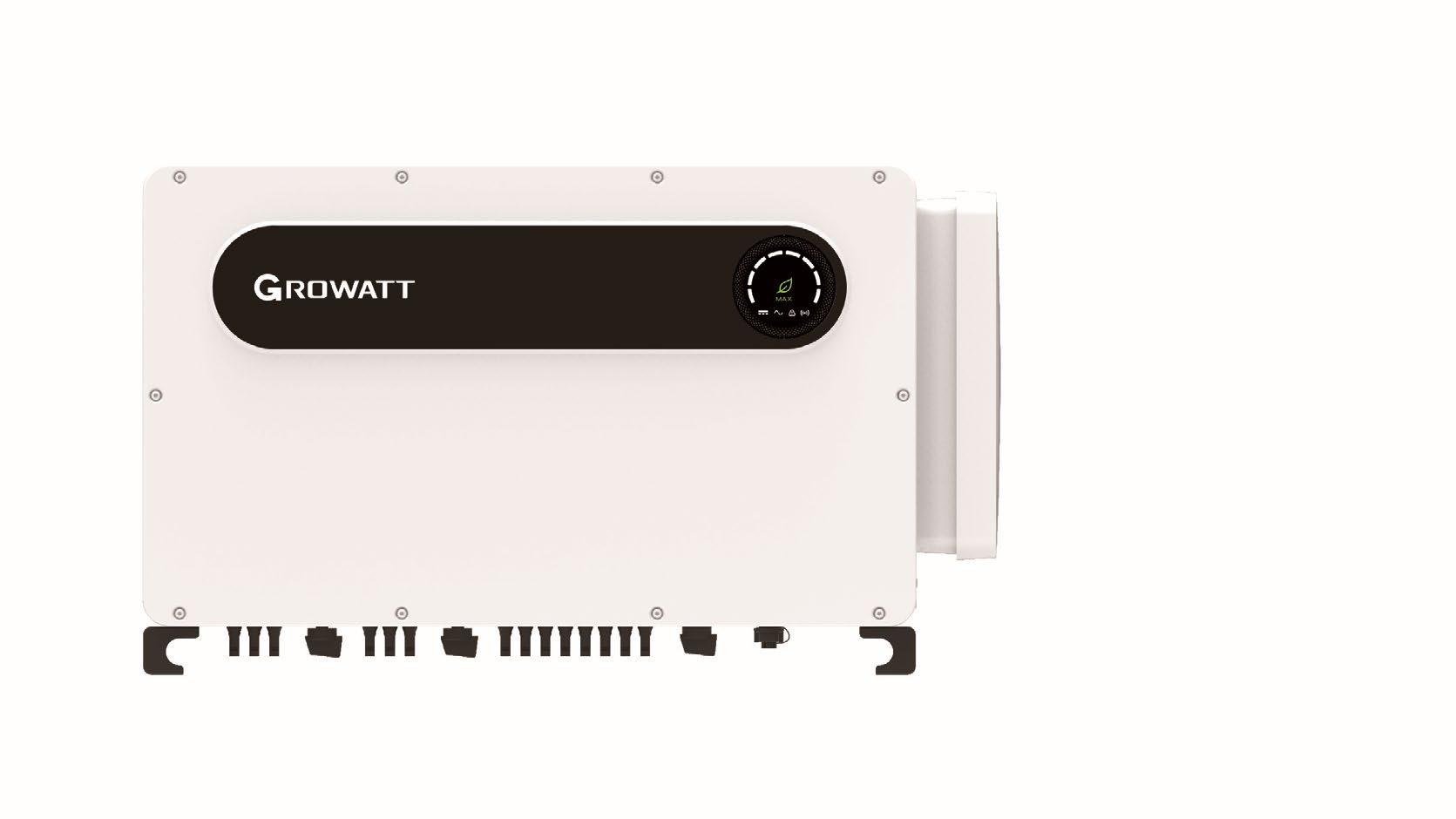

MAX THE SOLAR POWER GENERATION

10 MPPTs fusefree design

Smart I/V scan and diagnosis

Active safety with AFCI protection

Max. string current up to 22.5A Compatible with 600W+ high power modules

M P P T

1800 120 600 600 Sh e n z h e n G r o watt N e w En e r gy C o ., Ltd. w w w g i n v e rt e r c o m info@ginverter.com

54 OWNER : FirstSource Energy India Private Limited PLACE OF PUBLICATION : 95-C, Sampat Farms, 7th Cross Road, Bicholi Mardana Distt-Indore 452016, Madhya Pradesh, INDIA Tel. + 91 96441 22268 www.EQMagPro.com EDITOR & CEO : ANAND GUPTA anand.gupta@EQmag.net PUBLISHER : ANAND GUPTA PRINTER : ANAND GUPTA PUBLISHING COMPANY DIRECTORS: ANIL GUPTA ANITA GUPTA CONSULTING EDITOR : SURENDRA BAJPAI SR. GRAPHICS & LAYOUT DESIGNER : RATNESH JOSHI GRAPHICS DESIGNER : MAHENDRA PAGARIA Disclaimer,Limitations of Liability While every efforts has been made to ensure the high quality and accuracy of EQ international and all our authors research articles with the greatest of care and attention ,we make no warranty concerning its content,and the magazine is provided on an>> as is <<basis.EQ international contains advertising and third –party contents.EQ International is not liable for any third- party content or error,omission or inaccuracy in any advertising material ,nor is it responsible for the availability of external web sites or their contents The data and information presented in this magazine is provided for informational purpose only.neither EQ INTERNATINAL ,Its affiliates,Information providers nor content providers shall have any liability for investment decisions based up on or the results obtained from the information provided. Nothing contained in this magazine should be construed as a recommendation to buy or sale any securities. The facts and opinions stated in this magazine do not constitute an offer on the part of EQ International for the sale or purchase of any securities, nor any such offer intended or implied Restriction on use The material in this magazine is protected by international copyright and trademark laws. You may not modify,copy,reproduce,republish,post,transmit, or distribute any part of the magazine in any way.you may only use material for your personall,Non-Commercial use, provided you keep intact all copyright and other proprietary notices. want to use material for any non-personel,non commercial purpose,you need written permission from EQ International. SUBSCRIPTIONS : admin@eqmag.net VOLUME 16 Issue 02 CONTENT 12 35 30 HEAD SALES & MARKETING MUKUL HARODE sales@EQmag.net FEATURED FEATURED INDIA BUSINESS & FINANCE CLEANTECH SOLAR SECURES INR 6.25 BILLION GREEN FINANCING FROM TATA CAPITAL FOR PIONEERING SUSTAINABILITY SOLUTIONS THROUGH OPEN ACCESS PORTFOLIO IN INDIA GENERA 2024: SINENG ELECTRIC EMPOWERS GLOBAL ENERGY TRANSITION ONGC IN JOINT VENTURE AGREEMENT WITH NTPC GREEN FOR RENEWABLE ENERGY MAHAMETRO SIGNS SOLAR POWER DEAL WITH AMPIN ENERGY

RECYCLEKARO SIGNS AN MOU WITH BHABHA ATOMIC RESEARCH CENTRE (BARC) FOR COPPER OXIDE NANOPARTICLES PRODUCTION FROM E-WASTE

QUOTE ON BUDGET 2024

REACTION QUOTE FROM SUMANT SINHA, FOUNDER, CHAIRMAN AND CEO, RENEW FORCE MOTORS PLANS TO INVEST AROUND RS 2,000 CR IN 3-4 YEARS, TO FOCUS ON EV DEVELOPMENT: MD PRASAN FIRODIA

PRADHAN MANTRI SURYODAY YOJANA : A REVOLUTIONARY SCHEME FOR THE SOLAR INDUSTRY

APRAAVA ENERGY STRENGTHENS ITS LOW- CARBON PORTFOLIO WITH A NEW TRANSMISSION PROJECT WIN IN MADHYA PRADESH

PROJECTS

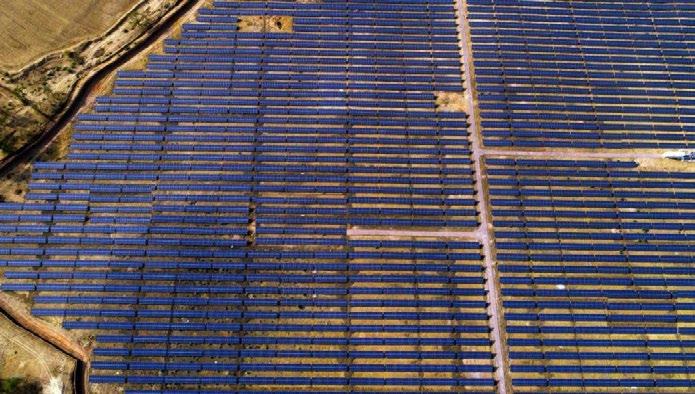

CLEANTECH SOLAR COMMISSIONS 24 MWP OPEN ACCESS SOLAR PV PROJECTS IN MAHARASHTRA, EXPANDING ITS PORTFOLIO OF SOLAR, WIND AND HYBRID POWER PROJECTS WITH A COMBINED CAPACITY OF OVER 300 MWP IN MAHARASHTRA

29 32 52 37 70 75

FEATURED FEATURED FEATURED Pg. 12-75 EQ News ELECTRIC VEHICLE SOLAR

SURYACON is the EQ's Flagship Event Multicity Conference on Solar Business, Technology, Finance, Policy & Regulation. Suryacon Conference has special focus on Rooftop Solar. Also includes Solar Parks, Offgrid Solar & Solar Applications.

EQ Int’l Magazine is India’s Premium and Oldest Solar & Renewable Energy Magazine Since 2009 having a print run of 20,000 Copies/Monthly, Readership of 80,000. EQ’s Digital presence is unparalleled with its Magazine viewed by over 100,000+ professionals in Digital Format every month (On Browser, Tablet, SmartPhone, etc...). Its unrivaled daily e-Newsletter and most visited website <www.EQMagPro.com> has lakhs of viewers and visitors daily. We provide various Medium and Tools to get the Highest Possible Visibility which we call the 365 Days, 24*7 Visibility Solution through the 360 Degree Approach. Print, Digital, Website, e-Newsletters, Conferences, Events & Video Content.

CLEANTECH SOLAR SECURES INR 6.25 BILLION GREEN FINANCING FROM TATA CAPITAL FOR PIONEERING SUSTAINABILITY SOLUTIONS THROUGH OPEN ACCESS PORTFOLIO IN INDIA

Cleantech Solar, a leading provider of renewable energy solutions to corporations in India and Southeast Asia, has secured a long-term senior secured loan facility worth INR 6.25 billion from Tata Capital Limited for its open access portfolio in India. A part of the drawdown has been done and the balance will be done in 2024 for meeting the funding requirements of Cleantech’s under-construction pipeline of open access projects.

The Rupee Term Loan (RTL) will be utilised towards construction, development and operations of open access solar and wind parks across different states in India. Cleantech Solar’s focus on expanding its commercial and industrial (C&I) portfolio, currently at 1.2 GWp, aligns with its commitment to sustainable growth. The renewable energy generated from these open access projects will be procured by esteemed corporate consumers on a captive basis to meet their energy needs for manufacturing / business operations. These projects cater to customers across sectors including automotive, FMCG, apparel, industrial equipment and chemical manufacturing, amongst others.

Sachin Jain, CEO of Cleantech Solar, said: tech Solar has been at the forefront of provid ing clean, cost-effective and stable power to corporate clients in India and Southeast Asia, helping them achieve their sustainability goals and improve their bottom line. This financing from Tata Capital will expedite the deployment of our open access renewable energy projects in India, delivering sustainable power to leading global corporates. It underscores our com mitment to strengthening these collaborations and accelerating our journey towards a carbon-free future.”

Mr. Pankaj Sindwani, Chief Business Officer - Cleantech Finance, Tata Capital, said: We are pleased to have part nered with Cleantech Solar in deploying funds towards open access renewables proj ects in India, aligning with our sustain ability goals and strengthening our green lending portfolio. This loan facility will facilitate access to affordable green power across corporates from varied sectors and geographies thus meeting their carbon footprint targets. Since the market is still in nascent stage, such innovative capital solutions will be critical to bridge the financing gap to accelerate the shift to renewable energy. With our wide array of sustainable lending solutions and deep understanding of the market, we are committed to enhance and support partnerships to scale up the implementation of open access projects and country’s climate goals.

12 EQ FEBRUARY 2024 www.EQMagPro.com INDIA

SOLAR MICRO GRIDS TO LIGHT UP OVER 9,000 REMOTE HOUSEHOLDS IN TRIPURA

Solar microgrids are set to illuminate more than 9,000 remote households in Tripura. This initiative aims to bring reliable and sustainable electricity to remote areas, contributing to improved living standards and supporting the transition to clean energy in the region.

The Centre has sanctioned Rs 81 crore to Tripura for setting up 274 solar micro grids in remote areas of the northeastern state to light up over 9,000 houses, an official said.Under the project of the Ministry of Development of Northeast Region (DoNER), the micro grids will be established in hamlets in Dhalai, Unakoti, and South, West and North Tripura districts, where “conventional electricity appears non profitable” to the state power utility because of low population density, he said.

“The DoNER has sanctioned Rs 81 crore to Tripura for setting up 274 solar micro grids in remote areas, particularly tribal hamlets, where conventional electricity has not reached the people yet. A total of 9,250 families will be benefited under the project,” an official of the Tripura Renewable Energy Development Agency (TREDA) said.

The northeastern state still has several tribal and non-tribal habitations where electricity has not reached yet due to geographical isolation and low population density, he said, adding the project will light up the houses by using solar power.

“Each solar micro grid will have an installed capacity ranging from 2 KW to 25 KW depending on the population of a particular habitation. Although the tariff has not been finalised yet, the beneficiary needs to pay a small amount for power consumption,” he said, adding the work is expected to commence in the current fiscal. According to TREDA estimation, the northeastern state has a solar power potential of 2,000 MW, of which only 19.50 MW is being generated at present.

Recently, the state has unveiled Tripura Energy Vision of generating 500 MW of solar power by 2030.

INDIA

INDIA

POLARIS LANDS ₹5200 CRORE DEAL FOR STATE-OF-THE-ART SMART METER ROLLOUT IN UTTAR PRADESH

• Wins contracts for important clusters of Lucknow and Ayodhya to install over 5.1 million smart meters

• Expands its footprint with additional Letter of Awards in Manipur and West Bengal worth ₹2400 crore to install over 2.3 million smart meters

• Has previously secured contracts for smart meter installation in Bihar and Ladakh for more than₹118 crores collectively

Polaris Smart Metering, a leading provider of advanced smart metering solutions, has been awarded two contracts valued at over ₹5,200 crore for smart prepaid metering in the state of Uttar Pradesh. Madhyanchal Vidyut Vitran Nigam Limited (MVVNL) has awarded the contracts to Polaris for installing over 5.1 million smart meters in the important clusters of Lucknow and Ayodhya/Devipatan, which the company plans to install over the next 27 months.

As per the agreement, Polaris Smart Metering will supply, commission, install and maintain smart meters for consumers and system metering across the consumer base in these important clusters for the next 10 years. These smart meters will be equipped with state-of-the-art technology, enabling prepaid billing, real-time energy monitoring, accurate metering, and improved grid management capabilities. This contract comes under a Design-BuildFinance-Operate-Own-Transfer (DBFOOT) agreement. In addition to Uttar Pradesh, Polaris has also received Letter of Awards (LOAs) from the states of West Bengal and Manipur, totaling over ₹2400 crores, and is set to install more than 2.3 million smart meters across these two states.

The primary objective of this project is to reduce losses for DISCOMs and to empower consumers by introducing smart prepaid meters, enabling them to have better control over their energy consumption. Through the implementation of these smart meters, consumers will have real-time access to their energy usage data, allowing them to monitor and manage their consumption patterns effectively. This will result in a more informed decision-making process for consumers, fostering a culture of energy conservation and responsible electricity usage. Additionally, consumers will have the flexibility to recharge their meter as per their convenience, avoiding the inconvenience of monthly visits from meter readers or the hassle of bill payment. This will not only enhance customer satisfaction but also streamline the overall billing process.

"We

Marjut Falkstedt, EIF Chief Executive says: “Better managing our energy needs is one of the most important challenges of our time. That’s why we are excited about our participation in the newly established fund. This investment aligns perfectly with the EIF’s strategic objectives and our commitment to driving the energy transition and supporting decarbonization efforts across Europe.”

To tackle power theft, Polaris has internationally patented algorithms to enable DISCOMs to detect and address power theft effectively. In addition, Polaris’s technology will also enable DISCOMs to implement advanced demand-response policies for maximum integration of renewable energy sources in their power purchase portfolios. In addition to this, Polaris ensures a high level of cyber security by encrypting its entire communication stack, and employing multiple layers of encryption for data privacy. This includes identity and access management, authorization, and a user privilege system.

are incredibly proud to have been entrusted with these transformative projects," said Yashraj Khaitan, CEO, Polaris Smart Metering "Our smart metering solutions will empower consumers with actionable insights into their energy consumption, while simultaneously delivering substantial benefits to the state governments in terms of improved grid efficiency, reduced pilferage, and improved environmental sustainability. We extend our heartfelt gratitude to MVVNL for recognizing the potential of innovative technology in shaping the future of grid management. The win in Uttar Pradesh and the LOAs in West Bengal and Manipur underscore Polaris’s commitment towards digitizing and transforming India’s electricity grid and marks a significant stride towards a smarter and more sustainable energy future for our country.”

Polaris Smart Metering is committed to partnering with state governments, utilities, and consumers to ensure a successful implementation of the smart prepaid metering system. Prior to this, Polaris has won multiple smart metering contracts, including contracts in Ladakh and Bihar for installing over 1,00,000 smart meters for a value of more than Rs 118 Crores cumulatively. Polaris is involved in manufacturing, supply, installation, integration, testing and commissioning of AMI Projects in India, which will herald a transformation in the energy landscape benefiting consumers, the environment, and the overall sustainability of the country.

14 EQ FEBRUARY 2024 www.EQMagPro.com

INDIA

Global Investors Meet: Mukesh Ambani said that Tamil Nadu has become one of the most business-friendly states in the country and that he believes that the state would soon become a trilliondollar economy.

Reliance Industries Chairman Mukesh Ambani has said that they will make new investments in renewable energy and green hydrogen in Tamil Nadu. Ambani, who skipped the Global Investors Meet hosted in the state, sent in a video message, addressing the summit. He said that the conglomerate would work closely with the state government to promote sustainable development.

Ambani said that Tamil Nadu has become one of the most business-friendly states in the country and that he believes that the state would soon become a trillion-dollar economy. “Reliance has proudly partnered in Tamil Nadu’s growth over the years. We have opened nearly 1,300 retail stores across the state, investing over Rs 25,000 crores. Jio has invested over Rs 35,000 crores in Tamil Nadu, bringing the fruits of the digital revolution to 35 million subscribers in every town and village in the state,” he said.

The billionaire said that Reliance has partnered with Canada’s Brookfield Asset Management and US-based Digital Reality to set up a state-of-the-art data centre that will be opened next week.

“Reliance has committed to making new investments in Tamil Nadu in renewable energy and green hydrogen. We shall work closely with the state government to promote sustainable development, which is necessary to save Mother Earth from the climate crisis,” he said, adding that he is confident that the Tamil Nadu government will support them with viable policies. Meanwhile, the Tamil Nadu government announced that it has signed investment pacts worth over $4.39 billion with firms such as Tata Electronics and Pegatron, both of which are suppliers for Apple, as well as auto major Hyundai Motors. Tata Electronics has committed to invest Rs 12,080 crore, while Pegatron has said it would invest Rs 1,000 crore.

JSW Energy committed to invest Rs 12,000 crore to develop re-

RELIANCE TO INVEST IN RENEWABLE ENERGY, GREEN HYDROGEN IN TAMIL NADU, SAYS MUKESH AMBANI

The billionaire said that Reliance has partnered with Canada’s Brookfield Asset Management and US-based Digital Reality to set up a stateof-the-art data centre that will be opened next week.

newable energy projects. Hyundai Motors committed Rs 6,080 crore, some of it earmarked for electric vehicle battery and car manufacturing.

Vietnamese EV maker VinFast agreed to set up its first manufacturing facilities in India and work toward an investment of up to $2 billion in Tamil Nadu.

Additionally, Tata Power stated that it plans to invest Rs 55,000 crore in wind and solar power generation in Tamil Nadu in the next 5-7 years.

16 EQ FEBRUARY 2024 www.EQMagPro.com

www.EQMagPro.com 17 EQ FEBRUARY 2024 EARN ADDITIONAL REVENUE THROUGH CARBON OFFSETS (+91) 731 42 89 086 business@enkingint.org www.enkingint.org EKI ENERGY SERVICES LIMITED One of the world’s largest carbon credits developer & supplier 40+ Countries | 3500+ Clients | 200+ Million Offsets Traded | BSE Listed also known as EnKing International Scan QR code to visit our website Get your renewable energy projects registered through us

NGEL SIGNS MOU WITH GOVT OF MAHARASHTRA FOR DEVELOPMENT OF GREEN HYDROGEN PROJECTS

NTPC Green Energy Limited (NGEL) signed a Memorandum of Understanding (MoU) with Govt of Maharashtra for development of Green Hydrogen and derivatives (Green Ammonia, Green Methanol) of up to 1 million Ton capacity per annum, including Pump Hydro Projects of 2 GW and development of RE projects with or without storage up to 5 GW in the state.

The MoU was exchanged between Shri Mohit Bhargava, Chief Executive Officer, NGEL and Shri Narayan Karad, Deputy Secretary (Energy), GoM in the presence of Hon’ble Chief Minister, Hon’ble Deputy CM and other senior officials. The above MoU has been signed as a part of Green Investment Plan of Govt of Maharashtra in the next five years and envisages a potential investment of approximately ₹ 80, 000 Crore. NTPC is in the path of building up RE capacity of 60 GW by 2032. NGEL is a wholly-owned subsidiary of NTPC and aims to be the flag bearer of NTPC’s Renewable Energy journey with an operational capacity of over 3.4 GW and 26 GW in pipeline including 7 GW under implementation.

ADANI GREEN DELIVERS CASH BACKED REDEMPTION PLAN FOR USD 750 MILLION HOLDCO BOND

Eight months prior to maturity, the outstanding notes fully secured with cash balance in Senior Debt Redemption Account (SDRA) of Holdco Notes Editor Synopsis

• AGEL delivers on refinancing plan for USD 750 million of notes due on 09 September 2024

• With this, AGEL has fully defeased the Holdco Notes, eight months prior to the maturity date and has further resulted in significant deleveraging in AGEL by way of equity proceeds while continuing to deliver on the growth plans

• AGEL has delivered USD 1.4 bn equity raising and USD 1.6 bn of debt for ringfenced project SPVs from international banks, demonstrating strong market access at attractive pricing, enabling AGEL to achieve its target of 45 GW by 2030.

Adani Green Energy Limited (AGEL) announced the redemption plan for the USD 750 million 4.375 notes due 09 September 2024 (Holdco Notes). The outstanding amounts of the Holdco Notes shall be fully secured through cash balances set aside as part of various reserve accounts securing the Holdco Notes, eight months prior to the maturity.

The redemption plan for the Holdco Notes is as detailed below -

1. Amounts in the Reserve Accounts and Internal Accruals - USD 169 million (including Debt Service Reserve Account, Hedge Reserves & Interest on Reserve Account).

2. TotalEnergies 1,050 MW JV Consideration – USD 300 million, transaction closed on 26 December 2023, and the funds are already lying in the Senior Debt Redemption Account (SDRA) of the Holdco notes.

3. Proceeds from Initial tranche of the Promoter Preferential Allotment – ~USD 281 million, (USD equivalent of INR 2,338 crores), expected in the end of January 2024, and the funds shall be deposited into the Senior Debt Redemption Account (SDRA) of the Holdco notes.

4. Total amount - USD 750 million

As a result, the entire amount of the USD 750 million Holdco Notes is fully secured eight months prior to its maturity date. With this outcome, AGEL has fully defeased the Holdco Notes, eight months prior to the maturity date and has further resulted in significant deleveraging in AGEL by way of equity proceeds while continuing to deliver on the growth plans.

Underpinning the repayment is the successful equity capital raise program of USD 1.425 billion (includes USD 1.125 billion of preferential issuance by promoters and USD 300 million from TotalEnergies JV), reflecting the deep interest of long-term investors, strategic partners, coupled with unwavering promoter commitment to meet AGEL’s strategic priorities of achieving its target of 45 GW by 2030.

18 EQ FEBRUARY 2024 www.EQMagPro.com INDIA

WELSPUN WORLD COMMITS RS 40,000 CRORE IN GUJARAT’S GREEN ENERGY SHIFT

The investment will be used to enhance the company’s production capacity and to diversify its product portfolio. This investment is expected to create numerous job opportunities and contribute to the economic growth of Gujarat.

Welspun World, through its entity Welspun New Energy Limited, is committed to supporting Gujarat’s decarbonisation ambitions with a cumulative investment of over Rs 40,000 crores. It plans to build a green hydrogen and green ammonia ecosystem in the state. In a release, Welspun said its new energy entity today entered into a strategic alliance with Gujarat Pipavav Port Limited (GPPL), promoted by APM Terminals, part of the AP Moller-Maersk Group, to mutually explore opportunities and develop green hydrogen facilities for the production of green hydrogen and its derivatives such as green ammonia and green methanol, at the land parcel provided by Gujarat Pipavav Port Ltd. The MoU, inked at the Vibrant Gujarat Global Summit 2024, will also explore collaboration in joint production and off-take arrangements for the green molecules to be developed at the facilities.

Kapil Maheshwari, Executive Director and CEO of Welspun New Energy said “This initiative reflects our dedication to contributing to the prosperity of the State and creating a positive impact on its economic landscape. Welspun New Energy is eager to be a catalyst for transformative changes in the energy sector across India by developing robust and reliable green energy infrastructure.”

BK Goenka, Chairperson, Welspun World, “As a responsible global conglomerate, Welspun World continues to invest in longterm, strategic projects that are aligned with Welspun’s Vision and our desire for a greener planet. Our initiatives align with Prime Minister Narendra Modi’s mission of making India a leader in Green Energy and transforming Gujarat as one of the growth engines on our journey towards achieving sustainable economic growth. We are delighted that our partnership with GPPL will explore avenues for reducing emissions by the shipping industry, a sector which is facing significant challenges in transitioning to Green Energy.”

With annual revenues of over USD 3 billion and a presence of over three decades, Welspun World is one of India’s fastestgrowing conglomerates, with businesses in line pipes, home textiles, building materials, infrastructure, water, steel, warehousing, new energy, advanced textiles and flooring solutions.

INDIA

UNION MINISTER R K SINGH ANNOUNCED RS 17.05 LAKH CRORE

INVESTMENT IN ENERGY SECTOR

Union Minister R K Singh announces a substantial investment of Rs 17.05 lakh crore in the energy sector. This significant financial commitment reflects the government’s focus on advancing energy infrastructure, promoting sustainability, and fostering economic growth in India.

Union Minister R K Singh declared a substantial investment of Rs 17.05 lakh crore in the energy sector. The funds are earmarked for the power and renewable energy domains, attracting a cumulative investment of about 16.93 lakh crore since 2014, as stated by Singh. In his briefing on the recently introduced Electricity (Amendment) Rules 2024, Singh highlighted that a total of Rs 16.93 lakh crore has been infused into the power and renewable energy sectors, as reported by ET. The detailed breakdown includes Rs 11.2 lakh crore directed towards generation, distribution, and trans-

mission, with an additional Rs 5.73 lakh crore allocated to the renewable energysector. Singh further emphasised the allocation of Rs 7.4 lakh crore for the power sector and Rs 9.65 lakh crore for the renewable energy sector. Singh also revealed that a power plant with 80 GW of thermal power generation capacity is currently under construction, anticipated to be operational by 2030. Simultaneously, approximately 99 GW of renewable energy is currently in the construction phase. Notably, he projected India’s power generation capacity to surpass 800 GW, a substantial increase from the current 428 GW. India’s ambitious plan includes bidding out 50 GW of renewable energy projects annually.

SUNPURE, AN INTELLIGENT PHOTOVOLTAIC ROBOTIC SOLUTIONS FIRM, HAS SUCCESSFULLY SECURED SERIES A FUNDING

Sunpure Technology Co., Ltd. (Sunpure) is pleased to announce the successful completion of its Series A financing round on January 24th. The round, which exceeded a hundred million yuan, was led by Hengxu Capital, with participation from Yuantai Investment Partners Fund, Guoyuan Fund, and existing shareholder GL Ventures.

Sunpure, a China-based high-tech innovative company, specializes in the research and development, manufacturing, sales, and service of intelligent photovoltaic (PV) robots. The company is dedicated to addressing installation, cleaning, and operation and maintenance challenges in renewable energy power plants through intelligent robotic solutions.

Since 2020, Sunpure has rapidly emerged as the fastest-growing company in the field. By the end of 2023, Sunpure had secured contracts for over 13 GW capacity. Sunpure's PV cleaning robot has been successfully deployed in 14 countries and regions, including the Middle East, Latin America, China, and India. The company's achievements were acknowledged in the Middle East, where it received the "Regional Robotic Solar Cleaning Solution" award from the Middle East Solar Industry Association (MESIA). Notably, Sunpure achieved over 1 GW in signed contracts during its inaugural year in the Indian market.

Sunpure has established a robust technological foundation, investing over 25% annually in research and development. The company has assembled a team of experienced experts in robotics and renewable energy, holding over 160 patents and securing a leading position in the industry. Additionally, Sunpure operates the industry's only TUV qualified client testing facility, ensuring international-standard testing levels and reliable product performance. With these advantages, Sunpure has received over 30 awards worldwide.

Presently, Sunpure's solution encompasses various scenarios, including mountains, deserts, fisheries, and commercial and industrial rooftops. The company is actively exploring robotic applications in different stages of PV plant development, with the aim of comprehensively enhancing power generation efficiency, increasing the overall internal rate of return (IRR), lowering the levelized cost of electricity (LCOE), and delivering higher value to global customers. The funds raised in this round will primarily be directed towards the research and development of intelligent robots for PV plants, as well as the optimization and upgrading of comprehensive cleaning solutions across various scenarios.

20 EQ FEBRUARY 2024 www.EQMagPro.com

INDIA

HARTEK POWER ACHIEVES 7 GW SOLAR GRID CONNECTIVITY, EYES FURTHER EXPANSION

Hartek Power, a leading power solutions provider, has achieved a significant milestone by achieving 7 GW (gigawatts) of solar grid connectivity. This accomplishment underscores the company’s expertise and capabilities in the solar power sector. With this achievement, Hartek Power has positioned itself as a key player in the renewable energy industry, contributing to India’s ambitious solar energy targets.

Key projects that have contributed to this milestone include collaborations with renowned entities, such as Azure Power, Aditya Birla, Renew Power, and Tata Power. Hartek Power said it has installed more than 7 GW of solar grid-connected projects. “In a remarkable leap, the company has expanded its projects from 5 GW (Giga Watt) to an impressive 7 GW in the second half of 2023, signifying a substantial 40 per cent increase in capacity,” it said in a statement. Key projects that have contributed to this milestone include collaborations with renowned entities, such as Azure Power, Aditya Birla, Renew Power, and Tata Power. The company is also in the process of executing a 22 MW floating solar project with SJVN, slated to be commissioned in the middle of this year.

REC TO RAISE ABOUT RS 3,500 CRORE VIA YEN-DENOMINATED GREEN BONDS

Rural Electrification Corporation Limited (REC) aims to raise approximately Rs 3,500 crore through yen-denominated green bonds. This initiative reflects REC’s commitment to financing environmentally sustainable projects and contributing to the green bond market

The bonds will issued as part of REC’s $10-billion global medium-term note programme, the company said in a regulatory filing State-owned REC Ltd announced it will raise 61.1 billion yens (about Rs 3,500 crore) through issuance of green bonds. The bonds will issued as part of REC’s USD 10-billion global medium-term note programme, the company said in a regulatory filing. Giving the break-up of each note, the company said a five-year bond worth 31 billion yens will have a coupon rate of 1.67 per cent, a 27.4-billion yen paper with maturity in 5.25 years will have a coupon rate of 1.79 per cent, and another 2.7-billion yen bond having maturity period of 10 years will carry a coupon rate of 2.20 per cent. These bonds will be listed on Global Securities Market of India International Exchange (India INX) and NSE IFSC, the company said. REC said the net proceeds from these notes will be used to finance green projects in accordance with the REC’s Green Finance Framework and the external commercial borrowing guidelines and directions of the Reserve Bank of lndia (RBI). REC, under the Ministry of Power, is a non-banking finance company focussed on power sector lending in India.

22 EQ FEBRUARY 2024 www.EQMagPro.com

INDIA

PM SURYA GHAR: MUFT BIJLI YOJANA LAUNCHED TO BOOST SOLAR POWER ADOPTION

The prime minister has allocated more than Rs 75,000 crore in investment, which aims to bring up to 300 units of free electricity per month to 10 million households

Prime Minister Narendra Modi unveiled the ‘PM Surya Ghar: Muft Bijli Yojana’ on Tuesday to accelerate solar power adoption and foster sustainable development ahead of the Lok Sabha 2024 elections. The project entails an investment of more than Rs 75,000 crore, in order to boost renewable energy while also enhancing people’s welfare. The initiative seeks to illuminate 10 million households by offering up to 300 units of free electricity per month. Modi highlighted the importance of grassroots engagement, announcing incentives for urban local bodies and panchayats to encourage the adoption of rooftop solar systems within their jurisdictions.

In a post on the prime minister’s official account on X (formerly Twitter), he wrote, “In order to popularise this scheme at the grassroots, Urban Local Bodies and Panchayats shall be incentivised to promote rooftop solar systems in their jurisdictions. At the same time, the scheme will lead to more income, fewer power bills, and employment generation for people.” READ: NDA provided 1.5x more govt jobs than UPA, says PM Narendra Modi

The prime minister also added that subsidies would be provided to people as well as “concessional bank loan” to ensure there is “no cost burden on the people”. Furthermore, all stakeholders will be seamlessly integrated into a National Online Portal to streamline the implementation process.

The prime minister also encourages youth to join this effort. He said, “Let’s boost solar power and sustainable progress. I urge all residential consumers, especially youngsters, to strengthen the PM – Surya Ghar: Muft Bijli Yojana.”

HERO FUTURE PLANS TO LAUNCH GREEN HYDROGEN PROJECTS IN COMING MONTHS

Hero Future Energies, a leading renewable energy company, is set to venture into green hydrogen projects in the coming months. The move reflects the company’s commitment to exploring sustainable and innovative energy solutions. Green hydrogen, produced using renewable energy sources, is gaining traction as a clean alternative for various industrial applications and energy storage. Hero Future Energies’ foray into this space signifies a strategic response to the evolving landscape of renewable energy and its potential role in the broader energy transition.

Hero Future Energies (HFE), a renewable energy developer, is exploring green hydrogen project opportunities in India. HFE, an arm of the Hero Group, anticipates making some announcements in the coming months as these discussions progress and materialise into concrete initiatives. The company is actively engaging with various customers across India to scout diverse project opportunities. Further, it is looking at green hydrogen in two ways- one is for supplying for conventional usage to replace alternate materials.

HFE has partnered with Ohmium International, an electrolyser company which manufactures in Bangalore, to develop 1,000 MW of green hydrogen production facilities in India, the UK and the rest of Europe. There are again two areas that could work in making green hydrogen available directly to consumers or the public. One which could have a significant impact is to blend it in the city gas distribution (CGD) system. The other way to get closer to the consumer is in heavy-duty mobility.

The firm has a global portfolio of three GW of renewable energy assets across India, Ukraine and Vietnam, comprising operational and under-construction projects. It has another two GW of projects in the pipeline across the above geographies as well as the UK and Bangladesh.

24 EQ FEBRUARY 2024 www.EQMagPro.com

INDIA

SWITCHING TO GREEN POWER JUSTLY

The move towards green power is inherently just, fostering environmental sustainability and addressing climate change. Transitioning to renewable energy sources ensures a fair and equitable distribution of resources, benefiting communities, and mitigating the impact of environmental degradation on vulnerable populations. The just transition also involves considering the socio-economic aspects, providing job opportunities in the green energy sector, and promoting inclusive growth. Ultimately, the shift to green power aligns with principles of justice, balancing ecological well-being with social and economic equity.

As can be seen from the case of Maharashtra, planning is essential for a just transition. One only has to read the newspaper headlines to realise that climate change is no longer a distant threat. For instance, a headline from January this year announced, “Mumbai experiences its hottest January day with temperatures soaring above 35 degrees Celsius.” Another alarming headline highlighted, “Delayed snowfall, forest fires, migration, and dwindling tourism signal a distress call from India’s mountains.” These examples vividly illustrate the local repercussions of global warming. They underscore that the real journey toward a sustainable future will unfold at the district and state levels. But what strategy can states and districts adopt to become the focal point of climate action? My colleagues and I explored this inquiry last year, selecting Maharashtra as a case study.

Maharashtra, both highly vulnerable to the changing climate and a major greenhouse (GHG) gas emitter, presents a microcosm of challenges posed by the climate crisis at the sub-national level. On the one hand, the climatic impacts will affect the state’s growth and development; on the other, transitioning away from fossil fuel, essential to reduce emissions, threatens to close thousands of factories and leave behind millions of workers. The critical question explored was how Maharashtra can adapt to these climatic shifts and transition towards sustainable energy sources without compromising its economic vitality and social welfare. The research suggests that the solution lies in a “just transition”—a strategic approach that weaves together climate action, green growth, and social justice.

In most studies on climate vulnerability, Maharashtra emerges as one of the most vulnerable states in the country. This is because climate change-driven extreme weather events are impacting every part of the state. While Marathwada and Vidarbha confront drought, the Konkan region experiences flood. The state has also been experiencing increasing heatwaves in the past two decades. A deadly example of this was the heatwave in Kharghar last year in which 14 died, and many were hospitalised. Mumbai, the country’s financial capital, is now hammered by floods and heat. All this is translating into a massive loss to the economy. Take the agriculture sector, which is badly affected by drought, floods, hailstorms, and cyclones. About threefourths of Maharashtra’s cropped areas are vulnerable to these extreme events, which is now causing real losses. In 2021-22, for example, the state government sanctioned about Rs 4,300 crore to farmers as compensation for crop losses. This increased to Rs 7200 crore in 202223—a two-third increase. However, these costs are just a fraction of the total losses, as the state is also paying for infrastructure damage and repairs. The losses to businesses and individuals are likely manifold due to work disruptions and loss of property.

Maharashtra is also one of the major emitters of GHGs, accounting for 10% of the country’s emissions. The emissions have grown at 4.1% per year since 2011-12, a rate higher than the national average. Besides, its per capita emissions are 2.5 tonnes, 15% higher than the national average.

26 EQ FEBRUARY 2024 www.EQMagPro.com INDIA

These emissions arise as the state’s economic engines run on fossil fuels. It has the largest fleet of coal-based power plants and is the second-largest consumer of petroleum products. It is the largest manufacturer of automobiles and the fifth-largest coal producer. Besides, it has the third-largest number of factories in the country, about 40% of which are heavily dependent on coal, oil, and gas. The transition to green energy will affect all these sectors, but most importantly, it will impact over a million formal workers and many lowpaid informal workers.

The top three sectors facing challenges within the next 10 years are coal mining, coalbased power, and automobiles. Over 60% of the currently operational coal mines in Maharashtra will likely close in the next 10 years due to economic unviability and resource exhaustion. Similarly, one-fourth of the thermal power fleet too is likely to be decommissioned due to economic and environmental factors. On the other hand, the automobile sector, which accounts for 7% of the gross state domestic product (GSDP), will be impacted by the electric vehicle transition, especially 2 and 3-wheelers. These sectors require transition plans soon to minimise disruptions to jobs and livelihoods.

Geographically, the green energy transition will affect 14 districts with a large concentration of fossil fuel-dependent industries. Many of these districts are also highly vulnerable to climatic impacts. For example, Nagpur, Chandrapur, and Yavatmal have large concentrations of coal mines, coalbased power plants, and factories. These districts are also draught-prone and highly vulnerable to extreme events. The other hotspot is the Pune district, with a large concentration of the auto industry. To deal with the climate emergency and the transition to green energy, the state needs a multi-pronged approach to enable a just transition. First, it needs a comprehensive just transition policy focusing on economic diversification, green energy, and industry development in the hotspot districts; land and infrastructure repurposing; workforce development; and social infrastructure investments. Second, it must develop tailored regional plans for hotspot districts to prioritise interventions and attract investments. The priority regions for such a plan are the Chandrapur-Nagpur-Yavatmal and Pune clusters. Third, repurposing land and factories will be essential to avoid economic disruptions. In Maharashtra, over 20,000 ha of land is available with closed and unprofitable mines, which can be repurposed for the development of green energy and green industries. This will also avoid the pains of land acquisition and displacement. Fourth, preparing the workforce for the green economy through skilling and reskilling will be essential to create millions of green jobs and push for the next stage of growth. Lastly, significant investments would be required from public and private sources to develop green energy, industry and infrastructure. Some existing funds, like the District Mineral Foundation (DMF) funds with coal districts, can be used to kick-start transition measures.

By prioritising a just transition, Maharashtra can navigate the disruptions due to economic and climatic change, create new green jobs, and achieve its ambitious goal of a trillion-dollar GSDP by 2030.

GOA’S PUSH FOR SOLAR POWER PROGRESSING AT SNAIL’S PACE

Goa’s efforts to promote solar power are progressing slowly, facing challenges in implementation. Despite intentions to boost solar adoption, factors such as regulatory hurdles, land constraints, and public awareness may be impeding the state’s solar initiatives. The government might need to address these issues to accelerate the growth of solar energy in Goa.

The generation of 150 megawatt of renewable power by 2050 seems to be a distant dream for Goa, that is making progress at a snail’s pace in transition to clean electricity.

In the last five years, the State has generated 110.91 million units (MU) of green energy, with an annual rise. From generating just 4.46 MUs of power in 2019, when the State launched its solar mission, to achieving 41.64 MUs of power by the end of November 2023, the coastal State has generated almost eight times more green energy. According to the Economic Survey report tabled in the House, the number of solar connections in the State as on December 2023 are 1134 with total installed capacity of 53.03 megawatts which has so far generated only 110 MU of power.

According to the Goa State Energy Vision 2050, the State aims to generate 150 megawatts of renewable power by 2030. The State intends to become the first in the country to run on 100 per cent renewable energy by 2050. As per data, the State’s power demand at present is 540 megawatt per day and it touches 750 megawatts per day during the peak hour. The State government had in February 2019, notified the Goa State Solar Policy and was subsequently amended in August 2020. Following lack of response, the policy was further amended in March 2023 to allow consumers with demand load of 1 MW and above to take power under Open Access from Solar project during day time generation and during the peak hours (6 pm to 11 pm) through Battery Enabled Storage System with maximum of 15% of demand of the State.

www.EQMagPro.com 27 EQ FEBRUARY 2024

INDIA

ENGIE PLANS TO INVEST RS 17,200 CR TO SET UP RENEWABLE PROJECTS IN GUJARAT

ENGIE has announced intentions to invest Rs 17,200 crore to establish renewable projects in Gujarat. This strategic investment reflects ENGIE’s commitment to advancing clean energy initiatives, contributing to Gujarat’s renewable energy goals and fostering sustainable development in the region.

The company has signed a MoU with the Gujarat government in this regard at the ongoing 10th edition of Vibrant Gujarat Global Summit 2024 in Gandhinagar Pune-based ENGIE plans to invest Rs 17,200 crore for the development of 2.5 GW of renewable energy projects in Gujarat. The company has signed a MoU with the Gujarat government in this regard at the ongoing 10th edition of Vibrant Gujarat Global Summit 2024 in Gandhinagar. These proposed projects are in addition to the ongoing development of a 400 MW solar project at Surendernagar in Gujarat, ENGIE said in a statement. “This MoU signifies an investment of Rs 17,200 crore along with creating 14,000 new jobs, reflecting ENGIE India’s commitment to contributing to the region’s socio-economic development,” the company said.

Amit Jain, Country Manager, ENGIE India, said, “Through this cooperation with the government of Gujarat, our goal is to play a significant role in advancing the state’s renewable energy sector and thereby making substantial contributions to India’s overarching clean energy objectives.” The company is mainly into renewable power generation.

IREDA, INDIAN OVERSEAS BANK INK PACT TO CO-FINANCE RENEWABLE ENERGY PROJECTS

IREDA (Indian Renewable Energy Development Agency) and Indian Overseas Bank have signed an agreement to co-finance renewable energy projects. This collaboration signifies a joint effort to support and fund initiatives in the renewable energy sector, contributing to India’s sustainable development goals.

The agreement was signed in the presence of IREDA CMD Pradip Kumar Das and IOB MD and CEO Ajay Kumar Srivastava in the national capital, a statement said State-owned IREDA announced a partnership with Indian Overseas Bank (IOB) to co-finance renewable energy projects in India.

The agreement was signed in the presence of IREDA CMD Pradip Kumar Das and IOB MD and CEO Ajay Kumar Srivastava in the national capital, a statement said. Indian Renewable Energy Development Agency (IREDA) and Indian Overseas Bank have joined hands by signing a memorandum of understanding (MoU). The agreement sets the stage for co-lending and loan syndication for a diverse spectrum of renewable energy projects across the nation, it added.

The IREDA CMD said, “By combining our strengths and resources, we aim to provide robust financial support to renewable energy projects. The partnership aims to streamline loan syndication and underwriting processes, management of Trust and Retention Account (TRA) for IREDA borrowers, and work towards fixed interest rates over a 3-4-year period for IREDA borrowings”.

This collaboration builds upon IREDA’s successful partnerships with other prominent financial institutions, including Bank of Baroda, Bank of India, Union Bank of India, India Infrastructure Finance Company Limited and Bank of Maharashtra, Das said. IREDA, under the Ministry of New and Renewable Energy, is a non-banking financial institution engaged in promoting, developing and extending financial assistance for setting up projects related to new and renewable sources of energy and energy efficiency/conservation.

28 EQ FEBRUARY 2024 www.EQMagPro.com

INDIA

RECYCLEKARO SIGNS

AN MOU WITH BHABHA ATOMIC RESEARCH CENTRE (BARC) FOR COPPER OXIDE NANOPARTICLES PRODUCTION

FROM E-WASTE

Recyclekaro, one of the leading e-waste and lithium-ion battery recycling companies in India, has entered into a Memorandum of Understanding (MOU) with Bhabha Atomic Research Centre (BARC), India's foremost nuclear research institution. The collaboration aims to utilize/leverage BARC's advanced technology for the extraction of high-purity copper oxide nanoparticles from depopulated printed circuit boards (PCBs).

The produced copper oxide nanoparticles hold immense potential as a catalyst for various industrial processes, antibacterial coatings for medical and electronic devices and sensors, as well as conductive inks and water purification. Beyond the evident environmental advantages, this strategic move is poised to create a positive socio-economic impact by generating employment opportunities throughout the PCB recycling process, from collection and transportation to processing and manufacturing of recycled materials. Notably, the recovery of precious metals from PCBs not only proves economically viable but aligns with circular economy principles, providing essential raw materials for manufacturing. In light of stringent regulations governing electronic waste disposal in India, this collaborative effort underscores Recyclekaro’ s unwavering commitment to sustainability.

Speaking on the association, Mr. Rajesh Gupta, Founder & Director, Recyclekaro, said, "At Recyclekaro, we are committed to exploring innovative methods within the recycling industry. This MOU represents a significant step in advancing our technological capabilities. Our ongoing research and development efforts are driving progress in sustainable technologies and waste management practices, underscoring our commitment to environmental responsibility and our contribution to a more sustainable future."

It's encouraging for Recyclekaro to actively contribute to the efficiency and sustainability of PCB recycling operations using the advanced technologies, aligned with global environmental goals, which emphasize the essential role of technology in addressing electronic waste challenges and promoting responsible resource management. This collaboration reflects our dedication to advancing a cleaner and greener future, and we're pleased to be part of initiatives that positively impact the ecosystem.

Rich in metal content, PCBs are considered a high-value waste. India generates around 3.2 million tons per year of electronic waste, which contains many precious materials. PCB recycling stands as a cornerstone for resource conservation, environmental protection, and economic growth.

Recyclekaro is currently in the stage of establishing its Nickel Metal plant and is in ongoing discussions with new partners for technology transfer, aiming to strengthen the ecosystem. This strategic approach aligns with our commitment to environmental sustainability and the cultivation of a robust Circular Economy and Urban Mining model.

www.EQMagPro.com 29 EQ FEBRUARY 2024 FEATURED

FEATURED

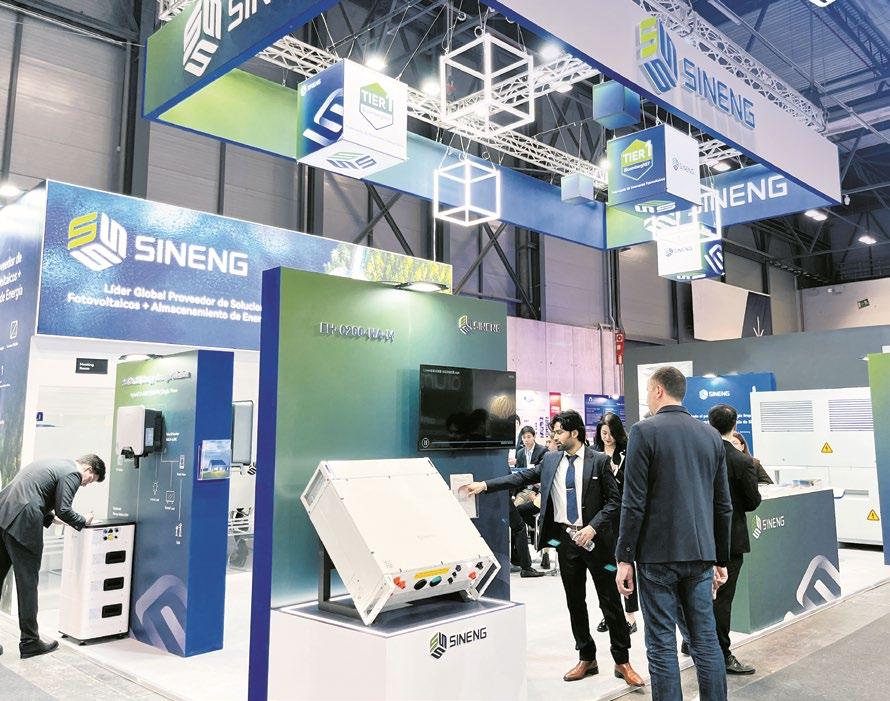

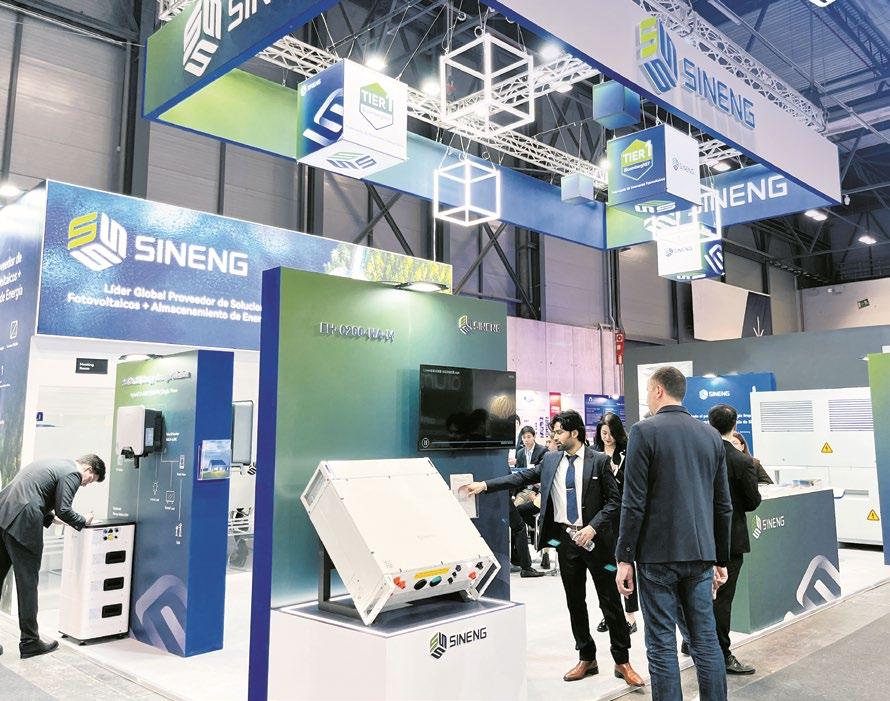

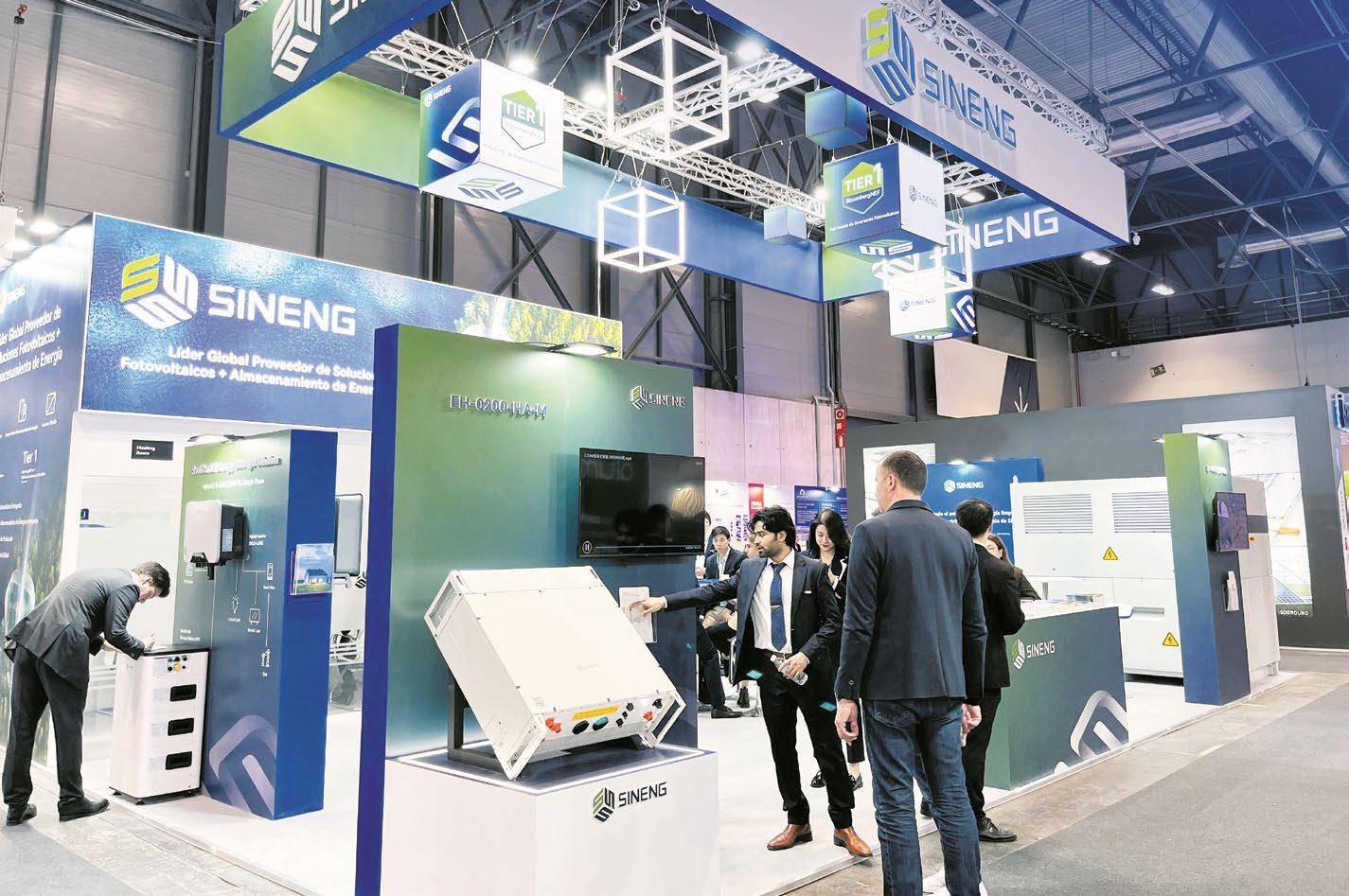

GENERA 2024: SINENG ELECTRIC EMPOWERS GLOBAL ENERGY TRANSITION

Sineng Electric, a leading global provider of photovoltaic (PV) and energy storage system solutions, unveiled its cutting-edge PV inverters and energy storage systems designed for diverse applications, garnering significant attention from attendees.

PIONEERING THE GREEN REVOLUTION WITH UTILITYSCALE PV SOLUTIONS

Sineng Electric showcased its utility-scale PV solutions as the center piece of Genera, creating a buzz in the atmosphere. The spotlight was on the 4.4MW central inverter, the EP4400-HA-UD, featuring isolated internal control, higher power output, simplified O&M, and larger array capacity, which optimizes every touch point of the user journey. Tailoring offerings to local market needs, Sineng emphasized its commitment to meeting the growing energy demands. The SP-350K-H1, with its high compatibility, increased power generation, lower system cost, and grid-friendly design, underscores Sineng’s dedication to propelling the global energy transition towards a greener and more sustainable future.

ENERGY STORAGE ON THE RISE WITH 1500V STRING PCS

Sineng showcased the EH0200-HA-M with exceptional system efficiency, achieved through battery rack level management and flexible modular design, which is well-suited for utilityscale and C&I applications. The higher battery capacity utilization ensures stable solar energy usage during peak consumption periods, reaffirming the belief that energy storage is poised to become a key player in Europe’s renewable energy market.

30 EQ FEBRUARY 2024 www.EQMagPro.com

FEATURED

RESIDENTIAL AND C&I SOLUTIONS FOR ENVIRONMENT-FRIENDLY ELECTRICITY

To meet the escalating demands of the future, Sineng introduced a solution for generating clean electricity for solar-powered homes. The SN3.0-6.0HS, with its wide battery voltage range, rapid on-off switch time, and intelligent management, stands out in optimizing hybrid inverter technologies, capturing the attention at the exhibition.

Jianfei Li, Vice President of Sineng Electric, remarked, “Sineng Electric has made remarkable strides in recent years, solidifying its position as a key player in the solar industry. Platforms like Genera serve as invaluable opportunities for meaningful exchanges, fostering stronger collaborations and a positive outlook for the future. Together, let’s continue shaping a green and sustainable tomorrow.”

Sineng also provided C&I energy solutions, enabling EPCs, developers, and owner-operators to harness rooftop resources efficiently. The SN50/60PT, an advanced string inverter, enhances generating capacity and PV system safety while streamlining installation and O&M efficiency, setting the benchmark of product reliability and driving industry transformation.

www.EQMagPro.com 31 EQ FEBRUARY 2024

FEATURED

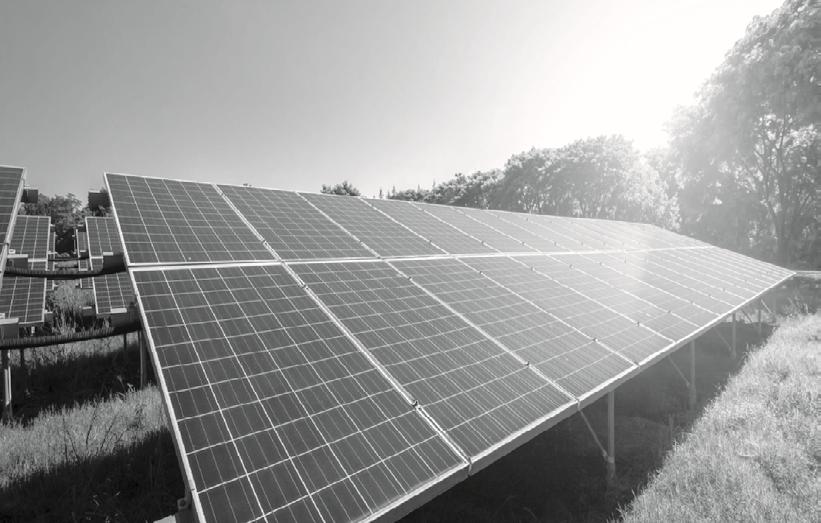

PRADHAN MANTRI SURYODAY

YOJANA : A REVOLUTIONARY SCHEME

FOR THE SOLAR INDUSTRY

PM Modi of our country, Narendra Modi, recently launched PM Suryoday Yojana on 22nd January 2024. With PM Suryoday Yojana, more than 1 crore rooftop solar will be installed on house roofs of poor and middle-class people of the country.

By installing rooftop solar under this scheme, people do not need to pay the electricity bills. In this way, PM Modi’s scheme becomes self-reliant on the energy front as well. The Pradhanmantri Suryoday Yojana will assist the poor and BPL citizens with power bills and energy related troubles. To avail benefits of Pradhanmantri Suryoday Yojana, applicants can observe the scheme from the website.Objective of PM Suryoday Yojana People of the country who are bothered by higher electricity bills can seek help from the Suryoday Yojana of the Indian government. The objective of the scheme is to reduce the electricity bills of poor and middle-class people in the country through installing rooftop solar panels at their homes & to make each house in India vibrant.

Under this scheme, the government will give subsidies on the installation of solar panels, which will help even the poorest of the poor to take advantage of this scheme. The central authorities have set a target of putting rooftop solar plant on 1 crore homes across India in the coming time.

PM Suryoday Yojana Registration

PM Suryoday Yojana is launched recently and soon the application process will be started. Applicants can sign up for the PM Suryoday Yojana easily by visiting the official site https://solarrooftop.gov.in/. There, you may see the scheme details and click on apply, enter all the required information, upload the files that are required, submit your application consent and Now, it is time to submit your application form. Download the application copy for your future references.

Citizens who belong to the BPL or poor category can register/apply for the scheme to get the benefits of the scheme. The approximate eligibility criteria for this scheme may be as follows:

• The applicant must be an Indian.

• There will be some specific earnings standards to make sure the scheme benefits the needy ones.

• Ownership of the assets where in the solar panels will be set up may be a criterion.

• Those who have no longer previously benefited for solar energy schemes from the comparable authorities are often prioritized.

With PM Suryoday Yojana will not only reduce the electricity bills of the Poor and middle-class citizens of the country but the country will become self-reliant in the subject of energy.

Vineet Mittal, Director- Finance & Strategy, Navitas Solar Finance Minister Nirmala Sitharaman while presenting Interim Budget 2024 said that PM Suryoday Yojana will aid households in saving up to ₹15,000-18,000 annually households from free solar electricity and selling the surplus to the distribution companies. This indicates that incremental budget allocation from the government will remain critical for successful implementation over the scheme period. Through rooftop polarization, one crore households will be enabled to obtain up to 300 units of free electricity every month. The scheme will also help to enable more EV charging, create entrepreneurship opportunities for a large number of vendors for supply and installation as well as provide more employment opportunities for the youth with technical skills in manufacturing, installation and maintenance.

At Navitas Solar, we believe that with this scheme approximately 20-25 GW of rooftop solar capacity will be supported. Due to solarization of homes, the demand from these households will save approximately about ₹2 lakh crore for DISCOMs over the next 25 years that is the life of a solar power plant. This scheme has massive upside for the solar manufacturers, developers and consumers leading to long-term investment opportunities. We thank Honorable PM Modiji and Indian Government for this bold move. We appreciate Government's approach and efforts for transition towards the Clean Energy.

32 EQ FEBRUARY 2024 www.EQMagPro.com

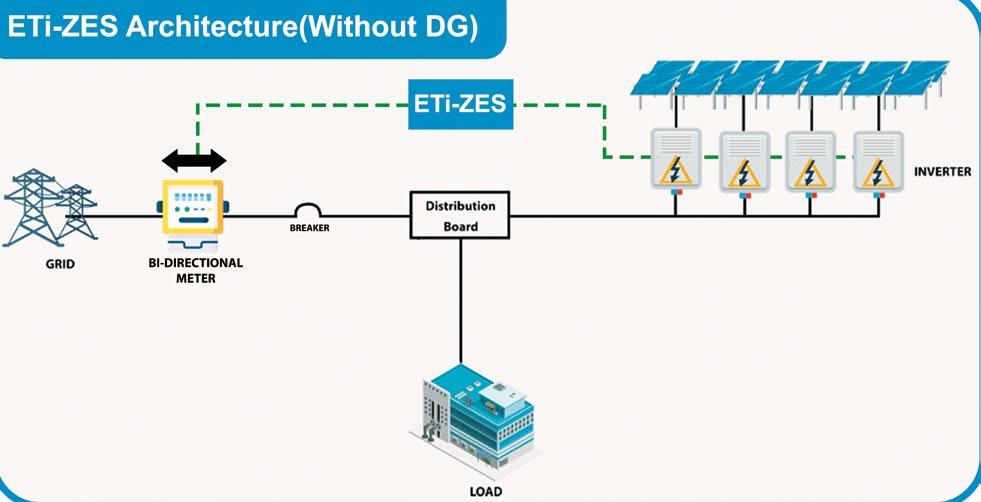

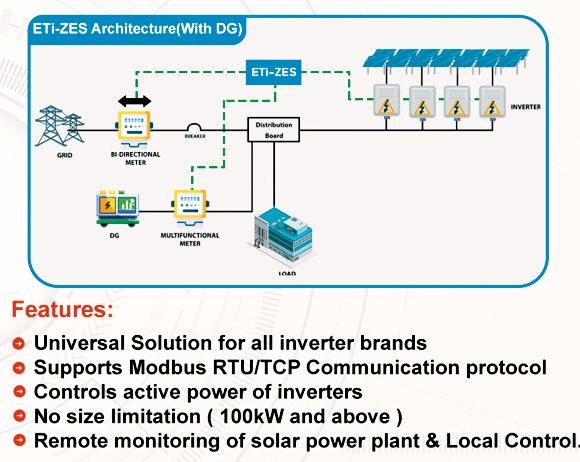

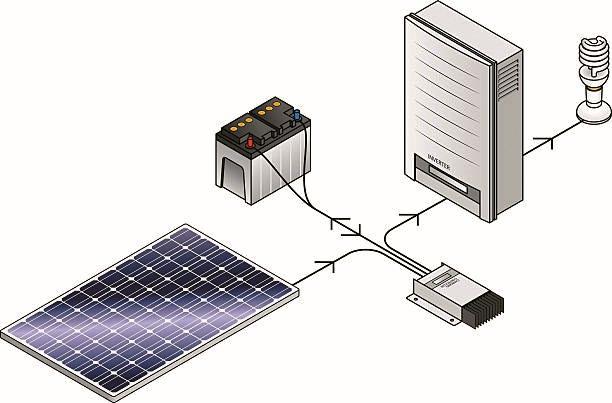

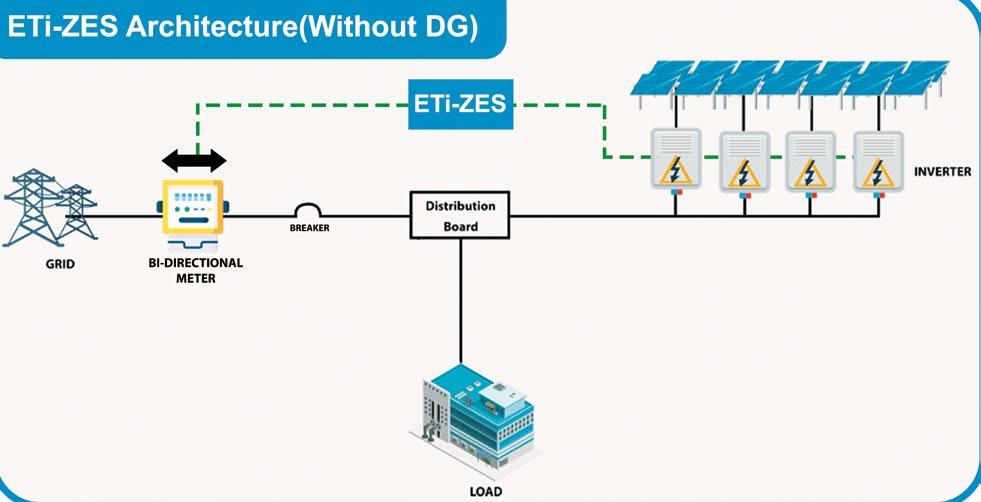

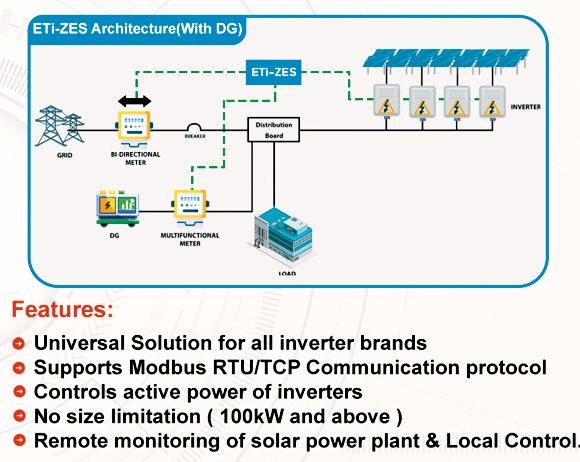

In 2021, India was ranked fourth globally in solar energy generation. With this, it would be fair to say the use of solar energy for self-consumption would greatly contribute towards greener, cleaner, and cheaper energy, which in turn helps reducing the carbon footprint, decrease in energy cost, or the possibility of re-selling this energy to the national grid when local regulations allow it. Solar panels are directly connected to the grid through inverters; the energy produced is transmitted to the load for self-consumption or is returned to the grid. However, in some regions, the local grid operator does not allow energy injection into the grid which is called a zero export or injection limitation. The injection limitation consists of controlling the amount of energy produced by a photovoltaic (PV) plant injected into the grid. Limiting active power injection may be necessary to relieve the grid and reduce the reinforcement costs that this would imply. Zero export system helps in achieving the goal by not injecting any amount of electrical power into the grid.

ZES?

To ensure the electric grid’s stability, the solar plants may require limiting the power injection into the electric grid. In some countries, the injection of electricity is prohibited i.e., it is called zero export. In compliance with the law and to ensure the supply of a reliable electric grid some countries prohibit electric power injection limitations. It helps mitigate the abnormal events in electric grid through the generation of “undesirable” harmonics. By default, excess solar energy is clipped by an injection limiter. A more economical approach would be to include an intelligent energy management system such as ETi-ZES, which helps optimize the amount of energy lost by clipping the right amount of solar-generated power.

Controlling the energy production of a PV plant by considering climatic variations and consumption while ensuring that the current is not injected into the electric grid proves to be a real challenge. Fortunately, there are solutions to facilitate the energy management of the PV plant. Before installing PV, you can make sure that your installation size best matches the consumption, the aim being not to resell energy to the grid but to optimize your rate of self-consumption.

EnerMAN’s ETi-ZES has a wide range of compatibility with commercially available inverters. It helps:

Manage the power flow: reduce the solar inverters’ electricity production to ensure that solar production is not exported to the grid.

Records the data of equipments connected to it: collecting all data and alarms from multi-function-meters, PV inverters, Weather monitoring stations, etc.

ETI-ZES: THE SMART ZERO EXPORT SYSTEM FOR SOLAR PLANTS - FROM ENERMAN

It helps benefit from extended compatibility: the communication protocol supported is Modbus RTU/TCP. A simple logic to help explain how ZES works is as follows:

Step 1. Read the Active Power from the net meter.

Step 2. Check if Active power > Max Set point? If yes, increase the power on the inverter side.

Step 3. Check if Active power < Min Set point? If yes, decrease the power on the inverter side.

Step 4. Check again from step 1.

Minimum set point: it is the minimum required power input from the grid supply.

Maximum set point: it is the maximum required power input from the grid supply in case there is enough solar power being produced to cater the load.

Key features of ETi-ZES are:

It ensures zero export of energy from Solar PV to grid as per DISCOM guidelines to avoid penalties.

It can be installed on Local workstation/PC/Server and if required data can be shared with cloud server for remote monitoring/ access.

Real time active power control of Solar Inverter(s) by monitoring on-premises power consumption.

Is Solar Still Beneficial, Even with Zero Exports?

Yes, the real savings come from using the solar electricity generated locally rather than purchasing it from the grid. With grid electricity costing roughly Rs. 4/- to Rs. 5/- per kilowatt hour, reducing this cost by using the locally generated solar power immediately saves money.

Conclusion

The zero-export system maximizes self-consumption and uses most of the solar power generated locally. ETi-ZES helps achieve this goal economically.

www.EQMagPro.com 33 EQ FEBRUARY 2024

WHY

EXISTING SOLUTIONS TO MANAGE ZERO FEED-IN ETI-ZES

FEATURED

FEATURED

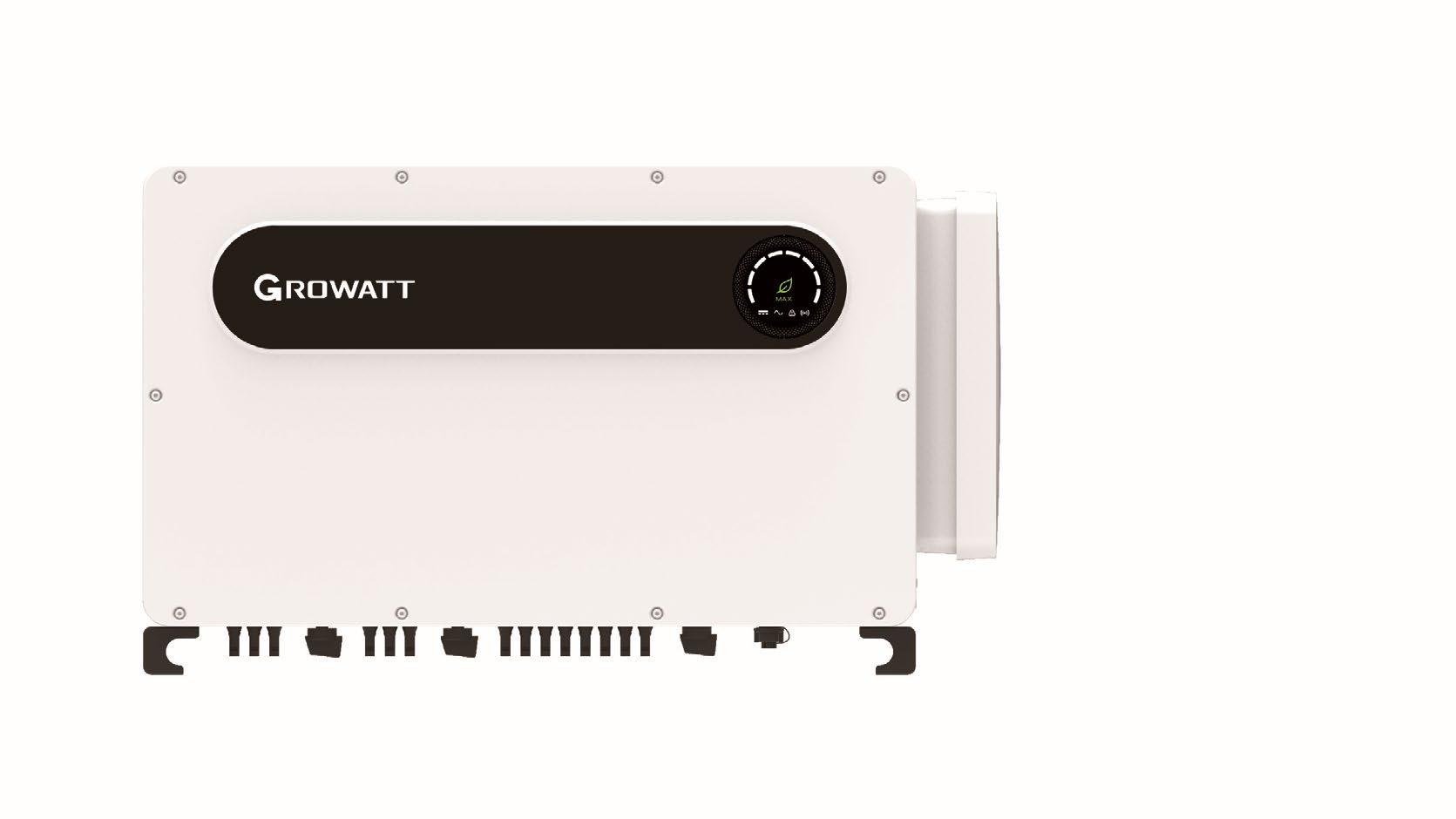

PUNE APARTMENTS GO SOLAR WITH GROWATT’S RESIDENTIAL PV SOLUTION

Imagine the first gentle rays of morning sunshine greeting your rooftop, not just warming your heart but also carrying an invisible force. Growatt’s residential rooftop PV solution is that magical key that turns this force into the daily electricity powering your home.

India has unique solar conditions and great potential for solar energy generation with about 250 to 300 sunny days per year. But these potential are not fully realized in residential rooftop segment, thus, the Ministry of New and Renewable Energy (MNRE) introduced supportive policies for its development. According to the Council of Energy, due to the subsidies, the installation of residential rooftop projects in India will reach 32GW. The booming rooftop solar market in India plays an important role in advancing the country’s renewable energy goals.

As the global No.1 residential PV inverter supplier, Growatt has provided products and services to global families across 180 countries and regions. Last year, they successfully empowered many homes, businesses and communities in India. Growatt unveiled a 350kW rooftop PV project for a prominent apartment, Rohan Kritika, in Pune.

Rohan Kritika comes with best in state amenities, tranquil surroundings and best in class architectural design for a luxurious and divine feeling for the occupants. The apartment has a incorporated several sustainable practices, one among them being installation of solar rooftop system. It is expected to generate 500,000 kWh per year for over 60 homes seeking solar energy to fulfill their daily needs and minimize their electricity bills. Witnessing these advantages, the remaining households in the apartment are planning to switch to renewable power very soon.

The installation is done by 'Harshal Enterprises', a renowned solar trader and service provider in Pune. The residents have opted the best in class inverter brand for this project- 46 nos. Growatt’s MOD 5000TL3-X & MOD 6000TL3-X, 10 nos. MIC 3300TL-X, and 4 nos. Growatt 5000TL3-S residential inverters. Growatt residential products feature user-friendly, high yields, great reliability. The new products are lighter, smaller and easier to install and transport. In addition, Growatt developed touch key and OLED display for an easier control. For safety, all inverters are all equipped with Type II SPD, optional AFCI 2.0 function and transfomerless design.

In recent years, facing with rapid economic growth and expanding population, India is eager to accelerate energy transformation at this stage. Reliable power supply is crucial to solve India’s power shortage and environmental problems. “We are committed to paving the way for more residents to embrace sustainability and enrich every aspect of life with clean power and vitality”, said Shantanu Sirsath, the India Technical Head of Growatt.

ONGC IN JOINT VENTURE AGREEMENT WITH NTPC GREEN FOR RENEWABLE ENERGY

ONGC and NTPC Green Energy Limited (NGEL) signed a Joint Venture Agreement (JVA) to develop renewable energy projects focusing on offshore wind. This was signed on 7 February 2024 during India Energy Week held at Goa. The JVA was signed in the presence of Hon’ble Minister of Petroleum and Natural Gas and Minister of Housing and Urban Affairs Hardeep Singh Puri.

The

The JVA marks a pivotal collaboration aimed at spearheading Renewable Energy Projects both within India and on the international stage. Specifically, the agreement encompasses ventures in offshore wind projects while also delving into potential opportunities in Storage, E-mobility, Carbon Credits, Green Credits, Green Hydrogen business, and its derivatives such as Green Ammonia and Green Methanol.

ONGC had earlier inked a Memorandum of Understanding (MoU) with NGEL on 27 September 2023 to advance its renewable energy goals in alignment with the energy transition. The primary focus of the MoU was to assess feasibility and establish renewable energy projects across various sectors. This strategic partnership between NGEL and ONGC signifies a concerted effort towards advancing sustainable energy initiatives, aligning closely with the nation's ambitious goals for a greener future. By synergizing expertise and resources, both entities are poised to contribute significantly to India's renewable energy landscape, driving innovation and fostering environmental stewardship.

www.EQMagPro.com 35 EQ FEBRUARY 2024

Joint Venture agreement was signed between NGEL CEO Mohit Bhargava, and ONGC Executive Director Satish Kumar Dwivedi. The signing took place in the presence of ONGC Chairman and CEO Arun Kumar Singh, and NTPC Limited Chairman and Managing Director Gurdeep Singh in the presence of Minister Puri

FEATURED

FEATURED

MAHINDRA SUSTEN WINS A NEW 300 MW SOLAR PROJECT AT SJVN 1500 MW

SOLAR TENDER

In an exhilarating development for the renewable energy landscape, Mahindra Susten Private Limited (“Mahindra Susten”), a leading Independent Power Producer (IPP), is proud to announce successful acquisition of a landmark project, awarded through competitive bidding processfollowed by e-reverse auction conducted by SJVN Limited (“SJVN”), a Renewable Energy Implementing Agency (REIA) of Government of India.

This accomplishment not only highlights Mahindra Susten's relentless pursuit of excellence but also its robust commitment to fostering sustainable energy solutions.

Tender / Tranche : SJVN 1500 MW Solar

Project Capacity

Won by Susten : 300 MW

Tariff Quoted : 2.53

Off taker : SJVN Limited

As a testament to this groundbreaking project, SJVN is set to formalize a 25-year Power Purchase Agreement with Furies Solren, a Special Purpose Vehicle (SPV) of Mahindra Susten, with completion timeline of 24 months. This project is poised to significantly bolster our renewable energy portfolio, illustrating our dedication to delivering sustainable energy solutions with precision and efficiency. At Mahindra Susten, our journey towards a greener future is marked by developed portfolio with over 1.54 GWp of renewable Independent Power Producer (IPP) projects across the Indian. Our strategic involvement as a co-sponsor of the Sustainable Energy Infra Trust (SEIT), India's largest renewable Infrastructure Investment Trust (InvIT), further underscores our commitment to pioneering sustainable energy infrastructures, showcased by its successful listing on January 15th, 2023. The fiscal year 2024 heralds a significant era of strategic achievements for Mahindra Susten, marking the acquisition of our fourth reverse auction renewable project

win. This victory not only enhances our aggregated under development capacity to over 1.3 GWp but also solidifies our position as a key contributor to India's decarbonization efforts.

Deepak Thakur, MD & CEO of Mahindra Susten, said, "This is our fourth bid win this fiscal year, subsequent to our strategic alliance with Ontario Teachers' Pension Plan in December 2022, signifies a pivotal moment in our journey. Our judicious selection in tender participation, achieving a win rate of over 40%, exemplifies our strategic acumen in navigating the competitive landscape. Our unwavering dedication to growing our renewable portfolio by 5x in the coming years is stronger than ever. With a special focus on solar, hybrid, and integrated energy storage projects, we look forward to announcing further growth in the coming days”

36 EQ FEBRUARY 2024 www.EQMagPro.com

APRAAVA ENERGY STRENGTHENS ITS LOW- CARBON PORTFOLIO WITH A NEW TRANSMISSION PROJECT WIN IN MADHYA PRADESH

Apraava Energy, a leading integrated energy solutions provider, announced that it has secured a new greenfield interstate transmission project in Madhya Pradesh through the Government of India's Tariff-Based Competitive Bidding (TBCB) process. The project involves setting up of ~ 40 kms of 765 kV double-circuit transmission lines and a 3,000 MVA substation. This is Apraava’s third transmission project win within the last 12 months, reflecting an increased momentum in growing its low-carbon business.

As part of the Transmission Service Agreement (TSA), the project will be developed by Apraava under BOOT (build, own, operate and transfer) model. The completion timeline is set at 24 months from the date of Special Purpose Vehicle (SPV) transfer. The project will cater to the increasing demand of the state.

Commenting on the win, Mr. Naveen Munjal, Director –Business Development & Commercial, Apraava Energy, said, “We are happy to add yet another significant transmission project in Madhya Pradesh, further cementing our commitment to addressing the increasing power demands in the state. Given the impressive progress witnessed in Madhya Pradesh in recent years, the seamless transmission of power across all regions is paramount for sustaining and accelerating this growth. Apraava Energy remains dedicated to being a trusted partner in advancing India's green goals and ensuring power for all.”

Apraava Energy will be responsible for the ownership, financing, development, design, engineering, procurement, construction, commissioning, operation, and maintenance of the project, and to provide transmission services for a period of 35 years post Commercial Operation Date (COD). In 2023, Apraava Energy secured two greenfield interstate transmission projects in Rajasthan, involving ~ 250 kms of 400 kV double circuit transmission lines and a pooling substation of 2500 MVA to be built as part of the Rajasthan REZ, phase-III, Transmission scheme that will enable evacuation of 20GW of renewable energy in the state of Rajasthan.

www.EQMagPro.com 37 EQ FEBRUARY 2024

FEATURED

€110 MILLION FUND FOR THE DIGITALISATION OF THE ENERGY TRANSITION ESTABLISHED

E.ON, the European Investment Fund (EIF) and Future Energy Ventures (FEV) jointly foster smart innovations for the energy transition with the help of a newly established fund. The fund managed by FEV already has a volume of €110 million and a target size of €250 million. Both E.ON and the EIF are holding a mid double-digit million euro stake as anchor investors. The fund invests primarily in start-ups and scale-ups that develop and implement digital solutions to drive the energy transition.

The capital of the fund is allocated entirely towards sustainable investments across three core investment themes with clear decarbonization potential: future energy, future cities, and future technologies. With an average initial ticket size of between €1-10 million for early-stage investments, it aims to target thirty new investments located in the innovation hubs of Europe, North America, and the Middle East. Future investors benefit from the partners' expertise in the energy sector.

“The clean energy economy is the greatest business opportunity of our generation, and we are excited to be raising our second fund at this pivotal moment. With FEV’s track record of portfolio successes, an ex tensive network of industry partners, our highly collaborative approach and deep sector focus, we are in a unique position to drive the digitization and decarbonization of the energy system. We are grateful to our investors and look forward to continuing discussions with potential institutional and strategic investors that share our vision.” said Jan Lozek, Founder and Managing Partner of FEV.

Marjut Falkstedt, EIF Chief Executive says: “Better managing our energy needs is one of the most important challenges of our time. That’s why we are excited about our participation in the newly established fund. This investment aligns perfectly with the EIF’s strategic objectives and our commitment to driving the energy transition and supporting decarbonization efforts across Europe.”

Thomas Birr, Chief Strategy and In novation Officer at E.ON, says: “This is a milestone for E.ON on our way to making the new world of energy work. Having access to ClimateTech and the resulting digital solutions is a central cornerstone of our innovation initiatives through which we continuously integrate new technologies and startup solutions into the E.ON business. The newly established fund which is open for external investors builds on our success of the existing venture portfolio and is the next important step for E.ON to broaden impact through collaboration.”

With this newly established fund, E.ON can further expand its many years of expertise in the field of innovation and, through a stable innovation ecosystem, bring new partners on board, who jointly have the confidence to invest in the energy transition. Today, FEV already runs one of the biggest global funds investing in Climate-Tech investing primarily in start and scale-ups that develop and implement digital solutions to drive the energy transition. The fund is expected to hold its final closing in the fourth quarter of 2024.

38 EQ FEBRUARY 2024 www.EQMagPro.com

FEATURED

FEATURED

HON’BLE PRIME MINISTER SHRI NARENDRA MODI TO LAUNCH POWER PROJECTS WORTH RS 28,978 CRORE

Hon’ble Prime Minister Shri Narendra Modi will dedicate to the Nation NTPC Darlipali Super Thermal Power Station (2x800 MW), NSPCL Rourkela PP-II Expansion Project (1x250 MW) and lay the foundation stone of NTPC Talcher Thermal Power Project, Stage-III (2x660 MW) with a total investment of Rs 28,978 Crore during a programme at Sambalpur on 3rd February, 2024.

Located in Sundargarh district of Odisha, Darlipali STPP is a pit-head Power Station with Supercritical (highly efficient) Technology, and is supplying low-cost power to its beneficiary states, such as Odisha, Bihar, West Bengal, Jharkhand, Gujarat and Sikkim. The 250 MW project of NTPCSAIL Power Company Ltd is established in Rourkela Steel Plant (RSP) to provide reliable power for the steel plant which is vital for economic growth. Further, NTPC is developing Talcher Thermal Power Project, Stage-III within old TTPS plant premises in Angul district of Odisha, which was taken over by NTPC from Odisha State Electricity Board in the year 1995. The old TTPS plant was decommissioned after completing more than 50 years of service to the Nation. The upcoming plant will have highly efficient Ultra Super Critical Technology based units and approxi-

capacity from this project is dedicated to the state of Odisha, other beneficiary states such as Tamil Nadu, Gujarat and Assam will also get low-cost power from this pit-head station. This project is being constructed with all modern environmental features like efficient electrostatic precipitator, Flue gas desulphurization, bio-mass cofiring, covered storage space for coal and will thus help in lesser Specific Coal Consumption and CO2 emissions.

Besides creating direct and indirect employment opportunities in the region, these projects have contributed to improvement of physical infrastructure such as approach road, drainage, transportation and communication facilities. Various community development initiatives are also being undertaken by NTPC in the surrounding villages in the area of education, drinking water, sanitation, health, women empowerment, rural sports, etc. NTPC has also set up a Medical College cum Hospital in Sundargarh, Odisha.

www.EQMagPro.com 39 EQ FEBRUARY 2024

FEATURED

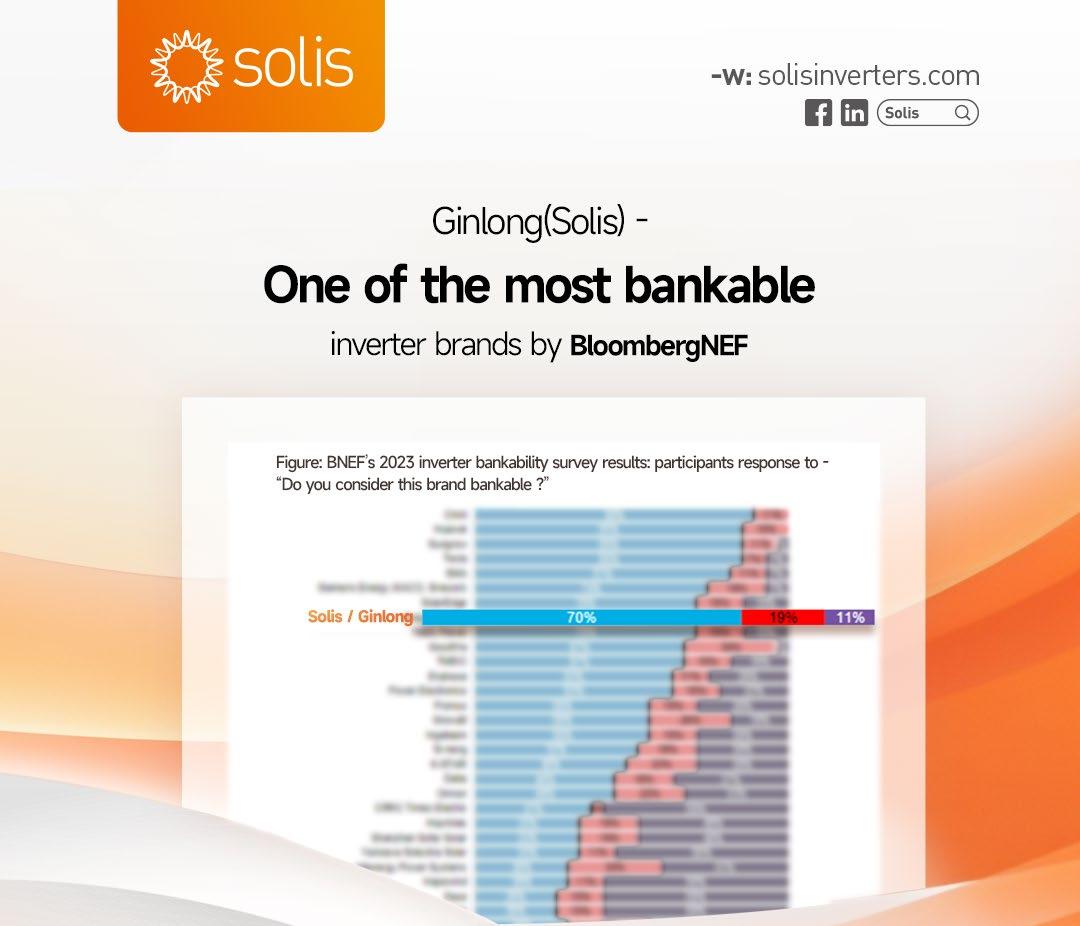

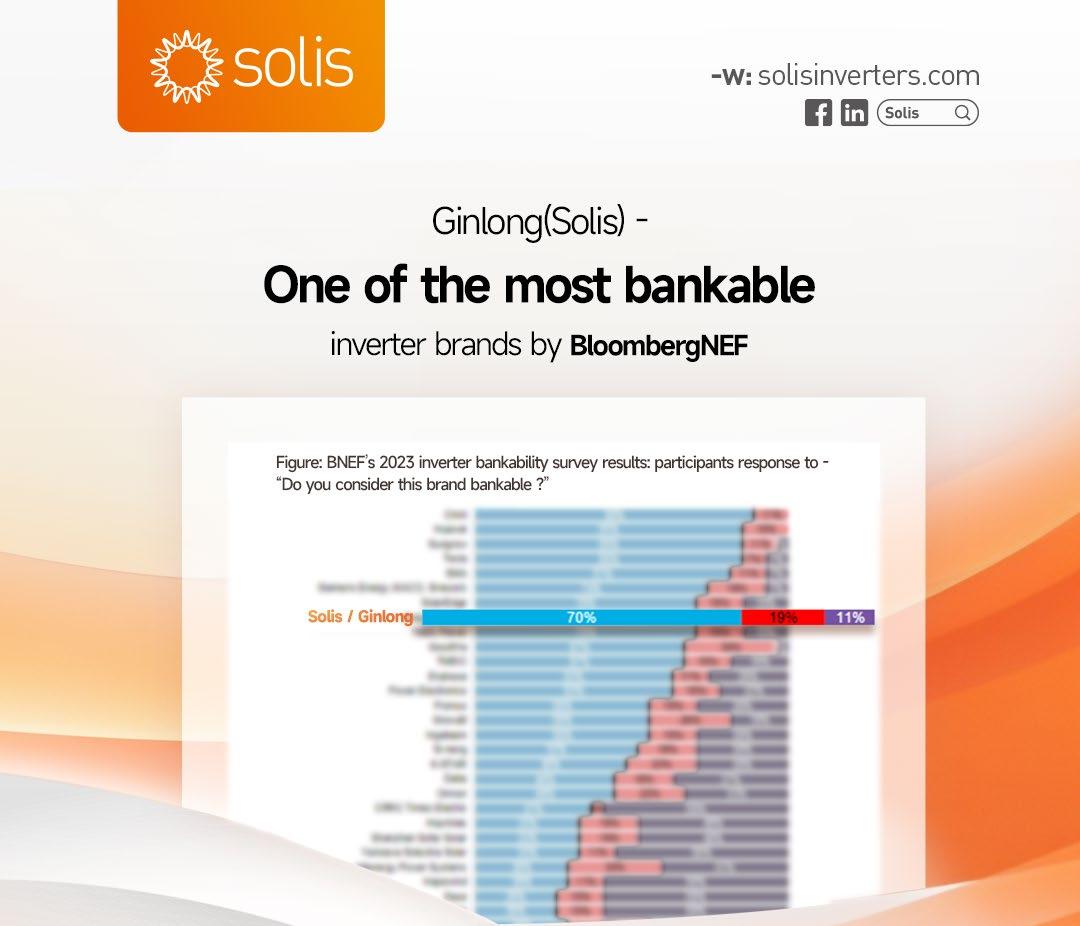

GINLONG (SOLIS) EARNS HIGH RANKING IN 2023 INVERTER BANKABILITY SURVEY

In a significant development for the global solar industry, Ginlong (Solis) proudly announces its notable position in the 2023 BloombergNEF (BNEF) Inverter Bankability Survey. The survey, engaging diverse industry stakeholders such as banks, solar engineering contractors, and technical advisers, sheds light on the solar inverter bankability landscape.