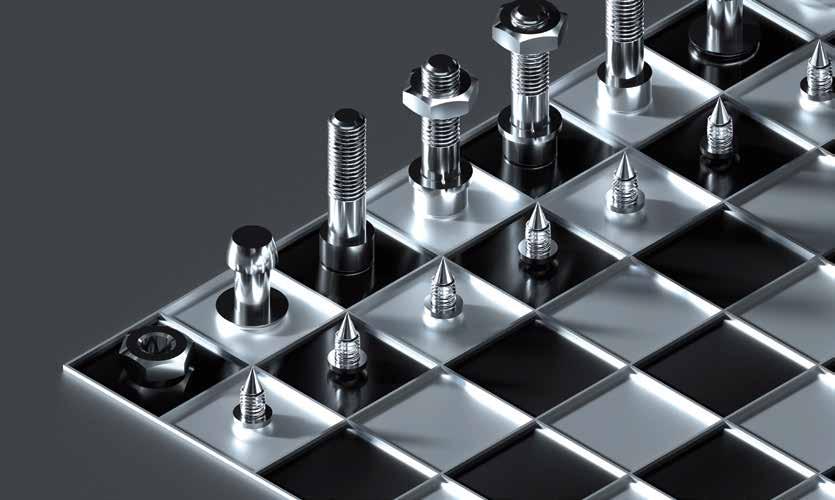

Continuing from my special interview with SUNCO Industries in September 2022, I touched on their big move to provide full English support for customers worldwide. A part of that achievement is their “3Q-Net”, an online all-in-one catalog system, a.k.a platform, dubbed as the game-changer to sweep the world. So what is 3Q-Net? If that is what you’re thinking, I have an exclusive scoop for global customers seeking all sorts of top quality fasteners straight from Japan and available for nextday delivery.

SUNCO Industries is known for 3 mascot penguins they put into their logo and ads. The penguins are symbolized into the alphabet “Q”, and hence “3Q” to denote Quality, Quick and Quest. “3Q-Net” is a catalog platform covering 1 million fastener items. It means they have every Japan-made fastener types— a feature exclusive to Sunco Industries only— and they support from inquiry to product search, inventory check, reference price, drawing and 360° rotatable photo display, and order placement in USD or JPY. It’s an ultimate genuine one-stop purchase source.

“For those of you struggling with finding which fastener fits your specific need, we’ve made the search extremely easy, which is the gamechanging part of our platform. We put our experience and know-how into it. If you want business expansion or if you are not well versed in fasteners (JIS, Metric, branded products), you’ve come to the right place,” said the company. 3Q-Net provides on-demand supply, stable routes and service. “If you want to sell your products to Japanese companies or want to expand business with special Japanese-branded fasteners. This is for you.” They are evolving 3Q-Net by adding credit card and Paypal support for utmost purchase convenience.

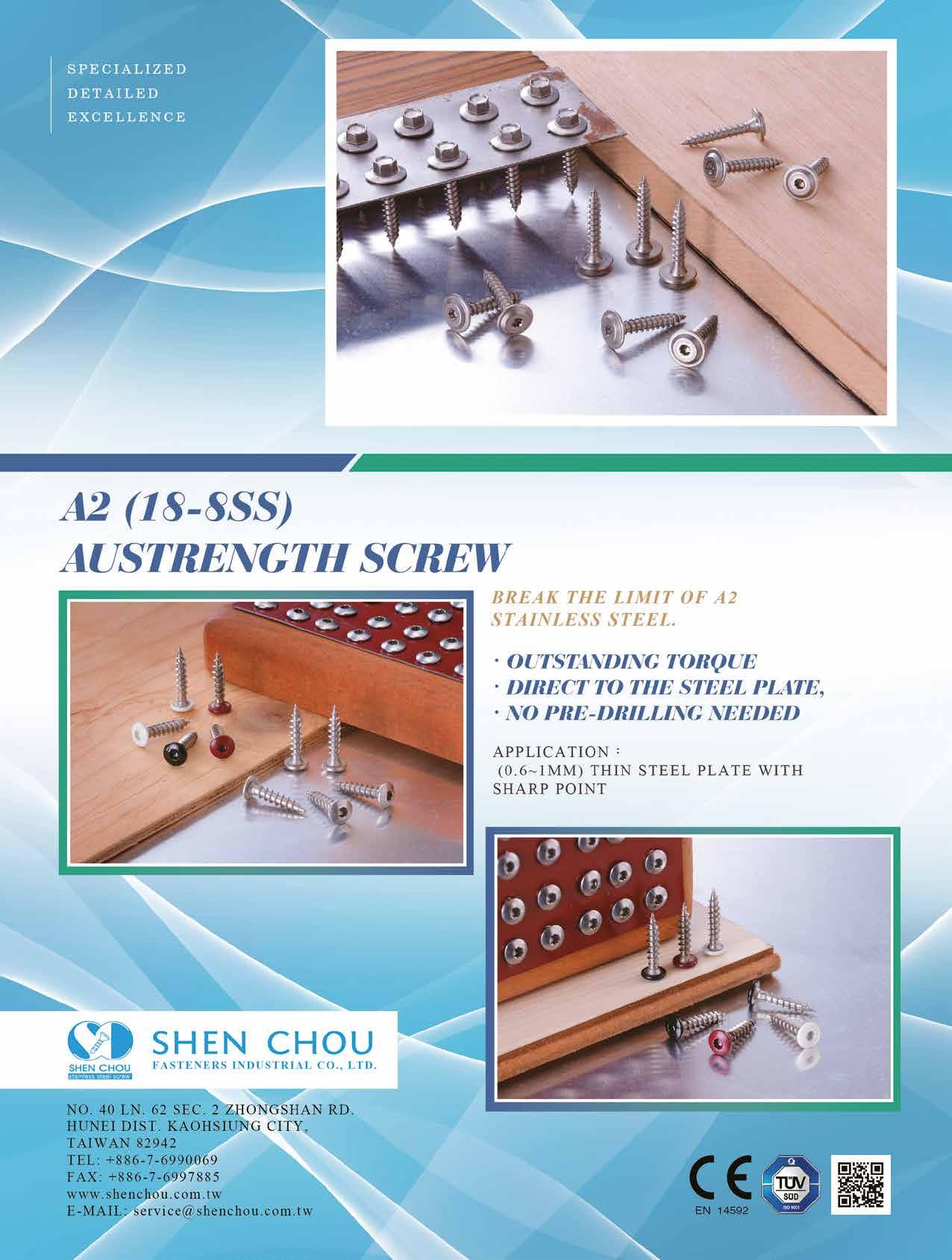

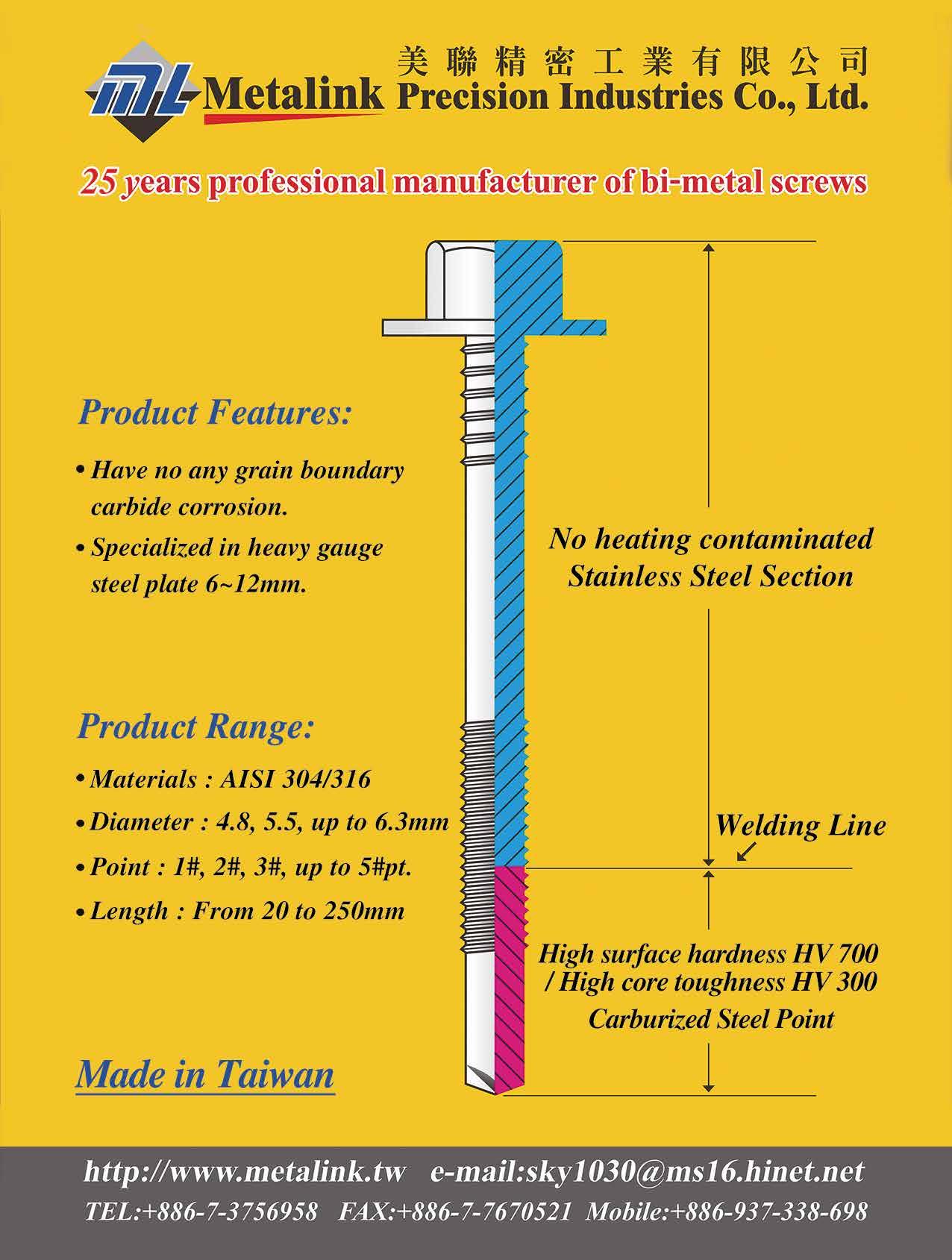

This is a product co-developed between SUNCO Industries and a Japanese manufacturer. You can drive it in with a common Phillips bit and it doesn’t require specialized tools. It delivers amazing corrosion resistance (through 2000 hours of salt spray test). The special cutting blade at the tip cuts SUS steel plates up to t=3.0 like a breeze without having to drill a hole beneath.

“We’re pretty confident that we will have increased inquires from the U.S. and Europe, but there are still someone out there not knowing us. We strive to be globally known as the Japanese top fastener distributor. Located in eastern Osaka with the most fastener production in Japan, we’re proud of our image processing technology that allows for precise and high-speed shipping from stock. We gained know-how in export from our logistics centers and trade regulations, so we’re building a problem-free purchase system for the world.”

SUNCO Industries is envisioning an increase in market demand throughout 2023 because supply chain restructuring is now the topic of the world. With depreciating JPY against USD, they suggest that purchase in USD now gets the best deal. A starter kit containing catalogs is offered for free for those making an inquiry.

Contact: Mr. Tomokazu Takada Email: tradeinfo@sunco.co.jp

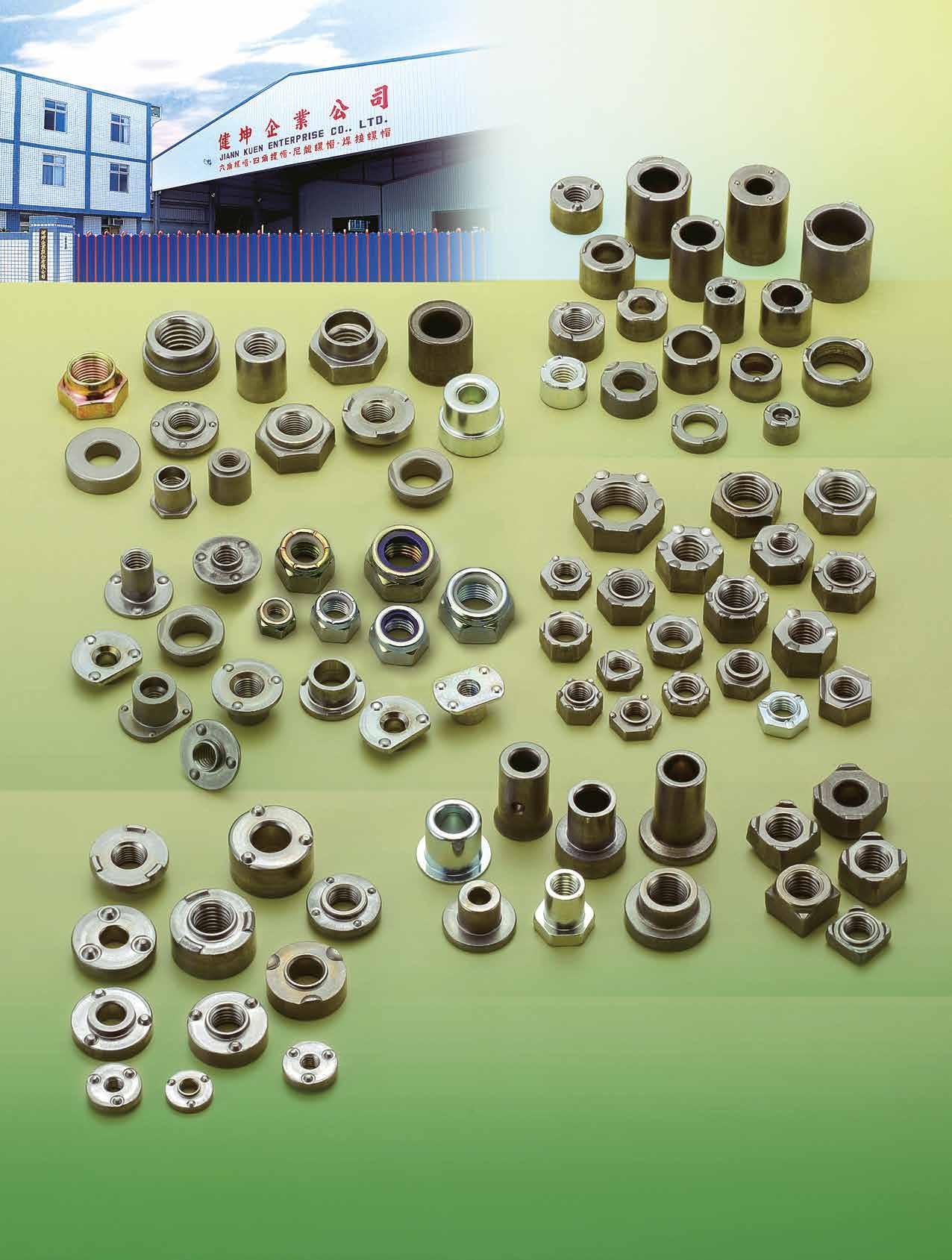

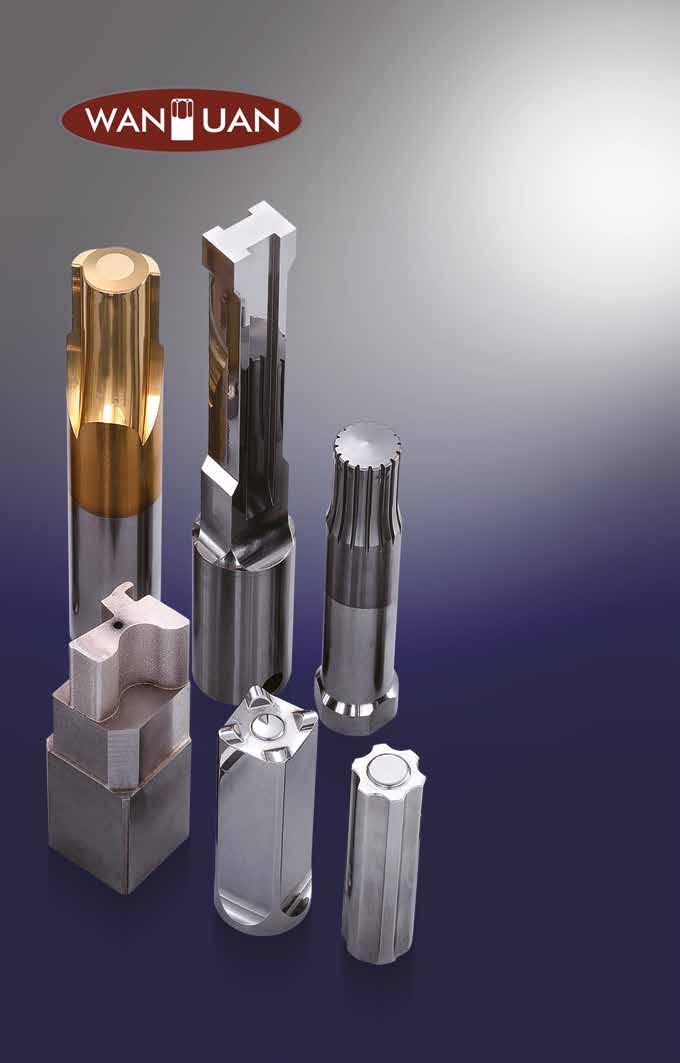

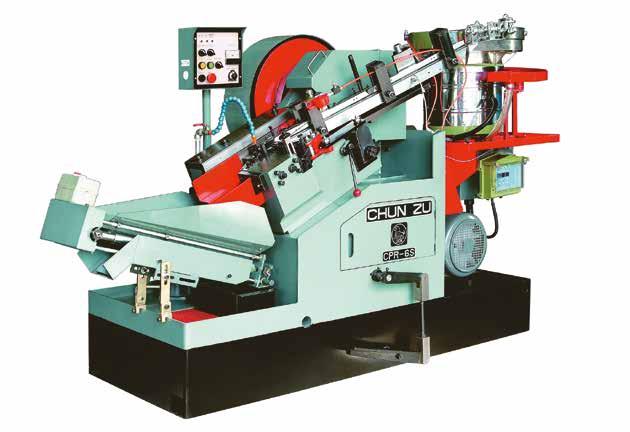

2945 BOLTUN CORPORATION

2948 SEN CHANG INDUSTRIAL CO., LTD.

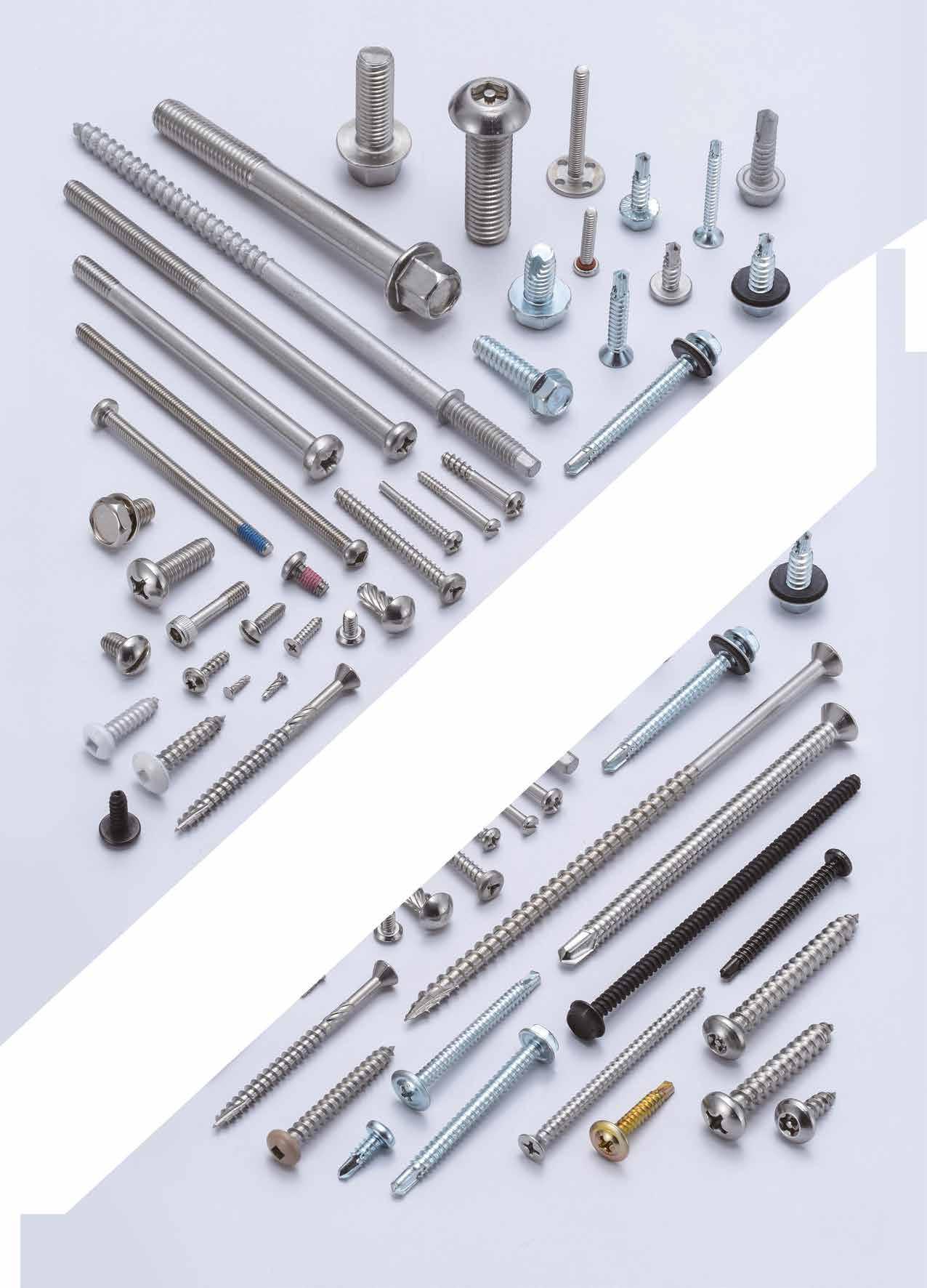

2949 ALEX SCREW INDUSTRIAL CO., LTD.

2950 SAN YUNG

HALL 9

Only Taiwanese exhibitors exhibiting through Taiwan’s exclusive agent Fastener World are listed.

為了方便統計準確,上述台灣扣件展團名單以 有向本展台灣總代理商匯達公司報名為準。

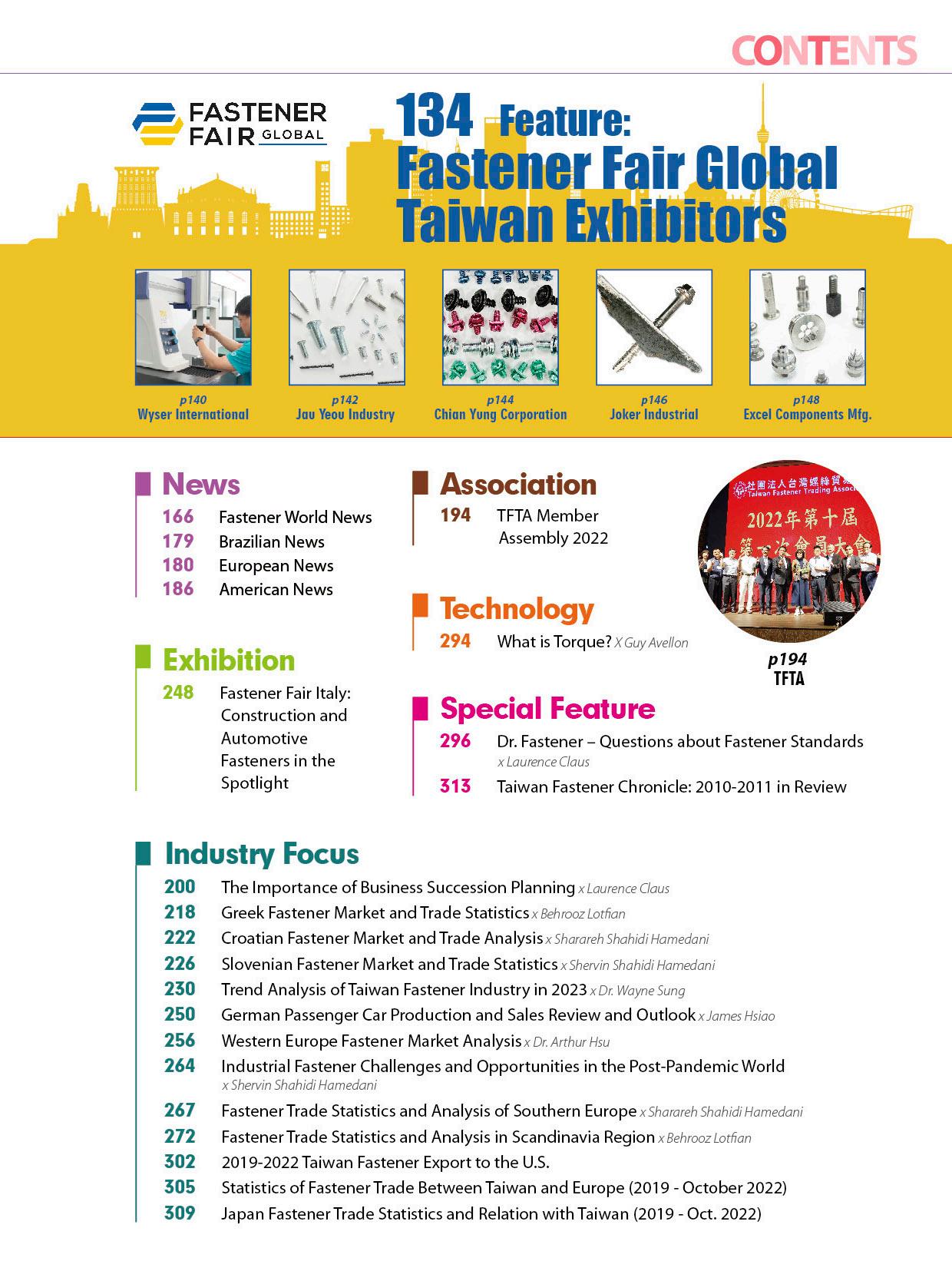

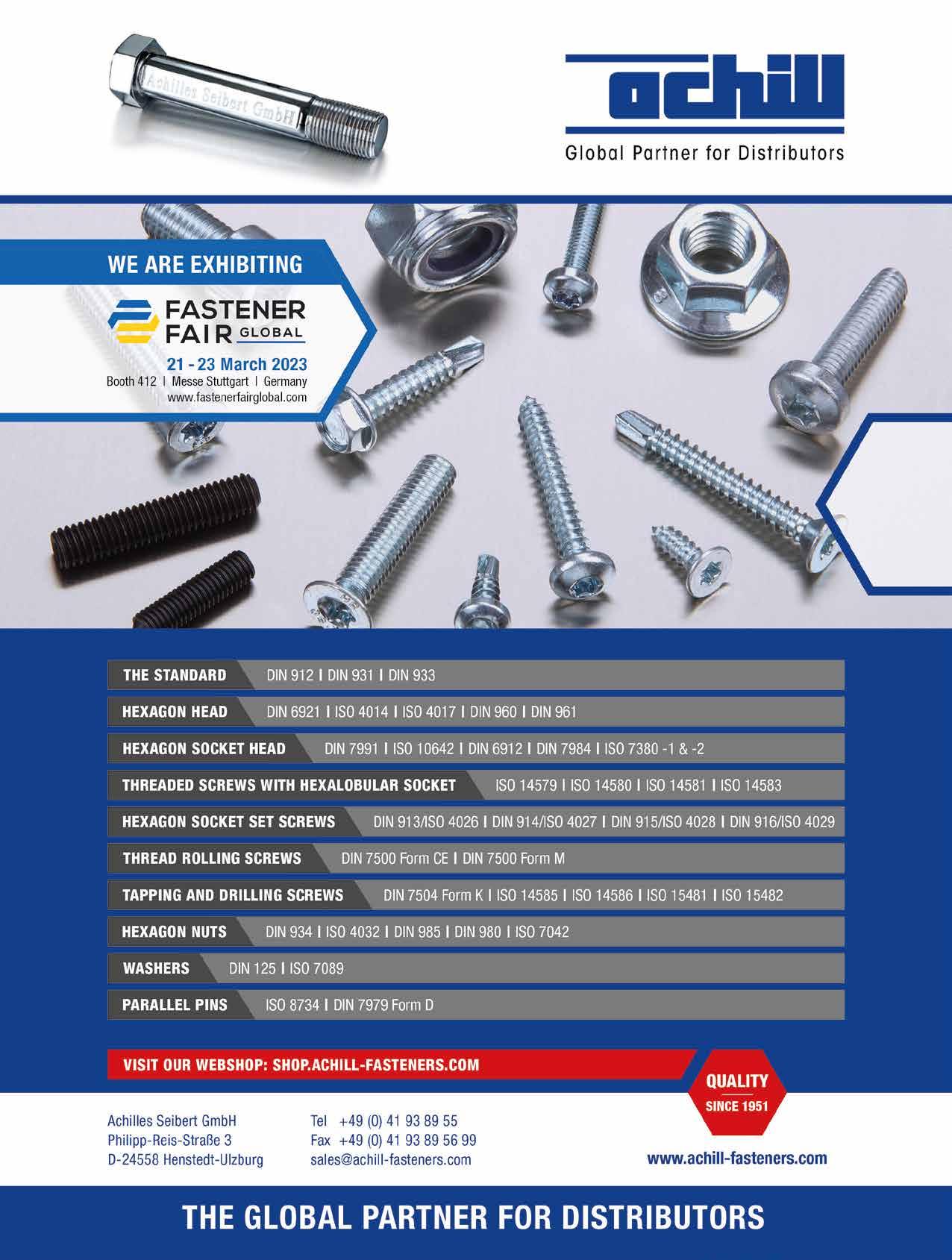

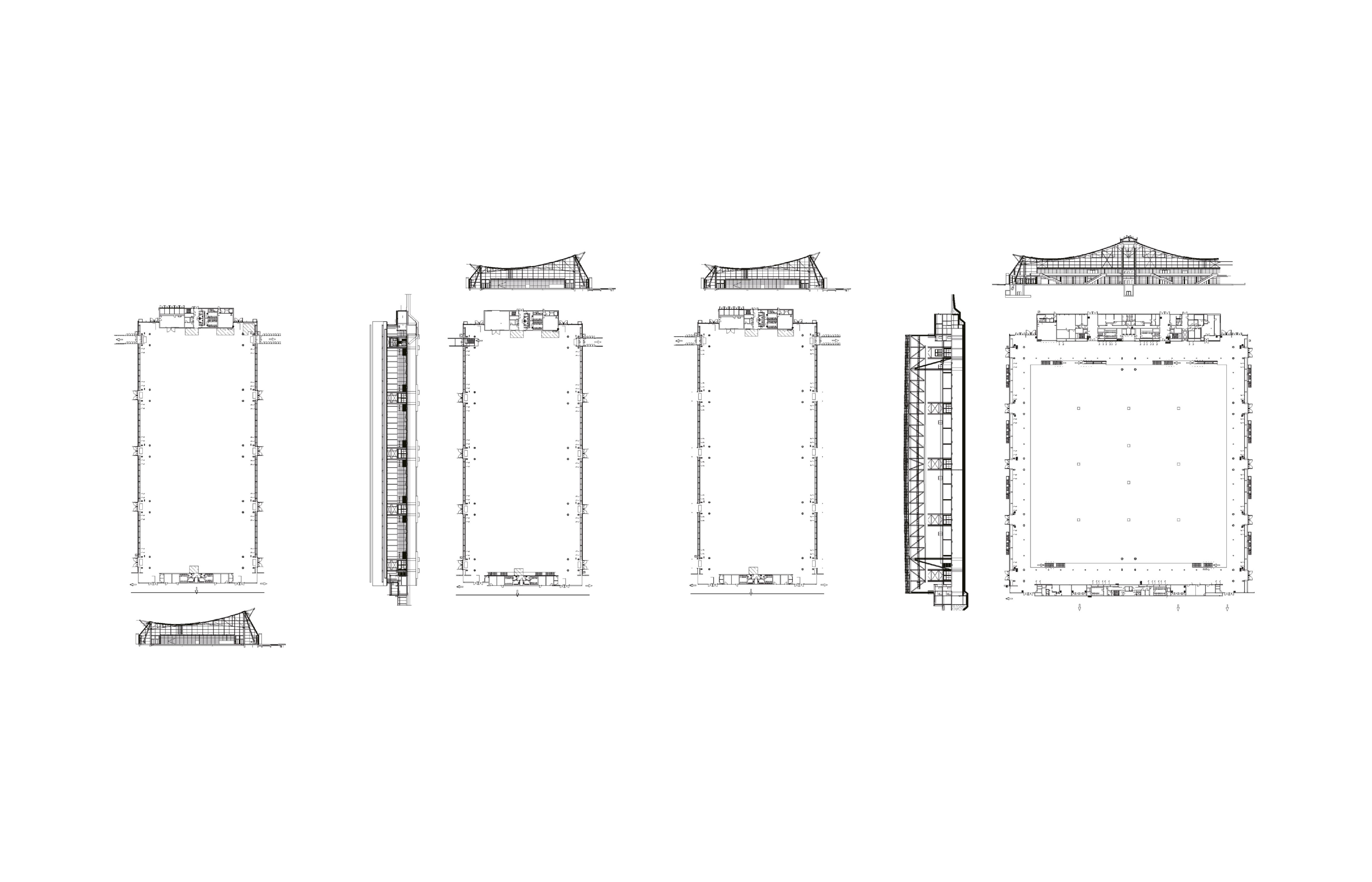

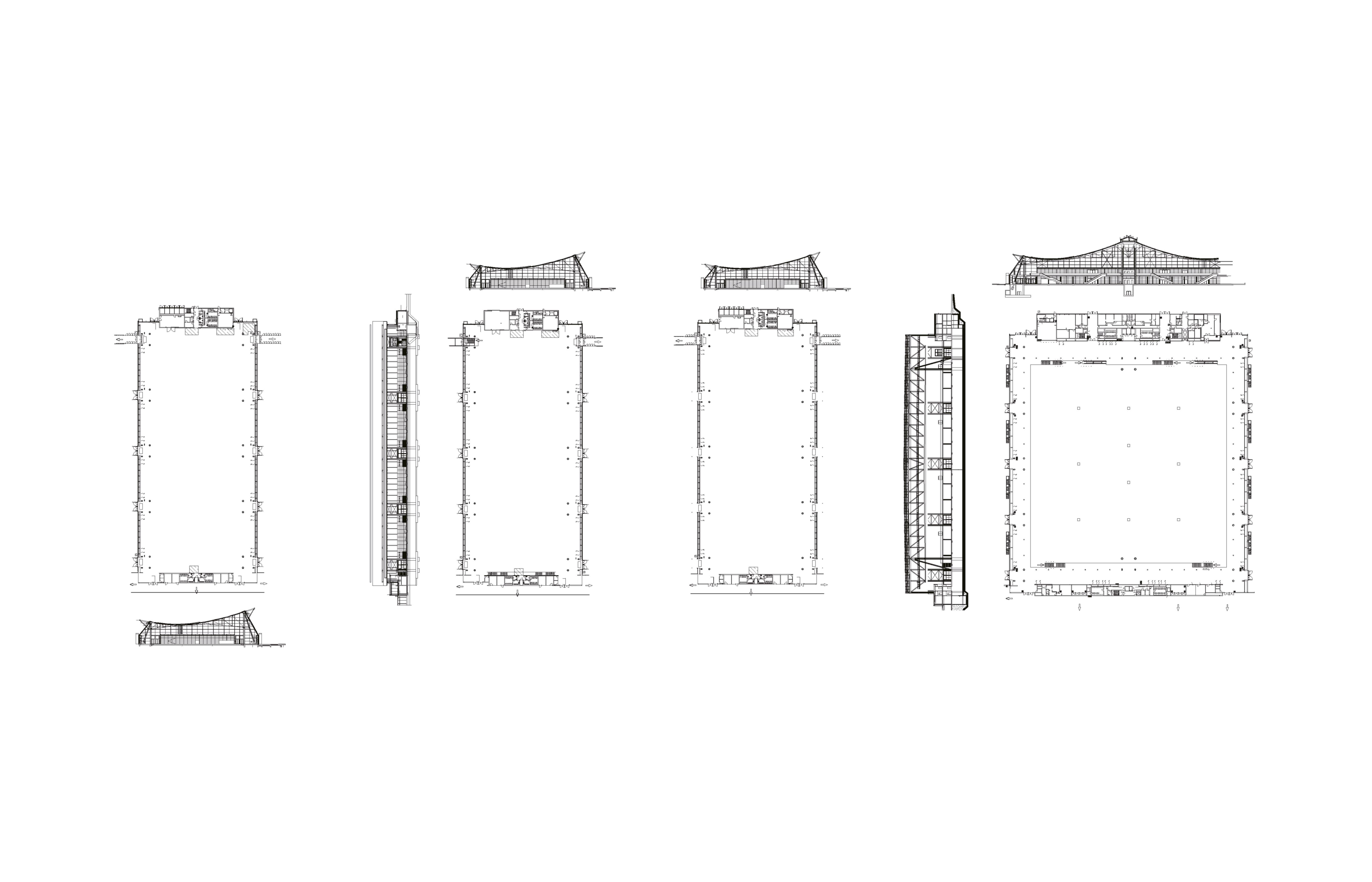

Fastener Fair Global 2023, the 9th International Exhibition for the Fastener and Fixing Industry, takes place from 21 – 23 March 2023 in halls 1, 3, 5 and 7 at Messe Stuttgart Exhibition Centre in Germany. The event is a meeting place for leading international organisations in the fastener and fixing sector and an opportunity for exchanging competencies and views on current technological developments.

Exhibitors at Fastener Fair Global present products and services from the following sectors:

• Fastener manufacturing technology

• Industrial fasteners and fixings

• Construction fixings

• Assembly and installation systems

• Storage, distribution, factory equipment

• Information, communication and services

Fastener Fair Global provides an excellent platform to establish new contacts and build successful business relationships between suppliers, manufacturers, distributors, engineers and other industry professionals from various production and manufacturing sectors looking for fastening technologies.

Some 835 companies have confirmed their participation at Fastener Fair Global 2023, covering 22,000 sqm of the exhibition ground. International firms from 42 countries are participating in the show, representing SMEs and large multinational enterprises mainly from Germany, Italy, China, Taiwan, India, Turkey, Netherlands, the UK, Spain and France.

Ahead of the event, Liljana Goszdziewski, Portfolio Director for the European Fastener Fairs, comments: "After four years since the last edition, it is rewarding and exciting to be able to welcome the international fastener and fixing industry at Fastener Fair Global 2023. The high turnout of exhibiting companies confirmed at the event reflects how keen the sector is to get together face-to-face and participate in the show to allow plenty of business networking activities and enable new sales and learning opportunities in a fast-growing market."

Fastener Fair Global provides a marketplace with a unique showcase and networking platform in one of the world's leading industrial economies. The global industrial fasteners market size was valued at USD 88.43 billion in 2021 and is predicted to expand at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030. The market is expected to be driven by population growth, high investment in the construction sector, and rising demand for industrial fasteners in the automotive and aerospace sectors. Moreover, the industrial machinery segment is set to expand at a CAGR of 5.0% from 2022 to 2030. The rapid growth of heavy machine-driven industries, including textiles, food and beverage, and chemicals, is expected to propel the demand for industrial machinery, thus driving the need for industrial fasteners over the forecast period.

Exhibitors will be aiming their products and services at many industries, including:

• Construction

• Automotive

• Aerospace

• Marine

• Electronic and Electrical Goods

• General Engineering - light/heavy

• HVAC / Air Conditioning / Services

• Energy and Power Generation

• Communication Technology

• Metal Products

• Furniture Manufacturing

• Sanitary Ware and Plumbing

• Installation

Over 12,000 senior managers, engineers and buyers visited the last edition of Fastener Fair Global. The mix of visitors to the show represented the diversity of markets served by the fastener and fixing industry. Most visitors were producers, wholesalers or distributors, playing a vital role in the supply chain to resellers and the manufacturing sector.

The vast majority of visitors at Fastener Fair Global achieved their business goals by attending the event, with 91% of visitors claiming to be highly satisfied with the show. As a result, 3 in 5 visitors would recommend Fastener Fair Global to their colleagues and business partners.

Fastener Fair Global belongs to the highly successful worldwide series of Fastener Fair exhibitions for the fastener and fixings industry. These include the portfolio flagship event, Fastener Fair Global, as well as Fastener Fair Italy, Fastener Fair India, Fastener Fair Mexico and Fastener Fair USA.

For more information on Fastener Fair Global 2023, visit https://www.fastenerfairglobal.com/

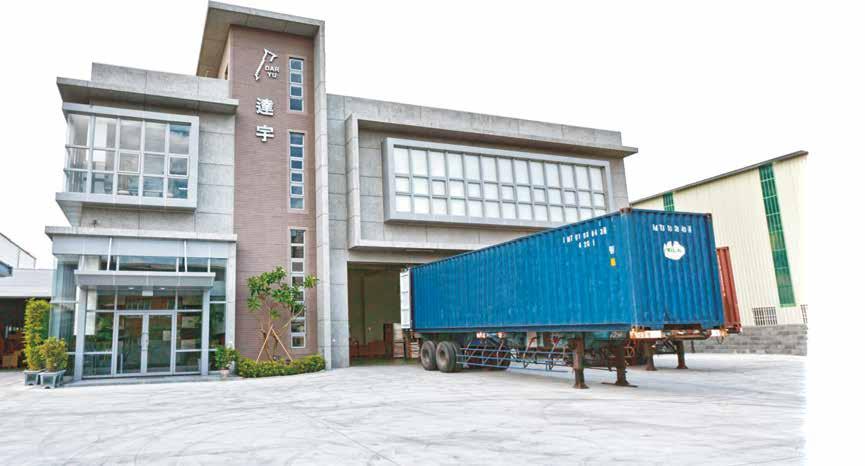

Wyser is a specialized exporter and trader of automotive fasteners and OEM special fasteners. They had just announced relocating to the new headquarters in Rende District of Tainan City, Taiwan in 2021. Fastener World's camera had revealed the headquarters’ modern white and Japanese-style interior design with solar panels on the rooftop. Soon, Wyser will kick-start an overseas sales campaign in spring 2023 in the European market for opportunities brought by Fastener Fair Global in Stuttgart.

Hall 5, No 3109

“We mostly sell to North America and Europe. Europe represents 35% of our revenues, so this shows how much we care about the European market. We will be showcasing customized products including screws, bolts, nuts, punched parts, cast parts, machined parts, wire forms, tubings and spacers that we supply to automakers and other OEM industrial markets,” said President Thomas Kan.

The great thing about this reputable fastener trader in southern Taiwan is that their products are developed and tailored to clients’ demand. “We look forward to working with specialized distributors, and we are glad to help them know about our products and distribute them to various industries,” said Thomas. Anyone who would like to purchase high quality fasteners from Wyser are welcome to find new possibilities. “The reason that we attend this show is to have a look around of the local market and visit old friends. We don’t have a set target. We just want to promote our service and Europe will see us and quality products proudly manufactured in Taiwan,” explained Thomas.

EU has been updating quality regulations and adding complicated requirements. To cope with it, Wyser has automated optical sorting equipment coupled with manual inspection to check final products. There is the addition of QC unit and equipment, including coordinate measuring machines, salt spray testers, roughness/flatness/hardness testers, torsional strength testers, plating thickness testers, gages and optical comparators. Layers of check ensures meeting requests made by European clients. “We have a complete lineup of inspection equipment, 10 specialized product quality engineers and inspection personnel. We have very good reputation in quality,” said Thomas. Wyser has had support from loyal clients for the past 30 years. Even in the global recession last year, Thomas still made sales growth. Over 90% of orders coming from high-end American and European markets proves Wyser’s service are trusted overseas.

Wyser is anticipated for European and other overseas customers to visit Wyser’s new headquarters after the show. In 2022 Wyser worked on the new headquarters announcement report and produced a promotional video with Fastener World to present the headquarters to the world. The new work environment not only brings comfort for employees but also gives clients a fresh look.

Thomas has overcome countless challenges in developing products for clients. Customizing products gives him a lot to tackle, but what he knows for sure is that a hard path like this is less traveled. He’s been cautious about the war, inflation, chip shortage and energy crisis. He uses his strength in customizing to increase market reach and product line. “We hope to meet those who know what we can do. We will take on more challenging products, develop the products with our clients and enjoy achievements with them,” said Thomas.

Contact: President Thomas Kan Email: wyser@wyser.com.tw

by Dean Tseng, Fastener World

A major manufacturer of low carbon steel small screws, Jau Yeou has also been listed among the top ten screw companies in Taiwan for several times. The revenue in 2021 grew 20.5% to NT$3.3 billion, of which Europe already accounts for 60%. With this growth momentum and the reopening of the market, they are expanding sales in Europe in 2023, and their critical stop is Fastener Fair Global (Stuttgart). This is the largest fastener exhibition they have participated in since the travel restrictions in 2020. They want to discover new potential customers in Europe with stable quality and delivery, as well as product customization services.

They will exhibit construction and automotive fasteners at the Stuttgart show. In addition to promoting long screws and drywall screws, they will also include welding screws. At least 15 types have been developed and mass-produced. Due to mastering the forming technology of solder joints (rings), they have good quality. Furthermore, they revealed to Fastener World that their composite screws are being developed and prototypes have been successfully made. They also purchased many machines to meet the demand for collated screws. In automotive fasteners, the main focus is on interior parts and welding screws. "Most of our interior parts are small screws, such as thread forming screws, tapping screws, and trilobular thread screws, which are in line with our construction parts expertise in which we have experience for more than 40 years. The source of materials is Taiwan CSC, and the quality is stable,” said the company.

The company has always been adhering to the principle of "Doing it right the first time, ensuring quality and improving efficiency", responding to the requirements of European industrial, automotive and high-end industries. They have technical personnel education and training, and through double supervision to meet customer needs.

According to Jau Yeou, since the fourth quarter of 2021, clients’ demand for the products of their subsidiary JYR Aviation Components has increased, bringing a turnover in 2022 up 105% from 2021, and has recovered up to 90% of the 2019 level. At present, it seems that the demand of international aerospace industry continues to grow. Due to global supply chain issues, as well as labor shortages, lack of production capacity, and loss of technical personnel, major international manufacturers such as Boeing and Airbus predict that the problem will not be alleviated until the second quarter of 2023. The war between Russia and Ukraine has caused soaring prices of raw materials and prolonged lead time. Although it has affected the aerospace industry, the prospect is still promising.

After the shipping congestion in 2020 and the subsequent overwhelming orders, Jau Yeou has experienced tight production capacity and inventory. In order to increase customer satisfaction and ensure stable delivery, they will expand their capacity and warehouse space in the future. The top two markets of Jau Yeou are Europe and America. Since Europe will start the carbon footprint audit process in 2023, and the United States will start the same process as soon as 2024, Jau Yeou is working with the government to obtain relevant certification as soon as possible in accordance with the needs of customers.

They observed Poland and Italy shows that the momentum of the fastener industry's recovery after the Pandemic should not be underestimated. In addition to the developed Western European market, the post-Brexit UK, Eastern Europe with rapid industrial development and countries that have experienced post-war conflicts are all potential markets.

Contact: Ms. Emmi Lin Email: emmi@mail.jauyeou.com

by Dean Tseng, Fastener World

Hall 5, No 3048

Chian Yung Corporation specializes in manufacturing SEMS screws in carbon steel/stainless steel/copper/aluminum in sizes of #0-1/2" (M1.4-M12) and lengths of 1/8"-4" (3mm-108mm), as well as SEMS screws with electroplating, coating and related post-production processes. With its products mainly exported to European and U.S. markets, Chian Yung’s nearly 5,000 sq. m plant in Benjhou Industrial Park in Gangshan, Kaohsiung, is fully equipped with automated production lines and quality control equipment to meet the needs of customers from all over the world. It is ready to exhibit its high quality products and services at Fastener Fair Global in Stuttgart, Germany again in 2023.

In many applications, fasteners need to be combined with different washers to achieve perfect locking performance, so it takes more time to assemble the fasteners than to assemble them alone. It is also needed to consider whether the stock of washers is sufficient or not, which will indirectly increase unnecessary time and labor costs. SEMS screws from Chian Yung can solve these problems at once, allowing users to experience the advantages and characteristics different from other ordinary screws.

“We'd like to make more customers understand SEMS screws. The most important feature of SEMS screws is that it saves time in assembly and eliminates the need to spend extra time assembling screws and washers. This means that users no longer have to purchase screws and washers separately, and do not have to think about the quantity and stock of both,” said Chian Yung.

The SEMS screws provided by Chian Yung are highly convenient to use and efficient to apply, and have won the favor and trust of its customers. About 70% of its production capacity is for the European and American markets (40% for America and 30% for Europe).

Established in 1987, Chian Yung has been serving customers worldwide for more than 30 years. It has not only sufficient production experience, but also knows the characteristics of screws and washers very well. Its stringent production capability and quality management enabled it to obtain the ISO 9001:2000 certification in 2000 and the IATF 16949 certification in 2015.

“For meeting the requirements of the IATF 16949 certification, the whole factory has been implementing strict quality control. In addition to increasing the number of our quality inspection instruments, the quality of quality control personnel is also a very important part of the process,” said Chian Yung.

Chian Yung’s products are widely used in the automotive, electronics, computer and electrical fields, and can be customized to meet the different needs of its customers. Its stable quality and on-time delivery make customers worry-free.

“We are pragmatic in dealing with our customers, just like screws, which are small in size, but as long as they are of good quality and strong enough, they can play an indispensable role. In response to the increasing demand of the automotive industry in the future, we are looking forward to developing more customers for automotive fasteners and parts, and we welcome domestic & foreign traders or manufacturers to cooperate with us to develop the market,” said Chian Yung.

by Gang Hao Chang, Vice Editor-in-Chief of Fastener WorldContact: Billy Chiu/ Judy Chang

Email: sales@chianyungco.com.tw

If European automakers and related companies are looking for a reliable source of purchase, Taiwan-based Excel Components Mfg. is one of the top choices. Established in 1978, this precision machining specialist has a long history of nearly 45 years of sales to more than 50 countries. In addition to their long experience in the industrial field, they have made many investments and structural improvements in the automotive field. The final result is that they have obtained many international certificates, including IATF 16949:2016 preferred by the automotive supply chain that they acquired 2021, as well as RoHS and REACH certificates for European environmental requirements, and the ISO 9001:2015 certificate. They are qualified for the APQP (Advance Product Quality Planning) standard and can provide PPAP and IMDS. This suffices to say they continuously update their production processes to meet the stringent European quality as well as environmental and cleanliness requirements. European companies can take them as a must-visit sourcing target.

In 2023, they will be back at Fastener Fair Global. This time, they will showcase customized non-standard parts, because customized production is their strength. Through the aforementioned APQP standard process, they can provide customers with product design and development services that meet the high-quality requirements of Europe and provide evaluation, feedback, and corrective mechanisms, together with the development of new products that customers really need. The company said their products can be used in a variety of industries, such as machinery, automotive, electronics, telecommunications, drones, etc. Customized products can be produced according to customer designs.

In particular, the company pointed out that they have CNC turning and milling machines for all kinds of plating and heat treatment, providing deep hole drilling, surface machining, long workpiece machining, and complete inspection equipment with optical sorting machines for final inspection to achieve higher quality. They use graphic measuring equipment from Keyence, telecentric visual measuring instruments, salt spraying machines, hardness/roughness testing machines, gauges, 2.5D projectors, coating thickness machines, etc. to check the products for European customers.

They said they have their own factory to reduce the cost to the lowest and provide competitive prices, along with strict control and complete inspection equipment, to provide customers with the best quality and diversified products, including automotive fasteners, cotter pins, tire studs, bleeder screws, and other non-fastener automotive parts, which can meet the needs of the European automotive supply chain from a single source.

They are a 100% export company, of which 30% are sold to the US, 30% to Sweden, 20% to Germany, and 20% to other countries. You will notice that they sell up to 50% of their products to Europe. By exhibiting at Fastener Fair Global, they say they are looking forward to adding new customers and developing a customer base in different industries. At this show, European customers can take advantage of the opportunity to explore business opportunities with them.

Looking to the future, the company says that diversifying their customer base across industries is their focus and goal and that they look forward to producing a wide range of products. In 2023, when the global market opens, they will have new business opportunities in Europe to look forward to.

Contact: Sales Manager Daisy Su Email: sales02@excelcomponents.com.tw

by Dean Tseng, Fastener World

The world’s leading Adolf Würth GmbH & Co. KG having more than 400 companies serving the markets in over 80 countries and focusing on providing trading of assembly and fastening materials has recently further strengthened its localized service capability in Taiwan with the relocation to a new branch office in Kaohsiung.

This new branch office is located in Zuoying Dist. of Kaohsiung, which is not far away from its previous operation and is quite close to the domestic supply chains and customers that it has been in collaboration with for years. This modern office neatly refurbished with the Würth Group’s iconic color and elements fully demonstrates the Group’s professional, skilled, and well-organized corporate image. With a main office area for staff to process routine tasks (e.g., quality testing, suppliers development, purchasing, product management, and R&D), the new office is also equipped with a multifunctional meeting room, 2 smaller rooms for group discussion, an area with advanced quality control instruments, and an open social space offering coffee machines and mini bars for everyone to refresh themselves anytime.

“Our target is to set up an open, light, and innovative workplace, where people can discuss and get ideas. Different from other traditional offices in Taiwan, this office combined with Asian and European elements in-between is also installed with some eye-catching stuff, such as height adjustable work tables and higher chest tables with enough space to make our staff feel comfortable, help them create ideas and perform well, and most importantly, like to work here,” said Andreas Dierolf, Managing Director of Adolf Würth GmbH & Co. KG Taiwan Branch Office.

With a more spacious area, this office is positioned as a hub for sourcing in Taiwan with the function of sample testing and suppliers auditing, and is a brainstorming and innovation center for people to create new ideas.

“Taiwan is one of our main sourcing countries, so we need more space to test samples, create ideas, speed up innovation cycles to facilitate more customer-specific service. This office also makes it easier for our vendors to participate in ideas creating process or discuss projects directly with us, so they can understand customers’ expectations, needs, or requirements immediately. This is a space where people can chat here as a whole team,” added Andreas.

Würth reporting the record-high 17,078 million EUR sales result in 2021 buys all types of fasteners from Taiwan and also sells fasteners, anchors, concrete screws, material treatments, drills, hand tools, hand operated machines, chemicals for maintenance, lubricants, motor oil, adhesives, etc. worldwide. With around 34,000 sales reps worldwide, Würth also regularly sends its Taiwanese employees to German HQ for training in order to ensure service and quality consistent with the Group’s highest standards. This is why the service Würth offers can always win the trust of customers.

“Taiwanese suppliers are one of the best all over Asia, in terms of service, quality and innovations,” said Andreas. With the well-trained staff and the relocation this time, Würth can further optimize its service capability in Taiwan and enhance the real-time connection and collaboration with local Taiwanese supply chains.

by Gang Hao Chang, Vice Editor-in-Chief of Fastener World ↗ Andreas Dierolf, MD of Würth Taiwan Branch Office (left) and Gang Hao Chang, Vice Editor-in-Chief of Fastener World (right)

↗ Andreas Dierolf, MD of Würth Taiwan Branch Office (left) and Gang Hao Chang, Vice Editor-in-Chief of Fastener World (right)

“This is actually a product originally developed for a Swedish customer for use in the military field, and was originally produced from other materials. But after our technical team understood its strength, friction and anti-corrosion requirements, we suggested using cobalt-based alloy, which is more wearresistant, to produce the product, and we use 100% material and processing technology from Taiwan. The hardness of cobalt-based alloy reaches HRC33-43 at room temperature, and the Average Cavitation-Erosion property is more than 15 times of general 304, which makes this material more difficult to be machined by general turning tools. However, we have successfully found a way to use various tools and drills to complete the machining process after research and discussion with our collaborators. The actual test report data also shows that our new cobalt-based alloy can last for more than 100 hours compared to the general 304 stainless steel products that reach the wear level in 7 hours. In addition, it has excellent resistance to jamming/scuffing/abrasion/ erosion/impact/high heat/oxidation/corrosion, and the material itself does not deteriorate under high temperature conditions,” according to Managing Director Jerry Huang.

ARK Fastech Corp. recently cooperated with an experienced associate partner to develop a product made of innovative material - cobalt-based alloy, which has strong corrosion resistance, high temperature resistance and performance strength performance. ARK Fastech is also the only fastener manufacturer in Taiwan that has successfully developed finished parts using this innovative material.

Managing Director Huang, who has many years of technical background in quality control, used to be the head of quality supply chain in Asia Pacific for a major European fastener distributor, and is very familiar with the operation of the supply chain, and has strong technical support in product development, which enables ARK Fastech, which was established only 6 years ago, to quickly meet different product requirements of customers. Inheriting the experience of major European and U.S. manufacturers, ARK Fastech focuses on high-end products for automotive applications and plays the role of a relay hub for European and U.S. customers' supply chain purchases in the Asia-Pacific region, assisting customers in product development and integration to ultimately meet their expectations.

Cobalt-based alloy valvetrains are suitable for top-level supply chain applications such as aerospace, petrochemical, energy, wind turbine and optoelectronics. Because of its high corrosion resistance (more than 30 years on average), high temperature resistance (working temp. up to 8-900 degrees Celsius) and high wear resistance, it is not easy to produce fatigue fracture and has a higher service life compared with carbon steel/stainless steel products, eliminating the trouble of frequent maintenance and repair when the products failed in the past and reducing management labor and other costs, while retaining the excellent characteristics of carbon steel hardness and stainless steel corrosion resistance.

ARK Fastech contact: Managing Director Jerry Huang

Email: jerry.huang@arkfastener.com

“In addition to new products, our product portfolio also includes automotive and custom products. ARK Fastech's role is not only to help customers find products, but also to provide product solutions (e.g. material/heat treatment/ plating advice, mold development multiple ways of packaging or supply chain integration, etc.). One example is our recent development of fasteners for roof rails that can solve load and stress breakage problems once and for all for our customer. Not only in Taiwan, but also in Singapore we have an agent, and in China and other places, we have collaborative factories to provide supply chain management support,” said Mr. Huang.

ARK Fastech is good at communicating with customers from the technical and cultural aspects, and dealing with different product needs according to customers. With the strong supply chain and technical support in Taiwan, ARK Fastech is dedicated to playing a reliable bridge between customers and the supply chain to create a co-prosperous supply chain environment," said Mr. Huang.

by Gang-Hao Chang, Vice Editor-in-Chief of Fastener World

Contact: Claudia Müller, Marketing

Email: claudia.muller@growermetal.com

Durable fastening solutions, investments in research, renewable energy and a responsible Environmental Management System: Greenmetal Project is Growermetal’s response to achieve ambitious sustainable development goals.

Since January 2016, 193 countries have been called to adopt new measures in order to achieve the Sustainable Development Goals (SDGs) by 2030. Today, halfway to the deadline, enterprises have faced a complex, challenging picture, with consequences on many aspects of their production and management.

A situation that involves Growermetal, an Italian safety washer manufacturer that during the last three years invested resources to rethink its productive model, setting a new phase of its business.

Actually, an ecological approach is not new to its history. In 2006 Growermetal obtained the certification UNI EN ISO 14001 for the Environmental Management System (EMS) and, four years later, it installed a photovoltaic plant on the headquarter roofs, in order to produce part of the electric energy on its own.

One of the strengths of the Italian fastener manufacturer lies in its wide portfolio of products, with a variety of safety washers and parts according to customers drawings, that covers the needs of a large number of sectors: from automotive and railway to aerospace, from energy production to electro mechanics, including different industrial applications.

In particular, the challenges of this period include the rapid evolutions in the automotive and transport fields, which led Growermetal to expand its range with new technologies.

Among the latest products introduced, there are high thickness and precision flat washers, special shaped blanked and bended parts, metallic parts with glued or moulded inserts and the technology of Grower SpheraTech®, an innovative preassembled set of a spherical top washer and a conical seat washer. Innovations that will be displayed by Growermetal at the booth 2208 in hall 3 of the Fastener Fair Global 2023 in Stuttgart (Germany) that will take place from 21st to 23rd March 2023.

The company’s answer to future expectations is the Greenmetal Project: a program created to align its conduct

to sustainable short-term and long-term goals. Among the objectives, there is the achievement of Carbon Neutrality by 2050, as set by the 2015 EU Green Deal for Carbon Neutrality, but also the purpose to optimize Growermetal’s environmental profile, to enhance the energy efficiency and to boost a circular economy.

In synergy with the internal code of ethics and the Policy for Quality, Environment and Safety, the Greenmetal Project provides guidelines for a strategic sustainable development, focusing on four aspects: suppliers, raw materials, processes and resources.

With regard to the supply chain, Growermetal puts great attention in the selection of its partners that must guarantee the full compliance to the Italian and international environmental protection regulations, in line with the manufacturer’s sustainable management goals.

This aspect goes hand-in-hand with the selection of low-impact materials and treatments, where the research of advanced resources merges with the need to reduce the ecological footprint of the supply chain. In addition, Growermetal works to create durable solutions, making the customer’s investment profitable and sustainable over time. To offer this benefit, effective coatings are essential, as they enhance the characteristics of the washer design, create long-lasting fastening systems and protect the pieces from corrosion whilst maintaining their performance in the most challenging conditions.

Talking about process, a large part of Growermetal’s investments has been addressed in improving the performance of the Environmental Management System, through interventions aimed at equipping the production departments, the quality control division and the R&D laboratory with cutting-edge and low-impact technologies.

Finally, resource optimization covers different aspects of the manufacturing process, ranging from energy efficiency to the replacement of dangerous chemicals with more eco-friendly products. Among the main key intervention, Growermetal includes the recycling and reuse of oil and water, the reduction of CO2 emissions through greater energy efficiency, the increment of electricity production from alternative energy sources, the heat recovery to warm the company’s departments, the reduction and responsible disposal of waste and the recovery of every liter of water through the industrial rainwater harvesting system.

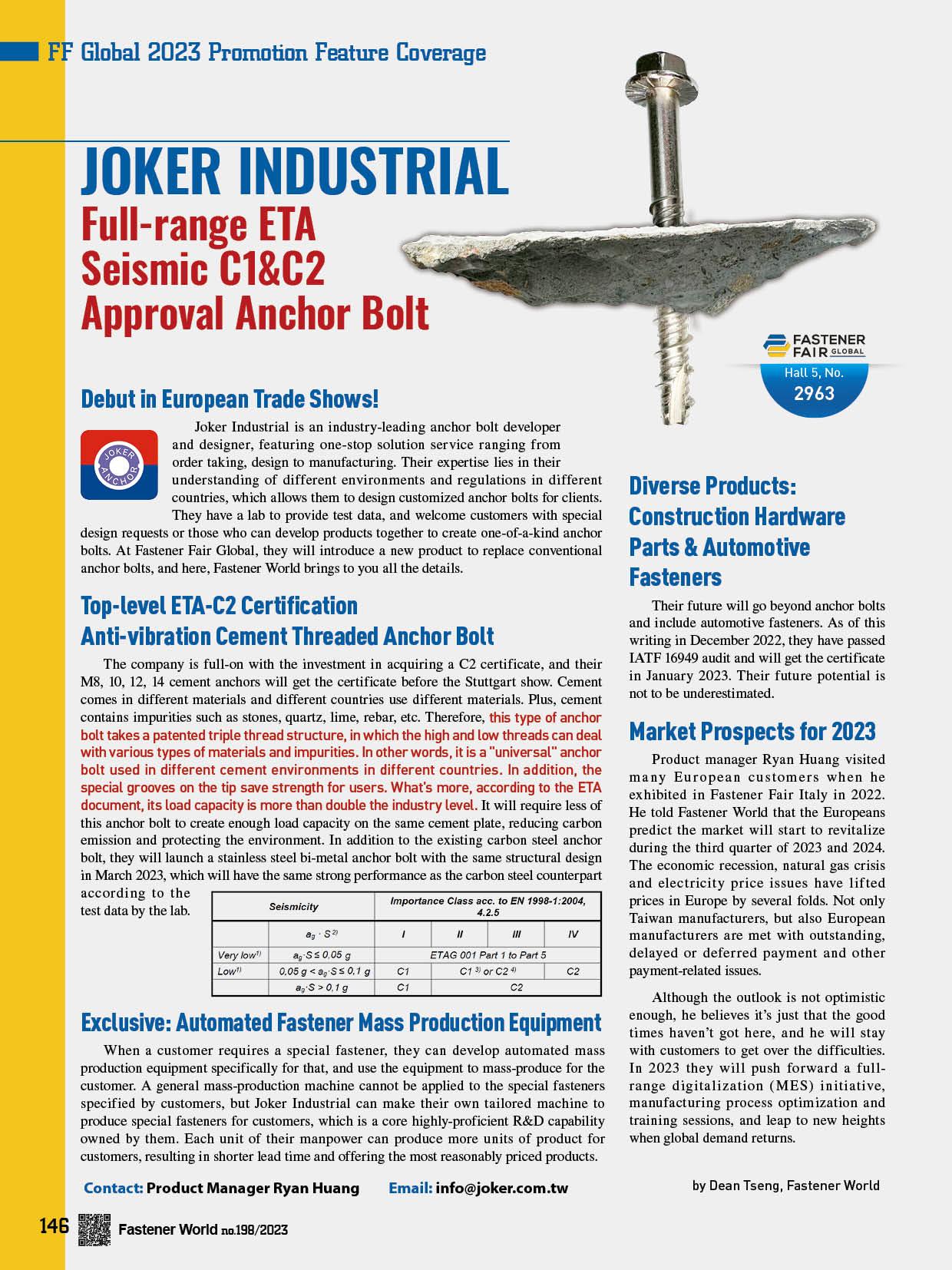

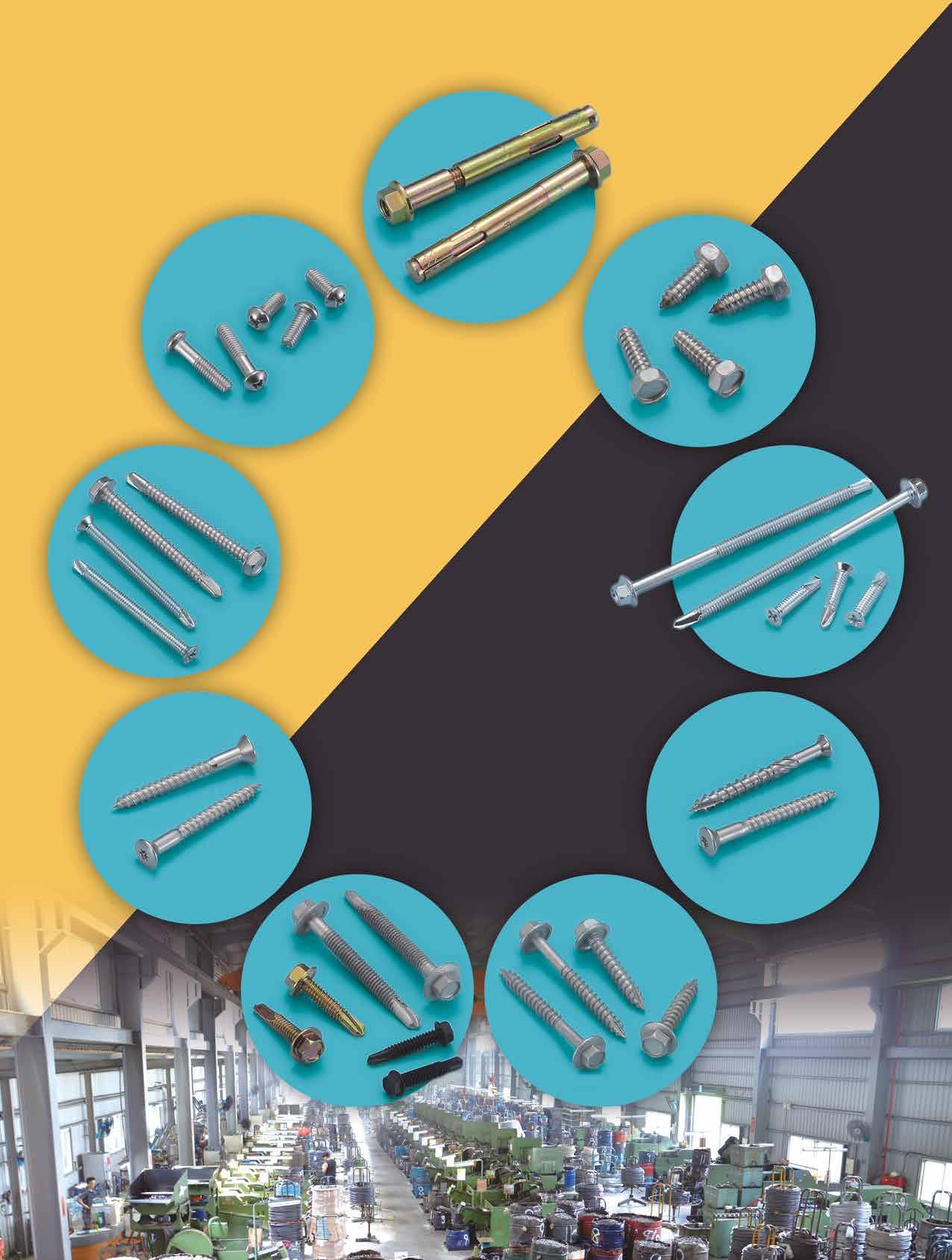

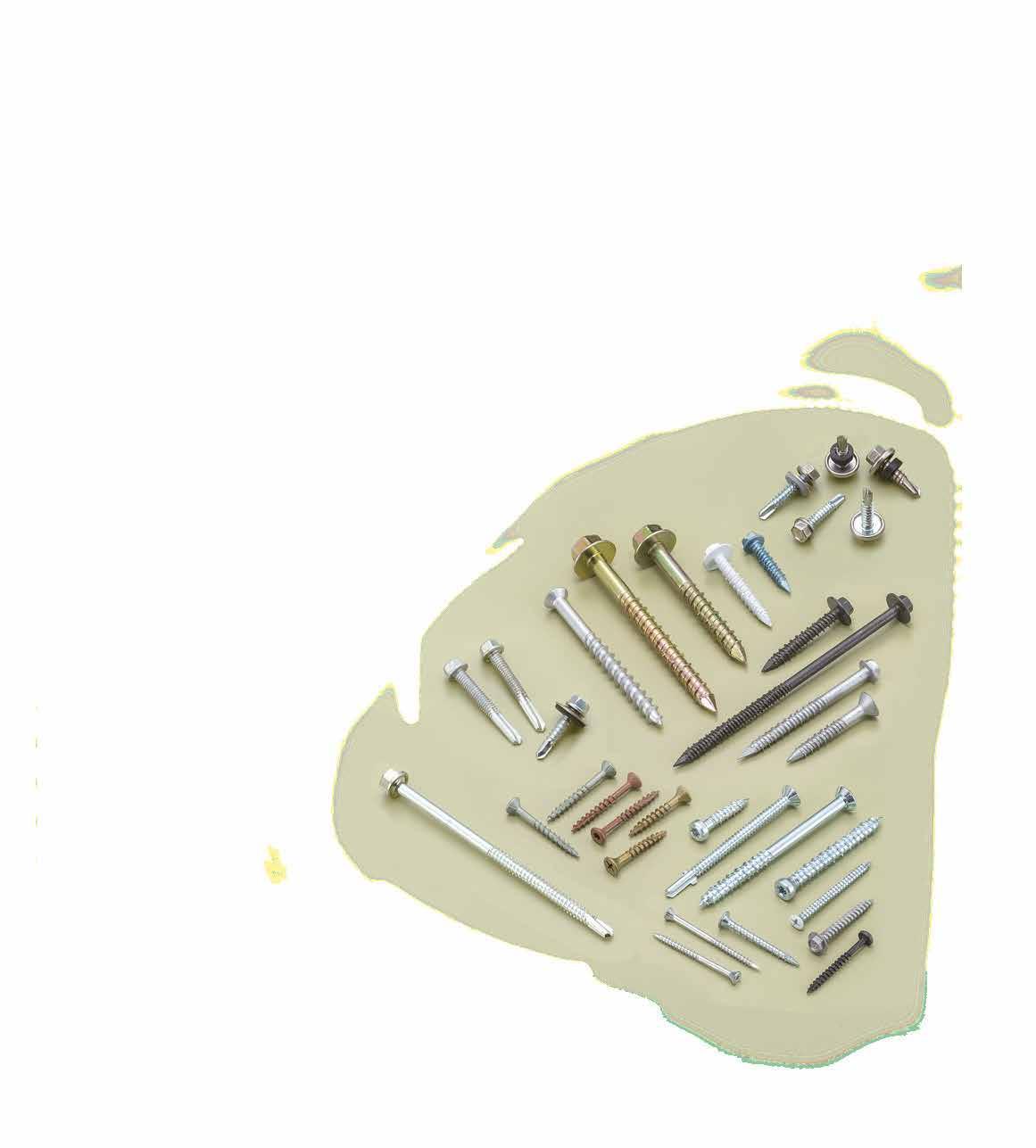

Sheh Kai Precision is one of the top professional manufacturers of bi-metal screws and anchors in Taiwan. Unlike conventional ones, bi-metal fasteners come with high technical requirements. “Heterogeneous metal bonding” and “local high frequency heat treatment” are two of the critical manufacturing technologies from this company, and years of R&D has earned them trust by the industry. Their Threaded Carbon Steel Anchors and Bi-metal Threaded Stainless Steel Anchors utilize those cutting-edge technologies. That was where they started from when tapping into construction threaded anchors development.

They invested NTD 21.8 million to develop the U.S. market. After two years of trials and evaluation, they got certified to ICC in November 2022. They design and manufacture critical automated equipment required in the production process in order to level up manufacturing technology and reduce production cost. ICC is the ticket into the high-end U.S. infrastructure market. Having this certificate means they are able to provide the market with highly safe products and increase their price competitiveness.

Building structures, large infrastructure projects, traffic engineering, tunnels and bridges need various threaded anchors used in concrete. To get a suited ICC certificate, it is required to test embedding depth in high strength and low strength concrete that will or will not crack. Another requirement is to pass 22 tests covering dimension measurement, installation torque, material tensile strength, hardness, hydrogen embrittlement, salt spray, tensile strength limit, shear resistance, sensitivity, margin load, dynamic load, and earthquake simulation. Their products that are ICCcertified include carbon steel hex washer head bolts and eye bolts. These products feature double heat treatment, additional harness at the tip, easy installation, increased resilience against hydrogen embrittlement.

Their threaded anchors are suited for applications ranging from shallow to deep embedding. These anchors can tap threads within pre-drilled holes on concrete of various strengths to provide direct fastening with high tensile strength, high fastening performance and stability. Installation is easy and 100% faster than conventional types. Other features include reusability that allows for adjusting fastening parts by backing out and driving in, as well as no pre-applied expansion force to suit concrete with cracks, and applying fastening closer to the brim of concrete blocks. Furthermore, the stainless steel bi-metal threaded anchors can resist corrosion outdoors for up to 50 years.

Sheh Kai Precision is at the forefront of global environmental protection. They have set 2022 as the base year for greenhouse gas (GHG) inventory which will be completed in 2023, and will finish verification by 2024. They are lifting solar power generation, reducing energy consumption in the manufacturing process, and ask collaborators to perform GHG inventory and provide data. “Our products are mostly sold overseas. The carbon tax from CBAM 2.0 will be imposed in 2027, so we have listed energy conservation, carbon reduction, carbon neutrality and green power as our critical tasks. Also, we have acquired ISO 9001. We do routined check of our manufacturing process. We make sure our products pass dimension checks and tests and then move on to the next step to check quality. We have equipment to test torsion, shear and pull-out which the product will have to go through to head on to packaging and shipping,” said Sheh Kai Precision.

Bi-metal fasteners have the advantage of conserving energy and reducing carbon emission and are in high demand still increasing. Plus, green power generation is being supported by many countries. Solar power generation in particular requires shorter construction time so it will become the leading industry in green power. Fasteners that are used for the setup are indispensable, and therefore, bi-metal self-tapping screw sales have grown obviously. Sheh Kai Precision is looking forward to seeing what this may lead to.

Sheh Kai's contact: Manager Barry Tsai Email:printf@shehkai.com.tw

/// by Dean Tseng, Fastener World

Supplying Italian high quality threaded inserts, blind rivets, clinching fasteners, welding studs, self-tapping threaded inserts, wire inserts, brass and stainless steel inserts and studs, Fixi is dedicated to fasteners for sheet metals, plastics and solid components.

Kicking off 2023, Fixi is sharing with Fastener World Magazine readers a recently introduced new complete line of presses for self-clinching fasteners. The presses are available in different models in terms of power, automated feeding system and other optional accessories. Fixi customers will not only find a complete range of self-clinching fasteners, but will also have the option of choosing the press that best suits their installation needs. Furthermore, Fixi has recently added new products to the range: inserts for marble and for composite materials increasingly used in the automotive industry. They count on completing their catalogue dedicated to these new items and increasing stock in their warehouse in the short term.

Then in March 2023 at Fastener Fair Global in Stuttgart, Fixi will highlight the new inserts for marble and composite materials among various fasteners in its range. They exhibit at many fairs, even up to eight in one year. Since 2022 they have already been planning and organizing their participation in 2023 trade shows. For the upcoming sheet metal working fairs, Fixi will definitely present the new presses in all available models and sizes. Another important milestone is the Fixi Lab, a product testing laboratory, and among many inspection instruments purchased throughout the years, Fixi now also has Fischer scope instruments designed to measure coating thickness.

Overviewing the market, Fixi found their situation in Europe has turned out to be much better than expected. Turnover breakdown shows there has been an increase in orders and volumes, regardless of the war in Europe and the price increase which could have caused a downturn in sales. That shall give them the best shot at scoring great records as the future unfolds!

Contact: Maurizio Mora

by Dean Tseng, Fastener World

by Dean Tseng, Fastener World

Contact: President Kou Matsubayashi

Email: info@artscrew.co.jp

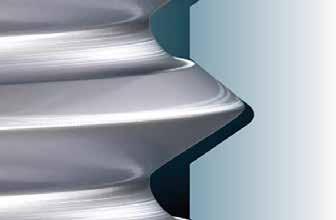

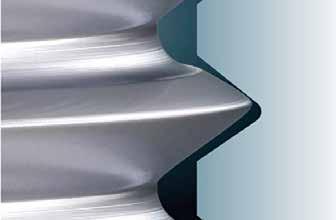

In our last interview with Art Screw president Mr. Kou Matsubayashi last September, he revealed his game-changing combo-technology with MOTIONTITE. It is an all-in-one solution to resolve loosening, rupture and galling in one shot. You see, it isn’t just one function. It is multi-functional. All you need to do is to drive it in with torque, and the threads work and tighten like using a spring.

It is a fantastic feature attracting the eyes of top Japanese corporations who now increase purchase from him, which triggered his thought that MOTIONTITE could also work for overseas customers, so he thought to sell overseas. It came to him that Europe and the U.S. seek eco-friendly fasteners that are free from using adhesives. These regions, like Japan, are the heartlands of automakers, so he is kicking off marketing there for starters in 2023.

It is a well-known fact that Europe and the U.S. are stringent about quality and yield. “I’ve been running my plant and threading automotive bolts for over 30 years in Japan. As far as quality and yield, Japan is more picky. MOTIONTITE has been used on motorcycle engines, wind turbine blade bolts, satellites, medical devices, even semiconductor manufacturing devices and more, so it speaks for itself. I’d like for European manufacturers to test it out if they wish so,” said Kou. MOTIONTITE isn’t limited to high-end application only, it is open for use by general industrial customers as well.

He is seeking overseas partners to manufacture and sell MOTIONTITE in their local markets. By them using the thread rolling dies and ring gages directly from Kou, MOTIONTITE can be manufactured anywhere on the globe. “It wouldn’t be cost-effective to manufacture the bolts in Japan first and then export them, but manufacturing the bolts at customers’ locations makes it possible to provide the safest and the best-performing anti-loosening products, so I’m welcoming European and American bolt makers to manufacture and sell MOTIONTITE,” said Kou.

Kou is working on a hex socket set screw and tapping screw with brandnew thread shapes. Before that, he could be starting sales of size-reduced bolts which are a combination of Grade 13.9 KSDN4 material and a newlydeveloped thread shape which doesn’t loosen at all in Junker vibration tests. Given the high axial force and loosening resistance, customers can change from M14 to M12 or from M12 to M10 bolts. The bolts can be electroplated and therefore can be used in various applications. They can be made smaller or in less volume to be lightweight, “so I recommend using them to fasten EV battery packs,” said Kou.

Last but not least, Kou has launched an English website for Art Screw. “I’ve packed the website with abundant information for your reference. Drop your request from my homepage or contact through my email if you have any questions,” he said. Web visitors will find test data, technical diagrams and demonstration videos there.

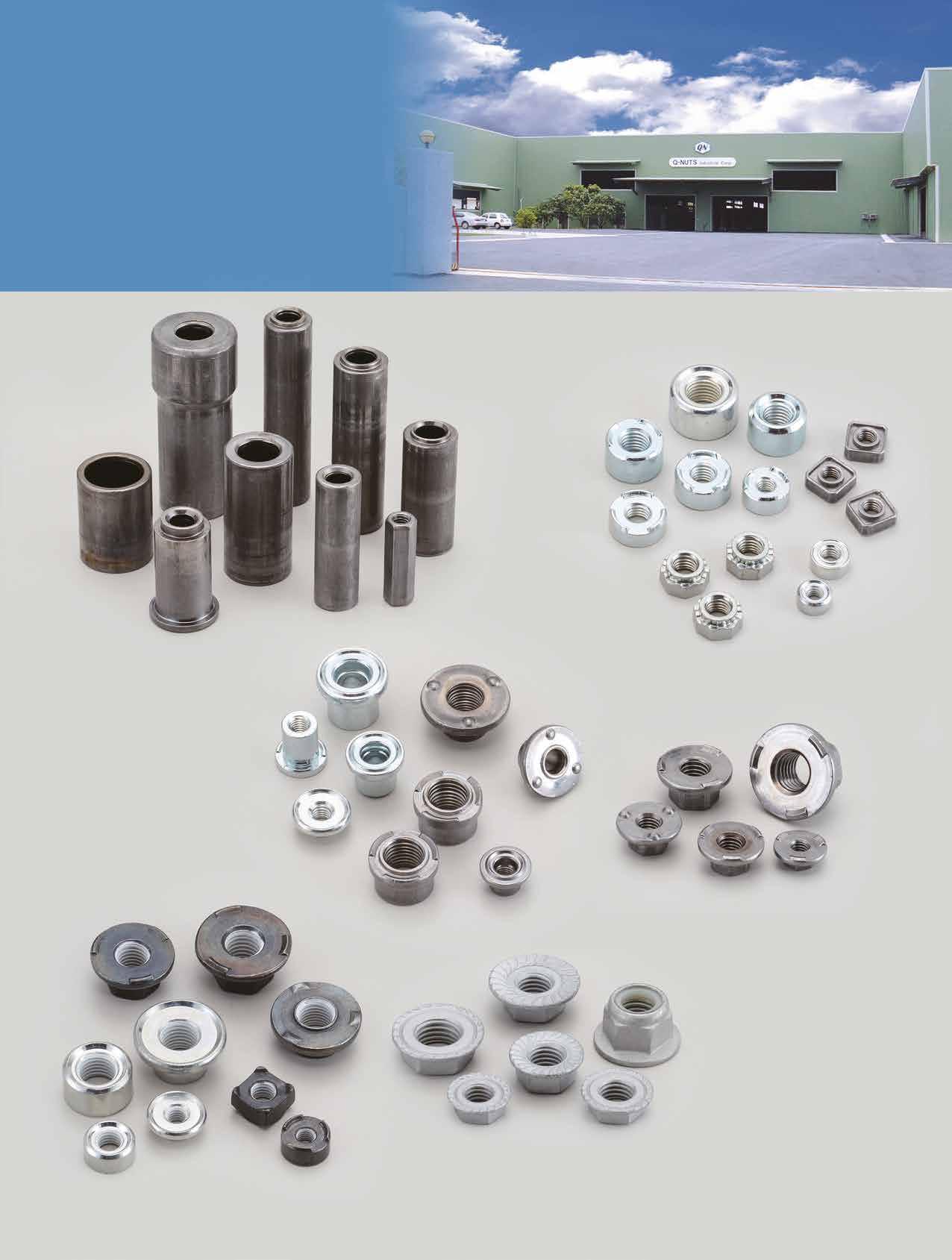

The 2022 National Talent Development Awards (NTDA) were presented to 15 outstanding companies at a ceremony held recently. Anchor Fasteners Industrial Co., Ltd., a leading Taiwanese manufacturer of anchors, rivet nuts and auto parts, was among the honorees of the NTDA (Outstanding Case Category). General Manager Hector Chu on behalf of the company received the award and the company is also the only fastener company in Taiwan receiving the award this year. NTDA established in 2015 is for highlighting the importance of talent development and training quality through the selection of top-performing organizations, and emphasizes the link between the performance of talent development, in anticipation of setting a benchmark and encouraging others to follow suit.

Unlike other fastener counterparts, Anchor Fasteners has been actively investing in talent development and training programs since 2008, and after years of implementation, it has gradually shown remarkable results, thus enabling it to stand out from 126 competitors this year.

"Anchor Fasteners keeps the management spirit of the TTQS Bronze Medal (a Talent Development Quality Management System) and applies it to internal education & training, with a special emphasis on the selection and retention of talents. We also make good use of the resources of the HR Development Center of the Workforce Development Agency

of Ministry of Labor (Kaohsiung-Pingtung-Penghu-Taitung Regional Branch) (e.g., in-plant counseling, function enhancement courses for management personnel, HR training courses, career counseling & development, function maps and workflow improvement courses) to enhance talent training. Unlike other big companies, we do not have sufficient capital, resources, and equipment, but we are able to find more external resources for talent development through these means. Anchor Fasteners also reduces costs by applying for subsidies such as the Youth Employment Flagship Program, Employment Incentive Grants, Secure Hiring Program, Workplace Learning and Re-Adaptation Program, and the Redesign and Recharging of Middle and Senior Positions Program, and creates unlimited possibilities for innovation and change through the transfer of experience. Anchor Fasteners’ transformation and development experience has even been selected into a junior high school textbook of social science, making it become a successful example of HR development to influence the development of upstream and downstream industry,” said Ms. Serlin Chen, Anchor Fasteners Personnel Section Chief.

"Receiving this award, which is the highest honor for HR development in Taiwan, is a recognition of Anchor Fasteners’ longstanding commitment to talent development, and it also promotes a sense of honor and centripetal force among the company's staff, which will also help to expand business and enhance service value in the future. We will also continue to think about how to break through innovation to improve personnel training, as through education and training, not only can the professional skills and management capabilities of our personnel be improved, but also help employees gain a sense of achievement and self-realization, and the company's efficiency and profitability can also be improved,” said Hector Chu, General Manager of Anchor Fasteners.

Most of Anchor Fasteners’ middle and senior executives have 5-6 years of TPM training. By passing on the concept of knowhow and establishing benchmark books or SOPs through the mentorship system, they can avoid the problem of inappropriate transfer of experience and technology from senior technicians. On the other hand, they also plan customized courses for different departments' functional attributes and operational needs.

"Talent training can also shape the corporate culture. By working on small details, employees themselves are the problem finders and solvers,” Chu added.

In order to attract and retain more talents, Anchor Fasteners will also focus on the integration of talents and systems, especially in ISO 45001 occupational safety and health education and carbon emissions, to create a work environment and a sustainable business future that emphasizes environmental and labor safety and health. On the other hand, it will continue to strengthen professional training, upgrade machinery and equipment, and digital transformation in order to cultivate employees' motivation and professional skills, so that they can see the future and are willing to work together with the company. Chu emphasized, "Education and training are the core elements of a company's competitiveness, and the resources provided by the government are an excellent way

companies to make good use to achieve this goal.”

by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

for

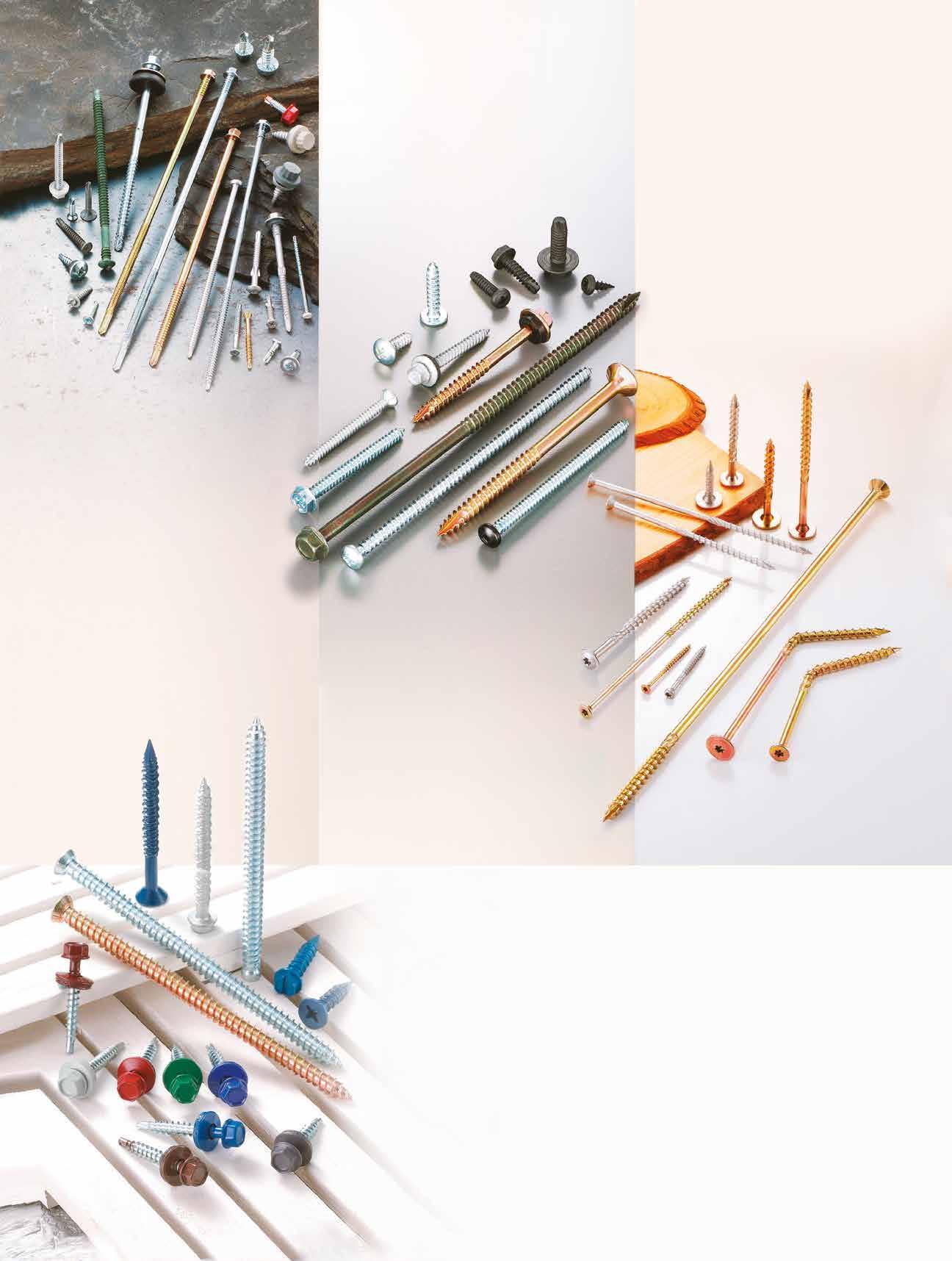

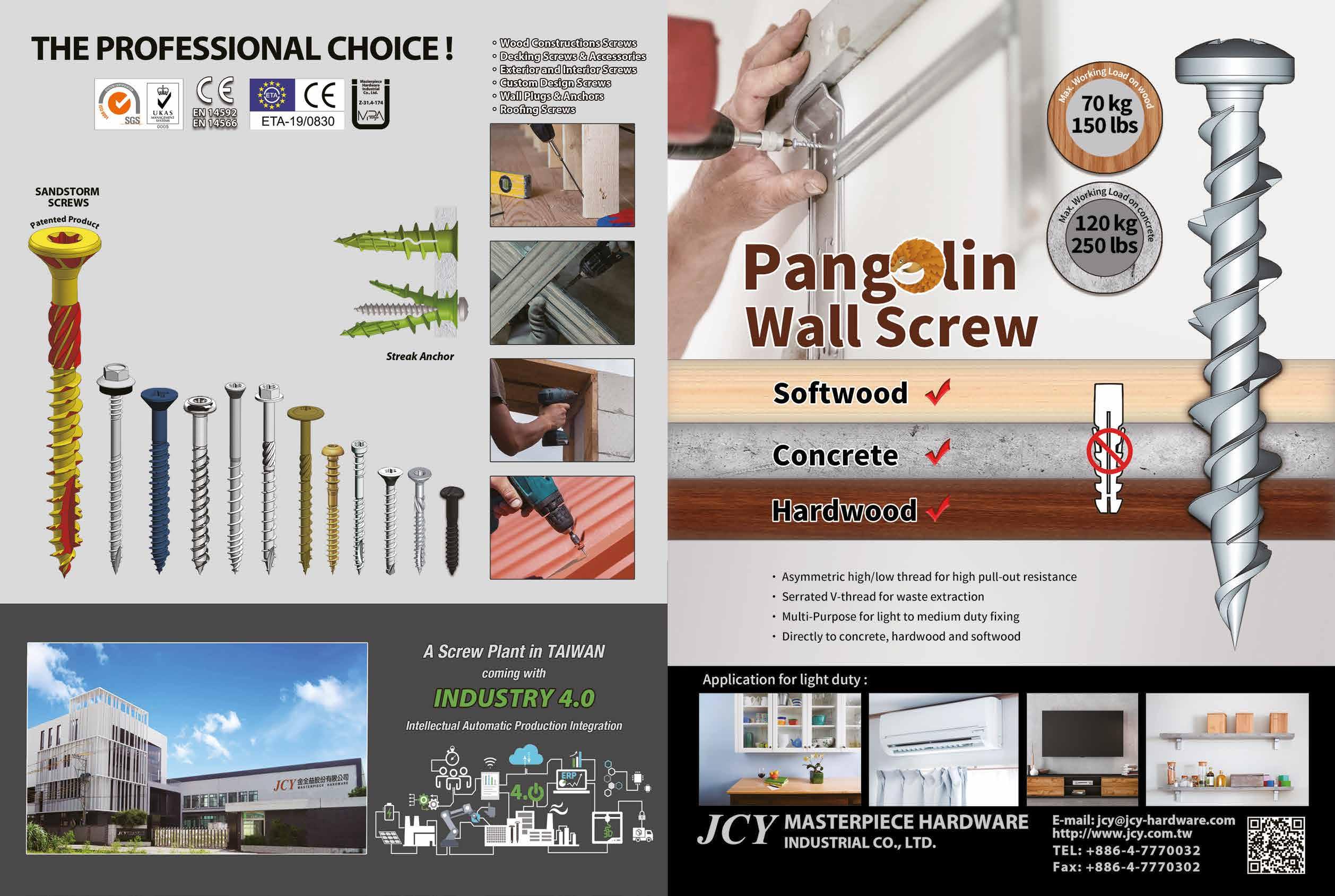

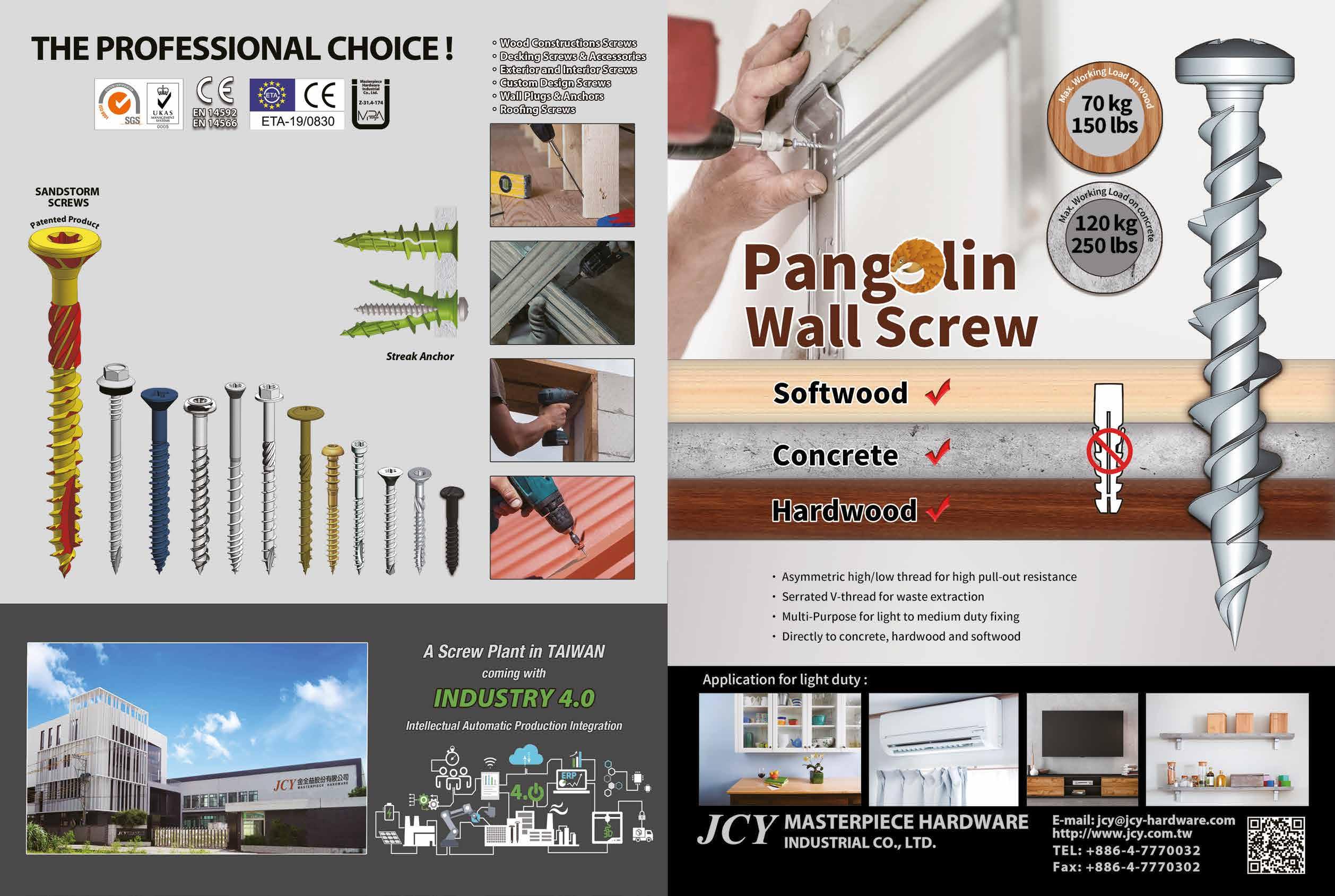

With high quality and reasonable price, Masterpiece Hardware Industrial supplies self-tapping screws, self-drilling screws, concrete screws, drywall screws, wood screws, expansion screws and drives 20% sales growth every year. The key to their success is that their president takes pleasure in product development and comes up with game-changing screw designs that define their irreplaceability. They have launched two patented products. Read on as Fastener World gives you an insider’s look at these products’ design.

The company’s naming of featured products is ingenious and always intriguing. This screw is named for pangolins' characteristic of being great at digging holes in the earth, and its threaded section has the apparent high threads with three grooves and a scale-like appearance, which is much similar to the features of pangolins' appearance. It is an all-round screw, mainly for multi-purpose use, and can be used on cement (work load 120kg, 250lbs), bricks, soft and hardwood (work load 70kg, 150lbs), and plasterboards. Just remember that it is a fit-for-all screw like a pangolin that can go in and out smoothly, freely and with agile.

Sandstorm Screw has a special design, including the underhead pocket, the slanted spirals on the shank, and the grooves on the threaded portion. There is even a large area of cut-out surface which gives Sandstorm Screw an aggressive look. The company explained that the grooves on high-low threads and the jagged design allow to effectively cut wood fibers when fastening the wood. As the screw pushes into the wood, the wood fibers break into powder-like matters. You can see during the fastening, wood powder is ejected out along the grooves and the screw drills through the wood with a rapid process, just like a raging scene of sandstorm comes. So it is named for its state of use. Used on various wood structures, it saves 45% of fastening time and reduces resistance by 20% Just remember that sandstorm screws can be fast, efficient, labor-saving, and finishes fastening perfectly

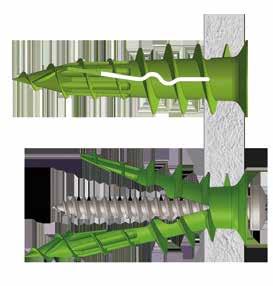

The self-drilling threads on the front of the Streak Anchor can drill into plasterboards quickly, and the resulting debris is discharged through the striped grooves on the shaft. When a screw drives into the Streak Anchor and reaches the pre-determined fastening result, Streak Anchor will crack along the lightning-shaped gap and support the back of the plasterboard. Consumers can tell that the anchor has transformed and completed its mission by the sound of a crack. In addition to the crack and stripe design, the fastening action is as fast as lightning, and the sound upon finishing installation is as loud as a thunder to remind consumers, so Streak Anchor is named to be intriguing and for its useful performance. (“Streak” denotes lightning and stripes.) The extra 20% work load (range: 25~35kg, 60~80lbs) makes it safer for consumers to use.

In response to Industry 4.0, the company is steadily advancing the upgrade through AI, smart manufacturing and automation. In addition to the continuous integration of data with ERP and other software and hardware, they have also set up electronic signage at the workplace, linked up information from each workstation and now provide real-time alert through the warning system on the equipment, so that operators can quickly troubleshoot abnormalities and review their own work progress and efficiency.

They have taken into consideration environmental protection and carbon reduction measures when designing the smart factory, including the recycling of lubricating oil and recycling of oil and gas to reduce pollution and waste in the manufacturing process. Not only because of the needs of customers, but also because of the fact that we are all part of the Earth. As an enterprise, Masterpiece Hardware Industrial has the obligation to follow international environment protection standards in their business operation, and seek improvement for most suitable carbon reduction solutions. In addition to continuously observing their carbon emissions, they have set up a task force to collect information and formulate response plans.

Utilizing patents and smart manufacturing, they break from the shackles of conventions in the fastener market and provide customers with cutting-edge and modern products!

by Dean Tseng, Fastener World

On December 6, 2022, the Annual General Meeting of the Hong Kong Screw & Fastener Council was held at HKPC Building (78 Tat Chee Avenue, Kowloon, Hong Kong) with virtual streaming online, having more than 70 participants in total. Chairman Tsui Ping Fai expressed his gratitude to the members for their support and reviewed the activities held in the past year, including the General Meeting, Firmware Market Project Sharing Session, Technical Forum and Association Exchange, etc. He also forecasted that a study tour to Japan will be held in April 2023, hoping to bring new technical information to member companies and create more development opportunities for members.

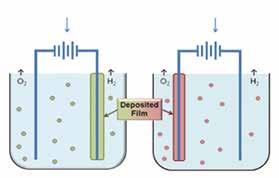

A seminar on "Application of Hybrid Sol - Gel Coating Technology to Enhance Corrosion and Wear Resistance of Fasteners" was also held to explain the technical theory of two common methods to mitigate corrosion and provide reliable and durable protection to metal substrates. At the end of the meeting, HKSFC Founding Chairman Tsui Ping Kwong, Lifetime Honorary President of Shenzhen Fastener Industry Association Weng Kejian, and Honourable Chairman Qiu Yong, exchanged views with the members on the activities, technical exchange and future development, and made an outlook for next year, hoping to continue to develop and grow with the joint efforts of everyone.

After overnight negotiations, EU countries and European Parliament representatives reached an agreement on Dec. 13, 2022, to impose a tax on CO2 emissions from imported steel and cement and other polluting goods, extending the scope of application from upstream products such as steel, aluminum and cement to downstream products such as screws and bolts. The new mechanism is scheduled to be implemented on a trial basis from October 1, 2023.

The agreement, called the Carbon Border Adjustment Mechanism (CBAM), is a new creation of the European Union in light of the global trend of carbon reduction, and was proposed by the Executive Committee in July 2021. Since EU has set strict carbon reduction requirements for local industries with high carbon dioxide emissions and in order to prevent enterprises increasing costs due to carbon reduction from ending up with uncompetitive prices against imported products, CBAM was created, requiring purchase of carbon reduction certificates for foreign high carbon emission products entering the EU market.

The speed of EV revolution could go beyond our expectation. A starup EV brand from the Netherlands rolled out the first solar energy car Lightyear 0. Production began from November 30, 2022. Unlike general EV cars that have to be pulled over to recharge, Lightyear 0 can recharge on the go under the sun. Even if the battery runs out, it can go ahead running on solar energy. With solar power, it can go 11,000 kilometers on flat grounds each year.

Lightyear 0 is manufactured at Valmet Automotive Group's plant in Finland. The current estimated capacity is 946 units. It uses 60 kWh batteries and runs 625 kilometers with a full recharge.

Taiwan’s China Steel Corp. has recently announced its latest price adjustments for steel products. The price of wire rod (including low carbon, medium-to-high carbon, cold forged, and low alloy) that is most relevant to fastener manufacturers will be reduced by NT$1,500 (about US$48.7) per metric ton. However, the price of automotive materials will be increased by NT$500 (about US$16.23) per metric ton. The average price adjustment margin for all steel products will be -0.83%.

Benefiting from the reopening of the border, zero carbon emission and new infrastructure projects in China and the U.S., the demand for fasteners for aerospace, new energy vehicles, solar energy and rail transportation has increased, which makes NAFCO, Boltun and Tong Ming relatively optimistic about the outlook for 2023. On the development of fasteners in the aerospace industry, NAFCO pointed out that the demand for new machines continues to grow. For instance, Boeing forecasts that the aerospace market will return to pre-epidemic levels in 2023~2024, and will maintain growth momentum in the coming years.

Although its revenue share of electric vehicles is still relatively low, Boltun said that the electric vehicle market is booming, and that the sales volume of existing customers is gradually enlarging. The proportion of conventional car manufacturers developing electric vehicles continues to increase, and new electric vehicle brands continue to join the market.

Although Tong Ming, a stainless steel fastener manufacturer with its main market in China, was facing China's lockdown in the first half of 2022, it is expected that the shipment volume will exceed 130,000 tons and continue to reach a new high under the support of China's infrastructure construction and the company's high market share. Tong Ming continues to be optimistic that the demand for fasteners for rail transportation, solar energy and electric vehicles in China will remain strong, especially under the energy crisis, and expects explosive growth for solar energy fasteners in the next 2~3 years. The company believes shipments in 2023 are expected to be better than in 2022, reaching a new record high.

Chun Yu said it is looking to end inventory adjustment in Q1 2023. Its corporate performance could stabilize in Q2 2023 and there could be a mild recovery. There is a chance for Taiwanese fastener market to recover in the second half of 2023. According to Chun Yu's analysis, its output in Taiwan peaked at 12,000 to 13,000 tons while the normal threshold is about 9,000 tons. It reached 8,000 tons from the end of Q3 to Q4 2022 and could return to 10,000 tons per month in 2023.

In terms of China, Chun Yu said the lockdown could soften in the future despite sporadic reoccurrence of COVID, that it couldn't go worse. In good times, outbound delivery can reach 6,000 to 8,000 tons. Currently it is 4,000 to 5,000 tons and could return to 6,000 tons in 2023. Chun Yu has high hopes for Indonesia because the country is breaking records in GDP with a robust local demand. Indonesia is a material producing country and is less subject to inflation. Currently Chun Yu sells 2,000-2,500 tons of products per month there. Chun Yu holds positive outlook toward Europe given the AD tariff on China's fasteners which is thought to favor Taiwanese fastener industry. Chun Yu is actively expanding its market share in the U.S. with steady increases.

In order to fulfil global manufacturing, reinforce int’l market expansion, and satisfy further business reach in Europe and America, Taiwan-headquartered Sheh Fung Screws, replicating its digital and automated transformation experience in Taiwan, will establish its Group’s first overseas manufacturing operation in T ỉ nh Bình Thu ậ n (Vietnam). It will invest NT$ 0.7 bn in establishing the phase-1 plant, which is expected to launch a trial run after Q4 2023 and will officially begin mass production by Q1 2024 at the earliest. Hosted by Sheh Fung’s president Terry Tu and general manager Kent Chen as well as witnessed by prominent guests and local officials, the ground-breaking ceremony was held on December 1st, 2022.

“Based on our sizable production and step-by-step advancement in automation, we’re able to achieve the most efficient utilization of capacity and human resources at our new Vietnam plant. And, with factors like EU-Vietnam FTA and EU’s antidumping taxes against certain Chinese fasteners,

many int’l leading brands have continuously adopted a more diversified sourcing strategy,” according to Sheh Fung’s general manager Kent Chen.

The new plant is planned to be completed through 2 phases of construction. The phase-1 plant will be used to manufacture medium-to-short sizes of tapping, drilling and coated screws. The monthly capacity is estimated to be up to 800 tons (around NT$ 670 million). In the future Sheh Fung will also make proper adjustment between the order intake of its plants in Vietnam and Taiwan in order to maximize the investment efficacy.

Boltun supplies automotive fasteners and components for ODM companies. Among its automotive fasteners, 70% are used on conventional cars and 30% on EVs. Given that the conventional car has reached a fully grown state, Boltun has shifted toward the EV industry in recent years. To cope with EV orders and expand capacity, Boltun Sales VP said the company plans to build a 160,100 square meters plant in Guiren District of Tainan City, Taiwan. The company aimed at a budget of NTD 1.7 billion for this investment, but it switched from purchase to land rental which in turn translates to NTD 871 million. The VP said land purchase is a huge expenditure, but that by switching to rental, Boltun can increase more capacity and flexibility in using the budget. The company sees EVs as the drive for growth in 2023, so it has to adjust capacity.

Tianrun, a wholly owned subsidiary of Goldwind, signed a cooperation framework agreement with Fengqing County Government in Yunnan. The two parties will make full use of Fengqing's wind energy resources to establish a long-term strategic partnership in decentralized wind power development, in order to achieve resource sharing and mutual benefit.

It is worth noting that on September 5, 2022, Goldwind also officially signed an Investment Cooperation Agreement with Yunnan Yunxian Government for the Yunxian Flange Fastener Plant Project. Fengqing has location advantages, huge market potential and a favorable business environment, and the development prospect of decentralized wind power projects is promising. Both sides hope to continuously broaden the collaboration and enrich the results.

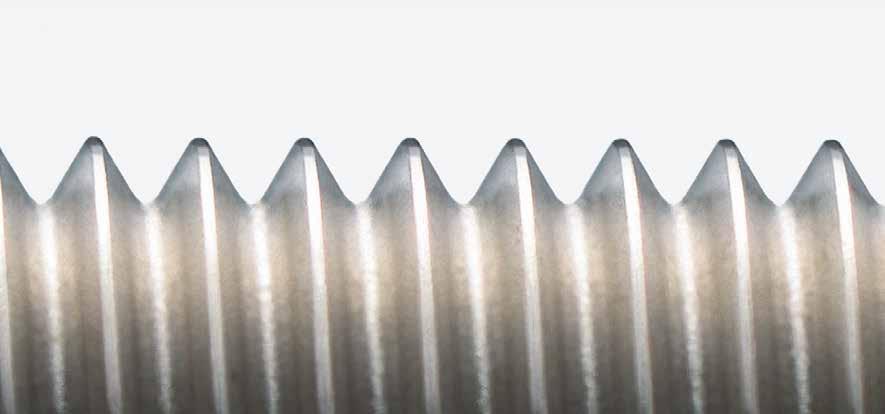

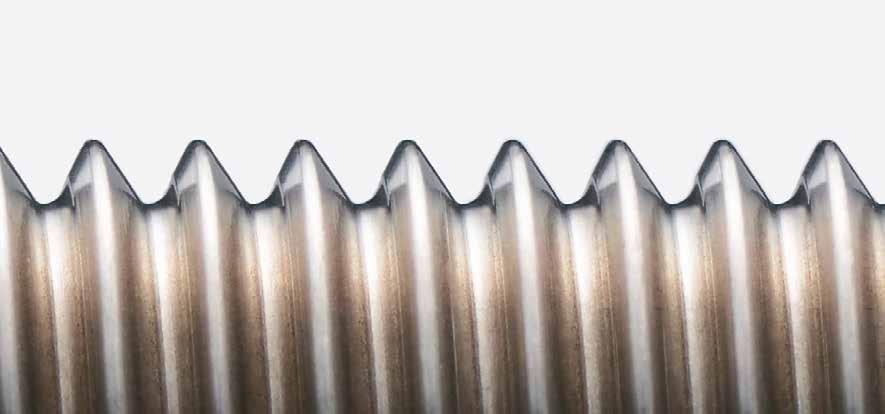

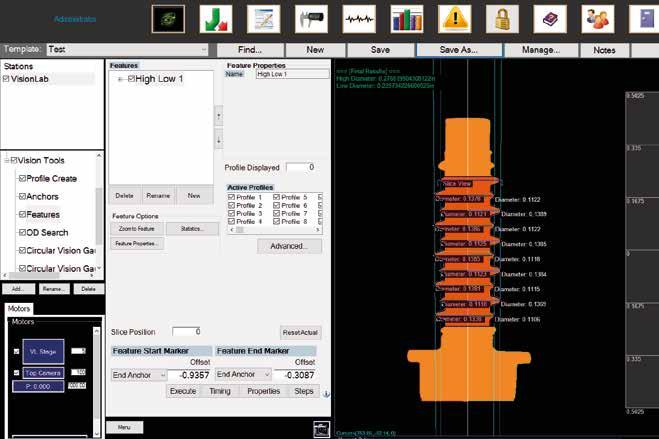

General Inspection, LLC recently added a new high/low thread measuring algorithm to its VisionLab. The 3D fastener gauging system has the most comprehensive thread measurement capabilities, including all pertinent system-22 requirements, lobular shaped threads and now a specific algorithm for high/low threads. Greg Nygaard said, “by popular demand, we’ve added a tool to our VisionLab system to make measuring high/low threads as simple as a press of a button”. The VisionLab allows manufacturers and distributors to measure all critical part features including high/low threads in less than 5 seconds.

In addition to threads, the VisionLab measures all profile features, including GD&T characteristics. An optional “end view” inspection measures and detects defects on both ends of parts including features such as: recesses, inner/outer diameters, through holes and counterbores. Optional surface control is used to detect visual detects, such as bad plating, thread patch presence/quality, as well as, measuring knurl width, gap and height. Optional upper tooling and bit kit are available for uneven parts or parts with a recess drive.

For time savings, traceability and removing error, the VisionLab creates customized, thorough reports

packages.

TR Fastenings Hungary Kft, part of the Trifast plc Group, is celebrating the opening of its new purpose-built facility in Budapest, building on years of rising demand in the region. Located in the southern suburb of Szigetszentmiklós, Budapest, TR Fastenings Hungary Kft is a fastener and Cat. C supplier to international OEM’s and their subcontractors not just in Hungary but in the seven countries that border them. The new 3,500 sq. metres modern facility has 9.5 metres eaves in the warehouse and is a high-capacity distribution facility that is ready to support TR’s future European growth strategy.

TR Hungary was first established in 2000 and has grown considerably in that time, quickly outgrowing two previous locations. Its rapid growth has been a real success story for TR and the region alike. It has come about through rising demand from large multinational household brands, many of which TR supplies to elsewhere in the world. Hungary has historically been a lower cost production region but with a highly skilled available workforce, making it ideal for this kind of strategic investment. Hungary has a central location in Europe with seven countries on its border, which is perfect for distribution hubs.

The TR Hungary team is fully supported by the Group encompassing Sourcing, Technical and Design, Commercial, Financial, HR and Marketing support.

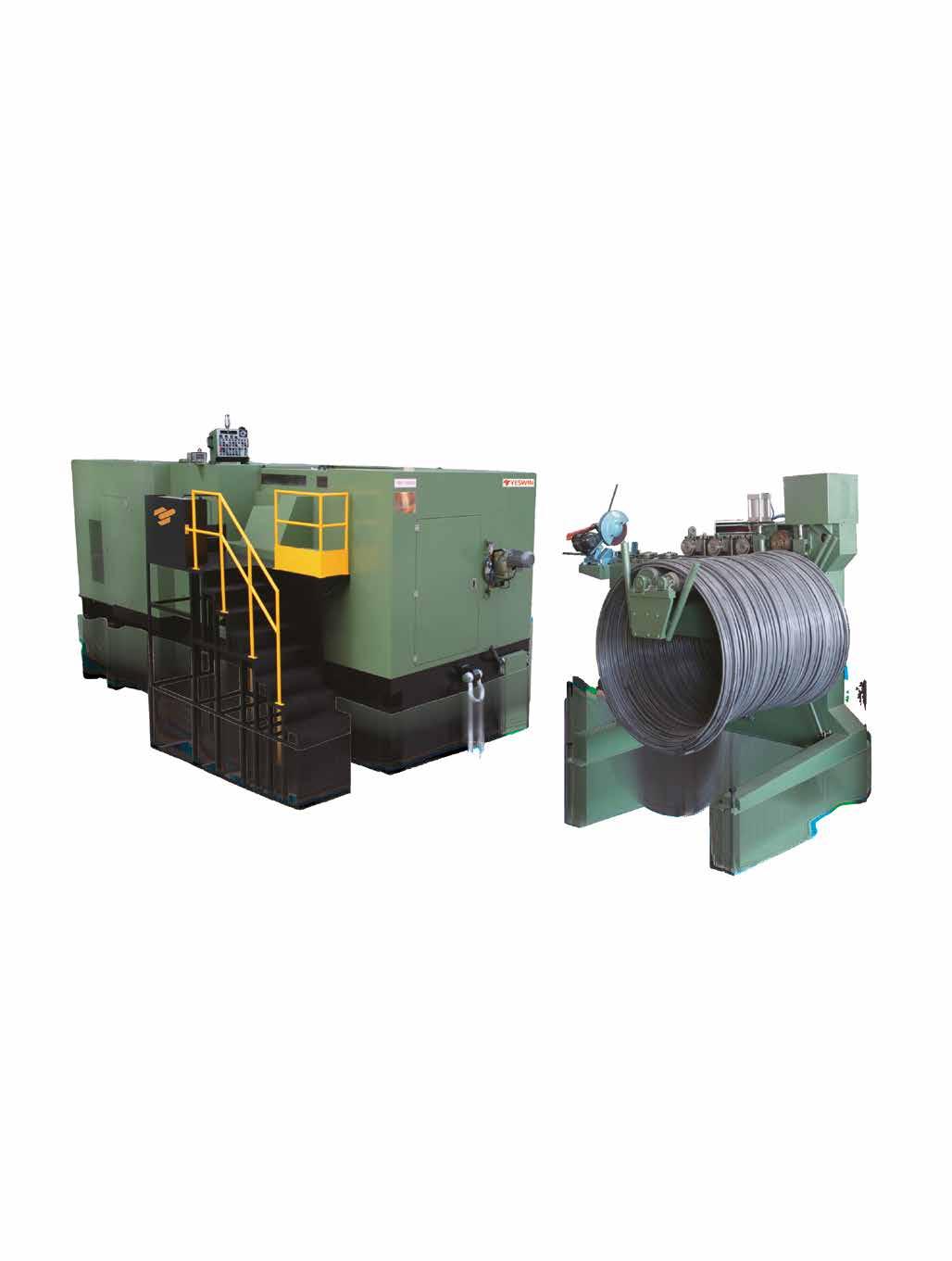

According to the company's strategic development plan, Ronnie Precision Machinery announced to set up a wholly-owned subsidiary.

The company's main business is (Ronnie. Co., Ltd.) for JPY13 million, manufacturing and sales of precision metal parts such as precision fasteners, connectors and structural parts, mainly providing precision metal parts to customers in downstream applications such as 3C, automotive, communications and power equipment.

In recent years, China's major projects such as West-to-East Gas Transmission, South-to-North Water Transfer, High Speed Railway and Westto-East Electricity Transmission have been fully rolled out, and the local automobile, machinery, home appliance, shipbuilding and transportation industries have continued to grow. The strong demand for production and construction will drive significant growth in the fastening industry.

NORMA Group has won a new major order for joining solutions in electric vehicles. From July 2023 until 2030, NORMA Group will equip several of the customer’s battery-electric premium models with hose connectors, hose adapters and quick connectors. The order has a total volume of around EUR 34.6 million. CEO Dr. Michael Schneider: “In our strategic business unit ‘Mobility and New Energy’, we consistently focus on the requirements of our customers. With our experience as a development partner and our certified production standards, we are very well positioned to support our customers in their technological transition towards emission-free mobility.”

NORMA Group’s connection products are installed in cooling water lines and are used to cool various units in the vehicle, including the battery. The hose connectors and quick connectors have been part of NORMA Group’s portfolio for many years. Development engineers at NORMA Group specially adapted them for this order in cooperation with the customer.

The joining products are manufactured at NORMA Group’s plants in Maintal, Germany, and in Pilica, Poland. Some of the parts include a temperature sensor in order to ensure optimal operating temperature. In order to meet the increased demand, NORMA Group is investing in injection molding production at the Maintal site, in new assembly machines for quick connectors and in training employees.

The Board of Directors of Howmet Aerospace declared a dividend of 93.75 cents per share on the outstanding US $3.75 Cumulative Preferred Stock (“Class A Stock”) of the Company, to be paid on January 1, 2023 to the holders of record of the Class A Stock at the close of business on December 9, 2022.

Howmet Aerospace Inc., headquartered in Pittsburgh, Pennsylvania, is a leading global provider of advanced engineered solutions for the aerospace and transportation industries. The Company’s primary businesses focus on jet engine components, aerospace fastening systems, and airframe structural components necessary for missioncritical performance and efficiency in aerospace and defense applications, as well as forged aluminum wheels for commercial transportation. With nearly 1,150 granted and pending patents, the Company’s differentiated technologies enable lighter, more fuel-efficient aircraft and commercial trucks to operate with a lower carbon footprint.

Fastener Tool & Supply, Inc. — a nationwide leader in fastener distribution – is proud to announce the launch of their brandnew website. The foundation of Fastener Tool & Supply’s business has been rooted in their commitment to operational excellence and customer service since 1977. Additionally, their focus on innovation, quality, and continuous improvement has helped grow their reach across North America. Now, their website is also centered around these fundamental principles.

The focus of the redesigned website is to put the user in control, adding useful elements and features that improve functionality, accessibility, and user experience. This investment reinforces Fastener Tool & Supply’s promise to deliver high-tech, user-friendly solutions to help streamline processes and boost efficiency.

Fastener Tool & Supply, Inc. is a trusted distributor of fasteners and related products and services. Headquartered in greater Cleveland, Ohio, they offer over 150,000 fasteners and supply chain solutions that help improve quality and boost productivity. These advanced technologies have propelled them into many cutting-edge industries, such as aerospace, alternative energy, automotive, industrial commercial, construction, high performance, military, and power generation.

San Shing Fastech said that the automotive fastener demand is not obviously recovering in the U.S. and Europe, and it expects that the market demand will continue adjustment at least until the first half of 2023. Its performance from Q4 2022 to Q1 2023 is expected to level with Q3 2022. Despite an ease on lack of automotive chips, the demand has not obviously come back due to inflation, interest rate hike, the RussiaUkraine war and European energy crisis. New car sales in the U.S. and Europe in 2022 are still declining.

Accroding to previous experiences, the sluggish market will take at least until the first half of 2023 to improve. Therefore, San Shing Fastech's business operation will remain relatively flat until Q1 2023, and for Q2 it will require monitoring how fast the market will recover. Its fastener products including screws, nuts and washers take up 85% of its product line, with the rest being dies, machines and wire rods. It sells 37.66% of all fastener products to Europe, 36.76% to the U.S., 16.84% to Taiwan, 8.74% to Asia and other regions.

San Shing Fastech continues to strengthen its manufacturing technology and improve the efficiency. By collaborating with Taiwanbased MIRDC on "San Shing Fastech Innovation Center", San Shing Fastech will develop new fastener manufacturing equipment, improve fastener surface treatments and improve inspection services.

BBI-Montreal has moved from a 90,000 sqft facility into a 154,000 sqft building and BBI-Toronto has doubled its warehouse space to 164,000 sqft facility enhancing just-in-time deliveries into Canada. Brighton-Best is currently located in 31 locations in 6 countries and supplies over 7,000 distributors throughout the world.

In August 2022, Fukui Byora established a logistics center in Shiga Prefecture to provide just-in-time delivery to the Tokai and Kansai regions. The company will capture the demand for EV parts, which is expected to expand significantly. The company will build a new plant located in Katayamazu in summer 2023 as a production base for EVs and high voltage battery parts. They will respond to new demand in the automotive field by utilizing its specialty in cold forging technology.

SUMEEKO announced on November/16/2022 that it is to acquire the other 49% shares of Max Mothes GmbH (MMG), a subsidiary of CS Beteiligungs GmbH, for 6.24 million euros in cash. The process is expected to be completed in July 2023 and after that MMG will be fully owned by SUMEEKO. Through an adjustment period of 2.5 years, MMG is back on track with profits gained in 2022 thanks to orders from European carmakers. Previously, SUMEEKO acquired 51% shares of MMG (a Tier 1 supplier for German automakers) for 6.5 million euros, which was completed in July 2018. By fully acquiring MMG shares, SUMEEKO can tap into the supply chains of Ford, Benz, BMA, Volkswagen, Bosch and Siemens.

Just three months after the death of Anderson Luiz Biason, another loss occurred with Max Del’s CEO. This time it was Américo Maximiliano Biason, Anderson’s father. A fastener manufacturer and founder, "seu Américo" (his nick name) passed away at the age of 83, on November 29, 2022, in Mauá Town, SP. Max Del has been his industrial plant and headquarters since 1977.

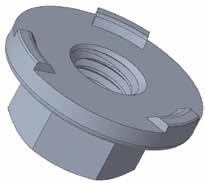

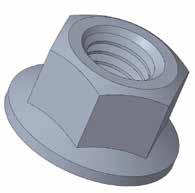

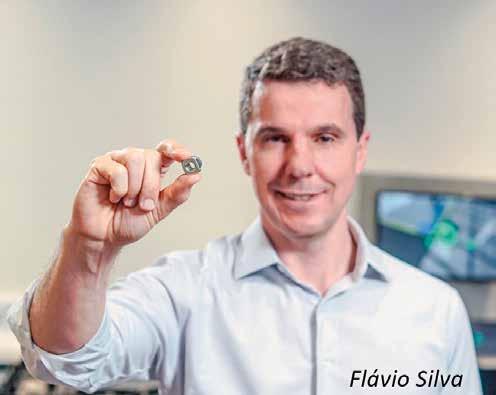

The Brazilian subsidiary from Böllhoff Group started production of high-resistance pressable nuts that meet the demands from the automotive, agricultural and electric energy sectors.

Specialized in fastening technology and assembly systems, Böllhoff Brazil informed of the new local production of KAPTI NUT®. The new line allows fixing pre-drilled thin metal sheets, resulting in the creation of a threaded fastening element for the application of a third component. The clamping system is specially designed to suit multiple drilling of strip and thin sheet metal, and can be applied to materials such as steel, aluminum, and stainless steel.

"The investment in that production line aims to benefit the local and export market, with faster service, competitive prices and the offer of products manufactured with the global quality standard of the Böllhoff Group", highlights the CEO of the Brazil unit, Flavio Silva. "These are highly resistant and pressable nuts, which can be applied via a mechanical process or also through automation possibilities that add more practicality and increase the productivity of our customers".

Brazil is one of the key markets for the Group. Currently, the local unit has sold an average of more than 620 million pcs of fasteners per year, with around 30% exported to France, Germany, USA, Italy, Poland, Mexico, Japan, Argentina, Chile, and Colombia. Other industries served by the company with Brazilian production are construction, aerospace, machinery, and equipment.

After opening a new office in China, the fastener manufacturer giant in Latin America expanded its activities and advanced in the Asian market.

As part of its strategic market expansion, Cia Industrial H. Carlos Schneider (Ciser), the Brazilian Fastener Manufacturer leader, announced some actions to mark its position as a relevant supplier in the Asia-Pacific region.

October 2021, Ciser inaugurated a new and modern office in Changzhou City, Jiangsu Province, China. In addition to Henry Osvald, president of BraCham (the Brazilian Companies in China for Industry, Commerce and Technology Association), and Susan Zou, a Chinese government representative, the event was attended by some executives who are Ciser’s major customers, such as WEG, Marcopolo, Progeral and Karl Mayer. On the occasion, the new company was presented as Ciser Fasteners Jiangsu Ltda.

by Sergio Milatias, Editor (milatias@revistadoparafuso.com.br) Revista do Parafuso (The Fastener Brazil Magazine) ww w.revistadoparafuso.com“We want to expand our share in the Asian market, not just in China, and to get the Ciser name across Asia and the Pacific region," said Renato Fiore, Sales Director.

In the first eight months of 2022, the Hilti Group increased sales by 6.1% to CHF 410 billion. The operating result declined by 36% due to global supply chain disruptions such as the Russian invasion in Ukraine, negative currency effects, as well as significant investments into building up the software business. In addition, the results are impacted by strong negative base effects that will level out until year end.

In local currencies sales increased by 9.1% with the strongest contribution coming from the Americas (+15.8%). Europe (+7.5%), Asia/Pacific (+6.7%) and the eastern Europe / Middle East / Africa region (+3.0%) made disproportionally low contributions to the overall growth over the first eight months of the year.

“2022 is an exceptionally demanding year for Hilti due to the challenging external environment as well as a strongly backloaded year in Europe triggered by the launch of our new battery platform Nuron in September. We are making massive efforts to limit our margin decline caused by the tremendous cost increases in our supply chain while staying in the course with strong strategic investments, especially into our software business. With a successful launch of Nuron we expect our results to improve until year end to above 10 percent growth in local currencies and a profit decline to below 15%. This corresponds to our pre-Corona 2019 profit level before software investments,” says Christoph Loos, CEO at Hilti Group.

Going forward, the Hilti Group expects a diminishing growth dynamic in the global construction market owing to continued cost inflation, growing uncertainties around the energy supply, political tensions and rising interest rates.

Third quarter 2022 revenues for Stanley Black & Decker reached US$4.1 billion (€4.13 billion), up 9% versus 2021 led by acquisitions in outdoor power equipment, strong industrial growth and price realisation.

Donald Allan, Jr, Stanley Black & Decker's president and CEO, commented: "We made tangible progress in transforming our business during the third quarter 2022 as we improved customer fill rates, deployed a new organisational structure, implemented cost controls and actively reduced our inventories. While the macroeconomic environment remains challenging, notably consumer and European demand weakness, as well as cost inflation, there were relative bright spots with continued strength in professional construction and industrial customer demand, as well as incremental progress unlocking global supply chain constraints."

He continued: "Today we are a more focused company, centred around our market leadership positions in Tools & Outdoor and Industrial, and built upon the strength of our people and culture. Our new organisational structure is largely in-place and we are accelerating our supply chain transformation to better serve our customers and improve efficiency. We are also continuing to invest in our iconic brands and are launching new advances in innovation, including the expansion of our DEWALT POWERSTACK battery technology and DEWALT FLEXVOLT System. Overall, we remain confident that our strategy and priorities position the company for strong, sustainable long-term growth, cashflow generation, profitability and shareholder return."