In order to further strengthen the link with the demand of first-tier retailers and distributors in Europe and the U.S., LINKFAST, having deeply engaged in the industrial fastener production for nearly 20 years, has been actively expanding its business from the production of advanced multi-purpose screws, timber fixing screws and decking screws made of 10B21 and C1022 to the DIY fasteners packaging service over the past 5 years. In the ever-changing global market, it hopes to create a new milestone for sustainable business development.

Unlike typical mass production lines, DIY fasteners packaging are characterized by small quantities and diverse categories, which are more time-consuming and labor-intensive, and therefore must be adjusted in a timely manner according to product attributes and quantities. In view of this, LINKFAST not only provides various tool boxes, plastic boxes/bins, blisters, blister boxes, cardboards, polybags and various color boxes for customers to choose, but also provides 100% customized service according to customers’ requirements.

“Backed by a strong professional team, we have introduced the ERP smart factory management system from production to packaging to ensure the flexibility and traceability. All products are controlled by the automated warehouse, and the automatic packaging line with more than 10 semi-automatic packaging machines is also directly connected to the stereoscopic warehouse, and the AGV automatic shuttle vehicles are applied to transport the goods directly to each packaging table, which effectively saves the goods delivery time and enhances the packaging efficiency and flexibility,” said LINKFAST.

LINKFAST has nearly 60 packaging staff with years of experience to assist customers in designing the best packaging methods to achieve twice the result with half the effort. At the same time, it has also worked with the automated packaging equipment factory to successfully develop 4 models (totally 12 sets) of packaging equipment which best fit the characteristics of their products, enabling them to significantly improve the packaging efficiency. From production to packaging, it completely follows the ISO 9001 specification. There are 6 QC employees to conduct strict quality inspection from raw materials to finished products, and all testing data are kept in record to ensure traceability.

“As an emerging DIY fastener factory, although DIY fastener packaging service currently only accounts for 6% of our annual export volume and in 2022 our total sales reached 7,500 containers, we are confident that we can perform better in the next few years,” said LINKFAST.

LINKFAST has been active in increasing its competitive edge in recent years. In addition to getting many screws CE certificates, its wholly-owned Haiyan Yousun Enterprise Co.,Ltd (Factory code:C788) has also successfully obtained the favorable 39.6% tax rate in Europe. In the future, if it successfully obtains the ETA certification, together with DIY fastener packaging service, it is expected to increase its proportion and competitiveness of screws exported to Europe.

“With the challenges of global economic contraction, customer demand weakening, unstable raw materials prices and exchange rates, we will continue to refine our capability, cherish every order, provide the best service, and be more dedicated to the DIY fastener’s field. We sincerely invite you to come to our stand at No. 3012 (Hall 5) at Fastener Fair Global 2023 in Stuttgart Germany for face-to-face negotiation.” said LINKFAST.

Contact: General Manager George Yu

Email: info@linkfast.cc

/// by Gang Hao Chang, Vice Editor-in-Chief of Fastener World ///

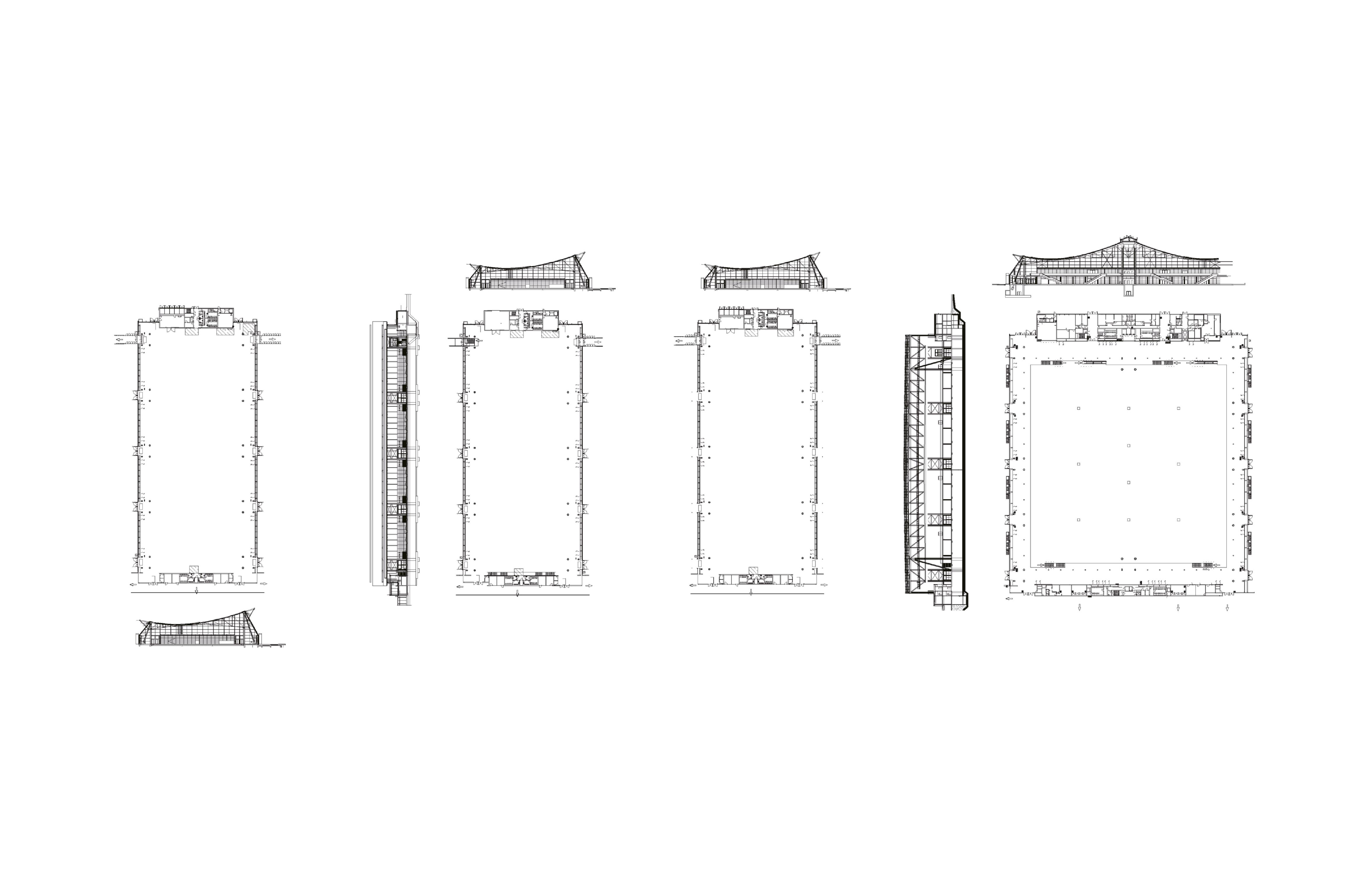

Industrial is one of the largest fastener suppliers in the world. They have critically selected 150 partners worldwide to provide over 4,000 types of fasteners to customers in Europe, Russia, USA, and South America, and also provide stocking services to customers in China. Now we have good news from them who announced to the world that their new factory is running very smoothly, not just growing bigger but also offering products in new materials. Through this cover story, we interviewed general manager Simon Liang to give you a bird's eye view of his plan for the new factory and his future roadmap.

The new factory began production in August 2022. The 32,000 square meters floor space accommodates more than 270 machines, including 140 one-die-two-punch heading machines, 2 multistation machines, 120 thread rolling machines, and 8 self-drilling screw forming machines. The number of machines is considerable, and most of them are imported from Taiwan to ensure the product quality meets international standards.

With 150 employees, the factory can produce 1,500 tons of screws for customers every month, 3 times more than the past. Simon said the motive of establishing the new factory is to expand production capacity and improve the quality of products, and at the same time improve the efficiency of running the factory and reduce the cost through automated equipment, offering clients products with higher cost performance and higher value.

Another key point of the new plant is completing the upgrade to an automated and intelligent plant. Hisener has introduced automated warehouses for wire, semi-finished and finished goods. Each warehouse is automatically connected with the production process. By integrating with ERP and WMS, they are able to achieve automatic feeding of materials in each process, which greatly reduces labor and transportation costs for the factory and greatly improves production efficiency. Simon believes that both domestic and overseas customers will be able to clearly see that Hisener has turned faster. In addition, the new plant has a larger laboratory that houses inspection equipment for dimension, composition, metallurgical, mechanical properties, and surface treatment analyses. Meanwhile, the lab is equipped with 10 staff members to ensure that all aspects of the products, from materials to production processes, are controlled by the staff members to ensure that each batch is strictly inspected and is traceable.

year, he will try his best to go out and communicate with customers face-to-face to better understand their pain points and difficulties, solve their problems in a forward-looking manner, and continuously strengthen the bond of trust with them. Simon concluded: "In the new year, we hope that all our customers will come to China to visit our new factory and expand collaboration with us!”

by Dean Tseng, Fastener WorldContact: Simon Liang, general manager Email: simon@hisener.com

Their products are becoming more high-end! In addition to the original ISO 9001:2015 certificate, they are in the process of applying for TS16949 automotive fastener certification and RoHS (Restriction of Hazardous Substances) certification, which shows that their technological level is well established and they are striving to provide quality fastener products to automotive companies.

Lizhan Hardware & Power Fastener has been engaged in screw export since its establishment in 2007. To meet the needs of high-end customers, in 2009, they invested in their first production line in Jiaxing, Zhejiang Province, to mainly produce higher quality screws, including self-drilling screws, deck screws, and special purpose (electric tapping) machine screws used on composite panels, windows, concrete, furniture, steel pipes, roofing installations, and more. The products are exported to more than 40 countries all over the world, and the company has created brilliant achievements with its customers!

Hangzhou Lizhan Hardware occupies 30 acres (28,000 square meters) of land. Their factory has 130 sets of equipment, 2 heat treatment lines, 2 fully automatic packaging lines, and automatic bagging machines. With more than 60 employees, they have an annual capacity of over 8,000 tons and export over 1,000 containers to customers worldwide each year. In addition, their external collaborators provide a capacity of over 20,000 tons. The combination of a complete in-plant production line and an external collaborative supply chain gives Hangzhou Lizhan Hardware the inherent ability to provide sufficient capacity to customers worldwide, providing a strong backing at the most competitive prices in the international market at a time when the global supply chain is being challenged.

In order to comply with the requirements of overseas buyers from Europe and the U.S., they are equipped with their own inspection room, heat treatment and hardness machines, torque testers, mechanical performance inspection equipment, surface treatment salt spray testers and various dimensional measuring gages. The products are exported after going through three procedures, including initial inspection, sampling inspection and pre-shipping inspection, in order to provide global customers with satisfactory quality products!

1. They offer great quality-ratio products. The have the best price for the same quality, and the best quality for the same price.

2. They also have professional service staff to solve problems for customers including small lot size, complicated product types and difficulty in procurement.

3. They also provide flexible payment terms , so that customers can use the same money to purchase more products to take market shares, and achieve a win-win!

2023 will be a critical year after the market is fully reopened. The company said, "We will focus on new products so our customers can develop more high quality markets. Given that Covid-19 has stalled development for three years, we will go to many countries one by one in 2023 to communicate with customers face-to-face and strive to create more value for them!

With performance featuring the “Three Seconds” tagline. Honghui’s stainless steel and carbon steel screws are designed to resist corrosion and rust. As a result, Honghui enjoys a high reputation in the fastener industry, which is not only sold nationwide, but also exported to Asia, Europe, Latin America and other parts of the world.

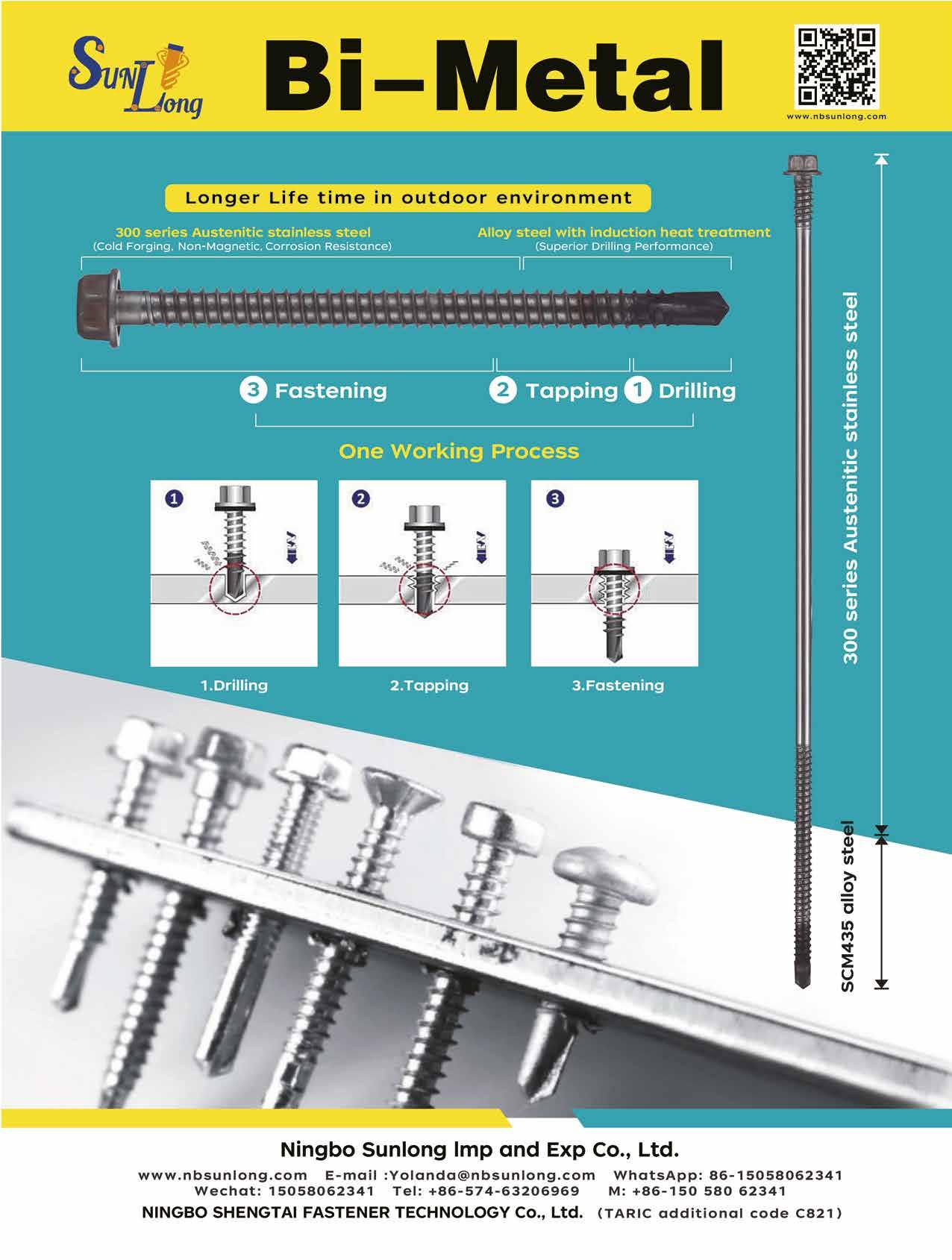

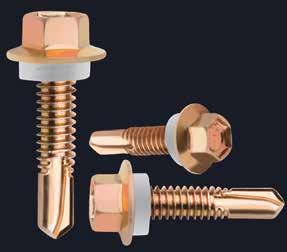

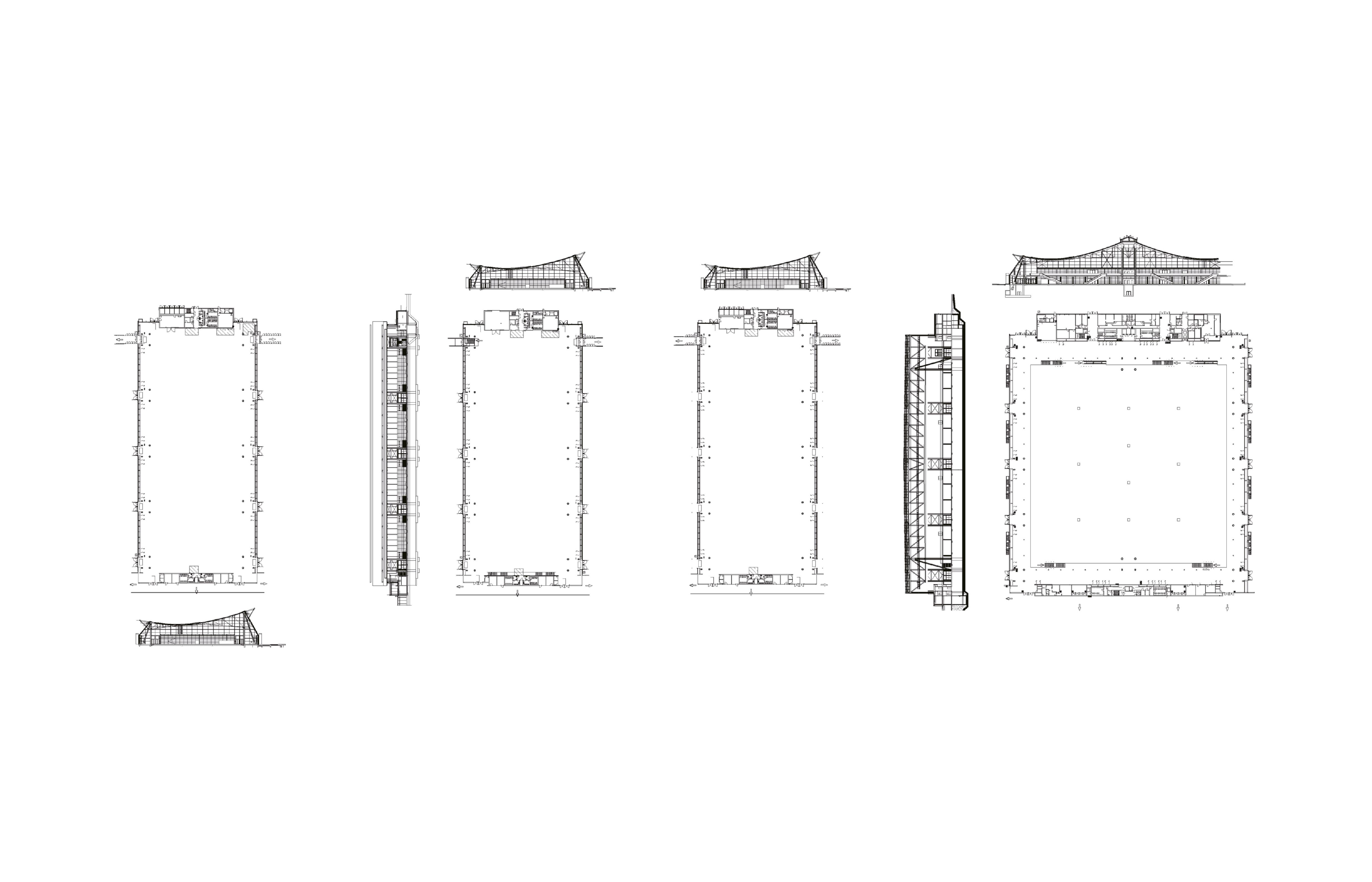

For 25 years, this fastener company has been dedicated to developing and manufacturing self-drilling screws. It is one of the first expert manufacturers and developers of self-drilling screws in China. In addition, it manufactures and sells various types of fastener products, providing high-end clients with premium service. Now it is the top manufacturer of selfdrilling screws in Guangdong.

In 2021, Honghui completed a new plant which marks a new milestone for its business. The new plant is located in Yinling Technology Industrial Park in Jiangcheng District of Yangjiang City in Guangdong, only a little more than 10 kilometers away from Yangjiang High-speed Railway Station, providing convenient access by traffic. The new plant spans 80,000 square meters and has over 200 pieces of elaborately designed production and inspection equipment. In the plant is a professional team of over 300 people who perform round checks and final product inspection in compliance to ISO 9001 quality system to manufacture GB, DIN, AS3566, ANSI, JIS and BS standard compliant products.

Through a manufacturing process including heading, wire drawing, annealing, threading, heat treatment, electroplating, washer assembling, packaging and shipping, Honghui provides clients with one-stop fastener service. It can also design and manufacture various self-drilling and selftapping screws per clients’ requests. Currently it can manufacture up to more than 20,000 tons of high quality carbon steel and stainless steel self-drilling screws annually.

“On the path of development, we adhere to the guideline of ‘quality for survival and reputation for growth’. We continue to enhance our corporate structure and we have acquired CNAS, ISO9001 and IAF certificates. We continue to pursue technical advancement and devote ourselves in self-drilling screw development. We have successfully developed self-drilling screws with high drive speed and sharp blades. The drive speed and sharpness exceed those of ordinary self-drilling screws made by conventional die punching.”

With excellent design, production and a complete after-sale system, Honghui has built a huge client pool domestic and abroad since its inception in 1999. “We will continue to strive for mutual gains and client satisfaction. We hope to continuously grow while having the strong support of many clients, and we want to position ourselves as the top self-drilling screw manufacturing expert in China to contribute our forces to the prosperity of the global fastener industry!”

by Dean Tseng, Fastener World

Founded in September 2003, Dongguan Grand Metal offers various standard clinching fasteners including A286 SP clinch nuts, ISO13918-compliant welded standoffs and studs, panel screws, rivet nuts, cage nuts, brass inserts and CNC parts. The company was initially an OEM to domestic clients before it began independent research and development on clinching fasteners. It went beyond by recruiting German specialists to do welding tests and mounting to sheet to optimize design. It studies welded and clinching fasteners performance and provides clients with solutions to clinching.

Grand Metal has a full set of clinching products from size M2 to M12, using good materials from qualified steel plants guaranteeing 50% higher quality and performance (torsion, thrust) than what the industry requires. The company is on par with automotive industry quality and is certified to IATF 16949. It offers Geomet, Dacromet, and Zinc-Nickel alloy surface treatment as well as eco-friendly electroplating and heat treatment.

Its equipment originates mainly from Taiwan and Germany known for high quality and therefore is stable and highly precise. It also has auto packaging machines, auto optical sorting machines and auto feeding machines that it developed with suppliers.

The company is backed by certificates and guarantees quality. It exports up to 1000 million fasteners a year which take up 60% of total sales and targets sales in Europe, Asia Pacific, the U.S., Singapore, India, New Zealand, Russia, Australia and South America.

Its new plant in Dongguan City of Guangdong Province was built to increase capacity by 300% and will commence operation in 2023. Overseas warehouses are planned to come up in the next two to three years to shorten lead time. Today, Dongguan Grand Metal has emerged as a first-rate clinching fastener manufacturer with more than 20% expected growth in future revenues.

Contact: General Manager Jason Zhu Email: jasonzhu@grandametal.com

by Dean Tseng, Fastener World

Established in 1992, Tianjin Pingyuan Hardware Co., Ltd. is located in the beautiful seaside city Tianjin, China. It's one of the key fastener and metal fabrication enterprises in Tianjin and northern China. Our factory mainly manufactures all kinds of washers and metal stamping parts. We fabricate special washers and structural components for industrial buildings, ship building, railway, agriculture, automobile and home gardening.

They have the ability to manufacture 10 thousand tons of products annually. The high tensile strength washers with "PY" marking have obtained the consistent high praise from customers both at home and abroad. Cast-inplates, cast-in-stumps, cleats and other metal parts made by welding, lathing, stamping, bending deep drawing are also provided as per engineering. The factory is equipped with Multi-station Cold Headers and all kinds of stamping machines. It has strong technological force and complete quality inspection machines. The products can meet all requirements from standards and customers.

They have been in taking the spirit of servicing customers with sound quality, competitive price and excellent service since the establishment of the factory. The company has been awarded ISO9001 certificate since 2000. Products are mainly exported to U.S.A, Australia, Europe, Asia and other countries. They are longing for the opportunity to cooperate with more customers and create more fruitful business relationship.

The global industrial fasteners market size was valued at USD 88.43 billion in 2021 and is anticipated to grow to USD 123.18 billion in 2030. The market is expected to grow at a CAGR of 4.23% during the next 8 years. The Asia-Pacific region has the major share of the market as stated above and it’s estimated to register a revenue of USD 57.9 billion by 2030 at a CAGR of 5.4%. North America has major players in the industry operating in the region and plays an important role in driving the industrial fasteners market forward. It is the second dominant region after Asia-Pacific with an impressive revenue generation of about USD 21.54 billion in 2021 and may grow rapidly to USD 29.4 billion by 2030 at a CAGR of 4%.

Increasing substitution of metal fasteners in automotive interiors due to improved aesthetics & lightweight characteristics and large-scale popularity of these products in automotive, space, oil & gas, and marine sectors is expected to drive the plastic fasteners market over the predicted years. The plastic fasteners industry is expected to witness a healthy growth in the next five years, thanks to the upsurge in residential and non-residential construction sectors, expansion in electronic industries, and expansion in the automotive industry. A good example is about the present needs to produce more electric and lightweight vehicles. Currently, the automotive and aerospace sectors are putting extra effort into keeping the weight of the final product low. The plastic fasteners' features of light weight, low cost, and great performance make them valuable in automotive and aerospace and many other industries.

The growth is more projected to be supported by the increasing funds and investments by the governments in infrastructure development activities, particularly in the Asia-Pacific region, due to rising population. Additionally, the intensified research and development activities are expected to bring more opportunities to the plastic fasteners market.

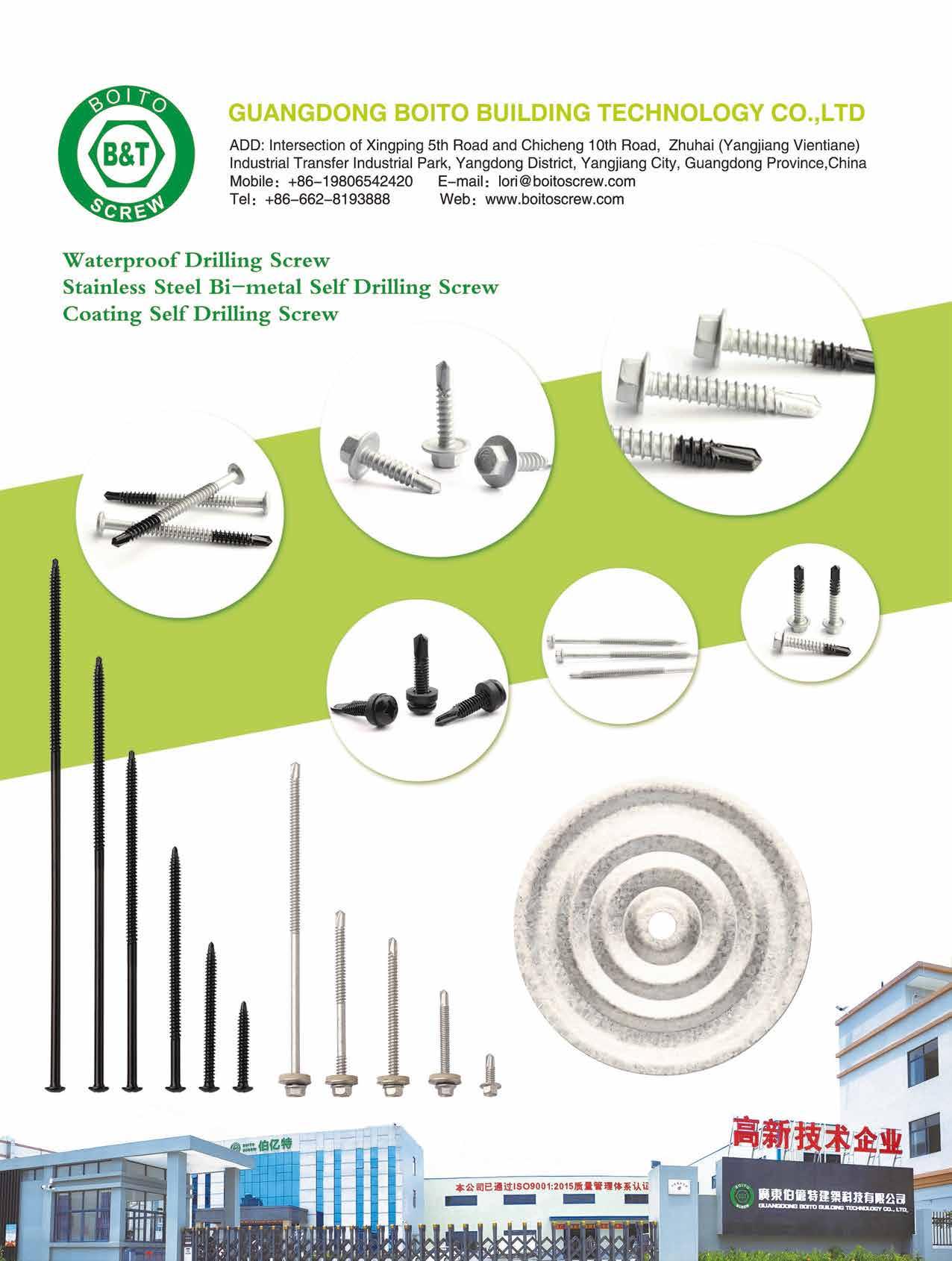

Plastic fasteners are flexible and strong screws tools which are used to maintain stiffness, temperature, and strength, and made from nylon, PVC, and polypropylene. In terms of the product type they are mainly segmented into Rivets & Push-In Clips, Cable Clips & Ties, Threaded Fasteners, Washers and Spacers.

The rivets & push-in clips segment is expected to hold the largest market share. Rivets and push-in clips are progressively used in vehicles, electrical and electronics. Push-in clips are used to connect plastic parts, light sheet metals, and insulating materials. They are also used as bumpers and hole plugs. Push-in clips are used with nylon washers to attach fragile materials.

The major target markets and end users of plastic fasteners, as mentioned, are Automotive, Electrical & Electronics and Building & Construction. The automotive segment as explained earlier, is predicted to grasp the most significant CAGR in the next five years as a result of the increasing demand for electric vehicles globally.

Geographically, the top three regions for plastic fasteners market’s production and consumptions are Asia Pacific, North America and Europe. The largest share in the market will be controlled by the Asia Pacific due to the rising construction expenditure and large scale production of passenger cars & commercial vehicles in countries like India, Japan, China, and South Korea.

The global plastic fasteners market was valued at about USD 5.33 billion in 2021. The market is further projected to grow to reach more than USD 7.65 billion by 2027, at a CAGR of 6.12% within the next five years.

The major drivers of the expected growth include but are not limited to the growing industrialisation and urbanisation, growing automotive sector, increasing demand for plastic fasteners in various applications, growing investments by key players. Successively, the key market trends guiding the growth of the industry include the sharp demand in the construction sector.

The modern age of technology is driving the global industry to new levels that mandate higher efficiency at minimal resources, which has been a major factor in the evolution of lightweight automotive products. The trends will be moving towards the substitution of metal fasteners in some of the segments with plastic fasteners as the cost of manufacturing metal fasteners are higher, and on the other hand, the demand for lightweight components keep growing. Plastics are low-cost substitutes for metals, and they can be moulded into any kind of shape with the injection moulding and extrusion technique.

The fasteners required in the automotive industry vary in size, design, and measurements based on their applications. This is why plastic fasteners are in demand and are available in various sizes in quick time, unlike metal fasteners. And the said substitution of metal fasteners with plastic fasteners is creating a huge window of opportunities that will lead the industrial fastener industry to new heights.

All in all, the growing popularity of lightweight fastener solutions has been identified in several reports as one of the prime reasons driving the plastic fasteners market growth during the next few years. More importantly, the manufacturing of plastic fasteners using 100% recyclable plastics and advances in plastic fastener design to support industrial automation will lead to sizable demand in the market.

Although the plastic fasteners market still accounts for a very small share in the overall industrial fasteners market, it is projected to gain increasing importance, especially by growing use of plastic fasteners in the automotive industry for interior, exterior, wire harnessing snapping, and electronics applications. Increasing focus of automobile manufacturers on developing lightweight vehicles for fuel efficiency is creating high demand for plastic fasteners due to its improved mechanical properties, lightweight, and low prices as compared to metal fasteners. That is, in the near future, plastic fastener manufacturers will be new threats to existing metal fastener players in the market.

Article by Shervin Shahidi Hamedani Copyright owned by Fastener World

The global industrial fasteners market is projected to witness a CAGR of 5.1% to reach US$ 168.7 billion by the end of 2032. In 2021, the market size was valued at USD 92.16 billion and it was expected to grow further to reach USD 102.8 billion by the end of 2022. North America holds about 20.5% (USD 21 billion), Europe holds about 27% (USD 27.6 billion) and China holds about 15% (USD 15.4 billion) of the global fastener market.

The market is mainly driven by the growing demand from diverse industries such as construction, automotive, marine and aerospace. The growing production of machinery and components, motor vehicles, and other durable goods due to the economic expansion of different countries is expected to further support market growth and increase the penetration of industrial fasteners in the coming years.

The global COVID-19 pandemic has been extraordinary and shocking, with products suffering lower-than-anticipated demand across all regions compared to pre-pandemic levels. The global market demand showed a drop of more than 6.7% in 2020 as compared to 2019. The interruption and closure of industrial operations, to control the impact of pandemic across the globe, severely affected product demand in 2020.

The pandemic has significantly hindered the growth of the automotive industry across the world, with disruptions in supply chain activities, interruptions in large-scale manufacturing, and restrictions on travel. The pandemic also significantly impacted the construction sector, which is sensitive to economic cycles. However, both automotive and construction sectors, as major contributors to the growth of the industrial fasteners market, have shown steady and strong restoration since early 2022. However, an increase in the substitution of metal fasteners for adhesives and tapes in bonding and Noise Vibration & Harshness (NVH) applications, mainly in the automotive industry, is expected to hamper the market growth.

疫後工業扣件的挑戰與商機

The COVID-19 pandemic introduced unprecedented challenges for everyone and with no doubt it has had a substantial impact on fastener manufacturers and production downtime. It’s also apparent that there has been an amplified pressure to improve overall efficiency as a natural response to the global pandemic. In terms of manufacturing, there have been key efficiency challenges during the pandemic that constantly stood out amongst the rest and those challenges still exist in the post-pandemic era.

The first and most important challenge is in the supply chain. It was a nightmare for manufacturers more specifically during the first year of the pandemic to deal with this problem. Challenges are mostly about delayed deliveries which have disrupted production plans and limited availability of resources which required manufacturers to even swing production lines. This challenge could still last in the post-pandemic era, if manufacturers do not seek supplier diversification. This is an obligation for fastener manufacturers in the post pandemic era to avoid order fulfilment issues.

It was never easy to find employees with the right skills and credentials for a manufacturing environment, and the pandemic made things worse than ever. Many businesses had to let their employees go during the pandemic. Now, in the post pandemic era, manufacturers have to find labours and skilled talents as their operations are getting back to normal. This is a very challenging task for fastener manufacturers as many job seekers especially specialists and technical experts are now looking more for work-from-home positions. They do not want to worry about their health and safety working in large manufacturing plants.

In summary, sourcing and procurement, operational changes and recruitment are the main challenges that fastener manufacturers are faced with in the post-pandemic era. Apparently, there is no single solution to address all those challenges, but Go Digital (i.e. Digital Transformation) would be one of the best solutions for fastener manufacturers, traders and players in the market to be more agile in order to repurpose and/or reinvent their operations based on immediate and actual needs.

As stated above, to meet the challenges posed by the pandemic, fastener manufacturers and traders around the world had to respond in agile and decisive ways. Moving into the next phase, now it is the time for businesses to look for and grab the opportunities emerging in the post-pandemic era.

The use of online technology, especially for fastener retailers, has taken a leap forward. Using disruptive technologies in operation, production and logistics brings more business opportunities for manufacturers. The rapid advancement in technology leads to the production of newer and more durable fasteners. Additionally, the pandemic has prompted a search for new markets more than ever. This has stimulated competition and the motivation to adopt cost-effective technologies.

In the post-pandemic era, fastener manufacturers should pay closer attention to these trends and align their business and technology strategies accordingly to maximize their operational execution and resiliency.

Last but not least, the lesson learned from the COVID-19 pandemic has increased the global focus on sustainability more than before. Growing recognition of the environment and the need for conservation of natural resources have made sustainability practices mainstream for both consumers and organizations in the fastener market. Customers and prospective employees alike want insight into what sustainable practices companies are pursuing. These practices also help reduce packaging and energy costs and can improve profits. Based on analyses, sustainability approaches can increase customer loyalty and bring more revenue gains in the post-pandemic era.

Sources:

• Industrial Fasteners Market Size, Share & COVID-19 Impact Analysis, by Fortune Business Insights

• Top 10 Manufacturing Trends in the Post-Pandemic Era, by Market Scale

Article by Shervin Shahidi HamedaniCopyright owned by Fastener World

Southern Europe consists of 11 countries, which include the following countries with the characteristics as below:

In terms of fastener trade, Italy was the biggest country in this region with a total trade value of USD 3,486,286,000 (62.6% export Vs. 37.8% import) in 2021. It has also the biggest economy in this region and its GDP in 2021 was USD 2,058.3 billion.

In terms of fastener trade, Spain was the second biggest country in this region with a total trade value of USD 1,436,664,000 (43.1% export Vs. 56.9% import) in 2021. It has also the second biggest economy in this region and its GDP was USD 1,435.6 billion.

The third biggest country in the fastener sector was Türkiye. Its trade value was USD 1,185,119,000 (54.5% export Vs. 45.5% import) in 2021. On the other hand, its GDP was USD 692.4 billion, making Türkiye the third biggest economy in southern Europe.

The fourth biggest fastener trader in the South of Europe was Portugal. Its fastener trade value was USD 298,824,000 (23.6% export Vs. 76.4% import) in 2021. The GDP of Portugal was USD 251.9 billion, making it the fourth biggest economy in this region.

Slovenia was the fifth biggest fastener trader in the Southern Europe region. Its trade vale was USD 237,761,000 (46.7% export Vs. 53.3% import) in 2021. Its GDP was USD 63.6 billion in 2021, making it the seventh biggest economy in this region.

Croatia was the 6th biggest fastener trader in the region with the total trade value of USD 102,168,000 (47.1% export Vs. 52.9% import) in 2021. Its GDP was USD 69.5 billion, which made it the sixth biggest economy in this region.

Bosnia and Herzegovina was the seventh biggest fastener trader and the eighth biggest economy in this region in 2021. Its fastener trade value was USD 95,322,000 (67.6% export Vs. 32.4% import) in 2021 and its GDP value was USD 23.4 billion.

In terms of fastener trade, Greece was the eighth biggest country in this region with a total trade value of USD 64,455,000 (7.9% export Vs. 92.1% import) in 2021. It had also the fifth biggest economy in this region and its GDP in 2021 was 222.8 billion.

In terms of fastener trade, North Macedonia was the nineth biggest country in this region with a total trade of USD 13,446,000 (10.6% export Vs. 89.4% import) in 2021. It had also the tenth biggest economy in this region and its GDP in 2021 was USD 14.2 billion.

Albania was the tenth biggest fastener trader in 2020 (there is no new statistics for Albania in this sector) and the nineth biggest economy in this region in 2021. Its fastener trade value was USD 6,287,000 (0.3% export Vs. 99.7% import) and its GDP value was USD 17.9 billion.

Montenegro was the eleventh biggest fastener trader and the eleventh biggest economy in this region in 2021. Its fastener trade value was USD 3,686,000 (0.6% export Vs. 99.4% import) and its GDP value was USD 6.0 billion.

南歐扣件貿易統計與分析

(Notes: Numbers in tables are in thousand USD) Table

Table 1 shows Italian fastener export to the world from July 2021 to June 2022. Italy exported on average more than USD 185 million fasteners per month, which means that the yearly fastener export may be increased from USD 2,168 million in 2021 to around USD 2,220 million in 2022.

Table 2 shows Italian fastener import from the world from July 2021 to June 2022. Italy imported on average more than USD 117.8 million fasteners per month, which means that the yearly fastener import may be increased from USD 1,319 million in 2021 to around USD 1,415 million in 2022.

Table 3 shows Spanish fastener export to the world from August 2021 to July 2022. Spain exported on average more than USD 51.5 million fasteners per month, which means that its exported fasteners in 2022 may not change a lot from USD 619 million recorded in 2021.

Table 4 shows Spanish fastener import from the world. Spain imported on average more than USD 77.2 million fasteners per month, which means that its fastener import may increase from USD 817.2 million in 2021 to around USD 926 million in 2022.

Table 5 shows Turkish fastener export to the world from August 2021 to July 2022. Türkiye exported on average more than USD 62.7 million fasteners per month, which means that its fastener export may increase from USD 645.8 million in 2021 to USD 753 million in 2022.

Table 6 shows Turkish fastener import from the world from August 2021 to July 2022. Türkiye imported on average more than USD 48.7 million fasteners per month, which means that its fastener import may increase from USD 539.3 million in 2021 to around USD 585 million in 2022.

The war in Ukraine risks upending southern Europe’s economic recovery. Higher energy prices and trade disruptions could destabilise Southern EU firms already weakened by the pandemic. Real economic growth in the Southern European Union is now expected to fall below 3% in 2022, down from the 4% estimated by the European Commission before the war. A recession could happen, and further trade disruptions or increased economic sanctions would increase the risk for the Southern European economy. But as the statistics show, countries with better conditions in their fasteners industry have better economic conditions.

and the share of other countries was 65%.

3050

Only Taiwanese exhibitors exhibiting through Taiwan’s exclusive agent Fastener World are listed.

5 HALL 9

HALL

Fastener Fair Global 2023, the 9th International Exhibition for the Fastener and Fixing Industry, takes place from 21 – 23 March 2023 in halls 1, 3, 5 and 7 at Messe Stuttgart Exhibition Centre in Germany. The event is a meeting place for leading international organisations in the fastener and fixing sector and an opportunity for exchanging competencies and views on current technological developments.

Exhibitors at Fastener Fair Global present products and services from the following sectors:

• Fastener manufacturing technology

• Industrial fasteners and fixings

• Construction fixings

• Assembly and installation systems

• Storage, distribution, factory equipment

• Information, communication and services

Fastener Fair Global provides an excellent platform to establish new contacts and build successful business relationships between suppliers, manufacturers, distributors, engineers and other industry professionals from various production and manufacturing sectors looking for fastening technologies.

Some 835 companies have confirmed their participation at Fastener Fair Global 2023, covering 22,000 sqm of the exhibition ground. International firms from 42 countries are participating in the show, representing SMEs and large multinational enterprises mainly from Germany, Italy, China, Taiwan, India, Turkey, the Netherlands, the UK, Spain and France.

Ahead of the event, Liljana Goszdziewski, Portfolio Director for the European Fastener Fairs, comments: "After four years since the last edition, it is rewarding and exciting to be able to welcome the international fastener and fixing industry at Fastener Fair Global 2023. The high turnout of exhibiting companies confirmed at the event reflects how keen the sector is to get together face-to-face and participate in the show to allow plenty of business networking activities and enable new sales and learning opportunities in a fast-growing market."

Fastener Fair Global provides a marketplace with a unique showcase and networking platform in one of the world's leading industrial economies. The global industrial fasteners market size was valued at USD 88.43 billion in 2021 and is predicted to expand at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030. The market is expected to be driven by population growth, high investment in the construction sector, and rising demand for industrial fasteners in the automotive and aerospace sectors. Moreover, the industrial machinery segment is set to expand at a CAGR of 5.0% from 2022 to 2030. The rapid growth of heavy machine-driven industries, including textiles, food and beverage, and chemicals, is expected to propel the demand for industrial machinery, thus driving the need for industrial fasteners over the forecast period.

Exhibitors will be aiming their products and services at many industries, including:

• Construction

• Automotive

• Aerospace

• Marine

• Electronic and Electrical Goods

• General Engineering - Light/Heavy

• HVAC / Air Conditioning / Services

• Energy and Power Generation

• Communication Technology

• Metal Products

• Furniture Manufacturing

• Sanitary Ware and Plumbing

• Installation

Over 12,000 senior managers, engineers and buyers visited the last edition of Fastener Fair Global. The mix of visitors to the show represented the diversity of markets served by the fastener and fixing industry. Most visitors were producers, wholesalers or distributors, playing a vital role in the supply chain to resellers and the manufacturing sector.

The vast majority of visitors at Fastener Fair Global achieved their business goals by attending the event, with 91% of visitors claiming to be highly satisfied with the show. As a result, 3 in 5 visitors would recommend Fastener Fair Global to their colleagues and business partners.

Fastener Fair Global belongs to the highly successful worldwide series of Fastener Fair exhibitions for the fastener and fixings industry. These include the portfolio flagship event, Fastener Fair Global, as well as Fastener Fair Italy, Fastener Fair India, Fastener Fair Mexico and Fastener Fair USA.

For more information on Fastener Fair Global 2023, visit https://www.fastenerfairglobal.com/

After four years of postponement, Fastener Fair Global will finally be held on March 21-23, 2023. The organizer’s exclusive agent in Taiwan, Fastener World Inc., is expected to form a large exhibiting group of more than 130 Taiwanese companies to participate in the Fair, which will further deepen the cooperation between Taiwanese fastener supply chains and the greater European market full of business opportunities.

In order to provide Taiwanese exhibitors with a more comprehensive understanding of the details that should be paid attention to before and during the Fair as well as the current situation of the European market before setting out to participate, the organizer’s exclusive agent in Taiwan, Fastener World, held a pre-show orientation on January 11 (Wed.) at Evergreen Plaza Hotel (Tainan) and invited more than 100 exhibitor representatives to attend. TFTA Chairman Josh Chen and TIFI Executive Secretary Shih-Tsung Huang on behalf of TIFI Chairman Tu-Ching Tsai were also present to deliver their speeches.

Fastener World Magazine President William Liao ▼

Chairman Josh Chen ▼

TIFI Executive Secretary Shih-Tsung Huang ▼

TFTA

TFTA

Fastener World Magazine President William Liao said in his opening speech, "I'd like to thank everyone for exhibiting at FF Global through Fastener World. Since the first edition of the Fair, its popularity and importance in the global fastener industry has been increasing year after year, and it is now the largest and most leading dedicated fastener fair in the world. Every past year, more than 100 Taiwanese exhibitors chose to exhibit through Fastener World. This show is also an important platform for Taiwanese exhibitors to develop the European market and strengthen their business deployment in Europe. We hope that through this pre-show orientation, our professional team can help exhibitors make adequate preshow preparations and seize the European fastener market, which is gradually recovering after the epidemic.

During the conference, the editors of Fastener World also briefed about the overall development trend of Taiwanese fasteners exported to the world over the past 20 years, important data and events of exporting to Europe and the United States, the dynamics of European target manufacturers and the recent concerns of European buyers, etc., which were presented in tables and charts. Vice Editor-in-Chief of Fastener World Magazine, Gang Hao Chang said, “In 2022, Taiwan's fastener exports reached 1,607,000 tons, almost the same as in 2021, and the export value reached US$6.142 billion, a 15.47% increase compared to 2021. The competitiveness and performance of Taiwan is more impressive than that of other countries. These slides will not only let exhibitors understand the importance of Taiwan's fastener supply chain in the global industry and the expectation of its future development, but also will let them know the fact that the current overseas exhibitions have gradually returned to normal and that overseas buyers are looking forward to contacting Taiwanese suppliers at the Fair face to face and to discussing purchasing and further cooperation.

Many exhibitors also made their inquiries about the floorplan, exhibition permits and documents applications, stand furniture and extra rentals, product delivery, exhibition planning and itinerary...etc. Fastener World’s staff were also present to provide detailed onsite explanations, which did help them a lot.

For more information about FF Global, please contact our foreign department (Email: foreign@fastener-world.com.tw)

by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

The 7th edition of Fasteners World Middle East which was held during January 9 to 12 at Expo Centre Sharjah is the only specialized fastener exhibition in the Middle East and North Africa region. This year the organizer arranged national pavilions for China, India, Turkey and Europe in the exhibition hall.

This year's edition coincided with the rising oil prices in the Middle East, which has created a boom in the local manufacturing and construction industries and promoted the rapid growth of the fastener industry. Intelligence reveals that the total construction market in the Middle East Gulf countries is valued at US$1 trillion, with as many as 5,000 construction projects in the UAE region. The size of the fastener economy that derives from it is not to be underestimated.

During the show period, we met traders and metalworkers from Dubai who were looking for companies interested in setting up manufacturing plants in Dubai. They indicated that the UAE government is interested in providing subsidies in the future to reduce the cost of transporting industrial goods for these companies.

A visitor mentioned the fact that Chinese manufacturing industry is affected by the Chinese government's policy has driven the Middle East buyers to prefer collaborating with other Asian manufacturers to ensure a stable supply. In addition, a visitor from India was looking for machines that can manufacture large sized screws. There was also a visitor from Sharjah who was looking for screws to fasten ship pipelines. We also heard from Taiwanese exhibitors that the anticipation for this show was high and that the number of exhibitors and visitors exceeded the last show!

by Dean Tseng, Fastener World

After overnight negotiations, EU countries and European Parliament representatives reached an agreement on December 13, 2022, to impose a tax on CO2 emissions from imported steel and cement and other polluting goods, extending the scope of application from upstream products such as steel, aluminum and cement to downstream products such as screws and bolts. The new mechanism is scheduled to be implemented on a trial basis from October 1, 2023.

The agreement, called the Carbon Border Adjustment Mechanism (CBAM), is a new creation of the European Union in light of the global trend of carbon reduction, and was proposed by the Executive Committee in July 2021. Since EU has set strict carbon reduction requirements for local industries with high carbon dioxide emissions, in order to prevent enterprises from increasing costs from carbon reduction and end up with uncompetitive prices against imported products, CBAM was created, requiring purchase of carbon reduction certificates for foreign high carbon emission products entering the EU market.

On 19 January 2023, Secretariat of Economy (Mexico) published in a public release the first final ruling on sunset review of anti-dumping of wire rods originating in or imported from China, deciding to maintain the anti-dumping duty of US$0.49/kg established in the final ruling of the initial review on 28 July 2016. The TIGIE tariff codes of the associated products are 7213.10.01, 7213.20.91, 7213.91.03, 7213.99.99, 7227.10.01, 7227.20.01, 7227.90.99, 9802.00.01, 9802.00.07, 9802.00.13, 9802.00.19 and 9802.00.23. The measure took effect from 29 July 2021 for a period of five years.

On 2 September 2015, Mexico initiated an anti-dumping investigation into wire rods originating from or imported from China. On 28 July 2016, Mexico issued a positive final determination to the case, imposing an anti-dumping duty of USD 0.49/kg on the products involved. On 22 July 2021, Secretariat of Economy published an announcement in a public release, saying to initiate the first sunset review investigation into the case upon the application by Mexican companies including Ternium México, S.A. de C.V., Arcelor Mittal México, S.A. de C.V. and Deacero, S.A.P.I. de C.V.

Japan External Trade Organization (JETRO) surveyed 7,173 Japanese companies around the world and published "Worldwide Overseas Japanese Companies Survey for 2022" report. The report is a barometer hinting at the future of Japanese companies in overseas markets and it draws three conclusions.

First, 65% of the 7,000 plus Japanese companies operating overseas expected to gain profit for 2022, but the losses in sectors such as auto parts were increasing. As a result of China's Zero COVID policy, more than 40% of Japanese companies in China were facing deteriorating sales, exceeding the proportion of companies having improved results.

Globally, 45.4% of Japanese companies would expand their business in overseas countries. Among them, 70% of the Japanese companies would expand in India and 60% in Vietnam, showing that Japan was continuing to tap into the Southeast Asian market. On the contrary, the percentage of Japanese companies intending to expand in China dropped from 40.9% to 33.4%.

Second, 60% of Japanese manufacturers would re-examine the supply chain. As raw material and transportation costs rise and the risk of supply disruptions became more apparent, Japan would accelerate its localization (self-production) strategy for sourcing, production and sales. In the next one to two years, the number of Japanese personnel dispatched to overseas countries will be reduced by half compared to the pre-epidemic period, while the number of Japanese domestic employees will be increased.

Third, Japan is accelerating carbon reduction. More than 40% of the surveyed companies are already taking action to achieve decarbonization, an increase of nearly 10% over the previous year. Compared with the previous year, this figure increased by nearly 10%. The number of companies making green purchases (requiring suppliers to reduce carbon) has more than doubled. With awareness of carbon reduction spreading rapidly throughout the supply chain, non-compliant companies may face the risk of limited trading opportunities.

According to the latest statistics from China Association of Automobile Manufacturers (CAAM), China's new energy vehicle production and sales continued to grow exponentially in 2022, with 7.058 million and 6.887 million units produced and sold respectively, up 96.9% and 93.4% year-on-year, topping the world for eight consecutive years. Its market share rose to 25.6%, 12.1 percentage points higher than the previous year, with global sales accounting for over 60% of the total. Of all new energy vehicles, 5.365 million pure electric vehicles were sold, an increase of 81.6% year-on-year, while 1.518 million plug-in hybrid vehicles were sold, an increase of 1.5 times year-on-year.

In 2022, the share of domestic sales of new energy passenger cars made by independent brands reached 79.9%, an increase of 5.4 percentage points year-on-year; 679 thousand new energy vehicles were exported, an increase of 1.2 times year-on-year. China accounted for three of the world's top ten companies in terms of sales volume of new energy vehicles. China's new energy vehicles have entered a period of full market expansion and are expected to continue to grow at a faster pace this year.

As the South Korean Hyundai Motor is enhancing deployment in Southeast Asia, its opponent BYD from China is making its way into Thailand to build a new factory, making Thailand a new ground for the face-off between South Korean and Chinese EV makers. BYD, the second largest EV maker in the world, is locked on the rapid growth of EV market in Southeast Asia and has decided to invest USD 491 million in its first overseas plant in Thailand. The plant is expected to launch in 2024 and manufacture 150 thousand units per year. Thailand has set the target to raise the proportion of new EV car sales to 30% by 2030. Last March, Hyundai launched a plant in Deltamas Industrial park in Bekasi. It is Hyundai's first manufacturing plant in ASEAN and manufactures the new BEV called IONIQ 5.

The speed of EV revolution could go beyond our expectation. A starup EV brand from the Netherlands rolled out the first solar energy car Lightyear 0. Production began from November 30, 2022. Unlike general EV cars that have to be pulled over for recharging, Lightyear 0 can recharge on the go under the sun. Even if the battery runs out, it can go ahead running on solar energy. With solar power, it can go 11,000 kilometers on flat grounds each year. Lightyear 0 is manufactured at Valmet Automotive Group's plant in Finland. The current estimated capacity is 946 units. It uses 60 kWh batteries and runs 625 kilometers after a full recharge.

The Chinese fastener enterprises in Yongnian are deeply engaged in overseas markets, and their products are exported to more than 110 countries and regions, such as the United States, Japan, Egypt and Dubai (UAE). At present, the Yongnian district encompasses 476 fastener enterprises with independent export license. There are more than 50 large factories specifically dedicated to export sales and 5 industry-leading fastener enterprises which have established their overseas warehouses. In 2022, Yongnian district generated about 158.6 million U.S. dollars worth of fastener export, a year-on-year increase of 70.8%, up against the nation-wide downtrend. In 2022, the annual output of fasteners in the region reached 5.6 million tons, with an output value of RMB 38.5 billion. By participating in exhibitions, Chinese fastener enterprises have received a large number of overseas orders at major international exhibitions.

Located in Gangyu District, the construction of the Phase III high-strength fastener industrial park was put into production starting February 2023. This industrial park costs a total investment of RMB 4 billion, covering an area of 410 acres. The third phase of the project is invested and constructed by Jiangsu Hengyue Hardware Technology Co ltd and two other companies. The total area of the park is 170 acres. The total area of structures is about 90,000 square meters and the total investment is RMB 1.02. The industrial park can produce 200 thousand tons of high-strength fasteners annually with an annual output value of RMB 1.6 billion as well as a tax revenue of about RMB 20 million.

So far, the main structure and auxiliary construction of Jiangsu Hengyue Hardware Technology whose annual output capacity is 60,000 tons of high-strength fasteners have been completed and put into use since February 2023.

China's total automotive production and sales achieved 27.021 million units and 26.864 million units respectively, an increase of 3.4% and 2.1% year-on-year, achieving a modest annual growth ranking first in the world for 14 consecutive years.

China Association of Automobile Manufacturers said, "In 2022, the automotive industry was impacted by a number of factors, but under the effective momentum from a series of policies to stabilize growth and promote consumption, and with the joint efforts of enterprises across the industry, the overall recovery of the automotive market is improving. Passenger cars achieved faster growth, contributing an important force for the steady development of the industry." In 2022, China's passenger car production and sales achieved 23.836 million units and 23.563 million units, a respective increase of 11.2% and 9.5% year-on-year, a higher growth rate than the industry as a whole.

Changhua Holding Group (formerly Zhejiang Changhua Auto Parts) intends to invest a raised capital of RMB351 million in building a production line with an annual capacity of 2 billion pieces of high-strength automotive fasteners. Upon completion of Phase I, the production line will be able to produce 925 million pieces of highstrength fasteners per year, which will provide important support for the Company's strategic development goal towards high-end and automated fastening products.

The main plant has been completed and two fully automatic electroplating production lines have been installed. The installation of a wastewater treatment system together with the electroplating line has been completed. Also completed is the installation of a spheroidized annealing furnace with protective atmosphere imported from Japan, with a production capacity of 1,900 tons per month.

Zhejiang Huayuan Auto Parts intends to be listed on the Growth Enterprise Market of Shenzhen Stock Exchange, raising RMB 300 million for the production of automotive fasteners, mainly to increase production capacity, expand market share and enhance competitiveness. The company's main products are special fasteners and locks for automobiles, and is one of the few companies in China that specializes in the research and development of automotive seat locks. Its products are widely used in car chassis and power systems, security systems, intelligent electronic systems and others. At present, the company has a customer base including Guangzhou Auto Honda, Changan Mazda, Great Wall Motor and well-known first-tier suppliers such as Lear, Adient, Faurecia, Magna. In the future, they will increase the development of new customers such as new energy customers and intelligent electronics customers to lay a good foundation for the new production capacity.

General Inspection, LLC recently added a new high/low thread measuring algorithm to its VisionLab. The 3D fastener gauging system, has the most comprehensive thread measurement capabilities, including all pertinent system-22 requirements, lobular shaped threads and now a specific algorithm for high/low threads.

Greg Nygaard said, “by popular demand, we’ve added a tool to our VisionLab system to make measuring high/low threads as simple as a press of a button”. The VisionLab allows manufacturers and distributors to measure all critical part features including high/low threads in less than 5 seconds.

In addition to threads, the VisionLab measures all profile features, including GD&T characteristics. An optional “end view” inspection measures and detects defects on both ends of parts including features such as recesses, inner/outer diameters, through holes and counterbores. Optional surface control is used to detect visual detects, such as bad plating, thread patch presence/quality as well as measuring knurl width, gap and height. Optional upper tooling and bit kit are available for uneven parts or parts with a recess drive.

For time savings, traceability and removing error, the VisionLab creates customized, thorough reports with graphs and data charts which can also be uploaded to 3rd party SPC packages.

Tianrun, a wholly owned subsidiary of Goldwind, signed a cooperation framework agreement with Fengqing County Government in Yunnan. The two parties will make full use of Fengqing's wind energy resources to establish a longterm strategic partnership in decentralized wind power development, in order to achieve resource sharing and mutual benefits.

It is worth noting that on September 5, 2022, Goldwind also officially signed an Investment Cooperation Agreement with Yunnan Yunxian Government for the Yunxian Flange Fastener Plant Project. Fengqing has location advantages, huge market potential and a favorable business environment, and the development prospect of decentralized wind power projects is promising. Both sides hope to continuously broaden the collaboration and enrich the results.

According to the company's strategic development plan, Ronnie Precision Machinery announced to set up a wholly-owned subsidiary. The company's main business is R&S, manufacturing and sales of precision metal parts such as precision fasteners, connectors and structural parts, mainly providing precision metal parts to customers in downstream applications such as 3C, automotive, communications and power equipment.

In recent years, China's major projects such as West-to-East Gas Transmission, Southto-North Water Transfer, High Speed Railway and West-to-East Electricity Transmission have been fully rolled out, and the local automobile, machinery, home appliance, shipbuilding and transportation industries have continued to grow. The strong demand for production and construction will drive significant growth in the fastening industry.

Finework New Energy Technology is a company specializing in the development and manufacture of high strength fasteners and provides total fastening solutions to customers. The company intends to establish a wholly-owned subsidiary, Finework International, in Hong Kong with a capital of HK$20 million. After the establishment of Finework International, the company intends to use Finework International to co-found Finework (Vietnam) Fastener Manufacturing (capital: US$2 million) in Vietnam with another company, where Finework International accounts for 95% of the capital and the other company accounts for 5%.

TR Fastenings Hungary Kft, part of the Trifast plc Group, is celebrating the opening of its new purpose-built facility in Budapest, building on years of rising demand in the region.

Located in the southern suburb of Szigetszentmiklós, Budapest, TR Fastenings

Hungary Kft is a fastener and Cat. C supplier to international OEM’s and their subcontractors not just in Hungary but in the seven countries that border them. The new 3,500 sq. metre modern facility has 9.5 metre eaves in the warehouse and is a high-capacity distribution facility that is ready to support TR’s future European growth strategy.

TR Hungary was first established in 2000 and has grown considerably in that time, quickly outgrowing two previous locations. Its rapid growth has been a real success story for TR and the region alike. It has come about through rising demand from large multinational household brands, many of which TR supplies to elsewhere in the world. Hungary has historically been a lower cost production region but with a highly skilled available workforce making it ideal for this kind of strategic investment. Hungary has a central location in Europe with seven countries on its border, which is perfect for distribution hubs.

The TR Hungary team is fully supported by the Group encompassing Sourcing, Technical and Design, Commercial, Financial, HR and Marketing support.

NORMA Group has won a new major order for joining solutions in electric vehicles. From July 2023 until 2030, NORMA Group will equip several of the customer’s batteryelectric premium models with hose connectors, hose adapters and quick connectors. The order has a total volume of around EUR 34.6 million.

CEO Dr. Michael Schneider: “In our strategic business unit ‘Mobility and New Energy’, we consistently focus on the requirements of our customers. With our experience as a development partner and our certified production standards, we are very well positioned to support our customers in their technological transition towards emission-free mobility.”

NORMA Group’s connection products are installed in cooling water lines and are used to cool various units in the vehicle, including the battery. The hose connectors and quick connectors have been part of NORMA Group’s portfolio for many years. Development engineers at NORMA Group specially adapted them for this order in cooperation with the customer. The joining products are manufactured at NORMA Group’s plants in Maintal, Germany, and in Pilica, Poland. Some of the parts include a temperature sensor in order to ensure optimal operating temperature. In order to meet the increased demand, NORMA Group is investing in injection molding production at the Maintal site, in new assembly machines for quick connectors and in training employees.

The Board of Directors of Howmet Aerospace declared a dividend of 93.75 cents per share on the outstanding US$3.75 Cumulative Preferred Stock (“Class A Stock”) of the Company, paid on January 1, 2023. to the holders of record of the Class A Stock at the close of business on December 9, 2022.

Howmet Aerospace Inc., headquartered in Pittsburgh, Pennsylvania, is a leading global provider of advanced engineered solutions for the aerospace and transportation industries. The Company’s primary businesses focus on jet engine components, aerospace fastening systems, and airframe structural components necessary for mission-critical performance and efficiency in aerospace and defense applications, as well as forged aluminum wheels for commercial transportation. With nearly 1,150 granted and pending patents, the Company’s differentiated technologies enable lighter, more fuel-efficient aircraft and commercial trucks to operate with a lower carbon footprint.

Fastener Tool & Supply, Inc. — a nationwide leader in fastener distribution – is proud to announce the launch of their brand-new website. The foundation of Fastener Tool & Supply’s business has been rooted in their commitment to operational excellence and customer service since 1977. Additionally, their focus on innovation, quality, and continuous improvement has helped grow their reach across North America. Now, their website is also centered around these fundamental principles.

The focus of the redesigned website is to put the user in control, adding useful elements and features that improve functionality, accessibility, and user experience. This investment reinforces Fastener Tool & Supply’s promise to deliver high-tech, user-friendly solutions to help streamline processes and boost efficiency. Fastener Tool & Supply, Inc. is a trusted distributor of fasteners and related products and services. Headquartered in greater Cleveland, Ohio, they offer over 150,000 fasteners and supply chain solutions that help improve quality and boost productivity. These advanced technologies have propelled them into many cutting-edge industries, such as aerospace, alternative energy, automotive, industrial commercial, construction, high performance, military, and power generation.

BBI-Montreal has moved from a 90,000 sq ft facility into a 154,000 sqft building and BBI-Toronto has doubled its warehouse space to 164,000 sq ft facility enhancing just-in-time deliveries into Canada.

Brighton-Best is currently located in 31 locations in 6 countries and supplies over 7,000 distributors throughout the world.

Optimas Solutions, a global industrial manufacturer/distributor and service provider, announced the elevation of Mike Tuffy to CEO, International, and Daniel Harms to CEO, Americas. The decision to implement a dual-CEO structure evolves the organizational model established in 2020 with autonomous, yet connected, business units.

By design, this structure has brought Optimas closer to customers and suppliers and created greater community within the organization. It also better reflects the scope of Harms and Tuffy’s roles and the contributions they’ve been making to Optimas for over a year.

The patent-pending TriLead screw, with a special bit shape newly developed by SYNEGIC, can cut wood and discharge wood chips to perfectly drill into MDF or particle boards without cracking the wood or creating burrs during the drilling process. There is no need to drill holes in the wood before use.

TriLead screw adopts chromate surface treatment, and can be used with hexagonal bits, suitable for wood with the thickness of 10-20mm, including shelves and other household furniture.

In August 2022, Fukui Byora established a logistics center in Shiga Prefecture to provide just-in-time delivery to the Tokai and Kansai regions. The company will capture the demand for EV parts, which is expected to expand significantly. The company will build a new plant located in Katayamazu in summer 2023 as a production base for EVs and high voltage battery parts. They will respond to new demand in the automotive field by utilizing its specialty in cold forging technology.

SUMEEKO announced on November/16/2022 that it is to acquire the other 49% shares of Max Mothes GmbH (MMG), a subsidiary of CS Beteiligungs GmbH, for 6.24 million euros in cash. The process is expected to be completed in July 2023 and after that MMG will be fully owned by SUMEEKO.

Through an adjustment period of 2.5 years, MMG is back on track with profits gained in 2021 thanks to orders from European carmakers. Previously, SUMEEKO acquired 51% shares of MMG (a Tier 1 supplier for German automakers) for 6.5 million euros, which was completed in July 2018. By fully acquiring MMG shares, SUMEEKO can tap into the supply chains of Ford, Benz, BMW, Volkswagen, Bosch and Siemens.

As the world's second largest commodity market, the EU has announced that it will implement the Carbon Border Adjustment Mechanism (CBAM) on a trial basis from October 1, 2023, whereby companies importing related products into the EU will be required to declare their carbon emissions. On the other hand, they will also be required to purchase the so-called CBAM certificates from the EU to pay for the carbon emissions of imported products, which will be formally implemented in 2027.

Initially, the CBAM covered only iron & steel, cement, aluminum, fertilizer, electricity, and hydrogen, but after a meeting of EU parliamentary members at the end of 2022, the scope was extended to include steel-related downstream products (i.e., steel screws and bolts will also be covered), with the goal of reducing EU carbon emissions by 55% before 2030 compared to the 1990 level. This will have a major impact on many countries around the world that export a lot of products to the EU and do not yet have a well-developed domestic carbon emissions mechanism or regulation.

The concept of carbon rights can be traced back to 2005, when the EU started to impose a carbon fee on carbon emitting companies within the EU, but the same measure was not applied to those outside the EU who imported goods and services into the EU. This is why the CBAM, the world's first carbon border adjustment mechanism, was created, with the goal of discouraging the export of cheaper and more

competitive products to Europe from countries that do not yet have complete environmental control policies. The objective of CBAM is to discourage the export of cheaper and more competitive products from countries that do not have complete environmental control policies to Europe to cause damages to the local industry. Although the EU has issued free carbon permits to domestic companies at this stage, the program will be gradually phased out after the implementation of the carbon tariff to meet WTO requirements.

Not to be outdone by the EU, the U.S. has also announced plans to impose a carbon tax by 2024, much earlier than the EU's 2027. By then, no matter whether the products are made in the U.S. or imported from abroad, as long as their carbon content is below the required baseline, they will not be subject to the tax; conversely, if they exceed the baseline, a carbon tax of US$55 per ton will be levied. And, the plan extends to downstream products after 2026, as long as they reach a certain carbon content, they will also be subject to the carbon tax.

Many analysts also believe that in order to obtain a level playing field, China, Japan, South Korea and other countries may also implement their own carbon tax measures in the future.

The ISO 14064 standard was developed by the International Organization for Standardization (ISO) as the basis for internal carbon inventory and verification methods. The other ISO 14067 is mainly used to measure the carbon footprint of a company, focusing on the total direct and indirect carbon emissions throughout the "life cycle" of the goods and services produced by the company. ISO 14064 focuses on the "carbon inventory" within a company, while ISO 14067 focuses on the "carbon footprint" tracking outside the company.

China, for example, is one of the world's largest carbon emitters, with a total export value of over 380 billion Euros to the EU in 2020. Some experts believe that once the EU carbon tax is implemented, it will increase the cost of carbon tax for China's steel, aluminum, fertilizer, cement and other industries, and the cost of carbon tax will reach 17%, 20%, 17% and 31% of the export value respectively. According to Goldman Sachs Group's calculations, after the carbon tax is formally implemented, China's exports to the EU are estimated to be subject to an annual carbon border adjustment tax of up to US$35 billion (roughly

7.7% of China's total exports to the EU), which will be a considerable cost burden for many Chinese companies that are mainly focused on export.

Moreover, since many enterprises in Europe and the United States started earlier in carbon emission control, if the carbon tax measures in Europe and the United States are formally in place, other enterprises with particularly high carbon emissions will obviously lose their competitiveness.

The carbon tax is a current trend in the global industry to pursue a win-win situation for both the environment and corporate sustainable development. Companies that focus on exporting to Europe and the U.S. will be the first to be affected. In view of this, enterprises should not only passively review whether they have the ability to monitor carbon efficiency and implement corresponding calculations and reports. They should also take the initiative to strengthen their manufacturing technology transformation (e.g., the introduction of more energy-efficient equipment and device) and invest more in R&D transformation that emphasizes low carbon emissions (e.g., use of green energy or adoption of low carbon emission materials) in order to gain the most advantageous competitive edge in the upcoming carbon tax challenge.

Alternation of generations can be defined as the reproductive cycle of living nature. Of course, this topic belongs more to the field of philosophy than to the pages of a technical engineering magazine, but this also applies in general to the carriers of progress in the field of mechanical joining of parts, even much more significantly than in other areas. And why?

At first glance, the meaning of the words in the title seems exaggerated. In the eyes of not only the lay public, screws are perceived as a less important structural element. What is the truth now? Few people realize what an important role the pioneers of the technical revolution and their vanguard - promoters of the mechanical joining of parts using threaded joints - played in life. It should be added here that screws would not be screws if there was no natural property of matter - friction. All of this had to be understood first by “reason, the most beautiful ray of heavenly light”, as a Nobel Prize laureate Romain Rolland says. Thank God, that this ray radiates knowledge one generation after another. This is

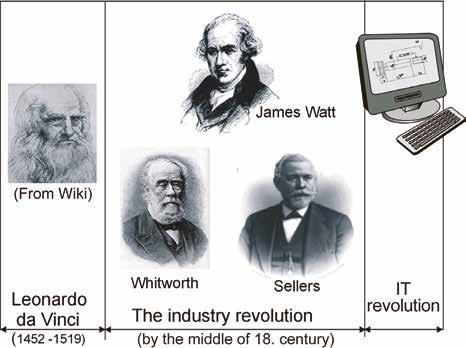

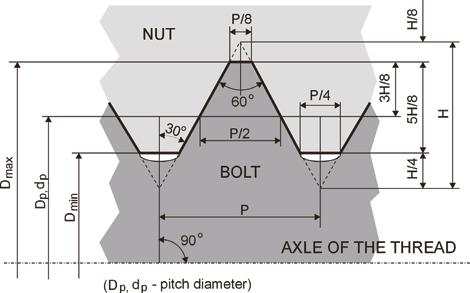

also confirmed by a famous physicist Isaac Newton: “If I have seen further it is by standing on the shoulders of giants”. So the alternation of generations, which mutually exchange experiences, is the basis of social progress. Let's look at Fig. 1. Perhaps the greatest genius in the realms of mankind, Leonardo da Vinci left an admirable message from which future generations benefited. Basically, it enabled the birth of technical revolution. Johann Gutenberg, the inventor of the printing press ( Fig. 2), should be mentioned in particular. His discovery turned out to be very important, because it started the mass production of books and, in connection with that, the information and scientific revolution and the spread of education among wider classes. Similarly, the steam engine designer James Watt ( Fig. 3). Or, although it is not known who was the first to construct a roller ( Fig. 4), in any case it would not have been possible without a strong generation of thread (Fig. 5) connection pioneers such as Joseph Whitworth or William Sellers (in Fig. 1). Of course they weren't alone, and the development continued.

The most difficult work of designer doesn’t end here, but just begins!

With the onset of IT revolution, it became possible to study the behavior of screw joints during assembly and in operating conditions. The use of the Finite Element Method (FEM), which replaced the complicated and impractical photoelastometric observation, meant visible progress in the field of studying stress distribution during stressing of structural elements ( Fig. 6 ). Based on FEM analysis, it is possible to take effective measures against the collapse of bolted joints during operation. The current generation of engineers can do what their predecessors could not even dream of - comfortably with the help of a computer to see inside a screw connection. Unfortunately, another thing is that not everyone can

correctly interpret the knowledge gained. And here we are at the basic problem of the current technocratic generation. Yes, we have excellent computer programs at our disposal and most students are proficient in them, but there are great reserves in interpretation skills. Today, it is no longer enough to just choose the right software, enter the input parameters and wait for the result.

As we have seen, each change of generations means a qualitative shift in scientific and technical knowledge to a higher level. Anyone who thinks that screw joints play only a minor role in this social cycle is very much mistaken. Almost all conquests of the technical revolution were, are and will be in future dependent on screw connections. Today, when we are in the field of IT revolution (Fig. 1), it is very important that the young generation, above all, realizes this. From this point of view, the question arises as to whether the curricula at vocational schools and technical universities are correct and whether they respond to current social needs. Because I am in close contact with important technical universities not only in SK and CZ, but e.g. even in Germany, such as TU Darmstadt and TU Zwickau, where I occasionally lecture, I can confirm the declining interest of students in this topic. Why this is so and how to stop this unfavorable development is a longer discussion. Perhaps it would help if some agency found the courage to create a platform for publishing a purely scientifically oriented magazine on this topic. I am ready to help. I’ve also thought of a suitable name - Science Friction.

Article by Jozef Dominik and Dominik Makuka

Copyright owned by Fastener World

Copyright owned by Fastener World

Scandinavia is a subregion in Northern Europe, with strong historical, cultural, and linguistic ties between its constituent peoples. In English usage, Scandinavia most commonly refers to Denmark, Norway, and Sweden. It can sometimes also refer more narrowly to the Scandinavian Peninsula (which excludes Denmark but includes part of Finland), or more broadly include Finland, Iceland, and the Faroe Islands.

In this article I will study the 4 biggest countries in this region, Denmark, Sweden, Norway and Finland.

Swedish population is 10.42 million and its GDP was USD 627.4 billion in 2021. Its growth was set to slow to 2.2% in 2022 and 1% in 2023. Heightened global uncertainty will weigh on business investment and exports. Household consumption is backed by a strong labour market, high savings and fiscal support, but will slow as higher inflation and interest rates start to bite. The unemployment rate continued to fall in 2022 but will level off in 2023, as skills in high demand become increasingly scarce.

Norwegian population is 5.408 million and its GDP was USD 483.4 billion in 2021. Mainland GDP growth of 3.5% was projected for 2022, reflecting the final phase of recovery in the wake of the pandemic. In 2023, its economic growth will decline towards its long-term potential rate, at 1.7%. Risks to inflation are pronounced, given the broadening of large price increases and elevated uncertainties around commodity prices. The labour market, already tight, will add to pressures on wage inflation. House prices and household indebtedness remain high.

Danish population is 2.857 million and its GDP was USD 397.1 billion in 2021. Its growth slowed due to the Russia-Ukraine war, with its GDP forecast to expand by 3% in 2022 and 1.4% in 2023. The resilience of the Danish economy is underpinned by its low reliance on fossil fuel imports and strong household, corporate and government balance sheets. However, consumer and business confidence have fallen considerably and inflation has increased to over 6%. Further energy market disruption could reduce growth and push prices higher again, while the tight labour market could trigger more sustained inflation if it leads to rapid wage growth.

Finnish population is 5.542 million and its GDP was USD 299.2 billion in 2021. Its economic growth slowed sharply to 1.1% in 2022 and will be 0.6% in 2023 owing to the waning of the COVID 19 rebound and to the war in Ukraine. Private consumption will be depressed by falling real household incomes but should slowly recover from late 2023 as they begin to rise again. Headline inflation fell slowly from a peak of 7% in late 2022. After dropping sharply in 2022, exports should accelerate in 2023 as exporters find new markets and world trade picks up. The main downside risk is that a wage-price spiral develops, increasing inflation and reducing competitiveness and growth.

1. https://www.oecd.org/economy/

Sweden ’ s fastener trade was USD 1016.197 million in 2021 (the share of imported fasteners was 58% and the share of exported fasteners was 42%).