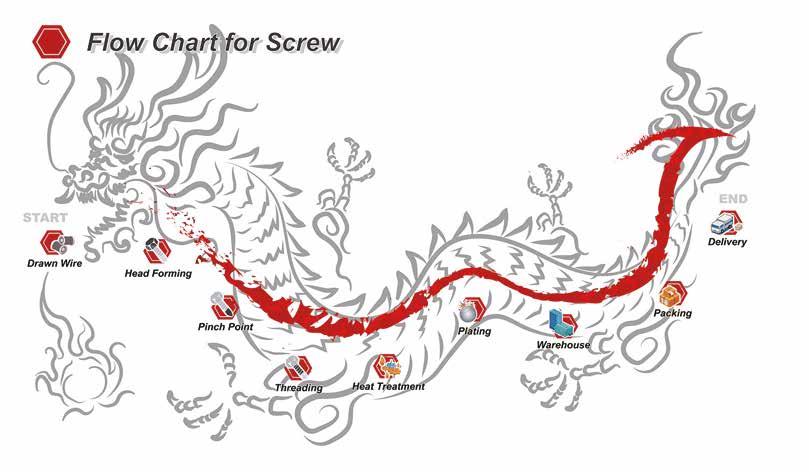

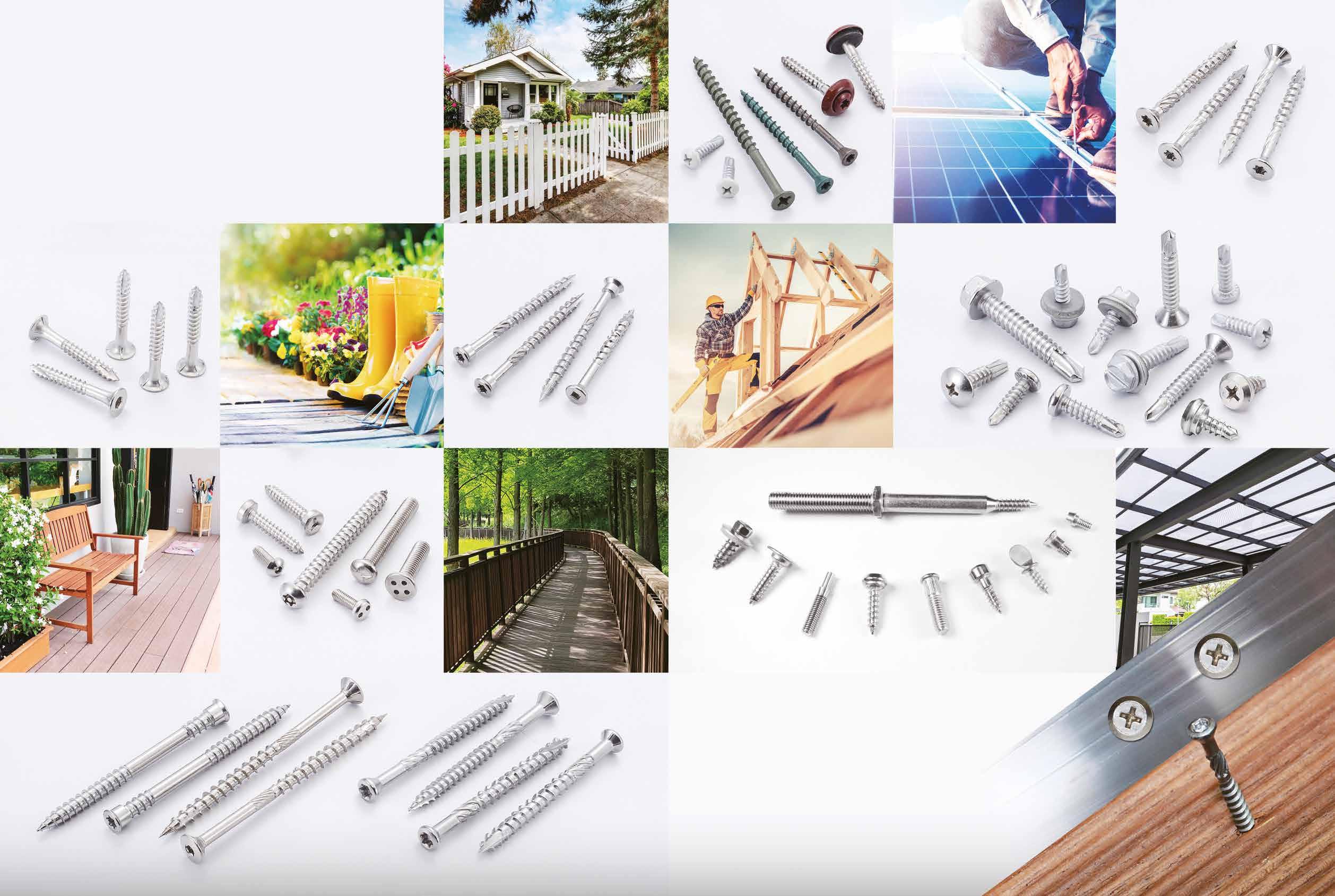

The Taiwanese manufacturing supply chain has made quite a presence worldwide in recent years. Bi-Mirth as a part of that chain is geared up and is all in on certification update and new product rollout. Now it has turned into an irreplaceable brand in the global construction market. In June, the international fastener show in Kaohsiung is set to unveil and Bi-Mirth will be featuring two highly acclaimed products there. The company is also announcing the latest development of its carbon inventory as well as future product R&D.

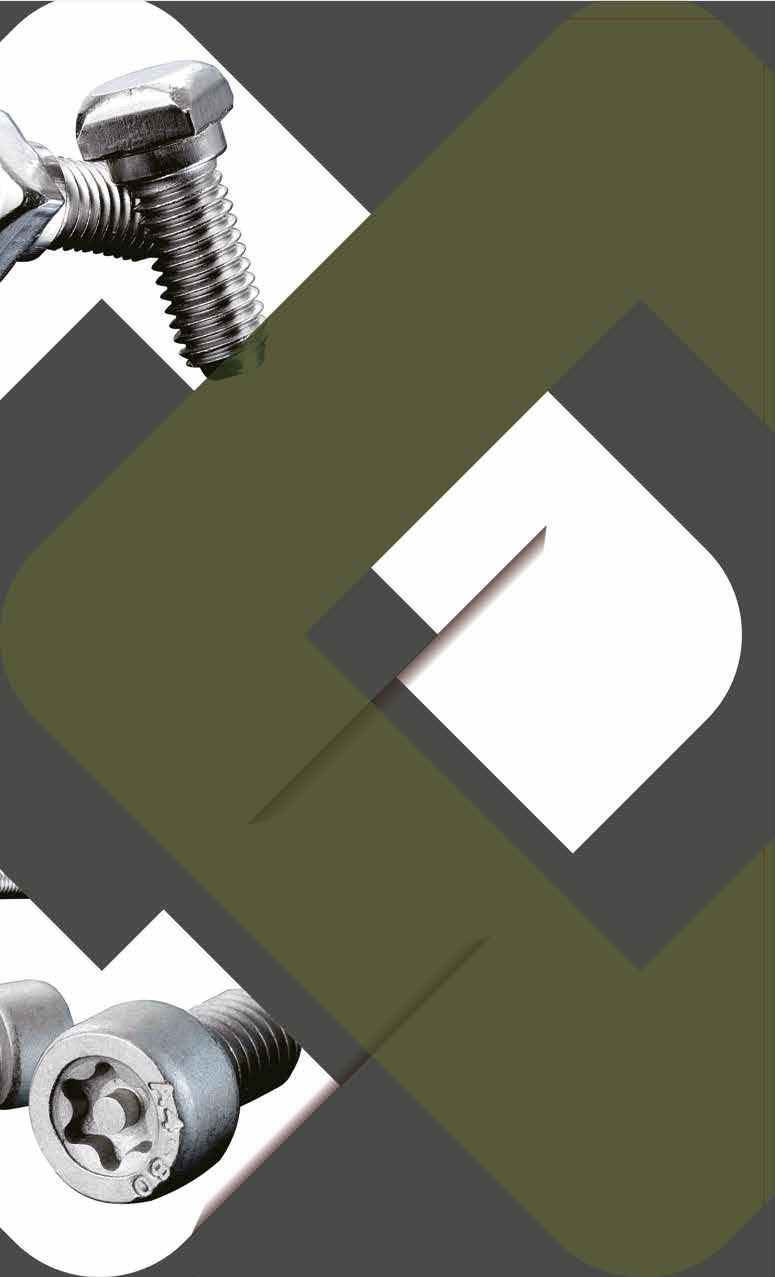

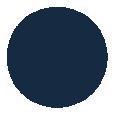

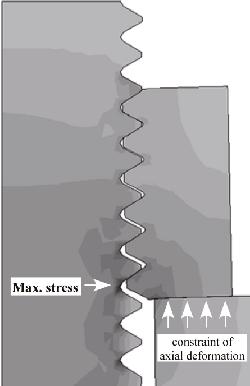

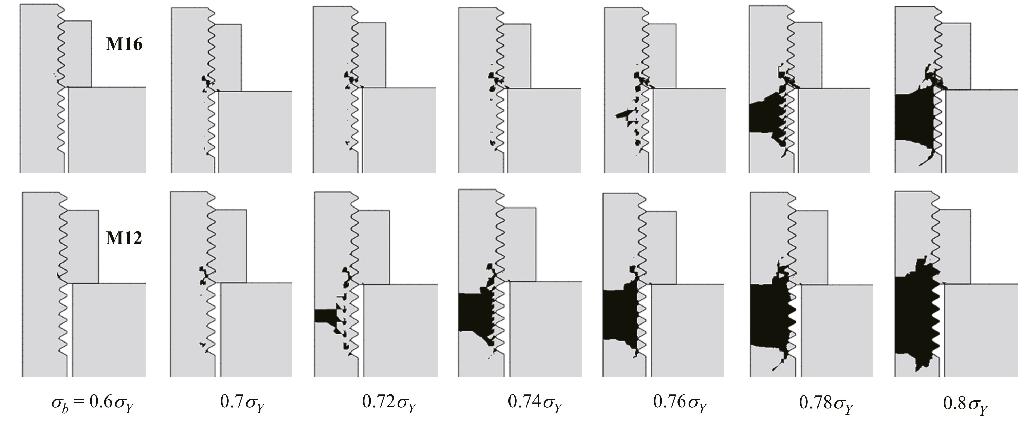

This screw which connects beams and columns to concrete is for old houses that need to be renovated. Wood has high tensile (elasticity) and shear resistance (uneasy to break), while concrete has high compression resistance. Constructing buildings with timber-concrete connector screws can utilize the advantages and prevent the displacement of both the building materials, and provide better sound insulation. Bi-Mirth observed a high demand for renovation due to the existence of many old houses and therefore developed a well-suited solution to connect concrete to wood. Plus, Bi-Mirth acquired the ITT test report this March and this screw is expected to pass ETA certification right before or just after the Kaohsiung show!

The strong earthquake in eastern Taiwan this April attracted international media attention and led to discussions on the safety of buildings’ seismic design. In fact, as of April 2024, there have been two magnitude 7.0+ earthquakes, and last year there were five magnitude 6.0+ earthquakes (in Turkey, Morocco, Japan, Philippines, and China). Every year, strong earthquakes cause heavy casualties in different corners of the world. Bi-Mirth's wood construction screws have passed seismic tests and can bring higher safety to building structures around the world.

Bi-Mirth’s carbon inventory calculates carbon emissions from its four factories as well as upstream raw material plants, covering scope 1 (direct emissions), scope 2 (indirect energy emissions), scope 3 (indirect emissions), and even scope 4, which is emissions from purchased electricity, tap water, gasoline and diesel, and emissions from solid and liquid waste treatment. The current progress is 50% completion, and the goal is to pass ISO 14064 certification.

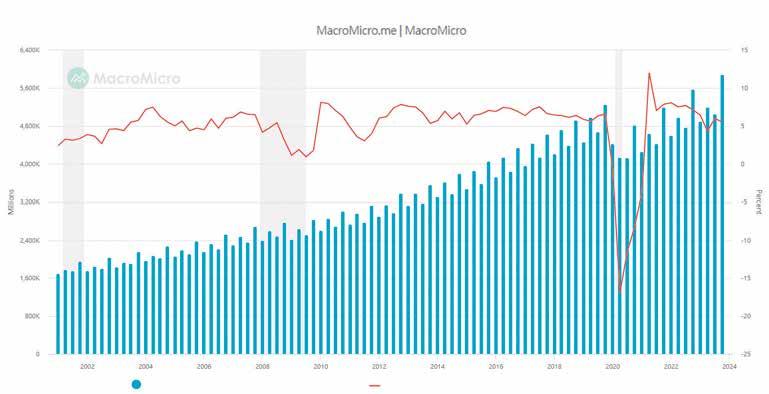

The company observed three factors that have turned the global construction market investment conservative. The first one is high interest rates. Second, 2024 is a super election year, and third, fastener stock level is still high at the locations of American and European clients. Inflow of orders to Taiwan is estimated to improve in mid-2025. No matter what, the company will take advantage of its thorough knowledge of JIS, EN, ASTM standards and CBAM regulations, and provide clients with advice on production methods and product applications to help save the use of molds and reduce costs.

Bi-Mirth also pointed out that in the past, Taiwanese fastener companies focused on high added value and production cost reduction. With high global awareness of carbon reduction, it is mandatory to consider the environmental impact of product development to ensure that cost reduction complies with environmental protection requirements. Balance must be found between pursuing high added value, reducing production costs and complying with environmental protection requirements. Looking forward, Bi-Mirth will exhibit at the Kaohsiung and Sydney shows and it looks forward to discussing new carbon reduction technologies and carbon border regulations with overseas visitors to set the stage for "Green Bi-Mirth 2.0"!

Copyright owned by Fastener World / Article by Dean Tseng

267 310EXPRESS COMPANY (Japan)

Security, Tamper Proof, Anti-theft Screws...

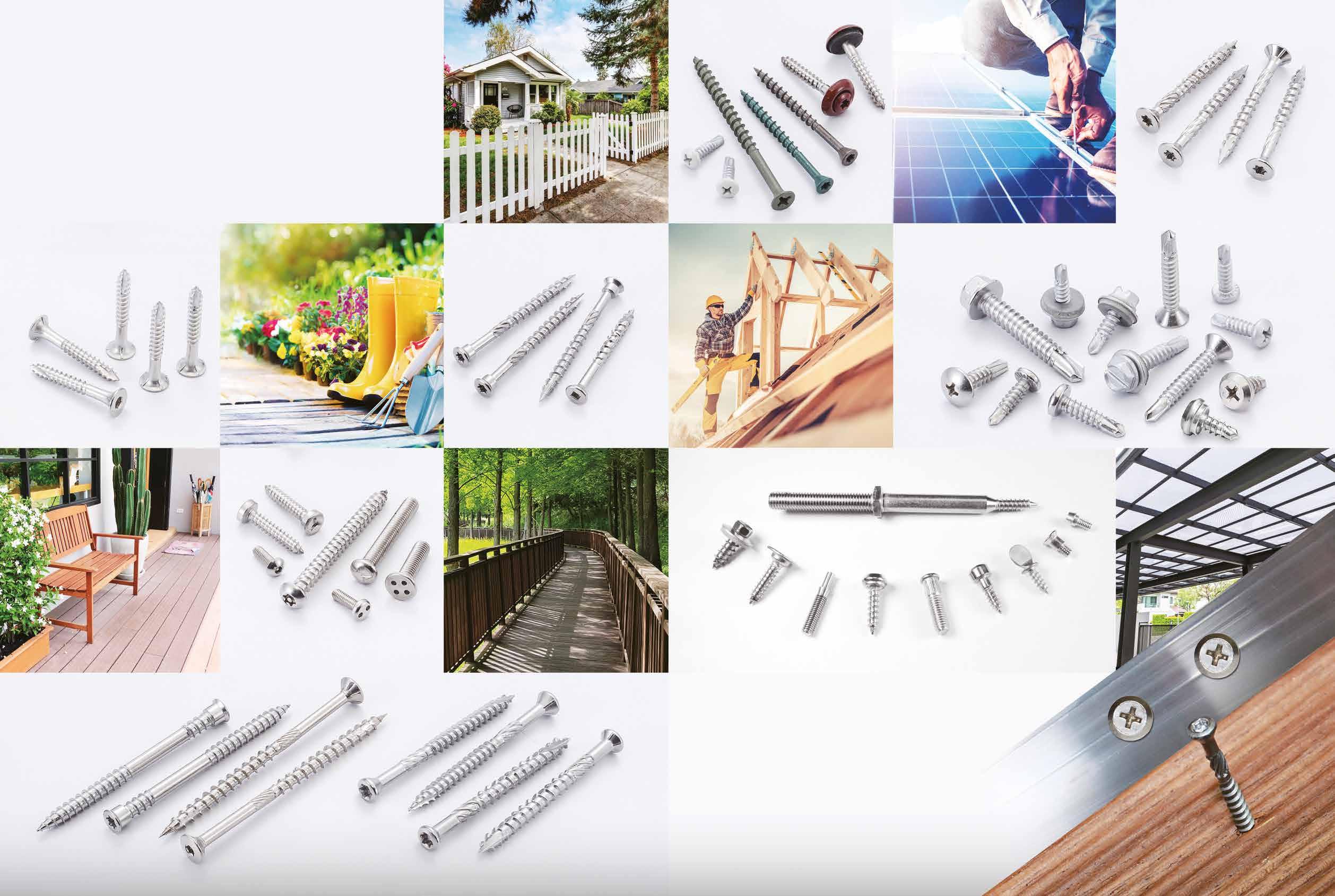

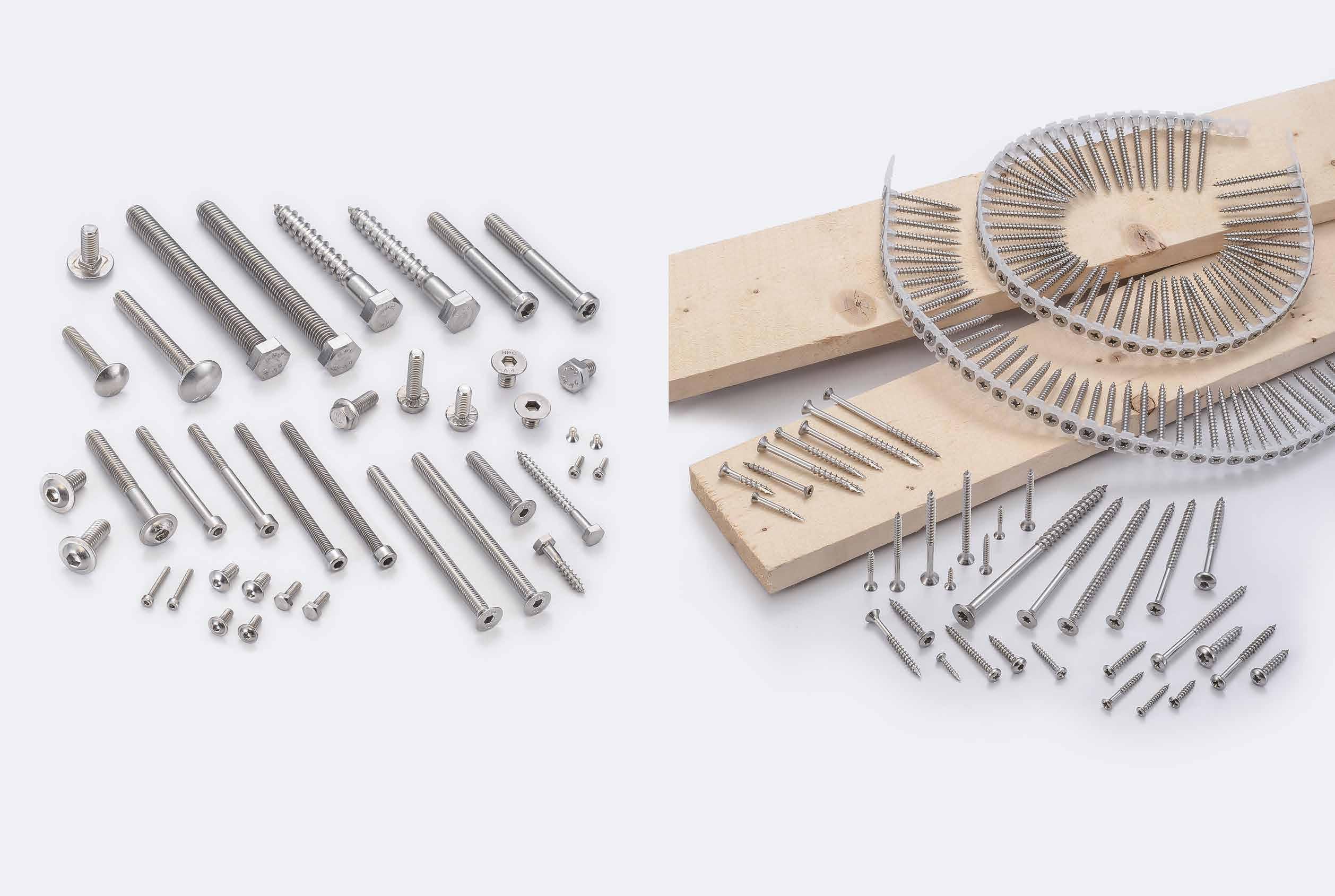

222 A-PLUS SCREWS INC.

Chipboard Screws, Customized Special Screws / Bolts…

207 A-STAINLESS INTERNATIONAL CO., LTD. 淳康

Chipboard Screws, Concrete Screws, Deck Screws...

336 ABC FASTENERS CO., LTD. 聯欣

Drop-in Anchors, Expansion Anchors, Wire Anchors...

105 ACHILLES SEIBERT GMBH (Germany)

Tapping Screws, Drilling Screws, Thread Rolling Screws...

257 ADOLF WüRTH GMBH & CO. KG TAIWAN 德商阿道夫

Screws, Screw Accessories, Anchors, Tools, Chemical-technical products...

215 ADVANCE FASTECH INDUSTRIAL CO., LTD. 毓盛

Aerospace Screws, Aircraft Nuts, Aluminum Bolts...

60 AEH FASTEN INDUSTRIES CO., LTD. 鉞昌

Clevis Pins, Dowel Pins, Hollow Rivets...

49 ALEX SCREW INDUSTRIAL CO., LTD. 禾億

Button Head Cap Screws, Button Head Socket Cap Screws...

80 AMBROVIT S.P.A. (Italy)

Chipboard Screws, Combined Screws, Machine Screws...

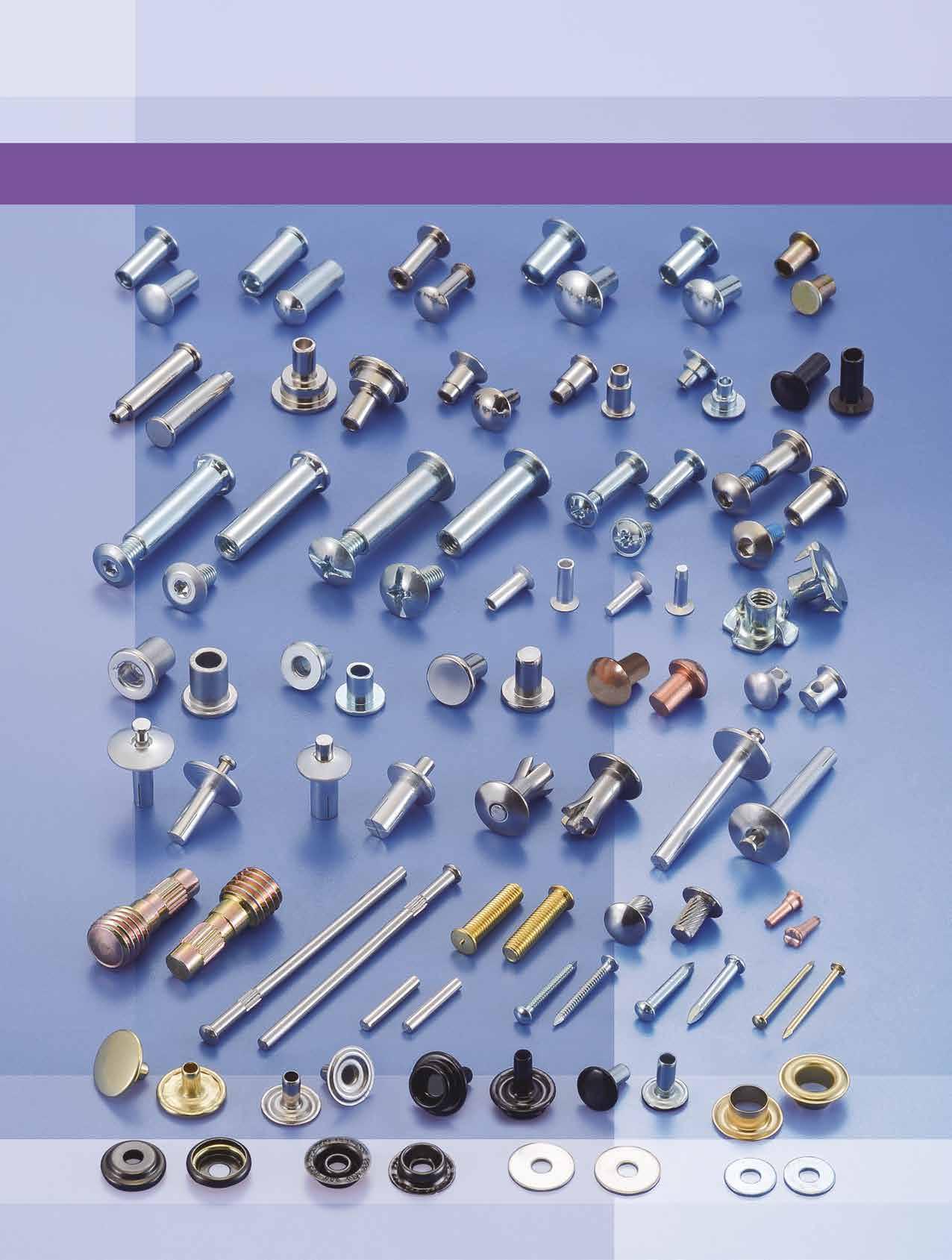

120 AMPLE LONG INDUSTRY CO., LTD. 寬長 Hollow Rivets, Drive Rivets, Semi-tubular Rivets...

346 ANCHOR FASTENERS INDUSTRIAL CO., LTD. 安拓

ETA Series, Anchor Bolts, Anchor Nuts, Automotive Parts...

67 APEX FASTENER INTERNATIONAL CO., LTD. 嵿峰

Nuts, Wing Nuts & Bolts, Turning Parts, Stamping Parts

116 ARK FASTECH CORP.

Multi-Station Cold Forging Bolts / Nuts...

96 ARUN CO., LTD.

Bi-metal Screws, Chipboard Screws, Drywall Screws...

方舟

鉅耕

166 ASCCO INTERNATIONAL CO., LTD. 今大唯

Chipboard Screws, Drywall Screws, Wood Screws, Tapping Screws...

126 AUTOLINK INTERNATIONAL CO., LTD. 浤爵

Automotive Screws, Machine Bolts, Flange Nuts...

322 AVIOUS ENTERPRISE CO., LTD.

Chipboard Screws, Drywall Screws, Flange Screws...

92 BCR INC.

Automotive Screws, Piston Pins, Weld Bolts (Studs)...

艾伯斯

必鋮

243 BEAR FASTENING SOLUTIONS, INC. 雄益

IFI, DIN, ISO, JIS standard, Drywall Screws, Decking Screws

132 BEST QUALITY WIRE CO., LTD. 上冠品

Stainless Steel, Carbon Steel, Alloy Steel Wire…

152 BESTWELL INTERNATIONAL CORP. 凱壹

Eye Bolts, Flanged Head Bolts, Hanger Bolts...

293 BIING FENG ENTERPRISE CO., LTD.

Blind Nut Formers, Multi-station Cold Forming Machines...

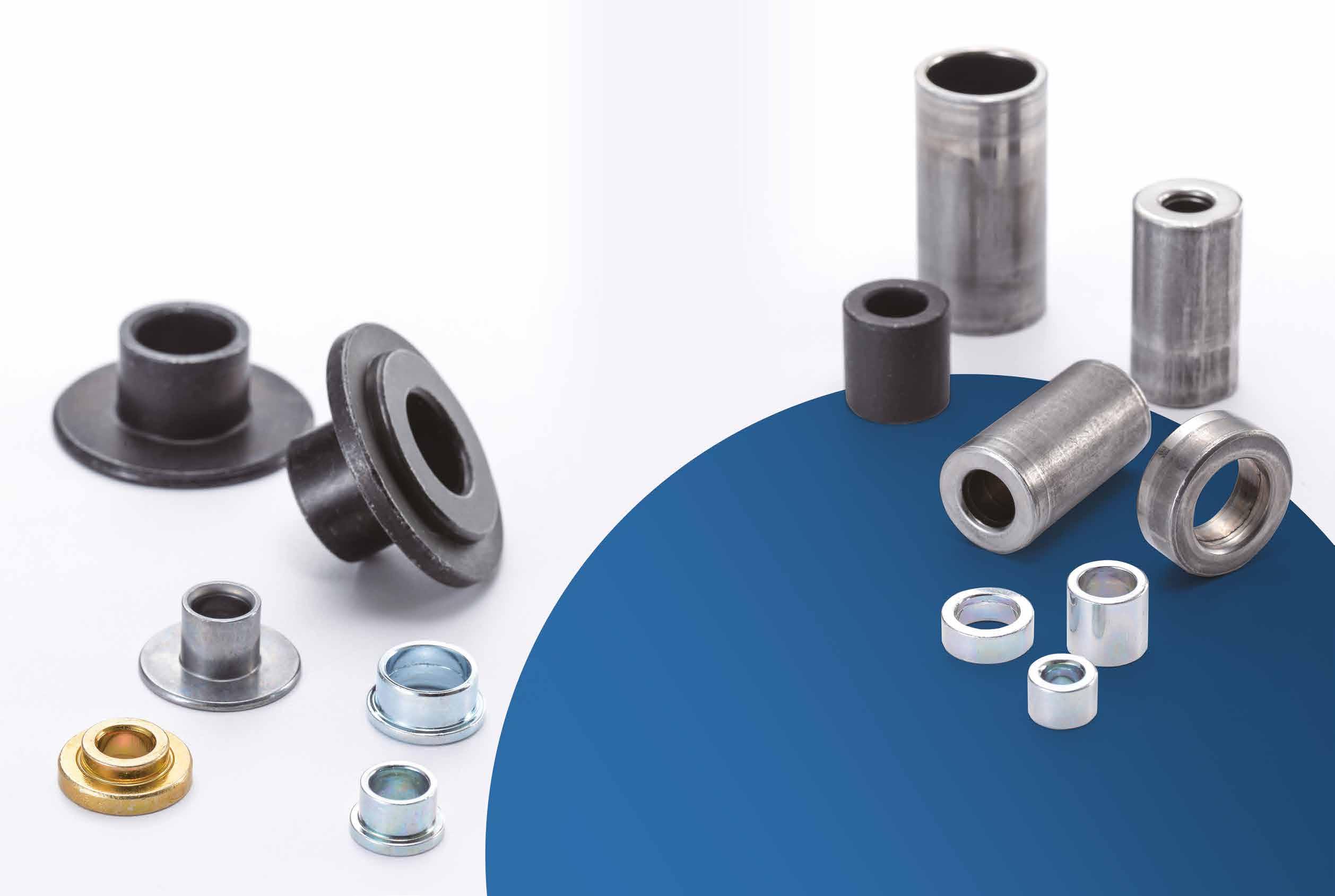

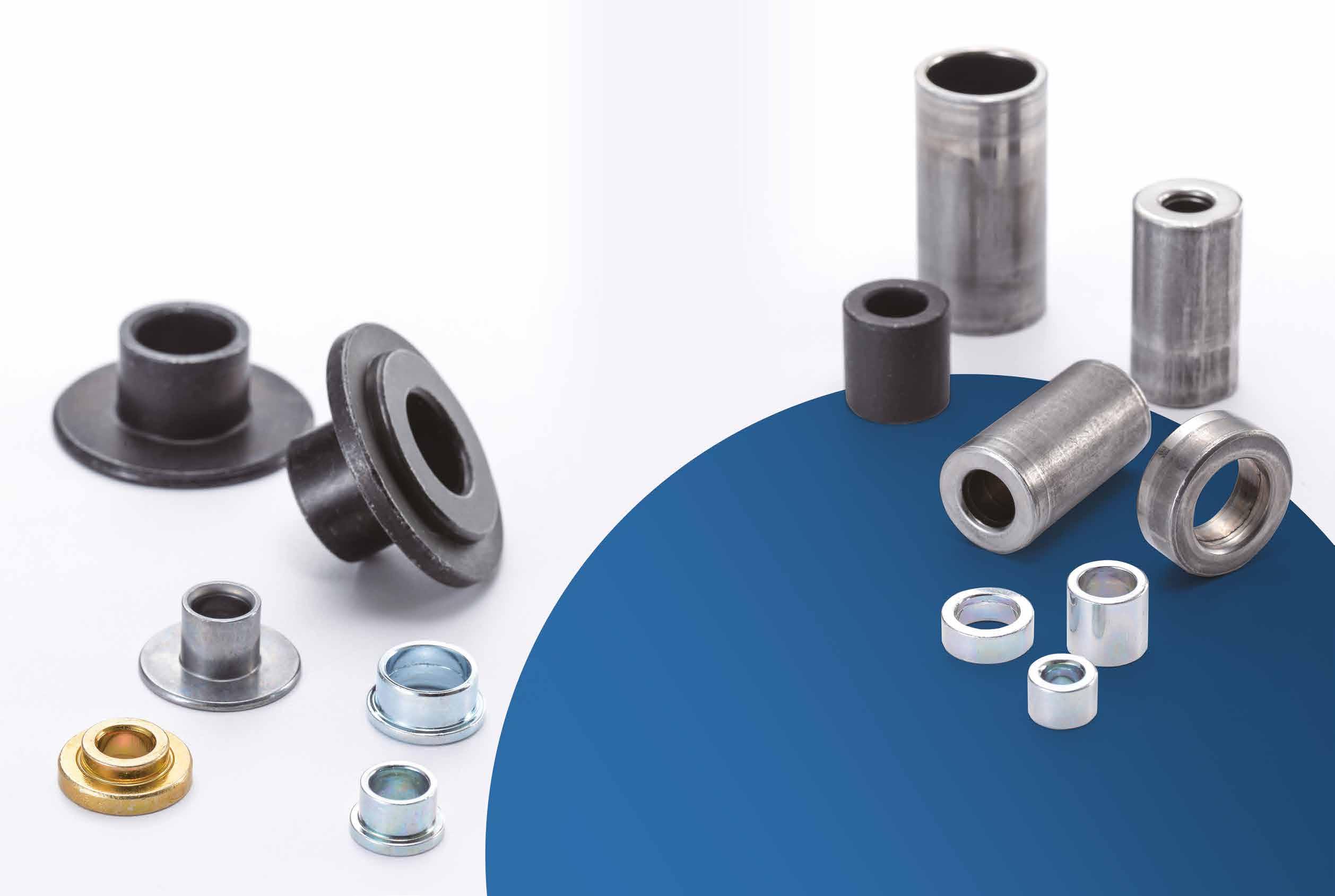

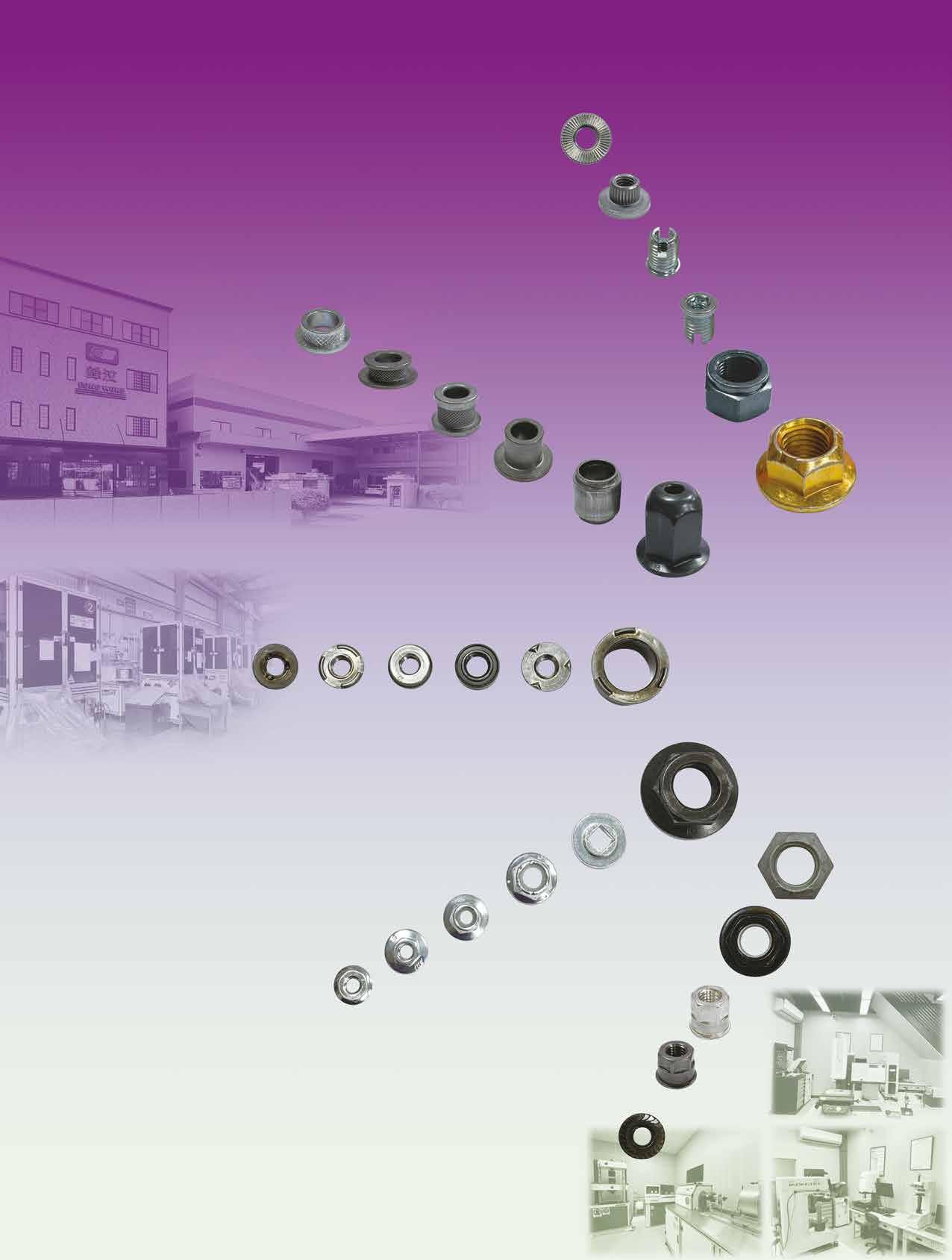

22 BI-MIRTH CORP.

Stainless Steel Screws, Chipboard Screws, Timber Screws...

265 BOLTINOX INDUSTRIAL CO., LTD.

Stainless Steel Solar Roof Hook, Hanger Bolts, Bolts, Nuts, Screws...

6 BOLTUN CORPORATION

Automotive Screws, Bushes, Conical Washer Nuts...

278 CHAN CHANGE MACHINERY CO., LTD. 長薔

Screw Head Machines, Bolt Former, High Performance Former...

243 CHANG BING ENTERPRISE CO., LTD. 彰濱

Hook Bolts, Holders / Hooks / Rings, Dowel Screws...

143 CHI NING COMPANY LTD. 旗林 Machine, Nuts, Tooling...

46 CHIAN YUNG CORPORATION 將運

SEMS Screws

312 CHIANG SHIN FASTENERS INDUSTRIES LTD. 強鑫

Flange Screws, Hexagon Head Bolts, Hexagon Head Cap Screws...

288 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財

Thread Rolling Machines

89 CHIN LIH HSING PRECISION ENTERPRISE (CLH) 金利興 Automotive Nuts, Brass Inserts, Bushes, Bushings...

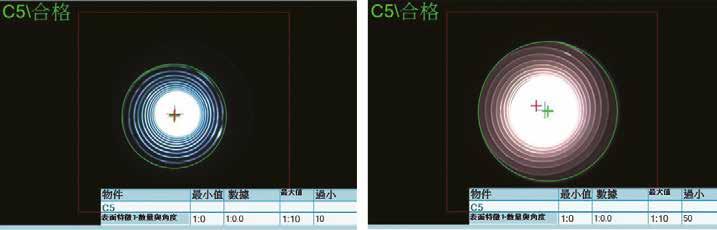

280 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛 Eddy Current Sorting Machines, Fastener Makers...

56 CHONG CHENG FASTENER CORP.

38

Cap Nuts, Coupling Nuts, Conical Washer Nuts...

CHUN YU WORKS & CO., LTD.

Drywall Screws, Socket Head Cap Screws , TC Bolt Sets...

253 CONTINENTAL PARAFUSOS S.A. 巴西商友暉

Automotive Part & Nut, Home Appliance Screws, Sems...

176 COPA FLANGE FASTENERS CORP.

98

Hex Nuts, Hex Flange Nuts, Combi Nuts, Weld Nuts...

CPC FASTENERS INTERNATIONAL CO., LTD.

Stainless Steel, Bi-metal Self-drilling Screws...

304 CYUAN HAO INDUSTRIAL CO., LTD.

Specialist of Fastener Dies, Hardware Fastener and Washers...

21 DA YANG ENTERPRISE CO., LTD.

Special Automotive Nuts, Special Weld Nuts...

106 DAR YU ENTERPRISE CO., LTD.

Chipboard Screws, Drywall Screws, Screw Nails…

158 DE HUI SCREW INDUSTRY CO., LTD.

Drywall Screws, Decking Screws, Self-drilling Screws, Roofing Screws...

238 DICHA FASTENERS MFG

Expansion Anchors, Sleeve Anchors, Nylon Nail Anchors...

DIING SEN FASTENERS INDUSTRIAL CO., LTD. 鼎

Chipboard Screws, Corrosion Resistant Screws...

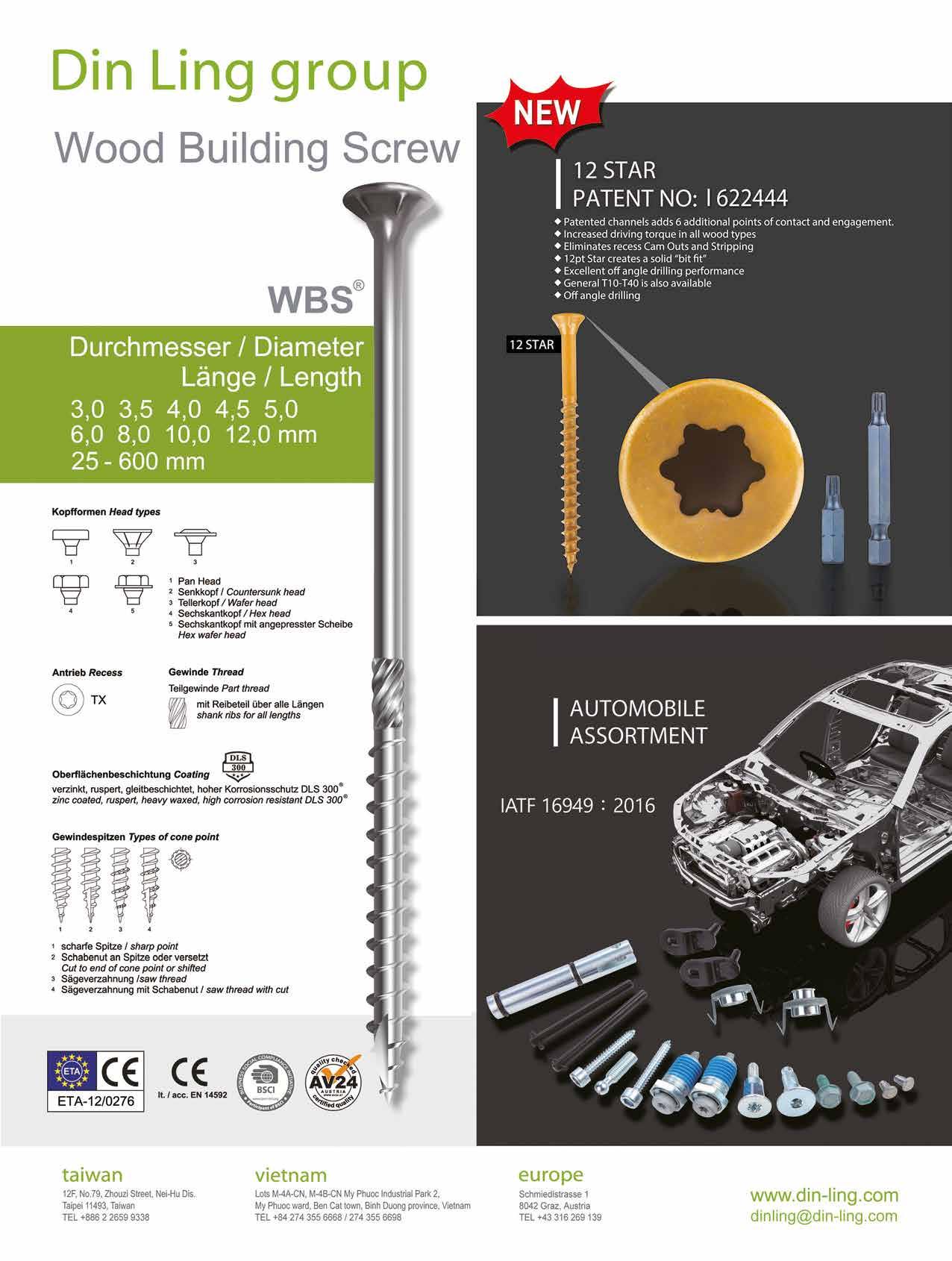

47 DIN LING CORP.

Chipboard Screws, Drywall Screws, Furniture Screws...

144 DRA-GOON FASTENERS CO., LTD. 丞曜

Chipboard Screws, Phillips Head Screws, TEK Screws...

42 DUNFA INTERNATIONAL CO., LTD.

Bushes, Spacers, Automotive Parts, Tubes, Turning Parts...

147 EASYLINK INDUSTRIAL CO., LTD.

Automotive Nuts, Thread Forming Screws...

211 EMEK RIVETS & FASTENERS CO. LTD. (Turkey)

Rivet Nuts, Spacers & Round Nuts, Tubular Rivets, Special Screws...

283 E-UNION FASTENER CO., LTD.

Conveyors, Thread Rolling Machines, Heading Machines...

119

62

2

FAITHFUL ENGINEERING PRODUCTS CO., LTD.

Anchors, Box Nails, Door/Window Accessories...

FALCON FASTENER CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

FANG SHENG SCREW CO., LTD.

Shoulder Bolts, Button Head Socket Cap Screws..

87 FASTENER JAMHER TAIWAN INC.

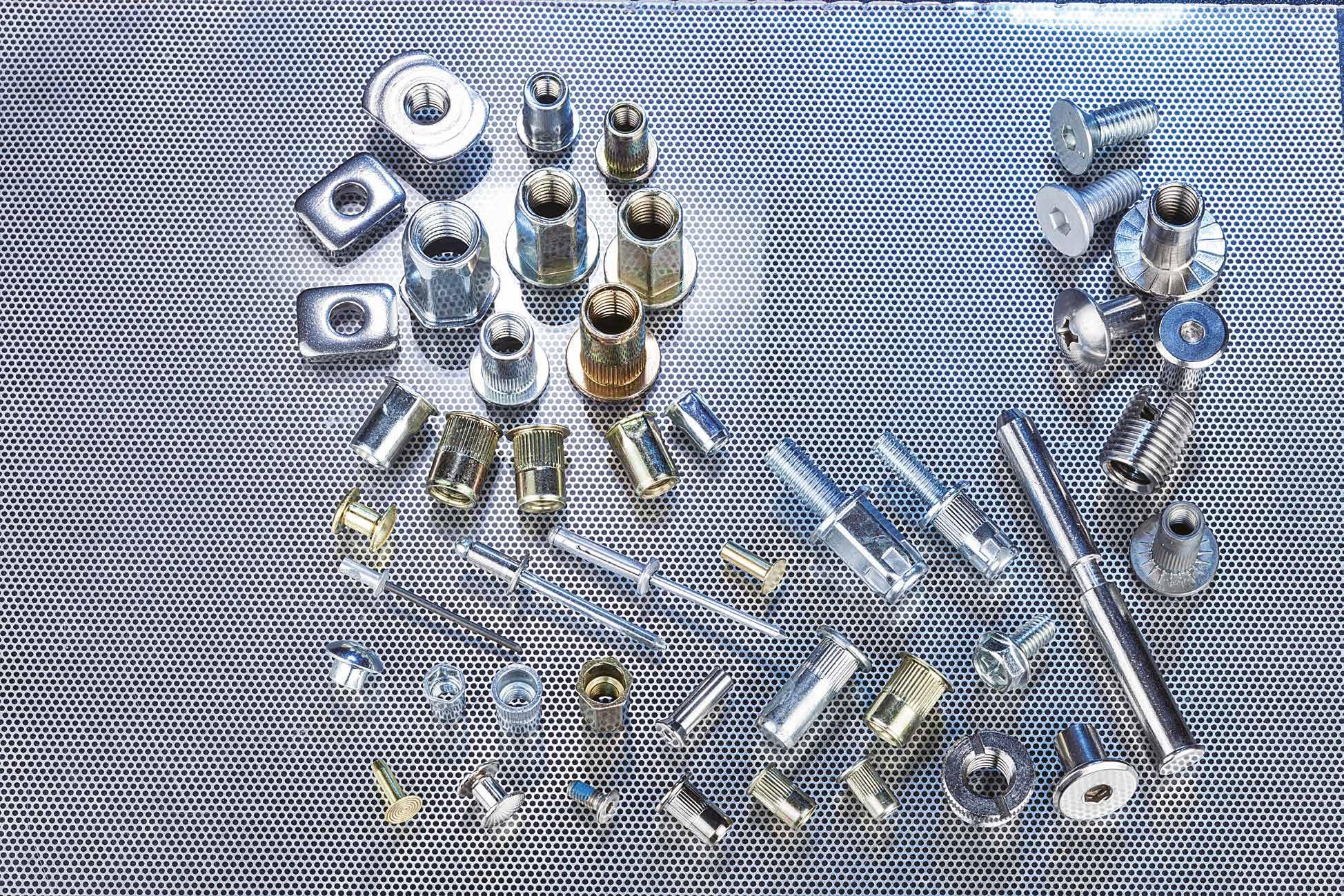

Automotive Nuts, Blind Nuts / Rivet Nuts, Bushings...

53 FASTNET CORP.

Dowel Pins, Flange Nuts, Weld Nuts, 4 Pronged T Nuts...

125

FILROX INDUSTRIAL CO., LTD.

Blind Nuts / Rivet Nuts, Tee or T Nuts, Blind Rivets...

84 FONG PREAN INDUSTRIAL CO., LTD.

Automotive Screws, Bi-metal Screws, Brass & Bronze Screws...

245 FONG WUNS CO., LTD.

Flange Nuts, Stainless Steel Nuts, Special Parts...

181 FONG YIEN INDUSTRIAL CO., LTD.

Eyebolts, Spindles...

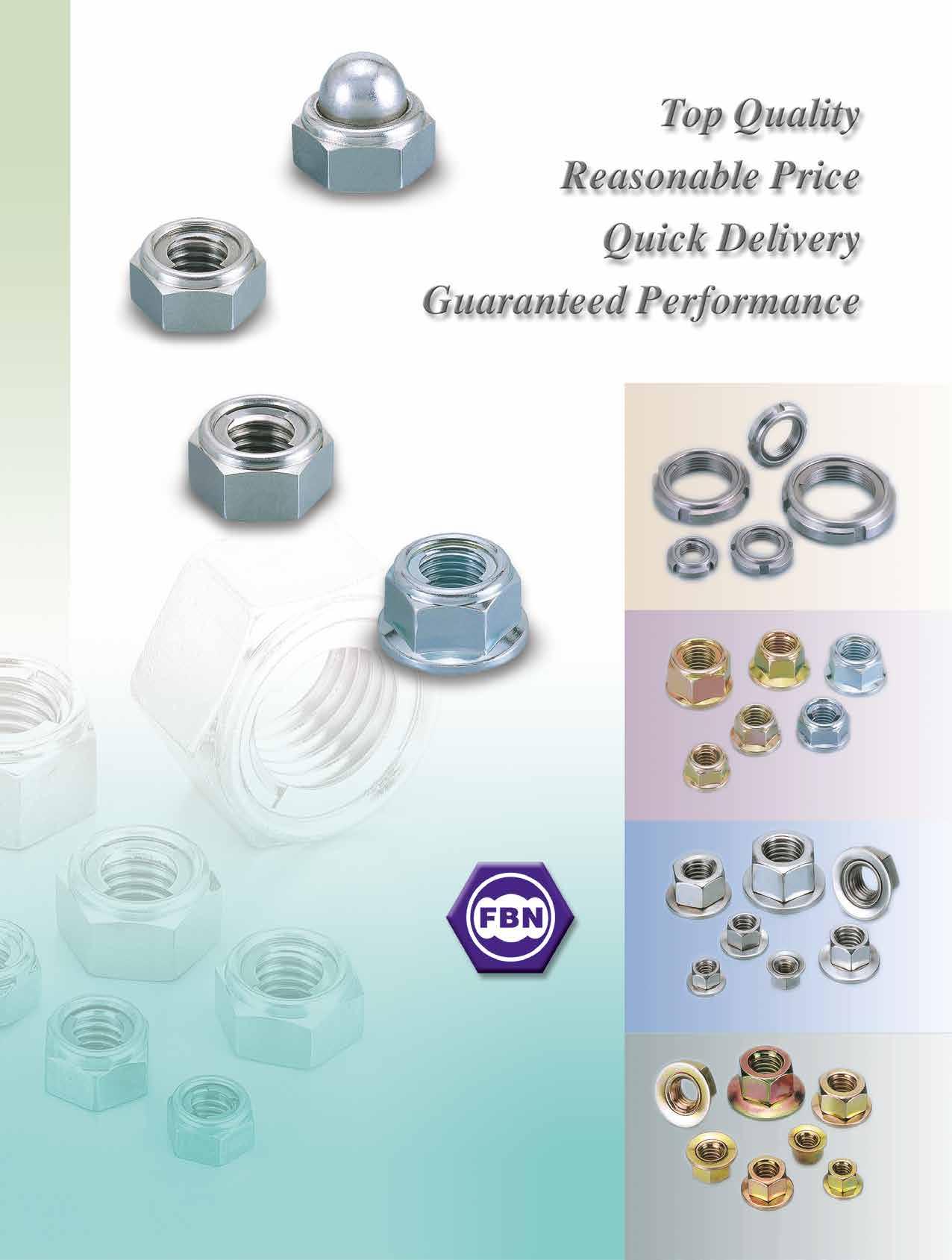

44 FORTUNE BRIGHT INDUSTRIAL CO., LTD.

Cap Nuts, Dome Nuts, Nylon Cap Insert Lock Nuts...

76 FU HUI SCREW INDUSTRY CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

150 FU KAI FASTENER ENTERPRISE CO., LTD.

Precision Electronic Screws, Special Screws, Weld Screws...

64 FUSHANG CO., LTD.

Carbon Steel Screws, Chipboard Screws, Concrete Screws...

285 GIAN-YEH INDUSTRIAL CO., LTD.

Rivet Dies, Self-drilling Screw Dies, Screw Tip Dies...

221 GINFA WORLD CO., LTD.

Chipboard Screws, Countersunk Screws, Drywall Screws...

108 GOFAST CO., LTD.

Open Die Parts, Stamping Parts, Assembly Parts...

301 GREENSLADE & COMPANY, INC. (U.S.A.)

Concentricity, Ring Gage, Plug Gage Calibration, Gages...

282 GWO LIAN MACHINERY INDUSTRY CO., LTD. 國聯

Handstand Type Wire Drawing Machines, Non-Stop Coilers...

107 HAO CHENG PLASTIC CO., LTD.

PP Boxes, PET Jars, ABS Boxes, PC Boxes..

219 HAUR FUNG ENTERPRISE CO., LTD. 豪舫

External Tooth Washers, Long Carriage Bolts, Roofing Bolts...

224 HEADER PLAN CO. INC.

Chipboard Screws, Collated Screws, Deck Screws...

205 HEY YO TECHNOLOGY CO., LTD

恆勇 Precision Pins, Rollers, Dowel Pins...

162 HISENER INDUSTRIAL CO., LTD.

海迅

Wood Construction Screws, Chipboard Screws, Drywall Screws...

102 HOME SOON ENTERPRISE CO., LTD.

宏舜 Bit, Bit Holder, Magnetic Nut Setter, Spring Nut Driver...

110 HOMN REEN ENTERPRISE CO., LTD.

Bi-metal Screw, Collated Screws, Composite Screws...

261 HSIEN SUN INDUSTRY CO., LTD.

Hexagon Nuts, Tubular Nuts, Spacers, All Kinds of Screws...

129 HSIN CHANG HARDWARE INDUSTRIAL CORP. 欣彰 Anchor Bolts, Anchors, Plastic Fasteners...

86 HSIN JUI HARDWARE ENTERPRISE CO., LTD.

Bushes, Construction Bolts, Special Cold / Hot Forming Parts...

229 HSIN YU SCREW ENTERPRISE CO., LTD.

Acme Screws, Hexagon Head Cap Screws...

40 HU PAO INDUSTRIES CO., LTD.

Automotive Nuts, Flange Nuts, Hexagon Nuts...

145 HWALLY PRODUCTS CO., LTD.

Drop-in Anchors, Chipboard Screws, Anchors...

287 INFINIX

195 iTAC LABORATORY CO., LTD.

Independent laboratory services for fastener tests

10 J.C. GRAND CORPORATION

All Kinds of Screws, Chipboard Screws...

31 JAU YEOU INDUSTRY CO., LTD.

Chipboard Screws, Drywall Screws, High Low Thread Screws...

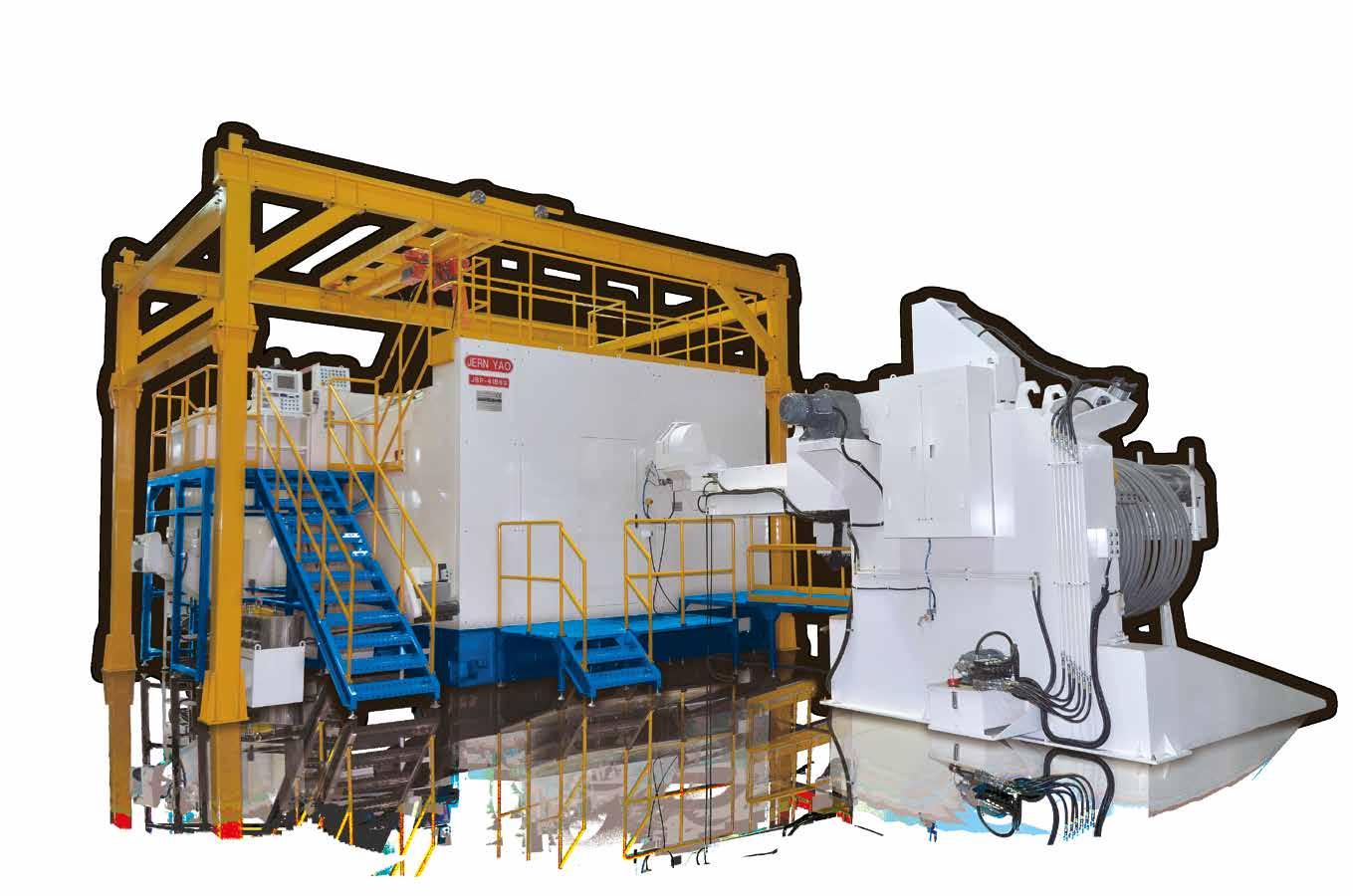

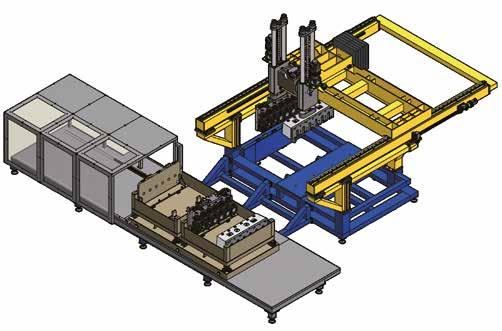

344 JERN YAO ENTERPRISES CO., LTD.

Multi-station Cold Forming, Parts Forming Machines...

41 JET FAST COMPANY LIMITED

Blind Nuts / Rivet Nuts, Aircraft & Aerospace Washers...

302 JIE LE MACHINERY CO., LTD.

捷仂 Consolidation of Artificial Intelligence Equipment

153 JIEN KUEN ENTERPRISE CO., LTD.

健坤 Hexagon Nuts, Nylon Cap Insert Lock Nuts, Square Nuts...

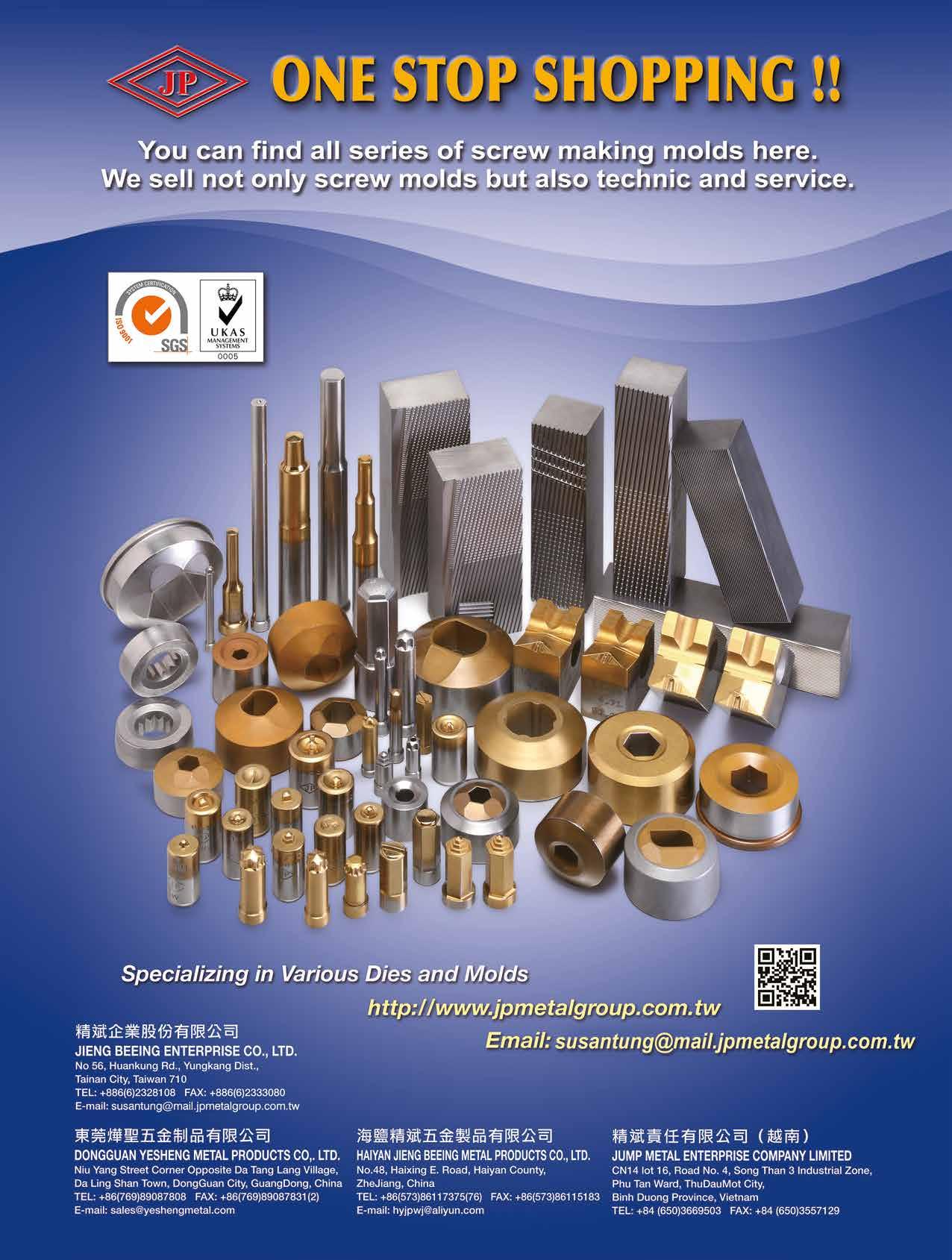

295 JIENG BEEING ENTERPRISE CO., LTD. 精斌 Forming Tool for Nut and Bolt, Dies, Molds...

140 JINGFONG INDUSTRY CO., LTD.

璟鋒 Hex Nylon Insert Lock Nuts, Wing Nuts with Nylon Insert...

148 JOINTECH FASTENERS INDUSTRIAL CO., LTD.

群創 Customized Parts, Bolts, Screws, Nuts, Automotive Parts...

61 JOKER INDUSTRIAL CO., LTD.

久可 Hollow Wall Anchors, Concrete Screws, Jack Nuts...

134 JUNGSHEN TECHNOLOGY CO., LTD. 榮燊 Bi-metal Screws, Automatic Welding & Automatic Inspection...

161 KAN GOOD ENTERPRISE CO., LTD.

鋼固 Fastener, Hardware, Plastic, Instruction Booklet Package in Bags...

247 KAO WAN BOLT INDUSTRIAL CO., LTD. 高旺 Hex Head Cap Screws, Carriage Bolts, Hex Lag Bolts...

146 KATSUHANA FASTENERS CORP.

濱井 Collated Screws, Drywall Screws, Roofing Screws...

321 KEY-USE INDUSTRIAL WORKS CO., LTD. 凱雍 Flanged Head Bolts, Milled Bolts, Rim Bolts, Round Head Bolts...

156 KING CENTURY GROUP CO., LTD.

慶宇 Drop-in Anchors, Self-drilling Anchors, Sleeve Anchors...

303 KING SHANG YUAN MACHINERY

金上源 Hydraulic Press for Lock Nut, Assembly

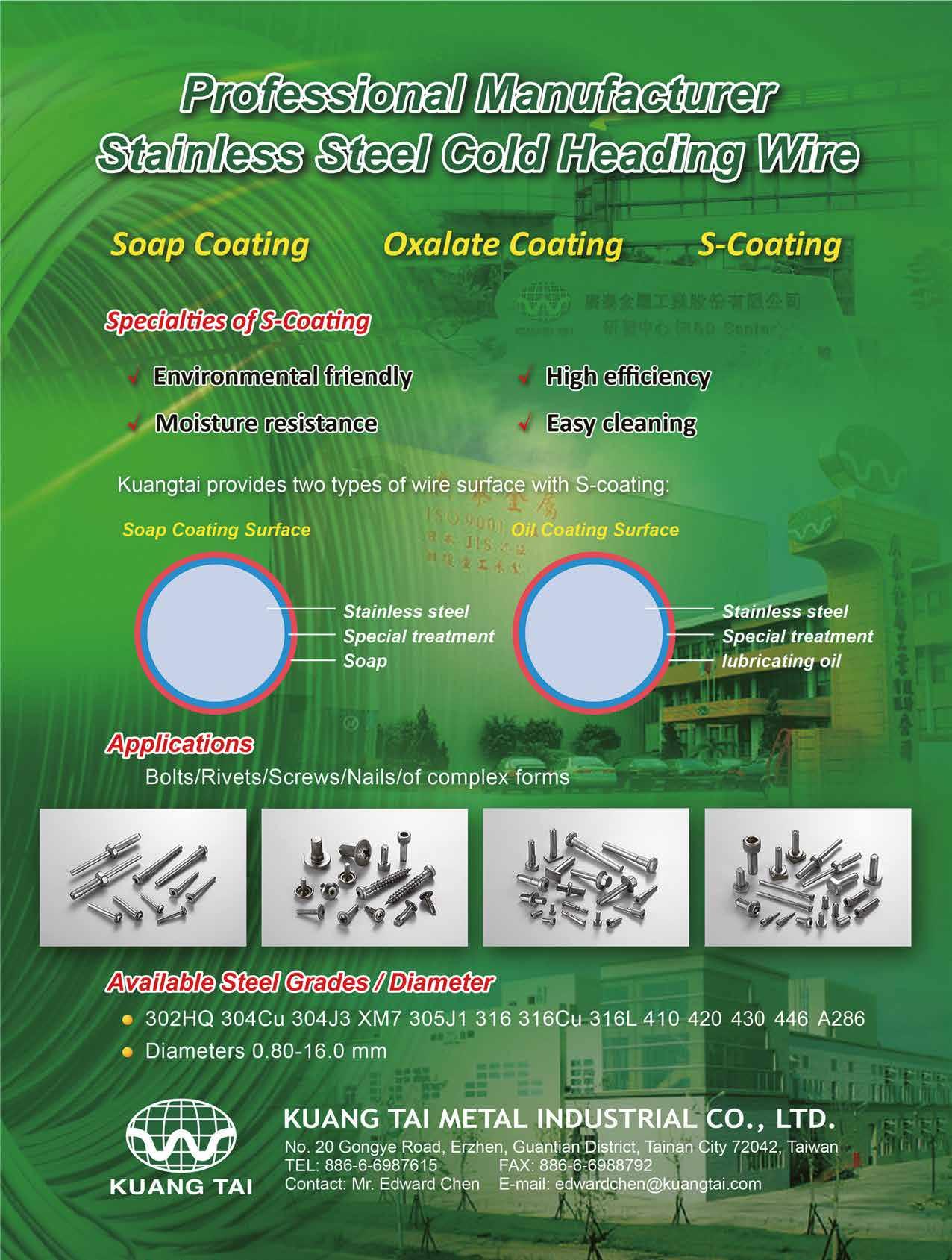

297 KUANG TAI METAL INDUSTRIAL CO., LTD.

Stainless Steel Cold Heading Wire

212 KUNTECH INTERNATIONAL CORP.

廣泰

鉅堃

All Kinds of Screws, Automotive & Motorcycle Special Screws / Bolts...

305 KUO CHEN MOLD CO., LTD.

國鎮 Self-Drilling Dies

206 KUOLIEN SCREW INDUSTRIAL CO., LTD.

國聯螺絲 Advanced Fastener

74 KWANTEX RESEARCH INC.

寬仕 Chipboard Screws, Wood Construction Screws, Deck Screws...

124 L & W FASTENERS COMPANY

金大鼎 Construction Fasteners, Flat Washers, Heavy Nuts...

189 LI YOU SCREW INDUSTRY CO., LTD.

立侑 Automotive / Sems / Nylock / CNC Machined Screws...

249 LIAN CHUAN SHING INTERNATIONAL CO., LTD.

連全興 Weld Nuts, Special Parts, Special Washers, Flat Washers...

338 LIAN SHYANG INDUSTRIES CO., LTD.

連翔 Nut Formers, Nut Tapping Machines

348 LINKWELL INDUSTRY CO., LTD.

All Kinds of Screws, Automotive & Motorcycle Special Screws...

20 LOCKSURE INC.

Custom Washers, Flat Washers, Automotive Screws...

順承

今湛

85 LONG THREAD FASTENERS CORP.

Bi-metal Self-drilling Screws, Chipboard Screws...

91 MAC PRECISION HARDWARE CO. 鑫瑞

Turning Parts, Precision Metal Parts, Cold Forged Nuts...

259 MACRO FASTENERS CORP. 宏觀

Multi-Station Screws, Nuts, Washers, Furniture Screws...

154 MAO CHUAN INDUSTRIAL CO., LTD. 貿詮

Professional Stamping Manufacturer

27 MASTER UNITED CORP. 永傑

Chipboard Screws, Drywall Screws, Furniture Screws...

66 MAUDLE INDUSTRIAL CO., LTD. 茂異

Button Head Socket Cap Screws, Flange Washer Head Screws...

232 MAXTOOL INDUSTRIAL CO., LTD.

Plastic Screws, Drop-in Anchors, Expansion Anchors...

136 METAL FASTENERS CO., LTD.

Thread Inserts, Self-Clinching Fasteners...

177 METECK ENTERPRISES CO., LTD.

Automotive Fasteners, Brass Screws (Bolts), Building Fasteners...

14 MIN HWEI ENTERPRISE CO., LTD.

Button Head Socket Cap Screws, Chipboard Screws...

133 MOUNTFASCO INC.

All Kinds of Screws, Alloy Steel Screws, Automotive Screws...

94 NCG TOOLS INDUSTRY CO., LTD. 昶彰

Tools for Fastening Anchors, Blind Nuts / Rivet Nuts...

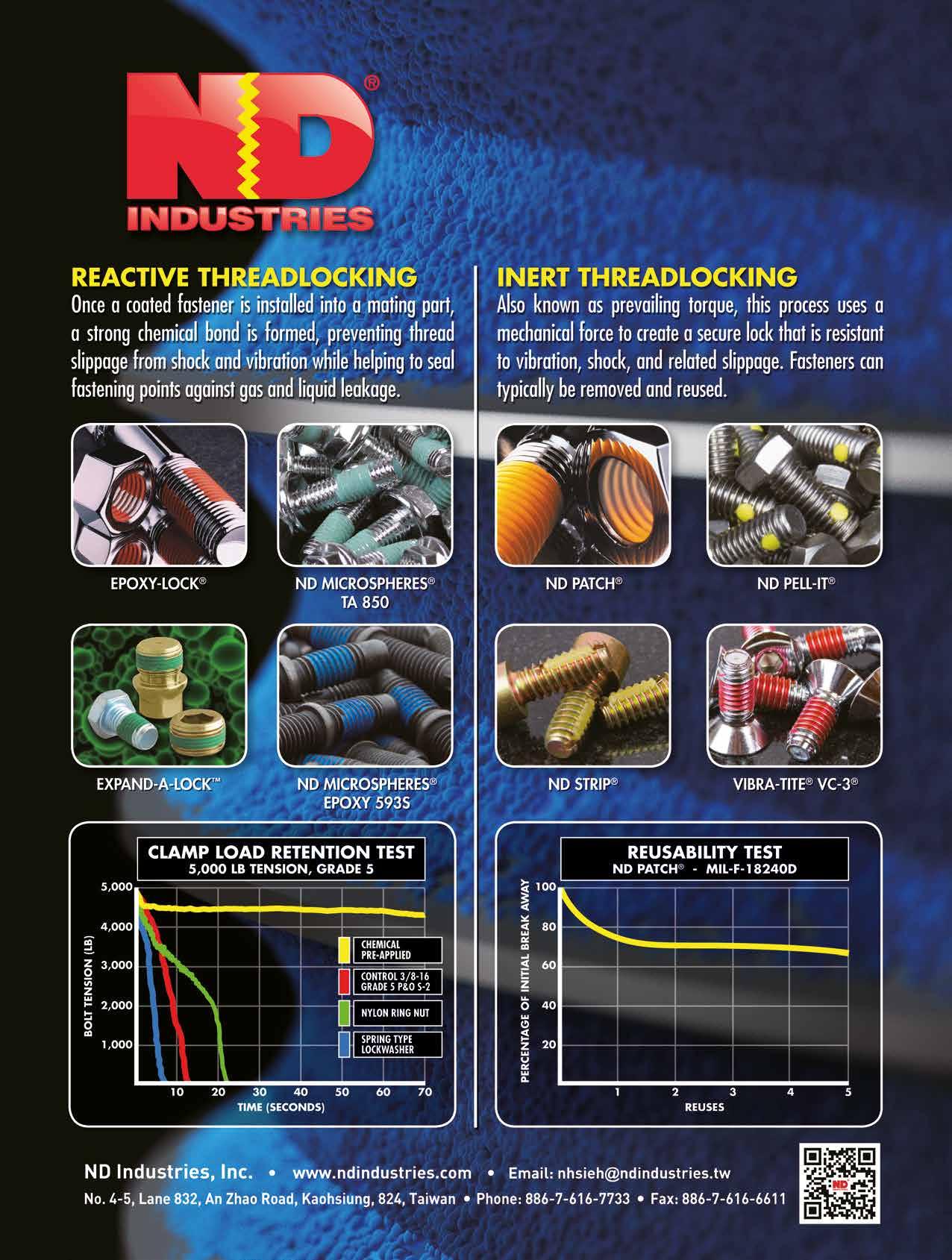

88 ND INDUSTRIES ASIA INC. 穩得

ND Pre-Applied Processes, Advanced Sealing Technologies...

291 NEW BEST WIRE INDUSTRIAL CO., LTD. 強新 Iron or Steel Wire Rod, Alloy Steel Wire & Rod, Stainless Steel Wire...

175 NOVA. FASTENER CO., LTD.

鑫星 Hexagon Nuts, Square Nuts, Wood Screws, Chipboard Screws...

171 PAKWELL CORPORATION

Bi-metal Screws

開懋

159 PEARSON INDUSTRIAL CO., LTD. 春郁

Automotive Cold Formed Parts, Self-Clinching Cold Formed Parts...

48 PENGTEH INDUSTRIAL CO., LTD.

SEMs Screws, Special Screws, Binder Screws, PT Screws...

彭特

109 PPG INDUSTRIES INTERNATIONAL INC. 美商必丕志

Chromium-free Coating, ED Coating...

173 PRO POWER CO., LTD.

Screws, Bolts...

123 PS FASTENERS PTE LTD. (Singapore) 汎昇

Washers, Socket Set Screws, U Bolts, Alloy Steel Screws...

142 QST INTERNATIONAL CORP. 恒耀國際

Hexagon Head Bolts, Square Head Bolts, Weld Bolts (Studs)...

103 RAY FU ENTERPRISE CO., LTD.

Construction Screws, Automotive Parts, Special Fasteners...

18 REXLEN CORP.

Clinch Nuts, Clinch Studs, CNC Parts, Stamped Parts...

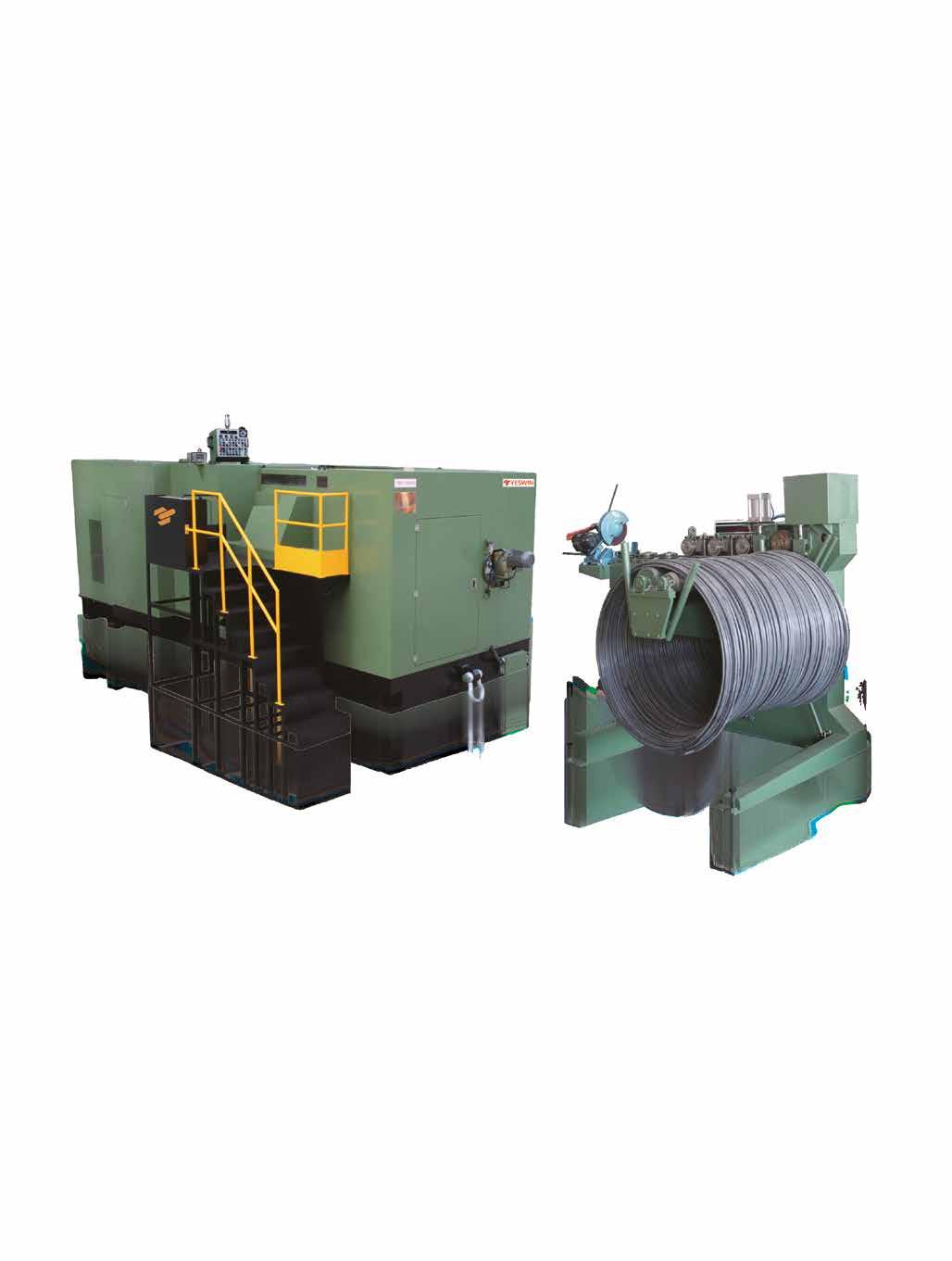

179 SACMA GROUP (Italy)

Net-Shape Parts Former

4 SAN SHING FASTECH CORP.

Automotive Nuts, Automotive Parts, Carbide Dies...

289 SAN SING SCREW FORMING MACHINES CO., LTD.

Cold Forging Bolt Formers, Thread Rolling Machines...

79 SCREWTECH INDUSTRY CO., LTD. 銳禾

Machined Parts, Thumb Screws, Micro Screws...

340 SEN CHANG INDUSTRIAL CO., LTD. 昇錩

Customized Special Screws / Bolts, Socket Head Cap Screws...

334 SHANGHAI FAST-FIX RIVET CORP.

137

Blind Rivets, High Shear Rivets, Closed End Rivets...

SHAW GUANG ENTERPRISE CO., LTD. 紹光

Cap Nuts, Conical Washer Nuts, Flange Nuts...

286 SHEEN TZAR CO., LTD. 新讚

Self-Drilling Screw Machines & Dies

272 SHEH FUNG SCREWS CO., LTD.

Chipboard Screws, Countersunk Screws, Wood Screws...

274 SHEH KAI PRECISION CO., LTD.

Bi-metal Concrete Screw Anchors, Bi-metal Screws...

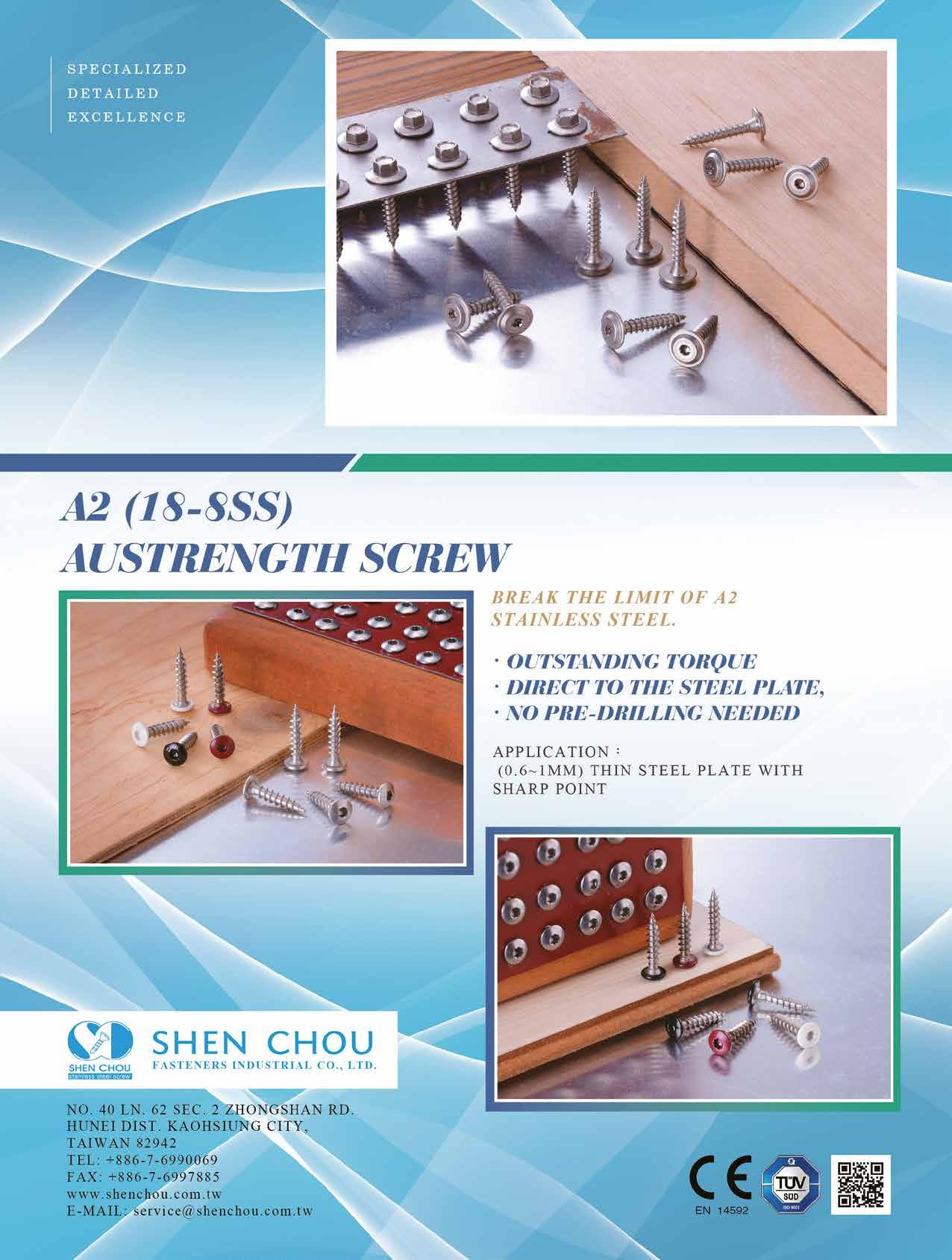

151 SHEN CHOU FASTENERS INDUSTRIAL CO., LTD.

Button Head Cap Screws, Chipboard Screws...

16 SHIH HSANG YWA INDUSTRIAL CO., LTD.

168

Flange Nuts, Flange Nylon Nuts With Washers...

SHIN CHUN ENTERPRISE CO., LTD.

Automotive Screws, Chipboard Screws, Customized Screws...

269 SHIN JAAN WORKS CO., LTD.

Flanged Head Bolts, Long Carriage Bolts, Round Head Bolts...

160 SHUENN CHANG FA ENTERPRISE CO., LTD.

Long Construction Fasteners and Other Modified Fasteners...

307 SHYEH MENNQ DEVELOPMENT CO., LTD. 偕盟

Screw Header Punch

170 SIN HONG HARDWARE PTE. LTD (Singapore) 新豐

Hexagon Nuts, Hexagon Head Bolts, Blind Rivets...

28 SPEC PRODUCTS CORP. 友鋮

Lincensee Fasteners, Turned/Machined Parts...

8 SPECIAL RIVETS CORP. 恆昭

Blind Nuts / Rivet Nuts, Blind Rivets, Air Riveters...

167 SPRING LAKE ENTERPRISE CO., LTD. 春澤 Chipboard Screws, Thread Forming Screws...

52

296

SUN CHEN FASTENERS INC.,

Cup Washers, Flanged Head Bolts, T-head or T-slot Bolts...

SUN FAME MANUFACTURING CO., LTD. 商匯 Shank Slotting Machines, Screw Point Cutting Machine...

183 SUN THROUGH INDUSTRIAL CO., LTD.

Bi-Metal Screws, Carbon Steel Screws, Stamped Parts...

113 SUNCO INDUSTRIES CO., LTD. (Japan)

Distributor Specializing in Fasteners

99 SUPER DPD CO., LTD.

All Kinds of Screws, Bi-metal Screws, Carbon Steel Screws...

45 SUPERIOR QUALITY FASTENER CO., LTD.

Weld Nuts, Turning Parts, Long Screws, Spring Nuts... 241 SUPREME FASTENER CORP.

Bolt & Screw, Special Fastener, Sems, Copper Bolt... 300 TAIEAG CORPORATION

Designed peripheral equipment suitable for fastener packaging

TAIWAN FASTENERS INTEGRATED SERVICE

Bolts, Screws, Nuts, Precise Mechanical Parts, Stampings... 292 TAIWAN INTERNATIONAL TOOL FORM LTD.

Nut Forming Dies, Parts Forming Dies, Bolt Forming Dies... 157

TAIWAN PRECISION FASTENER CO., LTD.

Drywall Screws, Wood Construction Screws, Roofing Screws...

100 TAIWAN SELF-LOCKING CO., LTD. (TSLG) 台灣耐落

Nylok®, Precote®, Nycote®, Nyplas®, Loctite®...

149 TAIWAN SHAN YIN INTERNATIONAL CO., LTD. 慶達

Bi-metal Self-drilling Screws, Chipboard Screws...

128 TANG AN ENTERPRISE CO., LTD. 鏜安

Customized Automotive Parts and Special Fasteners

36 THREAD INDUSTRIAL CO., LTD. 英德

Chipboard Screws, Flange Nuts, Heavy Nuts...

54 TONG HEER FASTENERS (THAILAND) CO., LTD.

Stainless Steel Metric Screws, Stainless Steel Screws...

54 TONG HEER FASTENERS CO., SDN. BHD (Malaysia)

Hex Bolts, Stud Bolts, Socket Cap Screws, Hex Nuts…

169 TONG HO SHING INTERNATIONAL CO., LTD. 桐和興

Hex Washer Head Screws, Indent Hex Head Screws...

12 TONG HWEI ENTERPRISE CO., LTD. 東徽

A2 Cap Screws, Button Head Socket Cap Screws...

55 TONG MING ENTERPRISE CO., LTD. 東明

Stainless Steel Fasteners, Wire Rods…

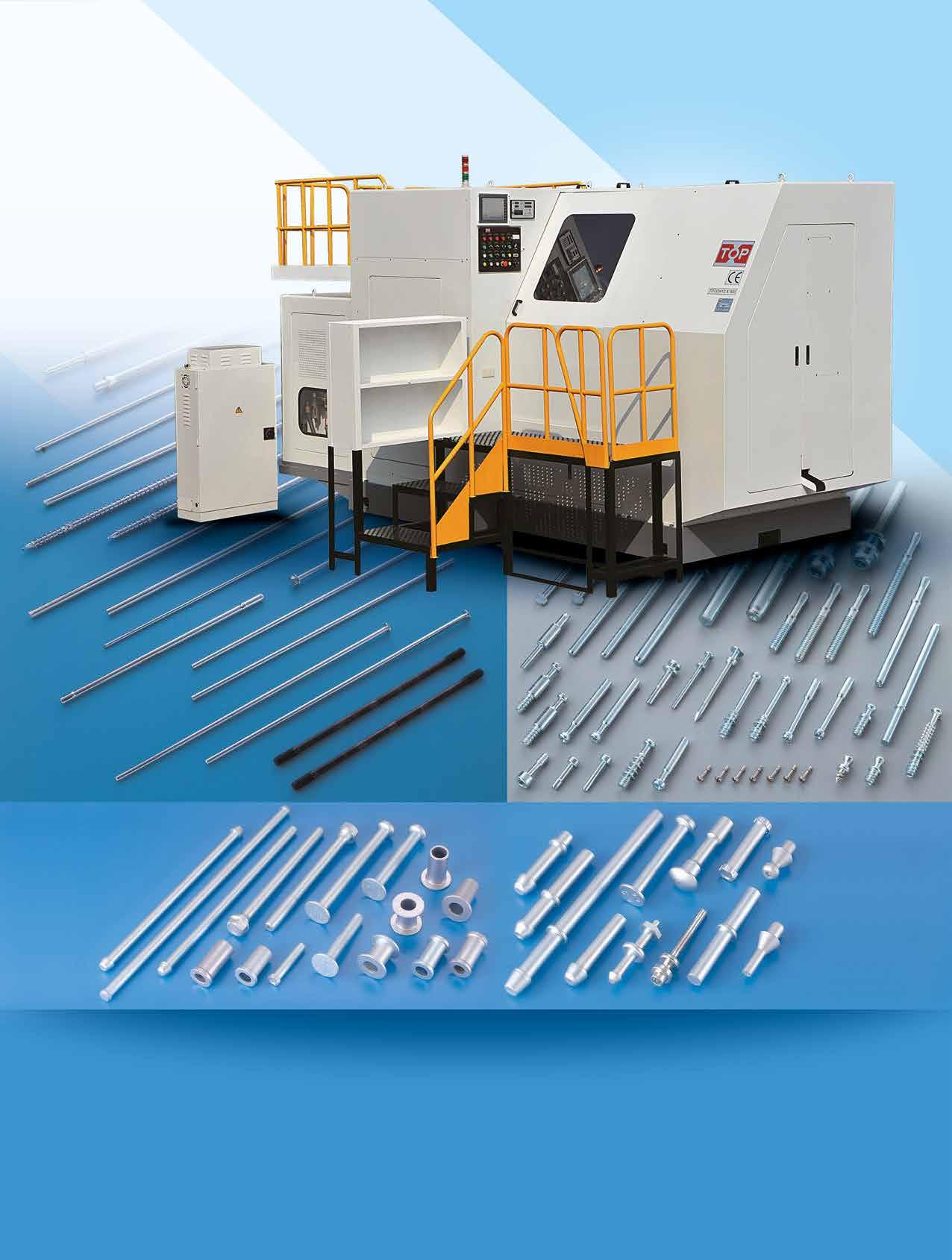

294 TOP STABILITY MACHINE INDUSTRY CO., LTD. 上穩

Thread Rolling Machine, Heading Machine, Nut Former...

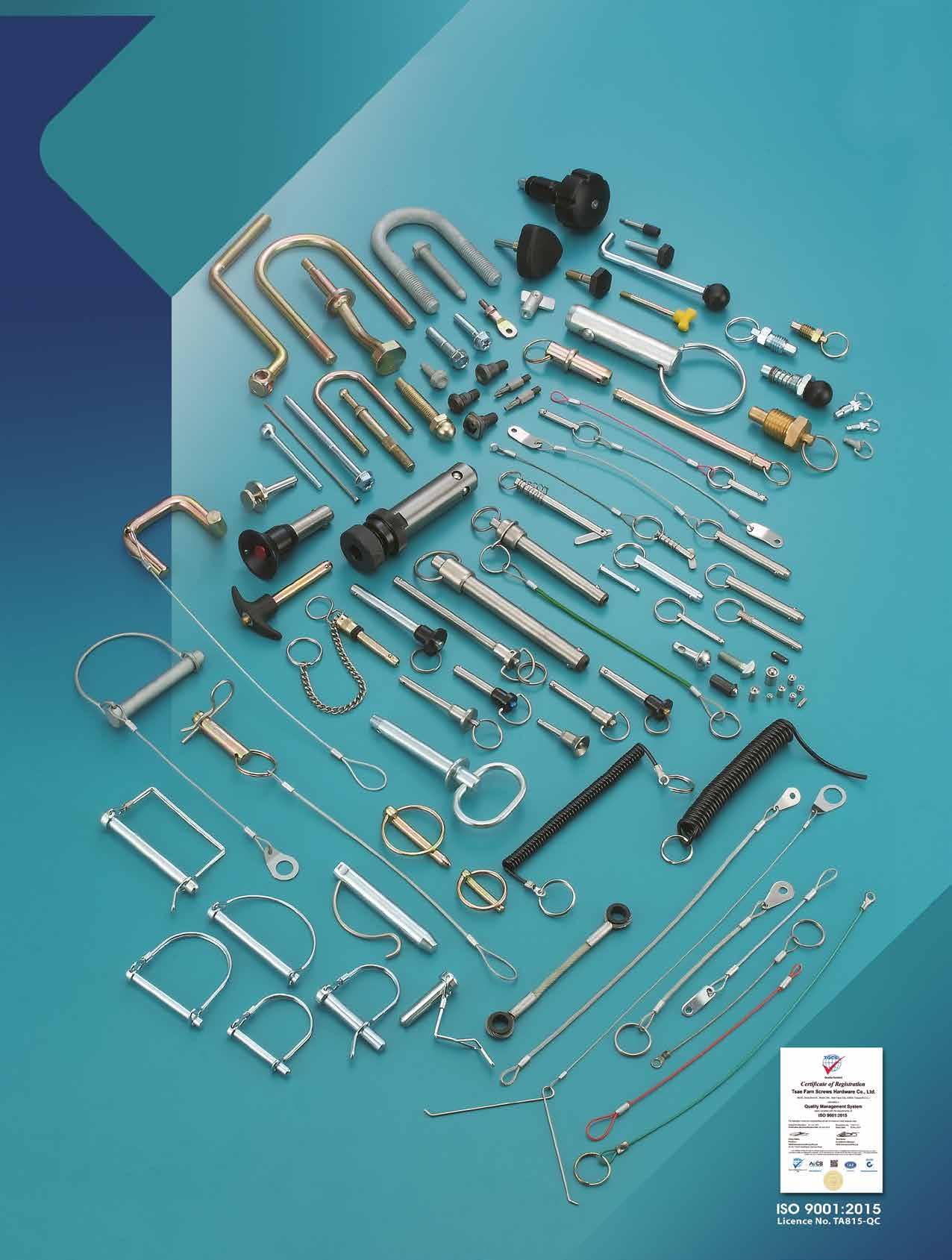

217 TSAE FARN SCREWS HARDWARE CO., LTD. 采凡

2 Cap Screws, Aircraft Nails, All Kinds of Screws...

138 TSIN YING METAL INDUSTRY CO., LTD. 晉英

Stainless Steel Cold Heading Wire, Oxalate Coating Wire...

299 TUNG FANG ACCURACY CO., LTD. 東鈁

Carbide Pins, Carbide Dies, Polygon R-type Punches, Square Punches...

284 TZE PING PRECISION MACHINERY CO., LTD. 智品

Open Die Machines, Cold Headers, Cold Forming Machines...

290 UNIPACK EQUIPMENT CO., LTD. 全立發

Packaging/Labelling/Palletizing Machines...

211 UNIVERSAL PRECISION SCREWS (India)

Dowel Pins and Shoulder Bolts...

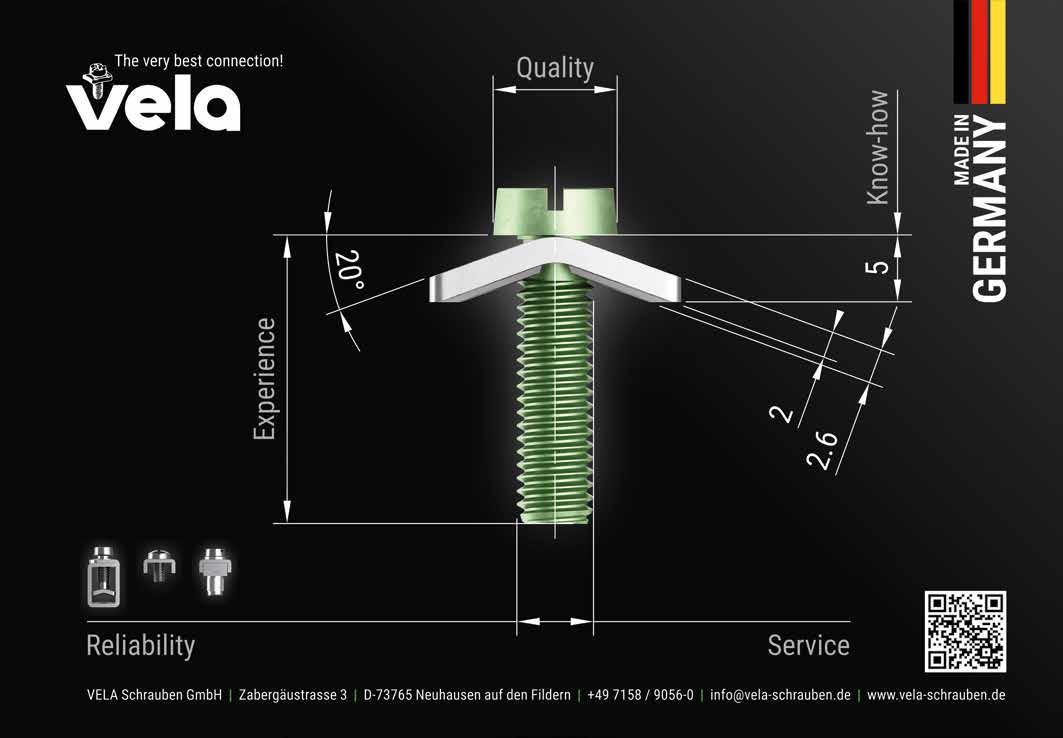

231 VELA SCHRAUBEN GMBH (Germany) Sems, Locking Teeth, Box Terminals, Earth Terminals...

121 VERTEX PRECISION INDUSTRIAL CORP. 緯紘 6 Cuts/ 8 Cuts Self Drilling Screws, Barrel Nuts, Cap Screws

208 WAN IUAN ENTERPRISE CO., LTD.

Punches/Dies of Various Nuts, Screws, Sleeves and Socket Boxes

58 WE POWER INDUSTRY CO., LTD.

Chipboard Screws, Concrete Screws, Drywall Screws...

130 WEIMENG METAL PRODUCTS CO., LTD.

Standard / Customized Parts, Machining Parts, Stamping Parts...

209 WEI-SHEN INDUSTRIAL FACTORY

Split Rivets, Bifurcated Rivets...

Steel Screws, Flange Bolts, Security Bolts, SEMS Screws...

WYSER INTERNATIONAL

97 YING YI CO., LTD.

Sems Parts, Special Nuts, Pressed Parts...

37 YOUR CHOICE FASTENERS & TOOLS CO., LTD. 太子 A2 Cap Screws, Bits & Bit Sets, Chipboard Screws...

342 YOW CHERN CO., LTD.

Flanged Head Bolts, Chipboard Screws, Floorboard Screws...

193 YU RUEN HARDWARE CO., LTD.

Automotive Fasteners, Customized Nuts, Special Screws or Bolts

63 YUH CHYANG HARDWARE INDUSTRIAL CO., LTD. 鈺強

Automotive & Motorcycle Special Screws / Bolts...

172 YUN CHAN INDUSTRY CO., LTD. 雍昌

Bits & Bit Sets, Hex Keys, Nut Setters, Wrench Sets...

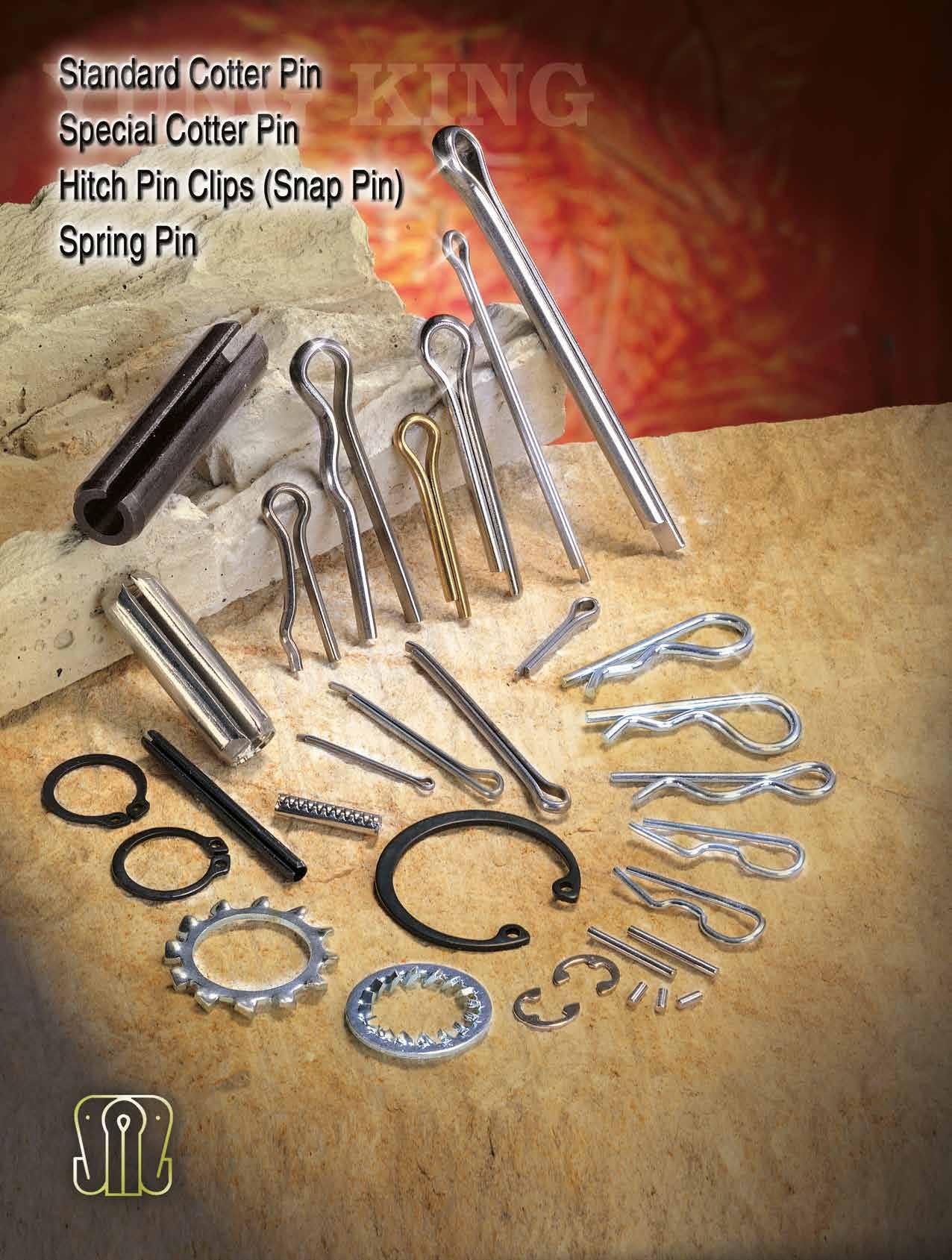

122 YUNG KING INDUSTRIES CO., LTD. 榮金 Dowel Pins, Roll Pins, Self-locking Pins, Cotter Pins, Split Pins...

117 ZYH YIN ENT. CO., LTD.

Euro Screws, Dowel Pins, Allen Keys, Confirmat Screws...

293 BIING FENG ENTERPRISE CO., LTD.

278 CHAN CHANGE MACHINERY CO., LTD.

288 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD.

280 CHING CHAN OPTICAL TECHNOLOGY CO., LTD.

283 E-UNION FASTENER CO., LTD.

301 GREENSLADE & COMPANY, INC. (U.S.A.)

282 GWO LIAN MACHINERY INDUSTRY CO., LTD.

344 JERN YAO ENTERPRISES CO., LTD. 正曜 302 JIE LE MACHINERY CO., LTD.

303 KING SHANG YUAN MACHINERY CO., LTD. 金上源

KUANG TAI METAL INDUSTRIAL CO., LTD. 廣泰 338 LIAN SHYANG INDUSTRIES CO., LTD.

291 NEW BEST WIRE INDUSTRIAL CO., LTD. 強新 179 SACMA GROUP (Italy)

289 SAN SING SCREW FORMING MACHINES CO., LTD.

SHEEN TZAR CO., LTD.

SUN FAME MANUFACTURING CO., LTD.

TAIEAG CORPORATION

TOP STABILITY MACHINE INDUSTRY CO., LTD.

TZE PING PRECISION MACHINERY CO., LTD.

UNIPACK EQUIPMENT CO., LTD.

YESWIN MACHINERY CO., LTD.

INFINIX PRECISION CORP.

In recent years, the fastener industry has experienced a remarkable transformation, driven by the increasing demand for sustainability and innovation. The industry is committed to reducing environmental impact and introducing new materials and technologies to meet the needs of an evolving market.

Fastening elements are key players that exponentially contribute to the success and longevity of projects in various sectors. These small elements play a crucial role not only in the design of structures and infrastructures, but also in terms of sustainability.

In a sector that every day faces a demand for greater ecological responsibility, related to products lifecycle, emissions reduction, and energy conservation, it is now essential to have concrete solutions. Additionally, numerous laws have been promulgated to address the longstanding issue of material disposal and its environmental impact.

In addition to a newfound attention for the fasteners sector from customers, partners and institutions, it is now a moral duty to adopt adequate measures to meet these needs. For these reasons, an increasing number of production plants are actively committed to improving their energy efficiency and ensuring emission reduction.

The future is an incredible adventure: Ambrovit at the forefront of sustainability and safety.

Ambrovit, a leading company in the fastening systems sector, is known for its constant search for innovative and sustainable solutions that can meet customer demands while maintaining the highest quality, in full compliance with current regulations.

Ambrovit catalog offers different safe and durable solutions for various materials, like screws for drywall, a versatile ductile material increasingly used for his high recyclability.

Ambrovit does not only support the use of sustainable materials, but it also offers a wide range of products, all strictly certified. Among the various certifications, mentions should be done for the renowned ISO 9001 standard, which guarantees high-quality standards and especially attests to the conformity of the company's management system.

Ambrovit also offers multiple treatments, aesthetic finishes and some special resistant treatments suitable for the most corrosive environments. All these products comply with specific European directives and / or regulations, therefore they are free from dangerous and carcinogenic components, guaranteeing and protecting the quality of life and the environment.

Recently, Ambrovit has launched a new website to improve the customer experience and facilitate access to information about their products and services. The company has also invested in avant-garde automated warehouses, Orion and Proxima, which represent a significant step towards more efficient logistics and waste reduction, contributing to the overall sustainability of the company.

Innovation does not stop here: Ambrovit has always been committed to communicating effectively and strategically with its customers through targeted communication campaigns and an active online and offline presence, informing and engaging the public about its sustainability and innovation initiatives and progress.

The future of materials in fastening is guided by sustainability and innovation, and companies like Ambrovit are demonstrating their commitment to these goals, with their proactive and future-oriented approach, they actively contribute to shape an eco-friendly fasteners industry.

Achilles Seibert works between distributors and manufacturers, and only sells to distributors, acting as an importer and a warehouse for distributors such a Bossard, Böllhoff, Würth, from big to small brand names and shops. “It’s like going to Costco for your daily supplies,” as Managing Director Timo Scholle put it, “and if you need or forget something to grab and you need it immediately, you’d go to Seven Eleven (convenience store) for quick purchase.” This year, they transcend themselves with a fullfledged expanded warehouse.

Copyright owned by Fastener World / Article by Dean Tseng

The expansion was completed last November. Now they have more space for pallets, with more high racks and a current capacity around 20,000 stock items, supported by a paperless document management system and 100% traceability back to the materials and records even as far as 3 years ago. “Now we can again deliver faster and better, because we don’t have any items in external warehouses anymore,” said Timo. He also has a new warehouse in Vietnam: “We have an employee there, so we can leave our goods there and always ship exactly what we and our customers need. Our incoming goods department doesn’t need to check the goods anymore.” The same goes with India: “We have an employee in India who manages quality for the goods. When the goods arrive in Germany, there is not much to work on, because it’s already been done in India.”

Timo thinks the biggest current challenge is the EU regulations such as CBAM. “Imports get more expensive, and it costs a lot of time to meet all requirements,” he said, who noted that “all transports also get more expensive because of higher road toll. It’s a challenge to keep good prices for customers, but we are always giving our best to keep the standards high.” “On another note,” he continued, “supply chain disruption has eased but now we have the next problems with the Red Sea and Suez Canal. Ships are sailing around the canal. Sea freight costs have risen immensely.”

Given those challenges, Achilles Seibert no longer just wants to sell fasteners, but also offers a service. They want to create added value for customers, including 24-hour fast delivery, delivery directly from their suppliers in 3-6 months, delivery from the Vietnam and India warehouses in 4-8 weeks. “Due to the geopolitical situation, we are spreading risks across several countries, paying attention to diversification and market spreading,” he added.

With CBAM, everything gets more expensive and consumes more time. The same goes with Achilles Seibert. “We are constantly striving to work better and more sustainably. We have installed photovoltaic systems and always pay attention to efficient transportation. We recycle packaging and strive to keep our ecological footprint very low with the use of EVs. We try to create an awareness of environmental issues among every employee,” he continued with advice for his suppliers: “Suppliers must ensure accurate and fast documentation. This will be very important for us in the future and can also be a selling point. Suppliers can call in external audit companies and get help with the documentation.” Looking ahead, he is ready to intensify ties with global suppliers.

Contact: Timo Scholle, Managing Director

Top-notch Japanese fastener trader Sunco Industries (hereinafter written as “Sunco”) has pushed its boundaries outside of Japan in recent years and transitioned into an international fastener trader, continuing to deepen partnership with Taiwanese fastener suppliers and fastener associations (TIFI also known as Taiwan Industrial Fasteners Institute, and TFTA as Taiwan Fastener Trading Association). Last May, Sunco President Mr. Yoshihide Okuyama visited Fastener World in person, right before he invited Fastener World general manager William Liao to the Sunco headquarters. On March 22 this year, the invitation came once again for Fastener World to participate in a large event in Japan held by Sunco.

Utilizing the three marketing channels (Magazine/Web Portal/Exhibition Exposure) of Fastener World, and thanks to the connections provided by TIFI and TFTA, Sunco is gaining traction in popularity both in Taiwan and across the world. While many readers have witnessed Sunco’s high-end logistics technology and the charisma of Japan-style management, you might not already know that this company, like many American and European companies do, has its own Suppliers Day, also known as “SUNCO-kai (General Assembly)”. This event is attended by over 100 supplier members each year and that alone shows the significance with Sunco in Japan fastener industry.

President Okuyama told Fastener World that SUNCO-kai began in 2006 and is held threes times a year, containing the General Assembly (Suppliers Day) (Photo 1) in March, the Quality Seminar in July, and the Yearend Party in November. “This assembly was founded to exchange technologies and build relationships among our supplier members. 13 new members enrolled in our list, add up to a total of 176 members, mainly Japanese manufacturers of or related to fasteners. We specially invited Fastener World to cover this event this year in hope for Fastener World to help us and our members deliver JIS standard fasteners to the whole world. The event provides a perfect opportunity for Japanese enterprises to learn about Fastener World Magazine and Taiwanese fastener suppliers it has reported on.”

The General Assembly was held at Hotel New Otani Osaka. The agenda was broken down into members’ voting, new members introduction, premium quality award ceremony, and dinner party.

Mr. Yasuhiro Nishi (of Nishi Seiko Co., Ltd., Photo 2), director of SUNCO-kai, gave an opening remark where he said Japanese enterprises are having a difficult time in lifting revenues and are troubled by shortage of components and labors, increased land price and other issues while trying hard to continue manufacturing. He suggested resorting to automation, information technology and digital transformation, which Sunco has already deployed investment in, and therefore he advised the members to seek experience and opinions from Sunco.

Following the director’s remark was President Okuyama (Photo 3), the lead character of the General Assembly, who reported that Sunco begins publishing its own Socket Boy Magazine (in English) to the world this year. (Editor’s note: Socket Boy is a mascot created by Sunco.) The Socket Boy Magazine introduces the latest updates of Sunco as well as cultural angles of Osaka and local enterprises. On another note, he reported that Sunco now provides 2.09 million types of products, an increase of 230 thousand types. He stated to continue to bring unique Japanese products to the whole world.

The General Assembly introduced Asia Giken, Kyoei Fastener, KFC, Suzaki, Daiki Mfg.(Daiki Manufacturing Co.,Ltd), Daiwa Denka, Tsukimori Kogyo, Nagasaka, Japan Power Fastening, Nihon Tokusyu Rasen Kogyo, Hoei Tekko, UNYTITE, and Bic Tool, including makers of hexagon bolts, self-drilling and selftapping screws, anchors, concrete screws, washers, electroplating, small screws and other products.

In the Premium Quality Award Ceremony, 9 suppliers (Photos 6 to 8) received Sunco High Quality Certificates from President Okuyama. Okuyama said this ceremony encourages members to supply high quality products and export Japan quality to the world via Sunco. With Fastener World’s coverage of this event, global readers will see these suppliers honored with the award.

After the ceremony, all members enjoyed dinner and exchanged views in a dinner party (Photos 9 to 11). Sunco invited the mayor of Higashiosaka City on stage who praised Sunco as the perfect export platform for Osaka to enter the world stage: “As a mayor, I witness the manufacturing power and progress of Osaka’s information technology. In recent years the Japanese government has been bringing enterprises to Southeast Asia, India and even Africa to set up factories. I observed apparent increased demand for Japanese high quality fasteners in these regions. Expo 2025 Osaka will be held next April and by then, delegations from Africa and other nations will come visit. Osaka will grasp this rare opportunity, and I’m very much anticipated that Sunco from Osaka will help send Japanese JIS fasteners to the world.”

Besides covering this event, Fastener World worked with Sunco to bring surprise for the members. A collaboration new to the fastener industry was reached before the event to make a logo sticker featuring Fastener World and Sunco (Photo 12). 200 copies of the latest Fastener World Magazines (Photo 13) with the sticker on the front cover was brought to the venue for the members to read (Photo 14). More than 40 members applied to get their hands on these magazines on the day of the event, said Sunco, which shows the level of interest by Japanese enterprises in the industry and company intelligence listed in the magazines. Sunco made preparations to carefully select members and sent out all the copies. After the General Assembly, Sunco arranged for a photoshoot of president Okuyama and main directors holding the Fastener World Magazines (Photo 16).

SUNCO-kai will have its quality seminar this July and yearend party on November 15. It is scheduled to be held again next year and the future potential is promising with Sunco going hand in hand with Fastener World on the world stage.

to go global”

Today the variety and the quantity of metal fasteners produced by cold forming of wire rod is impressive. Almost all of screws, bolts and nuts are made with that technology, but not only. The name of the process evokes itself the capacity to form a lot of special parts, solid or hollow, with a complex shape, to be used in the most important industry fields, automotive first. The cold forming is not anymore the simple heading of its debuts in the early fifties. By sophisticated multiple die presses, dedicated materials, accurate tooling, it becomes possible to produce parts that only few decades ago no one could imagine obtaining from wire. If we add the advantages coming from a high productivity, optimal use of raw material, consistency of precision, the success and the spread of this technology appears logical and motivated. There is another important point in favour, especially these days. I mean about his intrinsic sustainability, derived from the modest energy intake and the minimal scrap rate.

InSacma, we are always working to build, in a sustainable way, sustainable machines for the most sustainable technology. To do that, we chose solutions requiring low energy consumption, we increase own production of renewable energy, and we select accordingly our supply chain. The core activity of SACMA Group is to design and build machinery for cold forming process, a complete line of presses and rollers to fulfil the needs of the modern industry, including ancillary equipment and machines for secondary operations. Our mission is to offer to the producers of cold formed parts the best possible equipment with effective solutions, keeping at the same time the wellknown robustness and reliability of Sacma machines.

Looking to the most innovative solutions recently introduced, I would like to start with the mechatronics application. In our machines there are more and more functions activated by servomotors: wire feeder, stock gage, die kick out, transfer, starter… The purpose is to make easier, intuitive and quicker set-up of the machine, with more safety for the operator, because reducing their manual interventions, allowing to activate and control the operations directly by HMI. We started to introduce those functions in the bigger sizes of presses, where the advantage for the operators is more consistent, and gradually we are implementing also in the small machines. Ever focusing the user’s needs and the work environment, we re-designed the machine cabins, integrating inside them all the items, like the main motor and the lubrication unit, which were previously external. The result of this activity is a more compact machine, less floor consuming and emitting a lower noise level. Also, any oil dropping is eliminated, to keep clean and healthy the work room. We also improved the ergonomics with more comfortable doors and internal spaces for the interventions. The action plan is already in progress, with the target to fit all the machine models within the next year. Coming now to functions more connected with the cold forming, Sacma continues to develop and to propose solutions which scope is to enlarge the potential of this technology.

It’s known that complicate parts made with alloyed steels cannot be formed in one shot, even through more forming stations. The material, stressed by a too high

deformation rate, starts to crack. To avoid that, must proceed with an intermediate heat treatment to regenerate the metallographic structure. The production process becomes articulated and involving more machines. Sacma introduces the re-feeding equipment, allowing to apply the two steps process in the same machine, at the same time. Another solution for extended deformation sequences is the device for feeding preformed parts in the cut off station. By that, having a 6 die press, it should be possible to execute a deformation in 12 steps, with an annealing/coating operation in between. All done starting from a standard machine.

Inoptics to extend the borders of cold forming, SACMA is constantly involved to improve own WF machines. The warm forming technology is very near to the cold forming: same base machines, same concept of tools, only a special equipment, making them suitable to work at the temperature enlarging the deformability of difficult materials, like stainless steels, titanium alloys and nickel superalloys. Sacma recently presented a complete line of WF part formers, split in different model according to the operating temperature: WF300, WF500 and WF900, to work respectively up to 300°C, up to 500°C and up to 900°C, based on the parts and the materials to be produced. The program predicts all the machine sizes and, thanks to the Sacma Modular Design Concept all the machine models could be involved. Also, Ingramatic offers a complete line of WF rollers, for threading aerospace fasteners.

Aninteresting function could be integrated in all our machines is the thermoregulation of the die box and the cooling oil tank. When the tolerances of the part become tight, a stable temperature of tools and coolant is the priority. The TR unit is positioned nearby the machine, to heat up the die box and the oil at machine start. Afterwards, during the production, it cools down, keeping them inside the desired range of temperature. Thermoregulation means precision and consistent reduction of NC parts. That function can be implemented in the WF machines, and it is effective for the cold formers, too.

The combined machines are for SACMA a key product, since the first one, an SP27 still active at our Italian customer, left the Limbiate factory in 1974, something like 50 years ago. All in one production centre, including forming, pointing and thread rolling. One single machine, compact layout, quick plug in, sealed. One main motor moving all the units, high efficiency and energy recovering. The most effective and sustainable solution to produce threaded fasteners and not only. Those machines, suitable for products in the range from M3 to M24, are constantly innovated and improved by our engineers, focusing the easy use, the quick tool change and the energy consumption. Already in catalogue we have the SP59, in two versions, normal and short stroke. She’s a 6 die combined press, extending the range of products to the more complicated special parts. In the next period we will present the SP39 and following also the SP29. Considering that the WF equipment should be available, the flexibility in terms of feasible products becomes without comparison. Always on the subject of combined machines, Sacma is proposing the new KSP12, a fully re-designed successor of the iconic KSP11, an 1D2B header with thread rolling, suitable for production of screws, selftapping and metric, from diameter 3 to 8mm. The machine was enthusiastically accepted by our loyal customers and by new, too. The world preview occurred during the last Wire Düesseldorf, and the next step is to present a new version for ultra short and small head screws.

Being aware that the best machine to squeeze high performance needs the best tools, Sacma introduced recently for own customers the S-Tooling activity. In a structural way, we created a department, where skilled and experienced engineers develop and design the tools for new complex parts inquired by the market. They are supported by the most up to date and innovative instruments for the FEM simulation, to issue the perfect deformation sequence and the construction drawings of each tool. The successful feedback we are receiving from our customers is encouraging us to increase the capacity of this department with new hardware and resources.

theme dear to us is the service after market: technical assistance and spare parts, to keep the machines always in the best condition. Our products are designed and built to be durable, and our customers are expecting a long productive life. The availability of spares, even for machines born 40 years ago and more, is crucial. We are prepared with a large inventory in our warehouse of parts, ready to be delivered, minimizing the machine downtimes. All our branches and agencies, beyond the commercial activity, can give technical assistance. In the Limbiate HQ, we are boosting up the service with young resources and new structures.

Tofulfil the requirements of Industry 4.0, Sacma is offering different packages to implement the machine data, at increasing levels, inside the network of the customer. Moreover, we started to investigate in the AI fields how to obtain additional information from those figures and how to make quick and useful for operators the instructions for setup and ordinary maintenance. As soon as ready, we will open to the market.

Last new, Sacma presents end of February, at the IWA Show in Nuerberg, the presses and rollers of the S-AMTEC line, special machines dedicated to the production of metal components for light munitioning. 85 years from his foundation, Sacma Group strives, day by day, to improve with innovation own products, not only the Sacma presses and the Ingramatic rollers, but also the feeding and unloading equipment of Tecno Lift and the tapping and turning machines of HS Aspe. We are always looking forward how to offer to our customers of the fasteners and cold forming industry a wider range of machines and services, making them more successful in the global competition. Of course, we do that because it’s our business, but especially because of the passion pushing us: we love to build top class machines and we like to see the satisfaction of our customers.

Sun Through Industrial is recognized by the industry as a professional manufacturer of self-tapping/drilling screws, high strength bolts, drywall screws, chipboard screws, etc., with strong customization capability, continuous development of new construction fasteners, and innovation & quality on par with int’l standards. Always serving from the technology-based perspective, Sun Through can provide more cost-effective fastening solutions for customers with more difficult or complex product requirements. Not only is it a key partner for many European and U.S. customers seeking customized services, but it has also created a unique competitive advantage by staying ahead of competitors.

Spiral-type self-drilling screws, bi-metal screws, and high strength bolts are Sun Through's most competitive products and have been proven by customers to significantly improve technical and operational issues in real-world applications.

The main carbon steel or bi-metal spiral-type self-drilling screws feature faster iron scrap discharge, allowing users to easily penetrate steel plates up to 30mm thick. These products are available in sizes as small as 5.5mm and as large as 8mm and in lengths ranging from 50-350mm. The superior tapping performance provides customers with additional options, and products with a thickness of 8 mm can replace conventional structural bolts. “Our spiral-type self-drilling screws are more difficult to make than ordinary ones. We are also one of the few manufacturers that can satisfy customers’ needs of tapping thicker plates," said Sun Through. Considering the increasing market demand for bi-metal screws, Sun Through has also made indepth improvements to the critical welding process, making the strength of welded joints not only better than the laboratory requirements but can even be twisted and bent, which once and for all solves the problem of insufficient torsion when customers are using long screws for board tapping and are also subjected to gravitational loads. Sun Through has also successfully developed a Gr. 14.9 screw, which has a fatigue life 50% more than that of 12.9 screws. The feature of no brittle fracture has allowed it to enter the supply chain of U.S. EV and European heavy motorcycle & machine manufacturers.

Recently, Sun Through has announced that it will be releasing self-drilling screws for hollow cement bricks, which will be officially revealed at this year's Taiwan International Fastener Show (Fastener Taiwan). The traditional self-drilling screws for hollow cement bricks require drilling holes and using screws to complete fastening. In addition to the complexity of the workmanship and tools required, the diameters of holes and sizes of screws must also be taken into account, but this new product from Sun Through can directly tap into the wall, greatly saving users’ fastening time and effort.

In response to the global trend of carbon reduction, Sun Through has been conducting its carbon inventory and expects to make comprehensive improvements to the more energy-consuming heat treatments in manufacturing. Simultaneously tapping into the construction and automotive markets, Sun Through will also work with customers to develop fasteners for concrete materials related applications, and conduct management upgrades in response to PPAP requirements. "PPAP is a basic requirement for entering the automotive market, and we’ll do a good job of management upgrades in order to prepare for entry into the higher-end market. We sincerely invite you to visit our booth during Fastener Taiwan," said Sun Through.

Copyrightowned by Fastener World

Article by Gang Hao Chang, Vice Editor-in-Chief

During the decades of development of Taiwan fastener industry, there are many fastener companies with great int’l reputation, and when it comes to manufacturing of socket screws, the most well-known – YFS Fang Sheng Screw definitely must be mentioned. It can supply tens of thousands of screw specifications ranging from the smallest size of M1.4 with the length of 2mm to M60 with the length of 500-600mm.

The "YFS" brand, which is marketed all over the world and widely adopted by the industry, has not only been the only choice for many customers to purchase high-quality and durable socket screws for years, but also is one of the few Taiwanese self-owned fastener brands that has successfully tapped into the supply chain of the global market.

Since its establishment in 1978, YFS Fang Sheng has been focusing on socket screw manufacturing technology and process, and has accumulated a wealth of experience in product development. Although Fang Sheng's socket screws have gained a leading presence in Taiwan and int’l markets, the challenges ahead are bound to be even more severe.

Therefore, the 2nd generation management team has gradually expanded the product lineup to special products and automotive parts related fields for years, in order to create a new stage for Fang Sheng's business in the next 1 or 2 decades.

YFS Fang Sheng's expansion from socket screws to special products didn’t just start now. As early as more than 2 decades ago, when many Taiwanese fastener manufacturers started to set up factories overseas in order to win over better market competitiveness, indirectly supporting overseas factories to produce low/medium carbon steel screws and gradually taking some market share of Taiwanese manufacturers, Fang Sheng had foreseen the future market changes and planned for transformation in advance. As a result, the 2nd generation management team started to coordinate and plan the investment and deployment in the field of special products in terms of technology, equipment, talents, information integration and market customers.

"We made lots of preparations to enter the field of special products. Since 2005, we’ve been cultivating our technical talents, and started to plan for a new plant in 2010 and invested in hundreds of production machines to prepare for the subsequent demand of the special products market. It is understood that Fang Sheng's capacity has doubled and the proportion of socket screws and special products is 50%/50%, proving that its mature technique and product quality have been recognized by customers.

Therefore, despite the fierce competition, with our high quality products still creating significant differentiation, many customers continue to work with YFS Fang Sheng to create a win-win situation,” said the new generation Fang Sheng management team.

With sufficient talents, technology and equipment, Fang Sheng is capable of producing special products for various fields (e.g., machinery, bicycle, automobile/motorbike, heavy industry, customization), especially the orders from T1/T2 customers in the automotive industry account for about 80% of its special products sales. With the prospect of a booming automotive market in

Europe, USA, and China as well as growing demand in the midto-high-end market, YFS Fang Sheng's development opportunities in special products will be further enhanced. In addition to automotive applications, Fang Sheng Screw has also stood out among several European manufacturers and has been chosen by German ICE as its supplier, further proving the high quality and reliability of its products. In the high-end market, quality is always the key to winning customers' trust and continuous cooperation.

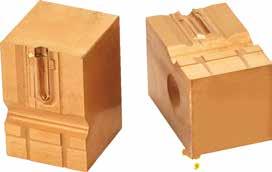

In order to improve the manufacturing efficiency of customized products, Fang Sheng established an R&D division in 2010, focusing on the design and development of dies and processes. Through self-development and in-depth understanding of raw material characteristics and manufacturing processes, Fang Sheng is able to flexibly adjust parameters such as pickling, wire drawing, spheroidizing, cold heading, thread rolling and head treatment to establish an integrated QC system from raw materials to finished products.

"Introducing in-house die development is the most challenging part of the transformation. In the past when there was no independent die development, technicians had to rush about between the die processing room and the factory to have in-depth discussions with operators, so working overtime until 9-10 o'clock at night was usually heard, but the results were still unsatisfactory, and we’ve even heard of the dilemma of a counterpart being unable to develop a screw in 3 months. Therefore, after the establishment of the R&D division, we adopted the training mode of "1 for 2" and "2 for 4" in order to cultivate more seed coaches to accumulate our technical momentum for special products manufacturing. Thanks to the establishment of the R&D division, the efficiency of our manufacturing process and quality control have been significantly improved," said Fang Sheng's 2nd generation management team.

Fang Sheng contact: Vice General Manager Jason Tsai

Email: sales@mail.yfs.com.tw

Fang Sheng’s 2nd generation management team has accumulated 10~20+ years of production management experience within the company before officially taking over the management role, and has also inherited valuable management concepts from the 1st generation management.

Under the principle of hierarchical management and each division taking care of its own duties, the sales, management, and manufacturing divisions will put forward their ideas and discuss together to make the most favorable decisions when encountering problems, and through monthly cross-divisional meetings to establish a smooth horizontal communication to coordinate and cooperate with each other, in the hope of achieving their own brilliant results on the success created by the 1st generation.

"The 1st generation management team laid the foundation of our business, on which we’ll open a new chapter in the field of special products, but it is up to us to make it grow. The professional knowledge and young mindset that we’ve acquired from home and abroad will help our company to develop innovatively in the future. In terms of information integration, we’ve set up software development and information divisions, developed our own ERP & MES systems, and introduced the IoT concept to manage hundreds of facilities, linking the processes of raw material control, manufacturing, and reporting together, and continue to explore and apply new technologies (e.g., AI, Big Data analysis) to optimize the production process and product design to further enhance the competitiveness of the company. In terms of customer relations, we’ll continue to deepen our partnership with existing customers and their offspring, and through building mutual trust we can open up opportunities for more cooperation and make it our development goal to enter more market areas,” said Fang Sheng's 2nd generation management team.

While many companies had not paid much attention to the issue of energy saving & carbon reduction, Fang Sheng had seen the trend and spared no effort in investing manpower and resources in carbon inventory and related certification. It launched the GHG inventory for ISO 14064-1 in May 2023 and the part of EU CBAM requirements has been internally verified and is awaiting subsequent certification. The relatively important ISO 14067 for carbon footprints is also expected to be audited and certified in June 2024. Many of Fang Sheng's customers have been impressed by its industry-leading carbon reduction efforts.

"We take a serious view of energy saving and carbon reduction. Through systematic reports, we let all customers clearly understand Fang Sheng's carbon emission data, and we’ve

Copyright owned by Fastener World

Article by Gang Hao Chang, Vice Editor-in-Chiefalso begun to draw up a 10-year carbon reduction plan, including installation of solar panels for our own use, the improvement of energy consumption in heat treating and spheroidizing furnaces, and the introduction of energy storage facilities for energy management, improving the utilization rate of renewable energy and the stability of electricity, balancing energy demand in the production process, reducing operating costs, and improving energy efficiency. These policies will be the key direction of our future energy saving & carbon reduction, with at least 30% carbon reduction target for 2030 going forward," said Fang Sheng's 2nd generation management team.

Bronze sculpture symbolizing the succession and sustainability of Fang Sheng's business

Li You is headquartered in Hwa Ya Technology Park in Guishan District of Taoyuan City. 40 years ago, it started as an OEM screw manufacturer for resellers. Over the years, it has undergone technological innovations and restructured its business model, transforming itself into an important supplier specialized in customized high-precision screws for clients from industries including automotive screws, springs, gaskets, and lathed hardware parts.

Besides the model transition, it continued to increase capacity. In addition to the Penang (Malaysia) plant, it expanded scale with the establishment of Guang Zhen Feng Precision Screw in 2020, extending business to Asia and many other critical markets with fastener demands. Today, Li You stands as a high quality partner recognized in Taiwan and throughout the world.

Li You’s product line covers special screws, combination screws, hexagonal screws, trilobular thread screws, selfdrilling screws, thread cutting screws and other precision screws, as well as rivets, studs, anchors, hexagonal wrenches, clip nut, rings, washers, nuts and other hardware accessories. Available materials include high and low carbon steel, free cutting steel, alloy steel, stainless steel, aluminum, titanium alloy, low-leaded brass, etc., with sizes ranging from 0.8mm to 12mm. Besides, the company established a highly flexible production management system to ensure it can provide customized production that meets customers' needs and creates advantages, and also achieve a monthly capacity of hundreds of millions of pieces. The ability to efficiently and flexibly supply products no matter how many pieces are required by clients makes Li You unique among its competitors.

Domestically, Li You has long been working with clients from the EV, industrial PC, industrial control system, optical, electrical and electronic industries. Overseas, it supplies to Asia-Pacific countries through Jiu Ji Guang Precision (Malaysia). The products manufactured in Malaysia are equivalent to those of the Taiwan headquarters.

Li You is particular with manufacturing process quality. In less than 4 years it passed three ISO certifications including ISO 9001 (quality management), ISO 14001(environment management) and IATF 16949 (automotive quality management). Its fasteners have made into the electric scooter supply chain. The company is focusing heavily on green manufacturing and continues to push for acquiring ESG and ISO 14067 (product carbon footprint) certifications.

To improve quality and expand the product line, it has invested in upgrading equipment over the years, including high and low temperature weather resistance testers, X-Ray coating thickness testers, XRF spectrometer automated material analysis device, salt spray testers, automatic optical sorters, and material push and pull testers, to ensure that product quality, tolerances, and inspections are in line with international standards. “We will continue to expand our current product line to include more components such as automotive fasteners, and we will work with our medical industry clients to develop products with high precision requirements. Harnessing ‘Li You Manufacturing', we hope to become an indispensable key player in the international fastener supply chain," said the company.

Copyright owned by Fastener World / Article by Dean Tseng

Contact: Ms. Candy Shih / Email: candy@liyouscrew.com

A great place to appreciate Tainan’s 4 centuries of magnificent past

Tainan, the ancient capital of Taiwan, founded 400 years ago, has many monuments and buildings of historical significance, as well as many old buildings that quietly tell travelers wonderful stories of the old times. In addition to the famous Anping Old Fort and Eternal Golden Castle, which continue to be popular attractions for tourists visiting Tainan, there is now a new Cultural Park worth visiting.

The unused space, which used to be called "Xiang-Xin Building" by local residents of Anping and was once the base of Combined Service Forces 304 arsenal, has been renovated and revitalized by the team of "Butterfly Love", which has successfully revitalized the Shanhua Sugar Refinery Cultural Park and the Guangmiao Rest Area (North) of National Highway No. 3 with the influx of more people, and has been officially open to the public earlier this year with a brand new look as "Anping Maritime City", in hope of leading visitors to appreciate the exciting development of the ancient capital under the Age of Sail through the echoing of humanities & history, the scenery of the fishing port, and the exquisite cuisine.

Anping Maritime City is one of the most successful projects in the transformation of old & dilapidated buildings with the concept of green eco-architecture. It links the local history and culture with the cultural images of countries that once visited Taiwan during the Age of Sail, creating a diverse yet noncontradictory atmosphere.

Walking through the English-style carved gate of the park, one will see the Fort Utrecht and the minarets at the entrance with strong Dutch cultural imagery, the colonialstyle Spanish plaza, the classic “Bocca della Verita” installation from the movie “Roman Holiday,” and the British double-decker buses with a sense of conflict seem to tell the story of the development of the ancient capital under the constant conflict and fusion of the old and new diverse cultures.

The interior planning team has not only skillfully preserved the existing L-type house arrangement and sword-lion decorations, but also carefully designed the Royal Mail Ship (RMS) Titanic lobby, which is modeled after the original blueprint of the shipbuilding company, with stained-glass doors to emphasize the building's splendor. In addition, there is also a museum themed on the British Industrial Revolution, a London street scene area, the Greek-inspired Aegean Sea Observation Deck and Clock Tower, the Royal Mail Ship (RMS) Titanic Decks, and the Romeo and Juliet balcony, where Shakespeare's iconic play is set, for visitors to stop and take photos.

The Age of Sail theater on the 1st floor is the highlight of the cultural park, introducing the history and culture of the countries involved in the Age of Sail as well as the role and importance of Taiwan during this period. Sitting on the antique chairs of a 200-year-old English church, visitors will be able to watch important historical footage of Taiwan that has been researched by professionals, quoted in books, and praised by many experts in literature and history, giving them a deeper understanding of Taiwan during the Age of Sail.

"We and the architectural design team leased this building from the Cultural Affairs Bureau of Tainan City Government and spent 3 years in total discussing and planning the project before we successfully built Anping Maritime City. Our original intention was to revitalize the old and abandoned buildings, so that visitors to Tainan would no longer be able to just walk around and see the sights, but would be able to stop for long periods of time to relax, get close to the fishing port, enjoy the sunset glow, and taste Chinese & Western cuisine, and more importantly, gain a deeper understanding of the cultural heritage of the city over the past few centuries, through the presentation of the role that Tainan and Taiwan played in the world during the 17th-20th centuries, the cultural interactions with associated countries, and the past of immigrants from mainland China and European countries looking for trade opportunities around the world or a microcosm of the history of colonization,” said President Lin of Butterfly Love.

Anping Maritime City is an attraction for everyone. Visitors who like to walk around uninterrupted, take an indepth tour of exhibitions, or enjoy the fun and interaction will find something for themselves here. Whether it's a casual photo stop, a sumptuous English afternoon tea and nice coffee in a quiet corner, an appointed tour of the building, or listening to live music performances on weekends or holidays, there's always something touching for everyone’s visit.

Butterfly Love’s official website: butterflylove.com.tw

"Although our current activities are mainly static exhibitions, we also arrange some musical performances on weekends or major holidays, and will even give various banquets or themed events. We also welcome requests for wedding photography or large-scale events. In addition, the grand opening of the European style buffet restaurant on the 3rd floor, which is now on a reservation basis, is expected to take place in the second half of 2024 at the earliest. We hope to fulfill the expectations of both local and overseas visitors through a variety of exciting static and dynamic events and culinary delights," said President Lin.

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

Started as a fastener trader and now focusing on customized automotive & motorbike fasteners and special cold-forged screws & nuts, Yu Ruen Hardware is recognized by the global industry as one of the leading manufacturers in terms of product quality. 99% on-time delivery and high production efficiency to flexibly meet customers' needs are the key factors that have helped Yu Ruen continue to gain global recognition in the fastener field over the years. Although founded only 13 years ago, the team has accumulated solid technical experience step by step under the goal of excellence and growth, hoping to provide the most satisfying cooperation experience to global customers with the most professional and mature service.

Contact: General Manager Mr. Shu-Ming Chang

Email: yu.ruen@msa.hinet.net

With an average capacity of 300 tons per month, Yu Ruen's processing capability is up to 34mm in outer diameter and 85mm in length, which can satisfy most customers’ product specifications and can be customized according to the differences in demand. With quality control comparable to that of its U.S. and European counterparts, it has accumulated a solid customer base in the U.S. and European markets. Currently, as much as 90% of its export orders come from Europe and the U.S., demonstrating the ability to penetrate into the mid-range and high-end application markets. The introduction of advanced forming machines in manufacturing is also a key reason for it to maintain a high yield and precision of finished products. "The tolerance of our products ranges from +/-0.1 to +/-0.2 depending on their size and degree of forming difficulty. We’ll evaluate the possibility of continuously purchasing new forming machines based on order volume in response to changes in customer requirements," said General Manager Mr. Shu-Ming Chang.

Die design is the key to Yu Ruen's ability to stand out from its competitors. As long as the product meets the forming conditions, Yu Ruen can develop it according to the customer's drawing requirements. Since dies are developed in-house, development time can be significantly shortened and, more importantly, leakage of customer's product details to the market can be avoided. It was also appointed as a supplier by a major Scandinavian fastener trader because of its emphasis on protecting customers' interests, as well as its strength in technical services. Recently, it has successfully utilized its development & production advantages to quickly test and deliver new products to an American customer within 3 months. "In addition to fully mastering the timing of on-line production and coordinating with machine tools and raw materials coming into the factory, we’ve also enhanced the efficiency of factory technicians in switching out products in order to meet customers’ required delivery dates," said General Manager Chang.

Yu Ruen, which has obtained the ISO 9001 certification, not only receives orders steadily in the fields of traditional automotive, construction and equipment nuts, but also actively develops customers from the supply chain of electric vehicles (EV), and is in the process of producing and delivering them. Yu Ruen will plan with experts to apply for the IATF 16949 certification in response to customers' requests, and at the same time plan relevant courses for CBAM issues, which are increasingly emphasized by buyers in Europe and the U.S., in the hope of keeping up with the world's pace and creating for itself more conditions and opportunities for cooperation.

Copyright owned by Fastener World Article by Gang Hao Chang, Vice Editor-in-Chief

Although there are many quality labs around the world, iTAC Laboratory Co., Ltd. is one of the few third-party labs with a focus on fasteners. Founded in 2005, iTAC was successfully certified to ISO/ IEC 17025 by TAF within just a year, and now it is a professional third-party lab with a certificate equally effective as the American A2LA. TAF is a member of the Mutual Recognition Arrangement, co-established by IAF and ILAC, and therefore the test reports issued by iTAC are accredited worldwide. This echoes with iTAC’s dedication to independence, fairness, and objectivity.

iTAC is the best partner for complete inspection services. Besides third-party test reports, the company provides:

(1) third-party lab tests;

(2) on-site test services at clients’ designated sites;

(3) plant evaluation, CQI-9 and CQI-11 evaluation;

(4) PPAP documents and consultation;

(5)consultation on the lab’s outsourcing and subcontracting;

(6) customized tests and test consultation;

(7) consultation on other quality-related documents (drawings, specifications, regulations) and service.

iTAC provides quality inspections, as well as supplier evaluations and quality monitoring for overseas clients, saving considerable personnel and travel expenses. The company has proficient quality inspection personnel in Yangtze River Delta of China (including Shanghai, Suzhou, Hangzhou, Jiashan, Haiyan and Ningbo) to provide clients with on-site test services, ensuring that product quality of their orders made in China maintain the highest quality standards.

iTAC is more than a testing lab. It has a team highly experienced in fastener manufacturing, with an extensive knowledge of improving communication between buyers and manufacturers. It can lower risks for both parties, find common grounds out of the differences, provide professional suggestions and effective solutions to create a win-win. This is a hidden added benefit delivered by iTAC to satisfy customers' needs for testing and deepen the trust between overseas customers and their suppliers, while allowing iTAC to develop a deep understanding of market and demand trends.

Another strength of iTAC is its deep knowledge of various test standards and methods used in the fastener industry. The company can effectively help clients spot non-compliant orders before products are shipped, avoiding exorbitant indemnities and substantially reducing the time and cost of handling customer complaints. iTAC continues to add new inspection equipment, and is building a cloud database that soon will allow clients to search test records through a superb user interface experience. Continuously surpassing itself is the key to iTac’s success in sustainable business.

Email: wlu@itac-lab.com.tw

Contact: Lab Operation Manager Ms. Winnie Lu

Contact: Lab Operation Manager Ms. Winnie Lu

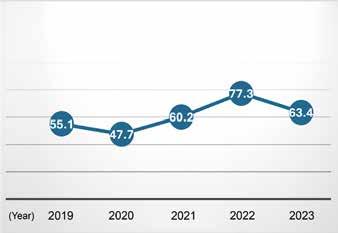

Automobile production and sales have always been one of the indicators for determining whether the related industries are doing well or not. The production of an automobile requires the use of many small parts and fastening components, so the fluctuations of production and sales will have an impact on the orders received in the supply chain of these products. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global automobile production and sales have been on a general growth trend over the past three years, with more significant growth margin between 2022 and 2023. In this article, we will analyze the latest automobile sales and production figures for 2023, and further compare them with those for 2021-2022 to give readers a glimpse of the changes in the automobile industry's outlook.

Global automobile production was about 80 million units in 2021, which grew to nearly 85 million units in 2022, and then expanded to nearly 94 million units in 2023, an increase of about 10% over the 2022 figure; the global sales were in a slight decline from nearly 84 million units in 2021 to nearly 83 million units in 2022, but grew sharply to nearly 93 million units in 2023, with a similar increase of more than 10% over the previous year. The goal of annual production and sales of more than 100 million vehicles seems to be within reach.

Europe's automobile production grew from approximately 16 million units 3 years ago to more than 18 million units in 2023, representing a 13% year-over-year increase. It is the world's 3rd largest automobile production region, with Germany, Spain, France, the Czech Republic and Slovakia being the top 5 automobile producers in 2023. Germany and the Czech Republic in particular showed the most significant year-on-year changes, which were 18% and 15%, respectively. Production in most European countries remained at growth levels, except for Serbia, Finland and Slovenia, which experienced significant production declines of 96%, 59% and 11%, respectively. In addition, Turkey, which is actively seeking to become a member state of the European Union, has also seen its automobile production grow year by year, reaching a level of more than 1.45 million vehicles in 2023, a year-on-year growth of 9%. These figures fully demonstrate that the momentum of the automobile manufacturing industry in Europe and neighboring countries is slowly picking up.

In Russia, Ukraine, and Central Asian countries, Russia's vehicle production in 2023 significantly reduced by more than 50% compared to the 2021 figures, and Ukraine shrank from more than 7,000 to less than 2,000 vehicles. However, Uzbekistan, Kazakhstan and Azerbaijan all showed significant growth over 2021.

The Americas, the world's 2nd largest automobile production region, grew from about 16 million units in 2021 all the way to more than 19 million units in 2023, an 8% increase from 2022. In North America, although Canada had the largest year-on-year increase, in terms of volume, more than 90% of production was still concentrated in the U.S. and Mexico. The overall production in South America was below 3 million units, with no significant year-on-year change. Brazil is the largest producer of automobiles in South America, with production of more than 2.3 million vehicles in 2023, which still showed a slight year-on-year decline of 2%. Argentina and Colombia rank 2nd and 3rd respectively.

Estimate

CARS: Audi, BMW, JLR, Mercedes not reported

COMMERCIAL VEHICLES: SINCE 2015Q1: Scania, Daimler Trucks, Volvo Buses not reported

N/A : Not Available

The Asia-Pacific region is the world's largest automobile production region, with its production volume rising from over 46 million units in 2021 to over 50 million units in 2022, and surpassing the 55 million-unit mark in 2023, representing a 10% year-on-year increase. The top 5 automobile producing countries were China (more than 30 million vehicles), Japan (nearly 9 million vehicles), India (about 5.9 million vehicles), South Korea (more than 4 million vehicles) and Thailand (nearly 1.9 million vehicles). Among the top 5 countries, except for Thailand, which experienced a slight decline compared to the year before last, the other countries still maintained positive growth. In addition, Indonesia in ASEAN and Iran in the Middle East also showed a production scale of more than one million units of strength. Malaysia's production volume was less than one million, but still had a 10% growth year-on-year.

Africa's production, though small compared to other regions, was still over a million units in size and grew by around 15% year-onyear to 2023. Automobile production in the region was concentrated in South Africa and Morocco, with more than 600,000 and 500,000 vehicles respectively. Egypt, on the other hand, had no published data on vehicle production between 2021 and 2023.