“For just as each of us has one body with many members, and these members do not all have the same function, so in Christ we, though many, form one body, and each member belongs to all the others.”

- THE APOSTLE PAUL (ROMANS 12:4-5)

Fellow shareholders

KRIS SEALE President & Chief Executive Officer

KRIS SEALE President & Chief Executive Officer

As I reflect on our success in 2023, not to mention DIG’s success over the past three decades, I am reminded of the “Parable of the Talents.” In this parable, Jesus talks to us about investing. A business owner/investor delegates the management of some of his wealth to three of his “employees” (referred to as “servants” in the parable). He gives five talents (a large sum of money in Jesus’s day) to the first employee, two talents to the second, and one talent to the third. Two employees earn 100% returns by trading with the funds, but the third hides the money in the ground and earns nothing. The business owner returns, and he rewards the two who gave him a return on his money but severely punishes the employee who did nothing. I encourage you to read Matthew 25:14-30 to fully grasp this parable.

Jesus is making a significant point that extends far beyond financial investments. Over the years, I have come to believe that Jesus is saying God gives each person certain gifts or “talents” (if you will indulge me), and He expects us to use those gifts to bring honor to Him. It is not acceptable to “bury” your gifts and not use them. Like the three employees, we do not have gifts of the same degree. The “return” God expects from us is commensurate with the gifts we have been given. The employee who received one talent was not condemned for failing to reach the five-talent goal; he was condemned because he did nothing with what he was given.

For our 2023 management conference, I had our executive management team read a book, The 6 Types of Working Genius, by Patrick Lencioni. This book was written to help people identify the type of work that leads to joy and energy and avoid work that leads to frustration and burnout. In short, it helps us determine our true gifts/talents! The types of Working Genius identified by Lencioni are wonder, invention, discernment, galvanizing, enablement, and tenacity. According to the book, here are the definitions of each type:

• Wonder – involves pondering and asking questions, contemplating the reasons why things are the way they are, and wondering whether there might be a different or better way.

• Invention – is about coming up with novel ideas and solutions to solve problems and address issues, involving creativity and original thinking, often with little direction.

• Discernment – involves making sound judgments and relying on instinct and intuition across a wide variety of situations; it entails pattern recognition and integrative thinking rather than expertise, knowledge, or data.

• Galvanizing – is about rallying and motivating people, often around projects, ideas, or initiatives; inspiring and persuading others to take action to get things moving, even if it involves convincing them to rethink or change their plans.

• Enablement – involves answering the call to action and seamlessly providing others with the unconditional support and assistance they need to get something started and by being the human glue required to hold it together.

• Tenacity – is about execution; it involves getting things done, achieving results, and realizing the desired impact of a task or project.

Lencioni says, “Beyond the personal discovery and instant relief that the Working Genius provides, the model also gives teams a remarkably simple and practical framework for tapping into one another’s natural gifts, which increases productivity and reduces unnecessary judgment.” What Lencioni is saying is that by determining your personal and specific gifts/talents and utilizing them in

conjunction with everyone else on your team, you will be more satisfied, happy, rewarded, and blessed – the same thing that Jesus is telling us in the Parable of the Talents. Finding your gifts and using them honors God!

As the Apostle Paul said in Romans chapter 12, “For just as each of us has one body with many members, and these members do not all have the same function, so in Christ, we, though many, form one body, and each member belongs to all the others.”

As I consider how our team works perfectly together, utilizing our unique gifts/talents, I am reminded of all our accomplishments in 2023.

DIRECTORS INVESTMENT GROUP (DIG)

• We implemented a company retirement program to honor those to whom honor is due.

• We launched our first “DIG Week,” during which our employees were encouraged to serve others.

• We rolled out a new paid time off policy for all employees.

• Net income exceeded budget by 30.8%; net income was $12.5 million!

• The quarterly dividend was increased twice during 2023, from $0.21 per share to $0.23 per share to $0.24 per share.

• We were able to use over $1 million of the Net Operating Loss carryforwards to reduce 2023 federal income tax liability.

• Our Modified Book Value increased from $86.94 at the end of 2022 to $95.51 at the end of 2023, a 9.9% increase!

• DIG was recognized with awards in Texas and nationally for our workplace culture.

FUNERAL DIRECTORS LIFE (FDL) CULTURE

• We brought best-selling author John O’Leary to four state conventions to present a keynote address on how funeral directors can overcome stress and potential burnout.

• We established an endowed scholarship with the Funeral Service Foundation, the charitable arm of the National Funeral Directors Association.

• We created the “Spirit of Kokua” program. “Kokua” translated means to give to others without expecting anything in return; we inspired our 2023 incentive trip participants to gift $100 to honor citizens of Maui.

FINANCIAL REPORTING

• We achieved a $213 million increase in assets during 2023 – total assets are now more than $2 billion!

• The average yield on FDL’s bond portfolio increased by 23 basis points, which had a $4.5 million positive impact on investment income.

DIRECTORS BUSINESS SOLUTIONS (DBS)

• We achieved a record-setting $63 million in new funeral home loan originations.

• We launched two new services in DBS:

> DBS Accounts Payable Automation – Billpay services for funeral homes that offer our clients an app-based solution and fully automate the way they pay bills.

> DBS InSights Reporting – Insightful reports that include key performance indicators that leverage the power of Passare to deliver well-structured data to funeral professionals.

• We formed a new partnership with SurePayroll, which has increased our efficiency in all facets of funeral home payroll.

ACCOUNTING DEPARTMENT

• We successfully completed four state department of insurance examinations.

COMPENSATION & BENEFITS

• We successfully transitioned from the Human Resources Department to the People Operations Department and the Compensation and Benefits Department.

CLAIMCHECK

• Our insurance assignment division achieved a return on investment of more than 16%!

TRUST CONVERSIONS

• We converted over $5 million in preneed funeral trust funds to FDL insurance and annuity products.

LEARNING & DEVELOPMENT

• We rolled out the “Wolfelt Experience 101” to further train our staff and funeral professionals nationwide on the value of funeral service.

ACTUARY

• We increased the growth rate on our products by 25 basis points on January 1st and another 50 basis points on October 1st – two increases in one year, which is a first for FDL!

DIGITAL MARKETING SERVICES

• We achieved record revenue of over $2.5 million and record net profit of more than $500,000!

• We launched new Digital Marketing packages.

• We began website management services in association with Tukios to help our funeral home clients have more effective websites.

• We achieved a record number of leads generated from Facebook – over 24,000!

PARKWAY

• Parkway signed six insurance clients to asset management services.

• Three new insurance companies were signed to consulting projects.

PASSARE

• Passare achieved $1.6 million in new annual sales contracts with 170 accounts.

• Passare has grown to approximately 10% overall market share.

• We launched the at-need Arrangement Guide to help facilitate online arrangements for our funeral home clients to better serve their customers through a digital experience.

• We launched Decedent Tracking and Case Management in a unified app for Passare customers. We are the only company in the profession to provide this robust functionality!

• We improved mortuary school and student engagement, so 1 in 3 students now have access to Passare.

• We achieved record revenue of $5.5 million!

• We achieved $1.2 million in net income!

• We increased cash by $1.5 million!

• We surpassed 1,000 customers and are serving over 2,500 locations!

• We now have over 100 Premium Support customers generating an additional $850,000 of revenue annually and growing!

• Passare is now facilitating 280,000 at-need funerals through the platform!

• We implemented a Premium Maintenance process that provides dedicated product and development time for Passare’s Premium Support and Premium Launch customers.

CONCLUSION

The achievements we had in 2023 were significant for our company and would have never happened

had we not had extraordinary teamwork! Helen Keller said, “Alone, we can do so little; together, we can do so much.” If each of us uses the gifts/ talents that God has given us, and we use them in conjunction with others who have different gifts/ talents, we can achieve so much more. As we know, by working together, we achieve synergy, and all of a sudden, 1 + 1 = 3! Mother Teresa said it best, “I can do things you cannot, you can do things I cannot; together we can do great things.”

Lastly, I must “give honor where honor is due” (Romans 13:7). Our management team is incredible! Our company continues to flourish due to their dedication, care for our people, and trust in my leadership! We are blessed with strong leaders, and my heart overflows with gratitude and love for them.

We thank you, fellow shareholders, for your support. There is no greater responsibility than earning and keeping your trust and confidence. Like the “employees” in the “Parable of the Talents,” we will continue to work tirelessly to keep our commitments and protect and grow the value of your investment in DIG.

With sincere gratitude and blessings,

KRIS SEALE Chairman of the Board President and Chief Executive Officer

management’s discussion and analysis

EXECUTIVE OVERVIEW

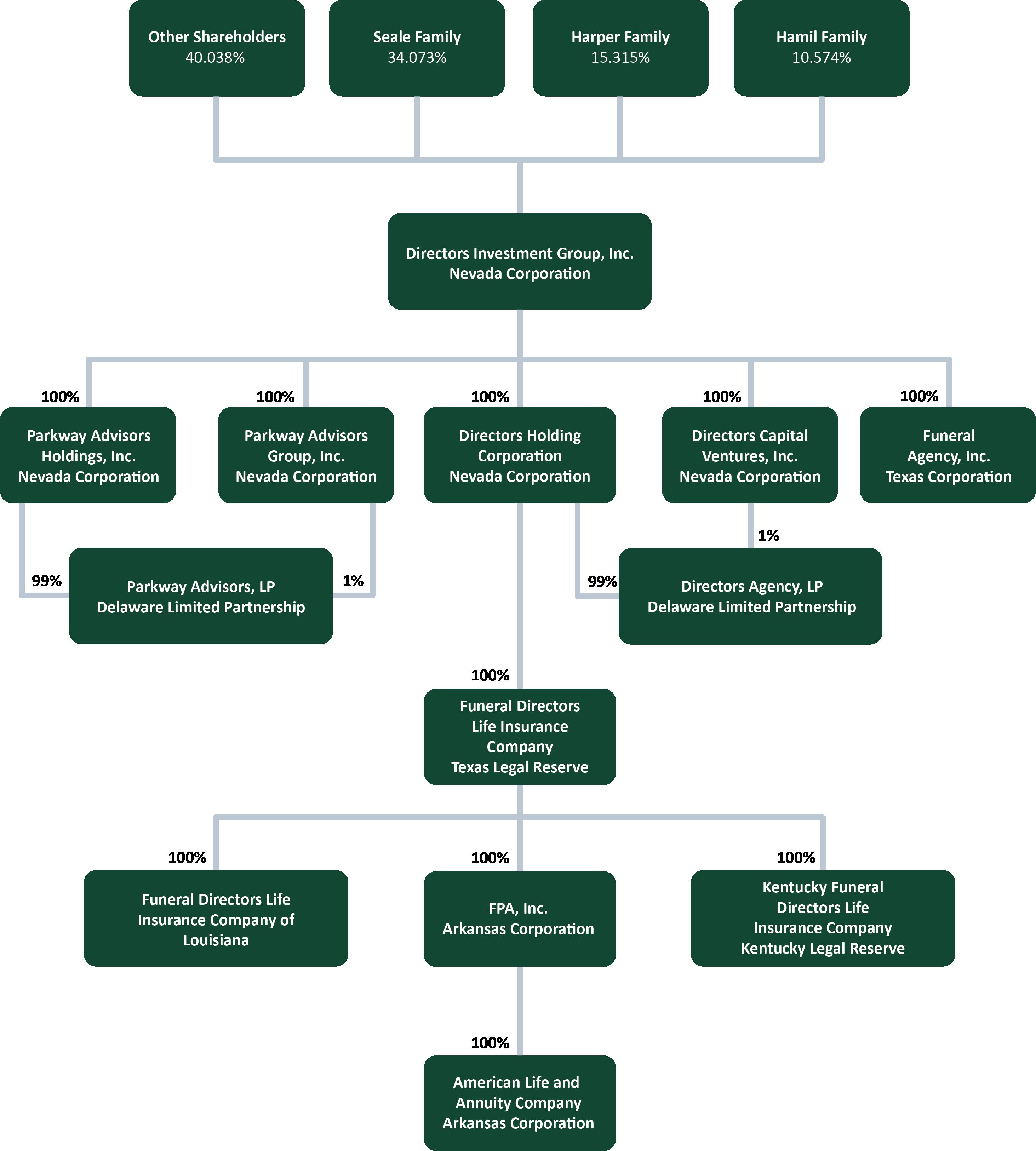

Directors Investment Group, Inc. (DIG), a Nevada corporation, is the parent company for a diverse group of companies with a focus on two strategic industries – life insurance and financial services.

The combined financial statements of Directors Investment Group, Inc. include all accounts of DIG and its subsidiaries (the Company) accounted for on a Generally Accepted Accounting Principles basis with the exception of the insurance subsidiaries that are accounted for on a Statutory Accounting Principles basis.

As of December 31, 2023, the subsidiaries of DIG include Directors Capital Ventures, Inc. (DCVI), Directors Holding Corporation (DHC), Parkway Advisors Group, Inc. (PAGI) and Parkway Advisors Holdings, Inc. (PAHI), and Funeral Agency, Inc. (FAI). Additionally, the limited partnerships owned by the subsidiaries are included in the combined statement. The limited partnerships are Parkway Advisors LP (PALP) and Directors Agency LP (DALP). Effective January 1, 2020, Passare, Inc. was merged into DIG and as a legal entity ceased to exist. Passare operations continue to be reported separately, but as a division of DIG. The insurance company subsidiaries include Funeral Directors Life Insurance Company (FDL), Kentucky Funeral Directors Life Insurance Company (KFDLIC), Funeral Directors Life of Louisiana (FDLA), and American Life and Annuity Company (ALAC). On September 15, 2022, FDL purchased 100% of FPA Inc., (FPA), an Arkansas corporation. FPA is the parent company of ALAC, a preneed life insurance company domiciled in the State of Arkansas. The value of the insurance company subsidiaries is recorded on the books of the Company at

book value in accordance with the methods set forth by the National Association of Insurance Commissioners (NAIC).

The sections that follow provide information about the important aspects of our operations and investments, both at the combined and subsidiary levels, and include discussion of our results of operations. The accounting periods for all of the entities end on December 31.

EARNINGS PER SHARE

Basic earnings per share (EPS) is calculated by dividing net income by the average number of common shares issued and outstanding for the current and previous years. Diluted earnings per share is calculated by dividing net income by the average number of common shares issued and outstanding plus stock options issued and outstanding for the current and previous years. For the purpose of these calculations, shares issued and outstanding do not include treasury shares purchased by the Company.

For 2023, the average number of common shares issued and outstanding, basic and diluted, was 2,557,584 and 2,792,026, respectively. For 2022, the average number of common shares issued and outstanding, basic and diluted, was 2,557,451 and 2,786,796, respectively. The exercise of 15,214 common stock options by employees and directors and the net purchase of 13,445 treasury shares by the Company are reflected in the change in average common shares outstanding.

Basic EPS was $4.89 and diluted EPS was $4.48 for 2023. For 2022, basic and diluted EPS was $4.91 and $4.51 respectively.

COMPUTATION OF SHARE VALUE

DIG’s Share Value was $95.51 for 2023 and $86.94 for 2022 based on the modified book value calculation. This was a 9.86% increase over 2022.

For 2023 and 2022, Share Value is calculated using the modified book value approach that was approved by the shareholders at the April 1996 annual shareholders’ meeting. The calculation is the 1996 book value method plus an additional amount added for the value of FDL’s insurance business and interest maintenance reserve (IMR). For 2023, the equity component was $197,264,723 and the value of FDL’s business and IMR was $47,096,848. Total actual shares issued and outstanding at the end of 2023 were 2,558,468. For 2022, the equity component was $187,337,230, and the value of FDL’s business and IMR was $34,941,228. Total actual shares issued and outstanding at the end of 2022 were 2,556,699.

INCOME TAXES

Directors Investment Group, Inc. and its noninsurance subsidiaries file a consolidated U.S. income tax return. All taxes are booked and paid at the DIG level. In 2022, the Company recorded $815.5 thousand in federal income tax. For 2023, DIG recorded $1.2 million in federal income tax. DIG was able to utilize $1.0 million in loss carryforwards assumed upon the merger of Passare into DIG in 2020. $3.4 million remains in loss carryforwards that expire in 2034.

The insurance subsidiaries - FDL, KFDLIC, and FDLA - file a separate consolidated U.S. income tax return. The method of allocation between the companies is based upon separate return calculations with current credit for net losses. Intercompany tax balances are settled annually after the federal income tax return is completed and filed.

ALAC will file a separate tax return but will be eligible for consolidation with the other insurance subsidiaries five years from date of acquisition.

DALP and FDL were also subject to filing state income tax returns for various states in which they are licensed to conduct business.

The corporate federal income tax rate for DIG and the insurance subsidiaries was 21%.

LIQUIDITY AND CASH FLOWS

Management has set forth strategic objectives to help ensure that we keep a focus toward growing our core business and increasing shareholder value, and that we are in a position to take advantage of opportunities when they arise. Those objectives include internal investment in our business (e.g. capital expenditures), share repurchases, shareholder dividends, debt reduction and management, and acquisitions of businesses that will complement our core operations. The Company believes that cash generated from operations, together with the Company’s existing financial resources, will adequately finance the Company’s planned 2024 cash requirements.

SUMMARY OF CASH ACTIVITIES

Principal sources of cash were commissions earned at DALP and FAI, investment advisory and consulting fees earned at PALP, subscription and activations fees earned at Passare, principal and interest payments received on business loans, and proceeds for issuance of common stock options and the sale of treasury stock. Our primary uses of cash were for operational expenses, reduction of debt, repurchase of stock, funding business loans, and payment of shareholder dividends. Net decrease in cash for 2023 was $3.0 million.

INVESTING ACTIVITIES

Business loans outstanding at year-end 2023 were $4.5 million compared to $1.3 million at the end of 2022. DIG received principal payments of $113.8 thousand and issued new loans of $3.3 million.

Remaining loans to funeral home customers earned interest at an average rate of 9.98%. DIG collected interest payments of $323.1 thousand.

In 2016, DIG initiated a short-term investment strategy with Parkway Advisors as a means to earn investment income on excess cash accumulated from net operating earnings, repayment of business loans, or proceeds from the sale of treasury stock. Previously, investments were short term in nature and laddered to throw off approximately $500,000 in cash at the end of each month. In order to achieve a higher return, in mid-2021 DIG revised its investment plan to invest approximately 40% in short-laddered bonds and the remainder invested with a growth and income focus. Total interest collected on investments was $325.6 thousand. At year-end 2023, total invested funds were $10.4 million.

FINANCING ACTIVITIES

DIG’s debt was comprised of borrowings from FDL. These loans originated in 2007 and were used to facilitate the funding of the funeral home financing program mentioned above in investing activities. The loans pay interest at the rate of 8.75% and mature in April 2027. DIG paid FDL $549.3 thousand in principal and $217.8 thousand in interest in 2023. At year-end 2023, outstanding borrowings on the loans from FDL were $2.4 million.

During 2023, the Company offered options on 268,520 shares of common stock at a price range of $58.03 to $95.63. Options on 15,214 shares were exercised at a price range of $58.03 to $86.94, providing $960.7 thousand in cash resources. 22,367

shares at a price of $58.03 were not exercised and forfeited, leaving 230,939 shares exercisable in 2024, 2025, 2026, 2027, and 2028 at a price range of $62.57 to $95.63. During the year, DIG also repurchased 46,861 shares of common stock for $4.2 million. In July of 2010, the Board of Directors approved the annual sale of a limited number of treasury shares. In 2022, DIG sold 21,045 shares of treasury stock for $1.8 million, and in 2023, DIG sold 33,416 shares for $2.9 million.

The Board of Directors approved the payment of quarterly dividends averaging $0.225 per share during 2023 for a total of $2.3 million. DIG paid $2.15 million in dividends in 2022.

SHAREHOLDER LIST & BENEFICIAL OWNERSHIP

The table beginning on page 41 sets forth certain information as of March 1, 2024, with respect to each person who owns the Company’s Common Stock, each director of the Company, and all directors and officers of the Company as a group. Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to the shares of Common Stock shown. Each Common share is entitled to one vote per share. The Company does have authorized Preferred Stock; however, none of the Preferred Stock was issued or outstanding as of December 31, 2023.

RESULTS OF OPERATIONS

FUNERAL DIRECTORS LIFE INSURANCE COMPANY

FDL is the primary investment and income source for DIG. FDL is in the business of funding prepaid funerals with life insurance and annuities. A simplified financial statement is included herein.

In 2023, FDL’s assets grew to $2.11 billion, up $213.3 million or 11.24% over 2022 assets of $1.90 billion. Invested assets are the largest component of assets for an insurance company. FDL’s investments were $2.1 billion for 2023, an increase of 11.25% over 2022 investments of $1.87 billion. The primary investment held by FDL was bonds - government, agency, and corporate - representing 83.65% of invested assets or $1.7 billion. FDL’s total common stock portfolio was $24.8 million comprised of $20.5 million for investments in KFDLIC, FDLA, and FPA, Inc., as well as $4.3 million invested in the Monteagle Select Value Fund managed by PALP. On September 15, 2022, FDL purchased 100% of FPA, Inc., an Arkansas corporation, for $7.4 million. FPA, Inc.’s only asset is its ownership in ALAC, a preneed life insurance company domiciled in the State of Arkansas. Investment in real estate includes $15.4 million for the Home Office building. During 2023, FDL’s mortgage loan portfolio increased by $38.3 million for the financing of funeral home locations for a total of $280.0 million. Other invested assets consist of loans to parent of $2.4 million, surplus debentures of $3.3 million and cash and short-term investments of $8.0 million.

Other assets exceeded 2022 by approximately $3.2 million and consisted largely of accrued investment income of $20.0 million, $5.1 million in deferred tax

assets, and $4.9 million in insurance assignment receivables.

FDL’s primary liability is its reserves for policyholders. For 2023, reserves were $1.9 billion, an increase of 11.69% over reserves of $1.7 billion in 2022. Asset valuation reserve (AVR) increased $4.5 million or 26.29% compared to a $1.9 million increase from year-end 2021 to year-end 2022. The $21.6 million in this account represents a loss reserve mandated by the NAIC to offset potential defaults of any of the company’s invested assets. Claims liabilities and premium received in advance were $1.1 million and $7.7 million, respectively, for a total of $8.8 million. The interest maintenance reserve of $7.3 million decreased by $795.0 thousand from year-end 2022 for net realized capital losses of $559.0 thousand and amortization of $236.0 thousand. Statutory reporting requirements mandate that gains or losses from the sale of bonds with a future maturity date must be held as a liability and amortized into income over the remaining life of disposed bonds. Commissions due to agents exceeded 2022 by $829.7 thousand. Dividends to policyholders decreased to $800.0 thousand. Borrowed funds of $517.5 thousand represent a grant from the Development Corporation of Abilene that was based upon the Company’s expansion of the Home Office and its commitment to create 70 new jobs over a 5-year period. Other liabilities of FDL included amounts due to affiliates, general expenses payable, premium taxes and fees, federal income tax payable, and other miscellaneous liabilities for a total of $7.0 million.

Total capital and surplus increased $8.2 million for 2023 as compared to the increase of $10.3 million in 2022. The increase in 2023 consisted of net income of $9.7 million, $2.3 million increase in net deferred income tax, and unrealized gains of $1.1 million, offset by a $4.5 million increase in asset valuation reserve, and a $312.1 thousand increase in non-admitted assets. The majority of non-admitted assets relate to non-admitted deferred income tax. The ratio of Capital and Surplus to Total Assets was 8.23% at year-end 2023 compared to 8.72% at year-end 2022.

Revenues for FDL were primarily premium collections and investment income totaling $556.3 million. When compared to the previous year, 2023 revenues increased 12.81% or $63.2 million. New business issued for 2023 was approximately 11.7% higher than 2022 production and 95.1% of projected. Net investment income reflects a $13.3 million increase due to increased investment yields and additional funds for investment.

Policyholder benefits increased significantly due to the increase in new business sales. Death and

annuity benefits paid during the year exceeded 2022 by $13.0 million but were only $340.0 thousand above expected. Monthly claims expense averaged $18.4 million in 2023 compared to $17.3 million in 2022. With the year-over-year increase in new business sales, aggregate reserves from year to year were up $27.7 million or 16.3%. General insurance expenses exceeded 2022 by $20.9 million and included commissions paid to agents of $66.7 million, general operating expenses of $47.6 million, and taxes licenses and fees of $5.9 million.

Net gain from operations was $15.7 million compared to $14.5 million for 2022. Policyholder dividends were $908.5 thousand compared to $1.2 million in 2022. Federal income taxes incurred were $5.4 million compared to $3.3 million in 2022 due to increased taxable income. FDL realized net capital gains of $328.5 thousand compared to capital gains of $2.0 million in 2022. Realized gains for 2022 included $1.8 million related to sale of investment real estate. For 2023, the company posted net income of $9.7 million compared to $12.0 million 2022.

BALANCE SHEET

KENTUCKY FUNERAL DIRECTORS LIFE INSURANCE COMPANY

KFDLIC, a wholly owned stock life insurance company of FDL, was incorporated in the state of Kentucky in 2001. KFDLIC is in the business of funding prepaid funerals with life insurance and annuities, similar to FDL.

The total assets of KFDLIC increased $1.9 million or 6.7% during 2023 compared to $2.1 million or 8.28% during 2022. For 2023, the investments account for KFDLIC was $29.5 million. Government and corporate bonds represented 96.1% of investments with cash and short-term investments representing the balance. Other assets consisted of investment income due and accrued of $354.7 thousand and a net deferred tax asset of $96.1 thousand.

Liabilities for KFDLIC ended the year at $22.9 million. Reserves for life policies were $22.4 million or 97.64% of the company’s liabilities. Claims liabilities and premiums received in advance were $4.2 thousand and $113.4 thousand, respectively, for 2023. Asset valuation reserve (AVR) was $159.3 thousand compared to $120.0 thousand at the end of 2022. Interest maintenance reserve was $87.3 thousand compared to $110.3 thousand for 2022. Other liabilities also included general expenses payable, taxes, commission to agents, licenses and fees payable, and other miscellaneous payables, representing $177.7 thousand.

For 2023, the capital and surplus of KFDLIC increased $234.9 thousand. The increase consisted

of net income of $281.6 thousand plus deferred income tax of $8.6 thousand, offset by a $16.1 thousand increase in non-admitted assets, and a $39.3 thousand increase in asset valuation reserve, resulting in an ending balance of $7.0 million. The capital and surplus of KFDLIC represented the value of the common stock investment that FDL holds for KFDLIC.

Revenues for KFDLIC were $5.4 million, slightly below 2022, and were composed primarily of premiums and investment income received. 2023 preneed sales production was $4.3 million, down from 2022 production of $4.7 million, and approximately 66.3% of expected sales. Premium income was $4.1 million while investment income was $1.3 million. Virtually all of the company’s expenses are variable based upon new business production. Policyholder benefits were $4.0 million. Death claims were $2.4 million – while reserves decreased $390.3 thousand compared to a $726.5 thousand increase from 2021 to 2022. General insurance expenses were down $123.5 thousand due to a $146.3 thousand decrease in commissions paid to agents.

Operating income for the year was $364.3 thousand compared to $281.0 thousand in 2022. Federal income tax was estimated at $82.7 thousand after the allocation of consolidated tax deductions shared amongst the insurance affiliates. Net income was $281.6 thousand compared to $196.5 thousand for 2022.

FUNERAL DIRECTORS LIFE INSURANCE COMPANY OF LOUISIANA

Funeral Directors Life Insurance Company of Louisiana (FDLA) was incorporated on June 6, 2019. On June 25, 2019, FDLA issued Funeral Directors Life Insurance Company 100% (100,000 shares) of its outstanding stock in exchange for $4.5 million in cash. FDLA commenced business on August 1, 2019, and was created in response to unfavorable regulation in Louisiana related to agent licensing requirements for foreign corporations only.

FDLA ended 2023 with $29.7 million in assets compared to $22.7 million at the end of 2022. As of December 31, 2023, 98.22% of FDLA’s total assets were invested assets. The majority of this account was government and corporate bonds, representing 92.45% of invested assets. The remaining investments were mortgage loans and cash and short-term investments.

Other assets consisted largely of investment income due and accrued of $271.1 thousand and a net deferred tax asset of $217.4 thousand.

Liabilities for FDLA ended the year at $24.4 million. Reserves for life policies were $23.0 million compared to $16.6 million at year-end 2022, representing 94.32% of the company’s liabilities. Claims liabilities and premiums received in advance were $55.7 thousand and $515.7 thousand, respectively, for 2023. Commission to agents were $250.5 thousand while taxes, licenses, and fees were $142.5 thousand. The asset valuation reserve (AVR) was $130.9 thousand. Other liabilities also included general expenses payable, premium suspense, and other miscellaneous payables, representing $291.5 thousand.

The company was capitalized with $100.0 thousand of common capital stock and $4.4 million of gross paid in and contributed surplus. For 2023, the capital and surplus of FDLA increased $66.4 thousand. The increase consisted of net income of $97.9 thousand plus deferred income tax of $27.8 thousand, offset by a $16.9 thousand increase in non-admitted assets and a $42.5 thousand increase in asset valuation reserve.

Revenues for FDLA were $13.1 million. Premium income was $12.2 million while investment income was $925.1 thousand. New business sales were $14.3 million compared to $11.6 million for 2022 and were 100.3% of projected. Virtually all the company’s expenses are variable based upon the level of new business production. For 2023, death claims increased by $1.2 million or 45.26% over 2022 while aggregate reserves for life policies compared to 2022 increased by $727.7 thousand. General Insurance Expenses were $2.6 million and consisted largely of $1.2 million in commissions to agents, $285.0 thousand in taxes, licenses, and fees, and $1.1 million of administrative service fees paid to FDL, salaries and benefits, and other sales related expenses.

Operating income for the year was $158.3 thousand compared to $96.1 thousand in 2022. Federal income tax was estimated at $60.4 thousand after the allocation of consolidated tax deductions shared amongst the insurance affiliates. Net income was $97.9 thousand compared to $64.3 thousand for 2022.

AMERICAN LIFE AND ANNUITY COMPANY

American Life and Annuity Company (ALAC) is an Arkansas-domiciled preneed insurance company and wholly owned subsidiary of FPA, Inc. FPA’s only asset is its investment in ALAC. ALAC was originally incorporated on October 1, 1920, but was purchased by FPA on July 3, 1989. ALAC joined DIG’s holding company system on September 15, 2022, through FDL’s acquisition of FPA.

The total assets of ALAC decreased $1.0 million during 2023 for a total of $53.1 million compared to $54.1 million at year-end 2022. The decrease in assets is due to the fact that the company is in run-off mode with all new business in Arkansas now being sold through FDL.

As of December 31, 2023, invested assets were $52.1 million, representing 98.14% of ALAC’s total assets. The majority of this account was government and corporate bonds, representing 94.28% of investments. The remaining investments consisted of common stock, policy loans, and cash and short-term investments.

Other assets consisted of investment income due and accrued of $450.3 thousand, deferred and uncollected premiums of $85.9 thousand, a net deferred tax asset of $111.3 thousand, and interest maintenance reserve of $301.7 thousand. Typically, a debit balance in interest maintenance reserve (negative balance) would be non-admitted and reduce surplus. For a two-year period of time, the NAIC is allowing negative interest maintenance reserve to be an admitted asset.

On December 31, 2023, ALAC’s total liabilities were $48.1 million. Reserves for life policies were $47.5 million or 98.67% of liabilities. Claims liabilities were $25.0 thousand for 2023. Asset valuation reserve (AVR) was $430.1 thousand compared to $374.0 thousand at the end of 2022. Commissions to agents were $51.9 thousand. Other liabilities included general expenses

payable, taxes, federal income tax payable, and other miscellaneous payables, representing $135.1 thousand.

The company was originally capitalized with $100.0 thousand of common capital stock and $337.0 thousand of gross paid in and contributed surplus. For 2023, the capital and surplus of ALAC increased $943.5 thousand. The increase consisted of net income of $774.1 thousand, plus a $35.7 thousand unrealized gain on securities and a $208.9 thousand decrease in non-admitted assets, offset by a $56.1 thousand increase in asset valuation reserve and a $19.1 thousand decrease in deferred income tax.

Premium income was $980.9 thousand compared to $3.3 million for 2022. Preneed sales production discontinued upon acquisition as ALAC customers were transitioned to FDL. Net investment income was $2.1 million –consistent with 2022 due to increased investment yields. For 2023, death and annuity benefits were down from the previous year by 6.7%, and aggregate reserves for life policies decreased by $1.8 million compared to the $696.8 thousand decrease between 2021 and 2022. General Insurance Expenses were down approximately $474.6 thousand for decrease in commissions and administrative expenses. Upon acquisition, the home office was sold, and all operations were moved to Abilene, Texas. Throughout 2023, ALAC paid administrative service fees to FDL related to the administration of in force business and financial reporting.

Gain from operations was $653.3 thousand. Federal Income tax expense was $72.4 thousand based upon taxable income. The sale of the previous home office location in Arkansas resulted in a net capital gain of $266.9 thousand for 2022. For 2023, net realized capital gains were the result of the sale of common stock. Net income for 2023 was $774.1 thousand compared to $539.0 thousand for 2022.

DIRECTORS AGENCY, LP

DALP is a Delaware limited partnership formed February 1, 2002, and owned 1% by DCVI and 99% by DHC, both wholly owned subsidiaries of DIG. DALP provides strategic sales and marketing support for the sale of FDL’s insurance products. At year-end 2023, DALP employed 62 sales professionals, called Select Producers, across the United States to support FDL’s active sales program.

For 2023, total assets were $2.0 million compared to $2.6 million at year-end 2022. The net year-overyear decrease was due largely to a decrease in cash due to distributions to partners.

Liabilities increased by $221.8 thousand for the timing of intercompany settlements and included amounts due to affiliates as well as general and

payroll-related payables. Capital accounts ended the year at $1.6 million after partner distributions of $4.0 million.

Revenues consisted largely of commissions earned from FDL and FAI and were $12.1 million compared to $9.9 million in 2022. Commission income from the active sales program was $9.6 million compared to $8.4 million in 2022. Expenses in 2023 consisted primarily of salaries and benefits for insurance agents hired to actively sell preneed. Employmentrelated expenses totaled $7.2 million. The remaining expenses were mainly related to training, recruiting, and lead generation. Net income for 2023 was $3.1 million – approximately $776.7 thousand better than 2022.

DIRECTORS HOLDING CORPORATION

DHC ended 2023 with assets of $180.1 million compared to 2022 assets of $173.6 million. The primary increase in DHC’s assets was in its investments. DHC’s Investment in SubsidiaryFDL increased $7.3 million to $178.5 million. As of December 31, 2023, DHC owned a 99% limited partner’s interest in DALP. DHC’s investment in DALP decreased $853.4 thousand after distributions from DALP of $3.9 million. Total investments in subsidiaries and partnerships for DHC increased $6.5 million.

DHC’s equity increased 3.74% to $180.1 million. During 2023, DHC declared and paid dividends to DIG in the amount of $3.96 million.

DHC’s operating expenses consisted primarily of corporate residency costs. DHC derived its earnings from equity increases in FDL and partnership interest increases in DALP. DHC’s earnings from its investments were $10.5 million in 2023 as compared to $11.8 million in 2022, resulting in net income of $10.5 million.

DIRECTORS CAPITAL VENTURES, INC.

DCVI is the general partner for the limited partnership investment in DALP and is the operating entity for the DIG Wellness Center - a company-provided health and wellness facility for employees of DIG affiliates that opened in February of 2013. DCVI owns a 1% interest in DALP that represents $15.6 thousand of its assets. Other assets include computer equipment and prepaid expenses. DCVI ended the year with assets of $22.0 thousand compared to $30.7 thousand in 2022.

Liabilities of $12.3 thousand are related to general accounts payable and amounts due to affiliates. Equity ended the year at $9.7 thousand. During 2023, DCVI paid dividends to DIG in the amount of $40.0 thousand and received contributions of $65.0 thousand. The contributions from DIG provided operating cash flow for the wellness facility.

Revenues consist of reimbursements from Blue Cross Blue Shield (BCBS) for services provided to DIG’s employees as well as monthly service fees from FDL. During the year, DCVI received $150.0 thousand in service fees from FDL and $69.4 thousand in reimbursements from BCBS and employees. DCVI had $284.9 thousand in expenses for operating the DIG Wellness Center as well as corporate existence expenses, such as registration fees and corporate residency expense. The DIG Wellness Center employs a nurse practitioner and a fitness director. DCVI’s equity in earnings was derived from its 1% ownership in DALP. Partnership income in the amount of $31.4 thousand was reported for 2023. DCVI recorded a net loss of $34.1 thousand in 2023 consistent with a net loss of $32.9 thousand for 2022.

PARKWAY ADVISORS, LP

PALP is a Delaware limited partnership that was created on March 22, 2001, and is owned 1% by PAGI and 99% by PAHI, both wholly owned subsidiaries of DIG. PALP is an investment advisory firm in the business of providing discretionary investment advisory, consulting, and investment accounting services to insurance companies.

Total assets for 2023 were $1.3 million. Cash ended the year at $895.7 thousand after partner distributions of $2.0 million. Receivables were $290.9 thousand and represent fees due from advisory clients as well as amounts due from affiliates. Investments in EDP equipment and software were $69.1 thousand. Other assets of $84.5 thousand consisted of prepaid expenses.

Liabilities consisted of general payables and payroll liabilities. Total partners’ capital ended the year at $1.3 million after net income for the year of $2.2 million less partner withdrawals of $2.0 million.

Revenues for 2023 were $5.2 million and were comprised of advisory service and consulting fees. Assets under management were approximately $3.4 billion at year-end 2023. The assets of consulting and investment reporting clients were $8.3 billion. During the year, Parkway added six new insurance clients to asset management and three clients for consulting services. Operating expenses were $3.0 million, largely comprised of salaries and benefits. Other operating expenses were general in nature.

Net income for 2023 was $2.2 million compared to $2.5 million for 2022.

PARKWAY ADVISORS GROUP, INC.

PAGI is the sole general partner for the limited partnership, PALP. PAGI is a Nevada corporation created on March 23, 2001.

PAGI ended the year with assets of $17.1 thousand. PAGI owns a 1% interest of the limited partnership that represents $13.3 thousand of its assets. Cash and accounts receivable comprised the remaining assets. Liabilities of $36.0 thousand represent amounts due to PALP. Total capital ended the year at negative $18.9 thousand after dividends to DIG in the amount of $20.0 thousand.

PAGI had limited expenses for its corporate existence, such as registration fees, telephone charges, and corporate residency expenses, resulting in an operating loss of $3.0 thousand.

For 2023, PAGI recorded partnership earnings of $22.3 thousand from its 1% ownership of the limited partnership investment in PALP. Net income for PAGI was $19.3 thousand.

PARKWAY ADVISORS HOLDINGS, INC.

PAHI is the sole limited partner for the limited partnership, PALP. PAHI is a Nevada corporation created on March 23, 2001.

PAHI ended the year with assets of $1.3 million. PAHI owns a 99% interest of the limited partnership that comprised the majority of its assets with a small amount of cash for remaining assets. Liabilities of $30.4 thousand represent amounts due to PALP. Total capital ended the year at $1.3 million after dividends paid to DIG in the amount of $1.980 million.

PAHI had expenses for its corporate existence, such as registration fees, telephone charges and corporate residency expenses. Total operating expenses were $2.4 thousand.

For 2023, PAHI recorded partnership earnings of $2.2 million from its 99% ownership of the limited partnership investment in PALP, resulting in net income of $2.2 million.

FUNERAL AGENCY, INC.

FAI is a marketer and seller of prepaid funerals and various insurance products on behalf of FDL in the states of Texas and Colorado. FAI is a licensed insurance agency and holds a prepaid funeral permit issued by the Texas Department of Banking and the Colorado Department of Insurance. A Texas corporation organized on June 18, 1982, FAI was acquired by DIG on January 1, 2006.

FAI ended the year with assets of $651.0 thousand, consisting mostly of claims receivable from FDL and goodwill. Liabilities of $2.8 million consisted largely of agent credit balances and suspense items. Equity ended the year at negative $2.1 million after contributions from DIG of $500.0 thousand offset

by dividends declared and paid to DIG of $2.0 million.

Through an agency agreement with FDL, FAI received commission income on premiums collected by FDL on preneed funeral business written in Texas. Revenues for 2023 were $2.6 million – consistent with 2022. FAI contributed approximately 23.4% of FDL’s preneed sales volume during 2023, producing $116.0 million in new business. Expenses consisted mostly of salaries and benefits of sales managers employed by the company and sales-related incentive programs. Net income for 2023 was $111.8 thousand compared to a net loss of $29.0 thousand in 2022.

PASSARE – A DIVISION OF DIG

Originally a Delaware corporation created November 26, 2012, Passare was merged into DIG effective January 1, 2020. Passare is a software-as-aservice company providing an online administrative platform specifically designed for funeral homes. DIG initially invested in Passare in 2013 and also provided an operating line of credit to sustain Passare’s operations. In April 2015, DIG negotiated an exchange of all outstanding debt with Passare in return for additional shares of stock, resulting in majority ownership. In 2019, DIG gained 100% ownership in Passare after an exchange of cash or stock for remaining minority interests in Passare. Gaining 100% control of Passare paved the way to substantial expense reduction and sharing of resources between Passare and other DIG affiliates as reflected in the 2023 financial results.

While Passare’s assets and liabilities were combined with DIG’s due to the merger, the operations of Passare are monitored and recorded as a separate division within DIG.

During 2023, Passare increased revenues by 28.05%, or $1.2 million, ending the year with approximately 1,000 customers. Passare continued to improve features to the software in line with the company’s vision to “make Passare the system through which a funeral home can run its entire business.” Passare also expanded on its consulting services, such as premium support and client services. Revenues were $5.5 million compared to $4.3 million in 2022. Total expenses in 2023 were $4.3 million compared to $4.5 million in 2022 – a $223.4 thousand decrease. The decrease in expenses was due largely to a decrease in contract labor expenses. Laborrelated expenses account for approximately 87% of total operating expenses with the majority of those expenses dedicated to further development of the software. Net income was $1.2 million compared to a loss of $215.0 thousand in 2022.

BALANCE SHEET

STATEMENT OF OPERATIONS

Net Income of Subsidiaries and Partnerships

Net Income - Parkway Advisors, LP

Net Loss - Parkway Advisors Group, Inc.

Net Loss - Parkway Advisors Holdings, Inc.

Net Income - Directors Agency, LP

Net Loss - Directors Capital Ventures, Inc.

Net Loss - Directors Holding Corporation

Net Income (Loss) - Funeral Agency, Inc.

SHAREHOLDERS’ EQUITY

TREASURY STOCK COMMON STOCK

CASH FLOWS

Cash Flows from Operating Activities:

Net Income

Adjustments to Reconcile Net Income to Net Cash from Operating Activities:

Depreciation and Amortization Change in Current Assets and Liabilities:

Increase (Decrease) in Receivables and Other Assets

Increase in Payables

Increase in Taxes Payable

Net Cash Provided by Operating Activities

Cash Flows from Investing Activities: (Increase) Decrease in Short-Term Investments

Increase in Investment in Affiliate - FDL (Increase) Decrease in Notes Receivable

from Financing Activities: