A re yo u a g re at p a st u re fa r m e r ? If you’re a dair y or beef farmer, you could win Halter free for a year. Apply now to be 1 of 3 winners!

Page 1 inside Vol 22 No 22, June 10, 2024 View online at farmersweekly.co.nz $4.95 Incl GST

Halter was started to back great Kiwi farmers and we’re proud to be working with hundreds of them every day If you’re a farmer who’s keen to unlock a new level of performance, we want to partner with you The winning farms can drive profitability and sustainability through:

You’ll get to collaborate with our teams to make Halter even better - just like our farmers have done throughout the years

Could you be the farmer we’re looking for ? Virtual fencing and herding Pasture management Heat detection & health monitoring

Apply now at halterhq.com/win *Dairy and beef farms are eligible to enter (conditions apply) Winners will receive the 'Unlimited' dairy package or the 'Base' beef product for 12 months Nominations close at 11:59pm on 16 June 2024 Winners will be announced by 17 July 2024 Full terms and conditions available via website or QR code Scan the QR code to nominate yourself or a deserving mate Tell us why they’d be a great pasture farmer with Halter If you're at National Fieldays, visit us at site E82 E 8 2 1

2

3

We’ll pick 3 farmers to unlock their pasture and repro performance! Wi n Ha l te r f re e fo r a ye a r !

.

.

.

Early dry-off as Southland weathers wet

Gerhard Uys

WET and cold weather in Southland means farmers have had to implement winter management plans earlier than anticipated.

Hokonui Hills dairy farmer Nigel Johnston said it has been a “rough couple of weeks” and that he had to dry off more than a week earlier than planned.

Johnston said the weather conditions are likely normal for Southland in May, but the region “had been blessed with fantastic autumns” over the past few years.

Adequate rainfall meant there was enough feed around, he said.

The region has been in the spotlight because of grazing practices, which means farmers have been implementing winter grazing plans, and are as a result prepared for wet weather, he said.

Concerns about what the general public thinks and how farms “look from the road” means most farmers have stepped up their winter grazing practices.

Rainfall data supplied by Metservice from four weather stations across Southland showed the total average rainfall between January and the end of May 2024 was 76mm higher compared to last year. It was also 183.7mm more than

the same period in 2022, 147.4mm higher than 2021 and 182mm higher than 2020.

In May, extreme minimum temperatures were as low as -5.7degC in Manapouri, -4.3degC in Lumsden and -3.3degC in Gore.

Woodlands dairy farmer Hannes du Plessis said he had not seen such a wet May in many years.

As a result of wet and cold conditions, and low pasture growth from mid-April, Du Plessis dried off a week earlier than usual.

He had planned to milk into June.

Du Plessis said besides a milk production loss there are other financial implications from an early dry-off.

“Most cows are only sent to grazers on 1 June. You still need to feed them once they’re dried off.

On a 600-cow mob you’d have to feed out an extra 30 to 40 bales a day,” he said.

Du Plessis said there are financial and animal health risks to drying off in these conditions.

His cows were dried off and teatsealed a week ago but then had to spend time in muddy paddocks.

This could not only lead to mastitis, but the teat seal costs money.

“Suddenly there’s water in places where you’d not normally have water. Cow management becomes important.

“Feed utilisation drops

Continued page 3

Winter worries for dry North Canterbury

An autumn drought has North Canterbury farmers offloading stock and searching for feed as winter approaches. Federated Farmers North Canterbury meat and fibre president Sara Black says caring for breeding stock is the focus now.

NEWS 3

SECTORFOCUS

Synlait suppliers who have handed their cessation notices did so to keep their options open.

NEWS 4

Prior commitment pays off for pair

Makuri farmers Mathew and Marilyn Prior have been named Tararua Sheep and Beef Farm Business of the Year.

SHEEP & BEEF 21-28

Fonterra should be wary of narrowing its focus in an uncertain world, says Ben Anderson.

OPINION 16

Rural broadcaster, beekeeper and breeder among those receiving King’s Birthday honours.

PEOPLE 18

1

Photo: Joseph Johnson

Vol 22 No 22, June 10, 2024 View online at farmersweekly.co.nz $4.95 Incl GST Room to grow at Bluff seaweed plant 19

NEWS Weather

Get in touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME Delivered by Reach Media Ltd

Advertise

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Andrew Fraser | 027 706 7877

Auckland/Northland Partnership Manager andrew.fraser@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Omid Rafyee | 027 474 6091

South Island Partnership Manager omid.rafyee@agrihq.co.nz

Julie Gibson | 06 323 0765 Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Scales Corporation has increased its ownership share from 33% to 50% in a petfood ingredients joint venture in Melbourne called Meateor Australia. The joint venture partner, the Fayman family, has also increased to 50%, thereby buying out a third unnamed partner between them.

Scales said the total cost of its half share will be A$11.5 million ($12.4m).

Scales grows petfood stake Pork board appointments

Experienced industry figures Jason Palmer and Nigel Young have been elected by fellow pork producers to the NZ Pork board of directors.

Palmer, a Mid-Canterbury pig farmer with interests in dairy and forestry, is a current director on the NZ Pork board. Young, currently general manager for PIC/Sunpork NZ, brings to the board 40 years’ experience in the sector in New Zealand, the United Kingdom and Australia.

Ravensdown taps Stuart

Graham Stuart has been appointed to the Ravensdown board, replacing departing director Jason Dale, who stands down after more than nine years with the co-operative. A respected leader in New Zealand’s primary sector, Stuart has over 30 years’ experience driving growth and transformation across multiple industries. He is currently chair of Northwest Healthcare Property Management Limited and Comhla Vet Limited.

Biosecurity levy relief

The Biosecurity (Response – Milksolids) Levy will reduce from 2.4 cents per kilogram of milksolids to 0.8 cents per kilogram of milksolids from July 1.

DairyNZ chair Jim van der Poel said the reduction is down to the national effort from New Zealand dairy farmers in response to Mycoplasma bovis.

“When the sector works well together, we get results,” he said.

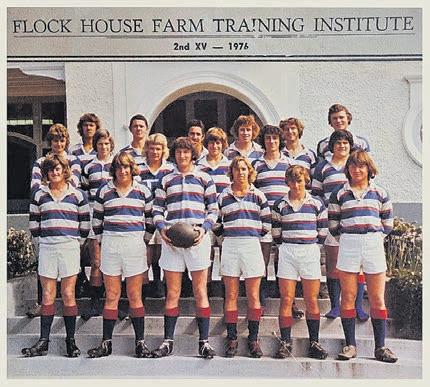

Brothers named Freshwater Champions

We chat with the 2024 Cawthron Freshwater Champion Rick Burke. Rick and his twin brother John have spent almost 30 years turning their Kati Kati farm into an environmental exemplar Rick told Bryan about their journey and the importance their catchment group had in helping them

My vision is that we’ll have farmers in their communities thinking about future proofing their landscapes, doing it as a community We’re not going to have pine trees everywhere, but pine trees in the right place “ Rick Burke,

Cawthron Freshwater

Champion

L I S TE N N OW

New Zealand’s most trusted source of agricultural news and information

Contents

IT’S TIME: Wool Impact chief executive Andy Caughey says the time is right for a wool paradigm shift. STORY P9 News . . . . . . . . . . . . . . . . 1-13 Opinion . . . . . . . . . . . 14-17 People . . . . . . . . . . . . . . . .

Technology . . . . . . . . . . . . 19 Sector Focus . . . . . . . 21-28 Federated Farmers . 29-32 Real Estate . . . . . . . . 33-36 Marketplace . . . . . . . 37-38 Livestock . . . . . . . . . . 38-39 Markets . . . . . . . . . . . 40-45 Weather . . . . . . . . . . . . . . . 46

18

News in brief

Island of extremes

Southland soggy as dry winter

bites N Canty hard

PREDICTED rain is failing to touch the ground, feed is running short with livestock leaving farms as the window closes for North Canterbury farmers battling the lingering dry conditions.

On top of that the bite is getting deeper with rising costs, soaring interest rates and low returns from sheep and wool, North Canterbury Federated Farmers meat and wool chair and Marble Point Station farmer Sara Black said.

Feed stores are fragile, winter crops are not doing well. It looks like summer – winter has arrived but any rain has been touch and go, maybe 2-3ml at a time for months on end, she said.

The region was declared in drought in March.

“We are very familiar with dry summers in this region but autumn has come and gone, now winter and the hills are still

Continued from page 1

significantly. In winter, 80% to 90% feed utilisation would be good; in these conditions it drops to 60%,” he said.

“You have to have a plan B in place for wet and winter management. Depending on slope there are runoff concerns. Some farms in Southland can’t winter cows because of soil conditions and slope,” he said.

summer-dry, winter crops are barely thriving and supplementary feed is running desperately low.

“The challenge now is to get feed to look after the breeding stock but that is a significant cost and transport costs are up there too.”

Black and her husband Matt farm the 2388 hectare mostly steep hill country of Marble Point Station near Culverden in an equity farming partnership running 4100 Corriedale ewes and 430 Angus beef cattle.

For the first time ever they have resorted to putting their 1100 two-tooths on an irrigated block. A further 1200 ewe hoggets have gone out to grazing.

Black acknowledged there are farmers “much worse off than us”.

“We have got rid of anything we could, we are not holding any additional trading stock and we are looking seriously at the R2 cattle.

“Just yesterday we stopped the grain feeding and all the ewes have been kicked up the hill.

“We have been lucky in that we

Du Plessis said DairyNZ’s website will have information that is especially helpful for new producers, and that a Google search for “wet weather management DairyNZ” will take them to the right information.

Environment Southland resource management manager Donna Ferguson said Southland is wet during winter and farmers should have a Plan B. Compliance monitoring began

The challenge now is to get feed to look after the breeding stock but that is a significant cost and transport costs are up there too.

have a small area of irrigation and that has been an extra lever we can pull to hopefully keep our breeding stock.”

But Black said that isn’t the case for most farmers in the wider drought-stricken region, who are faced with exorbitant costs to buy in feed and truck stock out.

“Farmers have quit big numbers of stock and hundreds have been

at the start of the season, which runs from May 1 to September 30, Ferguson said.

“For winter grazing in 2024, there are both local and national rules in play. While the government has indicated it will be repealing the rules around winter grazing, they remain in place for the 2024 season, we are required to ensure they are adhered to.

“While those rules look likely to be removed by the 2025 winter

trucked out, many to Southland, for grazing.

“In general farmers in the region are cutting back stock by 20% to cope with the dry as they balance buying in supplementary feed over winter ... the cost, and the cost of transport, is about the same value as the ewe, and that’s also the case in the cost of trucking the stock to grazing and back.”

Black said farmers having to quit their capital stock are losing some of the best genetics and the most productive animals in their farming systems.

With ewe scanning underway anything with multiples, more than twins, is out the gate.

“Sadly, that is a decision that will impact their farming operations for many years to come,” Black said.

The situation is delicate across

grazing season, rules for winter grazing activities are still in place under the Southland Water and Land Plan.”

Ferguson said in both the local plan and the national regulations, farmers in Southland are required to have winter grazing plans in place that include:

• Using no greater than 50 hectares, or 10% of the area of the farm (whichever is greater) for winter grazing; the slope of

the rugged hill country, with fragile feed stores and the dry still posing an elevated fire risk. Snow is a looming threat that would really escalate the challenge for farmers to feed stock.

The knock-on economic impact is being felt in the surrounding community.

The Hurunui Adverse Event Committee has been meeting fortnightly since March and in conjunction with the Rural Support Trust is keeping a close watch and co-ordinating support where needed.

“They have also been staging events to get farmers off farm and that’s been good for their mental wellbeing. It really is quite dire.

“We just need the predicted weather systems to actually drop rain, and hopefully not snow,” Black said.

land for winter grazing crops needs to be 10 degrees or less over 20 metres.

• Critical source areas must not be cropped in winter forage crops and cannot be grazed during the season.

• Stock must be kept at least 5m away from the bed of any river, lake, wetland or drain.

Environment Southland staff are available to help with understanding the rules, she said.

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 News 3 EOFY CLEARAN CLEARANCE SALE CE SAVE UP TO 50% AVE point to suit Simba ST, SL, Solo NOW $124.79 was $20799 Silage Tines up to 30% Off Selected Range 26” Scalloped Disc NOW $126.69 was $180.99 Linkage Parts up to 50% Off Selected Range on a huge range of Machiner y Parts Mixer Knife to suit Strautmann NOW $83.99 was $139 99 Check out the full range online! Limited stock available at discounted pricing. Sale ends July 5th 2024. 0800 00 31 32 wearparts.co.nz 3

Annette Scott NEWS Livestock

OUT THE GATE: North Canterbury Federated Farmers meat and wool chair and Marble Point Station farmer Sara Black says farmers in the region are cutting back stock by 20% to cope with the dry.

Photo: Joseph Johnson

Sara Black Marble Point Station

Synlait quit notices ‘an insurance tactic’

TWO Synlait suppliers who have handed their cessation notices to the company did so to keep their options open and to send a message to the Synlait board to lift its financial performance.

One of those farmers, Ōtorohanga supplier Michael Woodward, said doing so keeps his options open in case Synlait sells its Pōkeno factory.

“Our intention is to stay with the company, but if the worst case happens because we are supplying the North Island factory if it changes hands, we just want to make sure we still align with the values of whoever potentially purchases that operation.

“Putting in our notice gives us the chance of a two-year opt-out.”

Synlait announced on June 4 that a large majority of its

suppliers had handed in cessation notices.

If Synlait retains ownership of the factory, Woodward said, he will stay with the company.

He said he had heard that others who have had handed in their notice are similarly doing so as an ‘insurance policy’.

This is being done by suppliers across both islands, he said.

Our intention is to stay with the company, but if the worst case happens ... putting in our notice gives us the chance of a two-year opt-out.

Michael Woodward Ōtorohanga

The company indicated in April that the sale of the factory is a possibility as it looks at options to reduce $300 million in debt.

Woodward backed Bright Dairy’s $130m loan offer, which will require shareholder approval, saying it is the best option unless the money could be raised privately in New Zealand.

“I would like to think that it’s a short-term measure until they do get that balance sheet back into line. It’s nice to know that one of the major investors is there to make sure that business as usual continues.

“From an on-farm point of view, there’s no change in operations, we’re feeling no pressure from them – they have put out a really strong advance [rate] for next season – which they needed to because we have been behind – and we appreciate that and the milk price they have put up this season matches Fonterra’s price.”

Woodward said there is still support for Synlait among its suppliers, and that many of its financial problems are a result of decisions made by the previous management team.

Ashburton supplier and former Federated Farmers board member Willy Leferink said news that many suppliers are leaving was not unexpected. He agreed that many are also handing in their notice to keep their options open.

“It’s a tough going when you’re on the back foot – and when you’re trying to sell stuff when you’re on the back foot, the vultures are out.”

Many suppliers in Mid Canterbury are also considering walking away.

“I don’t know anybody from my circle that hasn’t put in their notice,” Leferink said.

He said suppliers have had hard conversations with both management and the board, where the supplier’s position has been made clear.

CAUTION: Synlait says its opening forecast of $8 for the new dairy season is conservative given the volatile global scene.

Synlait opening forecast matches Fonterra’s

Staff reporter NEWS Dairy

SYNLAIT’S opening forecast for the new dairy season is $8/ kg MS.

It said it is taking a conservative approach at the beginning of the season, given the exposure to volatile future global dairy commodity prices. The price matches Fonterra’s mid-point forecast announced on May 29.

Synlait also maintains its forecast for the 2023-2024 season at $7.80/kg MS, it said

“If they want to get their suppliers back, they need to do better than what they do now.”

Leferink said Synlait burned through a lot of trust and goodwill in its supplier base over the past season due to its payout not matching Fonterra’s and the financial struggles that resulted from that.

in a statement on NZX.

“Synlait farmer suppliers have received, on average, $0.28/ kg MS incentives above the base milk price for the last two seasons.

“The company is forecasting to pay similar incentives for the 2023/2024 and 2024/2025 seasons,” it said.

Synlait’s final milk price for the 2023-2024 season will be confirmed when the company’s full-year result is released in September.

The 2024/2025 season forecast will also be updated at the same time.

There is a lot of disappointment among suppliers.

Asked what went wrong with the company, Leferink said: “They built a factory in the wrong place at the wrong time.”

It also underestimated the decline in birth rates in China, which reduced demand for infant formula, he said.

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 News 4 4

Gerald Piddock NEWS Dairy

NO SURPRISE: Ashburton supplier Willy Leferink says news that many suppliers are leaving Synlait is not unexpected.

UN report wary of safety of methane mitigators

Richard Rennie TECHNOLOGY Emissions

Richard Rennie TECHNOLOGY Emissions

AUNITED Nations report has found that gaps exist in understanding the impact of methane mitigators – including red seaweed – on animal and human health, with more knowledge vital before many can be adopted with confidence.

The Food and Agriculture Organisation (FAO) report, Food Safety Implications from the Use of Environmental Inhibitors, drills deep into the key methane and nitrogen inhibitors being researched.

It highlights the strengths and weaknesses of compounds, including their possible toxicity.

One synthetic compound that has had a high profile is bromoform, also found naturally in red seaweed asparagopsis.

The report notes variants of bromoform have been linked to cancer, while bromoform itself could not be classified for its carcinogenic risk due to limited evidence at hand.

In analysing red seaweed, the natural source of bromoform, the report notes in studies of up to 147 days there was no detected bromoform in products

from treated animals. However, it also cautions that the use of bromoform-containing seaweeds needs to be thoroughly assessed, given synthetic bromoform was evaluated as a possible human carcinogen.

It also notes signs of inflammation and abnormalities in rumen cell walls of cows fed asparagopsis.

Dr Steve Meller, CEO of red seaweed mitigation company CH4 Global, told Farmers Weekly that, given the amounts in which his product is supplied to animals, there is no risk associated with it.

“There are no residues in the milk, urine or organs etcetera at the levels we feed it at. It is not an issue,” he said.

In March Australian CSIRO head scientist Dr Chris McSweeney told Farmers Weekly he remains cautious about asparagopsis and bromoform, still subject to scrutiny in terms of bromoform’s residue and longer-term implications for sustained feeding.

Other seaweed types have been highlighted in the report for their toxicity and possible residues in food items, depending upon the particular seaweed. The residues include microplastics, persistent pollutants found in the ocean, and bacterial pathogens alongside major concerns about arsenic, cadmium, iodine and salmonella.

Last month NZ Food Safety deputy-director Vincent Arbuckle responded to concerns raised by CH4 Global about its challenges getting approval in NZ to use red seaweed.

Arbuckle noted the FAO report’s concerns about gaps in knowledge, and potential food safety and trade implications.

“That the CH4 product is ‘natural’ is not central to determining its status as an inhibitor because natural products, just like synthetic products, can have risks associated with them,” he said.

He also pointed out that in Australia, methane inhibitor products do not meet the definition in legislation that would subject them to the Australian equivalent of the NZ Food Safety regulator.

“Therefore, even if the Australian regulator felt inhibitors should be regulated, this cannot occur until there is a legislative change.”

The report, which includes input from New Zealand’s Environmental Protection Authority, notes that most research to date on methane inhibitors has focused on productivity improvements, and less on the impact on nontarget organisms and human consumption of treated food products.

UNCERTAIN: An FAO report is cautious about many possible methane inhibitors including red seaweed, given the carcinogenic risks associated with its active compound, bromoform.

NZ’s own questionable experience with inhibitors is highlighted in the report.

The synthetic nitrogen inhibitor DCD was pulled from the market 10 years ago after small traces were unexpectedly detected in some milk products.

Some synthetic compounds’ toxicity risks have been underscored, including the likes of anthraquinones used in cosmetics, food colouring and medicines but still classified as “possibly carcinogenic” to humans.

The other high-profile methane mitigator, 3-NOP, trade name Bovaer, has not reported any safety concerns for consumers and no issues have been observed in rats.

Australian researchers are trialling the essential oil product

Agolin in conjunction with red seaweed in sheep feeding trials. The report notes that little information is available on essential oil safety in livestock diets.

Arbuckle confirmed there are four applications to NZ Food Safety for urease inhibitors used in nitrogen fertilisers, used to minimise nitrogen losses on application.

No applications have been received by the regulator for methane mitigation trademarked products.

MORE:

Want to share your thoughts on this issue? Text us on 027 226 8553 with the keyword SEAWEED followed by your comments.

Funding packages for 11 catchments announced

Neal Wallace NEWS Conservation

Neal Wallace NEWS Conservation

ELEVEN catchment groups from South Canterbury to Waikato are to receive a share of $7 million in government funding for land management practices.

The money is part of a $36m

package announced in last week’s Budget for catchment groups.

Agriculture Minister Todd McClay said this funding is in addition to MPI’s current investment in 46 catchment-based projects that support 290 groups and over 9000 farmers.

New projects include $2m over four years to catchment groups

across Tairāwhiti, $980,000 over four years to 13 catchment groups within the Manawatū River Catchment Collective and $950,000 over four years for the Ashburton Lakes Catchment Group in conjunction with the Mid Canterbury Catchment Collective.

The nine additional funding allocations are to: Puketoi to

BIGGER CALF GAINS

the Pacific, Manawatū-Whanganui, $650,000; Mackenzie Basin, South Canterbury, $625,000; Upper Waikirikiri, Canterbury, $625,000; Farmers across the Marble Aquifer, Tasman, $475,000; Te Arai River Catchment, Tairawhiti, $400,000; Tairāwhiti Whenua Māori Collective, $200,000; Aotearoa NZ Catchment Communities, $100,000; and

Western Firth Catchment, Waikato, $50,000.

The funding is variously for six months to five years.

Aotearoa NZ Catchment Communities has been formed to represent the country’s catchment groups, helping them share resources, identify opportunities for research and have input into government policy.

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 News 5 Available from quality rural suppliers Ph: 0800 545 545 E: sales@fiber-fresh com W: www fiber-fresh com See us on Facebook

LOWER FEED COSTS Rear calves faster. Save on total feed costs. IMPROVEDFLAVOUR 3 3 3 7 weeks to pasture No weaning check NZ made with local ingredients 5

M A X I M I S E I N C O M E F R O M

YO U R S U R P L U S C A LV E S

T H I S S E A S O N .

We currently have limited spaces available for farmers to sign on for 7 day, 95kg, 8 month and store contracts in the North Island.

W H Y F I R S T L I G H T FA R M S ?

• Guaranteed contracts with proven, long standing market demand.

• Fixed price for all cal ves for entirety of season.

• Confidence in farmers dealing with farmers.

• No commission, no sale yards, no gamble.

For all enquiries contact Adam Mathis on 02753 3 3292 or aamathis@firstlight .farm

6

Miraka posts strong price for new season

Staff

MIRAKA will pay its farmers a base price of $8.25/kg milk solids for the 20242025 season.

That amount could lift to $8.42/kg MS if farmers earn premiums under Te Ara Miraka, the company’s farming excellence programme.

Miraka CEO Karl Gradon said that following a tough season on farm, it is pleased to get in behind farmers for the season ahead with a strong milk price.

“We’re committed to doing our

part to pay the best milk price to the best people and farms.”

Te Ara Miraka rewards farmers for achieving high standards of sustainability, people development, animal welfare and milk quality.

“Under Te Ara Miraka, our suppliers can earn an additional premium of up to $0.20/ kg MS on top of our milk price. Since our establishment in 2010, Miraka has paid more than $21 million in premiums to our loyal farmer suppliers.”

Miraka GM of on-farm excellence

Chad Hoggard said the company’s 2024/25 milk price will be well received by its dairy farmers and that he is also proud of

We’re committed to doing our part to pay the best milk price to the best people and farms.

Karl Gradon Miraka

farmer performance, which has consistently improved over the past three seasons under Te Ara Miraka.

“Our farmers work hard to achieve high standards and it’s also pleasing when we can deliver a stronger milk price for the new season.

“Our farmers are more than just business relationships to Miraka –they’re people who become part of our whānau and their kaitiakitanga values align with ours.

“We have worked closely together to refine Te Ara Miraka to ensure we’re continuously improving.”

Aus opening prices down the $8 line

MOST of Australia’s 12 dairy companies have announced the new season’s opening milk prices at around $8/kg milksolids except for one specialised cooperative opting to pay about 50% more.

Norco has opened with $12.35, similar to last season, for 280 farmer-suppliers on the north coast of New South Wales and in southern Queensland.

Traditionally Norco leads the way in NSW as Tatua Co-operative does in Waikato, New Zealand, but it is also bouncing back from record-level floods in 2022 that shut its Lismore plant for 18 months.

In the floods of February 2022 it also lost two rural stores and a feed mill, and the head office was inundated.

Norco produces fresh milk and ice cream in Byron Bay and Lismore.

The other Australian national and regional dairy companies that announced opening milk prices to apply from July 1 included Fonterra, Saputo, Bega, ADFC, Bulla, ACM, Kye Valley, Burra and Frestine.

Two-thirds of our milk pool is impacted directly or indirectly by global commodity prices, so we need to understand where they might go over the next 12 months.

Pete Findlay Bega

The range of forecasts has been from $7.20 to $8.70, with a strong resemblance to Fonterra in NZ, which declared $7.25 to $8.25, not allowing for the small currency difference.

There are also regional differences between the major dairy farming zones in Australia, plus some seasonal variation based on historical weather patterns.

SAPUTO: Canadian company Saputo announced a milk price range of $8 to $8.15 across all five Australian regions where it has collections.

Most Australian companies pay on the basis of their domestic dairy products, including home brands, not the export prices.

There are 4000 farms producing around 8.3 billion litres annually, or about 700 million kg milksolids, for an average milk revenue per farm of $1.4 million.

On the south coast of NSW, Bega chief executive Pete Findlay said export conditions are increasingly variable.

“Two-thirds of our milk pool is impacted directly or indirectly by global commodity prices, so we need to understand where they might go over the next 12 months.”

Listed company Bega has strong cheese brands along with liquid

milks, foodservice products and non-dairy foods and annual revenue in excess of $3 billion.

The Chinese-owned Burra Foods company in Victoria’s Gippsland commented on the changing international markets and the need for flexibility.

“Sharing our product mix, markets, strategic focus and ongoing investment programme is important to ensure our milk supply partners feel connected and confident in the future of our business,” chief executive Stewart Carson said.

Canadian company Saputo announced a milk price range of $8 to $8.15 across all five Australian regions where it has collections.

Milk supply and planning director Kate Ryan said the price reflects the softer international milk market.

“Our opening milk price factors in ongoing global market volatility due to subdued demand, as well as greater variability in domestic markets and anticipated market returns,” she said.

Fonterra Oceania managing director Rene Dedoncker said weaker global cheese prices and increasing milk supply in Australia contributed to his opening price average of $8.

A year ago there was a bidding war between processors for supply contracts from farmers but conditions have changed, he said.

GDT prices leap into new dairy season

Staff reporter

GLOBAL Dairy Trade began the New Zealand 2024-25 dairy season with a strong auction for milk powder sales from a wide distribution of buyers.

The GDT index rose 1.7%, which was the third consecutive GDT lift, helped by skim milk powder up 3% and whole milk powder up 1.7%.

Six of the seven commodities offered rose in price, including buttermilk powder, up 10.4%, butter, up 1.7%, anhydrous milk fat, up 0.9% and cheddar, up 0.2%.

Lactose was the only fall, down 1.9%.

The milkfat products continue their recent strength, with AMF now setting a new record at US$7417/tonne and butter $6864, very close to its recent record high of $7000 in early-2022.

AMF is now 58% higher than a year ago and butter is 28% higher.

NZX dairy analyst Rosalind Crickett said the futures market had been expecting higher prices for milk powders and lower for milkfats, so was therefore half right.

“The milkfat group face short-term supply constraints so, all things considered, the GDT results are in line with our expectations.”

WMP buying strength was in southeast Asia and Oceania and the SMP demand was from Europe.

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 News 7 You Matter, Let ’s Natter Know someone having a tough time? Make time to listen. Sam Whitelock Farmstrong Ambassador For tips and ideas , visit farmstrong.co.nz 7

MARKETS Dairy

reporter NEWS Dairy

SUPPORT: Miraka CEO Karl Gradon says the company is pleased to get in behind farmers for the season ahead with a strong milk price for the new milking season.

Hugh Stringleman MARKETS Dairy

Pricier Angus bulls add spice to sales

Hugh Stringleman MARKETS Livestock

Hugh Stringleman MARKETS Livestock

SOME higher prices were paid for Angus two-year bulls in week three of the 2024 sale season, led by the Sherson family at Shian Angus, Taumarunui, with $75,000.

Shian 22-T635 was bought by Tangihau Angus, under management by Dean McHardy near Gisborne.

T635 was sired by Taimate Mako out of one of Shian’s best breeding cows and has excellent scanning results for eye muscle area, fat cover and intramuscular fat.

Shian stud sold 33 bulls out of 35, including Lot 1 for $18,000 to Ratanui Angus, and the top prices helped boost the average to $11,333, which compared very well to last year’s $7378.

Kayjay Angus at Masterton, owned by the Kjestrup family, had a very good sale with a complete clearance of 40 bulls, a top of $29,000 for Kayjay Bomb Squad T624, followed by $26,000 and $24,000 sales.

Their average was the season-todate high of $11,675, steady on the 2023 achievement.

The Hallmark Angus sale for Max Tweedie, at Tutira, Hawke’s Bay, had a top price of $36,000

paid for Hallmark McPenn T023 by Okaka Angus, Taihape.

Hallmark sold 48 of 49 and had an average price of $8708.

Black Ridge Angus, Taumarunui, sold Lot 3, T046, for $18,000 to a commercial buyer. Black Ridge sold 25 from 32 and averaged $7820.

Wairere Angus at Hāwera had its final bull sale on dispersal of the stud and sold 16 of 18, with a top price of $11,000 paid twice and an average of $7250.

Hingaia Angus, Te Awamutu, had a top price of $16,000 for Hingaia 22169, paid by a commercial buyer, and sold 26 of 29 bulls, averaging $7730.

Dandaloo Angus, Masterton, had a full clearance of 31, averaging $7675, and the top price was $15,500 for Dandaloo Sky 2057.

Near neighbour Tapiri Angus had a top price of $11,000, paid three times, and also had a full clearance of 20, averaging $8170.

Puke-Nui Angus, Taumarunui, sold all 25 bulls and averaged $6880. The top was $13,000, paid for Tyrant T913.

Waikaka Herefords, Southland, for its 50th sale, had a top price of $17,500 paid for Waikaka Redford 2209 and paid by Beechwood Herefords.

The average was $7363 for 11 sold from 21.

Okawa Herefords, Mt Somers,

Shian T635 has excellent scanning results for eye muscle area, fat cover and intramuscular fat.

had a top price of $15,000 paid by Limehills Herefords and there were a further four stud transfers.

The Okawa average was $7665 and it sold 35 of 48 bulls.

Otapawa Heerefords, Eketahuna, sold 33 of 35 bulls offered and averaged $7975.

Two bulls were stud transfers, Lots 5 and 18 to Ashby Herefords.

Top price was $13,500 and another bull made $13,000.

Kairuru Herefords, Reporoa, sold 13 of 25 two-year-olds offered and averaged $6115.

Top price was $9000 paid twice.

The four yearling bulls averaged $7475 and had a top of $10,200.

Ngakouka Herefords, Dannevirke, had a top of $15,000 paid by Monymusk Herefords and the sale average was $7600 for 13 out of 20.

Glenbrae Herefords, Porangahau, had a top price of $8000 for

OUTSTANDING:

Shian T635 sold for $75,000 to Tangihau station, Gisborne, the bull season’s highest price to date.

Glenbrae Tux 22112, and averaged $5700 for 16 sold of 22.

Orari Gorge Hereford, Geraldine, had a top price of $18,500 paid for Orari Winston 220083.

Storth Oaks Angus, Otorohanga had $18,5000 paid twice, once by Lomond Angus for stud transfer on Lot 30 Storth Oaks T 57. The average was $7788 across 60 bulls sold from 85 offered.

Merchiston Angus, Marton, sold 27 out of 28 and averaged $7962, with a top of $14,000 paid for Merchiston Goalkeeper T143, bought by Norbury Farms, a commercial buyer.

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 News 8 Stepping beyond the numbers MORE THAN ACCOUNTANTS BDO New Zealand L mited a New Zealand l mited l abil ty company is a member of BDO International Lim ted a UK company lim ted by guarantee and forms part of the internat onal BDO network of independent member firms BDO New Zealand is a national association of independent member firms wh ch operate as separate lega entities BDO Agribusiness Your boots’n all partner for accounting , tax , audit and business advisory services As farmers, you face change and challenges aplenty At BDO New Zealand, we can help you navigate these and ensure your business is operating efficiently, sustainability, and profitably With the largest agribusiness accounting network in the country and extensive knowledge of farm systems, we’ll work with you to help reach your goals. IDEAS | PEOPLE | TRUST SCAN HERE FOR MORE BDO.NZ/AGRIBUSINESS 8

Rates, premiums will erode inflation relief

Neal Wallace NEWS Finance

Neal Wallace NEWS Finance

HIGH interest rate costs that pushed farm inflation to a record 16.3% last year are expected to ease slightly this year – but much of that relief will be eroded by rising insurance and local body rates.

At 16.3% in the year to March 2023, onfarm inflation was the highest since 1981, surpassing the previous year’s 10.2%, which was in itself historically high.

Inflation is running at about 4% and the official cash rate at 5.5%. A study for Local Government NZ indicates average local government rate rises of 15% this year.

DairyNZ’s Econ Tracker indicates insurance premiums have increased about a third in five years.

Federated Farmers president Wayne Langford said on top of inflation, many hill country sheep and beef farmers have been battling drought and low product prices.

“Local councils putting their hands out for double digit rate rises is just ridiculous right now,” he said.

“We understand costs have gone up for them too but they need to cut their cloth as every dollar counts on farm right now.”

Like many farmers, Langford has been reviewing his budget looking for savings.

“Planning helps ease the mind, don’t be shy to ask for a bit of help. Sometimes a fresh set of eyes or a good yarn about things may be just what you need.”

Econ Tracker notes that on average 80% of farm term debt is on floating interest rates and these rates have increased markedly in the years up to 2023.

It calculates interest costs for an average dairy farm in 2018-19 were $187,182, peaking at $260,021 in 2023-24 but easing to $246,416 in 2024-25.

Over that same period interest rate costs rose 86.5%, feed and grazing 14.8% and fertiliser, lime and seed 14% – which followed a 23% rise the previous year.

Weighted as a portion of the 16.32% rise in on-farm inflation, rises in interest equated to 9.43%, fertiliser 2.53%, feed and grazing 1.11%, insurance 0.2% and rates 0.12%.

Econ Tracker has calculated insurance costs for an average dairy farm were $13,904 in 2018-19 and $21,481 in 202425, while local government rates for those same years were $16,852 and $20,633.

Beef + Lamb NZ forecasts an average $62,600 profit before tax per farm for 202324, which said would be the lowest farm profit since 2007-08.

DairyNZ calculates the national breakeven farmgate milk price for 2023-24

is $7.75 kg/MS and $7.76 kg/MS for the 2024/25 season.

Fonterra has announced its current season forecast farmgate milk price midpoint of $7.80 kg/MS and an opening forecast milk price for 2024/25 season of $7.25-$8.75 kg/MS with a mid-point of $8 kg/MS.

The Local Government NZ (LGNZ) forecast 15% rate increase this year is based on research of 48 draft long-term plans.

Average rates rose 5.7% a year from 20022022 and 9.8% in 2023.

LGNZ vice-president Campbell Barry said in the past three years the cost of building bridges has increased 38%, sewage systems 30% and roads and water supply systems 27%.

“Councils’ share of overall tax revenue has remained at 2% of GDP for the last 50 years, despite our ever-increasing responsibilities,” said Barry.

He said funding for local government is broken, with rates accounting for more than half council funding.

The impact of the Auckland Anniversary Weekend and Cyclone Gabrielle weather events has seen a reassessment of NZ by reinsurers and had an impact on premiums.

Kris Faafoi Insurance Council of NZ

“We need a range of levers to address the funding and financing challenges in front of us such as an accommodation levy, GST sharing on new builds, congestion charging and tourist levies.”

Insurance Council of NZ chief executive Kris Faafoi acknowledged the impact of a rise in premiums, which is due to inflation and rising global reinsurance costs.

“The impact of the Auckland Anniversary Weekend and Cyclone Gabrielle weather events has seen a reassessment of NZ by reinsurers and had an impact on premiums, which also happened after other large-scale natural disasters such as the Christchurch earthquakes and Kaikoura earthquakes.”

Faafoi said pressure on premiums is starting to ease and the council is working through the Fire and Emergency New Zealand levy process to ensure proposed levy increases do not add unnecessary costs.

Faafoi said the council agrees with the Reserve Bank that central government, councils and others must work together to invest in measures such as flood protection to help reduce risk and ensure insurance is affordable and available in the future.

FIRE: Insurance Council of NZ chief executive

Kris Faafoi says pressure on premiums is starting to ease and the council is working through the Fire and Emergency New Zealand levy process to ensure proposed levy increases do not add unnecessary costs.

10 News 10

Gabrielle bites into apple and pear hectares

THE area planted to apples in 2023/2024 will be substantially lower than before Cyclone Gabrielle, according to a report published this month by the Foreign Agricultural Service of the United States Department of Agriculture based in Wellington.

The report says the floodwaters from Cyclone Gabrielle are to blame for the fact that “New Zealand’s apple planted area in the 2023/2024 market year is forecast to be 9200 hectares, a substantial drop from 11,000ha at the start of the 2022/2023 market year ”.

The report says 510,000 tonnes were harvested in 2021/2022 from commercial orchards, with that dropping to 440,000t in 2022/2023. However, a post-cyclone recovery was predicted, with 10,300ha harvested in 2021/2022, 8900ha harvested in 2022/2023, and a predicted 9200ha to be harvested in 2023/2024.

Recovery is imminent as “New Zealand remains at an advantage by having a counter seasonal production to other countries; as a result, market demand will continue to stay strong”. According to the report, as a

result of the drop in production, more apples will be imported this season, with 300t of apples predicted to be imported, versus 157t of imports at the close of 2022/2023.

“Growers in the Hawke’s Bay and Gisborne regions are undergoing the decision process to salvage or repair damaged orchards. The estimated cost of reinstating apple and pear orchards is significant, between $180,000 to $250,000 per hectare for trees and planting, support structures, irrigation systems, and ground preparation.

“The lead time to obtain apple tree stock can be two to three years, with a further lead time before trees reach maturity.”

The report says to reinstate orchards, growers will have to borrow money, but this is a challenge as debt servicing levels are increasing.

The report cites the Reserve Bank of New Zealand as saying “the nation’s total bank loans to horticulture operations were $7.9 billion as of February 2024.

Since 2017, the total value of loans to horticultural growers has increased at a compounding annual growth rate of 11.5% per year, compared to dairy, livestock, and grain farmer loans combined, which have decreased at a CAGR of -0.6% per year.”

New Zealand Apples and Pears

CEO Karen Morrish said the hectares in the report do not align with the data New Zealand Apples and Pears has.

Morrish put the loss of hectares due to Cyclone Gabrielle at 610ha, almost half of the USDA estimate.

“Export volumes were estimated to be approximately 380,000t in January this year. An estimate review is underway. While the crop this year is excellent in fruit quality and colour, we expect

volumes to be down on this original estimate,” Morrish said.

She also predicted a bounce-back.

“The 2023 spring, which led to the current export crop, consisted of warm dry days and cool nights, growing excellent fruit,” she said.

A spokesperson for the Ministry for Primary Industries said the figures used by the USDA represent both apple and pear plantings.

The MPI does not forecast these

Updated forecasts for apple and pear plantings will be available in the MPI’s June 2024 Situation and Outlook for Primary Industries report.

Spokesperson Ministry for Primary Industries

separately, the spokesperson said.

The spokesperson said the USDA figures were drawn from the June 2023 Situation and Outlook for Primary Industries report, which was prepared soon after Cyclone Gabrielle based on the best available information and impact assessments at the time.

Updated forecasts for apple and pear plantings will be available in the MPI’s June 2024 SOPI, which will be released on June 13 at Fieldays, he said.

The lower hectares come off the back of concerns in the apple industry that apple sizes were small this season, also as a result of Cyclone Gabrielle and tree root damage.

This is a marketing concern as New Zealand tries to distinguish itself from other apple producing countries that sell smaller apples as commodities, by growing large apples.

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 News 11 11

Gerhard Uys NEWS Horticulture

DISCREPANCY: Apple and pear hectares are down after Cyclone Gabrielle devastated orchards, but there is no consensus on the exact amount as New Zealand Apples and Pears CEO Karen Morrish says estimates in a USDA report this month do not match their data.

Funding meets only part of rural need

THE mayor of floodravaged Wairoa District, Craig Little, says he is not popping any Champagne corks in light of the Budget’s funding allocation for repairing storm-damaged district road networks.

Alongside $21 billion allocated for roads of national significance, the Budget also included $940 million specifically for repairing roads hit hard by the extreme weather events last year, particularly along the North Island’s east coast.

Little said there are a few disappointments in the Budget’s funding announcements, not least of which is no funding for the Waikare Gorge realignment project.

The project was to see a new 160 metre bridge and a 4km road realignment near Putorino.

Consent for the project was publicly notified in February with an estimated cost of about $250m. It would have included one of the highest road bridges in NZ.

“This will prove very

disappointing to people here, and throughout the greater Hawke’s Bay,” Little said.

He also challenged the $250m estimate for a job that had multiplied many times in a few short years.

But Little said the Budget has failed rural communities in other areas as well, with its lack of funding commitment to baseline services like aged care and mental health, where, he said, problems are out of control.

We want people to live in rural areas like Wairoa, but why would you when it is taking another hour longer to get to the rest of Hawke’s Bay?

Craig Little Wairoa District mayor

“We want people to live in rural areas like Wairoa, but why would you when it is taking another hour longer to get to the rest of Hawke’s Bay? People are asking themselves ‘Why put ourselves through this?’ and moving away.”

He noted that so far, the only

funding for roading repairs has come from the previous government to the tune of $40m, and his district is grappling with a $200m bill it has no way of meeting itself.

Post Gabrielle, the council borrowed $8m to respond to immediate repair needs, but with only 4000 households in its ratepayer catchment Wairoa is unable to raise anywhere near the amount required.

“We already get 75% funding assistance from NZTA but even if we got 95%, we would struggle for the other 5%.”

Central Hawke’s Bay mayor Alex Walker said the unfunded price tag of $700m remaining for local road repairs is a burden the region’s ratepayers cannot face alone. She said restoring vital marketto-gate transport connections to support the region’s primary sector is key to reviving the local economy.

“Specifically, we asked for a combination of enhanced funding rates and bespoke additional funding assistance that would see central government cover the cost of most of the remaining roading repairs, with the balance to be funded through council rates.

“This would see us get our primary sector and overall economy back

LIMITED: Wairoa District mayor Craig Little says funds for roading are welcome, but a major project has been dropped for his district, and other services are crumbling from severe underspending, including aged care and mental health.

on its feet sooner and reposition Hawke’s Bay as a critical player in helping this government with its goal of doubling the value of exports in the next 10 years.”

Both mayors are taking a waitand-see approach on where the funding allocation will fall.

In Gisborne, Federated Farmers meat and wool chair Toby Williams said the roading allocation was welcome, but whatever portion Gisborne received of it would barely restore roads to where they were prior to last year.

“It will not be enough to ensure we are better connected, and as a region are capable of growing and adding wealth to our forest and farming production. Government has said it wants to double our exports over 10 years, but how can you do that when primary production regions are struggling with things like roading and access?”

His fear was Te Tairawhiti would see another generation of young people condemned to living in a

region incapable of attracting high value processing companies that bring good job opportunities.

“We only have a few years before alot of the forestry timber here has to have something done with it before the trees get too big, and shipping it out if raw form is not profitable.”

While the Budget funding is intended for the storm-damaged east coast North Island road network, much also still remains to be done in Marlborough after earlier events.

Marlborough District Council is still picking through a $230m bill for its damaged network, of which half is to be paid by ratepayers. The vital Kenepuru road link up the Sounds is estimated at $90m alone, while French Pass road repairs area further $26m.

Between Wairoa, Gisborne, Hawke’s Bay and Marlborough, the total repair bill to restore district roading networks is estimated to be about $1.4bn.

Science left skint by Budget

Richard Rennie NEWS Research

Richard Rennie NEWS Research

TOP scientists have been left deflated by a Budget they say only perpetuates decades of scientific under-investment in New Zealand.

in research and development are likely to come true.

In April he highlighted in Farmers Weekly that NZ was already well below the OECD average of 2.73% spend as a percentage of GDP, at 1.47%.

Other than a funding increase for geological hazards, this year’s Budget left the scientific community out in the cold. Cuts of nearly $370 million in operating budgets were made, and over $500m sliced off capital costs from the science, innovation, and tech portfolios over the next five years.

Troy Baisden, co-president of the NZ Association of Scientists, described the Budget as a “nothing-burger” for science, with no bailouts for areas of national importance that had been supported by the National Science Challenges, whose funding is due to end this month.

The primary sector’s research capacity has also been hit.

The loss of funding for the National Science Challenge funds is likely to push this country nearer to 1.37%, in line with the likes of Lithuania and Turkey.

He is hoping for a rollover of funding, at least until the National Science Committee headed up by Sir Peter Gluckman can determine the future funding pathways for NZ scientific research.

“That would at least give the scientists we have a level of stability. There is a risk the ones we have had are made redundant and go elsewhere. You don’t just click your fingers to get new scientists here, it takes 10-15 years for them to be fully trained in areas like ruminant nutrition.”

“Given the composition of the coalition, farmers might have hoped for some new research, but if there is I can’t spot it.

“Instead, the Ministry for Primary Industries is cutting about $4.6m a year from its Sustainable Land Management and Climate Change Research in coming years, a total cut of $13.6m over three years.”

He said there is now a distinct flatlining in scientific spend after a period prior to covid when funding enjoyed a growth rate of 24% between 2012 and 2019.

Professor Jon Hickford of Lincoln University shared Baisden’s dismay at the absence of any funding impetus. He said his fears of New Zealand slipping further down the OECD rankings for investment

He is concerned that some practical, value-added research in the pastural sector may grind to a halt. This includes work being done to better integrate quality beef genetics into the dairy herd, dealing with problematic bobby calves and providing a more sustained source of beef for processing plants.

Baisden said pressure is on Sir Peter to make a case for reform to help science rebuild its mojo.

“The groups will need to provide vision and hope for science and technology to address our biggest challenges with effective strategies in areas such as primary industries, and coping with climate change and hazards. Peer nations are investing more, and we should as well.”

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 News 12 2 TRO4235 ZAPP PROMO 24 [190h x 129w] $30 indd 1 8/4/2024 4:10 pm 12

Richard Rennie NEWS Budget

13

From the Editor

Something’s got to give

Neal Wallace Senior reporter

Neal Wallace Senior reporter

in the Red Sea causing ships to divert.

This sent prices soaring for herbicides, insecticides, fungicides and fertiliser, where prices have more than doubled.

While prices have since fallen, concerningly they are higher than 2022 with the consensus that these prices are the new normal.

For the past 40 years inflation had largely been under control.

little sign local government is doing the same.

There has been little evidence that functions have been cut or services pruned. In fact, it is business as usual, with Farmers Weekly reporting a Local Government NZ survey showing average rate rises this year of a whopping 15%.

Letters of the week

GE shift is brand suicide

Craig Smith Hawke’s Bay

HAVING lived in our beautiful country for almost 70 years, I’ve seen a huge amount of change, especially in the way of computer technology, but also in the way of human behaviour.

Our kids can ask Google any question and within reason they can find some pretty good information in minutes! We can buy livestock from the other end of the country sitting in front of a computer in our lounge! Amazing!

In hindsight, though, a lot of this “progress” has proven to be a mistake – and unfortunately no one seems to realise until it’s too late. (We didn’t have children ram raiding jewellery stores in the ’70s).

Our bureaucrats and politicians don’t seem to want to face up to the reality of a balls-up and do something about it, though. How is it that in a civil defence emergency where people are looting, police and army are so constrained by regulations that they can’t be armed to control the thugs?

We have so much “health and safety” on our roads now that we won’t be able to afford to build decent highways in the future, due to the increased costs. Now we have a government that is going to open our country to genetically modified plants and organisms. We’ve heard a bit about this with all the spin from the scientists, but I’m positive that this is not

Farmers Weekly is published by GlobalHQ, PO Box 529, Feilding 4740. New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

EDITOR

IT IS not news that several years of rampant farm inflation have been devastating farm businesses.

ADVERTISING

Bryan Gibson 06 323 1519

bryan.gibson@globalhq.co.nz

EDITORIAL

Carmelita Mentor-Fredericks editorial@globalhq.co.nz

Neal Wallace 03 474 9240 neal.wallace@globalhq.co.nz

As we report this week, farmers are caught in a pincer movement – high and rising costs on one side and, on the other, extremely low prices or, in the case of dairy, prices that are hardly provoking raucous cheering.

Colin Williscroft 027 298 6127 colin.williscroft@globalhq.co.nz

Annette Scott 021 908 400 annette.scott@globalhq.co.nz

Hugh Stringleman 09 432 8594 hugh.stringleman@globalhq.co.nz

After it peaked at 18.4% in 1980, Roger Douglas, the prime minister David Lange’s finance minister, charged the Reserve Bank governor with maintaining inflation within a 1-3% band.

Andy Whitson 027 626 2269

New Media & Business Development Lead andy.whitson@globalhq.co.nz

Steve McLaren 027 205 1456

But the gate has been opened since covid, with accusations that Reserve Bank Governor Adrian Orr overstimulated the economy, which unleashed a tsunami of price rises.

Auckland/Northland Partnership Manager steve.mclaren@globalhq.co.nz

Jody Anderson 027 474 6094

At 16.3% in the year to March 2023, onfarm inflation was higher than the 10.2% inflation the previous year, which in itself was a 40-year peak.

Gerald Piddock 027 486 8346 gerald.piddock@globalhq.co.nz

Richard Rennie 07 552 6176 richard.rennie@globalhq.co.nz

Waikato/Bay of Plenty Partnership Manager jody.anderson@globalhq.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Debbie Brown 06 323 0765

If there is a silver lining, it may actually drive a review of the way rates are set because the current cost-plus formula is no longer fit for purpose.

Noticeboard/Word Only/Primary Pathways classifieds@globalhq.co.nz

Grant Marshall 027 887 5568

Real Estate Partnership Manager realestate@globalhq.co.nz

Farmers have subsequently been doubly hit by high interest rate costs as the Reserve Bank keeps them elevated to control inflation.

Donna Hirst 027 474 6095

The 2023 rate was the highest on-farm inflation since 1981, driven mostly by interest rate costs, which rose 86.5% in the year to March 2023.

Nigel Stirling 021 136 5570 nigel.g.stirling@gmail.com

PUBLISHER

While councils face rising costs and costly infrastructure repairs, squeezed ratepayers deserve tangible evidence that our councils are being prudent.

Andrea Mansfield 027 446 6002 Salesforce director andrea.mansfield@globalhq.co.nz

PRODUCTION

On average, 80% of farm term debt is on floating interest rates.

Lower North Island/international Partnership Manager donna.hirst@globalhq.co.nz

Grant Marshall 027 887 5568

South Island and AgriHQ Partnership Manager grant.marshall@globalhq.co.nz

Inflation was more than double the consumer price inflation rate of 6.7%.

Dean Williamson 027 323 9407 dean.williamson@globalhq.co.nz

Forecasts are mixed. Farm inflation is picked at 5-6% in the coming year, but interest rates could remain at close to current levels for the rest of this year and into 2025.

Javier Roca 06 323 0761

It also reflects the sector’s exposure to international suppliers and supply chain disruption such as from the military tension

Livestock Partnership Manager 027 602 4925 livestock@globalhq.co.nz

Farmers are unhappy with the inequities of being charged for services they cannot access, such as public transport, but so too are councils, who rely on half their income from rates.

Lana Kieselbach 027 739 4295 production@globalhq.co.nz

Advertising material adcopy@globalhq.co.nz

Their share of the overall tax revenue has remained at 2% of GDP for the past 50 years despite increasing responsibilities.

SUBSCRIPTIONS 0800 85 25 80 subs@globalhq.co.nz

A logical response to these pressures is for businesses to look at all their costs and while the central government is asking its departments to do just that, there is

Printed by Ovato NZ Ltd Delivered by Reach Media Ltd

If there is a silver lining to this era of financial difficulty, it may actually drive a review of the role of councils and the way rates are set because the current cost-plus formula is no longer fit for purpose.

handypiece

■ Ideal for shearing sheep, alpacas, goats and cow tails

■ Variable speed from 2600-3500rpm

■ Latest brushless motor technology means minimal heat build up

■ 1400gms means 100-200gms lighter than standard handpiece

■ At 2800rpm the 12v lithium battery will crutch 300-400 sheep or trim up to 400-500 cows tails

■ Tough alloy switch box with auto reset fuse for overload or lockup – clips to belt View in action go to www.handypiece.co.nz

Free

0800 474 327 powerWorldsmost lvariable speed herepowerlvariable FIELD DAYS SPECIAL Receive a 10 & 6 amp lithium battery set LK0118571© Call us now for FREE freight to your door 14 Editorial

Email: dave@handypiece.co.nz

call

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 Opinion 14

Continued next page Best letter WINS a quality Victorinox Hiker Knife Send your letter to the Editor at Farmers Weekly P.0. Box 529, Feilding or email us at farmers.weekly@agrihq.co.nz of theWeek Letter

Best letter each week wins a quality Victorinox Hiker knife WRITE TO The Editor, Farmers Weekly P.O. Box 529, Feilding EMAIL farmers.weekly@globalhq.co.nz • FAX 06 323 7101 So go on! Stick the knife in

LK0107425©

In my view ...

Fonterra is out to sell its golden goose

Lloyd Downing

Downing is a dairy farmer and Fonterra shareholder-supplier near Morrinsville

FONTERRA’S decision in its strategic review to divest some or all of its consumer brands is in effect selling its golden goose.

It is short sighted and flies in the face of the work the cooperative has done over the years to build up its social licence.

In many ways, Fonterra has only itself to blame with this decision because it has under-invested in those brands for so long.

While it’s true that Fonterra lacks the scale required for the level of investment needed, the best global brands are long-term projects and selling them off now is short term thinking.

We mined the Tip Top brand for all it was worth and yes, we got a substantial payout with $380 million – but at what cost?

You have to take a long-term, multi-generational vision with brands because their accumulated wealth will always beat any oneoff payment if they are sold.

I don’t blame those farmers who support the strategy change. The prospect of a sizable cash payout if the brands are sold is an

Letters of the week

Continued from previous page

a good thing for our beautiful country. No one advertises the failures within GM development, but they are out there if you’re interested in looking. Once it’s here our clean green image is gone.

I can’t speak for everyone, but I’m certainly not interested in eating GM material, nor anything that has consumed it, and statistically, I’m in the majority. Who actually wants Frankenstein Food in their diet? Isn’t NZ still a democracy, where the majority is listened to?

Currently our food exporters have to sign a document confirming that their products have not come in contact with any GM organisms, before certain countries will take their produce. How’s that going to work when GM is here? Fonterra advertises its milk products overseas as being GMO free. It’s a great point of difference when marketing our food.

The consumer wants GE free food! We are a little country at the bottom of the planet whose carbon footprint, with regard to getting

enormous carrot being dangled in front of you, but the smart ones will look beyond that short-term gain and what it will mean for Fonterra down the track.

Fonterra CEO Miles Hurrell loves to talk about social licence, but what sort of licence do we have if we don’t have any iconic New Zealand brands that farmers worked hard create?

We are always talking about value added – and now we’re getting rid of that.

The rhetoric about wanting to preserve Fonterra for future generations is starting to ring very hollow.

They are changing their strategy to suit their vision of a co-op structure rather than changing the structure to fit their strategy – which includes running these consumer brands.

Like we strive to do on our farms, we need to leave the co-op in a better position than when we started.

I have seen farmers build it, and now in the past few years I have seen farmers pull it down, mainly because they can’t or don’t want to understand what they are doing.

You invest in Fonterra the co-operative to get your milk off the farm, create products for

our product to other countries, is an issue. The best way to market our product is to continually remind our consumers that we are natural, grass fed, GM free, and we want to provide you with excellent nutritious food.

Please can we stop this financial suicide!

This ain’t

Texas (woo)

Paul Davey Canterbury

THANK you for printing Ben Anderson’s column, “Learning to steer the brand, Texas style”, (May 13).

We need to be exposed to this brand of defeatist oligarchism and see it for what it is.

Ben chooses to contrast smaller farms with the corporate or semi-corporate farm operators. Of course there is contrast, but emphasising the dichotomy for Ben’s implicit purpose is an unhelpful antithesis.

The argument seems analogous to the error of concluding that correlation must equal causation.

Some scale is essential for efficiency, and co-operation substituting corporation may

You have to take a long-term, multigenerational vision with brands because their accumulated wealth will always beat any one-off payment if they are sold.

foodservice or remove its water for ingredients, sell it and get some money from your milk every month.

When the divestment takes place – and I think it will because the feeling I get from the board is that it’s a done deal – the co-operative must put the right structure in place.

That structure is to create something similar to the one more recently mooted by Farmers Weekly columnist Keith Woodford and others, but also floated by

sometimes be necessary for competitive survival.

But real challenges lie in our small New Zealand economy relying on a tiny marketplace to self-regulate the monopolies and oligopolies (like the banks, the oil companies, big pharma and machinery manufacturers) and the slowness of we NZ farmers to see what the issues and opportunities are and take the appropriate remedial/initiative steps.

Examples abound, too, of how our regulators, for example, are misdirected and stymie initiative.

The family farm will die, as we know it, if we all roll over and surrender. I, for one, am much more attracted to the reality of wanting our family-like farm to continue as a profitable, welfare-positive (that is, for staff, stock, environment, suppliers and customers), independent operation, and will work harder, and hopefully smarter (with collaborators of course) to do our best to see that it is successful (so help me God, I hasten to add with reverence).

By the way, I like Americans too, and have nothing against the Vollemans of this world, but let’s be assured that theirs is not the only right or successful model. Ben’s portrait of NZ’s rural future chills rather than excites.

some in the industry in the leadup to Fonterra’s creation back in the late 1990s.

It would see Fonterra split into two companies. The first would be 100% owned by farmers and would centre on milk collection and processing into either powders or products for foodservice such as cheese and creams.

For farmers, having a strippeddown co-operative would see them getting profits from the milk price and dividend.

The second company would centre on driving consumer brands with its milk, supplied initially from Fonterra. Its keystone shareholder would be a food company that can bring the expertise to drive value in those brands in the international market. Nestlé, Danone, Friesland Campina and Arla Foods are the type of companies that could be interested in such a role.

A Fonterra option

Chris Kaelin

Te Awamutu

NO DOUBT Fonterra has looked at the option of splitting the company to create a new company for its brands, retaining a 51% or maybe

STILL OURS:

Lloyd Downing says Fonterra’s consumer brands could be split off into a separate company that is still majority owned by New Zealanders.

New Zealanders – either as private citizens or as companies – would make up the rest of the shareholding but would retain a majority. This company would be listed on the stock exchange while shares in the other company would be nominal.

Having such a company structure would achieve two things: it would keep these brands in Kiwi hands and thus retain that social licence, while providing a means of injecting the necessary capital and knowledge from the keystone shareholder to drive value from those brands.

New Zealand farmers may be great at turning grass to milk, but do not have the business sense to run a multibillion-dollar company centred on marketing consumer products.

This structure would allow them to grow these brands without sacrificing the family silver.

40% shareholding and listing it on the stock exchange as a public company.

This company would focus solely on building those brands.

Having been part of the dairy industry through the 1980s, getting paid for not producing milk, and seeing what the industry has become today, it’s a shame to see valuable New Zealand assets sold to an overseas investor.

Do you know someone who deserves a story in Farmers Weekly?

Why not write it yourself?

We’re keen to hear local stories about the innovators, inspirations and characters that keep our communities ticking over. Farmers tell the best stories and we want to hear yours. yourstory@agrihq.co.nz

15 In My View

FARMERS WEEKLY – farmersweekly.co.nz – June 10, 2024 Opinion 15

Budget scythe cuts too sweeping a path

Alternative view

Semi-retired Wairarapa farmer and businessman: dath.emerson@gmail.com

LAST week’s Budget was an interesting document. Predictably, there are issues I agree with and some I don’t.

Starting with cuts to the government sector: while I totally support cuts and rationalisation, I don’t support a one-size-fits-all approach.

Asking for a 6.5% to 7.5% across the board doesn’t spin my wheels.

For example, I would have absolutely no doubt that in three organisations, the Ministry of Business, Innovation and Employment, (MBIE), the New Zealand Transport Agency, (NZTA), and the Ministry for the Environment, (MfE), the cuts could be considerably greater.

The staff numbers at the MfE rose 39% from June 30 2021 to December last year, taking

the figure from 648 full-time equivalents to 1068.

As a lot of the projects started under the previous Labour administration have since been canned, there is obviously fat in the system that can be cut.

I believe a 7.5% staff cut at the NZTA would be essentially meaningless. They have a team of spin doctors that are in my view unnecessary.

They come across to me as a hide-bound bureaucracy with lots of sound and fury signifying little.

The same could be said for the MBIE. I believe the cuts for all three could be well above the 7.5% guideline.

In other organisations, such as the Police and Ministry for Primary Industries, I believe any cuts need to be carefully considered. The MPI has been able to cut staff by 10% while assuring me all key services will be maintained. I’ll watch it with interest.

The Police are another story. They tell me they have cut 200 backroom staff but the police union tells me the frontline can’t perform without them and that frontline officers will have to take up backroom roles.

There’s not a lot of future in that approach.

I look forward to further rationalisation of the public sector but would prefer it to be on a caseby-case basis.

Another large part of the Budget was tax relief, and on that I believe the government greatly over-promised and massively under-delivered.

The much-promised $250 a week

Fonterra

–

Eating the elephant

Ben Anderson

Ben Anderson lives in central Hawke’s Bay and farms deer, cows and trees. eating.the.elephant.nz@gmail.com

IN NEW Zealand Fonterra is a big dog. In a good way. In fact, even in the global context it’s big, coming in as the sixth largest dairy company in the world.

I was quite proud of this, so I was a bit taken aback when it recently said it wanted to get smaller.

will go to just 3000 families while the 9000 poorest families will lose one dollar a week. For the minister to then tell me she didn’t know speaks volumes. A superannuant friend of mine claimed his tax relief would allow him to buy two bottles of gin a year, whether he needed them or not.

The issue going forward according to independent economist Cameron Bagrie is that things are going to get a lot worse.

I believe they will as the economic base of our economy is in strife.

Federated Farmers president Wayne Langford put the issue succinctly.

“Just like the average farmer’s budget this season, the government doesn’t have a lot of spare cash laying round to spend on nice-to-haves and optional issues.”

The MPI has been able to cut staff by 10% while assuring me all key services will be maintained. I’ll watch it with interest.

He was pleased that there was continued funding for things like frontline biosecurity, catchment groups and cyclone recovery. So am I.

I respect the opinions of economist Shamubeel Eaqub. His view of the Budget was “borrowing in the Budget to fund tax cuts and operating expenditure is like earning less and living off the overdraft”. I agree with him.

He added that “what we need is a non-political approach to ring-fencing stable maintenance funding”. He added that “for future generations a dollar spent on maintenance today may well be worth more than a dollar spent on a vanity project”. While I totally agree I think the chance of political consensus on anything is precisely zip.

His conclusion was that “this Budget, like many before it, has lived up to a dispirited tradition of short termism”. He added that “our spending is too lavish for our taxes”.

I’d wholeheartedly agree, which is one reason I didn’t want the massively over-sold tax cuts.