47 minute read

COLUMNIST ARTICLES

COMMERCIAL COFFEE MACHINE

By Ivana Smith

If you’re a coffee lover and would like to care for the environment, coffee grounds are the perfect ‘green’ answer.

Throw out your chemical cleaners and embrace versatile coffee grounds! There are probably as many uses for coffee around the home as your imagination can think of. Here are a few ideas to whet your creative appetite.

Air freshener

Food, pet odours, sweaty work and sports clothes, shoes – every home has obnoxious smells at some time. The good news is there’s no need to buy an air freshener.

Coffee grounds soak up all the odours around them. This is why fresh coffee beans need to be tightly sealed after each use. Dried coffee grounds are another matter.

Put used and dried coffee grounds in a bowl or open jar and place it in the offending room. For your shoes and wardrobes, hang an old stocking, sock or cheesecloth filled with dried grounds and tie up with an elastic band. The smells will disappear to be replaced with the fragrant aroma of coffee. Delicious!

De-flea your pets

Fleas are a common problem in household pets and treating them can be costly and time-consuming. Many of the flea-removal products on the market contain harsh chemicals and can produce unwanted side effects.

Unlike Melburnians, fleas don’t seem to like coffee! Simply rub dried coffee grounds throughout your pet’s fur after shampooing, then rinse them off and allow your pet to dry as usual. (Be aware that coffee grounds can be toxic to dogs if consumed.)

However, if this treatment does not work, take your pet to a vet.

Deodoriser

Food such as blue cheese, overripe vegetables and fish can leave unpleasant lingering smells. A small jar of dried coffee grounds on a shelf at the back of the fridge will absorb those unwanted odours. Neutralize smells in the microwave by combining 2 tbsp of grounds with 1/2 cup of water, then heat for less than a minute. You can also insert a small open bag of coffee grounds in your rubbish bin to minimise garbage smells.

Drain cleaner

Is your drain smelling a bit whiffy? It’s easy to fix with the help of leftover coffee grounds. Toss a couple of tablespoons of coffee grounds down the drain, followed by two drops of soap and a kettle full of boiling water. This breaks down the grease, and cleans the pipe, thereby reducing the smell. Don’t do this more than a couple of times per month so you can avoid accidental clogging.

Cleaner

Say goodbye to harsh chemicals! Use coffee grounds to clean things around the kitchen such as pots and pans, dirty dishes, sinks, stove tops and cooking hobs when they are becoming grimy. Make sure whatever you’re cleaning won’t get stained by the coffee. Place a few teaspoons of coffee grounds on a cloth and scrub the surface with the grounds to scour grease and grime away. Rinse thoroughly once the grease and grime have been removed. Coffee is a mild abrasive so scrubbing your cookware with it won’t scratch it.

Dark wood furniture stainer

If you have furniture with scratches or scuffs, there’s an easy way to mask the damage. Most staining solutions use toxic materials. Coffee grounds are just as effective while being entirely natural. Mix coffee grounds with warm water, dip a cotton swab into steeped coffee grounds and dab on scratches. Wait 5-10 minutes, buff the area with a soft rag and see how it looks. Repeat the process if necessary. It is best to first test on an inconspicuous area before applying to the visible parts of the furniture.

Hand cleaner

Who loves the smell of chopped onions or garlic on their hands? No one! Instead of reaching for the hand cream or soap, try rubbing your hands gently with dried coffee grounds. This will eliminate those smelly odours and exfoliate them at the same time, leaving them smooth and soft.

For advice on coffee and how to supply it to office spaces, workplaces and clubs, contact Ivana at ivana.smith@ xpressodelight.com.au.

Handy household uses for coffee

Ivana Smith

Commercial Coffee Machine Xpresso Delight 0418 393 085 www.xdcoffee.com.au

How To Set Yourself Up For Success In 2022

BOOKKEEPER

By Neha Nayyar

Well 2021 is finally behind us, hopefully 2022 can only bring us bigger and better things. For many people, January is the perfect time for reflection on the year that was, and goal setting for the future. Setting yourself up for success this year shouldn’t be hard or overwhelming. Here are some simple ideas to get started.

Ensure you are on the cloud

As technology rapidly advances, it is more important than ever that your business is keeping up. Touch of button reporting, fast payments, invoicing, and payment gateways all help us do business better and faster. Customer expectations are high where technology is concerned, don’t get left behind. If cloud accounting seems overwhelming, talk to a trusted bookkeeper or accountant about your concerns, I am sure they can out your mind at ease.

Leave it to the experts

Times have changed, as a business owner, you no longer need to ‘do it all’. There are so many outsourcing opportunities for you to make the most of. By looking into outsourcing, so you will see just how affordable these options may be for things like bookkeeping, marketing, recruitment, event management, admin… etc. Don’t let the word ‘outsourcing’ put you off, think of getting your taxes done by an accountant, that is outsourcing. Ask around, I think you would be surprised at how many business owners outsource many of their tasks, leaving them more time to do what they love- whether it is building their business or spending more time with loved ones.

Use downtime for training

When you have downtime in your business, use it to invest in yourself. This is so important and one thing that constantly gets overlooked by business owners. With the online world we live in, “training” is not what it used to be, you no longer need to set aside days and pay big dollars for facilitated training sessions onsite. There is plenty of free training and upskilling out there- start by looking on LinkedIn for free courses, and there are also plenty of paid online courses for whatever niche your business is in. Check out the reviews to make sure they seem suitable and go and learn new skills. Choose courses or training that interest you and that will assist you in building your business.

Get your books looked over

Are you sure you are on track? Same old spreadsheets being used year after year? By having an expert eye look over your books for a reasonable fee, you can start the year knowing you are on a solid path to growth. By ensuring you have everything in order and the best systems in place, you know you have a great base, and the figures are then one less thing you need to worry about.

At Sum and Substance we understand the importance and need for reliable accounting data to allow business owners to make informed business decisions. Please contact us if you would like more information about our Health Checks. We can be reached at (03) 9424 9447 or info@sumsubstance.com.au. You can directly book in a time to chat by clicking here.

Neha Nayyar

Bookkeeper SUM AND SUBSTANCE www.sumsubstance.com.au 0401 409 573

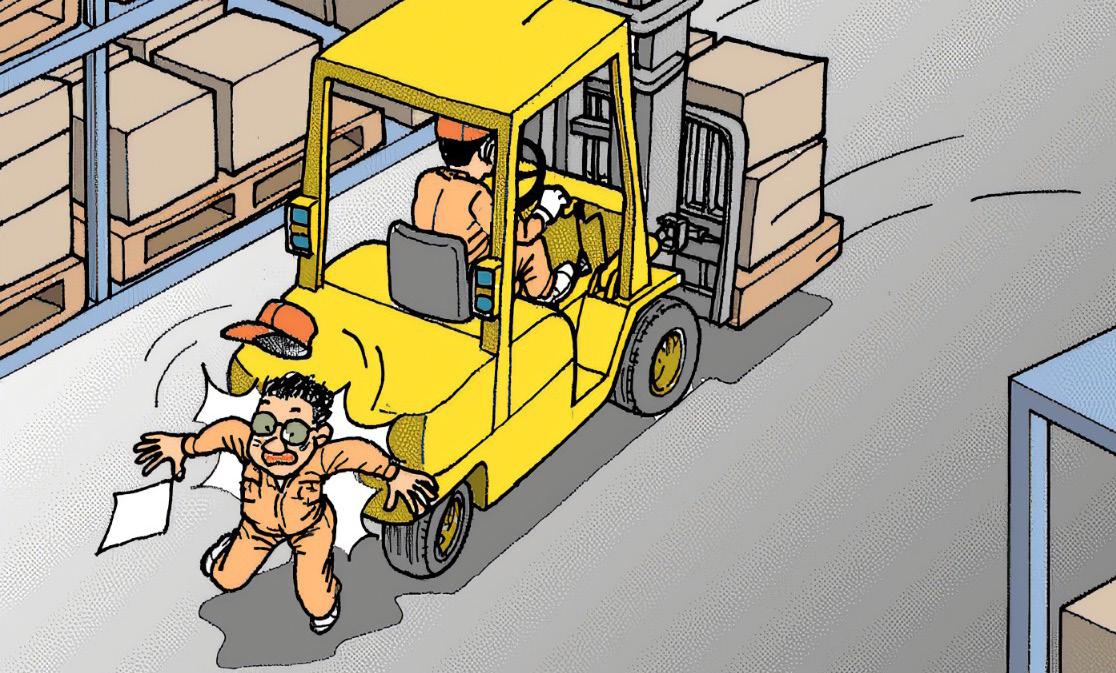

Pedestrians and Forklifts Don’t Mix.

OCCUPATIONAL HEALTH & SAFETY

By Mark Felton

Tragically, two workers have recently died in Victoria in separate forklift incidents. A 25-year-old worker was killed when standing near a forklift being driven on a sloping driveway. The forklift tipped over, crushing the worker.

In a second forklift incident a 49-year-old worker was fatally injured when a large unstable load fell off the fork arms (tines) onto him.

Pedestrians make up almost half of all people injured by forklifts. The most common forklift-related injury sustained by pedestrians is crushing. Pedestrians have also lost their lives or sustained traumatic injury when walking across forklift travel paths, doorways or from behind palletised goods or being hit by objects falling:

• during the loading and unloading of trucks • from an unstable load handled by a forklift • from forklifts carrying long, awkward shaped and unbalanced loads

Forklifts are a hazard and, where reasonably practicable, should be eliminated from the workplace, or substituted with other suitable load shifting equipment. If this is not reasonably practicable, the risks associated with using forklifts must be reduced, using engineering or administrative controls, such as traffic management plans (TMPs). TMPs are the key to separating forklifts from pedestrians, including truck drivers.

An effective TMP can include a range of controls, including:

• pedestrian and forklift exclusion zones • reduced speed limiting devices (smart forklifts) • halos • signage

Everyone at the workplace, including visitors, must be advised of the site’s TMP. Once risk controls are in place they must be regularly reviewed, especially when an incident occurs or there is a change in work practices, and revised where necessary in line with regulation 121 of the Occupational Health and Safety Regulations 2017 (OHS Regulations).

Pedestrian and forklift exclusion zones can incorporate:

• safety zones for truck drivers • fixed safety barriers • inward opening gates at pedestrian crossings • containment fences • clearly marked aisle ways, travel paths and pedestrian crossings

If separation by fixed barriers is not reasonably practicable, ensure pedestrians stay outside the advised three metre exclusion zone and do not interact with the load during forklift operations.

Do you or someone you know need help in understanding and Identifying hazards associated with forklift use, and developing control measures? I can assist by reviewing the current situation and systems, highlighting any shortcomings. I can then assist in the development and implementation of effective measures to reduce risk. Please feel free to contact Mark Felton at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers.com.au for an obligation and cost-free initial discussion.

Mark Felton

Occupational Health & Safety Beaumonth Advisory www.thebeaumontgroup.com.au

Your New Year’s Resolution - Review Your Finances

MORTGAGE BROKERING

By Jodie Moore

During the Christmas and New Year period we are focused on spending time with family, perhaps getting away for a well-earned break and preparing to put a difficult 2021 behind us. This time of year is a great time to relax and enjoy being with our loved ones, but it is also a time where a lot of us find ourselves in a difficult financial predicament due to over-indulgence with spending. That’s why the festive season is a great time to review your finances and help yourself into a better position going in to 2022.

I have listed below some areas where taking the time to review your finances could have a major impact on saving you money.

CREDIT CARD DEBT

The most common problem we have once Christmas is over is looking at our credit card statement and wondering how it managed to get so out of control. Should you find yourself in this situation there are a number of potential solutions to help get your credit card debt back under control.

1. Consolidate your credit card debt into a Personal Loan or Home Loan.

By consolidating your debts you will have a set term to repay the amount owing at an interest rate which is generally much lower than what your credit card costs. However this may also mean you are paying the debt back over a long term, so you need to be disciplined to ensure you repay the debt quickly. You don’t want to still be paying off this year’s

Christmas presents 5 years from now.

Set yourself a maximum two year term to repay the debt in full.

2. Reduce your available credit limits.

Once your credit card repayment arrangements are in place reduce your available limits to ensure you cannot get yourself into this position again. By having a small limit you will be able to manage the repayments more comfortably and clear the debt without further assistance. 3. Look for balance transfer deals. A number of lenders will offer either low or even zero interest rates on balance transfers of credit card debt. These offers usually come with a time limit to repay the amount owing in full. On the surface this is a great way to manage paying your accumulated debt, however there are potential traps that you should avoid. If you are able to access a balance transfer deal you should cut up the card, so you are unable to use it and add to the level of debt.

You can then set up a budget to repay the amount owing within the agreed term.

AFTERPAY/ZIPPAY ACCOUNTS

Many people are unaware that these types of buy now/pay later options come with a credit limit, and also now appear on your credit records. Banks treat them exactly like a credit card when assessing finance applications, so minimising their use will ensure your credit score is not negatively affected.

If you do get into a predicament with these types of accounts then the tips to helping with credit card debt will also apply here.

BUDGETING

To avoid getting yourself into a financial predicament in the future set a realistic budget to keep a track of your spending and, most importantly, stick to it. Why most budgets fail is that we place unrealistic expectations on ourselves. By setting realistic goals we are more likely to achieve them. Being consistent and putting smaller amounts into savings on a regular basis is more effective than making larger deposits at random. Your spending habits will also be aligned to your savings goals, but don’t be too hard on yourself if you have a period where you are unable to reach your savings goals due to unexpected expenses. Things happen. At SHL Finance we would love the opportunity to discuss your finance requirements with you. Please call Reece Droscher on 0478 021 757 to find out how we could help you save money or improve your financial situation.

REFINANCE TO A BETTER HOME LOAN Jodie Moore

Now is also a great time to review your Home Loan to make sure your lender is providing you with the most suitable loan to suit your needs. During the year we are generally so busy with life in general that reviewing what is usually our largest expense is put in the too hard basket. By taking some time now to see whether your current Home Loan is the best option you could save yourself thousands of dollars in interest and several years in time taken to repay your loan.

Mortgage Broker SHL FINANCE

SMSF: Where is your trust deed and is it up to date?

ACCOUNTANT

By Warren Strybosch

For Trustees, it is important to make sure the original trust deed is kept securely and updated when new superannuation laws change; especially where those laws will have an impact on the decisions made by the trustees of the fund.

A recent case, Jowill Nominees Pty Ltd v Cooper [2021] SASC 76, has highlighted the importance of ensuring that original trust deeds are kept securely, read and complied with.

As highlighted in Jowill, one of the key duties of the trustee is to know the terms of the trust deed and keep the original signed trust instrument safe and secure. If the trust deed is lost, it is very difficult for the trustee to discharge their duties. The duty in this regard is heightened for SMSFs given the interplay of the concessional taxation regime and the legislatively mandated rules around membership and trusteeship. These risks are magnified if, as a further example, it is the trust deed of a related unit trust or limited recourse borrowing arrangement that is lost.

Lost trust deed

If a trust deed is lost and reasonable searches and inquiries had been made with all relevant persons, legal and accountancy firms and 3rd party authorities that could have been expected to hold a copy of the trust deed, without success, the trustees might be able to relay on ‘secondary evidence’ to prove the existence of a trust. However, the secondary evidence must be clear and convincing evidence not only of the existence, but also the terms of the trust.

Secondary evidence

For a court to be satisfied the secondary evidence is suitable, the text of the missing document must be able to reproduce the trust in full (see for example, Barp Nominees Pty Ltd [2016] NSWSC 990) and there needs to be evidence to satisfy the '3 certainties of a trust', that is:

a. the identity of the beneficiaries; b. the property the subject of the trust; and c. the nature of the trust (i.e. whether fixed or discretionary or an SMSF).

Often, the information falls well short of producing the full contents of the trust deed and could not be relied upon.

Failure of trust

It is a timely reminder for all trust and SMSF advisers that the obligation to act in strict conformance with the terms of a trust deed is perhaps the most important duty of a trustee.

Where, the deed has been lost, a trustee cannot discharge this overriding obligation and will be held to be acting in breach of trust.

Therefore, if the trustee continued to deal with trust assets and administer the trust, they would effectively cause further breaches of trust, and this could lead to further sanctions. As an example, if a trustee were to make distributions, in the absence of a trust deed, this would be a clear breach of duty.

WARREN STRYBOSCH

Find Group

The founder of the Find Group of companies draws on his diverse background, which ranges form teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warren’s innovative approach in business means he was a champion of virtual financial advice long before the pandemic. Warren established the Find Foundation, which owns and operates across Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn't mean they are not making waves. Meet our Power 50.

Keeping it up to date

Not only should the trust deed be read and heeded, it also should be kept up to date. Given the trust deed governs the operation of the Fund and provides guidance to the trustee as to the particular actions they can undertake, it is extremely important to ensure that the Trust Deed remains current and that the Trustee has the authority under the Trust Deed to act to the extent permitted by the legislation.

There are numerous instances of when trustee actions have not been permitted due to an outdated trust deed. If the Trustees were to undertake such actions without the authority of the trust deed they could risk, to name a few:

• Audit exceptions because of invalid powers that could lead to ATO investigations and sanctions; • Loss of tax benefits - for example if they attempt to commence a particular pension without the power in the deed; • The wrong beneficiaries receiving

Death Benefits because of invalid documentation (eg BDBNs being deemed invalid etc).

Conclusion

Trustees have a duty to account to the beneficiaries of a trust. Having a trust deed in place, that has been read, as well as the terms of the deed being heeded, provides a good starting point to avoiding many of the breaches that might otherwise occur. A trustee needs to discharge its duty by ensuring that the original trust deed is kept secure, but also read; and complied with. Lastly, the trustee needs to review the trust deed to determine if the trust deed needs to be updated to allow them to perform the actions required of them.

At Find Accountant, we provide SMSF tax advice. Our senior accountant is also an award-winning financial advisor. If you require SMSF advice or are considering whether or not to wind up your SMSF, then speak to Warren Strybosch at Find Accountant Pty Ltd.

Warren Strybosch

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

Photo credit: Jenean Newcomb vis Unsplashed

Torticollis and Breastfeeding Difficulties

LACTATION CONSULTANT

By Dr. Joanna Strybosch

In my private osteopathic and lactation consulting practice I see quite a number of babies who have a persistent head tilt or turn. This condition is called torticollis (latin for “twisted neck”) and most of these cases are what we call congenital muscular torticollis. This means the baby was born with it and its origin is muscular.

When the sternocleidomastoid (SCM) muscle in the side of the neck is shortened, contracted or tight, it produces a characteristic tilt of the head to the affected side as well as a turn away from that side. In some babies, the head tilt component is more noticeable and in others it is the turn. The condition makes it difficult and uncomfortable for the baby to hold their head straight or to turn it the other way.

The cause of congenital muscular torticollis is usually due to the way the baby was positioned in utero. When a developing foetus grows in a restricted position within the confines of the uterus, their head can be abnormally tilted to one side. This persistent position impacts the way the SCM muscle grows and develops and then after birth the altered tone of the muscle affects its function and we see the characteristic postural changes.

Sometimes a baby’s head tilt is not very noticeable at birth, and it is not until the baby reaches a few weeks or even months of age that a caregiver may begin to notice it. However, it can be a missed cause for early breastfeeding difficulties.

In order to latch correctly, a baby must be able to position at the breast comfortably. If a baby has restricted movement in their neck from torticollis, there will usually be challenges for baby to turn into the breast on one side and this will manifest as difficulty latching and/or sustaining a latch. Baby may have difficulty latching onto the breast altogether, they may slip on and off repeatedly, they may come off early and cry, or they may tire quickly and stop before they have had a full feed. Baby often has extra difficulty regulating their state, quickly becoming unsettled and overwhelmed at the breast, and unable to relax enough to feed well. history of difficulty with latching. It is also why I often want to observe and assess a breastfeed when mum reports a head tilt or preferential turn.

As both an Advanced Pediatric Osteopath and an International Board Certified Lactation Consultant (IBCLC), I find combining these two skill sets invaluable in the assessment and management of congenital muscular torticollis and to provide good clinical outcomes.

As an osteopath, I usually provide gentle hands-on treatment to massage and relax the tight SCM muscle. I also advise parents on different home-based strategies, such as the best positions to hold baby in while breastfeeding, ways to gently and safely stretch the affected side of the neck and how to use tummy time to effectively assist in the management of this condition. Most babies go on to recover and to breastfeed well.

Dr. Joanna Strybosch

Osteopath B.App.Sc(Clin.Sc)/B.Osteo.Sc/Grad Dip Paeds LACTATION CONSULTANT www.childrensosteopathiccentre.com

Christian Super – Must Merge With Another Superfund

By Warren Strybosch

APRA, who regulates superannuation funds, has imposed additional licence conditions on the trustee of Christian Super to protect the best financial interests of the fund's members. APRA said the new conditions seek to address concerns from an APRA investigation into Christian Super's investment oversight, governance and strategic decisionmaking. They are also aimed at rectifying Christian Super's persistent investment under performance, which culminated in the fund's MySuper product failing the first annual performance test.

Under the terms of the new licence conditions, Christian Super is required to implement a strategy to merge with a larger, better performing fund by 31 July 2022. In doing so, Christian Super is required to engage an independent expert to ensure the merger is consistent with its duties under superannuation law.

Book a review appointment before the Merge

If you are a member of Christian Super and would like to know where best to move your superannuation before the merge takes place, then consider having a Free, no-obligation, superannuation review with Warren Strybosch, an awardwinning financial advisor and one of Australia’s top 50 most influential financial advisors.

You can book a phone call meeting time (he will call you) via his Calendly link at: https://calendly.com/findgroup/15minute-phone-conversation. After the meeting you will be provided with a FREE comparative superannuation report to help you decide whether or not to move your superannuation over to another provider.

Warren Strybosch, an accountant and financial planner, attends One Community Church, has been married for over 25 years, and has been providing financial advice for nearly 20 years.

Rassawatte Tea

By Elwynne Kift

Sometimes curiosity is a good thing!

I have no idea of the history of how I came to have this tea cannister & why.

I was being really well organised, and cleaning cupboards in the kitchen, last November – 2021- when I came across the cannister.

When I was a child, my family used to go to my father's parents farm in- Johnson's Creek, Alexandra. There was an elderly Indian gentleman who used to come with a horse drawn wagon, and sell items to my Grandmother. He quite often stayed the night in his wagon, and my Grandparents would make sure the horse was fed and had enough water. I think I can remember him using the laundry with a big aluminium tub to wash in – because we children were not allowed outside the house during that time.

My memory is that my Grandmother used to buy material from him, and I feel that she may also have purchased this tea. She was a very caring person and would have made sure she purchased something from him.

She no doubt also would have made sure he was fed for dinner. I can't remember those details. The history of the tea -- (with thanks to the Kiewa Historical Society.)

The cannister contained a blend of Ceylon tea – 1 pound net. The cannister was usually purchased so that the caddy could be used either for tea storage, or for the storage of other kitchen utensils. The agent was W.M. Peterson in Melbourne.

The Peterson building was burnt down in a horrific fire in the early 1900's - around 1930's. normal hot drink to have at evening meal or even at “smoko” where it would be had as “billy tea.” (I somehow remember my Grandmother also having Bushell's tea.)

The cannister itself would have originally contained Ceylon tea and is constructed from pressed light steel. It is embossed with the content details and the name of the general tea agent - Rassawatte - The main body of the cannister has been fastened by pressed (not soldered) connections.

Boosters critical as infections surge

By Money and Life (Australian Associated Press)

Australia has passed the grim milestone of more than 500,000 COVID-19 cases since the pandemic began.

The mark was passed on Tuesday after almost every jurisdiction posted record high daily totals, with more than 47,000 new infections.

Yet Australia’s Deputy Chief Medical Officer Sonya Bennett told reporters on Tuesday afternoon there were likely more cases in the community than were being officially recorded.

She said experts were monitoring the impacts on the healthcare system and hospital capacity, and asked people to wear masks, avoid crowded indoor venues and get a booster if eligible.

“There are things we can do now to work together to bring those case numbers under control,” she said.

The rise in cases comes as Prime Minister Scott Morrison is under increasing pressure to make rapid antigen tests free, with widespread shortages continuing.

Finance Minister Simon Birmingham said on Tuesday more than 100 million rapid antigen test kits would become available in the coming weeks but did not provide a set date.

He said the federal government was discussing a plan to ensure concession card holders and others would have access to subsidies and discounts on rapid tests.

But Opposition Leader Anthony Albanese lashed out at the government’s handling of the issue, calling for greater access to rapid tests.

“The fact is this government is responsible for the largest public policy failure in Australian political history,” he told reporters on the NSW Central Coast.

“Australians are being told, ‘You’re on your own and go out and get a rapid antigen test’, but they’re not available in so many areas. are doing an incredible job with demand to support testing services,” he told reporters in Adelaide.

While Mr Albanese has not called for the tests to be made free, he has urged the government to make them more affordable.

Australian Council of Social Service president Peter McNamara urged the government to secure better access to COVID-19 tests for the vulnerable.

“It’s a massive policy shift from providing free PCR testing for everyone, to expecting people and organisations to pay for their own rapid antigen tests,” he said.

“This is the worst time of the year for a sudden change of government policy like this.”

Australian consumer watchdog chief Rod Sims said the ACCC was closely monitoring reports of price gouging on rapid tests and promised to crack down on offending retailers.

The rapid test shortage coincides with the expansion of the country’s booster program, with an extra four million people becoming eligible from Tuesday.

The gap between second and third doses has been reduced to four months, and will shorten to three at the end of January.

Senator Birmingham said booster shots were critical following the Omicron surge. Children aged five to 11 are also set to get the vaccine from January 10.

Senator Birmingham said there was ample vaccine supply.

“We have doses ready and can start the childhood program on time next week, with the additional surge coming through of different channels of vaccine delivery,” he said.

There were 23,131 new cases reported in NSW on Tuesday, along with two deaths, while Victoria posted its first day above 10,000 cases, with 14,020 infections and two deaths.

The ACT and Tasmania also had one-day records, registering 926 and 702 cases respectively.

There were 5669 in Queensland, while South Australia had 3246, 75 were detected in the Northern Territory and Western Australia had 14 new cases – all related to interstate or international travel and now in quarantine.

2022, A SIGN OF A GOOD YEAR TO COME

SIGNAGES

By Glenn Martin

Signs guide and inform us about almost everything. From roadways to shopping venues to healthcare, education, and houses of worship to sports and entertainment venues, we rely on signs to help us navigate our lives. Every business needs identifiers to advertise their location, their hours, and special events. Sign products abound for exteriors, interiors, windows, walls, and even vehicles for new businesses desiring to attract customers for the first time, as well as established businesses that want to update their brand message.

Many considerations revolve around what type of sign products work for your business. For the exterior of your business, in terms of standing out in a crowd on a busy city sidewalk or attracting attention from vehicle traffic or pedestrian passers by, Signarama’s exterior sign products include:

• Building Signs – Sophisticated dimensional lettering, LED lightboxes, and back-lit LED signs add a layer of professionalism to your signage and get noticed day or night. Digital displays can be programmed to advertise specials and updated information for clients and passers-by. • Awning Graphics – Stylish and eyecatching, awning graphics punch up your company’s advertising potential and visual impact in a unique way that may work well with your building’s architectural style.

• Flags and Banners – Feather and teardrop flags advertise your location with motion that gets the attention of passers-by, as do sophisticated vertical banners and eye-popping horizontal banners. These can be custom designed to suit your needs and made of various materials.

• Vehicle Graphics – Fleet graphics, vehicle wraps, decals, custom lettering and magnetic vehicle signs add effective exposure for your business as mobile billboards everywhere you go and everywhere you are parked. • Window Graphics – Turn your storefront or office front windows into a powerful marketing tool with etched and frosted glass looks or create some privacy with seethrough perfs for your windows that don’t compromise your natural light.

• Wall Graphics and Murals – Enliven empty wall space with Signarama murals and wall graphics featuring bold logos and hi-res images in your lobby, fitting rooms, break room, hallways, or even in your conference rooms.

• Freestanding Signs – Elegant monument signs mark entrances in high style. They’re constructed to coordinate with your building’s exterior in carved and sand-blasted finishes. Post and panel signs can make a huge visual impact and businesses can save some money by changing just the faces of their signs from time to time. Interior signage sets the tone for all who enter your business and can add a unique WOW factor to your interior design. Signarama’s interior sign products include:

• Dimensional Lettering – Back-lit channel lettering enhances your brand image on walls, in foyers and reception areas, making a huge first impression.

• Floor Graphics – Vinyl floor decals take advantage of an often overlooked marketing opportunity to advertise or guide customers to your trade show booth or even to a specific sale or promotion in your store.

With many years’ experience in the field, Signarama are able to work with you to design, manufacture, install your signage, offering innovative solutions for all your signage needs. For more information about the services we provide, or to get advice on the best signage for your business, visit our website or simply call 1300 633 902 to get in touch with our team of experts today.

Glenn Martin

mitcham@signarama.com.au www.signarama.com.au/store/mitcham

3 COOL TIPS FOR YOUR HOME OVER SUMMER

ARCHITECT

By Kathy Ismail

With the La Niña climate pattern affecting the holiday weather across Australia this summer, we might not have as many super-hot days as usual. Nevertheless, the occasional day over thirty may see you scurrying for the air conditioner’s remote control.

While air conditioning is a blessing, it tends to fill the home with undesirable chemicals, can affect people with allergies badly and is massively expensive to run. What if there were other ways to keep you home efficiently cool?

Here are three tips for living in your home with a comfortable room temperature throughout the long summer days and nights.

1 Curtains and windows

Windows draw in heat from the sun. The best insulator for windows is double glazing or proper sealing. If that’s out of your budget or your plans for now, the next best option is triple-backed curtains.

Something as simple as installing heavy curtains can make a massive difference between enjoying your space and sweltering in it. Triple-weave curtains not only look good, as they drape beautifully, but they have the ability to drop the temperature in your room during hot weather. They are made with three tightly interwoven layers, the one in the middle made of a black thread that blocks sunlight and heat.

Triple-weave curtains come with other great advantages. They are mouldresistant, they act as a great fire-retardant and they filter outside noises. They are also easy to care for – just pop them in the washing machine, hang them out to dry, press them with a cold iron if necessary, then re-hang them in the room.

Keep them drawn during the hottest part of the day, only opening them again when the sun has shifted away from the windows. You will notice a marked decrease in heat in your home.

2 Insulation The ability of insulation to control temperature in buildings, especially in the ceiling–roof space, was recognised well before the Pink Batts scandal of the 2000s. (And the reason the government was installing the batts was to help people reduce their power bills by saving on energy consumption – a good thing.)

Insulating one’s home contributes hugely to warmth in winter and cooling in summer, as anyone who has lived in a home without insulation knows! Insulation also prevents mould and damp from permeating your home. Did you know that the floors can and should be insulated as well? This is not an issue for more modern homes vvbuilt on concrete slabs, but for homes constructed in the ’70s and ’80s built on wooden stumps, floor insulation is certainly worth considering.

Does the idea of emptying everything out of your home and lifting up the carpets and every floorboard make you shudder? Why not talk with an architect about this, as they will have many ideas on how this can be accomplished with your existing flooring arrangements.

3 Eaves

When you think about it, a house without eaves is really like person without eyebrows. Our eyebrows aren’t just decorative, just there to give our faces some sort of definition. They actually provide several useful functions, as do eaves. Our eyebrows protect our faces from sweat as eaves protect a home from rain. They prevent our eyes being filled with dirt as eaves prevent dirt and dust from entering our homes. (Just think of all the garden rubbish our eaves collect!) Eyebrows and eaves both protect our eyes (and homes) from glare and heat. In the summer months, the angle of the sun is higher and the temperatures are hotter, but the eaves prevent that light and heat from penetrating your home.

Eaves are an important home feature in the quest for cooler temperatures. If your house has narrow eaves that you wish to enlarge, you can do this after applying to your local council for permission to extend them. However, it is quicker and better to ask an architect to do that for you as they are more experienced with council applications and their authority will carry more weight.

Contact KIR Architecture at contact@ kirarchitecture.com.au for help with all your building projects. We are always happy to answer any inquiries.

Kathy Ismail

ARCHITECTURE KiR ARCHITECTURE 0422 026 962 www.kirarchitecture.com

GENERAL INSURANCE

By Craig Anderson

Different insurers have different wordings for their policies. Many will add very particular endorsements to their policy wording; either to extend cover, or to remove some aspect of cover. Therefore, it would be foolish to assume that the policy will meet your needs based on price alone. Yet many people assume all policies function in an identical manner, and that the only difference is price.

If you were to assume, for example, that a Business Pack Wording from one major insurer is identical to a Business Pack Wording from another major insurer, you would be wrong. If you think that different policy wordings from two insurers will give identical responses to claims you would also be wrong. It does not follow that if one policy covers something then the other must also cover it.

How do you know if your existing cover is actually right for you? You could scour through the multiple offerings in the market and establish what suits you best, or you could ask a broker to do the legwork for you. However, if you are the type to take all of your advice from your neighbours while watching them cremate some sausages on their barbeque, then I suggest you rethink your approach.

Understanding what an insurance policy

Never Assume

contract is designed to achieve will help you understand the limitations of what can be covered. This can take considerable some time and effort. If you have neither the time, nor the inclination to read through and understand the documents, it may be time for you to engage a broker.

If you have a discussion with a broker about your business, and ensure they have a good grasp of where your risk exposure comes from, you stand a very good chance of putting an effective policy in place. Foreseeable risks can be covered, however no policy is perfect. There is no “magic bullet”. However with some good advice, the risks which cannot be covered under the policy, may be possible to manage out of the business. For a “health check” of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

Craig Anderson

General Insurance Small Business Insurance Brokers

www. heightsafetyinsurancebrokers.com.au 0418 300 096

Elective Surgery Wait Lists to Increase

By Warren Strybosch

Public and private hospitals have temporarily reduced elective surgery to urgent procedures as the number of COVID patients increase. For the time being, hospitals across the state are only performing emergency or elective surgery procedures.

The reductions will apply to many private hospitals and not just restricted to public hospitals. It is hoped that these restrictions will reduce the strain currently being placed on the hospital system as the Omicron strain continues to spread rapidly throughout Australia.

RAT in demand but States are responsible for supply

By Warren Strybosch

The undersupply of Rapid Antigen Test (RAT) kits is causing frustration and concerns for many business owners and consumers alike. With PCR sites turning away people from as early as 4.30am in the morning, everyone is struggling to know how to move forward.

What makes matters worse is that the RAT kits are only free to those who have a Commonwealth seniors health card, a healthcare card, a low-income card, a pension concession card, DVA Gold card or a DVA white card, leaving the rest of Australians having to pay out of their own pockets.

The prime minister announced that anyone selling rapid antigen tests at more than a 20 per cent mark up would be in breach of a biosecurity regulation declared by the Health Minister. “And that carries a penalty of $66,000 and up to five years in jail,” he said.

“We will include rapid antigen test as those products covered by the export controls that we put in place.”

Mr Morrison said a purchasing restriction of one box of rapid antigen tests per person would be put in place.

The Government is under pressure to provide free RAT kits and more of them. However, it is estimated that it is costing the government $50,000 per person per year to manage the COVID virus. No wonder the government has moved away from government controls to more of a self-managed approach where people are now required to purchase their own RAT kits, and self-isolate for 7-days if the test comes back positive.

Interestingly, it has been heard that the RAT needs to be monitored closely and that at the 15-minute mark, the ‘true’ result will be displayed and after that the RAT test is known to display a negative result even if at the 15-minute mark, the test showed a positive test.

The federal government has stated that the states are responsible for the purchase and administration of the RAT kits. Also, the federal government has stated that RAT tests do not need to be reported. As per the norm, the Victorian State Government has once again gone against federal government mandates, not only are they complaining they should not be responsible for providing RAT kits (no wonder Victoria has run out), but the state government are insisting that anyone who records a positive RAT result must report it immediately.

Hopefully, the Labor government can find some additional supplies so that business owners and the wider community can get on with their lives.

What age should I retire?

FINANCIAL PLANNING

By Warren Strybosch

Retiring is a big life decision and does not occur overnight. For many it is a thought that usually starts to seriously be considered around age 65 and was likely bubbling from age 55 onwards.

For many the decision when to retire is carefully thought out and planned but for some the decision is made for them. Redundancy, ill health, losing one’s job, and most recently, deciding not to be vaccinated, may force you to lose your job and/or leave the workforce before you had intended to do so.

We often have clients approaching us as they get closer to age 65 or after they have turned aged 65. Many people believe age 65 is considered the benchmark age to retire. This is likely due to the fact that for many years you could not receive the Age Pension until you turned age 65. Now that the age pension age has increased to age 66 and by 1st July 2023, the eligibility age will age 67, it is likely the benchmark age will move from age 65 to age 67; in fact, we are already starting to see this occur.

Australians are very fortunate because there is no legal requirement to stop working. It provides people with the ability to keep working for as long as they want to but for many this is not their desired outcome. Working after age 65 is considered a less than desirable position to find yourself in.

Many people are quite capable of looking after their own finances whilst they are working however, we tend to find that they will start seeking advice in their early sixties or as they approach retirement. They want to answer the question, ‘When can I retire?’ or ‘What age can I retire?’ or “Will I have enough to retire and/or ‘What they should do with my assets, and should I consider placing them into super?’

Access to super and the Age Pension

Often, the real question they are asking is, “When can I access my super or the Age Pension.” The age rules for each are different, which no doubt causes much of the confusion. • Preservation age: This is the age when you can access your super provided you have also met a condition of release such as retiring.

Your preservation age is between the ages of 55 and 60, depending on your date of birth. The important point to note is that drawing down your super prior to age 55 comes with it tax implications whereas after age 60, any pension income is taxfree.

• Age Pension age: This is the age when you can access a full or part Age Pension. This age will rise progressively to 67 by 1 July 2023.

You can still access super and continue to work

After age 58 (moving to age 60 by 2024), you can continue working part time until age 65 and replace some income with a transition to retirement pension. This allows you to preserve most of your nest egg while easing into retirement and do some other things you have been putting off until retirement. We believe it is more important than ever to take mini retirements before fully retiring. Too often, we have seen clients push out retirement and once they finally retire, they cannot fulfil their dreams because one partner has become seriously ill.

When you stop working after age 60, you can access your super tax free whether you take it in the form of a lump sum, income stream or a combination of the two. Once you reach 65, you can access your super even if you haven’t retired. Even then, there is no compulsion to withdraw your super – you can leave it untouched for as long as you like if you have other sources of income. You can also continue making super contributions until you turn 74 (work-test requirements from age 65 to 74 are due to be removed in early 2022).

So, when do you retire?

Accessing your super or the Age Pension is only one component you need to address when considering retirement.

For many people, a big question is whether they will have enough money to live off when they do eventually retire. Interestingly, many self-funded retirees end up spending less and going without to try and maintain their capital base because they fear they will not be having enough in their later years, or because they want to live something for their children. Often, when you do the modelling, many retirees could easily spend more and still have plenty left over at the end of their lives.

It is important, before you start dipping into your savings, to think carefully about all the factors that might have a bearing on your retirement finances.

These include:

• How long you might live. None of us knows the answer to this, but your general health and well-being provide a clue, as do population

• mortality rates. Today’s 65-year-olds can expect to live to an average age of 84.9 years for men and 87.6 for women, or roughly 20 and 22 years respectively. Many of us will live well into our 90s. • Your retirement income needs.

This will depend on the lifestyle you hope to lead and how much it costs. As a rough guide, the ASFA Retirement Standard suggests a comfortable lifestyle will cost today’s homeowner retirees about $62,000 a year for couples and $44,000 for singles. Contrast this with the full Age Pension which is currently around $37,000 for couples and $24,500 for singles. That’s quite a gap that must be filled by super and other private savings.

Working out whether you will have enough to retire on or not is crucial before you retire. For many people, doing the modelling, is beyond their scope, especially where property or other income generating assets are involved. It is important to seek advice from a professional financial advisor.

Find the right advice

Australians are staying longer in the workforce, a trend that is likely to continue as the age at which people can access the Age Pension increases to 67. Currently, the average age of retirement has increased to 63.

When you start considering retirement, we recommend you seek professional financial advice. A good advisor will look at all aspects of your financial situation and provide sound advice you can rely on.

At Find Retirement, we take clients through a rigorous process which includes the following:

a. Cash flow analysis b. Comparing ‘needs’ vs ‘wants’ c. Obtaining Life-time Income Stream (LIS) quotes d. Discussing various income stream models to determine what is most appropriate for you e.g., do you require an allocated pension, LIS, or both? e. Understanding your future goals and needs f. fPreparing detailed modelling that covers a variety of scenarios e.g., do you keep the investment property, sell the investment property, downsize, and so on. The modelling will also answer all your questions e.g., how long will my super last, when will I get the Age Pension, what are the tax implications of the choices you make, etc. g. Once the modelling scenario has been chosen and you know what course of action is to be taken, we then provide advice regarding the investments to support your chosen scenario. h. We then implement it all and get you set up ready to enjoy your retirement. i. Every six months we then review your situation to make sure it is still relevant and meets your needs now and in the future. At Find Retirement, we don’t want fees to be a barrier to seeking sound financial planning advice. As such, we aim to keep our fees as affordable as possible for the average Dad and Mum client.

The first meeting is free and there is no obligation to continue with our services. We encourage you to book a time to discuss your retirement needs with us when you are nearing retirement.

This information is current as at January 2022. This article is intended to provide general information only and has been prepared without taking into account any particular person’s objectives, financial situation or needs (‘circumstances’). Before acting on such information, you should consider its appropriateness, taking into account your circumstances and obtain your own independent financial, legal or tax advice. You should read the relevant Product Disclosure Statement (PDS) before making any decision about a product. While all care has been taken to ensure the information is accurate and reliable, to the maximum extent the law permits, Alliance Wealth and its related bodies corporate, or each of their directors, officers, employees, contractors or agents, will not assume liability to any person for any error or omission in this material however caused, nor be responsible for any loss or damage suffered, sustained or incurred by any person who either does, or omits to do, anything in reliance on the information contained herein.

Warren Strybosch

You can call them on 1300 88 38 30 or email

info@findretirement.com.au

www.findretirement.com.au

Special Tax Return Offer

$99 Returns - PAYG Only

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to returns@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address. 2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required). 3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes. 4. We will then require you to upload your documents to our secure portal. 5. Once we have received all your documentation, we will complete the return. 6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.