Smithfield may be the shape of things to come

MORE meat processing plants are likely to follow the proposed closure of Alliance Group’s Smithfield site unless there is a reversal of fortunes for the sheep industry.

It’s not just greater profitability needed for the sheep industry. Greater leadership is needed around the board tables of the country’s meat industries to save the beleaguered industry, said Federated Farmers meat and wool chair Toby Williams.

Alliance Group announced on September 27 that it is proposing to close its Smithfield plant in Timaru, affecting the employment of 600 staff.

“There has to be more plant closures. As hard as it is on the regions and where these plants are closing, this is part of the cycle we’re in. We’re not building up sheep numbers anymore so we can’t afford to hold the capacity that we are,” Williams said.

There are also older plants around the country in similar situations to Smithfield that might be next to go.

“There will be more closures. Where are they going to come from? That’s the $10 million question.”

There needs to be a plan going forward and greater profitability is the only thing that will turn this around, he said.

While the latest free trade

agreement with the United Arab Emirates will help, meat companies and Beef + Lamb New Zealand have to be looking for new markets to drive up demand for sheep or sheepmeat could become a boutique industry.

A credible plan is also needed from industry leadership to drive profitability back into sheep farming.

The meat industries need to collaborate to keep processing costs to a minimum and to ensure those plants operate as efficiently as possible for shareholder farmers.

One possible solution is toll killing, where a company processes another company’s livestock because it is located closer to the farmer’s farm.

While it would mean that plant is more likely to run at capacity, it would still mean finding solutions around contracts and the processing plant’s set-up.

“It’s not as easy as it sounds but it would be the most efficient way of doing it,” he said.

BLNZ chair Kate Acland said the sheep sector has been hit by fundamental profitability issues over the past few seasons with a 32% increase in inflation over the past two years.

Critical to overcoming that is building on on-farm efficiencies, market access and having meat processors working as efficient as possible. But she concedes there’s no simple solution.

“We can’t ignore the fact there

Continued page 3

Nurturing the on-farm relationship

Ngāi Tahu Farming and PGG Wrightson saw first hand the fruits of their continued support for IHC when members of IHC’s Christchurch/North Canterbury rōpū group recently visited Te Whenua Hou farm in North Canterbury. The IHC Calf & Rural Scheme has been raising money to support people with intellectual disabilities and their families in rural areas of New Zealand for 43 years.

SECTORFOCUS

It could be 18 months before China’s red meat market recovers.

4

Whisky and wind anchor creative croppers

Few things are more deeply linked to history, land and tradition than whisky, and Scottish farmer Peter Mackenzie shares a stronger link than most.

ARABLE 16-17

Drones and AI tech to take the hassle out of counting livestock.

7

Flower grower Sarah Rutherford is used to getting her hands dirty.

PEOPLE 9

Gerald Piddock NEWS Sheep and beef

Get

in

touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME

Delivered by Reach Media Ltd

Advertise

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 777 2557

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Omid Rafyee | 027 474 6091 South Island Partnership Manager omid.rafyee@agrihq.co.nz

Julie Gibson | 06 323 0765 Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

AGRITECH: New BLNZ chief executive Alan Thomson’s recent work in the agritech space has included supporting farmers in the Great Barrier Reef catchment area to capture data to mitigate environmental impacts.

News in brief GDT up

The highest average whole milk powder prices for two years in the latest Global Dairy Trade auction have underpinned Fonterra’s latest 50c rise in the milk price forecast.

The October 2 GDT event saw WMP rise by 3% to an average US$3559/tonne, the highest since the $3573 posted on October 4, 2022. However, the WMP market level is still $1000-plus below the recent peak in early 2022, during a season in which a record $9.30/kg milksolids farmgate milk price was paid.

Orchard purchase

Craigmore Sustainables has purchased two apple orchards owned by Scales Corporation subsidiary Mr Apple New Zealand.

Te Papa orchard in Central Hawke’s Bay and Blyth orchard in the Heretaunga Plains have a combined title area of 234 hectares and will increase Craigmore’s apple portfolio to almost 700 canopy hectares once development is completed.

Greenpeace suing

Greenpeace Aotearoa is suing Fonterra for allegedly misleading customers by claiming that Anchor butter is “100% New Zealand grass fed” when up to 20% of a Fonterra dairy cow’s diet could be imported palm kernel linked to deforestation of rainforests in southeast Asia.

Greenpeace claims Fonterra has been trying to convince customers that the Anchor butter they’re buying is 100% New Zealand grass fed when this is far from the reality.

Miraka update

Miraka has updated its milk price forecast $9.17/kg MS for the current season as well as confirming $8/kg MS for the 2023-2024 season.

Miraka CEO Karl Gradon said he expects the company’s milk suppliers to be pleased with the strong forecast.

Back in 1860, exporting meat to the other side of the world seemed about as easy as nailing gravy to the ceiling But a few determined kiwis took the bull by the horns and now our grass-fed beef and lamb is sought-after all around the globe

At AFFCO, we see the same pioneering spirit alive and well in farmers today We’re playing our part too – exploring every opportunity to take New Zealand’s finest farm-raised products to the world

Dairy farmers are back in the black

FONTERRA’S 50 cent lift in its milk price forecast has put dairy farmers are back in the financial black.

The increase on September 25 lifted the forecast to a $9/kg MS midpoint and a price range of $8.25-$9.75/kg MS.

AgFirst agricultural economist Phil Journeaux said it will make a huge difference to the financial situations of Fonterra farmers.

“Basically, we have gone from the red to the black.”

An updated version of AgFirst’s Financial Survey data from July had a break-even payout within the season at $8.55/kg MS on an $8.85/kg MS payout – a $0. 31/kg MS surplus.

In July, that budget had a 39 cent loss.

“Back in July we were budgeting to pay off debt, but we weren’t certain we could do it. Now we can and we’re still in the black so I think you’ll see an increase in spending on farms – maybe some R&M, capital replacement.”

The annual survey uses a farm model based on 25 surveyed farms across Waikato and Bay of Plenty.

Continued from page 1

are 3.2 million less sheep than we had six to seven years ago and we have seen 300,000 hectares of farms sold to be converted forestry.

“Forestry isn’t the reason behind Smithfield, land use change is, and land use change has always happened.”

Rebuilding profitability and confidence will help stabilise those sheep numbers, Acland said.

Lincoln University agribusiness Professor Hamish Gow said claiming that more profitability is the answer misses the point that

The 2024 model, which originally had a $85,000 cash deficit, is now $11,000 assuming the $9/kg MS forecast holds and not including a dividend.

“The increase in the advanced payment is almost a dollar and it’s made a hell of a difference, especially on October 20 because they will get the increase in the

lamb has a price ceiling and is also competing against other proteins and plant-based products in the consumer market.

“If you go above that price, you get priced out of the market and you get removed from the menu.”

Once that occurs, the product remains off that menu, particularly if it’s a large restaurant business.

This is all occurring while consumers are battling with the cost of living, both overseas and in NZ, where the Wellington foodservice industry is struggling, he said.

“There’s always going to be downward price pressure in the

advance rate and the dividend,” he said.

Farmers have been running down some of their infrastructure and equipment and that could mean some seek to replace these at their local dealerships.

Interest rates are also dropping with the expectation being they will drop further. For now, he

marketplace and this idea that we can go and sell a steak at twice the price – it’s just not a reality.”

Gow said no one is to blame for the demise of Smithfield and the possibility of other plant closures. The meat industry is reacting rationally to the market settings it has created over the years.

But having those settings has come with consequences that are now being played out in Timaru.

“I don’t know whether there will be more plant closures but logically there’s going to be a consolidation of some sense. How that occurs is up to the market,” he said.

would drop interest rates on debt by a quarter of a percent which equates to 5-6 cents per kilogram of milk solids.

It is a huge turnaround in financial fortunes in a couple of months, he said.

Given the improved outlook, favourable calving conditions throughout much of the North Island and Fonterra’s strong financial position, he suspects farmer morale and confidence have also markedly improved.

DairyNZ’s head of economics, Mark Storey, said for the average farmer, the revised revenue forecast means they will have a cash surplus ranging from 0$.15$0.25/kg MS including dividend payments.

Prior to the lift in forecast, that figure was a $0.03/kg MS deficit.

“They are back in the black, on average, and it’s been an adjustment of 10-20 cents in terms of cash surplus per kilogram of milk solids.”

Operating profit margins are also looking a lot healthier. The only caveat is that it is still early in the season, and does not include possible interest rate falls, he said.

Te Aroha dairy farmer and accountant Melissa Slattery said the lift in the advance rate from

$5.10-$7/kg MS for October made a huge difference. It hit farmers’ cashflow straight away and will make a huge immediate material difference to their circumstances.

I think you’ll see an increase in spending on farms – maybe some R&M, capital replacement.

Phil Journeaux AgFirst

“$7/kg MS isn’t that far off what we got paid full season last year. We’re getting a healthy chunk of that early, which is fantastic.”

Fully shared-up farmers will also receive last season’s dividend at that stage on top of that advanced payment.

Slattery expects much of the extra cash will be used to pay down debt as well as repairing or replacing any equipment or infrastructure that was held off over the past few years.

“It’s definitely going to be a positive on the cashflow and a massive swing in overall profitability. It’s a material shift and it’s going to make a huge difference.”

PRICING: Lincoln University agribusiness Professor Hamish Gow says claiming that more profitability is the answer misses the point that lamb has a price ceiling.

Gerald Piddock NEWS Fonterra

IMPACT: Te Aroha dairy farmer and accountant Melissa Slattery says the lift in the advance rate will make a huge difference to farmers’ cashflow.

Red meat: China 18 months from recovery

MEETING the MARKET

7 COUNTRIES IN 6 WEEKS

Neal Wallace MARKETS Sheepmeat

IT COULD be another 18 months before the Chinese red meat market recovers and even then it is unlikely to return to the values of 2021-22. That is the message from Jiao Jiao Chen, the chief executive of China’s largest sheepmeat processor, Grand Farm, and Mathew Talbot, Alliance Group’s sales manager responsible for China.

“China is still a very big nation, the single largest lamb producer and consumer, but now prices are back to the normal range,” said Chen.

Grand Farm has been Alliance’s partner and exclusive distributor in China for the past 24 years, and Chen said the market has grown rapidly in that time but the post-covid price appreciation was an anomaly, caused by pent-up consumer demand and African swine fever decimating the pig industry.

A correction was inevitable.

“Total demand is relatively stable, it’s just in the past China’s demand has increased in average 2%,” she said.

“Now it’s not shrinking, it’s more stable.”

The lamb market is weighed down by low consumer confidence, high unemployment, inventory still to be realised, competition from continued high levels of Australian production – but also

from improved domestic Chinese production.

Talbot said the lack of Chinese confidence is evident by empty restaurants, causing a pivot in consumption from food service to retail.

He believes lamb prices have hit a floor and will appreciate, albeit slowly.

“The fundamentals of consumption, even though they are depressed, are still there,” he said.

Chinese eat lamb and their standard of living is improving, but how long before the Chinese economy recovers is the unknown.

New Zealand and Australia each account for 3-4% of China’s total ovine imports, about 188,000 tonnes each, but in the 2023 year China produced 5.2 million metric tonnes of sheepmeat.

Its grass-fed sheepmeat season is very short and concentrated on a belt that runs from the southwest to eastern China, encompassing Inner Mongolia.

Talbot said local lamb is 30-40% the price of NZ lamb, which is putting pressure on prices.

Consumers need to be educated on the benefits of grass-fed lamb vs grain fed.

Grain-fed lamb can be supplied all year round with lambs on feedlots for about 180 days and coming off at 25-30kg, double the weight of those finished on grass.

Exporters need to also add value to products and reduce their reliance on the commodity cycle, which Alliance is doing through its relationship with Grand Farm.

Together they are developing meat on skewers, hot pot sliced meat and flavoured ready-to-cook packaged cuts.

Talbot said Alliance and Grand Farm are also looking at how they connect with consumers through formats such as e-commerce and the format of retail products.

“I believe NZ lamb will become

like wild, line-caught tuna – a premium eating experience,” he said.

Traditionally red meat has been seen as a winter meal, but Talbot said that is changing as more Chinese adopt a western approach to eating meat.

Chen said the grass-fed, freerange and hormone-free attributes of NZ lamb resonate with consumers and underpin demand, but it faces competition from a resurgent local sheep farming industry.

The Chinese government has extended the pasture-land area of Inner Mongolia on which sheep can be farmed and there has been an increase in the availability of grain-fed lamb.

Grain-fed lamb can be supplied

Sheepmeat central for New Zealand

Neal Wallace MARKETS Export

XIBIN Chen started Grand Farm in the northwestern Chinese city of Harbin in 1982, with a cutting bench perched on meat boxes, three people making deliveries and a tricycle.

Today Grand Farm is China’s largest sheepmeat importer, a NZ$1 billion red meat business with 4000 employees, four processing factories certified to European Union standards, and 39 sales and distribution centres throughout China.

Since 2000, Grand Farm has been the Alliance Group’s distributor in China. It has similar agreements

with JBS, V and V Walsh, a large West Australian processor, and trading agreements with 19 countries.

Xibin Chen’s daughter, Jiao Jiao Chen, the company’s chief executive, said its customers want New Zealand’s consistently sized, high-quality, grass-fed, natural and disease-free sheepmeat. “New Zealand farmers take great care of their lamb and treasure it,” she said.

New Zealand farmers take great care of their lamb and treasure it.

Grand Farm relishes working with a co-operatively-owned food company, saying that by doing so they are dealing with the owners and producers of the sheepmeat they buy.

The relationship with Alliance has strengthened in the past 24 years to more of a partnership not only in the day-to-day business, but also product development.

For example, until recently they were turning 600 tonnes of forequarter meat a year into lamb skewers. That has now increased to 6000t.

Flaps from New Zealand lamb are a key ingredient in the Chinese staple hotpot dish, both domestically and commercially.

The Haidilao hotpot chain, which Grand Farm supplies, has 1351

under 40. It was just over 35 years 10 years ago.

The birthrate is one, well below the 2.1 required to replace a population.

I believe NZ lamb will become like wild, linecaught tuna – a premium eating experience.

Mathew Talbot Alliance Group

Chen said a lack of job certainty and tighter finances are hitting the middle classes, people aged in their 30s and 40s, especially hard as they have young children and elderly parents to care for.

A potential market for meat developing in China since covid is a desire to get outdoors, to reconnect with nature.

Stores are selling packages of everything needed to go camping, and Talbot said that provides an opportunity to provide meat for cooking on a barbecue or campfire.

two days after ordering, which removes market volatility.

The Chinese population is ageing and older people do not eat as much meat.

According to the Worldometer website, the average age of the 1.4 billion Chinese population is just

While China remains a key market for Alliance, Talbot said it is seeing growth in Malaysia and sees potential in Japan and Korea.

• Wallace is visiting seven countries in six weeks to report on market sentiment, a trip made possible with grants from Fonterra, Silver Fern Farms, Alliance, Beef + Lamb NZ, NZ Meat Industry Association and Rabobank.

outlets in China alone and another 23 overseas.

Grand Farm and Alliance are also working on developing new uses and dishes for the knuckle-tip and the aitch bone.

Chen said the two businesses exchange knowledge, expertise and, at the peak of the NZ season, staff to help if there is a shortage.

Grand Farm is now looking to strengthen its business with more beef and to de-seasonalise consumption of red meat, which Chinese consumers consider a winter dish.

Chen said the company is changing to reflect new challenges with its e-commerce business recently acknowledged as a leading

red meat retailer by the huge Chinese online retailer jd.com website.

Food security is a key policy of the Chinese government and while it lists rice and pork as the two top foods it wants secure supplies of, beef and lamb are considered high priorities.

But supplies of lamb in particular are likely to be volatile in the next few years, which Chen said is not ideal for business or the industry.

Xibin Chen is still heavily involved in the business but is also active in wider industry and government affairs and is the current chair of China Beef and Lamb, a subgroup of the China Meat Association.

PARTNERSHIP: Grand Farm chief executive Jiao Jiao Chen and Mathew Talbot, Alliance Group’s Asia manager.

INNOVATION: Allen Chua, Alliance Group’s regional manager, with innovative Grand Farm supermarket products that use Alliance meat.

Jiao Jiao Chen Grand Farm

Building a good name in a growing market

SOME things move very fast in the United Arab Emirates, but others take a lot longer.

Once a decision is made, the building of a road or even an island happens quickly. But doing business will take five or six initial meetings before discussion turns to the details of a proposed deal.

Nafis Ahmed, Silver Fern Farms (SFF) sales manager for the Middle East and North Africa, has worked for the company for 37 years and said the first step to doing business in the Middle East is establishing a relationship.

“In this part of the world relationships are very important.

“After your first approach there will be five or six meetings before you get down to business,” said Dubai-based Ahmed.

The territory overseen by SFF’s three-person office is vast: the United Arab Emirates (10 million people), Oman (4.5 million), Saudi Arabia (36 million), Qatar (2.5 million), Bahrain (1.5 million), Kuwait (4 million), Jordan (11 million) and Lebanon (5.5 million).

Red meat exports to the Middle East are worth about $290 million; last year the United Arab Emirates took $47m of red meat.

With a large Muslim population, the Middle East has a history of eating lamb.

A free trade agreement announced between New Zealand and UAE last month will remove a 5% tariff on frozen meat, saving exporters about $750,000 a year.

Chilled meat was already tariff free.

High-rise cranes dot the Dubai skyline with construction underway in every direction.

Ahmed said this reflects the

Emirate leaders’ desire to grow the economy, which should benefit food companies.

“Here it is a ‘build it and they will come’ approach, so we are expecting to see more growth as people move here.”

A further example of economic activity is the revived 13.4 sq km man-made island Palm Jebel Ali which, when completed, will be home to hotels and 35,000 people.

After being dormant for many years, the project was resurrected last year by Dubai’s ruler Sheikh Mohammed bin Rashid Al Maktoum. A further offshore island is also planned.

Tourism is a significant industry and boosts high-value cuts of SFFbranded chilled beef and lamb.

The UAE population alone is 75% Muslim and lamb is a key accompaniment to festivals such as Ramadan and other significant family occasions, which Ahmed said creates a noticeable increase in demand.

There are 200 nationalities living and working in Dubai, so beef

MEETING the MARKET

7 COUNTRIES IN 6 WEEKS

and lamb are used in a variety of cooking styles, while a large Asian community generates demand for tripe and liver.

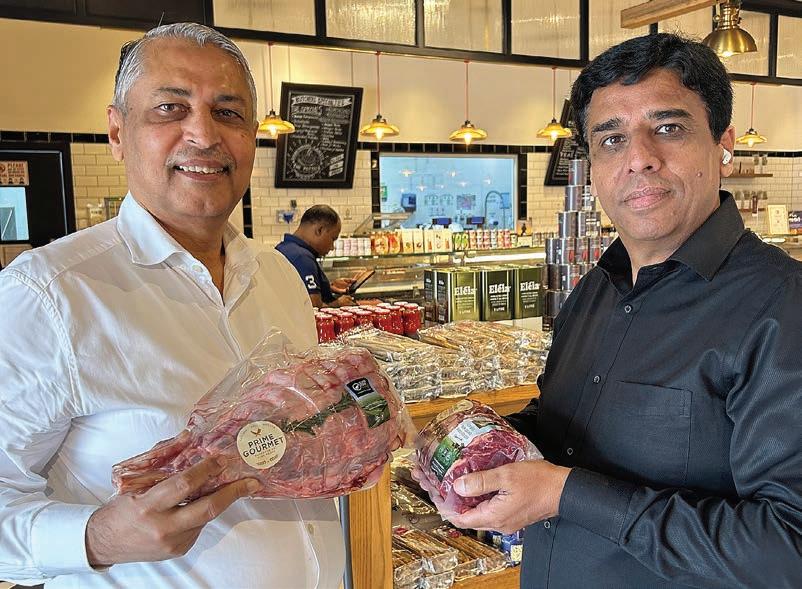

SFF-branded meat is stocked in supermarkets but also the highend specialty food chain Prime Gourmet.

Its seven Dubai stores sell topof-the-line cheese, fish, chicken and other gourmet food products.

NZ lamb is considered superior to comparable product from other countries, with supermarkets also stocking lamb from Pakistan and India and beef from Tanzania and Kazakhstan.

“There is trust in NZ, we have

a good name,” said Ahmed.

That aside, the Middle East is a price-sensitive market.

Issues of sustainable food production do not currently rate highly in the Middle East, but that will change in the UAE as that government starts considering the issue.

“It’s not as advanced as the rest of the world,” said Ahmed.

Food security is a significant issue with investment being made into vertical horticulture systems and the government importing fertile soil in which to grow produce.

Logistics can be challenging, especially with the conflict between Yemini rebels and western allies, which is creating shipping congestion.

Containers of meat have been trucked 2000km to a customer because the shipping line could not go into the disputed area.

It has also forced Jordan, traditionally a chilled meat market, to shift to frozen due to ships having to take the longer route around the Cape of Good Hope.

Ahmed was first employed by PPCS in Dubai in 1987 and has

Here it is a ‘build it and they will come’ approach, so we are expecting to see more growth as people move here.

Nafis Ahmed Silver Fern Farms

subsequently worked for five chief executives in the company.

He said SFF has Middle Eastern clients dating back 50 years. When PPCS took over Richmond, the office initially moved to Oman but later shifted back to Dubai due to its central location, easy access and its emerging market.

There are two additional staff employed in the Dubai office –sales and marketing executive Sasha Coughlan and key account manager Tom Latty.

• Wallace is visiting seven countries in six weeks to report on market sentiment, a trip made possible with grants from Fonterra, Silver Fern Farms, Alliance, Beef + Lamb NZ, NZ Meat Industry Association and Rabobank.

Neal Wallace MARKETS Sheepmeat

SALES: Silver Fern Farms Dubai office staff, from left, sales manager Nafis Ahmed, sales and marketing executive Sasha Coughlan and key account manager Tom Latty.

TOP END: Silver Fern Farms sales manager Nafis Ahmed and Prime Gourmet sales director Sayed Amir with SFF-branded meat, which is sold by the high-end Dubai retailer.

Drones now capable of counting livestock

Gerald Piddock TECHNOLOGY Livestock

THE laborious process of counting livestock for annual auditing

has been given a technological upgrade with drones now capable of identifying and recording stock numbers using artificial intelligence.

A collaboration between PGG Wrightson and local tech company Inde is now using drones and AI to take the hassle and cost out of this process.

Called SkyCount, it uses Microsoft Azure and Power Apps to reduce stock auditing to a halfhour operation with just one drone operator – and 97% accuracy.

The Christchurch-based

LEARNING:

SkyCount uses machine learning in drones to fly over livestock and record the numbers for auditing. It has 97% accuracy.

company operates in New Zealand and Australia in the tech space in a range of different sectors, including agriculture.

Inde chief technology officer Rik Roberts said they have been working with PGG Wrightson for nearly seven years.

“They had an idea about whether could we use some AI in drones to do some stock counting.”

Inde worked on it and came up with a system to do this where the drone flies autonomously across a paddock, recognises the stock and does a count of them for stock auditing.

“The current process for stock audits is two maybe three people and you have to spend all day herding the stock through gates and counting them and if you don’t get the same tally as your

colleague, you have to do it again.”

This system reduces that labour to one person.

PGG Wrightson CEO Stephen Guerin said the stock audits are an important part of their relationship with farmers, but the process can be time consuming and disruptive for the farmer, especially if the count gets interrupted by issues such as weather.

The project has been worked on since December 2022 and was released at Fieldays this year. PGW will now offer the stock counting as part of its services.

“The purpose of this technology is to enhance the farming system by not having to move animals, draft them and move them out to different paddocks, which is a labour-intensive process.”

Outside of yearly audits, farmers can use it following a weather event, or if the farm is sold, he said.

Roberts said the technology uses machine learning to identify the livestock in the paddock. This involves telling the computer what a sheep or a cow looks like by feeding it thousands of images.

“With only a few pixels, it can work out what a sheep is even when its half obscured by a bit of scrub.”

On hill and high country, the drone uses lasers to determine

Exports key to lamb’s future

Nigel Stirling MARKETS Trade

TRADE Minister Todd McClay says improving access to international markets remains a key component in helping to turn around the sheepmeat industry’s flagging fortunes.

McClay was responding to comments by AgriHQ analyst Mel Croad in a recent episode of the Farmers Weekly In Focus podcast.

With sheep numbers in free fall, Croad questioned the ability of the red meat industry to capitalise on trade deals currently being negotiated with India and Middle Eastern countries.

“There seems to be nothing out there to encourage even a stall in the decline,” Croad said.

“In the last 10 to 12 years we’ve lost six million breeding ewes from New Zealand.” Since the podcast, McClay announced the successful conclusion to trade talks with the United Arab Emirates.

McClay said the UAE is a large lamb market, with a significant share of the market accounted for by imports.

However, New Zealand exports to the oilrich state are limited by a 5% tariff on frozen lamb.

Those are due to be scrapped on the agreement’s first day.

McClay said returns to sheep farmers face dual challenges of market access restrictions and high costs at home.

Addressing both is crucial to turning around the industry’s fortunes and stemming further declines in the national flock.

Scrapping tariffs will put NZ exporters on an equal footing with rivals in the potentially lucrative UAE market.

“So we have levelled the playing field to

make Kiwi sheep farmers more competitive.

“Second of all, there have been huge costs put on particularly sheep farmers in the last six years.

“We are working to reform regulation and get those costs down so that they have better access to markets so they can earn more and the costs are less.”

McClay said the government is also taking steps to improve the viability of meat processors by removing the threat of more land conversion.

“We are working now on putting some constraints on the conditions for forestry conversion.

“We campaigned on that and will have more to announce before the end of the year.”

In the meantime the government is continuing to push for a larger trade deal with the six oil-rich states of the Gulf Cooperation Council, which includes the UAE.

A 30% tariff on sheep meat is also a key target in ongoing talks with India.

It can work out what a sheep is even when its half obscured by a bit of scrub.

Stephen Guerin PGG Wrightson

their height off the ground and retain that altitude as it flies over a hill. Geo-positioning is used to identify the stock.

The technology can be used both for sheep and cattle and while it is initially being used for stock counting, Roberts can see many future applications for the drones. These include surveying, digital mapping and cropping health.

The farm is mapped during

SPEEDIER: PGG Wrightson can now use drones to speed up and simplify livestock counting in a process that can take as little as half an hour.

the stock-counting process using advanced GPS that gives centimetre-level accuracy.

The drone’s propellers are also designed not to frighten the livestock and the flight path is designed so it does not travel at low altitudes.

“They have no idea it’s flying above them,” he said.

Once the stock are recorded, the drone uses Microsoft Azure to store and process the data. It can then be presented to the farmer either as a graph or in dashboard format.

“The stock counts are automatically generated reports from the cloud so once the AI has processed the count, it will create an email with the imagery and the account.”

BLNZ appoints new chief executive

ALAN Thomson, director of agribusiness with Hitachi Australia, is the new chief executive of Beef + Lamb New Zealand.

Originally from New Zealand, Thomson will relocate to Wellington for the role.

BLNZ board chair Kate Acland said she’s delighted with the appointment.

“The board was intent on taking the time to get the right person and we’re confident that’s Alan.

“He has a strong commercial background and will be focused on delivering great outcomes for farmers.

“He wants to see our farmers thrive and our sector realise its potential.

“I know he’s excited about bringing BLNZ’s refreshed strategy to life for farmers and making a real difference.”

Thomson’s recent work in the agritech space has included projects such as supporting farmers in the Great Barrier Reef catchment area to capture data to enable operational decisions in order to mitigate environmental impacts.

He is on the board of DataFarming, an Australian agritech business. Before Hitachi, he was at Ravensdown in a

variety of roles in New Zealand and Australia.

Thomson said he is excited to join BLNZ and make a difference for farmers.

“I’m deeply committed to agriculture and I see huge potential for sheep and beef farming.

“I’m really proud of work I’ve done on the ground with farmers in New Zealand and Australia, working to understand what they need. That really drives me.”

Thomson’s role will start on November 4. In the meantime, BLNZ’s chief operating officer, Cros Spooner, will continue to act as CEO.

AGRITECH:

Alan Thomson’s recent work in the agritech space has included projects such as supporting farmers in the Great Barrier Reef catchment area to capture data to enable operational decisions in order to mitigate environmental impacts.

Hi-Mineral continues to be the trusted triple-active mineralised oral drench for sheep in NZ. Discuss with your vet, how MATRIX fits into your farm plans, protecting

DoC, Mokai Station shake hands on access

Gerhard Uys NEWS Conservation

A DISPUTE between Mokai Station and the Department of Conservation has been resolved.

Farmer’s Weekly reported in August that public access to the Ruahine ranges through the station was in jeopardy as the owners said the DoC had reneged on a 48-year-old promise to make a paper road “disappear”.

Jessamine Corpe, MD of Maia Manawanui Whenua, the company that owns Mokai Station in Taihape, said the dispute related to an agreement about a non-registered easement that her father-in-law, Bruce Corpe, and the New Zealand Forest Service, now the DoC, entered into 48 years ago.

Corpe said she was in possession of decades-old documents showing the DoC agreed to a road stoppage of the paper road, officially known as an unformed legal road (ULR), if public access to the Ruahine range was granted via the non-registered easement.

Corpe said Mokai Station and the DoC came to an agreement early last week.

Corpe said the DoC agreed that the nonregistered easement would disappear and that public access would be through the paper road.

“I am pleased to have only one route [as access]. It’s the end of 48 years of a long and upsetting conversation, for me it’s the end of 31 years of participating in that conversation. I’m glad that the conversation is now over”.

Both the DoC and Corpe said the details of the agreement are still to be finalised.

for this generation and the next ceive

A spokesperson from DoC said: “DOC and Ms Corpe have resolved this issue in principle. We will meet with stakeholders on Monday, and following this will work towards formalising the agreed outcome.”

OVER: Jessamine Corpe, MD of Maia Manawanui Whenua, the company that owns Mokai Station, says she is relieved the dispute is finally over.

When a side hustle grows into a business

Olivia Caldwell PEOPLE Horticulture

RAISED on a Merino sheep station at the bottom of Lindis Pass, Sarah Rutherford is no stranger to getting her hands dirty.

On her family’s massive 5500 hectare farm, she would often get in the garden with her mother while growing up.

“My mum’s family were all really into gardening.

“I was never a passionate gardener, but I just loved gardens and flowers and helped Mum in the garden, growing up on the farm.”

The farm has been in her family from her mother’s side for over a century – her brother Tim and father Alastair run the stock now.

But tucked away at the end of her parent’s vegetable garden is a world of its own. It’s Sarah’s world of flowers and blooms. She is The Joy Farmer, and sells her flowers locally.

People expect farmgate flowers to be heaps cheaper, but in a lot of ways they are more expensive to produce.

Sarah Rutherford

The Joy Farmer

Since changing lanes in 2020, she has become an artisanal flower farmer and feels more at home in this occupation than she did in the Australian stock market, she said.

“I was in suits, high heels, dealing with executives, so a vast difference. When I came back to Wānaka, what I did as an accountant didn’t really exist here.”

Rutherford had a successful career in both London and Sydney as a chartered accountant working for Cadbury and Stocklands. She enjoyed the city life and even had a doorman at one of her offices in Central London.

“In Berkeley Square it was pretty awesome. We were in this beautiful old house with a doorman who would greet us.”

But the pull of home, the open country and fresh flowers was too much to resist.

During the pandemic she was unsure what her future as an accountant had in store for her, so she quietly started to plant, grow and sell blooms from her Joy Farmer Instagram account and at a tiny stall in Tarras.

“For me it was never meant to become a business, I was just doing it as a side thing. I just started this as a little play.”

As an accountant, the figures would have to add up for her to continue. And they do, just. But the job gives her more flexibility to be present for her seven-yearold daughter, while her partner’s job as a lawyer is more stringent.

“When people say they want to do it [grow flowers] as a job, I just say think very carefully about

what you want to get out of it. Because you can make money out of it, but to make it a full-time job you have to be going pretty hard.”

The flower industry in New Zealand has hundreds of independent growers and many still popping up around rural NZ.

The New Zealand Flower collective lists where you can buy local flowers at a place near you: some sell from the farm gate; some use the blooms as a hobby; and others sell wholesale.

Since her business sprouted, Rutherford has concentrated on seasonal selling.

“My focus is all about local and getting back to seasonal flowers. Flowers are a bit like food; you can go online and pretty much order whatever you want whenever you want and get things out of season.”

What a lot of customers don’t realise when buying from florists is that some of the flowers are imported. This is needed, as Kiwi growers cannot cater the full amount, but if you buy seasonally, you are more certain to be buying from NZ flower farmers.

“I was so unaware that roses were shipped from Columbia and get chemically treated when they come into the country for biosecurity ... would you want that on your kitchen table?

“I think there is a way of thinking about flowers and choices when you consume them. Consider that maybe you just get what’s in season and what is actually grown locally because it will sit better in the environment.”

While hothouses don’t get the storm damage that smaller flower farmers get, there are environmental question marks around them.

The prices for domestic and international flowers are often similar. Those at the farm gate can often be cheaper, but these growers aren’t usually looking to make a huge margin.

“People expect farmgate flowers to be heaps cheaper, but in a lot of ways they are more expensive to produce.

“A lot of people selling at the farm gate aren’t trying to make a profit there. It is artisan – you are doing a small amount of everything and learning to grow multiple varieties and you get so much wastage.”

Since taking up flower farming Rutherford has got in touch with her creative side, which is new for the financially minded grower.

“Obviously as an accountant you are not typically considered creative.

“I love it. It combines all the things I love: science, business and creativity.”

BLOSSOMING: Sarah Rutherford is an accountantturned-flower farmer and has managed to turn a pandemicinduced idea into a profitable business.

She said the industry has been welcoming and providing flowers for events such as weddings and hens parties has been the highlight.

“The people, even if you are dealing with someone that is grieving you are still bringing a little bit of comfort or joy to their day.”

Her next project will be “flower parties”.

“A lot of people don’t have

gardens and they want to play with flowers so I thought [about] hen’s parties, kids’ birthday parties –give them [customers] the tools and their flowers and they take it to their venue and they can make their bouquets.”

Would a flower farmer have a favourite type?

“I love scented flowers, I have always loved roses. But I fall in love with a different flower every week.”

Phil Colombus Rotherham Nor th Canterbur y

PRESENT: Sarah Rutherford says being a flower farmer gives her more flexibility to be present for her sevenyear-old daughter. Photo: Supplied

Photo: Camilla Rutherford

Fonterra narrows focus and lifts targets

Hugh Stringleman NEWS

Fonterra

FONTERRA has revised its 2025-2030 strategy to grow value for shareholders and raise its own targets.

The dividend policy has been lifted by 20% to 60-80% of earnings and the return on capital target increased to 10-12%, versus the five-year average of 8.6%.

Balance sheet stability will be maintained with a gearing ratio between 30% and 40% (currently 24%) and the debt-to-earnings ratio between two and three times.

In the FY24 results just released, Fonterra paid a dividend of 55c from earnings of 70c a share, which was a payout of 78%.

It also achieved 11.3% return on capital, at the upper end of the new strategy target range.

Capital investment requirements have increased to approximately $1 billion a year, on essential, sustainability and growth capital, compared with an average of $650 million over the past five years.

Emissions reduction targets for 2030 remain at 50% for Scope 1 and 2 and 30% for Scope 3 (onfarm emissions).

Fonterra chair Peter McBride said the renewed strategy, with

enhanced financial targets and policy settings, is aimed at stability and risk management for farmers.

“We can grow returns to our owners while continuing to invest

in the co-op, maintaining the financial discipline and strong balance sheet we have worked hard to build over recent years.

“At all times, we remain

Record organic milk payout

Hugh Stringleman MARKETS Fonterra

FONTERRA has paid $10.92/ kg milksolids to more than 100 supply farms for organically produced milk, a record premium of more than $3 in the 2023-24 season.

Last season’s farmgate milk price for organic milk is a record, surpassing $10.80 in the 202223 season. It is the fourth time that the organic milk payout has exceeded $10.

The $3.09 price margin over conventional milk is the biggest since the introduction of the market-based organic milk price in 2016-17. Previously the record margin was $3.05 in 2019-20.

The forecast FGMP range for the current season is $9.85 to $11.35, with a mid-point of $10.60, on which the advance payment rate is based.

Fonterra’s general manager for organics, Andrew Henderson, said the organics programme has been running since 2002 and in the past four years the number of supply farms has doubled.

“Demand for organic products continues to grow and to keep up with this we are looking to further expand the programme.

“Last season saw a shift from a surplus of organic milk globally over the previous four seasons to a deficit across both the United States and much of Europe.

“We were able to capitalise on this shift, which saw our sales volumes increase by 21.7% on a milk solids basis.

VARIABLE: The margin for organic milk comes and goes but looks set for a growth period, Fonterra GM organics Andrew Henderson says.

“We have seen particularly strong demand out of the US resulting in new partnerships with some exciting and fastmoving startup brands that are already delivering considerable

growth across butter, cheese and paediatric powders.

“Organic consumers are prepared to pay a significant premium for products they believe to be healthier and more sustainable.

“Our pasture-based farming offers a real point of difference that helps us to contribute to our co-op’s strategy and maximise value for our shareholders’ milk.”

Henderson said strong demand has enabled Fonterra to sell forward for 60% of its anticipated organics production volume in the current season.

“We continue to benefit from improving market conditions.

“The tight supply of organic milk in the US and Europe is expected to have a positive impact on demand and pricing for at least the next few years.”

Fonterra makes organic milk powder and butter at Morrinsville and UHT milk at Waitoa, and delivers liquid milks to various processors around the country.

committed to the maximum sustainable milk price.”

However, there are no milk price targets in the revised strategy.

Fonterra is forecasting stability in its milk collection around 1450 million kg milksolids annually and 78% milk market share.

It also aims to keep manufacturing costs stable around $2.60/kg MS and grow high-performing ingredients (non-reference products) and foodservice by 5% annually.

Fonterra’s revised strategy assumes that consumer businesses will be sold and a significant return to shareholders and unit holders will be made.

Chief executive Miles Hurrell said Fonterra is in a strong position, delivering results well above its five-year average, and the previous strategic targets.

“The foundations of our strategy – our focus on New Zealand milk, sustainability, and dairy innovation and science – remain unchanged.

“What has changed is how we play to these strengths.

“Following our recent strategic review, we are clear on the parts of the business that create the most value today and where there is further headroom for growth.

“These are our innovative ingredients and foodservice

businesses, supported by efficient and flexible operations.

“By streamlining the co-op to focus on these areas, we can grow greater value for farmer shareholders and unit holders, even if we divest our consumer businesses,” Hurrell said.

We can grow returns to our owners while continuing to invest in the co-op.

Peter McBride Fonterra

Fonterra said it has made six strategic choices for the next decade and beyond:

• Deliver the strongest farmer offering.

• Unleash the ingredients engine.

• Keep up the momentum in foodservice.

• Invest in operations for the future.

• Build on the sustainability position.

• Innovate to drive an advantage.

“This strategy has a clear-eyed view of where we best generate returns for farmers and unlock value at every point in our supply chain by focusing on our strengths.”

Synlait aims to hold wavering supply farms

Hugh Stringleman NEWS Dairy

SYNLAIT’S 20c/kg retention payment for South Island farmer suppliers demonstrates confidence in the newly refinanced and stabilised milk company, it says.

“Our capital raise shore up the balance sheet and we are taking some of that to shore up the milk supply,” Synlait’s director of on-farm excellence, sustainability and corporate affairs, Charles Fergusson, said.

While the 20c/kg retention premium may not be large when compared with a $9 forecast, he said the increment is meaningful to the average Canterbury farm.

Payment will be made to those farms that don’t have a cessation notice in place on May 31, 2025, are supplying in the 2025-26 season and remain “unceased” until August 31 2025. The company is confident of overturning the “significant majority” of two-year cessation notices placed ahead of May 31, 2024.

Five South Island supply farms were lost to Synlait last season and 13 more this season.

Fergusson said suppliers change dairy companies for different reasons, including changes in farm ownership.

“Some bought a Synlait farm

and are loyal to Fonterra, so they have waited out the two years.

“When someone gives you a cease notice, you spend two years trying to retain them, and you get a very strong sense of the reasons.”

Fergusson said the reasons for the latest batch of cease notices tended to be risk and Synlait’s performance compared with alternative processors.

Farmers have been clear in their expectations of Synlait to reduce its debt levels while paying a competitive milk price and strong advance rates.

“That’s why we are confident of overturning them, as we have satisfied a large number of the reasons for cessation notices,” Fergusson said

“Synlait’s premium farmers are relatively well paid, with an average of 28c over the farmgate milk price, including the A2 margin.”

Lead With Pride now covers 80% of all supply farms and is evolving towards environmental and greenhouse gas commitments.

“We want to overturn every cease notice and grow our milk supply,” Fergusson said.

North Island supply farms remain under contract and are being paid by Synlait, while their milk goes to Open Country. They can leave Synlait to go to Open Country.

RENEW: Fonterra chair Peter McBride says the renewed strategy, with enhanced financial targets and policy settings, is aimed at stability and risk management for farmers.

DOUBLED: Fonterra’s general manager for organics, Andrew Henderson, says the organics programme has been running since 2002 and in the past four years the number of supply farms has doubled.

Make every bit of advice count.

Ever y farm is di fferent . That ’s why your Ballance Nu trient Specialist will work with you to understand ex ac tly what e ver y corner of your land needs and when. That means better bang for your buck , better produc tivit y, and a better season for your business .

Ballance. Make it count.

News in brief

Wine investment

The government is backing a new, world-leading programme set to boost vineyard productivity and inject an additional $295 million into New Zealand’s economy by 2045.

Agriculture Minister Todd McClay said the Next Generation Viticulture programme will transform traditional vineyard systems, increasing profitability by $22,060 per hectare by 2045 without compromising wine quality. The government is coinvesting $5.6m over seven years.

Langford appointment

Federated Farmers president Wayne Langford has been appointed to the board of the Mental Health and Wellbeing Commission for a five-year term.

The appointment was announced by Mental Health Minister Matt Doocey and Rural Communities Minister Mark Patterson.

“We know our rural communities are reporting increasing mental health concerns and have endured several events in recent years that have affected their livelihoods and mental wellbeing. Langford is well respected in the agricultural industry and his keen knowledge of rural New Zealand gives him a unique perspective on the mental health needs of our rural communities,” Doocey said.

Bee platform

A new research project is giving beekeepers a platform for sharing their expertise to improve the health of the nation’s beehives.

The varroa mite has been in New Zealand for 24 years, and the destructive parasite continues to kill beehives. It is the main reason colonies die in winter.

Project Varroa, an operational research project by Biosecurity New Zealand, has highlighted the value of an integrated varroa management approach based on the “three Ms” – combining monitoring with a mix of miticide treatments and mechanical methods.

Record fine

A Waikato farming company, one of its directors and a farm manager have been fined a record $305,900 for discharging contaminants into the environment.

The fine is for unlawful discharges of dairy effluent into the environment and the contravention of abatement notices on numerous occasions between August 2022 and June 2023. Flint Farms Limited, farm owner Barry Flint and farm manager Gavin Flint were sentenced by Hamilton District Court Judge Melinda Dickey on 14 charges under the Resource Management Act as a result of a prosecution taken by Waikato Regional Council.

U-turn from EU on deforestation rules

BNigel

Stirling MARKETS Regulations

EEF exporters look set to get a 12-month respite from having to comply with new deforestation rules after an abrupt U-turn by the European Commission.

Due to come into effect at the end of the year, the European Union Deforestation Regulation (EUDR) requires a range of agricultural commodities entering the 27-country bloc to be accompanied by proof they are not a product of land cleared of trees in the last four years – or risk heavy fines.

The EU has faced mounting criticism for its heavy-handed approach since member states agreed to introduce the environmental measure at the end of 2022.

Along with others, New Zealand has been concerned its exporters would face the same heavy compliance burden as rivals with less credible deforestation credentials.

Those fears have only grown as the end-of-year deadline approached without the promised details from the EU about how the rules would be implemented.

Recently NZ led a group of seven countries at the World Trade Organisation calling for the rules to be delayed.

But the EU delegation to the WTO’s Geneva headquarters said the bloc wasn’t prepared to pass the legislation needed for a delay.

NORTHERNER: Blackbridge 23-338 the Simmental yearling bull is moving down the road in Kaikohe after making $7600 for vendors Vaughan and Susan Vujcich.

“This would not achieve our goal to provide legal predictability for operators as soon as possible,” it said.

However, in a significant about-turn late last week, the European Commission said it would delay the regulation’s implementation for a year until December 30 2025 to “support operators around the world in securing a smooth implementation from the start”.

“With this step the Commission aims to provide certainty about the way forward and to ensure the success of the EUDR which is paramount to address the EU’s contribution to the pressing issue of global deforestation.”

The European Commission has also responded to calls for differing levels of compliance by publishing a methodology for classifying countries as either low, standard or high risk.

“Following the methodology

Good bull clearances, north and south

Hugh Stringleman MARKETS Livestock

ANGUS yearling bull sales in the North Island have been well attended and successful for members of both breed societies.

Twin Oaks Angus, Te Akau, had a full clearance of 55 bulls, averaging $5480.

The top prices were $13,000 and $10,000, paid by MVP Genetics, Matakohe, and $12,500 paid by Te Atarangi Angus, Te Kopuru. Ranui Angus, Whanganui, sold 32 out of 32 offered, averaged $4048 and had a top price of $8000.

Merchiston Angus, Rata, sold 13 of 17, averaged $3800 and had a top price of $5500.

Blackbridge Simmentals, Kaikohe, sold 18 out of 19,

averaging $3711 for vendors Vaughan and Susan Vujcich.

The highest price of $7600 for Blackbridge 23-338 was paid by Rangitata Farm, Kaikohe and $6600 was paid by Mt Camel, Houhora.

A transfer of lot 3 at $5100 went to Gilead Simmentals.

Turning to the South Island yearling bull sales, Timperlea Angus, Oxford, had a complete clearance of 28 bulls, averaging $4200 with a top price of $10,500.

The combined Woodbank Angus and Matariki Hereford sales at Clarence Valley, Kaikoura, provided top prices $5500 twice for Woodbank and $5200 for Matariki.

Glen R Angus, Sheffield, had a top price of $6500 and an average of just over $5000.

applied a large majority of countries worldwide will be classified as low risk,” the Commission said.

“This will give an opportunity to focus collective efforts where deforestation challenges are more acute.”

In a statement, Beef + Lamb NZ and the Meat Industry Association, representing NZ farmers and exporters respectively, welcomed the delay as a chance to get easier treatment for up to $200 million of NZ beef and leather exports to the EU potentially caught by the regulation.

“Unlike some of our competitors NZ has a significant trend of afforestation, not deforestation.

“This regulation was not appropriate for NZ’s situation and risks adding additional unnecessary cost into the supply chain,” the statement said.

With end-of-year shipping deadlines just days away, exporters

DELAY: EU trade officials have agreed to delay the implementation of the regulations until December 30 2025, in a move that has still to be signed off by the European Parliament and European Council.

had been scrambling to pull systems together to provide the certification required by EU border authorities.

One exporter spoken to by Farmers Weekly last month said the timeframe to get a system matching satellite images of farms and records for individual animals using NAIT numbers up and running to meet the EU’s deadline of the end of this year had been “tight”.

Now it is the European Parliament and the European Council, representing member states’ governments, who face a race against time, with both required to sign off the delay before the end of this year.

European media has reported broad support for the Commission’s announcement, although some parliamentarians were opposed to the delay being used as an opportunity to water down its original objectives.

NZ blueberries off to Korea

Staff reporter MARKETS Horticulture

THE government has secured market access for New Zealand blueberries in Korea, unlocking an estimated $5 million in annual export opportunities for Kiwi growers.

Blueberries New Zealand chief executive Kelvin Bezuidenhout told RNZ growers expect positive spin-offs from the deal and a good deal of competition from local producers and rival southern hemisphere exporters.

“We know there are good opportunities for our window,” Bezuidenhout said.

“There are not sufficient blueberries for them to supply their market all year so it’s really up to us to exploit the opportunity we have been given.”

New Zealand sells about 80% of its export crop to Australia, with southeast Asian countries Vietnam and Singapore also taking New Zealand berries.

Korea published the legal requirements for the import of New Zealand blueberries last week.

Officials from the Ministry for Primary Industries will now move to implement the necessary compliance measures to ensure that New Zealand exporters are

able to begin shipping blueberries to Korea as early as this season (December/January).

Minister for Trade and Agriculture Todd McClay said the deal sees the conclusion of longrunning negotiations and comes on the back of increased bilateral engagement with Korea following the Prime Minister Christopher Luxon’s visit earlier this year.

BERRY: New Zealand sells about 80% of its blueberries export crop to Australia, with Vietnam and Singapore also taking New Zealand berries.

From the Editor

Blows keep raining on red meat sector

GNeal Wallace Senior reporter

OOD news has been in short supply for the sheepmeat industry recently.

Alliance has announced plans to close its Smithfield works, prices remain flat and word out of China is that it could be another 12-18 months for prices to recover and when they do it won’t be at levels enjoyed in 2021-22.

Markets are asking how exporters are going to fill their orders given a forecast 1 million-fewer lamb kill next season, but farmers are being told not to expect that shortage to automatically translate into higher global prices.

Markets are nuanced and complicated and, given that many consumers face tight budgets, they are likely to switch to cheaper alternative animal protein.

There are a number of factors at play which say a shortage will not increase global prices, namely that lamb is already an

expensive animal protein. While our mates across the ditch are forecasting lower lamb production in the coming season, it is still at historically high levels.

Additionally, geopolitical pressures, environmental and sustainability concerns are seeing the paring back of free trade gains.

Food security policies in countries like China will result in increased domestic production.

Chinese farmers are improving flock genetics and husbandry skills and in a signal that securing sheepmeat production is a government priority, it has increased by 20% the Inner Mongolia pastoral area on which sheep can be grazed.

Its production is already startling. NZ and Australian combined exports represent about 7-8% of all Chinese sheepmeat imports each year, about 380,000 tonnes.

China’s annual domestic sheepmeat production is about 5.2 million tonnes and about to increase.

The Chinese economy remains flat on the back of weak consumer confidence, evident by empty restaurants and retail shops as consumers save instead of spend.

Ironically, as the food service sector struggles for meat exporters, Chinese food service has been exceptionally strong for Fonterra.

The difference is that Fonterra services bakeries – about 350,000 of them – and while some have struggled, Chinese consumers are still frequenting them.

The world still wants our lamb, it is just that it doesn’t or can’t pay what farmers need.

The challenge for sheepmeat exporters will be accentuated with diminishing supply.

In the United States the challenge for meat exporters is to introduce more consumers to NZ lamb while in Europe and the United Kingdom it is competing with local product, other forms of protein and pricing competition from price-discounting supermarket chains.

It all presents a new suite of challenges for the meat industry, just when it could do with some stability.

Food security policies in countries like China will result in increased domestic production.

It is refreshing to see NZ companies developing new products such as lamb koftas, skewers, specially packaged products and superbly presented cuts in high-end retailers.

But such innovations have to add value, not further inflate what is an already expensive source of protein.

Finding new ways to add value is not new for meat companies, but if they have a golden widget sitting in their R & D department, now would be an excellent time to reveal it.

The sector could do with some good news.

SERIOUS INCINERATORS

Letters of the week Lining up to clip our ticket

Drew Peacock Hamilton

MANY older farmers are saying that the current financial climate for beef and sheep is “as bad as the ’80s” when interest rates were 20%-plus and government subsidies were removed.

Today’s dire situation for New Zealand livestock farmers is just as bad, the difference being that the current situation has more to do with horrendous value leakage beyond the farm gate.

Putting it in blunt terms, the supply chain for meat and fibre is extremely inefficient and supports a vast number of stakeholders clipping the ticket while adding little or no value. All this inefficiency and gouging beyond the farm gate is at the expense of us poor farmers, who simply receive what is left over.

In better times, what is left over is enough for us farmers to scrape by. Yet in tough times, like the present, what is left over is not nearly enough for the work and risk we farmers are burdened with.

Many livestock farmers this year will make close to a financial loss, particularly breeding operations. Yet your transport company, livestock agent, fert supplier, machinery retailer, meat company executives, farm consultants, farm supply merchandiser, real-estate agent, B&L extension manager, accountant and so many more, will all make good money off us, their farming clients.

Indeed, many of these stakeholders make obscene profits with virtually zero risk. Just ask your stock or wool agent when you see them next, what he/she made in the past year with no risk or cost. All of them will swear by their costs and emphatically insist they are vital to farming profitability.

What I believe is needed in the NZ meat and fibre supply chain is a good old clean-out and significant rationalisation to eliminate the fat in the system to allow more of the pie to return to the grower. Sadly, I don’t believe this will ever happen. As the saying goes “turkeys don’t vote for Christmas” and the status quo beyond the farm gate will be polishing their arguments as they read this, justifying their ongoing research.

In my career, I have worked extensively on both sides of the farm gate. Rest assured, beyond the farm gate the grass is much, much greener.

Scraper

Charcoal maker Spark arrestor & ash guard

Smithfield’s a warning we have to heed

Alternative view

Alan Emerson Semi-retired

Wairarapa farmer and businessman: dath.emerson@gmail.com

THE job losses in the small provincial town of Timaru caused by the inevitable closing of the Smithfield meat works will be a body blow for the local community.

With a population of less than 30,000 last census, the loss of 600 jobs is significant. In addition, as the OECD has found, the effect of 600 job losses has a multiplier effect that is greater in rural areas. Using its figures, 600 lost jobs will mean a total of between 1500 and 1800 jobs lost to the Timaru community.

Alternative employment isn’t an option in the current marketplace so workers will either get onto a benefit or leave town. The effect on Timaru will be devastating.

I’m not blaming Alliance. The

company posted a $97.9 million loss for the year to September 2023 and that isn’t sustainable.

My concern is that the Timaru closure could well be the canary in the coal mine. I expect more plants to close with our rural communities hit much harder.

Its not the first time we’ve had closures. Back in the late 1980s there was a major rationalisation with the closure of nine North Island plants and six in the South.

That meant 45 out of a total of 155 chains were gone.

The reason given for that drop in sheep numbers was the effect of Rogernomics – the removal of subsidies, among other things.

The current issue is that sheep and beef farming isn’t profitable.

We were told earlier this year that farmers’ wages had dropped 67% from the 2021-2022 year to $62,600.

The average wage in New Zealand is $53,040 and you don’t have to invest millions of dollars or work all hours in all weather to earn it.

The $62,600 income has not been seen since the 1980s except for a brief period during the GFC.

The harsh reality is that if farmers can’t make a profit farming sheep and beef, they’ll stop doing it.

Much has been made of the role of forestry in the demise of the sheep and beef industry and I agree it has had a considerable effect.

My views on carbon farming are well known and we’ve had large swathes of land taken out of

production in Wairarapa for just that. For the record I don’t think the consequences of the plantand-walk-away of carbon farming have been adequately considered.

The issue is that if farmers can make more money by planting trees and walking away that’s what they’ll do.

It doesn’t do anything for the real economy and it doesn’t contribute to feeding the 40 million people that NZ does, but it is more profitable than the farming practices that do.

The economic reality of that forestry conversion is depressing. Beef + Lamb NZ tell me that we’ve recently had 175,000 hectares of predominantly good farmland sold for forestry.

That means the loss of 1 million stock units. Translated that means

an annual farm production loss of $170m.

Mark Patterson is, in my view, a highly competent minister for rural communities. He described the closure of Smithfield as “pretty foreboding”. He acknowledged the problem of forestry and said that the government ‘has plans to introduce restrictions on afforestation to address the problem”.

“We need a balance in our rural communities and it has swung (to forestry) too far with the carbon price creeping up. We do not want to see more of this and we do not want to see the deindustrialisation of New Zealand,” he told RNZ.

Eating the elephant

Ben Anderson

Ben Anderson lives in central Hawke’s Bay and farms deer, cows and trees. eating.the.elephant.nz@gmail.com

THE problem with us

humans is our memories. They are typically patchy, selective and err on the side of convenience. This is why we can make such lousy witnesses in the court room, and why our recollections of our glory days should be taken with a big pinch of salt. This is also why many of us have lost sight of how our rural communities developed, and in many cases, have come to disappear.

I grew up in a small town in the King Country called Ōhura. I went to the local area school, which then had a roll well over 100.

The town had a garage, a small supermarket, a pub, two dairies, a butcher’s shop, a post office, a bank, a prison and a policeman to put people in said prison. Today, it’s virtually gone –recognisable only by abandoned buildings and a handful of hardy locals. Ōhura is a classic example of the great disappearance of small-town rural New Zealand, and, tellingly, there is barely a pine tree in sight.

If you believe many of our loudest voices in the drystock sector, forestry is now singlehandedly causing the wholesale loss of productive New Zealand farmland. It is destroying rural communities and tanking our great economy. Which, of course, is complete bollocks.

Our rural communities have been steadily disappearing for decades, without any assistance whatsoever from the dreaded Pinus radiata.

Urbanisation started the trend, but mechanisation and farm consolidation have kept the ball rolling. Ever since the removal of farm subsidies by Roger Douglas in the 1980s, pastoral farmers have been busy chasing efficiencies in

production. They have created larger landholdings, used bigger gear and, most tellingly, employed fewer people.

They have done this because they are producing raw commodities, and when you produce raw commodities, the simplest way to stay profitable (while hoping for a capital gain) is to chase economies of scale. In the commodity game, you want to produce the most you can, for the least amount of cost possible.

The loss of rural communities is the inevitable result of this approach, with forestry just a new take on an old game.

Economically, the average “summer dry” hill country drystock farm returns little more than $300 per hectare. Should that same property be put into plantation forestry, and providing it is within 150km or so of a port, it is likely to achieve an annualised net return in excess of $1000 per hectare. Not including carbon. These figures are based on recent historical averages, but the point is clear. Given the right circumstances, plantation forestry is significantly more profitable than drystock.

I understand why industry leaders dependant on the production of commodities such as meat and wool want to halt the conversion of those farms

The current price of between $6 and $7 a kilo isn’t sustainable. There’s been a lack of investment by some in the industry. There are also questions about the management of some of the meat companies.

On the bright side there are some signs of life coming out of the Chinese market.

I’d also suggest that the government taking a pro-American anti-Chinese position isn’t going to help that.

There are several key questions needing answers.

Will corporate farming take over NZ agriculture? I certainly hope not.

Have full co-operatives had their day in the meat industry? Silver Fern Farms certainly thought so. I’m also aware that Alliance has been looking for investors both here and overseas.

Will the lousy lambing season in Southland exacerbate the Alliance problem?

Finally, if forestry is about to expand to the levels the experts predict, is our present sheep and beef industry sustainable? I’d suggest not but I’m heartened by Minister Patterson’s comment that the government has plans to introduce restrictions.

Minister Patterson told me the Timaru closure was “a wake-up call for the industry” and that we “need to pull out all stops to achieve a long-term solution”. He added that “we’ve really got to get our arms around this because we don’t want to see regional NZ hollowed out”. I agree but the choices are stark.

Some big calls will need to be made.

When we can’t see the good for the trees

into trees. Their livelihood is being threatened by landowners choosing to use their land more profitably.

However, a more honest approach to this issue would be for these same leaders to ask themselves why their raw commodity is not as profitable as timber and do something positive about it, rather than trying to lock existing landowners into a state of perpetual poor returns.

Any industry group trying to block a farmer’s diversification options is not working in that farmer’s favour.

Personally, I don’t want to see all of New Zealand’s hill country planted into trees. A diversified landscape and economy is always going to be better than an economic “one-trick pony”. However, diversification requires economically viable alternatives, and this is what our respective industry groups need to focus on creating, rather than just undermining the other. This tendency to try to kneecap other industries is why the Common Ground concept has some appeal.

At a farmgate level, it seems that some of our industry-good organisations are so busy fighting with the government, with each other, and even within themselves, that they have forgotten why they exist.

I want our industry bodies to start thinking about how to drive greater value to those they are there to support. I want them to recognise that our real economic potential is rarely found behind the farm gate.

I would also like our politicians to receive balanced and considered perspectives on how best to grow the economic potential of our primary sector, rather than biased views from singular industry groups. Farmers need economically viable options to survive, let alone prosper. Any industry group trying to block a farmer’s diversification options is not working in that farmer’s favour.

I don’t know if the Common Ground will ever take flight, but it would be good if it could act as a positive stimulus to those who need it. The New Zealand primary sector badly needs fresh energy and aspirational thinking if it is going to drive real value back to its farmers, and by default, the country’s economy that is so dependant on it.

DOMINOES: The Alliance plant closure at Timaru – with the potential loss of 600 jobs and many more indirectly – may be just the first, says Alan Emerson.

Sector Focus

Whisky and wind help anchor creative croppers

Richard Rennie MARKETS Arable

FEW things are more deeply linked to history, land and tradition than whisky, and Scotland farmer Peter Mackenzie shares a link with the amber dew that is stronger than most.

His family have been growing grain for whisky in the Tain district for over 100 years, including their highest-grade barley for Glenmorangie’s nearby distillery. Wheat is also grown, for other assorted whisky labels, while other crops include oil seed rape, potatoes and oats.

The 175 hectares of land that surrounds the Glenmorangie House estate was once bought from the family by the Glenmorangie company, only to be sold back to the Mackenzies 40 years ago. It is part of the Mackenzie family’s 800ha total holding, covering a range of soils and contours in the idyllic landscape around the Cromarty Firth, in Scotland’s Tain district.

Perhaps surprisingly, the district is one of the driest in Scotland, receiving less than 700mm of rainfall a year on account of being protected from the rain-bearing westerlies that sweep the loch country to the west.

Despite the challenges of the past year, this usually makes it good early-harvesting country.

The Mackenzies supply about 600 tonnes of their best barley a year for Glenmorangie’s Cadboll limited edition whisky.

It’s a whisky renowned for the

touches of honey, hazelnuts, mandarin oranges and toffee in its aroma. Its tasting notes refer to “a gently spicy mouthfeel with a burst of sweet and spicy flavours, including heather honey and gingerbread”.