5 minute read

RELIANCE WILL SET UP 10 GW OF RENEWABLE CAPACITY IN UTTAR PRADESH

The group plans to invest Rs 75,000 crore across multiple business segments, including renewable energy, in Uttar Pradesh.

Advertisement

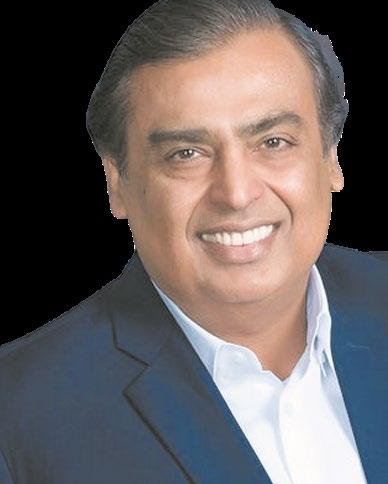

Billionaire Mukesh Ambani said on February 10 that his group plans to set up 10 gigawatts of renewable energy capacity in Uttar Pradesh and start a bio-energy business in the state. Reliance Industries (RIL) will invest Rs 75,000 crore across multiple business segments, including renewable energy, in the state over the next four years, Ambani said at the Uttar Pradesh Investor Summit.

Commenting on the occasion, Rupesh Agarwal, Acting CEO, Azure, said, “We are delighted to have Jean-François Boisvenu on our Board. His extensive knowledge and experience will play a crucial role in driving our company forward. I look forward to working with him and achieving Azure goals together.”

Source: PTI

Hero Future Energies Global Limited is a private corporation from England as well as Wales. The main target of this business is to set up and acquire projects for plants that are engaged in solar power and wind power generation. This business also operates in India (Hero Future Energies Private Limited India) under Indian Companies Act, 1956. These shares will be subsequently converted into equity shareholding. Official releases stated that the competition commission of India or CCI had approved shares of convertible preferences of Hero Future Energies Global Ltd. HFE is the right hand for renewable energy of The Hero group. In a press release, the regulator also stated and confirmed that Shobana Kamineni had bought 20% of Keimed Pvt Ltd’s equity share capital. The capital was acquired through Prime Time Logistics Technologies Pvt Ltd or PTL.

The acquisition of shares and capital concerning Mitsui & Co. (Asia Pacific) Pte Ltd is based on the combination related to the business of pharmaceuticals, sales, wholesale, etc. A few other deals beyond the threshold are yet to be approved by the competition commission of India or CCI. The proverb of these deals will be based on promoting fair and clean competition in the market as well as keeping practices related to unfair business aside.

Source: PTI

EVE WILL INVEST RMB 15.5 BILLION TO ADD 43GWH OF BATTERY PRODUCTION CAPACITY VIA TWO PROJECTS

On January 18, Chinese battery supplier EVE released several notices concerning its latest capacity expansion projects. All in all, EVE plans to invest RMB 15.5 billion to add 43GWh of production capacity in Jianyang (Sichuan Province) and Qujing (Yunnan Province). These notices were first picked up by other Chinese renewable energy news websites.

According to the information provided by the notices, EVE has signed an investment framework agreement with the government of Jianyang for a production base. The base will be mainly used to manufacture Li-ion batteries and battery packs used in EVs and energy storage systems. However, it could also churn out batteries for consumer electronics. The production capacity of the base is set at 20GWh per year. Furthermore, the site of the base will host office buildings, dormitory, cafeteria, and other related facilities. The investment in this project is estimated at RMB 10 billion. The development period is expected to last two years. EVE said a local subsidiary will be established to fund, build, and manage the base in Jianyang. The registered capital of this wholly-owned subsidiary will be at least RMB 100 million. Moreover, the investment related to the fixed assets of this project will be at least RMB 6 billion.

The notices also provided an update to the project in Qujing. Specifically, EVE has amended and re-signed an investment agreement that it previously arranged with the government of Qujing and the administrative committee of the Qujing Economic Development Zone. According to the amended agreement, EVE will build a base with a total production capacity of 23GW per year for cylindrical LFP batteries used in EVs. The project now entails an estimated investment of around RMB 5.5 billion, of which around RMB 4.5 billion will be related to fixed assets.

Source: energytrend

COMMIT RS 5,300 CRORE INVESTMENTS IN TN, TO ROLL OUT 6 NEW MODELS INCLUDING EVS

The fresh round of investments would witness roll out of six new models between the two companies including — two electric vehicles — representing the two global brands, Nissan Global chief operating officer and Member, Alliance Board Ashwani Gupta said here. Currently, both the auto makers produce four models at the Chennai plant located at Oragadam about 45 kms from here. According to Gupta, the Renault-Nissan manufacturing facility would also become 100 per cent carbon neutral by 2025 with use of renewal energy.

Gupta, in the presence of Chief Minister M K Stalin, Renault India Country CEO Venkatram Mamillapallee exchanged memorandum of understanding with Tamil Nadu government promoted nodal agency Guidance Bureau MD and CEO Vishnu Venugopal at an event here.

Source: PTI

Sk On And Urbix Will Collaborate On Developing New Anode Materials

SK On announced that it has signed an agreement with Urbix to collaborate on developing new anode materials that not only offer a better performance but are also environment-friendly. SK On is a supplier for EV power batteries from South Korea, whereas Urbix is a graphite processor from the US. nder the agreement, SK On and Urbix will jointly research and develop new anode materials. SK On will procure the successfully developed products from Urbix and use them at its battery manufacturing plants located in the US. The effective period of the agreement is two years but can be further extended. Established in 2014 and headquartered in Arizona, Urbix specializes in processing natural graphite. The company has finished setting up a commercial pilot production line and configuring the equipment of the line. The line is capable of outputting 1,000 tons per year, and the company plans to upgrade it to 28,500 tons per year by 2025. Urbix is recognized for its coated purified spherical graphite (CSPG). This material and the associated processing technology offers significant advantages in terms of product quality, production cost, energy consumption, production time, and facility space. CSPG is specifically designed for the anode of high-performance EV power batteries. Urbix is now rapidly expanding its production capacity as it aims to meet 30% of the graphite demand from EVs in the US and Europe by 2030.

SK On stated that it continues to strengthen its supply chain. In order to make the incoming flow of lithium materials more stable, SK On already inked supply agreements with Chile’s SQM and Australia’s Lake Resources and Global Lithium Resources in 2021. SK On added that successes in its partnership with Urbix will extend and smooth out its local supply chain in North America. This, in turn, will improve the supply situation with respect to graphite and help rapidly scale up production. These benefits will then translate to improved competitiveness for the battery manufacturer.

Source: energytrend

ADANI POWER’S RS 7K CR DEAL TO BUY DB POWER ASSETS FALLS THROUGH

Adani Power Ltd’s Rs 7,017-crore deal to buy thermal power assets of DB Power has fallen after the initial pact expired. “We wish to inform that the long stop date under the memorandum of understanding dated August 18, 2022, has expired,” Adani Power said in a regulatory filing

Earlier in August 2022, Adani Power had informed the bourses that it has agreed to acquire DB Power Ltd (DB Power), which owns and operates a running 2×600 MW thermal power plant at district Janjgir Champa in Chhattisgarh. Queries regarding the status of the deal sent to Adani Power did not elicit any response. This assumes significance in view of allegations of fraud against Adani group by the US-based short-seller Hindenburg Research. This issue rocked Parliament also earlier this month and opposition had demanded Joint Parliamentary Committee as well as a Supreme Court monitored probe into the issue. The initial term of the MOU (memorandum of understanding) was October 31, 2022. Later the deadline for the transaction got four extensions till November 30, 2022, December 31, 2022, January 15, 2023 and February 15, 2023.

DB Power is engaged in the business of establishing, operating and maintaining a thermal power generating station in Chhattisgarh. DB Power has long and medium-term power purchase agreements for 923.5 MW of its capacity, backed by fuel supply agreements with Coal India Ltd, and has been operating its facilities profitably.

Source: PTI