europeanbusinessmagazine.com SPRING EDITION | 2020

How can you adapt your business to the changing market? Business success is often achieved through adaptability. In retail it is no different. The changing balance between bricks and clicks requires a credit management approach that efficiently insures bad debts, monitors unpaid invoices and collects outstanding debts. Atradius can provide you with that credit management package enabling you to trade with confidence in the ever changing markets. Protect your business against bad debts, go to atradius.com Credit Insurance | Debt Collections | Business Information

ﻞﻬﺳأ ﻲﻠﻫ ا ﻰﻠﻋ ﺰﺋﺎﺤﻟا ﻲﻤﻴﻠﻗ ا ﻚﻨﺒﻟا ﺰﺋاﻮﺠﻟا ﻦﻣ ﺪﻳﺪﻌﻟا

www.kaiserwetter.energy 2017 2018 Renewable Energy driven by data and loved by us. The leading Data Analytics as a Service Company

LATAM’s Innovation Hub for the New Energy World EXPO CENTER NORTE, SÃO PAULO, BRAZIL JOIN LATAM‘S ENERGY FUTURE The core topics of tomorrow‘s energy world Unifying solar, energy storage and e-mobility Innovations and industry trends in the spotlight Join 28,000 visitors from more than 40 countries and 380 exhibitors at three parallel exhibitions The Leading Energy Exhibitions and Conferences at The smarter E South America Special Exhibition

w Or e fr A Na th N lW y de red l dor Tea poleonic sure om Ear Schmuckmuseum Pforzheim 19. 10. 2019 through 01. 03. 2020 l d a o l s m O W f N t T E r r a h o r e p o r a r extended until 14.06.2020

11 CEO Shuffle

12 Latest News

14 Latest Technological Gadgets 2020

16 Atradius and Kemiex shake-up the raw material trading landscape in pharma, veterinary, food and feed

18 Nurturing a female-empowered environment in a non-female-led business

19 Why diversity is the only way to generate great ideas

20 How diversity can unlock innovation in healthcare

22 Qatar: Five Stars for Property

24 European Business catches up with Fadi Kreiker

26 Understanding the Experience of Distributed Global Team Members

29 The Public Health Emergency Is Radically Reshaping The Economy

30 Corporate debt is in serious trouble – here’s what it means if the market collapses

32 Economic effects of coronavirus lockdowns are staggering – but health recovery must be prioritized

34 How economies can survive a period of ”economic pause” to deal with coronavirus

36 North Africa: How Morocco Is Dealing With Coronavirus

38 How to avoid a coronavirus debt crisis? Issue a new type of government bonds linked to GDP

40 Closing your Gender Pay Gap is Business Critical in 2020

42 Female Leadership: Mind the Gap

44 Where Does it STOP WithElon Musk

46 Crisis communications during the Coronavirus chapter

48 Understanding the impacts of digital transformation

50 Nets and KPMG explore the power of AI in fraud prevention

51 What Future Do Airlines Have?

58 Coronavirus: Why We Should Be Sceptical About The Benevolence Of Billionaires

60 How China is revolutionising e-commerce with an injection of entertainment

62 The impact of interruption

64 The whole idea of global value chains will be reconsidered after coronavirus

66 EU is gridlocked over €1 trillion coronavirus fund – here’s a way forward

68 Hiring from Home

70 Can crypto help us through the coronavirus crisis?

72 National Defence in the Coronavirus Era: Germ Warfare and Digital Security

74 Solutions: In a Time of Crisis

76 HONEY CORN and SPIRIANT Make a Beeline for Sustainability

77 COVID’s Cash Handling Dilemma Sees PFS EML Step into the Spotlight

78 Berkshire Hathaway’s Clipped Wings Could Spell Danger For European Airlines

80 Why London’s Position As A Fintech Hub Is Secure

82 Oil Industry Hit by Coronavirus Crisis: What to Expect in the Future?

84 Denise Coates: How the World’s Best-Paid Female Boss Built an Empire Against All the Odds

86 Sky Wars: Who’s leading the PR game?

88 Cinematic Phenomenon

90 Halfway Between Europe and the US: Why Iceland is the Perfect Spot to Do Business

92 The Environmental Positives of a Global Lockdown

94 Where are countries finding the money to mitigate economic

Publisher Nick Staunton

Editor

Patricia Cullen

Deputy Editor

Anthony Gill

Associate Publisher

Brad Adams

Features Editor

Katie Winearls

Head of Production

Paul Rogers

Head of Design

Vladimir Mladenovski

Subscriptions Manager

Rebecca Hill

Head of Business Development

Paul Matthews

Advertising Sales

Brad Adams

Tara Duckworth

Advertising Sales

Tara Duckworth, Mike Ray, Andy Ellis, Mark Holburn

Contributing writers

Patricia Cullen, Richard Fitzpatrick, Bala Murali Krishna, Shilpa Meen, Argee Laraya, Aimee Ni Mhaolcraibhe, Gordana Ristic, Jonathan Hooker, Jose Ignacio Latorre

Head of Digital

Stephen Scott

Photographer

Ben Fisher

NST Publishing Ltd, 19 Leamington Spa (studio 1) Leamington Spa,Cv324tf, UK

The information contained has been contained from sources the proprietor believes to be wholly correct however no legal liability can be accepted for any errors. No part of this publication can be reproduced without consent of the publisher.

europeanbusinessmagazine.com 10

catastrophe?

Will challenger Banks catch the check on COVID-19 Disruptions?

Denmark’s supply chain finance programme targets business bounce-back with $55bn working capital injection

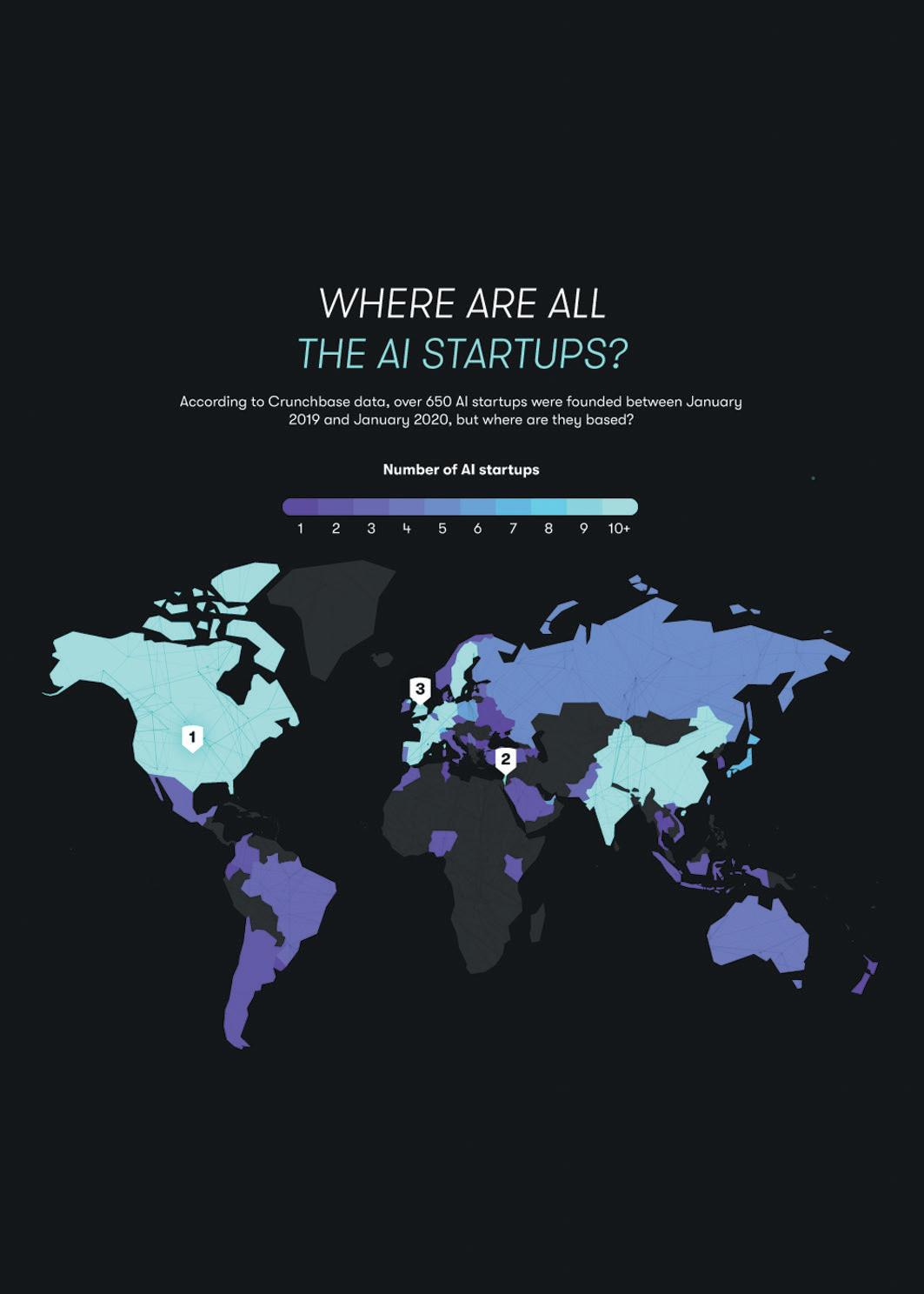

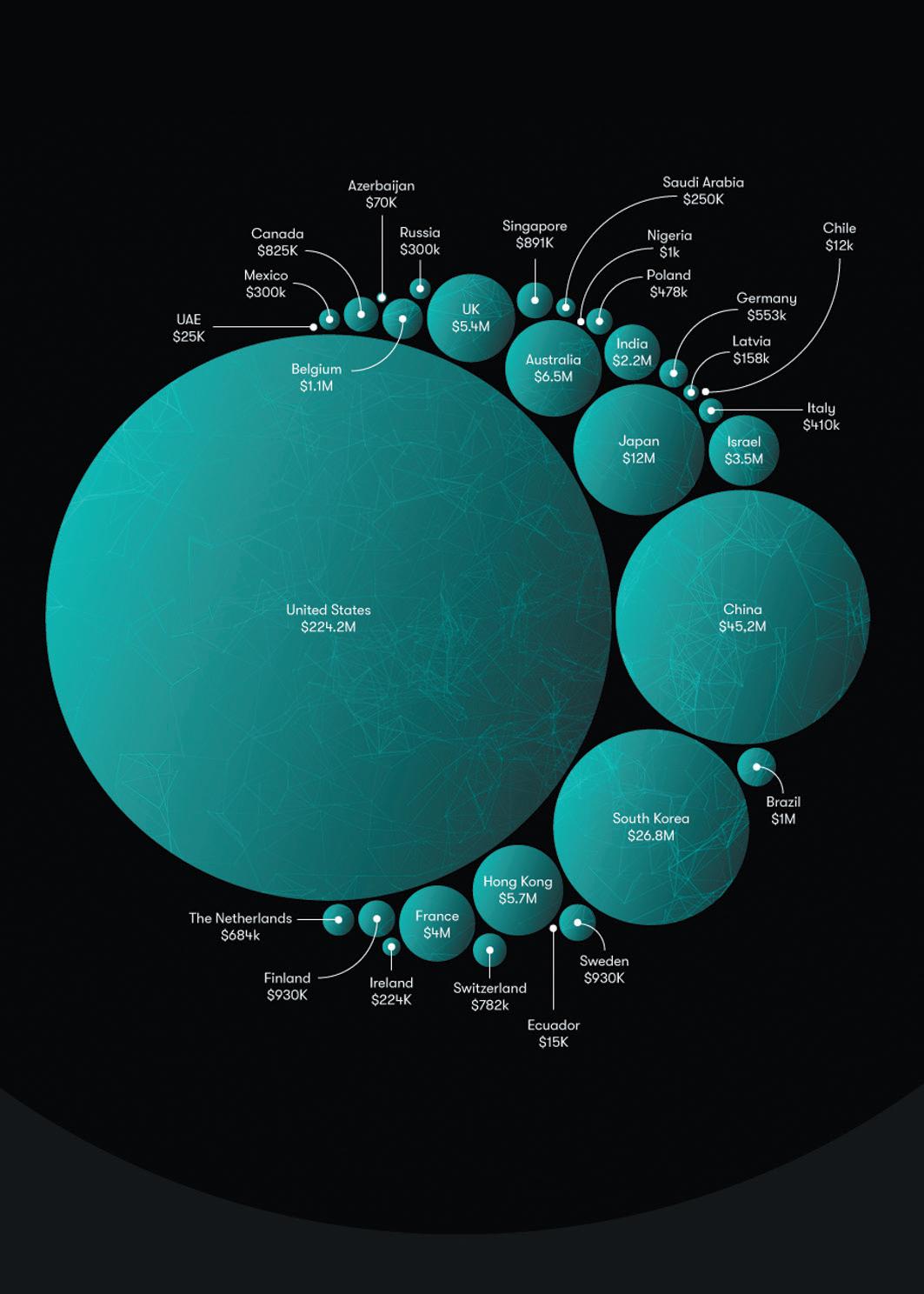

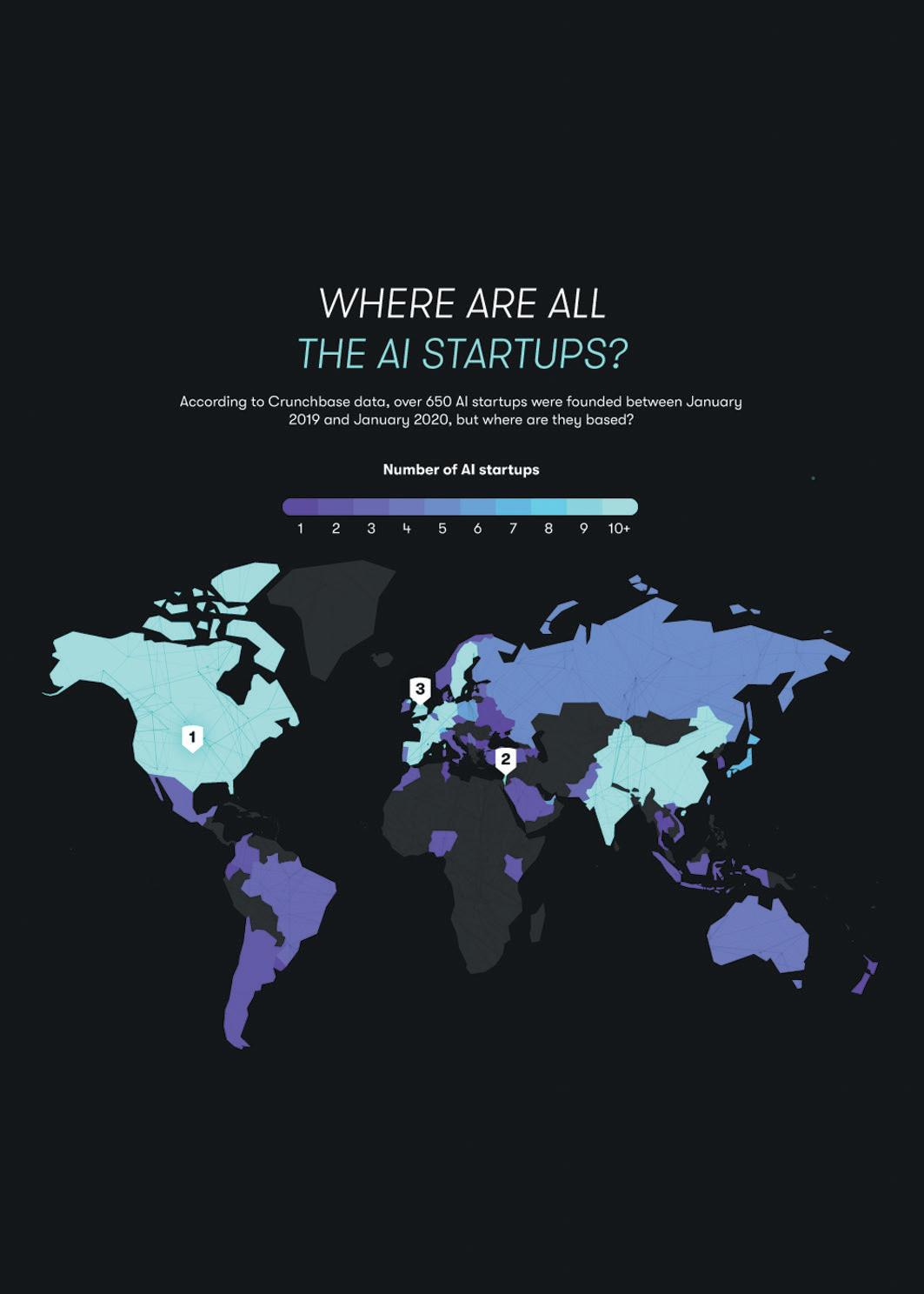

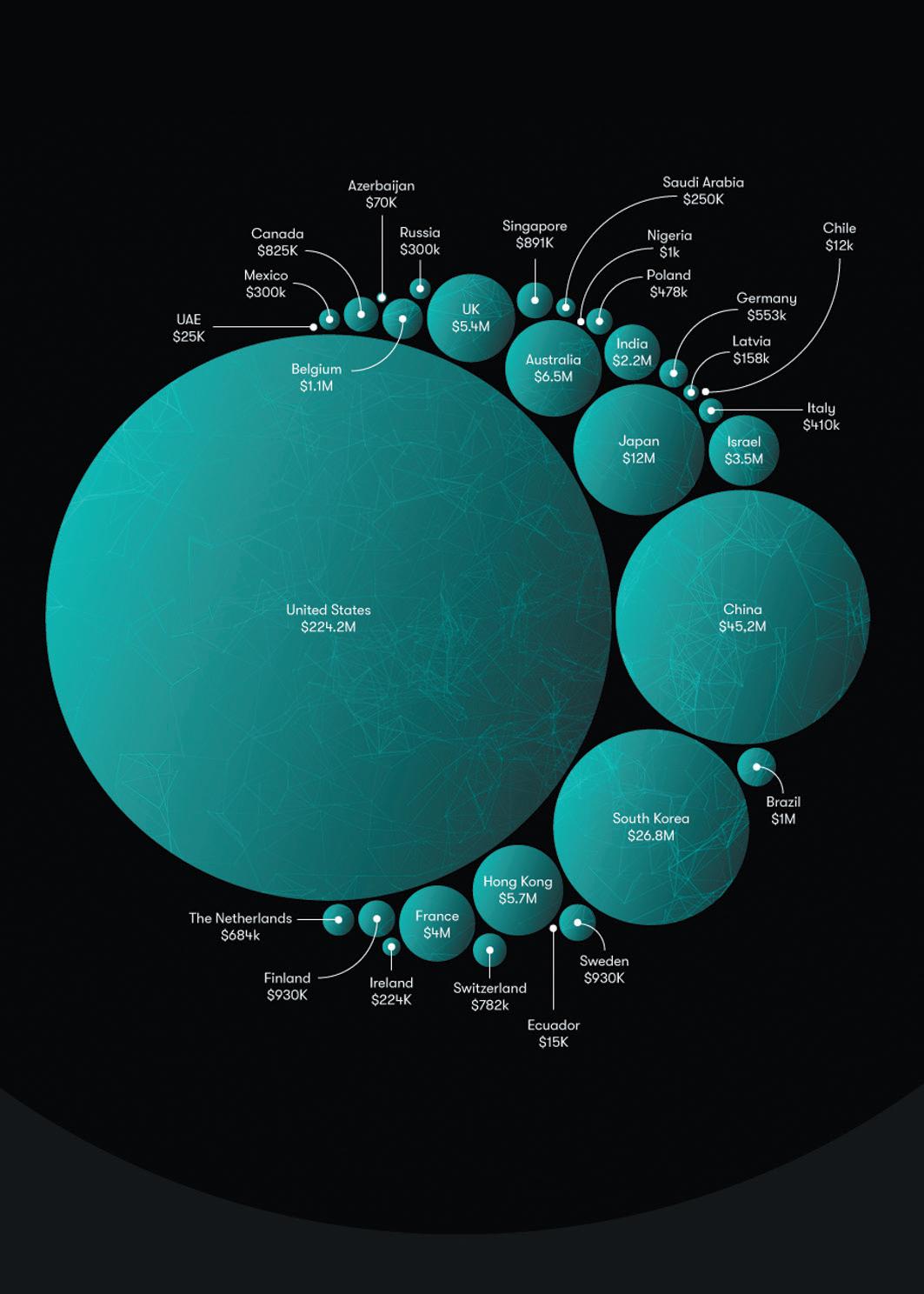

AI startup

of Contents europeanbusinessmagazine.com

96

98

100

Table

MAGAZINE EUROPEAN BUSINESS

CEO SHUFFLE

European Business Magazine gives the low down on some of the recent reshuffles amongst the highbrow in the business world

New Challenges and New CEO for Disney

Victoria’s Secret Goes Private as L Brands CEO Steps Down

After nearly 6 decades, founder and CEO of the L Brands, Les Wexner, stepped down from his executive role at the company. Following the announcement, L Brands, which is the main name behind such mall staples like Victoria’s Secret, Bath&Body Works, and Pink, declared that it will also separate into 2 companies: Bath&Body Works became a standalone public company, while Victoria’s Secret went private as a single brand. Andrew Meslow, the COO of Bath&Body Works, has been promoted to the new CEO of Bath&Body Works and will become a new CEO of the L Brands after the transaction is closed.

WarnerMedia has a New Boss

As the longtime Disney CEO Bob Iger suddenly announced that he was stepping down after 15 years spent in this position, affecting immediately, Bob Chapek has taken his role, becoming the 7th CEO in Disney’s nearly 100year history. Chapek is a veteran at the Walt Disney Company, as he has been working here for 27 years, but he noted that he obviously has “huge shoes to fill.“ Disney, on the other hand, is sure that “he’s going to commit with both feet and jump into the deep end.“ However, the new position also came with immediate challenges, as Disney had to close parks due to the coronavirus outbreak, and the company’s upcoming film releases could also be disrupted.

IBM Board of Directors

elected a new CEO

The tech giant announced that it’s Senior Vice President for Cloud and Cognitive Software, Arvind Krishna, is the next CEO of the company. He is taking the role over from a longtime boss Virginia Ginni Rometty, who will serve as Executive Chairman until the end of 2020, at which point she will retire. Rometty, who has held the CEO position at IBM since 2012, noted that Krishna “is a brilliant technologist who has played a significant role in developing our key technologies such as artificial intelligence, cloud, quantum computing, and blockchain. He is also a superb operational leader, able to win today while building the business of tomorrow.“

Match Group CEO Stepping Down

A former Amazon executive and Hulu co-founder, Jason Kilar is a new CEO of WarnerMedia. The company is now preparing to launch its new streaming service, HBO Max, an answer to Netflix’s NFLX and Disney+. Kilar is known for his streaming-oriented resume and a strong reputation in tech and media circles. John Stankey, company’s president and chief operating officer of WarnerMedia’s parent company AT&T noted that “adding Jason to the talented WarnerMedia family as we launch HBO Max in May gives us the right management team to strategically position our leading portfolio of brands, world-class talent and a rich library of intellectual property for future growth.“

Match Group, home to Tinder, Match, OkCupid, PoF, and a host of many other online dating apps, has a new CEO, as Mandy Ginsberg, who has been working at the company for 14 years, announced that she is stepping down due to the personal reasons. The new CEO, Shar Dubey, who has also been with the company for 14 years, has served as a Match Group’s president and was formerly Tinder’s chief operating officer. Ginsberg noted that Dubey “ is so well suited for this role and we won’t miss a beat during this transition. Not only is she a brilliant, analytical, and action-oriented executive, but she is a great leader because she wants every single person on the team to win.“

europeanbusinessmagazine.com11

Latest News

Facebook Invests $5,7 Billion in Indian Internet Giant Jio

On April 21, Facebook made its largest single investment by putting $5,7 billion into Jio Platforms in India, one of India’s biggest multinational companies and a big player in cellular phones and the internet services market in the country. This investment, once it’s approved by competition regulators, would give Facebook a 9,99 percent stake in Jio Platforms. The move is aimed at strengthening Facebook’s foothold in India, which is a vital market for the company and it’s messaging app WhatsApp. “India is a special country for us,“ Facebook said in a press release right after placing an investment, adding that “This investment underscores our commitment to India.“

Oil Prices Fall Below Zero for the First Time in History

Demand for oil has dropped tremendously, as due to the coronavirus’ lockdowns people had to stay inside. The price of West Texas Intermediate crude oil in the US went down to -40,32$ on April 20. The New York Times explained that the dramatic price drop was caused because more oil is being produced that can be stored, so buyers had to pay traders to take their May supply. As the world witnessed the historic drop, Bjarne Schieldrop, chief commodities analyst at SEB in Oslo noted that “What’s very apparent is someone lost their shirt. A drop to negative $40/barrel is pure financial action, rather than a reflection of the true market.“

FDA Approves First In-Home Test for Coronavirus

After weeks of back-and-forth attempts to create an at-home test for coronavirus, it finally happened. According to the Food and Drug Administration (FDA), the green light was given to LabCorp, which created a nasal swab kit for in-home testing. The approved test will initially be available to health care workers and first responders, who may have been exposed to the virus. After using the test, the patient will have to mail it in an insulated package back to the LabCorp. Dr. Sheldon Campbell, associate director of the Yale School of Medicine’s Clinical Microbiology Laboratory, noted that “a home-collection testing procedure will support telemedicine and help patients with transportation difficulties and in hard-to-reach places to access testing.“

Bill Gates Steps Down from Microsoft Board

One of the world’s richest men and the co-founder of Microsoft, Bill Gates, stepped down from the company’s board, as, according to him, he wants to focus on global health and development, education, and tackling climate change. He will still serve as a “technology advisor“ to the current CEO Satya Nadella. Announcing his decision, Gates said that the company would always be an important part of his life’s work and he would continue to be engaged with its leadership. He also added that he’s “looking forward to this next phase as an opportunity to maintain the friendships and partnerships that have meant the most to me, continue to contribute to two companies of which I am incredibly proud, and effectively prioritize my commitment to addressing some of the world’s toughest challenges.“

europeanbusinessmagazine.com 12

Europe’s leading global airline is in trouble due to the Covid-19 standstill

Airlines around the globe are feeling the impact of the coronavirus pandemic, and Lufthansa Group — Europe’s leading global airline — is one of them as well. Right now Lufthansa fights to avoid bankruptcy, as it was unveiled that the company recorded a $1,3 billion first-quarter loss. The German flag carrier’s CEO Carsten Spohr described the current situation as “extremely bitter, devastating, and painful.“ In his speech, Spohr noted that as of today, the Lufthansa Group has practically no earnings, and they still need to pay for staff, materials, rent, and fuel hedging. As a result, the company is currently losing around $18 thousand per minute. German weekly Der Spiegel reported that Lufthansa is negotiating a $10,8 billion bailout with Germany that would give the government 25,1 percent of the company and a seat on its supervisory board.

Tesla Model 3 is April’s best-selling new car in the UK

With the world at a standstill, because of the coronavirus outbreak, the UK car market just went through the most difficult month in more than 7 decades. In April 2020, the sales of new vehicles went down by more than 97 percent. According to the Society of Motor Manufacturers and Traders (SMMT), only 4321 cars were sold last month in Britain, compared with 161064 in April the year before. However, figures from the SMTT show that 658 Tesla Model 3s were sold last month, accounting for around 15 percent of all new car sales. This is the second time Tesla has appeared in the UK top 10.

Apple announces a date for its biggest event of the year

Apple has announced that it’s annual Worldwide Developers Conference (WWDC) 2020 will begin on June 22, and for the first time ever, it will be held virtually. The event, which usually takes place in California, will be free for all developers, who will be able to access it through Apple’s developer website and app. The company will give a glimpse of what news and innovations it will bring to iOS, iPadOS, macOS, tvOS, and watchOS. Phil Schiller, Apple’s senior vice president of Worldwide Marketing, noted that “WWDC20 will be our biggest yet, bringing together our global developer community of more than 23 million in an unprecedented way. We can’t wait to meet online in June with the global developer community and share all of the new tools we’ve been working on to help them create even more incredible apps and services.“

China starts major testing of its own digital currency

China’s central bank — People’s Bank of China (PBOC) — has introduced a trial of a state-run digital currency across several cities, including Shenzhen, Suzhou, and Chengdu, as well as areas that will host some of the events for the 2022 Beijing Winter Olympics. The 3 cities have a combined population of more than 38 million people. According to a report by the state-owned China Daily, a statement by PBOC said that the digital currency — known as the e-RMB — “will not be issued in large amounts” for public use in the short term and that the digital currency in circulation would “not lead to an inflation surge”. Unlike the most popular cryptocurrency Bitcoin, China’s version of digital yuan will be a centralized currency, and the central bank officials will be able to track all digital cash in circulation, making it nearly impossible to launder money or dodge taxes.

europeanbusinessmagazine.com13

Latest Technological Gadgets 2020 Samsung Sero TV

Nintendo Switch Lite Handheld Console

The it console for every gamer-on-the-go out there, Nintendo Switch Lite is a compact, lightweight, reasonably priced option of Nintendo’s popular gaming console. It is designed specifically for handheld gaming and can sync together up to 8 Nintendo Switch or Nintendo Switch Lite consoles, allowing to play games with friends and people from all over the world. The battery, once fully charged, can handle up to 5 hours of gaming. The console has a lightweight design and a more compact 5,5-inch display compared to the regular Switch and is available in several eye-catching colors.

Samsung has reached a new level with its products yet one more time, as the new Sero TV has been introduced to the public. The Sero, which means “vertical“ in Korean, does just that: transitions from the horizontal plane to the vertical plane — just like your phone — with one click. The company says that it is “designed for the mobile generation“ and hopes that the unique concept will attract millennials who like to watch and shoot videos on their phones and who might want to watch those videos on a bigger and more expressive screen. The 43-inch 4K Sero is already available in South Korea and is going global this year.

europeanbusinessmagazine.com 14

Anden Valet Charging Stand

Perhaps the most stylish gadget of 2020, the Anden Valet, a brand new Apple Watch wooden charging stand, easily fits any series of Apple Watch charger. Made to order in London and finished by hand using the finest natural oils, the Anden

Valet can be made from sustainably sourced solid walnut, maple or cherry wood. You can keep up to 4 Apple Watch straps on it, displaying your watch strap collection, and it is available in dimensions of L175xW15xD30mm.

Weber Connect Smart Grilling Hub

The Weber Connect Smart Grilling Hub will quickly become your secret ingredient to the perfectly grilled food, as it provides you with step-by-step assistance from the setup to when it’s time to eat. The company invented a device, which, once attached to your grill, syncs with your smartphone and allows you to monitor the temperature and food-readiness. Basically, the Grilling Hub includes a small device with ports for connecting wired thermometers and alerts you via the app when your meats or veggies reach the proper temperature that you desire. It is compatible with any barbecue, however, the Weber Connect App is only available with iOS and Android devices.

Bose Audio Sunglasses

Music without earbuds? Bose just showed us that the future really is here, as the new sunglasses not only provide UV protection but also can be used to play music, make and answer calls, and connect to Bluetooth. Described as the “Sunglasses with a soundtrack“, the Bose frames have built-in sensors and a pair of hidden speakers, which transfer music to your ears. They can be paired with your other devices and can access many different apps, such as Spotify, Skype, or Google Maps. You can choose from different frames and they are also available with prescription sunglass lenses.

europeanbusinessmagazine.com15

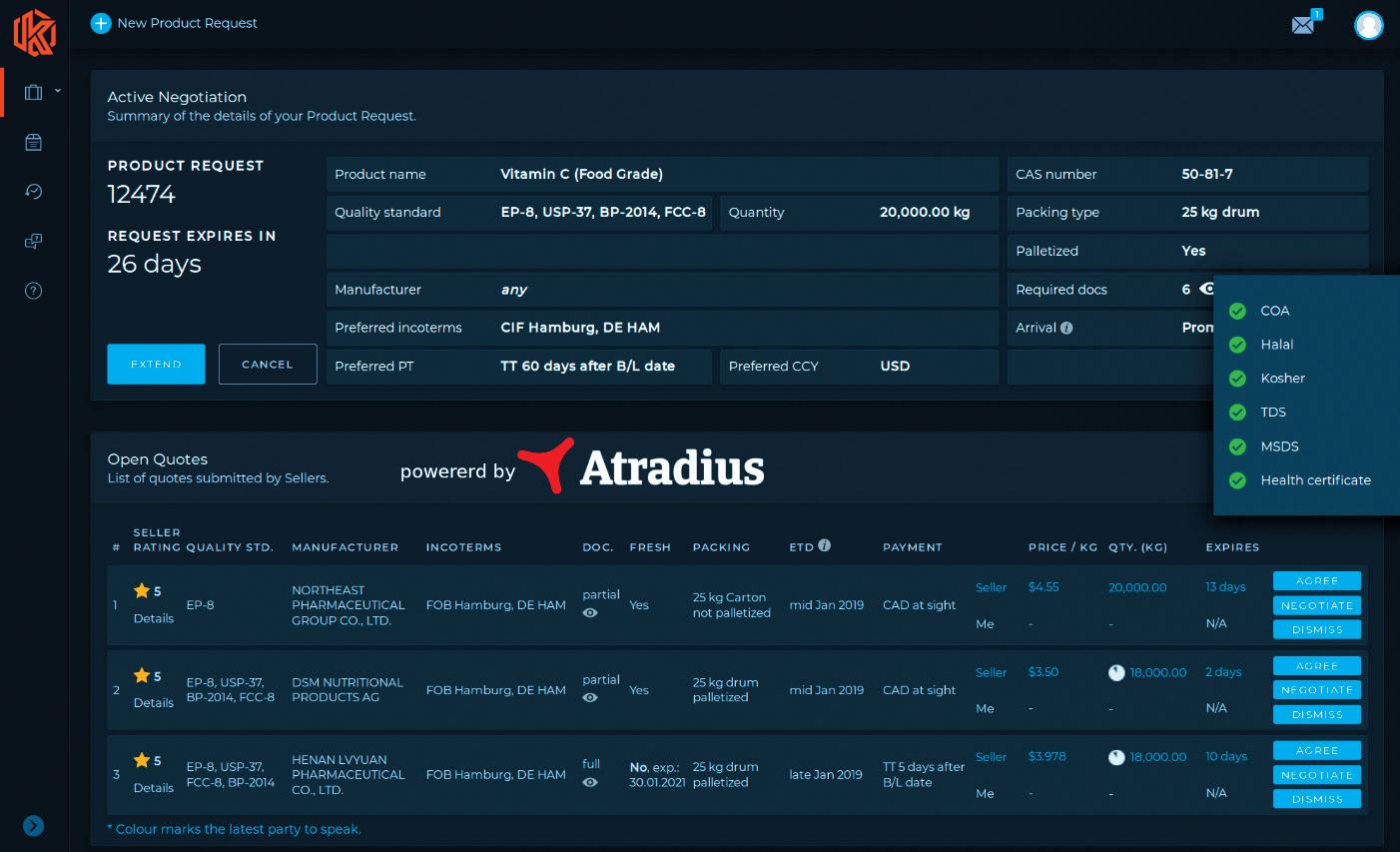

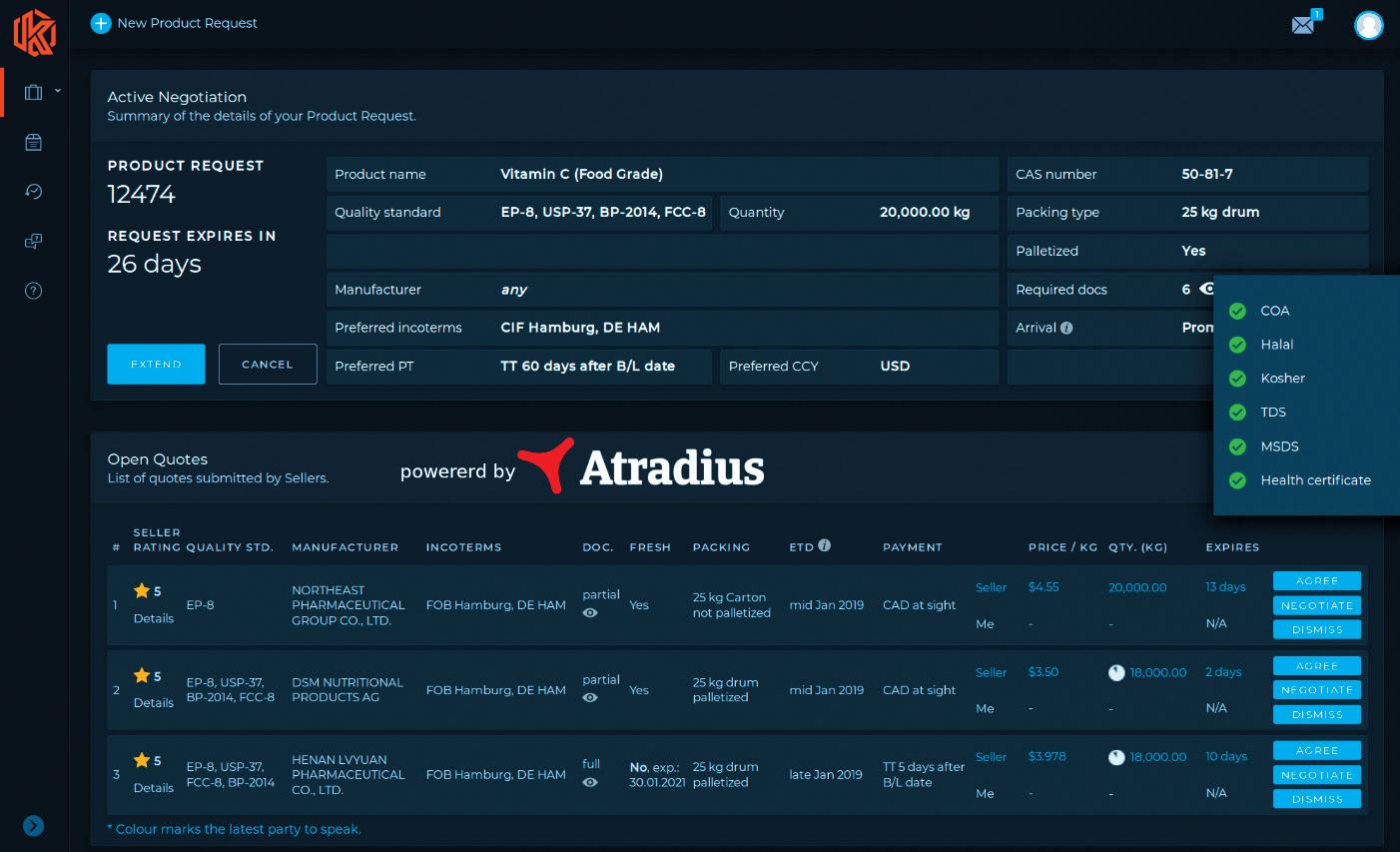

Atradius and Kemiex shake-up the raw material trading landscape in pharma, veterinary, food and feed

The annual trade volume for active pharmaceutical ingredients (APIs), vitamins and other food & feed additives is estimated at USD 300 billion, of which approximately 90% are traded based on long-term contracts. With a secular shift of production to China and India and increasingly volatile markets, the share of spot transactions is growing. The new solution brings low and transparent fees structures into the rather secretive spot market brokerage industry. Current trading processes are often time consuming, opaque and limited to personal networks. In this complex environment, trading network Kemiex and credit

insurer Atradius are the first to offer an online trading platform that helps to easily identify reliable and compliant counterparties and conduct trade in a safe way at the click of a button.

Trusted and secure

Nowadays, technology and digitalization are disrupting multiple and traditional trade ecosystems progressively and at a fast pace. In line with this trend, the partnership between Atradius and Kemiex is setting new and unparalleled standards for security and trust in B2B marketplaces for raw materials in the life sciences industries by means of a revolutionary online

platform. With this digital solution the future of exchanging raw materials between buyers and sellers on the global spot market are brought in today. The platform aims to decrease the number of touch points in the sourcing process, and yet, secure that all stakeholders comply with restrictions and regulations accordingly.

Combined expertise

The Swiss-based Kemiex is an independent online trading platform for commerce of commoditized additives, vitamins, amino acids, APIs and other substances for the human and animal health and nutrition industries.

europeanbusinessmagazine.com 16

An online trade platform designed and introduced by Kemiex and Atradius is revolutionizing the B2B global trade landscape for APIs, vitamins and other food and feed additives by integrating digitalization and credit insurance in a sophisticated network ecosystem

With this digital solution the future of exchanging raw materials between buyers and sellers on the global spot market is realized today. The platform aims to decrease the number of touch points in the raw material sourcing process, and at the same time, ensure that all stakeholders comply with restrictions and regulations accordingly. Kemiex’s success and market acceptance are noteworthy and outstanding. The platform has attracted hundreds of B2B companies in the respective sector by now, and its premium network is flourishing rapidly. Atradius, operating across 54 countries, is one of the world’s leading credit insurers and an avid supporter of innovative technologies to serve customers in the most efficient way. Apart from credit insurance, Atradius is also leading in other financial services such as bonding, collections and reinsurance.

Through the first of its kind strategic partnership with Atradius, transactions occurring on the platform can be insured right away. Atradius

will provide Kemiex’s customers credit risk insights and invoice credit insurance for single transactions between traders, sellers and buyers. In order to build a holistic network and assure a high level of trustworthiness and product quality among stakeholders, Kemiex has outlined strict on boarding rules and a quality management system overseen by a qualified person. In addition, the platform has a systematic monitoring structure that renews members’ trade excellence scoring after every finalised transaction. This provides a meticulous account of the entire trade stream by continuously assessing the behaviour and reliability of the transaction counterparts throughout the transaction.

Through the unprecedented strategic partnership with Atradius, transactions occurring in the platform can be insured at a mouse click. Atradius provides Kemiex’s customers credit risk insights and invoice credit insurance for single transactions among traders, sellers and buyers

Added value

Being a Kemiex stakeholder minimizes transaction lead times and allows businesses to offer more competitive prices while staying in full control of trading activities from A to Z. Simultaneously, Atradius is using its years of risk mitigation expertise to provide, through Kemiex’s platform, single invoice insurance and financial insights, supporting Kemiex’s customers in making smarter decisions across their trade deals.

The platform has already benefited multiple buyers in the acquisition of raw materials, and they have been able to increase product availability and reduce purchase prices in parallel. At the same time, sellers kept their margins stable. Both effects positively influenced businesses short- and long-term growth. In a world where trade increasingly takes place online, Kemiex and Atradius offer the comfort of doing this in a trusted environment that is ready for the future. Why wait any longer to join?

europeanbusinessmagazine.com17

Despite the exponential growth of the UK tech space (attracting more than $9.7bn in funding in 2019), the Guardian reported that “the number of women in the tech sector has barely moved over the past 10 years”. Combine this with the fact that only 5% of leadership positions in the technology sector are held by women despite the fact that we make up 49% of the general UK workforce, these figures are disappointing. Even more so given the increasing awareness of the gender gap in tech being a problem.

Before launching Paybase, I was lucky to work in female-empowered environments (which were unusual for traditionally male-dominated industries). For me, it was a significant advantage, especially in terms of dispelling myths and misconceptions about women working in leadership positions. But I wonder whether it’s possible to nurture a female-empowered environment in a non-female-led business? I think that it is, absolutely, but some fundamental development must be made at the grassroots.

STEM subject representation

In 2018, the portion of female graduates in STEM subjects (Science, Technology, Engineering and Maths) was just 9% - and this was up by 1% on the 2017 figure. Whilst this demonstrates a year-on-year improvement, the statistics are still a startling comparison with the more than 90% male STEM graduates. A recent UCAS

Anna Tsyupko, CEO and co-founder, Paybase

gender balancing efforts. Women in Tech recently surveyed over 1000 women and found that 82% of them believed that there were more males than females in tech, suggesting that awareness of the issue is also significant.

To tackle this, having pioneering female tech leaders speak in schools could both give aspiring students a clear goal and role model to work towards but it could also be incredibly useful for the speaking companies themselves. By planting the equality-championing seed early, tech firms could bolster their own brand awareness and attract more female graduates to their workforce when they come to start their careers.

study furthermore found that specifically in computer science, engineering and technology, the fields “show the largest gender imbalances from current students, to graduates and the workforce figures”. The figures decrease as they candidates progress through each stage. The implications of this are that something in the STEM environment deters female students, graduates and employees from persevering with their careers in the space. One of the most positive factors in any workforce is being able to thrive from a diversity of experience, and it directly correlates with success at work, a sense of belonging and emotional safety in the work environment. But to implement this, gender balance is key. The more female applicants that can be attracted to and, more importantly, nurtured on STEM higher education programmes, the more chance there will be of achieving this balance.

More tech companies presenting in schools

In order to attract female applicants onto STEM higher education courses, action must be taken when they are studying at school. STEM projects (like those run by stem.org) are important but representation i.e. being able to see real life examples of females thriving in STEM-based careers, is even more valuable.

Representation is a crucial tool and one that should be at the core of

Female training grad schemes

Taking the imbalance of STEM students and graduates into account, it seems worthwhile that it should be tackled with a wide-reaching approach. Female graduate schemes must, therefore, not only be targeted at students who are graduating from STEM subjects but also those who are graduating from subjects outside of it.

Training female graduates from nontech backgrounds to take on technical roles would help to not only diversify the workforce in terms of gender but furthermore in terms of culture i.e. bringing in perspectives from those in subjects outside STEM.

We, the women in technical positions, must capitalise on our positions

By default, female leaders in the FinTech space stand out from the norm and I believe that this position can be used to establish a vantage point and to dictate the standards of diversity. Women in technical positions must continue to put themselves out there as much as possible to ensure that they are represented to the fullest extent. Presenting in schools, doing TED talks and generally raising awareness are just a few examples of this, and they are all of paramount importance to changing the tech industry’s traditional tides.

europeanbusinessmagazine.com 18

Nurturing a femaleempowered environment in a nonfemale-led business

WHY DIVERSITY IS THE ONLY WAY TO GENERATE GREAT IDEAS

Natalia Escribano, chief commercial officer, VIOOH

Where do your ideas come from? From books, conversations, something you’ve seen online, overhead, watched? Ideas come from anywhere, at any time, but they have one thing in common – they do not come out of thin air. They’re sparked by inspiration, by something external to the person that comes up with it, that gets them to think ‘what if…?’.

All organisations love ideas; most want to be seen as innovative, to be able to generate new services and products that get people excited, get customers talking and, more importantly, buying. Why wouldn’t they? Ultimately, the more ideas a company generates, the more likely it is to come up with something that punches through, that turns into tangible results. In other words, money. The challenge they face is that as an organisation, there are rules and structures and processes to follow. How do they generate ideas within those confines? Entrepreneurs will be familiar with the concept of balancing working in the business with working on the business. The former is the dayto-day, the tasks that keep the wheels turning. The latter is thinking about the direction the wheels should be facing, strategy, growth. Quite often, it’s hard to take a step back and do that, particularly when it’s not immediately translating into sales.

New perspectives as a source for new ideas

That’s where having a diverse workforce comes into play. If you only employ the same type of person, with the same education, background, outlook on life, then you are going to get the same ideas. By having a more diverse outlook, new external sources come into play – new books, new conversations, new perspectives. New ideas.

It’s good business to be diverse - according to a Boston Consulting Group study, “companies that reported above-average diversity on their management teams also reported innovation revenue that was 19 percentage points higher than that of companies with below-average leadership diversity—45% of total revenue versus just 26%.”

In short, more diverse leadership teams equals more ideas that make money. It doesn’t stop with ideas, either; another study said “companies in the top quartile for gender diversity are 15 percent more likely to have financial returns above their respective national industry medians.” For any sector, that’s enough to make people sit up and take note; for advertising, in which the quality of ideas is the service being sold, it’s vital. Traditionally male-dominated, we’re seeing slow and steady improvement in diversity at all levels of the industry –in the UK, women make up 52.6% of all employees in advertising agencies and a third of all C-level executives.

Accelerating change, from the top down

Yet more needs to be done. Change always needs to come from the top, and advertising is no different. That means empowering leaders and those with hiring responsibilities to recruit with diversity and gender equality actively in mind, and really commit to building inclusive cultures.

Broadening the talent pool available, so that a greater mix of candidates are available, is critical, as is investing in new ways to recruit – the days of being able to hide behind saying ‘we can only hire people that apply’ doesn’t cut it if you don’t make the effort to look beyond your traditional channels, recruiters and networks.

There’s also the need to fight stereotypes, confront and push back against bias. Everyone has their own biases, and in turn unconscious bias affects everyone. It’s important, therefore, that people are self-aware, that they recognise when they have allowed their own prejudices to influence decision-making, and take active steps to combat it. That also means helping their teams to have awareness too, and creating an environment where biases can be challenged appropriately. Finally, there’s a responsibility on everyone controlling budgets to think about who they work with. If clients only work with partners that foster an active approach to gender equality, then they are sending a clear message that firstly, diversity is seen as a point of attraction and secondly, that they understand that with diversity comes a greater range of backgrounds, ideas and inspiration.

Investing in ideas by cherishing and nurturing diversity

Advertising is an ideas business –if we can’t come up with new ways to engage our audiences, then we’re redundant. Therefore, ensuring that our idea generation pipeline is working properly should be seen first and foremost as an investment. Diversity is intrinsic to that – as we’ve seen, without diversity, ideas and innovation suffer. It is vital that it is cherished and nurtured.

europeanbusinessmagazine.com19

How diversity can unlock innovation in healthcare

experience for patients and healthcare professionals, but also has the potential to provide great financial and operational savings to healthcare providers, whether public (such as the NHS) or private. It is the only way we are going to be able to deliver high quality care and prevent the spread of disease in a hyperconnected, globalised and diverse society in a responsible, inclusive and long-term manner.

Yet challenges remain. From a technical perspective, these range from how providers incorporate mission critical legacy systems into digitalised operations, to the fragmentation and non-standardisation of data across hospitals, regions and countries. Then there’s the paucity of investment resources and established quality assurance frameworks available to validate new technologies.

Just as important are the cultural and human considerations. This new era of healthcare has to be inclusive; that means being able to deliver care that meets the needs of patients in the ways that best suit them – rather than in a way that best suits providers. New perspectives, views and considerations need to be incorporated to overcome established bias and legacy thinking – the only way to do that is through greater diversity, at all levels of healthcare.

Karina Malhotra, founder and director, Acumentice Health – a UK based Healthcare Management Consulting firm

We’re at an important moment in healthcare. Across Europe, the challenges of meeting increasing and ever more complex and individualised demands of patients are straining both countries’ economies and their healthcare systems.

To deal with this, more and more governments are looking to digitally transform their health services. The UK’s National Health Service published its long-term plan in January 2019, outlining how it would become fit for the future, which included establishing NHSX to drive digitisation across the entire service. Elsewhere, the EU is aligning its mission to change the delivery of health and care with that of the Digital Single Market.

While each initiative is different, the fundamentals remain the same –reducing health inequalities, improving prevention and providing better quality outcomes for patients, both in periods of relative normality and while dealing with pandemics such as Covid-19. In addition, the setting and point of delivery of care itself needs to be right for patients’ individual needs. Underpinning this valuable effort is making sure that it is financially sustainable and delivered by a robust, correctly skilled and appropriate workforce.

Overcoming the challenges to unlock benefits

It’s undeniable that digital transformation and innovation is critical to all health services. Being able to harness data does not just provide better outcomes, engagement and

The gap between workforce and leadership diversity

Traditionally, this has been a challenge; as an article in The Lancet from 2019 notes , from a gender consideration, while “women’s representation in science and medicine has slowly increased over the past few decades… this rise in numbers of women, or gender diversity, has not been matched by a rise in gender inclusion.”

The numbers back up the argument – the NHS workforce is 75% women , yet only 37% of Foundation Trust directors are female. It’s a similar picture across the European Union, where 78% of workers in the healthcare sector are women. While the US has a very different delivery system, the gap between

europeanbusinessmagazine.com 20

representation at an employee level and an executive level is even more stark – three percent of healthcare CEOs and Chief Medical Officers are female, yet women comprise 80% of the entire workforce.

From an ethnicity perspective, the story is even worse - appointments of black, Asian and minority ethnic candidates (BAME) to non-executive positions at NHS trusts and hospitals have fallen over eight years, with the latest UK government data stating that 4 out of 5 (79.2%) NHS staff were white. In the US, 70% of physicians and surgeons were white. Does the diversity of the people who make investment decisions behind the scenes, or those in senior management positions at providers, matter? Of course it does. In an article for the World Economic Forum , entrepreneur and economist Vijay Eswaran writes that “The coming together of people of different

ethnicities with different experiences in cities and societies is a key driver of innovation.” He is considering the issue of diversity from a business perspective, yet the lessons apply just as powerfully in a public service setting. Particularly one, like healthcare, that desperately needs to engage innovation to unlock the benefits of digital transformation to suit its increasingly diverse users.

Evolving mindsets to deal with legacy structures

Interestingly, the tackling of both the diversity issue, and overcoming the technical obstacles, are about dealing with legacy structures. In the case of the latter, solutions such as data validation, artificial intelligence (once data is cleaned), automation and the deployment of hybrid cloud (allowing the use of legacy systems alongside newer applications) can

help speed up digital transformation. With the former, it’s about looking at the cultural structures in place that stop more diverse individuals progressing. What suited traditional leadership applicants may no longer work. In the same way that, what were once considered appropriate management skills are now outdated or not as necessary, and need to be replaced by different attributes and strengths that non traditional candidates may offer.

It is a mindset change, but then all transformation is. Ultimately, if healthcare providers are serious about being innovative in order to deliver better care and keep people healthier for longer, then they need to ensure that they are not only transforming their systems, but their workforces as well. What once worked in healthcare delivery clearly need to be reshaped; the same goes for who delivers it.

europeanbusinessmagazine.com21

QATAR: Five Stars for Property

As the coronavirus crisis impacts national and global economies, causing stock markets to plummet, oil prices to crash and unemployment to reach new heights, Qatar’s economy remains strong and continues to develop. Property prices are expected to grow and a wide range of exciting infrastructure projects are in the pipeline. Furthermore, in this unprecedented climate, the quality, safety and comfort of residential and commercial properties is more important than ever.

The Qatar National Vision 2030 (QNV 2030) was launched. Its main goal was to drive the country forward by aligning economic growth with improvement in both human and natural resources, to help differentiate the economy and to decrease the country’s reliance on oil and gas. Fast forward 12 years, a global recession and an international health crisis, and this central intention remain unchanged.

The QNV 2030 seeks to ambitiously transform the economy by working towards an advanced educational and health system, increasing Qatari numbers in the workforce, pursuing an effective social protection system and playing an important part in the international community. It also calls for sound economic management, responsible exploitation of oil and gas resources, economic diversification and environmental protection. While Qatar aspires to invest in its human capital, cultivating the abilities of its citizens in order to build and maintain a thriving society, where the inhabitants live and work will take central stage.

As Qatar’s population continues to grow, demand for property will rise, but the coronavirus pandemic has inevitably triggered a slump in demand for all properties, stalling residential sales, inhibiting exchanges and promoting remote working. However,

these challenges and obstacles have merely encouraged a renewed focus on the goals of the QNV 2030, which centres on a robust commitment to elevating the infrastructure and putting the country firmly on the map as a primary destination for tourists and investors. To help realize these objectives Prime Lands Real Estate and Development, an award winning real estate Development Company, based in Doha, designs and build architecture that will benefit both the communities and corporates that it serves.

Unlike traditional builders, Prime Lands Real Estate does not deliver meaningless, concrete structures. Rather, their ultimate mission has always been to adapt its high-end residential, commercial and industrial projects to the particular needs of its target market. Fundamentally, since its inception, the mission of Prime Lands Real Estate has aligned

europeanbusinessmagazine.com 22

with that of the QNV 2030, including building environmental awareness campaigns and promoting sustainable urban growth.

The Qatari construction market is expected to register a CAGR of 9.6% over the 2019-2024 periods, after a decade-long boom associated with the implementation of large infrastructure projects in preparation for the FIFA 2022 World Cup. In fact, the country is expected to be among the fastest-growing global construction markets, showcasing robust growth forecasts. Under QNV 2030, nearly £13.5 bn in infrastructure and real estate investments are planned over the next four years to help offset falling FIFA-investment spending. However, unlike Japan which saw the summer Olympics cancelled, Qatar, which is hosting the 2022 World Cup, may still have the chance to conduct the games as normal, depending on how the pandemic evolves.

Under the QNV 2030, which hopes to support unprecedented levels of community, commerce and development through the construction of modern and practical architecture, the country is set to award an estimated £70bn worth of planned projects in the coming years. Traditionally, because of the rapidly growing population base and chronic under-supply, developers have historically preferred quantity over quality. However, there has been a shift within the construction sector, with a demand for excellence that rivals international standards.

Step forward Prime Lands Real Estate, which has experienced unrivalled success and is on top of its game, winning five important awards at the Property Awards 2020. Firstly, winning the Best Real Estate Development Award, which focused on the modern and unique office building development in the fantastic Prime Square. This location centres on high end corporate tenancy

and offers retailers a strategic location. Secondly, the Best Architectural Residential Design Award was granted in response to Prime Lands Real Estates work on the AL Rayyan Village Complex. This comprises of 383 villas in a range of four different types promising the perfect work-life balance for Qatar’s business community and their families in the heart of Doha. Sustainability was central to the design of the village, including eco-friendly features such as durability, low emissions and a large underground water tank that regulates the water temperature. Prime Land Real Estate received a further three ISO Certificates in the Property Awards 2020.

All these coveted awards and environmentally friendly design features highlight how Prime Lands Real Estate are ahead of the mark, and how high end architecture can help Qatar realize its QNV 2030 corporate and community goals.

europeanbusinessmagazine.com23

European Business catches up with Fadi Kreiker

the instrumental CEO heading up Prime Lands Group which is based in Doha, Qatar. His group is a multi-award winning international real estate development group which is also instrumental in helping achieve Qatar’s National Vision 2030 through their own unique designs, construction and architectural prowess.

You’ve been CEO of Prime Lands Group for two years now. This year you were awarded the Best CEO in the Middle East within the Real Estate Sector award, which is truly impressive. What were the main challenges that you, as CEO, had to overcome during this time?

I’ve been working in this field more than 20 Year, Started my experience in Lebanon, Saudi Arabia, Oman and Dubai before I joined Prime Lands Group in Qatar. The main challenges I’ve faced as CEO are managing the departure of the outgoing CEO, a lack of feedback, leading former peers & being less accessible to former reports, and establishing the right pace of change.

What is the best lesson that you’ve learned along the way?

Innovation is harder than replicating what you already know. The lessons I’ve learned as a CEO reflect that unavoidable truth: the harder choice is usually the belter choice.

Recently, at the Property Awards 2020, Prime Lands Group won an impressive Five signify cant awards. What does it mean for the company to be recognized by the Arab Real Estate Awards?

Winning accolades such as the International Property Awards provides you with the evidence you need to prove you are better than the rest, as well as giving you use of an important platform to promote yourself, and your award, with visual reminders and online endorsements. It also showcases how hardworking the firm is in ensuring that our clients find and realize their dream homes and properties. It recognizes our achievements.

The Prime Lands Group has certainly had its fair share of interesting, challenging projects. Which project was the most interesting one for you personally?

Al Rayyan Village.

The real estate development and investment sphere is very dynamic and constantly changing. Yet, Prime Lands Group always manages to stay on top of the game and is a market leader. What is the secret behind this? Are there any particular skills that you need above others when working at Prime Lands Group?

Prime Lands’ secret is simply honesty and flexibility. And of course we must have skills such as the ability to relate to and trust in others, knowing how and when to show empathy, active listening skills, always keeping an open mind, having a great sense of humor, knowing your audience, proactive problem solving, good manners, and being supportive and motivating others.

In 2018, Prime Lands Group established a global division, and just a year later it witnessed a growth rate of over 200%. Did you expect such a big success in such a short period? What was the main strategy for going international?

Prime Lands Group Global offer a standardized product worldwide, and have the goal of maximizing efficiencies in order to reduce costs as much as possible. We are highly centralized and our subsidiaries are often very dependent on the HQ. Their main role is to implement the parent company’s decisions and strategies.

europeanbusinessmagazine.com 24

You once mentioned that, “Our adherence to the real values of life has been the driving force for Prime Lands recognition.” Could you explain more about the most important values that are implemented in the company, and how this approach helps to achieve and maintain collaborations with clients?

In 2018, Prime Lands adopted a company culture of “Prime Lands is a great place to work”. The model is about embracing collaborative and non-hierarchical working. All managers focus on coaching rather than commanding. According to the evidence we looked at, this approach best harnesses the creativity and innovative potential of our employees as well as ensuring greater employee and client satisfaction. Let’s start with management culture. We changed our operations and management structure to give staff more power and autonomy. Our managers should see themselves as coaches –motivating staff to want to improve, offering them support and rewarding them on merit. Our most important goal is what we call “peripheral decisional autonomy” – which means that staff are actively encouraged to make decisions based on their own informed judgment. We also want employees to reach their own personal goals, not just company goals. This approach is backed up by ensuring staff have access to high-level training at all time. Respect and responsibility are two key words for us when thinking about employee relationships at all levels of the organization on. Everyone in the company needs to have and show respect for others, and everyone needs to take responsibility for decision-making. Generally, I think employees are happier working in an environment that fosters respect, improvement and career advancement. Passion is a motivating force for the company, and it is important for people to feel that they are making a difference – that they are having a social impact and making change for the better. We encourage people to smile – this improves wellbeing across the company. A true smile is contagious, and it is the identity of Prime Lands Group and its concept of being a great place to work.

In your opinion, how will the real estate development and investment sector in Qatar evolve over the next five to ten years? And what about Prime Lands Group how it will look five years from now?

Qatar’s economy is one of the fastest growing in the world. Some of the major factors driving the growth of commercial real estate in Qatar are increasing construction activities, GDP growth and introduction of various policies by the government for boosting the real estate sector in the country. The majority of the construction activities happening in the country are for high-end resident al towers, white-collar office spaces, luxury hotels and shopping malls. Events, such as the 2022 FIFA World Cup, are estimated to draw nearly 1.5 million fans, which may increase the demand for hotel rooms in the country. The retail space growth also doubled in the last three years, and it is expected to grow by nearly 50% more by 2021, with many new malls that are scheduled to open in the upcoming years. There is a significant increase in the number of market players in Qatar, majorly driven by infrastructure development and construction activities happening in the country. The Qatari real estate market is also witnessing innovations and improvements, such as increased public-private partnerships by the government, which is driving more companies to enter the real estate market of the country. In terms of Prime Lands Group – we will remain as one of the leading groups both in Qatar’s market and globally within the next five years. Prime Lands Group currently includes:

• Prime Lands Real Estate Development

• Prime Contracting & Trading

• Logano. (Food & Non-Food Trading)

• Monarch. (Vehicles & Spare Parts)

• Villagers. Restaurants and cafes

• ABK. Shipping

We are further planning to grow our group in new, different fields and new areas over the coming years.

europeanbusinessmagazine.com25

Understanding the Experience of Distributed Global Team Members

Exchanging Ideas

Did you ever get the chance to participate in a school exchange programme when you were younger? If you were fortunate enough to have done so, you’ll probably remember what a positive experience it was and how much you learned about different cultural values and new perspectives on life. If you’re lucky, you might even have made some life-long friends and are still in contact today.

These are experiences that we, as adults, can take into the workplace. Global teams with a rich mix of cross-border members have the potential to be stronger, more productive and more innovative. But, there is a caveat—teams with a higher number of international employees

have specific requirements that need to be addressed. Understanding what those are will enable them to thrive and deliver the kind of results that their employers expect.

Globalization Partners’ 2020 Survey ‘ How Inclusion and Diversity Impact

Distributed Global Team Members’, suggests this means creating an atmosphere that respects and fosters cultural diversity. This could include the regular use of at least two different languages for business and ensuring employees working in satellite offices feel as connected as people in the organization’s HQ. Indeed, one of the key lessons to learn from our study is that successful cross-cultural team development does not start and end with a hire—it needs to be ongoing and based on understanding and respect.

Without giving these issues serious consideration, businesses looking to improve cultural diversity and cross-cultural working—with only the best intentions—may unwittingly create a situation in which its global employees feel disconnected, undervalued and misunderstood.

The language of connection and trust

The number of languages spoken to do business in a company is a good indicator of its diversity and the effectiveness of its cross-border team structure. We found that 85% of companies whose employees describe themselves as diverse use more than one language for business—while 71%

europeanbusinessmagazine.com 26

Following the publication of the results of Globalization Partners’ 2020 Global Employee Survey, Nicole Sahin, the company’s CEO, takes a look at some of the benefits of setting up cross-border teams and encouraging cultural diversity within the workplace. She also explores some of the most common issues that businesses face when seeking to create the inclusivity that their global workforce needs to thrive.

of companies use between two and five languages for business. You don’t need to be a psychologist to appreciate that speaking to international team members in their language—or at least not expecting them to speak the language used at their company’s HQ all the time—is a compelling and effective way to work across borders and to show individuals how much you value and respect them. Workers whose companies used more than one language for work were 11-16% more likely to feel connected to their organization. Likewise, those workers were more likely to report that their voice mattered. It is interesting to note that there seems to be a sweet spot for companies who employ between two and five languages for

business and that the multiple language benefit tapers a bit for those using more than five languages. This may come as a result of communication barriers creating a sort of “Tower of Babel” effect, with a lower likelihood of employees speaking more than two or three languages fluently and a greater opportunity for communication barriers to present themselves. A measured amount of multilingualism definitely improves trust between colleagues and between international staff and senior management. It could be one reason why almost eight out of ten respondents from diverse companies said that they trust their leadership team. Trust in leadership is hugely important to the health of an organization. Our study found that employees who trusted their senior

management were three times more likely to stay at their present company and half as likely to leave. By contrast, companies flagged as non-diverse were two and a half times more likely to distrust senior management—22% said that they did not trust all or most of their leadership and 33% said that they only “somewhat” trusted them.

Happiness is relative: HQ vs Satellite Offices

Cross-cultural understanding is good for employee happiness too—more than three times more employees in diverse companies said that they always felt happy at work. In contrast, employees at non-diverse companies were four times more likely to report never being happy at work. This is a jump from 2% to 8% and may seem small but just a few unhappy employees within an organization can have a significant effect on company culture. Think of it this way, across a team of 30, that’s two people who are not bought into the projects they’re working on, or broader company aims.

Troublingly, our survey revealed that employee happiness levels are not consistently high across companies. Employees working at a corporate HQ tend to have a better experience than those working in satellite offices. This is a critical issue to deal with across all employees, but it is particularly important in the context of fostering good relationships with culturally diverse team members—most of whom are statistically more likely to be working in satellite or remote offices.

Looking further into these findings, only 12% of workers at HQ admit to feeling unhappy at work (saying they are not often or not at all happy). That number rises to 20% for remote office workers and doubles to 24% for those working in the field or at home.

Cultural diversity and integration

One of the most significant issues facing businesses with cross-border teams is that hiring a culturally diverse workforce does not immediately or automatically make them

europeanbusinessmagazine.com27

culturally sensitive. It’s relatively easy to tick diversity boxes—and even, dare we say—indulge in a bit of corporate virtue signalling by hiring employees from different countries and with varied backgrounds. But hiring culturally diverse talent isn’t enough. These people are more than mere numbers on a spreadsheet to boost diversity credentials.

Our study found that employees who said they work for diverse companies were more likely (38% vs. 29%) to say those companies often struggle to align with and be sensitive about local cultures than employees who worked for non-diverse companies. Perhaps that’s why nine out of ten employees from diverse companies said they think their companies would benefit from regular assistance from outside experts in local and regional culture, hiring, and accounting practices—and 31% said their companies already engage with such experts. Even in non-diverse companies, 74% of those surveyed acknowledged the need for such experts.

Without addressing these issues, the benefits that were supposed to come about from cross-border team working are negated. Indeed, our study suggested employees felt that the more engagement they had with their global peers, the more they felt their

company was struggling to understand their local culture. So instead of walls coming down, barriers go up, and everyone retreats into their local silos.

This is also evidenced in our study, which found more than half (55%) of those who interact every day with global peers said they often experience struggles. In comparison, a majority (39%) of those who rarely interact with global peers said this is never a problem for them. This provides tangible proof that building up a culturally diverse workforce does not automatically lead to a more integrated cross-border way of working. Instead it can lead to isolation and disconnection, and even foster resentment for colleagues, management and the business as a whole.

What can I do to improve cultural understanding and foster local talent?

Overall, enthusiasm for working on a global team remains high amongst employees. The numbers in this year’s study were statistically nearly identical from last year to this year despite more than doubling the respondents and number of countries surveyed. This year, 75% of respondents said they like working for a multinational

or global company (vs 72% last year), 22% said they sometimes like it (vs 24% last year), and only 4% said they don’t like it at all (same as last year).

We’d suggest that there are two critical areas that international companies should focus on if they’re looking to capitalise on this enthusiasm. First off, businesses should prepare their teams for the increased complexities of cultural diversity. Ninety per cent of survey respondents told us that their companies are culturally diverse. Still, two thirds of them say their companies are struggling with that diversity.

Secondly, businesses should focus on understanding the employee experience outside headquarters. Our study shows a significant disconnect for many workers outside headquarters—who statistically-speaking are more likely to be diverse in their makeup. If companies want to continue to earn their international employees’ enthusiasm, they would be smart to conduct internal research to understand their relative experiences. This will help them find more meaningful ways to incorporate their voices and earn their trust.

As global teams grow, it will be more important than ever that companies understand and accommodate a diverse range of global team members. This will help them retain local talent and maintain their competitive advantage in the global marketplace.

About Globalization Partners

Globalization Partners enables you to hire in more than 170 countries within days, and without the need to set up costly international subsidiaries. You identify great talent anywhere in the world, and we put them on our fully compliant global payroll— lifting the burden of global corporate tax, legal, and HR matters from your shoulders to ours. Globalization Partners: we make global expansion fast and easy.

To download your copy of “How Inclusion and Diversity Impact Distributed Global Team Members,” please click here or contact our local in country experts.

europeanbusinessmagazine.com 28

The Public Health Emergency Is Radically Reshaping The Economy

The economy isn’t something fixed in stone. Unlike governments and public institutions, it can change rapidly, adapting to circumstances and consumer preferences. This changeability is actually the basis of the wealth of our society. It is the ability to adjust what we produce that provides people with the goods and services that they want.

The current public health emergency is a case in point. While some businesses are shuttering, others that deal directly with the pandemic are thriving. Investors are ploughing resources into them to meet the ever-growing demand for specific services. It is a beautiful example of the power and flexibility of the market.

You can see good examples of this phenomenon all over the economy.

Food retailers are laying on tens of thousands of new staff to provide delivery services to their customers. So too are online retailers. Manufacturers are retooling their plants to create products that public health services and individuals need to fight the virus. And carmakers are

refitting their factories to produce respirators – vital in the fight against COVID-19.

If you head out onto the road today, you see an abundance of vans all over the place, delivering goods to vulnerable people in need of food. Resellers like Southern Commercial Sales are witnessing an explosion in business. The inability to be physically proximate is leading entrepreneurs to rethink how they manage and distribute their goods radically. The lack of brickand-mortar interactions needn’t be a death blow in an economy undergirded by the internet.

Of course, not all of the “reshaping” is good news. Neither is it a reflection of consumer demand in a state of freedom. What we see right now is what you get when you make everybody a prisoner in their homes. Things won’t stay as they are right now. They’ll snap back to pre-crisis patterns when it becomes safe to venture outdoors again.

The economy is also going to take a big hit in areas that people never

expected. How the travel industry will recover from this episode isn’t yet clear. We’re likely to see massive wage cuts in some sectors as they limp back to health over the next couple years. And assets will go on a fire sale. If major firms fail, then new owners will sweep in and snap up the remaining resources.

Companies will also have to fundamentally rethink their approach to risk management. It no longer makes sense to borrow money to buy back shares and inflate the share price. Firms just learned that the real world is full of risks and that holding back some cash is actually a good idea.

On the money side of the equation, things don’t look so good. As both aggregate demand and supply collapse in the short-run, we’re likely to see prices fall. But it is hard to imagine that inflation won’t rear its ugly head when workers return to their jobs. All that central bank money printing is going to come back to bite us. And when that happens, it will take people by surprise. Ray Dalio is right when he says “cash is trash.”

europeanbusinessmagazine.com29

Corporate debt is in serious trouble –here’s what it means if the market collapses

Markets abhor uncertainty. The coronavirus pandemic is a severe supply shock that will substantially reduce the world’s economic output, and there will potentially be several waves as the contagion returns in the autumn or spring 2021.

Many governments are trying to form a bridge over the lockdown period to allow economic activity to be restored. This involves keeping viable businesses in operation with a furloughed workforce that can quickly

re-open when appropriate. One major impediment is that the private corporate debt market is likely to completely implode, which risks pushing a substantial number of businesses over the edge.

Corporate debt is traded on the open market in several ways: bonds issued directly by companies, and bank loans that are sold on to investors by the bank that agreed them, either individually or in packages of multiple loans. Bonds make up the majority of the market.

Ratings agency Fitch is forecasting a doubling in defaults in 2020 on US leveraged loans, which refers to bank loans to businesses considered more risky. The agency expects a default rate of 5% to 6% this year, compared to 3% last year. The dollar value will exceed the previous high of 2009, and for retail and energy companies, the default rate could approach 20%.

Fitch then expects defaults of between 8% and 9% next year in this market, amounting to a total of

europeanbusinessmagazine.com 30

US$200 billion (£161 billion) in bad debt over two years. Other sectors at risk include airlines, hotels, restaurants, casinos and cinemas.

That 2008 feeling

A second measure of corporate debt is the market price of credit default swaps (CDSs), which are tradeable contracts that investors use to insure against companies defaulting on their debts. Both for investment grade and “junk” debt, the price of these swaps is back at the levels of the financial crisis of 2007-09. It is striking how quickly this has happened.

The final measure is to look at the risk premiums associated with different types of debt. In other words, how much it costs companies to

borrow compared to the benchmark ten-year US treasury bond. We have seen spikes in these rates for highgrade corporate debt and junk bonds alike. Both have eased back in recent days, but borrowing costs remain considerably higher than before the crisis. This will be putting pressure on many companies already struggling to cope.

As a general rule, if one company has a negative shock through no fault of its own, even a severe one, it will be able to obtain financing to continue in business. Anyone seeking online deliveries from Ocado will realise, for example, that the company is still suffering logistically from its devastating warehouse fire in England in July 2019, yet it has continued to have access to finance.

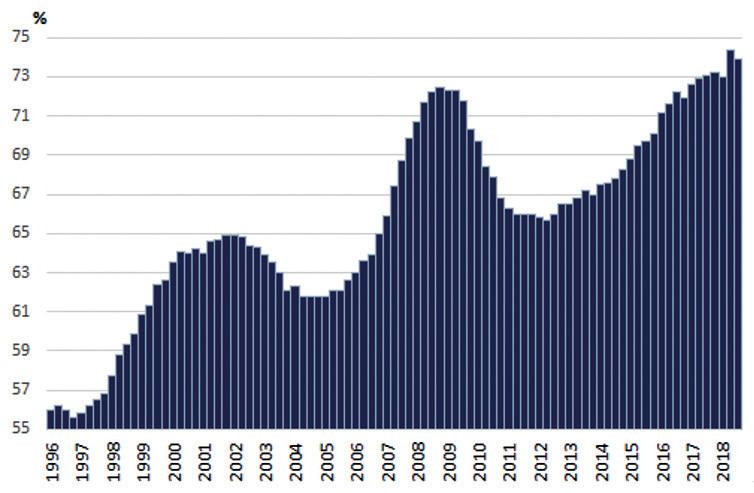

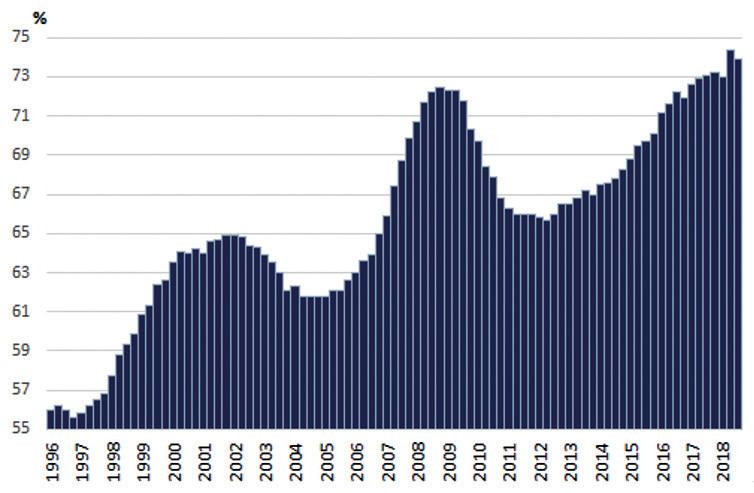

It’s a different story if a majority of firms are all suffering shocks at the same time, and the outcome looks as uncertain as it does at the moment. To make matters worse, companies are entering this period carrying high levels of debt. US corporate debt, for example, is over 70% of GDP, much higher than historic levels.

Alternatives

While the markets for trading corporate debt may well collapse, some companies may still be able to borrow

privately. During the financial crisis, Goldman Sachs chose not to participate in government bailouts, which came with restrictive conditions. Instead, the US investment bank went to Warren Buffett’s Berkshire Hathaway in 2008 and effectively borrowed US$5 billion. This created enough investor confidence to allow Goldman to issue new shares on the open market to raise extra capital. This time around, Berkshire holds about US$125 billion in “cash”, which could be used to strike similar deals. An alternative option for some promising companies will be private equity finance , in which investment firms buy stakes in them.

In some cases, bank lending may also be available: central banks have given continual assurances that the major commercial banks have passed strenuous stress tests, so they will hopefully be in a position to do their jobs and lend. Yet despite these possibilities, current uncertainties may cause companies in sectors hit hard by the pandemic to be insolvent if they cannot trade for several months. Here, the UK programme on paying up to 80% of wages for furloughed workers is well judged. This should help high street retailers, for example, since they have high wage bills. It will also help these firms that business rates have been suspended.

europeanbusinessmagazine.com31

US corporate debt as a % of GDP

Economic effects of coronavirus lockdowns are staggering – but health recovery must be prioritised

With the oil prices going to below zero and the spike in unemployment claims is the proverbial canary in the goldmine,we should expect a swathe of bad economic numbers coming down the pipeline. The head of the St. Louis Fed expects a 30% unemployment rate and a 50% drop in US GDP by summer. More importantly, as the health crisis rises and crests at different times in different parts of the world, the horrifying numbers on GDP growth, unemployment, business closures are not likely to let up in the near term. Multiple countries

are in a recession, and eventually, the whole world will fall into a deep recession.

The plunge from prosperity to peril will be as swift as the switch to lockdown protocols in most countries. We cannot even rely on the data we have to reveal the speed and depth of the crisis since this is collected and updated with lags. For instance, the US monthly jobs report for March collects data in the second week of March, failing to capture the massive spike in unemployment claims that appears after March 12.

In the meantime, sources such as restaurant booking website OpenTable can offer some insights into the magnitude of things. Combine a black swan event with missing data, and it is not surprising that markets are swinging violently.

Deep freeze

The question is not one of whether we are in a recession – we are. The more pertinent questions are: how long it will last? How deep it will be? Who will be impacted the most? And how swift will the recovery be?

europeanbusinessmagazine.com 32

These questions are complicated and even top economists must admit a lack of confidence in their answers. We are not experiencing a standard downturn. Nor is it simply a financial crisis, a currency crisis, a debt crisis, a balance of payment crisis or a supply shock.

We have not seen anything like this since the flu pandemic of 1918. Even there identifying the effects of the flu is confounded by first world war that took place at the same time. What we have here is something different. At its heart, we are experiencing a healthcare crisis with various parts of the world succumbing in a staggered fashion.

To slow down this global health crisis (the “flatten the curve” mantra), we have chosen to put the economy into deep freeze temporarily. Production, spending, and incomes will inevitably decline. Decisions to reduce the severity of the epidemic exacerbate the size of the contraction. While the initial decision to reduce labour supply and consumption are voluntary, this will likely be followed by involuntary reductions in both, as businesses are forced to lay off workers or go bankrupt.

Of course, government policies will attempt to mitigate these effects. Some are using traditional monetary and fiscal policies (cutting interest rates, quantitative easing, increasing unemployment insurance, bailouts). Others are trying out non-traditional methods (direct cash transfers, loans to businesses conditional on maintaining unemployment, wage subsidies).

Public health priority

How long the economic impact lasts depends entirely on how long the pandemic lasts. This, in turn, depends on epidemiological variables and health policy choices. But even when the pandemic ends, the resumption of normalcy is likely to be gradual. Countries will persist with a strict containment regime like in China today, and continue to impose travel restrictions to various parts of the world where the disease continues to spread.

The many factors at play in this complex, interlinked crisis that affects both people’s health and the global economy introduces massive uncertainty into anyone hazarding the pace, the depth and the length of the impact. As a result, we should treat any precise estimates (such as “GDP will decline by X%” or “markets have reached their bottom”) with scepticism.

Lockdown is geared toward stopping health services from being overwhelmed.

EPA-EFE/Will Oliver

Especially frustrating is the idea that there is a conflict between academic disease modellers and hard-edged economists saying that steps to slow the spread of coronavirus has trade offs. This could not be further from the truth. Among economists there is near unanimity that countries should focus on the healthcare crisis and that tolerating a sharp slowdown in economic activity to arrest the spread of infections is the preferred policy path. In a recent survey carried out by the University of Chicago, respondents universally agreed that you cannot have a healthy economy without healthy people.

The health crisis has naturally created a crisis of confidence. This, in turn, can have damaging long-term effects with continuing uncertainty leading

firms and households to postpone investment, production and spending. Restoring confidence requires a singular focus on containing and reversing the spread of COVID-19.

Slowing the rate that people fall ill with COVID-19 is not the end in itself. It is a means to temporarily reduce the pressure on hospitals and give time to identify treatments and a vaccine. In the interim, we must build testing capacity, perform contact tracing, setup the infrastructure for extended quarantines, rapidly expand the production of masks, ventilators and other protection equipment, build and repurpose facilities into hospitals, add intensive care capacity and train, recall and redeploy medical personnel.

All of this is also the way to restore the economy’s health and economic policy must complement it. In the short run, economic policies should mitigate the impact of lockdowns and ensure that the current crisis does not trigger financial, debt or currency crises. It should focus on flattening the recession curve, ensure that the temporary shutdown has only transient effects, and facilitate a quick recovery once the economy is taken out of the deep freeze.

In the meantime, it’s important to also recognise that this is an unprecedented crisis. Everybody has their role to play, but nobody is infallible and uncertainty is inevitable.

europeanbusinessmagazine.com33

AScoronavirus spreads across the world, politicians are confusing the current economic situation with a recession. The current decline in production and employment is not due to declining demand or supply, as is normally the case in a recession spiral. Rather, it is because governments are shutting down vast swathes of the economy. It is their reactive policies which will take us into a recession that we can avoid.

An extreme hypothetical example will help clarify this. Consider a government mandate to shut all businesses on one random Tuesday for a holiday. People are asked to stay home. What happens on Wednesday? There is no significant economic impact.

Employees, consumers and businesses start on Wednesday where they left off on Monday. We could even imagine this market closure or “economic pause” being extended to two or three days, still with no significant impact. Indeed, the market closure could go on as long as consumers, employees, and businesses are able to go into a state of “suspended economic animation”. Everyone significantly reduces their economic activity, but, critically, maintains their ability to restart their economic activities where they left off.

An overly long market closure would lead us into a recession. Consumers wouldn’t be able to pay their rents and mortgages, and there would be

chain reactions of unpaid bills across the economy. This in turn would reduce demand and businesses, in turn, would fire employees. We would be in a recession spiral.

To avoid this, there does need to be government intervention. Governments need to ensure that consumers, employees and businesses don’t degenerate during this state of suspended animation. They must be able to start up after the market closure where they left off before.

A different kind of crisis