CPA Day leads to success. Page 12

New team doubles down on advocacy. Page 15 FICPA fights to protect profession. Page 18

2

CPA Day leads to success. Page 12

New team doubles down on advocacy. Page 15 FICPA fights to protect profession. Page 18

2

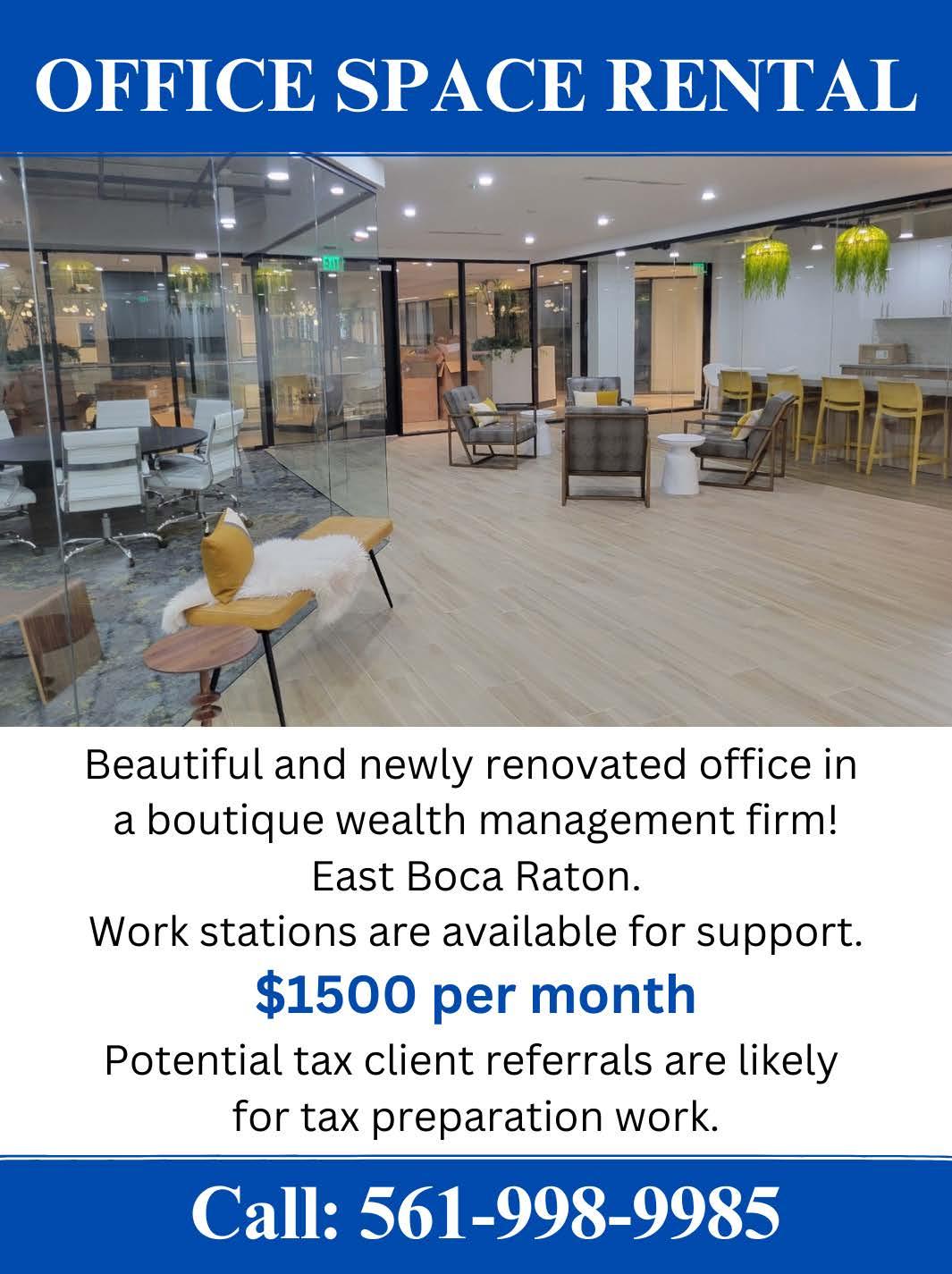

JUNE 11-13,2024

UNIVERSAL’S LOEWS SAPPHIRE FALLS RESORT

ORLANDO, FL

In-person and Livestream.

when you attend the Conference and pre-conference Learning Labs, which are included in your conference registration.

Register early and save Scan the QR code or visit ficpa.org/MEGA to learn more.

Special group rates available. Call 800-342-3197 ext. 1 for details.

PRESIDENT & CEO

Shelly Weir

Lynda M. Dennis, CPA, Chair

Joel M. DiCicco, CPA

Christina Durta, CPA

David J. Hochsprung, CPA

Jonathan S. Ingber, CPA

Keith Johnson, CPA

Douglas B. Keith, CPA

Michael S. Kridel, CPA

Matthew Leto, CPA

Ryan A. Myers, CPA

Will Quilliam, CPA

FICPA STAFF

Nick Menta

Communications Manager and FCT Editor

Lindsay Cannizzaro

Graphic Designer

All articles submitted to Florida CPA Today are subject to technical review, Editorial Committee review, space availability, and editing requirements and restrictions.

Statements expressed herein are those of the identified authors and not necessarily those of the Florida Institute of Certified Public Accountants, Inc. (FICPA), nor should statements be considered endorsements of products, procedures or otherwise.

The FICPA reserves the right to reject any editorial material or paid advertising that does not meet Florida CPA Today criteria or detracts from its ethical and professional standards.

Florida CPA Today is published quarterly by the Florida Institute of Certified Public Accountants, Inc., 250 S. Orange Ave., Suite 300P, Orlando, Fla., 32801. Telephone: (850) 224-2727 or (800) 3423197. Visit our website at ficpa.org . This magazine is provided to members of the FICPA. No specific amount of your dues, either expressed or implied, is for this publication. This magazine is not available for purchase by either FICPA members or nonmembers.

For display advertising information , contact FICPA Strategic Partnership Manager Marjorie Stone at 850-521-5950 or MarjorieS@ficpa.org

© 2024 by the Florida Institute of Certified Public Accountants, Inc. All rights reserved. Reproduction in whole or part is prohibited without the express written consent of the FICPA.

of

Claims in Bankruptcy: A Debtor’s “Fresh Start?”

SHELLY WEIR president & ceo

SHELLY WEIR president & ceo

As a member of the AICPA’s National Pipeline Advisory Group and its Experience, Learn and Earn Task Force, I’ve been proud to represent our state in high-level conversations about the future of the CPA profession. Through our work with national partners and other state societies, the FICPA has taken a leading role in the ongoing effort to strengthen the CPA pipeline and protect the integrity of licensure.

While we continue to advance these national discussions, we’re also committed to taking action right here, right now in Florida.

That’s why I’m excited to announce our new partnership with Nova Southeastern University and three South Florida accounting firms – Berkowitz Pollack Brant, Kaufman Rossin and PAAST – that will assist future CPAs on their path to licensure.

Business and Professional Regulation’s Clay Ford Scholarship Program.

These actively employed young professionals will have the opportunity to earn a salary and complete the educational requirements necessary for licensure – all at once.

Class curricula has been approved by the Florida Board of Accountancy, and the program is set to launch in Fall 2024, with plans for expansion in 2025.

“Bridge to CPA participants will assume no tuition costs on their path to licensure.”

Our Bridge to CPA pilot program, the first of its kind, will give firm employees who have already completed 120 hours of undergraduate education the opportunity to fulfill their remaining 30 credit hours –necessary for licensure as a CPA –through online classes with Nova’s H. Wayne Huizenga College of Business & Entrepreneurship, an Association to Advance Collegiate Schools of Business-accredited institution.

Program participants will assume no tuition costs through the combined support of Nova Southeastern University, employer firms, and tuition awards from the FICPA Scholarship Foundation and the Florida Department of

Speaking of expansion: Bridge to CPA is just one aspect of our newly unveiled 5-Point Pipeline Promise. This is the FICPA’s comprehensive commitment to (1) spreading awareness of the CPA profession at the elementary and high school levels, (2) providing scholarships and support to higher-education students, (3) matching employers with emerging young talent, (4) expanding access to licensure and (5) cultivating future leaders through multifaceted professional development programs.

Whether you’re a student, a candidate, a Young CPA or a firm leader, I strongly encourage you to visit www.ficpa.org/pipeline-promise to learn more about all our pipeline initiatives.

When it comes to issues surrounding talent, recruitment, licensure and mobility, the FICPA is transforming how professional associations deliver on their mission.

Our comprehensive commitment to securing the future of the CPA profession in Florida.

Reaching K-12 Students

Providing Scholarships and Supporting Through the

Expanding Access to Licensure

Pairing Employers with Talent

Cultivating Tomorrow’s Leaders

Together, we can close the talent gap and open the door to the future of accounting.

Scan to learn more or visit ficpa.org/pipeline-promise.

Let me start off by saying what an honor it’s been to serve as your 2023-24 Chair of the FICPA. I wholeheartedly believe in the value of this organization and its ability to support and sustain our profession.

By now, many of you are familiar with my passion for Chapter involvement and member participation at the local level. But it’s only fitting in this advocacy-focused issue of Florida CPA Today that I draw attention to the tireless work of the FICPA’s Governmental Affairs team.

for those in the affected areas. This FICPA priority was ultimately included in the state tax package.

3. Thanks to our relationships with key lawmakers and steadfast defense of the profession, the FICPA was able to protect CPAs in Florida from several pieces of legislation that would have harmed CPA mobility and devalued licensure.

“It’s only fitting in this advocacy-focused issue of Florida CPA Today that I draw attention to the tireless work of the FICPA’s Governmental Affairs team.

Chief Executive Affairs Officer Jason Harrell, Deputy Director Lauren Henderson, and the team at Liberty Partners of Tallahassee led by Jennifer Green fought and delivered for our members during the 2024 Legislative Session. This year’s Legislative Report, spanning pages 15-22, goes into great detail on their successes and challenges throughout 60 days in Tallahassee, but here are three key takeaways – no pun intended – FICPA members should celebrate:

1. Effective July 1, CPAs age 65 and older will be able to place their license into a retired status, a longtime FICPA priority that was finally passed this year in the Legislature and signed into law on April 15 by Gov. Ron DeSantis.

2. Effective July 1, natural disasters that occur within five days of a state tax filing deadline will trigger automatic extensions

To briefly expand on that final point, FICPA President & CEO Shelly Weir has been sounding the alarm for the last year about oncoming changes to the existing framework that allows CPAs to practice across state lines. The style of deregulatory legislation we protected our members from in Florida may well pass in other states, and additional changes to licensure will have a domino effect, impacting CPAs nationwide.

As much as the FICPA is about making connections, building relationships and supporting one another at the local level, our membership also ensures that Shelly and the Governmental Affairs team have the resources necessary to advocate for us at the state and national levels. Thanks to their work and our support, Florida has the opportunity to play a leading role in reshaping the future of our profession.

Always remember: Just as we fight for our clients, the FICPA fights for us.

Your Membership is up for renewal on June 30 for the 2024-25 membership year.

• Stay connected with 18,500 peers.

• Benefit from representation in Tallahassee and Washington.

• Enjoy affordable, high-quality CPE with up to 20+ hours of FREE CPE (an $800 value).

• Receive concierge-quality membership support and more.

Renew today to WE’RE

FICPA OFFICIAL NOTICE

In compliance with Article XI, Section 6 of the FICPA Bylaws, be it known that a regular meeting of the FICPA Council will be held on:

JUNE 13, 2024

9:00 a.m.

Loews Sapphire Falls Resort, Orlando

SEPT. 25, 2024

9:00 a.m.

Virtual

FEB. 25, 2025

9:00 a.m.

Virtual

JUNE 12, 2025

9:00 a.m.

Loews Sapphire Falls Resort, Orlando

The window for FICPA membership renewals opened in early April, with fees due by July 1, the start of the membership year.

You can renew online with a one-time payment, take advantage of our auto-renew options, or send payment by mail to the address listed on your invoice.

As you renew, be sure you take advantage of the additional savings on self-study Florida Ethics (ETHOL23) and our ondemand 24/7 Learning Library found on your invoice.

MEMBERS

Your renewal will automatically process on July 1, 2024. If your credit card has changed since last July, please call us

to update your payment information.

Your renewal will stay on the current schedule.

FICPA 100% FIRMS

If your office participates in firm billing, no action is required on your part. If your firm is not currently an FICPA 100% Firm and you invest in FICPA memberships for all your staff, please email firmconcierge@ficpa.org, and we will get you set up.

NEED HELP?

Email membership@ ficpa.org, chat with us on our website, or call 800-342-3197 x 1. Thank you for being part of our community. You are the reason we are here!

YOUR HOMEWORK WITH OUR GRATEFUL APPRECIATION

A lot can change in a year, and staying connected with you is extremely important to us. Please take a moment to check your:

Personal profile: Did you move?

Email addresses: Please add an alternate email.

Email communication preferences: Curate your content.

Business profile: Are you linked to the correct firm/company?

Membership category: Have you graduated or retired?

FICPA 100%: Contact us so we can update your payment method.

The FICPA celebrates the 12 individuals from Florida who were included in Forbes' list of the Top 200 CPAs in America.

Congratulations to FICPA Peer Review Committee Chair Ileana Alvarez (ZOMMA Group), Florida CPA/PAC - South Chair Tony Argiz (BDO USA), Avani Desai (Schellman), Suzanne Forbes (James Moore & Co.), Blain Heckaman (Kaufman Rossin), Armando Hernandez (H&CO USA), 2025-26 FICPA Chair Karen Lake (Berkowitz Pollack Brant), Brent Leslie (Berkowitz Pollack Brant), Steve Riggs (Carr, Riggs & Ingram), Joseph Saka (Berkowitz Pollack Brant), Jeffrey Taraboulos (Kabat, Schertzer, De La Torre, Taraboulos & Co.), and JaJuan Williams (The LADY CFO).

Per Forbes, the list "is a compilation of the finest CPAs active in public practice, culled from a collection of candidates sourced through independent nominations and accolades from every society and association of CPAs. Nominees were rated on a range of weighted criteria, including expertise, innovation, thought leadership, experience, and service to the community and to their profession, as well as responses to selected questions."

Congratulations to all our honorees from Florida, with special recognition to BDO's Tony Argiz, who was featured in an adjoining Forbes' profile, detailing his journey from Cuba to the top of the CPA profession in South Florida.

Florida CPAs with a CPE deadline of June 30, 2024, will be the first to encounter the Department of Business and Professional Regulation’s (DBPR) new CPE reporting tool. The Division of Certified Public Accounting has implemented a new reporting procedure after CPE audits showed compliance well below the state statute’s 95% threshold.

It is critical that CPAs upload their CPE and corresponding certificates into their DBPR account in advance of the deadline. The state is anticipating a heavy influx of online traffic on the DBPR website as the reporting deadline draws near, and we do not want our members to be behind the curve.

As a reminder, the CPE deadline is June 30, and licensees will have until July 31 to upload their CPE.

Failure to upload your CPE documentation by July 31 will automatically opt you into an extension, requiring you to complete eight extra hours of A&A by Sept. 15 or 16 extra hours of A&A by Dec. 31.

Please visit our resource page (ficpa.org/cpetracker) for more information and to access tutorial videos on how to use the reporting tool.

As a reminder, FICPA members are eligible for up to 20 hours of free CPE each year. Our CPE Tracker generates one comprehensive certificate you can submit to DBPR, listing all your completed FICPA-sponsored courses in one place.

If you need to complete CPE before June 30, we encourage you to review our list of upcoming conferences at ficpa.org/ conferences.

If you need to complete Florida Ethics, we offer in-person, online, and ondemand options at ficpa. org/ethics.

The FICPA congratulates Rep. Cyndi Stevenson, CPA, on her nine years of service in the Florida House of Representatives.

Elected in 2015, Rep. Stevenson has been a close friend of the FICPA and a tremendous advocate for the CPA profession.

Though Rep. Stevenson's term in the Florida House

ends later this year, we look forward to seeing what's next for one of our CPA Lawmakers, and we wish her the best in her future pursuits.

Please join the FICPA in thanking Rep. Stevenson for all she has done to advance the profession in Florida.

IVEY ROSE SMITH

VP of Membership & Corporate Relations

Central Florida & Brevard County Ivey@ficpa.org I 850-521-5918

KAREN DOW

Regional Director of Membership Broward & Palm Beach Counties

KarenD@ficpa.org I 850-251-5921

KATHRYN HERNANDEZ

Regional Director of Membership Miami & The Keys KatH@ficpa.org I 850-521-5951

ALINA PENJIYEVA

Regional Director of Membership North Florida AlinaP@ficpa.org I 850-521-5930

JAY PROPST

Regional Director of Membership Tampa & Southwest Florida JayP@ficpa.org I 850-521-5946

IVELISSE SANTIAGO

Chapter Connections Manager Ivelisse@ficpa.org I 850-521-5919

North Florida and Panhandle

Central Florida

Tampa and Southwest

Broward and Palm Beach

Miami and the Keys

FICPA Advocacy

FICPA Headquarters

When you attend an FICPA Chapter event, you make a strategic investment in your career. When you engage locally, you gift yourself the trifecta of professional development: education, networking and fun. Chapter events are hubs of opportunity that enrich you personally and professionally.

In a field as dynamic as accounting, the learning never stops. Local events feature dynamic speakers who share cutting-edge insights, updates and strategies to help you stay ahead of the curve and bring fresh perspectives to your practice.

In our digital world, face-to-face interaction is invaluable. Local Chapter events provide a relaxed setting to forge new relationships that can lead to mentorship opportunities, joint ventures, new clients, or your next big career move.

Every new connection is a doorway to potential business, and Chapter events offer you a look beyond the accounting

world. By engaging with professionals from other industry backgrounds, you can create a diverse and robust referral ecosystem, broadening your reach.

Local chapters are known for choosing venues that inspire and energize attendees. From classy clubs to unique locales, you’ll make memories and new like-minded friends.

Don’t miss out! Mark your calendar and make local Chapter events a priority. Check out our full calendar of events at www.ficpa. org/connect/chapters. You may also connect with your Regional Director of Membership (listed to the left).

If you’re looking to play a leading role in your area, consider stepping up as an FICPA Chapter officer. Nominations for officer positions are taking place now through June. Positions available include chair, chair-elect, secretary, treasurer, and programming officer. Connect with our Chapter Connections Manager, Ivelisse Santiago, to explore our opportunities.

Left: Young CPAs across Central Florida enjoy a pre-game social event at Dapper Duck in downtown Orlando, followed by an Orlando Solar Bears hockey game at the Kia Center.

Bottom: The Volusia County Chapter convenes for an evening CPE event at Embry-Riddle Aeronautical University.

The

1. Promoting the FICPA’s “retired CPA” status bill.

2. Promoting the FICPA’s automatic tax-deadline extension language.

3. Reinforcing the importance of the current “gold standard” regulatory structure, allowing CPAs to provide services to clients across state lines while protecting the public.

On Jan. 17, during Week 2 of the 2024 Legislative Session, the FICPA hosted its annual advocacy day, CPA Day at the Capitol.

More than 100 FICPA members and staff took time out of their busy schedules to travel to Tallahassee for the event.

The event kicked off with a Tuesday evening welcome reception in the Dunlap Champions Club at the home of the Florida State Seminoles, Doak Campbell Stadium.

In addition to enjoying great food and networking with colleagues, attendees heard from FICPA President

& CEO Shelly Weir, who hosted an intriguing fireside chat with FICPA member and Seminole Boosters CFO J.P. Sinclair, CPA.

On Wednesday morning, the FICPA held its 2024 Leadership Academy graduation ceremony at the Challenger Learning Center of Tallahassee.

Graduates started their morning by learning from influential speakers, including Kathy Mears, Assistant Commissioner, Florida Department of Agriculture and Consumer Services; Melinda Miguel, Chief Inspector General, Executive Office of the Governor; and Ken Burke, CPA, Pinellas County Clerk of Court and Comptroller.

The graduates also learned about the FICPA Governmental Affairs program from FICPA Chief External Affairs Officer Jason Harrell and Deputy Director Lauren Henderson.

The official program then opened with our CPA Day luncheon. Rep. Mike Caruso, CPA, kicked off the lunch, speaking to graduates and FICPA members about the importance of advocating in the halls of the Capitol.

The luncheon’s keynote speaker was Department of Business and Professional Regulation (DBPR) Secretary Melanie Griffin, who provided updates on DBPR’s legislative agenda, its new continuing professional education reporting system and the excellent partnership between the FICPA and the Department.

FICPA members then headed to the Capitol to make their voices heard. The Governmental Affairs Team scheduled meetings with members from all six committees – three from each chamber – that would later

decide on the FICPA’s proposed legislation. FICPA members were strategically grouped and matched with committee members from their respective regions.

In all, members either met with or personally delivered an FICPA-prepared packet of information to all 160 legislators. These meetings were extremely impactful, and ultimately led to our success, both on offense and defense, during Session.

CPA Day events concluded with a reception at the Florida Restaurant and Lodging Association, just steps from the Capitol.

This tremendously impactful event was a critical part of the FICPA’s success during the 2024 Legislative Session. The momentum and education FICPA members provided was invaluable and carried into the remaining weeks.

The FICPA thanks all members who took time out of their busy schedules to participate in this important event.

The FICPA's Key Person Contact (KPC) Program helps us forge our strongest relationships in Tallahassee. KPCs serve as liaisons between the FICPA and lawmakers, creating critical lines of communication before, during and after session.

The FICPA's continued legislative success depends on you. Contact govaffairs@ ficpa.org to learn more.

During the 2024 Legislative Session, the Florida Institute of Certified Public Accountants (FICPA) was led by its all-new Governmental Affairs team of Jason Harrell and Lauren Henderson.

Named Chief External Affairs Officer in July 2023, Harrell has worked alongside President & CEO Shelly Weir to strengthen the FICPA’s advocacy program and position advocacy as the Institute's No. 1 member benefit.

To advance those goals, the FICPA brought in Henderson in October 2023 as its new Deputy Director of Governmental Affairs, adding years of lobbying experience to complement Harrell’s extensive legislative background. Having two strong internal lobbyists made for a robust new approach, allowing for key political relationships and duties to be divided, making the FICPA more efficient and effective in its advocacy efforts.

“My earliest conversations with Shelly centered on the need for a strong counterpart to help strengthen our program” Harrell said. “Lauren has brought tremendous experience and political savvy to the process.”

During the 2024 Session, legislative duties, relationships, and political capital were divided between Harrell, Henderson, FICPA’s longtime lobbyist Jennifer Green and her team at Liberty Partners of Tallahassee. This new lineup became known around the Capitol as “Team CPA,” with seven different individuals taking meetings with legislators and representing the profession’s interests during the most active session for the FICPA in recent history.

“Alongside the team at Liberty Partners, Lauren and I were able to successfully advocate for our FICPA priorities and play defense against multiple pieces of potentially troublesome legislation,” Harrell added. “It takes a team effort to be successful in Tallahassee, and I’m proud of what we delivered for our members this spring.”

The FICPA entered the 2024 Legislative Session with two main offensive priorities:

1. Create a “retired CPA” status in statute.

2. Enact automatic tax extension language when a state of emergency has been declared.

FICPA priority bills seeking to create a new retired CPA status in statute were filed in December 2023 by two of our CPA Lawmakers, Rep. Mike Caruso (R-Delray Beach) and Sen. Joe Gruters (R-Sarasota). HB 813 - Certified Public Accountants and companion bill SB 954 allow CPAs at least 65 years of age who have an active or inactive license to apply to the Board of Accountancy (BOA) to place their license on retired status. Under this designation, an individual may use “retired CPA” as part of their business card, letterhead or any electronic communication.

The legislation enables CPAs who have had long and distinguished careers to continue serving, without

compensation, on boards or in other mentoring or advisory roles for certain specified charitable or civic organizations. However, with this new status, retired CPAs may not represent to the public that they have an active license. Should they want to go back into public practice, the bill creates a pathway for retired CPAs to reactivate their licenses.

FICPA is proud to report that HB 813 by Rep. Mike Caruso (SB 954) passed all committees and both the House and Senate unanimously during the 2024 Legislative Session. And on Monday, April 15, Gov. Ron DeSantis signed the bill into law. It goes into effect on July 1.

“This important change will allow our members who are retired or ready to retire to use the designation ‘retired CPA’ for volunteer work,” Weir said. “This richly deserved licensure category helps uphold retired CPAs’ profound sense of pride and accomplishment and preserves their professional identity.”

A licensee with their CPA license on “active” status:

Must complete 80 hours of continuing professional education (CPE) every two years (specific types are in 473.312).

Must pay a license fee.

Can use the “CPA” designation.

A licensee with their CPA license on “inactive” status:

Does not have to complete any CPE.

Must pay a license fee.

Cannot use the “CPA” designation.

If an inactive licensee wants to reactivate their license, they must take 120 hours of CPE.

A licensee with their CPA license on “retired” status:

Does NOT have to complete any CPE.

Can use “CPA retired.”

Agrees not to provide services to the public for payment (they can volunteer).

To reactivate their license, they must take 80 hours of CPE for every two-year license renewal period while they are in “retired” status.

“This legislation will allow Florida CPAs to continue adding value by serving their communities while maintaining a title that has meant so much to them throughout their careers,” Harrell added. “Advocating for the profession is at the center of what we do at FICPA, and we are happy to have gotten this bill across the finish line. We thank our CPA sponsors, Sen. Gruters and Rep. Caruso, and the entire Legislature for their support.”

Likewise, the FICPA was also successful in its effort to secure automatic tax extensions. Team CPA worked tirelessly to ensure that the extension language was included in both the House and Senate tax packages. Once approved by the Governor, the language will provide for automatic tax extensions when a state of emergency has been declared within five days of a deadline. The language was included in the final tax package, HB

7073. Supported by the FICPA State Tax Committee, these extensions will be greatly beneficial for taxpayers. With this change, when Florida experiences the inevitable hurricane, taxpayers can prepare for the storm without worrying about if, and when, an extension will be granted.

In recent years, there has been a significant push – nationally and in other states – to increase trade and professional licensees’ ability to be recognized from state to state. This is sometimes referred to as universal licensure or license mobility.

With thousands of people moving to Florida every day, this issue is at the forefront of legislators’ minds. Unfortunately, the phrase universal licensure can be very misleading; and under certain circumstances, it can become a significant threat for the profession, as it directly conflicts with the minimum standards of substantial equivalency and the practice mobility infrastructure CPAs enjoy across 55 jurisdictions. Having already passed in other states, universal licensure bills have created a mess of conflicting standards that do the opposite of their

intended purpose, especially for CPAs who already have access to the gold standard of license mobility.

During the 2024 Legislative Session, there were 15 active bills moving through the legislative process that proposed changes to Ch. 455, the general licensing statute for the Department of Business and Professional Regulation (DBPR).

Due to the scope of the issues being considered and the significant threats posed by several of the proposed bills, FICPA Governmental Affairs had to heavily engage on these issues to make sure that the CPA profession was protected. From the Governmental Affairs team to FICPA President & CEO Shelly Weir to the team at Liberty Partners of Tallahassee, it was all hands on deck.

In general, these bills would have disrupted the national CPA license infrastructure, taken power away from the Board of Accountancy, and further deregulated Florida. In specific, there were two main bills of concern:

Senate Bill 1600 Interstate Mobility by Sen. Jay Collins (House Bill 1381 by Rep. Alverez) was aimed at improving license mobility to attract more talent to Florida’s workforce. This bill provided a new process and criteria for licensure by endorsement for those professions that do not already have it in statute. It also provided new license mobility provisions for certain health care practitioners. Originally, the FICPA had worked to ensure the CPA profession was not impacted by these changes.

HB 1273 Reciprocity or Endorsement of Licensure by Rep. Susan Plascencia provided that before a board – or DBPR if there is no board – enters a final order denying an application for licensure by reciprocity or endorsement based on a finding that a “basis license” from another state is not substantially equivalent, the finding must be submitted to the Secretary, who can then agree or disagree with the order. The FICPA was extremely concerned about this bill; not only did it take further power away from the Board of Accountancy, but it could have also overridden our CPA license statute which allows an individual to seek licensure by endorsement in Florida, even if they came from a state that was not substantially equivalent. Initially, this bill did not have a Senate companion.

As the Legislative Session progressed, the FICPA Governmental Affairs team was closely monitoring the progression of the three bills mentioned (SB 1600 and HB 1273). Towards the end of session, unfortunately, the problematic language from HB 1273 was amended into SB 1600. Importantly, this amendment also rolled the bills into part of a larger legislative priority called “Live Healthy,” a proposal by Senate President Kathleen Passidomo to increase the health care

workforce through licensure changes, where legislative leadership and Gov. DeSantis had negotiated alignment.

In the end, Team CPA worked hard into the final days of the 2024 Legislative Session to gain clarification on the potential impacts to Ch. 473 and secure any necessary licensure exemptions for the profession. SB 1600 Interstate Mobility by Sen. Collins did eventually pass the Legislature. Section 1 of the bill does provide a new process where an applicant for licensure by endorsement may request that the DBPR Secretary review a Board’s decision on whether a state is substantially equivalent to Florida. Most importantly, while this bill did pass, the CPA

profession – with help from our CPA Lawmakers, Rep. Caruso, Sen. Gruters, and Rep. Stevenson – was the only profession to secure what we deem a “verbal carve-out,” which was an on-the-record clarification that this legislation does not supersede the regulations in Ch. 473, preserving critical mobility and licensure by endorsement processes for the CPA profession. SB 1600 is awaiting action by Gov. DeSantis before becoming law. The FICPA will work closely with DBPR and the Florida Board of Accountancy on the implementation and rule-making process should this bill be signed into law.

Here is a look at the key pieces of legislation the FICPA monitored and engaged with on behalf of our members during the 2024 Session.

Audit/Tax/Industry

House Bill 939 Consumer Protection by Rep. Griffitts Jr. (Senate Bill 1066 Consumer Protection by Sen. Burton)

This bill was part of the Department of Financial Services legislative agenda and require that any CPAs who audit insurance companies have at least four hours of insurance-related CPE.

Senate Bill 1746 Public Employees by Sen. Ingoglia (House Bill 1471 Public Employees by Rep. Black)

This bill is a follow-up to last year’s legislation requiring additional audits of unions. This bill, among other changes, provides clarification to audit language.

Condos and HOAs

House Bill 1021 Community Associations by Rep. Lopez (Senate Bill 1178 Condominium and Cooperative Associations by Sen. Bradley)

This bill make numerous changes to the current Florida condominium statues.

House Bill 1203 Homeowners’ Association by Representative Esposito (Senate Bill 7044 Homeowners’ Associations by Regulated Industries)

This bill provides new requirements for certain community association's managers and firms, and revises some official record requirements.

House Bill 293 Hurricane Protections for Homeowners’ Associations by Rep. Sirois (Senate Bill 600 Hurricane Protections for Homeowners’ Associations by Sen. Ingoglia)

This bill requires the board or a committee of a homeowners’ association to adopt hurricane protection specifications.

Senate Bill 1366 My Safe Florida Condominium Pilot Program by Sen. DiCeglie (House Bill 1029 My Safe Florida Condominium Pilot Program by Rep. Hunschofsky and Rep. Lopez (V))

This bill establishes a My Safe Florida Condominium Pilot Program within DFS.

Mobility and Licensing

Senate Bill 1600 Interstate Mobility by Sen. Collins (House Bill 1381 by Rep. Alvarez & House Bill 1273 Reciprocity or Endorsement of Licensure by Rep. Plascencia)

This bill allows out-of-state licensees under chapter 455 to practice in the state of Florida if they meet the designated criteria. The FICPA worked with our CPA legislators to clarify that this legislation does not supersede the regulations in Ch. 473, preserving critical mobility and licensure by endorsement processes for the CPA profession.

Senate Bill 382 Continuing Education Requirements by Sen. Hooper (House Bill 497 by Rep. Melo)

This bill allows departments and boards to exempt some licensees from continuing-education requirements under certain criteria. FICPA Advocacy in Action: CPA profession is not impacted.

House Bill 1335 Department of Business and Professional Regulation by Rep. Maggard (Senate Bill 1544 by Sen. Hooper, Department of Business and Professional Regulation)

This bill from the DBPR agency legislative package and would require CPAs, and other professions and trades regulated by the DBPR, to have and maintain an online account with the Department to ensure all communication information is up to date for licensees.

Audit/Tax/Industry

Senate Bill 1030 Taxation by Senator Rodriguez (House Bill 1001 Taxation by Rep. Stevenson)

This bill is the Department of Revenue's annual agency package bill. Although this bill was not successful, some elements of this bill did pass in the annual Tax Package, HB 7073.

Condos and HOAs

Senate Bill 426 Community Associations by Sen. Garcia

This bill would have created the Condominium and Homeowners’ Association Economic Crime, Fraud and Corruption Investigation Pilot Program within the Department of Legal Affairs in the Office of the Attorney General.

Mobility and Licensing

House Bill 751 Disqualification from Licensing, Permitting or Certification Based on Criminal Conviction by Rep. Hunschofsky (Senate Bill 1012 Employment of Exoffenders by Sen. Calatayud)

This bill prohibits departments or boards under certain circumstances from denying a license if a person’s past crime was not followed by a conviction.

Each Legislative Session, there is only one bill that the Legislature is constitutionally mandated to pass: the state budget, also known as the General Appropriations Act (GAA). HB 5001, the Fiscal Year (FY) 2024-25 GAA, passed the full Legislature on March 8, 2024. With the distribution of federal COVID-era funds ending, the Florida Legislature took a more conservative approach, focusing on having a strong position in upcoming fiscal years. This year’s GAA totaled $117.46 billion ($49.4 billion General Revenue; $68.1 billion Trust Fund). The budget includes $10 billion in total reserves and $500 million authorized to retire state debt.

The final budget is still pending review by Gov. DeSantis. The Governor has line-item veto authority before signing the FY 2024-25 GAA into law, which we expect to happen prior to July 1, when the state of Florida’s next fiscal year begins.

The FICPA is happy to report that both budget items of interest to the CPA profession - the Clay Ford Scholarship Program and funds to combat Unlicensed Activity - are fully funded in the state budget for FY 2024-25.

$100,000

Funded by a five-cent portion of CPA license fees. Provides funding to the Board of Accountancy to combat the unlicensed practice of public accounting.

$200,000

Funded by a five-cent portion of CPA license fees. Provides funding to minority accounting students to finish their fifth year of accounting courses to sit for the CPA exam. Since the program’s inception, more than 400 scholarships have been awarded to help advance diversity within the profession.

Each year, the Legislature typically handles most major tax law changes in one bill, known as the tax package. This year, the Legislature passed HB 7073 – Taxation, which provided numerous changes to Florida tax laws for the upcoming fiscal year. Taxpayers and consumers are projected to save $1.5 billion over the next two years under this new bill.

Among the more notable items is a credit to insurance companies that reduce premiums for homeowners. The provision is projected to save homeowners $417.5 million over two years. This proposed initiative started in the Senate before the legislative session, in which the House negotiated a comfortable placement for the final allocation.

A sizable portion of the tax proposals were initially in either the House or the Senate, but a $450 million toll rebate program for drivers with more than 35 toll transactions per month was included as part of a last-minute deal from Gov. Ron DeSantis.

As mentioned in other summaries, the FICPA is incredibly happy that our automatic tax extension

language was included in the final tax package.

Below is a brief overview of all items listed within the 2024 Tax Package

A Back-to-School Sales Tax Holiday (July 29 -Aug. 11): For school supplies, learning aids, personal computers and certain clothing and footwear.

Disaster Preparedness Sales Tax Holidays (June 1-14; Aug. 24-Sept. 6, 2024): For generators, radios, flashlights, coolers, and pet evacuation supplies during a disaster.

Freedom Month Sales Tax Holiday (July 1-31): For tickets for admission to live music events, sporting events, museums, cultural events and other recreational events through Dec. 31, 2024. Also for boating and water, camping, fishing, and general outdoor supplies.

Skilled Worker “Tool Time” Sales Tax Holiday (Sept. 1-7): For tools used by skilled trade workers, such as carpenters, electricians, plumbers and welders.

$450 million in toll rebates for drivers with more than 35 transactions each month.

$5 million credit against the corporate income tax for three years for businesses that employ workers with special needs ($1,000 per employee).

$5 million tax credit for three years for businesses that incur childcare expenses on behalf of their employees.

Increases the Strong Families Tax Credit Program from $20 million to $40 million.

Automatic extensions for sales tax and corporate tax during a natural disaster or state of emergency (FICPA priority).

One-year residential property insurance tax exemption for residential property insurance policyholders on policies written between Oct. 1, 2024-Sept. 30, 2025.

One-year flood insurance policy premium tax exemption on flood insurance policies written between Oct. 1, 2024-Sept. 30, 2025.

The FICPA is the premier provider for Florida Ethics. FICPA Florida Ethics courses fulfill the requirements for Florida CPAs established by the Florida Board of Accountancy. Review the options below and complete your four hours of Board-approved Ethics with the FICPA.

Ethics: Protecting the Integrity of Florida CPAs – 0004980*

4 ETHICS HOURS

Date Start Time Code Member Price

June 10 8:00 AM ETHMEGA $175

Nov. 6 8:00 AM ETHSFAC $195

Governmental Ethics: Protecting the Integrity of Florida CPAs - 0006957*

4 ETHICS HOURS

Date Start Time Code Member Price

Aug. 14 1:00 PM ETHSLGAC $195

Ethics: Protecting the Integrity of Florida CPAs – 0004980*

4 ETHICS HOURS

Date Start Time Code Member Price

May 9 8:30 AM THWBR02 $104

May 29 8:30 AM ETHWBR03 $104

June 18 8:30 AM ETHWBR04 $104

June 27 8:30 AM ETHWBR05 $104

July 25 8:30 AM ETHWBR06 $104

Aug. 28 8:30 AM ETHWBR07 $104

Sept. 26 8:30 AM ETHWBR08 $104

Oct. 10 8:30 AM ETHWBR09 $104

Nov. 8 8:30 AM ETHWBR10 $104

Nov. 21 8:30 AM ETHWBR11 $104

Dec. 4 8:30 AM ETHWBE12 $104

Dec. 18 8:30 AM ETHWBR13 $104

Ethics: Protecting the Integrity of Florida CPAs – 0004980*

4 ETHICS HOURS Course Code Member Price ETHOL23 $90

Brent Sparkman, CPA, CFF, CITP, is chair of the Florida Board of Accountancy and a senior partner and shareholder of Carr, Riggs & Ingram in the Tallahassee office, responsible for the firm’s government consulting with the state of Florida; corporate and individual matters; developing related firm policies and procedures; and ensuring client satisfaction. Sparkman, a Florida native, was born in Tampa and raised in Tallahassee, graduating from Florida State University with a bachelor’s in accounting and a degree in finance, cum laude. He is the proud father of two sons and in his spare time enjoys the outdoors.

WILLIAM G. BENSON, CPA

Bill Benson, CPA, is the vice chair of the Florida Board of Accountancy and managing partner in the CPA firm of Keefe McCullough, LLP, in Fort Lauderdale. Benson joined the firm nearly four decades ago and has been a partner for the past three. He is the partner in charge of the governmental, not-for-profit and educational divisions, which provide accounting, auditing and consulting services. He is a graduate of Washington and Lee University in Lexington, VA, with a bachelor’s in business administration and accounting, with special attainments in commerce. He and his wife of 35 years, Sharon, reside in Plantation; they have two children and three grandchildren.

Bill Blend, CPA, CFE, is a shareholder of MSL CPAs & Advisors. He is a member of the firm’s Governmental Practice Group and shareholder in charge of quality control. Blend has more than two decades of public and private sector accounting experience. He has performed audits on more than 30 governmental entities, including counties, municipalities, utilities, airports and special districts. Blend served in and received an honorable discharge from the U.S. Navy before earning his bachelor’s in accounting from Long Island University.

TRACY L. KEEGANTracy L. Keegan most recently served as president, CFO and director at BankFlorida. With close to 30 years of experience, Keegan has held significant senior executive officer and director roles and has extensive experience in starting, recapping and growing financial organizations from the de novo stage to amassing more than $6 billion in assets. Keegan holds a bachelor’s degree in accounting.

Jason Lafser, CPA, CFE, is the tax managing director for BDO USA, LLP. He focuses on business management consulting as well as tax planning and preparation for commercial businesses and individuals. Lafser has more than 15 years of public accounting experience in the health care industry. He centers his public accounting practice on the health care and professional services industries, with an ancillary focus on real estate. Lafser earned his master’s in business administration from the University of North Florida and his bachelor’s in accounting from Murray State University.

Michelle Maingot, CPA, is an audit partner with Ernst & Young and the leader of the firm’s Florida and Puerto Rico audit practices. She has more than 25 years’ experience serving a variety of mid- to large-sized companies, specializing in SEC-registered companies. Maingot has extensive experience auditing companies with high-volume, low-dollar transactions and a strong background in accounting for leases and real estate transactions and with multi-location and international businesses. She graduated from Florida State University with a bachelor’s in accounting and lives in Tampa with her husband, Chris, and their three children.

Steve Platau, CPA, J.D., is an accounting professor at the University of Tampa, where he has served on the faculty since 1984. He is the immediate Past Chair of the Florida Board of Accountancy. He is a principal consultant to the CNA Insurance Companies, providing loss control programs to CPA firms nationally. Platau’s business experience includes time with two of the “Big 5” international accounting firms, private law practice and industry accounting, along with financial interests in several hospitality businesses. He earned his bachelor’s and master’s degrees in accounting from The Ohio State University in Columbis, OH, and his juris doctorate from the University of Cincinnati.

Shireen Sackreiter is the Tallahassee office managing director for Accenture, a multinational management consulting, technology services and outsourcing company. She has spent her entire career at Accenture, working for public sector clients throughout North America, with a focus on Florida. Sackreiter has an extensive background in the design and delivery of large system integration engagements across a variety of industries in state and local government. Sackreiter is a Florida native and graduated from Florida State University. She lives in Tallahassee with her husband, John, and their daughters, Lauren and Jaclyn.

Caridad “Carey” Vasallo is a partner at VMBG Accounting and practice leader for the firm’s Consulting Services division. With more than a decade of experience providing litigation support services, Vasallo specializes in assisting high net-worth individuals in marital dispute cases and business valuation matters. Under her direction, the practice has been listed on the South Florida Business Journal’s Top 25 Litigation Support Accounting Firms. Vasallo serves on the FICPA Scholarship Foundation Board of Trustees and has served on the Miami-Dade Advisory Board for the 13th District, the FICPA Board of Directors and Council, and the Florida Bar Grievance Committee for the 11th Judicial Circuit Court.

In 2022, the American Institute of Certified Public Accountants (AICPA) issued a new set of quality management (QM) standards. These standards are set to replace the Statement on Quality Control Standards (SQCS) that were last updated by the issuance of SQCS No. 8 in 2010.

The QM standards represent a significant milestone in the profession, aiming to enhance quality, promote ethical behavior and elevate the integrity of accounting practices. In this article, we delve into the intricacies of AICPA’s new QM standards, exploring the key features, implications and impact they are poised to have on the accounting profession, as well as a timeline for firms to consider when implementing the standards.

The QM standards will affect every firm that performs engagements in accordance with the Statements on Auditing Standards (SAS), Statements on Standards for Attestation Engagements (SSAEs) or Statements on Standards for Accounting and Review Engagements (SSARS). The new QM standards are embedded in each of the sets of standards through SAS No. 146, “Quality Management for an Engagement Conducted in Accordance With Generally Accepted Auditing Standards;” a recently issued amendment to the SSAEs; and SSARS No. 26, “Quality Management for an Engagement Conducted in Accordance With Statements on Standards for Accounting and Review Services.”

All firms meeting the requirements noted above must have the new standards implemented and operational for engagements performed in accordance with the respective

standards for periods beginning on or after Dec. 15, 2025. This will allow firms some time to fully implement the new standards; that said, firms should not put off the design, implementation and operation until the last moment. Firms are encouraged to start the process now, if they have not already done so, by taking some of the following steps:

1. Gain an overall understanding of the standards. This can be accomplished by reading executive summaries, comparing the extant SQCS to the QM standards, downloading and familiarizing yourself with the AICPA or other third-party practice aids available, and/or taking continuing education on the topic.

2. Develop an implementation plan. Who in the firm will own and lead the implementation process? What resources will be needed for successful implementation? Talk with the firm’s peer reviewer about the timing of the next peer review year. Firms do not want to have a hybrid peer review based on two different sets of quality standards.

3. Develop a timeline. Firms can start implementing parts of the new standards before the final operational due date for different components of QM. (See chart for sample timeline.)

4. Start performing risk assessments. Establish the required quality objectives. Identify and assess quality risks.

One of the notable changes introduced in the new standards is a more principles-based approach, emphasizing overarching objectives and fundamental principles of QM,

rather than prescribing specific procedures. This shift reflects AICPA’s recognition of the diverse nature of practices within firms and the need for flexibility in implementation.

The AICPA’s new standards encompass a comprehensive framework that addresses various aspects of QM within CPA firms. Some key features/changes of these standards include:

1. A new risk-based approach focused on QM tailored to a firm’s circumstances.

2. Revised components of the QM system, including information and communication.

3. More robust leadership and governance requirements.

4. Engagement monitoring and remediation process.

5. New requirements for networks and service providers.

The intent of the new QM system and its components is to:

Focus on QM though a riskbased approach.

Ensure the QM system evolves from a linear system to one that operates in an iterative and integrated manner.

Provide a proactive approach to QM systems, with a continual flow of remediation and improvement.

Result in a tailored QM system, scalable to the nature and circumstances of the firm and the engagements it performs.

The majority of the components listed should not be new for most firms that have adopted the SQCS. However, when firms transition to a QM system, they may need to consider some new and more robust requirements during implementation.

Risk Assessment

Risk assessment is a new component of the QM standards. It requires the firm to establish quality objectives, identify and assess those quality risks, and design and implement responses to those quality risks. Firms should design quality objectives for each component as outlined in the graphic to the right.

Effective leadership and a culture of quality are essential for maintaining high standards of professionalism and integrity within CPA firms. The new standards place greater emphasis on leadership responsibilities, including setting the tone at the top, defining quality objectives and promoting a culture of ethical behavior and continuous improvement. Matters for firms to consider include:

Personnel assigned to specified responsibilities.

Leadership required to undertake an annual evaluation of the system and conclude thereon.

Leadership with appropriate qualifications, influence and authority.

Periodic performance evaluations of leadership.

Upholding ethical principles is foundational to the CPA profession. The new standards reaffirm the importance of integrity, objectivity, professional competence, confidentiality and professional behavior. Firms are expected to demonstrate a commitment to ethical behavior in all aspects of their operations. Matters to consider are the new:

Emphasis on responsibilities for all relevant ethical requirements, including independence.

Requirement that a firm ensures that others (e.g. network of firms, individuals within the network, and service providers) involved in the firm’s system of QM or in performing

Identify and assess quality risks.

Understand the factors (that is, conditions, events, circumstances, actions or inactions) that may adversely affect the achievement of the quality objective.

Consider how, and the degree to which, the factors may adversely affect the achievement of the quality objective.

A risk that has a reasonable possibility of:

(i) Occuring: and (ii) Individually, or in combination with other risks, adversely affecting the achievement of one or more quality objectives.

engagements understand and fulfill relevant ethical requirements.

Before accepting or continuing a client relationship or engagement, CPA firms should conduct a thorough assessment of the client’s integrity, ethical values and the risks associated with the engagement. The new standards advocate for a risk-based approach to client acceptance and continuance, ensuring that firms only engage with clients

whose values align with their own and that the firm can effectively manage the risks associated with the engagement.

Not much has changed in this component compared to the extant SQCS. It is likely CPA firms already have a good understanding of the objectives. The new standards do require that engagement teams understand and fulfill their professional responsibilities, including an engagement partner’s overall responsibility for managing and achieving quality and being sufficiently and appropriately involved throughout an engagement. The new standards may provide firms with an opportunity to enhance their requirements and tailor their policies and procedures. For instance, peer review statistics show that less engagement partner interaction and involvement increases the likelihood of a nonconforming engagement. Thus, firms might want to look closely at their policies and procedures to increase engagement partner interaction.

Resources

This is a re-titled component of QM standards from the extant Human Resources. This component now includes requirements relating to technological and intellectual resources, in addition to human resources. Firms need to consider what information technology (IT) applications they use to support the QM system and engagement performance. When assessing IT risks for an audit, depending on the complexity of the firm, the processes could be relatively simple or more complex. The firm should determine the appropriateness of the technological or intellectual resources; how to obtain or develop, implement, maintain and use those resources; and how to assess the accountability of personnel and their commitment to quality. When external service providers are part of the QM system, firms should consider whether the resources from the service provider are appropriate for use, as some resources

may be geared to more experienced firms and would be less suited for less experienced firms.

Information and Communication

While this is another new component under QM standards, firms may already have communication procedures in place.

The firm’s QM system should establish the following quality objectives that address obtaining, generating or using information regarding the system and communicating within the firm on a timely basis:

Information and communication processes that support the firm’s system of QM.

A culture that reinforces personnel’s responsibility for sharing information with one another and the firm.

How information is to be exchanged throughout the firm so that personnel and engagement teams understand and perform activities related to the system of QM and engagement personnel and teams communicate information to the firm.

Monitoring and Remediation

QM is an ongoing process that requires continuous monitoring, evaluation and improvement. The new standards mandate firms establish robust monitoring procedures, including internal reviews, inspections and assessments of firm compliance with QM policies and procedures. By continuously monitoring and evaluating their performance, firms can identify areas for improvement and enhance their QM processes over time. The new standards require the following:

Monitor the whole system of QM.

Tailor monitoring activities based on assessed risks and design of the responses as noted in the risk assessment process. Such risks might include changes in the system of QM,

“the AICPA’s new QM standards represent a significant step forward in the ongoing efforts to enhance professionalism, integrity and quality within the profession”

results of previous monitoring activities and peer reviews, complaints and allegations, regulatory oversight results and more.

Inspect completed engagements on a cyclical basis (at least one engagement for each partner) to ensure they consider risk and other monitoring activities.

Provide a framework for evaluating findings and identifying deficiencies and evaluating the severity and pervasiveness of deficiencies. This now includes determining the “root cause” of the deficiencies noted.

Establish appropriate remediation of deficiencies and determine that the remedial actions are effective.

Communicate to leadership, engagement teams and others.

In conclusion, the AICPA’s new QM standards represent a significant step forward in the ongoing efforts to enhance professionalism, integrity and quality within the profession. The standards are more of a principles-based approach, focusing on leadership, ethical behavior and continuous improvement. They provide firms with a flexible framework for implementing robust QM processes. While challenges may arise during implementation, the benefits of adhering to the new standards are clear, contributing to a stronger, more reputable and more resilient profession.

At the FICPA, we strive to deliver top-notch, relevant, year-round CPE. Each year, the FICPA provides several unique conferences. These events are developed by a committee of your peers, bringing you current updates that are delivered by national and international speakers. For more information visit ficpa.org/conferences.

MEGA

CPE: Up to 24 Hours

Location: Orlando Dates: June 11-13, 2024

SUMMER EDUCATION CONFERENCE

CPE: Up to 20 Hours

Location: Gulf Shores, AL

Dates: July 21-26, 2024

CPA PERSONAL FINANCIAL PLANNING BOOT CAMP

CPE: 8 Hours

Location: Orlando

Date: June 10, 2024

SUMMER VACATION CLUSTER

CPE: Up to 20 Hours

Location: Orlando

WOMEN’S LEADERSHIP SUMMIT

CPE: 4.5 Hours

Location: Orlando

Date: June 13, 2024

STATE & LOCAL GOVERNMENT ACCOUNTING CONFERENCE

CPE: Up to 16 Hours

Location: Orlando Dates: Aug. 15-16, 2024

CONSTRUCTION INDUSTRY CONFERENCE

CONSTRUCTION INDUSTRY CONFERENCE

CPE: Up to 8 Hours

Location: Virtual Date: Oct. 24, 2024

SOUTH FLORIDA ACCOUNTING CONFERENCE

CPE: Up to 20 Hours

Location: South Florida

COLLEGIATE ACCOUNTING SYMPOSIUM

CPE: 18 Hours

Location: Virtual Dates: Nov. 14-15, 2024

COMMON INTEREST REALTY ASSOCIATIONS CONFERENCE

COMMON INTEREST REALTY ASSOCIATION CONFERENCE

CPE: Up to 16 Hours

Location: South Florida

CONFERENCE

Dates: Jan. 9-10, 2025

Boot Camp: Jan. 8, 2025

Dates: Nov. 2024

INDUSTRY INSIGHTS CONFERENCE

Location: Orlando Dates: April 2025

Supreme

BRENNAN

JR. Esq., LL.M.In the ever-complicated environment of state and local taxes, clients look to CPAs as their go-to resource for potential issues. State tax issues are different from federal tax issues and require specialized knowledge to handle appropriately. Should you or your client have a misstep during the process, the results can be devastating. This article reviews areas CPAs must pay attention to, tactics the state can and will use against clients, and how CPAs can mitigate a client’s exposure as well as their own.

Let’s go back where this began: the 2018 United States Supreme Court (“Court”) case of South Dakota

v. Wayfair, Inc. In this case, South Dakota (as well as other states not a party to the case) was attempting to force out-of-state sellers meeting certain sales criteria to collect South Dakota sales tax. The Court upended decades of law to conclude South Dakota could require Wayfair to collect South Dakota sales tax, as Wayfair’s sales into the state exceeded $100,000 or 200 transactions. Like wildfire, states began implementing similar provisions, with some using the same threshold as South Dakota and others adopting higher thresholds. Today, there are numerous standards across the country based on the dollar amount of sales and/or number of transactions. States differ on whether and to what extent exempt sales are included in determining the calcu-

lation, and not all states agree as to whether sales via a marketplace facilitator (e.g., Amazon) count toward the threshold. The list of issues goes on.

With these new thresholds in place, states continue to ramp up their auditing of out-of-state companies for sales and use tax purposes. States usually will send a letter and/or questionnaire of some sort to kick off the audit process. The letter may be a standard communication informing the unfortunate recipient of the impending audit, while the questionnaire may or may not lead to an audit, depending on the answers. The state will often structure these questionnaires to elicit potentially incriminating information about a business. Questionnaires may also have the potential unintended

“CPAs will want to get ahead of the state tax issues before the state decides to 'assist' your clients.”

consequence of leading to exposure for other tax types. Accordingly, CPAs must be careful when responding to these questionnaires. If a CPA were to simply fill out the questionnaire without understanding the possible ramifications of divulging such information, it could lead to serious and crippling liabilities for the client. In certain cases – depending on the client – responding via a letter is a better option than filling out the questionnaire.

What are some of the tax types CPAs must be cognizant of when answering questionnaires? The first answer is sales and use tax. However, there might be a net income tax for the entity or a nonresident net income tax for the nonresident owners of the business. Some states have a stock tax or a tax for the privilege of being an entity. Other states have a gross income tax (as opposed to a net income tax) to attempt to circumvent certain established federal law. The various ways a state can tax are endless. The important thing for the CPA to know is that if a client receives a questionnaire, the submission of responses to the questionnaire must be carefully considered or the client may face potentially bankrupting liabilities.

Bankrupting liabilities are a paramount concern for business owners. A question frequently asked is why the state is targeting the business when the business never collected the money. The simple answer is because it is easier for the state to go after the

One donor advised fund. Endless possibilities.

The Nicklaus Children’s Hospital Foundation Donor Advised Fund, sponsored by the BNY Mellon Charitable Gift Fund, was created to support the mission of a leader in pediatric healthcare while giving the donor flexibility on their charitable plans.

When individuals choose the Nicklaus Children’s Hospital Foundation Donor Advised Fund, they agree to make a gift of cash or other non-cash assets to Nicklaus Children’s, with a portion of the gift allocated to a sub-fund that can be granted to other IRS approved charitable causes they care about.

Learn more by visiting nicklauschildrens.org/DonorAdvisedFund or contact Greg Romagnoli, CAP® at greg.romagnoli@nicklaushealth.org or (305) 582-0137.

business instead of each customer. What does a business have to look forward to in this instance? Certainly, tax and interest will be on the table. The state may even impose penalties on top of paying the tax and interest out of pocket. These liabilities usually start with some sort of surprise audit. The audit might be for one or more tax types simultaneously. In some instances, businesses find out about the audit well after the audit has concluded. The audit period could be anywhere from a few years to six or seven years. The lookback period of the audit not only depends upon the state but also the factual scenario of the audit. In some cases, a business owner may only find out about the liability during due diligence when trying to sell the business.

When trying to buy or sell a business, outstanding state tax liabilities create risk to the buyer. The risk is significantly higher if the business has collected sales tax (or other “trust fund” type taxes) and not remitted the same. It is important for CPAs involved in business sales or mergers to be cognizant of these risks and consider ways to potentially save the deal. The best way to handle the situation is to become aware of and resolve as many of the liabilities as possible before the business is put up for sale. In some cases, the timeframe required to properly and fully clean up the exposure and mitigate the total amount the business owner pays out of pocket can take months. Of course, this approach is not always practical. When buyers are willing to accept some level of risk due to state tax liabilities, the sides may agree to a large reduction in the sale price, a significant amount put into escrow based on various terms, or some combination of both.

If a client fails to or refuses to clean up a liability, the state will certainly help the client do so. This might be when a client attempts to question or blame a CPA for the client’s own inaction. The CPA may wish to consider memorializing advice in writing or having the client sign a document acknowledging the issues, options for resolution, and a refusal to do so. Such an action

by the CPA could help mitigate the CPA’s over all exposure.

When a state does opt to pursue a cli ent, it commonly employs a “guilty until proven innocent” approach. Unless and until the state receives “sufficient documentation and information” proving the tax is not owed, the state may maintain the assessment. The state might also impose a civil penalty on the business and potentially the owners, officers, directors and responsible person(s). A responsible person usually means the person who files the sales tax returns and has control over whether the sales tax is paid. A personal liability assessment may be for the same amount or more than the tax assessment. States may also attempt to revoke the sales tax license or filing with the Secretary of State. A state may deny new sales tax registrations because the same individuals own the entity owing the liability and the new entity. States can also impose liens against the company or criminal charges against certain individuals with the business. Criminal charges usually come about when there are issues of sales tax collected and not remitted.

sures might be known? Try creating your own questionnaire for clients to fill out when onboarding them. Alternatively, you could employ such a questionnaire for clients at the beginning or end of the year to uncover what you otherwise might not know about. Getting this done sooner rather than later can help you to identify problem areas, assist the client with discussing what the problem is, and direct the client on how to resolve the issue in the most favorable manner. Bear in mind, not every solution will require the same method to resolve the exposure.

If your client has collected sales tax and not remitted it (or other trust fund taxes), you will want to ensure your client gets this resolved immediately. While every situation is different, there are sometimes very advantageous methods for resolving the issues that can save your clients money. The key is to get ahead of the state contacting your client. If the state contacts your client first, then it could be game over. Time is absolutely of the essence in these situations.

How can you ensure these unknown

In summary, CPAs will want to get ahead of the state tax issues before the state decides to “assist” your clients. Ensuring clients are aware of the potential state tax exposure might help to remedy any finger pointing by clients in the future. Above all, clients should be strongly encouraged to resolve issues as quickly as possible.

David J. Brennan Jr., Esq., LL.M. (Tax), is a partner at the law firm of Moffa, Sutton, and Donnini, P.A. He was a senior attorney at the Florida Department of Revenue before entering private practice and now focuses primarily on multistate tax controversy as well as planning issues.

If a taxpayer were able to eliminate their federal income tax liabilities for many prior years, filing a voluntary petition in bankruptcy would have been a more common occurrence than it currently is.1 Before initiating a discussion of the eligibility requirements for such relief, a relatively brief overview of bankruptcy in general is appropriate.

The bankruptcy clause is found in Article I, Section 8, Clause 4 of the United States Constitution: “The Congress shall have the Power … To establish uniform Laws on the subject of Bankruptcies throughout the United States.” Title 11 (Bankruptcy) of the United States Code would seem to preempt state law, as it is the legislative branch of the federal government that is empowered to enact uniform laws throughout the United States. Unlike the “dormant commerce clause,” which, even in the absence of federal legislation, by its mere inclusion in the Constitution, as interpreted by the United States Supreme Court, prevented the states from passing legislation that discriminated against or excessively burdened interstate commerce, judicial interpretation did not produce a dormant bankruptcy clause. “Undoubtedly, this is partly the result of the narrower focus of the Bankruptcy Clause: It is much easier for Congress to occupy a greater part of the field with regard to bankruptcy.” 2

Historically, the first comprehensive bankruptcy law appeared during the reign of Queen Elizabeth in 1571.3 “A debtor could be pilloried and have his ear cut off.” It was an involuntary remedy brought by creditors and applied only against debtors who were merchant traders. In the United States, Congress enacted temporary bankruptcy legislation in 1800 (to 1803), 1841 (to 1843), and 1867 (to 1878), all three of which were in response to economic disruptions. The first permanent piece of bankruptcy legislation occurred in 1898 (the “Act”). There were amendments through the years until Congress passed the Bankruptcy Code (“Code”) in 1978 as a replacement.

The states were active during the periods of federal inactivity, but the Supreme Court held in Sturgis v. Crowninshield4 that the constitutional prohibition on impairing the obligation of contracts prevented any discharge for contract liabilities arising prior to enactment. Ogden v. Saunders5 held that states could not discharge the debts due a citizen of another state. Under the 1898 Act, the federal district courts sat as “courts of bankruptcy” with most of the judicial and administrative work performed by “referees in bankruptcy.” While the referees were replaced by “bankruptcy judges” in 1973, such judges of an Article I court created by Congress lack the life tenure and prohibition of salary reduction during service that applies to Article III judges.

"The Bankruptcy Code of 1978, as amended innumerable times, is every bit as complex as the Internal Revenue Code."

Today, the Bankruptcy Code has nine different chapters. The first three – Chapter 1 (General Provisions), Chapter 3 (Case Administration), and Chapter 5 (Creditors, the Debtor, and the Estate) – provide general provisions that may apply to the different kinds of bankruptcies under the remaining chapters. Chapter 7 (Liquidation), Chapter 9 (Adjustment of Debts of a Municipality), Chapter 11 (Reorganization), Chapter 12 (Adjustment of Debts of a Family Farmer or Fisherman with Regular Annual Income), Chapter 13 (Adjustment of Debts of an Individual with Regular Income), and Chapter 15 (Ancillary and Other Cross-Border Cases) cover the remainder of Title II.

The three obstacles to discharge are found in two sections in Chapter 5 –section 507 (Priorities) and section 523 (Exceptions to Discharge). The first one, the three year rule, reads: “Section 507(a)(8)(A)(i) – ‘The following expenses and claims have priority in the following order: (8) Eighth, allowed unsecured claims of governmental units, only to the extent that such claims are for – (A) a tax on or measured by income or gross receipts for a taxable year ending on or before the date of the filing of the petition –(i) for which a return, if required, is last due, including extensions, after three years before the date of the filing of the petition.’” Accordingly, if one files a petition in the bankruptcy court on Oct. 28, 2023, a 2019 federal individual income tax return extended to Oct. 15, 2020, would meet the threeyear provision by 13 days. Section 523(a)(1)(A), by cross reference to section 507(a)(8), confirms this limitation to discharge.

The second limitation is found immediately after the above quoted provision: Section 507(a)(8)(A)(ii) –“assessed with 240 days before the date of the filing of the petition, exclusive of – (I) any time during which an offer in compromise with respect to that tax was pending or in effect during the 240-day period, plus 30 days; and (II) any time during which a stay of proceedings against collections was in effect in a prior case under this title during the 240-day period, plus 90 days.” Note that the provision is extended during a pending offer in compromise or because of a prior petition in bankruptcy during the period that all collection processes are stayed because of the bankruptcy proceeding. The assessment process is a mechanical one, and is described by regulation as, “The assessment shall be made by an assessment officer signing the summary record of assessment. The summary record, through supporting records, shall provide identification of the taxpayer, the character of the liability assessed, the taxable period, if ap-

“In our federal system, bankruptcy law suffers from the same reliance on state law as does the federal tax law.”

plicable, and the amount of the assessment.”6 Self-assessment always occurs when a taxpayer files their income tax return. Consequently, to fall within the 240-day parameter and also satisfy the three-year rule, the assessment would be attributable to a subsequent Internal Revenue Service audit or an amended individual income tax return.

The third and final obstacle (for the purposes of this article) is the twoyear requirement found in Section 523(a)(1)(B): “A discharge … does not discharge an individual debtor from any debt … (B) with respect to which a return, if required - - (ii) was filed or given after the date on which such return…was last due, under applicable law under any extension, and after two years before the date of the filing of the petition .” Thus, we are dealing with a return that meets

the three-year requirement above and was filed late as well but at least two years before the filing of the petition in bankruptcy. Such a late filed income tax return must constitute a valid “return,” meaning that the return contains sufficient information to calculate the tax liability, purports to be a tax return, is an honest and reasonable attempt to satisfy the requirements of the tax law, and that the taxpayer executes the return under penalties of perjury7. Want to learn more? Reference the 2023 case in a bankruptcy court.8

The law of bankruptcy as found in the Bankruptcy Code of 1978, as amended innumerable times, is every bit as complex as the Internal Revenue Code. In our federal system, bankruptcy law suffers from the same reliance on state

law as does the federal tax law. So as to whether a particular asset constitutes “property” that would be a part of the bankruptcy estate, it is the attributes under state law that must be examined. Once that is done, the federal question asks whether such state law attributes should be considered “property” for bankruptcy law purposes.9

Finally, it should be remembered that the law of bankruptcy satisfies two fundamental objectives. The first is that bankruptcy court proceedings are a collective method to ensure that general unsecured creditors are treated equitably in that the remaining assets are distributed in proportion to the magnitude of the creditor claims. The second is that, to permit the debtor to “move on with life,” unsatisfied obligations may be discharged. Hopefully, the above information will enable the tax-preparing community to advise taxpayers on the bankruptcy law that governs the discharge of federal income tax liabilities.

Jonathan Inger is a member of both the FICPA’s Federal Tax Committee and its Editorial Committee.

1. Only 1,221,091 bankruptcy cases were filed in the 2012 calendar year. Law of Bankruptcy, Third Edition, Charles Jordan Tabb, Chapter 2, Invoking Bankruptcy, page 117. 2. “A New Understanding of the Bankruptcy Clause,” Stephen J. Lubben, footnote 155. Cf. Felix Frankfurter, The Commerce Clause under Marshall, Taney and Waite (1937). 3. Id footnote 1 at page 36. 4. 17 U.S. (4 Wheat) 122 (1819) 5. 25 U.S. (12 Wheat) 213 (1827) 6. Treas. Reg. Sec. 301-6203-1 7. Beard v. Commissioner of Internal Revenue, 82 T.C. 766 (1984), aff’d 793 F.2d 139 (6th Cir. 1986) 8. Tax claims in bankruptcy— dischargeability. Taxpayer’s motion to enforce Chap. 13 discharge order against IRS was denied: IRS’s claim was nondischargeable under 11 USC 523(a)(1)(B)(ii). IN RE: WORRELL, 132 AFTR 2d 20235460, (Bktcy Ct FL), 08/08/2023 9. The pivotal issue is whether a seat on the Exchange, an intangible item, is a tool of the trade. If the seat is a tool of the trade, a second issue is whether the debtor can stack a personal property exemption on business property that constitutes a tool of the trade. In re Zais, 202 B.R. 263 (Bankr. N.D. Ill. 1996)

“Failure to submit ‘zero returns’ is one of the most common forms of noncompliance the Department encounters.”

Florida