2023 is likely to be the lowest number of closings ever recorded in Sugarloaf Country Club. The root cause is the incredibly low inventory. 2021 was a record-setting year for Sugarloaf Country Club real estate In 2021, we had 81 closings which was the highest ever recorded 2006 and 2010 were the prior peaks of the market – 2006 before the real estate recession and 2010 as the height of foreclosures and short sales In 2022, we had 46 closings which is pretty consistent with recent years other than 2022. In 2023, we only have 13 closings so far.

The last few months of 2022 and early 2023 were slower due to the rapid rise of mortgage rates. Now Buyers have adjusted to the new normal. The spring market is here and Buyer activity is very strong! Listed inventory has reached all-time lows with an average of 3 listings. This is good for Sellers. Home values remain strong due to the low inventory. Buyers are struggling to find the homes they want because there are simply not enough desirable homes.

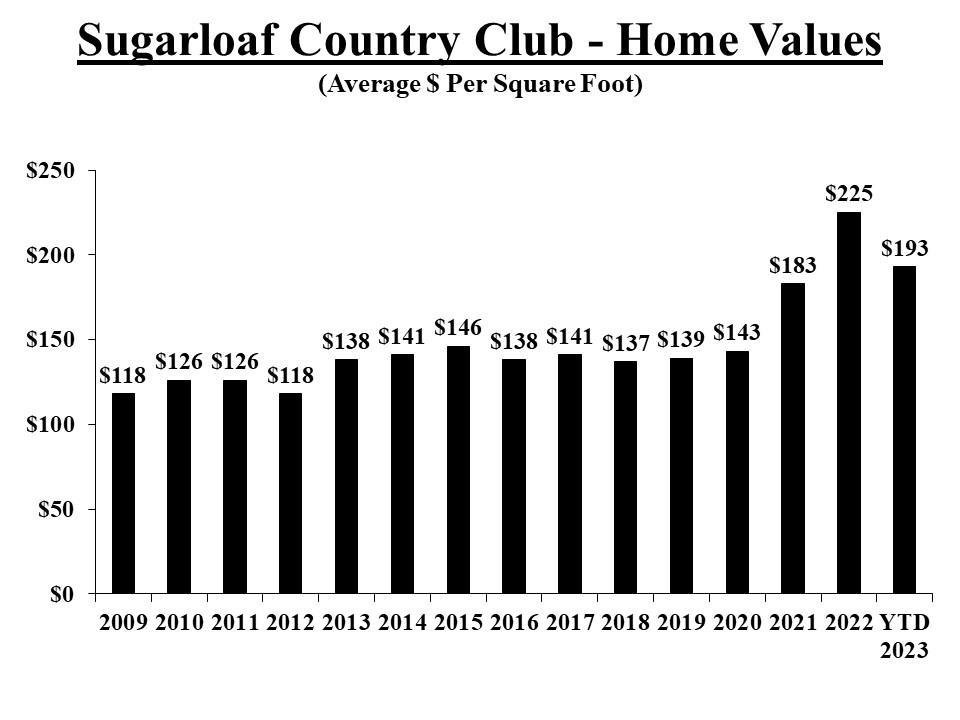

The average $ per square foot in 2022 was $225 – a 23% increase from 2021 and a 57% increase from 2020! In 2023, the average $ per square foot is $193. Still strong but not as high as the peak of 2022. We are seeing fewer multiple offers and fewer offers above list price. The list to sale price ratio is 92% in 2023 versus 99% last year. Average Days on Market has increased from 22 days to 107 days.

The good news is our home values have increased! The bad news is our home values have increased! Many of us received 2022 and 2023 tax assessments that were considerably higher than past years. Remember, based on the average $ per square foot from 2020 to 2022, our values increased 57% on average! Of course, these are averages and every home is different. Last year, we had better comps to fight our increases. Those are more scarce this year.

If you have the Homestead Exemption and Value Offset Exemption, Gwinnett County will freeze your county property taxes at the original rate regardless of the value assessment! The only items that will increase based on your home value is Schools and School Board fees. Schools represent around 61% of the overall tax bill so this is still significant. There are also charges for County Solid Waste (Trash Collection) and Stormwater Service. Those are not based on your property assessment and only represent about 3% of the total bill. You can view your 2023 Property Tax Bill by visiting this link:

https://gwinnetttaxcommissioner.publicaccessnow.com/ViewPayYourTaxes.aspx

Enter your address or owner name (last then first). Then click search. You will see some options. Select your property, then click on the parcel number for the detailed 2022 Property Tax Bill. You will see the section that shows whether you have a Homestead Exemption and Value Offset Exemption. You can also see the County Government Taxes section that will not increase. Then you will see the School Taxes that will increase. Compare these amounts to your 2023 assessment amount. That is going to be your true 2023 Property Tax increase. If you do not have your Homestead or VOE exemption, click this link to apply:

https://gwinnetttaxcommissioner.publicaccessnow.com/HomesteadExemptionApplication.aspx

Tax assessments are generally based on local trends in the market. Those facts are not on our side. I looked at both $ per square foot and average sales prices. Average sales prices were more favorable to our case but still quite high. According to FMLS data, Gwinnett County median sales prices increased 19% from 2021 to 2022. In zip code 30097, median sales prices increased 17.4% It is no surprise that Gwinnett County is sending us significant property tax increases based on this kind of data.

The good news is that there are ways you can appeal your property taxes. As I stated before, Gwinnett County assesses values based on local trends and comparable properties When you appeal your property taxes it starts to look more like an appraisal than local market trends. You can choose to appeal yourself or you can hire a local firm to help.

Here are a couple of options if you want to hire someone.

Equitax | 404.351.5354 | equitaxusa.com

They charge $250 plus 25% of the first year’s savings or $150 plus 35% of the first year’s savings. This is the largest firm in this space.

Georgia Tax Appeals | 770.217.3267 | gataxappeals.com

They charge $100 plus 40% of the first year’s savings.

Ownwell | ownwell.com

This is a national provider. They charge 25% of the savings. Many law forms offer this service, but they can be very expensive!

Can

This takes some effort so you may not want to invest the time. Here is the online link to appeal your taxes.

https://www.gwinnettcounty.com/web/gwinnett/departments/financi alservices/taxassessorsoffice/propertyappeals

Or just Google “Gwinnett County Property Tax Appeals” and you will see the Gwinnett County options. The number of days to file an appeal of an annual assessment in Georgia is within 45 days of the date located in the upper right-hand corner of the assessment notice.

Step 1: Click the Online Appeal Link:

Step 2: Identify your property by address, parcel # or your name. Click search to see the options and then select yours.

Step #4: Enter your appeal value and explain why you are filing an appeal. Here is where you make your case for a lower valuation. You have limited text so you need to be brief and to the point. Note: Your appeal value cannot be lower that your previous year value. If your new value is less than a 15% increase, you are probably wasting your time. Think like an appraiser who is using comps to support a value estimate. In your summary, use the high-level math in averaging the comps to achieve your lower valuation. In this case, you are looking for the lowest/ worst comps versus higher/ more valuable comps. Remember, this is a math exercise. See the list provided that shows all the properties in Sugarloaf that were sold in 2022. Look for properties in your price range and square footage range. For example, if you believe your property value is under $1 million you might choose 2681 Nutwood Trace. Appraisers will adjust for things like square footage variances, lot size variances, upgrades, pools, etc. You can look up any of these properties on Compass.com to see the details.

Step 5: Attach supporting documentation. You can screen shot the online pages for comps. If you need help, we can assist you with a printout from the MLS services.

Step 6: Enter your contact information.

Step 7: Sign your name, copy/ paste your signature key and click continue to submit. Then print a copy of your appeal for your records.

Step 8: After 3 business days, you can go back to the website to check on the status of your appeal. They are getting a lot of appeals so it may take longer than normal.

Frequently Asked Questions:

Q. Can I appeal if my taxes only went up a small percentage?

A. You can try but you are probably wasting your time. Our values have gone up substantially. If you received an increase higher than 15%, then you may have a shot.

Q. This looks a little complicated.

A. If you feel that way, you are probably right. Might be a good option to hire one of the firms listed.

A. The county assessor has the right to visit your property and do a live assessment. If they determine your value is higher than the original assessment, you can get the increased assessment. If your square footage is understated in the tax records, you may not want to pursue an appeal.

A. If you win your appeal, your taxes will be frozen for the next three years. That is one of the biggest advantages of this process since we expect property values to continue to rise in the next few years.

A. Get active in the political scene and support candidates who will pledge to control property taxes and spend wisely. We are all supportive of our local schools – but where is all this money going? Our governments are raking in record tax revenues and need to be very smart about spending. Otherwise, they will always find more ways to spend more of OUR HARD EARNED MONEY!

Once again, Compass was ranked as the #1 Brokerage in the nation. Compass has the largest network of productive agents in the industry. Over 30,000 agents serve celebrities and high-net-worth clients and their friends & families in major markets nationwide. We chose to affiliate with Compass because this helps us give the most advantages to our clients. We would be honored to have a confidential conversation with you about listing and selling your home – or helping you buy your next home.

COMPASS Concierge fronts the cost of home improvement services with no interest and no fees. Concierge is the hassle-free way to sell your home faster and for a higher price! To get funds directly in your hands, COMPASS has partnered with Notable, an independent lender to provide Concierge Capital, an interest-free loan.

COMMON USE CASES:

Staging & Decor

Appliances

Flooring

Kitchen and bathroom updates

Light fixtures

Landscaping

Painting

Inspection Items

De-cluttering

Moving & Storage and more!

“Buyers want homes that are updated and in great condition. If the home is not updated and needs a lot of work, buyers will offer significantly lower prices. The most common areas of focus are kitchens, bathrooms, flooring, windows and outdoor living. COMPASS Concierge can provide an easy solution that will help you get the highest value and sell faster!”

We can pay for the cost of home improvement services with no interest or fees ever.

Mary Floyd has been a licensed REALTOR® since 2005 and has consistently been one of the top luxury agents in North Atlanta. Mary is a Certified Relocation Specialist, Short Sale/ Foreclosure Specialist, Certified International Property Specialist and has earned many performance awards including Chairman’s Circle, Legend Award, Master’s Club, NAMAR Top Producer, Phoenix Award and Best of Gwinnett. With a passion for service, Mary places the highest value on building trusted relationships and achieving exceptional results for clients.

Tony Floyd served 14 years as Chief Marketing and Innovation Officer for a global real estate brokerage. He is considered one the leading marketing and technology experts in the real estate industry and pioneered numerous innovations that delivered better value for clients. Prior to real estate, Tony led sales and marketing organizations for respected companies including IBM, Fujitsu, Trilogy Software and BellSouth eBusiness. No other real estate agent or team has this level of expertise to assist clients in selling, buying and investing in real estate.

As we work to help everyone find their place in the world, COMPASS Cares empowers agents and employees alike to support meaningful causes right where it counts most: at home. COMPASS Cares contributes funds and skills-based volunteering to local organizations, with 100% of real estate transactions resulting in a donation to the community.

Floyd Real Estate Group is a proud supporter of the Women’s Club of Sugarloaf Country Club Charities including Annandale Village, Duluth Co-Op, Mosaic, The Next Stop Foundation, and Special Needs School of Gwinnett

We were honored that COMPASS also made a substantial donation to Rainbow Village on our behalf Rainbow Village is a wonderful organization here in Duluth that supports homeless single mothers and helps give them a path forward in life. Giving back and being involved in our community is an important aspect of our lives.