2 minute read

Currency outlook: US dollar firms in risk-off trade, Pound rocked by fluctuating BoE rate expectations

Euro

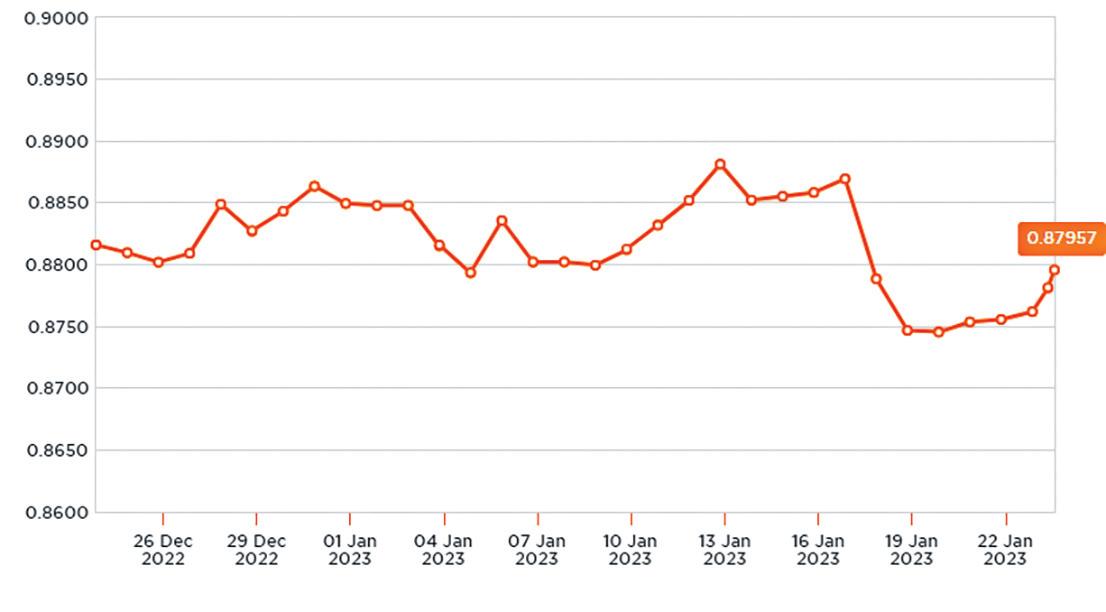

EUR/GBP: Unchanged at £0.88

EUR/USD: Down from $1.08 to $1.06

Trade in the euro has been erratic over the past month amid a repricing of European Central Bank (ECB) interest rate expectations and concerns over the conflict in Ukraine.

EUR investors were confident going into the ECB’s February policy meeting that the bank would deliver several more hikes this year.

While the bank delivered a 50bps hike and signalled it would pursue another increase of equal size in March, it indicated it’s March hike might be its last for now. Triggering a slump in EUR exchange rates.

The euro was then subsequently pressured by concerns over Russia’s next moves in Ukraine, amid considerable speculation Vladimir Putin would launch a new ground offensive to coincide with the first anniversary of the war.

Coupled with the single currency’s negative correlation with the US dollar this kept the pressure on EUR exchange rates.

Going forward it’s likely that events in Ukraine may continue to dictate movement in the euro. Any escalation of the conflict is likely to exert more pressure on EUR exchange rates.

Business Extra

On the scent

SPAIN is the EU’s second mostaffected country regarding counterfeit perfumes and cosmetics, losing 16 per cent of genuine sales amounting to €1 billion each year, revealed Spain’s National Perfumer and Cosmetics Association (Stampa). As well as damaging the firms’ reputations, the fakes also destroyed an annual 8,000 jobs, Stampa said.

Strike off

THE Inditex retail clothing chain has agreed to pay a fixed minimum salary of between €18,000 and €24,500 a year for all employees, the majority of them women, who work in their shops. The wages pact, described as “historic,” arrived only hours before a strike was due to begin.

Pound

GBP/EUR: Unchanged at €1.13

GBP/USD: Down from $1.23 to $1.20

Heading into February, the pound enjoyed relatively robust support amid Bank of England (BoE) interest rate speculation.

Sterling then quickly fell from grace at the start of February, with the GBP/EUR exchange rate plunging to a four-month low after the BoE’s first rate decision of the year. While the bank raised rates by 50bps, its dovish signals lead to speculation the BoE might be nearing the end of its hiking cycle.

Trade in the pound was then choppy in the weeks that followed. Buoying Sterling sentiment were some hawkish comments from BoE policymakers in addition to confirmation the UK narrowly avoided slipping into a recession at the end of 2022.

A softer-than-expected inflation print in January then placed renewed pressure on GBP exchange rates in mid-February. Before a surprisingly strong PMI release helped to revive BoE rate hike bets and catapult the pound higher again.

Looking ahead, it’s likely BoE rate speculation will remain a key catalyst of movement for the pound. If GBP investors grow more confident