DAILY REPORT 30th SEPT. 2013

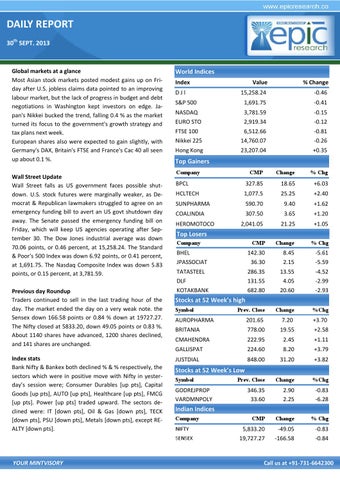

Global markets at a glance Most Asian stock markets posted modest gains up on Friday after U.S. jobless claims data pointed to an improving labour market, but the lack of progress in budget and debt negotiations in Washington kept investors on edge. Japan's Nikkei bucked the trend, falling 0.4 % as the market turned its focus to the government's growth strategy and tax plans next week. European shares also were expected to gain slightly, with Germany's DAX, Britain's FTSE and France's Cac 40 all seen up about 0.1 %. Wall Street Update Wall Street falls as US government faces possible shutdown. U.S. stock futures were marginally weaker, as Democrat & Republican lawmakers struggled to agree on an emergency funding bill to avert an US govt shutdown day away. The Senate passed the emergency funding bill on Friday, which will keep US agencies operating after September 30. The Dow Jones industrial average was down 70.06 points, or 0.46 percent, at 15,258.24. The Standard & Poor's 500 Index was down 6.92 points, or 0.41 percent, at 1,691.75. The Nasdaq Composite Index was down 5.83 points, or 0.15 percent, at 3,781.59. Previous day Roundup Traders continued to sell in the last trading hour of the day. The market ended the day on a very weak note. the Sensex down 166.58 points or 0.84 % down at 19727.27. The Nifty closed at 5833.20, down 49.05 points or 0.83 %. About 1140 shares have advanced, 1200 shares declined, and 141 shares are unchanged. Index stats Bank Nifty & Bankex both declined % & % respectively, the sectors which were in positive move with Nifty in yesterday’s session were; Consumer Durables [up pts], Capital Goods [up pts], AUTO [up pts], Healthcare [up pts], FMCG [up pts]. Power [up pts] traded upward. The sectors declined were: IT [down pts], Oil & Gas [down pts], TECK [down pts], PSU [down pts], Metals [down pts], except REALTY [down pts].

World Indices Index

Value

% Change

15,258.24

-0.46

S&P 500

1,691.75

-0.41

NASDAQ EURO STO FTSE 100

3,781.59 2,919.34 6,512.66

-0.15 -0.12 -0.81

Nikkei 225 Hong Kong

14,760.07 23,207.04

-0.26 +0.35

DJl

Top Gainers Company

CMP

Change

% Chg

BPCL

327.85

18.65

+6.03

HCLTECH

1,077.5

25.25

+2.40

SUNPHARMA

590.70

9.40

+1.62

COALINDIA

307.50

3.65

+1.20

2,041.05

21.25

+1.05

CMP

Change

% Chg

142.30 36.30 286.35 131.55 682.80

8.45 2.15 13.55 4.05 20.60

-5.61 -5.59 -4.52 -2.99 -2.93

Prev. Close

Change

%Chg

AUROPHARMA

201.65

7.20

+3.70

BRITANIA

778.00

19.55

+2.58

CMAHENDRA

222.95

2.45

+1.11

GALLISPAT

224.60

8.20

+3.79

JUSTDIAL

848.00

31.20

+3.82

Prev. Close

Change

%Chg

346.35 33.60

2.90 2.25

-0.83 -6.28

CMP

Change

% Chg

5,833.20 19,727.27

-49.05 -166.58

-0.83 -0.84

HEROMOTOCO

Top Losers Company

BHEL JPASSOCIAT TATASTEEL DLF KOTAKBANK

Stocks at 52 Week’s high Symbol

Stocks at 52 Week’s Low Symbol

GODREJPROP VARDMNPOLY

Indian Indices Company NIFTY SENSEX

YOUR MINTVISORY

Call us at +91-731-6642300