1 minute read

MELBOURNE CBD OFFICE - MARKET REPORT, Q1

Pre-commitments

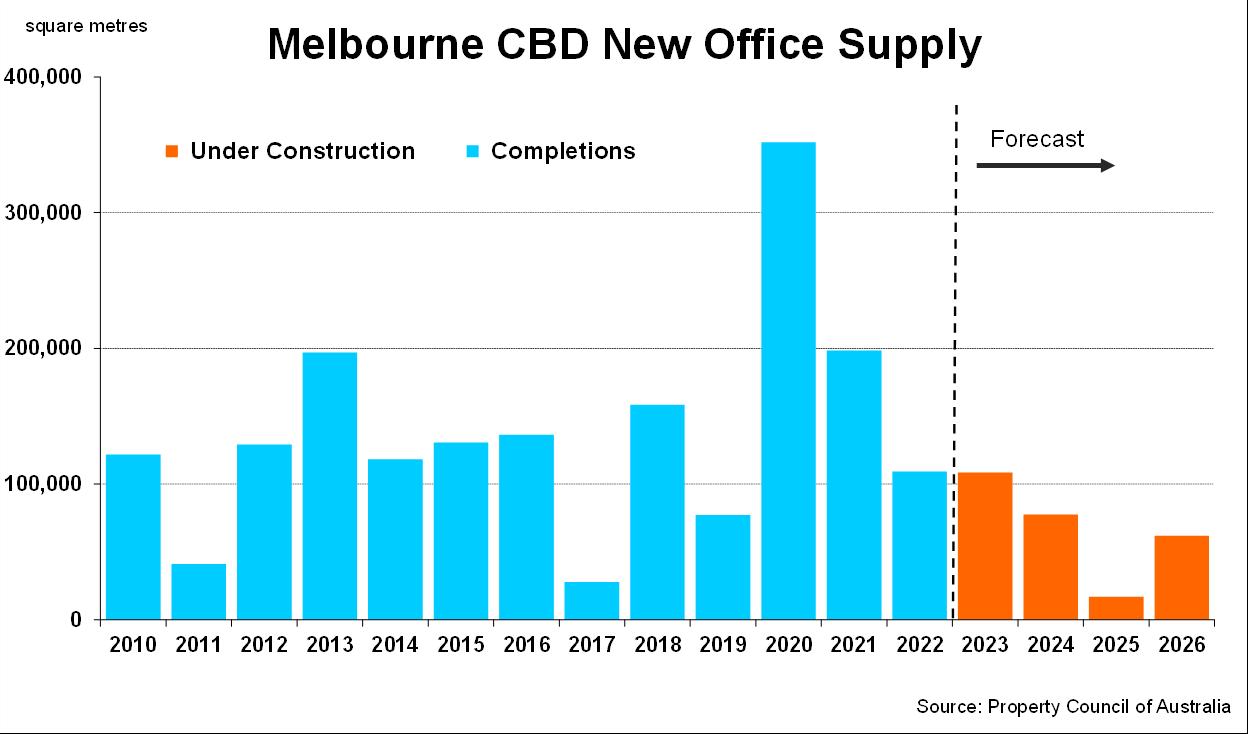

Of the space that is under construction, pre-commitment levels remain modest compared with previous years with 30% pre-leased. With development activity projected to remain below average levels for the medium term, adversely impacted by the elevated high vacancy rates, pre-leasing activity is anticipated to increase as tenants seek to upgrade their workplaces to encourage staff back into offices.

CBD Projects Under Construction/Siteworks

Beyond those offices currently under construction, there are a number of projects at various stages of development approval proposed for the Melbourne CBD office market including: DEXUS’ 60 Collins Street (42,182sqm), Stage 2 of 555 Collins Street (35,000sqm) and Hines’ development at 600 Collins Street (60,000sqm).

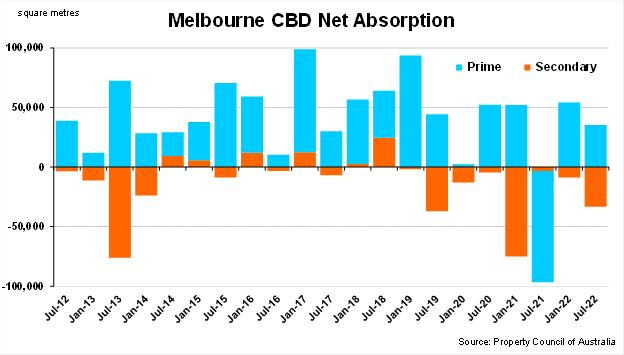

Over 2022, net absorption totalled negative 13,663sqm with the occupied space in the CBD office market adversely impacted by both new supply and subdued tenant demand. In comparison, the 10-year average annual net absorption level for the Melbourne CBD office market is almost 50,000sqm. While the Melbourne CBD office market recorded negative net absorption over the past two years, it obscures the clear “flight to quality,” trend as many businesses are vacating older, secondary office buildings in favour for new high-quality space. In the six months to January 2023, prime (premium and A-grade office space) net absorption totalled 40,054sqm, whereas tenants vacated 55,708sqm of secondary office space in the Melbourne CBD office market.

Having rebounded strongly following the worst of the effects of the pandemic, employment growth across the State appears to have peaked with 49,000 new jobs added during 2022 compared with 104,000 jobs added in 2021. Reflecting the easing employment growth of Victoria, the State’s unemployment rate increased to 4.0% as at January 2023, up from 3.2% as at July 2022.

Mirroring the location of new supply, the only precincts of the Melbourne CBD office market to record positive net absorption in the six months to January 2023 were the North Eastern precinct with 26,310sqm absorbed underpinned by the move of the Australian Federal Police into their new office and the Western Core precinct with 15,134sqm absorbed.