LIVESTOCK companies are off the hook and farmers are being hunted down in a new recall of insolvent transactions following the liquidation of a New Zealand live export company.

In a change of legal advice, the heat has come off the livestock companies while farmers have become the new target for repayment of millions of dollars being recalled by the liquidator of the failed Hamilton-based live export company Genetic Development (NZ) Exports Limited Partnership (GDEx). GDEx was put into liquidation by the High Court in Hamilton on September 5, 2022, with directors blaming the company’s financial challenges on a failed shipment of cattle to China, known as the Ocean Ute shipment.

The livestock ship involved never came to New Zealand in early May 2022 to collect 12,000 head of cattle waiting on two preexport isolation farms.

Total direct costs and losses for the failed shipment added up to more than $5m.

Initially all livestock companies involved with the Ocean Ute shipment received letters advising that transactions at the time of GDEx’s last live cattle consignment to China, prior to the company’s liquidation in September 2022, were insolvent.

The companies were advised that by way of Assignment of Proceeds, payments were insolvent transactions under the Companies Act 1993.

Accordingly, the livestock companies were directed to return the funds.

Whether individual farmers would be held responsible and liable to return payments had not been determined at that time.

Livestock agent companies spoken to by Farmers Weekly last week said they had responded through their lawyers but heard no more from the liquidator.

There is good reason for the silence.

Further investigation and a change of legal advice now has liquidator Malcolm Hollis trawling through the GDEx database to track down more than 100 farmers who received payment, deemed insolvent transactions, via the livestock agent companies.

“The advice we received initially was we need to write to the livestock agent companies and ask, ‘Please pay the money back’,” Hollis said.

“Now adjusted legal advice is we need to go directly to farmers because effectively the livestock companies paid the money on.”

Others in the supply chain –including trucking companies, quarantine businesses and all other services and goods industries

Continued page 3

Marlborough hay producer Scott Bishell of Caythorpe Farm has been making baleage for about 25 years. This year he received enquiries as early as December as drought conditions started to bite.

NEWS 3

Beef prices should recover by mid-year but sheepmeat may take longer.

After more than 70 years in business, Southland tulip grower and bulb exporter Van Eeden Tulips has shut up shop.

SECTOR FOCUS - HORTICULTURE 20-23

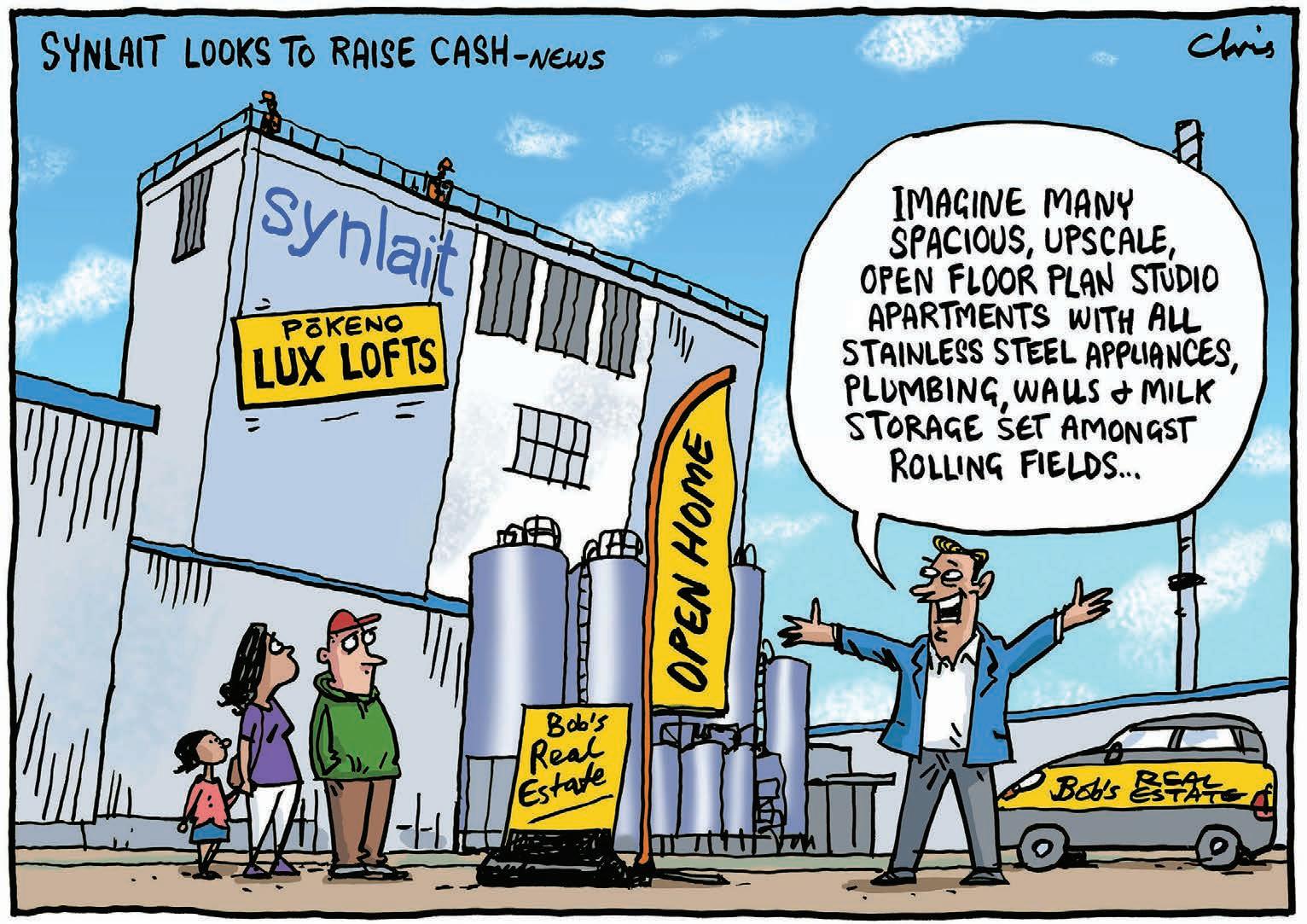

Synlait is battling for nothing less than survival, says Keith Woodford. OPINION 17

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS

0800 85 25 80 subs@agrihq.co.nz

PRINTER Printed

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Andrew Fraser | 027 706 7877

Auckland/Northland Partnership Manager andrew.fraser@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Omid Rafyee | 027 474 6091

South Island Partnership Manager omid.rafyee@agrihq.co.nz

Julie Gibson | 06 323 0765

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80

Marketplace wordads@agrihq.co.nz PUBLISHERS

Dean

our pioneering spirit tells us nothing’s out of reach

New Zealand exported red meat products worth $932 million during February, with demand from the United States helping to offset the weak Chinese market.

Overall, exports in February were up 10% on 2023, largely due to a rise in sheepmeat and beef exports, particularly to the US. Sheepmeat exports increased to nearly all major markets, apart from China.

The government plans to direct an independent review of methane science and targets and will also finalise policy to keep agriculture out of the Emissions Trading Scheme.

In other plans of note to farmers, the government will introduce legislation to amend the Resource Management Act to clarify the application of the National Policy Statement on Freshwater Management in relation to individual consents for freshwater.

A temporary ban on some New Zealand fish exports to the United States has been lifted.

The US’s Court of International Trade lifted a preliminary injunction that temporarily stopped trade for nine fish species, including popular species like snapper, caught in the Māui dolphin habitat along the West Coast of the North Island.

The medium-scale adverse event classification for much of the South Island has been extended to Northland, Taranaki, Horizons, Greater Wellington and Wairarapa Agriculture Minister Todd McClay said extremely dry and difficult conditions are now affecting communities across the North Island with little expectation of relief in the short term. The declaration will provide up to $80,000 to support Rural Support Trusts in Northland, Taranaki, Manawatū-Rangitīkei, Tararua, Horowhenua and Wairarapa.

Back in 1860, exporting meat to the other side of the world seemed about as easy as nailing gravy to the ceiling. But a few determined kiwis took the bull by the horns and now our grass-fed beef and lamb is sought-after all around the globe.

At AFFCO, we see the same pioneering spirit alive and well in farmers today. We’re playing our part too – exploring every opportunity to take New Zealand’s finest farm-raised products to the world.

Fiona Terry NEWS Weather

Fiona Terry NEWS Weather

THE Top of the South Rural Support Trust is experiencing a greater than usual number of calls to its confidential helpline as a result of the extreme stress caused by drought conditions. Enquiries are mostly relating to matters of financial assistance, as well as advice regarding feed distributors and freight costs.

The organisation’s Drought Shout events – which include advice from consultants as additional support – have been well attended, with more planned

as increasing numbers struggle.

“A lot of people have destocked early to significantly reduce their numbers,” said chair Richard Kempthorne, who also chairs the Rural Advisory Group.

“They’re using the supplementary feed in the summer they normally have for winter, so they’re going to be short of feed going forward. One of the things we will be looking at is how to help access stock feed for the winter.

“In the top of the south we’re all affected, so it’ll be a case of looking elsewhere, but Canterbury is also in drought and the West Coast is just now experiencing drought too.

“Freight costs are very high so

RESERVES: Farmers are breaking out the supplementary feed they normally reserve for winter, says Top of the South Rural Support Trust

it’s quite a challenge and a case of trying to set that up as efficiently and economically as possible.”

Last month drought was declared in the Marlborough, Tasman and Nelson region as a medium-scale adverse event.

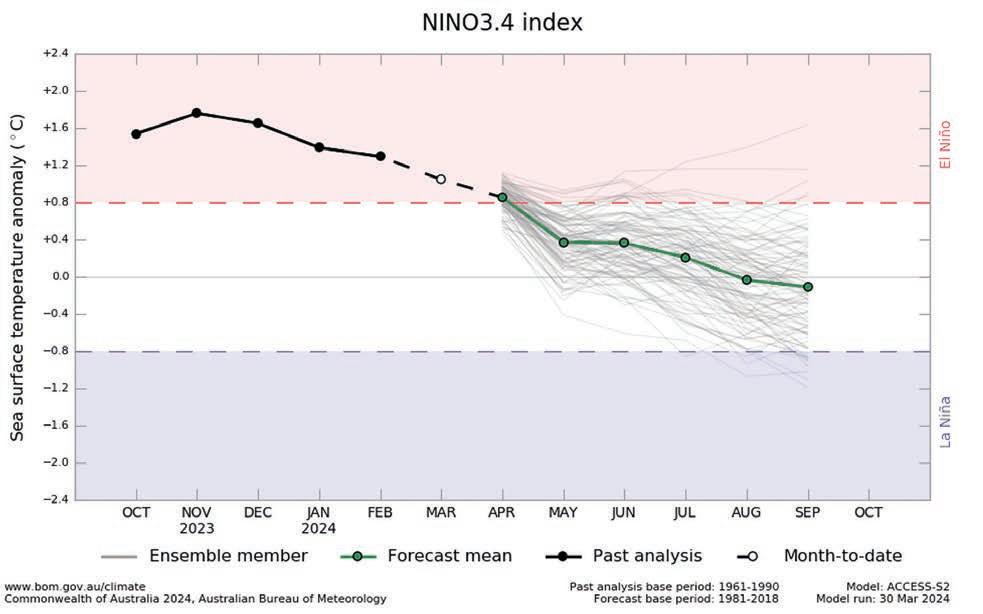

“NIWA has been suggesting we’ll have a drought through April but what’s needed is a weather pattern change with settled rain over a day or two. We need 50 to 100mm to really make a difference.”

Although many farmers are resilient, their struggles won’t be without stress, he said, and many have already had to part with a number of capital stock.

“They’re just under continual pressure,” Kempthorne said. “They get out of bed in the morning, look after the stock, see how little feed they’ve got and know it’s going to continue until we get significant rain.

“It’s very depressing for them so we’ve got people involved with the trust who can get alongside farmers and help with support.”

As well as giving access to counsellors, another Rural Support Trust facility is the Business Advice Fund, which gives up to $6000 for financial or consultancy advice to plan through difficult times.

Kempthorne urges those under pressure who need help to phone the trust’s 0800 787 254 number.

The line’s certainly been in demand, said Sarah White,

Hugh Stringleman NEWS Dairy

Hugh Stringleman NEWS Dairy

SYNLAIT’S FY2024 delayed interim results have disclosed the extent of its debt predicament and some possible recovery routes.

The deleveraging options include sale of the Pōkeno processing plant and the Auckland blending and canning plant, a discounted sale of Dairyworks subsidiary and, reluctantly, an equity raise backed by its largest shareholder, Bright Dairy.

However, the interim results make no mention of Synlait’s largest customer and secondlargest shareholder, a2 Milk, a rumoured possible buyer of the main Dunsandel plant where A2 infant formula is made.

For the six months to January 31, Synlait reported a net loss of $96.2 million after tax, hammered by massive writedowns of underutilised North Island manufacturing facilities and Dairyworks.

Acting chair Paul McGilvary and chief executive Grant Watson said the No 1 priority is to reduce the debt level, which was $559m on January 31.

“Net debt is $145.5m higher than FY23 due to poor operational performance, seasonal inventory build, and higher financing costs.

PRIORITY: Chief executive Grant Watson says the No 1 priority is to reduce the debt level, which was $559m on January 31.

“Synlait is facing several material uncertainties with regard to the timings and outcomes of deleveraging options which are currently progressing, and which are critical in ensuring Synlait will continue to meet financial obligations as they fall due,” they said.

“As the balance sheet has come under continued pressure, cessation notices from our farmer suppliers have increased

they need to have feed now rather than in June or July.

“During past events we have relied on groups to contribute towards the cost of freight of donated feed but that’s not currently available and it’s putting real financial pressures on farmers.”

Marlborough hay producer Scott Bishell of Caythorpe Farm in the Wairau Valley has been making baleage for around 25 years and started receiving enquiries as early as December.

compared to previous years.”

Because the cessation notice period is two years, Synlait hopes that farmers will reconsider when the debt problems are fixed.

“We are confident, given the progression of the reset plan, that there is currently limited material risk to our future financial performance.”

The company was placed in a trading halt on March 28 pending last week's announcement. Shares traded at 65c, down 10c, when trading resumed.

The forecast base milk price for the current season has been lifted by 30c to $7.80, plus an expectation of 29c premiums from Lead With Pride.

Synlait’s bank syndicate has extended the deadline for $130m debt repayment from March 28 to July 15.

It also has $180m of five-year unsecured subordinated fixed rate bonds which mature in December 2024.

The letter of support from Bright Dairy includes a commitment to participate in a future equity raise and extend a loan, if required.

Given that Synlait’s share price is trading at a significant discount to its net tangible asset value, the board prefers asset realisation, but equity raising remains an option.

MORE: See page 17

wellbeing coordinator at the Top of the South Rural Support Trust, who also provides a link to available resources, including with Inland Revenue.

“It’s much busier than we would usually see at this time of the year,” said White, who notes the greatest number of calls from those seeking feed have come from Nelson.

“We’re hearing from other parts of the country that there is excess feed but getting it to the top of the south is costly because it’s either in Southland or parts of the North Island. Getting it across the Cook Strait is uneconomical for farmers, especially at a time when they’re getting less for their product, but

Continued from page 1

– are also being investigated.

“It is a complex administrative and legal scenario and equates to several millions of dollars.

“We have a copy of all the GDEx software and we are working our way through the database, then we will write to all the farmers asking that they please pay the money back.”

Hollis could not put a timeframe around when farmers would receive a letter but said “the process is quite well advanced”.

So what happens if farmers don’t pay up?

“I have not thought about that, there is a lot of water to go under the bridge yet,” Hollis said.

“Unfortunately, it’s the legal process I have to follow to ask these farmers to repay in the millions of dollars.

“Any payment made six months prior to the liquidation [September 5, 2022] is automatically void unless they can prove to me otherwise.”

Hollis said he is not expecting farmers to rush to pay up.

“I don’t know how farmers will respond. In reality it’s not likely they are just going to pay up and it may be that they band together; it may be that I choose to take one as a test case.

“All I can do is follow the process the law provides me with, and it could take 18 months.”

Overall 160 farmers were involved in the May 2022 shipment.

“Baleage historically has sold well here because Marlborough is traditionally summer dry, so those of us on the flats that do have irrigation have been able to produce supplementary feed for those up on the hills, but the level of demand this year has been greater than ever.

“Normally it’s winter before it’s wanted but this year it’s moved a lot faster and by early January most of it had gone.”

As well as feed, another main issue has been the lack of water, said Stephen Todd, president of Federated Farmers Nelson. He knows of some, especially in the Dovedale and Moutere catchment, having to truck water in for stock, at a cost of over $500 a day in some cases.

A farmer shared with him recently that he is buying in feed for his cattle at a cost of $1000 a day.

The exact number of livestock companies has not been disclosed.

About 47 farmers never received any payment for their cattle as they missed the cut to be part of the pre-arranged financial agreement with the selected agent companies.

Hollis said the purpose of the insolvent transaction focus is to determine equalisation between creditors.

Adjusted legal advice is we need to go directly to farmers because effectively the livestock companies paid the money on.

Malcolm Hollis PwC liquidator“We have the powers to go through and determine any element of unfairness with some [creditors] paid in full and others not paid at all.

“If some are aware they were getting paid in full and others not at all, therefore knowing how the process was happening indicates it’s not fair and equal, then the liquidator can make void any payments if they are found to have happened out of due process.

“The issue we are looking to address is about a clear group of farmers and agents who managed to get protected and a group who did not get anything at all.”

BEEF prices are expected to recover in the coming few months but sheepmeat may take a bit longer, says Silver Fern Farms Ltd chief executive Dan Boulton. He said markets remain tough as they did for much of last year, the primary reason for the company reporting a $24.4 million after-tax loss for the year to December 31.

Turnover for the year was down $497m at $2.78 billion, reflecting weaker market sentiment and increased competition from Australian and South American lamb and beef.

The loss compares to a $198.2m net after-tax profit in 2022 from $3.27bn of revenue. That year it paid a $76.9m divided but none will be paid this year.

The company declares two results for the year to December 31 2023, one for the operating company, Silver Fern Farms Ltd which is jointly owned by Silver Fern Farms Co-operative and Shanghai Maling, and another for

SFF Co-op, the farmer-owners’ investment arm.

The co-operative recorded a $10.7m loss after tax, having last year reported an $94.1m profit.

SFF Ltd chief executive Dan Boulton said challenging market conditions persisted throughout last year and have continued into the current year accentuated by competing beef and lamb.

“This has added more volume to already high in-market inventory

levels and put downward pressure on pricing,” he said.

In response the company has adjusted the pace of planned investment and focused on reducing operating costs.

“Some technology programmes that were in progress will be finished, however the timing of some larger projects has been deferred until our spending envelope increases,” he said. Boulton said in an interview

that had SFF not embarked on its market-led strategy five years ago, the size of the loss would have been greater.

“If we were fully exposed to the commodity cycle and traders and had not invested in the end consumers, then the result would have worse. We have some protection from creating incremental value but we need to go after it faster.”

The industry did not experience the labour shortages of the past few years and the $70m invested in plants last year has improved efficiency and performance.

That was part of $106m of capital expenditure last year, but Boulton could not say what would be spent this year as it will be determined by market strength and income.

Prices for beef and lamb fell sharply last year, and while market prospects remain tough, returns for beef are likely to improve in the middle of the year due to demand from the United States, but sheepmeat returns could stay flat for the remainder of this year.

Venison prices are likely to stay

unchanged. About 55% of SFF’s throughput is beef and about 45% sheepmeat.

The company’s balance sheet is strong after five years of favourable trading and Boulton said the company remains confident in its market-led strategy.

If we were fully exposed to the commodity cycle and traders and had not invested in the end consumers, then the result would have worse.

Dan BoultonCo-op chairman Rob Hewett said after several years of strong performance and record returns to shareholders, it is disappointing not to receive a dividend.

He is confident in the operating company’s ability to recover when market conditions become more favourable.

CANTERBURY farmers will be the first to have the opportunity to sign up for fertiliser from independent Australian company Marnco as it unloads its first consignment of superphosphate and DAP at its Timaru site.

Almost 25,000 tonnes of Vietnamese-sourced superphosphate and DAP has been delivered in the company’s entry to the New Zealand market on the bulk freighter African Goshawk, delivering to the Timaru and Tauranga sites.

Marnco commercial manager

Jamie Thompson said the company is excited to be delivering to NZ for the first time, and farmer interest in the product has been high.

He said sales so far extend in value to seven figures.

“The product looks good. We can now validate ourselves in the market, that we have delivered on what we promised.

“This is a very high quality product, well granulated and with minimal dust. We think clients will be impressed with what we have to offer.”

He said the superphosphate is notable for its low cadmium level compared to most of the product sold in NZ.

Julia Baynes, Sales and Marketing Manager, CRV

Julia Baynes, Sales and Marketing Manager, CRV

The company has established a presence in Australia over the past five years, claiming 20-25% of the Victorian-South Australian markets and selling 400,000t last year.

It enters the NZ market claiming it will be able to sell fertiliser 1015% below current rates.

Prospects of a price war with existing fertiliser companies Ballance and Ravensdown look to be heightened, with both companies releasing revised pricing for the super and DAP products in recent days.

Thompson is confident that if farmers chose to support the company, future shipments will be assured.

Richard Rennie NEWS Governance

Richard Rennie NEWS Governance

BKate Acland is warning that a recent vote to not raise director’s fees will only increase the difficulty of recruiting future directors unable to afford or justify the time off farm that the role demands.

The BLNZ annual meeting last month saw the remit to increase directors’ fees from $38,000 a year to $45,000 a year and chair fee from $76,220 to $90,000 getting the thumbs-down from two-thirds of the 12% of farmers who voted.

In comparison, DairyNZ directors averaged $47,765 for the 2022-23 financial year. Chair Jim van der Poel received $95,740. BLNZ’s levy income for the September 2022 financial year was $30.4 million, compared to DairyNZ’s $67m.

DairyNZ’s total directors’ fee payments amounted to $582,000, compared to the $402,000 for BLNZ.

Another key industry comparison group is Federated Farmers.

Farmers Weekly understands Feds directors are paid $45,000 plus a recent 6% increase, while the chair is paid $90,000 plus the 6% increase.

Acland said the decision to not pass the remit did not solve the gap between BLNZ and other primary sector industry bodies, and will still need to be addressed in future.

She said the move to increase directors’ fees was the result of an independent remuneration committee review, headed up by respected farmer and director Murray Donald.

“It was an independent

recommendation. Possibly if the board had done the analysis ourselves, we would not have been so bold to suggest an increase of such magnitude.”

While it was a significant increase, she said it would only have brought BLNZ into line with other industry groups, and came after only one earlier, small, fee increase.

When

you

look at the commitment and workload of the role off the farm, it is a lot.Kate Acland BLNZ Chair

“When you look at the commitment and workload of the role off the farm, it is a lot.

“One director kept a log of their hours, and it is 500-600 a year. I personally have spent 90 days off the farm. You only need to miss one or two key decision-making points on farm and it will cost you.”

She cited her own example, where she was fortunate enough to have her husband at home to make the call to offload lambs over the dry period and gain an additional 40 cents a kilogram.

“We really want to encourage the best director candidates and finances should not be a barrier to that.”

Survey work by the Institute for Directors and EY this year drew on feedback from 3950 directors across almost 1700 organisations to provide insights to what directors are earning in New Zealand.

The survey found both notfor-profit organisations and commercial company directors have averaged a 3.9% increase

in fees, with the primary sector averaging 7% increases.

The average not-for-profit directors’ fee is $34,148 a year, with the average chair fee $49,558.

The need for farmer engagement with BLNZ has never been greater, with a low 12% turnout voting this year, and ongoing difficulties attracting a broad range of quality candidates for board positions.

Acland cited the DairyNZ director elections that attracted 13 candidates for two seats, compared to BLNZ attracting only three candidates for two seats, with only two of them being farmers.

“There is a perception there the Feds do it for free. They do not, and nor should they.

“As farmers we really need to value the job done, regardless of

whether it is Feds, dairy, or beef and lamb.”

A spokesperson for the Institute for Directors said the not-forprofit sector can be complex and challenging, with many organisations operating in size and scale on par with large commercial organisations, yet facing more scrutiny from society

relating to overhead costs.

He said remuneration for board members needs to be set at a level acknowledging responsibilities and risks, and to attract, motivate and retain members with the ability and character necessary to conduct the critical and demanding functions of being a director.

PĀMU has passed its use-by date, and selling the state-owned company could boost government coffers by $2 billion.

That’s the view of Canterburybased specialist agricultural chartered accountant Pita Alexander, who is suggesting the government sell Pāmu’s assets to New Zealand farmers or local private investors.

Alexander said the sale of Pāmu could potentially boost government finances by $2bn.

Just last month, Minister for State-Owned Enterprises Paul Goldsmith told Pāmu the company needed to lift its game, though he said selling the company was not on the government’s agenda. Pāmu runs 110 farms across NZ with a mix of dairy, sheep and beef,

We’re excited to launch the Level 4 Farm Environment Planning micro-credential which now offers staff the ability to choose how they wish to undertake our environmental training.

Plus, for those who are working towards accreditation with the NZFAP Plus Programme, this micro-credential covers a number of the standards required within the environment module. And in 2024, domestic learners are also eligible for 50% off* fees. *Terms

deer and forestry. In its day Pāmu farms – what were then known as Landcorp farms – were fit for purpose; right now, they’re not, Alexander said.

“They own 83 farms, manage another 27, totaling 358,866 hectares.

“If the private sector owned these farms, they would operate them more efficiently than Pāmu.

“It has often been suggested that it acts for a lot of industry good, and it has done in the past, and it maybe still will, but that’s not a good enough answer for the government, which has $2bn involved,” Alexander said.

“There is no question that their financial results for some years have been disappointing and considering that NZ taxpayers have just on $1.85bn invested here, the return over the years has in the main been very poor.

“With a for-profit business, there

is no structure that will compete with private enterprise that would operate the Pāmu farming assets much more soundly and efficiently.”

“If the government ever needed $2bn to spend in better areas, now would be the time.

“How have they lasted this long – their industry good talk has been good, but their very low debt servicing has been the real key.

“Pāmu has passed its use-by date and passed its original purpose.”

Alexander suggested a gradual sell-down on a piecemeal basis.

The phased exit strategy could take up to 10 years, he said.

“The present structure has good intentions, good bones, but has not been fit for purpose really for many years.

“New Zealanders, as a rule, do not like selling public assets, but sometimes this action is a nobrainer, and this is one of them.”

LIQUIDATORS say an unnamed party is close to purchasing Home Farm, part of the former Taratahi Agricultural Training Centre near Masterton, which was placed in liquidation in 2018. In its latest report, Grant Thornton says if the deal is completed, it will satisfy the government’s requirement that Home Farm continue to be a centre for the delivery of education.

“While discussions have been positive and we have been informed they have approval to sign the agreement, we continue to wait to receive the signed agreement,” the liquidator’s report says.

“The party has continued to undertake further due diligence on the property and has expressed an expectation to complete a sale.

“Once the signed sale and purchase agreement has been received, we will present this to the Minister of Agriculture for his approval of the sale.”

The liquidator continues to operate Taratahi’s Home Dairy Farm in Wairarapa and the dairy, sheep and beef farms at Telford in South Otago as going concerns.

“This strategy will be continued until the ownership of the Home Campus and dairy farm have been resolved in order to maximise returns to creditors.”

Since 2019 the liquidators have had a formal agreement with the Southern Institute of Technology (SIT) to provide education from the Telford Campus.

“We continue to work with SIT to make the Telford Farm available to assist in the education of its students.”

They have had discussions with the Tertiary Education Commission and Ministry for Primary Industries on the future of the Telford farms.

“It is our intention that following the settlement of any sale at the Home Campus we would look to transition our operation of the Telford Farms to an agreed party.”

Taratahi was placed in liquidation in late 2018 when it was determined there were 1194 unsecured creditor claims totalling $15.9 million.

The liquidators say that to date it has received 248 unsecured creditors’ claims totalling $15.2m.

All employee preferential entitlements have been paid but the Inland Revenue Department is still owed pre-liquidation payroll taxes, which have preferential status.

GLOBAL Dairy Trade prices had a broadbased bounce-back in the latest auction, the index rising 2.8% after two events in which it fell by similar amounts.

Cheddar and whole milk powder led the way, increasing by 4.1% and 3.4% respectively.

Prices for anhydrous milk fat, butter and skim milk powder also rose; only butter milk powder and lactose fell.

The latest 2.8% rise in the GDT index means that the dairy commodities market has lifted by 27.5% since last August, despite two recent falls totalling 5%.

Chinese buyers have returned to the market along with those from the Middle East, dairy analysts say.

“WMP has found a near-term price floor following two weak results in March,” NZX analyst Lewis Hoggard said.

Westpac chief economist Kelly Eckhold pointed out that European buyers took their largest proportion of sales since 2021 and that may indicate some milk production softness at home.

The rebound in WMP prices reduced some of the modest downside risk to the Westpac milk price forecast of $7.90, he said.

PGG Wrightson has put governance issues behind it and is re-focused on delivering the earnings guidance and restoring dividend sustainability, chair Garry Moore says.

The directors want to support senior management and PGW’s 1800 employees in getting on with the business of serving rural people and their needs, without any distraction at board level.

“Times are difficult for farmers and our trading figures reflect that, but there are some green shoots like kiwifruit and apples,” Moore said.

“On-farm financial figures are some of the worst for several decades and the drought conditions in many areas are weighing heavily on farming families.

“That is where our focus has to be – in helping our customers wherever we can.”

Having joined the board as an independent director in 2022, Moore was elected chair on February 16 after majority shareholder Agria Corporation gave notice of proposals to replace three directors with four of its own appointees.

Agria has since withdrawn that disruptive action and its request for a special general meeting.

Moore has a rural background in Mid-Canterbury and a long investment advisory history with the Christchurch branch of Forsyth Barr.

He said recently that all PGW directors should have an appropriate balance of expertise, skills and independence.

With 44% shareholding, Agria has nominated U Kean Seng, based in Singapore, and Meng Foon, the former race relations commissioner and Gisborne mayor.

On-farm financial figures are some of the worst for several decades and the drought conditions in many areas are weighing heavily on farming families.Garry Moore PGG Wrightson

Moore thinks the right board size is six directors, not the five currently, and that matter will be addressed by the next board meeting in May.

“I think we all agree that Agria should have its appropriate weighting on the board with a couple of representatives,” he said.

“We believe that having an

independent, NZ-based chair is a positive,” the directors said after replacing acting chair U Kean Seng.

Elders Australia has grown to a 12.5% shareholding in PGW and has said it is following a geographical strategy.

“We see them as friendly and complementary, especially in procurement matters.”

The PGW share price fell $2 in the past 12 months, $1 of that in the month-long period of Agria aggravation.

After Agria withdrew its action on March 22 the share price rose 15c to $2.20 presently.

Moore said the decline in the share price was a natural market reaction and can be recovered as PGW regains its momentum.

The suspension of dividend payments can be reversed with good cashflow management and the end of the current capitalintensive IT transition.

“When the market sees stability and guidance achievement, a lot of confidence will be restored.”

Moore said the network of nationwide premises is stable and good for business and that young people continue to be recruited into the company.

Saleyards and wool auction rooms are being supplanted with electronic sales channels.

INVESTMENT in world class research that will create new and innovative uses for New Zealand strong wool is making meaningful progress.

As the specialist funder of postharvest research, development and information transfer for the New Zealand wool industry, the Wool Research Organisation of NZ (WRONZ) it is acutely aware of the need for innovative solutions, alongside stabilising traditional markets.

“Only then will the wool price have a chance to recover,” WRONZ chair and North Canterbury sheep and beef farmer Andy Fox said.

“It is frustrating to see the continuing weak strong wool prices and with the situation compounded by the recent decline in sheep meat pricing, many farmers across the country will struggle to break even this year.

“We all know the story. The strong wool sector has faced increasing competition from synthetic fibres since the 1960s, and especially in the last 20 years.

“At the same time, we’ve seen a significant decline in sheep numbers and the amount of wool produced.”

Despite genuine intentions, the wool industry has also seen the ambitions of many ventures

remain unfulfilled over the years.

Fox said while there are encouraging signals that demand for natural sustainable products will prompt a return to wool, this has yet to translate into a recovery of the wool price.

“It’s meant many farmers are wary of promises, pledges and plans to fix the sector.”

That’s why, he said, WRONZ is investing in world-class research that will create new and innovative uses for NZ strong wool.

“We’ve been determined to walk the talk and deliver tangible outcomes for growers and the sector.

“And we’re making meaningful progress,” Fox said.

Under the New Uses programme, WRONZ has been able to deconstruct strong wool to a cellular level to create new products in particles, powders, pigments and cortex.

These retain the performance benefits of wool in a wide range of applications from personal care to printing.

The programme has recently made a significant technical breakthrough in the pigments field that could lead to the opening of very large market sectors that had not previously been anticipated.

“We’re not yet in a position to share any more details on this development due to commercial sensitivity and the need to protect

intellectual property, but we believe it is ground-breaking,” Fox said.

In parallel, WRONZ is exploring what options exist for it to leverage its IP to benefit the NZ wool industry.

This includes exploring the development and operation of a mid-sized production facility.

“An independent analysis highlights a good commercial opportunity that we are determined to leverage as quickly as possible for the benefit of the wider sector and in particular growers.

“Once we’ve proven the initial production plant, we can quickly move to a bigger production facility with this larger facility having the ability to make a significant positive change in the wool industry.

“While it’s tough out there for farmers, we believe these developments offer some light at the end of the tunnel.”

Fox said WRONZ is dedicated to finding markets and opportunities that will return the most value for growers, lift the price of wool at the farm gate, and capture as much margin as possible within NZ.

“We remain focused on doing everything we can to play our part in helping turn around the sector’s fortunes.”

Meanwhile WRONZ-backed Wool Source is hitting its stride.

Wool Source was founded by

WRONZ in 2021 and tasked with commercialising and launching new uses for NZ strong wool.

Wool Source reports an “incredible response” from the different sectors and industries it has been introducing to the new wool-derived powder, pigments and particle products.

The value proposition wool offers is as diverse as personal care and cosmetics to ink and coatings.

“We’re selling product, we’ve got multiple product development projects underway with international brands and a significant opportunity is opening for our Wool Source Pigments in the inkjet printing market,” Wool Source chief executive Tom Hooper said.

“We are crystal clear that our mandate is the WRONZ mandate, to maximise the returns of growers.

“We are looking for volume sales opportunities for our products and access to our IP and technology is conditional on customers using NZ strong wool.

“This puts us in a different position to a commercial entity looking to maximise their own profitability or short-term returns.

“There is momentum gathering with a lot of irons in a lot of fires.

“Product adaptation of new and novel technology is not an overnight endeavour but I’m feeling positive and excited by the opportunities ahead,” Hooper said.

Gerald Piddock NEWS Animal welfare

Gerald Piddock NEWS Animal welfare

ANEW report has highlighted the vast amount of animal products entering New Zealand that are produced in ways that are illegal under New Zealand’s own animal welfare laws.

Titled Closing the Welfare Gap: Why New Zealand Must Apply Its Animal Protection Standards to Imports, it reveals that these imports include battery cages for egg-laying hens, sow stalls for pregnant pigs, and the mulesing of sheep.

All of these practices have been banned in NZ due to animal welfare concerns. It recommends that NZ extend its animal protection laws to cover all products placed on the NZ market, regardless of origin.

Not only is this supported by public expectations, it is permitted under World Trade Organisation rules to protect public morals, it says.

The report was launched by Animal Policy International, the SPCA and the NZ Animal Law Association at an event in Parliament hosted by Green Party MP Steve Abel. He said Kiwis have serious

Advertising Promotion

concerns about the welfare of farmed animals, with over 80% of people believing imports should respect NZ law.

“In the longer term it is unsustainable not to apply welfare standards to all products placed on the market. Otherwise, instead of improving the welfare of animals, as demanded by New Zealanders, the production is simply shifting to countries where there are little or no standards.”

The report found:

• Over 90% of pork comes from countries that allow sow stalls and farrowing crates. NZ banned sow stalls in 2016, and the government has passed regulations phasing out farrowing crates by 2025.

• All of the wool imported in 2022 came from Australia, where mulesing remains common. In NZ performing mulesing can result in a criminal conviction.

• Over 80% of liquid egg imports in 2022 came from China and Australia, where egg-laying hens can be kept in battery cages. NZ’s ban came into force in 2023.

• Over 70% of imported fish comes from Thailand, China, Australia and Vietnam – all countries with no welfare standards around slaughter. NZ has a Code of Welfare that concerns aquatic animals at the time of slaughter.

NZ is importing animal products

RULES:

There’s a clear disconnect between our laws and imports. Animals overseas are being kept in conditions that New Zealanders have already clearly rejected.

Arnja Dale SPCAthat undermine the standards that we are holding NZ farmers to and wanting them to aspire to.

Extending animal welfare laws

could level the playing field for NZ farmers, who are currently competing against cheaper imports produced to weaker standards, as seen with the NZ pork industry with already around 60% of pork imported.

Future free trade agreements, such as with India, may further open NZ’s market for low-welfare imports.

NZ Pork chief executive Brent Kleiss backed the report’s findings, saying they align with what his organisation has been advocating for some time.

While recognising that the government has a balancing act

As stewards and kaitiaki, farmers have worked to get the best out of their land for generations.

Now, with growing resource constraints and as we face the transition to a low-emitting economy, we all need to be thinking about how we can become more productive while also future-proofing our businesses.

New Zealand’s productivity lags behind other countries and as a result we work longer to make up for low capital investment.

To improve living standards and set us up for the future, we need to lift productivity performance across the board.

According to new research commissioned by ASB, business holds the key to boosting productivity.

Through its considered and sustainable practices, New Zealand’s world-renowned food and fibre sector not only feeds and clothes the nation – it is the backbone of our economy.

And, our premium-quality food and drink products are valued the world over, with more than half the food we produce delivered to millions of people in more than 140 countries.

We are working closely with our rural customers to help them understand the potential opportunities and efficiencies that can be made.

This is not just a box ticking exercise. Improvements in environmental and social output can lead to a business operating more efficiently, reduced emissions and better financial performance.

Agri-tech innovations are already geared towards better production for better financial performance. Technology can also help farmers to adapt to the changing environment and maintain profitability with a reduced environmental footprint. Plus, it can help to meet modern consumer demands, and enable premium pricing.

We’re supporting our rural customers to adopt technology to smooth out the end-to-end running of a farm and improve quality of life for farmers.

From back-office tools and technology, to improved water supply or effluent systems, automatic pickers, or cow collars and farm management software, there is a range of technology available that can improve on-farm performance.

And there’s a lot we can learn from each other too. ASB’s research highlights the effectiveness of collaboration and knowledge transfer in other countries to drive innovation and export growth.

when it comes to trade talks, he believes more could be done to advocate for a higher standard of animal products coming into NZ.

“The points in the report show there is a possible pathway to do it and maybe it should be more seriously considered.

“We import pork from 22 countries and those countries –they are providing pork that’s been raised to lower standards of care than what we expect of our own producers.”

There are few precedents around animal welfare standards being brought into trade agreements, but Kleiss believes this, along with public sentiment, has changed.

If the public wants farmers to succeed in the standards expected of food production, there has to be a level playing field when it comes to imports, he said.

SPCA chief scientific officer Arnja Dale called the findings “extremely concerning”.

“There’s a clear disconnect between our laws and imports. Animals overseas are being kept in conditions that New Zealanders have already clearly rejected, and yet products from those conditions continue to be sold to New Zealand consumers.

“The new government has an opportunity to close the welfare gap by extending animal welfare regulations to imports.”

As farmers, we aren’t competing against each other, and that makes our sector both special and also more readily available to share knowledge.

We all need to adopt a curious mindset and get comfortable with the cycle of innovation, learning and sharing for us all to benefit.

ASB has the experts to help support productivity and on-farm performance to ease the transition that’s already underway and ultimately enable a more productive sector that capitalises on the opportunities ahead. We back the sector and are here to support its continued success.

The rural sector’s strong sustainability track record, world-class products and increasing consumer demand, means it is well placed to become more productive. This is what we need to do to create more opportunities and choices for future generations of New Zealanders.

To read the full report, visit: asb.co.nz/productivity

Richard Rennie in Victoria TECHNOLOGY Soil

Richard Rennie in Victoria TECHNOLOGY Soil

DESPITE a multitude of machines available to aerate, cultivate, plough and rip the soil, east Victorian beef farmer Niels Olsen struggled to find one that did the job he needed doing on his 200 hectare property.

But rather than just getting by with something that was less than ideal, he opted to build his own. That was over a decade ago, and

today there are over 100 Soilkee soil renovators forming part of the kit for pastoral farmers across Australia, the United States and, soon, New Zealand.

“What I was looking for was a machine that could encourage more feed growth in the paddock. We wanted to plant a maize crop in our pasture, grow it for six weeks and then feed it to the dairy cows we were grazing at the time.”

After trying “every different seeder under the sun” he found the existing pasture would ultimately take over the maize he planted into it.

He realised he needed a machine that would maintain 80% of the pasture while also allowing the maize to be sown in a manner that would give it a chance to emerge, and be competitive with the pasture.

Experimenting with a variety of different cultivation blades, he knew he had hit on the right design when he noticed a deep green streak of successfully emerging crop after trialling a prototype.

“We realised then we were onto something. Today the Soilkee is patented in 40 countries around the world.”

Over time and with trialling working alongside his sons Shane, Jamie and Sean, he found multiple pasture species could be planted into existing pasture, topping up the perennial pasture whose persistence can be an issue under Australia’s hot conditions.

“We have got to the point where we are really increasing the functionality and recycling of nutrients in the soil, rapidly rebuilding carbon, and holding onto that extra moisture as well.”

Today the farm’s sward profile is a “who’s who” of pasture species, including plants as diverse as wheat, oats, peas, vetch, linseed, chicory, plantain, brassicas and even sunflowers.

“It can handle up to 20 species planted at the same time.”

The machine’s blades provide a variation in the cultivated soil environment to suit the wide range of seed sizes planted, including zones of semi-disturbed, disturbed and undisturbed soil.

The resulting pasture sward viewed in mid-March is a dense mix of those species being breakfed off to Olsen’s Angus cattle daily, with sunflowers proving particularly popular with the young steers.

Today the machines are built on the farm with Shane overseeing. Independent trials using the machine have just kicked off in Queensland, funded through the state’s drought resilience package.

For Niels, the machine has also delivered carbon gain benefits that have been more of a welcome bonus than the intention of a farmer who initially set out simply to grow more feed.

“We did an initial proof of concept trial with Commercialisation Australia.

“In the first couple of years

Suz Bremner MARKETS Livestock

Suz Bremner MARKETS Livestock

THE boner cow market is heating up as autumn calving gets going, and Temuka is the major outlet for this class of cattle in the South Island.

Most of these cows have a oneway ticket to the processors and though schedules have held up to date, the extra supply has meant that schedules are starting to be pulled back.

That would typically have a flowon effect to the yards as lower schedules and larger supply puts pressure on auction prices, but

that wolf waited at the gates of the Temuka saleyards for another week at least.

Despite a short week and some noted buyers missing, the boner cow sale at Temuka on Tuesday, April 2 was firm on the previous week, and in line with the previous year. Over 500 cows were offered and most were Friesian, and Friesian-cross.

The Friesian cow average lifted 8c/kg to $1.47/kg, complemented by a 15kg increase in the average weight. An additional 10c/kg was paid on the top end for Friesian, which weighed in at 554kg.

Crossbred and Jersey cows also lifted 4-10c/kg, which meant most

sold for $1.40-$1.50/kg. On a whole, close to the entire yarding of boner cows traded from $1.40/ kg to $1.54/kg and most weighed 430-645kg.

Values are steady to slightly up on last year, which reflects a stronger schedule.

The increase in cow volume coincides with the annual beef calf sales at Temuka, making March and April the busiest months of the year at those yards.

For more market insights, browse the range of AgriHQ’s livestock reports. Tailor a subscription to suit your needs at www.agrihq.co.nz/livestock-reports

we were getting 11.7-12 carbon credits per hectare per year. Seveneight years in, it is coming up at 26-27 credits per hectare, which is about six tonnes of carbon increase on a hectare.”

Today the income from carbon credits earned is valuable.

“Doing the beef plus carbon credits, each are about the same income amount, which is better than what we would get dairying.”

With NZ’s focus on pasture, Niels sees increasing opportunity for the machine to help maintain or even lift levels across the Tasman.

“I was surprised to see NZ

We realised then we were onto something. Today the Soilkee is patented in 40 countries around the world.

getting rid of farms and planting pine trees. We see plenty of potential in building more into the soil’s carbon, and keeping farmers farming.”

Richard Rennie NEWS Apiculture

Richard Rennie NEWS Apiculture

VARROA continues to gnaw into national hive health and beekeeper wellbeing, with the latest Manaaki Whenua Landcare Research survey finding the mite contributed to almost half last winter’s hive losses.

The agency’s colony loss survey provides a snapshot of national hive health, and its results are based on responses from about 40% of New Zealand’s beekeepers.

For the first time the survey also surveyed for autumn hive losses, reported at 16.8%, compared to the 12.7% losses suffered over winter.

The increase in varroa comes as the mite’s resistance to chemical treatment continues to grow.

Manaaki Whenua Landcare Research surveyAlso for the first time, the survey took a snapshot of beekeeper wellbeing, and highlighted the mite’s broader impact on the industry.

The survey questioned hobbyist beekeepers and commercial operators about their wellbeing, using a national standard

wellbeing score.

Hobbyist beekeepers are reportedly thriving, while commercial operators are struggling, and have wellbeing lower than the rest of the primary sector producers and the general population.

While concerning, the surveyed hive losses sit below the results of 2021 and 2022 –thought they are still higher than those of 2015 and 2020.

In 2022 colony hive loss rates were 13.5%. Varroa’s impact on losses has been steadily increasing since it was first discovered over two decades ago.

In the latest survey it has contributed to 50% of hive losses, compared to only a 12% contribution seven years ago.

Other than varroa, beekeepers reported problems with queen populations and suspected starvation within hives as problems over both winter and autumn. The autumn losses were chalked up largely to the devastating impact of Cyclone Gabrielle down the east coast wiping out significant numbers of hives.

Three-quarters of beekeepers surveyed described their varroa pesticide treatment as “mostly successful” or “completely successful”, but all the treatments used were perceived by them as being less successful than in the previous survey.

The increase in varroa comes as the mite’s resistance to chemical treatment continues to grow.

Work by Manaaki Whenua Landcare Research released earlier this year highlighted that varroa mites were developing a unique resistance to flumethrin, the main insecticide used.

It is one of only two compounds effective against varroa.

The reported losses were higher in the North Island than South.

The survey also took a look at what constitutes a “typical” NZ beekeeper: reportedly a male in his late 50s, most likely a first-generation beekeeper with three hives and five years of experience.

Neal Wallace NEWS Water

Neal Wallace NEWS Water

OWNERS of dams up to 4m high will no longer require an engineer’s report on the potential impact should they fail.

Chris Penk, the Minister for Building and Construction, said regulations introduced by the previous government requiring an engineer’s report on the safety of dams 1m high and above, were to come into force from mid-May.

This has been amended by the coalition government, and a new threshold above which an engineer must complete a safety report has been set at 4m.

Federated Farmers has welcomed the change, but board member Mark Hooper said it could have gone further.

The government claims the change will exempt 1900 dams but the lobby group estimates about 800 dams, many on farms, will still be captured by the regulations.

Hooper said they lobbied for a system where an assessment by a lower qualified

consultant could be made on the potential impact and threat of a dam failure, excluding the need for an engineer’s report.

He said some dams that still meet this new threshold pose no threat to life or property, and with only about a dozen engineers in the country qualified to do dam assessments, those reports are going to be time consuming and costly.

“If a dam is captured the only option is to go to a specialist engineer.”

Penk said the change will exempt 1900 dams and save owners $13.3m in compliance costs.

The changes align dam safety regulations with the requirement for dams over 4m to also have a building consent.

“This higher threshold strikes the right balance of managing risk while easing the regulatory burden faced by owners of smaller dams like farmers and growers.”

The new regulations come in to force on May 13 and Penk said owners of classifiable dams must provide their relevant regional authority with a dam classification certificate by August 13.

Neal Wallace MARKETS Sustainability

Neal Wallace MARKETS Sustainability

CHINA’S consumers have typically made purchasing decisions based on what is good for them and not what is good for the environment, but a new report says that is changing.

A report, The Green Dragon: Sustainability in the China market, by the NZ ConsulateGeneral in Shanghai, says sustainability credentials and messaging can help brands command higher premiums, especially when linked to claims of health outcomes.

Surveys regularly show that China’s consumers rate health benefits as the top consideration for their purchases followed by the quality and safety of a product.

“This requires companies to position how they incorporate sustainability into their marketing, less of ‘it is made naturally so it does not harm the planet’ and more of ‘it is made naturally so it is good for you’.”

Claiming a product is eco-friendly is no longer sufficient as consumers need to see a link between environmental credentials and health benefits that is supported by science and innovation. The authors note some dairy brands promote the quality and benefits of grass-fed cows in China because customers perceive that farming system to be close to organic.

Chinese importers recognise NZ’s track record in naturalness and biodiversity management as a point of difference.

Green Dragon report

Others leverage other environmentrelated attributes, such as being carbon zero, all natural ingredients, biodegradability, and being chemical free.

Unlike Western multinationals, Chinese food and beverage importers are not yet prepared to pay premium prices for low greenhouse gas emission products, the report says.

If that happens, NZ is well-positioned. “Chinese importers recognise NZ’s track record in naturalness and biodiversity management as a point of difference for them in their premium NZ-sourced product lines.”

China has a top-down approach to environmental regulation, which can quickly change companies’ behaviour, evident by the speed of expansion of renewable energy, electric vehicles, reducing waste and excess packaging and improving resource management.

Investment in solar and wind energy is five years ahead of schedule and the 8.5 million target for new electric vehicles has also been easily exceeded.

In Shanghai alone 327,000 new electric vehicles were registered in 2022.

But China’s government-driven compliance approach to environmental management is not necessarily resulting in intrinsic changes to consumers’ attitudes to the environment, but that is changing.

“There are, however, signs that younger Chinese consumers are caring more about sustainability, in that they are concerned about their own health and welfare, with an embedded expectation within this that higher environmental standards are being met.”

While NZ has a natural advantage in

sustainability claims, other exporters are burnishing their green credentials and telling their green stories effectively.

Linking sustainability to value is an opportunity for NZ businesses to leverage and move products and services up in value and closer to the consumer.

“Showing a clear link between sustainability, science and innovation, and better health outcomes it is important in order for marketing to resonate loudly with the broader group of Chinese consumers.”

Laming is a director of NZAB with 22 years’ experience in the agribusiness and advisory industry.

NEW Zealand has been through and continues to experience a period of pretty ugly inflation.

It impacted all sectors of our economy but farming felt it more keenly, being exposed to some big increases in wages, fertiliser and fuel.

So what does a “good” milk payout look like now, given the inflationary changes?

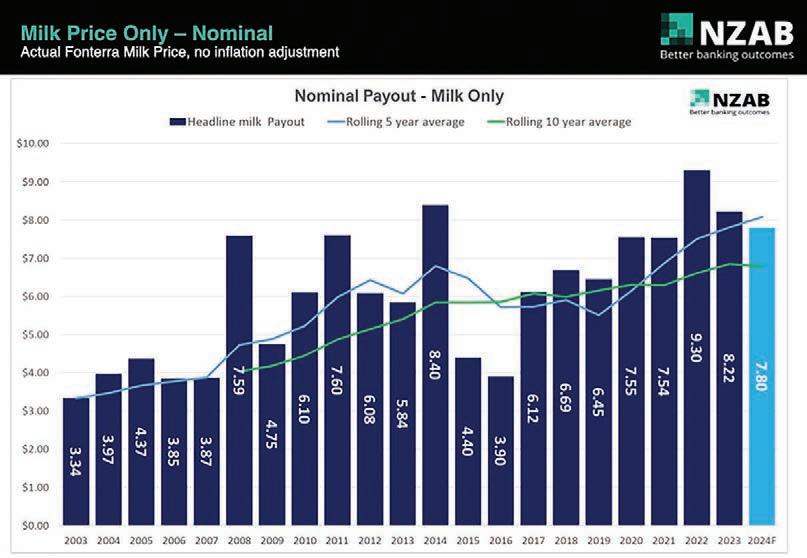

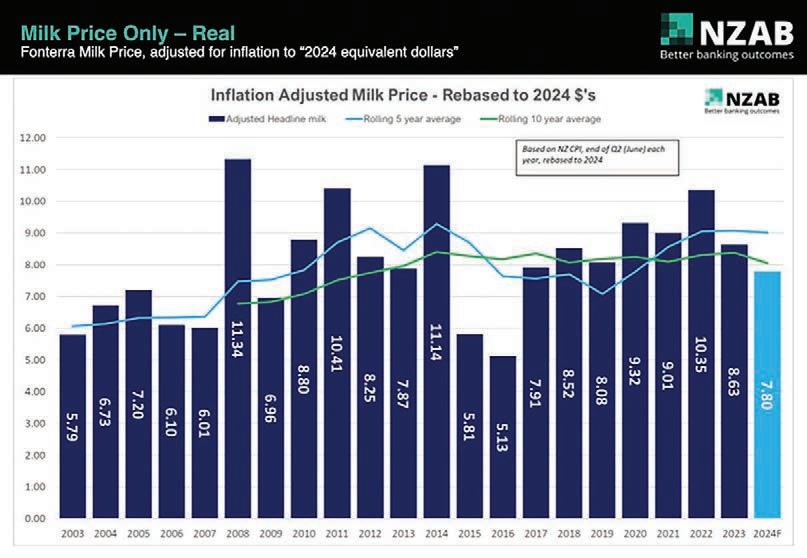

We think it is useful to look at graphs showing the difference between inflation- and noninflation-adjusted payouts over the past 20 years.

This will help farmers making investment decisions and considering hedging their milk prices.

First up is the nominal milk

payout from Fonterra, not including dividends, since 2003.

Nominal is just that, being the actual payout that year unadjusted for inflation.

We have added two lines:

• The rolling five-year average in blue, including this year’s current forecast of $7.80, which is currently $8.08.

• The rolling 10-year average in green, currently $6.80.

Both lines are trending up, which is obviously good, and this season’s $7.80 would be the fourth-highest nominal payout of all time.

But given we have ongoing inflation, what does it look like historically adjusted for inflation all of the past 20 years of payout?

Look at the next graph (below left), which now expresses each payout year in 2024 dollars, according to CPI inflation.

This is where it gets super interesting.

When we line up our current $7.80 against this data, the fourth-

best payout drops to 14th place.

And what becomes “average” in these inflation-adjusted payouts?

Including this year, the fiveyear average is $9.02 (blue line) and the 10-year average is $8.06 (green line) in 2024 dollars.

Another way of putting this: if this year’s payout nudges up to $8, it will be only average for the past 10 years when adjusted for inflation.

But in the context of the past five years, it looks a little underwhelming, being behind by over $1 the average of $9.02.

If we took the inflation-adjusted average over the entire 20 years (all the data), this would be $8.23.

If you decided to ignore the extreme market dynamics caused by increased world milk supply that occurred in 2015/2016, the five-year average has been consistently around $9 in 2024-dollar terms since 2011.

However, if you thought that this volatility was going to be an ongoing feature of the market, then something around $8.25 would be your average.

Either way, we start to get a relatively tight range of $8-$9 that we can start using as “average” for investment and hedging planning.

On this basis alone, the current year of $7.80 would seem to be an underside outlier and where we started the season at $6.75 certainly was.

Furthermore, if an average of $8.50 was put into every dairy farmer’s budget this year, most would be continuing to enjoy a very sound (without being spectacular) rate of return.

And importantly, given the inflation-adjusted average line is

ADJUSTED: Andrew Laming from NZAB has crunched the numbers for dairy payouts over the past 20 years, searching for what might be called ‘average’.

$8.32 over the past 10 years and $8.57 over the past 20 years.

If this year’s payout nudges up to $8, it will be only average for the past 10 years when adjusted for inflation.

level (and in the case of the past five years, increasing), this means that the New Zealand dairy payout is at least keeping track with inflation and arguably moving ahead.

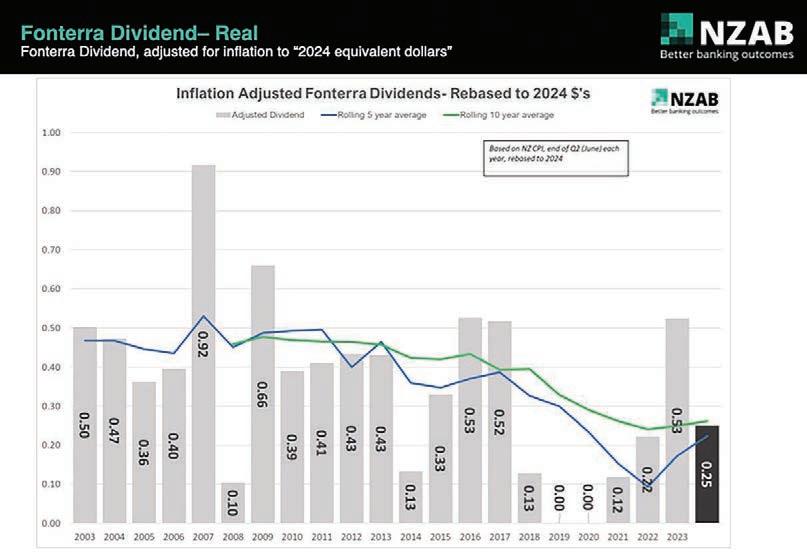

The final graph of inflationadjusted Fonterra dividends, without milk payouts, shows some interesting rolling averages as well.

Putting the inflation-adjusted dividend together with milk payout, a fully shared Fonterra farmer has received averages of $9.25 over the past five years,

So how should we use this information and what are its limitations?

The overall CPI for the NZ economy does not equal the cost inflation for farming.

A better way to examine whether dairy farm returns are tracking with or ahead of inflation is to also take into account farm inflation as well. We will explore this in the future.

However, using some adjustment for inflation is better than not at all, particularly when we have been through some significant step changes in inflation in the past two or three years.

Using nominal data alone has risks. This inflation-adjusted data might help farmers form part of their decision making for what average might look like when assessing their investment strategy or putting in place hedging policy.

At the same time, it’s worth noting that farmers need to assess a multitude of factors beyond just payout when forming their own policies for risk management and investment decisions.

These other factors include debt leverage levels, regional climatic and production volatility, facility headroom and credit availability, balance sheet strength and liquidity, income diversity, shareholder risk appetite and operational leverage.

Annette Scott PEOPLE Safety

Annette Scott PEOPLE Safety

SAFER Farms is calling on farmers to share their tips and tales on farm vehicle safety.

“It’s time to put the brakes on vehicle-related harm,” Safer Farms chair and Farm Without Harm ambassador Lindy Nelson said.

“We want to hear from those

who know farm vehicles best, the people driving them.

“We’re calling for first-hand and unfiltered accounts in farmers’ own words, sharing what they have learned from years of experience.

“We’re asking farmers to tell us about a close call or their views around farm vehicle safety.

“What are the key steps they’re taking to keep them or their people out of harm’s way on farm and what needs to change.”

Nelson said by farmers bringing relevant and practical knowledge and insights to the table, “we can start to design harm out of the system as a sector for good”.

Vehicles are almost always involved when someone dies as a result of a farm accident.

From 2019 to 2023, WorkSafe recorded 22 quad bike-related fatalities.

The majority involved rollovers with steep grades, with incorrect

driving position the leading cause.

Harm caused by vehicles and machinery is a priority focus in Safer Farms’ Farm Without Harm Strategy, the first whole-of-sector and whole systems approach to designing preventable harm out of New Zealand’s farming systems.

All stories and experiences submitted will go into a draw to win either a $500 Greenlea voucher thanks to FMG, or one of two $250 meat vouchers from

Alliance Group and Silver Fern Farms. Stories and experiences can be submitted via www. farmwithoutharm.org.nz by March 25.

The initiative is part-funded by Beef + Lamb NZ.

Hawke’s Bay farmer and BLNZ director Patrick Crawshaw is one farmer who has offered his take on farm vehicle health and safety in a video at www.farmwithoutharm. org.nz.

FISH & Game staff across the country are out of their offices catching and counting birds or kitting up in wetsuits to count fish.

Fish & Game New Zealand chief executive Corina Jordan spent two days recently helping the Taranaki and Wellington offices band mallard and grey ducks.

“It’s great to get away from computer screens and meetings, to get out in nature and get stuck in with the team doing valuable monitoring work as CEO of Fish & Game,” said Jordan, who helped band 500 birds.

“Every year we band about 3500 birds in Auckland and Waikato and a further 3000 in Taranaki and Wellington and a further 1800 in our eastern region.

“We’ve been banding waterfowl for more than 30 years because it’s important we have a good understanding of numbers and harvest rates so we can sustainably manage hunting.”

Birds are tempted with grain, and information about their age and sex is recorded when they are banded with a uniquely numbered band attached to their leg.

It’s great to get away from computer screens and meetings, to get out in nature and get stuck in with the team.

Corina Jordan Fish & GameUnlike their northern hemisphere counterparts, most New Zealand ducks don’t tend to travel more than 25km from where they were banded – but there have been instances where a few extremely tired mallards made it more than 2000km away, landing in New Caledonia and Vanuatu in the Pacific.

“We need hunters to report their bands so we can collect data on [the bird’s] age and where it’s travelled. This information is crucial to help us understand what is happening with waterfowl across the country so we can better manage the population for our licence holders.”

Fish & Game staff are also out drift-diving rivers to monitor trout populations.

The surveys determine overall trout abundance and set catch limits for anglers. The organisation monitors more than 100 rivers this way.

“We kit up in wetsuits and snorkels and glide down rivers, not only counting trout but also assessing water clarity and habitat, and aquatic insect life and noting indigenous fish abundance, which gives us a

broad picture of river health,” Jordan said. Many regions have information dating back over 30 years – the longest running data set of its kind in NZ. Because trout have the highest requirement for clean water of any freshwater species in the country, this can give valuable insight into the long-term trends of river health.

“No other organisation does more of this important type of monitoring of our waterways than Fish & Game,” Jordan said.

Craig Page Deputy editor

Craig Page Deputy editor

THE buzz around the honey industry continues to be drowned out by the threat of varroa, more than two decades after the mite was first discovered in New Zealand.

The latest Manaaki Whenua Landcare Research survey revealed the mite contributed to almost half of last winter’s hive losses.

The survey gives a snapshot of national hive health, and results are based on responses from about 40% of NZ’s beekeepers.

But perhaps the real concern from the data is the growing stress and pressure beekeepers are under as they go about their jobs.

This is the first time the survey looked at beekeeper wellbeing, and it clearly showed that the mite is having a wider impact on the industry.

The pressure of trying to run a beekeeping business in tough times is taking its toll, as it is on others in the industry.

The survey questioned both hobbyist beekeepers and commercial operators about their wellbeing. Not surprisingly it showed hobbyist beekeepers – part-time beekeepers – are happy in their work.

But that was not the case for commercial operators, who are struggling and, according to the survey, have wellbeing lower than other primary sector producers and the general population.

There has been plenty said about the wellbeing of farmers in these tough times. In February it was reported that growing numbers of farmers and growers are seeking help from the Rural Support Trust as they grapple with weather events, compliance and economic pressures.

The trust received 2904 calls to its 0800 number last year, 1000 more than a year earlier.

But beekeepers have flown under the radar despite facing pressure from a drop in prices, growing regulatory demands and weather events. Sound familiar?

Varroa’s impact on hive losses has steadily increased since it was first discovered over two decades ago. This survey showed it contributed to 50% of hive losses, compared to only a 12% contribution seven years ago.

But it is not just varroa that is decimating hives – there are also problems with queen populations and suspected starvation in

hives. Then there are weather events, such as Cyclone Gabrielle, to contend with.

Earlier this year Farmers Weekly spoke to Wellington beekeeper Frank Lindsay after he was awarded a New Zealand Order of Merit award in the New Year’s honours.

The award was recognition of Lindsay’s more than 50 years of dedication to the bee industry – as a beekeeper, administrator, life member, disease expert and teacher.

Commercial operators have wellbeing lower than other primary sector producers and the general population.

Lindsay, who now runs about 60 hives in and around Wellington, said commercial beekeepers face plenty of adversity.

The industry has experienced tough times in recent years, as overseas markets were flooded with honey.

The “mānuka gold rush” attracted plenty of people to the industry in search of a quick dollar, but many have now moved on. Recently a beekeeper had to destroy 2000 hives after going bankrupt. No one wanted to buy the hives and they can’t be left sitting around without being looked after.

Lindsay might be an optimist, but he is adamant the good times will return for the industry. It’s just a matter of keeping faith and, most importantly, keeping an eye out for each other in tough times.

John

McOviney Palmerston NorthI REFER to “Three cheers for the long goodbye to SNAs” in Alan Emerson’s Alternative View (March 25).

I can only totally back up his thoughts regarding Significant Natural Areas and how they affect the New Zealand farming community.

I was contacted by my local council some five years ago whilst under the previous administration specifying the legislation bought in by the Labour / Green Government.

Their assessment was done totally by satellite mapping, concluding that the area needed to be protected [as it included] “indigenous vegetation, wetlands and habitat essential to maintain healthy populations of threatened plants and animals”. Map attached!

The area identified on my property had previously been grazed, prior to our ownership, but allowed to revert to bush, presumably because it was unprofitable at that time.

I suggested the council’s consultant company got out from behind their desk and visited the property to see for themselves that it was previously farmed.

I subsequently talked to the council about the situation and they said getting the consultant company to visit on site may be, I quote, “a bridge too far”.

I concluded in writing that I objected to any SNA designation without a site visit, as to have it designated SNA would preclude it from being grazed in the future and would require Environment Court consent.

As at April 2024 I have not been contacted one way or another by the consultant firm or the council regarding this issue.

Maybe getting gumboots on and trudging up hills to identify the area concerned is a “bridge too far”.

Felicity Burgers

Takaka

I HAVE a request about staples, not the fencing kind, but those in Farmers Weekly. It’s a good weekly and useful for lighting the fire when we’ve finished reading it. But those pesky staples make it hard to separate the pages (no doubt that’s why they are there).

Would the Weekly really fall apart without them?

In my view ...

As we eye an Indian FTA, remember: Small country, hard choices

and talents of the Indian business sectors.

OUR new government has set itself a daunting challenge: a determination, publicly and unequivocally stated, to deepen and widen New Zealand’s relations with India with the aim of concluding a free trade agreement with what is the world’s fastest growing large economy.

The objective is admirable. But it won’t be easy.

India’s protectionist trade instincts are deeply embedded –especially as regards agricultural products. They stretch back to the country’s independence in 1947 when, almost overnight, an exhausted Britain left it and the newborn Pakistan – born by caesarian – to their own devices.

Surprisingly soon, these devices created a stable and unified nation out of a set of provinces that had long, proud and very different histories, cultures and languages. Independent India’s first prime minister, Jawaharlal Nehru, once said that India was “a bundle of contradictions held together by strong but invisible threads”.

On the economic front he was a committed socialist and for decades India’s economy was run out of New Delhi – and run badly at that. What was called the License Raj all but strangled entrepreneurship and business initiative. The state developed and ran the industrial sector. And it established high trade barriers against the outside world.

I had the good fortune to be New Zealand’s high commissioner to India for almost five years in the 1990s , at a time when the Congress Government at long last began to take the state’s shackles off the entrepreneurial instincts

The results over the past 30 years have been impressive –similar to the economic vitality that Deng Xiaoping unleashed in China in the 1980s and beyond, but which is now back under the political controls of a CCP fearful about the freedoms of a vibrant private sector infecting society as a whole.

Despite Nehru, now airbrushed aside as a colonial collaborator by the ultra- nationalist BJP Government, the average Indian is instinctively a trader and an entrepreneur. Witness the energy and talents that the Indian diaspora has brought into many Western economies.

Agriculture is the one sector that the BJP government is apprehensive about opening up to the trading world. The livelihoods of tens of millions of families in village India are based on the outputs of their fields and of their cows. And each family has votes in the world’s most vibrant democracy.

It was on this account that, despite some imaginative and always enjoyable efforts, my time in India produced no satisfactory commercial outcomes for the government.

My riding instructions had been short and to the point: nothing airy fairy about human rights or values in common or Kashmir or an aid programme. The objective was quite simply to help NZ companies in their efforts to do more business with India. And especially to ease the restrictions on our agri-exports.

So, we strengthened the two NZ/ India Business Councils. NZ’s was chaired by the CEO of the ANZ Bank, which in those days, partnered with Grindlays, had many branches in India. Leading companies came on board. As

OUTPUT:

did the producer boards. In India, one of its most prominent entrepreneurs, CT Chidambaram, became head of the outfit.