19 minute read

LOCAL STORIES

The National Cabinet agreed in-principle to an updated fourstep National Plan to transition Australia’s National COVID-19 Response (National Plan) taking into account the Doherty Institute COVID-19 modelling and the Commonwealth Department of Treasury economic analysis.

The National Plan charts the way back.

The National Plan provides a graduated pathway to transition Australia’s COVID-19 response from its current prevaccination settings focused on continued suppression of community transmission, to post-vaccination settings focused on prevention of serious illness and fatalities, whereby the public health management of COVID-19 is consistent with other infectious diseases.

A sub-group of National Cabinet consisting of Victoria, Tasmania and the Northern Territory will also prepare options on how restrictions can be eased for vaccinated Australians in Phase B.

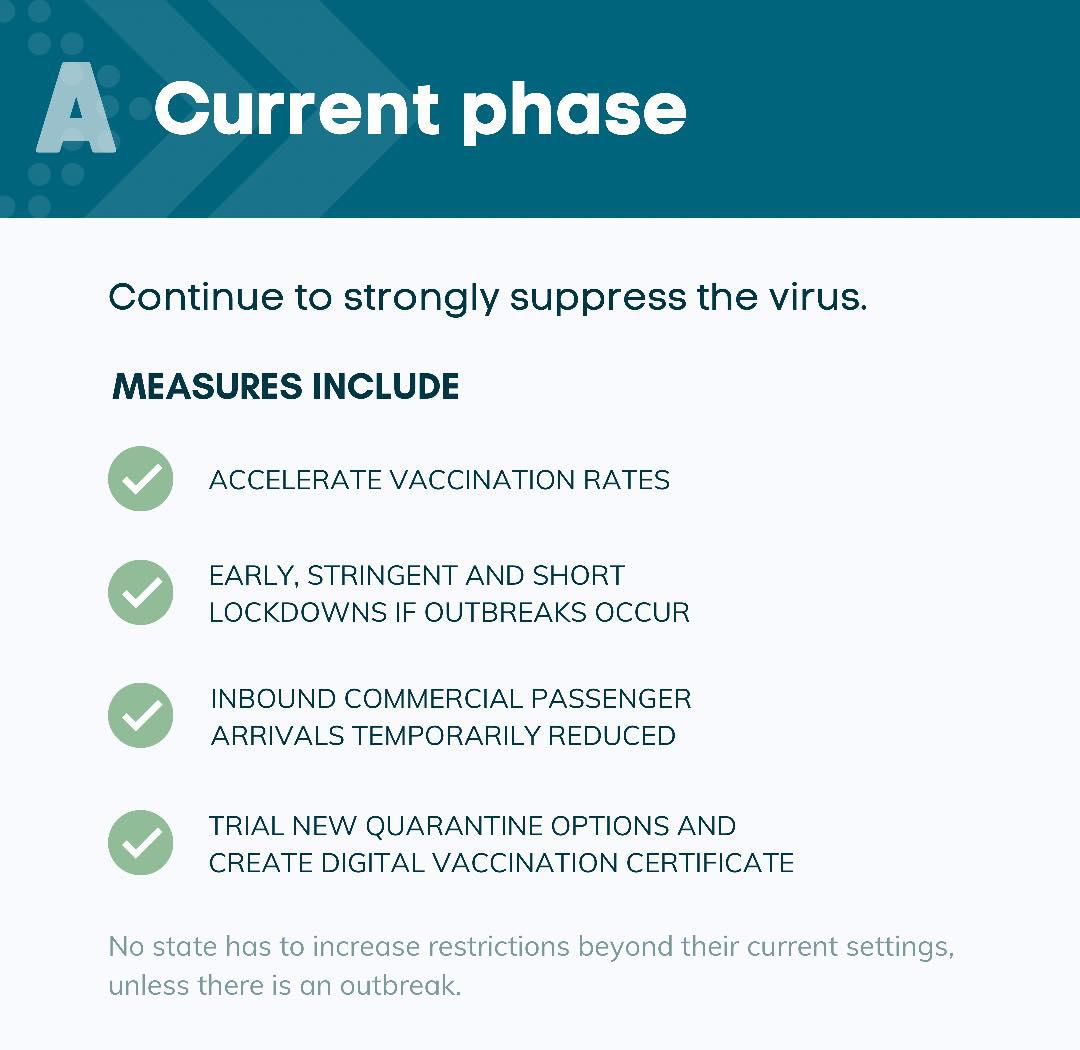

Phase A. Vaccinate, Prepare and Pilot (Current Phase)

Australia will continue to strongly suppress the virus for the purpose of minimising community transmission. Measures may include accelerating vaccination rates, closing international borders to keep COVID-19 out, and early, stringent and short lockdowns if outbreaks occur.

Phase B. Vaccination Transition Phase (~70% of adult population fully vaccinated)

In this phase, Australia will seek to minimise serious illness, hospitalisations and fatalities as a result of COVID-19 with lowlevel restrictions. Measures may include maintaining high vaccination rates, encouraging uptake through incentives and other measures, minimising cases in the community through ongoing low-level restrictions and effective track and trace, and with lockdowns unlikely but possible and targeted.

The National Plan sets out four phases to effectuate this transition. Each phase will be triggered by the achievement of vaccination thresholds of both the nation, and the individual state or territory expressed as a percentage of the eligible population (16+), based on the scientific and economic modelling conducted for the COVID-19 Risk Analysis and Response Taskforce.

The updates agreed in-principle today by the National Cabinet are the Vaccination thresholds to move to Phase B and Phase C. The National Cabinet will commission further detailed modelling over the coming months to update and refine the National Plan as required.

Phase C. Vaccination Consolidation Phase (≥80% of adult population fully vaccinated)

In Phase C, Australia will seek to minimise serious illness, hospitalisations and fatalities as a result of COVID-19 with baseline restrictions. Measures may include maximising vaccination coverage, minimum ongoing baseline restrictions adjusted to minimise cases without lockdowns, and highly targeted lockdowns only.

(Source: https://www.pm.gov.au/media/national-cabinetstatement-10)

National Cabinet agreed to formulate a national plan to transition Australia's National COVID-19 Response from it's current pre vacination settings, focussing on continued suppression of community transmission, to post vaccination settings focused on prevention of serious illness, hospitalization and fatality, and the public health management of other infectious diseases.

Phases triggered in a jurisdiction when the average vacination rates across the nation have reached the threshold and that rate is achieved in a jurisdiction expressed percentage of the eligible population (16+), based on the scientific modelling conducted for the COVID-19 Risk Analysis and Response Task Force

~ 70% vaccination (2 doses) ≥ 80% vaccination (2 doses)

A. Current Phase: Vaccinate, Prepare and Pilot*

Continue to strongly suppress the virus for the purpose of minimising community transmission Seek to minimise serious illness, hospitalization and fatality as a result of COVID-19 with low level restrictions Seek to minimise serious illness, hospitalization and fatality as a result of COVID-19 with baseline restrictions Manage COVID-19 consistant with public health manangement of other infectious diseases

B. Vaccination Transition Phase C. Vaccination Consolidation Phase D. Final Post-Vaccination Phase

Measures may include: • Accelerate vaccination rates • Close international borders to keep COVID-19 out • Early, stringent and short lockdowns if outbreaks occur • Minimise cases in the community through effective test, trace and isolate capabilities • Implement the national vaccination plan to offer every Australian an opportunity to be vaccinated with the necessary doses of the relevant vaccine as soon as possible; • Inbound passenger caps temporarily reduced • Domestic travel restrictions directly proportionate to lockdown requirements. • Commonwealth to facilitate increased commercial flights to increase international repatriations to Darwin for quarantine at the

Centre for National Resilience in Howard

Springs; • International Freight Assistance Mechanism extended • Trial and pilot the introduction of alternative quarantine options, including home quarantine for returning vaccinated travellers; • Expand commercial trials for limited entry of student and economic visa holders • Recognise and adopt the existing digital Medicare Vaccination Certificate (automatically generated for every vaccination registered on AIR); • Establish digital vaccination authentication at international borders; • Prepare vaccine booster programme; and • Undertake a further review of the national hotel quarantine network. Measures may include: • Maintain high vaccination rates, encouraging uptake through incentives and other measures • Minimise cases in the community through ongoing low-level restrictions and effective track and trace • Lockdowns less likely but possible • International border caps and low-level international arrivals, with safe and proportionate quarantine to minimise the risk of COVID entering • Ease restrictions on vaccinated residents (TBD) • Restore inbound passenger caps at previous levels for unvaccinated returning travellers and larger caps for vaccinated returning travellers; • Allow capped entry of student and economic visa holders subject to quarantine arrangements and availability; • Introduce new reduced quarantine arrangements for vaccinated residents; and • Prepare/implement vaccine booster programme (depending on timing). Measures may include: • Maximise vaccination coverage • Minimum ongoing baseline restrictions, adjusted to minimise cases without lockdowns • Highly targeted lockdowns only • Continue vaccine booster programme; • Exempt vaccinated residents from all domestic restrictions; • Abolish caps on returning vaccinated

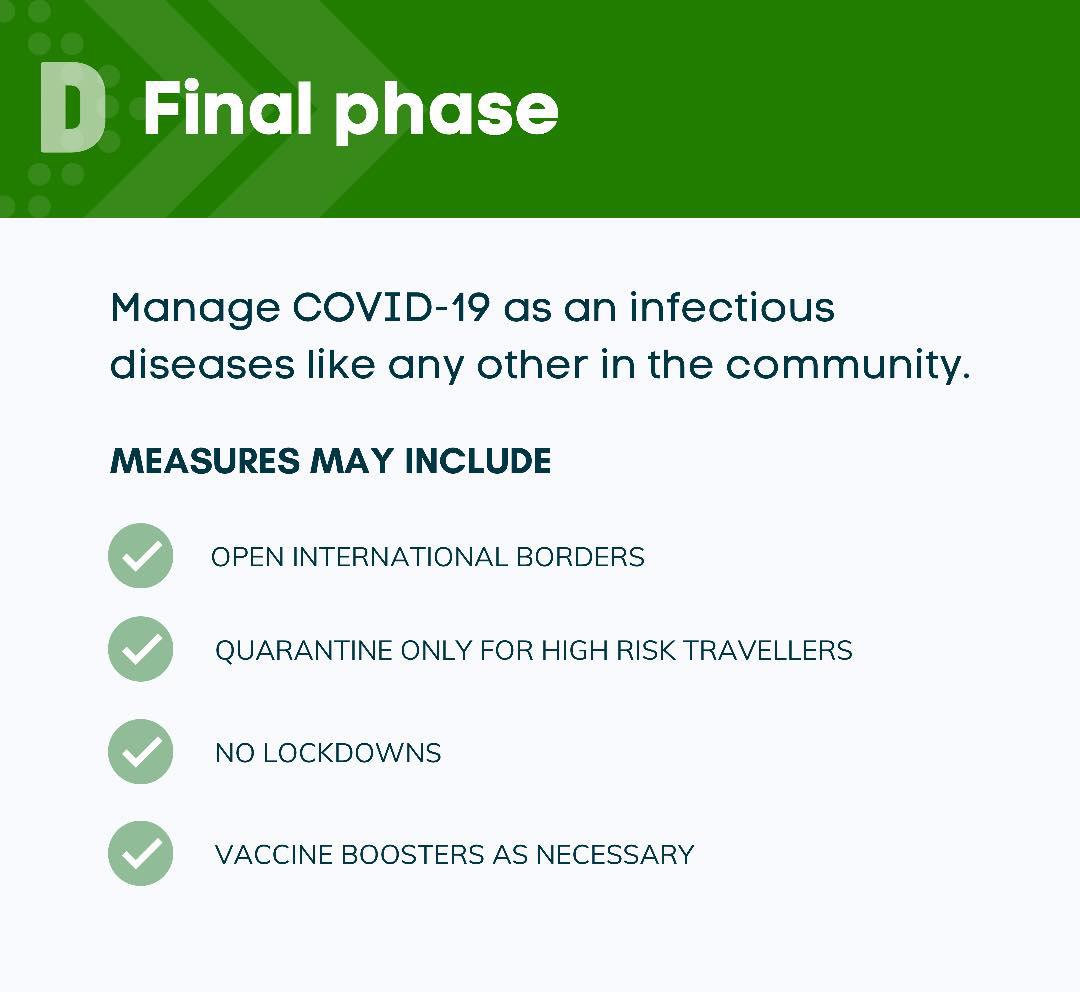

Australians • Allow increased capped entry of student, economic, and humanitarian visa holders; • Lift all restrictions on outbound travel for vaccinated Australians; and • Extend travel bubble for unrestricted travel to new candidate countries (Singapore, Pacific) • Gradual reopening of inward and outward international travel with safe countries and proportionate quarantine and reduced requirements for fully vaccinated inbound travellers. Measures may include: • Open international borders • Quarantine for high-risk inbound travel • Minimise cases in the community without ongoing restrictions or lockdowns • Live with COVID-19: management consistent with influenza or other infectious diseases • Boosters as necessary • Allow uncapped inbound arrivals for all vaccinated persons, without quarantine; and • Allow uncapped arrivals of non-vaccinated travellers subject to pre-flight and on arrival testing.

*No jurisdiction required to increase restrictions beyond current settings The Plan is based on the current situation and is subject to change if required The COVID-19 Risk Analysis and Response Taskforce’s report will be available once finalised at: pmc.gov.au.

Another Recession Not On Cards, Just Yet

Colin Brinsden, AAP Economics and Business Correspondent (Australian Associated Press)

A growing number of economists are predicting that with half the population in lockdown, the economy will contract in the September quarter.

But at this stage they doubt this will be followed by a second negative quarter in the final three months of year, which would signal the economy has sunk back into a recession.

The Westpac-Melbourne Institute leading index, which indicates the likely pace of economic activity three to nine months into the future, eased further in June, but still points to annual growth above trend about 2.8 per cent.

Westpac chief economist Bill Evans is forecasting the economy will contract by 0.7 per cent in the September quarter.

“We expect the economy to bounce back once measures bring outbreaks under control, with the December quarter expected to show a 2.5 per cent rebound nationally,” he said. Greater Sydney and some NSW regional areas are in lockdown until July 30, and Victoria is in an extended shutdown until next Tuesday, as is South Australia. Greater Sydney and Melbourne alone account for about half of the economy’s output.

As such, independent economist Nicki Hutley says another recession can’t be ruled out.

“This Delta virus just seems almost unstoppable. You have seen how difficult it has been for NSW to get on top of it,” she told ABC radio.

“If we can’t do that very quickly, this could drag on. That is the worst case scenario.”

The Australian Bureau of Statistics will issue its preliminary retail trade figures for June on Wednesday.

Economists’ forecasts centre on a 0.4 per cent decline, wiping out the 0.4 per cent gain seen in May, although some believe it could be as much as a one per cent drop. The data will cover the full impact from last month’s Victorian COVID-19 lockdown. Sales for July are likely to be even weaker, clobbered by earlier snap lockdowns in Brisbane, Darwin and Perth, as well as the now lengthy restrictions in Greater Sydney.

Those latter restrictions include the closure of construction sites, the first time such a measure has been included.

“If the pause goes beyond July 30, it could bring smaller contractors to their knees due to cashflow issues,” Australian Constructors Association chief executive Jon Davies warned.

The National Skills Commission will also issue its final report for skilled vacancies for June.

Its preliminary figures showed job advertisements posted on the internet fell 0.5 per cent in the month, the first decline since the pandemic low point in April 2020.

However, jobs ads were still 43.8 per cent higher than their pre-pandemic levels.

Melbourne’s Best Kept Parenting Secret

Einstein once said: “We cannot solve our problems with the same level of thingking we created them. Likewise we

cannot solve our current issues for the generations today with the same thinking, rules and conditioning of the past!

Disrupt your thinking and empower yourself with a Leadership Mindset today for the generations of tomorrow! Call Now 0432 848 418

Leadership and Parenting Disruptor Lesley Banton 0432 848 418 www.theparentwhisperer.com.au

Young Australians Share Their Covid Fears

By Emily Woods (Australian Associated Press)

Young Australians are stressed about how the pandemic has impacted their education and mental health and are concerned about ongoing isolation, a new survey has found.

Mission Australia released results from its 2020 Youth Survey on Wednesday, showing young Victorians have been hit the hardest by issues brought on by the pandemic.

Additionally, 17-year-olds were the most likely to say their education has been severely impacted by COVID-19.

Many of those surveyed said disruptions to their everyday lives due to the pandemic have made them feel worried, stressed and without access to their usual supports.

“Our school is not doing enough in terms of accounting for the abnormal state of the world when it comes to setting assessments – I have never felt so simultaneously stressed and unmotivated,” a 17-year-old Victorian girl told the survey.

“There has been an extreme lack of allowances for COVID and online learning so I am consistently stressed about school – on top of being stressed about the world.”

More than 25,000 people aged between 15 and 19 responded to the survey, with 1650 young people saying COVID-19 had been their biggest personal concern in 2020.

About two thirds of young people who had mental health concerns due to COVID-19 were girls – 68.9 per cent, compared with 23.9 per cent of boys.

Mission Australia’s chief executive James Toomey says the results are particularly important given the pandemic continues to cause disruption for young people. recently triggered in response to COVID-19, we must take heed of what young people told us about their experiences and solutions in 2020,” he said.

“We are very concerned that the impact of this virus will continue to have flow-on effects on young people’s lives now, and their futures.”

Despite various levels of government investment in mental health, Mr Toomey says there are still “large gaps” in the mental health system, particularly for vulnerable and marginalised groups.

Mission Australia has recommended more support for young people in schools, to help their wellbeing as well as to support them completing school work.

The charity says mental health prevention and early intervention support delivered in more flexible formats is needed to address issues that may arise during periods of isolation.

COVID-19 disaster payments are now tax-free: Do you need to amend your tax return?

By Warren Strybosch

Prime Minister Scott Morrison has declared that COVID-19 disaster payments will now be tax-free. For all of those who have submitted their tax returns before 1st August 2021, you may need to amend your returns or lose the tax you otherwise previously paid.

On Tuesday, the Treasury Laws Amendment (COVID-19 Economic Response No. 2) Bill 2021 was introduced into Parliament, confirming Prime Minister Scott Morrison’s comments that COVID-19 disaster payments would now be tax-free.

Previously, COVID-19 disaster payments were taxable income. However, after the announcement, they will now be treated as non-assessable non-exempt income. The Institute of Public Accountants general manager of technical policy, Tony Greco, said granting the $750 a week payment with a tax-free status would mean workers will take home more than they did under the original JobKeeper program.

Disaster payment recipients can expect to be better off by $90 a week compared with the JobKeeper wage subsidy, based on an annualised $39,000 income of $750 each week.

“The main concern is that these payments have always been stated as assessable, so now there’s confusion,” said Mr Greco. “It is a significant shift in treatment from what people have been told and what we have come to expect. According to Mr Morrison, more than $490 million in COVID-19 disaster payments have been paid to over 955,000 workers in NSW and Victoria.

The payments, which were increased on Wednesday from $600 to $750 a week for workers who lost more than 20 hours and raised from $450 from $375 for those who lost between eight and 20 hours, are expected to cost the federal government $750 million a week.

For those of you who have already lodged your returns and the COVID-19 disaster payment was included as taxable income, you might like to consider amending your returns and potentially getting some money back from the ATO.

Special Tax Return Offer

1300 88 38 30

$99 Returns - PAYG Only

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to returns@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address.

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

SuperStream for SMSF

ACCOUNTANT

By Warren Strybosch

SuperStream is the new standard for super transactions designed to improve the quality of data and improve processing efficiency for both employers and super funds. SuperStream servicea will collect contribution data from employers and distribute this data to SMSF software providers.

As part of this, all trustees of SMSFs must comply with a new data and e-commerce standard. Employers will be able to send superannuation contributions and data to multiple funds in one standard electronic format, instead of sending information to separate funds in multiple formats.

What is SuperStream?

SuperStream is a government reform designed to enhance the efficiency of the super system. Under SuperStream, employers are required to make super contributions, both data and payment, on behalf of their employees electronically. All super funds, including SMSFs, must receive contribution data and payments electronically in accordance with the SuperStream standard.

SuperStream Gateways will collect your contribution data from employers and distribute this data to your SMSF.

Go to ATO website to read more: https://www.ato.gov.au/super/superstream/

Australia Post will provide Simple Fund 360's SuperStream Gateway

BGL has partnered with Australia Post to provide SuperStream services. Registration can be done directly through Simple Fund 360 free of charge. Do not register directly through Australia Post as a cost will be incurred. All BGL clients must use Australia Post as their default gateway as Simple Fund 360 will not integrate with any other gateway provider. If you register with another gateway, you will not be able to use the SuperStream data in Simple Fund 360.

Where can I find the Electronic Service Address (ESA)?

The Electronic Service Address (ESA) is required by employers so that they can send contribution data to that address. Each SuperStream Gateway has a unique ESA.

The ESA is available in the Trustee/Employer Notification Letters which can be prepared after you or your accountant has registered the fund for SuperStream.

The ESA will also be saved under Fund | Fund Details.

Once registered, SMSF Trustees will need to provide the following information to their employer:

Self Managed Super Fund name, ABN, The Electronic Dervice Address (ESA), BSB and Account Number. An Employer Notification Letter can also be generated in Simple Fund 360.

Thankfully, the ATO has confirmed it will not take a hard-line enforcement approach to SMSFs that do not comply with the new SuperStream requirements set to be implemented on 1 October this year even though funds in this predicament will be considered to have committed a regulatory contravention.

When speaking to the SMSF Association, the ATO superannuation and employer obligations director, Belinda Black said: “Not complying [with the SuperStream requirements] is a breach of the payment standards and penalties may apply. However, like any new functionality and change, the ATO wants to support those impacted and therefore will allow a transition window for the industry to get up to speed and understand SuperStream.”

There are currently several SMSF software providers already compliant with SuperStream. For Trustees of SMSF, it is best to talk to your accountant regarding SuperStream to make sure they, more importantly, you as the Trustee, will be able to meet your obligations after the 1st of October 2021.

At Find Accountant, we provide SMSF tax advice. Our senior accountant is also an award-winning financial advisor. If you require SMSF advice or are considering whether or not to wind up your SMSF, then speak to Warren Strybosch at Find Accountant Pty Ltd.

Warren Strybosch

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

Importance of Budgets and Planning

BOOKKEEPER

By Neha Nayyar

Budgets and planning go hand in hand. It’s important for every business owner to have a budget to help them understand the direction they want their business to go in and come up with a plan on how to get there. Budgeting helps you understand your business's current financial status and will enable you to make more informed business decisions in the years to come.

Not sure where to begin? Here are our top tips to get you started:

1. Start somewhere - Whether this is your first or your fifth year setting a budget, every business needs to start somewhere. Budgets allow business owners the ability to hone in on cashflow, reduce expenses, and increase profitability. It’s helpful to have an accounting system that enables you to monitor your budget on a regular basis.

2. Use historical trends - Maybe you discover that you’re constantly in debt at the end of the year or that suppliers are constantly chasing you up for outstanding payments every month? Review your books from previous years to determine any trends in your spending or earnings.

This would help you identify the problem areas and allow you the opportunity to rewrite your spending future.

3. Get technical – Review your financials in a profit and loss format. The profit and loss statement lists your sales and expenses each month, quarter or year. To put it simply, a profit and loss report shows you the true profitably of your business. It can even help you determine an appropriate price for your goods and services.

4. Plan big picture - Where do you see your business in the next 1, 3, or 5 years? Imagine it, plan it, write it down and then break it down. Now that you’ve got your eye on the prize, the question is how do you get there?

Break your yearly goals down month by month. Tightening the budget down to months reduces the risk of overspending and over projecting profitability.

5. Use your Budget - Once you’ve setup a budget try it in your business. You can then run an analysis every quarter to see how it is tracking. This will help you quickly identify whether you are spending too much and need to cut costs or if you have a little extra wiggle room to work with. Until you have established a tried and true budget that works for your business, it’s good to review it often to avoid a surprise at the end of the year.

Need help reviewing or establishing your budget? We’re here to help. We at Sum and Substance work closely with businesses helping them set budgets and plan their financials for the year ahead. Please contact us if you’d like some assistance setting up a budget in your business. We can be reached at (03) 9424 9447 or info@sumsubstance. com.au. You can directly book in a time to chat by clicking here.

Neha Nayyar

Bookkeeper Sum and Subtance Bookkeeping and Training Services 0401 409 573