63 minute read

COLUMNIST ARTICLES

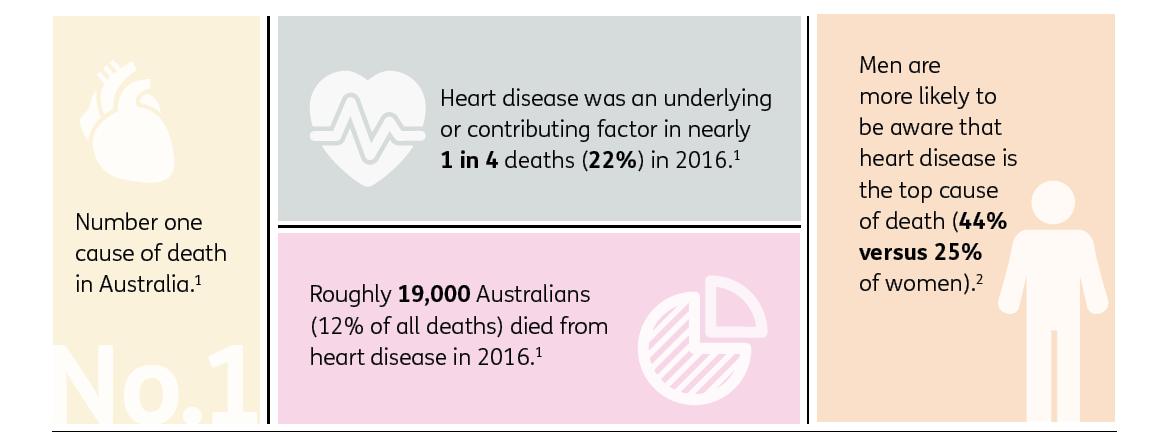

The number one killer in Australia. Take steps to protect your heart.

What is Heart Disease?

There are many different heart conditions. Ischaemic heart disease, or heart disease, is the most common form of cardiovascular disease and refers to conditions that involve a reduction of blood supply to the heart. This can lead to a heart attack, angina (chest pain) or stroke.

Heart disease is a broad, umbrella term that includes a range of heart-related conditions – blood vessel diseases, coronary artery disease, heart rhythm problems and congenital heart defects.

In the last decade, the number of deaths from heart disease has fallen by more than a third from 99.1 deaths per 100,000 in 2007 to 62.4 deaths in 2016.3 Despite this, heart attack claims around 22 lives per day.

Warning Signs

Warning signs of a heart attack can include one or more of the following symptoms and may vary in intensity: pain or tightness in the chest, difficulty breathing, breaking out in a cold sweat, dizziness, nausea, an aching jaw, discomfort in your neck, aching shoulder/shoulder blades/back and numb or tingling arms. In the event of warning signs, the Heart Foundation recommends calling 000 immediately.

Fixed Risks

A Heart Foundation study revealed that almost three-quarters (73%) of Australians, aged 30 to 65 years, have been told by their doctor they have at least one risk factor for heart disease.4 There is no single cause of heart disease but multiple contributing factors. Some risks are fixed and can’t be changed but the good news is that many can.

Variable Risks

The risk of heart disease increases with age. Men are at a higher risk – it is the leading cause of death for males. Women are also highly susceptible to heart disease. A women’s risk grows after menopause and it is the second leading cause of death for females. Ethnicity and genetics can also play a role.

“ There is no single cause of heart disease but multiple contributing factors. ” Protect yourself: Minimise risk

The first step to protect yourself against heart disease is to understand your risk factors.

1. Many risk factors come down to lifestyle choice so a change in behaviour is likely to reduce your level of risk.

2.

3.

4. Maintain a healthy weight. If all Australians were in a normal weight range, the burden of heart disease would be reduced by 25%.

A heart health check, conducted by a doctor or health practitioner, is recommended for people over 45 years old. For Aboriginal and Torres Strait Islander people, the recommended age is 35. It involves a blood test, blood pressure check and a discussion about your lifestyle and family history.

Knowing your risk, consider whether you have adequate insurance (e.g. life, trauma, total & permanent disability, income protection) to protect what you value most in life.

Dementia

What is it?

Dementia is the fastest growing cause of death in Australia. It has become the leading cause of death overall for females and second leading for males. It is responsible for 11.3% of all female deaths and 5.8% of all male deaths each year, most occurring in people aged over 85. Australia’s dementia rates are higher than other comparable countries2.

Dementia is not one specific disease. The word ‘dementia’ is an umbrella term used to describe the symptoms of a broad group of neurological conditions that cause a progressive decline in a person’s brain function. The knock on effects include difficulty in performing everyday tasks.

There are different types of dementia, each with their own causes, including Alzheimer’s disease, vascular dementia, frontotemporal dementia, Parkinson’s disease, alcohol related dementia and Lewy body disease. All up, more than 100 conditions are said to cause dementia. Alzheimer’s disease is the most common, affecting up to 70% of all people with dementia. It damages the brain resulting in impaired memory, thinking and behaviour.

Warning Signs

Given the complexity of dementia, diagnosing it can be a challenge. There are also a number of other conditions that have similar symptoms including vitamin/ hormone deficiencies, depression, infections and brain tumours. There are some early warning signs to watch out for, however these can be very vague or subtle. The list includes progressive and frequent memory loss, confusion, personality change, apathy and withdrawal, and reduced ability to perform everyday tasks.

Risk Factors

As with many other health-related conditions, many risk factors for dementia are within our control but others are not.

Fixed risks: The risk of dementia increases with age and currently affects more women than men. It is more common in people over 65 years old however it can occur much earlier. Around 26,000 cases have been diagnosed for people in younger age groups. Some types of dementia can be inherited, but most cases are not. A number of genes in relation to developing Alzheimer’s disease have been identified but more research is needed. Variable risks: A number of health-related conditions have been linked to some types of dementia. For example heart disease, hypertension, high cholesterol, diabetes, obesity and high homocysteine levels are associated with an increased risk of Alzheimer’s disease. Smoking has also been identified as a risk factor.

Protect yourself: Minimise Risk

The first step to protect yourself against dementia is to understand your risk factors. Some risk factors can be addressed through lifestyle changes and proactive management. Your brain matters. The importance of a healthy body is well-known but the importance of a healthy brain less so. Dementia Australia recommends five steps that can help keep dementia at bay: look after your heart, engage in regular physical activity, challenge/stimulate your brain, eat healthily and socialise. Knowing your risk, consider whether you have adequate insurance (e.g., life, trauma, total and permanent disability, income protection) to protect what you value most in life.

Questions? The National Dementia Helpline is 1800 100 500.

By Colin Brinsden, AAP Economics and

Business Correspondent (Australian Associated Press)

Treasurer Josh Frydenberg expects Australia’s economic contraction in Wednesday’s national accounts won’t be as bad as other countries.

Forecasts centre on an economic downturn of around six per cent during the June quarter as a result of restrictions to tackle the coronavirus pandemic, although economists concede there is a degree of uncertainty about the result.

But it would compare with the enormous 20 per cent slump in UK gross domestic product and double-digit percentage falls in France, Canada, Germany and the US.

“COVID-19 has wreaked enormous havoc across the global economy,” Mr Frydenberg told parliament on Tuesday.

“The expectation is that the fall here will not be as large as we’ve seen in other countries around the world, indicating the remarkable resilience of the Australian economy.”

Even so, if economists are right it will mark the biggest decline since the Australian Bureau of Statistics started plotting the national accounts in the late 1950s.

Reserve Bank governor Philip Lowe went even further back in history, saying the economy is experiencing the biggest contraction since the 1930s.

“As difficult as this is, the downturn is not as severe as earlier expected and a recovery is now under way in most of Australia,” Dr Lowe said in a statement following the central bank’s monthly board meeting. The sharp fall in the June quarter follows a more modest 0.3 per cent decline in the March quarter but will constitute a technical recession – two consecutive quarters of contraction. As expected, the Reserve Bank board left the cash rate at a record low 0.25 per cent and will continue to target market interest rates at the same rate through the buying of bonds.

However, the Reserve Bank has extended its term funding facility to allow banks to have access to additional funding at a fixed rate of 25 basis points for three years, which will be available until the end of June 2021 and beyond the original September cut off date.

New ABS figures show Australia’s export performance has been a bright spot for an economy in recession, while government spending was also strong.

Net exports – exports minus imports – are expected to add one percentage point to economic growth in the June quarter.

It came as the nation’s current account trade surplus ballooned to $17.7 billion in the June quarter compared with $9 billion in the previous three months. The expected confirmation of a recession was blamed for a decline in consumer confidence in the past week.

The weekly ANZ-Roy Morgan consumer confidence index – a pointer to future household spending – fell 2.7 per cent, ending two weeks of gains.

But ANZ head of Australian economics David Plank was encouraged to see confidence in Victoria bucking the trend as the number of new COVID-19 cases in Melbourne continued to drop.

While Victorians may be in a better mood, separate data shows the state’s house prices remain in decline and its manufacturers are proving a drag on the sector’s national recovery.

The national CoreLogic home value index fell 0.4 per cent in August, with Melbourne prices falling 1.2 per cent.

The Australian Industry Group performance of manufacturing index also fell by 4.2 per cent to 49.3 points in August, just below the 50-point mark that separates a contraction in activity from an expansion. Victoria’s index fell 9.3 points to 44 but NSW and South Australian remained in expansion territory and Queensland improved.

SEPTEMBER 2020 | FIND CASEY 15

Self-Managed Super Funds: Members to increase to 6

ACCOUNTANT

By Warren Strybosch

A measure from the 2018–19 budget to increase the number of members allowed in an SMSF from four to six has been reintroduced into Parliament on the 2nd of September, after it was scrapped prior to the election.

Senator Jane Hume has introduced

Treasury Laws Amendment (Self Managed Superannuation Funds) Bill

2020 into the Senate this week, which amends the SIS Act, Corporations Act, ITAA 1997 and Superannuation (Unclaimed Money and Lost Members) Act 1999 to increase the maximum number of allowable members in SMSFs from four to six.

The amendments will apply from the start of the first quarter that commences after the Act receives Royal Assent.

Former Minister for Revenue and Financial Services Kelly O’Dwyer said the change would increase choice and flexibility for members. Labor has opposed the bill already and other SMSF specialists have concerns that this measure may lead to elderly abuse.

The SMSF sector has been growing over the past decade and continues to do so. However, with higher fees, further regulatory requirements placed on auditors, and accountants losing their exemption to provide advice in this area, it will be interesting to see if this sector will continue to grow as it has in the past.

Next month, we will be providing a special edition regarding SMSF. We will invite an accountant, financial planner, and mortgage broker to provide further insight into SMSF and help you decide whether or not a SMSF is right for you. We will look at the costs associated with setting up and maintaining a SMSF, how to obtain finance for a SMSF, insurances a SMSF can hold, and the obligations required of trustees to maintain one.

Warren Strybosch

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

Special Tax Return Offer

$99 Returns - PAYG Only We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home. Here are the steps involved:

1. Email to returns@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address. 2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required). 3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes. 4. We will then require you to upload your documents to our secure portal. 5. Once we have received all your documentation, we will complete the return. 6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

1300 88 38 30

Write Well to Earn More

ACCREDITED EDITOR

By Susan Pierotti

‘Our organisation needed a more contemporary reimagining of our functional strategic hardware. This would involve recalibrating our KPIs and other quantifying and reporting mechanisms within the established framework in order to report back to the CEO and COO on or before COB on a date yet to be decided.’

Where do you think this quote came from? Can you describe the ideal reader the writer was targeting? Do you even know what it means? Amazingly, this is quoted from a church newssheet!

Writing is a basic form of communication and when we write well, it shows a courtesy to the reader, who is expending valuable time to read what you’ve written in order to understand or learn something. Writing well ensures that your efforts will be rewarded with people reading what you’ve written.

The quote above is not written well because it’s unintelligible to anyone outside the church congregation – and probably quite a few within!

You don’t need a tertiary degree in English to be able to write well. Try applying these tips to ensure you are read and understood every time.

Say what you mean

Let’s look at the phrase above, ‘a more contemporary reimagining’.

The word ‘contemporary’ has the meaning of ‘up-to-date’, ‘current’ or ‘fashionable’. As the process of reimagining (and even just ‘imagining’) takes place privately inside people’s brains in real time, who decides what is more up-to-date or what the fashion is that our imagination needs to conform to? The words ‘more contemporary’ are superfluous.

And what about the word ‘reimagining’ – does such a word exist? If the writer of this quote meant to say their branding style needed updating, why not just say so?

English has more descriptive words than any other language but simple, plain words are often more powerful.

What do all those letters stand for?

There are many abbreviations that we use to help us to read. USA, NSW and ALP are just three that spring to mind. Shortening the text in this way helps the reader process information quickly. However, we should be aware that we don’t litter our text with loads of threeletter acronyms (known as TLAs).

KPIs, CEOs, COOs, CFOs and COBs are TLAs in standard business jargon and are appropriate when used in a business context. They refer to Key Performance Indicators, Chief Executive Officer, Chief Operations Officer, Chief Finance Officer and Close of Business. But there may be many of your clients and customers who don’t know what the letters stand for.

Best editing practice is to spell it out the first time you write it with the TLA in brackets; after that, you can use TLAs to your heart’s content.

Beware the jargon

The industry I used to work in was the Classical music scene. Some of my colleagues would introduce a wonderful piece to an audience like this: form, followed by a beautiful slow movement, a Scherzo replacing the usual Minuet and ending with a Presto vivace.’

The audience was almost comatose with boredom after that! What the audience wanted to hear was whether Beethoven was deaf when he wrote it, how the slow movement describes his walks through the countryside and what is a Scherzo.

Every industry has its own special words. Do your readers know what they mean? Again, simple words (but not patronising ones!) will win your clients and customers over.

Features or benefits?

The reason behind why you are writing and why the reader is reading may be two different things! You may want to advertise your latest product or service but your reader is probably wanting to know if you can solve their problem.

Your new offering may indeed be just the thing to assist your customer but be wary of filling your text with all the great features your product has, or the amazing new program you’ve designed. Tell you reader how your newest business add-on will benefit them, how it will solve their problem and, most importantly, how it will make them feel.

Not everyone has the time, resources or skills to write. If that is you, and you have blogs, newsletters or marketing that need quality content aimed at your target market, contact Susan at Creative Text Solutions, susan@creativetext.com.au.

Be The Leader Your Child Needs You To Be

PARENTING

By Lesley-Anne Banton

Now more than ever your child needs you to lead the way for them, help them navigate their emotions and how they see themselves in the world. They live in an age where they are surrounded by instant gratification, lack a sense of belonging, connection, fear, uncertainty, limited skills of patience and resilience.

Leadership is about challenging what we know and to be open to new ideas. Parenting has been conditioned into us for many decades it is seen as something that is what we have always done, wash, rinse and repeat, generation after generation and is sometimes undervalued because of this.

Parenting is more that the conditionings of the past. It is more than something you ‘do’. It is seeing a child that is more than just something that moves through developmental milestones. It is leadership in the most profound way,

It is starting with the end goal in mind for each child as an individual and helping them navigate their unique road map, not yours.

Leadership in parenting is identifying the unresourceful patterns and dysfunction that help you back and not unintentionally and subconsciously passing this on to your child to own and work out when they get older.

It is being open to being challenged on what you have been doing that has not worked and changing it so it works better for you.

It is facing the unresolved stuff that you have carried forward from childhood and still subconsciously playing this out in your parenting.

It’s letting go of being that misunderstood child that didn’t reach their potential and allowing yourself to fully reach that potential by understand yourself now as an adult so you don’t misunderstand your child and pass it on for another generational cycle.

Having a leadership mindset helps us to tap into the curiosity we were born with, keep growing, moving forward, keeps us stretching, seeking the next level and reaching goals. Having a leadership mindset motivates us to live our passion and show our children how to live theirs, create our visions and design a life of fulfilment. Having a leadership mindset assists us in challenging the status quo and rules and allows us to be innovative in our own lives and business.

What is a leadership mindset?

A lifelong learner, that finds a way. It is someone who seeks to continuously challenge themselves to grow and stretch.

Someone who seeks to challenge their mindset, breakthrough limiting thoughts and beliefs, (which inevitably can be traced back to some point in the Imprint years of 0-7 years old where they were first embedded).

It is someone who seeks out the right mentor, coach, book, podcast or gathering that will support their growth.

It is someone who seeks to see and understand each individual, sees through their eyes and shines the light on their uniqueness.

It is someone who helps people achieve their goals and develop leaders around them and give them the tools to become visible.

It is someone who seeks to fully understand their internal worlds and put language to it so they can then support others.

Someone who has congruency between what they say and what they do. It’ is someone who empowers themselves and others.

Someone who has a proactive attitude takes responsibility, accountability and finds a solution.

Sees failure as feedback and challenges as growth.

Seeks to understand others, see through their eyes and learns a range of communication styles.

Has empathy and compassion to others, and so much more…

Simon Senik, author and motivational speaker, describes a leader to take care of those in our charge not be in charge, leadership is a skill that is practicable and a learnable skill that starts with empathy and a change in perspective. He says leadership is an infinite game where rules are changeable, and the game keeps going (a long-term vision) not a finite game where there are fixed rules and time limitation.

Why is this important? It’s important to you so you keep growing and adapting and your vision can grow. It’s important to those who you inspire and those around you, it’s part of your legacy. Gandhi once said “be the change you want to see in the world”.

By continuously growing your leadership skills, mindset and actions you are creating change around you, including your children and loved ones.

Imagine the change you would create by challenging your mindset and adopted a leadership mindset, challenging the rules and conditionings of the past. Come from compassion and empathy and seeking to fully see the world through the child’s eyes.

What if you could fully see the child, not as you are but as the child is?

What if you could clearly see their strengths, uniqueness and their point of difference?

What if you could help them master their challenges and build their resilience to failure?

What if you chose parenting as an infinite game with a long term inspiring vision with a clear why and purpose?

What if you helped install empowering beliefs in the imprint years of 0-7 years old? What if?

Lesley-Anne Banton

Leadership and Parenting Disruptor and Coach. The Parent Whisperer 0432 848 418 www.theparentwhisperer.com.au

Learn from the mistakes of others

GENERAL INSURANCE

By Craig Anderson

Handling claims is an inevitable part of your job when you’re an insurance broker. They don’t however, have to be an inevitable part of running your business. Increasingly the insurers I deal with on a daily basis are asking me what my clients have done to ensure they don’t have a repeat occurrence. The policies, procedures, administration, training, education, and execution of the tasks are called into question. In the eyes of the insurer, a repeat of the same claim due to a lack of action from the insured is unacceptable once a cause is identified. That’s a fair criticism if a few easy changes and small adjustments can prevent a repeat of a mishap.

Whilst it’s not possible to gaze into a crystal ball to see the future, it’s easy to look at past claims examples from recent history to see where others have failed. For instance, if you are a tradie and you could look through the claims history of all tradies, you’d see a pattern of similar claims emerge where some key learnings could be taken for your own business, which would help you avoid future losses. Examining others’ mistakes can give you some insight into what to avoid but not always how to avoid it. Fortunately, with a little help the answers are easily found. As this article is intended to be general in nature, I won’t give examples specific to only one trade as this won’t help too many people. What most trades have in common is the need to attend site, and so transport and tools seem to be a good area to focus on. An increasingly frequent loss for trades is tools being stolen from trade vehicles on driveways at night. Those left unattended on the open tray of utes and trailers can go missing in an instant. Disappointingly, the vehicles and trailers go missing too. If they’re not locked in the vehicle, the tools aren’t usually covered. Although parking in a locked garage is not always practical, it’s advisable when possible. You can start by locking the tools away in the vehicle, add some visible and high quality cameras and sensor lights to the house looking over where you park, and have a dash-cam in the vehicle which records to the cloud. Often thieves will pull a cap down low, and a good picture of their face could be picked up by a dash-cam which sits at a much lower angle than a house mounted camera. To aid in vehicle recovery, a GPS tracker mounted in a hard to reach spot may greatly increase the odds of getting your prized workhorse back. An alarm and immobilizer are also good investments which might cause a would-be thief to give up quickly. Locked gates can also slow down thieves. If it becomes too hard, the hope is that they will find a softer target elsewhere and leave you alone.

If all else has failed and your precious tools are gone, a good insurance policy can save you from shouldering the loss alone and get you back to work quickly so you can earn an honest living again with the minimum of fuss.

When it comes to avoiding third party damage on site, that’s a whole other conversation best had one-on-one. Talk with your broker about minimising risk before something expensive (and very easily avoided) happens to you.

As always, any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

Craig Anderson

Small Business Insurance Brokers 0418 300 096

FIND LOCAL COUPONS Support your Local Not-for-Profit

COFFEE DINING TAKEAWAY

BREKKY, BRUNCH & LUNCH ENTERTAINMENT

See Page 57 for more info about Find Coupons

TRAVEL

ARCHITECT

By Kathy Ismail

What is a small home? A more realistic concept of big or small depends on how many tradies it takes to complete the job. I always believe that if you only need one carpenter, it’s most probably a job for a handyman or even DIY. If you have three or four, it might worth getting someone in with a little a bit of knowledge, that is, a handyman with a team or a builder. Once it needs five tradies or more, with two waterproofed-required areas, it’s time to get an architect!

Architects don’t believe that size is everything. Whether a house is small or large doesn’t matter when you consider the requirements for building plans and permits, design, collaboration with the builders and so on. You might be surprised how useful architects are, even for small homes!

That’s because architects are the masters of utilising space. They are able to point out where extra room can be unlocked in your home and show you imaginative ways to convert your small house into something more spacious.

The most obvious time to employ an architect is when you’re thinking of extending or if you want to your existing space to fit your needs better. Extensions are probably the second largest expense you will ever have (the first being buying your home), so why not employ the best professional to help you?

Go upwards if you don’t have the land area to extend outwards. This is a particularly common practice in many cities around the world where land is scarce while needing to make room for their family members.

Architects have professional indemnity insurance, meaning their clients are protected, and they are able to acquire all the necessary documentation from your local council, leaving you with peace of mind to dream of how you’d like your small home to look and feel.

Let’s think about the space you already have. Do you want an open-plan layout but can’t see how the walls could be knocked down? Do you need an extra bedroom because, joy of joys, you’re having another baby? Do you need a granny flat in your backyard or an extension to your garage? Architects live and breathe space – it’s their medium. They will create opportunities for more spacious living by developing every inch of your dwelling to its maximum effect.

There are several features you already have in a small home that can be redesigned to increase its space potential. Door openings, room to room views, windows, lights, mirrors, skylights, colours, piping, vents – all these can adjusted, replaced or realigned to deceive the eye into thinking your home is higher and wider than it really is.

If there is no room for an actual extension, an architect will be able to work within your small home’s given parameters. Small homes often have a problem with clutter as there simply is nowhere to store things. Furniture can be custom designed to solve this.

Beds can be built upon a base that include drawers. Furniture that can be folded up and stowed away when not in use is a great addition to a small home. Imagine being able to shut up the ‘office’ at the end of a working day, especially if you are now required to work from home due to Covid-19. How about a workstation tucked in beneath a small mezzanine bedroom? Multifunctional spaces, built-in storage, longer and wider views – these are the tricks that an architect can apply to make the smallest home seem like a large mansion.

Contact Kir Architecture at contact@ kirarchitecture.com.au for help with planning your building projects. We have a questionnaire that could potentially help you in narrowing down your ideas for your next dream home. We are always happy to answer any inquiries.

Kathy Ismail

ARCHITECT www.kirarachitecture.com 0422 026 962

MORTGAGE BROKERING

By Reece Droscher

As most of us are impacted by the effects of the current State of Emergency lockdown in the wake of the COVID-19 pandemic, be it physically, emotionally or financially, it is becoming increasingly important for anyone with a mortgage to understand whether their current loan is the best solution to meet any potential change in circumstances. Borrowers need to know how much their current loan is costing them, and how will their current lender support them in times of financial crisis. Is your Home Loan healthy enough to help you through this pandemic?

Workers in most industries have been severely affected by the restrictions put in place to prevent the spread of coronavirus . In response to this most lenders have programs designed to assist clients financially should their employment/ income be impacted negatively. As at June 30th the data provided by Home Finance lenders showed that around 10% of Home and Investment loans were under a repayment deferral program, representing around $195 billion in loans. Small business had also taken up the offer of repayment deferrals on commercial loans at around 17% of the total small business loan market.

The assistance package generally consisted of repayment deferrals for periods initially up to six months, however a large percentage of those loans under the repayment deferral program will be coming to the end of this period. Some lenders have commenced reviewing the requirements of those who took up the deferral option in the first wave of restrictions. Most lenders have advised that, for those who still require assistance, there will be options available to extend the deferral period, however these will be subject to regular review and arrangements will be for shorter periods.

There is also a misconception amongst some borrowers that, with repayments put on hold, any other costs will also be deferred. This is not the case. If you decide to defer your loan repayments the interest on the loan is still being calculated and is added to the loan balance. Once the deferral period is completed, borrowers could find themselves in a worse position as they owe more than they did before the deferral period commenced. They may have to commit to a higher loanrepayment than they were paying before the repayment deferral period commenced.

If you are a borrower who is about to finish the initial repayment deferral period, or due to lockdown need to approach your lender for repayment deferral assistance, there are ways to mitigate the impact of this, now and in the future.

1.

2. Review the current interest rate and approach your lender to switch to a cheaper option before you request the repayment deferral. This will help to reduce the amount of interest that would be capitalised to your loan during any repayment deferral period.

Re-commence your repayments as soon as possible to reduce the additional interest costs if you can afford to do so. Even setting up a part-payment arrangement with your lender will help to offset some of the extra interest which will be charged during the deferral period.

4. Refinance to another lender should you still be employed. A number of lenders offer discounted rates to new customers, and these can be significantly cheaper than rates offered to existing borrowers. Some lenders will take JobKeeper into account as acceptable income to repay a Home Loan, so even though you are receiving some assistance you may still be eligible to borrow to refinance and get into a better position.

A mortgage broker can help borrowers navigate the way through the options to ensure they get the best outcome under the circumstances. At SHL Finance we are already proactively helping our clients negotiate a better rate with their current lender, reviewing their existing loans and discussing ways to potentially save their clients thousands of dollars. We would love the opportunity to help you too.

Please call Reece Droscher on 0478 021 757 should you want to discuss your options.

Reece Droscher

Managing Director of SHL Finance Pty Ltd 0478 021 757 reece@shlfinance.com.au

5 Types of Garage Doors Noises and What to do about them

GARAGE DOORS

By Chantal Djuric

Noises from garage doors are like pains in our bodies – they tell us when something is not quite right. Here are 5 types of noises you may hear your garage door making.

1 Bent tracks

If your garage door makes rubbing noises when you open and close it, this could be a sign that the metal rail has bent. Another sign of this is if you see loose screws.

Don’t try tightening them using a wrench or socket set. Call a garage door specialist at once.

2 Loose parts

Each piece of your garage door hardware can become loose and they each have their different sounds. Highpitched squeaking or grinding noises may mean that the rollers or hinges are worn out. A loud slapping sound is caused by the rollers smacking against the track. This is because of jerky door movements due to a loose garage door opener chain becoming loose. A vibrating or rattling noise when you open and close it indicates that nuts and bolts have become loose. Metal or sloppy rollers or hinges will become noisy and worn after an extended period of use or if they are bent.

Call in a specialist to tighten whatever is loose and to replace old and worn out parts.

3 Poor lubrication

When the door moves, it results in friction, which can cause squeaking, rattling or grinding.

If you think of lubricating the worn rollers, don’t reach for your WD40 – check with a garage doors specialist what the best lubrication is. Remember the extreme tension the torsion springs are under — don’t place any part of your body in or near the springs. Don’t repair, remove or adjust the springs or any connected components of the counterbalance system.

A regular service by a garage door technician will prevent parts from wearing out.

4 Unbalanced doors

Banging, rattling, scraping or squeaking noises could be bad news – your garage door could be unbalanced. If so, the springs could be either exert too much tension or not provide enough to counterbalance the door’s weight, resulting in a snapped spring or cable, or the opener failing prematurely.

Worn-out hinges aren’t as common as worn out rollers, but they can make a lot of noise. Check to see if the hinges are broken, worn out or have metal fillings or dust around them. Don’t repair, remove or adjust the hinges yourself. This is definitely a case for a garage door specialist.

5 Improper installation

If your garage door is grinding, squealing or rattling loudly, it may have been installed incorrectly. Other indications of this closing or stopping halfway up, not closing or opening properly and being difficult to operate.

The good news is that a garage door specialist can reinstall your door so that everything is aligned as it should be.

Specialist assistance

Fixing the noises of your garage door yourself is definitely not a DIY job. There are many factors to consider, such as the variety of garage doors – panel doors, roller doors etc. How they are attached to your garage, the structure of your garage and its alignment to your house, your garage’s overall condition and even the weather are factors that only a specialised garage door expert can analyse to fix the noise problem.

Here are 4 ways a professional garage door technician can make your door quieter:

Replacing steel or metal rollers with nylon rollers Installing a belt-driven garage door opener instead of a chain-driven one Installing torsion springs rather than extension springs, if there’s space Performing a thorough inspection to confirm your garage door is appropriately operating.

The best way to keep your door operating correctly and safely is to have regular garage door maintenance. For 24/7 garage door servicing, give Cruzin Garage Doors a call on 0427 894 603 or email us at sales@cruzingaragedoors. com.au.

Chantal Djuric

GARAGE DOORS 427 894 603 www.cruzingaragedoors.com.au

Feeding Cues: The Secret To Knowing When To Feed Your Baby

LACTATION CONSULTANT

By Dr. Joanna Strybosch

How do you know if your baby is hungry? Are they crying because they are hungry or because they are tired? Or for some other reason? Pain? Too hot? Cold? Wet nappy? Navigating the world of a new baby can be overwhelming at times and the learning curve can be steep. One of the most important things a parent needs to know is if their baby is trying to signal their hunger. Wouldn’t it be helpful if babies could tell us when they are hungry?

Fortunately, the fact is that babies signal their desire to feed in predictable stages and they use their movements to indicate these. Once parents learn to observe these behavioural cues, they can more easily tune in to what their baby is communicating. Many new parents make the mistake of thinking their baby will cry when they are hungry. Unfortunately crying is the last stage of hunger and by the time a baby is crying they are no longer in a good state to feed.

Dr Bronwyn Leigh, from the The Centre for Perinatal Psychology describes six states of alertness that babies oscillate between, from deep sleep through to crying. Dr Leigh says that each baby is unique in their rate of transition between their states, with some babies moving quickly between them and others spending considerable time in each state. The 1st state is “Deep Sleep”, the 2nd is “Active (Light) Sleep” and the 3rd is “Drowsy”. The 4th state, “Awake, Alert”, is one most parents will resonate with. It’s often the most rewarding state for parents, as babies are relatively quiet and inactive with bright shining eyes. The 5th state is “Alert but Fussy” and the 6th state is “Crying”. Herein lies the key. Babies will begin to cue their hunger while in the “Awake, Alert” state, which is often long before parents expect it. The earliest and most subtle feeding cues involve mouth movements. If their signal to be fed is not met, babies will then move to mid feeding cues which involve body movements. By now a baby’s state is shifting to “Alert but Fussy”. As a last resort, if still not fed, a baby will transition to the “Crying” state. Unfortunately, once a baby is crying they are not able to feed well. They have become hyper-aroused, their sympathetic state has been heightened and they have become neurologically disorganised. Now, a baby must be assisted to shift their state back down the continuum before he can latch correctly and co-ordinate sucking, swallowing and breathing.

Early Feeding Cues: Mouth Movements

These may include licking their lips, opening their mouth and turning their head. These mouth movements are driven by a baby’s innate reflexes that are associated with feeding. They can be seen right from birth and are especially noticeable in young babies up to about 3-4 months of age. The best time to feed a baby is when he shows these early cues. This will most likely occur soon after a baby has woken from a sleep, as he transitions from a “Drowsy” state into the “Awake Alert” state. Some babies will even show early feeding cues in a “Drowsy” state of alertness, which is great for dream feeds late at night when you want to feed your baby without them being fully awake. For some mums, they find their baby feeds better overnight than in the day time. This can sometimes be because in the daytime, a baby has passed their best state to feed in before mum offers the feed. So, look out for those early feeding cues so you don’t miss the most optimal moment to feed.

Mid Feeding Cues: Body Movements

Body movements indicate an increasing state of alertness and may include stretching, wriggling/jerking of arms and legs, fisting of hands and putting hands to mouth. Once a baby is signalling with these cues, they require feeding straight away. Even a delay of a few minutes can mean the difference between a successful feed and being too escalated.

Late Feeding Cues: Upset Baby

This may present as fussing, outright crying, and turning red. An upset baby is in need of calming first, before feeding. It is not physiologically or neurologically possible for a baby to organise themselves to feed well while they are crying.

Some babies are able to return to a better state for feeding quickly. But most babies who have reached a state of distress will require some soothing to assist them to calm down. This could come in the form of talking to them in a calming manner, stroking and cuddling them in an upright position, and best of all, skin to skin contact. Once the crying abates for a moment, try offering the feed. If baby cries again rather than feeds, return to soothing for a little longer and then try again.

For more information on feeding cues and practical help with feeding your baby, consult a certified Lactation Consultant.

Dr. Joanna Strybosch

Osteopath B.App.Sc(Clin.Sc)/B.Osteo.Sc/Grad Dip Paeds Lactation Consultant 9876 3011 https://www.childrensosteopathiccentre.com/

SIGNAGES

By Glenn Martin

We know how important maintaining your business is right now, and we want to help you to inform your customers of your new processes, and to share your important safety messages. We understand the unique needs of business owners to ensure they are providing staff and customers a safe environment, and we know how to associate your brand with safety, professionalism, and comfort.

We are waiving rush fees and offering next day service on most signage related to Coronavirus (COVID-19). In case you are not familiar with what your options might be, or what Covid Safe and Social Distancing graphics might entail, we thought we would put together a helpful guide for you. You are probably well aware of Government advice for Social Distancing is to keep a distance of 1.5m from each other wherever possible, and there are a variety of formats that this message can be communicated.

Floor graphics

Installing bespoke floor graphics is a great way to ensure your customers, the general public, students or staff, understand the safe distance to stand apart from each other. It is all too easy to overcompensate distance or to stand too close to someone, especially in a somewhat unfamiliar or more crowded environment.

It is important to use the correct materials when producing floor graphics for areas of public use, so a trip hazard is not being introduced. A good strong adhesive, suited to the flooring material, with a rated anti-slip seal is a must. Installing floor graphics allows you to add communication that follows your brand identity to speak to the public visually, even when asking them to follow a procedure.

Free-standing signage

If you are looking to remind the public to follow Social Distancing directives, freestanding signs, in important positions around your store, school, office, etc. are a great idea. There are a number of options for these including pull-up banners, small A3-size print holders with a pole and base, or an A-Frame sign.

Custom Acrylic Cough Screens

If you are thinking about adding acrylic barriers between employees and customers, did you know we can either

engrave directly to the acrylic, or apply cut vinyl to the surface? This would allow your brand or your messages to be applied directly to the surface for customers to view on your custom-made screens.

Posters and Banners

A good old fashion poster or banner is a simple yet effective way to share your Social Distancing policy and information with those around you. We can print to any size, from standard A sizes to bespoke shapes and dimensions and these can be made for internal or external solutions.

Window and walls

As well as the above, we can produce signage and graphics for your windows and walls too. Perhaps you want to share a Social Distancing policy on your windows, doors, or exteriors before the public enters. These can be in the form of cut vinyl decals, posters, boards, selfadhesive vinyl, hanging signs or even wall paper.

Standees and Strut Cards

Ideal for check outs, shelving, or even the floor, we can produce free-standing signs with supporting struts to fit in most locations. These could house any information, from simple messages, to a full-size cut out of a staff member asking customers to maintain a safe distance. Standees can be straight cut or cut to shape or printed double-sided for double the impact. These are great vehicles for directional signage, and simple, yet important, messaging.

If you want to print a creative custom design, feel free to challenge our designer, or we can use off the shelf stock images to meet your requirements. If you want to get creative and have any other ideas for Social Distancing graphics, just let us know and we will be happy to brainstorm ideas with you and suggest interesting production methods and materials to get the message across.

Send us an email to mitcham@signarama. com.au with any requirements or questions you may have. Our showrooms are closed, but we are still open to take your orders and make them available to you by delivery or contactless pick up at your local Mitcham store. Our ability to install signage is impacted under stage 4 restrictions, but there is nothing stopping us from getting the ball rolling on your upcoming project.

Glenn Martin

0411 835 668 Glenn.mitcham@signarama.com.au

FIND CASEY | SEPTEMBER 2020 findcasey.com.au Jobkeeper: Fair on Unfair

BOOKKEEPER

By Neha Nayyar

In March 2020 the government introduced the JobKeeper payment scheme; a response intended to keep more Australians employed while supporting business owners affected by the current economic downturn due to the global pandemic. This was a great initiative introduced by the government however due to a strict set of guidelines on who is eligible for JobKeeper and the Cashflow Boost, getting the support doesn’t come easy for some.

Something as simple as whether you report your BAS monthly/quarterly/ annually can determine whether your business is eligible to receive the government financial support or not. The reporting cycle also gets you a different amount of cash flow boost.

While there is supposedly a lot of support - there are a lot of business owners missing out. Following are some case studies from we have experienced:

Cafe ABC - A business owner opened a cafe in December 2019, registered for annual BAS lodgement and was denied the cashflow boost. In order to determine your eligibility for Cashflow boost the ATO requires a lodgement to prove your income. Had they lodged a December 2019 BAS if they were on quarterly basis, they would have received the cash flow boost.

Hairdresser ABC - A Hairdresser was advised by their bookkeeper that they do not qualify for Jobkeeper. However looking at all the tests we found they were eligible. It does not hurt to take a second opinion if you have been told by one provider that you are not eligible for the boosts.

Wine Distribution business ABC - A wine distribution business located in Northeast Victoria opened its doors in January of this year. The business immediately suffered as a result of the bushfires and just when things were looking promising, their business was once again affected by the pandemic. Unfortunately this newly established business was not eligible to receive any Covid financial support because they had registered for quarterly BAS lodgement and did not make any sales in the first three months of opening their business. Many new business owners find themselves in this exact predicament. With the start-up costs associated with opening your doors while trying to build up your clientele, the financial burden weighs heavily as they are being denied the support.

4.

Carpenter ABC - A carpenter who had not earned any business income since April 2020 was ineligible to receive any Covid financial support because of a mistake made by his accountant. In this scenario the carpenter hired a Tax Accountant to lodge his tax returns however the accountant did not process the returns with the ATO even though the client had signed the documentation. In the eyes of ATO they are behind by 3 years of lodgement. They were not GST registered so no BASes to prove in the absence of Tax returns. Due to this situation the client has not been able to receive the Jobkeeper. Unfortunately this is not an isolated incident, time and time again business owners are expected to put their trust in accountants who can often fall short and it is the business owners who suffer.

These are unprecedented and difficult times for every business owner and it’s essential to our economy that businesses remain open. Unfortunately, due to the strict eligibility criteria many business owners are missing out and have no other choice than to shut their doors for good. Now more than ever Accountants and Bookkeepers have a huge responsibility in relaying accurate and timely information to their clients to help them receive the financial support they need.

At Sum and Substance we are passionate about providing accurate and timely information to our clients. If you would like our support in determining your eligibility for JobKeeper and Cashflow Boost or simply have a question about the economic stimulus packages offered then please contact us. We can be reached at (03) 9424 9447 or email. You can directly book in a time to chat by clicking here.

Neha Nayyar

Which Platform Should I use for Marketing

MARKETING

By Matthew Benn

This is by far the #1 question I’m asked, after someone finds out I run a marketing firm.

Before I give you the answer… let me give you some context about why this is such an important question to ask, prior to launching into ANY marketing activity.

Unfortunately, a lot of people (and businesses) jump to conclusions that will hurt them financially, and make it harder for them to be successful with marketing in the future.

Let’s jump in…

Organic Content Marketing

Most platforms have an element of organic content marketing, which use an algorithm to serve content to its users. How your content is served to the users of a specific platform is based largely on the algorithm on that specific platform. Aspects of how your content accurately answers the questions being asked by their users as well as your following (people who follow your content actively) also make a substantial impact on your results. The algorithms for each platform change on a regular basis… hence you need to be a frequent, skilled and knowledgeable user as well as have an active and growing following to be able to get a good ROI from an individual platform.

Paid Advertising

The majority of digital platforms that we use these days have an element of advertising which is served up to us based on our habits ‘surfing the web’ and on their specific platform. Certain platforms are a little better at targeting than others but all have their benefits for certain types of selling and certain types of market sectors/ industries. Make sure you have a very specific target market dialled in – whenever you advertise.

Please take note: Facebook is one of the easier platforms for advertising… however this opens the door for just about anyone to “give-it-a-crack”… hence there are millions (probably more) of businesses that are using it badly and just making noise. If you don’t use it well – you’re just adding to the noise and throwing money into the abyss!

3.

4. Multi-touch, Multi-platform

The majority of buyers need between 8-12 touch points (current stats) with the right information and knowing your brand to make a purchasing decision. Most companies disregard these figures and try for a one-touchwin and normally on the cheap = almost never works and is potentially damaging for the future. Buyers are on different platforms and don’t get to a buying decision after seeing one blog or Ad… it’s called a “buyers or customer journey”; hence anything you do – needs to be a multi-step and multi-platform effort. Now it comes down to which platform you use first, because you need to use multiple platforms.

Targeting

First you need to know who very specifically you are trying to target with each piece of content/ Ad. Then you need to understand where they are spending their time “looking/ searching” for answers to their questions - about how to solve the problem in their life that you solve. And then how you will present the piece of information = attractively with words and also images or video.

If you understand these things your job is easy… however most people jump straight to “we sell this and it is great”.

This last point - is the most important point. PLEASE do some research on your buyers, the market and competition – prior to doing any marketing. There are multiple reasons… but mostly because buyers need to be wooed by your advertising and they are sick of terrible advertising. and says exactly the same thing as everyone else in the same space. If you stop and think about it for a minute, your current customers have come to you because you are different. Think about what they say about you, when you talk to them about why they do business with you = they’ll be more than happy to tell you! Your message needs to reflect what they say.

To wrap it up (in SHORT)…

A) Awareness = You need to intimately understand your buyers, your competition and your unique value proposition in the market. This will help you understand where best to advertise and what mix of advertising is best = called a marketing mix, see this article for more information. B) Build a Base = You need to have a very specific plan, system and the creative material to get the attention of and attract your potential customers; with whatever types of marketing you found was appropriate in “Phase A”. This second phase is the time to define and refine these things and put them into a solid marketing message and the creative pieces that make it pop!

C) Campaigns that convert = Start marketing, test and measure the results to see what gives the best outcomes and keep refining on the platforms and with whichever methods work best.

This is the system we use with all our customers, the “ABC Growth System”…

making Business Growth Simplified!

“All buyers want to feel like they are getting a lot more value than they are paying for!”

Just remember good marketing is a fairly slow, detailed and group of methodical activities – which gets results if patience and good planning are used in the right way. Buyers want to be gently guided with information that answers their questions and given value along the way that is different from your competition and helps them to identify you as having the solution that they see as the best fit for their problem.

Most people are too impatient and hurt their chances of getting good results by doing things that seem “needy” and just plain pushy… which no buyer enjoys.

If you are confused or frustrated with marketing and would like someone to guide you and your business from where you’re at, to getting results give us a call or email and we’ll have a chat to see how best to help you.

…this could be just to give you some advice on how best to go forward – we don’t work with all who enquire about marketing with us.

We are business growth experts, helping frustrated owners get better results with their marketing and sales; also offering training for those that want to do it themselves.

Matthew Benn

Marketing Consultant www.abcselling.com.au 402 507 394

26 FIND CASEY | SEPTEMBER 2020 findcasey.com.au ISO Father’s Day!

EDIBLE BOUQUETS

By Tk Saunders

So we are still in Iso, and another special day is here, fathers day!

Well luckily we have many customers that booked in to send a bliss bouquet to their special dads.

This bouquet (pictured) is one of our most popular bouquets, it’s our XL meat and cheese with chocolate the absolute best of the best! A bit of sweet, a bit salty, a bit of savoury!

Its has chocolate dipped strawberries, ferreros, salami dried apricots, dried blueberries, twiggy sticks, ,more salami, wasabi peas, pistachios, mixed roasted nuts, trail mixes, prosciutto, kabana, smokey cheese, Brie, baby bells, more salami, chorizo, olives, chillies, oh and did we mention salami? Who doesn’t love salami?

So to all the dads stuck in Iso Happy Fathers day!

By Daniel McCulloch (Australian Associated Press)

Cyber attacks on Australia’s critical infrastructure could soon trigger a national emergency declaration, empowering security agencies to launch counter assaults. The federal government is seeking greater powers to protect private sector assets such as electricity grids, communication lines and big banks from hacking attacks. The Department of Home Affairs has and provide advice on mitigating picture and unique capabilities to We sincerely hope you have a great day! Hopefully soon we will all be out of Iso and can start to see our families, loved ones and friends!

Remember any special occasion coming up we can help with a delicious bliss bouquet just give us a call on 0487823523, or check out our facebook or instagram pages, mention this article to receive a $5 discount on your first bouquet.

As always stay safe and stay cool, much love Tk and Marie,

Bliss bouquets,, The flavour of extraordinary.

Hacking could trigger ‘national emergency’

released a discussion paper on declaring an emergency during an immediate and serious cyber threat to Australia’s economy, security or sovereignty.

“In an emergency, we see a role for government to use its enhanced threat take direct action to protect a critical infrastructure entity or system in the national interest,” the paper says. “The primary purpose of these powers would be to allow government to assist entities take technical action to defend and protect their networks and systems,

Tk Saunders

damage, restoring services and remediation.”

The department says the emergency powers would primarily be discharged on a voluntary basis. “However, there may be cases where entities are unwilling to work with government to restore systems in a timely manner,” the paper says.

“Government needs to have a clear and unambiguous legal basis on which to act in the national interest and maintain continuity of any dependent essential services.”

SEPTEMBER 2020 | FIND CASEY 27

How to do a Budget

FINANCIAL PLANNING

By Mari Nguyen Easy Steps to plan and manage how you spend your money

Having a budget helps you to feel in control of your money. You can put aside money for big bills when they arrive, and plan savings to achieve your money goals.

You don’t need an accountant or special software to set up your own budget. Start by looking at where you are right now and where you want to be.

Set your money goals

First, work out why you want to do a budget. This can help you to decide where you want your money to go.

Ask yourself: what is my goal? It could be to stay on top of bills, save for emergencies, pay for your children’s education, or save for a holiday or a house deposit.

See where your money goes

Having a clear picture of your regular expenses and spending habits will help you set up your budget.

To do this, track your spending over a week, a fortnight or a month. See track your spending for practical ways to do this.

How to set up your budget

Use how often you get paid as the timeframe for your budget. For example, if you get paid weekly, set up a weekly budget. Then follow these steps to set up each section. Use our budget planner Set up your budget and save it online or use our Excel budget spreadsheet.

1. Record your income

Record how much money is coming in and when. If you don’t have a regular amount of income, work out an average amount. Make a list of all money coming in, including:

how much where from how often (weekly, fortnightly, monthly or yearly) This money could be from your wages, pension, government benefit or payment, or income from investments.

2. Add up your expenses

Record your regular expenses, including:

what for how much when

Regular expenses are your ‘needs’ — the essential items you need to pay for to live. These include:

Fixed expenses, for example:

• rent or mortgage payments • electricity, gas and phone bills • council rates • household expenses, like food and groceries • medical costs and insurance • transport costs, like car registration and public transport • family costs, like baby products, child care, school fees and sporting activities • Debt expenses, for example:

personal loan repayments credit card payments mortgage repayments

Unexpected expenses, for example:

car repairs and services medical bills extra school costs pet costs

To make sure you’ve recorded all your expenses, look at your bills or bank statements. If you tracked your spending, use your list of transactions.

3. See if you can save

Having some savings can help create a safety net for unexpected expenses. Set a savings goal and work out how much you can save each payday.

Use our savings goals calculator

Work out how long it will take you to reach your savings goal.

4. Set your spending limit

The money you have left after expenses and savings is your spending money. This money is for ‘wants’, such as entertainment, eating out and hobbies.

Make a plan for what you want to do with your spending money. This will help you to keep within your limit. Keep track of your spending so you always know how much you’ve got left.

Set up three bank accounts: a high interest savings account for savings, and two transaction accounts for spending and bills. Schedule transfers of your savings and direct debits for your bills to automate your finances.

Review your budget regularly

It’s important to adjust your budget as things change. For example, if you find you can’t cover all your expenses, savings and spending, you may have to reduce your spending limit, or change your savings goal.

For ideas to help reduce spending, see simple ways to save money. You can also look for ways to increase your income.

Tax Savings Seperate From Income: Report

By Colin Brinsden, AAP Econimics and Business Correspondent (Australian Associated Press)

New economic figures will highlight the impact of Melbourne’s COVID-19 restrictions on Victorian businesses’ hiring intentions.

Victoria had been one of the strongest states in seeking workers when the virus was first suppressed.

The Department of Employment will release its monthly vacancy report for July on Wednesday, which counts job advertisements on the internet.

Its June report, which didn’t capture the start of the second virus wave in Melbourne, showed job ads across the country soared by 26.3 per cent as restrictions were unwound.

Victoria showed a massive 35.4 per cent increase.

Despite this rebound, job ads overall were still down 31 per cent than a year earlier, reflecting the initial impact of the virus on the economy.

Job ads more broadly, as calculated by ANZ earlier this month, showed the pace of the rebound in hiring had slowed in July.

People who want to become blood donors can visit the Lifeblood website or call 13 14 95 to set up an appointment.

There has been a marked increase in employment in the past couple of months, including a 114,700 jump in July.

This, along with a decline in the rate of coronavirus infections in Melbourne and Sydney, helped to stem a sevenweek drop in consumer confidence. The weekly ANZ-Roy Morgan consumer confidence index released on Tuesday gained 2.4 per cent. People who want to become blood donors can visit the Lifeblood website or call 13 14 95 to set up an appointment.

There has been a marked increase in employment in the past couple of months, including a 114,700 jump in July.

This, along with a decline in the rate of coronavirus infections in Melbourne and Sydney, helped to stem a sevenweek drop in consumer confidence. The weekly ANZ-Roy Morgan consumer confidence index released on Tuesday gained 2.4 per cent.

Confidence, a pointer to future retail spending, was still well below average.

However, companies like home entertainment group JB Hi-Fi and supermarket giant Coles have shown it is not all doom and gloom for the retail sector.

Both posted full-year profits this week, a rarity in the current company reporting season because of COVID-19.

JB Hi-Fi was bolstered by people seeking goods for working and learning from home, while Coles benefited from the stockpiling when the virus first struck Australia’s shores and prior to restrictions being put in place.

In both cases, there were strong increases in online sales. Meanwhile, a new survey of start-up companies found more than half feel they are being ignored by governments, and a quarter believe Australian regulations have impeded their growth.

The survey of 400 start-ups conducted by Pause Fest also found they feel Australian policies compare unfavourably with Asia, the US and Europe.

“As Australia looks toward economic recovery following COVID-19, the technology sector will play a pivotal role in job and wealth creation,” Pause Fest CEO George Hedon said. “Clearly we need to examine the barriers startups face and listen to their concerns if we want to maximise the benefits the industry has to the nation.”

Ten Thousand Blood Donors Urgently Needed

By Tiffanie Turnbull (Australian Associated Press)

A nationwide shortage of blood and plasma stocks could be only weeks away if more than 10,000 additional donors do not sign up to give blood.

Each week, 31,000 donations are needed to help Australians through trauma, major surgery, cancer treatment, pregnancy and a host of other situations.

But, over the past three months, Red Cross’ Lifeblood service has seen a drastic increase in no-shows and cancellations.

Looking ahead, the number of appointments in the next few weeks has also dropped.

By Matt Coughlan (Australian Associated Press)

Australian manufacturers are being urged to tell the federal government if they could help reproduce a coronavirus vaccine. Submissions will be used to determine the national capacity to make and distribute the drug if an effective candidate is found. Industry Minister Karen Andrews said the government was aware of Australia’s existing ability to produce vaccines. “This request for information is about identifying more niche manufacturers, including those who may be able to pivot or have the capability but would need support to scale up their operations,” she said on Tuesday. “Australian scientists are at the heart of the global quest for a vaccine and we want to make sure Australian manufacturers can be central to the production once that vaccine is found.” Ms Andrews said the information would boost manufacturing capability to respond to other possible pandemics down the track. Manufactures have until next Thursday to respond to the government. The vaccine race has more than 150 candidates being developed and tested around the world with 25 in human clinical trials. “To meet the needs of Australian patients, we really need 10,383 additional people to donate over the next two weeks,” Lifeblood chief executive Shelly Park said. She is concerned confusion about lockdown measures may be keeping people away.

“Donating blood and plasma is classed as essential care giving and we have worked with all state and territory governments to make sure donors can keep their appointments, even in lockdown.”

Ms Park says donation centres are COVID-safe, with strict social distancing, temperature checks and regular, thorough cleaning. Acting Chief Medical Officer Paul Kelly is increasingly hopeful a vaccine will be found through the global search. Prime Minister Scott Morrison has urged any nation that finds the substance to make it available globally.

People who want to become blood donors can visit the Lifeblood website or

Google Queries New Digital Platforms Code

call 13 14 95 to set up an appointment.

“Any country that were to find this vaccine and not make it available around the world, without restraint, I think would be judged terribly by history,” he said.

Plan for Working from Home Award Changes

By Matt Coughlan (Australian Associated Press)

Employees and bosses will be able to agree on flexible working from home arrangements during the coronavirus pandemic under a proposal from the industrial umpire.

Fair Work Commission president Iain Ross has released a draft plan to change awards, likely to be most relevant to small businesses without enterprise agreements.

The model includes a provision allowing agreement on working from home arrangements that balance personal and work responsibilities against the business needs of the employer.

Employees would be able to compress their week so usual hours are worked over fewer days. Starting and finishing times could be staggered and employees directed to work at home or other locations.

Workers could take double the annual leave at half pay and also buy extra time off if bosses agree. With the agreement of three quarters of a workforce, a cut to hours could be shared if an employer can’t usefully employ everyone.

Justice Ross said working from home had been one of the most significant shifts since the start of the pandemic.

“It is likely the direct economic and social impacts of the pandemic will be felt for some time to come,” he said.

By Daniel McCulloch and Matt Coughlan (Australian Associated Press)

JobKeeper wage subsidies are being split into a two-tiered system and extended for another six months. “There will (likely) be a continuing need for flexible work arrangements to assist employers and employees in adapting to the changed conditions and to support the recovery.”

The draft proposal could be potentially be included in modern awards, most of which don’t expressly deal with working from home.

The commission president said that could constrain working from home arrangements if business was forced to pay penalty rates or overtime, despite employees seeking flexibility. Labor has waved through the extension after failing to introduce a wage floor for workers who are no longer eligible for the scheme. Independent senator Rex Patrick also could not secure enough support for an amendment to force businesses that have paid dividends or executive bonuses to repay the wage subsidies. The split system replaces flat $1500 subsidies paid each fortnight. People who worked less than 20 hours a week before the crisis struck will be paid $750 a fortnight from the end of September, while all others will receive $1200. The maximum payment will come down to $1000 from December to March.

“It is intended that the model schedule be used as a starting point for discussion between parties,” Justice Ross said.

“Not all of the clauses proposed in the schedule will be suitable for all awards and some clauses will require tailoring to meet the needs of a particular industry or occupation.” Australian Industry Group chief executive Innes Willox said the draft was an important initiative which would deliver flexibility. “A very large number of employees are currently working from home, and it is evident that workplaces will never be the same again,” he said on

JobKeeper Extension Passed by Parliament

Tuesday. Prime Minister Scott Morrison described the wage subsidy scheme as the most significant economic intervention in

Australia’s history. “We are now extending and transitioning,” Mr Morrison told coalition party room colleagues on Tuesday.

“Transitioning and looking to a day when Australian communities don’t need JobKeeper and when Australians can then run their businesses and hold their jobs sustained by a vibrant and growing economy instead.”

The second tranche of JobKeeper payments is expected to cost more than $30 billion.