63 minute read

COLUMNIST ARTICLES

Accountants No Longer Want To Provide Financial Planning Advice - It's All Too Hard And Costly

ACCOUNTANT

By Warren Strybosch

For many years, accountants looked down on financial planners. After all, financial planners supposedly caused all the financial crises that we have all experienced over the last 20 years, they took commissions for doing nothing, and simply sold products. Not so for accountants, who unlike the financial planners, provided a service that everyone required e.g., tax returns, and were the only ones who ever provided sound advice. I do say this with a bit of tongue in cheek, but you can be assured that is how some accountants viewed financial planners a few years back. How things are changed.

In July 2012, the FoFA reforms were introduced. Out of the FoFA reforms was born the Ripoll Report, which examined the collapse of some big-name financial institutions Storm, Trio, Opes Prime, that resulted in many ordinary ‘mum and dad’ investors losing a lot of their money even though they were just following the advice of their financial planners, advisers and even accountants.

FoFA introduced to protect consumers, and to enable ordinary consumers to obtain access to more affordable and competent financial advice. As part of the reforms the government decided that all financial advice should be afforded the same level of regulatory rigour, irrespective of who delivers that advice. That is, whether a financial planner or an accountant provides advice to a client, the client should still expect the same level of competence and protection from the law. Consequently, this meant that the accountants’ exemption relating to SMSFs had to be removed.

After much debate and argument, it was decided that SMSFs are a financial product and therefore had to be included in the FoFA reforms. However, the experience of accountants was acknowledged and the government agreed to deem that accountants had relevant experience (normally this has to be proved to ASIC). This applies only to members of the Joint Accounting Bodies (JAB) (IPA, CPAA and CAANZ) with a PPC and during the transition period.

This was a major concession. Other concessions were also won, including the introduction of a limited license with an advice scope broader than under the exemption; and providing an annual compliance certificate instead of a full audit (which financial planners have to do).

A three-year transition period was also granted, ending on 30 June 2016. Most of the FoFA reforms have not directly impacted accountants. The impact has been mostly on financial planners – including the changes around conflicted remuneration, opt-in, to name a few. It should also be remembered that the accountants’ exemption was introduced as a temporary measure during the last round of financial reforms, until a more permanent solution could be developed. However, ‘temporary’ lasted for about ten years during which time establishing SMSFs became embedded for many accountants. This was evident with a large take up of

limited licenses by accountants, which reach its peak take up in 2018.

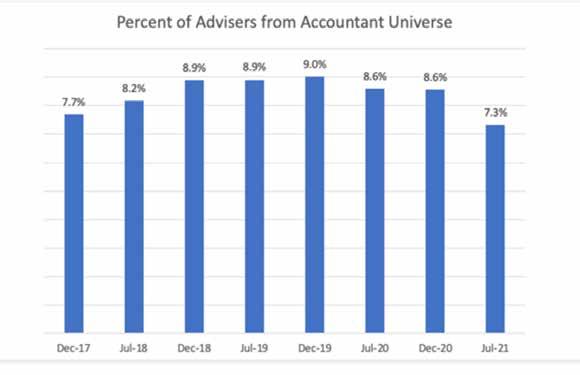

In December 2018, when there was close to 29,000 financial advisors offering advice, almost nice per cent (9%) were made up of accountants.

Since 2018, and after the introduction of the FASEA Code of conduct, higher education standards, a FASEA exam that all advisors had to sit, including accountants, and most importantly, the burgeoning increase in costs to be able to be able to give advice in this space, there has been a sharp decline in the number of accountants holding on to their limited licenses. Since 2019, there has been approximately 28 accountants every month handing back their limited license to ASIC which has reduce the number of accountants able to provide limited advice down to about 1300 accountants.

What is interesting to note is that the cost to be able to provide advice has nearly doubled with most advisors having to now pay approximately $45,000 to their respective licensee per annum. When you add on PI, software fees, and association fees, that are mandatory to be able to provide advice, the costs can jump up to easily $60,000 per year. With financial advisors now having to pay ASIC levy fees on top of already high yearly running costs, you can understand why accountants are reluctant to stay in the game of providing financial planning advice. After all, their licence costs, including software, is easily under $5000 per annum – chalk and cheese when comparing accountant costs vs financial planning costs of running a business.

Given, the government had formed the view that many accountants were operating in breach of the exemption, they decided they either had to have a limited license to be able to provide advice or become a fully qualified financial planner. However, after the Haynes Royal Commission and the introduction of the FASEA Code of Conduct, it was decided that anyone who wanted to provide financial planning advice, regardless of the type of license they held, needed to have the same qualifications e.g., minimum Bachelor related to financial planning and had to pass the FASEA exam. Given only 60% of those sitting the FASEA exam in August passed, it is likely we will

Source: AR Data

see more accountants and financial planners exit the industry. It is expected that the numbers will reduce from the 29,000 advisors to approximately 15,000 advisors by 2026 when all education requirements have to be met. We are close to 19,000 at this present time.

Of those who are accountant firms remaining, many are handing in their limited licenses and there are now less accounting advisors per limited license; approximately 1.6 advisors per limited advisors, from the highs of 2 per limited license.

Source: AR Data

With the decrease in advisors, there will be fewer advisors having to carry the burden of covering the ever-increasing costs associated with being a financial advisor. For instance, the ASIC levy is paid proportionately amongst all advisors, so the fewer there are the higher the levy will be per advisor. This will result in more accountants leaving the industry.

Not only are fees increasing but accountants are worried about the proposed Compensation Scheme of Last Resort that is likely to be introduced next year, which will required advisors to pay another levy to cover future compensation payments to consumers who suffer a loss as a result of inappropriate advice provided. With the ever-increasing fees associated with providing personal advice, which includes SMSF advice, higher education standards, and increased compliance requirements to make sure the advice is appropriate, it is likely more accountants will not want to work in this space, and more accountants will give up their limited licenses.

Given that many accountants service SMSF clients, it will be interesting to see what accountants will do with regard to the provision of advice. If they do not have a license to provide the advice (and having the SMSF Specialist designation is not a license), then accountants will need to refer their clients on to a financial advisor that specialises in the SMSF space.

At Find Accountant, we are doing just that. Whilst we have an accountant who is also a qualified financial planner which SMSF certifications, we felt it was best that the accountant looks after the tax side of SMSFs and a different advisor looking after the financial planning side of the SMSF. As such, we have invited a SMSF financial planner to join the Find Group so that we have a tax SMSF specialist and a financial planner SMSF specialist working under the same business and providing a comprehensive service to future SMSF clients. This will also enable us to avoid any conflicts of interest e.g., not just having one person providing tax and financial planning advice to SMSF trustees.

At Find Accountant, we provide SMSF tax advice. Our senior accountant is also an award-winning financial advisor. If you require SMSF advice or are considering whether or not to wind up your SMSF, then speak to Warren Strybosch at Find Accountant Pty Ltd.

Warren Strybosch

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

Special Tax Return Offer

$99 Returns - PAYG Only

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to returns@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address. 2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required). 3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes. 4. We will then require you to upload your documents to our secure portal. 5. Once we have received all your documentation, we will complete the return. 6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

1300 88 38 30

DIY Bookkeeping

BOOKKEEPER

By Neha Nayyar

Expenses, invoicing, pays, BAS, GST… the list goes on. Every business (big and small) has to do bookkeeping to some extent, and if it is done by yourself or an employee, as long as you have the right training, software and support, you can do it successfully. Here are some key tips to help you successfully DIY your books.

Invest in your bookkeeping

Think of professional training for your bookkeeping as an investment rather than an expense. You are investing in knowledge customised to your business, which will pay in dividends over the years as you become proficient and can see insights at the click of a button to see how your business is performing, not to mention the sound knowledge that you are doing your books correctly.

Choose your training wisely

By choosing a bespoke, tailored training approach, you will walk away with the knowledge you need, customised for your business. People fall into the trap of generic bookkeeping courses, or courses offered by the software provider, however generally, they are completely overwhelming as they cover every aspect, and many of the modules will not apply to your business and you will walk away more confused than when you started.

If you are unsure, STOP!

It is a lot easier (and cheaper for you) for a professional to come in and assist you if you get stuck on something, instead of having to pay for a big clean up of errors. If something doesn’t look or feel right, stop and get some help.

Ensure you have the right software

There are many platforms on the market, however they all offer varying features (and pricing), so ensure you take the time to research several to choose the best one for your business. You may have used one platform for many years, however there could be a better product more suitable out there which could save you both time and money. I strongly suggest seeking professional, unbiased advice on choosing the right software to suit your businesses needs.

Get a health check on your books

Have an accountant or bookkeeper go over your books to ensure you are on the right track. They will be able to offer advice on improvements and you will also have the reassurance that you are doing it correctly.

Beware of the financial repercussions

As a business owner, you are responsible for your declarations to the tax office. The onus is on you to provide the correct information when it comes to your tax and BAS obligations. If your bookwork is not correct, you could either be paying too much tax or not enough, which can have disastrous consequences.

At Sum & Substance, we offer Health Checks where we go through your files, check for inconsistencies, ensure bank feeds and reconciliation are being done correctly and then meet with you online to go through the findings. If you do your own books, this is a worthwhile investment for peace of mind. Please contact us if you would like more information about our Xero Health Checks. We can be reached at (03) 9424 9447 or info@ sumsubstance.com.au. You can directly book in a time to chat by clicking here.

Save Your Time & Grow Your Business

• New and Micro Business Owners

• Xero Training for Business Owners • Xero Health Check and Clean up • Virtual CFO

• Training and Webinar • Small and Medium Size Business Owners

• Setup, Training & Review • Phone and Email Support • Payroll • Bookkeeping Sum and Substance Bookkeeping, Training and VCFO services Neha Nayyar - Director

9/31 Dudbley St, Eltham VIC 3095 PO Box 759, Eltham VIC 3095 Office: (03) 9424 9447 Neha: 0401 409 573 Email: info@sumsubstance.com.au Website: www.sumsubstance.com.au

SMSF Deeds and Legal Advice

Should I use a Lawyer?

SOLICITOR

By David Heasley

A SMSF deed is a bit like insurance. You don’t know how well it protects you until the worst happens. For example, you discover the SMSF deed itself is invalid, or doesn’t comply with legislation. As superannuation and tax laws are constantly changing, SMSF deeds should be reviewed on at least an annual basis and revised as needed, preferably, by lawyers who are SMSF experts.

This situation can come about because it has been possible for several years for advisers, such as accountants and financial planners to obtain the use of SMSF and related legal templates in order that the adviser can prepare documents themselves.

Typically, the adviser pays a licence fee that permits them to download the template and prepare the documents as compared to paying a law firm to prepare an SMSF deed for a particular client.

Generally speaking, the template suppliers do not have any significant technical or legal expertise in respect of drafting documents such as SMSF deeds or other related legal documents.

But it was signed off by a Lawyer- Right?

Many non-qualified SMSF document suppliers claim that their documents are “signed-off by a lawyer”. While a reference to “signed off by a lawyer” does not have a fixed meaning, it is meant to give the impression that the document in question was prepared and reviewed by a lawyer who has approved that individual document, and not just the template. Thus, care is required when dealing with such claims.

The actual template (for example a SMSF deed) may very well have been prepared by a lawyer, any resulting completed document may not have been.

The position is likely to be clearer where the SMSF deed is supplied directly from a law firm and not from an advisor using a template. In this case a lawyer reviews the instructions for each SMSF, and then drafts documents that are appropriate to those instructions.

Can I sue the lawyer when it all goes bad?

Unfortunately, probably not. Unlike the scenario where a lawyer handles the whole matter, where the work is done by a non – lawyer there may be little or no protection for any badly done or erroneous work.

One example (of erroneous work) may be an ineffective binding death benefit nomination (BDBN) where the SMSF deed has not been varied correctly. In these instances there is unlikely to be professional indemnity insurance available to an adviser who prepares the invalid deed, as a non-qualified person is not legally authorised to prepare a legal document for a client.

In fact, most professional indemnity insurance for advisers (other than lawyers) also excludes cover for services that a lawyer must perform.

Advisers and end-users should therefore not assume that professional indemnity insurance is available. Further, some non-qualified suppliers may have no insurance cover at all, leaving the only option for recovery being to sue the advisor.

In the cases the money saved by not involving a lawyer (as competent advisors will do) may prove to be expensive indeed.

David Heasley

Principal Solicitor HEASLEY LAWYERS www.heasleylawyers.com.au 0408 611 834

How is your emotional cup doing?

PARENTING

By Lesley-Anne Banton

How is your emotional cup doing? Have you checked in with yourself recently?

Is it full?

Dosed it need a little attention?

Are you just hanging in there?

There is so much unrest and unease currently, most seen on social media and in the media, some may be seen within your friendship groups and families. It can be all consuming and draining. Our emotional cups may be empty, and we haven’t even notice, some might of disengage from life and not noticed. There is all too much fear and anger around at this moment. Our focus might be so far outside ourselves that we have forgotten to check in or we might have checked in too late and we feel emotionally paralysed or overcome and living in a state of fear or anger. Give your self a gift. STOP for a moment, BREATH and CHECK in with yourself.

Where are you? What’s your thinking state? What’s your emotional state? How full is your emotional cup? What’s in your emotional cup?

Is it full of fear and anger? Is it full of love and peace? Is there a mix?

BREATH, that’s it, take this moment for you for your wellbeing.

Notice your breath coming into your body and filling your lungs and diaphragm, breath. Focus on your heart and lung area.

Check-in, how are you doing?

Is there an area in your life, thoughts or emotions that needs some TLC?

Have you been in fear? Anger? Distress? This can drain our body, consume our thoughts, and create unhelpful thinking patterns that we might not know we are in whilst we are consumed by the noise of the day, the media, and social media. It is said that this state can really damage our health, our emotional health and psychological health. Take this moment to breath.

Our mind can be our biggest controlling illusionist when it comes to telling what to think, feel, be and focus on. Our mind makes meaning of things well before we realise, we are reacting to the meaning and absorbed in the emotions and physical state it leaves behind. It is not until we take a moment to breath, notice the now this immediate moment that we can even begin to observe ourselves, our thoughts our emotions and they way our body is feeling.

Most people in a heightened state of fear and anger wouldn’t have made it this far in to reading this, there mind would have already pulled them away. Their internal dialog might have been, “this is a load of rubbish”, “I’ve got better this to do with my time”, This is boring, and I can’t relate”. And that’s ok if did. If you are still reading you have realised that you do need to take a moment, that you might be running on empty or you may have realised that you have and rare in a state of fear and you want to move away from that feeling. If you are still here, breath and celebrate yourself for taking this moment for you, for your emotional, physical, and psychological wellbeing. This is self-care, this is learning to observe yourself, this is helping your mind to get into the present moment and noticing that you are safely sat where you are simply noticing. This is noticing where your emotional cup is, what it has in it or not and how to fill with the stuff that make you feel good, the stuff that fills your heart, the stuff that helps you to focus on the things that bring you joy, even the smallest of things. It may even be gratitude for your self for taking this moment for you. In taking this moment you can start to recharge you can start to come out of a state of fear and or anger. You might even start to notice a small change in perspective of your world one that might seem a little more manageable, one that you might feel you can feel unstack and see some possible choices. You might even notice that those around you might be in a state of fear or that their cups might be empty or fill with unhelpful emotions. You might be able to help them now.

Now that you have taken this moment you might decide that you need some self-care, some kind words said to yourself internally, you might choice to take different action that help fill your cup with the good stuff, you might even notice your cup already starting to fill. If you are still with me keep breathing, notice where you are sitting, how good does it feel? Can you see anything around you that might fill you with happiness or joy? Can you hear the birds singing? Your pet calling? Or if you have children, can you hear them? Smile, breath, and smile? Are you outside? Notice the sky, the trees, the spring flowers, the clouds, the sun, or the wind on your face? You can?! This is presence, you are becoming present to the moment not your thoughts, you are becoming present to the moment and focusing your attention to it not your thoughts. You are filling your cup. You might start to notice and feeling of stillness coming in or happiness flowing, to enhance these express words of gratitude to yourself for your self and for this moment. Express gratitude for witnessing the sky, the birds sing or your pet’s joy. Feel this moment without judgement, feel it with gratitude and simply notice YOU.

Source: pixabay - novelro

Lesley-Anne Banton

Life Coach THE PARENT WHISPERER

0432 848 418 | theparentwhisperer1@gmail.com

www.theparentwhisperer.com.au

Run Off Cover – What is it and why do I need it?

GENERAL INSURANCE

By Craig Anderson

Some insurance policies are written using ‘claims made’ wording. This means that they will only respond to claims which are made against an insured and notified to the insurer during the policy period, regardless of when the work was carried out by the insured. If the policy expires, no claims which have not already been notified to the insurer, can be made against the policy. The implication here is that all previous years of cover will cease to be in effect when a policy of this type is not renewed.

So what can I do if I want to close a company, which has live ‘claims made’ policies in place, and there is a risk that a claim relating to past work will arise in the future?

A run-off policy designed to indemnify the insured only for prior work performed can be purchased before the entity stops trading. This will provide cover for future claims relating to acts, errors, or omissions, which pre-date the inception of the run-off policy period. These policies can sometimes be purchased as a multi-year policy with a single up-front premium, but may also be purchased on an annual basis. Buying run-off cover may also be a condition imposed on the sale of a company by a new owner who doesn’t wish to take on all of the past risks of the entity, so it is not confined only to company closures.

Some policies where run-off cover may be required are Professional Indemnity, IT Liability, Management Liability and Directors & Officers Liability.

Keep in mind that directors responsibilities can linger on long after a company is sold or dissolved. The lack of an entity to sue does not protect the past directors and owners from claims against them personally in many cases. So before you decide to close, or sell, or stop providing professional services, consult your broker. Some good advice could save you a bundle.

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

Craig Anderson

General Insurance Small Business Insurance Brokers

www. heightsafetyinsurancebrokers.com.au 0418 300 096

CRAIG ANDERSON

Height Safety Insurance Brokers

Trust the insurance experts in covering your business against risks and losses. Let us create a specialised program for you to ensure any overlooked issues are covered. If you’d like us to handle insurance renewal get in touch with our friendly team. We also offer free assessments of your current program so you can make an informed decision for your business’ wellbeing.

www.heightsafetyinsurancebrokers.com.au 0418 300 096 | sales@heightsafetyinsurancebrokers.com.au ABN: 26689211803

So, you want to be an architect?

ARCHITECT

By Kathy Ismail

I’ll tell you how I became an architect as it is a good illustration of the path someone aspiring to be an architect can follow.

Interest and talents

When I was twelve, I told my parents that I wanted to work as an architect. I loved science, maths and technical challenges. My dad was an engineer and my mum was an accountant; I suppose the precedent was there for me to follow. However, I also absolutely loved arts. I did all sorts of arts – traditional Malaysian wax painting, watercolours, acrylics, modern calligraphy, Arabic script calligraphy, model making with scraps ... Basically you name it, I’d probably have done it. I also had a strong affinity for reading. I decided to combine those all those interests together by becoming an architect!

Architecture is one of the few science subjects with a strong arts focus. Read widely broad range of subjects and an extensive knowledge base will equip you well to be an architect.

University life

For my Bachelor’s degree, I enrolled in a university that focused on the technical. In the first three years, we produced our architectural drawings by hand – no architecture software or renders for our presentation! We were allowed to use AutoCAD or similar software for our final year of the undergraduate degree. Other useful softwares at this stage were Photoshop and Illustrator.

Throughout university life, I was involved with the debating society that honed my critical thinking and helped my communication skills. Due to heavy loading of the semester (eight subjects!), I had to work smart in a field whose culture includes sleeplessness and caffeine. Upon graduating, I spent a couple of months working for a small firm. It wasexciting to put into practice what I’d learnt. When I enrolled in my Masters degree, I landed a student position at a local architecture firm, and continued working there after I graduated. It was a great firm to start my career in Australia. All the team members were so helpful and I learnt a great deal about construction detail. I have always been interested in technical detail so this helped propel my knowledge and career.

Learn to love technology! There is so much software out there designed specifically that pinpoints accuracy and saves you time. Gains skills from other activities on offer at university, such as I did on the debating team. Learn to work smart, and maintain a mindset of learning. Though tertiary qualifications are necessary, they are just the groundwork; you will learn more about the architecture profession in your first jobs.

Registration

To work on the projects I desired and at the level I aspired to, I needed to become a registered architect. I sat for the Architectural Practice Exam. The Architects Accreditation Council of Australia (AACA) has outlined areas of competencies within architecture. You have to fulfil at least 3,500 hours in accumulation of these skills for architect registration. That is equivalent to almost two years working full-time post-graduate level as an architectural graduate.

Once I passed the logbook and national written exam stages, I was interviewed by a panel of amazing and highly experienced architects who made me comfortable while answering the questions. Was I nervous? Oh yeah! My interview was held in winter but the room, for some reason, seemed really warm ... When the interview ended, I thought I just woken up from a running nightmare!

Each state has their own architecture registration board. Each state has a slightly different building law; hence, the final hurdle is conducted with the state’s architect registration board. You can find out more from these organisations:

ACT: https://www.planning.act.gov.au/ build-buy-renovate/for-industry/otherpractitioners/architect-registration ARBV: http://www.arbv.vic.gov.au/ NSW: https://www.architects.nsw.gov.au/ NT: https://architects.nt.gov.au/ QLD: https://www.boaq.qld.gov.au/ SA: http://www.archboardsa.org.au/ TAS: http://architectsboardtas.org.au/ WA: http://www.architectsboard.org.au/

Resource link: AACA: https://www.aaca. org.au/

A week later, an email advised me that I passed all the hurdles to be become an architect. I was invited to be registered with the Architect Registration Board of Victoria (ARBV)! This allowed me to start my own architecture business three years after registration, KiR Architecture.

Would you like to ask Kathy about becoming an architect? Let her know at contact@kirarchitecture.com.au.

Contact Kir Architecture at contact@ kirarchitecture.com.au for help with planning your building projects. We are always happy to answer any inquiries.

LACTATION CONSULTANT

By Dr. Joanna Strybosh

This month I have been confronted by the devastating impact of post natal depression, anxiety and psychosis which, for me as a clinician, has brought into laser focus the critical importance of perinatal mental health care.

In my own clinical training, in the perinatal literature and textbooks and on social media alike, there is so much emphasis placed on the birthing process, on early parenting transitions, breastfeeding skills and problem solving, as well as child rearing, and development. Whilst these aspects are vitally important, underpinning the lived experience of parenting is the mental health and emotional well-being of every mother, and also of every father. Good mental health is, in fact, the most fundamental basis for a healthy and positive parenting experience.

Postnatal Depression & Anxiety

Parenting is a job that requires you to be well in both body and mind. But we know from research that up to 1 in 5 women experience postnatal depression (PND) in Australia every year, and up to 1 in 10 men. The rates of postnatal anxiety (PNA) are similar and many parents experience both at the same time.

Postnatal anxiety and depression can be a frightening and isolating experience, especially when combined with caring for a newborn baby. Many parents have a difficult time disclosing their true thoughts and feelings. But if symptoms continue for more than 2 weeks, it’s time to seek help. PANDA (Perinatal Anxiety And Depression Australia) is an excellent resource. Panda.org.au informs us that the common signs and symptoms of PND & PNA are variable but may include:

• Panic attacks (a racing heart, palpitations, shortness of breath, shaking or feeling physically

‘detached’ from your surroundings) • Persistent, generalised worry, often focused on fears for the health or wellbeing of baby • The development of obsessive or compulsive behaviours • Increased sensitivity to noise or touch • Changes in appetite; under or over eating • Sleep problems unrelated to the baby’s needs • Extreme lethargy: a feeling of being physically or emotionally overwhelmed and unable to cope with the demands of chores and looking after baby • Memory problems or loss of concentration (‘brain fog’) • Loss of confidence and lowered self esteem • Constant sadness or crying • Withdrawal from friends and family • Fear of being alone with baby • Intrusive thoughts of harm to yourself or baby • Irritability and/or anger • Increased alcohol or drug use • Loss of interest in previously enjoyed activities • Thoughts of death or suicide.

Photo Credit: Motrek Bali, via Unsplashed

How parents describe the experience of PND/PNA

Parents who have postnatal anxiety or depression describe some of the following experiences and thoughts:

• Anger or guilt about not having

‘normal’ feelings of maternal or paternal love • Confusion or frustration about feeling low during a time when everyone is saying, “You must be so happy!” • Being overwhelmed or confused by the advice or opinions of doctors, family or friends about how to manage their baby • Wondering if their relationship with their partner will ever be the same • Resenting physical changes to their bodies after childbirth and motherhood (“I was just a mum in some puked on dressing gown, day in day out”).

Postnatal Psychosis

Postnatal (or postpartum) psychosis is a form of acute mental illness that usually occurs within the first four weeks after giving birth but may occur up to 12 weeks post birth.

Although relatively rare (1 or 2 in every 1,000 women), it is a serious and potentially life-threatening condition that puts both mother and baby at risk.

It is important to recognise postnatal psychosis as soon as possible. Women with postnatal psychosis will almost always need admission to hospital for specialised psychiatric assessment and treatment. Beyond the immediate treatment period, a lot of support and care is required throughout the recovery process. The good news is women generally experience a full recovery with time and appropriate treatment.

The symptoms are generally sudden and very noticeable, and can include:

• Extreme sudden mood swings, from very high to very low • Aggressive or even violent behaviour • A high level of agitation • Irrational or delusional thoughts or beliefs, which may include irrational beliefs or thoughts about the baby • Hallucinations and changes in sense perception, such as smelling, hearing or seeing things that are not actually there • Paranoid or strange beliefs about the baby that cannot be countered by rational discussion • Grandiose or unrealistic beliefs about own abilities as a mother • Unusual or inappropriate responses to the baby • Thoughts and conversations may be disordered or nonsensical.

If this article has raised any concerns for you, please go to panda.org.au and take the online mental health check, or call PANDA’s National Perinatal

Mental Health Helpline1300 726 306 9am – 7.30pm Mon – Fri(AEST/AEDT)

You can call for yourself, or someone you’re concerned about. No diagnosis is needed to call.

For further help, please speak to your doctor, lactation consultant or maternal child health nurse.

In next month’s edition, we will explore ways to support perinatal mental health.

How many times does the word ‘Culture’ get raised at a sports club?

By Peter Horton

Is it time your club looked at its culture?

There are several important issues that need to be addressed when reviewing the culture within your club.

Have you got the right people around your club?

Has your club developed its own brand and formulated a marketing and communication plan?

Has your club updated its website in recent times and looked at how it can use social media to promote membership and social activities? Does your club involve its sponsors in events and invite them to meet with members and discuss their business?

It is important that your members fully understand the direction the club is taking including how it plans to grow membership and increase revenue that can be used to improve facilities at the club.

Many sports clubs are struggling to retain membership and need to focus on ways to attract new members because without them revenue declines and there are less people to attend events and fewer volunteers prepared to assist around the club. The Ringwood Bowls Club fully understands the views of its members and values their input and these are important ingredients that the club has addressed in recent times to ensure that its culture is geared to take the club forward.

Its mission statement says it all – to give members of the Club reasons to remain loyal and opportunities for them to enjoy their bowling experiences.

Take the time to review how your club is going – make sure it has a vision for the future not the past.

Four Attractive Doors And Gates Options For Commercial Premises

GARAGE DOORS

By Chantal Djuric

Your commercial premises need to be super safe, especially during this period of fluctuating lockdown cycles.

Here are four attractive door and gate options that you might not have thought of for securing your business workspace and assets.

Sliding gates

Sliding gates make an open, welcoming appearance to a property such as a car sales yard or gardening retail space. Here are four benefits that may persuade you to install boom gates at your commercial premises:

• improved security – as they can only be opened with a card or other security device, unwanted vehicles are prevented from entering. Boom gates can also monitor and record vehicle registration details of all who enter and leave. • control of traffic flow – where there are limited parking spaces and a lot of vehicles, boom gates allow full control over the amount of vehicles that can be on a property at any one time. • cost savings on security – with minimal operating and maintenance costs, boom gates also remove the need for a security guard. • saving space – boom gates require significantly less space than swinging and sliding gates and require only a small amount of vertical space to swing upwards.

Though boom gates are easy to install and maintain, we recommend that you call a garage door specialist to do the job.

High cycle panel lift door

High cycle panel lift doors are built for durability, speed and efficiency. They perform more quickly and reliably than traditional sectional doors, and are therefore especially suitable for transportation, distribution and manufacturing businesses, as they have faster opening and closing speeds.

There are several varieties of sliding gates on offer – face-welded radiatorstyle gates, aluminium slates, aluminium garden styles, Colorbond fencing and even laser-cut screens. They all come in a large range of up-to-date colours and sizes. They are typically made using 40 x 40 mm or 50 x 50 mm frames, with a design pattern to be specified.

Guideposts are positioned at the back of the gate on either side; one supports the gate when sliding, the other supports the gate when it is closed. Sliding gates operate on an aluminium track with 90 mm wheels insert in the bottom rail. As the gate sits a total of 40 mm above ground, this needs to be factored in when determining the overall height of the gate.

Sliding gates should always be installed by a garage door specialist.

Boom gates

Effective and affordable, boom gates are a popular option in carparks, shopping centres, hospitals and apartment complexes. Also perfect for gated industrial estates, these barriers can offer both privacy and security for business owners. An added bonus is that they are easy to clean and maintain. They also have an increased lifespan by eliminating the need for counterbalance springs. As if all that wasn’t enough, their rapid open-close cycles promote energy efficiency through reduction of heating and cooling.

High cycle doors are made with strong components and heavy-duty springs. Most models have a barrel and spring construction; that means there’s a barrel holding the rolling mechanism while the springs ease the tension from the door’s weight. This kind of roll-up door is made from sturdier materials compared to others, so the size of springs used on them is very important.

Regular repair and maintenance is essential for high cycle doors. We recommend servicing every three months to keep these doors in prime condition.

Mesh panel doors

Mesh panel doors have been designed for security and functionality. A strong and rigid aluminium frame surrounds the diamond mesh inserts for a door that is aesthetically pleasing in appearance yet will provide the user with many years of reliable service.

Suitable for use in residential and light commercial premises, an aluminium mesh roller panel door provides both security and ventilation of approximately 60%. They are ideally suited to carparking spaces in and under home units and commercial office buildings where security, reliability and ventilation issues are paramount, adding natural light and airflow to your garage. These doors can be operating at least a hundred times per day, so we highly recommend a routine service is done every three months to keep this door running its best at all times.

For 24/7 garage door servicing, give Cruzin Garage Doors a call on 0427 894 603 or email us at sales@ cruzingaragedoors.com.au.

Significant Addition To The OHS Act Is Now In Place

OCCUPATIONAL HEALTH & SAFETY

By Mark Felton

If you are a business owner and employ staff, then you need to be aware of the recently introduced industrial manslaughter laws that have been added to the OHS Act, affecting businesses, including partnerships, corporations, self-employed persons, as well as officers of corporations.

The new laws attract the highest penalty in the OHS Act, with maximum fines of approx. $16.5m for employers and jail terms of up to 20 years and fines of up to $1.65m for officers whose actions or omissions:

• cause the death of a worker or member of the public; • involve a breach of an OHS duty; • were negligent.

So what does this mean for and your business? What steps do you need to take to ensure that you are in step with demonstrated actions that will protect you from having a workplace death at your business, and finding yourself facing a prison sentence and/or a massive fine? Do you have an understanding of your obligations under the Act in general? Initially you will need to review your site and the nature of the tasks carried out within it. You will need to gain an understanding of the elements of the Act relevant to the running of your business. You may need to develop procedures and practices, as well put in place protective measures, including equipment.

What systems do you have to record relevant information, and to be able to recall these records? Do you have the right sort of consultative mechanisms to ensure that you develop effective measures and comply with the Act? Beaumont Advisory can assist you in clearly identifying where you are currently at, and the measures that need to be developed to keep you and your employees healthy and safe. Please feel free to contact Mark Felton at Beaumont Advisory on 0411 951 372 or mfelton@ beaumontlawyers.com.au .

Occupational Health & Safety BEAUMONT LAWYERS www.thebeaumontgroup.com.au

CORPORATE EVENTS

Make more meaningful connections with your clients and team!

enquieries@norwoodsportingclub.com.au

One Easy Way To Prevent Elderly Loved Ones Feeling Lonely

ACCREDITED EDITOR

By Susan Pierotti

The City of Maroondah has great facilities for families and young people setting up home. There are numerous private and public schools, sporting clubs and grounds, libraries, house styles to suit everyone and shopping areas from small and chic to the giant-like Eastland.

Bit did you know that Maroondah also has one of the highest numbers of elderly people living within it in the greater area of the city of Melbourne? They may be living in their own home, they may be enjoying the lifestyle of a retirement village or they may be in aged care.

Wherever they are, aside from their family members and friends, they are often the ‘silent generation’.

Old age is filled with challenges. Our bodies begin to slow down, our mind is often not so sharp, and our strength begins to fade away. We get more wrinkles, our sight and hearing get worse, and often our life becomes slower and less adventurous.

Everyone pretty much knows all of that, but there’s something that happens to a lot of old people that isn’t talked about enough. That’s elder abuse.

Elder abuse

A lot of elderly people are abused. This tends to happen because, like children, they are now vulnerable.

The World Health Organization defines elder abuse as ‘a single or repeated act, or lack of appropriate action, occurring within any relationship where there is an expectation of trust, which causes harm or distress to an older person. This type of violence constitutes a violation of human rights and includes physical, sexual, psychological, and emotional abuse; financial and material abuse; abandonment; neglect; and serious loss of dignity and respect.’

WHO has revealed that, worldwide, around 1 in 6 elderly people experience some form of abuse in their lives. One of the saddest things in our society is a lot of the elderly have got nobody in the world, nobody to stand up for them and nobody to be there.

When we get old, things can get lonely. We can become isolated and vulnerable.

Sadly, there have been too many instances where elderly people have found themselves belittled, neglected, mistreated and taken advantage of when they are in a rest home or in some form of assisted care. Even after the 2018 Royal Commission into Aged Care, the 2020 COVID crisis revealed continuing neglect of elderly residents in some aged care facilities. There are many more still who are never technically ‘abused’ but who are rudely treated, ignored, or just sadly misunderstood.

When we get old, things can get lonely. We can become isolated and vulnerable. Sadly, there have been too many instances where elderly people have found themselves belittled, neglected, mistreated and taken advantage of when they are in a rest home or in some form of assisted care. Even after the 2018 Royal Commission into Aged Care, the 2020 COVID crisis revealed continuing neglect of elderly residents in some aged care facilities.

There are many more still who are never technically ‘abused’ but who are rudely treated, ignored, or just sadly misunderstood.

How to let them know they are valued

One simple way to prevent elderly ones from feeling neglected, ignored or lonely is to take the time to sit and listen to their stories.

This isn’t as easy as it sounds. Besides finding the time to do this consistently, this can be tricky as we often don’t have the time or headspace to ask the relevant questions. The elderly person may think, ‘Oh, everyone knows that story so I won’t repeat it’ or think that some facts are so ordinary that they are not worth telling.

Why not employ a life story professional to complete your loved one’s story? In the telling of their tale to a stranger, the elderly story teller simply comes alive! They feel valued and important, and it is a sure-fire way to prevent them feeling lonely or neglected.

Caring about someone’s life and showing them that they are loved is probably the most precious gift we can ever give. Contact Susan at www. creativetext.com.au to discuss recording your elderly loved one’s story.

Susan Pierotti

Accredited Editor Creative Text Solutions 0437 127 159 www.creativetext.com.au

Stick to national reopening plan: Morrison

By Matt Coughlan (Australian Associated Press)

Scott Morrison has warned ongoing lockdowns will cause more harm than benefit when coronavirus vaccination coverages reaches 70 per cent.

The prime minister insists high case numbers will not derail a national plan despite some states warning Doherty Institute modelling needs updating.

Under the agreement, lockdowns will be less likely at 70 per cent and become highly targeted at 80 per cent.

Mr Morrison said negative economic and mental health impacts would outweigh benefits when 70 and 80 per cent immunisation coverage is reached.

“That’s the advice, that’s the basis for the plan. We’ve all signed up to it, we need to get on with it,” he told the Seven Network.

WA Premier Mark McGowan wants new modelling given high levels of virus circulating in NSW which reported 753 new local cases on Tuesday.

Victoria is having a hard time getting on top of an outbreak with another 50 new cases, while the ACT had its worst daily rise since the start of the pandemic with 30 new infections. Queensland Premier Annastacia Palaszczuk argues the initial research was based on having 30 cases in the community.

The Doherty Institute will provide updated advice to national cabinet on Friday.

In a statement, the Doherty Institute said opening up at hundreds of cases nationally a day would be possible at 70 per cent vaccination coverage.

“However, we will need vigilant public health interventions with higher case loads,” it said.

The institute said hitting that vaccination rate would make it easier to live with the virus, similar to the flu. “However, it won’t be possible to maintain a situation where there are no cases at all.”

Labor leader Anthony Albanese accused the prime minister of pretending the report ruled out lockdowns at 70 per cent coverage.

“Mr Morrison is a barrier to the end of the tunnel, not the light. He’s the gaslight on the hill,” Mr Albanese told Labor MPs and senators in Canberra. He said Mr Morrison desperately wanted to argue he was pro-freedom while casting everyone else as being against reopening. The prime minister insists the opposition leader is undermining the plan and hoping the government fails for political gain.

Mr Morrison remains optimistic the Queensland government won’t keep its border shut with NSW if high case numbers continue.

“It doesn’t matter whether it’s 30 cases or 800 cases, the conclusions are the same and that’s what the Doherty Institute said last night,” he told the Nine Network.

He dismissed the federal-state bickering as a “bit of noise” with the vaccination targets still months away from being reached.

“We can’t stay in the cave and we can get out of it safely.”

The Doherty modelling recommends a staged reopening at 70 and 80 per cent with high-quality preventative measures remaining in place.

Australia has fully vaccinated 30.27 per cent of its population aged 16 and over and 52.78 have received one jab.

Finance Options For Small Business

MORTGAGE BROKERING

By Reece Droscher

One of the most competitive finance sectors for lenders in the current environment is the commercial lending market, particularly finance for small business. Once the domain of the major banks, there has been an influx of new providers in this market offering cheaper products and different solutions to help small business with their finance needs. Trying to work out the most suitable product for a particular finance need can be a difficult task. Here is a list of the most common products available to small business and how they are designed to help.

SECURED BUSINESS LOANS

These loans are the traditional products offered when a business requires to fund a large expense over a long term. For example the business may be looking to:

• Buy a property to occupy. • Complete a shop fit-out. • Buy another business. • Restructure the existing business, ie buy out an existing business partner. • Consolidate or restructure existing business debt. • Fund a start-up.

Secured loans come with a lower rate and are usually available for amounts between $50k and $10million depending on the lender. Residential or commercial property must be held as security and you may be able to access up to 70% of the security value. This will depend on the type of property offered as security.

Generally lenders will offer up to a 15 year term, however there are some products available where a 30 year term may be available.

UNSECURED BUSINESS LOANS

Loans that can be offered without security are generally available for businesses which have a profitable trading history and have an urgent finance need which can be repaid over a shorter term. Examples of where an unsecured loan may be required would be:

• Immediate cash flow injection with a secure debt repayment source, such as outstanding debtors or sale of an asset. • Purchase of inventory or equipment. • Working Capital. • Small fit-out or renovation.

As these loans have a higher risk than secured loans the maximum a lender would consider is more conservative. Generally loans between $20k and $250k would be considered depending on the business performance, but some lenders may offer a higher loan limit if the business has a strong trading history and operates in an industry which is not affected by COVID-19 lockdowns.

Loan terms are also usually lower than a secured facility. Maximum terms of 5 years for an unsecured loan are typical, and interest rates are higher in line with the greater risk associated with these types of loans.

BUSINESS OVERDRAFTS

This product would be the most common type of facility small businesses have utilised. It is a revolving line of credit usually attached to the main operating account of the business and is used as a tool to assist businesses with their cashflow and working capital needs. Overdrafts can be secured or unsecured, depending on the limit the business is requesting, and the cost for the facility would be determined by the security offered.

SME RECOVERY LOANS

As part of a number of initiatives for small businesses affected by the COVID-19 pandemic the Federal Government announced the implementation of the SME Recovery Loan program. This product is designed to assist businesses who have been unable to trade or had trade significantly reduced due to the pandemic.

Loans can be accessed for business purposes only, including:

• Refinancing existing business debt, unless already over 30 days in arrears. • Purchase commercial property. • Acquisition of another business. • Businesses are also able to apply for a repayment deferral where their cash-flow has been affected, meaning they can access the credit but defer repayments for a period up to 24 months. These loans can be secured (except by residential property) or unsecured. Amounts, loan terms and interest rates will be determined by the level of security offered. Although lenders can determine the interest rate applied the facility is Government Guaranteed by up to 80% of the loan amount, so rates may be lower for this type of loan than other similar options.

The maximum accessible is $5million, with a maximum 10 year term offered.

These products are just some of the options available. The commercial finance market is extensive and business needs are many and varied. There are even products designed for certain industries, like professional sectors, agriculture and franchises, that we haven’t scratched the surface of yet. That’s why speaking with a finance broker is the best way to find the right product to suit your business needs.

At SHL Finance we are helping a number of small businesses improve their cashflow by reviewing their finance needs and accessing products that are more suitable for their requirements. Please give me a call on 0478 021 757. I would love the opportunity to help your small business in any way possible.

Reece Droscher

MORTGAGE BROKER www.shlfinance.com.au

7 Signage Tips Business

SIGNAGES

By Glenn Martin

I have been in the print and signage industry for over 20 years and I have seen a lot of designs that really work and unfortunately, a lot that don’t. Below are some quick thoughts that may help those thinking about how to promote their business off-line. Bottom line, know what you want before you go in, and you will be much happier with the results when you walk out. So, here’s my signage tips for any business:

#1 Why do you need to get your message out there?

This will be the foundation for your sign plan and should be taken into consideration when you ask the other questions.

Are you trying to improve your Brand awareness?

Do you have a sale or special on?

Do you need to tell people where you are or when you’re open?

Does your audience need to know about your products or service?

#2 Who is your target Audience for your message?

This will influence the style of your design, the size, the colours and the information on it. Is your audience walking past your shop looking for a deal, or do you want to catch the eyes of vehicles driving past at a distance, or is your message going to be on a moving vehicle? Knowing who you are marketing to is the first step in successful signage design.

#3 What is the key message for each sign?

We have far more time to take in the message of a fixed sign on the side of a building, or on a window, than on a moving object. Keep your message appropriate for its location.

Your audience need to know in a very short space of time what you are trying to say, so keep the message short, and the font large, not the other way around. Are you trying to promote your products, or your business?

#4 Where are you going to place your signs?

Do you have permission? Check with your landlord, building owner or body corporate before placing any new signs. If you have taken over a new lease, there is no guarantee you have the right to the existing sign in a common area. Check the legal requirements with your local council regarding signs as they can vary from a residential zone to retail and industrial location. You may need to obtain a permit? Keep in mind you are responsible for the permit if the council catch you out and not your sign supplier.

#5 What is your budget for signage?

The old saying you get what you pay for counts in signs just like many other areas in life. Get a good idea on what your budget is and what you hope to see for your finical input. Your budget will dictate not just the size but the quality, location and materials. A solid message on the right sign in the right location should cover its costs quickly.

#6 Branding.

Branding is one of the most important pieces of the marketing model. It helps your suppliers and customers tie your whole storey together. Make sure when you are putting your message out there that your logos, message, fonts, images etc reflect your Branding. People see the logo/colour schemes well before they see the many bullet points on what you do.

#7 Research.

Next time you are driving in the car look around at the various signs and take a mental note on what caught your eye and why. Try and read the A-Frames as you are driving by or the message on the back or sides of the car, did you get all the information on the Banner in front of the local school or church? Look for your competitors, what are they doing, do you think it is working for them? If a sign catches your eye stop and ask the owner how it works for them. Most people are more than happy to tell you their story.

Have a signage project in mind? If you already have a design, simply send us the files and we will be in touch to start the process, including a free consultation and site audit to help your business stand out from the crowd. If you’re unsure of exactly what you want to say, or how you’d like it to look, that’s okay too, just contact the team on 1300 633 902 and together we’ll create the perfect signs for your business and to ensure you get current promotions, follow us on Instagram @Signarama_Mitcham.

Best Coffee Dessert Recipes

COMMERCIAL COFFEE MACHINE

By Ivana Smith

There’s something so evocative about the smell of freshly baked cakes or muffins. That warm, enticing aroma, the promise of sweet delights, of comfort – yum, yum! And what about an exotic dessert to end a gourmet dinner party?

If you are looking for that special something to give an extra zing to your well loved classic recipes, why not try adding a dash of coffee to your usual repertoire of cakes, biscuits, slices and desserts.

Coffee and chocolate – a match made in heaven

Chocolate is nearly everyone’s favourite flavour but if you want a more sensual experience, try adding a little coffee for extra richness. Though coffee is originally from Ethiopia and chocolate from South America, coffee and chocolate together are a divine combination. They are both seeds of tropical plants, both are fermented and dried and both need some level of roasting. Probably the characteristic they have most in common are their bittersweet overtones (which is why they’re often combined with milk to reduce their inherent bitter aftertaste.)

The easiest way to amplify the chocolate velvetiness of cakes, muffins, cupcakes and slices is to add a teaspoon of instant coffee granules or espresso powder to your batter or dough when you assemble your other dry ingredients. And for recipes such as cake mixes that require hot water, replace the water with strongly brewed coffee.

So, if you’re in the habit of making brownies, chocolate cakes or muffins, spice them up by adding some coffee. There are so many mocha recipes around, and you’ll be a winner baking any one of them.

Coffee goes with this...and that...

Coffee is so versatile in that it blends with so many other flavours besides chocolate. For those who love the creamy, smooth texture of caramel but are seeking a flavour with more tang, coffee is your answer. Give your chocolate caramel slice extra tang by adding coffee to the caramel mixture. In fact, any dessert that has a milk base can partner happily with coffee. Coffee and custard combine well together as do coffee and cream. Whisk strongly brewed espresso coffee to milk and cream when making baked custard, a Tuscan delight known as café in forchetta (coffee on a fork).

The fabulous Italian dessert, tiramisu, is nothing without a strong dose of espresso. The name ‘tiramisu’ (tira mi su) literally means ‘pick me up’, which is what the coffee does when combined with the sweet biscuits, mascarpone and cream of a dessert that Australians have adopted as their own.

Ironically, the original ‘coffee cake’ had no coffee in it at all. It was called ‘coffee cake’ because it was baked (by the Austrians) to be eaten with a cup of coffee. It is a teacake topped with a fair amount of streusel – a crumbly topping made from flour, butter and sugar – whose crunchy texture complements the delicate taste of the cake. Its main flavouring is often not coffee but cinnamon, another great complementary flavour that aligns well with coffee.

Easy no-bake desserts

So many coffee desserts need only a few ingredients and are easy to make. For instance, who doesn’t love chocolate mousse?

Now imagine it infused with coffee for that ‘wow’ factor!

For a stunning dinner party closer, try whisking cold coffee and marshmallows together before folding in whipped cream. You can make this before the guest arrive, keep it in the fridge and triumphantly escort it to the dining table, on the principle of keeping the best till last.

Cold coffee granules melt quickly and smoothly. A no-bake cheesecake can become an exotic treat with a spoonful of espresso powder or instant coffee granules.

Let’s not forget coffee slices, coffee fudge, coffee parfaits, coffee kisses, coffee macaroons, coffee ice cream – the list is only as limited as your imagination.

The great news that coffee, while bursting with flavour, adds not one single calorie to your favourite desserts!

With just a small dash of coffee, you can enhance ordinary cakes and desserts with a taste of the exotic. You, too, can become the master chef in neighbourhood – and no one need know your secret success ingredient!

For advice on coffee and how to supply it to office spaces, workplaces and clubs, contact Ivana at ivana.smith@ xpressodelight.com.au.

Ivana Smith

Commercial Coffee Machine Xpresso Delight 0418 393 085 www.xdcoffee.com.au

Are you with one of Australia's worst 13 funds? You might need to consider changing super funds?

FINANCIAL PLANNING

By Warren Strybosch

The results our out and the 13 worst super funds are currently sending letters out to their clients explaining why they underperformed and to try and convince them to stay with them.

The 13 funds that did not do very well and failed to meet the objective benchmarks set up by APRA are:

• AMG Super — AMG MySuper • ASGARD Independence Plan Division

Two — ASGARD Employee MySuper • Australian Catholic Superannuation and Retirement Fund — LifetimeOne • AvSuper Fund — AvSuper Growth (MySuper) • BOC Gases Superannuation Fund —

BOC MySuper • Christian Super — My Ethical Super • Colonial First State FirstChoice

Superannuation Trust — Colonial First

State FirstChoice Superannuation

Trust • Commonwealth Bank Group Super — Accumulate Plus Balanced • Energy Industries Superannuation

Scheme-Pool A — Balanced (MySuper) • Labour Union Co-Operative

Retirement Fund — MySuper

Balanced • Maritime Super — MySuper

Investment Option • Retirement Wrap — BT Super MySuper • The Victorian Independent Schools

Superannuation Fund — VISSF

Balanced Option (MySuper Product)

The Australian Prudential Regulation Authority (APRA) assessed 76 MySuper products based on a comparison of fees versus performance over seven years.

While 84 per cent of the funds passed, the 13 funds that failed collectively hold $56 billion of Aussies’ investments.

In fairness to these funds, it is not clear what tests APRA is using to assess the performance of these funds as some have done well over a 5 year and 10-year period. The Association of Superannuation Funds of Australia (ASFA) urged consumers to exercise caution in how they interpret the report’s results and think carefully before making important decisions about their superannuation – not to simply base a decision on whether or not the super fund has has fallen one basis point below an arbitrary cut-off point in the performance test.

While ASFA has long supported the removal of habitually underperforming products, according to ASFA CEO Dr Martin Fahy, some of those called out by this test are in fact good products.

“Among these so-called ‘underperformers’ we have products which have doubled people’s investments over the past decade,” he said. “The irony is that the financial performance of these so-called ‘underperforming’ products would be in the top quartile in many OECD countries,” he said.

Of the total 76 MySuper superfund products, available to consumers, 84 per cent of products passed the performance test, however APRA remains concerned about those members in products that failed,” APRA executive board member Margaret Cole said.

“APRA has intensified its supervision of trustees with products that failed the test and has requested they provide a report identifying the causes of their underperformance and how they plan to address them,” Ms Cole said.

In a separate statement, Treasurer Josh Frydenberg revealed that $56.2 billion is invested in the underperforming products, with these products holding almost 1.1 million accounts.

From next year, the annual performance test will also be expanded to a wider range of superannuation products, providing more members with the assurance that their product is being held to the highest standards of accountability.

If you are a member of one of the above-mentioned funds and would like to review your superannuation, then consider obtaining a Free Super Report from Find Wealth (www.findwealth.com. au). The Free Super Report compares what fees you are currently paying to that of your current super fund. A saving of fees equals an additional real return on capital. At Find Wealth they, under their management and in conjunction with using one of Australia’s top performing super funds, are able to get fees as low as 0.25% per annum.

If you would like to receive a Free Super Report then simply email Find Wealth at warren@findwealth.com.au and request your Free Super Report.

If you are unsure as to how you’re tracking now or leading up to retirement, or are considering retiring in the next few years, then speak to an advisor at Find Retirement (www.findretirement.com.au). They will help you plan the next stage of your life and provide greater certainty for you and your family.

This information is current as at July 2021. This article is intended to provide general information only and has been prepared without taking into account any particular person’s objectives, financial situation or needs (‘circumstances’). Before acting on such information, you should consider its appropriateness, taking into account your circumstances and obtain your own independent financial, legal or tax advice. You should read the relevant Product Disclosure Statement (PDS) before making any decision about a product. While all care has been taken to ensure the information is accurate and reliable, to the maximum extent the law permits, Clearview and its related bodies corporate, or each of their directors, officers, employees, contractors or agents, will not assume liability to any person for any error or omission in this material however caused, nor be responsible for any loss or damage suffered, sustained or incurred by any person who either does, or omits to do, anything in reliance on the information contained herein.

Warren Strybosch

You can call them on 1300 88 38 30 or email

info@findretirement.com.au

www.findretirement.com.au

Joe Biden Praises Mateship With Australia

By Matt Coughlan (Australian Associated Press)

Joe Biden has pledged to maintain an unsurpassed partnership with Australia as the two nations strive for a free and open Indo-Pacific region.

The United States president marked the 70th anniversary of the ANZUS treaty with a video message singing the alliance’s praises. He said the enduring partnership had been about strengthening the fabric of peace.

“That partnership is as essential today as it ever has been in securing the safety and prosperity of both our countries,” Mr Biden said.

“On this anniversary, we reaffirm our commitment to our shared values, democratic norms, global security and the prosperity for the next 70 years and beyond.”

The president said Australians and Americans had built “unsurpassed partnership and an easy mateship”. He noted ANZUS was invoked for the first and only time after the September 11 terror attacks.

“Our Australian friends stood with us in that darkest hour just as our two nations stood shoulder to shoulder in every major conflict since World War One.” Prime Minister Scott Morrison declared the two nations supported a world that favoured freedom.

“Our alliance and America’s deep engagement in our region is essential as we look to rebuild from the pandemic and shape a free and open Indo-Pacific that is stable, secure and prosperous,” he said.

Opposition Leader Anthony Albanese used the anniversary to pledge the first major review of where Australia’s soldiers are stationed since 2012.

“With the US again engaged in a Global Force Posture Review, it is time for Australia too to have a closer look at our own posture to ensure that it fully meets the times,” he told parliament.

The force posture review would ensure the government is looking at long-term strategy as well as short-term needs with the Indo-Pacific a key focus.

It would also respond to the emergence of cyber security as a central challenge to Australia’s strategic positioning over the coming decade.

Mr Morrison said Australia was confronting the most challenging strategic environment for decades. and refresh our commitment to one another.”

China’s increasingly assertive stance in the region shapes as a critical for Australia and the US.

The prime minister said the alliance spanned security, defence, intelligence, new technology, boosting supply chains, supplying vaccines in the Pacific and tackling climate change.

Mr Albanese called for an immediate boost to climate change co-operation with the US.

Australia is increasingly isolated over climate action globally.

“While so much of the region’s immediate focus is the response to COVID, its more profound concern is climate change,” Mr Albanese said.

The prime minister, Defence Minister Peter Dutton and America’s charge d’affaires Michael Goldman laid a wreath in Canberra to mark the anniversary on Wednesday.

Coronavirus scuppered plans for the event to be marked with a face-to-face meeting between Mr Morrison and Mr Biden.

No Power Reliability Gaps To 2025: Report

By Paul Osborne (Australian Associated Press)

Enough new power generation and storage is in place to ensure sufficient electricity for most of Australia over the next five years, a new report says.

The early closure of some coal-fired power plants is expected to create some pressures in NSW and Victoria post-2025.

But Australian Energy Market Operator CEO Daniel Westerman says there are “well-progressed generation, storage and transmission projects, which, once operational, will maintain reliability as coal plants start to close earlier”.

A new report by AEMO released on Tuesday found that by 2025 there would be periods when all customer demand across the national electricity market could be met by renewable generation.

The annual reliability outlook, known as the Electricity Statement of Opportunities, said the transition to cleaner energy was being driven by residential solar installation, grid-scale wind and solar projects and thermal generation retirements. “No reliability gaps are forecast for the next five years, primarily due to more than 4.4 gigawatts of new generation and storage capacity, as well as transmission investment and reduced peak demand forecasts,” Mr Westerman said.

“Significant renewable energy investments, and well-progressed dispatchable generation projects, including gas plants, pumped hydro and battery storage, will all help replace retiring coal and gas plant.” As well, investment in new and upgraded transmission infrastructure, including Project EnergyConnect linking South Australia and NSW, will reduce consumer costs while improving the resilience and security of the system.

AEMO also forecasts a further 8.9GW of commercial and residential solar power to be installed by 2025 across Queensland, NSW, Victoria, SA and the ACT.

These solar systems alone could supply up to 77 per cent of total electricity demand at times by 2026. As a result, minimum operational demand across Queensland, NSW, Victoria, SA and the ACT is expected to drop to a record low of 4GW to 6GW by 2025, down from 15GW in 2019.

AEMO said this underscored the need to improve the security of the system by developing grids capable of running at up to 100 per cent instantaneous renewables by 2025.

Demand for electricity was expected to lift as more electric cars hit Australia’s roads.

Support Local, Buy Local, Discover Knox

Do you have photos from a local event or a great story you would like to share?

SEND US YOUR NEWS!

editor@findknox.com.au