Keep it co-op, urge Alliance stakeholders

ALLIANCE Group shareholders will lose influence and the meat industry a price setting yardstick should it cease being a co-operative, say supporters of the co-operative model.

A group of Alliance shareholders formed to promote discussion on the role of co-operatives said farmers need to know the cost and implications should the country’s largest 100% farmerowned co-operative be fully or partly sold.

The chair of the group, Andrew Morrison said business owners reap the financial benefits, as they should, and currently for Alliance those benefits go back to its cooperative owners.

Group member David Pinckney believes many of his fellow shareholders do not appreciate what they will be losing nor the longterm implications of a business model that is not a co-operative.

“I feel if we lose this one, that difference may not be in our profit and loss accounts this year or next year but it will play out in the long-term future.

“Alliance shareholders and the red meat sector generally will be worse off.”

They acknowledge the timing of going to shareholders for new capital has not been helped by two years of low sheepmeat prices.

Lincoln University agribusiness professor Hamish Gow said cooperatives ensure red meat and dairy suppliers receive a fair price and they provide market discipline and insurance for their suppliers by maintaining processing capacity when it is needed.

“Whether it’s Alliance or not, what we know is it’s important to have a co-operative operating in market channels as it creates market pressure by being a yardstick, allows flexible farming systems and an insurance so farmers can move animals when weather events move against them.”

Southland farmer and shareholder Matt McRae said neighbours and friends who are not Alliance suppliers tell him of the importance of the co-operative in setting prime stock prices for the industry.

He said the sheep industry needs to be strong for future generations of young farmers.

“We can’t keep shrinking to success so we must ensure the sheep industry is profitable and an Alliance co-operative is a big part of that.”

The Alliance board needs up to $200 million in new capital but announced at last month’s annual meeting that it is pausing the capital raise from shareholders through livestock deductions and the issuing of new shares and

Continued page 4

a

ensure there will be a fifth generation on

a new tool for fert use

FAR regional facilitator Donna Lill says a project measuring micronutrients aims to give arable farmers a better handle on efficient fertiliser application.

ARABLE 15

How harmless are the lies some opt to believe, asks John Foley. OPINION 13

Fourth-generation Southland sheep and beef farmer and Alliance shareholder Matt McRae says

strong industry and strong Alliance Group co-operative are needed to

his Wyndham farm.

Photo: Gerhard Uys

Neal Wallace NEWS Production

Get in touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469

Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME Delivered by Reach Media Ltd

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

News in brief Milk powder surge

A 5% surge in whole milk powder prices has given a 1.4% lift to the Global Dairy Trade price index after two weaker auction outcomes in late December and early January.

The latest 1.4% index increase, on January 22, reversed the market fall at the previous GDT auction, but the components of the index were widely dispersed.

The first South Island wool sale of the year reached prices not seen in several years with the overall strong wool indicator up 15% on the same time last year.

PGG Wrightson South Island auction manager Dave Burridge was confident the $4 clean price barrier could be exceeded in the coming sales. Good style crossbred fleece fetched $3.90, up 3%, while average style lifted 5% to $3.84 with poorer up 3% to $3.63.

The Foundation for Arable Research is urging maize and sweetcorn growers to scout their crops after evidence that fall armyworm populations are two to three weeks more advanced than in previous seasons.

Actively scouting crops and monitoring for any signs of fall armyworm presence allows growers time to assess infestations and consider numbers in terms of economic damage and treatment thresholds. Secondgeneration FAW has already been observed in Northland, where small populations have been widespread since November.

Seeka revision

Listed horticultural company Seeka has made a second $4 million upwards revision of its earnings guidance for the 2024 financial year, which has a December 31 balance date.

The new guidance range for profit before tax is $27.5m to $31.5m. The guidance is based on unaudited financial results, which are expected to be formalised in late February.

Milk and money set monthly records

Hugh Stringleman MARKETS Dairy

NEW Zealand milk production during 2024 was the biggest in a decade and the recent monthly payouts to dairy farmers have set records.

In mid-January, Fonterra made its largest ever monthly payment to farmers for milksolids. It was a combination of an 85% advance rate on December’s production, the catch-ups on payments for June to November production and the 3.7% season-to-date increase of milk production versus 2023. December’s production was 228.3 million kg MS, 1.4% higher than in December 2023 and the highest December since 2020.

Over a longer time frame, total NZ milk production during calendar 2024 was 1923 million kg, the highest in a decade since cow numbers started falling.

With the exception of Southland, the main dairying regions have boosted productivity in the past six months and appear to be on track to carry that momentum

through the rest of the 2024-25 season.

NZX dairy analyst Rosalind Crickett said in a commentary on the latest milk production numbers published by the Dairy Companies Association of NZ that the current season is forecast to end up 1.3% on 2023-04.

“The rate of increase month-bymonth will taper off but we think the season as a whole will be up on recent seasons, going back to 2013.”

We think the season as a whole will be up on recent seasons, going back to 2013.

Rosalind Crickett NZX

Agricultural economist Phil Journeaux, in Hamilton, said the seasonal tide of extra milk production has been weather related on top of a lower rate of per-cow and farm productivity gain.

“The 85% Fonterra advance rate has certainly put a lot more money

GROWTH: December’s production was 228.3 million kg MS, 1.4% higher than in December 2023 and the highest December since 2020.

in farmers’ accounts this year compared with previous years.”

Right now, dairying’s ability to carry the NZ economy – as it has in previous recessions – cannot be overstated, Journeaux said.

Fonterra has front-loaded the advance rate compared with its historical pattern because of better cashflows and lower corporate debt levels.

Chief executive officer Miles

Liquidators chase GDNZ funds

THE liquidators of a failed live export company, Hamiltonbased Genetic Development (NZ) Exports Limited Partnership, are chasing up voided transactions worth millions of dollars issued to all parties initially believing themselves to be secured creditors.

This includes the $630,000 commission fee paid to Irishbased Purcell Brothers SPV (Purcell Exports, Australia), which brokered a financial arrangement with Allied Irish Bank (AIB) that enabled the voyage of the Ocean Ute shipment of live cattle to China in May 2022.

Overall, 160 farmers were involved in the shipment with 20 companies listed as secured creditors in the initial report at the time of the liquidator’s appointment.

PwC liquidator Malcolm Hollis said this had been determined to include about 90 farmers, but leaving a further 47 farmers out on a limb in the pool of more than 100 unsecured creditors owed about $11.3 million.

Secured creditors with transactions now declared voidable –transactions that unfairly occurred when the company was unable to pay its debts – include livestock companies, farming businesses, feed and service suppliers.

“There was quite a number who got themselves nicely paid in full,” Hollis said.

This also included Purcell Exports Irish-financed payment from proceeds of the sale of livestock from Genetic Development, during the restricted period prior to liquidation.

At the time the Ocean Ute sailed, director Patrick Purcell said when complications set in, he was asked to facilitate a financial solution so the shipment could go ahead.

“We found a solution with an overseas bank (AIB).

“Our instruction was to pay 11 or 12 suppliers, and the bigger contracts with agents and it was for about $8m and the letter of credit was for these suppliers only.

“That’s what we were instructed to do. We were instructed to issue payment to those suppliers and they got paid.”

All those payments have since been declared void by the liquidator.

With no provisions in the NZ Companies Act for service on overseas companies abroad, the liquidators have had to serve the Irish finance company using the Irish rules.

Hollis said this process is now being driven by the lawyers.

“In our view the whole finance arrangement reduced credit risk but was not equal and fair.

“It’s complex. It’s about a clear group of farmers and companies

who managed to get protected and a bunch of farmers and others who received nothing.

“I have to run by the legal process. It’s very expensive and not fast, it takes time and money.”

Voidable transaction notices have been issued to all identified parties. Responses have been received from some parties acknowledging receipt of the notices providing reason for dispute. Other parties have not responded, Hollis said.

“We continue to pursue this avenue of recovery. Our intention is to commence legal action against selected parties that are representative of the entire group.

“We will also continue to investigate the actions of the directors of the general partner and the affairs of the partnership to identify if there are any further avenues for recovery or breaches of law for further investigation.”

Hollis said all voided transaction recoveries will go into the overall creditor pool.

Any distribution to creditors will be dependent on successfully resolving matters around these transactions.

be the largest annual financial expenditure for Fonterra in its 24-year history.

Hurrell has also said that half of all milk payments to farmers are spent on wages and farm inputs in the regions.

December is historically the third-highest month in the year for NZ milk production.

In the months during which Fonterra pays dividends and, in 2023 and 2024, the special dividend and capital return, total monthly payment to farmers may have been higher.

But January 2025 set a record for milk-only payouts.

Files

Hurrell has repeatedly said a key target of the company’s financial management is to pay more money earlier to its farmers.

With the current $10/kg midpoint of the farm gate milk price forecast, Fonterra will pay its farmers close to $15 billion in total over 16 months between June 2024 to October 2025, when the seasonal retro payments finish.

That milk procurement cost will

The January payments to its 8500 farms exceeded $1.5bn. All dairy processors collectively would have paid more than $2bn.

With the exception of share dividends, most other dairy companies in NZ match or slightly exceed Fonterra’s milk payments.

The recent fall in the value of the NZ dollar will also help dairy companies maintain their $10-plus forecasts for milk, although their forward currency conversions may be hedged at higher USD/NZD levels.

LIC posts strong half-year result

Gerald Piddock NEWS Genetics

IMPROVED economic conditions have resulted in a strong half-year result for LIC with total revenue up 8% to $185.7 million.

The result for the six months to November 30 2024 showed that net profit after tax was up 34.8% from the same period last year, totalling $39.1m, and underlying earnings totalled $33.7m, up 17.4% from the same period last year.

The result is a significant improvement from the prior year, indicating that farmers have generally weathered the tough financial headwinds of 2023 and early 2024.

The co-operative expects underlying earnings for 20242025 to be in the range of $18-22m, up from $16-22m announced in July 2024.

This range assumes no significant events, including climate events, or milk price change takes place between now and then.

Board chair Corrigan Sowman said he was incredibly pleased to see farmers continue to recognise the value of investing in productive herds and resilient farms.

“As a generational co-operative and world leader in pasturebased dairy herd improvement, we will continue to work alongside farmers to improve the profitability and efficiency of the national dairy herd.”

LIC chief executive David Chin

said the performance was driven by good conditions both for farming and in the market.

Farmers are also more focused on herd improvement with an added focus on disease prevention and animal heath testing.

As farmers improved their efficiencies and bred better cows, the farm becomes more profitable with better fertility and more milk solids.

That in turn makes them more sustainable and efficient. Rather than expanding their herd size, farmers are looking at breeding better quality animals, which they see as more profitable, he said.

“It’s making genetics and herd improvement far more relevant.”

Chin said they will be investing a lot of the profit and earnings back into the co-operative and are making significant progress in its dairy-beef programme as well as toward breeding cows with lower methane emissions.

“Our research (funded by the New Zealand Agricultural Greenhouse Gas Research Centre) has confirmed that genetic variation influences how much methane heifers produce.

“We are now one step closer to breeding low-emission cows. The next step is the building of a state-of-the-art research barn to enable large-scale monitoring of lactating cows.”

That barn will be constructed over the next six months at its innovation farm site near Rukuhia in Waikato.

Photo:

Annette Scott NEWS Genetics

VOIDED: Liquidators of Hamilton-based Genetic Development (NZ) Exports Limited Partnership are chasing up voided transactions worth millions of dollars.

exploring other funding options. Those appear to be either a hybrid farmer-corporate ownership or a sale.

The farmer group does not think it is too late for Alliance to retain its co-operative status and it supports any restructuring that may be required.

Chair Mark Wynne has previously said Alliance retains the support of its bank syndicate.

The shareholder group is encouraging discussion among shareholders on the merits of co-operative ownership and risks should that cease and is arranging meetings and webinars with agribusiness academics such as Gow and James Lockhart, a senior lecturer at Massey University.

“It is most important that people understand and recognise the value of cooperatives in establishing a competitive market return for farmers,” said Lockhart.

“Co-operatives provide the basis against which all other companies need to compete.”

Alliance has 4500 shareholders and processes about 10m livestock carcase equivalents a year, of which 70% are sheep.

Prior to pausing the capital raise, it was deducting $1/head for each lamb, sheep and bobby calf processed, $12/head for cattle and $4/head for deer.

Morrison said a shareholder in Tatua Dairy Co-op with a $10m business would have 44% of their enterprise value in co-op shares.

For a Fonterra shareholder it would be about 10% but a fully shared-up Alliance shareholder, it is about 0.6% of their enterprise value.

He said it would cost 4000 shareholders up to $50,000 each to provide the $200m on new capital required but it would enhance their supply chain investment.

“The simple question to ask is how important is that investment to a shareholder?”

McRae said so long as the schedule is competitive and payment is staggered, then an investment of that scale is achievable but farmers need to realise it is for five to 10 years.

Alliance at a glance

• Alliance Freezing Company Limited was formed in 1948.

• Initial processing site was at Lorneville near Invercargill.

Became a co-operative in 1980.

• Owned by 4500 shareholders. Net assets as at September 30 2024: $288 million.

• Average annual turnover for the last six years: $1.9 billion.

• Average net result for last six years: $9.4m loss.

Increase in term debt for last nine years: $102m.

Plants at Lorneville, Mataura, Pukeuri, Nelson, Levin, Dannevirke (it closed Smithfield last year).

Meat industry at a turning point

Neal Wallace NEWS Production

THE Alliance Group and the meat industry are at an inflection point, with the last large 100% farmer-owned co-operative likely to lose that status, says Associate Agriculture Minister Mark Patterson.

“It’s an inflection point for the company and the industry as a whole,” said Patterson, a South Otago farmer and Alliance shareholder.

An advocate of co-operatives, he said whatever ownership option Alliance directors put to shareholders needs to target the next generation of farmer suppliers.

“We’ve got to think about what is best for the next generation, not just the next 12 month’s cash flow,” he said.

It’s very hard to set up a co-operative but it’s easy to lose it.

Mark Patterson Associate Agriculture Minister

Should Alliance lose its cooperative status, he said, it will never get it back.

“It’s very hard to set up a cooperative but it’s easy to lose it.”

Patterson said he is not privy to any more information about Alliance’s situation than other shareholders are but speculates a company like Silver Fern Farms could have a role in its future.

“There could be potential that Silver Fern Farms could be a white knight coming over the hill and might offer a portion of farmer ownership.

“It could be the best we can

hope for – a semblance of farmer control.”

He believes Alliance was complacent and “sleepwalked” into its sudden need to find new capital, which also saw it lose its financially dominant position.

The refusal of management and the board to listen to supplier anger and end favourable payment for stock supplied by third-party traders was one reason for losing its current predicament, he said “Now they come to shareholders as a last resort and they have got the expected response from shareholders given the way they have been treated.”

He tempers his criticism with praise for current chair Mark Wynne, describing his performance as “a breath of fresh air” despite being dealt a “weak hand”.

While not committing government support, Patterson said his NZ First Party would be open to considering assistance for an industry-wide resolution to Alliance’s situation, although he was not aware of anything being considered.

John McCarthy said little in the meat industry has changed since the 2015 Meat Industry Excellence group, which he chaired, commissioned its Pathways to Long-Term Sustainability report.

It estimated there would be more than $400 million in gains over five years from a merger of the then two co-operatives Alliance Group and Silver Fern Farms, and a further billion dollars in savings from industry rationalising plants.

McCarthy, who is retired and describes himself as an observer from afar but with farming interests, is critical of the Alliance board for being too slow to act.

He said it should have moved earlier to invest in plants and diversify from its reliance on sheep.

The industry today has few

options given declining sheep numbers, he said, while a sector-wide solution requires disparate companies putting their differences aside and agreeing to work together.

McCarthy said in 2015 they had an industry-wide solution with financial backing from ANZ Bank that they wanted to take to the shareholders of Alliance and Silver Fern Farms.

At the time SFF was close to looking for an outside investor and McCarthy said this was an alternative based on a collective restructuring of the two co-operatives.

He said the ANZ had agreed to contribute a substantial amount of money to fund the new structure but it was refused when it asked then prime minister John Key for the $300,000 to promote it to shareholders.

The Pathways to Long-Term

Sustainability report found strong support from sheep and beef farmers for a consolidated cooperative model. It also addressed concerns about foreign ownership of the supply chain.

Its recommendations included processors working collaboratively to find an industry-wide solution to excess capacity, which was costing both farmers and processors.

It recommended creating a structure or holding company to park redundant processing capacity to facilitate plant closures and remove the cost from balance sheets.

It found the government had an enabling role in industry restructuring, but equally farmers needed to commit or contract supply to provide stability and transition from a production-led to a consumer-focused, valueadded model.

Time and options running out for Alliance

Neal Wallace NEWS Production

TIME is running out for the Alliance Group to raise the $200 million in new capital it needs, says chair Mark Wynne.

While the board’s preference is to remain a fully farmer-owned co-operative, Wynne said in a statement that the chances of raising the necessary funds from shareholders are slim.

“Raising sufficient capital solely from farmer-shareholders is highly unlikely given the current market returns and within the timelines expected by our banking partners,” he said.

The board has paused the internal capital raise and the issuing of new shares from livestock retentions.

He reiterated that shareholders have three options: remaining

100% farmer-owned, entering into a joint venture, or pursuing a full sale of the co-operative.

He declined to speculate on potential investors or partners but said shareholders will be advised of any opportunities and risks.

Alliance has previously announced the recruitment of Craigs Investment Partners to lead an external capital-raising programme.

“At this early stage of the external capital-raise process, we don’t yet know what the future of Alliance will look like.”

Wynne acknowledged that two poor financial results have tested the trust and confidence of farmers. In 2023 it reported a $70m loss and last year a $95.8m loss, and he said shareholders have sent the board and management a clear message.

“They’ve emphasised the need to strengthen the balance sheet,

simplify processing sheets, review processing capacity and provide a more competitive schedule.

“They’ve also called for a more equitable business and a reassessment of third-party arrangements to ensure fairness across the co-operative.

Raising sufficient capital solely from farmershareholders is highly unlikely.

Mark Wynne Alliance

“We committed to making all these changes by the end of September last year and have delivered against these commitments.”

There has been talk of an

industry-wide solution to issues facing the meat industry such as surplus capacity, but Wynne said first the wider challenge of profitability and capturing more value from the market needs to be addressed.

Three million fewer lambs were born in 2024 than in 2020, and last year Alliance closed is Smithfield plant near Timaru.

“Currently, the returns on capital for both processors and farmers are inadequate, driving many farmers to logically shift land use in search of better returns.

“This issue is particularly pronounced in the sheep sector, where the longstanding poor returns from wool have placed even greater pressure on meat to support the entire value chain.

“Without addressing these fundamental challenges, we cannot secure a sustainable future for the sector.”

SPECULATE: Associate Agriculture Minister Mark Patterson says he is not privy to any more information about Alliance’s situation than other shareholders but speculates a company like Silver Fern Farms could have a role in its future.

Photo: File

Science marked for major shake-up

Richard Rennie NEWS Research

AFTER existing for almost a generation, the country’s seven Crown Research Institutes are to be folded into three entities under government plans to transform New Zealand’s science sector.

The changes reflect several of the recommendations in the long-awaited report of the Science System Advisory Group, headed up by Sir Peter Gluckman.

Originally due in June last year, the report’s publication – and the government’s moves on science – coincided with Prime Minister Christopher Luxon’s state of the nation speech.

He undertook to see the sector transformed, with a sharp focus on the commercialisation of technology.

In what appears to be close adherence to Sir Peter’s review recommendations, the government will turn the current seven CRIs into three Public Research Organisations (PROs), focusing on bioeconomy; earth sciences; and health and forensic sciences.

The bioeconomy PRO is likely to include AgResearch, Manaaki Whenua-Landcare Research, Scion and Plant and Food Research.

A separate advanced tech PRO will focus on the likes of artificial intelligence development and quantum computing technology.

A PM’s science, innovation and technology advisory council will provide strategic direction and oversight for the PROs, identifying priorities and opportunities.

AgResearch CEO Sue Bidrose said it is pleasing to have certainty from the government after years of debate about the sector’s structure.

“In the months ahead, we’ll be

focused on working with those other CRIs, the government and our industry partners to make the transition to the new entity as smooth as possible.”

She said she is optimistic about how “other challenges” facing the sector can be addressed.

AgResearch has been under a sinking lid policy for staff over the past five years, with numbers falling from 722 full-time staff in 2019 to 666 in 2023.

Sir Peter’s report does not mince words in its description on the need for urgent change within NZ’s science system, to play catchup with the rest of the developed world.

The report described NZ as a global “outlier” in its attitude to science, where every other small, advanced country had long recognised and demonstrated the core role of science in advancing productivity.

“The prize if we can get it right will be game changing for NZ,” the PM said in his state of the nation speech.

The revamped science structure aims to link into the government’s announcement to create an Invest New Zealand entity aimed to lift foreign investment into the country.

But the report does not let the government off the hook and simply allow it to pass funding needs to the private sector.

The review points to overwhelming global evidence of the critical need for greater public investment to ensure stronger private sector investment in the sector.

While emphasising the reform to be done, the PM’s announcement failed to make any reference to any increases in public investment into the science sector.

NZ’s investment in R&D is only half the OECD average.

Dr Kate Muise, CEO of Science New Zealand, the body representing CRIs, said NZ’s 30-year-old system was due for

a change. She acknowledged the work of the advisory group.

“It is gratifying to see decisions coming from that work.”

Done well, she said, the changes have the potential to enhance the system and drive NZ’s prosperity.

The government is also following up on the review’s recommendation to disestablish Callaghan Innovation, moving its most important functions to other parts of the science system.

The government has already moved to make 61 roles at the institute redundant over the past 18 months.

“Callaghan has simply been spread too thinly across too many functions, leading to poor financial performance and an overreliance on Crown funding,” said Minister for Science Innovation and Technology Judith Collins.

Review to report on approvals logjam

Bryan Gibson TECHNOLOGY Pests

FARMERS are missing out on important tools to combat pests and disease, but there’s hope a review of the approval path for agricultural and horticultural products will result in an improved regulatory system.

Animal and Plant Health New Zealand chief executive Dr Liz Shackleton said the review will look at the backlog of new products waiting for approval, while also recommending how the process can be improved to foster collaboration, risk balance, and transparency.

“And that’s what’s mission critical, because these delays are impacting our rural communities,”

Shackleton told the Farmers Weekly In Focus podcast.

Right now farmers are facing an outbreak of fall armyworm, and Shackleton said there are new

products sitting in the approval queue at the Environmental Protection Authority.

“This is one of the world’s most devastating pests and our farmers have limited options. They need alternatives, including biologicals for control that they’ve got in other jurisdictions like Australia.

“When fall armyworm arrived in New Zealand in 2022, farmers lacked the full toolkit to combat it. The existing chemicals face some challenges with resistance and impact to our beneficial insects. So we need alternative options and in the queue at the moment there is a new mode of action for fall armyworm called tetraniloprol and it was submitted back in December 2022.”

Apple growers are facing trade barriers because they lack options in the fight against black spot, with some experiencing disease levels between 5-10%.

“That’s well beyond market

access cutoff points for a market like China.”

There’s a new product that has been waiting for approval since August 2021.

“And in that time, Australia has approved the active, had label extensions, and Australian growers are out in front of us.”

Shackleton says the review should be released soon.

“The Ministry for Regulation has been leading it. Cabinet are due to consider the findings and the report is due to be released very soon. So that’s at the end of February, from what we understand.

“We and others from the sector, and the regulators, have provided feedback into the review. And from there, we will regroup and look at what comes through in that report.”

MORE:

Listen to Farmers Weekly In Focus wherever you find your podcasts.

REFORMED: The announced government reforms are the first major changes for a generation.

Funding failure threatens QEII covenant protection

TConservation

HE QEII National Trust is approaching the edge of a financial cliff as funding ends this year, despite growing numbers of farmers clamoring to register their land under its protection.

The trust oversees over 180,000 hectares of covenanted farmland protected in perpetuity, most largely on privately owned farmland. Last year it approved 2600ha of high value land and has 5300 formally registered covenants under it.

But the trust’s Department of Conservation-sourced funds of $4.27 million a year have been frozen for the past decade. Additional funding from the government’s covid-inspired Jobs for Nature programme, which amounted to $3.9m last year, is due to end in June, effectively halving the trust’s income base.

Trust CEO Dan Coup told Farmers Weekly it would not be able to accept any further covenanted titles from then,

despite landowners’ appetite to offer more land for protection.

“The Jobs for Nature funds have kept us going for the last four years. That is a bit of a cliff that we face in June.”

He said despite sheep and beef farmers facing a tougher couple of years, demand for protection from the trust has remained strong, with covenants growing from 4000 in 2015 to 5300 today.

“There are plenty of good people out there keen to protect their land.”

One option mooted within government circles for further funding has been sourcing it through the newly minted international visitor levy. Coup said the trust has no influence over that decision, but it was one angle.

One of the biggest expenses for the trust is field visits, with every covenant owner receiving a visit once every two years.

One other possible income source would be administering biodiversity credits for land planted and protected as native species.

Associate Environment Minister Andrew Hoggard said he is

working on biodiversity credits farmers could claim.

“It would be about how the government could come up with a framework and assurance for a market to invest in them, rather than a government-controlled market. Government has no money to put into it, so we’re not talking a subsidy.

“It would require oversight and assurance, which is the sort of work QEII do. They could have the administration of it and take some financial income from it.”

Coup said the challenge would be for QEII to extract value from the credits given landowners need to get the bulk of the benefit if more are to be encouraged to run with them.

“But we would want to be involved in such a system if it came along.”

Environmental Defence Society chair Gary Taylor said given government claims about how valued private landowners are in protecting landscapes, any halt to trust funding would be “highly inconsistent.”

He said the funding shortfall of about $3m a year that the trust

would experience with Jobs for Nature ending is minimal in the scheme of things.

He welcomed any consideration of a biodiversity credit scheme.

“These were always going to sit alongside the regulations imposed by the last government but never eventuated.”

Federated Farmers has shared concerns that QEII funding has not kept pace with the area it is managing.

Vice-president Colin Hurst told Farmers Weekly that if the government is serious about improving environmental outcomes and protecting biodiversity, the trust needs to be financially supported.

“For the Department of

Conservation’s annual funding to have remained unchanged at $4.5m for a decade is totally disgraceful. In real terms, it’s a huge cut,” Hurst said.

He compared that to DoC’s total budget doubling over that time from $350m in 2015 to over $700m today.

“The QEII land is effectively a national park in terms of scale. All of that land has been volunteered, at a cost, by farmers who want to do the right thing.

“This isn’t a case of the Department of Conservation needing more money; it’s a case of them needing to prioritise funding for initiatives that have community buy-in and actually work.”

ZQ suspends farms in sheep shearing abuse probe

Neal Wallace NEWS Animal welfare

TWO farms have been suspended from New Zealand Merino’s ZQ quality standard supply programme after undercover video of alleged animal welfare breaches during shearing was released by an animal activist group.

NZ Merino (NZM) is also launching an independent investigation to determine, among other issues, whether a breach of its ZQ supply

standards has occurred.

“If further information or footage is released, we are committed to expanding our investigation,” said NZM chair Kate Mitchell.

This is one of three separate investigations underway following the release earlier this month of multiple videos by animal activist group PETA.

The Ministry for Primary Industries is also investigating.

“We have identified some instances in the video footage

Dair yNZ associate director sought

As an industr y-good organisation, Dair yNZ supports farmers to lead the world in sustainable dair ying by investing in scientific research, new solutions and advocacy. We exist to progress a positive future for New Zealand dair y farming.

If you are a dair y farmer seeking to contribute more to the dair y sector, we encourage you to apply for the associate director role with Dair yNZ.

The role is an opportunity for farmers who have already invested time in public-good activities to contribute to their industr ygood body and participate in discussion and debate It is also an opportunity to gain further experience in a governance role.

The position is open to current levy paying farmers who are demonstrating leadership within their community and/or dair y sector. An indication of professional development in governance will be of benefit.

which are very concerning, and these are our focus in the next phase of the investigation,” said Glen Burrell, director of compliance and response at the MPI.

The NZ Shearing Contractors Association is also launching an investigation, saying in a statement that the scenes shown on the video footage are “completely inconsistent with NZSCA members’ in-shed practices and our animal welfare policy”. Mitchell said the footage, which shows people standing on sheep’s

necks, dragging sheep across the floor and sewing up a bloody wound without painkillers, shows practices that are counter to the values and practices of the 600 farms that are part of the ZQ programme.

“These farms, many of which are multigenerational family properties, are committed to being part of a standard that advocates for the highest levels of animal welfare.”

The ZQ programme is a guarantee that the wool meets

Qualities we are looking for:

• Active involvement in the dair y sector

• An emerging leader with future governance potential

• Proven contribution to their community or dair y sector through a leadership or volunteer role

• A commitment to personal and professional development

ethical standards and requires suppliers to meet fibre quality, animal welfare, environmental and social responsibility standards. Those that are and have been identified, have been suspended and their wool quarantined.

She said all farms in the ZQ programme have been assessed to determine whether animal welfare protocols are being upheld and an additional 50 animal welfare-focused spot checks will be undertaken by its third-party auditor by the end of February.

• Previous governance experience or training is desirable

• Strong interpersonal skills and can be an active contributor in Board discussions

• An interest in Dair yNZ and the work we do

• A passion for making a difference in the sector

Associate directors hold non-voting roles and are appointed for one year

A commitment of approximately 30 days a year and the ability to travel are required

The role will commence on 1 June 2025.

To apply, email your CV and cover letter to sheree.kara@dairynz.co.nz

Richard Rennie NEWS

THREATENED: The major decline in funding after June means the QEII Trust will not be able to accept any further covenants for protection from private landowners.

Photo: QEII National Trust

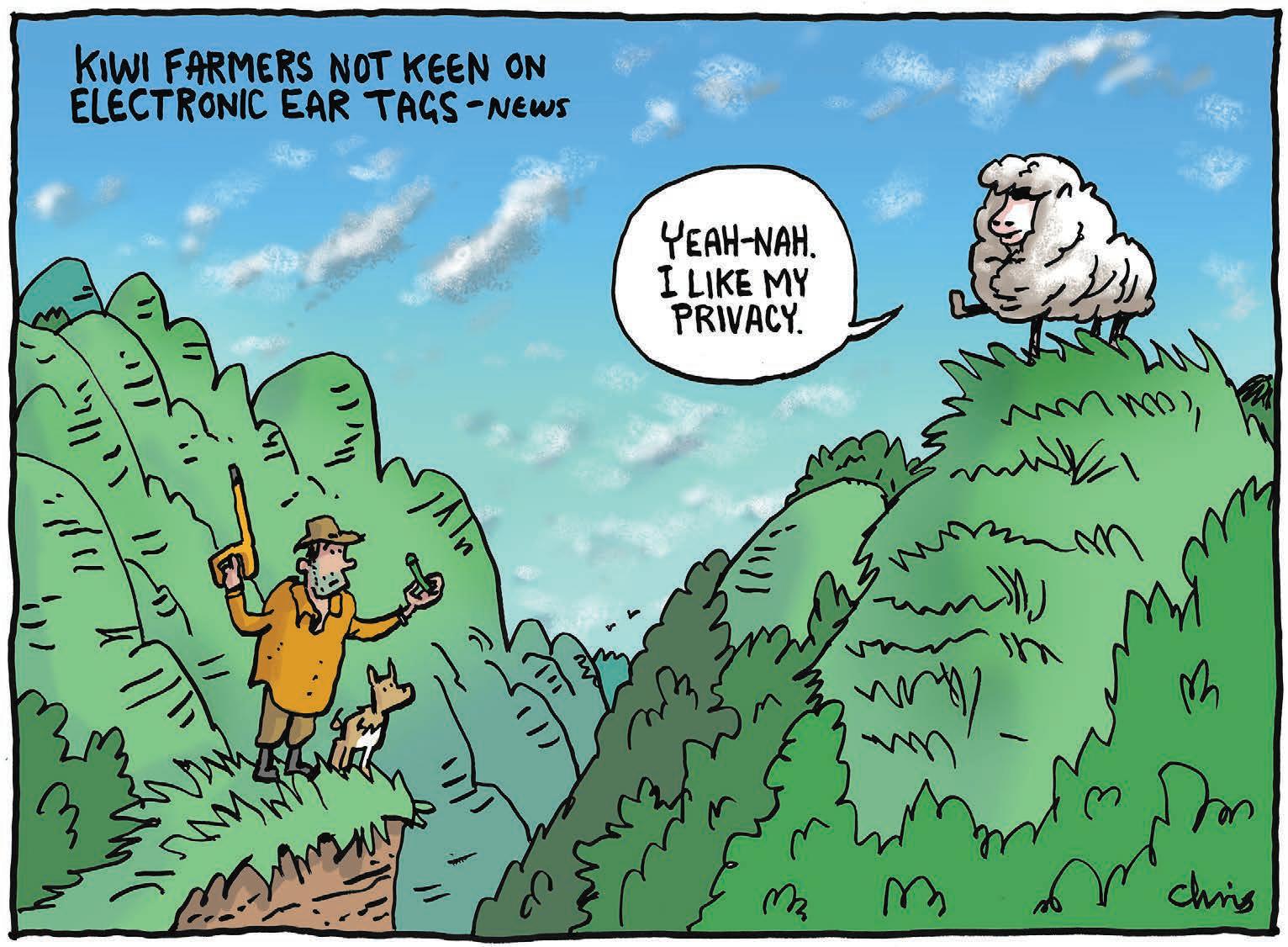

Kiwi sheep likely to dodge electronic tags

Richard Rennie TECHNOLOGY Sheep and beef

IT IS unlikely that New Zealand sheep will be required to have individual electronic ear tags any time soon, despite the technology now being compulsory on all sheep and goats across the Tasman.

New Year’s Day marked the start of Australia’s compulsory sheep electronic identification (eID) sheep tagging programme, which until now had been compulsory only in the state of Victoria. Australian farmers have had compulsory eID tagging for cattle since 2005.

The national eID system for that country’s 75 million sheep is aimed at improving the biosecurity response in the event of disease outbreak and is the result of two years of planning and farmer communications led by Sheep Producers Australia and the Goat Industry Council.

The risk of a foot and mouth disease (FMD) outbreak has been a key motivator for the policy, with recent outbreaks in Indonesia spurring greater biosecurity attention in Australia.

The cost of a FMD outbreak in Australia is estimated at AU$80 billion in direct economic impact while also bringing loss of market access and reputational damage as an exporter.

Earlier disease outbreak alerts have shown it took only one hour to identify 320 cattle suspected of having Johne’s disease by using eID tags, which disclosed animal grazing locations and disease status.

In contrast it took three days to locate 74 sheep infected with anthrax on a Victoria property.

The potential for sheep tagging here in NZ was first raised when the National Animal Identification and Tracing (NAIT) programme was developed in the early 2000s.

The system is not currently mandated for the sheep sector, and NAIT officials referred Farmers Weekly to Beef + Lamb NZ about the possibility of eID sheep tagging coming into play here.

BLNZ senior technical policy manager Will Halliday said the agency strongly supports improving traceability of sheep movements through electronic tracing at a mob level.

That includes the phasing out of paperbased Animal Status Declarations (ASD) s and replacing them with an electronic equivalent (eASD).

“These have been tested and used on a voluntary basis. They work and are popular with farmers and meat processors.”

He said BLNZ does not support mandatory electronic individual identification for sheep as the costs significantly outweigh the modest additional benefits over mob-based traceability.

BLNZ said mob-level movement records are more relevant than individual animal tracking for managing FMD.

In contrast, individual eID systems like those used for cattle and deer in NAIT were developed overseas as a safeguard for diseases like mad cow disease, which require long-term tracking of individual animals.

“eID for sheep would also be costly and impractical due to their large numbers, behaviour such as jumping and difficulty moving in single file, and the extensive systems in which they are farmed.

“Sheep are moved far less frequently than cattle in New Zealand, reducing the potential benefits of eID.”

Enhancing existing systems rather than introducing costly individual ID is a better approach, and strengthening mob movement recording offers a practical,

effective solution, Halliday said.

Andrew Cooke, chief tech officer at Map of Ag and founder of agri software development company Rezare, was involved in early NAIT developments.

He said the ability to handle eID tags was considered at the time but not taken further.

He said today most sheep breeders would already have individual sheep eID in their flocks.

“The tech we can do, but people will ask ‘What is the value in having it?’

“I think for most commercial farmers the answer is no. You make the decision to draft the animals at the point you handle them, so building up information is not as vital.”

You’ve always tried to breed from your best, and you already know the power of genomics. Through our new GeneMark ® Genomics ser vice, you can continue to identify superior genetics with increased reliabilit y at a younger age

GeneMark Genomics takes the guesswork out of matching calves to parent s while accessing genomic data, adding precision to your animals’ breeding values at a more cost- effective price

All of which helps yo u fast-track your herd’s genetic gain

So continue breeding from your best and building your conf idence with GeneMark Genomics Tal k to your Agri M a nager

GeneMark® Animal

WIRELESS: New Zealand sheep are likely to remain eID free for now, based on a BLNZ assessment of individual tagging’s value.

Ingredients chief to help shape strategy

RICHARD Allen, Fonterra’s president of global markets ingredients, is the newest member of the senior management team, having just relocated to the Auckland head office after two years in Chicago. On his shoulders rests the responsibility of earning the largest share of New Zealand’s annual merchandise exports. Ingredients, mostly traded under the NZMP brand, are the bulk of dairy exports such as milk powders, fat and protein products, amounting to over $15 billion in revenue a year.

Allen said he shares that load with 10,000 Fonterra divisional employees making and selling to more than 1100 customers in 130 countries.

The ingredients division is now the cornerstone of strategy, should the divestment of consumer businesses and brands go ahead as planned.

Since joining the co-operative 17 years ago, Allen has spent the majority of that time in businessto-business sales and optimisation in ingredients and foodservice, in China, Europe and the Americas.

“We have an extremely strong base for adding value to milk in our plants and our sales relationships,” he said.

“But changes happen every day along the supply chains and we have to be in the best possible shape to continue to lead.”

Allen said the experienced international sales staff and the long, strong customer links will secure the foundation of the co-operative.

“The new leadership role is a huge privilege and myself and the senior management team take that very seriously.”

He was named the 2024 Young Executive of the Year in the Deloitte Top 200 business awards in December, when Miles Hurrell was named Chief Executive of the Year and Fonterra the Company of 2024.

Accolades may be repeated, as Fonterra forecasts its highest $10 payout and most profitable year in 2025.

In the previous decade, Allen led the My Milk farmer recruitment programme, spent two years in Shanghai as vice-president in foodservice and more than four years heading Farm Source stores and advisory services domestically.

Those were among some of the most difficult years for farmers, dipping to a $3.90/kg payout in 2015-16.

The most recent two years in Chicago were as president of Americas and Europe, “fortifying the partnerships with some of the world’s leading global food, beverage and nutrition companies”.

The job description changed to president of the Atlantic region, acknowledging the strong similarities among fast-moving consumer goods multinationals on both side of the ocean.

Supply chain efficiencies and earnings growth flowed from that

re-orientation, he said.

When Allen sits down with Nestlé or Mars, the links and experiences with farmers are vital in authenticity for food safety, sustainability and excellence.

“They bring it to life – cooperative ownership, rural communities, service industries, care for the environment.

“Having sat at the kitchen tables and seen the riparian plantings is a huge advantage.

“We are among the lowest carbon footprints in dairy ingredients, from grass-fed, freerange farms.

“Consumers know that sunshine and water are the basis of our products.

“The naturalness of our dairy is our unique factor.”

Those attributes now flow on to products made by customers of NZMP ingredients, featured on their packs and in their marketing.

Dairy farming and milk productivity improvements will underpin the NZ industry in future, not land use change and cow numbers.

Allen helped present the Fonterra FY24 results to farmer meetings and praised the forwardlooking questions and discussions.

“Questions and comments were very constructive, and I feel the co-op is in a really good space.”

Speaking on the eve of Donald Trump’s inauguration as president of the United States, Allen said the big unknown is the extent of tariff imposition and trade disruption.

Fonterra’s product optimisation and market diversity will remain strengths, he said.

Little hope for meat co creditors

Richard Rennie NEWS Production

THE latest liquidator’s report on a failed Whanganui meat company has done nothing to reassure farmers who are left tens of thousands of dollars out of pocket.

Waimarie Meats Limited was put into liquidation last May owing unsecured creditors almost $800,000, and an additional $300,000 to the Inland Revenue Department.

The list of unsecured creditors extends to businesses and farmers throughout the lower North Island.

The latest liquidators’ report has confirmed these creditors are unlikely to see any of what they are owed repaid from the company proceeds.

Secured creditors are listed as Kiwibank and weigh tech company ScaleLogic of Whanganui, claiming all “present and after acquired property”.

Hawke’s Bay farm business

trustee Andrew Field blew the whistle on Waimarie and initiated liquidation proceedings last year after a farm he is a trustee of was

owed $100,000 for stock sales over six months.

Field said he was not surprised the latest liquidators’ report gives little hope of any repayments, and nor does he regret putting the company into liquidation.

“Had they continued to trade they would have continued to have taken people under. I was not prepared to stand by and see that happen.”

It still defies me these same directors cannot be held accountable given they were accepting and processing stock in full knowledge they were not able to pay for them.

Andrew Field Waimarie Meats creditor

He said with the likes of the IRD listed as a preferential creditor for so much, there is little hope he will be seeing any funds paid to those further down the creditor chain.

“It still defies me these same directors cannot be held

NZ’s Ministry of Foreign Affairs and Trade, NZ Trade and Enterprise and our diplomats will do their very best to keep markets open.

“Access problems may arise but we can find other markets to hold value in that milk for farmers,” Allen said.

His role in NZ’s biggest company, delivering its biggest revenue, contrasts with his board position as co-founder of Snowball Effect outside of Fonterra.

It aims to identify, fund and grow start-ups and provide investment opportunities in managed funds.

Founded in 2012, Snowball has raised over $200 million and has contact with 55,000 investors.

As a relatively new University of Auckland business graduate entry to Fonterra, Allen devised and launched Snowball with

accountable given they were accepting and processing stock in full knowledge they were not able to pay for them.

“Fortunately, we are having a better year in the farm business this year. I really feel for some of the other farming families owed even more than we were.”

One of those is the Ramsden family, owed almost $200,000 for 104 head of cattle amounting to about 30 tonnes of beef.

Dan Ramsden likened the Waimarie failure to the Fortex meat failure of the 1990s, when senior staff were found guilty of fraud.

He wants to see Waimarie directors Murray Owles and Bryan Lester take greater responsibility for the company’s failure.

He has raised the issue with Wairarapa MP Mike Butterick.

The liquidators note that Waimarie’s ownership structure involves Waimarie Meats General Partnership (GP) having a relationship with Waimarie Meats Limited Partnership (LP) running the operations.

Waimarie Meats GP’s role was to manage the LP, acting as its agent and not owning the LP’s assets.

others, including colleague Simeon Burnett, who continues as CEO.

“In the early days it was a lot of time and effort outside of work hours and I am proud of the people we have helped and technologies and products developed,” Allen said.

News of Ubco’s receivership had just broken as Allen spoke; Snowball participated in some raising of capital for the electronic utility motorcyle start-up.

“Starting and running a business is hard and a lot of NZ exporters are doing it really tough,” he said.

“Cashflows and capital are tight right now, and dairying and Fonterra are providing critical dollars into the economy.

“We may not be the newest and most cool industry, but what a critical role our dairy farmers are playing.”

Ubco grinds to a halt

Staff reporter TECHNOLOGY Transport

HIGH-flying electric motorcycle manufacturer Ubco has been put into receivership.

The Tauranga-based company designed and produced electric utility bikes for farm, business and recreational uses and reportedly sold more than 6000 units worldwide.

Receivers at Grant Thorton, Stephen Keen and David Ruscoe, said their appointment has been made by secured noteholders.

“As there is no funding available, the receivers have ceased to trade the business of the companies,” Grant Thorton said in a media release.

“The business and assets of the companies, including stock and intellectual property, are available for expressions of interest.”

No statement was made on the company’s debts or its creditors.

Two years ago Kiwibank ran a feature article on how it had funded Ubco from its beginning. Since its incorporation in 2015, when the first model was shown at National Fieldays, Ubco had a series of capital raises.

Taiwan-based components manufacturing partner TPK is the largest shareholder, around 40%, and the Bay of Plenty founders – Timothy Allan, Daryl Neal and Anthony Clyde – still have small holdings of under 1% each.

GREEN FIELDS: Fonterra senior executive Richard Allen has returned to head office to head the ingredients division, a major export earner.

Hugh Stringleman PEOPLE Fonterra

DESIGN: Taurangabased company Ubco designed and produced electric utility bikes for farm, business and recreational uses.

Photo: File

Elk stand tall at S Island deer stud sales

Annette Scott MARKETS Deer

THE annual South Island deer stud sales have rounded up some mixed results with elk emerging the shiners.

“There was pre-sale scepticism in the confidence around current velvet prices but all in all there was some top money paid,” PGG Wrightson national deer stud specialist Steve Annan said.

While North Island sales in December saw average prices up, velvet market uncertainty one month later did impact on some southern sales.

“While averages, particularly in the red deer, were back, there were some good animals put up at some good weights and certainly the money was paid for them.

“Velvet is the elephant in the room, but personally I think still bloody strong sales even given the background.”

Annan said farmers showed confidence in the future.

“You can’t afford to take your foot off the pedal. What you buy today is what you will reap in three years’ time.”

“We were back a bit but we anticipated the mess in the velvet industry having an effect,” Peel

You can’t afford to take your foot off the pedal. What you buy today is what you will reap in three years’ time.

Steve Annan PGG Wrightson

Forest Estate farmer Graham Carr said.

The Peel Forest Estate 7000 hectare operation in

South Canterbury has been farming deer for more than 30 years, providing high-quality genetics for over two decades, earning a reputation as a global leader in semen and embryos.

“Trends come and go but the classics last forever.

“It’s where we’ve built our reputation. Our focus at Peel Forest Estate is, and always will be, to cultivate the classic red deer antler.”

But Carr wants to see marketing issues sorted.

“The market demand is there,

HISTORY: The Peel Forest Estate 7000 hectare operation in South Canterbury has been farming deer for more than 30 years.

Photo: File

very strong, but the buying power for genetics is not because buyers use the money from the velvet to buy and leading into this [sale] the velvet crisis was a definite dampener.”

For the first time Peel Forest put up two yearling hinds for sale that each fetched $15,000.

The top stag sale was at $28,000, well back on last year’s sale where the top price reached $40,000. The average across the sale was $9000.

“Overall, given today’s environment in velvet, we are happy and we are very confident in the

Karen Williams to head IrrigationNZ

Annette Scott PEOPLE Irrigation

WAIRARAPA farmer and former national vice-president and arable industry chair of Federated Farmers Karen Williams has been appointed chief executive of IrrigationNZ.

Williams, who is currently national client propositions manager at FMG, will take up the role on February 24.

IrrigationNZ chair Keri Johnston said Williams brings a wealth of experience to the role, including a background in resource management, agriculture

and farming, notable awards for her achievements and wide recognition for her leadership skills.

She said Williams’s appointment comes at an interesting time.

“It’s a critical time for New Zealand in terms of how we safeguard our water for different uses, so getting Karen at the helm now is timely for advocating the best direction for irrigation in NZ.”

Williams said she is excited to take on a new challenge and sees the chief executive role at IrrigationNZ as a natural progression in her career.

“Having held other executive and

board roles, this is an opportunity for me to combine my skills and experience, while also allowing me to help advocate for a sector I’m passionate about,” Williams said.

“There are synergies with the work I’ve been doing at FMG too. We’re both about getting better outcomes for farmers, growers and rural communities and that includes wider water users too.”

Together with husband Mick, Williams runs an irrigated cropping farm in the Wairarapa region.

Her passion for what she does has seen her make strong connections across the farming sector and political spectrum.

Williams received the Biosecurity Farmer of the Year Award in 2019 for her work on the pea weevil biosecurity incursion, and the couple won the Environmental and Sustainability Award at the 2022 NZ Arable Awards.

Williams was named as one of NZ’s most influential and inspiring women in food and drink in 2023.

Current acting IrrigationNZ CEO Stephen McNally will remain in the role until Williams starts.

“Stephen will then continue to add his expertise to IrrigationNZ as we work with both our members and partners to strengthen irrigation in NZ,” Johnston said.

industry. Velvet demand is strong; there’s some big players coming in from Korea and China but we need more strength in marketing to avoid the hiccups.

“When our price is back 20-30% for velvet against good strong demand, there’s an issue there that needs to be resolved.

“We must make sure we as farmers get the benefit and not be manipulated by the middleman,” Carr said.

It was a different story with elk.

“Elk would be the shiners,” with Raincliff near Geraldine and Edendale in the Ashburton high country having very strong sales, Annan said.

“Competitiveness in the buying power, including the traditional band of North Islanders that pushed prices along for the top end animals – that’s the beauty of auction and that drives business to the market.”

Top elk prices fetched $12,500 at Raincliff compared to $9500 last year, while Edendale topped at $8500, up from last year at $7000.

“Velvet has a long history. Certainly with the Asian and Korean medicinal markets, people are still consuming and these markets are continually looking for advanced product, that nationally sales-wise is holding up industry confidence,” Annan said.

CHIEF: Karen Williams will take up the top seat at IrrigationNZ next month. Photo: Supplied

Consistency grows sharefarmer confidence

Hinuera Valley sharefarmers Mike and Donna O’Connor manage a farm that offers a challenging variety of land types with the grazing, milking and bush country all in tune with the contour and land beneath.

Richard Rennie ON FARM

Dairy

THE Waikato river’s old course through the Hinuera Valley made a dramatic departure 20,000 years ago, and in its wake left idyllic dairying country as scenic as it is productive.

For 50:50 sharemilkers Mike and Donna O’Connor, the 194 hectare Hinuera property they are on offers an excellent step up as they work to build equity and tune the farm to achieve its optimal, sustainable output.

Now in their third season on the property, Mike and Donna knew when they arrived they were coming to a farm that had proven its merit on sustainability grounds.

Aesthetically it also held great appeal, sharing contour and district with the famous Hobbiton film location, only a couple of kilometres away as the crow flies.

The farm’s owners, Rod and Sandra McKinnon, proved their environmental credentials by claiming the Ballance Farm Environmental Awards regional supreme award for Waikato in 2018. The award was validation for years of hard work after first buying the property in 1992 as a 44ha “nasty little wet farm”, in Rod’s words.

Today the property comprises 140 effective milking hectares, with 20ha of bush and 30ha for grazing beef animals. In 2016 Rod founded the Piako River Catchment forum, when catchment groups were still relatively unknown.

His involvement and commitment to “walking the walk” of the group is reflected in a farm fully fenced along all its riparian

areas including the significant Mangawhea Stream, a tributary to the Piako River.

The farm also features wetlands, trees for shade and erosion control, and has infrastructure with some smart tech to manage effluent distribution.

Stepping onto the farm as sharemilkers, Mike and Donna could see the potential to increase production but were also firmly aware of the need to respect its environmental credibility as they lifted the production envelope.

This season the district was gifted with an early summer that delivered rainfall in double digit amounts with appreciated regularity and has the farm on target to achieve a 2% lift on the 2022-23 season’s record 190,000kg milk solids production.

As a System 4 farm, inputs include 250t PKE and 40 tonnes of meal fed in-shed, and 16ha worth of maize silage that Mike feeds out for much of the season.

The useful rainfall over summer matches Mike’s “little, often” approach to applying urea nitrogen to optimise summer production.

“We work to try and time our applications of nitrogen with the rainfall. Having our own spreader means we can be pretty tactical about it.

“Over an entire season we would be averaging about 105kgN/ha but that also includes the side dressings we put on 16ha of maize.”

The effectiveness of timely nitrogen application is also enhanced by the farm’s Halo effluent management system, which extends across 80ha of the milking country.

“It really is one of the best setups you can have. It’s all run off your phone. Works via GPS, can be preset and send alerts if there is a problem, and shuts down automatically if something like a pipe bursts. It’s the first time I have worked with it.”

Given the wider area for effluent distribution, there is reduced risk of potash accumulation and its flexibility enables Mike to move the sprinkler into targeted paddocks, such as maize areas, with ease.

“For the remaining nutrients, it’s pretty simple: we are just applying phosphate in a split spring/autumn dressing, with some potash for the non-effluent areas.”

Mike and Rod enjoy an excellent relationship with their local Ballance farmer rep and nutrient expert Katie Wilkinson.

“Katie is great to work alongside. Nothing is ever a problem and she is always open to a yarn and advice with fert recommendations. She also works in well with our Pioneer maize rep to help make sure we get the most yield we can, especially on the continuously cropped paddocks.”

EQUITY: Mike and Donna O’Connor say the 194ha Hinuera property they are on offers an excellent step up as they work to build equity.

PROVEN: Mike and Donna O’Connor, pictured with children Nate and Lucy, say they knew the Hinuera farm had proven its merits in terms of sustainability.

On Farm Story

Timely applications of urea through late spring-early summer set the farm up well should weather turn dry in late February. It’s something Mike still has to experience after a couple of particularly wet summers, including the memorable Cyclone Hale/Cyclone Gabrielle summer of 2023.

“But should it get dry, we have the maize to come in and keep us ticking along.”

A feed pad is another part of the farm’s infrastructure aimed to contain nutrient loss and optimise feed use. Using timed Batt Latches on farm gates also means the herd is drawn to the pad before milking, reducing the need to spend time and energy rounding them up twice a day.

Mike and Donna have enjoyed stepping onto a farm that offers a challenging variety of land type with the grazing, milking and bush country all in tune with the contour and land beneath, and reflecting sensitivity to each area’s environmental limitations.

Aesthetically it’s an appealing property with Rod’s work on the wetlands and tree plantings now coming into its own, with plenty of bird life and shaded areas spread through the landscape.

“We also appreciate the quality of the infrastructure here. All the fences are well maintained, the gates all work, the waterlines are good capacity. Everything has been done properly, enabling you to get on and do the best job you possibly can and get the best we can from our herd,” Mike said.

Now hitting their straps in the third season on the farm, Mike and Donna can see the potential to lift cow numbers, leveraging off the solid infrastructure and improvements they have witnessed in pasture quality and within their own herd’s potential.

“We have also been really getting on top of the weeds, dealing with the likes of blackberry, so the place is starting to look pretty spotless.”

In terms of their future in dairying, Mike said he has seen enough peaks and troughs in the industry after 15 years to feel

I think I have learnt it’s all about the law of averages, you just have to stay pretty constant in your approach and not try to change in response to payouts too much.

Mike O’Connor Sharemilker

confident about whatever is to come.

“I think I have learnt it’s all about the law of averages. You just have to stay pretty constant in your approach and not try to change in response to payouts too much.

“Dairy seems to be appreciated again, and animal protein is being recognised for the high-quality food that it is.”

POTENTIAL: Mike and Donna can see the potential to lift cow numbers, leveraging off the solid infrastructure and improvements they have witnessed in pasture quality and within their own herd’s potential.

SHADE: The farm also features wetlands, trees for shade and erosion control, and has infrastructure with some smart tech to manage effluent distribution.

From the Editor

As the Fonterra Dairy Co-operative does for dairy, Alliance influences prime livestock prices because as a co-operative its motivation is to return maximum value to its owners.

Its size and dominance in sheep meat are other influential factors.

arm by Silver Fern Farms Co-operative and Shanghai Maling.

The reluctance of Alliance shareholders to commit is not helped by two financially tough years for sheep and beef farmers.

Letters of the week Don’t rush to judgement

Neil Walker Hawera

LET’S not begin by being negative. I suppose it’s easy to be so in harder economic times but I think some of the critics already storming angrily about the consultation on the possible use of unused government land as “premature” and “over reactionary” are, in “Thumbs down for high country tree plans” (January 13).

All the government has done is sought feedback on the possible use of empty land. I understand that the amount of land is huge (1-2 million hectares). It is often remote, often steep and sometimes infertile.

As an investor who has bought similar land and doesn’t plant pine trees on it, maybe sometimes it is possible that a sow’s ear can be turned into a silk purse.

In New Zealand it is always unhelpful just to be negative and I congratulate the government on trying to see if it can come up with good options which make exports and jobs come from an unused and often unloved asset.

Let’s wait and see what the consultation can deliver and then judge, rather than imagining dystopic or silly cartoons.

06 323 1519

Neal Wallace Senior reporter

4740. New Zealand Website: www.farmersweekly.co.nz

ADVERTISING

bryan.gibson@globalhq.co.nz

Mentor-Fredericks

IT IS a blunt reminder to Alliance Group shareholders: you won’t appreciate what you’ve lost until it has gone.

03 474 9240

neal.wallace@globalhq.co.nz 027 298 6127

colin.williscroft@globalhq.co.nz 021 908 400

annette.scott@globalhq.co.nz 09 432 8594 hugh.stringleman@globalhq.co.nz 027 486 8346 gerald.piddock@globalhq.co.nz 07 552 6176

The names Thomas Borthwick and Sons, Vestey, CWS and Swift and Co may not mean much today, but they are etched in New Zealand’s red meat sector history.

Andy Whitson 027 626 2269

New Media & Business Development Lead andy.whitson@globalhq.co.nz

Nor is it helped by shareholder resentment at the board’s refusal to address what many consider favourable treatment for third-party traders.

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

For almost a century they and other foreign-owned processors dominated NZ’s export meat industry.

Debbie Brown 06 323 0765

Noticeboard/Word Only/Primary Pathways classifieds@globalhq.co.nz

The group fears shareholders will meekly accept an outcome that ends Alliance’s status as a co-op.

Steve McLaren 027 205 1456

This from a group of Alliance farmershareholders who want to ensure their fellow owners understand what is at stake should their co-operative – and one of the country’s big four meat processors – fail to raise $200 million in new capital.

Auckland/Northland Partnership Manager steve.mclaren@globalhq.co.nz

Jody Anderson 027 474 6094

To break their industry stranglehold, groups of farmers up and down the country banded together through the 1950s, ’60s and’70s to establish co-operatives to compete with the predominantly United Kingdom-based companies.

Waikato/Bay of Plenty Partnership Manager jody.anderson@globalhq.co.nz

It looks increasingly unlikely that the cash will come from its owners, prompting the board to pause its policy of retaining earnings from livestock retentions.

Donna Hirst 027 474 6095

Lower North Island/international Partnership Manager donna.hirst@globalhq.co.nz

richard.rennie@globalhq.co.nz 021 136 5570

027 323 9407

dean.williamson@globalhq.co.nz

Grant Marshall 027 887 5568

Real Estate Partnership Manager realestate@globalhq.co.nz

The Alliance shareholder group believes the recapitalisation failure is also impacted by a lack of understanding at what a cooperative is and what will be lost.

Andrea Mansfield 027 446 6002 Salesforce director andrea.mansfield@globalhq.co.nz

AFFCO, Hawke’s Bay Farmers Meat Co and PPCS, among others, were formed to give shareholders skin in the game and to share in the profits captured by the foreign owners.

PRODUCTION

Lana Kieselbach 027 739 4295 production@globalhq.co.nz

The group fears shareholders will meekly and with little debate accept an outcome that ends Alliance’s status as a co-operative, citing the demise of the wool industry as an example.

Grant Marshall 027 887 5568

South Island and AgriHQ Partnership Manager grant.marshall@globalhq.co.nz

Alliance still needs capital, and according to chair Mark Wynne that means the board has to consider outside investment or outright sale, potentially bringing the curtain down on what has been 100% farmer co-operative ownership since 1980.

It also gave suppliers a presence beyond the farm gate and ultimately the cooperatives helped the industry become mostly locally owned.

Javier Roca 06 323 0761

Livestock Partnership Manager 027 602 4925 livestock@globalhq.co.nz

This has implications for the wider red meat sector.

Advertising material adcopy@globalhq.co.nz

SUBSCRIPTIONS 0800 85 25 80 subs@globalhq.co.nz

Instead of considering what they were losing, sheep farmers allowed an end to the strong wool levy and without that income, the value of strong wool has been lost.

Printed by Ovato NZ Ltd Delivered by Reach Media Ltd

About 15 years ago Silver Fern Farms, like Alliance today, failed in its attempt to raise capital from its shareholders.

This drove SFF to seek outside capital, in this case hybrid ownership of its processing

This is another watershed moment for the meat industry with the Alliance board left with few options. The risk is that by extension, their ultimate decision could also leave the wider sheep and beef sector with few options as well.

Send your letter to the Editor at Farmers Weekly P.0. Box 529, Feilding or email us at farmers.weekly@agrihq.co.nz

Building real trust in a post-truth age

Eating the elephant

John Foley

This week’s guest columnist on Eating the Elephant, John Foley, lives near Lincoln in Canterbury and works in the seed industry.

Y GRANDMOTHER’S

Melder sister Kathleen married Gordon Baker, an Australian shearer. Gordon had come to New Zealand after World War 1. He met Kathleen and settled in the Waimate district.

Gordon was well known for his wartime exploits. Over the years, there were numerous references in newspapers, and he served in Waimate’s home guard during World War 2. In 1975, Gordon featured in an edition of the Timaru Herald marking 60 years since the Gallipoli landings.

Gordon had been a boy soldier. In 1914, at the age of 16, he enlisted at Duchess, a town in Cloncurry in remote Queensland. He served with the Australian Light Horse at Gallipoli, and later with the Australian infantry on the Western Front.

After single-handedly capturing a German machine gun position on the Somme, he was awarded the Distinguished Conduct Medal (DCM).

There’s a wrinkle to this great

story, though: almost none of it is true.

Gordon never served in the Australian forces, he wasn’t at Gallipoli or awarded the DCM. He wasn’t even Australian. In fact, he was from England. In 1912, at age 14, Gordan enlisted in the Royal Artillery. He served through to 1919 and was deployed to France.

Gordan seems to have emigrated first to Australia, and then made his way to New Zealand.

The real story finally came to light in the 2024 ANZAC Day issue of the Press, in a feature piece on boy soldiers written by Timaru-based researcher Liz Shea. The truth finally caught up with Gordon, albeit 47 years after he died.

In many ways Liz confirmed long-held suspicions about Gordon. In our family there were two camps: “Gordon Baker, war hero” and “Gordon Baker, there is something not right about this story”.

My father was firmly with the former and liked the story of Gordon’s exploits. After reading the Liz Shea article, Dad simply stated that “the movie version is always better than real life”. Dad had a point. Fiction is often better than reality. Did Gordon’s embellishments really “hurt” anyone?

If stories are to be believed (and lies, for that matter), they rely on the “suspension of disbelief”. This is the avoidance

of critical thinking and logic in understanding that something is impossible in reality in order to enjoy a good story. So, is there such a thing as a “good lie?” Madeup war stories? The tooth fairy? My cricket batting average?

Ernest Shackleton, as the leader of the Imperial Trans-Antarctic Expedition (1914-17) faced one of the most challenging situations in human history when his ship the Endurance was crushed and sank in the ice.

Marooned on an iceberg, he calmly stated to his crew, “Ship and stores gone – so now we go home.” Given the impossible situation they faced, such an improbable statement served to give his crew courage against all odds.