59 minute read

News

Seaspiracy row: seafood industry hits back at Netfl ix documentary’s claims

The fi shing and aquaculture industries, scientists and environmental activists have clashed over a controversial documentary that questions whether the seafood industry can ever be called ‘sustainable’

IN the Netfl ix documentary Seaspiracy, fi lm-maker Ali Tabrizi examines the seafood sector’s claims to sustainability and argues that it is fundamentally unsustainable and unethical.

Starting with an examination of the impact of throwaway plastic on sea life, Tabrizi quickly moves on to mount a wide-ranging critique of the fi shing industry, from illegal large-scale trawling and modern slavery on board ship to “dolphin safe” tuna fi shing and discarded nets contributing to seaborne pollution. He concludes that the only way to protect the oceans is to abandon eating seafood altogether.

Seaspiracy also examines the aquaculture industry as an alternative to wild fi shing, and concludes that fi sh farming itself is highly problematic in terms of sustainability and fi sh welfare, citing some high profi le critics of the salmon farming sector by way of evidence. The fi lm-makers also quote anti-farming activist Don Staniford’s assertion that farmed salmon would be grey if an artifi cial dye was not added to their feed.

Among the specifi c criticisms of aquaculture are, fi rst, that it represents “wild fi shing in disguise” because more bait fi sh are caught for fi sh feed than the amount of farmed fi sh produced, and also that the level of mortalities is unacceptably high and fi sh are kept in cramped, unsanitary conditions.

Dr Iain Berrill of the Scottish Salmon Producers Organisation (SSPO) said: “While this fi lm raises some very important issues, the claims made against salmon farming in Scotland are wrong, misleading and inaccurate. As a result, this part of the documentary was simply privileged activism masquerading as investigatory fi lm-making.”

“To take just a few of these exaggerated and emotive claims - salmon farming is not responsible for degrading wild fi sh stocks for use in feed, lice on our fi sh are not out of control and claims equating organic waste from salmon farms to human waste are misleading and have been repeatedly debunked. Farmed Scottish salmon swim and shoal freely in high-quality, cool seawater that is constantly being refreshed by tides and currents.

“Aquaculture is a key part of the answer, not the problem, with regards to concerns over wild fi sh stocks. The United Nations has recognised this fact which is why it supports fi sh farming as crucial to feeding the world’s growing population, now and in the future.”

The fi lm claims that 50% per cent of salmon are dying “from egg to plate and from hatch to catch” and showed graphic images of dead fi sh in bins.

In fact, Dr Berrill says, the mortality rate for Scottish salmon in 2020 was 14.5%. He commented: “The salmon farming sector is unique in UK farming for openly publishing monthly data detailing mortality rates and other health challenges. When fi sh unfortunately do die they are kept in appropriate containers, prior to disposal in full adherence with regulations.

“A single female salmon can produce 10,000 eggs on the very basis that the vast majority will not survive even the earliest stages – and up to 95% of salmon that do make it to sea might not survive long enough to breed. Our farmers have achieved a remarkable survival rate, but of course they’re always investing and innovating in fi sh health and welfare to increase that survivability.”

On salmon colour, the SSPO points out that the feed provided to farmed fi sh contains astaxanthin, a carotenoid naturally found in algae and throughout the ocean food chain. This is the substance that gives farmed and wild salmon – and pink fl amingos – their distinctive colouring. As an antioxidant, it is benefi cial to the immune system for humans as well as fi sh.

The Marine Stewardship Council (MSC), which campaigns for sustainable fi shing and certifi es fi shing operators with the “blue tick” symbol, also disputed the fi lm’s allegation that certifi cation is obtained simply by paying for it.

The MSC said: “Contrary to what the fi lm-makers say, certifi cation is not an easy process, and some fi sheries spend many years improving their practices in order to reach our standard. In fact, our analysis shows that the vast majority of fi sheries that carry out pre-assessments against our criteria, do not meet these and need to make signifi cant improvements to gain certifi cation.”

The MSC pointed out that, contrary to what was stated in the fi lm, it is funded by charitable donations and by retailers and others licensing the “blue tick”, not by the fi shing operators themselves who are audited by independent third parties, not directly by the MSC.

New support vessel for Organic Sea Harvest

DAMEN Shipyards Group has delivered the fi rst of a new generation of aquaculture support vessels to independent Scottish farmer Organic Sea Harvest. The Landing Utility Vessel (LUV) 1908 has more deck space, higher freeboard and a larger crane than earlier models in the series.

Like Damen’s previous LUV vessels, the 1908 features a bow ramp giving it RO-RO (roll on-roll off) capability anywhere. Its tasks will include transportation of people, equipment, feed and other dry cargo to offshore fi sh-farming locations with loading and unloading taking place either by RO-RO direct to the shore or by using the deck crane. On-site, the vessel can also be used to support activities of all kinds including pen maintenance and net cleaning.

The LUV 1908 is 19 metres in length and 7.5 metres across. In total, the vessel can carry 40 tonnes of cargo and also has day accommodation for up to eight people.

The new vessel was built with Damen’s support at Coastal Workboats Scotland in the UK, and will serve Organic Sea Harvest’s farms on Skye.

Above: Damen’s Landing Utility Vessel 1908

More support for Northern Irish aquaculture

Above: Edwin Poots

NORTHERN Ireland’s aquaculture sector is to receive a further fi nancial support package of up to £325,000 to help mitigate the impact of the Covid-19 pandemic.

Fisheries Minister Edwin Poots MLA announced the package, which brings the total amount of funding provided by the Department for the sector to £685,000.

Funding will be in the form of a grant payment, covering the four month period from 1 September to 31 December 2020 and will be based on a percentage of the income lost from the sales of aquaculture products due to Covid-19, using average income over the past three years as a baseline.

The Scheme will be delivered under the European Maritime and Fisheries Fund 2014-20, co-funded by the NI Executive and the European Union.

There are approximately 28 active aquaculture producers in Northern Ireland, and the sector, worth around £11m annually, employs around 130 people.

Aqua-Life Aqua-Life Aqua-Life

PRODUCTS

Bespoke delousing vessel puts fish welfare first

A new multi-purpose service vessel has been delivered to Scottish Sea Farms, and the company says it has been designed with fi sh welfare as its top priority. The Kallista Helen, launched in Glasgow in March, will be fi tted with a state of the art thermolicer system.

The 26-metre vessel was built by Ferguson Marine, based in Port Glasgow and designed by Macduff Ship Design in partnership with Inverlussa and Scottish Sea Farms. The Kallista Helen is on long-term lease to Scottish Sea Farms from Mull-based Inverlussa Marine Services and will be used for lice treatment among other functions, allowing earlier intervention.

Ben Wilson, Managing Director of Inverlussa, said the Kallista Helen, named after his niece, was built with fi sh health and welfare front of mind: “From the outset, Scottish Sea Farms was looking to minimise fi sh handling and maximise fi sh welfare, designing the boat around those. The result is so much better when you start with the fi sh then consider the boat, rather than the other way round.”

The Thermolicer itself was designed and engineered by ScaleAQ in Norway in partnership with ScaleAQ UK. It features a simpler, straighter pipe layout creating a gentler experience for the fi sh; a wider than standard pipe of 600mm diameter to ensure a smoother journey through the system; increased capacity of up to 120 tonnes per hour; and a 150-micron fi ltration to separate and collect the dislodged sea lice for removal.

The Kallista Helen is expected to arrive in Shetland in early May.

Left: Ferguson’s Kallista Helen

Mowi brand lands on Sainsbury’s shelves

THE Mowi consumer salmon brand has moved into the UK retail sector for the fi rst time – and with Scottish fi sh. The world’s largest salmon farmer has started selling three products through Sainsbury’s which owns 600 supermarkets and 800 convenience stores.

The products are Smoked Scottish Salmon Slices (rsp – retail sale price – £5/100g), piri piri-fl avoured Slow Roast Salmon Fillets (rsp £5/180g) and Scottish Salmon Fillets (rsp £4.50/230g).

Mowi said the move brings a new dimension to the fresh salmon chillers in UK supermarkets offering “delicious product range that has been described as stand-out”.

James Cowan, Head of Sales for Mowi Consumer Products said: “We are investing in Mowi to play a dynamic role, inspiring new consumers to eat salmon on new occasions and to inform consumers that not all salmon are equal.

“Mowi salmon is high in Omega-3, and fresher than fresh for taste. Retailers who support the Mowi brand will inevitably benefi t from a halo of the brand driving traffi c to stores.”

SSPO calls for urgent reform of export red tape

SCOTLAND’S salmon farmers are spending £200,000 each month on extra paperwork following the end of the Brexit transition period. So says the Scottish Salmon Producers Association which is calling for urgent reform of the export health certifi cates regime to cut down on red tape.

Tavish Scott, Chief Executive of the Scottish Salmon Producers Organisation (SSPO), said there was an urgent need for the Export Health Certifi cate (EHC) to be redesigned.

Scottish salmon producers have had to cope with signifi cant delays since the transition period ended on January 1 and the full effect of Brexit came into force.

The SSPO said that despite improvements since January when it was taking many hours – and sometimes days – to process orders of seafood for the continent, orders are still being held up because of the bureaucracy of the extra paperwork.

It now takes about two hours for each seafood load to be processed and given an export health certifi cate for transport to the EU and, in some case, this process is taking four hours or longer.

These delays mean salmon is not arriving in France on time, leading to lost orders, discounted sales and disgruntled customers, the industry says.

One of the biggest problems with the certifi cate, according to the SSPO, is that numerous boxes have to be crossed out by certifying offi cers, scoring out all products which the supplier is not exporting to the EU. This often leads to confusion and mistakes, causing delays both in the UK and at the EU border posts.

Tavish Scott has asked the UK Government to look into this issue as a matter of urgency and he raised the issue personally with Michael Gove, the UK Government’s Brexit Cabinet minister, on a recent call.

Scott said he had received a verbal assurance from Gove that the UK Government would look to redesign, redraw and simplify the export certifi cate, which can run to dozens of pages for each order.

ANIMAL welfare organisation RSPCA “Following a thorough investigation, Assured has reinstated certifi cation for the which included visits to the farms by fi ve leading Scottish salmon farms whose specially trained staff and a detailed review practices were criticised in a report from of the footage, we were unable to fi nd Compassion in World Farming (CIWF). any evidence to support the allegations

The reinstatement follows special made. As such, we have today lifted their inspections by RSPCA Assured. CIWF’s suspension from RSPCA Assured. report Underwater Cages, Parasites & Dead “Any complaints of poor welfare, Fish, published in March this year, alleged or breaches of the RSPCA Assured

poor welfare practices on the part of Above: One of CIWF’s grim images membership agreement, are not tolerated

Scotland’s biggest salmon farmers and was accompanied by and we always take them very seriously. We would always urge graphic images of dead or injured fi sh obtained by activists working anyone with any concerns about an animal to contact us straight with CIWF. away, without delay. This is so that we can immediately investigate,

Farms belonging to Mowi, Scottish Sea Farms, The Scottish visit the farm and address any welfare issues as a priority.” Salmon Company, Cooke Aquaculture Scotland and Grieg Seafood Tavish Scott, Chief Executive of the Scottish Salmon Producers Shetland were criticised in the report. On behalf of the industry, Organisation (SSPO) said: “Each of the Scottish salmon farms the Scottish Salmon Producers Organisation described the subjected to unfounded allegations of welfare breaches by the allegations as groundless and said it would welcome unannounced campaigning group CIWF have been thoroughly investigated and inspections to prove that standards at Scottish farms are high. given unequivocal bills of clean health. All sites were physically

Following the publication of the CIWF report, RSPCA Assured visited and inspected by RSPCA Assured auditors, in addition to suspended its certifi cation for the farms concerned and instituted extensive reviews of the information initially received. No evidence a programme of additional inspections. The organisation has now was found to support the claims made by anti-fi sh farm activists reinstated certifi cation for all the farms concerned. and RSPCA Assured certifi cation for the sites has been reinstated

In a statement, RSPCA Assured said: “We were really shocked with immediate effect.” and upset by some of this footage taken last year, especially as Scott added: “Our farmers maintain exemplary standards of fi sh some of the farms were reported to be RSPCA Assured certifi ed. health and welfare which is why we were adamant that there was We immediately launched an investigation, as soon as we received no substance to any of these distorted and exaggerated claims. details of the farms on 23 March 2021, and suspended those sites We respect the role that RSCPA Assured plays in keeping our in the video that were members of RSPCA Assured, pending standards high with their unannounced inspections, with auditors investigation. welcome on any farm, at any time.”

Grieg values Shetland assets at £125m

GRIEG Seafood has placed a total net asset value on its ‘for sale’ Shetland business at 1,481 million kroner – or £125m.

The fi gure is published in the company’s 2020 annual report. Grieg said it still intends to sell the operation and expects to complete the process this year, although it did not disclose whether it was currently in meaningful negotiations.

The biological assets are valued at NOK 449.8m (£38m) and the property and plant at almost NOK 720m (£61m). Intangible and deferred tax assets etc make up most of the remainder.

It has appointed DNB Markets and Nordea Markets to advise on a “potential divestment of the Shetland assets”, which are no longer shown as part of the group’s main accounts. The future focus will now be on its fi sh farming operations in Norway and Canada.

Grieg Seafood Shetland harvested 15,705 tonnes last year, against 11,273 tonnes in 2019. The Shetland operation made a net loss (for the period from discontinued operations in 2020) of NOK 231.5m (£19.5m) compared to a profi t of NOK 18.9m (£1.6m) in 2019.

Logistics

Logistics

JDOT LOGISTICS

- Established in 2019 by O’Toole Transport and John Driege Sarl

- Operating from a 20,000 ft chilled facility in Bellshill, Scotland

- 6 Strategically located depots in Europe serving all major seafood platforms

- 200 Refrigerated Trailers with Live temperature tracking

- Operating daily services between Scotland and Boulogne France

JDOT LOGISTICS O’Toole Transport are proud to be supporting Scottish Seafood producers and suppliers with export transport and customs services. - Established in 2019 by O’Toole Transport and John Driege Sarl We offer daily groupage or full load services to France and beyond, with Export Health Certificates and customs paperwork carried out - Operating from a 20,000 ft chilled facility in Bellshill, Scotland at our hub in Bellshill. - 6 Strategically located depots in Europe serving all major seafood platforms A family business established in 1996 which has grown with over 100 vehicles and 200 trailers whilst retaining our core values of honesty, - 200 Refrigerated Trailers with Live temperature tracking punctuality, reliability, flexibility and a continuous desire to improve. - Operating daily services between Scotland and Boulogne France If you would like to find out how we can add value to your business please get in touch.

AquaLeap shortlisted in Knowledge Exchange Awards

Above: The AquaLeap team at the Roslin Institute (2019) A collaborative project between genetics experts and the fi sh farming industry has been shortlisted for the sixth Scottish Knowledge Exchange Awards.

The Aquaculture Genetics Alliance brought together the University of Edinburgh’s Roslin Institute, University of Stirling, Hendrix Genetics, and the Centre for Environment, Fisheries and Aquaculture Science to fi nd key genetic markers for disease resistance, to identify and breed salmon with resistance to viral disease, and to tackle other diseases of salmon and aquaculture species. Set up in February 2019, the £1.7m AquaLeap initiative focuses on four key species that have substantial economic and environmental importance for the UK - the European lobster, European fl at oyster, lumpfi sh and Atlantic salmon. Researchers have been working closely with industry partners to identify sustainable solutions to current challenges facing aquaculture production, including signifi cant diseases.

The Scottish Knowledge Exchange Awards recognise the benefi ts of collaboration between businesses and academics in Scotland. The programme is organised by Interface, which connects businesses from all sectors with Scotland’s universities, research institutes and colleges.

All the winners will be announced online at the Scottish Knowledge Exchange Awards Ceremony which takes place on 21 April.

Stephen Divers takes up non-exec role at Gael Force

STEPHEN Divers is set to move complete the shareholding as part into a non-executive director of the acquisition deal. That position on the board of option to complete has now aquaculture technology and been exercised. services group Gael Force, Divers will retire from as he prepares to retire day-to-day management at from his management role Gael Force Fusion in April, at the company at the end maintaining his directorship of June. at Group board level before

Divers is stepping down moving into a non-execu-

from his role as Group Ex- Above: Stephen Divers tive Group Director role

port Director. An industry at the end of June. veteran, he played a major role in build- Gael Force Group’s founder and maning fi sh farm pen manufacturer, Fusion aging director, Stewart Graham, said: Marine – now known as Gael Force “We are delighted to be able to secure Fusion – for almost three decades, Stephen’s continued contribution to alongside former colleague and direc- the Group. His knowledge and expetor Iain Forbes who retired in 2020. rience built up over 30years has been

Gael Force Group acquired a 75% a huge contribution to aquaculture in majority shareholding in Fusion Marine Scotland and to the Gael Force Group in 2018 with planned options in place to as it is today.”

Shellfi sh industry threatens legal action over Brexit

BRITAIN’S shellfi sh producers are threatening legal action against the Westminster government, claiming they have been misled over post-Brexit arrangements with the EU.

The shellfi sh industry, which includes aquaculture and fi sheries businesses, has suffered more than most other seafood sectors since the transition period ended on 31 December because live mussels, cockles, oysters and other molluscs are no longer allowed to enter the EU unless they are from waters with the highest purity rating.

A solicitor representing 20 shellfi sh fi rms told The Guardian newspaper that the government had shown “negligence and maladministration” and that a group action was being considered for compensation.

Separately, an exporter of mussels sent a legal letter to the Secretary of State, George Eustice, saying the fi rm will sue for “substantial damages” if the shellfi sh market with the EU is not opened up by September, the paper reported.

George Eustice, offi cials and other ministers have claimed the bloc originally planned to let this trade resume after Brexit and that it altered its position earlier this year. Brussels has consistently denied the British government’s claims and said the rules for third countries such as the UK are clear and longstanding.

Andrew Oliver, a partner at Humber-based Andrew Jackson LLP, said he was representing 20 shellfi sh fi rms considering possible legal action against the Department for the Environment, Food and Rural Affairs: “We are taking a leading counsel’s opinion as to the government’s actions in regard to the EU trade agreement and the assurances given by the government... we feel that there has been negligence and maladministration regarding the government’s negotiations on the agreement and its treatment of our clients.”

EIGHT students from across the UK and France will be the fi rst to receive CPD qualifi cations in Aquaculture Management after completing the NAFC Marine Centre UHI’s new Aquaculture Management CPD course.

The fully online continuous professional development course, launched in 2020, is aimed at experienced aquaculture staff and other persons seeking a qualifi cation in aquaculture management. The fi rst students to complete the programme were based in Scotland, England and France and included staff working in salmon farming and marine hatcheries as well as private individuals.

“All of the students have worked extremely hard over the past year and all passed to an excellent standard,” said Stuart Fitzsimmons, NAFC’s section leader for aquaculture training. “While the COVID epidemic has posed signifi cant challenges for both our students and our staff, the fact that this course was designed to be fully online meant that its delivery was largely unaffected. Online delivery has also allowed students from a wide geographical area to complete the training at times that suited them and without having to leave their homes or jobs.”

NAFC said the Aquaculture Management CPD has been designed to be relevant to a wide range of different types of aquaculture anywhere in the world, including marine and freshwater species, as well as hatchery and offshore facilities.

Left: The NAFC

Anne Anderson joins Scottish Sea Farms

SCOTTISH Sea Farms Director Jim Gallagher has announced the ap- said: “The time feels pointment of a new, right to bring in our dedicated Head of very own sustainaSustainability & De- bility champion to velopment to spear- coordinate the many head the company’s worthwhile activities drive to minimise its already underway,

environmental im- Above: Anne Anderson identify where else

pact and maximise we could be making a its social and economic value to real and positive difference, and Scotland. accelerate the collective results.

Anne Anderson, former “Anne has worked tirelessly Chief Offi cer of Compliance & over recent years to introduce Beyond at the Scottish Envi- a sector-wide sustainability ronment Protection Agency charter and establish the need (SEPA) and most recently for a fi t for purpose regulatory Sustainability Director at the regime, making her our go-to Scottish Salmon Producers candidate for this strategic new Organisation (SSPO), took up role. I’m hugely excited to see the newly created role on 29 what we deliver together.” March. Commenting on the move,

Sustainable development will Anderson said: “After two nonbe a key focus, with Anderson stop years at the SSPO, during working to evaluate, enhance which I achieved what I set out and advance the company’s to do – namely, help the sector social, economic and environ- identify what would be required mental contribution, helping for it to develop and grow lay solid foundations for further sustainably – I’m ready to roll growth. up my sleeves and help deliver

Scottish Sea Farms’ Managing those advances.”

Netwax E4 Greenline

Netwax E4 Greenline offers excellent protection against fouling on pen nets

► Powerful waterbased antifouling that offers excellent protection against fouling ► Protects against UV radiation ► Keeps nets soft and pliable ► Controlled leaking of the active ingredient, which is approved by Ecocert (Institute for Marketechology) and listed by OMRI (Organic Materials Review Institute)

Slalåmveien 1, NO-1410 Kolbotn, Norway Ph.: +47 66 80 82 15 - post@netkem.no

NEWS...

$10k Aquaculture scholarship aimed at women

Above: Alf-Gøran Knutsen: making two scholarships available for women in aquaculture

ONE of Norway’s internationally lesser known, but highly progressive salmon companies is about to begin accepting applications for its second annual Women In Aquaculture Scholarship.

Kvarøy Arctic, based on a postcard-pretty island near the Arctic Circle, started the scholarship programme last year because it recognises that it can be quite diffi cult for women to break into farm level aquaculture operations around the world.

The company is renowned for innovation, managing to double the omega-3 content over other farmed salmon, an achievement which has been certifi ed by the American Heart Association’s Heart-Check programme. It also uses no antibiotics or chemicals in its production cycle.

Kvarøy CEO Alf-Gøran Knutsen, said: “The pandemic delayed our plans for last year’s recipients to join us on the farm but not our dedication to supporting them in their career development and to continuing this program.”

The scholarship is hosted in partnership with SAGE with (Seafood and Gender Equality), a non-profi t initiative founded by former Fair Trade USA director Julie Kuchepatov with a mission to build a more equitable, diverse, and inclusive seafood industry and sustainable seafood movement.

Two scholarships are available this year with one dedicated to an applicant from any country globally and a second designated for applicants from countries in Africa.

The recipients will each be awarded a US $10,000 scholarship and a paid, one-month summer internship on the Kvarøy Arctic farm site in Norway. Recipients are welcomed to continue their internship each year they are in school, and will be considered for employment upon graduation.

According to a UN study, it is expected that by 2050, “half of the world’s population growth will occur in Africa.”

“Aquaculture is a burgeoning industry in this part of the world,” says Kvarøy Arctic Strategic Development Offi cer Jennifer Bushman.

“It’s within the Kvarøy Arctic value system to take a collaborative approach to advancing aquaculture and we’ve chosen to dedicate one of our scholarships to African women who are permanent residents on the continent and who are committed to supporting that region’s development in one of the most effi cient and nutritious animal protein sources available.”

The inaugural programme hosted with the James Beard Foundation received a swell of applications motivating Kvarøy Arctic to go beyond its plan to award one scholarship.

The result was Kvarøy Arctic awarding scholarships to three women in 2020, from Tunisia, South Africa, and the United States.

Applications and a full list of qualifying criteria will be available via the Kvarøy Arctic website (KvaroyArctic.com) from April 13, 2021.

Nordic Halibut in U-turn over share issue

NORDIC Halibut sprung a big surprise last month by announcing that it was cancelling plans to list on Oslo’s Euronext Growth – less than a week after unveiling the proposal.

The Norwegian halibut farmer told investors and the Exchange that the planned issue would not go ahead because of “unfavourable conditions”.

Nordic Halibut CEO Edvard Henden said: “I am of course disappointed that we have not received the right signals from the market, but see that the infl ux of new companies on Euronext Growth has created a situation that does not allow us to list this spring.”

The company had hoped to raise up to 270 million kroner (£23m), saying the net proceeds from the transaction would have been used, subject to availability of debt fi nancing, to fund the company’s growth plan.

This includes a new land-based facility for broodstock, juvenile and on-growth, the expansion of its sea operations at Edie and the establishment of VAP (value-added production) capabilities, as well as for general corporate purposes.

Despite the cancellation, the company said it will continue to develop its farming activity, including a new fry and hatchery and further processing locally on Averøy in Møre og Romsdal.

Henden added: “These plans are fi xed. We have a unique breeding programme, space and opportunity to produce halibut in a much larger volume than we do today to be able to deliver what the market demands at any time.”

Founded in 1995, Nordic Halibut is a prime mover in the growing halibut farming industry with licences to produce 4,500 tonnes a year.

Severinsen joins Sensor Globe team

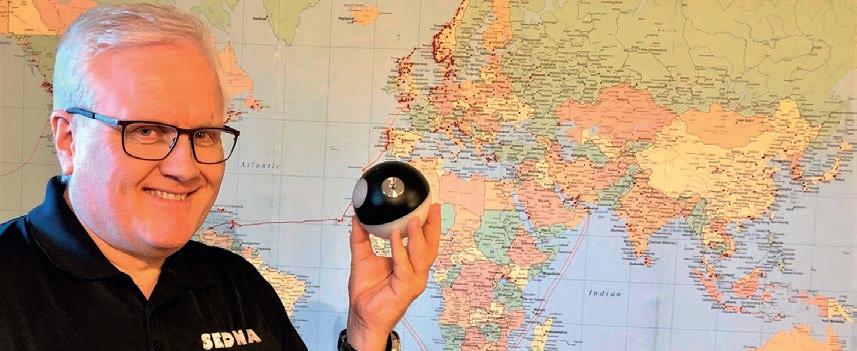

Above: Trond Severinsen A former AKVA Group executive has teamed up with Canadian firm Sedna Technologies to promote and develop an innovative water monitoring device for the aquaculture sector.

Trond Severinsen – formerly Senior Vice President, Technology & Development with AKVA – will, as Sedna’s Norwegian partner, lead the commercialisation of Sedna’s Sensor Globe, a wireless multi-functional sensor the size of a small grapefruit.

Sensor Globe enables aquaculture operators to monitor real time data through an app on a smartphone, tablet or via the Internet, or alternatively to log data autonomously over a period of time.

The device was originally designed, by founders Sheamus MacDonald and Aleksandr Stabenow, to monitor water quality and animal welfare for the live lobster fishing industry on Canada’s East Coast. Its internal ballast is adjustable, so that it can float like a small iceberg, sink or operate with neutral buoyancy. It measures only 95mm diameter, weighs 325 grams and is designed to “flow-with-the-fish” through pipes, hoses, fish pumps, lice treatment and other machinery. This means it will be able to measure both water quality and physical impact on the fish (acceleration and shock).

Trond Severinsen said: “I am very excited to work with such young and talented entrepreneurs in Canada, to offer my lifelong experience in the aquaculture technology industry and together grow the company, work on R&D, and set up a global sales and service network.”

Conditional approval for oil rig farm plan

A plan to convert a conventional offshore drilling platform into a fish farm has been given conditional approval by Norway’s Ministry of Trade and Industry.

The project – known as the Octopus Concept – is the brainchild of Stavanger-based offshore services company Roxel Aqua and involves a modified jack-up rig fitted with between 12 to 14 cages for breeding salmon and trout.

The cages encircle the rig and can be pulled down below the sea surface using specially designed winches.

The Directorate of Fisheries had originally rejected the application. Roxel Aqua now has until September to fulfil the new conditions in the ministry’s decision. If they fail to do so, the Fisheries Directorate will assess whether the application fulfils other conditions for obtaining development permits.

Above: Roxel Aqua

OXE DIESEL OUTBOARD

The OXE is the world’s firsthigh-performancediesel outboard. It combines the reliability and endurance of marine inboards with the flexibility and agility of outboard engines. It is the only outboard that complies with EPA Tier-III, IMO Tier II and RCD emissions and environmental standards. It is designed and built for commercial users according to commercial user demands.

oxemarine.com

Hauge’s ‘egg’ prepares to hatch

HAUGE Aqua Solutions has embarked on the construction of the first of its futuristic enclosed fish farm projects, known as the Egget. It has awarded the contract to another Norwegian company, Herde Kompositt, which will build the 21-metre high egg-shaped fibre-glass unit.

The Egget is the latest in a series of unusually shaped salmon farm Above The Egget facilities from Norway that might look more at home in outer space than anchored off a fjord.

It is designed to help solve some of the problems associated with salmon farming, such as lice, escapes and pollution. The Egget project was initially a collaboration with Mowi (formerly Marine Harvest), but in February Hauge announced its intention to go it alone after apparently becoming frustrated with the pace of progress. Mowi is continuing to invest on other closed containment systems.

Kim Røssland, general manager and one of Herde Kompositt’s four partners, said: “We look forward to contributing to this major innovative project that will be able to contribute to a more sustainable aquaculture industry.” Hauge Aqua has also taken over the operation of a lifeboat factory in Norway for the project. The company said current production platforms, based on the open pen system, were too weak to sustain significant growth and achieve environmental performance.

The shape of the new robust and enclosed tank is that of an egg, built as a composite sandwich. The shape provides a complete double curved surface. Ninety percent of the tank is submerged and not visible during operation, while 10% is above the water and filled with ventilated air..

Bakkafrost reports year on year rise in output for Q1

FaRoEsE salmon farmer Bakkafrost is forecasting a 17% higher total harvest for the first three months of this year.

In a Q1 trading update, the group said output for both the Faroe Islands and scotland will reach 21,000 tonnes, compared to 18,000 tonnes over the same period last year. The increase in production was seen in the Faroes, while scotland saw a slight fall in volume.

The total, heads on gutted, is made up of: Faroe Islands Farming North 11,400 tonnes (2020: 6,300 tonnes); Farming West 2,500 tonnes (2020: 2,800 tonnes); Farming south 100 tonnes (2020: 1,600 tonnes) and Farming scotland 7,000 tonnes (2020: 7,300 tonnes).

Feed sales in Q1 2021 were 23,800 tonnes (19,100 tonnes). Havsbrún sourced 48.5 thousand tonnes of raw materials in Q1 2021.

The main reason for the large increase at Faroe Farming North this year is that in February 2020 the area was battered by some of the worst storms seen on the islands for many years, which affected output. They lasted for at least four days and took a heavy toll on fish farming operations, leading to the loss of around a million small fish and harvest volumes being 10% lower.

The full Q1 2021 report from Bakkafrost will be published on 11 May.

See Bakkafrost feature, page 30

Benchmark signs up first customers for CleanTreat

ANIMAL health and breeding group Benchmark has signed up the first customers for its ground-breaking CleanTreat water purification system. CleanTreat will be used in combination with the company’s new sea lice treatment, BMK08, to treat farmed fish.

The announcement was made in a London Stock Exchange update by the group’s parent, Benchmark Holdings plc.

CleanTreat is a closed water purification system which captures the medicine from the water when fish are being treated. It therefore prevents medicines from being discharged into the ocean, addressing a serious environmental concern. The system also catches sea lice and strings of lice eggs captured during treatment,

Benchmark CEO Trond Williksen said: “I am very pleased to be signing our first customer agreements for Benchmark’s transformational solution. Our solution addresses the biggest challenge facing the salmon industry today in a sustainable way both in terms of animal welfare as well as environmental impact.

“BMK08 and CleanTreat are testament to Benchmark’s commitment to its mission of driving sustainability in aquaculture.”

Mowi promotes Diez-Padrisa to health role

MOWI Scot- since February land’s Produc- 2020 and has tion Director, overseen signifMeritxell icant biological Diez-Padrisa, improvements in is to take up farming during a new role as this period. the company’s Mowi said the Fish Health company seeks Director as to benefit from from May. her expertise in Stepping into the other farming her position regions, alongas Production side continued Director is Roar Pauls- Above Meritxell Diez-Padrisa improvements to its operations in en, currently Scotland. Production Director for Lerøy Roar Paulsen will be based in Midt AS. Fort William, Scotland. He will be

In her new position, Diez-Pa- responsible for all farming actividrisa will oversee fish health ties. Sean Anderson will continue programmes in all regions for the to deputise for the Production company. A veterinarian and fish Director and oversee Marine health expert, she has been Pro- Operations, and he will also take duction Director at Mowi Scotland responsibility for Purchasing.

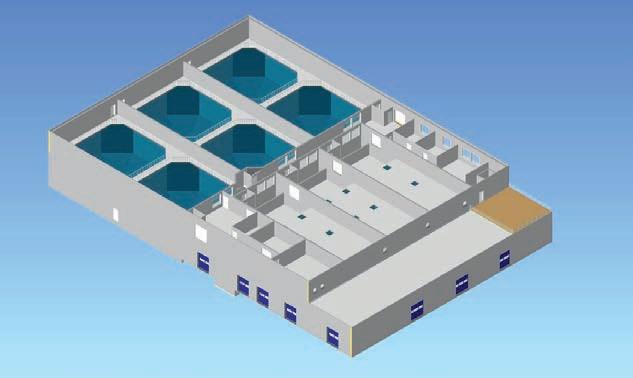

Sande Settefisk signs RAS farm deal

INVESTMENT in land based salmon farming continued apace this week with another company announcing large scale investment in a new project.

Sande Settefisk has signed a deal with water treatment specialists Sterner AS to build a new RAS (recirculating aquaculture system) facility in Gloppen, in the south-west of Norway.

Construction should start soon, with the new facility expected to be ready by the summer of 2022.

The investment figure is around 250 million kroner – or just over £20m.

A company press release said the project will include a production plant for post-smolt. This investment will allow annual output to increase from one million to five million smolts.

The Gloppen site will produce both salmon and rainbow trout for delivery to Nordjord Laks and Svanøy Havbruk, which together with Hyen Fisk, are the owners of Sande Settefisk.

Sande Settefisk chairman Svein Klaevold said they chose Sterner because of the company’s reputation in this field.

He said: “They have over 30 years’ experience in clean water technology, their unique professionalism and very good components that make them leaders in this market.”

Sterner general manager Bjarne E. Pettersen said he was very pleased that such trust had been placed in his company.

He added: “This plant will be incredibly cost effective and, based on experience with similar plants, we expect very good production results.”

• Fish Cage Nets – Nylon & HDPE • Predator Solutions • Net Service Plant • Treatment Tarpaulins • Lice Skirts • Supplier of LiFT-UP • Wrasse Hides

Record March for Norwegian salmon exports

NORWEGIAN seafood exports hit record high volumes last month, with farmed salmon once again out in front.

After a slightly disappointing January and February, overseas sales of fish of all types increased by 13.5% to NOK 10.9bn (£940m) in March.

Seafood and Fisheries Minister Odd Emil Ingebrigtsen declared: “Despite the fact that the corona pandemic continues to affect the seafood markets, it is gratifying that the export value of Norwegian seafood has never seen a stronger March than this year.

“Our seafood is sought after all over the world, and behind the numbers is an adaptable industry with good people at all levels.”

The country’s salmon farmers exported 108,200 tonnes of fish in March worth NOK 7.2bn (£617m). Volumes were up by 28% which led to a 22% or NOK 1.3bn (£110m) increase in value.

Salmon exports during the first three months of this year rose by 18 per cent to 297,200 tonnes and were worth NOK 18bn (£1.54bn), an overall decline of 4%.

Norwegian Seafood Council analyst Paul T. Aandahl said: “The value of salmon exports in March was the highest recorded in a single month, which is primarily due to record high volumes.

“Despite the fact that the Norwegian krone has strengthened against the main currencies the euro and the US dollar, the average price in March was only one per cent lower than in the same month last year.”

He said Asia was now the strongest growing market.

Seafood Council CEO Renate Larsen said a weak Norwegian kroner had helped to keep export values up in 2020. But exports have not had that traction this year since the kroner has now strengthened.

“Although Norwegian seafood has become more expensive for buyers outside Norway, there have been large volumes and a relatively strong demand for products of salmon, herring and king crab in the first quarter, “ she added.

However, March was not such a good month for the farmed trout sector with volumes down by 11% to 4,500 tonnes and value down by 5% to NOK 300m (£2.5m).

Fresh cod exports last month shot up by 76% to 14,300 tones and by 37 per cent in value to NOK 490m (£42m).

Frozen cod exports in March rose by 22% to almost 12,000 tonnes and the value was up by 3% to NOK 464m (£39m).

Above: Norwegian salmon

Cargo ship and workboat saved from storm

Above: Rescue helicopter Florø / Hovedredningssentralen Sør-Norge / NTB

SALVAGE teams have successfully taken in tow a £5m aquaculture support boat and the stricken Dutch cargo ship it came off in a storm.

The AQS Tor boat fell from the cargo deck during severe storms off the Norwegian coast early Tuesday, 6 March. The crew were forced to abandon ship amid 45 to 50 ft high waves and the weather was so bad at one point there were fears it might be lost.

What made a successful rescue all the more urgent was the news that the Eemslift Hendrika was carrying a total of four support vessels of varying size, worth NOK 150m (£13m). They were being delivered by Moen Marin, the world’s largest supplier of workboats to the aquaculture sector.

The cargo ship was also carrying 300 tonnes of heavy oil which could have posed a threat to the environment and coastal fish stocks.

After a day of high drama, the Eemslift Hendrika itself was taken in tow after a team from the Dutch company Smit Salvage were landed on deck by helicopter.

Another salvage company, Stadt Sjøtransport, had earlier been brought in to rescue the support vessel AQS Tor being delivered to the fishing and fish farming support company AQS. The vessel was drifting helplessly near the Eemslift Hendrika.

The AQS Tor was taken to the port of Florø, about 120 km north of Bergen. AQS said that the boat seems to be in fairly good condition

AQS also said it was pleased at the success of the operation, adding the AQS Tor had demonstrated its seaworthiness and should soon be carrying out the job it was designed for.

The company stressed the main priority throughout was to protect the environment and the safety of those involved in the salvage operations.

European Commission aims to encourage organic aquaculture

THE European Commission has placed aquaculture at the heart of its plan to significantly increase organic food production.

It has prepared an action plan in line with its European Green Deal and tied in with agriculture through its “Farm To Fork” and Biodiversity Strategy.

The Commission says it wants to encourage member states to include increased organic aquaculture in their reviewed Multi-annual National Strategic plans for fish farming.

It is a strategy which could help countries like Ireland where much of its salmon is organically produced.

“Organic aquaculture can help meet consumer demand for diversified high quality food produced in a way that respects the environment and ensures animal welfare,” says the Commission, adding that farming can also help ease pressure on wild fish stocks.

The new guidelines on the sustainable development of EU aquaculture, expected to be adopted by the Commission this spring, will encourage member states and stakeholders to support the increase in organic production.

Beginning next year, the Commission intends to: support research and innovation on alternative sources of nutrients, breeding and animal welfare in aquaculture; the promotion of investments on adapted polyculture and multi-trophic aquaculture systems; and the promotion of hatcheries and nurseries activities for organic juveniles; and identify and address as appropriate any specific obstacles to the growth of EU organic aquaculture

Its report concludes: “A sustainable and resilient agricultural and aquaculture sector depends on enhanced biodiversity, which is fundamental for a healthy ecosystem and critical for maintaining nutrients cycles in the soil, clean water and pollinators. Increased biodiversity allows farmers to adapt better to climate change.

“The organic sector is by its very nature oriented towards higher environmental standards, enshrined in its objectives and principles.” Above A Norwegian salmon farm

A group of 25 Norwegian salmon and trout farming companies have lost their challenge against the country’s “traffic light” system which regulates growth within the industry. They face a sizeable legal bill into the bargain.

The companies, mostly based in the south west of Norway, took their case to a district court in Bergen at the end of January.

Their region – designated as production area 4 or PO 4 – had been placed into a “red zone” which prevented future expansion. It also demanded a reduction in existing activity of six per cent, totalling up to 12,000 tonnes of fish. The cost to the farmers in financial terms was estimated during the case to be more than NOK 420m (£35m) a year.

The group argued that they were not only being robbed of their livelihood, but the decision would hit local communities who depend on aquaculture for jobs.

The system sees the Norwegian coastline divided into several colour coded production zones, consisting of green, where aquaculture expansion can take place virtually unhindered, amber or orange, where limited expansion is allowed and red where fish farming activity must be reduced. The Oslo government’s case was that the scheme is part of a wider strategy to reduce salmon lice and protect wild fish stocks.

In a verdict delivered by the court on 17 March, the farmers lost their main arguments: first that the move was an abuse of power, that it lacked legal authority, and second that it represented a violation of European human rights.

The farmers had also claimed the government case contained factual errors. The court said the imposition of a red light zone did not signal a permanent ban on growth in PO 4, suggesting that the situation could change if the environmental situation improves.

The fish farmers are clearly disappointed by the decision and are likely to launch an appeal. Meanwhile, they have been ordered to pay government legal costs of more than 1,700,000 kroner (£150,000).

Norwegian ministry looks to streamline regulations

NORWAY’S Seafood and 1 June this year. Fisheries Minister has However, they can only recruited a small team of fi sh change those regulations farming industry experts to which come under the remit help him get rid of outdated of the Fisheries and Seafood regulations. Minister.

Odd Emil Ingebrigtsen The Minister said he hopes wants to simplify many of the working group will not the rules which govern the only simplify some of the sector and replace them with rules, but will drop those they legislation more in line with feel are outdated or unnecesthe needs of the future. sarily bureaucratic.

Instead of turning to civil He added: “At the same servants, he has invited fi ve time we must ensure we still executives from various have good control where that branches of the commercial is necessary.” industry to help him. The Minister’s working

Ingebrigtsen said: “I have group consists of industry on a number of occasions operators and advisers: Line received input [from the Above Line Ellingsen Ellingsen of Ellingsen Seafood; sector] on what changes Fredd Wilsgård of Wilsgård and simplifi cations governing arrangements for increased value creation, and fi sh farming; Jim Roger Nordly regulations that affect the aquaculture industry more jobs along the entire coast.” of the aquaculture support company STIM; Liv are needed. The working group, which has been given a Marit Aarseth of Grieg Seafood; and Harald Ellef-

“We must try to remove as many unnecessary brief to iron out ambiguities and come up with sen of the Norwegian legal fi rm SANDS, which obstacles as possible for both the large and ideas that avoid areas of potential confl ict, is includes aquaculture among its areas of expertise. small players so that we can provide even better scheduled to have its recommendations ready by

Fish health predictor shows high accuracy level

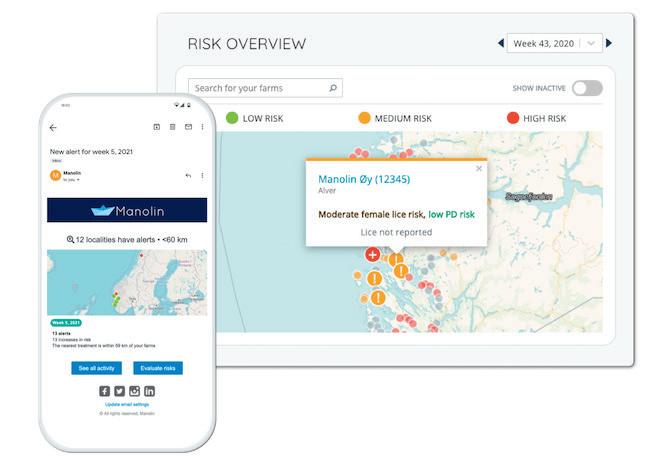

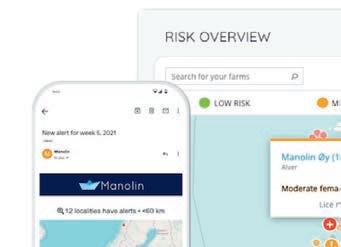

Above John Costantino. Right: Manolin’s health forecasting tool

AN application that can help fish farmers to predict disease outbreaks has been found to have 93% accuracy or more. The developer, Manolin, has announced its results after a year tracking health challenges for salmon farmers across Norway.

Manolin’s fish health forecasting tool was launched in February 2020. It uses machine learning to predict the early onset of PD (pancreas disease) and ISA (infectious salmon anaemia), based on a range of data inputs, and is the only commercially available disease forecasting tool for farmers in Norway.

Manolin’s Chief Technology Officer and co-founder John Costantino said: “This is a true breakthrough moment for our company and the industry as a whole. The last few months have been a culmination of many years of work—integrating numerous data silos, filling the gaps in industry data, expanding on academia’s disease research, and making it accessible for all farmers with user-friendly software.”

Manolin was founded in 2018 and is based in Bergen, Norway and Denver in the USA. Its machine learning models are powered by millions of data points including live disease outbreak reports, oceanographic forecasts, marine sensors, boat traffic, marine activity across all 600 active farms, and more than two decades of historical data.

Tore Holand, board member in several Norwegian farm companies, says, “It’s important for the industry to continue to raise its standards. Manolin has built a tool that doesn’t replace but works with farmers’ experience and expertise. With these types of insights, farmers can keep finding new ways to rethink their processes and improve. To be a part of the future, one needs to keep up with the technological advances.”

Manolin’s customers in aquaculture include Kvarøy Fiskeoppdrett, Lingalaks, Hofseth Aqua, and Firda Seafood.

Manolin raised 8m NOK (£680,000) last year from Boost VC, Hatch AS, and Innovation Norway, and recently added to its fish health and engineering teams. The company is expanding its forecasting tools to include feeding, growth, and mortality models.

NEWS...

Mowi plans faster growth, supported by technology

MOWI, the world’s biggest salmon Vindheim said the “megatrends” producer, is aiming to ramp up its volume driving salmon demand are stronger growth over the next few years and the than ever and driven by health trends, “new industrial revolution” is a key part a growing need for more low-carbon of its strategy. That was the message footprint diets, and salmon’s ability to from Mowi’s Chief Executive Ivan appeal to the wider population as highly Vindheim, speaking at the company’s versatile and suitable for almost any Capital Markets Day presentation. eating occasion.

Vindheim said that Mowi’s strategy had Mowi expects the continued strong “three pillars”: volume growth, cost and growth in demand for Atlantic salmon sustainability. While the company is a to exceed supply growth in the next five leader on cost and sustainability, he said, years. it has lagged behind the industry as a “Salmon is a scientifically proven whole in terms of volume growth. natural superfood. It is also versatile

He said: “To further strengthen and appeals to people of all ages with the company’s position, Mowi’s its highly appetising taste, look, texture strategic trajectory towards 2025 will and colour. In the coming years, I see be focused on four main objectives: countless opportunities for Mowi and we

growth throughout the value chain with Above: Ivan Vindheim are working on many important initiatives

particular focus on Mowi Farming, further cost savings across the group, greater sustainability, and capitalising on digitalisation and automation. “All four objectives are of equal importance and apply throughout our value chain.” Despite achieving record high volumes in 2020, Mowi Farming’s volume growth has been lagging behind the industry in the past few years. This is not satisfactory, Vindheim said, and will duly be addressed through various growth initiatives including increased investment in post-smolt. Vindheim said: “With the right measures in place we believe Mowi Farming has the intrinsic potential to grow well beyond 500,000 tonnes organically, using existing license capacity.” Investment in post-smolt production is expected to create volume growth in Norway, which accounts for 60% of Mowi’s output, from 2025. Ben Hadfield, COO for Scotland, Ireland and the Faroes said that we can expect to see volume growth in Scotland as from the current year, and Ireland is expected to reverse the decline in volume that has occurred over the past five years. Mowi’s operations in Canada have been affected by the Canadian government’s decision to close down salmon farming in the Discovery Islands region in British Columbia, so the company expects that production in North America will remain static at best, but its Chilean operations are expected to see organic annual growth between 3% and 4%. Vindheim said: “Mowi Farming will also pursue farming growth through accretive acquisitions when this fits with its operational strategy. The main focus in Mowi Farming has been and will continue to be conventional farming. “That said, we are monitoring developments in alternative technologies closely and may introduce such technologies when, and if, we find it timely and profitable.” He also pledged that “smart farming” – using technology to improve productivity, automate feeding and enable remote monitoring and control of farms – will be rolled out through all the company’s sites in Norway by 2025. There was a hint that Mowi could increase production at its new Scottish feed factory which was commissioned last year. Shareholders were told: “After commissioning the second feed mill in Kyleakin, Scotland in 2020 Mowi is now selfsufficient for feed in Europe. Feed is by far the most important cost component in farming. The strategy from here is to grow Mowi Feed along with Mowi Farming.” Mowi has unutilised capacity at its feed mill in Kyleakin, Scotland, and can add a new production line at the feed mill in Bjugn, Norway if needed with limited capital expenditure. that will further develop the company and bring it into the future,” he added. On sustainability Mowi has again been ranked the world’s most sustainable animal protein producer in the 2020 Coller FAIRR Protein Producer Index. Atlantic salmon is also ranked the most sustainably produced animal protein. On cost, Vindheim said, Mowi is consistently the number one or number two performer among peers in the regions in which the company operates. However, he added, cost is still too high in absolute terms, particularly in some regions outside Norway. The cost variation between the regions is also too high. Thus, Vindheim said, Mowi Farming will continue unabated with its work to address cost initiatives going forward. In Sales & Marketing, Mowi said it will continue to develop new, innovative, high quality products that are easily accessible to its customers to keep pace with constantly evolving food habits. “We will also continue in our long-term quest to de-commoditise the salmon category through our MOWI branding strategy. At the same time we must acknowledge that salmon is still mainly sold as a commodity subject to fierce competition – particularly in Europe. Thus, it is key to be a cost leader in this part of the value chain too, in order to attain a reasonable profit on our sales”, the CEO stressed.

Salmon Evolution commits fi rst wave of funding for Kore

DETAILS have been technology and we published of Salmon see a huge economic Evolution’s deal and strategic potential to build a large- in K Smart in the scale land-based coming years.” salmon farm in The company said South Korea. The the fi rst tranche Norwegian company of investment will has committed be used for design its fi rst tranche and engineering; of investment this site evaluation and month. permits; acquisition The facility, in Gangwon province, Above: The South Korean land-based salmon farm of an existing and operating smolt will be run as a venture with Dongwon in an facility in Jeongseon, joint venture – K Smart – effective manner. After seeing of which closing has already with Korean fi rm Dongwon the impressive magnitude of taken place; and general Industries, which will own 51%. Dongwon’s operations in South corporate purposes.

Salmon Evolution’s equity stake Korea fi rst-hand and witnessing Finance for the joint venture is estimated at NOK 200m the Korean authorities’ solid will be a mix of equity (25%) and (£17m). The equity contribution backing for the project on both debt (75%), with the latter being from both parties will be split a national and local level, we are facilitated at “attractive cost into three milestone-driven confi dent that we have found levels” by Dongwon. The facility tranches, and Salmon Evolution the perfect partner for our will have a total capacity of expects to provide its fi rst international expansion into one 20,000 tonnes by live weight. tranche, of around NOK 30m of the most interesting salmon Salmon Evolution is also (£2.6m), this month. markets globally. The natural building a production facility

Håkon André Berg, CEO of characteristics of the South at Indre Harøy, strategically Salmon Evolution said: “We Korean coastline and water located on the Norwegian west are very pleased with being temperature profi le represent coast, which is currently under able to formalise our joint an ideal fi t for our HFS construction. AQUAFEED multinational BioMar is setting up an Asia division to manage its operations in the region, including Vietnam and China. The new division will be headed by Francois Loubere as Vice President, Asia.

The move follows BioMar’s acquisition, announced earlier last month, of a majority share in the shrimp feed business of Viet-Uc Seafood Corporation. Vietnam is one of the world’s biggest farmed shrimp producers and represents a major growth opportunity for BioMar, while China’s aquaculture market has also seen large-scale investment.

Francois Loubere was previously BioMar’s VP West Med & Africa and has more than 30 years’ experience in the aquaculture industry. His former role will be taken up by Luis García Romero, Commercial Manager in the West Med & Africa division.

Above: Luis García Romero (L) and Francois Loubere

Skretting to open new shrimp feed factory in Vietnam

INTERNATIONAL feed group Skretting has announced plans to construct a new factory in Vietnam this year. The new factory will supply the growing market in Vietnam and the broader southeast Asia region, with an annual capacity of 100,000 tonnes

The new factory will be located next to Skretting Vietnam’s existing facilities in Thuan Dao Industrial Zone, Long An and represents an investment of €24m for the group.

Skretting says the new factory will alleviate current demand on supply.

Bui Thuy Tien, General Manager of Skretting Vietnam, said; “With a mission and commitment of bringing good solutions to farmers and contributing to the sustainable development of aquaculture in Vietnam, Skretting Vietnam is dedicated to leveraging our global resources to offer a complete value proposition for our customers.”

Skretting’s expansion into Vietnam began in 2010 through the acquisition of Tomboy Aquafeed JSC, a Vietnamese fi sh and shrimp feed company. The group’s latest shrimp feed factory opened in 2017.

“This new factory in Vietnam is a logical and necessary step towards strengthening Skretting and Nutreco’s position as a global competitor in Asia,” said Therese Log Bergjord, Skretting CEO. “We have a very solid growth strategy, matched with the huge potential of the sector. We have activated an expert team to make sure we deliver, and I’m excited to see how we continue to grow in the coming years.”

The future of fish farming

A first-class RAS feed and an optimal feeding strategy are fundamental to the performance of both your fish and filter.

www.alltechcoppens.com/ras-guide

AquaBounty optimistic despite Q4 loss

NORTH American land-based salmon farmer AquaBounty Technologies has posted a US$6.1m loss for the fi nal three months of 2020, close to double the fi gure for Q4 2019.

Despite that, the company, which is pioneering the development of genetically modifi ed (GM) salmon, says the outlook for this year was positive. AquaBounty has started customer feedback trials with its fi sh and says it is “optimistic”.

Q4 Revenues – based on limited sales of non-GM salmon – totalled $50,197 against $46,367 a year ago.

AquaBounty said it had fortifi ed its balance sheet with $192.3m in gross proceeds from the closing of underwritten public offerings of common stock in December 2020 and February this year, providing the fi nancing to fund the expected cost of Farm 3, its planned 10,000 metric ton farm.

The company also said it had selected Innovasea, a global leader in advanced aquatic solutions for aquaculture, as the recirculating aquaculture systems (RAS) technology solutions provider for Farm 3.

It has also appointed packaged food industry veteran Dr. Ricardo Alvarez to the company’s board of directors. Operating expenses were $6.1m, as compared to $3.5m in the same quarter for the previous year.

The increase was primarily ascribed to an increase in production costs as the biomass of fi sh in the company’s farms grew from 161 metric tonnes to over 603 metric tonnes. In addition, the company recorded an inventory reserve of $1.5m related to non-GMO stock.

“Net loss in the fourth quarter of 2020 was $6.1m, as compared to $3.4m in the same year-ago quarter.”

CEO Sylvia Wulf also told investors: “The impact of the Covid-19 pandemic on market demand required the company to address the inventory levels of the conventional salmon at our Indiana farm, which began to exceed capacity in December.

“We needed to make room at the farm for our growing biomass of AquAdvantage salmon. As a result, we decided to harvest and begin donating our conventional salmon to local food charities.”

Mowi Canada wins reprieve on salmon stocking for BC farms

MOWI Canada has won an injunction in a Canadian Federal court that will potentially allow it to continue stocking farms in the Discovery Islands region, at least temporarily.

In December, Canada’s Fisheries and Oceans Minister Bernadette Jordan ordered that all opennet fi sh farms in the Discovery islands, in British Columbia, will need to close by the end of June 2022 and also said that fi rms would not be allowed to restock the farm sites in the meantime.

Mowi took the minister to court, arguing that the ban on transferring stock to two of its farms was unreasonable and would lead to job losses, and the unncessary culling of more than 12 million healthy fi sh - since there would be nowhere to transfer them.

The court has now granted an injunction that means the minister must consider Mowi’s request for transfer licences. Subject to veterinary approval, Mowi hopes the applications will be granted but the decision remains with the government.

In January this year, Mowi Canada West, Cermaq, and Grieg the operators of other Discovery Island farms, fi led an application in Federal Court seeking a ruling to overturn the Minister’s order of December 2020 altogether.

Above: Bernadette Jordan

Russian Aquaculture sees volume up, profi ts down

RUSSIA’S largest commercial fi sh farmer, Russian Aquaculture, has reported record sales volumes and a strengthened balance sheet for 2020, but profi ts are down on the previous year.

Russian Aquaculture’s sales volume for 2020 was 15,510 tonnes, up 9% on 2019. Revenue, however, was down 5% to RUB 8,336m and operating profi t was down 13% to RUB 3,302m, in what was a challenging year for salmon producers internationally. Adjusted EBITDA saw a decline of 2% to RUB 3,375.

The company said it intended to pay dividends totalling 30-50% of net profi t. 2020 saw the fi rst dividend payments for 10 years.

Russian Aquaculture also strengthened its balance sheet over the period, with three successful bond issues and a share buy-back programme, and current assets went up by 48% to RUB 12,555m. Capital and reserves were up 29% on 2019’s fi gure, to RUB 11,276m.

The company invested in a number of assets including a barge, wellboat, nets, cages and a catamaran, and acquired two new sites at Pitkov Bay and Tyuva Bay.

Chief Executive Offi cer Ilya Sosnov said: “The unprecedented nature of 2020 has shown everyone the importance of a sustainable and effi cient business. We were able to continue our operations uninterrupted, without losing a single day of production. Despite a decline in the global salmon market amid the pandemic and challenging climatic conditions, we delivered strong operational and fi nancial results and strengthened the company’s core fundamentals, paving the way for future growth.

“Thanks to the systematic execution of our strategy, our stock continues to increase from year to year, and by the end of 2020 the value of our biological assets was at a record high. We are not stopping there, and are continuing to invest billions of roubles into developing our business. As a result of the option to increase our stake in our processing plant, the acquisition of two new high-quality fi sh farms, and the launch of our new Inarctica brand, we are closer to achieving our long-term goal of becoming the largest vertically integrated player in the aquaculture industry.”

‘Technical’ incident setback for Atlantic Sapphire

LAND-based producer Atlantic Sapphire looks set to lose up to 500 tonnes of salmon following technical problems at its plant near Miami, Florida. The losses represent 5% of of its expected initial harvest. The company said in a stock market announcement last month that the issue appeared to be in one of its RAS growth systems. While its preliminary analysis still had to be confi rmed it is looking at the possibility that a “design weakness from its RAS [recirculating aquaculture system] supplier” may have led to a signifi cant amount of particles fl owing from Above: Bluehouse salmon its particle fi ltration system to bio-fi lters and side fi lters. This resulted in increased turbidity and possibly gases, causing abnormal fi sh behaviour. The company found that fi sh accumulated at the bottom of the tanks, disrupted the fl ow of new water and caused an increase in mortality.

Atlantic Sapphire said it expects to lose 500 tonnes of fi sh – around 5% of its fi rst phase annual harvest volume – as a result of the problem. However, it stressed that the incident will not affect the continuity of deliveries to the company’s customers.

The episode is likely to be seen as a temporary setback for a company with big ambitions. In January it was reported to be seeking to register on the US OTCQX market, which offers young enterprises the opportunity to expand investor access. To qualify, companies are required to meet high fi nancial standards and follow best practice governance.

A couple of weeks later, Atlantic Sapphire announced plans to scale up output from 15,000 tonnes to 25,000 tonnes, gutted weight, in the second phase of its highly acclaimed “Miami Bluehouse” salmon production in Florida.

The company also has a site in Hvide Sande, Denmark.

Chilean salmon company algae losses rise to $4.4m

THE losses suffered in a recent algae attack are far higher than fi rst feared for Salmones Camanchaca, Chile’s largest salmon farmer.

After being hit by further algaebased mortalities, the company issued an update late on Sunday night saying it had lost 1.3 million fi sh which is likely to cost it more than $4m.

In a statement published on Oslo’s Euronext website, Salmones Camanchaca, said: “The toxic algal bloom in the Comau Fjord, Los Lagos Region (of) Chile affecting the Leptepu, Porcelana and Loncochalgua farming sites, has caused to date an accumulated mortality of 1.3 million fi sh, equivalent to 2,250 tons of biomass, with weights between 450 grams and 2.5Kg depending on the affected site, making an average weight of 1.2Kg.

“This mortality corresponds to 11% of the company’s total fi sh.”

The previous loss estimate when the original algae attack was fi rst reported in mid-March was 162,000 fi sh or 2.9% of biomass.

The statement adds: “Based on the information available at this time, it is estimated that the event in the Comau Fjord will generate a direct fi nancial loss of $4.4m (£3.17m), net of estimated insurance claim, which has been activated, and of which deductibles have already been fully applied to this calculation… 2021 harvest volume estimates are reduced to a range of 41,000 to 44,000 tonnes whole fi sh equivalent (WFE) of Atlantic salmon.”

The collection of dead fi sh will continue to be carried out normally and in accordance with current contingency plans, the company said, and the surviving fi sh are being transferred to sites outside the Comau Fjord, which is expected to be completed soon,” it concludes.

Algal blooms suck up oxygen in the water, suffocating fi sh contained in farm cages.

www.eggedosis.no

A Global Supplier and Partner for Maritime Aqua Services

Local presence, global reach.

SERVICE VESSELS HARVEST VESSELS LIVE FISH CARRIERS

FEED CARRIERS

www.aquaship.no