Red faces at OSPRI as upgrade fails

Bryan Gibson TECHNOLOGY Livestock

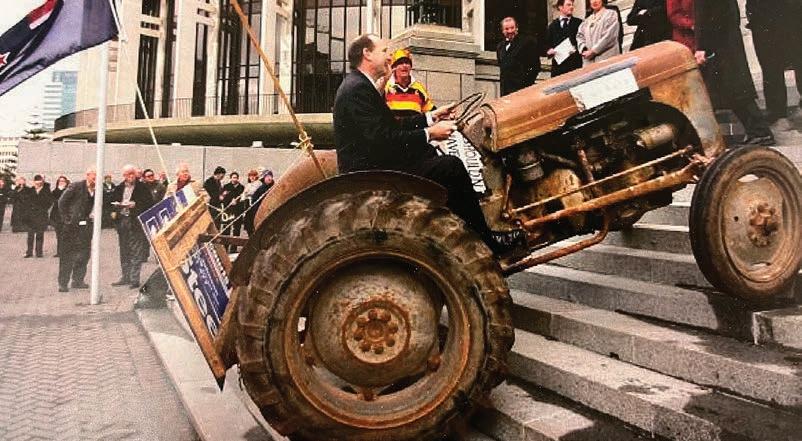

OSPRI has apologised to farmers and its shareholders after major flaws were found in a technology upgrade project.

An independent review of its Information Systems Strategic Programme (ISSP) identified issues with the technology project that was meant to integrate its animal disease management and traceability systems.

The review identified problems in every aspect of the programme, including the way it was governed and the suitability of the technology itself.

The costs of running it would be ridiculously high.

Dr Paul Reynolds

Chair Dr Paul Reynolds said OSPRI had let itself and its stakeholders down.

“The OSPRI board and management apologise to farmers and partner organisations that the improvements promised have not been delivered in a timely manner.”

Reynolds stressed that this issue did not impact OSPRI’s current disease management and animal tracing systems.

“There is no risk to the

assurances needed for export purposes and our shareholders can be assured that with their continued participation, our warning systems are as good as any in the world.”

Early progress on developing the new platform went well, but Reynolds said delays and cost concerns raised the alarm.

“The board was asking questions and receiving assurances and it put in independent reviewers to check on progress and to ask the question, ‘Is it reasonable for us to assume that this platform is going to be delivered on time or within the new timeframe, and is going to be successful?’

“And we received those assurances. However, delays continued and our former chief executive was increasingly uncomfortable and in the end the board decided that we would pause the program.”

Reynolds said the independent review made it clear that the project would not deliver what was required.

“Most importantly, and catastrophically, [the review found] issues with the complexity of the technology, platforms and architecture. It became increasingly apparent that what ultimately was going to be built was just going to be ruinously expensive to run.

“So we had issues about the complexity of the platform, issues

Continued page 3

PARTNERING FOR A PRODUCTIVE SEASON AHEAD.

Global brand builds on base layer

The Merino action-sports brand Mons Royale is the result of a winning partnership between high-country couple Hamish and Hannah Acland.

PEOPLE 14 Century-old farm and a lifelong nurse

Spring growth, rising schedules create perfect storm for store cattle market. NEWS 4

NZ’s new free trade agreement with Europe already working as intended. MARKETS 5

The dairy shed is a peaceful escape for nurse Megan Moore, who regularly changes between overalls and scrubs.

17-25

A strategy without a team behind it is just words on a page, says Kate Scott.

OPINION 13

News in brief

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME

Delivered by Reach Media Ltd

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 777 2557

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Omid Rafyee | 027 474 6091

South Island Partnership Manager omid.rafyee@agrihq.co.nz

Julie Gibson | 06 323 0765

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Focus

16

17-25

Farmers . 26-29

30-32

33-34

34-37

Fieldays chief executive Peter Nation will step down from the role in December.

This will end nearly 30 years of his involvement with the New Zealand National Fieldays Society, which owns and operates Fieldays and the 114 hectare site at Mystery Creek and the Events Centre. “I have made the decision to step aside so I can pursue more personal interests and time with family,” Nation said.

Nation steps down Welfare petition

A petition has been launched to stop imports entering New Zealand from countries that allow farming practices that would be illegal in this country.

The petition, by animal law expert and University of Auckland Associate Professor Marcelo Rodriguez Ferrere and supported by Animal Policy International, urges the government to enact legislation ensuring all imports meet New Zealand’s domestic animal welfare standards.

Costly disease

A foot and mouth disease incursion could cost New Zealand $14.3 billion a year in lost export values, according to a new report.

Biosecurity Minister Andrew Hoggard said the NZ Institute of Economic Research report reinforces his government’s commitment to “stamp out” any New Zealand foot and mouth disease incursion. The Ministry for Primary Industries presented the government with three management options for consideration – stamping out the disease, managing an outbreak over a longer period using vaccination, or living with the disease.

Quad bike fatal

Worksafe is investigating the death of a child in quad bike accident in Waikato on September 7. Police said emergency services were called to the Kaihere property after reports a quad bike had rolled. WorkSafe said it is too early determine the cause, but investigators are working to establish the circumstances and factors involved.

LIC joins cows for Africa bid

Staff reporter NEWS Genetics

LIC is collaborating with United States-based precision breeding company Acceligen and the Bill & Melinda Gates Foundation to breed heattolerant and disease-resistant dairy cows for sub-Saharan Africa.

The initiative seeks to address food insecurity in the region by providing highperforming dairy animals to help grow sustainable dairy markets.

It will combine LIC’s knowledge in breeding efficient dairy cows for pasture-based systems, with Acceligen’s cutting-edge gene-editing capabilities to produce animals that can produce more milk than native species.

LIC chief executive David Chin said the co-operative is proud to be involved with the initiative.

Embryos bred from LIC’s world-class pasture-based genetics will be sent to the US, where Acceligen will perform gene edits on the stem cells.

Continued from page 1

in the program, about its timely delivery. But even if all that was swept away, we came to the understanding that the costs of running it would be ridiculously high.”

In a joint statement, shareholders Beef + Lamb NZ, Deer Industry NZ and DairyNZ said they were incredibly disappointed with OSPRI’s performance.

“We are working with the OSPRI board and recently appointed chief executive to take urgent

Synlait rescue plan back on track

Hugh Stringleman NEWS Dairy

SYNLAIT Milk’s do-ordie special meeting on Wednesday, September 18 will go ahead despite the complaint lodged by co-founder, former chief executive and former chair John Penno.

Penno sought to have only minority shareholders eligible to vote on two crucial resolutions to raise capital from majority owner Bright Dairy of Shanghai and major customer a2 Milk Company.

His complaint was dismissed by the sharemarket regulator NZ RegCo and the Takeovers Panel.

Synlait has warned several times that the recapitalisation is essential to ensure the future of the listed dairy company.

The votes will now proceed with Bright able to vote on the a2 Milk resolution and a2 Milk able to vote on the Bright resolution.

The intended outcome is that Bright contributes $185 million and becomes a 65% controlling shareholder and a2 Milk contributes $33m to maintain its 20% stake.

Both big brothers have said they favour the recapitalisation plan and therefore the resolutions are expected to pass.

The special shareholders meeting will be held at 9am

steps to get this project back on track. Shareholders have added representatives to the OSPRI board’s ISSP sub-committee to ensure additional expertise is available to recommend the way forward.”

The OSPRI shareholders, in consultation with the Ministry for Primary Industries (MPI), have also initiated an independent review of the OSPRI governance framework.

“The review has made a number of recommendations for strengthening OSPRI’s governance

on Wednesday at the Synlait Dunsandel plant and online.

“The support of all shareholders remains essential to safeguard the future of Synlait, and all shareholders are encouraged to exercise their right to vote at this important meeting,” the company said.

That appeal is directed at minority shareholders, whose collective influence will fall from 40% to 15%.

Synlait has argued that any other form of capital raise, or liquidation of the company, would wipe out shareholder value.

Meanwhile Synlait has decided to stop receiving milk at its Pōkeno plant in South Auckland and has called on Open Country to process the supply of 54 Waikato farms.

“They will remain Synlait suppliers until the end of their supply agreements and we will remain their first port of call for support,” chief executive Grant Watson said.

Pōkeno will change over wholly to non-dairy, plant-based proteins for the manufacture of advanced nutrition products.

Watson said that after a thorough review the company now had insight to lift the financial performance of world-class assets.

Switching between dairy and non-dairy had hindered operational efficiency.

and shareholder oversight. The shareholders are discussing the governance recommendations with OSPRI and OSPRI’s other funder, MPI, and have committed to all involved that changes will be made promptly over the next few months.”

Reynolds said he acknowledged the criticism.

“I think that in hindsight, the business case could have been clearer, more robust, more fulsome. I think the level of clarity around what was needed was probably not there.”

The support of all shareholders remains essential to safeguard the future of Synlait.

Synlait

Pōkeno began processing plantbased products for nutrition and healthcare multinational Abbott after an expensive refit. Analysts said that the Pōkeno

OSPRI is now working to fix key programme management foundations, is simplifying the new platform’s architecture and prioritising the replacement of the NAIT system, Reynolds said.

“OSPRI is confident that the measures implemented in response to the review will enable us to deliver a NAIT replacement system that meets the needs of New Zealand’s primary sector.”

There will be a significant impairment to the value of the current MyOSPRI asset, but the figure is yet to be confirmed.

site cost about $400 million to build over six years and is running with annual losses as high as $40m.

A buyer for Pōkeno will not be actively sought but if a compelling offer is made the company may consider it.

Synlait has raised its forecast farmgate milk price for the current season by 60c to $8.60 and will confirm its final price for last season with the annual results on September 30.

Chief executive Sam McIvor said as well as the independent review, he is taking a “deep dive” into the technology in the business.

“We’ve pulled in some expertise to do that and I guess that will give us the clear path on whether we fix what’s been built, or is it an alternative route, for example, of starting again. We’re deep into that process at the moment.”

McIvor stressed that the development of the new NAIT system user interface, created in collaboration with farmers, has progressed well and will be used.

REARRANGED: Synlait Milk CEO Grant Watson says a viable pathway to profitability for the Pōkeno plant has been settled on.

Store cattle market goes ‘ballistic’ as stars align

Annette Scott & Gerald Piddock NEWS Livestock

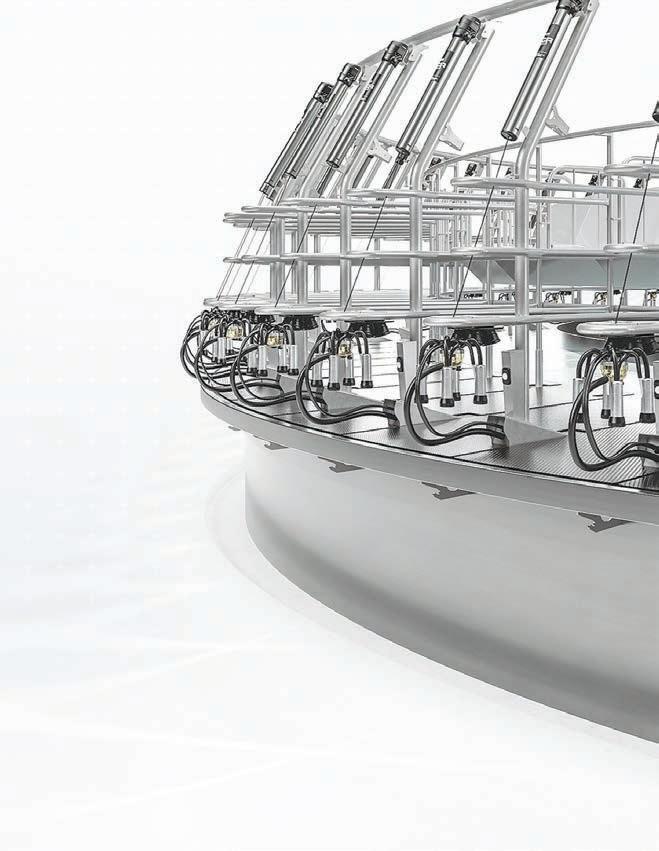

THE earliest spring pasture flush in recent years across large parts of the country, coupled with rising processor schedules, has created the perfect storm for the store cattle market.

The sudden price spike in store values at saleyards, especially in the South Island, has been influenced by the autumn drought that brought good numbers of both prime and store cattle to the market, PGG Wrightson livestock manager Joe Higgins said.

“There’s also been minimal numbers of beef cross calves retained in the dairy industry and there’s no doubting the recent strengthening in the market has been fuelled by confidence from the surge of early spring pasture growth.”

Most processor schedules are $1.10-$1.25/kg stronger than a year ago, hovering around the $7 mark.

“This would be the best store beef prices I can recall for this time of the season.

“There is positivity; farmers are sitting pretty comfortable. The market has reached its pinnacle and holding.

“I wouldn’t like to say whether it’s market or procurement driven, but the positivity is there so we’re good to run with that,” Higgins said.

Hazlett livestock manager Ed Marfell said the early spring pasture flush coupled with the large number of calves that went to the North Island earlier, clearing out the yearling stock numbers in the South Island, has impacted the market.

In the last two months, there doesn’t seem to be anything holding it back.

Vaughan Larsen PGG Wrightson

“A lot of calves left Canterbury with the autumn drought, and we have certainly felt the recent buying power of the North Island pushing exceptional prices across the board and above expectation.

“We have seen huge inquiry from the North Island for young stock

Notice of change to TB Slaughter Levy Rate

and two-year cattle and once they cross the water they don’t come back to the mainland.

“These are not one-off sales, these hyped sales have been going for a month or so and while the market down here is strong, we are not at the level of the North.”

The agents said the margin would be reasonable for farmers selling prime stock at $7/kg and who have done their sums; they can afford to buy replacements, despite the inflated store market.

“Farmers want something to eat the grass and make money and if replacing killed prime stock it’s not a problem, it can be justified paying in the current store market.”

According to NZX data, growth rates in Canterbury for the August–September period have been above average while the rest of the country is similar to previous years.

Waikato-based PGW agent Vaughan Larsen described the prices at the weekly cattle sale at Frankton as “ballistic”.

“In the last two months, there doesn’t seem to be anything holding it back. It’s a perfect storm for the store price.”

Heifers are selling at $4.55/kg

Pursuant to Clause 10 of the Biosecurity (Bovine Tuberculosis – Cattle and Deer Levy) Order 2016 notice is hereby given that commencing 1 October 2024 the rates of slaughter levies for Dairy and Beef Cattle will change. Levy rates from 1 October 2024 are (GST exclusive):

• Dairy cattle

$12.25 per head (increased from $11.50 per head)

• Beef cattle $4.50 per head (decreased from $4.75 per head)

Background to change

The National Pest Management Plan for Bovine Tuberculosis is funded by agreement between the Ministry for Primary Industries, DairyNZ, Beef + Lamb New Zealand, Deer Industry New Zealand, and TBFree New Zealand. Funding is through a combination of fixed funding and levies charged on the slaughter of cattle.

The respective industry shares of this funding are subject to annual adjustment based on shifts in the relative size and value of each industry. The funding received is also affected by the actual cattle slaughter volumes for the dairy and beef sectors. Each financial year a reconciliation is made of the amount contributed by each industry and levy rates may be adjusted accordingly.

Sam McIvor, Chief Executive, TBfree New Zealand Limited.

For further information on OSPRI’s TBfree programme, please visit ospri.co.nz

LW, which equated to over $1000 for a 250kg animal, 430kg twoyear heifers averaged $3.58/kg, up around $1/kg LW on 12 months ago.

It is not just store prices. The prime market remains strong and the price for manufacturing beef from cull cows is also high.

AgriHQ senior analyst Mel Croad noted in the latest Livestock Outlook report for September that farmgate beef prices for bull, prime and local trade are sitting at record highs for this time of the year.

AgriHQ data shows that due to

the lack of killable cattle through winter, prime and local trade prices have lifted by double their usual amount since June.

“This boosted confidence and it’s clear there is a lot riding on the beef job to hold up through spring to ensure on-farm returns are met.

“Although we have very strong prices now, the general trend is for slaughter prices to seasonally ease as we get closer to summer.”

By how much will be determined by export demand and how quickly spring cattle supplies build, Croad said.

Growers want contracts before committing

Gerald Piddock NEWS

MAIZE growers are playing a waiting game regarding their planting intentions for this spring after a difficult past season marred by low prices and falling demand.

Waikato Federated Farmers arable chair

Don Stobie described those intentions as “the $64,000 question”.

“A lot of them are stepping back and having a deep think about what they are going to do going forward. A lot of growers at the moment are saying they are going to reduce their planting intentions for the coming season.

“The other thing they are talking about is any ground they do plant, they are wanting a contract on for the crop.”

This will give them surety of price at harvest time because so many got badly burned last season from the low price and lack of demand, he said.

Corson Maize national business manager Graeme Austin described the silage industry as static and the grain industry as hesitant.

“There are a whole lot of things happening, they are not sure about contract prices yet, so end users haven’t committed to contract amounts and growers are waiting to hear what contract prices will be.”

The other issue at play is the shortage of natural gas, which companies such as Vittera use to fuel their maize grain dryers, he said.

The contracts these companies for gas have ceased, meaning they will have to purchase the gas on the open market.

“The likelihood is there will be gas available, but we don’t know what the price will be.”

Stobie said the early spring will have little impact on planting dates as farmers are wary of an early spring cold snap that could affect a freshly planted or emerging crop.

“Growers will be wanting some surety that someone is going to want their crop later on. I wouldn’t envisage that there will be many people growing without a contract this season.”

One positive for the maize growers is they could benefit from Fonterra and Nestlé’s push to reduce Scope 3 emissions, he said.

“Maize grain has a very good emission intensity rating compared to palm kernel and currently we import around 2 million tonnes of palm kernel into New Zealand. If they reduced that by even 10%, that would be potentially 20,000t of grain farmers could swap to using.”

IMPACT: Hazlett livestock manager Ed Marfell says the early spring pasture flush, coupled with the large number of calves that went to the North Island earlier, has impacted the South Island market.

Flow of goods brings trade pact to life

Neal Wallace MARKETS Food and fibre

THE first consignment of New Zealand beef has arrived in Europe, and European construction supply companies are reciprocating with exports to NZ. This is proof, according to officials in Brussels, that the free trade agreement (FTA) is working as intended.

Signed in July last year and having come into force in May, the FTA could potentially provide a $1.8 billion boost to the NZ economy by 2035.

There was some criticism at the concessions achieved by NZ, but the word in Brussels is that our negotiators achieved more than expected due to tough bargaining.

NZ successfully secured improved access for politically sensitive beef, sheepmeat and dairy products, with the terms of the FTA accepted by member states and the European Parliament.

The terms of the FTA are such they NZ could potentially supply up to 60% of the European Union’s butter imports, up from 14% currently, and NZ cheeses could make up 15% of the EU’s imported cheeses, up from 0.5% today, Access for beef increases eightfold to 10,000 tonnes while in sheepmeat, NZ could supply up to 96% of EU imports.

In comparison, the FTA being negotiated by the EU and Mercosur and large beefproducing countries Uruguay, Argentina, Paraguay and Brazil, allows for tariff-free imports of only 99,000t of beef.

Australia is still to secure an FTA with the EU and the consensus is that it is not finalised because it broke down when Australia attempted to backtrack on mutually agreed quotas for market access.

NZ trade officials said a golden era of international trade has ended but in Brussels they term it the end of the age of innocence for trade.

The EU and China are engaged in

a tit for tat dispute over imports of Chinese-made electric vehicles.

The EU is considering imposing tariffs, claiming China is competing unfairly due to excessive government financial support.

Europe’s biggest manufacturer, Volkswagen AG, announced last week it is considering closing a plant that makes electric Audi cars due to the flood of vehicles from China.

China has retaliated by targeting imports of EU dairy and brandy, and observers say the tit for tat action is only going to intensify.

What the world has previously known as free trade is being redefined in Brussels as free and fair trade.

To EU officials that means sustainability and climate change are priorities when negotiating market access.

Covid tested its supply chains, but the Ukraine-Russia war has forced a rethink, prompting Europe to diversify supplies of key products such as energy and food to ensure security.

Prior to the conflict, Europe

To EU officials sustainability and climate change are priorities when negotiating market access.

MEETING the MARKET

was reliant on Russian gas but as European countries sided with Ukraine, Russian President Vladimir Putin used its supply as a political weapon.

Europe has accordingly made a huge effort to diversify away from Russian gas. The share of Russia’s pipeline gas as a percentage of EU imports dropped from over 40% in 2021 to about 8% in 2023.

In 2022, just 23% of energy was from renewables but the EU has set a goal of taking that to 42.5% by 2030.

In efforts to strengthen the supply-chain resilience, it is partnering with what it calls the G7-plus.

That group includes the G7, the world’s seven most advanced countries – Canada, France, Germany, Italy, Japan, United Kingdom and United States – plus sympathetic countries South Korea, Australia and NZ.

Europe is still seeking trade deals.

Negotiations with the selected Mercosur countries continue. They have been underway for 25 years, looking for opportunities in the Indo-Pacific and India.

• Wallace is visiting

in six weeks to report

a

Forestry frustration remains

Neal Wallace MARKETS Regulation

THE potential trade flashpoint of the European Union’s deforestation regulations does not look like going away.

The view in Brussels is that implementation of the regulations, which obligate importers and European producers to provide evidence that certain products have not caused deforestation, will not be dropped but its implementation could be delayed.

The regulation covers products and their derivatives such as beef, leather, furniture, wood, paper, soy, cereals, chocolate, coffee, palm oil and rubber, including tyres.

Exporters say it is too far reaching, impacting countries

such as New Zealand that do not have deforestation.

They claim that meeting the required EU standards will require historic and current satellite imagery or geolocation data of where the product was sourced.

The regulation, strongly promoted by non-government organisations, is designed to prevent deforestation of natural areas for production, such as the Amazon.

The policy applies to imports of related products into the EU and is scheduled to be implemented from January 1.

Such has been the backlash, including from NZ, that some in Brussels believe its implementation could be delayed to allow more consultation and deliberation but is unlikely to be abandoned.

seven countries

on market sentiment,

trip made possible with grants from Fonterra, Silver Fern Farms, Alliance, Beef + Lamb NZ, NZ Meat Industry Association and Rabobank.

SENSITIVE INDUSTRY. The first consignments of NZ beef have arrived in European markets under the free trade agreement, achieved despite it being a particularly sensitive sector. Photos: EU Commission

TRADE PROGRESS. The EU-NZ free trade agreement could see NZ supply significant volumes of butter and cheese.

A growing appetite for sustainable dairy

Neal Wallace MARKETS Dairy

ASENIOR executive of one of New Zealand’s largest dairy customers, Mars, is applauding sustainability efforts by NZ dairy farmers and is urging them to continue working with their customers.

7 COUNTRIES IN 6 WEEKS

Srikanth Ramachandran, Mars Snacking’s global category director for dairy, said Mars is similarly improving its sustainability, and he acknowledged gains made by pastoral farmers despite significant challenges.

Speaking to Farmers Weekly in Chicago, Ramachandran said continuous improvement will come from farmers embracing new tools and systems as they become available. He said farmers are not alone.

“We at Mars share their sustainability mindset, which is why we are supporting NZ dairy farmers.

“But we need to go further and drive continuous improvement on farms so NZ can retain its production advantages. It is not just about driving environmental impact but also making it economically viable.”

Dairy is Mars Snacking’s second-largest greenhouse gas contributor behind cocoa.

Mars Snacking has a goal of halving its greenhouse gas emissions from a 2015 baseline by 2030, which will impact NZ dairy farmers by virtue of Fonterra being its largest global dairy supplier.

“Dairy and cocoa are the top two sources of emissions for Mars Snacking.

“Cocoa growers are making progress reducing their emissions and as dairy we have a huge potential to make a significant impact.”

Raw ingredients used by Mars Snacking contribute roughly 60% of its total emissions.

Ramachandran, who regularly visits NZ, acknowledges that NZ has the world’s lowest dairy production greenhouse gas footprint, but said housed-cow farm systems are likely to have earlier access to methane mitigation technology than pastoral.

Retaining that title requires NZ to relentlessly chase farm emission reduction tools.

“It’s a mindset to want to continuously drive a reduction of emissions on farm,” he said.

The ace card for Fonterra suppliers is the extensive farm-level database, which he said provides a foundation to determine the volume and source of emissions.

“It gives farmers a huge advantage. You can’t improve what you can’t measure.

“It will also help us set up an incentive or rewards system that is objectively based because we know exactly what that starting point is.”

Mars’s sustainability drive comes from its owners, the Mars family, but is increasingly raised by customers

Ramachandran said sustainability is part of the company’s DNA, which means balancing both the financial and societal sides of ledgers.

In hand with that is a mutuality policy of sharing benefits throughout the supply chain.

“Shared benefits will endure,” said Ramachandran.

Mars is investing NZ$75 million over the next three years in dairy sustainability alone under a “Moo’ving Dairy Forward” programme.

It includes farm-level investment in programmes alongside dairy companies Fonterra, Land O’Lakes, Interfood and Friesland in methane emission reduction, manure management and feed production.

With Fonterra it is exploring use of the asparagopsis seaweed as a feed supplement to reduce methane and in Poland it is launching one of the first and largest Bovaer feed additive trials with Interfood and Mlekovita.

In a further example of how seriously Mars is taking sustainability, he said remuneration for leaders is linked to progress against Mars’s sustainability goals.

“The approach here is that each manager has to own and drive performance.”

This multi-pronged focus has helped the company achieve a 16% net reduction since 2015 – while the business has grown 60%.

Mars Snacking, of which dairy is a key ingredient, is a NZ$29 billion business that has brands such as Bounty, Celebrations, Wrigley’s gum, M&M’s and Snickers. It is part of Mars Inc, a NZ$80bn-plus family-owned business, with a diverse and expanding portfolio of pet care products and veterinary services, snacking and food products.

• Wallace is visiting seven countries in six weeks to report on market sentiment, a trip made possible with grants from Fonterra, Silver Fern Farms, Alliance, Beef + Lamb NZ, NZ Meat Industry Association and Rabobank.

FLAG targets a signal of change to come

Neal Wallace MARKETS Sustainability

FOOD producers need to be preparing now to meet the sustainability targets required by their markets, says a Rabobank business strategist.

Marjan van Riel, a Rabobank senior business strategist in food and agribusiness for Rabobank in the Netherlands, said sustainability issues are a priority for companies and remain so for governments, evidenced by their importance transcending changes in administration.

These challenges are not going away, but food producers have time to meet emission targets, she told Farmers Weekly.

“You better start preparing today instead of rushing to do more in the future,” she said.

Sustainability concerns include climate, water quality and quantity, land use, biodiversity loss and social issues.

The Paris Accord recognised the importance of not putting food production at risk while reducing greenhouse gas emissions, but, Van Riel said, it did not provide a free pass.

The growing global population requires more food and, as wealth increases, so does demand for carbon intensive food.

But that does not mean the environmental impact of that production can be ignored.

The United Nations Intergovernmental Panel on Climate Change (IPCC) recognises that the agriculture sector cannot completely decarbonise because biological processes will always occur.

The IPCC aims for carbon dioxide to reach net zero sooner than all other greenhouse gases combined, including methane and nitrous oxide.

But Van Riel said consumers, banks and governments are asking producers what progress they are making.

“The direction and momentum is clear. Steps are being taken but we need some time to come together in practice.

“But this will not go away.”

It is also not just a European Union issue but is spreading globally and surviving changes in government.

You better start preparing today instead of rushing to do more in the future.

Marjan van Riel Rabobank

“It can swing depending on how fast a government wants to go, but the direction is one way and is probably not going to disappear with another government.”

At corporate level, Van Riel said, companies that have 20% or more of their emissions from the forest, land and agriculture (FLAG) sectors are required to set FLAG-specific emission reduction targets to retain certification by the Science Based Target Initiative (SBTi) climate organisation.

Danone and Rémy Cointreau were among the first with approved FLAG targets but are being followed by a who’s who of the food industry: Charoen Pokphand Foods, Domino’s, Heineken, Hilton Foods, Sainsbury’s, Mars, McDonald’s, Nestlé, Sime Darby Plantation, Sodexo, and Tesco.

The aim of signatory companies is for a

MEETING the MARKET

7 COUNTRIES IN 6 WEEKS

TIME: Marjan van Riel, a Rabobank senior business strategist in food and agribusiness, says food producers have time to reduce their emissions.

30% decline in FLAG emissions by 2030 and a 72% reduction by 2050. They also require a 90-100% reduction in energy and industrial emissions by that date.

FLAG-accepted reductions can be steps such as stopping land-use change emissions, including from deforestation, reducing on-farm emissions by improving agricultural practices, changing diets, reducing food loss and waste as well as increasing carbon removals or carbon sequestration below and above ground.

The removal or sequestration of carbon from the atmosphere can include the restoration of forests, sustainable forestry management and agroforestry, and an increase in agricultural soil and biomass carbon sequestration.

A recent analysis of 843 European companies by the Carbon Disclosure Project reported significantly more companies had absolute emissions reduction targets approved by the SBTi, with 47% in 2022 versus 14% in 2019 but that these targets covered only 13% of the total GHG emissions disclosed.

This suggested that Scope 3 emissions – activities from assets not owned or controlled by the reporting organisation but which indirectly affect its value chain –remain a challenge despite in some cases contributing 90% of a company’s emissions.

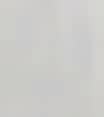

Ben & Samantha Tippins

Sharemilking 950 cows in Tokoroa

Par tnering wit h farmers like t he Tippins to reach milk quality targets.

Dairy farmers like Ben and Samantha know that being proactive with udder health from the star t of calving is crucial for a successful season

With 950 cows and a switch to once-a-day, maintaining a consistently low somatic cell count was always going to be a challenge. But by teaming up with FIL and implementing a 10-step milking routine, they ’ve seen significant results: fewer mastitis cases, lower SCC, and more milk in the vat.

They ’ve also shaved an hour and a half off milking time, giving them and their team more family moments.

Now that ’s what we call a successful par tnership.

Learn more about Ben and Samantha’s success by scanning the QR code or visiting FIL.co.nz.

New pan-industry organisation mooted

Hugh Stringleman NEWS Agriculture

COLLABORATION

Aplatform called The Common Ground has been launched by AGMARDT and KPMG, for the food and fibre sector to tackle shared problems.

It is aimed at the 150-plus industry good organisations in the sector, AGMARDT general manager Lee-Ann Marsh said.

“The call is to everyone to join a constructive conversation about our collective future,” she said.

“We are proposing one potential vision on The Common Ground platform, to stimulate discussion and debate on how to break down silos and meet the many shared challenges and opportunities ahead.”

A 40-page report on the platform is available on thecommonground. org.nz website, written by Marsh and three KPMG authors, Ian Proudfoot, Andrew Watane and Brig Ravera, and citing input from 26 industry subject matter experts.

Proudfoot, who has led the annual KPMG Agribusiness Agenda publication for the past 12 years, said The Common Ground concept can help unlock new funding opportunities and reorient the sector’s focus.

It needs to be aiming outwards towards global markets than inwards behind the farm gate.

Although the industry-good structure has been successful in the past, its constraints can no longer be ignored, he said.

“An erosion of trust, shortterm decision-making, siloed inefficiency and the lack of focus on global markets are limiting our ability to confront risks and compete for global capital and market share.”

The Common Ground approach will pool resources and act as a back-office engine room.

Areas of collaboration include on-farm energy, rural wellbeing, high value exporting, zero carbon production systems, sustainable oceans, protection of Taonga (IP/mātauranga), water quality and quantity, diversification of producer income, future workforce and agri-education, soil health, rural prosperity, biodiversity, animal welfare and adapting to climate volatility.

The engine room functions include a standard enterprise platform shared by all participating organisations, cutting the estimated $9-plus million spend annually on duplicated back-office services like software, accounting, legal or HR.

Another goal is to reduce data entry duplication for individual

producers. Marsh said The Common Ground is just one vision of the future of industry-good in the sector and the proponents would like to hear back from all corners, especially from producers.

The authors considered alternative industry-good structures and models here and abroad and while all had their strengths and weaknesses none were able to address the collective issues.

The nine-month exercise began with a question: Are industry-good organisations good for industry?

The 150 organisations are mainly producer funded with 33 commodity levy orders gathering about $164m annually, plus $16m of membership subscriptions.

Biosecurity levy orders account for $75m of the $183m total annually.

In other countries industry-good organisations are majority funded or co-funded by the government. For example, in Australia $300m annually goes into rural research and development.

In NZ, duplication of effort and resource is a commonly identified problem and organisations, both levy-funded and subscription, must regularly demonstrate their value.

Increasingly, populism has taken over value demonstration, and addressing the immediate needs

of producers has become the focus rather than addressing the most critical needs.

“Organisations are choosing not to address complex needs in order to prioritise remaining relevant and surviving.”

Four key constraints appear to be holding the sector back from its potential, the report says.

These are a lack of trust, inadequate aspirational thinking, turf wars and inward thinking, not outward.

The belief that industry-good organisations are acting in the best interests of producers has been eroded.

Lack of trust between

organisations and with regulators means no confidence that anyone else would have the capability or credibility to do the job better.

“Too few are thinking of an aspirational future for New Zealand.”

Territorialism around land use is creating barriers to working together and encourages siloed thinking.

The export sector is oriented upside down, missing connections to customers and markets.

The proposed Common Ground structure would be voluntary and host communities of action that identify the right people and seek funding to find solutions.

UNLOCK: Ian Proudfoot says The Common Ground concept can help unlock new funding opportunities and re-orient the sector’s focus.

Colraine focus pays off in record price

Hugh Stringleman MARKETS

Livestock

COLRAINE Herefords at Ohaupo, near Hamilton, has set a yearling bull price record for the breed of $37,000 in what is only the second on-farm auction for the stud.

Colraine Washington 23 421 was bought by Mahuta Herefords and sold with a guaranteed oneyear dairy semen contract from LIC for 10,000 straws. He was independently identified by LIC beef genetics team as the very top Hereford yearling bull, suited to what the dairy beef semen market is demanding.

John and Mary Allen, Mahuta Herefords at Tuakau, will still hold all semen rights for the beef cattle market in NZ and overseas.

Colraine principal Colin Corney said the sale vindicates a 10-year dedicated breeding programme focusing on calving ease, growth and a drive to improve eye muscle area along with intramuscular fat.

“The improvements are due to us working along with our

good friend Dave Warburton, a production veterinarian who set up a group of breeders to join him importing genetics from the United States, Canada and Australia to help lift key traits within the NZ Hereford population.

“On top of this we have invested heavily in recording as much as we can on all our animals to provide a genetic package that is as reliable as possible.”

Colraine sold all 10 of its bulls and averaged $6100, compared with last year’s $3480.

The sale was in conjunction with Kanuka Polled Herefords, which sold eight out of eight and averaged $3112 with a top of $4200 for Kanuka Seismic 2302.

The third vendor was Arabica Herefords with a complete clearance of nine bulls, averaging $2733 and a top of $3200 paid by Tawanui Herefords.

Waimaire and Otengi Herefords at Kaeo in the Far North kicked off the spring bull sale season with a top price of $9500 for a yearling paid by Bluff Herefords.

The average price paid for two-year-olds was $3960, with a top of $5000, and the averages for 18-month and two-year

bulls were $2943 and $3851 respectively.

Bluff Herefords at Glenbrook, South Auckland, had a full clearance of 48 bulls, averaged $3389, nearly $1000 up on last year, and had a top price of $7700 paid by Streamlands Herefords.

Staying in Northland, Te Atarangi Angus at Te Kopuru had a complete clearance of 120 bulls and averaged $3856 compared with last year’s $3457.

Top price was $8500 paid by J Marchant.

Maranui Herefords and Angus at Waihi cleared the offering of 25 Herefords and 14 Angus, averaging $3000 and $3614 respectively.

Top price was $11,500 paid by

Matapara Angus at Te Puke.

Totaranui Angus, Pahiatua, sold 76 of 79 bulls offered, averaged $4453 and had a top of $9000 paid by Ross Bolt of Horoeka.

Craigmore Herefords at Ohaupo sold 97 bulls with an average of $3037 and top prices of $6000 paid by Riverton Herefords and $5000 paid by Colraine Herefords.

Hoobees Herefords, Coroglen at Coromandel, sold 10 of 10 offered and averaged $4570 with a top of $8000 paid by Te Puna Herefords.

bull sales.

Trade union critical of govt over mill closures

Staff reporter NEWS Energy

THE New Zealand Council of Trade Unions Te Kauae Kaimahi has criticised the government for failing to bring a plan to the table to save around 300 jobs in the Ruapehu district, following Winstone Pulp International’s decision to close two mills.

Hundreds of people are set to lose their jobs after Winstone Pulp, one of the Central North Island’s biggest employers, announced last week it will be pulling the plug on the Karioi pulp mill and the Tangiwai sawmill for good.

NZCTU president Richard Wagstaff said the mill closures will be devastating for the Ruapehu district, which is already dealing with high unemployment and a lack of opportunities.

“Government has a responsibility to keep rural communities alive by supporting regional economic development and stepping in to show leadership when critical industries are struggling. Writing off whole communities is simply unacceptable.”

In recent weeks, the company had been meeting with energy company Mercury and government ministers to find a way to keep the mills open.

RECORD SETTER: Colraine Washington 23 421 has set a breed price record for Herefords in the first batch of spring yearling

From the Editor

The world is changing and we need to adapt

Neal Wallace Senior reporter

FOR most of us the list of positives about living in New Zealand is extensive and far exceeds the negatives.

But a lack of an international perspective is one point counting against our South Pacific paradise, something you quickly appreciate when in places like Europe.

In Europe you have 500 million neighbours and in just a few hours’ drive you are in a different country, usually with a different international view of the world.

In comparison, NZ’s isolation and distance from key markets restricts that global context, more so when your focus is fixing a fence, milking the cows or sowing a new crop.

Yet this broad perspective is crucial for food producers because the pace at which the world is changing is accelerating and we need to keep up.

And we aren’t.

It wasn’t so long ago the growth of plant-

based protein was such that eulogies were being prepared for animal protein products. Just a few short years later, those imposters have virtually disappeared.

Recently animal fats were being categorised as the new tobacco, yet as we reported last week the world wants dairy protein because of its health and wellbeing benefits.

Fads and trends rapidly wax and wane and we need to keep up.

The world’s leading food companies, such as McDonald’s and Mars Wrigley, still want our meat and dairy, there is absolutely no disputing that.

But it’s no longer a linear equation and that is where our lack of international perspective hampers us.

They acknowledge we have a low greenhouse gas emissions footprint, but want more than just our milk powder, butter, cheese or beef. They also want evidence that we take seriously their sustainability and animal welfare concerns.

These standards reflect what their consumers, communities, financiers, owners and, ultimately, their governments require.

Sustainability is no longer a nice-to-have in business these days. It’s a bottom line.

The European Union – unkindly anointed by some as the world’s leading exporter of regulations – has a suite of environmental sustainability policies dubbed the Green Deal.

An indication of its priorities is that they are being implemented despite independent

analysis calculating that they will reduce livestock numbers by 10-15%.

Sure we can tell them to take a jump, but these are the high-paying, A-grade customers.

Do we really want to be playing with those in the second and third divisions?

We need to act because, as McDonald’s revealed, some countries previously considered pariahs are competing for our spot in the starting XV.

Amazon biome beef farmers are now supplying McDonald’s, prepared to provide irrefutable evidence their production methods are not contributing to rainforest loss.

The world is rapidly changing.

Obviously these additional requirements are daunting for NZ farmers squeezed between low returns and rising costs and facing a financial loss or breakeven situation.

But these major customers are not about to hang us out to dry.

They are investing billions of dollars into supply chain resilience and research into greenhouse gas emission mitigation and they talk openly about paying premium prices to suppliers who meet certain standards.

This may sound fearful, but it also provides an opportunity if we can change our mindset.

The world is changing and we need to adapt so we don’t lose our privileged position.

Letters of the week Exotic forests a growing problem

Laurie Collins West Coast

I READ “Rural NZ risks being measured for a pine box” (August 26) and was left questioning the message that planting pines would improve freshwater.

I don’t know the credentials of the Our Land and Water National Science Challenge but I doubt whether science backs up a case for more pines. After all, the cases of pine slash covering farms, rural communities and beaches has been headline news in recent times. Pines suck water out of the natural ecosystem.

Then there are the wilding pines that originate from commercial plantings whether commercial or carbon farming. Wilding pines are a problem in almost every region, threatening iconic landscapes and high-country farms.

Then there’s carbon farming being used by speculators to invest in carbon prices.

The Labour government stupidly opened the door wide for foreign corporations to cash in, meaning large-scale loss of quality sheep and beef farms. Even the New York Times ran an article on how New Zealand’s climate fight is “threatening NZ iconic farmland”. Americans can see the folly, New Zealand governments cannot.

The units are bought by big polluters to offset their emissions and to generate carbon credits that can be traded for value in the Emissions Trading Scheme.

The ETS was another giant mistake by prime minister John Key and his government.

The policy of climate change is skewed and needs searching scrutiny of its integrity.

The practice of offsetting emissions is an “easy out” for industry polluters at the expense of New Zealand’s farming, the backbone of exports and the economy. Again it’s more stupidity.

The widespread establishment of exotic forests and, in particular, permanent exotic forests, is problematic because it:

• Takes out productive land use, ruins rural economies and communities.

• Increases environmental risks and damage – debris, fire, disease, pests, wilding pines. It reduces stream flows and deposits heavy silt loads in streams.

Best letter WINS a quality hiking knife

Send your letter to the Editor at Farmers Weekly P.0. Box 529, Feilding or email us at farmers.weekly@agrihq.co.nz

Letters of the week

You can’t eat a tree

Pippa Hawke Lincoln University student

WHY is New Zealand planting out so much farmland in trees if they are not able to be consumed by humans? The United Nations expects the world population to increase to 9.7 billion by 2050, so there needs to be food production systems that can produce high-quality protein foods to feed the world, and this is exactly what NZ sheep and beef farmers specialise in.

As an 18-year-old with the intention of a career in agriculture, I am questioning where the future in sheep and beef farming is when so much of our farmland is being converted into trees.

The roll-on effect of all this planting is devastating for our communities, economy and country. So many people, businesses and their services will no longer be required. This includes staff, mechanics, shearers, contractors, transport drivers, vets, agents and the list goes on. So what happens next? You get unemployment as businesses

Happier people, happier farms

Alex

White Lincoln University student

I AM writing to say how much I enjoyed your article “Have you hugged a farm worker today?” (farmersweekly.co.nz).

It is great to see the importance of dairy worker wellbeing getting recognised so prominently, as it can have such a profound impact on the dairy production system that is so important in New Zealand.

Championing the workers on the ground is the ethical and humane way to go. In society the welfare of animals on farm is, quite rightly, protected and valued. It is equally important to treat our farm workers just as well. It is a tough job that has exceptional people doing it; they are out there no matter the weather, and let’s not forget that they carried on throughout the pandemic when most of NZ sat safely at home waiting for the storm to pass.

With suicide rates and mental health issues in farming at scary levels, it has never been more important to enable farm workers to have a good work-life balance, while also earning a decent wage.

Looking after our farm workers will lead to better outcomes on farm, too. The article suggested providing professional development opportunities for staff members enhances mana for the staff by giving them responsibility, recognition and self-esteem, but also results in a bigger skills pool. It even frees up farm manager time, by enabling them to delegate a greater range of duties. Everybody wins!

My favourite thing about this piece was that it shared so many useful ideas about possible ways to look after staff that other managers could consider. As an active member of Young Farmers myself, the power of coming together with like-minded people to get advice, share experiences or just let your hair down cannot be underestimated.

Coming originally from rural England as I do, this article also brought back fond memories of arriving at the local pub to find groups of farmers from all backgrounds having a yarn and laughing the evenings away while supporting each other.

From the simple idea of one-to-one staff conversations to dropping off meals when people are unwell, there are easy ideas that any farm could use.

cannot survive. All this is going to lead to poverty.

It is not only the local communities affected, but the whole of NZ. With less livestock being farmed, prices will increase – which will push up the prices in the supermarkets. Meat processing facilities such as ANZCO and Alliance will have less work and risk having to cut staff or shut down as there will not be enough animals to keep the plants running. This leads to more unemployment.

Another contributing factor will be an increased risk of pests and Tb, which puts our food-producing industries at risk.

Once the land is planted in trees there is no converting it back, because if you do you have to repay the money for carbon credits that were earned off the land.

What is going to happen when all these

trees need harvesting after having been planted in the past few years? The timber market will get flooded.

I disagree with polluting companies that are buying land to plant trees or buying carbon credits to offset their carbon emissions.

This is just giving them an easy option to keep polluting and not taking any responsibility to improve their practices.

Trees that are planted now will be harvested in 30 years’ time, which means 30 years of lost sheep and beef export revenue. NZ farmers are among the most carbon efficient in the world, so why do we not keep doing what we are good at rather than destroying our country to offset other industries’ carbon emissions?

Rather than using plantations as a bandage, why do we not focus on cutting

want to be munching on pine trees in 30 years?

ECLIPSE® and MATRIX® are right at home in engineered to deliver optimum protection. Just like this oilskin vest - they stand the test of time when you need them most

greenhouse emissions in all industries? Do you really

FUTURE: As an 18-year-old with the intention to pursue a career in agriculture, Pippa Hawke is questioning where the future in sheep and beef farming is when so much farmland is being converted into trees.

We happen to grow plastic’s natural enemy

Alternative view

Wairarapa farmer and businessman: dath.emerson@gmail.com

I’M CERTAINLY over all the experts and politicians telling me what a great product wool is. I’m also over reading about our representatives going to international trade shows and conferences, rapturously selling the advantages of using New Zealand wool.

Wool is a magnificent product, we all know that, but my approach would be to develop a strategy to promote wool that goes back to basics.

We should be thinking outside the square and not continuing with the failed policies of the past.

We all know that wool ticks all the boxes regarding the environment and sustainability but that hasn’t been enough to encourage the purchasing of wool products and that needs to change.

For example, while researching this article I came upon a report from 2022 telling me that the United Nations Environmental Agency had agreed to develop a plan aimed at ending plastic pollution. The competition for wool is plastic in its many forms.

I read that “Heads of state, ministers for the environment and other representatives from UN member states endorsed the

resolution to proceed with the plan.”

Our Ministry for the Environment (MfE) said in June this year that we were “working with other countries on an international treaty on plastic pollution”.

It went on to outline the problem that “every year 19-23 million tonnes of plastic waste leaks into aquatic systems alone, harming marine life and ecosystems”.

The cynic in me would suggest that if that pollution came from the agricultural sector it would be front page news but because it comes from the oil industry that’s fine.

The prime minister’s Chief Science Adviser, Professor Juliet Gerrard, has been concerned about the amount of pollution that plastics have created and published her views on our options to reduce the problem.

They include wanting a National Plastics Plan, rethinking plastics in the government agenda and the need to mitigate environmental and health impacts of plastics.

We shouldn’t pursue the issue on our own but should present it as a campaign from the woolproducing countries.

According to the UN, microplastics have “infiltrated our oceans, soil and even the air we breathe”, and “humans constantly inhale and ingest microplastics”.

Microplastics “are linked to serious health issues such as endocrine disruption, weight gain, insulin resistance, decreased reproductive health and cancer”.

In addition, 8 million tonnes of plastic flow into the oceans annually with a correspondingly toxic effect on fish. These include severely affecting marine life and microplastics residing in tissue waiting to be consumed by a third party. Plastic is also a problem with our soil as the product in

landfills can “take up to 1000 years to disintegrate”.

In the United States, 32 million tonnes of plastic goes into the landfills annually and will remain there for 1000 years.

Microplastics can also have a major effect on our flora and fauna and can be present in tap water.

Imagine for a minute if that amount of pollution had been generated by farming pursuits?

There would be riots in the streets.

There has been much hue and cry about nitrates in waterways but the reality is microplastics are much worse. People wring their hands about glyphosate but it is more environmentally friendly than plastic.

We need to front-foot the issue by strongly arguing for the environmental friendliness of wool versus the environmental degradation caused by plastics.

We tax fuel, why not tax plastics? Synthetic carpets would be a good start. We limit nitrogen application, why don’t we limit plastic use?

We were going to tax food production. Why not tax plastic pollution?

We tax alcohol and tobacco because of the harmful effects on health. Why not tax plastics for the same reason?

The only reason I knew about the proposed UN policy on plastics was from personal research and not from mainstream publications. I only figured we were a signatory by going through the MfE website. Again, it was private research that showed me how environmentally destructive plastic was, how it was a major risk to our land, oceans and human health. Those stories need to be shouted from the rooftops.

As an aside, we shouldn’t pursue the issue on our own but should present it as a campaign from the wool-producing countries. Like what used to happen before New Zealand decided to go alone.

In the current debate rankings I’d give the oil companies 10 and

the conservation and farming lobbies zero.

How I came onto the story was from a Greenpeace missive asking me to sign a petition opposing plastics. It called on the NZ government “to support a strong Global Plastics Treaty at the UN”. At the time of writing it had over

73,000 signatures, which should tell us that there is strong support for a move away from plastics. That also tells me that we need to tell the story of wool a lot better than we are currently doing. Maybe even a visit to Greenpeace to tell them what’s missing in their debate.

How fast and low are rates set to go?

Straight talking

Cameron Bagrie Managing director of Bagrie Economics and a shareholder and director of Chaperon

BAD news has become good news with interest rates coming down, setting in motion a better economic climate for 2025. The catalyst has been a third recession in two years, only this one has really broken the back of pricing behaviour. Tough times have crimped spending, meaning discounting has become more widespread as firms seek to shift product.

Firms have spare capacity for work, so the pricing of work becomes sharper, especially in construction.

Higher unemployment has tempered wage demands as job

Continued next page

IMPACT: Alan Emerson says 8 million tonnes of plastic flow into the oceans annually with a correspondingly toxic effect on fish. These include severely affecting marine life and microplastics residing in tissue waiting to be consumed by a third party.

Alan Emerson Semi-retired

Doubling our ag exports starts with us

Eating the elephant

Kate Scott

This week’s guest columnist, Nuffield scholar Scott of Bannockburn Vineyard is an environmental consultant. She writes in her personal capacity.

LAST week’s Eating the Elephant column by David Eade was about the “how” of our sector’s strategy to double exports. I want to talk about the “who”.

If you’re like me, all this talk of sector strategy feels like déjà vu. The fact that we’ve tried a few times to have this conversation is a sign of two things. One, that it’s a burning issue and two, we have to address the reasons previous conversations and attempts have gone nowhere.

If we want to grow exports in a way that also takes care of our land and our people, a clear strategy

Continued from previous page

security becomes more important. This is the basic disinflation playbook.

There are still some sticking points that will add some persistence to inflation. Local authority rates and energy prices being examples not linked to the economy at all. Geopolitical concerns at any time could set of further disruptions to supply chains or oil prices.

However, there are enough “bad news” economic disinflation forces that point lower for inflation to give the Reserve Bank of New Zealand comfort to start cutting the Official Cash Rate (OCR). With an easing cycle underway the obvious question is how fast and low will interest rates go?

The trajectory for inflation will have a big say over how fast they can fall. A steady decline in interest rates over 2025 is dependent on the RBNZ’s “confidence that pricing behaviour remains consistent with a low inflation environment, and that inflation expectations are anchored around the 2% target”.

Let’s assume it all goes to plan and inflation keeps falling.

The first port of call for assessing how low they will go is the neutral OCR. This is where the RBNZ has the foot on neither the accelerator nor the brake. Think of it as when the RBNZ is on holiday basking in

has to be the first step. But a strategy without a team behind it is just words on a page.

To build that team, let’s focus on four things – herding the politicians, building future leaders, collaboration by design and the consumer.

Firstly, herding the politicians, or “multipartisanship” for the policy wonks out there. This might sound like the least likely place to start given the past few years, but hear me out.

Having all political parties across the spectrum agree on a regulation and investment framework to double exports would be a gamechanger. No more sudden rule changes after elections, and imagine the progress we could make with guaranteed priorities and investments alongside government.

To gently nudge the politicians through this gate, though, we first need to lock in the fundamentals of what the sector wants to achieve. What priorities can everyone, across all of our industries, agree on? Sure, there will be plenty of matters where we don’t agree (and shouldn’t). But by focusing on the shared goals (such as water quality, emissions and biodiversity), we can make agriculture one of those “bigger than politics” issues.

The second pillar we need for a strong team is a step-change in how we invest in future leaders.

Technology is going to help to double exports – no doubt about it – but it will be people who drive that change. People who intuitively understand technology

the sunlight of having inflation at 2% and not having to do a lot.

The neutral OCR has moved over time. Back in 2000, it was up around 5% and the OCR wobbled around it. By 2020 it was estimated to have fallen to 2%, allowing interest rates to be a lot lower on average.

New Zealand has a clear structural problem where home lending is being prioritised at the expense of lending into the real productive sector.

and millennial and Generation Z value sets. Tomorrow’s leaders.

A Path to Realising Leadership Potential in Aotearoa NZ’s Food and Fibre Sector, by Rural Leaders and the Food and Fibre Centre of Vocational Excellence (FFCoVE), sets out a principles-centred approach for leadership in the sector, allowing us to foster highperforming teams capable of successfully doubling exports.

I love this wisdom from Ta Tipene O’Regan (Ngai Tahu) on the difference between “future takers” and “future makers”.

Future takers, he says, “accept the future for what it is, feeling powerless to change what will be, and allowing today’s realities to obscure tomorrow’s potential”.

Future makers, on the other hand, “shape the future by reading the signs, determined to create future spaces for people to excel, undaunted by today’s problems, and ready to lead change”. We need future makers now.

The third bit is a tired record these days, but that doesn’t make it wrong. A focus on genuinely collaborating with each other, building on existing foundations. It’s pretty straightforward – we’re not going to succeed unless we work together.

It’s about realising that collaboration around an ambitious future is the only way to tackle this beast of a strategy. And yes, we might bump into a few challenges along the way, but with the right high-performing teams, the right leadership ecosystem and clear areas of agreement (and disagreement), we’ll manage.

If policy rates are below the neutral rate, policy is stimulatory and, conversely, rates above neutral make policy contractionary.

The RBNZ estimates the neutral OCR is now around 2.75-3%, which it is projecting the OCR will fall to. Demographic changes, productivity growth, and changes in consumers’, businesses’, and governments’ attitudes towards savings and investment can all influence the neutral OCR. Future neutral interest rates may be higher due to de-globalisation (adds to costs), ageing populations as they start to spend as opposed to save, decarbonisation (adds to

such as water quality, emissions and biodiversity, we can make agriculture one of those ‘bigger than politics’ issues, says Kate Scott.

of any future strategy.

Imagine the progress we could make with guaranteed priorities and investments alongside government.

Finally, let’s not forget who we’re doing this for – the consumer, our global oyster. Sure, doubling our exports sounds great, but even then, we won’t be feeding the whole world. Instead, we need to focus on a strategy that provides value to both our global consumers and New Zealanders at home with affordable, healthy food. Domestic food security must be a clear part

costs and inflation), and higher government debt.

Westpac economists and I put the neutral OCR around 3.5-4%.

Irrespective of the RBNZ or Westpac view of the neutral OCR, the good news is that they are both well below the current level of the OCR.

Historically, monetary policy spends periods both contractionary (above neutral) and stimulatory (below neutral), and here we are simply talking about rates going back to neutral from a period of being contractionary.

Other factors will also play a role over the coming years on borrowing costs. Two key ones are bank funding costs, of which the OCR is one factor, and the pricing of risk relative to the taking of it.

As people have invested more in term deposits in recent years, this has added to bank funding costs. As the Funding for Lending (FLP) programme also winds down (which gave the banks cheap funding from the RBNZ), banks will likely replace FLP funding with retail and/or wholesale funding, although this is more expensive.

New Zealand has a clear structural problem where home lending is being prioritised at the expense of lending into the real productive sector. There is also a related issue regarding the pricing of risk (think bank margins, which drive profits) relative to the taking

Staying stuck in our ways won’t cut it. We need to anticipate what our global consumers want before they even know it themselves. We’ve got the potential to offer the best of the best. The world really is our oyster – it’s just up to us to deliver.

In the end, realising our ambition to double exports will be a team effort. If we can nail multipartisanship, nurture strong leadership, foster greater collaboration, and stay laserfocused on our consumers, we’ve got a real shot at making this strategy work. And who knows, maybe we’ll even enjoy the ride along the way.

of risk (think about the volatility of bank earnings, which tend to be very stable). The Commerce Commission has highlighted an inconsistency between the two. Banks deliver superior returns without the risk.

This is where a key part of the upcoming Finance and Expenditure Committee’s inquiry into banking competition needs to focus.

Rural lending will always be more expensive than residential lending. Banks need to hold more regulatory capital against the former. This inquiry needs to put the spotlight on the risk-adjusted returns across residential, business and rural lending, though. We need to see attention on the return on capital from business, rural, and residential mortgage lending. The bottom line is that lower interest rates are welcome news but there is still some uncertainty over the magnitude of the decline we will see. Assuming inflation remains contained and monetary policy goes back to neutral, a 150225 basis points drop in borrowing costs from the peak seems in the ballpark with the lower estimate based on a higher assumed neutral rate and the impact of some changes in bank funding costs. More sunlight on bank rural lending margins could accentuate more competition and that projected decline in borrowing costs.

In this series, the team each offer a big-picture strategy for food & fibre.

SHARED GOALS: By focusing on the shared goals,

RELATIVE: While rural lending will always be more expensive than residential, Cameron Bagrie says the banking inquiry needs to put the spotlight on the risk-adjusted returns across residential, business and rural lending portfolios.

This global brand builds on a base layer

The Merino action-sports brand Mons Royale is the result of a winning partnership between a high-country couple. Annette Scott reports.

TWO Kiwi farm kids who had no interest in farming instead created the Merino clothing brand Mons Royale and showcased it to the world.

Born from the mountains of New Zealand and founded by Hamish and Hannah Acland in 2009, 15 years of Mons Royale has grown into a global success story.

Both from high country farms – Hamish grew up on Mt Somers Station in the foothills of Mid Canterbury, and Hannah (née Aubrey) hailed from Dalrachney Station near Wānaka – the couple knew there was potential to do something special with NZ Merino wool.

They pioneered Merino in action-sports apparel, creating garments that provide superior warmth, breathability, and durability.

It all started from a somewhat ambiguous email subject line.

Acland grew up in an entrepreneurial family learning how to see things differently, identifying opportunities and adding value.

His grandfather Sir Jack Acland farmed Mt Peel Station and was a former chair of the NZ Wool Board and vice-president of the International Wool Secretariat.

His father Mark, with Sir Tim Wallis, pioneered the NZ farmed deer industry and with his brother John introduced flexible cattle ear tags to NZ, and later the Lynn River gloves.

“My family has played a big part. Looking back I grew up in an entrepreneurial environment.

“I come from that sort of family where you are always looking at designing a better way, solving a problem.

“When I first met Hannah, I asked her to give me her opinion of Mons.”

The email subject line was “an anatomy of an idea”.

“Her feedback was quite brutal.”

Said Hannah: “I kind of dissected the anatomy of an idea.”

From that dissection the thread was woven.

“Essentially it was two Kiwi farm kids not interested in farming, ended up husband-and-wife business partners creating Merino clothing brand Mons Royale.

“There were very strong links: wool, farming, sports, design to connect the dots and have a real positive impact.

“Mons sits at the intersection of farming and a customer base; it was our job to create connection and demand.

“Starting a brand was quite hard. Hannah brought style and energy that balanced the sporting person I was.”

Hamish was a professional freeride skier, ranked fifth globally in 2005.

“As a professional skier I travelled the world for 10 years living out of ski bags, and I noticed that I wouldn’t wear the Merino base layer that I had at the time other than on the mountain.

“The outdoor industry was all about making everything look like it was for climbing Everest.

“This led to the idea of creating a brand that designed technical products that could be worn as easily on the mountain as off.

STRIKE FLIES AND LICE

That’s where the idea of Mons came from.”

Acland identified a gap in the market for stylish and functional base layers for extreme sportswear.

“The job was to replace the cotton T and synthetics to something that could be worn for days and not need washing.

“I wrote what you might call a blueprint and how the brand would develop over the first years, focusing on the gap in the market and how to differentiate itself against what was an established category.”

Come the end of 2008 Acland developed samples and sold them to NZ retailers.

It was then he met his wife to be, who was just back from a threeyear stint in New York at an idealed innovation company.

From the anatomy of an idea, Mons Royale was born in 2009 and is now stocked in more than 1000 stores globally.

Why the name? “Mons” is Latin for mountains “and because we hold the mountains supreme, we treat them like royalty”, hence Mons Royale, representing the culture and the energy of the mountains, and made from premium-quality NZ Merino wool.

The brand was designed to be global from the start, but the couple’s first trip to ISPO, the

world’s largest trade fair, in that first year was a “big failure. We realised the original translation wasn’t quite right.

“We returned home, stalled production and Hannah redesigned all of the graphics and identity in a week.”

Hamish’s contacts from his skiing career were key to targeting some of the world’s best athletes.

“Another key part of sales was that the outdoor and snow industry was extremely male dominated.”

Mons targeted women. More than 50% of its sales were to women, half its staff were women, and they made clothing women wanted to wear.

“A lot of brands missed that.”

They also connected with their fans year-round in ski towns. Dirt was the new snow with the rise of mountain biking, which had become another target market.

In 2009 Mons Royale shipped its first orders overseas and by the next ISPO trade show “we were on a roll”.

A flagship Mons Royale retail store opened last month as part of the 15-year anniversary celebrations.

It’s in Wānaka, where the couple live with their young family, Ted, 10 and Frankie, 7.

Mons Royale has four other retail outlets in NZ, two in Queenstown and two in Christchurch.

Globally Mons Royale has a base in Innsbruck, Austria and

Squamish, near the Canadian ski resort town of Whistler.

“We are based with teams in mountain towns; mega cities are not us.”

Hannah continues to design all the clothing while Hamish runs the business.

The business is the largest NZ company buying fine wool through contract with the NZ Merino company.

“We are still buying from some of the same farmers we bought from on Day 1.”

Future plans for the business include scaling up the impact of wool through innovative constructions and natural fibre blends such as hemp.

Learning the retail game in NZ is something the couple have both enjoyed as they look forward to now taking that overseas.

While tiny in scale on the global stage, commitment to succeeding globally has paid off.

“We have probably flown under the radar here in NZ but we wanted to put our heads down, do the work and let the brand do the talking.

“To succeed globally a brand needed to stand for something and for Mons it has been its distinctiveness, energy and performance.