Our world changed dramatically over the past two years, from the way we work to the way we connect with one another. This forced all of us to reconsider how we want to live our lives and how we can best serve those who depend on us.

At PPI, these changes led us to think about how to elevate support for advisors. We believe that more than ever, it is critical that you have the best digital tools to serve your clients… across all markets, wherever you are, and however you want to work.

We’re excited to announce Stratosphere. Instead of a single application, it’s an ecosystem of leading proprietary tools for prospecting, analysis and presentations, complemented by exceptional third party offerings curated to help your business ascend to new heights.

Our goal is to empower you to choose the tools that work best for your practice and make them work together better with smart two-way connections, utilizing your brand, so they are more than the sum of their parts.

We support you with a team of digital sales enablement experts –from training to trouble-shooting – available to help you get started, and they’re just a phone call away to lend a hand. Talk to us today.

Unparalleled Resources. At Your Command.

Vancouver Edmonton Ottawa Halifax Burnaby Winnipeg Montréal St. John’s Surrey Mississauga Brossard Calgary Toronto Québec City

P U B L I S H E R : Peter Wilmshurst advocisforum@gmail com

E D I T O R : Alison MacAlpine alison@amcommunications ca C O P Y E D I T O R A N D P R O O F R E A D E R : Alex MlynekA R T D I R E C T O R : Giselle Sabatini gisellesabatini@rogers com

A D V E R T I S I N G : Peter Wilmshurst

a d v o c i s f o r u m @ g m a i l c o m Tel: 416-766-4273 Fax: 416-760-8797

T FA A C B O A R D O F D I R E C T O R S

CHAIR

Catherine Wood, CFP, CLU, CHS

VICE CHAIR

Eric Lidemark, CFP, CLU, CH F C , CHS

PAST CHAIR

Rob Eby, CFP, RRC

SECRETARY

Stephen MacEachern, CFP, CLU, CH F C , CHS

TREASURER

John W Hamilton, CLU, FEA, CPCA

CHAIR, INSTITUTE

Ejaz Nadeem, CFP, CLU

CHAIR, CLC

Will Britton, CFP

DIRECTOR AT LARGE

Wendy Playfair, CFP, CLU, CHS

DIRECTOR AT LARGE

Arun Channan, MASc, MBA, CSP, CFP

DIRECTOR AT LARGE Kelly Gustafson

PUBLIC DIRECTOR

Sara Gelgor, LLB, LLM, MBA, ICD D

PRESIDENT & CEO Greg Pollock, CFP

FORUM is published four times annually by The Advocis Publishing Group, 10 Lower Spadina Avenue, Suite 600, Toronto, Ontario M5V 2Z2 TEL: 416-444-5251 or 1-800-563-5822 FAX: 416-444-8031

FORUM is mailed to all Association members, the subscription price being included in the annual membership fee Address changes can be made through info@advocis ca or by calling member services at 1-877-773-6765

The opinions expressed in articles and advertising are those of the authors/advertisers and not necessarily those of FORUM or the Association Material of a technical or semi-technical nature may become invalid because of later changes in law or interpretation The Association is not responsible for obsolescence of FORUM articles whose content should be checked by the reader before implementation

Requests for permission to reprint articles are to be addressed in writing to the editor of FORUM ™ Trademark of The Financial Advisors Association of Canada carrying on business as Advocis

hen I star ted in the financial services industry 25 years ago, working in communications at a mutual fund company, I didn’t have a career mapped out But, each step along the way, I was guided by a mento r O n e o f t h e m w a s D e a n n e G a g e , w h o expertly steered FORUM for eight years and g ave m e s e ve r a l o f my f avo u r i te w r i t i n g assignments for FORUM and other industry publications I’m honoured to be stepping into her role for this issue as she moves on to a new chapter in her career

Mentorship can happen informally, as it has many times for me, or it can be structured by a firm According to MentorcliQ’s 2 0 2 2 M e n t o r i n g I m p a c t R e p o r t , 8 4 % o f U. S . F o r t u n e 5 0 0 c o m p a n i e s h a v e a m e n to r i n g p ro g r a m i n p l a ce a n d t h e p ercen t a ge r i s e s a s yo u m ove u p t h e l i s t Ever y For tune 50 company has a mentoring program Interestingly, the same report fo u n d t h a t com p a n i e s w i t h a m en tor i n g p ro g r a m we a t h e re d t h e p a n d e m i c m o re successfully The average Fortune 500 company experienced a 59% drop in profits in 2 0 2 0 co m p a re d to 2 0 1 9 . Bu t t h e d e c l i n e wasn’t equally distributed Firms w ithout m en tor i n g pro g r a m s aver a ge d a d rop of 1 0 8 % , w h i l e t h o s e w i t h m e n to r i n g p rograms limited the damage to 50%.

Wh e n I s p o ke w i t h f e m a l e f i n a n c i a l adv isors for the last issue of FORUM about what helped them succeed in an industr y s t i l l d o m i n a te d by m e n , m a ny o f t h e m t a l ke d a b o u t t h e i m p o r t a n ce o f h av i n g m e n to r s . B u t p re t t y m u ch e ve r yo n e c a n b e n e f i t f ro m h av i n g s o m e o n e i n t h e i r co u r t , re co g n i z i n g a n d p ro m o t i n g t h e i r strengths and constructively pointing out areas for improvement Lea ders can also get a lot out of both informal and formal m e n to r i n g . T h e y m a y l e a r n n e w s k i l l s (mentees are probably better than you are at some things), discover new oppor tunities (mentees have different networks and can expand yours), and of course cultivate mot ivate d team memb ers (mente es may even become ideal successors).

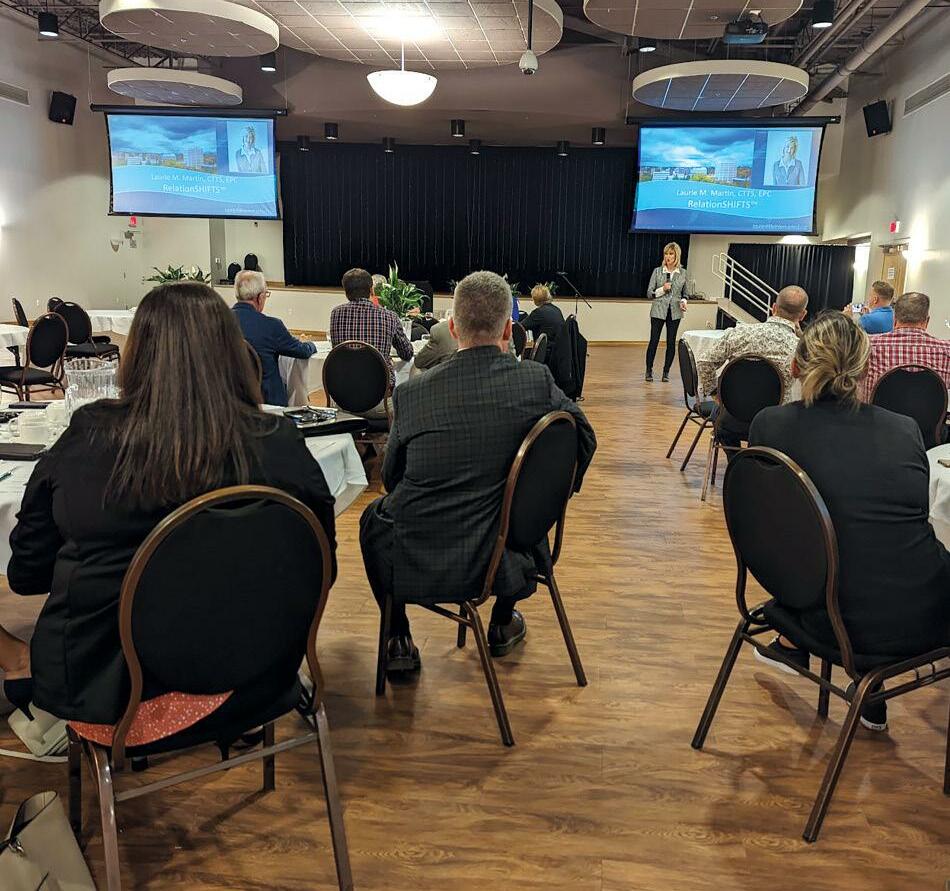

Mentors and mentees find each other throug h networ king The recent Advocis Regulator y Affairs Symposium, which was b a c k to i n - p e r s o n t h i s ye a r, p rov i d e d a valuable opportunity for colleagues to mix and mingle while learning about structural ch a n g e s w i t h i n t h e f i n a n c i a l s e r v i ce s i n d u s t r y Su s a n Ye l l i n s h a re s h i g h l i g h t s f ro m t h e Sy m p o s i u m o n p a g e 1 4 . Su s a n also spoke w ith Advocis’s chair, Catherine Wood, who stresses the value of mentoring while descr ibing her v ision of the future o f a dv i ce o n p a g e 1 0 . O n p a g e 2 4 , To d d Fithian’s case study shows how even ver y successful adv isors can take their business to the next level w ith suppor t from a specialized consultant essentially ser v ing as a mentor. And on page 32, Jaclyn Nemethy d i s c u s s e s h ow l e a d e r s c a n p ave t h e w ay f o r a smooth t r ansition to a successor to p ro te c t t h e h a rd wo r k t h e y ’ ve p u t i n to mentoring their teams.

Januar y is National Mentoring Month T h a t m a ke s t h i s a n i d e a l t i m e to l o o k around at your staff and beyond, identify s o m e o n e yo u c a n te a ch a n d l e a r n f ro m , a n d m a ke a m e n to r i n g co n n e c t i o n t h a t fosters personal and professional developm e n t Wi s h i n g yo u a l l t h e b e s t ove r t h e h o l i d ay s a n d a p ro s p e ro u s a n d f u l f i l l i n g 2023 from the entire FORUM team.

If you go onto Tina Tehranchian’s website you can’t help but notice the long list of de g rees and desig nat ions that trail after her name Armed with everything from her BA and MA to her CFP®and a host of other educational titles, in 2021 she became the first wo man and the first Canadian to be selected as the Top Senior Wealth Advisor of the Decade by the International Association of Top Professionals

Success has been hers. But like any other pro du c t ive profe s s i on a l , Te h r a n ch i a n , a senior wealth advisor at Assante Capital Management Ltd., acknowledges she could not have reached this far without her passion for the business and her understanding of the industr y and the magnitude of helping people achieve their financial goals.

“D esig nat ions are imp or tant b e cause they give you confidence and build trust for your clients,” she says. “Making sure you get

your CFP and additional designations shows yo u r com m i t m en t to t h e i n du s t r y, yo u r dedication to your clients, and your responsibilit y to continue lear ning and keeping up to date.”

All her clients want someone they can t r u s t w h o c a n h e l p t h em t h ro u g h t h e i r journey of building wealth, preser v ing it, and then passing it on to the next generation “As long as they feel you are the kind of partner who can gui de them through the complexities that come their way it can be

In the past couple of years, some of your clients may have started dabbling in cr y ptocurrency, a blockchain-based d i g i t a l a s s e t t h a t h a s b e com e p op u l a r w i t h cer t a i n investors although less so, recently, given the price volatility experienced in the past few months.

While clients are likely aware that the sale of cr y pto needs to be declared for tax pur poses, ma ny may not realize that cr y ptocur rency mig ht also be considered foreig n proper t y. This may necessitate annual reporting if the client’s total cost

a ver y go o d, long-last ing , and rewarding relationship.”

G e t t i n g i nvo lve d i n h er com mu n i t y, i n clu d i n g t h e Ma r k h a m B o a rd of Tr a de , the McMichael Canadian Ar t Collection, a n d t h e Ma c ke n z i e He a l t h Fo u n d a t i o n , h a s al lowed her to fol low her passion for philanthropy.

Tehranchian acknowledges the import a n ce of h av i n g go o d m en tors a n d ro l e models and regrets she never had a formal mentor herself She has been lucky, however, i n h av i n g a s u p p o r t ive h u s b a n d o n s i d e w ith her goals, especially in the early years of star ting a business a time that often coi n c i de s w i t h g row i n g a f a m i ly, s ays Tehranchian.

B or n i n Te h r a n , Ir a n , a n d r a i s e d i n a p a t r i a rch a l s o c i e t y, s h e s ays s h e n e ver thought of herself as a “female” advisor, and her clients never gave the impr ession that gender was an issue

“My parents raised me and my sister to believe that as girls we could do ever ything that men could do There was nothing that was off limits to us and that became second nature.” Susan Yellin

of all foreign property exceeds $100,000 at any point in a tax year. In that case, clients are required to file Form T1135. The penalty for filing late is $25 per day to a maximum of $2,500, plus arrears interest

The Canada Revenue Agency (CRA) was asked about this at the Association for Tax and Financial Planning conference held in fall 2021, during the CRA’s roundtable on taxation of financial strategies and instruments. It published its formal answers in a June 2022 technical interpretation.

The CRA stated that it is of the view that cr yptocurrencies a re f u n ds or i n t a n g i bl e prop er t y a n d a re s p e c i f i e d forei g n property that should be disclosed on a taxpayer’s Form T1135

Continued on page 8

One of the most common qu e s t i on s I ge t a s a n en t re pren eu r i s , “ How c a n I ge t pre s s cover a ge for my company?” Prior to launching my own business, I ran a public relations agency for six years, helping clients like TELUS secure media cover a ge a n d bu i l d bu z z Now I handle our PR strategy at Willful, f i n d i n g w ays to m a ke w i l l s a n d estate planning re le v ant to jour nalists a cross Cana da to r a i s e aw a ren e s s a b o ut t h e i m p or t a n ce of ge t t i n g a w i l l . We’ve been featured in hundreds of articles in top-tier publications, including profiles on CBC, CTV, and in the Globe a n d Ma i l , a n d we ’ ve s e en h ow pre s s m en t i on s c a n d r ive sales, build trust with your audience, and capture the attention of stakeholders such as investors and partners

Here are three strategies that can earn you media coverage as a financial advisor

As w ith any t y pe of sales out reach, you’ll be much more successful if you have an existing relationship In fact, one of the biggest reasons people hire PR agencies is to leverage t h e re l a t i on s h i p s a gen c y s t a f fers h ave w i t h j o u r n a l i s t s Earlier in my career, I spent two years as a tech journalist, and I know from experience that journalists get hundreds of em a i l s a d ay. If yo u r n a m e do e s n’t s t a n d o ut i n t h e i r inbox, your pitches will disappear into the abyss Star t by making a target list of publications based on what your target clients read. For each, identify the person who covers your “beat” (for example, the personal finance editor). Next, find appropriate ways to get on their radar. T h i s cou l d i n clu de fo l l ow i n g t h em on s o c i a l m e d i a a n d sharing or commenting on their articles, getting an introduction from a mutual connection, or meeting them at an industr y event.

Building relationships w ith a core group of 10 to 20 is much more effective than sending 100 cold emails to journalists who have no idea who you are.

As soon as something happens in the news, journalists look for people to comment on the issue and provide a relevant

perspective. When ne ws breaks, aim to be the first person i n t h e i r i n b ox of fer i n g to s h a re profe s s i on a l i n s i g h t s . Ultimately, your go al is to become a source the y tur n to whenever they need a well-informed take on an event related to your areas of expertise.

For example, when singer Aretha Franklin passed away in 2018, it was revealed she died w ithout a w ill. The next morning, we had email pitches out to journalists with ti ps on w hy ce l e br i t i e s of ten don’t h ave w i l l s , a n d w h a t Ca n a d i a n s c a n l e a r n f rom t h i s to apply to their own estate plans. This was timely, relevant, and something I could speak to with expertise as the C E O of a n on l i n e w i l l com p a ny. It resulted in multiple media interviews

Over the years, we ’ ve continued to use the same approach. When Queen E l i z a b e t h I I p a s s e d aw ay, we h a d a p i tch o ut i m m e d i a te ly on w h e t h er she had a will and how wealth transfers Next time you see a big financial stor y, have your target list ready and make sure you ’ re the one journalists turn to.

You’re likely already creating content for your blog, email newsletters, or other client-facing materials Why not turn yo u r t h o u g h t s o n c u r r e n t f i n a n c i a l e v e n t s i n t o m e d i a coverage? Instead of waiting for journalists to cover you, w r ite op eds or columns for industr y publications Most publications accept submissions, with guidelines posted on their websites. If you don’t have the ability or time to write ar ticles yourself, you can prov ide outlines to w riters who can help to flesh out your pieces

Opinion articles should be relevant to the current news cycle and take a firm stance on an issue for example, why recessio n fears are unfounded or why Gen Z consumers are set up for failure in the housing market. Many publications accept educational articles as well for example, I’ve contributed articles to MoneySense about estate planning basics

Just as in this column, there’s ty pically a bio at the end of the article that showcases your company. That makes it a g reat way to build awareness and position yourself as a trusted expert.

Ultimately, PR isn’t rocket science. Like any other aspect of marketing, it involves some subject matter expertise But mostly it requires a commitment to learn and resources time and skills on your team. If you don’t have those resources, consider hiring an external consultant or agency Either way, don’t ignore PR as a way to grow your client list in 2023.

ERIN BURY is the CEO at Willful co, a platform that provides an affordable, convenient, and easy way for Canadians to make a w ill and other end-of-life plans online Willful works w ith financial planners across Canada to help their clients get a solid estate plan in place

if the cr y ptocur rency in question is “situated, deposited or held outside of Canada ” Form T1135, however, not only requires the identification and reporting of foreign property, but also an indication of which countr y the property is from.

The CRA went on to state that it’s “impossible to precisely locate c r y p t o c u r r e n c i e s t h a t a r e m e r e l y t h e r e s u l t o f m a t h e m a t i c a l f o r mulas, the records of which are contained on ser vers that can be in several different locations around the world, and may even be moved and copied to a USB drive that may be in another location. It could also be argued that passwords can be stored by users and holders of cr y ptocur rencies, and thus follow the location of the physical person. The procedures for storing public and private data may also var y depending on the cr y ptocurrency.”

In the U K , the local tax guidance states that for as long as a person is a U K resident, the exchange tokens that person holds as a beneficial ow ner w ill be located in the U.K. In other words, in that taxing authority’s view, the situs of the cr y ptocurrencies will follow the holder’s residence for all tax purposes

T h e U. S . , h o w e v e r, h a s c h o s e n a d i f f e r e n t a p p r o a c h . I n December 2020, the Internal Revenue Ser v ice issued a statement indicating that it intends to add v ir tual currency accounts to the

When interest rates are rising, seniors should make sure they have a cash wedge to give them security to get over market slumps, says Francine Dick, a Toronto-based certified financial planner who works mostly with senior women. Seniors who star t draw ing on their Registered Retirement Income Funds or Registered Retirement Sav ings Plans when they are around 72 also need to find investments that will give them long-term grow th so their money lasts another 20 or so years

“I tell them they haven’t lost any thing until they sell,” says Dick, who favours value stocks and div idend funds for lower volatilit y, “but they do need to stay invested in the market ” Most clients are concerned these days with even fixed-income vehicles like bonds down in the markets. However, Dick p oints out, “If you ’ re looking long term, this too shall pass ” Dick says women tend to be a little more risk-averse than men. She spends time helping clients understand the issues making the news and why they should take the steps she suggests Re t i re e s a l s o n e e d to re a s s e s s t h e i r r i s k c a p a c i t y ( t h e amount of r isk the y can afford to take) in addit ion to their r isk tolerance (their comfor t w ith volatilit y), says Stephanie Holmes-Winton, founder and CEO of CacheFlo in Halifax

Not only do they need to save for their own personal needs, but they should also be setting aside money for emergencies

“Until we have absolutely guaranteed expenses and absolutely guaranteed resources, and nothing can affect those, we all need some financial flexibility Retirees need to be v igilant w ith all of their resources that are market-exposed ” S Y

re p o r t a b l e a cco u n t s u n d e r t h e Re p o r t o f Fo re i g n B a n k a n d Financial Accounts (FBAR) rules, which apply to the foreign bank accounts of a U.S. taxpayer.

The CRA was asked whether, for simplicity purposes, it would adopt a principle like that of the U K and treat the situs of cr yptocurr encies as following that of the holder’s residence and thus not require repor ting on For m T1135. The CRA’s response was non-committal, say ing the matter is “currently under rev iew ” In May 2022, at the International Fiscal Association Conference, the CRA confirmed this issue is “still under review.” In the meantime, the best advice is probably to disclose cr yptocurrency on Form T1135 or else risk hars h penalties from the CRA for non-disclosure.

As tax lawyers William Musani and Ashvin Singh concluded in a 2021 article published in Tax for the Owner-Manager, “This highly complex and unique form of intangible property flouts the traditional concepts and methods historically used to determine the situs of other types of intangible property Given the CRA’s administrative p osit ion and the heft y p enal t ies asso ciated w ith a failure to file Form T1135 … the cautious approach is to report cr yptocurrency holdings if the situs of the holdings is ambiguous ”

Wi t h l i f e e x p e c t a n c y a p p r o a c h i n g 8 3 y e a r s ,

Canadians gear ing up for retirement should star t thinking early about what, where, and how they want their retirement years to unfold.

While a good chunk of retirement has to do w ith finances, Rick Atkinson, a retirement fulfillment coach a n d a u t h o r i n To ro n to, f i n d s t h a t re t i re m e n t a l s o means helping people figure out their goals and how to achieve success in this period of their lives

“Yo u c a n’t j u s t p l a n t o r e t i r e a n d t h e n e x t thing you know you hit t h e b u t to n a n d yo u ’ re t h e re , ” a g re e s To ro n tob a s e d b u s i n e s s c o a c h Claudine Pereira of The Pink Co ach “It requires planning and st r ate g izing It’s almost like a business plan You map the w hole thing out and ever y year we take a next step for ward to the day they want to retire ”

Pe re i r a s ay s s h e a n d h e r c l i e n t s a l s o d o a b i t o f dreaming as to what they want their future to look like, creating ideas that go into their personal retirement strategic plan

B o t h Pe re i r a a n d At k i n s o n a g re e t h a t f i n a n c i a l a dv i s o r s c a n b e ke y to h e l p i n g p e o p l e re a ch t h e i r retirement goals, including finding purpose

In the summer of 2022, Canadians had a lower financial perception score than at any time since LifeWorks and TELUS Health started reporting this measure in the winter of 2021. Financial perception measures the way an individual sees his or her financial situation, as well as stress caused by finances and a comparison to peers earning the same income. Women, parents, young adults, and lower-income households all had lower than average financial perception scores.

Most young adults aged 18 to 24 are paying attention to their finances contrary to their parents’ impressions.

describe themselves as very or extremely engaged in their finances

have started saving for a home

have started saving for retirement

agree that financial stability is key to their overall happiness

s t h e c h i e f s t r a t e g y, p r o d u c t , a n d mar keting officer of Co ast Capital Savings, one of Canada’s l a r g e s t c re d i t u n i o n s , Advo c i s chair Catherine Wood has had a front-row seat to how ever yday Ca n a d i a n s we a t h e re d t h e p a ndemic and recent uncer taint y.

“ It f e e l s l i ke e ve r y b o dy i n o u r i n du s t r y h a s b e en wrestling with how to best suppor t their clients in what continues to be an undeniably complex and challenging en vironment,” says Wood in an exclusive inter view with FORUM “We’ve seen market volatility before, but when com bi n e d w i t h t h e ch a l l en ge s a n d ch a n ge c re a te d by COVID, it’s clear that Canadians need advice now more than ever ”

Looking to the future, Wood believes helping clients improve their financial futures re quires the indust r y ’ s deliver y of adv ice to continue to become more holistic, more inclusive, an d increasingly enabled by the thoughtf u l a n d p u r p o s ef u l u s e of te ch n o l o g y to h e l p i m prove outcomes

“Clients are going to continue to expect their financial par tner to understand multiple aspects of their life and prov ide comprehensive adv ice that not only considers t h e i r g o a l s , b u t a l s o t a k e s i n t o a c c o u n t t h e i r v a l u e s a n d their needs now and over time,” says Wood. “Adv ice can o f c o u r s e s t i l l b e m o d u l a r a c r o s s d i f f e r e n t c l i e n t n e e d s whether that’s saving, borrowing, investing and the like but the realit y is that people are holistic and

are looking for an integrated approach similar to how we now think about health.”

Wood emphasizes that a holistic perspective is critical as many clients weather the impacts of financial decisions made when the economic outlook was more optimistic. “Cre d i t h a s b e en s o e a s i ly a cce s s i bl e Ma ny p e op l e a re now finding that the y ’ ve overextended themselves and that they don’t know how to manage their debt responsibly or effectively ”

She adds, “From my standpoint, caring and empathy the how will be as important as the what. As advisors, we need to recognize that building trust and understanding w ith clients w ill be critical to ser v ing them well ”

Wood believes that trust will be particularly critical in situations where clients need to moderate their spending to counter the impact of inflation and the hig h cost of borrowing.

“ This w ill be key for adv isors, and yet it w ill be hard advice for clients to follow It will require making different a n d s o m e t i m e s d i f f i c u l t c h o i c e s e a c h d ay a g a i n s t a n external culture that for decades has told us that we can have it all ”

The challenging economic climate and continued need for adv ice was one of the dr iv ing motivators for Wood to s te p i n to t h e ro l e o f Advo c i s ch a i r. S h e h a s b e e n a member of the organization for nearly 20 years.

“Advocis plays a cr itical role in helping adv isors prov ide the r i g h t a d v i c e a t t h e r i g h t t i m e w i t h t h e t o o l s t h e y n e e d t o b e s u ccessful, par ticularly in our suppor t of education and practice m a n a g e m e n t . We n e e d t o c o n t i n u e t o a d v a n c e t h e p r i o r i t y i n i t i a t i v e s outlined in our 2023–2027 str ateg ic plan so that we can continue to prov ide Canadians w ith educated adv isors that provide sound advice aligned to current and emerging client needs,” she says.

One sig nificant oppor tunit y Wood sees to improve adv ice is ensur ing the indust r y cont inues to e volve to refle c t the diverse needs of clients.

“ There are major demographic and social issues that adv isors h a v e t o n o w t a k e i n t o c o n s i d e r a t i o n , [ i n c l u d i n g ] a n a g i n g p o p ulation, mental health, and a g row ing demand for ESG,” she s ays “ I a l s o t h i n k t h a t t h e a dv i s or y i n du s t r y n e e d s to b e m ore re f l e c t ive a n d i n c l u s ive o f t h e co m mu n i t i e s we s e r ve to c re a te the p s yc h o l o g i c a l s a f e t y n e e d e d to h e l p p e o p l e h ave a u t h e n t i c c o nversations and nav igate throug h potentially complex times ”

In addition to her work at Coast Capital, Wood’s passion for inclusiv it y and social purpose is informed by her experience as a woman in the industr y and her communit y engagement outside of the office

E a r l y i n h e r c a r e e r, s h e p r i o r i t i z e d a c c u m u l a t i n g a s m a ny de s ignations as she could (she has her MBA, MISt , ICD D, CFP, CLU, TEP, and CHS) so she could be “taken seriously in an industry w ith some ver y heavy hitters and only a few women. ” Wood has since been named one of Canada’s Most Powerful Women, one of the Top 50 Wealth Professionals, and one of the Top 50 Women in Life Insurance.

As a board member at Holland Bloor view Kids Rehabilitation H o s p i t a l , s h e i s a l s o p a s s i o n a t e a b o u t e q u i t y f o r t h o s e w i t h d i s abilities. “We have a lot more wor k to do to understand and correct the ways our industr y has historically overlooked or failed t o f u l l y s u p p o r t t h o s e t h a t e x p e r i e n c e b a r r i e r s a n d s y s t e m i c inequities.”

Since joining Coast Capital in 2019, Catherine has been instrumental in establishing the credit union as a social purpose organization, while g row ing its impact as a Cer tified B Cor poration™ a n d wo r k i n g tow a rd e n d - to - e n d a l i g n m e n t o f t h e co r p o r a te , brand, and member experience strateg y

“ T h e e vo lut i on to a s o c i a l p u r p o s e or g a n i z a t i on i s on e t h a t builds on our co-op er at ive ro ots and 80-year le g acy of helping C a n a d i a n s u n l o c k f i n a n c i a l o p p o r t u n i t i e s , ” s ay s Wo o d “O u r mem bers value banking with a partner that prioritizes supporting more equitable access to education, employ ment, and financial advice to help more Canadians get ahead It really proves that there is a business model where you can do good and also do well.”

Wood believes a critical component to building a more inclusive indust r y is continuing to invest in mentorship, par ticular ly for younger adv isors. “I’ve had the oppor tunit y to benefit from the adv ice of many mentors who have helped to suppor t my career, and I believe that ever yone in our industr y has a responsibility to pay it for ward.”

Another key oppor tunity is suppor ting younger adv isors who are reimagining how to be relevant to their clients, especially when it comes to technolog y

“Clients’ expectations have changed, especially among younger professionals and newer investors,” says Wood “Our competitors are no longer just peers at rival firms, or even robo-advisors and fintechs The rise of crypto, and even the TikTok finance influencer, has created more opportunities for Canadians to hear advice that may not be right for their situation and, as a result, make poor decisions

“We need to understand and appreciate that we are no longer necessarily our client’s only choice, default choice, or most-trusted choice As an industr y, we need to continue to invest in experience and relentlessly identify oppor tunities to streamline and simplify, b o t h a t a n i n du s t r y a n d i n d iv i du a l f i r m l e ve l , to com p e te w i t h clients’ evolv ing ser v ice expectations ”

Wo o d a d d s t h a t re d u c i n g i n d u s t r y co m p l e x i t y w i l l re q u i re co-opera tion and par tnership across the industr y, including w ith re gulators and ke y indust r y par t ners “It’s al l par t of creat ing a sustainable Advocis, sustainable adv isors, and ultimately helping more Canadians to thrive.”

Wood is excited to explore these themes with Advocis In addition t o h e r w o r k a t C o a s t C a p i t a l , s h e b r i n g s e x p e r t i s e i n d i g i t a l experience from senior roles at Aviso Wealth Inc., Qtrade, TD Bank, CI Assante Wealth Management, and as a pr incipal in her ow n technology consulting company “long before tech was even a thing.”

While there’s sig nificant wor k ahead, Wood is optimistic for t h e f ut u re Wh en s h e f i rs t b e g a n i n t h e i n du s t r y, mut u a l f u n d s were just starting to become a mainstay and much of the financial ser v ices industr y operated in silos.

“As a n i n d u s t r y, we s h o u l d b e p ro u d o f t h e p ro g re s s we ’ ve made; and Advocis has a proud t r adition of continual ly r aising the bar for financial adv isors and planners. As we look to br ing hig her professional standards across the count r y, and w ith title protection now being recognized in Ontario, I believe our transformation as an industr y is really just beginning.”

SUSAN YELLIN is a Toronto-based w riter specializing in the financial ser vices industr y.

Th e f i n a n c i a l s er v i ce s i n du s t r y i s u n der goi n g major structural changes Title protection, capital markets modernization, and reforms in the life a n d h e a l t h s e c tor a l l re pre s en t p a t hw ays for mu ch - n e e de d pro g re s s for a dv i s ors a n d consu m ers , s p e a kers to l d t h e Advo c i s Re g u l a tor y Affairs Symposium 2022.

Title protection, for example, is a long overdue issue but one that gives consumers con fidence when working w ith a credentialled financial advisor (FA) or financial planner (FP), said Greg Pollock, president and CEO of Advocis “ Title protection raises the bar for financial advisors and planners. It offers a tremendous benefit to our clients and to the public interest … and has been the goal of our association for decades ”

The credentialling legislation, passed in 2019, is a consumer pr otection mandate, but also deals w ith advisor education and consumer confidence, said Mark White, CEO of the Financial Ser vices Regulator y Authority of Ontario (FSRA). White noted work still needs to be done, comparing the legislation to a large

What impact w ill structural changes have on the industr y, adv isors, and clients? Susan Yellin repor ts from Advocis’s 2022 Sy mposium

skeleton that needs more flesh on the bones to prov ide optimal guidance for clients and advisors

He added that advisors should have multiple pathways of education to provide financial advice and financial planning while consumers, too, want their adv isors to meet minimum standards o f e d u c a t i o n s o t h e y c a n h ave co n f i d e n ce i n t h e i r f i n a n c i a l prov iders.

White said consumers polled by FSRA were shocked when told the industry wasn’t already regulated in this area. It surprised them that “ someone can call themselves a financial advisor or a financial planner and actually have no education or oversight ”

While a number of credentialling bodies have been approved, FSRA wants a public registry system so consumers can easily determine who is licensed and who isn’t, w ith an end goal of national harmonization.

Peter Bethlenfalvy, Ontario’s minister of finance, said instituting b o t h FA a n d F P d e s i g n a t i o n s i s a l l a b o u t c o n s u m e r s a n d t h e confidence it gives them that they are receiving the ty pe of advice they want.

“It’s a complex landscape,” he said “We are looking to streamline things.”

B e thlenfalvy said he b e lie ves g row th in te chnolo g y w il l also prov ide consumers w ith a better exper ience and that Ontar io is t h e m o d e l to f o l l ow. “ I w a n t O n t a r i o to b e t h e m o s t a dv a n ce d d i g i t a l ju r i s d i c t i on , i f n o t i n t h e wor l d t h en cer t a i n ly i n Nor t h America At the same time, we need to make sure we ’ re efficient and effective.”

Catherine Wood, chair of Advocis, said the industr y has come a long way when it comes to education But Wood expressed surprise that it’s taken this long for advisors to become regulated.

“I am amazed that al l of us didn’t step back for many, many years and say : why aren‘t we regulated? People spend eight to 10 and sometimes 12 hours each and ever y day [as advisors] and this is something that wasn’t regulated ”

Ontar io is also tr y ing to modernize its capital markets, the first such evaluation for the Ontar io Secur ities Act in almost 15 years, s a i d Wa l i e d S o l i m a n , ch a i r of t h e O n t a r i o Ca p i t a l Ma r ke t s Modernization Task Force.

Soliman acknowledged modernization has been a low priority on the gover nment agenda Over the course of a centur y, many small elements have been added to the legislation, turning it into “ a little monster.”

However, he said Ontarians are concerned and want to get back to basics when it comes to regulation, as well as job and wealth creation. “I think it’s a cr itical, cr itical shift in focus for our capital markets and for our Ministr y of Finance to think not only about how we police the capital markets and how to grow the capital markets, but also [what] will allow for job and capital creation in this province ”

Soliman acknowledged that a national securities regulator was a non-starter, but that a more robust system is needed for clients who want protection, adding that the current system through the Ombudsman for Banking Ser v ices and Investments isn’t working as well as it should.

What is going ahead at the end of the year is a new self-regulator y organization (SRO) that will consolidate the functions of the Investment Industr y Regulator y Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA). In addition, the Ontario Securities Commission (OSC) is reinventing itself based on the task force’s recomme ndations

The goal of the new SRO is to give investors easier access to differen t pro du c t s a n d en h a n ce d i nve s tor pro te c t i on . Un der t h e Ca n a d i a n S e c u r i t i e s Ad m i n i s t r a tors’ Cl i en t Fo c u s e d Refor m s (CFR), client interests come first in their dealings with firms, which promotes better protection for retail investors.

Wade Baldwin, president of Baldwin and Associates Financial Services Ltd., said he has witn essed first-hand the pressures advisors and investors are feeling with all the regulatory changes. “I’m trying to understand the regulator y burdens and how the y ’ ve affected our individual practices from an advisor’s perspective, where we ’ re supposed to be at this point with CFR, and all these [other] issues.”

According to Ivy Lam, a member of the OSC’s Investor Advisory Panel, investors are concerned about how technology has changed the way retail investors can access their purchases. They are also worried about the heightened risks for those who use online selfdirected investing, robo-advising, and other platforms that provide easier access to products (such as cr y ptocurrency) that may not be well understood

T h i s , L a m s a i d , i s w h ere i m prov i n g i nve s tor l i ter a c y com e s into play. “I think investor education is key in preventing a lot of the problems that we see for instance, preventing them from falling victim to scams and all sorts of fraud I think it would also help reduce the mistrust of investment advisors and the industr y. I think ever yone has a role across the whole spectrum of stakeholders ”

Irene Winel, senior vice-president of member regulation and strategy at IIROC, said rebuilding t he regulator y securities framework will take time, but it is important that the industry be nimble

“We are tr y ing to ensure that we have the cor rect r isk-based approach to continue to focus on areas so we can support investor protection and help capital markets,” said Winel

Most regulators are using a principles-based approach, taking into account the needs of both clients and business, said Susan Silma, head of risk and regulator y business practices at Sun Life Silma emphasized that CFR is a broad initiative with a significant number of implications for adv isors, clients, and back-office systems.

“I think [CFR] is a big deal,” she said “In my experience, something this size will take some time for regulators to wrap their arms around. … We’re not done with CFR.”

The life and health sec tors are also seeing changes, par ticularly when it comes to treating clients fairly.

F r o m a n i n s u r e r ’ s p e r s p e c t i v e , “ c u s t o m e r s s h o u l d n o t b e prejudiced by any specific channel that they’re using,” said Ali Ghiassi, v i ce - pre s i den t of i n du s t r y a f f a i rs a n d gover n m en t re l a t i on s a t Canada Life “It also requires insurers to build in processes to ensure t h a t t h e c u s to m e r i s re s p e c t e d … f ro m t h e ve r y b e g i n n i n g o f creating products and all the way through.”

Ghiassi said that in 2020, Canada Life determined it had to have fair treatment for its customers, a move he said was also good for business The firm redrafted its contracts with advisors and developed principles that involved hiring and training advisors, as well as complaint handling and contract terminations. It also tasked a compensation review committee with closely examining the incentives and compensation the insurer offers “We see this as something that needs to be enhanced.”

For h er p a r t , L a u r a Ta m bly n Wa t t s , pre s i den t a n d C E O of CanAge, said fairness comes down to the ability of a client to consent and address a problem afterwards in a way that is neither difficult nor expensive

The Canadian Council of Insurance Regulators (CCIR) brought in fair treatment o f customers guidelines in 2018, which Tamblyn Watts called a pathway for change for the industr y, as well as for aging clients whose needs are becoming more prevalent

She said consumers are interested in finding information quickly and are “ less w il ling to hear baffleg ab.” Over al l, Tamblyn Watts stressed, “It’s a more complex environment This means that we, as insurance advisors, have a vital role to play.”

Pro duc ts, to o, are b e coming more complex, she said. While some can go online to find the information the y need, adv isors must be much clearer in their communications with clients. “That trusted professional role is going to be the offset for those internet searches ”

Huston Loke, executive vice-president of market conduct regulation at FSRA, said the objective of the CCIR guidelines is not to div ide, but to align incentives and the value of the product to the consumer. The regulations look to identify who the customer is and how compensation should be tied to the ser vice and needs of the client It’s necessar y, he said, to take strong actions against those who make major errors because “the actions of a few [bad advisors] taint the entire industr y. ”

Tamblyn Watts noted the industr y needs to wor k on language, especially when it comes to such topics as total cost reporting. She said the industr y can do better than it has and should aim for a

s i m p l e on e - p a ge o ut l i n e w i t h cl e a r ex pre s s i on s a n d a d d i t i on a l e ducational mater ials. “Disclosure means more understanding , not more words ”

The industr y is also ver y much involved in technolog y and innovation, particularly with the opening in 2020 of FSRA’s innovation office Glen Padasser y, executive v ice-president, policy and chief consumer officer with FSRA, said the office’s goal is to remove the traditional thinking that a regulator is there to say no to insurtechs and other small businesses

“Innovation is a process. It’s not the destination,” emphasized Padasser y Some companies will succeed, while others will fail, but together he said the industr y will learn to grow

So far, FSRA’s innovation office has put together an innovation framework and launched its first test and learn project, w ith the goal of keeping its approach flexible

Pa d a s s er y s a i d t h ere i s a m i s con cep t i on t h a t t h e i n n ov a t i on office approves fintechs over t r aditional companies. In fact, the office sur veyed 4,000 Ontar ians who said they prefer red human interaction over purely digital streams.

“Our office is not in the business of defining what fintech is you are So, if you create something and it should be broug ht to the mar ket, we w il l wor k w ith you to t r y to make this a realit y, ” Padasser y said.

At a s e s s i on fo c u s e d on l e a d i n g a n d ch a m p i on i n g p o s i t ive ch a n ge , fo o t b a l l l e gen d Mi ch a e l “ P i n b a l l ” Cl em on s to l d t h e Symposium that advisors ar e doing a great job, but need to reach more people so Canadians can live the kinds of lives they deser ve

“ L e t’s h e l p f i g u re t h i s t h i n g o u t . L i f e i s n o t a b o u t s t u f f . It’s about people.”

YELLIN is a Toronto-based w riter specializing in the financial ser vices industr y.

The life insurance industry has long been a proponent of health promotion. As early as 1903, life insurers proposed the idea that healthier living and the benefits of disease prevention could be promoted to their members. Longer, healthier lives are good for policyholders and good for insurers. It is and always has been a natural alignment of interests — everyone benefits from better individual health.

Only now, however, do we have the tools and resources to make it a reality. New insights into the way people make decisions that affect long-term outcomes have powered an innovative approach whereby:

• Short-term incentives, applied to the business of life protection and health improvement, can put consumers on the path to better health and better life decisions.

• A well-timed, well-framed, well-delivered and integrated series of small steps can lead to real progress and lasting change.

Change with a “nudge” means starting the process with a suggestion in the form of an appealing incentive, then encouraging the consumer to adopt it as a new behavioural direction by offering equally appealing, ongoing incentives to continue.

This new kind of life insurance uses data and behavioural science insights together to ignite positive, ongoing change in the health of individuals.

This new approach to life insurance is Manulife Vitality. Manulife Vitality integrates the concept of incentives: It provides clients with attractive incentives for adopting an active lifestyle, access to a broad range of wellness and prevention options and value through earned premium savings and rewards.

By providing immediate rewards for healthy choices (for example, going for a run or going for a medical checkup), short-term rewards are married with long-term goals. The formula for effectiveness: Break down long-term health improvement goals into immediate, achievable steps and provide rewards for many of the small accomplishments that make up the overall path. Deliver these consistently, frequently and soon after the activity is completed, and the consumer becomes engaged; timing and framing of the rewards are also key.

The Manulife Vitality program delivers this on an individual, customized basis, no matter what the client’s initial state of health or activity might be. It is a dynamic, progressive model that can work for everyone regardless of their starting point. It’s highly sophisticated, data-driven and complex in its actual design, but the consumer view of it is extraordinarily simple and engaging.

This new kind of life insurance will create two fundamental changes in our business:

• A move from static to dynamic pricing. In the traditional pricing model, risk assessment is produced at inception then essentially locked for the policy duration. In a dynamic pricing model, frequent and individual health inputs offer the potential for more efficiently priced premiums that can result in savings for the policyholder.

• Improved mortality. As policyholders engage in positive health and wellness management, their life expectancy can improve, which results in improved mortality and the opportunity for premium savings.

With Manulife Vitality, your clients can interact with their insurance daily. Everyday activities offer an opportunity to remember and act upon healthy choices — and earn rewards for doing so. A well-designed, incentive-driven health program cleverly and productively leverages the natural human tendency towards short-term gratification.

This practical method of health engagement encourages all policyholders, regardless of health status, to take steps to become aware of, monitor and manage their health risks. Policyholders also have the opportunity to influence the premiums they pay. Improving their health can reduce their risk and their cost of insurance.

For advisors, taking a shared-value approach brings three key benefits:

• Broader market appeal.

Manulife Vitality transforms traditional insurance to a new kind of insurance that clients can interact with and feel the benefits of immediately.

• More satisfied clients.

With Manulife Vitality, your clients don’t just own their insurance, they experience it daily. As a result, they may be likely to feel differently about their insurance and about you, which may help enhance customer satisfaction across the board.

• Stronger relationships and better business outcomes. Manulife Vitality is founded on engagement. You’ll have multiple opportunities to reach out to your clients and see how they’re doing. This ongoing interaction can help you forge stronger client relationships, leading to fewer lapses and increased referrals, as well as open up sales opportunities.

Our industry has always been an ally of the public health promotion movement, and Manulife has always been a strong proponent. Manulife Vitality realizes that promise: Life insurance products actively promote individual progress towards better health and directly reward the policyholder on many levels for taking positive steps.

More than just a noble idea, this is a next-generation solution — a whole new approach to life insurance — that actively engages and assists people from all walks of life to lead longer lives in good health.

For more information, reach out to a Manulife Sales Representative or visit advisor.manulife.ca

1 Manulife Vitality program member data as of February 28th, 2022

Insurance products are issued by The Manufacturers Life Insurance Company. The Vitality Group Inc., in association with The Manufacturers Life Insurance Company, provides the Manulife Vitality program. The Manulife Vitality program is available with select policies. Vitality is a trademark of Vitality Group International Inc. and is used by The Manufacturers Life Insurance Company and its affiliates under license. Manulife, Manulife & Stylized M Design and Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it and by its affiliates under license. Accessible formats and communication supports are available upon request. Visit manulife.ca/accessibility for more information. © 2022 The Manufacturers Life Insurance Company. All rights reserved.

hen you ask someone “How are you?” w h a t’s t h e m o s t com m on re p ly yo u h e a r ? T h e No. 1 t h i n g we ’ re h e a r i n g f r o m f i n a n c i a l a d v i s o r s a n d o t h e r professionals is “I’m so busy” As coaches, we n a t u r a l ly pro b e de e p er, a n d o u r advisor clients often elaborate with “I’m busy, but still not feeling productive ” One advisor recently told me he felt like Sisy phus from Greek my tholog y. If you aren’t familiar with the stor y, Sisyphus was sentenced by Zeus to roll a boulder up a hill, only for it to roll dow n ever y time before making it to the top. Sisy phus had to repeat this action for eternity. Can you relate?

A re ce n t s t u dy o f f i n a n c i a l a dv i s o r s i n t h e U. S . by f i n a n c i a l blo g ger Micha e l Kitces found that only ab out 20% of a dv isors’ t i m e i s s p en t i n cl i en t m e e t i n g s e ven t h o u g h a dv i s ors ’ d a i ly ro ut ines should b e fo cused mainly on client mee t ing s as this is the most productive use of their time The average adv isor works 45 hours a week, so this means about 36 hours weekly are spent on other activities, such as preparing and doing follow-up for meetings, management, suppor ting administration, compliance, and myriad other tasks required to run a business The study also found that increasing the amount of client-facing time by just four hours a w e e k s e p a r a t e d t h e to p 2 5 % o f a d v i s o r s f ro m t h e re s t o f t h e study group A small change in routine increases productivity with a big payoff.

We see many productivity challenges when we dig deeper into an advisor’s day Here are some of them, with suggested solutions

The most productive activity is time spent with clients It becomes easier to make this a priority when you have a compelling v ision of your life and business, with defined goals and values. If you don’t have a clear plan, it’s much easier to get distracted and pulled off course When you are inundated w ith to-dos, a great question to ask yourself is, “What is the one thing I can be doing right now to move me closer to my goal?” Think of Sisy phus and hi s rock. You h ave m a ny d i f feren t - s i ze d ro ck s to m ove on a re g u l a r b a s i s Answering this question daily can ensure you spend time on the big rocks (your main priorities) first.

Also, we often see advisors putting little or no time in their calendars to work on their business. Even finding a two-hour block per week to focus on areas to improve makes a big difference. These strategies should align with your vision as well

Once you ’ re clear on your vision and goals, check to make sure your current schedule aligns with them. A best practice is to create your Ideal Week and aim for a similar structure ever y week We recommend colour coding your main activities so you can see where you are spending your time w ith a quick g lance at your calendar. We use a system developed by Way ne Cotton of Cotton Systems He outlines four categories:

• Mellow Yellow is personal time

• Green Machine is revenue-generating time

• Red Tape is administrative time

• Blue Sky is planning time

Using those four colours, you can get a clear indication of where your time is spent each week

We suggest scheduling time in the morning, when most people are at their hig hest energ y level, for the most impor tan t tasks or tasks that make you procrastinate The book Eat That Frog! by Brian Tracy is a valuable resource on this topic If you procrastinate with prospecting, for example, you may want to make sure you reach out to 10 people before 10 a m each day

Another effective tactic is to block time right after your client meeting to get star ted on your notes and follow-up tasks before you che ck emails, re tur n cal ls, or other w ise ge t dist r a c te d T he notes will be more detailed and accurate while the meeting is still fresh in your mind.

Also, don’t think of this as more work, because it w ill end up being the opposite when done effectively Structure and processes like the ones above create more freedom for you.

We also say, “Delegate to people, process, and technolog y. ” One of the most impac tful exercises adv isors can do is to calculate their hourly rate. Divide your revenue by 2,000 (an average number of hours worked in a year). Typically, this hourly rate will range from $250 to $1,000 an hour

Now, you want to hire someone at less than your hourly rate. Paper work, meeting notes, and calling clients to book appointments can all be delegated to someone else at a much lower cost On the personal side, you can delegate household tasks that don’t br ing you joy. Someone else can clean your home, prepare your m e a l s , m a i n t a i n yo u r ya rd , or de t a i l yo u r c a r a t l e s s t h a n yo u r hourly rate. Of course, if you love gardening or cooking, keep doing those tasks!

If you have team members, or e ven if you are a solopreneur, de ve l op pro ce s s e s to c re a te s t r u c t u re for ro ut i n e t a s k s . Cl i en t onboarding, me eting preparation, and follow-up are all common activ ities for which you can create a process that you document and do the same way ever y single time.

F i n a l ly, yo u a n d te a m m em b ers c a n de l e g a te to te ch n o l o g y. Many of us have access to a client relationship management (CRM) system but haven’t learned how to maximize its value. Other examples include using templates for documents such as Reason Why

letters and investing in scheduling software for your calendar Ask your head office or technolog y specialists in the industr y if you can automate certain routine processes to make your life easier

This is a common ailment in the modern world and is the downside to technology. We’re bombarded 24/7 with communications, while social media and other software applications have been specifically programmed to give us a dopamine rush for checking messages, g e n e r a t i n g l i ke s , a n d e ve n p l ay i n g g a m e s . T h e y w a n t u s to b e addicted. Nir Eyal has written an excellent book on this topic called Indistractable

One tip is to turn off email and phone notifications when you are doing focused work and especially in client or team meetings. One of the downsides of virtual meetings is that attendees can be checking their phone or email less obviously than in person but we are not fully paying attention if we do that. Another suggestion is to choose a different location for different ty pes of work for example, going to a boardroom to return phone calls or going to a coffee shop to work on a creative project such as a newsletter. A young advisor we work with shared that he deletes Instagram from his phone from Monday to Friday and only allows himself to check it on the weekend.

If you ’ re at the point of feeling that ever y thing is just too much, you ’ re not alone. If you ’ re in this state currently, it’s important to ask for help and if possible take some time away to reset. As coaches,

we often schedule our own buffer time to catch up when we find ourselves in a backlog. Can you take a temporar y break from client meetings if needed to clear your task list and get organized?

It can he lp to enlist your assistant or a fr iend to ta ckle your backlog of tasks together. As you go through either physical files or electronic tasks, use the 4 Ds: do it now (if it will take only a few minutes), delegate it, defer it and schedule time in your calendar to do it, or dump it and don’t do it at all.

Time for rest and rejuvenation is important so you are at your b e s t w h en yo u a re wor k i n g We s e e m a ny a dv i s ors n o t t a k i n g enough breaks throughout the day or not taking enough vacation time. This is extremely important to ensure you can recharge your en er g y a n d avoi d bu r n o ut a n d o t h er s er i o u s h e a l t h pro bl em s Often, if we don’t slow down, our bodies will slow down for us in the f orm of a physical or mental health crisis. If you ’ re at the point of feeling anxious or experiencing panic attacks, it is imperative to seek the help of a professional therapist or doctor.

Eve n m a k i n g a s l i g h t ch a n g e o r a p p l y i n g j u s t o n e o f t h e s e strategies to enhance your routine can allev iate a lot of stress and help you get back to focusing on what you do best. At the end of t h e d ay, we ’ re h u m a n s o we c a n’t b e to o h a rd o n o u r s e lve s . S o m e t i m e s , t h e re i s j u s t to o m u ch to d o, a n d t h e re i s n o t h i n g w rong w ith say ing “ no ” to things that are not feeding your v ision and g iv ing you energ y. As Daniel H. Pink said, “Deciding w hat not to do is as impor tant as deciding what to do ” If you focus on the activ ities that only you can do, you w ill be in a great position to achieve your v ision and goals.

APRIL-LYNN LEVIT T is a business coach w ith the Personal Coach, providing customized coaching to financial advisors and their teams.

Donating publicly traded securities in-kind is the most tax e cient way for your clients to support their favourite causes. Our process is simple, e cient and, if required, includes anonymous giving to charity.

Abundance Canada is a public foundation with a long history of assisting professional advisors and their clients with significant and complex charitable gift planning scenarios.

Visit abundance.ca/for-professional-advisors or call 1.800.772.3257 to speak with a Gift Planning Consultant for more information on this and other tax e cient ways to give.

Generosity changes everything

How can you build a world-class

In M a y 2 0 1 9 , I w a s i n O t t a w a a t t e n d i n g t h e Conference for Advanced Life Underwriting (CALU). Several of our current and past clients were there, to o, s o we d e c i d e d to h o s t a re ce p t i o n to b r i n g ever yone together. I remember being excited when I s a w B r e n t Pe a c o c k a n d A l l a n H r y n i u k e n t e r t h e ro om We h a d n’t s e en e a ch o t h er s i n ce 2 0 0 9 , w h en I wor ke d on a pro je c t for their fir m, the Pea co ck Sher idan

Group (PSG), so I was eager to get an update on their busin e s s . We s o on fo u n d o u rs e lve s i n a convers a t i on a n d I re m e m b e r t h i n k i n g s o m e t h i n g w a s o f f I a s ke d i f e ve r yt h i n g was OK, and they shared that their business par tner Grant Sheridan was in a coma and they were not sure if he would recover

If you ever had the oppor tunit y to meet Gr ant or were lucky enough to be in his close circle, you know he was a pillar

Four members of the Peacock Sheridan Group team: (from left) Allan Hr yniuk, BPhEd; Heather Fox, CFP; Brian McGuire, BA, CFP; Brent Peacock, BA, CHS

his

with

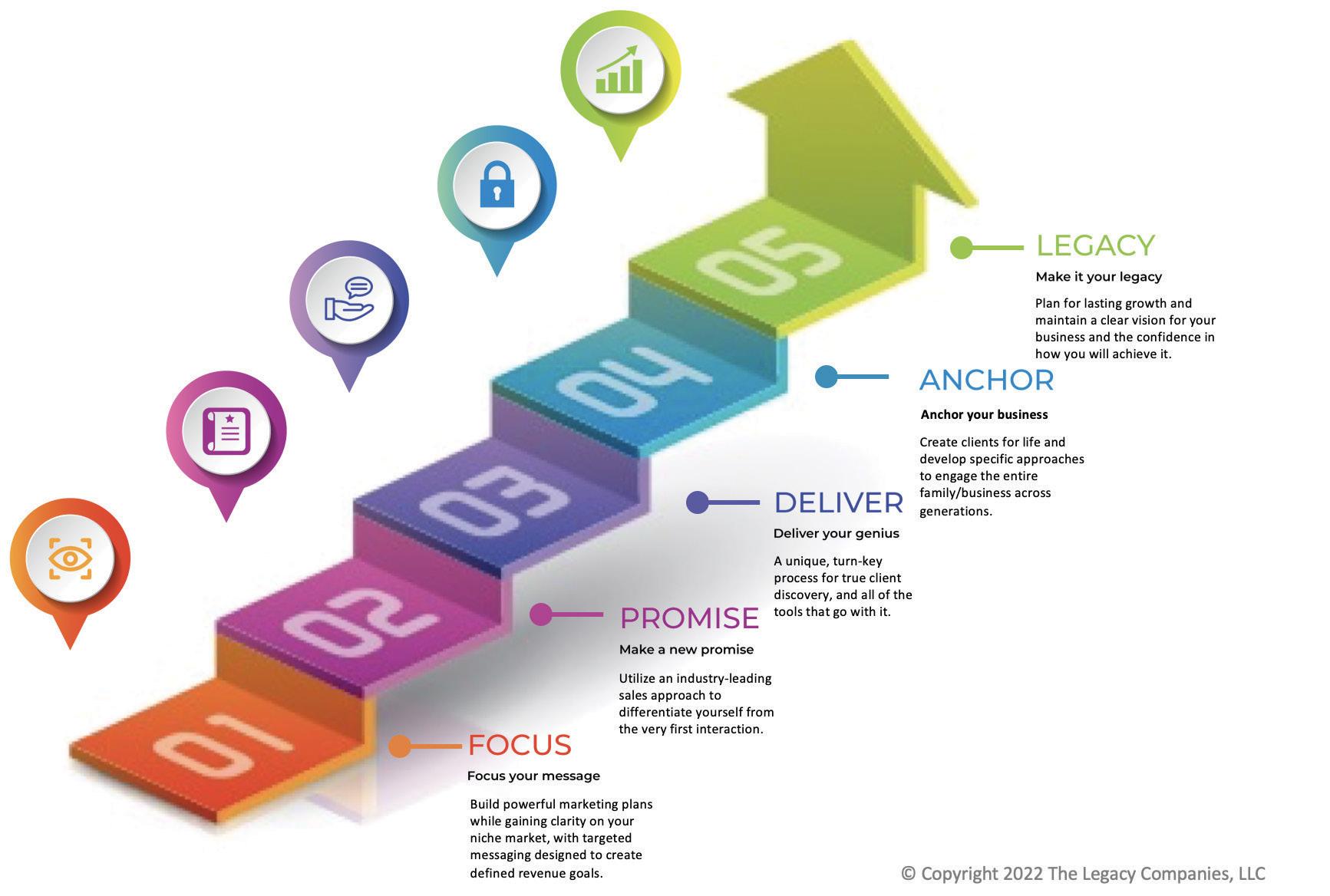

in the CALU communit y. Two months after CALU, Brent reached out to le t me know that Gr ant had passed but h i s l e g a c y re m a i n s s t ro n g In 2 0 2 0 , a f te r mu ch h e a r t a ch e and griev ing, PSG’s co-founder and par tner, Brent, managing par t ner, Al lan, and their new par t ner, Br ian McGuire, w e re re a d y t o re - e n g a g e w i t h my f i r m , T h e L e g a c y Companies, to continue what Grant had started: positioning PSG as a lea der in its communit y and a cross the count r y. We began our work w ith the five stages of Legacy’s Adv isor Grow th Journe y.

Depending on the specific needs of the advisory firm, we conduct an assessment to determine the optimal starting point Given what they had just been through, the legacy stage was a clear w inner for PSG. It focuses on clarify ing a business’s values, vision, and goals

Smart, successful people have many ideas about how they want and don’t want thing s to be in the future. The team at PSG was no different The first essential step was to align the team behind a cr ystal-clear vision for the future

After doing this work for more than two decades, I have found that a company ’ s v ision becomes much clearer once you understand two things: the core values of th e business and the culture the group wants to create. So, that is where we began our exploration

We guided the team through the Legacy Values Exercise, which highlighted the need for alignment and a clear energ y t o a c h i e v e w h a t P S G b e l i e v e d w a s i m p o r t a n t f o r t h e i r cl i en t s , te a m , a n d com mu n i t y A s t ron g c u l tu re i s cen t r a l to P S G , a s e ve r yo n e w h o i n te r a c t s w i t h t h e m k n ow s . We ar r ived at the fol low ing core values that PSG now refers to as their culture co de:

• Customer Delight: Our client interactions are inviting and productive. We break stereoty pes by having fun along the way

• Discreet: We respect the confidentiality and sensitivity of our clients and the work we do on their behalf.

• Positive Attitude: We bring positive and constructive energ y to ever y situation. We choose to be part of the solution.

• Innovation: We look at each client as a brand-new opportunity to apply our collective knowledge to maximize their returns.

• Collaboration: We work as a team with our clients and strategic partners to find the best solutions.

• Long-term Partnerships: We put solutions and relationships before profits

• Obsessive about Process: We are methodical with each client’s plan. Hav i n g t h i s p e r s p e c t ive a l l owe d t h e te a m to d e f i n e a vision for the business: PSG was to become the pre-eminent independent planning firm in the Okanagan Valley and be know n and respected nationally

To g e t h e r, we de f i n e d f o u r go a l s re qu i re d to m a ke t h a t v i s i on a re a l i t y : e vo lve m a r ke t i n g , m e s s a g i n g , a n d br a n d ; enhance client deliverables and the overall client experience; build on a strong network and collaboration with other professionals; and expand the team to ser ve the grow ing needs of clients

The focus stage clarifies a business’s niche, brand, and core messaging, and builds a strategic marketing plan. With PSG, this stage included a powerful discussion and confirmation of the t y pes of clients for whom the practice can do its best work. The firm’s niche is medical and dental professionals and business owners While this is not a tightly defined niche, we discovered PSG’s clients have strong commonalit y and are looking for the same things from their relationship w ith the practice In particular, they value PSG’s approach to comprehensive planning and the collabor ative team approach that focuses on finding the best possible financial outcomes for clients, their businesses, and their families While many advisor s talk about ser ving the best interests of their clients, PSG lives it. The firm thrives by prioritizing client relationships and solutions rather than profits

In t h i s s t a g e , w e d e c i d e d t h a t w h i l e P S G co u l d s t i l l d o s o m e g r e a t w o r k w i t h o u t l i e r s , a l l m a r k e t i n g e f f o r t s would cent re on the core targe t g roup Subsequently, PSG h i r e d a m a r ke t i n g te a m to h e l p l a u n ch a n e w we b s i te a t w w w. p e a co ck s h e r i d a n . co m t h a t p owe r f u l l y te l l s t h e P S G stor y The site includes v ideo testimonials from clients who all echo the value, experience, and results they get from their relationship with PSG. The theme that stood out is that PSG clients feel like family

The promise stage zeroed in on how to differentiate PSG’s value, from the first interaction with ideal clients. We worked o n d e f i n i n g w h a t m a ke s t h i s f i r m u n i q u e i n t h e c rowd e d financial ser vices marketplace We talked about how 65% of the p eople we meet are v isual processors w ho understand a n d r e m e m b e r t h i n g s t h e y s e e , w h i l e 3 0 % a r e a u d i t o r y p r o ce s s o r s w h o re t a i n i n f o r m a t i o n t h ro u g h h e a r i n g a n d listening . So, if we created a v isual representation of PSG’s value and a story to explain it, we would dramatically increase the odds for client engagement

We use The Planning Horizon® to demonstrate an advisor’s competitive advantage in a conversational way that is also experiential Over the last 30 years, I’ve seen things through the lens of an advisor, trainer, and coach to advisors. During that time, I’ve found most advisors take a defensive approach to differentiating themselves from the competition Many focus on demonstrating their technical competency because that’s where they have the most confidence and opportunity to make money Our approach with PSG was to concentrate

solely on how they ser ve those who are looking to them for guidance PSG’s differentiator is that the team starts by understanding what matters most to clients before even beginning to discuss or recommend any ty pe of solution

What was powerful at PSG was that this belief system was already instilled in the team. They just didn’t have the right visual to tie it all together The Planning Horizon® provided what they needed, along with the words and structure of the conversation, so it became part of PSG’s culture.

In the deliver stage, we worked to enable PSG to make good on the promise to deliver a t r uly comprehensive planning process w ith a strong qualitative and quantitative balance. Al lan and Br ian, along w ith adv isor Heather Fox, prov ide g reat planning bench st rength Fur ther more, PSG already had some great practices in place. We wanted to look at ways to standardize the planning across the entire business and team, while enhancing the experience for clients.

O u r f o c u s w a s o n d e l i v e r i n g Legacy’s advice-based model where t h e p l a n n i n g pro ce s s i s a ke y component that also includes the elements o f e m p a t h y a n d u n d e r s t a n d i n g Empathy is leading w ith deep care a n d re s p e c t for cl i en t s a n d t h e i r vision for the future Understanding is b eing aware of and appre ciat ing the circumstances that affect clients. P l a n n i n g i nvo lve s qu a l i t a t ive a n d quantitative analysis that addresses each client’s needs. Clearly, this goes far beyond buy ing RRSPs or insurance products. This is truly comprehensive planning and clients love it.

PSG combines Legacy’s Qualitate™

application with the new Conquest financial planning software to create truly differentiated plans for clients

T h e f i n a l l e g of t h e j o u r n e y w a s t h e a n ch or s t a ge , ge a re d toward creat ing p ower ful business st r uc tures desig ne d to serve client needs across generations PSG had a strong desire to operationalize the business. This meant putting the right team members in the r ig ht roles and for malizing Leg acy ’ s adv isor y busi ness org char t The model is simple, yet profound. It is designed to leverage the assets of the business and organize each function in such a way that it both allows for g row th and stimulates it In the model there are two main areas of the business. Production refers to the licensed clientfacing advisors who have a primar y responsibility of producing new profitable business Operations encompasses the team members who are responsible for enabling production while

“

protec ting the business throug h client eng agement, client ser vice, compliance, marketing, and accounting.

The key to this model is what we call the operations team leade r (OTL), w hose role is to ensure that the pro duc t ion team has what it needs to effectively engage new business, and that the operations team has the resources to onboard new clients and suppor t current client relationships

In smaller teams, the OTL can have operations responsibilities, but as firms like PSG grow, there is a need for the business to have one person w ith oversight responsibilities for both teams. This leader must have the respect of the operations team and the advisors The OTL’s purpose is to direct the business and its resources toward an unmatchable client experience while achiev ing the firm’s top-level goals.

The PSG team has told me this five-stage process was valuable in par t because it helped them create and believe in a common stated objective For PSG, this is to be recognized a s o n e o f t h e m o s t re s p e c t e d p l a n n i n g f i r m s i n B C a n d w e s t e r n C a n a d a by t h e a u d i e n ce t h a t m a t te r s m o s t : i t s c l i e n t s . B e f o re t h i s wo r k , P S G a c k n ow l e d g e s t h e p r a c t i ce ne ver ha d a fir m mant r a the team t r uly b elie ve d in Now,

protect and grow what you ’ ve built” informs ever ything the team does for clients. It has become par t of the culture and w h a t t h e e n t i re te a m wo r k s h a rd to d e l ive r o n f o r c l i e n t s ever y day

While PSG was always process-focused, our work together re-energized and reorganized the planning process to allow the team to bring even greater value to clients Specifically, the model for organizing operations and the team from lead advisors to managers and other key staff was a game changer that PSG says has brought excitement, momentum, and a new sense of clarit y to the team.

“We organized our planning process, and the why behind i t , s o we c a n g e t to t h e h e a r t o f o u r c l i e n t s ’ co n ce r n s a n d objectives in a much more compelling and efficient manner, ” Brent says “As we focused on our why, which is to do right by our clients at all costs, and protect and g row what the y have built, our revenues began to grow significantly. In 2021, we g rew revenues by more than 40% In 2022, we are projected to grow 40% over the prev ious year and we couldn’t be more excited.”

TODD FITHIAN is the co-founder and managing par tner of The Legacy Companies, which help advisors grow their businesses He can be reached at todd@think-legacy com Advocis and The Legacy Companies have formed a par tnership to bring Legacy’s courses to Advocis members

As expected, the annual allotment o f Ta x - Fre e S av i n g s Acco u n t ( TFSA) room w ill rise to $6,500 b e g i n n i n g i n 2 0 2 3 , a f te r f o u r years at $6,000

T h e f i g u re wo u l d h ave r i s e n i f t h e Consumer Price Index (CPI) had been as little as 1 5% But with the kind of inflation we ’ ve been experiencing this past year, the indexation factor came in at over 6%. That contrasts sharply w ith the sub-2% annual average for the last 15 years since the TFSA was launched.

T h i s i s m o re t h a n j u s t a w a l k d ow n economic memor y lane The way that the i n d ex i n g f o r m u l a i s s t r u c t u re d , i t’s a n arithmetic inevitability that we’ll see more frequent annual increases in TFSA room, with the next one possibly coming as early as next year

One of the distinguishing features of the TFSA is how it is designed to keep up with inflation. Like many other elements of our t a x s y s t e m , i t m a ke s u s e o f a n i n d e x i n g f o r m u l a , b u t o n e t h a t o p e r a t e s u n l i k e o t h e r s i n t h a t ch a n g e s i n a n nu a l T F S A room don’t necessarily happen annually

The indexation factor is in section 117 of the Income Tax Act. For a coming year, it is the average of the CPI for the 12-month period that ended on September 30 of the current year, divided by the average of the CPI for the 12-month p er io d that ended on September 30 of the preceding year.

For things like income tax brackets and RRSP room, that factor applies directly to increase the respective element ever y year. That same factor is used for the TFSA, but i t’s a n i n d i re c t c a l c u l a t i o n , s u ch t h a t ch a n ge s to T F S A ro om on ly o cc u r e ver y f e w ye a r s . T h e f a c to r a u g m e n t s a b a c kg ro u n d re f e re n c e f i g u re , a n d o n l y o n c e t h a t f i g u re ro u n d s to t h e n ex t $ 5 0 0 l e ve l does actual TFSA room rise by that amount.

Le av i n g a s i d e t h e o n e - t i m e d o u b l i n g to $10,000 in the 2015 e le c t ion year, that $500 prescribed increment has been applied t h re e t i m e s t o t a ke u s f ro m t h e o r i g i n a l $ 5 , 0 0 0 r o o m i n 2 0 0 9 t o $ 6 , 5 0 0 t o d a y ( s e e t a bl e ) . T h a t’s a b o ut e ver y f ive y e a r s on aver age, bear ing in mind that the first m o v e r e q u i r e d j u s t a h a l f - st e p o f $ 2 5 0 f o r t h e r e f e r e n c e f i g u r e t o c r o s s $ 5 , 2 5 0 a n d r o u n d u p t o t h e n e x t a c t u a l r o o m o f $5,500

A beneficial byproduct of this two-stage p ro ce s s i s t h a t T F S A ro o m i s a lw ay s a ro u n d f i g u re Wh i l e b e i n g c a re f u l n o t to overstate the case, this simpler expression m ay m a ke T F S As m o re u n d e r s t a n d a b l e a n d a cce s s i b l e f o r t h o s e w h o m ay f e e l intimidated by tax minutia

Now consider that, at the b e g inning , the $ 5 0 0 i n c re m e n t w a s 1 0 % o f t h e o r i g i n a l $5,000 room That same $500 is now just 7 . 7 % o f t h e 2 0 2 3 $ 6 , 5 0 0 ro o m . Wi t h a n ever-higher base upon which to apply the i n d ex a t i o n f a c to r, t h e nu m b e r o f ye a r s required to reach future levels will continue to compress.

We c a n o b s er ve t h i s w i t h a n ex a m p l e t h a t a p p l i e s a co n s i s t e n t 2 % i n d e x a t i o n factor. Assuming a current reference figure of $6,27 5 (just enough to round to $6,500 room), it w ill take four years to step up to $ 7 , 0 0 0 , a n o t h e r f o u r ye a r s to h i t $7,500, and then three years to get to $8,000, w ith continuing narrow ing in follow ing years.

O n t h e o t h e r h a n d , i f t h e re ce n t 6 % jump is the har binger of a per iod of sust a i n e d h i g h e r i n f l a t i o n ( h op e f u l l y n o t ! ) , t h e n t h o s e t i m e s co u l d b e co m p re s s e d even further By my calculation, the current re ference figure is already well past $6,500, a n d i f i n f l a t i o n c o n t i n u e s t o b e i n l i n e w ith recent histor y, next year ’ s indexation factor w ill push the annual TFSA room to $7,000 in 2024.

T h o u g h t h e o r i g i n a l $ 5 , 0 0 0 o f a n nu a l

T F S A ro o m m ay h ave s e e m e d m o d e s t , t h e re i s n ow m o m e n t u m to i t s i n d exe d increases And w ith the benefit of unlimi te d c a r r y f o r w a rd o f u nu s e d ro o m , t h e T F S A i s l i ke l y to b e co m e a n e ve n m o re prominent financial tool for many people

In fact, another way to look at indexing is to consider how the addit ion of ro om each year effectively indexes accumulated u n u s e d T F S A ro o m . Wi t h t h e $ 6 , 5 0 0 o f annual room credited for 2023, accumulated unused room stands at $88,000 For someone w ho has not ye t taken advantage of their TFSA capacity, that’s an 8% increase to their waiting tax-sheltering room

O n e co h o r t f o r w h o m t h i s co u l d b e e s p e c i a l l y a p ro p o s i s co u p l e s w h o we re e a r l y h o m e ow n e r s w h e n t h e T F S A w a s introduced. Mor tgage pay ments w ill have dominated their monthly budgeting in the i n ter ven i n g ye a r s , but n ow t h e y ’ re l i ke ly s e e i n g l i g h t a t t h e e n d o f t h a t t u n n e l . Through accelerated bi-weekly pay ments, t h e y w i l l h ave b e e n a b l e to re d u ce t h e a m o r t i z a t i o n o f a 2 5 - ye a r m o r t g a g e by a lmost eig ht years. Give it a couple more ye a rs a n d t h a t ex t r a h o u s e h o l d c a s h f l ow w i l l a l i g n n i ce l y w i t h t h e co m b i n e d $ 2 0 0 , 0 0 0 + T F S A r o o m w a i t i n g t o b e exploited

Recent changes in Ontar io leg islat i o n h i g h l i g h t t h e v a l u e o f t h e adv ice you can prov ide to clients who are undergoing a separation o r d ivo rce . Un f o r t u n a te l y, t h i s l i f e e ve n t triggers more than an unwinding of family and personal relationships It also means t h e s p l i t o f f i n a n c i a l a s s e t s a n d re a s s e s sm e n t o f e s t a te p l a n n i n g a r r a n g e m e n t s Here are some of the estate and insurance planning issues your clients should consider as part of their separation or divorce

One major question is whether your clients n e e d to i m m e d i a te l y re v i s e t h e i r w i l l s , powers of attorney, and trusts as a result of separation or divorce

For wills, the answer depends in part on the rules in the province where your clients reside Legislation in most prov inces prov ides tha t divorce gener al ly re vokes g ifts m a d e t o a n e x - s p o u s e u n d e r a w i l l , a s we l l as excluding the former spouse from s h a r i n g o n a n i n te s t a c y. In a d d i t i o n , t h e appointment of an ex-spouse as executor o r t r u s te e u n d e r a n ex i s t i n g w i l l i s n o longer valid.