Will Spry 0782 519 4608 renewablesstatistics@energysecurity.gov.uk

Key headlines

In Quarter 2 2024, total renewable generation increased by 19 per cent on last year to 32.8 TWh, largely due to more favourable weather conditions.

Predicted growth of +2% in 2025 led by a rebound in housing activity and underlying demand from major infrastructure projects.

Predicted growth of +3% in 2026 based on broader construction output recovery.

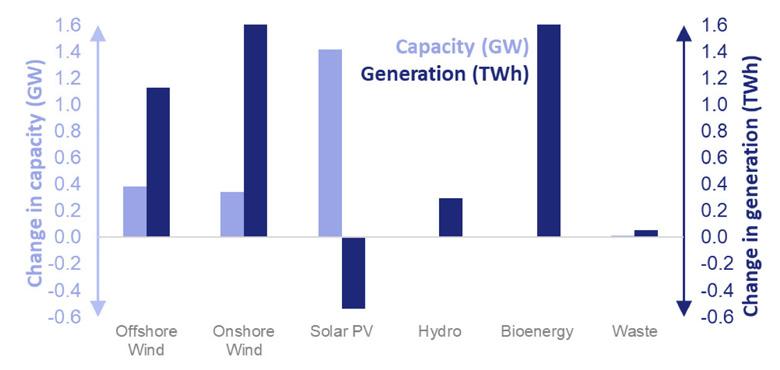

Onshore wind generation increased by 42 per cent to 7.3 TWh, the highest such figure for this time of year Offshore wind generation increased by 13 per cent to 9.7 TWh Generation was boosted by higher average wind speeds over the second quarter and onshore wind output had been affected by outages last year Hydro generation increased due to higher average rainfall, while solar PV generation decreased due to lower sun hours. Generation from bioenergy increased by 29 per cent, generation had been low last year due to outages at two major plants.

Since Quarter 2 2023 there was 2.1 GW of new renewable capacity, of which arounds two thirds was solar PV and one third was wind. This represents a 3.9 per cent increase over the last year.

In Quarter 2 2024, total renewable generation increased by 19% on last year to 32.8 TWh, largely due to more favourable weather conditions.

Since Quarter 2 2023 there was 2.1 GW of new renewable capacity, of which arounds two thirds was solar PV and one third was wind. This represents a 3.9% increase over the last year.

Renewables’ share of electricity generation was a record 51.6 per cent, breaking the current record of 51.1 per cent set in the previous quarter This was driven by lower demand for fossil fuel generation due to record levels of net imports; although renewable generation showed strong growth compared to the same quarter last year, it remained lower than the record levels observed during Quarter 4 2023 and Quarter 1 2024 (see Table 5.1). This is now the third consecutive quarter where renewables’ share has exceeded 50 per cent.

Chancellor Rachel Reeves presented the first Autumn Budget under the new Labour government, drawing mixed reactions from industry experts. UK farmers and Estate owners, essential to Britain’s economy and food supply, now encounter a unique set of challenges and opportunities likely to impact most farms and rural ownerships. Changes to inheritance tax legislation might prompt farming and estate families to undertake timely succession planning, which may have been previously overlooked.

As with any major policy shift, these adjustments will take time to fully materialise, allowing owners to prepare and adapt to evolving requirements. Despite immediate concerns that land values must be reduced to reflect a potentially depressed outlook on owning land, the reality is that quality will be key. As food security becomes more important, key commercial farmland areas are likely to become more popular. While they may not bring alternative uses, the value of food production with an ever-growing population and climate change will undoubtedly have implications.

Changes to Inheritance Tax: A significant announcement in this Budget is the limitation of Agricultural Property Relief (APR) and Business Property Relief (BPR). From April 2026, the traditional 100% APR and BPR will be capped at £1 million of farm and business assets. Assets above this threshold will receive only 50% relief, potentially burdening farmers inheriting larger estates. The new effective Inheritance Tax (IHT) rate of 20% on substantial agricultural assets could force farmers to sell parts of their land or assets to pay taxes, jeopardising family farms’ sustainability. This limit also applies to farming and business assets transferred into trust, significantly impacting the agricultural industry and potentially leading to more farm sales and restructuring. The age profile of property owners and their successors will influence decisions, making professional advice crucial before the tax changes take effect in April 2026. The potential increase in farmland supply could affect land values, though the extent remains uncertain.

Implementation of Carbon Tax: The fertiliser sector has warned of a severe impact if the government moves forward with plans to implement a hefty carbon tax on fertiliser from 1 January 2027. Industry sources suggest the tax would see fertiliser costs increase by a minimum of £50/t, affecting the entire agricultural sector and potentially leading to higher food prices.

Impact of Increased National Insurance (NI) Contributions: Employers’ NI contributions will increase to 15%. Additionally, the threshold at which businesses begin to pay this will be lowered, impacting labour-intensive farms and estates, such as those run by growers and those with diversification and increased labour requirements.

Farming Support Schemes: The government will be phasing out old farming support schemes, with the fastest subsidy reductions applying to the top 4% of recipients of delinked

payments. Farmers who received more than £100,000 in payments in 2020 will see their subsidies reduced, with payments capped at just £8,000 in 2025 and probably none for 2026 & 2027. This government approach aims to enable more farmers to access funding for sustainability and environmental initiatives. However the rapid reduction in support will disproportionately impact larger farms, which may rely heavily on these payments for their operations. Farmers will need to rethink their business models and practices to adapt to this new financial landscape with an increase in environmental schemes as one option.

The initial understanding of the proposed Budget changes looks severe to rural owners of property. That said the details of these headline changes, which are yet to be fully released by Treasury are still being scrutinised. Whilst we can all make assumptions, that detail will be key to owners’ plans and strategy. Time must be put aside for calm and careful consideration of the impacts and options to mitigate them.

For additional assistance, please reach out to a member of our rural or agribusiness teams to discuss how we can support your business.

Rebecca Ruck Keene 01234 827118

Farmers and landowners have faced numerous challenges recently, including changes to tax rules for holiday lets, the introduction of the Renters Rights Bill with its proposed abolition of Section 21 notices and rent review controls, and changes to compulsory purchase rules that allow acquiring authorities to disregard hope value.

Additionally, the Autumn Budget has brought announcements impacting IHT reliefs, Capital Gains Tax (CGT) rates, and increasing the NI burden for employers, along with other measures negatively affecting the rural community.

Despite these difficulties, there are some positive developments as we approach the end of 2024. These include the easing of planning rules for rural development, government support for renewable energy projects, opportunities for Biodiversity Net Gain, and confirmation that Agricultural Property Relief will extend to land in environmental schemes. With the right advice and planning, farmers and landowners, who are typically long-term custodians of property, should be able to navigate these challenges successfully.

David Kinnersley 01530 410806

2024 has certainly been a year of significant changes in agriculture and agricultural policy. The introduction of the Basic Payment Scheme (BPS) delinked payments this year meant that the usual BPS deadline pressure of the 15th May was absent, although the Countryside Stewardship (CS) scheme claims continued.

The Environmental Land Management (ELMs) programme saw the early termination of the 2022 Sustainable Farming Incentive (SFI), followed by the 2023 SFI, which then closed for new applications in June. Now, the 2024 Extended SFI is open with a wide range

of options. The SFI is set to replace the Mid-Tier scheme as these agreements conclude, with the Higher Tier announcement expected in early 2025.

Adverse weather conditions from last autumn persisted into the spring, complicating farming operations. The lack of sunlight has led to significantly lower crop yields compared to last year, and the wheat quality has suffered for the second consecutive year. Despite a drop in fertiliser and fuel prices, the financial outlook for 2024 harvest remains bleak, and the use of SFI options instead of break crops has been a topic of discussion.

Kate Mason 01244 567705

In light of the recent budget announcements, particularly the changes to Inheritance Tax, strategic future planning has never been more crucial. These changes present a prime opportunity to reassess the future and direction of farms and estates. With change comes opportunity, and reviewing your assets now can better position you to understand and seize these opportunities. Our Strategic Asset Consultancy team is here to help you evaluate your property performance, identify potential opportunities, and develop a strategic plan for the future of your property portfolio.

Tom Beeley 01858 411227

Ten months after the introduction of Biodiversity Net Gain (BNG) for planning applications across England, our natural capital experts have observed a growth in BNG and habitat offsetting activities.

For developers, BNG introduces additional complexity, necessitating early consideration in the development process to prevent delays and extra costs. However, approaches among Local Planning Authorities (LPAs) remain inconsistent, posing particular challenges for smaller sites.

For those exploring habitat offsetting, the supply of units is rising. Yet, the number of fully registered units remains limited, with provisions varying across planning authorities. Increased clarity around costs and delivery mechanisms is enhancing transparency.

Conservation Covenants and diverse business models offer alternative

market routes tailored to specific circumstances. Understanding unit demand in terms of volume and habitat types is crucial, and economies of scale are vital for competitive pricing.

Our team is currently assisting several clients in navigating the BNG process, leveraging our market knowledge to provide independent, expert advice on habitat offsetting and support in acquiring habitat units.

This year, the supply of land and farms has increased by about 20% compared to 2023, with significant regional variations. Supply is up in the East Midlands and South West but down in the North East and West Midlands. A restricted marketing window led to a frantic marketplace, with pastureland values rising 5-10% and arable land values growing more slowly. Highquality, well-managed holdings in accessible locations are attracting the most interest and highest values. Private transactions vary by region, with significant premiums achieved through genuine private marketing campaigns.

Our advice is to focus on current facts, seek early professional advice, and prepare for discussions with family and business partners. Inheritance tax changes (APR and BPR) will take effect in April 2026, allowing time to consider options and tax implications. Our short-term forecast for farmland values remains firm, and we will review the Budget’s impact on longterm values. If you’re considering a sale or want to learn more about the farmland market, please get in touch.

Sarah DeRenzy-Tomson 01530 566578

At the end of September 2024, the consultation period for the draft National Planning Policy Framework (NPPF) document concluded. Reports indicate that many thousands of consultation responses were submitted, which was anticipated given the significant proposed changes. Consequently, the publication of the revised NPPF might be delayed from scheduled publication in December until the New Year as the Government reviews the feedback.

The draft NPPF proposed several major changes including the reintroduction of mandatory housing targets and a new method for calculating housing requirements, which would result in most authorities needing to deliver more housing than under the current system. Additionally, changes to Green Belt policy were suggested, requiring authorities to review and potentially release poor quality ‘grey belt’ land from the Green Belt through both plan-making and decision-making to meet local development needs.

‘Grey belt’ refers to previously developed land and other areas within the Green Belt that contribute minimally to its function and purpose. Any release of Green Belt land will adhere to sustainable development principles and the newly introduced ‘golden rules,’ which aim to ensure public benefit from such developments, including a target of at least 50% affordable housing. It remains to be seen whether the consultation responses will lead to further amendments and clarifications in the final NPPF, making it a topic to watch closely.

William Gagie 01530 410859

From April 1, 2025, the aggregates levy will rise from £2.03 per tonne to £2.08 per tonne. Additionally, landfill tax rates will increase: the lower rate, mainly inert material, will go from £3.30 per tonne to £4.05 per tonne, and the standard rate (active or hazardous waste) will jump from £103.70 per tonne to £126.15 per tonne.

These tax hikes may lead to an increase in fly-tipping incidents as disposal costs rise. On a positive note, the construction sector is expected to benefit from increased capital spending on hospitals, roads, schools, and other infrastructure projects. However, there is concern about potential delays in the commencement of these projects, which could impact the sector’s growth.

Darren Edwards 01858 411 236

Labour’s recent return to power has led to swift and significant changes in the Green Energy and Sustainability sector. Shortly after taking office, the new Energy Minister, Ed Miliband, lifted the de facto ban on onshore wind developments in England in July. He also committed to doubling onshore wind capacity by 2030, re-opening the market and creating new opportunities for landowners. Additionally, he approved major new solar farms, adding over 1.35GW of new generation in Lincolnshire (Gate Burton Energy Park), Lincolnshire/ Rutland (Mallard Pass Solar Farm) and Suffolk/Cambridgeshire (Sunnica Energy Farm). These actions signal the new government’s strong commitment to the sector, further reinforced by positive announcements in the Autumn Budget.

With the new Labour government’s ambitious housing targets, the UK faces a significant challenge in meeting the need for construction aggregates. The gap between the extraction of construction aggregates and the replenishment of these resources through new mineral planning permissions has been widening for years. We caught up with Partner and mineral expert, Tom Giddings, to learn more about how this discrepancy poses a critical threat to the sustainability of the UK’s construction industry and its ability to meet future housing demands.

The government’s commitment to boosting housebuilding is commendable, but it must be supported by a sustainable supply of construction materials. Without addressing the gap between mineral use and replenishment, the country’s ability to meet its housing targets could be severely compromised.

According to the Mineral Products Association (MPA), the UK has been consuming construction aggregates at a rate that far exceeds the approval of new planning consents for quarrying. For every 100 tonnes of sand and gravel used, only 61 tonnes of new permissions have been granted. The situation is even more dire for crushed rock, with only 33 tonnes of new material consented for every 100 tonnes consumed. This trend has led to a steady decline in the UK’s total permitted mineral reserves, which has been ongoing for over a decade.

The MPA’s latest Annual Mineral Planning Survey highlights the urgency of this

issue, warning that the future supply of essential construction materials is “approaching a cliff edge”. The survey reveals that the rate of consumption, driven primarily by construction output, has not been matched by the rate of approval for new quarrying permissions. This imbalance is attributed to a “broken” mineral planning system that is often delayed and can prioritise local interests over national needs.

The Labour government’s recent announcement to increase housing targets aims to address the acute housing crisis by delivering 1.5 million new homes. This ambitious plan includes mandatory targets for councils and a review of the greenbelt to identify “grey belt” land that can be developed to meet local housing demands. However, this initiative places additional pressure on the already strained supply of construction aggregates.

Despite the challenges, there is a significant opportunity for securing future mineral resources. By integrating more of our clients’ land into county mineral plans, we can help ensure a steady supply of construction aggregates. This proactive approach will not only support the government’s housing ambitions but also contribute to the long-term sustainability and security of the construction industry.

We are well-placed to assist in this endeavour. Our expertise in navigating the complexities of mineral planning and our commitment to securing future resources make us a valuable partner for clients looking to contribute to the UK’s construction needs. By working together, we can help bridge the gap between permitted mineral reserves and the nation’s housing goals, ensuring a stable and sustainable future for all.