Vol

Vol

TNeal Wallace MARKETS Lamb

HE hoped-for boost to lamb prices from Chinese New Year celebrations has failed to materialise.

Dave Courtney, the chief customer officer at Silver Fern Farms, described sales from the annual celebrations held this year on February 10 as “subdued”.

“Overall, the Chinese New Year period was relatively subdued compared to previous years,” he said.

AgriHQ senior analyst Mel Croad said that is also her understanding and consistent with a lacklustre Chinese economy, which affects pricing and sales for high-value products such as meat.

Chinese traditionally celebrate the 15-day lunar Chinese New Year festival with family gatherings centred on food.

China took 56% of New Zealand sheepmeat exports last year, and exporters had hoped the new year celebrations would boost lamb prices, which are currently about 25% lower than last season.

Courtney said Chinese consumers remain cautious due to the effects of deflation, a weak property sector and high local government debt, but the country remains an important market for exporters.

“The Chinese market gives us optionality and the ability to move volumes, which helps to create price tension in other markets and also maximise the value we can make from the whole carcase.”

The global sales director for the Alliance Group, James McWilliam, said consumer demand in China remains weak due to cost-ofliving pressures and stagnating incomes.

“The food service sector, which is where a significant amount of our products are consumed, continues to be weak.”

View

Dave Courtney Silver Fern Farms

The market is being inundated with greater volumes of cheap South American beef, and Australia continues to export large volumes of mutton.

“Although it is early days, there are indications of increased sales activity post-Chinese New Year so we will be focused on leveraging this to support increased consumption over the coming months,” said McWilliam.

Continued page 3

5

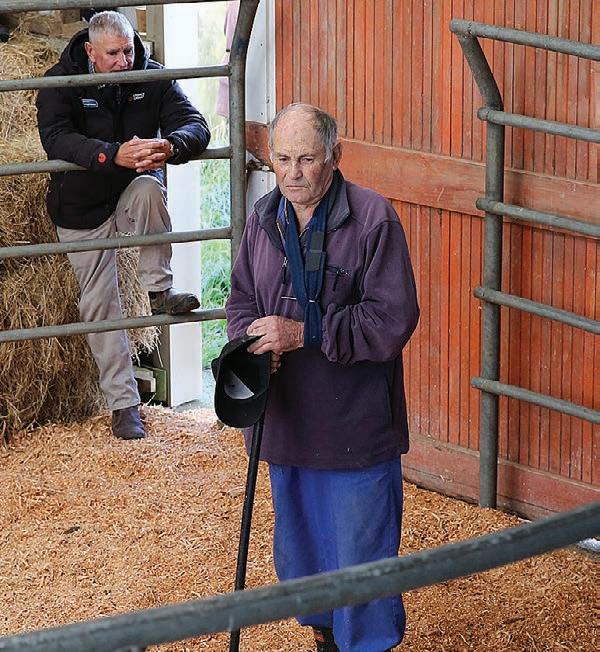

Katie Smith was one of the competitors in the junior shearing heats at the Golden Shears in Masterton at the weekend. It was her first time competing – “It’s a bucket list thing!” she says. Smith learnt to shear while working with her shearer husband and was pushed to enter by her family, who shear their own sheep on their 540 hectare sheep and beef property at Alfredton, Wairarapa.

NEWS 3

William Morrison, like his father John before him, has always believed in the future of Wiltshire shedding sheep.

Increasing productivity growth by 1% would unlock tens of billions of dollars in economic value.

NEWS 13

As tough years for Synlait follow an era of remarkable growth, Keith Woodford looks at its future.

OPINION 17

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594 Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256 Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570 Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by Stuff Ltd

Delivered by Reach Media Ltd

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Andrew Fraser | 027 706 7877

Auckland/Northland Partnership Manager andrew.fraser@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Omid Rafyee | 027 474 6091

South Island Partnership Manager omid.rafyee@agrihq.co.nz

Julie Gibson | 06 323 0765

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

Dean and Cushla Williamson

Phone: 027 323 9407

dean.williamson@agrihq.co.nz

cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand

Phone: 0800 85 25 80

Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print)

ISSN 2463-6010 (Online)

DairyNZ is partnering with Irish researchers to better understand methane emissions from pasture-based farm systems.

The four-year project, which started February, will see experts from DairyNZ and Ireland’s Agriculture and Food Development Authority, University College Cork and the Irish Cattle Breeding Federation working together to quantify methane emissions from dairy cows in pasture-based systems.

Listed honey company Comvita has disclosed an unsolicited, non-binding indicative offer for all shares from a credible overseas party.

The proposal is highly conditional, and the party has indicated it would prefer to implement any acquisition by a negotiated scheme of arrangement. The Comvita share price jumped 90c on the news, from $1.75 to $2.65. However, it had fallen by 50% over the past two years, down from $3.50.

Agritourism NZ has launched an agritourism academy.

Founder Marijke Dunselman said the accelerator programme workshops that were previously hosted across the country have ended. The new academy is more comprehensive, with pre-recorded courses for farmers who want to begin an agritourism business as a way to diversify.

People Expo events are back, providing dairy farmers with opportunities to better understand workforce dynamics, and get ideas on actions they can take to find and keep great people.

DairyNZ and Dairy Women’s Network are partnering to deliver four People Expo events in Northland, Bay of Plenty, Manawatū-Whanganui and Southland in March.

Neal Wallace PEOPLE Employment

Neal Wallace PEOPLE Employment

WELSH-born Myfanwy Alexander is unashamedly blunt when she says the dairy industry’s greatest asset is under threat from poor and antiquated employment practices.

The North Otago contract milker and Federated Farmers branch president said unrealistic expectations for staff are causing burnout and deterring new workers from entering the industry.

Adding to her concern is that those not pursuing a career in dairying are denying themselves an opportunity to use New Zealand’s successful career pathway of share and contract milking to achieve herd or farm ownership.

Alexander, a contract milker on a 1000-cow farm near Duntroon in North Otago, was responding to “Dairy industry’s staffing tensions mount” (February 26) in Farmers Weekly, which reported that the Rural Support Trust and farming leaders in Southland are dealing with increasing stress and mental health issues stemming from employment issues.

Continued from p1

Croad said the Chinese economy still faces some challenges before it “will start firing”.

Markets in the United Kingdom, European Union, United States and Middle East are performing better than expected.

As parts of NZ start to dry and feed quality declines, Croad expects stock flows, which have

Alexander, along with dairy farm owner Louise Gibson, has established Sharefarming Consultants, a business that fosters a fair and balanced relationship between farm owner, sharemilker or contract milker.

The days of rewarding hard work with a box of beer are gone, she said, as young people want to be valued, have control over their lives, to play sport, join clubs and spend time with friends and family.

We need to move away from the view that movement and running around a farm to look like you are busy is productive.

Myfanwy Alexander Sharefarming ConsultantsShe fears pressure from farm owners and managers and unrealistic expectations for staff are prompting the next generation of farmers to take well-paying, 40-hour-a-week, Monday-toFriday jobs with agricultural servicing companies.

“My worry is, do we have a sustainable pathway for those leaving school or university to go dairying and get where they want

been slow to date, will accelerate.

A NZ Foreign Affairs and Trade report on China says the fundamentals that make it our single largest export market remain, but there are headwinds.

Plummeting consumer confidence saw NZ sales last year of dairy, meat and forestry fall by up to 20%.

A year after dropping its pandemic restrictions, China

Array NEA2 perennial ryegrass offers a unique ‘array’ of benefits, including high intake, yield, nitrogen uptake and persistence.

Ask about Array, the new superstar, today.

barenbrug.co.nz

to go?” Alexander said.

Dairying is a high-pressure environment, with that pressure and stress passed down through a farm’s workforce, creating unrealistic expectations and ultimately discouraging people from pursuing farming careers.

“Someone who was up bringing in the cows at 3am cannot be expected to still be cognisant at 5.30pm. Physically you cannot do that.

“It’s a cycle and we need to break the cycle.”

Alexander said dairy farms need to create a culture with boundaries so workers are recognised as humans. Ultimately that environment will allow them to be productive.

“We need to move away from the view that movement and running around a farm to look like you are busy is productive.”

She is not apportioning blame, saying that was how most current owners and managers were treated and it is all they know.

The Rural Support Trust is dealing with workers without employment contracts, which Alexander said reflects the traditional relaxed and trusting way the sector has operated.

That also needs to change if it is to attract a new generation of workers.

is undergoing an economic transition but the report adds it still provides a large and growing market of middle-class consumers seeking high quality food.

The Chinese economy grew 5.2% last year, exceeding the government’s 5% target and bouncing back from a lacklustre 3% growth in 2022. It is still well below the 6% achieved between 2015 and 2019.

CHANGE: Employment conditions on dairy farms need to change to attract the next generation of workers, says North Otago’s Myfanwy Alexander.

“The times I have struggled mentally and physically were when there were no boundaries, which meant I had no autonomy.

“People need to feel they have a say in their lives. They’ve got relationships, family, a life outside the farm.”

Staff should not be expected to devote every waking minute to farm work.

“At the end of the day you have to ask yourself, ‘Who is going to show up to my funeral and who is going to look after my children should I die?’”

Despite price discounting, last November’s Singles Day, China’s largest e-commerce sales festival, saw a modest 2% increase in yearon-year sales, less than the 2.9% achieved a year earlier.

Forecast economic growth for this year is 4%, with economists stressing the need to stabilise the property market and encourage consumer spending. Youth unemployment,

If she could change things, Alexander said, her first move would be to ensure staff are treated as humans with employers and managers understanding that employees have a life outside the farm.

Her second move would be to ensure employers and managers were equipped with soft or staff management skills. Such skills have not previously been valued, she said.

“We need to get those old fashioned blokes to go learn those soft skills.”

considered an obstacle to consumer confidence, dropped from 21.3% in June to 14.9% in December while deflation was 0.3% last year.

The report says that the Chinese Government has introduced stimulatory economic policies such as issuing sovereign bonds and allowing local governments to refinance debt by issuing bonds.

BNigel Stirling MARKETS Trade

BNigel Stirling MARKETS Trade

OTH sides in talks to tackle nearly a trillion dollars in tradedistorting agricultural subsidies were digging in their heels at the halfway mark of a meeting of global trade ministers last week.

New Zealand was represented by Trade Minister Todd McClay at the week-long biennial meeting of 164 World Trade Organisation ministers in Abu Dhabi, scheduled to finish up last Friday.

WTO director-general Ngozi Okonjo-Iweala heralded the consolidation of competing proposals for the agricultural talks into a single negotiating text as a significant step towards an agreement to tackle subsidies and tariffs on global agricultural trade.

However, the head of the organisation’s agricultural division, Edwini Kessie, on Tuesday said significant obstacles to progress in the talks remained.

Foremost among these was India’s request for a permanent dispensation for subsidies paid to its farmers.

In 2013 India was granted a temporary pass by WTO countries, and was demanding this be made permanent at the meeting in Abu Dhabi.

The temporary dispensation was to help India build up food reserves available to be released during times of shortages in the country.

But opponents argue this has led to excess production being exported and has depressed international prices for some commodities, among them rice.

Stephen Jacobi, the executive director of the International Business Forum (IBF), which includes New Zealand exporting heavyweights Fonterra, Silver Fern Farms and Zespri, among others, said making the dispensation permanent risked undermining an earlier WTO ban on export subsidies and emboldening agricultural protectionists around the world.

“Other countries that would love to get back into the export subsidies game might see this as an opportunity,” Jacobi said.

According to the OECD, governments around the world already pay their farmers $817 billion in subsidies annually.

The Dairy Companies Association of NZ released research last week showing prices on international dairy markets stand to gain 8% if European agricultural subsidies are reduced by half.

However, a former head of the Centre for WTO studies in New Delhi, Abhijit Das, who was attending the talks in Abu Dhabi, said subsidies are crucial to the livelihoods of Indian farmers and the welfare of the wider population.

He said the extra subsidies allowed by the temporary dispensation meant enough rice and wheat had been produced for state reserves to feed 800 million people during the height of the covid pandemic.

Das rejected the claim that subsidies paid to Indian farmers are undermining global export markets.

The subsidies are designed to build up domestic reserves and are not aimed at production for export. Where the Indian government has exported surpluses in the past it has done so at prices 30% to 50% above the international price, Das said.

He said if other WTO countries agree to the dispensation being

made permanent it could unlock progress in other parts of the talks.

However, with the United States and the 19 agricultural exporting powerhouse countries of the Cairns Group, including NZ, opposing the Indian proposal, the chances of a broader breakthrough seemed slim.

Speaking before the meeting’s scheduled conclusion last Friday, the IBF’s Jacobi said while it was positive that competing proposals in the agricultural negotiations have been consolidated into a

single document, there remain plenty of brackets in the text indicating disagreement between countries over the final wording.

“What that says is that while they are working on the same text they are not changing their views very much.”

Jacobi said the best outcome from the meeting would be an agreement for countries to keep talking with the hope that differences could be bridged by the time of the next WTO ministerial meeting in two years’ time.

DESPITE having poorer health outcomes than their urban counterparts, rural New Zealanders are considerably less likely to be admitted to hospital, a University of Otago-led study has found.

Published in the New Zealand Medical Journal, it is the first time large rural-urban differences have been demonstrated in use of

hospital services in the country.

Lead author Professor Garry Nixon, head of the rural section in Department of General Practice and Rural Health, said the results are surprising given rural New Zealanders have poorer health outcomes, including higher preventable mortality rates.

“The problem is even greater for our most remote communities.

“Despite the poorest health outcomes, highest levels of socioeconomic deprivation and

“

I think the issue is relatively complex and I think there is a degree of

the highest proportion of Māori residents, these areas have the lowest hospital admission rates and lowest utilisation of other hospital services such as emergency departments, specialist clinics and allied health services,” he said.

The findings also go against the pattern seen in similar countries – in Australia and Canada, the poorer health status and lack of access to primary care services results in higher hospital admis-

sions for people in rural areas.

The study used hospitalisation, allied health, emergency department and specialist outpatient data from 2014 to 2018, along with Census information, to calculate hospital utilisation rates for residents in the two urban and three rural categories.

The researchers found, overall, regional centres had the highest hospitalisation rates, and rural areas the lowest.

Relative to their urban peers,

rural people had lower allcause, cardiovascular, mental health, and ambulatory sensitive hospitalisation rates.

Those living in the most remote communities had the lowest rates of specialist outpatient and emergency department attendance, an effect that was accentuated for Māori.

Nixon believes there needs to be better monitoring of healthcare utilisation to help reduce these inequities.

TNeal Wallace MARKETS

TNeal Wallace MARKETS

Sheep and beef

HERE appears to be little reprieve in store for New Zealand sheepmeat exporters battered by record volumes of Australian sheepmeat, with the lucky country forecasting another year of record production.

Meat & Livestock Australia (MLA) is forecasting lamb production will this year reach 621,000 tonnes, a 9% increase on 2023, and the fourth successive year of record production.

If achieved, the 2024 production will be 21.3% above the 10-year average.

The MLA forecasts the 2025 lamb crop to drop to 587,000t and then rise to 606,000t in 2026 due to improved carcase weights.

Record Australian sheepmeat production in the past year has

been blamed for dampening international prices in key NZ markets like China.

After three years of consecutive

growth, the Australian sheep flock is forecast to fall 2.9% this year to 76,500,000, but that will do little to curb meat production.

Mutton production this year will be the largest since 2006 at 254,000t, up 3.14% on 2023, before falling for the next two years.

Stephen Bignell, MLA’s market information manager, said as the largest world’s sheepmeat exporter, Australia is optimistic markets will absorb the extra production.

“Economic resilience in the United States and emerging markets will drive demand for lamb, while the outlook for consumer demand in China remains uncertain,” he said. Meanwhile, Rabobank said limited or negative wage growth in key global economies in the coming year could mean steady or declining beef consumption.

Jen Corkran, Rabobank’s senior NZ animal protein analyst and author of the Global Beef Quarterly report, said as a premium-priced protein, beef sales often suffer when economic

AROUND the boardroom table of some of New Zealand’s biggest primary sector businesses are influential women blazing a trail for future generations.

Marked annually on March 8, International Women’s Day (IWD) is a global day celebrating the social, economic, cultural and political achievements of women. With the theme this year of Inspire Inclusion, it aims to forge a more inclusive world.

The first woman to head a major NZ agri-business co-operative, Jessie Chan, said NZ needs strong leaders in the primary sector now more than ever before.

“Women need to build the confidence to say to ourselves, ‘I belong here,’ and hold our own

at the leadership table.”

Chan is quite deliberate in what she takes on, always looking to ensure her governance roles interconnect in a way that serves the community and wider industry, while also striving to inspire others to take up leadership roles and achieve their goals.

She said women don’t need to be represented as movers and shakers.

“We just need to be respected equally for our work and contribution to the sector. We must also remember that respect must still be earned, regardless of gender.

“There is a fine line as a woman in leadership between holding your own and practicing humility and respect for others.

“There are less challenges than there used to be, but we are still not quite there.

“I still occasionally come across

old-school men that secretly, or not so secretly, think I shouldn’t be there, but I see them as the minority and remind myself that the rest of us will move on without them.”

The other challenge is being able to make space among other roles as mum, organiser, farm manager, school volunteer and the list goes on.

“I see so many talented women that could contribute further in the leadership space, but they are giving so much to their families and communities that it is almost impossible.

“The inspiration part starts with our rangatahi. As mothers, aunties, grandmothers, we should be teaching our young people the concept of equality, not only in gender but in all areas, and living it by example.

“Influencing the next generation

is where we will see real change. Women in leadership won’t be a big deal, it will just be normal, and we are getting there.”

Chan attributes much of her success to her humble beginnings, learning her leadership skills from her sawmiller father who raised her and her three siblings after her mother left when she was 10 years old.

Chan has worked in a range of primary sector management positions over a 20-year period, including central government, local government, non-profit and commercial organisations. She was awarded a Member of the NZ Order of Merit in 2022 for services to dairy and agriculture, received the Women in Governance Award for Inspiring Governance Leader in 2021, and was named Dairy Woman of the Year in 2017.

Economic resilience in the United States and emerging markets will drive demand for lamb.

Stephen Bignell Meat & Livestock Australiaconditions put pressure on consumer spending.

“In a market where beef production growth is limited, like the US for example, we may see consumers willing to tolerate higher prices at the expense of some consumption, thus maintaining demand,” she said.

“While in a market with growing supply such as Australia, lower prices may be needed to encourage consumption.”

The NZ bull beef kill is down 3.9%. Beef exports for 2023 were up 7% by volume (511,680t) but down 9% in value ($4.4 billion).

NO EXCEPTION: Jessie Chan says women don’t need to be represented as movers and shakers, they just need to be respected equally for their work and contribution to the sector.

Chan is currently a director of AgriZero, AgReserach, NZ Pork, and PharmaZen and previously served on the boards of RuralCo, Ngai Tahu Farming, Alpine Energy, Meat the Need and Bioprotection Aotearoa.

We've been busy working on some game-changing new features. If you are on the fence about FarmIQ, now is a great time to jump on over.

New packs, new features and multi-farm discounts.

We've got a tool that will make sorting your FWFP a hell of a lot easier, taking you through all the sections step by step.

Have a play around with FarmIQ free for 30 days and check out our new features including tasks, animal health treatments, FWFP and more.

Hugh Stringleman NEWS Food and bre

Hugh Stringleman NEWS Food and bre

WOOL-shedding sheep and those breeds that don’t grow wool are now being marketed on workload and productivity gains for hill country sheep farmers around the country.

Coarse wool returns that do not cover the costs of shearing and crutching, along with the labour demands of drafting and dosing, are convincing a growing number of farmers to look for no-wool options.

The buying and selling of Wiltshires has dominated sheep sales over the summer, this year and in two or three previous years.

Some older farmers are not prepared to breed their way to shedding sheep, opting instead to sell all existing ewes and replace them with full-breed Wiltshires, Southland breeder Tom Day said.

Day promotes his sheep for the easy care, low labour, and frugal expense qualities that enable him to run 5800 hectares with only two labour units.

Morrison’s father, John, gathered all the Wiltshires in the country together at Marton in the 1980s and the Morrison family has used and championed that breed ever since.

Morrison said demand for rams has doubled every year for the past four or five years and is now being led by commercial farmers all over the country.

He likened this move toward shedding sheep to the flurry of exotic sheep importations in the 1990s when the focus was on fertility.

“We find that single-trait focusing on shedding up until now is giving way to productivity traits such as carcase characteristics, growth rates and reproductive performance.

“But sometimes the real sheep farming traits are being left out of selection decisions as people advocate or demand 100% shedding.

“This also drives a market expectation that all Wiltshire sheep shed their fleece completely, all of the time, which is not the case.”

He called for more research into how shedding occurs, because it is not 100% genetic.

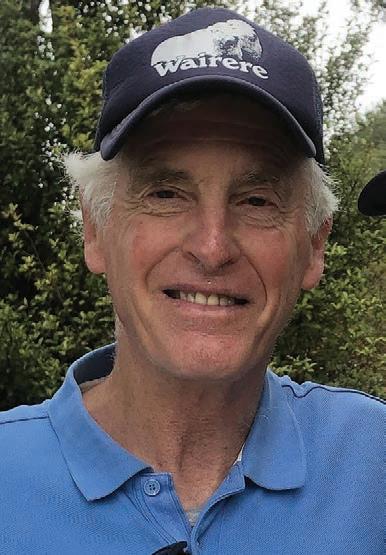

To make sense of sheep that have no wool, farmers need to plan for what they will do with the extra time available.Derek Daniell Wairere Rams

While a decade ago there may have been only four or five recorded flocks, there are now somewhere between 20 and 30, Morrison said.

“Wiltshire sheep and the range of alternative breeds will benefit hugely from the large increase in performance recording, both in the numbers of stud flocks and numbers of sheep being recorded.

selling newly named Nudie sheep – is Derek Daniell’s Wairere Rams based at Masterton and Pahiatua.

Wairere is quickly building its no-wool sheep numbers by using artificial insemination (AI) and embryo transfer (ET) with genetics from the United Kingdom that were not previously in New Zealand, along with natural mating to NZ-born Nudie ram hoggets retained by the company.

Over three mating seasons it has put 4500 ewes to both AI and ET, with conception rates in the mid to high 60s for frozen semen AI and about 10% lower for ET.

All Nudie and Streaker (halfbred) ewe lambs were retained for hogget mating and returned 78% conception for the Nudies and 91% for the Streakers, with 103% and 135% scanning results respectively.

Surplus Streaker lambs have been killed this summer for comparison against Wairere Romney ram lambs, showing good weight-gain margins in the early drafts, levelling off later on.

flock will be graded up from the Wairere ewe base to ensure that all the renowned traits will be incorporated in the Nudie flock, including facial eczema resilience.

“April 2024 will be the last year for artificial breeding with genetics from the UK, as we have a strong and diverse genetic pool to

sheep industry demand – wool or no wool.

He still believes coarse wool has a brilliant future, especially in its deconstructed uses, and is a member of Wools of NZ.

“To restore faith in wool the researchers and marketers need to come up with at least $10/kg.”

“In the past three or four years the demand has increased dramatically, and it is not just the lifestylers now but bigger commercial sheep farms.”

Day sold 30 two-tooth rams and 20 ram lambs at his annual Tarata Hills sale in February near Dipton for an average of about $1000, with a starting bid of $600 to keep them affordable to all buyers.

Day and his father before him, Malcolm, have been breeding Wiltshires since 2002, when Malcolm bought a farm in the Tākitimu mountains without power supply or a woolshed.

“He got some flack in the first few years, and it is great to see him getting recognition as the popularity of these sheep grows.

“We now have coastal sheep farmers near us talking about it, and if anyone is hard to convince, it is a Southland farmer.”

That was an observation echoed by leading Wiltshire breeder and ram seller William Morrison, Ardo Farms, in Rangitīkei.

“These sheep will make huge genetic gains in the next five to 10 years,” Morrison said.

Somewhat later to begin – but now throwing big bucks and plenty of energy into breeding up and

“Currently our focus is building numbers in our flock, so that we can get to a stage where we can exert some selection pressure,” Daniell said.

Wairere will have over 2000 Nudie and part-breed ewe lambs after this year’s reproductive cycle.

“The bulk of the breeding

establish our flock with,” Daniell said.

Besides shedding, farmers using Nudies want to know that lambs can grow quickly to 20kg CW or more, maintain or improve their flock lambing percentage, allow a good hogget mating and maintain or improve constitution.

The Wiltshire genetics in NZ have been limited in their scope and outcrosses are needed, Daniell said.

Farmers who buy in also need more than first-cross hybrid vigour which, although welcome, is by its nature limited.

“To make sense of sheep that have no wool, farmers need to plan for what they will do with the extra time available.

“You might not need that additional shepherd, or their house, or their farm bike.”

The bulk of the Wairere home and satellite sheep flocks remain Romneys and their composites, and the Nudies and their partbreeds are catering for what Daniell calls a split underway in

Wairere marketing manager Pierre Syben said that “the reality is that as a breeder of sheep genetics for the sake of our client base we have looked for an alternative to wool-growing sheep”.

“The move to shedding sheep is deeper and wider spread than many may realise,” he said.

PGG Wrightson genetics representative and auctioneer Cam Heggie said shedding sheep have become more affordable and the ewes and ewe lambs are coming to market.

He said of ewe lambs for $400 and two-tooth ewes for $500, “it is not just shedding, but faecal egg counting, facial eczema resistance, carcase characteristics and recorded breeding, all providing options for intending buyers”.

“We are seeing older farmers, perhaps the more traditional ones, taking an interest in what shedding sheep have to offer.

“We have given crossbred wool 35 years of hope, but hope is not paying the bills.”

Neal Wallace NEWS Business

Neal Wallace NEWS Business

has reported a softening in halfyear results as it faces the same challenging trading conditions as its rural clients.

Announcing its six-months result to December 31, it reported revenue of $560.9 million, down 4%; net profit after tax of $12.7m, 40% lower; and operating earnings before interest, tax, depreciation and amortisation (EBITDA) of $36.6m, 24% lower.

A majority of the PGG Wrightson (PGW) board decided not to pay an interim dividend, with the capital reinvested back in the business to avoid extra debt.

Compared to the same period a year earlier, operating EBITDA was down $11.2m, revenue was $24.9m lower and NPAT $8.4m less.

Chair Garry Moore said despite challenging market conditions, PGW traded solidly in the period under review.

High inflation and interest rates, and rising debt levels combined with subdued demand and softer returns, created a demanding environment for the agricultural sector.

“This half-year result can be

This half-year result can be described as steady in the context of the headwinds the sector and the wider economy face.Garry Moore PGG Wrightson

described as steady in the context of the headwinds the sector and the wider economy face,” Moore said.

He said the Retail and Water Group, which includes rural supplies, Fruitfed Supplies, water and agritrade, traded well despite less farm and orchard spending.

The Agency Group, which includes livestock, wool and real estate, reported an operating EBITDA of $1.4m for the period, a reduction of $2.2m, with revenue of $81.6m, down $3.1m.

The livestock business was affected by the reduced volumes of livestock traded, particularly North Island cattle and dairy.

PGW has been actively managing and reducing spending in a variety of areas, prompting Moore to describe the outlook for the agricultural sector as “cautious”.

International markets are still challenging, El Niño is affecting the weather, prices for sheep and lamb in particular are low, input costs are high and demand from New Zealand’s largest export

market, China, remains subdued.

“The carryover impacts of Cyclone Gabrielle together with supply chain issues associated with offshore conflicts and higher interest costs are all contributing to temper the short-term outlook and prospects,” Moore said.

There are positive signs from rising dairy prices, the removal of tariffs on dairy exports to China, heavy kiwifruit, apple and pear crops and signs that interest in real estate will recover in the months ahead.

But there are headwinds.

“On balance, we remain cautious and expect to see subdued activity over the remainder of the financial year,” Moore said.

“Given the mixed signals in the

macroeconomic environment, we have revised our forecast operating EBITDA guidance for the year to June 30 2024 to around $50 million.”

Chief executive Steve Guerin said given the context of the challenges facing the agricultural sector, it is a pleasing result.

“It’s been a tough year for us and a tough year for our clients and it has been rare to have a cycle in farming where every sector is doing it tough.”

That said, Guerin said there are some signs of optimism, helped by recent increases in the forecast milk price.

Inquiries for pivot irrigation systems have picked up, interest in buying horticulture units and dairy farms is higher and PGW has increased its retail market share.

While beef prices are stable, he said there are few signs of improvement in the sheep industry.

Guerin said while farmers and growers continue to buy the necessities, discretionary spending is low as they focus on servicing and paying down debt.

PGW makes most of its income in the first half of the year and while it has lowered its full-year result, Guerin said company forecasts include expected lower income.

RRichard Rennie TECHNOLOGY Emissions

RRichard Rennie TECHNOLOGY Emissions

ESEARCH studying the effect of the methane mitigator Bovaer on dairy cows has been given the thumbs-up by New Zealand’s head of gas research.

In research published in the Journal of Dairy Science, scientists at Wageningen University in the Netherlands studied the impact of feeding 3-NOP, trade name Bovaer, to Friesian dairy cows over the course of their lactation for one year.

The research found Bovaer had no effect on the cows’ body condition score, weight, or food intake, but they had a 6.5% increase in milk yields, milk fat and protein.

Bovaer was developed by giant Dutch nutrient company DSM as a methane mitigation treatment to be administered in cows’ daily ration.

Since commercialising it is

now approved for use in 40-plus countries and territories including the European Union, Canada, Australia, Brazil, Chile, and Turkey.

In the critical area of methane reduction, Bovaer also demonstrated the expected positive results over the length of lactation with reductions of 21% in methane emissions per cow per day, 20% reduction per kg of dry matter fed, and 27% in methane intensity per kg of milk production.

It is a credit to [Bovaer manufacturer] DSM. As a company they wanted to be very comprehensive about how they have tested their product, compared to short-term claims that some products may make.

Dr Harry Clark NZ Agricultural Greenhouse Gas Research CentreThe level of methane reduction also varied significantly over the lactation period. It ranged from a 16% reduction in methane per kg of feed at the dry period to 20%-16% reduction through mid-lactation, and spiking at 26% reduction in late lactation.

Dr Harry Clark, director of the NZ Agricultural Greenhouse Gas Research Centre, said the trial work was valuable on grounds of its robust design and the length of time the scientists had plotted the impact of Bovaer in the cows’ diets.

“It has tried to look at the whole long-term impact, and it also highlighted how the actual reduction in methane is quite dependent upon the type of diet the cows are on.”

The cows were fed a conventional dairy feedlot diet, comprising meal and grass-corn silage, but the proportion of fibre within the diet altered depending upon the lactation period.

The researchers noted that dietary composition had a large

ENDORSED: Dr Harry Clark, director of the NZ Agricultural Greenhouse Gas Research Centre, has given a thumbs-up to the latest research on methane mitigator Bovaer.

effect on 3-NOP’s effectiveness.

“It is a credit to DSM. As a company they wanted to be very comprehensive about how they have tested their product, compared to short term claims that some products may make.”

He noted it was also a positive that using Bovaer may increase milk production, although the amount detected was relatively small at 6.5% increase. He said the work indicated the

Richard Rennie NEWS Horticulture

Richard Rennie NEWS Horticulture

THE use of the controversial bud break spray Hi Cane on kiwifruit will come under the spotlight with a week-long hearing in Tauranga.

The hearing will determine the future of the spray, which has been given a 10-year phase-out period by the Environmental Protection Authority (EPA).

Hi-Cane, or hydrogen cyanamide, is a plant growth regulator widely used by the sector to promote the growth of shoots and bud break in a controlled manner. Its action mimics winter chilling for bud production, and a gradual rise in winter temperatures has meant its use has become particularly widespread in recent years in the western Bay of Plenty.

Its use has a controversial past, and in 2019 the EPA called for more information on its impact upon the environment and humans. There was no visible

alternative on the horizon to replace hydrogen cyanamide at the time.

In late 2022 evidence was submitted by New Zealand Kiwifruit Growers Incorporated (NZKGI) on its low environmental impact, but the EPA determined there remained a level of “moderate technical uncertainty” around the chemical’s original risk assessment. It extended an original five-year phase-out period to 10 years.

That decision sent NZKGI back to dig further into the science of the spray, which will form the basis of its presentation to the committee over the hearing week.

“With this hearing, it will now be up to the decisionmaking committee to decide if they support the EPA’s recommendation,” NZKGI CEO Colin Bond said.

NZKGI’s submission maintains that EPA modelling overestimates the risks of the spray, while also underestimating its benefits, and that the EPA’s economic benefit

estimate of Hi-Cane as “mediumhigh” should be reclassified as “high”.

NZKGI also maintains that the EPA has failed to take account of the strict systems, controls and practices instilled around the spray’s use in NZ.

With this hearing, it will now be up to the decision-making committee to decide if they support the EPA’s recommendation.

Colin Bond CEO NZKGIZespri has also submitted to the EPA hearing.

In its submission the kiwifruit marketer maintains removing use of the spray will have significant economic impacts, amounting to over $2 billion over 10 years.

It estimates that it could make 15% of commercial orchards unprofitable immediately and up to 30% could be placed into

financial distress by removing HiCane use.

It also challenges the EPA’s use of data from trials that did not involve Hi-Cane or kiwifruit, and says it has overestimated the human health risk, modelled on risks that did not account for controls already in place to minimise that risk.

“Neither the EPA’s assessment of risk nor the controls proposed are evidence based,” it states in its submission.

Bond said growers also have the opportunity to present in person to the committee and there are “quite a significant number” who intend to do so.

He said he understands there are four individuals submitting in person against the spray’s use. The EPA is obliged to abide by whatever decision comes out of the committee hearing. Bond acknowledged such committees tend to support EPA recommendations.

“So, we are cognisant of the challenge there, but all our science supports what growers tell us, so

If you‘re short on sta , shed space or patience get in touch with us today. We‘ll rear your dairy replacements or beef calves to 100kg ensuring they‘re ready for future success.

reductions in methane output for New Zealand cows fed Bovaer may be at the smaller end, given the higher fibre content in their diet compared to feedlot Dutch cows.

The research indicated there was an inverse relationship between increasing fibre content and the amount of methane reduction achieved.

“It is great to see a long-term experiment that has been done well.”

CANED: NZKGI CEO Colin Bond says the sector will be obliged to adhere to whatever the recommendations are from the committee hearing, but hopes the sector has a good science-based case for its continued use.

we feel we have a strong case.” He expected the industry will have a ruling from the committee by April.

TNeal Wallace NEWS Health

TNeal Wallace NEWS Health

HE awarding of €3.4 million (about $5.9m) in damages to an Irish machinery operator who lost an arm while working for a Southland contractor could raise questions about New Zealand’s legal jurisdiction if the order is enforced here.

The ruling from the High Court in Ireland followed a hearing initiated by Padraig Lowry, who was injured in the 2015 accident.

The Irish Times reports that his lawyer now intends seeking to have the order enforced in NZ.

Daryl Thompson, the Southland contractor who employed Lowry, said he did not defend the case as the employment contract was signed in NZ so NZ law applied, and the incident had been investigated by WorkSafe NZ, which found he was not at fault.

Rural Contractors NZ chief executive Andrew Olsen said if the court ruling is enforced in NZ, it

raises significant questions about the jurisdiction of WorkSafe NZ and the Accident Compensation Corporation system.

“There seem to be two different interpretations of the same set of facts by two different jurisdictions.

“We’ll stick to the findings from NZ and we’ll support our member.”

The Irish Times reports Lowry lost the lower part of his right arm when it was caught clearing a blockage in the chute of a combine harvester in January 2015 while working for D Thompson Contracting.

Thompson is examining the judgment and its implications, but said he has no idea what it means given an investigation by WorkSafe NZ found no evidence

There seem to be two different interpretations of the same set of facts by two different jurisdictions.Andrew Olsen Rural Contractors NZ

his company was at fault.

“The inquiry concluded Padraig received an induction on the general health and safety policy, hazard register, safety procedures and a copy of the operators’ manual for the harvester.

“It also found Padraig failed to follow the operator’s manual or our health and safety policy.

“The investigation stated Padraig accepted responsibility for reaching into the chopper of the harvester when he was aware that it was still winding down, and that he did not wish any action to be taken against the company as he believed that he was trained and competent in the operation of the harvester and was aware of the company policy and procedures.

“The investigation was also clear that it was difficult to identify any additional practicable steps that we could have taken to avoid this accident,” Thompson said.

He acknowledges the impact on Lowry and his family.

“This was a tragic accident and we recognise the life-changing impact this had had on Padraig

Lowry. Our thoughts are with him and his family.”

Asked if he could be liable for the fine should he enter the European Union, Thompson thought it unlikely.

Farmers Weekly approached Lowry’s lawyer for comment and clarification about why the case was taken, the contradictory findings and the implications, but received no response.

Olsen said between 400 and 500 experienced seasonal machinery operators come to NZ to work each year and he does not expect the case to deter people from coming here.

“We anticipate workers will continue to come to NZ next year and beyond and have petitioned

FAILURE: A

WorkSafeNZ inquiry concluded that Padraig Lowry ‘failed to follow the operator’s manual or [the contractor’s] health and safety policy’ when he reached into the chopper of a combine harvester to clear a blockage as it was winding down. He lost the lower part of his right arm.

the immigration minister to remove more red tape from the Accredited Employer Worker Visa to allow easier entry access for highly skilled drivers.”

Olsen said the association has been in touch with sister organisations in Europe to provide balancing arguments in the case.

Unrelated to the Irish case, Olsen said the association has approached WorkSafe NZ to see how members can interact more with officials to address the 10 biggest health and safety issues they face.

The idea is to find simple-tomanage solutions that small to medium businesses, which most of the organisation’s members are, can adopt.

Staff reporter NEWS Animal welfare

A FAR North farming couple has been fined $29,000 and banned from dairy farming over a lack of feed and poor treatment of their farm animals.

Mathew Hudson, 78, and Josette Eleanor Hudson, 73, were sentenced in the Kaitaia District Court on February 20 after pleading guilty to four charges under the Animal Welfare Act, following a successful prosecution by the Ministry for Primary Industries (MPI).

MPI regional manager for animal welfare and NAIT compliance north, Brendon Mikkelsen, said animal welfare inspectors visited

the Hudsons’ farm in September 2020 following a complaint about the poor condition of their dairy herd and a lack of feed.

“One of their cows was found

RESPONSIBILITY:

The Ministry for Primary Industries’ regional manager for animal welfare and NAIT compliance north, Brendon Mikkelsen, says people in charge of animals are responsible for their health and wellbeing at all times.

suspended in hip clamps, because it was severely underweight and incapable of supporting its own weight. The animal was suffering pain and distress for days from

the abrasions on its bony hip area and it was euthanised to end its suffering,” Mikkelsen said.

Animal welfare inspectors found their cattle were producing less than five litres per cow per day, considerably less than they would be capable of if appropriately fed. Grass cover at the farm was uniformly low, and they were not providing supplementary feed to their dairy herd.

The inspectors concluded the Hudsons failed to provide proper and sufficient feed to all their animals.

Of the 242 cattle at the farm, 69 cows were below the minimum standard of Body Condition Score, meaning they were too thin and needed urgent action to improve their condition.

“The Hudsons are experienced farmers who knew their responsibility to their animals and failed to live up to it. One of these cows was so thin, Mr Hudson used a tractor to drag it from a drain it was stuck in – leaving the animal with significant open wounds which were not treated.

“When we find evidence of neglect and cruelty to production animals we will prosecute. Most farmers do the right thing for their animals – providing supplementary feed when needed and timely veterinarian care,” Mikkelsen said.

In addition to the fines, the court ordered the Hudsons to pay $18,213.72 in costs for veterinarian services and farm consultant fees.

Gerald Piddock MARKETS Dairy

Gerald Piddock MARKETS Dairy

CONTINUED improvement in customer demand has led to Fonterra lifting the forecast for its organic milk price from $9.55/kg milk solids to $9.85/kg MS.

It brings the revised forecast range for organics to $9.35-$10.35/kg MS, up from $9.05-$10.05/kg MS.

That demand is from the United States and the United Kingdom, where almost 90% of Fonterra’s sales book is now contracted, Fonterra group director of Farm Source Anne Douglas said.

“Fonterra Organics is in a strong position and, as always, we will keep monitoring any risks that could potentially impact the business.”

Fonterra has 110 organic farms throughout the North Island, Fonterra Organics business relationship manager Stuart Luxton said, speaking at a field day at Pāmu’s organic dairy farm Earnslaw, just north of Taupō.

“I refer to our programme as a small cooperative within the embrace of a much larger co-operative,” he said.

The milk is processed at Morrinsville, Hautapu and Waitoa. As a result, transport is the biggest expense.

Fonterra general manager of organics Andrew Henderson said its milk solid growth has doubled from 2020 to 2023/2024.

The products go into the market as Mainland organic cheese and butter, Kāpiti Mature Cheddar, Anchor Blue Milk and NZMP Ingredients.

These products go into 13 different countries that have different certification criteria.

While the spike in costs of living over the past few years has put downward pressure on organic sales, consumer demand for more sustainable products and health and wellness influenced by the covid pandemic has offset a lot of that pressure, he said.

“That’s why we’re still seeing growth.”

The co-op’s market development manager for organics, Anna Maginness, said the organic dairy market globally is worth US$24 billion (more than $38bn) and growing around 5% a year.

“Depending on what data source you look at, it’s expected to grow to around US$50bn by 2030.”

However, it is still minuscule compared to the global conventional dairy market, which sits at US$570bn.

“It’s still very much a niche premium offering.”

Organic dairy had a 20-50% premium over conventional dairy depending on the brand and product range, Maginness said.

Two of its biggest markets are the US and China. The former is well established with a lot of growth across butter, cheese and yogurt.

Fonterra sends a lot of its organic product into this market in the form of powders and beverages through Orgain.

It also sends ingredient products into infant formula as well as butter and cheese.

The market in China is still developing with infant formula and UHT milk being the main product categories driving this market.

In China, the milk is sold under the Anchor brand with this market experiencing huge growth over the past three years.

Fonterra’s product also goes into South Korea in the form of cheese products for children.

UPWARDS: Fonterra general manager of organics Andrew Henderson says milk solids growth from its 110 organic farms has doubled from 2020-2023/2024.

Hugh Stringleman MARKETS Livestock

Hugh Stringleman MARKETS Livestock

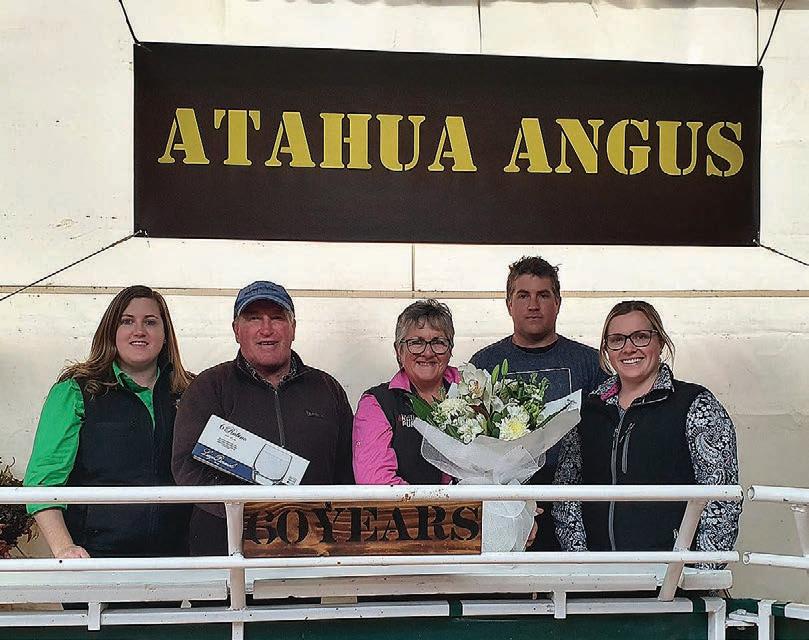

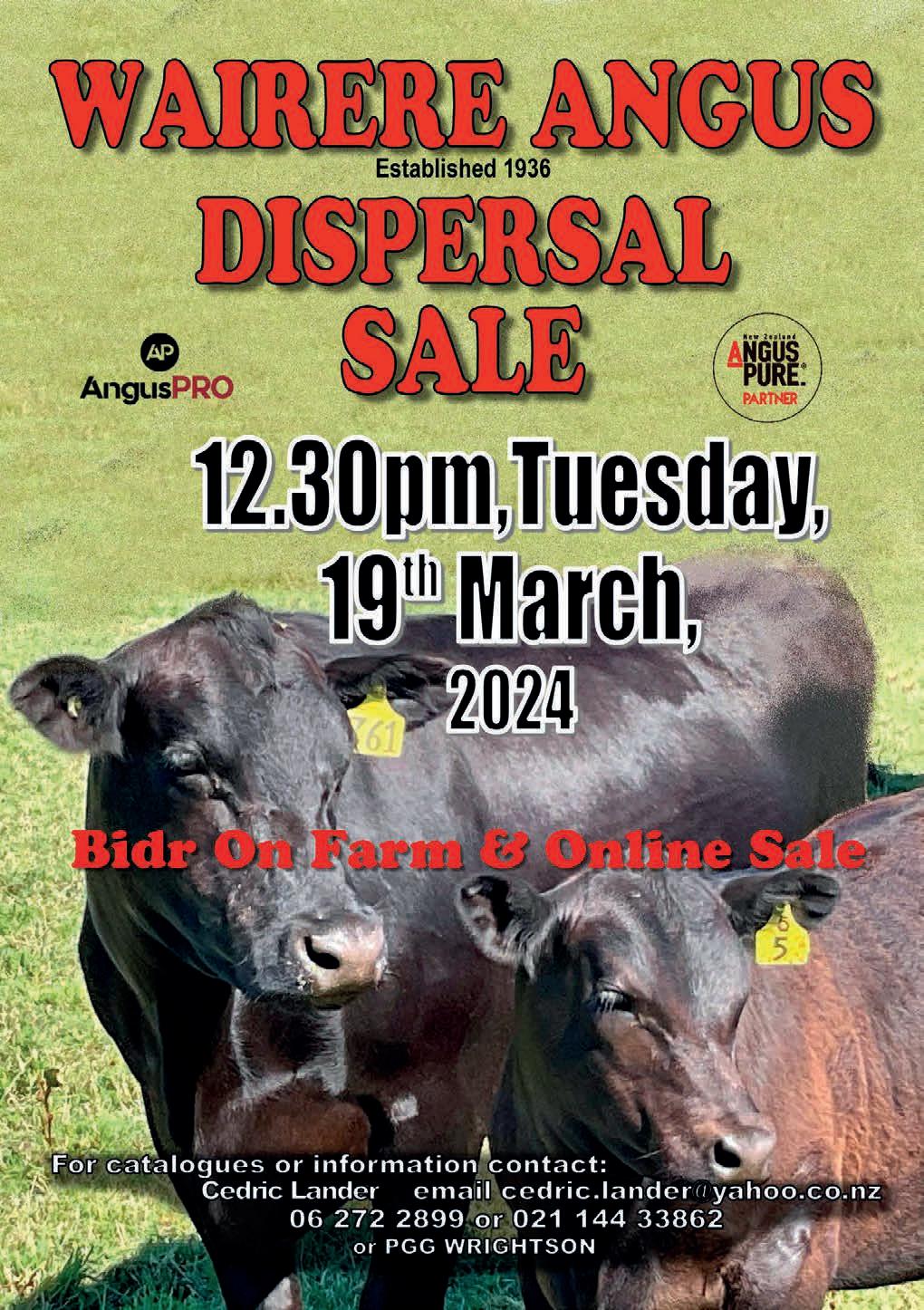

BUYERS will have great opportunities to go deep into proven Angus beef genetics during March and April when long-established North Island studs Atahua and Wairere have dispersal sales.

For the Tuesday, March 19 Wairere Angus sale at Meremere, near Hawera, there will be over 100 recorded heifers, in-calf heifers, PTIC cows and calves.

At the Monday, April 8 dispersal sale, Atahua Angus will put up all its breeding females, comprising 40 mixed-age cows, 26 first-time calvers and 30 rising two-yearold heifers, plus all the associated calves.

There will be 140 to 150 lots in total, being all recorded, tested and transferable females and their calves. A bull sale in June will complete the exit from stud breeding.

In the autumn season for dispersals, cows and the older heifers are pregnancy tested, but not too big for transport, and the calves are usually weaned before or after the sale.

Wairere Angus has been at the forefront of the industry for several decades, including being among the first to utilise

Breedplan and ultrasound scanning.

It is a foundation member of Angus Pro in 2021 – now one of 40 members.

Stud principal Cedric Lander aims to wind Wairere Angus down after its final bull sale in early June.

“In recent years we have put more and more carcase into cattle, including using plenty of artificial breeding, bringing in American and Australian genetics.

“We mainly focus on high growth rate, rather than worrying about birthweight.

“By selecting sires, individually mating cows, and using artificial breeding where that suits best, we have kept the EBVs rising and improved the overall averages of the females,” Lander said.

Alan, Michele, Colin, and Louise Dalziell are the owners of Atahua Angus in Manawatū, after Alan and Colin’s parents established it back in 1961.

Atahua has regularly brought in bloodlines from Australia and Canada, and since the early 2000s has morphology tested sperm, aiming for results of more than 70% normal sperm to guarantee their clients fit-for-purpose bulls.

A firm supporter of the Beef Expo, formerly known as the National Angus Show and Sale, Atahua Angus has amassed a total of 10 Supreme Champion Angus titles and six Champion of Champion titles over the decades.

A highlight was the 1992 auction when one of its bulls, Atahua Legacy, sold for $155,000 to a syndicate of Kaharau Angus and Rangatira Angus at a record price for a New Zealand bull, bid by the late Colin Williams.

The Angus stud has operated on the 240 hectare home farm at Kiwitea. For 25 years that was run in conjunction with an Āpiti hill country block of 290ha, which was sold in May 2023.

Speaking for the family, Michele Dalziell said the decision to disperse the stud is an emotional one, but all agree it is the right time.

They will continue with commercial beef cattle farming and look back with pride on the “legacy” of Atahua.

PGG Wrightson Livestock national genetics manager Callum Stewart has had a lifelong connection with Atahua, going back through his father Bill, also a livestock representative.

“Although their dispersal sale marks the end of an era, Atahua won’t disappear.

“No matter where the breeding focus goes in future, I know the bloodlines the Dalziells have built up over more than 60 years will continue to provide value in Angus herds across New Zealand for generations to come,” Stewart said.

Neal Wallace NEWS Production

Neal Wallace NEWS Production

INCREASING productivity growth by just 1% would unlock tens of billions of dollars in economic value for New Zealand, with gains from the primary sector central to achieving that.

That is according to research released by ASB, which also found that businesses, not the government, need to lead that charge.

The NZ Institute of Economic Research (NZIER) report shows NZ productivity continues to lag behind international peers – meaning New Zealanders work harder but produce less.

The report looked at growth opportunities and what business, the government and banks can do to grow productivity and found lifting productivity growth from 1.5% to 2.5% would see real GDP hit $500 billion by 2045, an increase of about 5% on current projections.

Despite agriculture, forestry and mining contributing more to value-added products than the OECD average, the report found

the sector is not highly productive.

NZIER principal economist Christina Leung said investment in capital, knowledge, research and development to improve productivity in NZ has been low, but any change has to come from business, not the government.

“When we look at other more productive small, advanced economies, business is leading the way with support from government and the finance sector,” she said.

NZ business needs to be more ambitious, embrace innovation and invest in capital.Christina Leung NZ Institute of Economic Research

“NZ business needs to be more ambitious, embrace innovation and invest in capital, knowledge and research and development as an engine for growth and sustainability.

“The country’s economic growth over the past two decades has been largely driven by adding more people to the workforce, and this

needs to change, we need to work smarter.”

Leung said NZ’s exports have grown in the past 30 years, but relative to other small, advanced economies, still remain low with earnings accounting for less than a quarter of gross domestic product.

Of the top 20 companies in the 2023 Deloitte Top 200, only seven are exporters or have international operations: Fonterra, EBOS Group, Air NZ, Mainfreight, Zespri, Silver Fern Farms and Alliance Group.

The report cites the kiwifruit industry as an example of an industry that has improved productivity by using its scale and exports built on a partnership between growers, processors, researchers and Zespri.

“Since the changes in the industry that led to the formation of Zespri in 1997, the industry has been transformed and is a textbook case of how to turn a worthless food commodity into a high-value product.”

This model allows growers to adopt new, protected varieties and quickly develop and share growing and vine management practice across the industry.

This has been supported by an estimated $800 million

investment in automated postharvest infrastructure and technology.

The report notes that NZ research is heavily oriented towards agriculture.

“Outside the agriculture (primary) sector, the linkages are limited, so access to research funding is often very competitive and proprietary.”

The report concluded that NZ businesses rather than the government need to take the lead in increasing productivity by treating innovation as an engine

for growth and sustainability.

“If the business cannot or does not recognise the need to innovate its products or processes, then no government incentives will make a difference.”

The report suggests business, researchers, government agencies and financiers work together to support innovation, identify opportunities and develop plans.

This can require a shift in the attitude of managers to embrace new ideas and technology for the government to remove any policy and regulatory obstacles.

YCraig Page Deputy editor

YCraig Page Deputy editor

OU could never accuse those in New Zealand’s rural sector of not working hard.

But, according to new research released by ASB, it may all be in vain. Hard work, it seems, doesn’t always equate to high productivity.

In fact, the NZ Institute of Economic Research (NZIER) report shows productivity in the country continues to lag behind that of many other countries.

In short, New Zealanders work harder but produce less. The report says it’s because businesses have been slow, or reluctant, to invest in those things that can make everyone’s lives easier: capital, knowledge and research and development.

The report looked at growth opportunities and what business, the government and banks can do to grow productivity. It found lifting productivity growth from 1.5% to 2.5% would see real GDP hit $500 billion by 2045, an increase of about 5% on current projections.

NZ relies heavily on the agriculture industry.

But despite agriculture, forestry and mining contributing more to value-added products than the OECD average, the sector is not highly productive.

NZIER principal economist Christina Leung says any change in approach has to be driven by business, not the government. If businesses cannot, or does not, recognise the need to innovate, there is little point in asking the government for a helping hand.

There is also concern about NZ’s aging labour force, with the report highlighting the need to take action on productivity now to ensure the future sustainability of providing essential services like health and education.

Leung issued a challenge to NZ business to be more ambitious, embrace innovation and invest as an engine for growth and sustainability.

“The country’s economic growth over the past two decades has been largely driven by adding more people to the workforce, and this needs to change, we need to work smarter,” she said.

NZ’s exports have grown in the past 30 years, but compared to other small, advanced economies, exports still remain low with earnings, accounting for less than a quarter of gross domestic product.

Of the top 20 companies in the 2023 Deloitte Top 200, only seven are exporters

or have international operations: Fonterra, EBOS Group, Air NZ, Mainfreight, Zespri, Silver Fern Farms and Alliance Group.

But there is one shining light in this country. The kiwifruit industry has improved productivity, building on a partnership between growers, processors, researchers and Zespri.

“Since the changes in the industry that led to the formation of Zespri in 1997, the industry has been transformed and is a textbook case of how to turn a worthless food commodity into a high-value product,” Leung said.

The report says businesses have been slow to invest in those things that can make everyone’s lives easier: capital, knowledge and research & development.

It is an approach that has allowed growers to adopt new, protected varieties of kiwifruit and quickly develop new technology and share information across the industry.

It hasn’t come cheap. The kiwfruit industry has invested an estimated $800 million in automated infrastructure and technology.

But, as the old saying goes, sometimes you have to spend money to make it.

Dr Clive Dalton

WaikatoTO THOSE in the industry wanting the live cattle export trade to resume, and the politicians who will have to approve it, can I suggest that they all sign on as deckhands for a trip, and enjoy the fresh sea air and tropical sunshine for three weeks to decide the future of the trade.

Then include a short stay at voyage end, to see what kind of life the cattle will enjoy.

And on the flight home, study the Five Freedoms that animals must have under the Animal Welfare Act 1999.

Pay special attention to No 2 – Freedom from discomfort, and No 4 – Freedom from distress.

Decisions can then at least be based on facts, and not on predictions or bull’s wool about a “Gold Standard”.

QUITE astonishing to read about [Foundation for Arable research CEO] Dr Alison Stewart’s speech at a Hamilton conference, urging farmers not to think agriculture is exceptional and to get over “this ‘we’re special and need to be treated in a special way’” mindset, in “Changing crops for a challenging world” (February 19).

I don’t know of any farmers who think this.

I find it incredible that she makes this comment considering FAR gets its funding from farming, from everything we grow, by way of a levy.

I showed this article to my husband, and he said farmers are essential.

She also said “There’s no one in New Zealand saying ‘Let’s make life difficult for agriculture’.”

Has she been asleep for the past six years of the previous government?

Tourists may be important too, but we can’t eat them!

Send your letter to the Editor at Farmers Weekly P.0. Box 529, Feilding or email us at farmers.weekly@agrihq.co.nz

In my view ...

Acland is chair of Beef + Lamb NZ and a sheep, beef and dairy farmer.

FARMING is the foundation of New Zealand’s economy – it’s our country’s engine room.

It provides the key ingredients to multiple products and multiple stories that we sell to the world.

Farming can’t afford to stand still, we need to continue to improve in all pillars of our production – people and planet. However, we will struggle if we’re not profitable.

Profitability is the key.

We know regulation is needed to give New Zealanders confidence that farmers are good custodians of our environment, but regulation must be light on bureaucratic process and enable farmers to lead change.

Farms are biological systems, so rules need appropriate flexibility to allow farmers to manage their specific catchment and farm risks and to innovate to solve challenges in the way farmers are so good at.

We know that meaningful and enduring change in the rural space must be farmer-led – it needs to be from the ground up.

Catchment communities are critical to this progress.

When farmers are working together, in a co-ordinated way, to tackle the risks in their region –that’s when real progress is made. It’s critical that the government continue to support these groups.

The other thing farmers need is certainty – most of us are here for a generation or more, we operate on generational cycles rather than election cycles.

Certainty means we need enduring regulation.

We need to aim for cross-party support on environmental issues – farmers don’t want to be at the mercy of pendulum-swing politics.

Policy should focus on the outcomes we’re looking for and give farmers the ability to innovate and adapt our systems to meet those outcomes.

Climate change in agriculture is a prickly issue – most farmers accept they have a part to play, but they want the methane targets to be fair.

The scientific understanding of methane, its warming impact and how it should be dealt with from a policy perspective has evolved recently.

It’s clear from research carried out by respected climate scientists at Oxford University for Beef + Lamb NZ last year that the current methane reduction targets are too high.

We welcome the coalition government’s agreement to review the targets based on no additional warming.

NZ can be a world leader in terms of setting appropriate targets for biogenic methane, targets that recognise the warming impact of gases, as well as the important role our agricultural sector plays in producing quality sustainable protein for a growing world. But leading needs to have our people following – all our people.

If farmers feel confident that targets are underpinned by the latest science they will get on board with achieving them and

if they meet those targets, they shouldn’t face a tax on their emissions, but be celebrated.

If farmers have certainty on this, they will invest in and try new technologies that they otherwise might not be willing to do.

Pricing agricultural emissions needs a rethink.

Things have moved significantly on this issue globally, and NZ needs to look outwards and explore other ways to achieve our goals.

Rather than pricing agricultural emissions, most countries are now looking at ways to incentivise change.

In California, farmers earn carbon credits by using biodigesters to reduce their methane emissions.

The Canadian government is currently consulting on a proposal where farmers could earn carbon credits for undertaking actions like improved diets, management or other strategies that support more efficient animal growth. The European Union has also moved back from pricing agricultural emissions.

We have an opportunity to position our produce and grow trade through promoting and celebrating NZ farmers for the fact they are already the most emissions-efficient producers of protein in the world and they continue to improve.

Biodiversity is another area that needs work.

Sheep and beef farmers care about biodiversity. We know this because 24% of the country’s native vegetation cover sits on sheep and beef farms

But the National Policy Statement (NPS) for Biodiversity penalises farmers who have done the most to protect their biodiversity to date.

Those farms will have major areas identified as having a Significant Natural Area (SNA) and face major restrictions going forward in what they can do on that land.

The definition of an SNA currently identifies any biodiversity (regardless of value) as being significant. If implemented in its current form, a substantial cost and time burden will fall on landowners.

It’s vital we pause implementation of the Biodiversity NPS and take time to create a new framework. This framework should support landowners to integrate and manage biodiversity as part of productive farming systems and incentivise rather than penalise the protection and enhancement of indigenous biodiversity. This could include support with fencing, pest control or even the possibility of establishing biodiversity credits. We must strike a balance

with policy where increasing profitability and productivity from our rural sector sits alongside a thriving environment.

We also need to recognise the significant progress farmers have made in improving their environmental performance over the past decade – this has come at considerable cost.

We can’t afford for the environment to be an election issue – it’s just a part of what we do as farmers to manage our land and we need to get to a place where we’re celebrated for the great job we do.

My challenge to decision makers is to enable and empower meaningful long-term change by allowing farmers to innovate and grow, with policy that will set us up for a generational cycle rather than an election one.

• This is an excerpt from Acland’s Pitch a Policy address delivered at the National Bluegreens Forum in February 2024

BACK in the late 1970s my late father said to my brother and I that if we wanted to own our own farms the only way to do that was through dairy. Dairy, he said has a co-op structure that is designed to support the farmer, work for the farmer owners, and as a collective invest and add value to the product.

Meat and wool, he said, were driven by short-term imperatives of securing supply.

“Flirting for supply,” he would say. “No future.”

Consequently, we did one of the very first dairy conversions, in 1981. We are forever grateful to the Dairy Board consulting officers, the LIC, NZDG – they

created wealth for us beyond our imagination at the time. We had been trying to survive but with dairy we thrived.

So, I was fascinated when the Open Country flyer turned up in the mailbox headed “Cash flow is king”, offering “payment methods that pay faster and can pay more than Fonterra”. (I note “can”, not “will”.)

Undoubtedly cashflow is king, but I would argue that total cash trumps it.

I looked at Dairybase data as of February 10 this year. I used operating profit per hectare as my basis for comparison as it considers costs associated with producing the milk. Milk price alone is a poor measure of on-farm profitability.

The data shows that over the past nine years, Fonterra farmers enjoyed a cumulative total of an

extra $2426 /hectare of operating profit.

It is worth noting that it is in seven of the past nine years that Fonterra farmers enjoyed a higher operating profit per hectare and for two years Fonterra was behind, presumably through the impacts of the restructure. True that Open Country’s milk price was higher on average by 7c a kg over the period, but that didn’t seem to follow through to profit lines.

I avoided using individual years in isolation as timing of payments relative to the accounting year does impact the numbers. However, for the record the biggest advantage that Fonterra had in a season was $1066/ha and biggest advantage Open Country farmers had was $618/ha, but that can be distorted by the timing of payments hence the use of the nine-year average.

Average milksolids per hectare was similar with 1198 kg/ha for Fonterra and 1249kg for open country farmers.

Fonterra farmers do have capital tied up in the processing side of the business and we have seen a depreciation in share value resulting from both changes in methodology of valuation – and with dairying no longer being in growth mode. With Fonterra now focused on adding value to New Zealand milk, I foresee a time when any new supplier wishing to join the co-op will have their supply put through a model to see whether it adds value to the existing shareholders’ milk – Fonterra will no longer be the fallback option if the others disappoint. We make extensive use of the six months’ free credit on supplies and milk powder, which enables us

to sell surplus calves before paying rearing costs.

The Farm Source points have enabled us to install solar on the house and all but eliminate the house power bill.

Every 10 cents Fonterra pays in dividend will add about $120/ ha to our operating performance, only needing a 20 cent dividend to cover our cost of capital (plus some) on shares at 8% interest cost. Within that there is a natural hedge against lower milk prices. The LIC shares have yielded us well into double digits.

Silver Fern Farms have provided us with a no-wait collection of cull stock plus bonuses and dividends. Farmers Mutual Group has given us 40 years of competitive insurances and no-hassle claims. We will continue to be co-op members because they continue to add real value to our business.

IRECENTLY caught up with ACT MP Mark Cameron, the chair of the Primary Production Select Committee.

After the 2020 election I emailed the agricultural spokespeople of ACT and National, asking for any relevant information for my columns. Cameron sent me a weekly summary. I was duly ignored by the various National Party agricultural spokespeople, which was their choice.

The select committees are a vital part of our electoral system. They are where the hard work is done. After legislation is read for the first time in the House it is generally referred to the select committees, where they debate the issues. Whereas in the full Parliament political posturing seems the order of the day, in the select committees common sense generally prevails.

As well as deliberating on legislation, they receive reports from relevant government departments and are able to cross-examine. They are also able to go into much greater depth than is possible in the chamber. Individuals and organisations can make written and oral submissions to the committee.

The Primary Production Select Committee currently has a majority of members who are either farmers themselves or have strong links to the rural sector. The one exception is Green MP Steve Abel, who is described as a climate and environmental activist with strong links to Greenpeace. The good news is that he is but a small minority in a pro-farming group.

Cameron knows what he wants from his team and it is all positive for the rural sector. He wants a collegiate approach when it comes to fresh water, Overseer and any law that affects farming.

That’s really positive.

He is committed to having local solutions to local problems. He strongly opposes the top-down approach. He points out that issues like sediment load and E coli pollution are issues for individual catchments and should not be legislated for on the basis of one size fits all.

He also believes that the job of the central government is to provide a template for the local councils to adapt for their individual challenges. That markets should create environmental requirements and not the central government.

I’ve been covering Parliament on and off for longer than I care to remember, and I was really

heartened by the Cameron approach.

I’m totally over the dictums from on high on the basis that Wellington knows best. It doesn’t. What is suitable for Southland is totally different to the issues facing Wairarapa.

I’m also totally over the current circus over Significant Natural Areas, the crass stupidity of some regional councils over wetlands and the present vagaries of the Resource Management Act. That Cameron wants to fix them in the current term was music to my ears.

I also totally agree with the industry setting scientifically based sustainability and environment goals that are appropriate to our markets. Again, I don’t want a government edict telling me what the markets want and how we need to change if we are to succeed.

Who knows best, a civil servant behind a desk in Wellington or the industry, as Fonterra is currently doing with its environmental initiatives?

Cameron’s second-in-command is Miles Anderson, who I also rate particularly highly. He is a feeton-the-ground, super-intelligent grassroots farmer who will represent the sector well.

As you may have gathered I came away from the meeting in a positive frame of mind. For the first time in decades the industry has a select committee that knows what we’re about and that’s great news not just for the sector but for the country. Our success isn’t limited to the Primary Production Select Committee. We have three associate ministers – Nicola Grigg,

For the first time in decades the industry has a select committee that knows what we’re about.