Fi Global Insights 2022 Trend Guide

Sustainability and plant-based represent ‘major shifts in the industry’ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 interview with Lu Ann Williams, Global Insights Director, Innova Market Insights

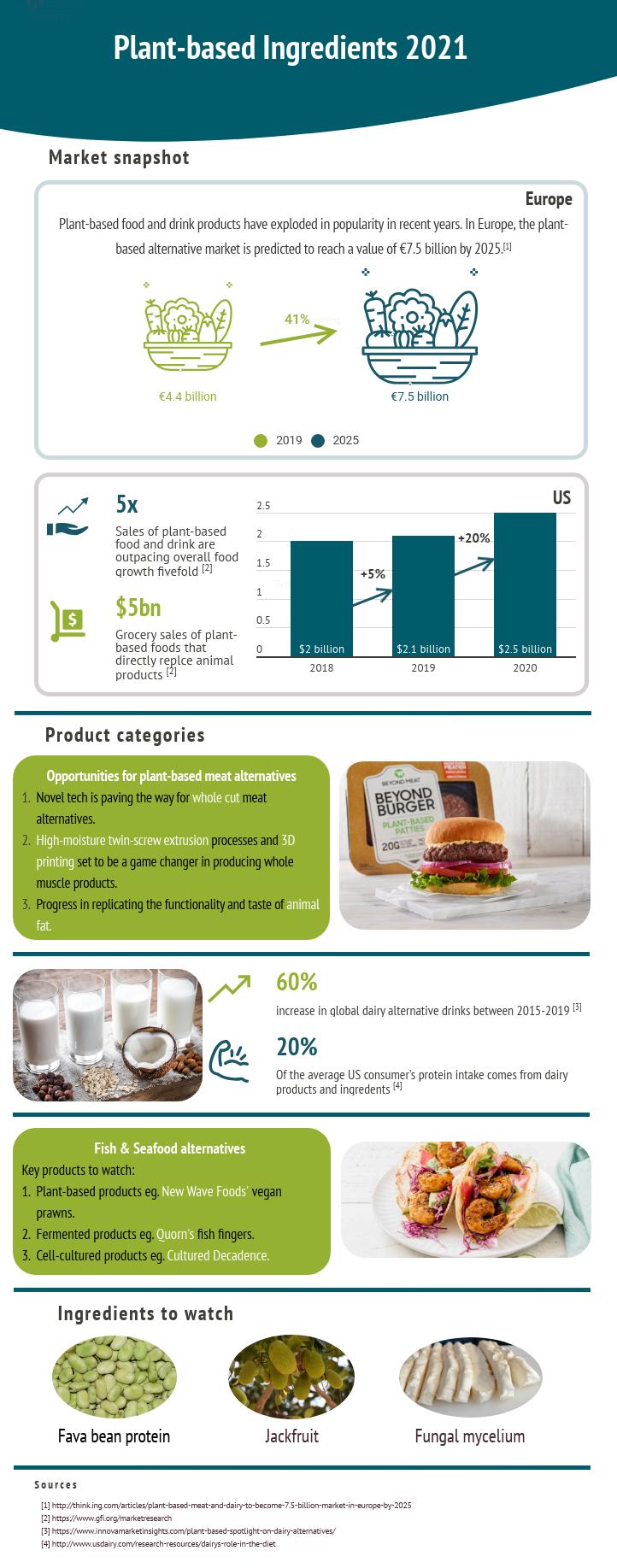

Infographic: Plant based ingredients 2021 7

Personalised nutrition and the future of ingredients . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

interview with Rick Miller, Associate Director, Specialised Nutrition, Mintel

Aligning health and wellness with tackling food waste 10 interview with Mike Hughes, Head of Research and Insight, FMCG Gurus

Sponsored content: Use plant protein concentrate for science-based sustainability . . . . . . . . . . . . . . . . . 12 interview with Maurizio Decio, CEO, Alojas

Infographic: Sustainability trends in 2021 and beyond, FMCG Gurus 14

Infographic: The fragmentation of the plant-based protein market, FMCG Gurus . . . . . . . . . . . . . . . . . . . 15

‘Healthy’ and ‘natural’ continue to drive the clean label trend . . . . . . . . . . . . . . . . . . . . . . .

interview with Emma Schofield, Associate Director - Global Food Science, Mintel

Sponsored content: Uelzena - A pioneer in sustainable dairy production

interview with Bernd Gewecke, Managing Director of Dairy Products, Ingredients & Contract Manufacturing, Uelzena

Meet our charity partner: The Hunger Project

Fi Europe Innovation Awards 2021 Finalists and Winners

Fi Global Startup Innovation Challenge

Interviews with the 2021

Bionutrients

Finalists and Winners

Tours in partnership with NutriMarketing

We have created this Fi Global Insights trend guide to shine a spotlight on some of the trends and innovations that could be found at Fi Europe 2021 We have gathered interviews with leading trend experts at the show, offering perspectives on the most important trends and innovations of 2021 and beyond, that are transforming the food and beverage industry

Fi Europe is renowned for being the place to showcase cutting-edge innovation in Food and Beverage ingredients. Included in this trend guide you will find information on the finalists of the 2021 Fi Innovation Awards, which celebrate people, companies and organisations breaking new ground in the Food & Beverage industry

Learn about the new products and suppliers at Fi Europe 2021 selected for the Innovation Tours, which this year focused on sustainability, plant based, health and well-being and reformulation.

Discover some of the most ground-breaking Food and Beverage solutions currently being developed by startups at the Fi Global Startup Challenge 2021 These startups offer a glimpse of the opportunities and challenges that lie ahead for our industry .

The health of the planet has now surpassed personal health as consumers’ biggest global concern, according to Innova Market Insights, which recently launched its Top Ten Trends for 2022

Based on consumer research and global surveys conducted across 11 countries, the trend predictions offer food and drink manufacturers insights into the issues that will drive and shape consumer choices throughout 2022 .

“Sustainability is very much on the agenda, and even if it’s not the number one purchase driver for consumers, it might be the tie-breaker,” said Lu Ann Williams, Global Insights Director at Innova

“Consumers are aspirational, so it’s definitely going to be on people’s minds more and more.”

Lu Ann Williams Global Insights Director Innova Market Insights“Sustainability is more and more a consumer issue Instead of making some big general proclamation about their credentials, brands now have to [do] something more understandable in terms of measurements or the social impact,” Williams said

Innova’s second big trend for 2022 is the evolution of the plant-based category. According to Williams, plant-based products are no longer just about mimicking meat or dairy, but instead represent a whole platform for innovation with expanding sub-categories and increased premiumisation.

The past year has seen a diverse range of product launches, from vegan salmon in Brazil to a range of plant-based seafood in Asia by Omnipork, for instance, and Innova has tracked a 59% increase in new plant-based products that also carry a premium or indulgence claim over the past year.

“We see now top chefs offering vegan menus, we see whole muscle foods creep onto the agenda with more plant-based steaks or sushi, and higher quality [products]. This is because, still, one-third of consumers across the 11 countries we surveyed said they don’t want to buy 100% plant-based products because of poor taste and texture. There is still a massive opportunity there.”

Sustainability and plant-based represent “major shifts in the industry”, according to Williams, and will at some point cease to be trends

“At some point, sustainability will go the way of clean label We talked about clean label for 15 years and, for the past five years, we’ve been saying, ‘it’s not a trend anymore, it’s that the rules have been rewritten’. I think we’re definitely going to see that with sustainability.”

In 2022, food brands may also begin to make more diverse claims around sustainability, such as using regenerative farming practices or carbon neutral production, while plant-based will become increasingly embedded into people’s mindset

“Meat is not going away – meat consumption actually went up in the past year – but I think a larger proportion of the population will understand that there is probably a better balance to be had by consuming more plant-based,” said Williams.

Innova’s fifth defining trend for 2022 – the voice of the consumer – ties in with demands for sustainable and plant-based products. People are seeking out food and drink brands that align with their political, social and ethical beliefs and won’t hesitate to shop around to find them, or even co-create products that meet these needs

Seventy-five percent of consumers surveyed said companies should listen to them more when developing their products or strategies

“Today, consumers don’t want to be told what to do or be educated; it has to be a conversation,” Williams said

This approach can be applied to ‘light-hearted’ issues, such as asking consumers to vote for their favourite flavour for instance, but also to weightier topics.

Nestlé’s Beneath the Surface initiative is an interesting example of this, Williams said . The Swiss company, which failed to meet its pledge to source only deforestation-free palm oil by 2020, directly asked consumers for their opinion about its supply chain, posing questions such as ‘Should we stop buying palm oil from small-scale farmers who contribute to deforestation?’

“They turned the whole controversy around palm oil into a short educational film and questionnaire to help consumers understand how complicated it is,” said Williams. “Everybody is always looking for really simple solutions to complex problems, and Nestlé did a good job of helping consumers to understand why it’s more complex than they think. There should be a back-and-forth between brands and their consumers.”

Consumers are increasingly looking to personalised nutrition in order to meet specific dietary and health needs. We spoke with Rick Miller, Associate Director of Specialised Nutrition at Mintel, to find out how this trend is shaping the ingredients sector, and also how technological innovation is opening up new opportunities .

What is driving this trend towards personalised food products – what are consumers expecting?

“The drive towards personalisation has been developing for quite some time. Mintel’s consumer trend ‘Make it Mine’ explains that consumers view personalisation – that is, the ability to purchase bespoke and customised products or services to their needs – as a right, not a privilege . This is set against a backdrop of increasing sophistication in health wearables technology, such as smart watches, and reducing prices for direct-to-consumer health testing, such as DNA tests. Consumers expect technology to continue to improve as well as brands and suppliers to react, creating food and drink products and services that are more seamlessly integrated with their unique health and performance needs.”

Rick Miller Associate Director Specialised Nutrition MintelWhat have been some of the challenges manufacturers have faced in meeting these demands?

“There are a number of challenges that manufacturers have faced but the most obvious is where a product has been launched at a time when consumers are not ready for it.”

Where have we seen most success in using personalised ingredients?

“The vitamins, minerals and supplements (VMS) sector has seen marked success in the personalisation sector. Brands and their respective suppliers have been quick to use a variety of methods to personalise VMS, including using online assessment tools, health assays (e g , results from blood tests) and healthcare professional support This has led to a surge in brands entering the personalised VMS market and expanding into new demographics, such as children’s VMS.”

“DSM who are well established within ingredients, and have displayed considerable innovation with their Mixfit service. Mixfit is a personalised nutrition drinks system that integrates with a multitude of consumer wearables (including activity trackers and food diaries) to create and dispense bespoke drinks that ‘top up’ nutrient deficits. A premium-positioned product but nevertheless innovative in terms of its ability to adapt to a consumer’s changing nutrient needs over time.”

“Personalisation is the future of nutrition and in turn, ingredients There are indications, as outlined by Mintel’s 2030 Global Food & Drink Trend, Smart Diets, that personalised approaches to food will become mainstream by the end of the decade. Hence, manufacturers need to prepare and react now.”

“Personalisation in ingredients has huge implications for the mass market seeking to optimise health, but also for more specialised areas such as foods for special medical purposes that seek to manage recovery or mitigate malnutrition As our global population continues to age, these types of products and the role of nutrition in prevention and management of disease becomes increasingly important Furthermore, in the wake of COVID-19, we’ve seen a glimpse of the limitations of current healthcare systems and the need for agile manufacturing systems to create personalised products for the vulnerable, and this is a huge opportunity for manufacturers.”

“The category will see a greater sharing of consumer health, food preference and performance data with suppliers and brands. This is the only way to create more adaptive algorithms that can more confidently predict consumer nutrition needs before they even ask for it That may seem like something from the realm of science fiction, but the evidence suggests that technological improvements are edging in this direction. Our consumer insights suggest that consumers are happy to do this on the basis that the end result is a better product or service.”

Manufacturers are under increasing pressure to address the issue of food waste . Mike Hughes, Head of Research and Insight at FMCG Gurus, discusses how this trend is driving the upcycling of ingredients and the shortening of supply chains, and how this is creating new product opportunities

Environmental concerns have ramped up significantly in recent years, with tangible evidence of climate change – freak floods, intense heatwaves, and unseasonable weather – amassing . Consumers increasingly link the state of the planet to their own wellbeing, underlining the belief that a healthy planet equals a healthy person .

Mike Hughes Head of Research and Insight FMCG Gurus“This has only increased since the COVID-19 epidemic,” explains Hughes. “Citizens look at the state of the planet and ask whether environmental degradation contributed to the spread of the virus.”

This is influencing consumer consumption habits, though often in modest ways. Consumers for example are looking to take home a little less plastic packaging, purchase more products from local stores and markets, and make more meals that are based around freshly bought produce

“I think we can get caught up a little in current trends,” says Hughes. “Yes, people are buying more plantbased products, but when addressing the environment, they are more likely to try to be resourceful, rather than making fundamental changes to their diets . They are more likely to avoid unnecessary food waste and seek out alternatives, over eliminating meat or dairy from their diets completely.”

Linked to this is the issue of food waste. Buying specific ingredients from a local market often means less food is thrown away Many people have had to tighten their belts during the pandemic, which means that reducing food waste is a financial issue as well.

Critically, such growing environmental consciousness has put more pressure on businesses to take the lead . Citizens no longer think that acting responsibly should be left up to individuals alone

“Brands have to demonstrate their green credentials,” notes Hughes. “This will soon be more important than heritage.”

The issue of brands and food outlets throwing away perfectly good food has been brought sharply into focus in recent years

“At a time when people are struggling with living costs and falling below the poverty line, food waste is something that actually disgusts many consumers,” says Hughes.

“This isn’t a case of forgetting an out-of-date packet of something in the cupboard – it is food waste on an industrial scale.”

The COVID-19 pandemic has also highlighted the importance of community and how we support each other

“Consumers tend to take a more negative view of corporations during challenging times,” says Hughes. “They don’t want to see big businesses trampling over the little guys This ties into the point about food waste – at a time when people are more vulnerable than ever, consumers want businesses to act responsibly.”

Hughes sees two key industry trends emerging – an increase in the upcycling of ingredients, and a shortening of supply chains

“More and more businesses will look to turn perfectly edible food into ingredients for something else,” says Hughes “A great example of this is Toast Ale in the UK, a craft beer made from bread that would otherwise be thrown away.”

Another example is The Ugly Company in the US, which takes misshapen fruit that would normally be thrown out to make dried snacks .

We are also likely to see a shortening of supply chains. Benefits include a reduced carbon footprint due to lower transport overheads, a reduced risk of food becoming perishable, and a closer relationship with local suppliers All these issues appeal to the modern consumer

“We will see some manufacturers moving towards ‘Just In Time’ production, rather than just stockpiling ingredients,” says Hughes.

Early adopters of these trends have the chance to build sustainable brands that are not only sustainable and environmentally friendly, but also ‘cool.’

“If you think about the last 20 years, consumers have been moving away from liking brands simply because they are big,” says Hughes. “They want brands they can identify with, and which match their attitudes and outlook If you can achieve that, then you have the chance of making a cool product that consumers won’t mind paying a premium for.”

Formulating plant-based products with protein concentrate, rather than isolate, is the most sustainable choice according to life cycle assessments, says Latvian supplier Alojas

“By 2050 if we go on as we are currently, there won’t be enough food to feed 10 billion people,” said Alojas CEO, Maurizio Decio. “We need to look and rethink the way we eat and produce food We are not against animal ingredients because there are some animal-based ingredients that are relatively sustainable; what we are doing is trying to minimise the impact on the environment with the products we produce more sustainably in a measurable way.”

Maurizio Decio CEO Alojas

Alojas says it takes a science-based approach to its portfolio, producing ingredients and solutions that it can prove to be sustainable based on objective parameters such as life cycle assessments

In keeping with this core principle of sustainable business, the Latvian company decided to produce and supply plant protein concentrate, rather than isolate, due to the milder production process that consumes less water and energy

“To extract the protein from pea or fava or other agricultural commodities, [you can use] a wet process This is the most successful process to produce relatively high-purity plant protein but it consumes 15 times the weight of pea in water, uses chemicals, and then uses energy for drying,” the CEO explained.

“The amount of water that an isolate factory consumes is enormous . We didn’t go for that process for this reason, we went for a dry process […] where you mill, use air to separate, and the ingredient is ready.”

Maurizio Decio said major food manufacturers are increasingly moving away from protein isolate because its energy and water footprint is not in line with consumer reasons for choosing plant-based products in the first place, noting that it is very difficult to find life cycle assessments for protein isolate production.

Alojas recently invested in a food academy where it helps customers with their product development, including how to seamlessly switch from isolate to concentrate

“[The dry process] gives you a product that has between 50 and 60% protein. You need to know how to use it because it contains a significant quantity of starch and fibre, so we help our customers to use it in their products If you teach the customer to use it, the advantage in sustainability is unmatched In many applications, the use of concentrate doesn’t make much difference when compared to the use isolates.”

For pasta, bread, biscuits and even mayonnaise, it is not necessary to use protein with 80% purity according to Alojas, and a concentrate with 50% protein can provide the desired taste, texture and appearance . The company has also used its concentrate, which is made using pea and fava beans, to make cheese alternatives, ice cream and baked products

While Alojas is not the only company producing protein concentrate, its local sourcing policy helps it stand out from the crowd, it says:

“We are crop agnostic, which is one of the consequences of being sustainability-focused. We only process crops that are surrounding the factory within a radius of around 400 to 500 km . We are not going to get pea from Canada or the other side of the world and transport it to Latvia We process what we can source locally and where we cannot source locally, we find partners in other agricultural areas that can process for us.”

“We use pea and fava beans, but we could also source something else if it is grown in the region,” said Maurizio Decio . “For example, buckwheat is a very interesting crop that is grown in Latvia . We haven’t yet thought about valorising it but that could be the next step.”

Aloja Starkelsen was founded in 1991 and was purchased in June 2021 by IRLMD Food Solutions, a company founded and led by Maurizio Decio. It is currently building a 15,000-metric ton capacity for legume processing and plans to increase this to 50,000 tons within three years . It is also debottlenecking its starch production to triple the volumes in the next two years, Decio said.”

The clean label demand continues to drive new product development Emma Schofield, Associate Director, Global Food Science Analyst at Mintel, examines the issues that have driven this trend, the challenges in meeting consumer expectations, and what we can expect next .

Emma Schofield Associate Director - Global Food Science, MintelThe clean label trend started as an industry response to consumer concern about ‘unwanted’ ingredients in food and drink, typically those with an artificial image. Schofield notes that the media has gone on to play a role in influencing consumer opinion of ingredients like carrageenan or MSG, resulting in these ingredients being less compatible with what consumers consider to be a ‘clean label . ’

“Another important step in the clean label trend has been the development of ingredients lists that are authentic to a traditional recipe that consumers would follow when making products at home,” says Schofield.

“For example, flour or starch ingredients would be expected in bakery products, but not in products like yogurt when added as thickeners. Therefore, an ingredient may be compatible with ‘clean label’ in one product, but not in another.”

‘Short and simple’ ingredients and recipes have also driven the trend. As Emma says:

“‘Short and simple’ refers to the use of ingredients that are found in an authentic recipe. As such, a packaged lasagne would not be expected to contain ‘just five’ or ‘just four’ ingredients, but rather to contain ingredients that would be found in a traditional lasagne recipe.”

More and more attention has been paid in recent years to the relationship between the food we eat, our own health, and the health of the planet. Interest in foods and diets that are ‘better for you, better for the planet’ have created opportunities for products linked to plant-based dieting, local food and drink production, and organic agriculture

“Consumers today demand foods with ingredient lists that are compatible with their expectations for clean label,” says Schofield.

“However, clean and natural ingredients often carry higher price points, and may impact other food and drink properties such as sensory attributes and shelf life . Consumers may not be prepared to pay more for clean label ingredients, especially if other attributes are compromised by substituting ‘regular’ ingredients with ‘clean’ ingredients.”

When considering ‘what next,’ Schofield points out that the definition of a clean label has often been extended beyond artificial or ‘inauthentic’ ingredients, to encompass ingredients that may concern consumers in some way, such as allergens or genetically modified ingredients. ‘Unwanted substances’ such as pesticide residues, hormones, micro-plastics and antibiotics have also been associated with the clean label trend, even though these substances are not ingredients .

“Consumer interest in natural and fresh foods will continue to secure opportunities for clean label ingredients,” says Schofield.

“The fundamental of the clean label trend still concerns developing food and drink without artificial ingredients . However, in regions like Europe, the clean label trend is very established, and so this alone may no longer deliver a point of difference because ‘clean labels’ have become an expectation.”

Schofield also believes that attention to the link between the consumption of ‘ultra-processed’ foods and health will continue to drive demand for ingredients that deliver foods with a cleaner, and less-processed image .

“Consumers’ definition of a healthy food is not limited to the infor mation on the nutritional panel, but encompasses attributes linked to naturalness, too,” she says.

The Uelzena Group - a dairy cooperative from northern Germany – has placed sustainability at the heart of its business. Bernd Gewecke, Managing Director of Dairy Products, Ingredients & Contract Manufacturing at Uelzena, explains how involving all stakeholders and basing decisions on solid data have been key to helping the firm transition towards more sustainable practices .

Bernd Gewecke, Managing Director of Dairy Products, Ingredients & Contract Manufacturing, Uelzena

Uelzena was founded by a group of regional milk producers in 1952, as a means of centrally processing and marketing milk . Today, the company is active in four company-wide business areas: Ingredients & Contract Drying, Dairy Products, Instant Beverages and Health Products.

“As a cooperatively organised dairy company, sustainability is part of our DNA,” explains Gewecke.

“The responsible use of natural resources is in our own interest, because preserving them ensures our longterm survival of our company. Thinking and acting sustainably also matches our cooperative values.”

The Group sources raw materials predominantly within a radius of 150 km, and its milk producers operate in a highly sustainable manner “For example, they produce their own fodder, and invest in renewable energies as well as in animal-friendly stables with outdoor access,” says Gewecke.

Critical resources such as electricity, water and gas are also major cost factors in dairy production . Investing in green technology therefore make perfect economic, as well as environmental sense

“In recent years we have made investments in a number of energy- and resource-saving processes,” notes Gewecke

“These include the installation of energy-saving LED lighting, comprehensive heat and process water recovery, frequency-controlled burners for our steam boilers, the modernisation of our own combined heat and power plants and the construction of a new energy-efficient evaporator for milk. And these are just a few examples! As a result, we have already been able to reduce our CO2 emissions by almost 50 % since 2012.”

Another key innovation has been data collection, and making data more transparent and visible . “In order to improve anything, you need to know what’s going on,” says Gewecke.

With this in mind, the Group participates in a dairy sustainability tool run by the Thünen Institute and QM Milk This started an intensive dialogue with dairy farmers, though a fair amount of persuasion was needed to begin with .

“The project includes extensive surveys on aspects such as the economy, ecology, social issues and animal welfare,” says Gewecke. “This was a lot of work for the farmers. We are so pleased to see that many of our farms are now engaged, and will continue to be so.”

This touches on a key point raised by Gewecke - the importance of involving all market participants in the sustainability transition He points out that a large part of the Uelzena Group’s greenhouse gas emissions can be traced back to the upstream area of milk production .

“This is why it is vital to look at the entire value chain and to get everyone involved,” he says. “This means not just milk producers, but also technology suppliers and logistics service providers, and even customers What we have learned along the way is that it is immensely important to involve all stakeholders along the entire value chain from the very beginning.”

Such investment, effort and commitment has ensured that sustainability is now deeply embedded in the company’s culture It is central to every decision, from procuring raw materials to maintenance projects

In order to ensure coordination, the position of sustainability representative was created This person reports directly to the CEO and Chairman of the Executive Board Since 2014, the Group has produced an annual sustainability report in accordance with the GRI standard, in which it reports transparently on its objectives and achievements

“Energy efficiency and the careful use of resources are a fundamental part of project planning,” says Gewecke. “Cutting energy costs has contributed to maintaining our profitability and is a part of securing the future of our company.”

The company is confident in the future of sustainable milk production in Europe, and is at the same time evaluating new product development directions

“We are currently observing a tremendous dynamic in plant-based products and are looking into spraydrying oat milk, for example,” says Gewecke.

The company is also currently assessing the greenhouse gas emissions of its products and processes, on the basis of data from its merchandise management system .

“We continue to be involved in the dairy sustainability tool project, and are looking at the carbon footprint of milk together with our dairy farmers,” says Gewecke.

“By gaining an overview of the emissions from milk production, we can work out possibilities for reducing them.”

As a proud partner of The Hunger Project, Fi Europe is committed to contribute to Zero Hunger – #2 of the 17 UN Sustainable Development Goals .

The Hunger Project is a global non-profit strategic organization committed to the sustainable end of world hunger by 2030

The Hunger Project shifts the mindsets of women and men in over 14,500 villages so they transform into leaders for the sustainable end of hunger

Then, through various programs such as education, microfinance, agriculture and health, The Hunger Project’s volunteers empower people with the skills, knowledge and resources they need to break the poverty cycle themselves

The Hunger Project is uniquely placed to activate 500,000-strong volunteer leaders to end hunger in some of the most rural, remote places across Africa, Asia and Latin America

Your investment will support and extend this Golden Network of volunteers.

Learn how your company can join our charity partner The Hunger Project and invest in #ZeroHunger: get to know The Hunger Project and donate now .

Fi Europe invests financially in The Hunger Project’s community-led programs and we invite you to join us!

Pictures by: Johannes Odé

This awards an organization or company that has developed the best clean label ingredient or process in terms of sensory and physical properties or application costs

Preference is given to entries introduced within the last 2 years.

Entry:

Karibon: 100% shea-based premium Cocoa Butter Equivalent

Description:

Karibon is the first 100% shea-based premium Cocoa Butter Equivalent (CBE) that has all the processing benefits & versatility of leading CBEs with the nutritional & sustainability benefits of shea. It has an improved nutritional value compared to Cocoa Butter & traditional CBEs

Karibon can be used in the final recipe to partly replace or complement cocoa butter while maintaining the performance and sensory perception in the final application

Oils and fats play a key role in consumers’ taste experience, and Karibon is everything food manufacturers are looking for in a premium CBE while delivering consumers’ favourite indulgences

Entry:

Lutkala: Natural thickeners

Description:

At Lutkala, we believe that the production of truly healthy food WITHOUT SYNTHETIC CHEMICAL ADDITIVES is possible, even on the industrial scale That is why we have created a product which is COMPLETELY NATURAL and produced WITHOUT USING CHEMICAL REAGENTS at any stage Its environmental footprint has been limited to the absolute minimum At the same time, Lutkala has the properties of a GOOD FOOD THICKENER

Clean Label: Lutkala is a natural replacement for chemical or synthetic thickeners, such as pectins, modified starch or xanthan gum. The use of Lutkala makes it possible to eliminate undesirable “E” ingredients, visible on the labels of many food products. Lutkala allows to change the perception of the product from “artificial” to “completely natural”, with an image desired by consumers. Lutkala is a thickener which perfectly fits the “Clean Label” trend.

Description:

Meat Substitute Mix Ragù is a plant-based Mix totally allergen-free, GMO-free and gluten-free, specifically developed by MartinoRossi R&D department for the production of plant-based bolognese style sauce with excellent nutritional characteristics. Meat Substitute Mix Ragù is rich in protein and fibre, shelf-stable (12 months shelf-life), CLEAN LABEL and with a short ingredient list: only four ingredients, two of them being pulses flours. Meat Substitute Mix Ragù is neutral flavour and is with no methylcellulose, it has a great mouthfeel and is very easy to use . It allows an outstanding sauce final structure result, thanks to its great water absorption property.

Entry:

X-Tra Guard: Natural preservatives

Description:

X-Tra Guard - The Shield of plants: X-Tra Guard is a natural ingredient that eliminates the use of chemical preservative Sorbic Acid. X-Tra Guard has been extracted from the Rowanberry (Sorbus Aucuparia L ), The Extraction has been meticulously developed to help preserve the best from the Rowan Berry. X-Tra Guard is wholly derived from Rowanberry’s natural botanical compounds

The product is stabilised with Tapioca for most uses and with Dextrose where a coldwater-soluble solution is needed making this product not only clean-label but also suitable for all diets, and Kosher and Halal Certified.

This awards an organization or company that has developed an innovative technical processing/ manufacturing/packaging/waste reduction solution or service for food ingredients or finished products .

Preference is given to entries introduced within the last 2 years.

Entry:

AkoBisc GO!: The new Biscuit Fat revolution

Description:

AkoBisc® GO! is the new biscuit fat revolution This structured emulsion combines hydrated monoglyceride bilayers with sugar, stabilizing oil droplets in the aqueous phase with a revolutionary technique. Sugar increases the viscosity and reduces the water activity to obtain increased technical functionality and microbial stability, ensuring an extended shelf-life of the emulsion.

When used in biscuit manufacturing, AkoBisc® GO! enables an easy production process and multiple sensorial benefits. It is low SAFA, non-hydrogenated, free from tropical fats and low in 3-MCPD.

AAK is Making Better Happen from plant to brand using our unique customer codevelopment approach

Entry:

Next-generation FreshQ®: Fermentation-enabled Bioprotection Solution for Dairy

Description:

The new generation of FreshQ® food cultures is a game changer enabling fermentation-based bioprotection against yeasts and moulds without undesirable sensory impacts and acidity development often experienced with other culture solutions in the market

This launch builds on a breakthrough discovery by our scientists. They were first to explain the mode of action coming from the ability of the culture to compete with spoilage contaminants for a specific nutrient, manganese (Mn).

FreshQ® food cultures can be used in yogurt, sour cream, quark, tvorog, white and cottage cheese and plant-based alternatives and helps producers improve quality and shelf life – naturally

Description:

ICL Food Specialties designed a new generation of their trusted JOHA® emulsifying salts, the JOHA SF line, used to optimize protein content in processed cheese and deliver 360° benefits. JOHA SF line is ideal for spreadable, snackable, and aluminium foil-packed processed cheese (PC) applications, as well as analogue and UHTtreated cheese applications

Choose JOHA SF for:

• Improved appearance: Maximize first impression by reducing the stickiness, even in economical formulations

• Healthfulness: Reduce sodium compared to competitive formulations

• Cost control: Optimize protein content by keeping the same level of firmness

• Cleaner label: Reduce use of hydrocolloids or starch

• Processability: Ensure a constant, ideal viscosity during packaging

This awards an organization or company for the development of the best ingredient or application in terms of proven contribution to digestive, cognitive, immune or physical health Preference is given to entries introduced within the last 2 years.

Entry:

Microbiome Modulation through HT-BPL1 (Heat-Treated Bifidobacterium animalis subsp lactis BPL1)

Description:

ADM helps food, beverage, and nutrition developers meet evolving demand as consumers take a more proactive approach to holistic wellbeing. With industryadvancing innovations, a complete portfolio of ingredients and solutions to meet any taste, and a commitment to sustainability, ADM gives customers an edge in solving the nutritional challenges of today and tomorrow

In line with this mission, ADM’s revolutionary HT-BPL1 postbiotic provides food and beverage manufacturers with the opportunity to incorporate a gut microbiomefocused ingredient into a variety of applications that require heat processing conditions

Entry:

Rhuleave-K®: Using a patented SPEED™ technology to deliver fast pain relief

Description:

Rhuleave-K® is a unique formula that combines the goodness of turmeric, Boswellia and other actives using a patented SPEED™ technology that creates a powerful formula designed to deliver fast pain relief and reduce inflammation. Unlike conventional natural formulations for pain management for long, which typically provide relief in days or week. Rhuleave-K® with its unique proprietary SPEED™ technology supports pain relief in up to 3 hours. It stands as the first natural solution for safe and effective pain management. This formula is scientifically documented with clinical data proving its efficacy in providing fast pain relief comparable with Acetaminophen

Entry:

NuliGo: A uniquely structured Medium- and Long-chain triglyceride (sMLCT)

Description:

NuliGo: rapid energy directly to muscles for building, maintenance and recovery . Consumers prioritize wellness and physical fitness, focusing on functional ingredients that contribute to enjoying a longer, active lifestyle In response to this trend, Bunge created NuliGo, a uniquely structured medium- and long-chain triglyceride (sMLCT) that supports muscle building, maintenance and recovery

NuliGo combines the rapid energy of MCTs with longer lasting energy from LCTs, in a single molecule and delivers it directly to muscles. This unique benefit makes it an ideal ingredient for sports nutrition, active aging, and medical foods categories

Entry: BeniCaros™: A proprietary immune health ingredient

Description:

BeniCaros™ is a proprietary immune health ingredient that has been clinically studied and shown to support immune function and optimize responses to potential threats and challenges . NutriLead’s proprietary extraction process to produce BeniCaros unlocks rhamnogalacturonan-I (RG-I), a soluble fibre, upcycled from carrot pomace With a dual mechanism of action, BeniCaros directly supports the immune system to become more responsive and indirectly supports immune function by stimulating beneficial gut microorganisms and their metabolites, which in turn support the immune response Both mechanisms help to support a healthy immune system to be at its best when it matters most

Entry:

S7™: Phytonutrients clinically shown to target the reduction of ROS (oxidative stress) within the body .

Description:

S7™ is truly unique because it has been shown to deliver natural energy by clinically supporting, quantifiable nitric oxide increases and oxidative stress reductions directly in two human clinical studies It is standardized to a high level of phytonutrients and clinically shown to target the reduction of ROS (oxidative stress) within the body . S7™ is a plant-based proprietary formula that delivers seven phytonutrient-rich botanicals - green coffee bean, green tea, turmeric, tart cherry, blueberry, broccoli and kale at a low and effective dose. S7™ delivers documented results at only 25 - 50mg.

This award recognizes an organization or company that has developed the best plant-based ingredient or application based on a plant-based ingredient in terms of sensory and physical properties or application costs .

Preference is given to entries introduced within the last 2 years.

DSM Entry:

Delvo®Plant: Portfolio of enzymes for great tasting plant-based dairy alternatives

Description:

To help producers truly differentiate their plant-based dairy portfolio, DSM launched Delvo®Plant PHY and Delvo®Plant PSP enzymes. Part of DSM’s innovative Delvo®Plant range and uniquely broad portfolio of plant-based dairy solutions, Delvo®Plant PHY and Delvo®Plant PSP help to improve the nutritional value of plant-based drinks and create gluten-reduced dairy alternative varieties. DSM’s Delvo®Plant range also includes solutions to optimize the taste, texture and mouthfeel of cereal-based (such as oat and rice) and non-cereal-based (like soy and almond) dairy alternative drinks

DSM Entry:

Maxavor® Fish YE: First-of-its-kind vegan fish flavor

Description:

Derived from algal oil, DSM’s range of Maxavor® Fish YE process flavors is natural, sustainable and meets vegan, Kosher and Halal requirements, making it suitable for a range of label claims. The Maxavor® Fish YE solution helps to build authentic fish flavors in plant-based fish alternative products, including vegetarian fish nuggets and vegan fish sauce. Maxavor® Fish YE enables producers to emulate the body, mouthfeel and taste of distinct fish varieties and offers two taste profiles; one for rich and oily dark fish and another for fresh, light and fleshy white fish.

Germination - a natural way to awaken the faba bean to its full potential. Faba beans demonstrate huge potential to help both agriculture and the food industry become more sustainable However, their use is limited by the digestive discomfort they may cause as well as their beany flavour. With the germinated faba bean Sprau, this is no longer the case. During germination, the bean efficiently degrades FODMAPs and our unique treatment leaves the bean with a mild, cereal like flavour, making the beans easier to enjoy in the everyday diet .

This awards an organization or company that has developed the best ingredient or process in terms of enhancing the sensory experience of food products such as taste, texture, smell and /or appearance, without significantly increasing application costs.

Preference is given to entries introduced within the last 2 years and supported by independent sensory analysis

Entry:

AkoBisc GO!: The new Biscuit Fat revolution

Description:

AkoBisc® GO! is a revolutionary biscuit fat, low in saturated fatty acids and free from tropical fats. When using a simple liquid oil to answer the low SAFA trend, there are multiple sensorial issues that arise such as oiling out, undesired fried taste, high cookie hardness and fat blooming AkoBisc® GO! is the latest AAK innovation which tackles all those issues, enabling the best sensorial experience for consumers

AkoBisc® GO! is creating a unique sensory biscuit quality, with a crunchy bite, no fat bloom and no discoloration over time .

AAK is Making Better Happen from plant to brand using our unique customer codevelopment approach .

Description:

With the visual appeal of chocolate-based products being the second most important purchase driver and with white chocolate growing in popularity, Cargill cocoa & chocolate took the challenge to sublimate regular yellowish white chocolate and create a dazzling white chocolate that is truly white in colour: Bright White. Identified by 92% of consumers as whiter than regular white chocolate, Bright White is visually appealing as well as really indulgent with its balanced, sweet and smooth taste profile. And its ingredients’ list remains the same as for regular white chocolate – hence clean. Turn your treat into an eye-catcher with Bright White!

This awards an organization or company for a measurable supply chain strategy that champions environmental, economic or socially sustainable practices in the F&B industry Preference is given to entries introduced within the last 2 years .

Enabling chocolate to meet deforestation-free claims

Description:

Focus on sustainability has never been as high for consumers as now Consumer awareness puts producers under pressure to ensure deforestation free end-products in line with consumer expectations . Chocolate manufacturers need to transform all their different ingredient supply chains e.g. plant-based oil blends to achieve a solid deforestation free claim for their consumer products AAK offers a deforestation free claim for our highly functional ILLEXAO™ SC 70 that is a plant-based ingredient going into chocolate and confectionery Customers and consumers don’t need to make the choice for sustainability standards, as the solution provided by AAK will be certified deforestation free.

Acting on climate change today through carbon zero capability

Description:

Fonterra’s purpose is to create goodness for generations We’re committed to acting on climate, providing options that are better for the environment, our customers and consumers

We’re moving to renewable in manufacturing and have programmes supporting our farmer suppliers; to develop farm environment plans, sustainable dairying advisors’ access, identifying practices improving environmental outcomes, and partnerships to trial methane solutions on-farm.

NZMP recently launched its first carbonzero™ certified ingredient – Organic Butter. It’s certified carbonzero™ by Toitū Envirocare, who has verified our lifecycle and reduction plan emissions Remaining emissions are offset using credits from projects that sequester carbon like native forest regeneration.

This category covers innovations related to food and beverage ingredients or additives specifically from a plant-based or alternative non-animal source.

Moolec Science is an Ag-FoodTech company, producing real animal proteins in plants to develop affordable animal-free ingredients.

SACCHA extracts proteins from microorganisms such as brewer’s yeast that are like egg protein, but without the egg . These are distributed to food companies to help them create authentic alternatives to animal products and bring them into every European kitchen and every European household

Sophie’s BioNutrients is developing a new sustainable plant-based protein out of microalgae

Time-Travelling Milkman (TTM) produces and sells plant-based fat ingredient for creamier, healthier and more sustainable plant-based products.

Update Foods are producing the next generation of dairy alternatives, powered by faba protein and algae .

This category covers innovations related to food and beverage ingredients or additives from an animal / plant / alternative source, and/or food processing technologies that have the potential to positively impact the F&B industry

California Cultured is producing chocolate that is free from deforestation and slavery by growing non-GMO chocolate from cocoa stem cells via cell culture technology Producing chocolate and high value cocoa ingredients that have customisable flavour, bitter, and health compounds.

Eighth Day Foods are enabling food producers to create ground-breaking premium plant-based products under their own trusted brands. They are also the inventors of a global breakthrough in plant-based protein, called LUPREME®.

Hoow Foods are focused on enabling healthy living by healthy eating, and aim to do so by using their deep insights of foods and formulations to create healthier ingredients

WINNER

NoPalm Ingredients is on a mission to reduce carbon emissions and save tropical rainforest by replacing palm oil as an ingredient in food, cosmetics and detergents

Umami Meats is cultivating the future of sustainable seafood by crafting delicious, nutritious, and healthy cultivated fish that is better for our health, our oceans, and our planet

This category covers innovations that support improvements in ingredients sourcing and production, food safety, traceability, transparency, or supply chain management

Allozymes applies its proprietary platform technology to rapidly develop novel enzymes, revolutionizing the way that industries manufacture complex natural products

AMBROSIA’s proprietary, disruptive enzyme technology platform is designed to convert high-calorie, obesity-promoting sugars embedded within natural juices into rare, practically no-calorie sugars, such as Allulose.

Mi Terro is the world’s first synthetic biology and advanced material company that utilizes big data to create home compostable, single-use plastic-alternative packaging materials made from plant-based agricultural waste – this is a first-of-itskind approach

Allozymes scooped up first prize in 2021 for the Most Innovative Service or Technology Supporting F&B category. It uses microfluidics technology to build and test millions of enzymes a day – the company says this is significantly faster and more cost-effective than current robotics technologies, which typically screen about 1000 samples a day . Increasing the speed of development and the probability of success means that companies can bring products to market in less time, and through using less resources

“A recent customer came to us to say that they were using ten tonnes of tomato skin to extract 3 kg of ingredient and want to streamline this process,” says the company’s co-founder, Peyman Salehian. “By looking at the skin, we worked out which enzymes work together in the tomato skin to produce the end ingredient; engineered these enzymes; and placed them in the yeast to ferment the desired ingredient. The client can now generate all the ingredient they need through fermentation.”

Click here to read the full interview with co-founder, Peyman Salehian .

Allozymes' enzyme engineering is 'a paradigm shift' in biotech

Sophie's BioNutrients makes plant-based proteins using microalgae strains that it feeds with food waste - a circular economy approach that is inherently more sustainable than animal-derived proteins, it says . The startup, which is based in both Singapore and the Netherlands, won the Most Innovative Plant-Based or Alternative Ingredient category for its pioneering work in microalgae

The company trialled over 1,200 strains of microalgae before identifying four strains capable of growing in the dark that could also be fed food waste, yielding a light, flavourless protein flour. The company’s founder, Eugene Wang, says its ingredient is inherently sustainable but also, crucially, functional .

“What really differentiates us, I think, is our focus on functionality,” he says. “This is the thing most relevant to manufacturers. We have successfully turned our protein flour into milk, cheddar cheese, cheese spreads and alterative meat. We currently have six provisional patents and are in the process of filing more.”

Click here to read the full interview with Eugene Wang .

NoPalm Ingredients is using microbial fermentation to produce palm oil in laboratories without oil palms, a development that it says will reduce deforestation rates in tropical regions. NoPalm Ingredients won first prize in the Most Innovative F&B Ingredient or Processing Technology category

Co-founder and CEO Lars Langhout says its aim is to help businesses replace conventional palm oil as an ingredient in food, cosmetics and detergents with its locally produced, sustainable alternative made via a process of microbial fermentation using food waste and other low-value biomass as the feedstock .

“We’re bold and unafraid,” says Langhout. “In the future we want our microbial oil to be the standard alternative ingredient to palm oil in food, cosmetics and detergents. We foresee a future where our children don’t get to see the devastations of those palm oil plantations, but instead, lush green tropical rainforest with abundant wildlife.”

Click here to read the full interview with Lars Langhout

NoPalm Ingredients on creating deforestationfree palm oil

The plant-based trend is gaining momentum and taking new directions, as climate change has emphasized the need for sustainable food supply chains and created a growing number of climateconscious consumers. According to BIS Research, the market for plant-based products is expected to reach $480.43 Bn in 2024 with a CAGR of 13.82% between 2019 & 2024.

Watch this tour, brought to you from the Fi Europe show floor, to discover the latest plant-based initiatives by food ingredients’ suppliers.

This Innovation Tour features products by the following Fi Europe 2021 exhibitors:

• Avebe

• Hi-Food SpA

• FrieslandCampina Ingredients

• Sancon Costaligure

• Sprau

According to FMCG Gurus, 71% of consumers worldwide feel more concerned about environmental issues as a result of COVID-19 and 47% say they pay more attention to environmental claims. From global warming, CO2 emissions, plastic waste pollution, food waste, deforestation, and air pollution, to the extinction of animal and/or plant species, the list of concerns is as long as the expectations of consumers towards the food industry are high Watch this tour, brought to you from the Fi Europe show floor, to discover the latest sustainable initiatives by food ingredients’ suppliers

This Innovation Tour features products by the following Fi Europe 2021 exhibitors:

• ALGAplus

• Cashewmeetly

• Fazer

• Kokoonic Co , Ltd

• Molini Pivetti

• Musselfeed

• Tebrito

Consumers are increasingly aware of the impact of their diet on their health and, as a result of COVID-19, their expectations in terms of healthier alternatives are growing According to a study by FMCG Gurus (2020), 84% of consumers worldwide were mainly concerned about how the virus affected their health and well-being, and 79% of consumers were concerned about the effects on the health of their loved ones.

Watch this tour, brought to you from the Fi Europe show floor, to discover the latest developments in innovative healthy products

This Innovation Tour features products by the following Fi Europe 2021 exhibitors:

• Activ’Inside

• Abyss Ingredients

• Agrana

• Arjuna Natural Extracts Ltd

• Evolva

Reformulating for the modern consumer often requires replacing unhealthy, artificial, or highly processed ingredients by nutrient-dense, natural, or raw ones. Besides solutions for sugar or salt reduction, consumers are also looking for natural ingredients and less processed products, made in a traditional and sustainable way, with familiar ingredients, by real people and with full transparency about the origin of the ingredients

Watch this tour, brought to you from the Fi Europe show floor, to discover new ideas for reformulation.

This Innovation Tour features products by the following Fi Europe 2021 exhibitors:

• Griffith Foods Europe

• Ingredia

• Lutkala Ltd

• Nordic Seafarm

• Sweegen