IsNeo Banksafe, Expert Answers?

www.finlaw.in

Is Neo Bank safe? Neo-bankaccountsarejustassecure forstoringmoneyastraditionalbank accounts.InIndia,allneo-banks operateintandemwithconventional banks.Thisindicatesthatclientfunds arekeptinareputablebank.

If you're unfamiliar with neobanking and digital accounts and are thinking of opening a digital savings account with one, you might be worried about the security of your money, your personal information, and other sensitive data. This is an entirely reasonable worry if all of your banking experience has been with conventional institutions. Neo bank license transforms the fintech scenario.

Safety and Securities of Neo Bank-

The Reserve Bank of India's (RBI) and government oversight, stringent rules, and traditional banks' physical presence all contributed to their favorable reputation and high level of client trust. But instances of internet fraud have brought to light some of the security and safety issues that exist even in conventional banks.

Neo-bank accounts are just as secure for storing money as traditional bank accounts. In India, all neo-banks operate in tandem with conventional banks. This indicates that client funds are kept in a reputable bank. In fact, through the Deposit Insurance and Credit Guarantee Corporation (DICGC) insurance, the RBI ensures client funds up to 5 lakhs if your account is a savings or current account with a traditional bank. The same rule also applies to customer accounts formed with neo-banks because a traditional bank provides the underlying account.

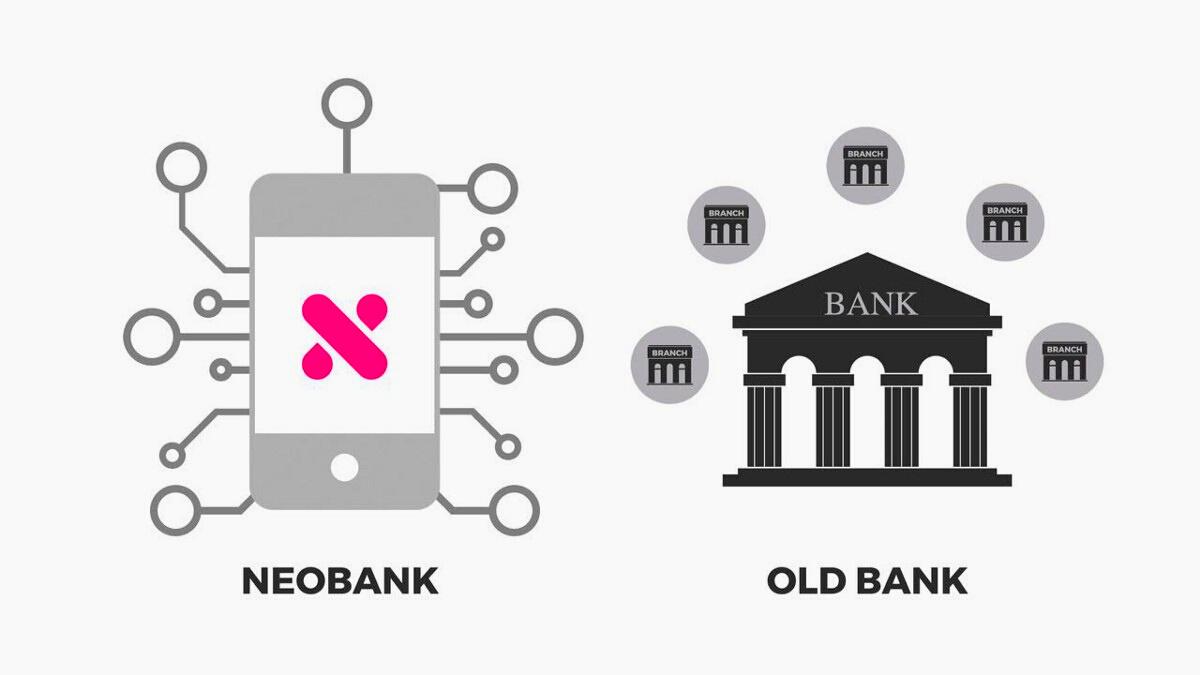

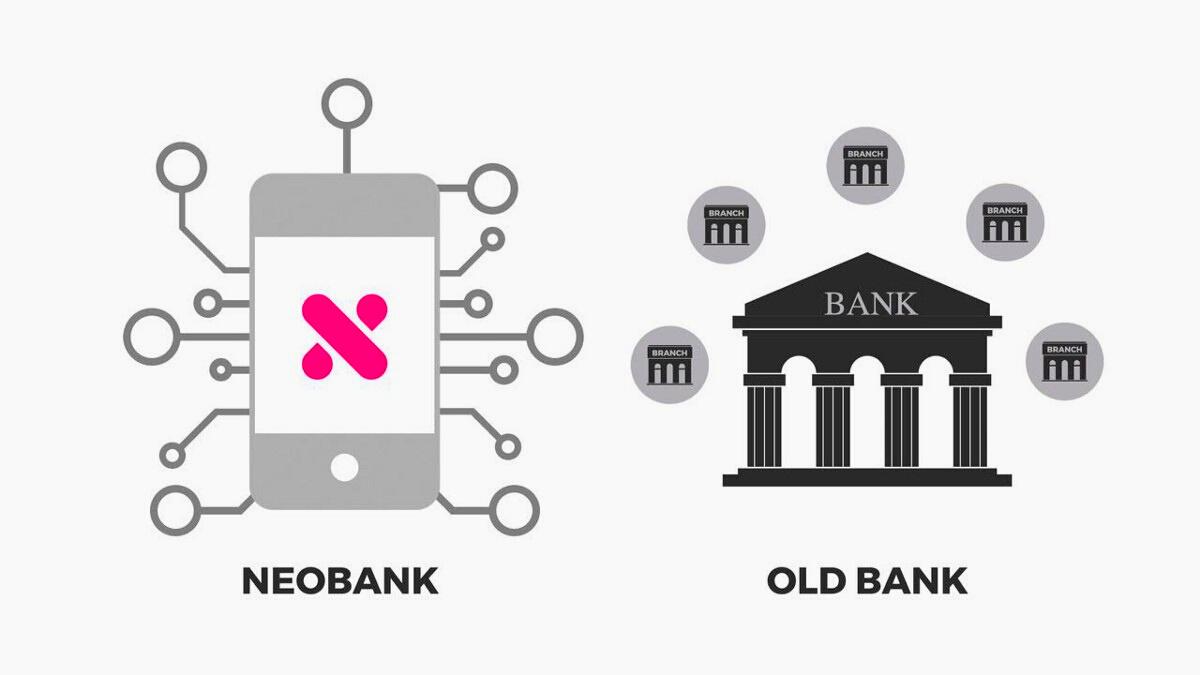

Since its inception, neo-banking has revolutionized the financial industry. Because it offers a 100 percent digital alternative to traditional banking, its branchless structure actually plays a significant role in its success. In India, neo banks collaborate with traditional banks to offer consumers a full range of digital banking services. Here are seven ways that it has improved business operations in the contactless payment age.

In contrast to traditional banks, neo banks are free of the encumbrance of legacy infrastructure. Customers on such platforms pay lower transaction processing fees in order to complete transactions or use any other features that are made available to them due to lower back-end maintenance costs.

Neobankingservicesincludeawide rangeoffeaturesthatarealldesigned tomakebankingasconvenientas possibleforplatformusers.Automated accounting,digitalpayroll management,e-invoicinguptothe filingofGSTreturns,andapreintegratedpaymentgatewaytosupport collectionandeaseofreconciliationfor multiplepaymentmethodsareall specialfeaturesthatbusinessescan takeadvantageofeffectivelyandareall availableinoneplace.

Merchants who work with neo-bank license have

access to their money every single day. Through the Internet, users can continuously monitor the status and specifics of all transactions made possible by the platform.

Contact Us 9820907711 / 1800-4198-402 www.finlaw.in admin@finlaw.in Thank You