’ REQUIREMENTS WITH WHAT INFRASTRUCTURE CAN DELIVER FOR THEM”

STANDARD BANK

THE BEST BANK IN AFRICA, OFFICIALLY

Standard Bank Group (SBG) is no stranger to recognition of the quality of its provision, and this year has been no different. Battling extraordinary circumstances it has emerged triumphant, and now looks to future-proof itself through a continued evolution into a digitally-enabled, diversified services organisation. “Africa is our home, and we drive her growth,” sets out Sim Tshabalala, Group CEO SBG.

PRODUCTION: Benjamin Southwold

24 | www.f inance-focus.net

INDUSTRY FOCUS: BANKING

We are a proudly African, integrated financial services group with compelling competitive advantages,” SBG explains, “providing banking, insurance, investment as well as non-financial complementary solutions that drive the financial wellbeing of our clients at every stage of their financial journey.

“Our differentiator,” it continues, “is our long-term commitment to Africa, our home, underpinned by a heritage of over 150 years on the continent.”

Pushing economic growth has been a pursuit which has extended across the African continent and beyond through the group’s multiple divisions. “As a connected, real economy bank, our insight and experience helps unlock opportunities and mitigate risk for our broad range of clients,” SBG underlines. “Standard Bank has a proud history of serving clients and supporting economic development across Africa as the largest financial services group on the continent.”

SIMPLY AFRICA’S BEST

Standard Bank operates in more than 20 countries in Africa and abroad, a worldwide presence consisting of an integrated suite of end-to-end wealth management services and banking solutions. Fittingly, it was the prestigious Global Finance that bestowed upon Standard Bank Group the ultimate honour of best bank in Africa in the 28th annual World’s Best Banks listing, as well as in both South

Africa and Uganda, individually.

Performance over the year at hand is a major factor in consideration of the worthy winners, alongside multitude other criteria including reputation, management excellence and leadership in digital transformation and corporate citizenship.

“To be recognised in this way by Global Finance is a great honour for the Standard Bank Group,” enthused CEO Sim Tshabalala. “Over the past year we have had to work even harder than usual to support our employees, clients and communities during difficult circumstances. I’m delighted to accept this award in grateful recognition of the excellent work done by my dedicated and resilient colleagues throughout our business.

“These awards are testament to the trust placed in us by our clients, and as we look forward towards 2022, we’re focused on creating more solutions for our clients across Africa and helping them achieve their goals.”

Standard Bank’s deep understanding of the continent, the product of its more than 150 years of business in Africa, was acknowledged as central to its performance during the Covid-19 pandemic and key initiatives underway in its operational markets, such as its OneFarm platform. Highlighted for specific praise, OneFarm Share has partnered

with HelloChoice, a digital agritrade platform, and FoodForward, a beneficiary network, to match excess produce from farmers with certified food recipients.

As a result, food is procured at a reduced cost or donated by farmers and then provided to beneficiary organisations, allowing OneFarm to have already provided six million meals to people across South Africa.

Global Finance also singled out Standard Bank’s partnership with Salesforce for praise, its initiative to power the group’s digital platform and service the bank’s ecosystem of clients. “The partnership between Standard Bank and Salesforce will allow both organisations to cocreate bespoke solutions for clients,” SBG detailed, “also enabling them to create solutions themselves by partnering with the Group’s service providers and vendors.”

“WE’RE FOCUSED ON CREATING MORE SOLUTIONS FOR OUR CLIENTS ACROSS AFRICA AND HELPING THEM ACHIEVE THEIR GOALS”

26 | www.f inance-focus.net

“WE ARE FOCUSED ON ENSURING THAT WE REMAIN RELEVANT BY OFFERING MORE OF THE SERVICES AND SOLUTIONS THAT OUR CLIENTS NEED”

INDUSTRY FOCUS: BANKING

STRATEGY DRIVES TRANSFORMATION

The innovative bent of the business saw Standard Bank again among the big winners, this time at the 2021 World’s Best Digital Banks Awards in Africa, selected for multiple awards across seven categories including Best Consumer Digital Bank in South Africa and Best Corporate/Institutional Digital Bank in Africa for both Trade Finance Services and for SME Banking.

“Over the past few years, Standard Bank has made significant structural changes to better serve clients,” the group stated, and it has paid off in multiple areas including the strength of

its strategy for attracting and servicing digital customers, breadth of product offerings and evidence of tangible benefits gained from digital initiatives.

“These shifts have allowed the Group to realise a more seamless delivery of financial services to its diverse customer base, reduce time and costs, and allow the organisation to innovate more quickly and efficiently.” The Covid-19 pandemic has only served to accelerate the rate of this change, and despite the obvious challenges, the crisis has presented numerous opportunities to problem solve, be creative and be innovative.

“With the global pandemic

forcing people to conduct their personal and professional banking activities from their phones, tablets and computers, digital banking took on an importance and prevalence far beyond anything that had come before,” said Joseph Giarraputo, publisher and editorial director of Global Finance.

“We will continue leveraging our scale advantages and strengths to defend and grow our current position in the market, while accelerating toward our 2025 ambition of becoming a client-centric, digitally-enabled platform business,” responded Adrian Vermooten, Chief Innovation Officer at Standard Bank Group. “We are creating new solutions and new partnerships to serve our clients better and grow our revenues across Africa, our home. These awards are testament to the excellent

28 | www.f inance-focus.net

“OVER THE PAST FEW YEARS, STANDARD BANK HAS MADE SIGNIFICANT STRUCTURAL CHANGES TO BETTER SERVE CLIENTS”

leadership within the organisation and our incredibly committed employees who have been walking this digitisation journey with us.”

FUTURE-READY

“The financial world is evolving rapidly,” Tshabalala says, “and we are excited about the opportunity that this presents to the group. We are focused on ensuring that we remain relevant by offering more of the services and solutions that our clients need.” Accelerating the execution of its strategy to become future-ready, SBG has already made significant internal structural changes, with the revised segments serving clients using all the preferred physical and digital channels.

The next phase of the existing business strategy will build on the substantial investments already

made by the Group into employee development, digital technologies, infrastructure upgrades and strategic partnerships in recent years.

“Transforming Standard Bank Group from a traditional financial institution to one that is defined by modern innovation will enable it to deliver on the promises made to help Africa grow, develop and fulfil its potential,” SGB declares.

It seems to be working, with the interim results for 2021 reflecting a recovery in client activity, an improved outlook and the strong momentum in the underlying business. Headline earnings were up 52%, while return on equity (ROE) rose from 8.5% to 12.9%. The group’s capital position also remained robust, with a common equity tier 1 capital adequacy (CET1) ratio of 13.5%.

“The first six months of 2021

STANDARD BANK

were another exceptionally difficult period for many of our clients, staff and stakeholders,” commented Tshabalala, “but we are now hopeful that the worst phase of the pandemic is behind us.

“Our underlying business has strong momentum and, relative to this time last year, we have seen a recovery in client activity, an improved outlook and lower impairment charges. The global backdrop is expected to remain favourable, supported by sustained low interest rates, continued fiscal stimulus and consumer demand. We look forward to building on the progress we have made in 1H21 and remain steadfast in delivering on our purpose.”

WWW.STANDARDBANK.COM

www.f inance-focus.net | 29

30 | www.f inance-focus.net

OUTSURANCE

OUT-OF-THIS-WORLD SERVICE WHEN YOU NEED IT MOST

PRODUCTION: William Denstone

For more than two decades, OUTsurance has provided innovative, value-for-money insurance products developed with the needs of South Africans at the centre. “Disciplined underwriting and risk selection, great customer service and deep technology and data skills - these are our key differentiators,” sets out CEO Danie Matthee, and it is working, with growth, strength and recognition all continuing to come OUTsurance’s way.

www.f inance-focus.net | 31

INDUSTRY FOCUS: INSURANCE

To day comprising some 5000 employees and South Africa’s third-largest insurance group, OUTsurance was launched in 1998 as a wholly-owned subsidiary of Rand Merchant Investment Holdings (RMI Holdings), a South African based financial services investment holding company. A main campus in Centurion, Pretoria is staffed by nearly 4000, with the remainder spread across offices in the likes of Cape Town, Johannesburg, Durban and Gqeberha.

“From an African perspective,” begins CEO Danie Matthee, “our focus remains very much on the South African markets, where we still consider that we have very strong growth opportunities.” This

has not prevented this ambitious, young company from establishing subsidiaries in Namibia and even Australia – in the form of ‘Youi’, which was successfully launched in 2008.

Si gnificantly expanding its scope since formation, OUTsurance’s offering now encompasses the full breadth of short and long-term insurance, as well as investment products, to individual and corporate customers. In 2010, the group also launched OUTsurance Life, to enable it to offer fully underwrite life insurance products in South Africa, as well as funeral and endowment products.

GROWTH DESPITE DISRUPTION

A crisis such as Covid-19 affects all business sectors, but for the insurance industry there have been some unique challenges to broach, from employee and business continuity issues to client service considerations to the financial outlook. Amid intermittent lockdowns, anxiety and stress surrounding the virus and tough economic circumstances Matthee details how the group

has remained both strong and, impressively, growing.

“We have been really fortunate as a business to have not had to let anyone go during this period of time,” he says. “In fact, we have grown our headcount by close to 800 people in net terms over the last 18 months.

“From a consumer perspective there has been a concerted trend of being cost-conscious and downbuying, particularly when it comes to vehicle insurance, but overall, barring these visible consumer stresses, we are really proud of how we have managed to navigate Covid-19. Not only from a staff point of view, evidenced in our increased personnel numbers, but whether with premium relief, or claims payments for business interruption during hard lockdowns, for example, we have offered incredible support to our customers when they have needed us most.”

As sistance which has gone beyond the borders of the business, OUTsurance also moved nearinstantaneously to commit R102 million in March 2020 to help in

32 | www.f inance-focus.net

“WE ARE THE LARGEST DIRECT INSURER IN SOUTH AFRICA BY SOME MARGIN”

South Africa’s time of greatest need, in support of clients, service providers, the healthcare sector and the Solidarity Response Fund. “With decisive leadership, togetherness and community support, we will emerge stronger,” Matthee said at the time.

“O f paramount importance to us is the safety and well-being of our staff and partners who work with us, while making sure that our clients are assisted. As a major South African financial services company, we have a

social responsibility to contribute to the fight against this debilitating virus and its devastating economic impact.”

Then followed in July of this year another vital operation under OUTsurance’s ‘Staff Helping SA OUT’ banner, seeing it join the RebuildSA movement by donating more than 60 tons of food to riot-stricken areas in KwaZulu-Natal. “This is a time where we have to join hands and help wherever we can”, explained Matthee. “We’re always looking for ways to uplift those in need and create social change. OUTsurance is a special place to work and is full of exceptionally caring people.”

SE RVICE SETS IT APART

“The business is in good shape in the face of enormous obstacles and tragedy,” Matthee is able to relate, “and to have been able to continue to focus on

OUTSURANCE

growth, and on disciplined underwriting and cost management, without the need to downscale our staff or affect anybody’s salary negatively is something from which we draw real pride.”

In an extremely competitive and ever-changing marketplace, filled to the brim with competent competitors, there is one factor that he feels is of paramount importance to keeping OUTsurance at the top. “The enduring competitive advantage that we retain is the ability to offer our customers great value for money, backed up by fantastic expertise and care,” he rounds up. “We think that the quality of our service is a significant differentiator in this tough field.”

Th e 2020 Consumer Satisfaction Index (SAcsi) for short-term insurance

Continues on page 58

“WE HAVE OFFERED INCREDIBLE SUPPORT TO OUR CUSTOMERS WHEN THEY HAVE NEEDED US MOST”

www.f inance-focus.net | 33

THESL: IMPROVING LIVES THROUGH EFFORTLESS AND FAIR CONTENTS CLAIMS

“With our range of trusted products and solutions, we automate the replacement process as much as possible to ensure that claims are settled as quickly and efficiently as possible”

Thesl is a leading insurance industry partner, delivering claims processing and settlement so that positivity can be returned to negative situations.

Possessions are broken, lost and stolen – that’s life but that does not have to be the end of the story. Thesl, which stands ‘For The Silver Lining’, aiming to be the good in a bad situation, works with insurance providers, including OUTsurance, to ensure the claims process is efficient, effective, and fast.

By utilising best-in-class technology, Thesl can, often instantaneously, evaluate and act on claims to ensure the best possible outcomes for policyholders.

“We’ve been working with OUTsurance for the past five years,” explains Thesl CEO Craig Rawraway. “We facilitate the quantification and settlement of household contents claims. We provide the ability to value a claim and then settle it on behalf of the policyholder.

“Typically, when an item is lost, broken or stolen, the policyholder contacts OUTsurance to lodge their claim and they would, where required, ask us to assist with identifying the item of loss correctly, get best pricing from multiple reputable suppliers, and to potentially facilitate replacement for the policyholder in the most seamless way possible.”

With more than a century of combined insurance industry experience behind it, the team at Thesl are now looking forward, with a view to incorporating technology to ensure an even more efficient delivery for end-users.

“In the near future, it will be common practise for a claimant to use a mobile device to lodge their claim which we can, through our data set and algorithms, quantify instantaneously and automatically issue a buying voucher or a virtual card to spend at a store of their choice. It’s about streamlining and minimising the input so that the claim is settled as quickly and efficiently as possible,” says Rawraway.

Offering solutions which includes TenderSystem to quantify claims, as well as settlement mechanisms such as ClaimsCard, mobile vouchers and purchase orders, efficiency is the end-goal for this business – formed to bring ease, simplicity and automation to the claims process. Right now, the company is close to finalising the build of a fully automated claims process, removing multiple interventions where possible and saving even more time and money for insurers.

“We are busy piloting parts of that process” details Rawraway, “and have built a new system to ensure our data engines and data mapping is accurate. When a claim comes in, we must be able to accurately identify an item, which is mapped against our extensive product data set built up over many years. Once identified, a succession mapping process ensures the policyholder is provided with the best available replacement option. Our system then maps this to live pricing from multiple feeds and recycle quotes from various suppliers so that we can give instantaneous responses. This will reduce turnaround times and increase efficiencies, ultimately lowering the cost of claims.”

Offered on a Software as a Service (SaaS) model, Thesl’s service relieves pressure on handlers when processing complex and, sometimes, high-value and multiple item claims allowing them to offer better service to the claimant.

“We have a great working relationship with OUTsurance as we are both innovators,” says Rawraway. “Our goal is to get the best result for our client. They, like us, are a data driven company, and therefore we focus on providing them relevant data sets, which facilitates providing the most value adding replacement solution for their client base.”

By constantly rolling out innovative solutions, Thesl continues to achieve its goal of leveraging product data to promote efficiency and improve situations for policyholders and all stakeholders across the claims process.

34 | www.f inance-focus.net

IMPROVING LIVES THROUGH EFFORTLESS AND FAIR CONTENT CLAIMS

EVERY “AAARGH” SITUATION NEEDS A SILVER LINING

It is said that every cloud has a silver lining; even the darkest clouds on the gloomiest days hold the shimmer of hope and possibility. Thesl stands for “The Silver Lining” as we want to be the good in the bad situation that clients find themselves in. We are a financial technology company that knows that when you focus on possibilities, you’ll have more opportunities.

With Thesl, your shortcut to easy just became an opportunity. With our range of trusted quantification and settlement solutions, we automate the replacement process to ensure that your content claims are settled as efficiently as possible

www.thesl.co.za | hello@thesl.co.za

021-8525420 | 0861-252467 (CLAIMS)

EFFICIENT PROCESSES COST SAVING TIME SAVING HAPPY CLIENTS

INDUSTRY FOCUS: INSURANCE

Continued from page 55

polled 2600 customers across major South African during the second half of 2020, with the results corroborating the perception of what Consulta calls, ‘an industry where competition between players is fierce, with the difference between the top four scoring brands on customer satisfaction score barely more than a single index point’.

“For the first time in the history of the SAcsi, the Short-term Insurance SAcsi score overtook the Banking SAcsi score, which has traditionally performed at a very high level,” it explained. OUTsurance was pitted against true industry heavyweights such as Auto & General, Discovery, Momentum, Old Mutual and Sanlam, and, with a score of 82.3, succeeded in scooping the top spot in the overall customer satisfaction measure. It is unique among the swathes of companies also vying for the honour in demonstrating consistent yearon-year improvement in its customer

satisfaction score from 2016, finally cementing the leading position in 2020. No t only ranked number one for customer satisfaction out of all the major short-term insurers, adds Matthee, OUTsurance’s approach also incurs very few grumbles from its customers. “We are fortunate in South Africa to have the ombudsman for short-term insurance, for example,

“OUTSURANCE IS A SPECIAL PLACE TO WORK AND IS FULL OF EXCEPTIONALLY CARING PEOPLE”

36 | www.f inance-focus.net

and for the last six or seven years consecutively we have had the fewest complaints referred by consumers compared to our peers. Our service is top-rated by the readers of numerous newspapers, including The Star and City Press, and we have won numerous awards relating to our service delivery.

“This is truly part of our DNA, and embedded into everything that we do,” Matthee furthers, and is backed by deep technology skills and capabilities. “We already consider ourselves something of an Insurtech,” he details, “and the tech that we employ in our business is all

self-built, proprietary and built to serve a specific purpose. We are able to construct processes and systems that allow us to give customers better services, and use customer feedback to continuously improve.

“Looking at our business mix,” Matthee summarises, “we are predominantly a largely personal lines motor and household insurer which provides in the region of 70% of our premium income, and this makes us the largest direct insurer in South Africa by some margin.” Some of the most glaring opportunities looking forward, he adds, are those that OUTsurance has identified in the commercial insurance space.

“We already have a great business here, made even stronger by our heavy investment over the last three years to build face-to-face distribution. We recognised that often SMEs need someone to come in and really understand how their business works, and offer a much less commoditised product as a result.

This is a big area of growth and opportunity for us in the next three to five years,” he states.

“We have just over a million existing clients to take care of, however,” Matthee stresses, “and this existing business will continue to receive the primary focus that it merits.

“After all, we are in an industry of trust,” Matthee concludes, “and it is essential that we give the consumer confidence in the economic value we can add by protecting their assets and balance sheets through insurance. In our sphere there is no tangible product in return for the payment of a premium, essentially we sell people a promise. What they can rely on is we are a committed, trusted and deeply skilled organisation that is there for you when you need us most.”

WWW.OUTSURANCE.CO.ZA OUTSURANCE

www.f inance-focus.net | 37

“WE THINK THAT THE QUALITY OF OUR SERVICE IS A SIGNIFICANT DIFFERENTIATOR IN THIS TOUGH FIELD”

AVBOB

INCOMPARABLE CARE AND COMPASSION IN TIMES OF COVID AND BEYOND

One of South Africa’s best-known and most trusted funeral service providers, AVBOB exists to ensure that the lives of loved ones are honoured with special nurturing, sensitivity and care. The pandemic has ripped through the country and torn apart families; what AVBOB has been able to do, explains CEO Carl van der Riet, is take the spirit of care and compassion cultivated throughout its unique lifetime, stand at the focal point of the trauma and help move people through the devastation and grief.

Established in Bloemfontein in 1918, AVBOB has grown over a century into Africa’s largest Mutual Assurance Society, with around 7000 staff providing a one-stop shop for funeral insurance and funeral service.

Partly due to its relative affordability, funeral cover has an exceptionally high penetration rate, and of the approximately 55 million population in South Africa, currently more than 7.6 million lives are insured by AVBOB.

“AVBOB as a mutual insurance society is the pacesetter in the funeral industry,” the group states. Across its three operating divisions it provides a comprehensive range of funeral products and services to meet the wide-ranging needs in the market, a full funeral and cremation service via a network of highly-trained staff and a factory in excess of 14,000m² where an

PRODUCTION: Timothy Reeder

38 | www.f inance-focus.net

“AVBOB AS A MUTUAL INSURANCE SOCIETY IS THE PACESETTER IN THE FUNERAL INDUSTRY”

INDUSTRY FOCUS: INSURANCE

extensive range of coffins, wreaths and fittings is manufactured.

Of course, death and the associated funeral is not something one wants to ponder at length or often. However, even in circumstances not akin to those we have seen since March 2020, in reality every person will at some stage go through this process, and in South Arica a high mortality rate together with the level of importance placed on funerals by the majority of the population, have combined to give rise to a large funeral services industry.

The sub-sectors within the industry

are substantial too, among them a vibrant funeral supplies sector provides such items as family cars, flowers, catering and clothing. The funeral service market operates on a national level as well as regional and local levels.

Elaborate burials are still a significant status symbol to many in South Africa, spawning a funeral insurance industry valued at somewhere between R7.5bn and R10bn per annum. A funeral can be a hugely expensive exercise - costing anything from R12,000 to R100,000 - and as such it is today the most popular insurance cover in South Africa.

UNIQUE IN APPROACH

“Ours is the largest funeral service operation in the country,” AVBOB CEO, Carl van der Riet, states. “We are national, with around 350 branches across the country targeting low, middle- and high income markets. More than simply the biggest, being an integrated insurance and funeral service operator makes us truly unique in the country. Where other insurers stop at the point of a claim, that’s where our

full-service kicks in and we fulfil the complete need of our clients.”

“The second way in which we are unique is that we are a mutual,” van der Riet adds. “In South Africa, contrary to the UK or Europe, this is really rather rare; there remain only a very small number of mutual insurers in South Africa. With it comes the absence of shareholders - instead we are entirely owned by our members, the policyholders.

“All of the excess profits generated from operations and investments, are returned to the policyholders through special bonuses and free funeral benefits. This is a unique model in South Africa and it makes our goals very focused and aligned; we do not have split loyalties between extracting value for shareholders and trying to provide value to customers - everything is focused on the policyholders.”

The approach has been crucial in shaping the company, van der Riet stresses. “Our mutual ethos pervades everything that we do.”

This ethos has another important

“WE PROVIDE A MECHANISM FOR FAMILIES TO PROCESS GRIEF, AND TO TRANSITION THROUGH THAT EXPERIENCE”

40 | www.f inance-focus.net

Now is not the time to sit by idly.

Now is the time to question.

The time to challenge.

Now is the time to act.

To believe in something bigger than ourselves.

Now is the time to help small business.

Big business.

And nurture new business.

Now is the time to put our money where it matters.

By investing R2,25bn of our own capital.

To jumpstart the economy.

To keep business doors open.

And keep food on the table.

Now is the time to plan.

We know the importance of keeping as many businesses going as possible. That’s why we’re actively supporting businesses that have been negatively impacted by COVID-19 by creating the Sanlam Investors’ Legacy Range – three impact funds with the core objective of helping to preserve current jobs and creating new ones. To find out more about the Sanlam Investors’ Legacy Range, visit www.sanlamintelligence.co.za/institutional/

www.sanlaminvestments.com

KINGJAMES 53115

Sanlam

Investment Management is an Authorised Financial Services Provider.

INDUSTRY FOCUS: INSURANCE

knock-on effect, he goes on. “We also have a very important corporate social investment (CSI) drive, whereby we believe that we are not here only for our customers, although paramount, but also for the communities that we serve. We have a range of initiatives that we are pursuing, from enterprise and supplier development through to active investments in education.

“This even extends to more unusual, cultural programmes, such as our flagship national poetry competition that we run every year in 11 languages, providing an all-important, powerful platform for people to express themselves in their mother tongue.”

Shipping containers also become fully-fledged libraries due to this highly socially-aware, community-conscious spirit, complete with books, computers, solar panels and ventilation. To date,

AVBOB has delivered 57 libraries to underprivileged schools. “The whole ethos behind our significant investments into a wide range of projects and programmes is that we are owned by our members, who are part of these communities. This drives our core aim - to allow people to participate in the economic benefits from the endeavours that we undertake within their communities.”

CRUCIAL SUPPORT

Always crucial to its members, the supportive, caring and compassionate service AVBOB renders has been utterly invaluable amid the devastation of the pandemic and the toll of bereavements it has left in its wake. “It has been the most incredibly tough year,” says van der Riet. “The convergence of all the various factors was, however, a perfect reminder

of why it is we are in this business, and brought home a real sense of purpose.

“I often say that it is at times of real stress that character is truly revealed, and for me, as a business and as a country we have gone through a huge amount of trauma which has evidenced the real character and purpose of the company.

“Funeral services, as a sector, is still often misunderstood,” he adds. “People envisage the men with tall top hats and dark coats mournfully presiding over the ceremony. This is not even close to accurate - what we actually provide is a mechanism for families to process grief, and to healthily transition through that experience, which can be agonisingly painful.

“As well as the practical side, we offer the advice people solicit, the counselling where required and

South Africa has so much potential, and your investment can help make a difference. With STANLIB’s Infrastructure Investment Funds, your money can do more to help grow a sustainable future, stimulate the job market and have a real impact on the economy. All while delivering meaningful growth.

STANLIB’s INFRASTRUCTURE INVESTMENT FUNDS. One of SA’s largest infrastructure funds. Invest with more impact at stanlib.com/more

STANLIB Asset Management (Pty)Ltd is an authorised

Provider

TBWA\HUNT\LASCARIS 931361/R

Financial Services

42 | www.f inance-focus.net

GOOD GOVERNANCE BEGINS IN THE BOARDROOM.

With so many companies severely affected by Covid-19, we’ve all seen how vital it is that good governance is driven by strong leadership. That’s why Old Mutual Investment Group is always clear about what we expect from the companies we invest in. It’s how we encourage greater industry collaboration around key environmental, social and governance (ESG) factors – like transformation, ethical leadership and green growth. And it’s an approach that helps us lead the way in responsible investing – delivering sustainable, long-term returns to our clients and making a positive impact along the way.

Investing for a future that matters. Visit oldmutualinvest.com/institutional to find out more.

even the mediation in family disputes which do arise; we help people to come to terms with bereavement, which then leads to closure and allows people to move on in their life. What we do, helps people to heal and move forward and this is our true value.”

AVBOB is well-versed in adversity: its formation came about at the same time as swathes of soldiers bringing back Spanish Flu at the end of the First World War, one of the worst viral epidemics of modern times, and the

ensuing wave of deaths. The culture of the organisation and its deeply ingrained principles allow it to stand firm and resolute among the most intense adversity, van der Riet says.

“Over time, and almost unnoticed, people are made to feel like they belong, and part of the family. That results from the sense of commitment and belonging, and of integrity in what we stand for. This has been a key differentiator in our culture and among the people that we have in AVBOB.”

Taking such good care of its people has paid real dividends, and as it moves out of these darkest of times, AVBOB will be able to gather together the strength and knowledge accrued over these trying months to bring comfort to many more people in their time of need. “In these extraordinary

circumstances, not once did our staff complain, and we are very proud of what they have accomplished,” he closes. “Clearly we are growing, and have been stretched, but it seems that this increased market share is continuing and sustaining, rather than subsiding after the waves.

“We will endeavour to employ the best aspects of technology, but never to the detriment of the empathy for which we are known. Most important is to continue building our physical infrastructure to retain the human contact we value so highly. That is what family is, ultimately.”

Old Mutual Investment Group (Pty) Ltd (Reg. No. 1993/003023/07) is a licensed financial services provider, FSP 604, approved by the Financial Sector Conduct Authority (www.fsca.co.za) to provide intermediary services and advice in terms of the Financial Advisory and Intermediary Services Act 37 of 2002. Old Mutual Investment Group (Pty) Ltd is wholly owned by Old Mutual Investment Group Holdings (Pty) Ltd. INVESTMENT GROUP DO GREAT THINGS EVERY DAY

23030MMS OMIG Governance Print Ad 144mmx100mm_Final.indd 1 2021/10/06 16:05

WWW.AVBOB.CO.ZA

“I OFTEN SAY THAT IT IS AT TIMES OF REAL STRESS THAT CHARACTER IS TRULY REVEALED”

AVBOB www.f inance-focus.net | 43

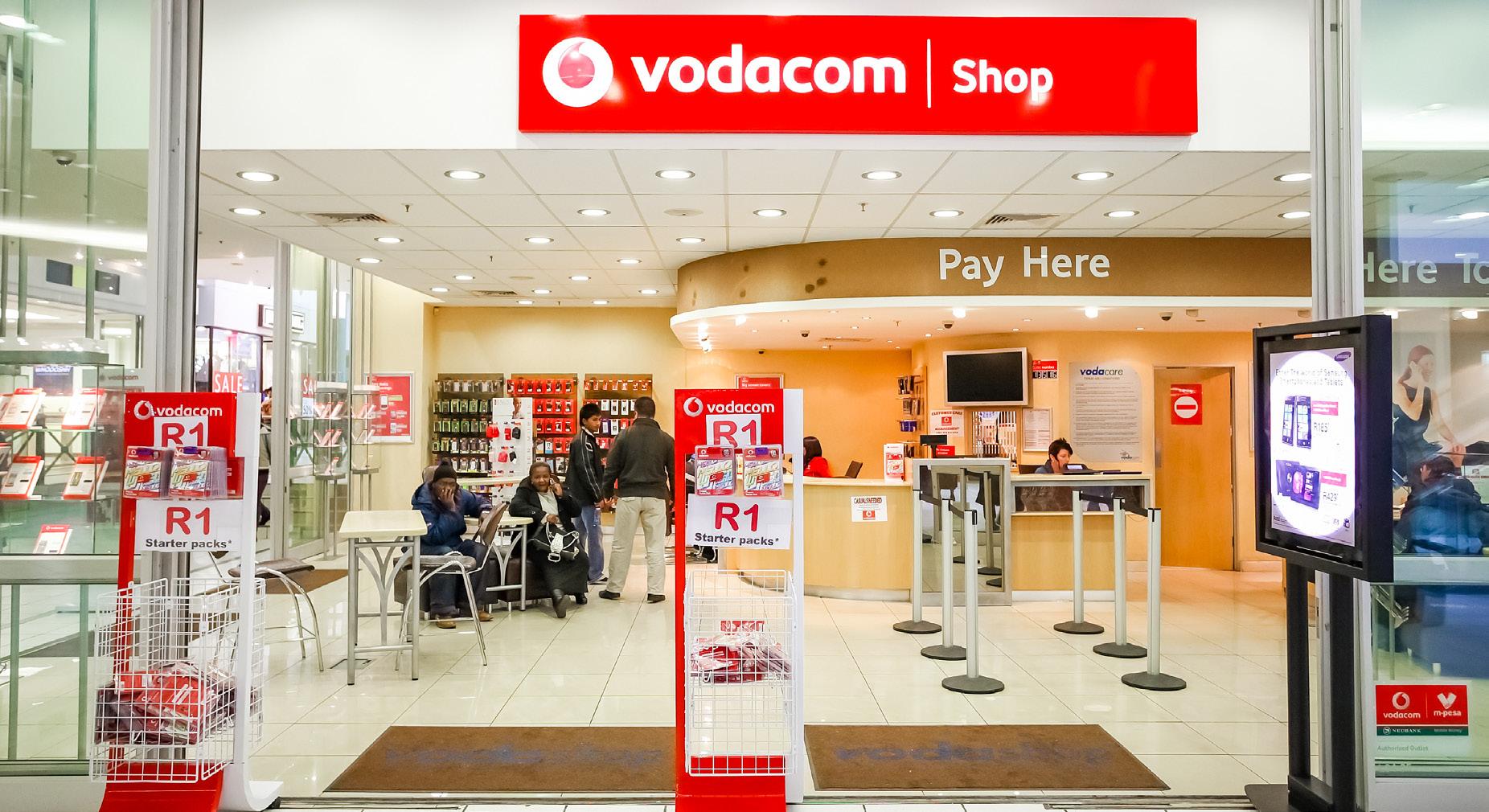

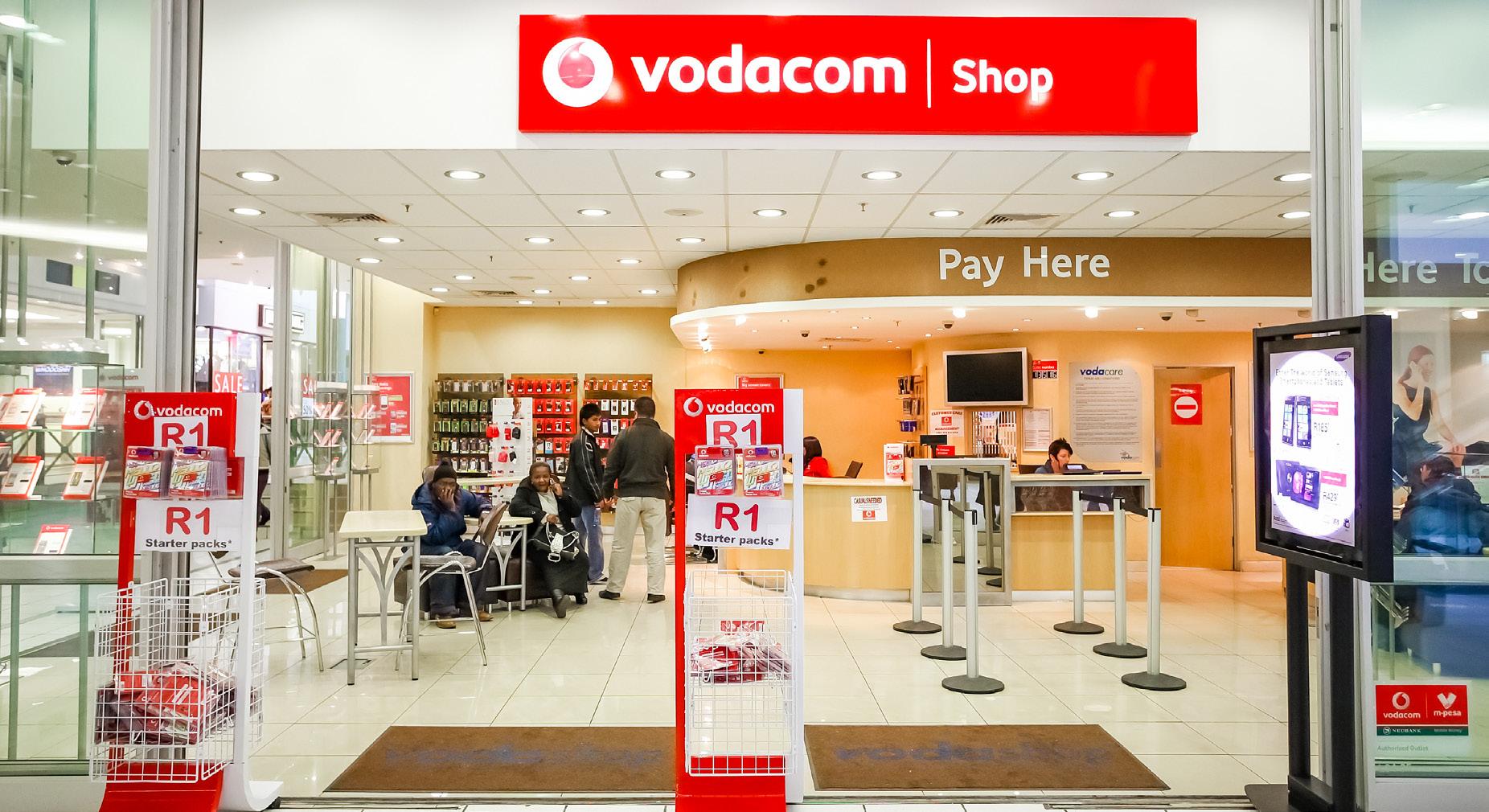

VODACOM

SUPER APP SET TO DISRUPT SOUTH AFRICAN E-COMMERCE

PRODUCTION: Timothy Reeder

PRODUCTION: Timothy Reeder

Vodacom’s VodaPay super app is poised to revolutionise financial inclusion and economic growth in South Africa. Offering users basic mobile peer-topeer (P2P) and QR code payments, alongside loans and an online shopping platform, the new business opportunities it will drive will be a major factor in transforming South Africa’s digital economy.

44 | www.f inance-focus.net

www.f inance-focus.net | 45

INDUSTRY FOCUS: TECHNOLOGY

Vodacom, the South African telco group majority owned by one of the world’s largest communications companies by revenue in Vodafone, is a leading and purpose-led African connectivity, digital and financial services company. Roots in South Africa have propelled the business’s operations to now encompass Tanzania, the Democratic Republic of the Congo (the DRC), Mozambique, Lesotho and Kenya, with mobile networks covering a population of over 295.8 million people.

“We believe in a connected digital society that connects people, communities and things to the internet like never before,” states the group, and across the eight strategic pillars underpinning its top three position in African telecoms are a raft of references to the significance of digital technology and its implementation. “We aim to be the leading telco in all markets through best network and IT excellence, with digital at the core,” it summarises.

South Africa has a rapidly growing e-commerce sector, spurred massively since 2020 by the Covid-19 pandemic and its reverberations. Despite the boom in growth, online shopping still only accounts for around 2% of South Africa’s total retail spend - 14% less than the global average. Vodacom is here to harness its benefits to businesses and consumers alike, as unlocking the full potential of the e-commerce sector will have a prodigious impact on the entire economy.

VODAPAY SUPER APP

“We build an organisation of the future where digital is first for all employees, underpinned by innovation, agility and new skills,” Vodacom underlines, “and scale our financial services offerings to empower the lives of our customers through financial inclusion.” These aims have all combined to result in Vodacom’s launch of a super app in South Africa.

VodaPay, developed by Vodacom Financial Services in partnership with

leading global digital lifestyle services platform and e-commerce giant Alipay, is an all-encompassing mobile payments solution that has been customised to meet the specific lifestyle and payment needs of consumers, businesses and tech developers. Alipay, which has in excess of a billion users, is in turn owned by Ant Financial, affiliate of China’s Alibaba Group Holdings.

“The world is moving toward e-commerce,” underlined Vodacom CEO Shameel Joosub to Bloomberg, “and

46 | www.f inance-focus.net

“WE HAVE MADE SIGNIFICANT STRIDES WITH THIS TECHNOLOGY SOLUTION THAT WILL TRANSFORM THE FINTECH ECOSYSTEM IN SOUTH AFRICA”

while leveraging off what we already have we also need to grow that side. Since we announced the VodaPay Super App in July last year, we have made significant strides in developing this technology solution that will transform the fintech ecosystem in South Africa.”

Developers and businesses of all sizes are now being invited to join the VodaPay ecosystem by building their very own mini programs, as termed by the group, which employ worldclass technology to accelerate digital engagement and increase access to market. “The VodaPay Super App offers endless possibilities in acquiring new customers, trading and advertising through these Mini Programs,” Vodacom enthuses.

Vodacom reports that 70 businesses have already signed up or have committed to building their own mini programs on the one-stop shop for online transactions, including some of the giants of the African retail landscape. Makro, Builders Warehouse, Clicks and Edgars all occupy the list, as well as the likes of Game, Big Blue, FlightSite, Dollar Thrifty, NetFlorist, KFC and Booking.com, among many others.

Mariam Cassim, Chief Officer of Vodacom Financial and Digital Services, advised that VodaPay will be accessible to customers on any mobile network, but even more lucratively, it will be zero-rated for Vodacom users. “It is an opportunity for your business to join a platform that has 43 million customers, and the ability to customise your products for the customers,” she remarked of the multiple benefits the app will afford.

“The beauty of the super app is that, in time, it is actually meant to target every single segment that we have in South Africa. As a start, we will be focusing on the highvalue segment, that is mainly the smartphone-enabled customers, and mid- to high-value segments. However, we have interesting use cases that look at the lower segments, such as creating bank accounts.”

Droppa is an on demand delivery service that makes it safer and easier to move office or household goods and furniture. Once you’ve booked a Droppa delivery, you will be able to track your goods throughout the entire journey, from pick up to drop off! Our drivers go through a vigorous screening and training process where all checks are conducted and drivers are taught how to handle goods in transit.

VODACOM

www.droppa.co.za

www.f inance-focus.net | 47

INDUSTRY FOCUS: TECHNOLOGY

WORLD OF POSSIBILITIES

This is the next logical step in Vodacom’s history of positively transforming millions of lives across its markets, initially by connecting them to voice and digital products and services.

“Through our affordable products and services, we are bridging the digital divide in our markets,” it says at the dawn of this new era. African telecom operators’ businesses have expanded enormously from traditional voice

calls into providing data and mobile payments, and digital financial services are now cemented as a significant aspect of the offering.

“As part of our vision to be a leading digital company that empowers a connected society,” says Vodacom, “we are using technology to transform our business model and enable a customercentric and digitally-connected world.”

Together with Safaricom, Vodacom recently acquired the M-PESA brand, to accelerate its growth in Africa and lead its expansion into new African markets. “Our joint venture will allow Vodacom and Safaricom to drive the next generation of the M-PESA platform – an intelligent, cloud-based platform for the smartphone age. It will also help us to promote greater financial inclusion and help bridge the digital divide within the communities in which we operate,” Shameel Joosub commented of its perfect alignment with both

Vodacom’s overall strategy and the aims of VodaPay.

M-PESA is the largest payments platform on the African continent. Launched in 2007, it now has 40 million users and processes over a billion transactions amounting to R366.4bn every month. M-PESA is operational in Kenya, Tanzania, Lesotho, Democratic Republic of Congo, Ghana, Mozambique and Egypt, and benefits from the growing smartphone penetration of these territories - currently around 25% of all M-PESA customers have access, a figure that is growing by 10% every year.

“We see this super app as a precursor to M-Pesa’s evolution,” Joosub explained, “supporting accelerated growth across our financial services’ businesses and assisting us in connecting the next 100 million African customers so that no one is left behind.”

Chief Financial Officer Rasibe Morathi highlighted the potential for

48 | www.f inance-focus.net

“THE ADOPTION OF DIGITAL TECHNOLOGY IS CRITICAL FOR BUSINESSES IF THEY ARE TO REMAIN RELEVANT IN THESE UNCERTAIN TIMES”

the super app to boost the group’s revenue. “Our financial services offering both in South Africa and the international market will benefit from further augmentation and the deeper product offering that comes from this super app,” he stressed. “Today South African financial services contributes 4.2% of our service revenue, but that 4.2% is growing faster than the rest of our business.”

VodaPay provides the infrastructure on which merchants and consumers transact, managing all the login, authorisation and payments processing aspects of their transactions, while the app allows consumers to do everything, from paying bills and sending money to playing games and ordering takeaways.

“Businesses also have access to next-

gen recommendation engines and data analytics to deliver personalised offers to customers as well as simplified checkout options, and advertising capabilities to drive sales,” Vodacom explained. “A choice is available for customers of paying upfront, with rewards, or with payment terms such as buy-now-paylater and nano-credit offerings.”

“Our powerful partnership with Alipay strengthens our access to world-class technology and puts us on par with leading global digital counterparts,” Joosub neatly abridges.

“If we are to drive financial inclusion, and go even further together, we want to offer the capabilities of the VodaPay Mini Programs to as many businesses, of all sizes, across multiple industries as possible.

“The adoption of digital technology is critical for businesses if they are to respond to change quickly and remain relevant in these uncertain times. As we position ourselves as a leading pan-African technology company, we are excited to see the innovation from businesses and developers who will partner with us in using this technology to connect people to markets, and to build and support a resilient, dynamic, digital economy,” Joosub outlines.