3 minute read

Internal Carbon Pricing

by 2050, though China and Ukraine are aiming for 2060 and 2070, respectively, while a handful of European nations are targeting earlier dates. Of the 29 countries that have adopted net-zero targets, 22 already have carbon prices in place. While some countries have already begun to articulate the role that carbon pricing will play in achieving their net-zero commitments, much more work is needed to clarify the nature and scope of these commitments and how they will be achieved.

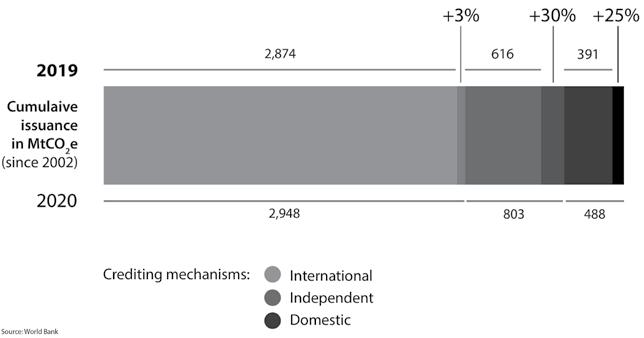

CUMULATIVE CREDIT ISSUANCE OF CREDITS (2019-2020)

Advertisement

Source: EQiSearch

CREDIT ISSUANCE AND NUMBER OF PROJECTS REGISTERED BY A MECHANISM

Source: EQiSearch

CARBON CREDITING DEMAND

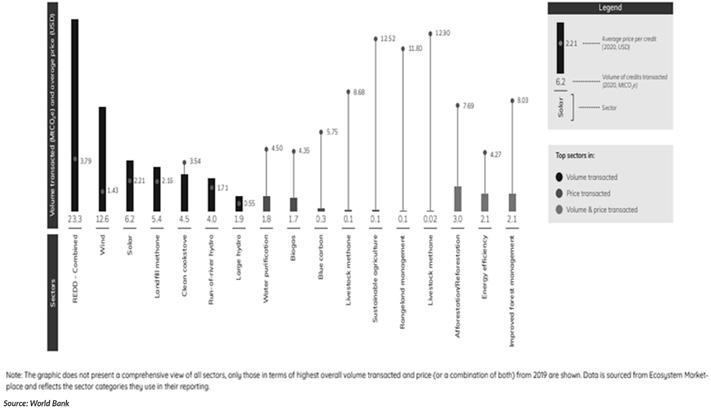

VOLUMES TRANSACTED AND PRICES PER SECTOR (2019)

In 2019, the demand for carbon credits from voluntary buyers surpassed 104 MtCO2e, representing an increase of 6% based on 2018 figures. The increased demand, mostly for credits from VCS (Verified Carbon Standard) and the CDM (Clean Development Mechanism) projects - is providing certainty and consistent revenues for project developers. In 2019, renewable energy and forestry, and land-use projects accounted for most of the credit transactions in the market, though transactions of forestry and land-use credits reduced significantly compared to 2018. Meanwhile, sustainable agriculture and rangeland management emerged as opportunities for carbon storage and drew the highest prices in the market.While several carbon pricing instruments allow entities to use carbon credits to meet their obligationsparticularly those in East Asia and North America, these only accounted for 18 MtCO2e in 2020, though this does represent a 13% increase in 2019 demand. South Africa moved a step closer to credit, as the Carbon Offset Administration System went live in 2020, becoming the first official registry for carbon credits generated under independent standards such as the VCS. The share of credits surrendered for domestic compliance may grow with upcoming sources of demand like Canada’s federal offset system and the use of credits in China’s national ETS. Chile’s crediting mechanism is also set to start in 2023. This demand source is likely to remain limited given the quantitative and qualitative restrictions on offset usage in its jurisdictions.

Source: EQiSearch

As of October 2020, 1,565 companies across all continents had adopted commitments to reduce their emissions to net-zero. The list of companies adopting such commitments is diverse, encompassing tech giants, oil majors, consumer brands, and airlines, among others. About half of these companies have expressly indicated their interest to rely at least partially on carbon offsetting to achieve their targets, with few companies having entirely ruled out the possibility of offsetting. Shell alone has announced it intends to purchase 120 million carbon credits per year by 2030, more than the entire size of the voluntary carbon market in 2019. For some companies, in particular, those serving consumer markets, the possibility to establish a clear correlation between their local environmental impact and crediting projects is attractive, and there is a willingness to pay a higher price than the average in the market. This is cultivating a growing number of local standards covering emissions that are not tapped by other existing carbon pricing instruments. North America is purchasing most of its carbon credits in its region, with buyers in Oceania purchasing 41% of their credits locally in the below table. The share of local carbon credits bought by European buyers, in contrast, remains small. However, buyers’ willingness to pay more than three times as much for these credits is leading to a growth in the number of local European standards, with four new standards having been launched in the past two years.